How to Use the Sage 50 Sales Invoice Import Template for Easy Integration

Efficient handling of business transactions is crucial for maintaining smooth operations. Automating data entry and reducing manual errors can significantly save time and effort. When it comes to processing large volumes of financial records, utilizing the right tools can make a world of difference in terms of accuracy and productivity.

Optimizing data flow from external sources into your accounting system ensures that records are correctly aligned with your financial reporting standards. By using structured file formats and tools designed for quick integration, businesses can avoid common pitfalls associated with manual data entry, such as misclassifications or delays in processing.

Modern solutions allow for easy customization, enabling users to adjust the system to their unique needs while ensuring compliance with local regulations. With the right setup, it becomes easier to maintain accurate financial documents and manage large datasets with minimal effort.

Understanding the Sales Document Integration Tool

Efficient financial management relies on the seamless transfer of transaction data into the accounting system. A well-designed solution allows businesses to quickly upload and process external records, ensuring that all relevant information is captured accurately. By automating the transfer of data from external files into the system, the risk of human error is significantly reduced, leading to more reliable reporting and faster processing times.

The system offers a structured way to organize incoming records, making it easier to map data fields from external documents to the appropriate categories in your accounting software. This integration tool is customizable, allowing businesses to adjust it according to specific needs and workflows, ensuring smooth operations even with complex financial data.

| Field | Description | Example |

|---|---|---|

| Document Number | Unique identifier for each transaction record | INV12345 |

| Date | Date of the transaction or document | 2024-11-05 |

| Customer ID | Unique identifier for the customer involved | CUST001 |

| Amount | Amount of the transaction | $500.00 |

| Tax Rate | Applicable tax rate for the transaction | 8% |

Understanding how to format and structure external files correctly for integration into the system is key to ensuring the process runs smoothly. The tool provides flexibility while maintaining a consistent framework for data entry, making it easier to handle large volumes of financial records without sacrificing accuracy or efficiency.

What is the Data Integration Tool?

In today’s fast-paced business environment, managing financial transactions efficiently is crucial. A specialized tool designed to handle large sets of transaction data helps automate the process of transferring external records into the accounting system. This tool allows businesses to eliminate manual data entry, minimizing errors while improving the speed and accuracy of processing financial records.

Key Features of the Integration Tool

The primary function of this tool is to enable easy and accurate data transfer from external files into the accounting software. By using a standardized format, the tool ensures that the information is properly structured and mapped to the appropriate categories within the system. This process allows businesses to manage large volumes of financial transactions with minimal effort and reduced risk of errors.

Customization and Flexibility

Flexibility is a critical feature of the data integration system. It allows businesses to customize the file structure based on their specific needs. Users can adjust the layout of incoming data to match the software’s requirements, ensuring a seamless fit for any type of financial document. This makes it easy for companies to maintain accuracy even when dealing with diverse transaction types or unique workflows.

By utilizing this tool, businesses can ensure that their financial records are quickly and accurately processed, freeing up resources for more strategic tasks. The simplicity of the integration process also reduces the time spent on administrative tasks, enabling teams to focus on more impactful aspects of business management.

Benefits of Using Document Data Upload Solutions

Using a structured system for transferring external records into your financial software can streamline the entire data entry process. By automating the process, businesses can ensure greater accuracy, save time, and reduce human error. This method not only increases productivity but also ensures that all relevant transaction details are captured without the need for manual input.

Time and Cost Efficiency

One of the main advantages of employing a document data upload solution is the significant reduction in time spent on manual tasks. This method eliminates the need for entering data by hand, freeing up resources for more important activities. By automating repetitive tasks, businesses can save both time and money, leading to overall improved operational efficiency.

Improved Accuracy and Consistency

When dealing with large volumes of financial records, accuracy becomes a critical factor. The use of a standardized system ensures that all necessary fields are populated correctly, reducing the risk of errors. Additionally, the consistency of data formatting ensures that each record is processed uniformly, minimizing discrepancies between transactions and reports.

| Benefit | Description | Example |

|---|---|---|

| Reduced Human Error | Automated systems ensure accurate data transfer with minimal mistakes | Automatic mapping of fields from the source file to the system |

| Faster Processing | Automating data entry leads to quicker processing times | Bulk processing of multiple records in seconds |

| Seamless Integration | Easy integration with existing accounting systems | Direct transfer of transaction data into the software |

| Cost Savings | Reduces the need for manual labor and related expenses | Less time spent on data entry tasks |

By leveraging a well-organized system for managing external records, businesses can maintain better control over their financial data. With these solutions, you can ensure greater productivity, efficiency, and accuracy in your financial processes.

Setting Up Your Accounting System for Data Transfers

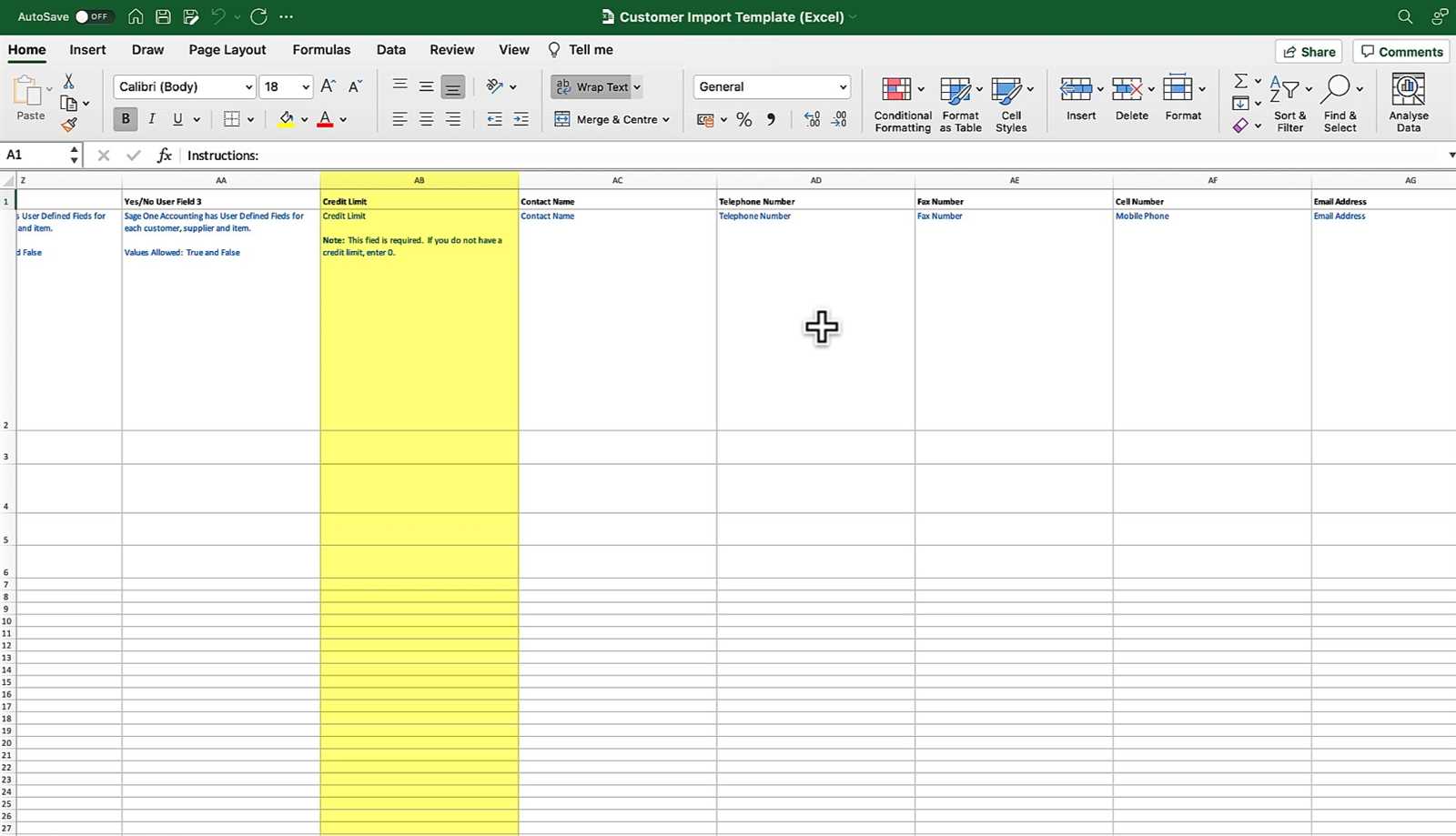

Configuring your financial software to handle external data transfers is essential for automating workflows and reducing manual errors. By ensuring that the system is properly set up, businesses can efficiently integrate external records into their accounting platform, saving time and maintaining accuracy. The setup process includes defining key parameters, mapping data fields, and ensuring that the system recognizes the format of incoming files.

Preparing Your System for Data Integration

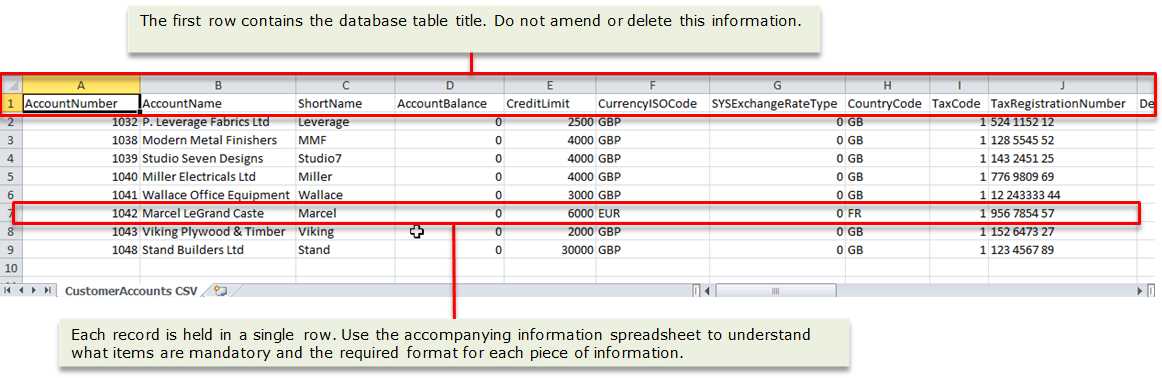

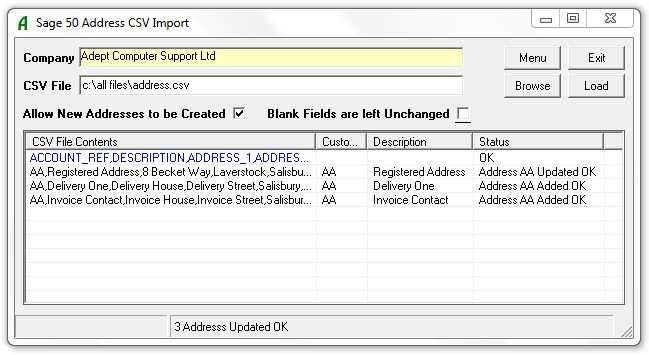

The first step in setting up your accounting system is to configure it to accept data from external sources. This often involves choosing the appropriate file format for the records you wish to upload, such as CSV or Excel. You should also review and update any system preferences to ensure that the incoming data aligns with the software’s expected structure. This step is crucial for ensuring smooth and seamless data entry without errors.

Mapping Fields and Adjusting Settings

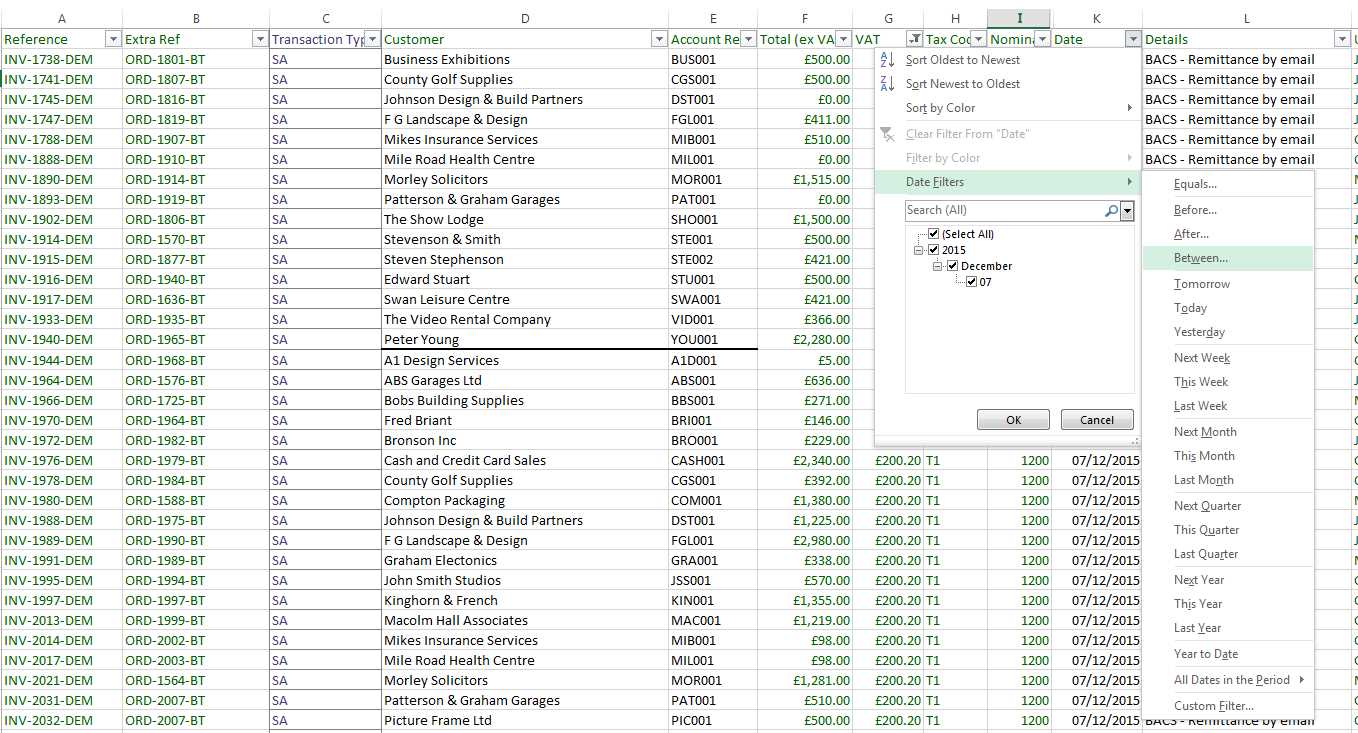

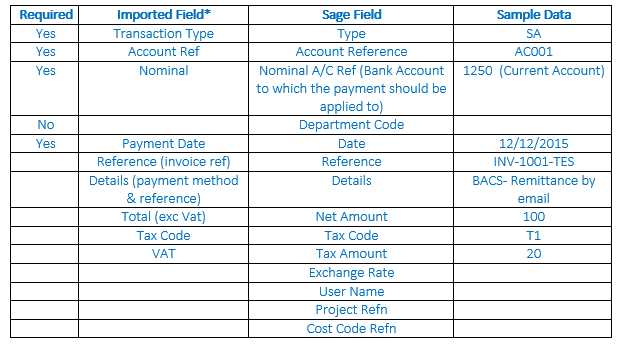

Once the basic configuration is in place, you need to map the relevant fields in the external records to the corresponding fields within your accounting software. This step allows the system to correctly process and categorize each transaction. Adjusting system settings for tax rates, customer information, and other variables is also necessary to ensure that the data is interpreted accurately. Proper field mapping is key to minimizing discrepancies and ensuring that all records are imported correctly.

By taking the time to set up your system correctly, you can streamline the process of transferring financial data. Proper configuration will ensure that records are processed quickly and accurately, reducing the time spent on manual data entry and enhancing the overall efficiency of your accounting workflows.

Common Data Formats for Importing Financial Records

When transferring transaction data into your accounting system, it’s essential to choose the correct file format to ensure compatibility and accuracy. Various formats are commonly used to structure external records for seamless integration. Each format has its own strengths, and selecting the right one for your needs can streamline the data transfer process and minimize errors.

CSV (Comma Separated Values)

The CSV format is one of the most widely used formats for handling financial data. It organizes information into a plain text file where each piece of data is separated by a comma. This format is ideal for transferring large datasets as it is simple, lightweight, and compatible with most accounting systems. It allows users to easily import and export data between different platforms, making it a popular choice for integrating external records.

Excel (XLS/XLSX)

Excel files are another commonly used format, particularly when the data includes multiple rows and columns with complex data relationships. Excel allows for more advanced features, such as formulas and formatting, making it suitable for users who need to handle detailed financial records. While it may be slightly more complex than CSV, it provides additional functionality that can be beneficial for more intricate data management tasks.

XML (Extensible Markup Language)

XML is a more structured file format that allows for greater flexibility when dealing with large or complex datasets. It uses tags to define the structure of the data, making it easier to handle hierarchical information. XML files are often used in cases where there is a need to integrate with other software systems or where detailed metadata is required alongside transaction records.

Choosing the right file format for your data is key to ensuring a smooth integration process. Whether you opt for a simpler format like CSV or a more advanced option like Excel or XML, it is important to ensure that your accounting system can handle the selected format correctly to avoid processing errors and ensure consistency across records.

How to Customize the Data Integration Structure

Customizing your data structure is essential for ensuring that external records are correctly processed within your financial system. Tailoring the structure allows you to align the data import process with your business’s specific needs, ensuring that every relevant field is captured accurately. By adjusting the layout and data mapping, you can improve the efficiency of your accounting workflows and reduce errors during the transfer process.

Adjusting the File Layout

To begin customizing, you first need to modify the file layout to match the requirements of your accounting platform. This includes organizing the data into specific columns or sections, depending on the type of information being transferred. For example, you may need to rearrange columns to ensure that transaction amounts, dates, and customer information are correctly positioned for easy recognition by the system. A well-structured file layout will ensure smoother processing and minimize errors.

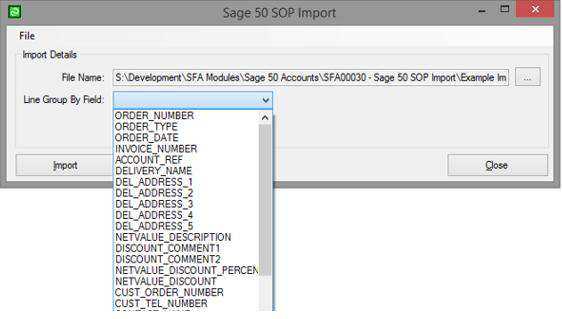

Mapping Fields to System Categories

Mapping the data fields to the appropriate system categories is another critical step in customization. Each column in your external document must be assigned to a corresponding field in the accounting system, such as transaction type, date, or amount. This ensures that the incoming data is interpreted correctly and placed in the right sections of your financial records. Customization allows you to match the system’s categories with the structure of your data, reducing the chances of misclassification or errors.

Once these adjustments are made, it’s important to test the configuration by importing a small batch of data to ensure that everything is mapped correctly. This ensures that any necessary tweaks can be made before moving forward with large-scale imports. With a customized structure, you can streamline the transfer process and ensure that all data is accurately reflected in your financial reports.

Mapping Data Fields in Your Accounting System

Properly mapping data fields ensures that external records are correctly interpreted by your financial software. This process involves aligning the data from external documents with the corresponding categories in the system, allowing for accurate data processing and record keeping. Field mapping is essential for preventing discrepancies and ensuring that all transaction details are entered into the system correctly.

Understanding Field Mapping

Field mapping refers to the process of linking the columns in your external data file to the corresponding fields in the accounting system. Each data point, such as transaction amounts, dates, or customer IDs, must be assigned to the correct field in the system to ensure that the information is categorized and processed appropriately. For example, the “Total Amount” from an external document should be mapped to the “Amount” field in the software, while the “Date” field should match the transaction date field in the system.

Ensuring Accuracy with Proper Mapping

Accuracy is critical when mapping fields. Misalignment can result in errors, such as incorrectly categorized transactions or missing information. It is important to review the data mapping process thoroughly to ensure that all fields are matched properly. Many accounting systems allow users to preview the data mapping before finalizing the upload, which provides an opportunity to spot and correct any issues. By carefully mapping the fields, you can minimize errors and improve the overall quality of your financial records.

Once the fields are properly mapped, it is important to test the setup with a sample of data before proceeding with large-scale uploads. This ensures that the system processes the data correctly, and that all records are imported as expected. Effective field mapping ultimately leads to smoother workflows and more reliable financial reporting.

How to Upload Financial Records Quickly

Efficiently transferring transaction data into your accounting system can save significant time and reduce manual effort. By using the right tools and following a streamlined process, you can upload large volumes of financial records with minimal delays. The key to fast and accurate uploads is ensuring that all data is correctly formatted and mapped before initiating the transfer.

Prepare Your Files for Fast Uploads

Before uploading any records, make sure that the external documents are properly formatted and aligned with your system’s requirements. This includes organizing the data into appropriate columns and ensuring that each field matches the expected category in the software. By reviewing and adjusting the file structure beforehand, you can avoid unnecessary delays caused by formatting errors.

Utilize Bulk Upload Features

Bulk uploading is an effective way to quickly transfer large sets of data. Most accounting systems offer an option to upload multiple records at once, which can significantly speed up the process. Instead of uploading data one by one, you can select a batch of documents and transfer them all in a single action. This reduces the time spent on repetitive tasks and ensures that all records are processed simultaneously.

Once your files are ready and the bulk upload feature is enabled, simply follow the system prompts to begin the transfer. The system will automatically map the data fields and categorize each record based on the predefined setup. After the upload is complete, double-check the records to ensure that the data has been entered accurately and completely.

By preparing your files properly and using the bulk upload functionality, you can drastically reduce the time required to add financial data to your system and focus on other critical tasks in your workflow.

Troubleshooting Data Upload Errors

When transferring external records into your financial system, errors may occur that prevent smooth processing. These issues can arise due to incorrect file formatting, misalignment of data fields, or system configuration problems. Identifying and resolving these errors promptly is essential for maintaining accurate financial records and ensuring that the upload process is completed successfully.

Common Causes of Data Transfer Errors

Several factors can lead to issues during the data upload process. The most common causes include:

| Error Type | Possible Cause | Solution |

|---|---|---|

| File Format Error | The file is in an unsupported format or has improper structure | Ensure the file is saved in a compatible format (CSV, Excel, XML) and follows the correct structure |

| Field Mapping Issues | Data fields are not aligned with the system’s categories | Check the field mapping setup and ensure that each external field corresponds to the correct system field |

| Missing Data | Required fields are empty or incomplete | Ensure all mandatory fields (e.g., transaction amounts, dates, customer details) are populated before uploading |

| Data Format Mismatch | Data type errors (e.g., text in a numeric field) | Verify that the data types in the external document match the system’s expected format (e.g., numerical values in amount fields) |

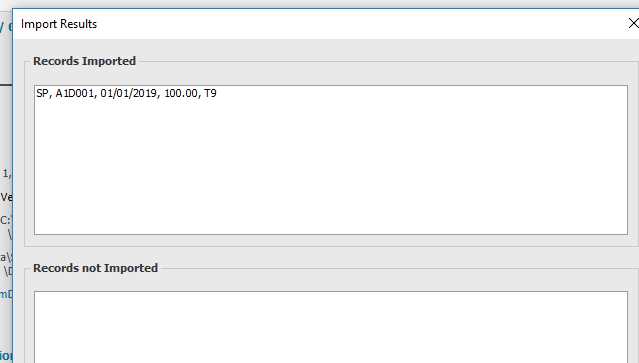

Steps to Resolve Import Errors

To fix errors, start by reviewing any error messages that the system provides. These messages often contain specific information about the issue, such as the field or record causing the problem. Next, carefully examine the external document to ensure that all data fields are correctly formatted and that the file adheres to the system’s guidelines. If necessary, adjust the file and attempt the upload again.

In some cases, it may be helpful to break the data into smaller batches for easier identification of the source of the error. After correcting the issues, test the process with a small sample of records before performing a full upload. This will ensure that all problems have been resolved and that the data is successfully transferred into your system.

By following these troubleshooting steps, you can quickly identify and address common issues, ensuring a smooth and error-free data upload process.

Best Practices for Data Accuracy in Transfers

Ensuring the accuracy of data during transfers into your financial system is essential for maintaining reliable records. Data discrepancies can lead to errors in financial reporting and decision-making. By following best practices for preparing, structuring, and validating data, you can significantly reduce the risk of inaccuracies and ensure that the transfer process runs smoothly.

1. Validate Data Before Uploading

Before transferring any external records into your system, it is important to perform a thorough validation of the data. This includes checking for missing or incomplete fields, verifying that all required information is present, and ensuring that there are no inconsistencies in data formatting. For example, ensure that all numeric fields, such as transaction amounts, are properly formatted and that dates follow a consistent structure. Validating data beforehand will help you catch errors early and avoid complications during the upload process.

2. Use Consistent File Formatting

Consistency in file formatting is crucial to prevent errors during data transfer. Always ensure that the file structure aligns with the requirements of your accounting system. This includes organizing data into the correct columns, using the proper delimiter (e.g., commas or tabs), and maintaining uniform data types. If your system requires CSV or Excel files, ensure that all rows and columns are consistent in format and free from special characters or unnecessary spaces that might interfere with the data recognition process.

By using consistent file formatting and performing regular validation checks, you can greatly improve the accuracy of your data transfers. These simple steps can prevent common errors, minimize the need for troubleshooting, and help ensure that your financial records are accurate and reliable.

Importing Bulk Financial Records Efficiently

When handling large volumes of transaction data, efficiency becomes crucial. Bulk uploads allow you to process multiple records at once, saving time and reducing manual effort. However, to ensure smooth and accurate processing, it is important to follow a well-structured process. By preparing the data, leveraging system tools, and following best practices, you can maximize the efficiency of bulk uploads while minimizing errors.

Steps for Efficient Bulk Uploads

- Prepare Data Files: Ensure all records are correctly formatted and organized into consistent columns before uploading. This includes verifying that all necessary fields are present and properly filled.

- Use System Bulk Features: Most accounting platforms offer bulk processing tools that allow you to upload multiple records at once. Familiarize yourself with these features to speed up the process.

- Ensure Field Alignment: Make sure that the data fields in your file are properly mapped to the corresponding system categories. Correct field mapping ensures that each record is processed correctly.

- Test with a Sample: Before uploading the entire batch, test the process with a small sample to ensure that all records are imported accurately and that no errors occur during the upload.

- Monitor the Upload: Keep an eye on the upload process to catch any issues early. Most systems will provide error logs or notifications that can help identify any problems quickly.

Best Practices for Minimizing Errors

- Check for Missing Data: Before uploading, ensure that all required fields are filled and that there are no empty cells in critical columns, such as transaction amounts or dates.

- Use Valid File Formats: Ensure that your files are in the correct format (e.g., CSV, Excel) and that all data types are consistent with system requirements, such as numerical values in amount fields.

- Review the Error Log: After the upload, check the system’s error log to quickly identify and correct any issues, such as mismatched data fields or incorrect formats.

By following these steps and best practices, you can efficiently upload large batches of financial records while minimizing the chances of errors. Proper preparation, data alignment, and testing will ensure that the upload process is fast and reliable, saving you time and improving you

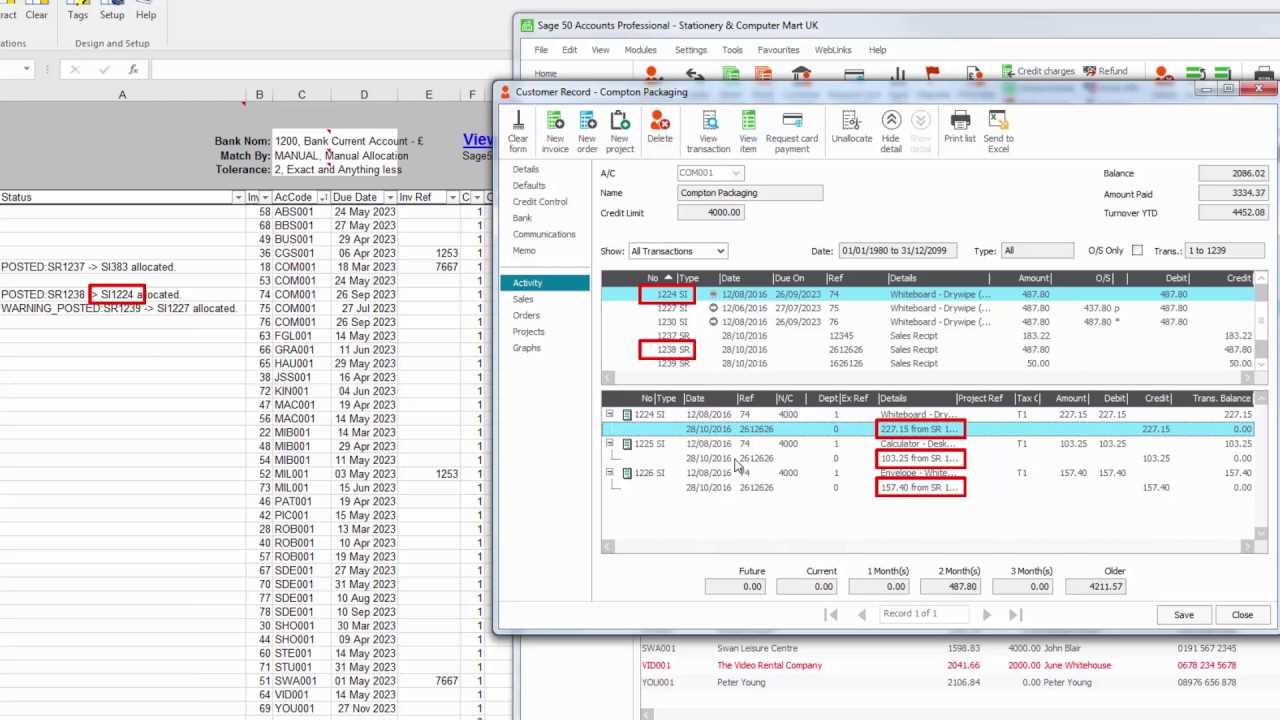

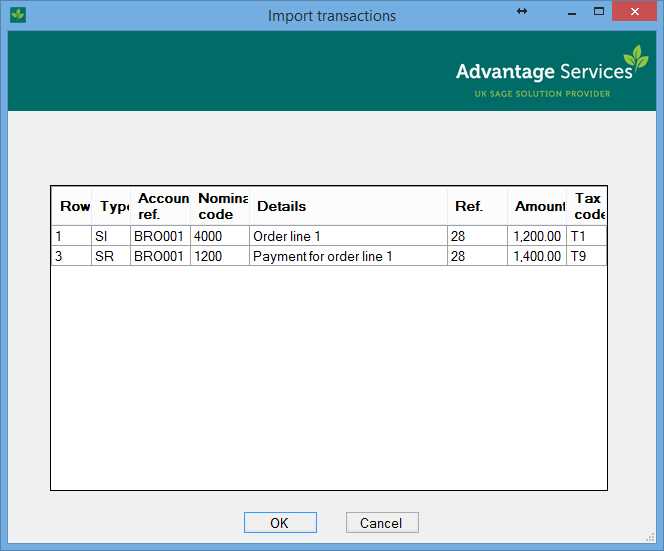

How to Validate Imported Transaction Data

After transferring external transaction data into your accounting system, it’s essential to validate the accuracy of the imported information. This step ensures that the data has been entered correctly and aligns with your financial records. Proper validation helps catch errors such as missing details, incorrect data mapping, or inconsistencies, which could affect your reporting and decision-making.

Step-by-Step Validation Process

To validate the accuracy of imported records, follow these key steps:

- Review Data Mapping: Ensure that the fields in the imported file are correctly mapped to the corresponding categories in the system. This prevents misclassified data and ensures that all transaction details are processed correctly.

- Check for Missing Data: Examine the imported records for any missing or empty fields, particularly in essential categories such as amounts, dates, or customer information. Missing data can result in incomplete transactions or errors in financial reports.

- Verify Numeric Accuracy: Double-check the numeric fields to ensure that amounts, taxes, and other numerical values are correctly formatted and fall within the expected ranges. Incorrect formatting, such as text in a numeric field, can disrupt the upload process.

- Cross-Reference with Source Files: Compare the imported data with the original source documents or files to confirm that all records match and that no discrepancies exist. This ensures that the data transferred is identical to the source information.

- Run a Test Upload: Before processing a large batch, it’s advisable to test the upload with a small sample of records. This allows you to identify any issues early and make necessary adjustments without affecting your entire dataset.

Tools and Features for Data Validation

Many accounting platforms offer built-in tools to help automate the validation process. These tools may include:

- Error Reports: Error logs or reports can provide detailed information about any issues encountered during the upload, such as misaligned fields or invalid data.

- Preview Mode: Some systems allow you to preview the imported records before finalizing the upload. This gives you a chance to review the data and make corrections before it’s permanently added to the system.

- Data Validation Rules: Set up validation rules within the system to automatically check for common errors, such as missing fields or invalid dates, during the upload process.

By following these steps and utilizing the available tools, you can ensure the accuracy and completeness of imported transaction data. Proper validation reduces the risk of errors and helps maintain the integrity of your financial records.

Integrating Accounting Software with Other Systems

Integrating your accounting software with other business systems can streamline operations, improve data accuracy, and enhance overall workflow efficiency. By allowing different platforms to communicate with each other, you can eliminate the need for manual data entry, reduce errors, and ensure that financial records are always up-to-date. Whether it’s connecting with your CRM, inventory management system, or eCommerce platform, integration helps centralize your data and improves decision-making across departments.

Benefits of System Integration

When your accounting system works in tandem with other business applications, it brings several key advantages:

- Improved Data Accuracy: Automated data transfer between systems reduces the risk of human error and ensures that information is consistent across all platforms.

- Time Savings: Integration eliminates the need for repetitive manual data entry, allowing your team to focus on more valuable tasks.

- Real-Time Updates: Syncing data in real-time ensures that your financial records reflect the most current information, providing more accurate reporting and insights.

- Better Decision-Making: With all your data in one place, managers and decision-makers can access comprehensive and accurate reports that improve business strategy.

Popular Integration Methods

There are various ways to integrate accounting software with other business systems:

- API Integration: Many accounting platforms offer Application Programming Interfaces (APIs) that allow you to connect with other systems and exchange data in real-time. This method is often preferred for more complex or custom integrations.

- Third-Party Integration Tools: Several tools and services are available that help bridge the gap between different software applications. These tools are often designed to work with popular platforms and can handle data transfers with minimal configuration.

- Manual File Transfers: If API or third-party integration isn’t an option, you can transfer data manually by exporting files from one system and importing them into another. While this method is less efficient, it’s still a viable option for systems that don’t support direct integration.

By integrating your accounting system with other platforms, you can significantly enhance your business’s efficiency, reduce errors, and streamline the data management process. Whether through API connections, third-party tools, or manual transfers, integrating systems can provide a competitive advantage by improving data accuracy and decision-making.

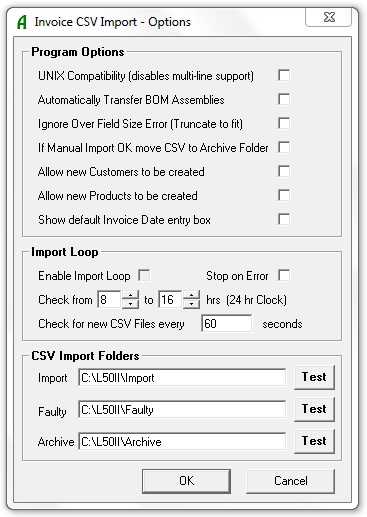

Automating Transaction Data Transfers

Automating the transfer of transaction records into your financial system can save time, reduce manual errors, and enhance overall productivity. By setting up automated processes, you can streamline data entry, ensuring that information is accurately captured and processed without the need for constant oversight. Automation tools allow businesses to seamlessly integrate external data sources, making it easier to manage large volumes of transactions efficiently.

Advantages of Automating Data Transfers

- Time Efficiency: Automation significantly reduces the time spent on manual data entry, allowing employees to focus on more strategic tasks and reducing bottlenecks in workflow.

- Improved Accuracy: Automated processes eliminate the possibility of human errors, ensuring that records are entered correctly every time.

- Consistency: Automated systems ensure that the same steps are followed for each data transfer, maintaining consistency and reducing the risk of mistakes or omissions.

- Real-Time Data Syncing: Automation allows for real-time data synchronization, ensuring that financial records are always up to date with the most recent transactions.

How to Set Up Automated Data Transfers

Setting up an automated data transfer process involves several key steps. Here’s how to get started:

- Choose the Right Tool: Select an automation tool or service that integrates with your accounting platform. Many systems offer built-in automation features or third-party tools that can handle data transfers.

- Map the Data Fields: Ensure that the data from external sources matches the fields in your accounting system. Proper mapping is essential for accurate and efficient data transfers.

- Set Up Data Schedules: Configure automation to run at specific intervals, whether it’s daily, weekly, or triggered by certain actions. Regular scheduling ensures that new records are added promptly without manual intervention.

- Test the System: Run initial tests with a small batch of data to ensure that the automation process works as expected. This step helps identify any errors or discrepancies before automating large volumes of transactions.

- Monitor and Adjust: Continuously monitor the automated system to ensure smooth operation. If errors arise or data is not transferring correctly, make adjustments to the configuration to resolve the issue.

By automating transaction data transfers, you can improve the efficiency of your financial processes, ensure data accuracy, and free up valuable time for other important tasks. With the right tools and setup, automation can become a powerful asset in managing your financial operations effectively.

Ensuring Compliance with Data Transfer Regulations

When transferring transaction data into your financial system, it’s crucial to ensure compliance with local and international regulations. Adhering to data protection laws, tax regulations, and industry-specific standards is not only necessary to avoid legal issues but also helps maintain the integrity of your financial records. By following best practices for data management, you can ensure that all data transfers are secure, accurate, and compliant with relevant regulations.

Key Compliance Areas to Consider

- Data Protection and Privacy Laws: Ensure that all personal or sensitive customer data is handled according to data protection laws such as the GDPR (General Data Protection Regulation) in Europe or other regional privacy laws. This may include encrypting data, obtaining consent for data sharing, and restricting access to authorized personnel only.

- Tax Compliance: Verify that all transaction data complies with local tax laws and regulations. For example, ensure that the correct tax rates are applied, tax documentation is accurate, and proper reporting formats are followed to avoid penalties.

- Industry-Specific Regulations: Depending on your industry, there may be additional compliance standards that must be met. For example, financial services or healthcare sectors may have stricter rules for data handling and reporting.

- Auditing Requirements: Maintain an audit trail for all data transfers. This helps track changes, monitor for errors, and ensure that the data can be traced if an issue arises during the transfer process.

Best Practices for Compliance

To maintain compliance, consider implementing the following best practices:

- Regular Audits: Perform regular audits of your data transfers to ensure that all processes are in line with compliance standards. This includes reviewing the accuracy of data, validating transfer protocols, and ensuring that no sensitive information is mishandled.

- Use Secure Systems: Employ secure file transfer methods such as encrypted file formats or secure APIs to protect data during the transfer process. This helps prevent unauthorized access and ensures that the data remains safe.

- Document Compliance Procedures: Develop and maintain detailed documentation of your data transfer processes, including compliance checks and security measures. Having this documentation will not only help during audits but also ensures that your team is aware of the necessary compliance steps to follow.

- Training and Awareness: Regularly train your team members on compliance requirements and the best practices for handling and transferring data. This ensures that everyone involved in the process is aware of their responsibilities and can help avoid potential mistakes or oversights.

Ensuring compliance with data transfer regulations is an essential aspect of maintaining trustworthy and secure financial operations. By following the best practices outlined above, businesses c

Maximizing Features for Streamlined Billing

To enhance the efficiency of your billing process, it’s essential to make the most out of the features available in your accounting software. By fully utilizing the built-in tools for managing transactions, tracking payments, and customizing billing documents, businesses can automate and streamline their operations. These features help reduce manual work, improve accuracy, and ensure that every transaction is recorded and processed correctly.

Key Features to Maximize for Efficient Billing

- Automated Billing: Set up recurring transactions for regular customers or subscriptions. Automation ensures that invoices are generated on schedule, reducing the risk of human error and ensuring timely payments.

- Customizable Documents: Tailor the look and feel of your billing documents to match your business branding. Customization options include adding logos, adjusting layout, and modifying payment terms to reflect your company’s policies.

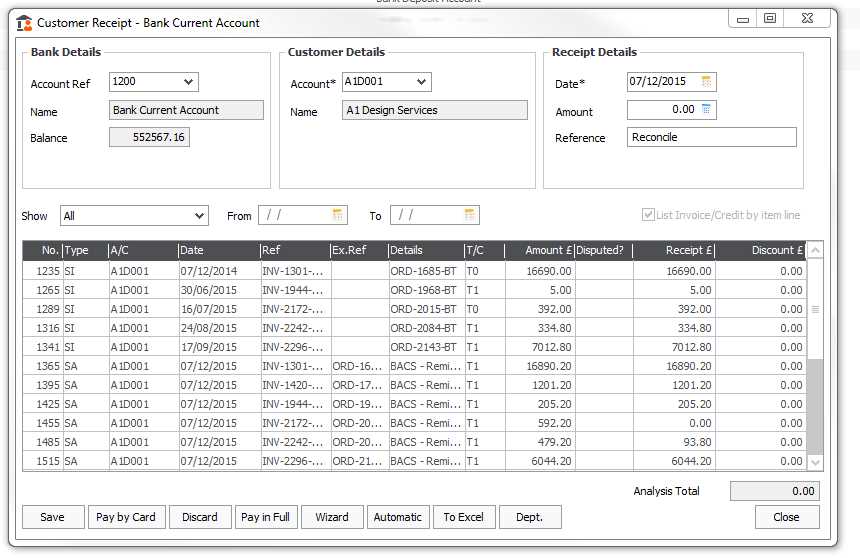

- Real-Time Payment Tracking: Use integrated payment tracking to monitor incoming payments instantly. This allows you to reconcile transactions quickly and efficiently, reducing the time spent on manual account matching.

- Multi-Currency Support: For businesses with international clients, leverage multi-currency features to manage and convert different currencies automatically. This ensures that all transactions are accurately recorded in the appropriate currency.

- Comprehensive Reporting: Utilize built-in reporting tools to generate detailed reports on accounts receivable, outstanding balances, and payment history. This helps you stay on top of overdue payments and spot trends in customer behavior.

Best Practices for Using These Features

To maximize the benefits of these features, here are a few best practices:

- Consistency: Ensure that all customer details, payment terms, and contact information are accurate and up-to-date. This reduces errors when generating billing documents and ensures smooth communication with clients.

- Integrate with Other Business Systems: Sync your accounting software with other business applications, such as CRM or inventory management systems. This allows for seamless data flow between platforms and ensures that your billing process is always aligned with inventory and customer data.

- Review and Adjust Settings Regularly: Periodically review the settings for automated billing and customization options to make sure they still meet your business needs. As your business grows, you may need to adjust workflows or update templates to keep up with changing requirements.

- Utilize Alerts and Notifications: Set up alerts to notify you of overdue payments or billing errors. This proactive approach helps you stay on top of collections and ensures that issues are addressed quickly.

By fully utilizing these features, businesses can significantly reduce the administrative burden associated with billing and focus more on growth and customer satisfaction. Automation, customization, and real-time tracking are just a few of the powerful tools available to streamline and optimize th