Free Contractor Invoice Template for NZ Businesses

For businesses and freelancers in New Zealand, ensuring proper payment documentation is essential for smooth financial operations. A well-structured billing document not only helps track payments but also builds trust with clients. Using the right format can simplify the process and minimize errors, making it easier to get paid on time.

With various tools and formats available, it’s important to select a solution that fits your needs and complies with local regulations. The right design and content can significantly impact how your clients perceive your professionalism. Whether you’re working on a one-off project or have long-term contracts, having a clear and consistent billing method is crucial for maintaining a steady cash flow.

Customizable solutions are particularly useful for businesses looking to streamline their financial processes. By tailoring your documents to reflect the nature of your work and your brand, you can create an effective system for billing clients without unnecessary complications.

Understanding Billing Documents in New Zealand

In New Zealand, ensuring that payment records are accurate and legally sound is essential for freelancers and businesses alike. Proper documentation provides clarity for both parties, establishes a clear payment schedule, and helps avoid disputes. The format of these documents plays a key role in ensuring compliance with local laws, particularly when it comes to tax requirements such as GST. Whether you are working on a short-term project or have ongoing agreements, having the right structure for your financial documents is vital for smooth transactions.

These records must include certain information that clearly defines the agreement between you and your client. From the type of service provided to the payment due date, every detail should be accounted for to ensure that both parties are on the same page. A well-organized document reflects professionalism and ensures timely payment.

| Essential Elements | Description |

|---|---|

| Contact Information | Includes details such as the name, address, and phone number of both the service provider and the client. |

| Service Description | A brief explanation of the work completed or the product delivered, including any relevant dates. |

| Payment Amount | The total amount owed, including applicable taxes (GST), and any applicable rates. |

| Payment Terms | Details about when and how the payment is due, including any late fees or early payment discounts. |

| Legal Requirements | Any legal or regulatory details that must be included, such as GST registration numbers or tax codes. |

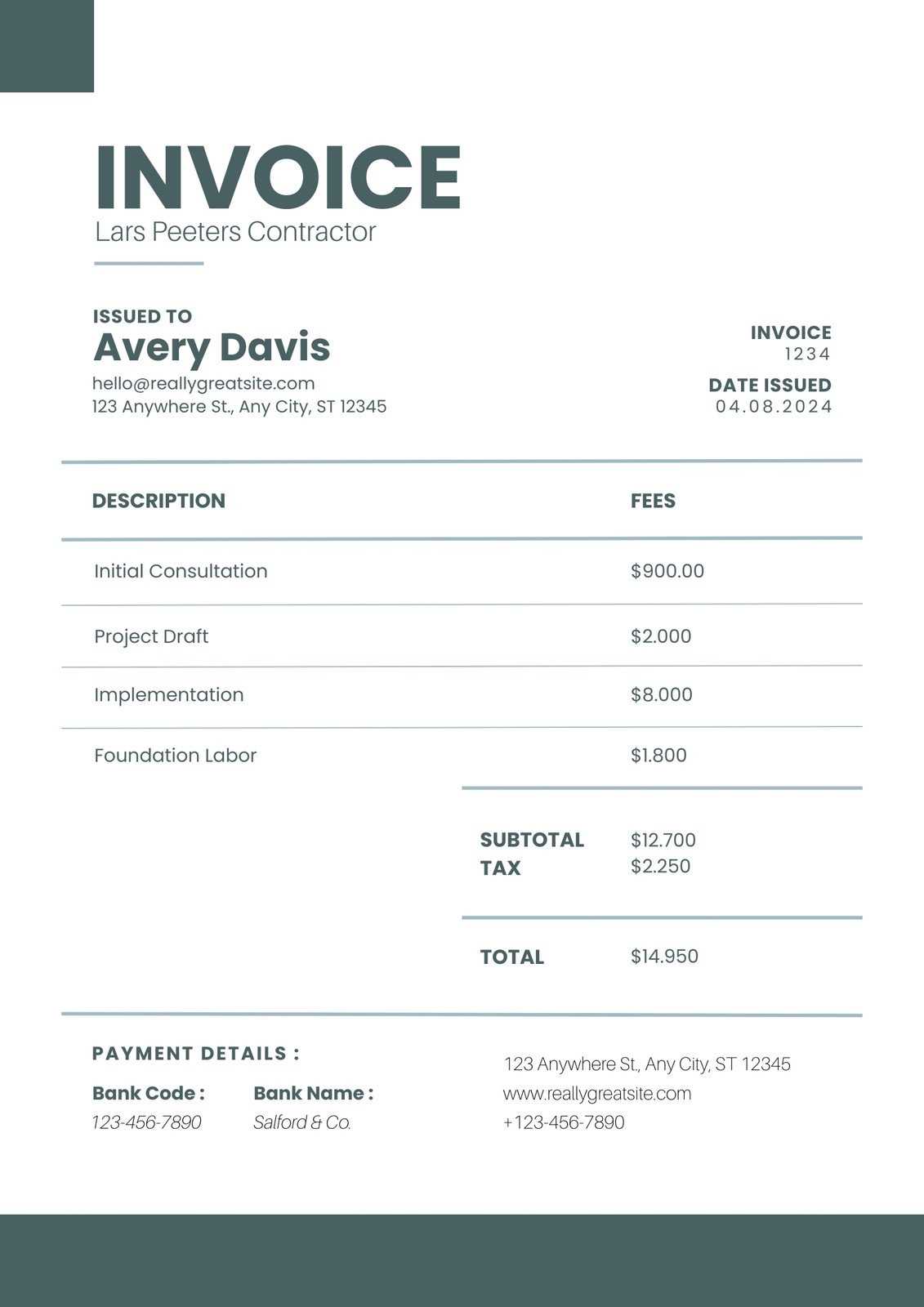

Why Use an Invoice Template

For businesses and freelancers, maintaining consistency and organization in financial records is crucial. By using a pre-designed format, you can ensure that all necessary information is included, reducing the chances of overlooking important details. A well-structured billing document makes it easier to keep track of payments, stay compliant with tax regulations, and streamline administrative tasks.

Using a standardized format offers numerous advantages. It saves time by eliminating the need to create documents from scratch for each transaction. Additionally, it reduces the likelihood of errors, ensuring that the same key details are consistently provided in every document. With a uniform structure, both you and your clients can quickly understand the terms and amounts, improving communication and professionalism.

Customization options allow you to tailor the document to suit your business needs while still keeping the format clear and easy to follow. Whether you’re dealing with one-off projects or ongoing services, having a reliable structure in place helps you focus on what matters most–getting paid efficiently and maintaining good client relationships.

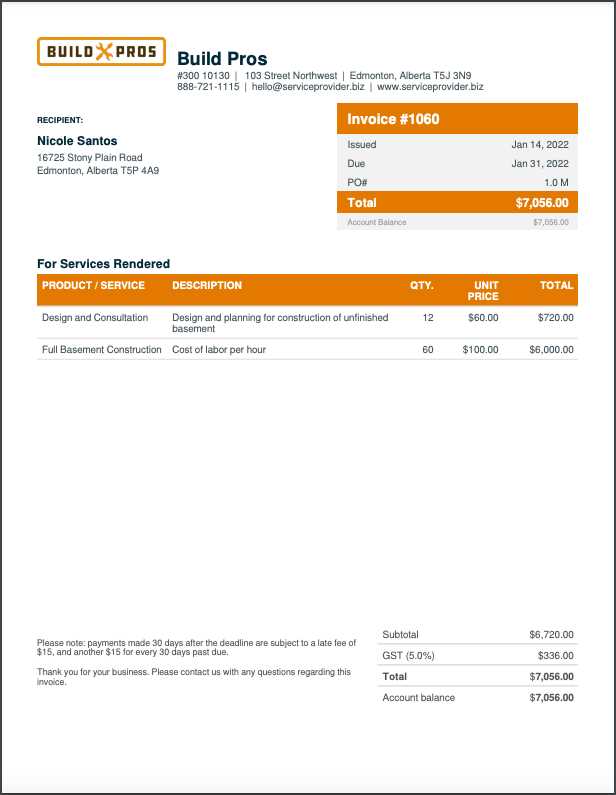

Key Elements of an Invoice Template

To ensure clarity and accuracy in billing documents, certain elements must be included in each record. These details not only help define the terms of the transaction but also contribute to a smooth payment process. A complete and organized document reduces the likelihood of misunderstandings and supports legal compliance, especially when it comes to taxes and payments. Below are the essential components that should be present in every document to ensure professionalism and accuracy.

1. Contact Information

Including both your and your client’s contact information is critical. This typically includes names, addresses, phone numbers, and email addresses. Clear contact details help resolve any potential issues that may arise after the document is sent and ensure that both parties can easily communicate if needed.

2. Payment Details

This section outlines the amount owed for the work completed or services rendered. It should clearly state the total sum, any applicable taxes (e.g., GST), and any additional charges such as late fees or discounts for early payment. Having a clear breakdown helps prevent confusion and ensures that both parties are aligned on the expected payment amount.

Additional elements such as service descriptions, dates, and payment terms should also be clearly defined. This helps establish the scope of the work, the timeline, and the payment schedule, which all contribute to the efficiency of the transaction.

How to Create a Billing Document

Creating a clear and professional billing document is essential for ensuring timely payments and maintaining good client relationships. By following a few simple steps, you can produce a document that includes all necessary details while also reflecting the nature of your work. Whether you’re handling one-time jobs or ongoing projects, an organized record will help streamline your financial processes and reduce the chance of misunderstandings.

Step 1: Include Essential Information

Start by ensuring that the document contains all the critical elements, such as your contact information, your client’s details, and a brief description of the services rendered. It’s also important to specify the payment amount, any taxes (e.g., GST), and the payment terms. A well-organized document helps establish transparency and sets clear expectations for both parties involved.

Step 2: Format the Document Clearly

Once all necessary details are gathered, arrange them in a simple and easy-to-read layout. A table format is often the best choice to present the information clearly, allowing the reader to quickly locate the key points like the service description, payment due date, and total amount. Make sure the document is free of unnecessary clutter and focused on the essential details.

| Item Description | Amount |

|---|---|

| Service 1 Description | $200.00 |

| Service 2 Description | $150.00 |

| Total | $350.00 |

Step 3: Be sure to include the payment terms, such as the due date, any late fees, or early payment discounts. A professional and comprehensive billing document helps ensure that both parties are on the same page, reducing the chances of delays or disputes.

Importance of Accurate Billing in NZ

In New Zealand, accurate financial documentation is crucial for businesses and freelancers to ensure smooth transactions, maintain legal compliance, and build trust with clients. Properly recorded financial details not only help in securing timely payments but also contribute to the overall efficiency of business operations. An error-free record can prevent disputes, facilitate tax reporting, and ensure that all legal obligations are met, particularly concerning Goods and Services Tax (GST) and other regulatory requirements.

Preventing Payment Delays

When billing details are clear and precise, it reduces the likelihood of payment delays. Clients are more likely to process payments quickly if the amount due, the services provided, and payment terms are well-defined. Errors, such as incorrect totals or missing information, may lead to confusion, causing clients to hesitate or even dispute the charges. This can significantly delay cash flow, which may negatively affect your business operations.

Maintaining Legal Compliance

In New Zealand, accurate financial records are vital to ensure that businesses comply with tax laws, including proper GST reporting. If your documents are incomplete or incorrectly formatted, it can result in non-compliance with the Inland Revenue Department (IRD) regulations. This can lead to penalties or fines, which can be easily avoided by keeping well-organized, accurate records that include all required tax details.

Professionalism is another key factor. Consistently accurate documentation portrays a professional image to clients, helping to establish trust and credibility. When you provide clear, correct records, clients are more likely to return for future business and recommend your services to others.

Common Mistakes to Avoid in Billing Documents

When preparing billing records, it’s essential to avoid certain common mistakes that can lead to confusion, delays, or even financial loss. Small errors, such as missing details or incorrect calculations, can significantly impact the payment process and harm your professional reputation. By understanding these pitfalls and taking steps to prevent them, you can ensure that your financial documents are clear, accurate, and compliant with local regulations.

Below are some frequent errors that should be avoided when creating payment documents:

| Mistake | Impact |

|---|---|

| Missing Contact Information | Clients may struggle to reach you with questions or payment issues, leading to delays in payment processing. |

| Incorrect Calculations | Errors in totals or tax calculations can cause confusion and may result in disputes or delays. |

| Vague Descriptions of Services | Unclear or missing details about the work performed can cause misunderstandings, leading to payment delays or disputes. |

| Not Including Payment Terms | Lack of clear payment deadlines or late fees can cause confusion and lead to delayed payments or non-payment. |

| Omitting GST or Tax Information | Failure to properly account for GST can result in tax issues and potential penalties with the Inland Revenue Department. |

Attention to detail is crucial when preparing financial records. By avoiding these common mistakes, you can ensure that your documents are both professional and legally sound, leading to smoother transactions and better client relationships.

Legal Requirements for Billing Documents in NZ

In New Zealand, businesses must adhere to specific legal requirements when preparing payment records. These regulations ensure that documents are compliant with local tax laws, such as those concerning Goods and Services Tax (GST), and help maintain transparency in financial transactions. It’s important for service providers to understand these legal obligations to avoid penalties or disputes with clients and the Inland Revenue Department (IRD).

1. GST and Tax Registration

If your business is registered for GST, it’s crucial to include your GST number on all financial documents. The document must clearly show whether GST is applied to the payment, as well as the total amount, including tax. Failure to accurately reflect tax details can lead to serious consequences, such as fines or the inability to claim back GST from the IRD.

2. Mandatory Information to Include

New Zealand law mandates that certain details must be included in payment documents. These include:

- Your business name, address, and contact details

- Your client’s name and contact information

- A clear description of the services provided

- The date the service was completed

- The total amount payable, including GST (if applicable)

- Payment terms, such as due date and any late fees or discounts

- Your GST registration number (if applicable)

Failure to include any of these elements may result in legal complications, particularly if the transaction is subject to tax audits or disputes. To ensure compliance, regularly review your records to make sure that all necessary details are included and formatted correctly.

Benefits of Customizing Your Billing Document

Customizing your financial records can provide a range of benefits, from enhancing professionalism to improving clarity and efficiency in your payment processes. By tailoring your documents to reflect your specific business needs and brand identity, you can make the payment experience smoother for both you and your clients. A personalized approach not only helps ensure that all necessary details are included but also boosts your credibility and makes your records stand out.

1. Enhanced Professionalism

By personalizing your billing documents, you present a more polished and professional image to clients. Custom branding, such as your company logo and contact details, adds a level of professionalism that can make a positive impression, fostering trust and encouraging timely payments.

2. Clear and Accurate Information

Customizing allows you to structure your documents in a way that clearly communicates all the essential details. Whether it’s breaking down payment terms, outlining service descriptions, or specifying taxes, a tailored layout ensures that everything is presented in a straightforward and easily understandable format. This reduces the risk of confusion or disputes over payment terms.

| Customizable Elements | Benefit |

|---|---|

| Business Branding | Helps establish a professional image and brand consistency across documents. |

| Detailed Service Breakdown | Improves clarity and ensures all services are well-documented, reducing misunderstandings. |

| Payment Terms | Clear terms prevent payment delays and help establish expectations for clients. |

| Tax Information | Ensures compliance with local tax laws and reduces the chance of audit issues. |

Customization also allows you to adapt documents for different clients, projects, or services, making it easier to manage various billing situations and ensure that all necessary details are always included. This flexibility can save you time and help prevent errors in the long run.

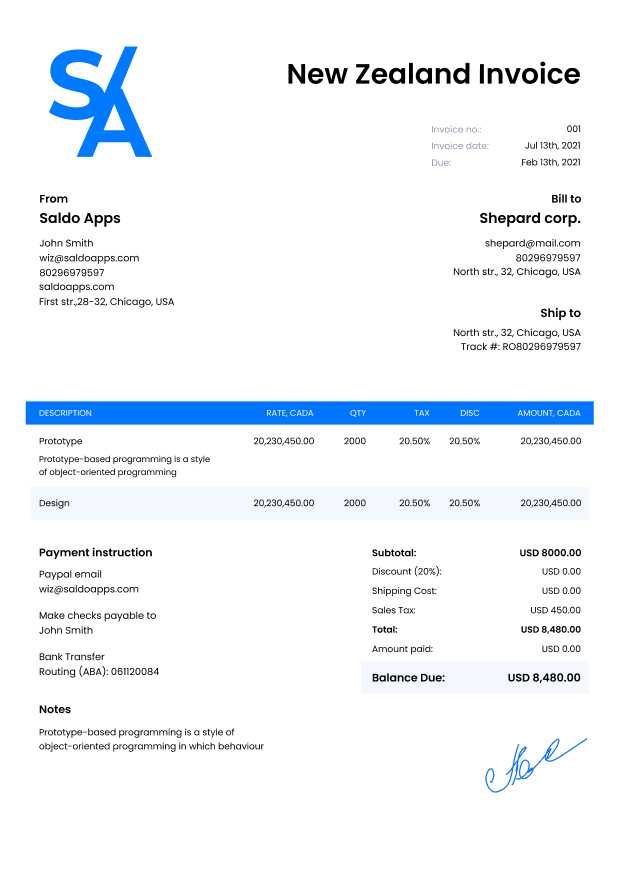

How to Include GST on Your Billing Document

When conducting business in New Zealand, including Goods and Services Tax (GST) in your payment records is essential if your business is registered for GST. This tax must be clearly stated on each financial record to ensure compliance with New Zealand tax laws. By properly reflecting GST, you make it easier for clients to understand the total amount due and for your business to maintain accurate financial documentation.

To properly include GST in your billing documents, follow these steps:

1. Confirm GST Registration

Before including GST in your financial records, make sure that your business is registered with the Inland Revenue Department (IRD) for GST. If you’re registered, you are required to charge GST on most goods and services you provide, unless an exemption applies.

2. Add GST to the Total Amount

Once you confirm your GST registration, include the tax on the amount owed. This should be calculated separately from the base amount to ensure clarity for the client. The total amount should reflect the base cost plus the GST percentage (currently 15% in New Zealand).

| Item Description | Amount (Excl. GST) | GST (15%) | Total (Incl. GST) |

|---|---|---|---|

| Service A | $100.00 | $15.00 | $115.00 |

| Service B | $200.00 | $30.00 | $230.00 |

| Total | $300.00 | $45.00 | $345.00 |

Clearly indicating GST ensures that both you and your clients are on the same page regarding the tax amount. Make sure to list your GST number on the document as well, as required by the IRD, to confirm that the tax is being collected properly.

Best Practices for Billing Document Delivery

Delivering payment records to clients in a timely and professional manner is essential for maintaining a smooth workflow and ensuring prompt payment. Proper delivery methods help avoid delays, enhance communication, and reduce the risk of disputes. Whether you send your records digitally or physically, it’s important to follow best practices to ensure that the process is efficient, secure, and clear for both parties involved.

1. Choose the Right Delivery Method

Depending on the client’s preference and the nature of the transaction, you should select the most appropriate method of delivery. Email is often the fastest and most convenient way to send documents, especially for regular transactions. However, for larger or more formal transactions, you might opt for physical delivery or use secure online platforms that offer encrypted sending for sensitive information.

2. Ensure Clear Communication

When sending your records, make sure the recipient knows exactly what to expect. Include a clear subject line and a brief message explaining the contents of the document. This helps the recipient know what to look for and can make the payment process smoother. You may also want to follow up if payment is not received by the agreed-upon date.

| Delivery Method | Pros | Cons |

|---|---|---|

| Fast, convenient, and easy to track | Risk of lost or overlooked emails | |

| Postal Mail | Good for formal or larger transactions | Slower delivery and risk of delays |

| Online Payment Platforms | Secure, convenient for both parties | May require client to have an account or platform setup |

Follow-up is crucial when using email or digital platforms. Sending a reminder after a certain period, especially if the payment has not been processed, helps ensure that your payment records are noticed and acted upon promptly.

Payment Terms to Include in Your Billing Document

Clearly outlined payment terms are essential for avoiding misunderstandings and ensuring timely compensation for services rendered. Including detailed terms helps set expectations between you and your clients, ensuring both parties are aware of deadlines, payment methods, and any additional conditions. By being transparent about payment procedures, you make it easier to maintain positive business relationships and secure prompt payments.

1. Payment Due Date

One of the most critical aspects of payment terms is specifying when the payment is due. Clearly state the due date, whether it is immediately upon receipt, within 30 days, or another agreed-upon timeframe. This sets clear expectations for your client and encourages them to settle the balance on time.

2. Late Payment Fees

To encourage timely payments, it’s wise to include a late payment fee or interest rate for overdue balances. This serves as a reminder to clients of the importance of meeting deadlines and can help compensate for the inconvenience caused by delayed payments.

3. Accepted Payment Methods

Specify the methods by which you accept payments. Whether you prefer bank transfers, credit card payments, or online payment systems, be sure to list all accepted methods so clients know how they can settle the balance. This helps streamline the payment process and avoid any confusion.

4. Early Payment Discounts

To incentivize quicker payments, some businesses offer early payment discounts. If you decide to implement this, clearly outline the percentage discount and the timeframe within which the discount applies. This provides clients with a financial incentive to pay early, benefiting both parties.

- Payment Due Date: E.g., “Due within 30 days of receipt.”

- Late Payment Fee: E.g., “A late fee of 2% will be charged for each month payment is overdue.”

- Accepted Payment Methods: E.g., “We accept payments via bank transfer, PayPal, or credit card.”

- Early Payment Discount: E.g., “A 5% discount will apply if payment is received within 10 days.”

Clear payment terms not only help avoid delays and disputes but also contribute to the overall professionalism of your business. By outlining your expectations and being upfront about payment procedures, you help ensure that both you and your clients are on the same page, leading to a smoother transaction process.

How to Track Unpaid Billing Documents

Effectively tracking outstanding payments is essential for maintaining healthy cash flow and ensuring that your business operations run smoothly. By monitoring unpaid balances, you can stay on top of which clients owe you money and follow up promptly when necessary. This proactive approach helps prevent overdue payments from becoming a financial burden and ensures that you are compensated fairly for your services.

1. Maintain a Detailed Record

To keep track of unpaid balances, it’s crucial to maintain a detailed record of all billing documents sent to clients. This can be done using accounting software or a simple spreadsheet. Be sure to include essential details such as the issue date, due date, and total amount due, as well as the client’s contact information and payment status.

2. Set Up Payment Reminders

Automated reminders can be a helpful tool in ensuring that clients are aware of upcoming or overdue payments. Set up reminders for both upcoming due dates and late payments. This allows you to follow up with clients without having to manually track each account, saving time and reducing the chances of missing a payment.

3. Create a Follow-Up System

If payments are not received by the due date, having a follow-up system in place is essential. Contact clients regularly to remind them of overdue payments and provide any necessary details to resolve the issue. Keep track of all communication and document each follow-up attempt.

| Client Name | Amount Due | Due Date | Follow-Up Date | Status |

|---|---|---|---|---|

| Client A | $500.00 | 2024-10-15 | 2024-10-22 | Unpaid |

| Client B | $150.00 | 2024-10-05 | 2024-10-12 | Paid |

| Client C | $250.00 | 2024-10-20 | 2024-10-27 | Unpaid |

Consistent tracking ensures that you don’t lose track of any outstanding payments and allows you to take timely action if necessary. Whether you choose manual or automated tracking methods, the key is to stay organized and proactive to avoid any negative impact on your cash flow.

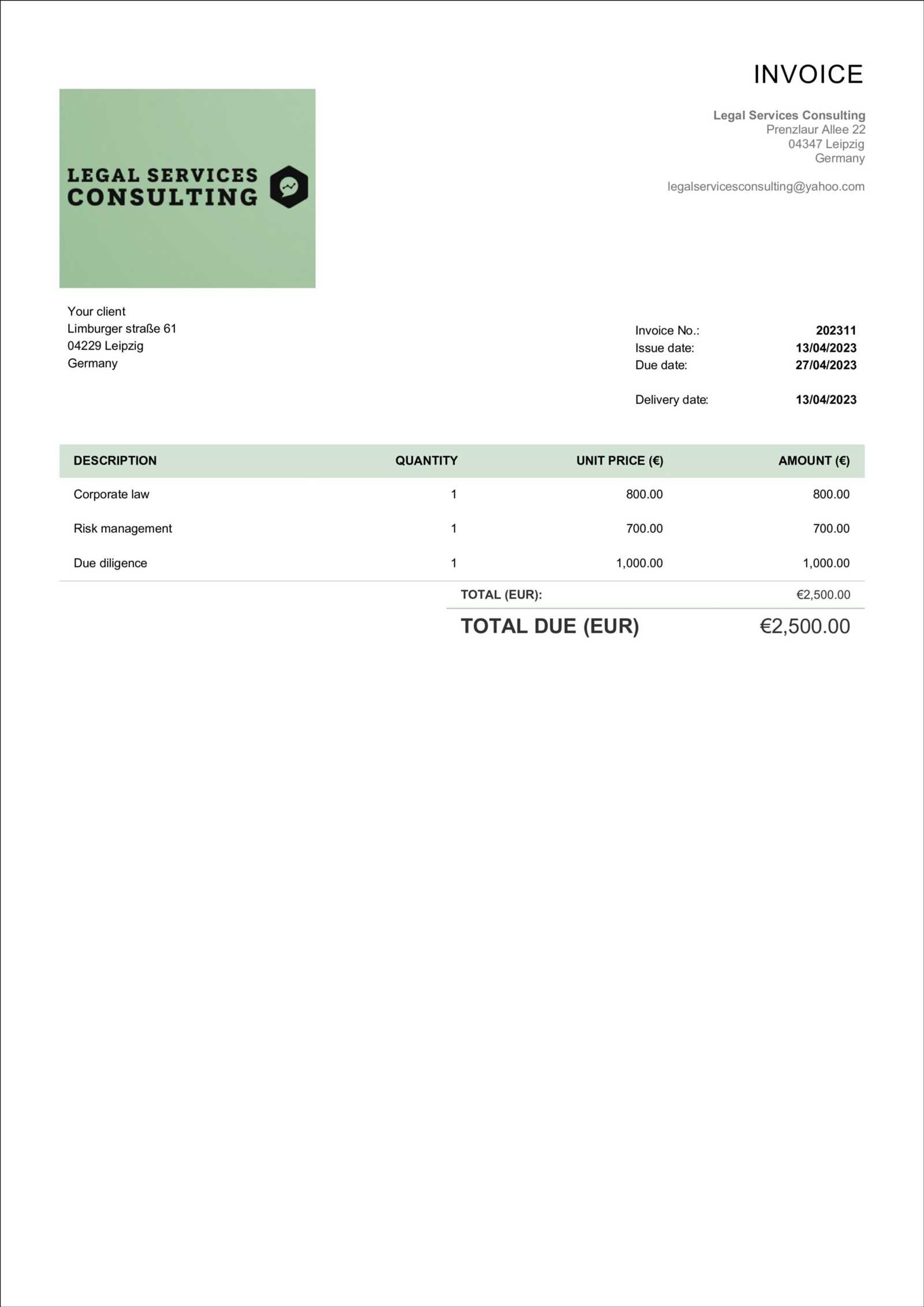

Free Billing Document Templates in NZ

In New Zealand, many businesses, particularly small enterprises and freelancers, benefit from using free billing record formats. These documents can be easily customized to suit different services and client needs, helping you create professional, clear records without the need for expensive software or design tools. By utilizing free templates, you can save time and ensure that all necessary details are included for smooth transactions.

Here are some advantages of using free billing record formats:

- Cost-Effective: Free templates eliminate the need to purchase software or hire professional designers, making it an affordable solution for all businesses.

- Time-Saving: Ready-made formats allow you to quickly generate payment documents, speeding up your workflow.

- Professional Appearance: Many free templates are designed to look professional and can be easily personalized with your business details, logo, and branding.

- Easy Customization: Templates can be tailored to fit the unique needs of your business, such as adjusting tax rates, payment terms, and itemized service descriptions.

Where to Find Free Billing Document Formats in NZ

Several platforms offer free billing document templates that comply with New Zealand’s legal and tax requirements. Here are a few places to explore:

- Online Accounting Software Providers: Many accounting platforms like Xero and MYOB offer free downloadable templates for creating billing records.

- Government Websites: The New Zealand Inland Revenue Department (IRD) provides resources that can help you create compliant records, including free sample formats.

- Business Websites and Blogs: Various small business resources and blogs offer free templates that are ready to use and often include tips on filling them out correctly.

Using these free resources ensures that you create payment documents that meet legal and tax standards, while also helping you maintain consistency and professionalism in your business communications.

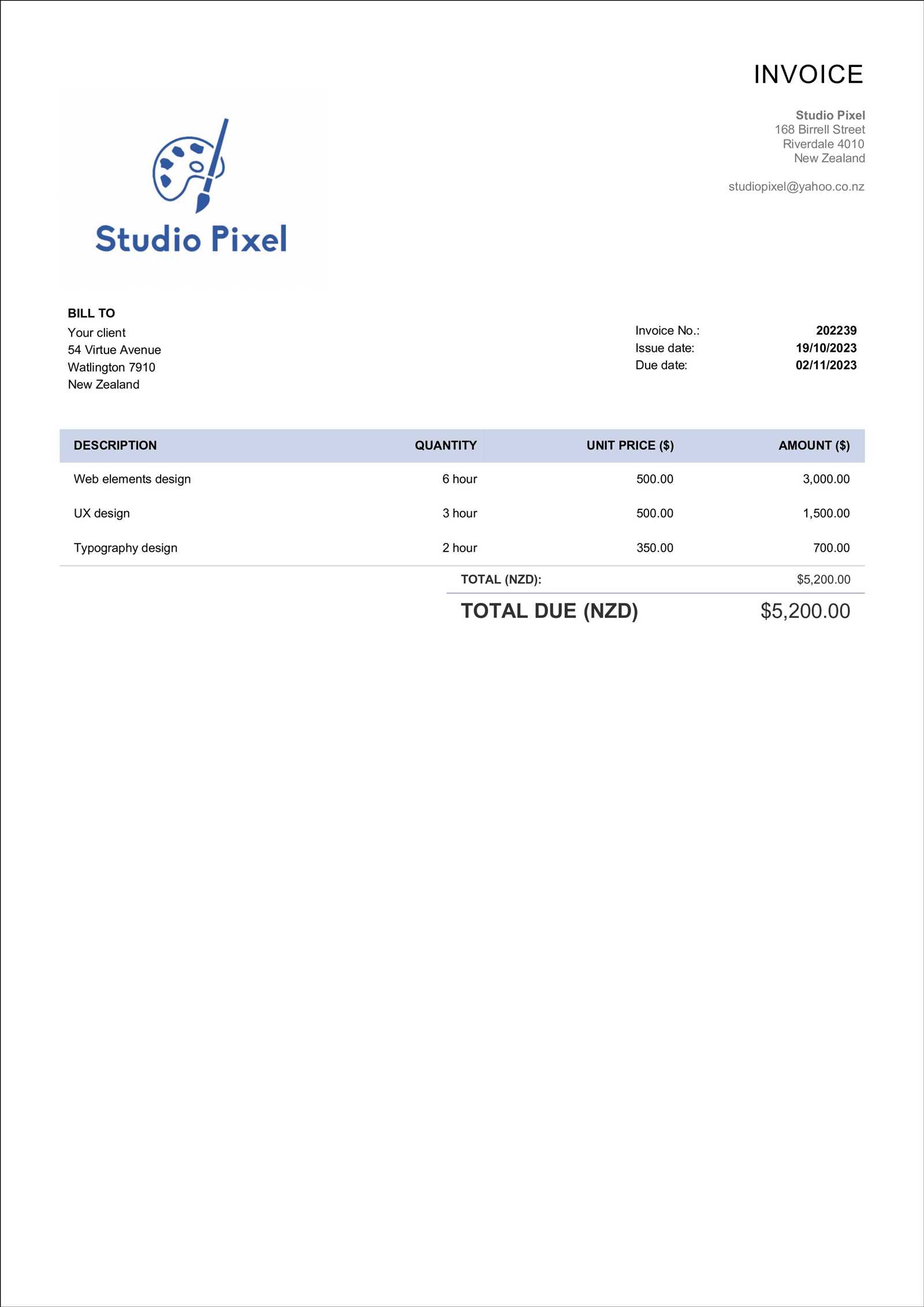

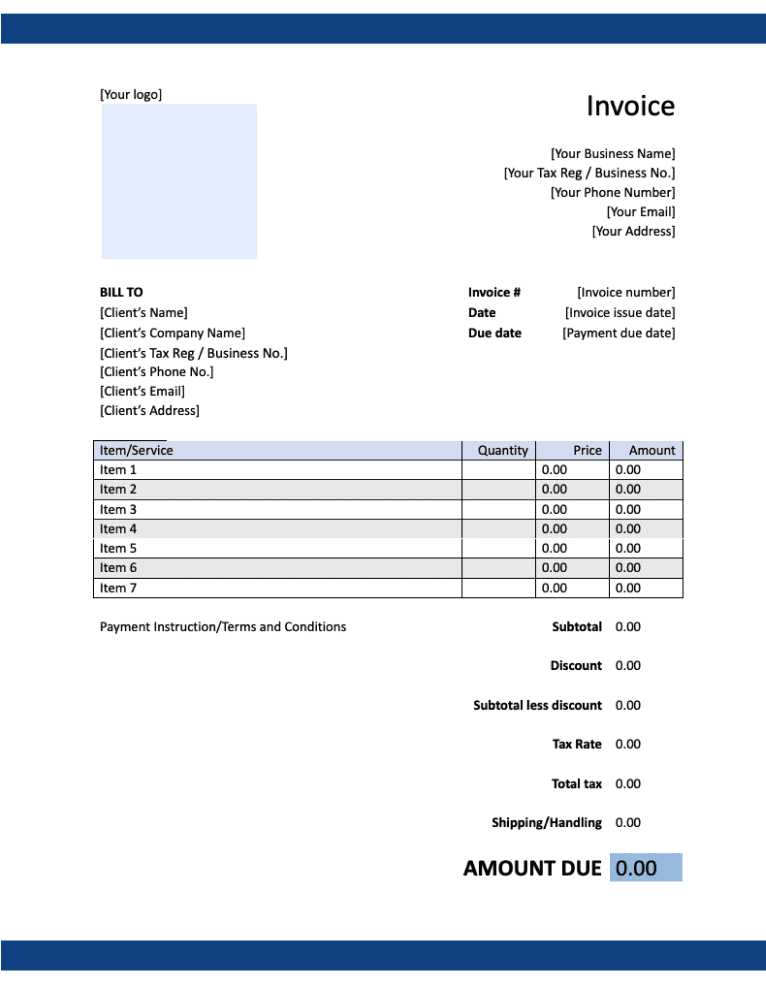

How to Choose the Right Billing Document Format

Selecting the right billing document format is essential to ensuring clear communication with your clients and maintaining professional standards. A well-designed format not only makes the payment process easier but also reflects positively on your business. It’s important to consider several factors before choosing a format that suits your needs, including the complexity of your services, the size of your business, and your client preferences.

1. Assess Your Business Needs

Start by considering the nature of your business and the type of services you provide. If you offer simple, one-off services, a basic document format with minimal details might be sufficient. On the other hand, if you provide complex or ongoing services, you may need a more detailed format that includes breakdowns of hours worked, itemized services, and multiple payment options.

2. Consider Client Expectations

Different clients may have different expectations when it comes to the format of their billing documents. For example, larger businesses may require more formal, detailed documents, while smaller clients may prefer a simpler, easy-to-read format. Understanding your clients’ preferences and aligning with them can improve your relationships and reduce the chances of disputes over payment.

| Business Type | Document Features Needed |

|---|---|

| Freelancers | Simple, clear format with basic service details and payment terms |

| Small Businesses | Basic format with itemized services, tax information, and payment due date |

| Large Enterprises | Detailed format with project breakdowns, multiple service categories, and payment schedules |

Choosing the right format is a key step in streamlining your business processes and maintaining good client relationships. By tailoring the format to your business needs and client expectations, you ensure that the document is both effective and professional.

Digital Tools for Billing Document Management

In today’s fast-paced business environment, managing payment records efficiently is crucial for maintaining smooth operations and timely payments. Digital tools offer a range of solutions that can automate, organize, and streamline the process of creating, tracking, and storing payment records. These tools help businesses save time, reduce errors, and stay on top of overdue balances without the hassle of manual processes.

1. Accounting Software

Accounting software is one of the most comprehensive tools available for managing all aspects of financial documentation, including payment records. These platforms often include built-in features to generate professional-looking documents, track payments, and integrate with your business bank account for easy reconciliation. Popular accounting software options include Xero, QuickBooks, and MYOB, all of which are widely used in New Zealand.

2. Online Payment Platforms

Online payment systems like PayPal, Stripe, and Square not only allow businesses to collect payments but also provide tools for managing payment records. These platforms often offer the ability to create payment requests, track transactions, and generate reports on unpaid or overdue amounts. They are especially useful for businesses that rely on digital payments or international clients.

Digital tools can significantly reduce the time and effort required to manage your financial documentation. By automating processes and centralizing your records in one place, these tools help you maintain a professional and organized approach to billing, allowing you to focus on growing your business.

Integrating Billing Documents with Accounting Software

Integrating payment records with accounting software can significantly streamline your financial management processes. By syncing your documents with an accounting system, you can automate tasks such as tracking payments, generating reports, and reconciling bank transactions. This integration helps reduce errors, saves time, and ensures that your financial data is always up to date.

Many accounting platforms, such as Xero, QuickBooks, and MYOB, offer seamless integration with billing document creation tools. This allows you to generate accurate payment requests directly from the software and automatically update your records once payments are made. Furthermore, having a centralized system ensures that all your financial information is stored securely and can be easily accessed for tax filing or financial analysis.

Benefits of Integration:

- Automation: Automatically syncs payments and updates your records, eliminating the need for manual data entry.

- Accuracy: Reduces the risk of errors, ensuring that your records are always correct and up-to-date.

- Time-Saving: Streamlines processes like payment tracking, reconciliation, and reporting.

- Efficiency: Centralizes all your financial data in one system, making it easier to manage and review.

By integrating your billing documents with accounting software, you create a more efficient, accurate, and organized workflow, allowing you to focus on growing your business and serving your clients.

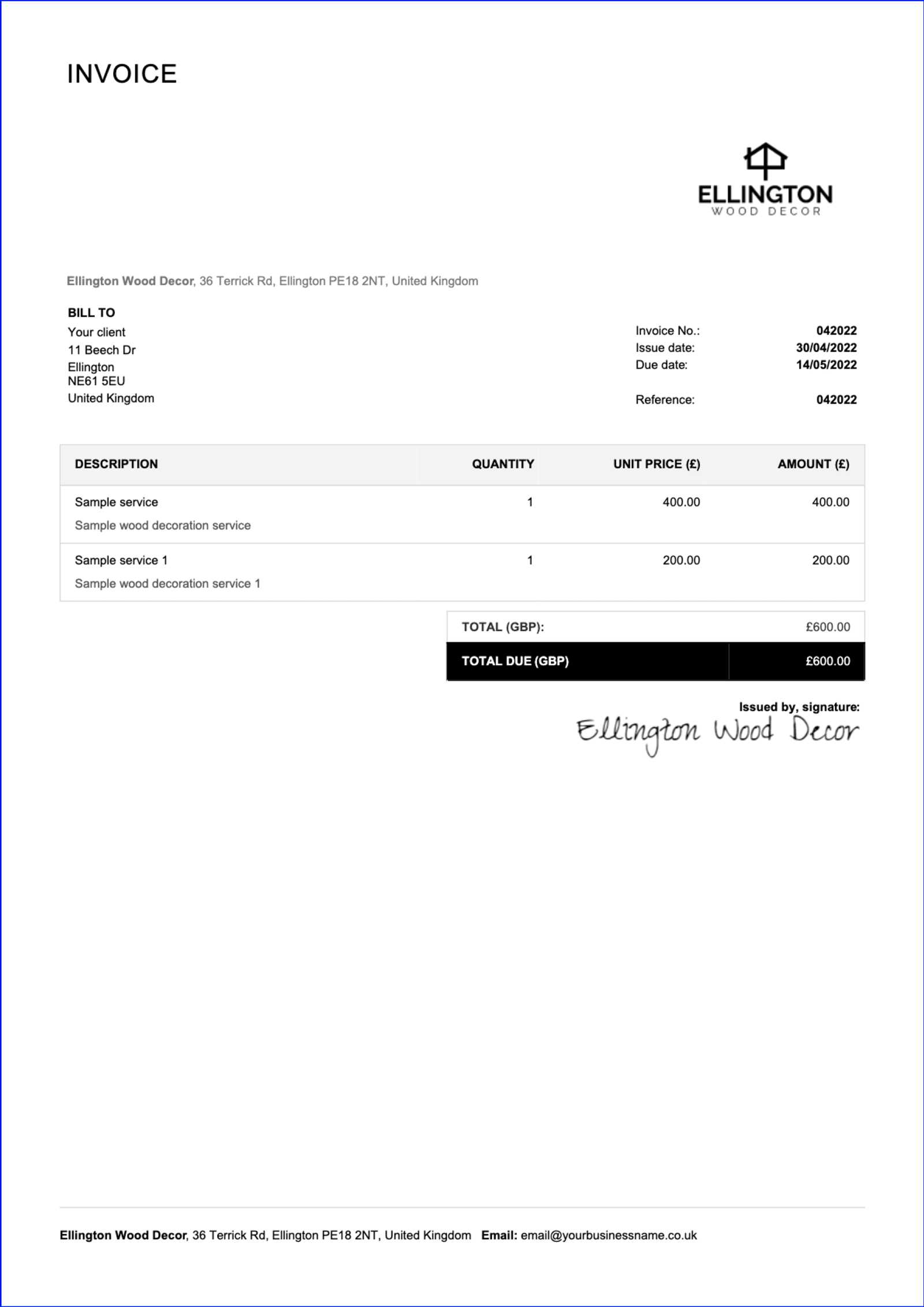

How to Maintain Professionalism with Billing Documents

Maintaining professionalism in your billing practices is essential for building trust with clients and ensuring timely payments. A well-structured and clear document not only helps your clients understand what they are paying for, but also reflects positively on your business. By adhering to best practices and paying attention to detail, you can create documents that convey professionalism and instill confidence in your clients.

1. Use Clear and Organized Layouts

One of the easiest ways to maintain professionalism is by ensuring that your billing records are easy to read and well-organized. Include all the necessary details such as service descriptions, payment terms, and due dates in a clear, logical layout. Avoid clutter and ensure that the document is visually appealing with consistent fonts and formatting.

2. Include All Relevant Information

Always ensure that the document contains all required details, such as your business name, contact information, and relevant tax details. Incomplete or missing information can create confusion and may delay payments. Be sure to include:

- Client’s name and address

- Description of services provided

- Payment terms and due date

- Applicable tax rates and amounts

- Payment methods and instructions

3. Be Timely and Consistent

Sending your documents promptly and on a regular schedule helps establish your reliability. Avoid delays, as timely billing encourages timely payments. Regularly issuing professional billing records shows your clients that you are organized and value their business.

4. Double-Check for Accuracy

Before sending a payment request, always double-check for any errors in service details, pricing, and calculations. Accuracy not only prevents confusion but also reinforces the perception that your business is thorough and professional.

By following these practices, you ensure that your payment records are not just a means of requesting funds, but an important part of maintaining strong client relationships and enhancing your business reputation.