How to Use a Honeybook Invoice Template for Easy Professional Billing

Managing payments and ensuring smooth financial transactions is a key aspect of running any business. With the right tools, you can simplify these tasks, minimize errors, and save valuable time. Whether you’re a freelancer, small business owner, or contractor, using the right billing system can make a significant difference in how you handle client accounts.

Many professionals turn to customizable solutions that allow for easy creation, tracking, and sending of financial documents. These platforms offer flexibility and automation, allowing you to tailor each document to meet the specific needs of your clients while maintaining a professional appearance. By integrating payment options and tracking features, such systems help you stay organized and reduce the stress of manual billing.

In this guide, we’ll explore how to take advantage of such systems to optimize your invoicing process. From personalization to automation, you’ll learn how to create seamless financial documents that not only reflect your business’s professionalism but also contribute to a more efficient workflow.

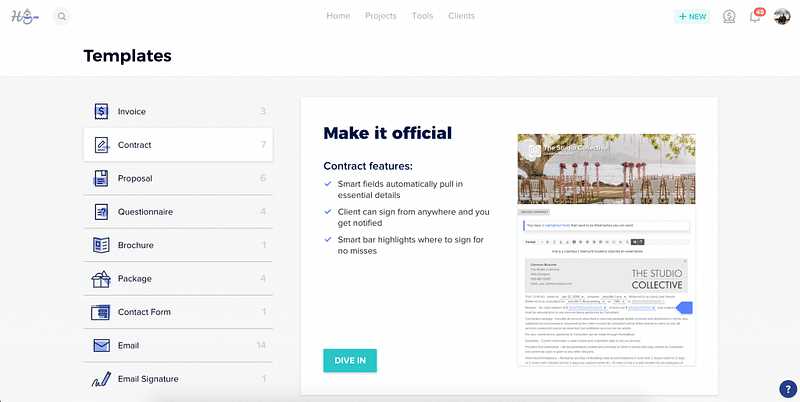

Honeybook Invoice Template Overview

When it comes to managing your business finances, the ability to quickly create professional documents is essential. With the right digital tools, you can generate customized billing forms that streamline the process and enhance your client relationships. These solutions not only offer customization but also help you stay organized and ensure timely payments.

The platform allows you to create tailored financial documents that are both efficient and professional. By using a simple yet powerful system, you can easily generate and send documents to clients without needing complex software. Key features include automation, customization options, and the ability to integrate payment methods directly into the forms.

- Customization: Personalize each document with your branding, logo, and specific client details.

- Automation: Set up recurring billing cycles and automate reminders to ensure payments are on time.

- Easy Tracking: Track the status of payments and send reminders or updates to clients when necessary.

- Integration: Connect payment gateways to allow clients to pay directly from the financial document.

- Professional Design: Choose from a variety of pre-designed layouts that reflect your business’s professionalism.

By using such a system, you’ll not only save time but also improve the consistency and accuracy of your financial documentation. This streamlined approach allows you to focus on your work while ensuring your business’s financial health remains in order.

Why Choose Honeybook for Invoices

In today’s fast-paced business environment, having an efficient and reliable tool to handle your financial documentation is crucial. Many professionals are turning to specialized platforms that offer integrated solutions for managing client transactions, simplifying the process, and ensuring accuracy. These systems offer a wide range of features that can streamline your administrative tasks and enhance your workflow.

Key Advantages of Using This Platform

There are several reasons why this solution stands out when it comes to generating and managing client billing forms:

- Ease of Use: The platform is user-friendly, allowing you to create and manage documents without the need for technical expertise.

- Customizable Options: Tailor each form to suit your business’s specific needs and maintain a professional appearance with minimal effort.

- Automated Features: Set up recurring billing, reminders, and follow-ups to save time and reduce manual effort.

- Integrated Payments: Accept payments directly through the system, making it easier for clients to settle their accounts quickly.

- Time-saving: Automate invoicing and payment tracking, freeing up time for you to focus on your business’s growth.

Streamlined Client Communication

In addition to simplifying the document creation process, the platform enables seamless communication with clients. Automated reminders ensure that you never miss a payment, while customizable messages allow you to maintain a personalized approach. This level of efficiency helps build trust with clients, as they will appreciate the smooth transaction process.

Customizing Your Honeybook Invoice Template

Tailoring your financial documents to match your business’s unique style and needs is a key part of maintaining professionalism and efficiency. Customization allows you to reflect your brand’s identity, while also making the process of creating and sending documents faster and more efficient. Whether it’s adjusting the layout, adding personalized details, or incorporating specific terms, having the ability to modify your forms enhances both client interaction and overall workflow.

With the right platform, you can easily make changes to various aspects of your financial documents. From logos and color schemes to the structure and content of the forms, every detail can be adjusted to meet your preferences. This level of flexibility ensures that each document is as unique as your business.

- Branding: Add your business logo, choose your preferred colors, and include branding elements to create a consistent experience across all client interactions.

- Content Customization: Edit the text fields to include your specific payment terms, services provided, and other details that reflect the nature of your business.

- Layout Adjustments: Rearrange sections, add or remove fields, and change font styles to improve readability and suit your professional image.

- Payment Options: Integrate payment gateways directly into the document, making it easy for clients to pay right from the form.

By customizing your financial documents, you ensure consistency and professionalism, while also reducing the time spent on manual entry. This customization ultimately leads to a more streamlined and productive billing process, benefiting both you and your clients.

Steps to Create an Invoice in Honeybook

Creating a professional financial document doesn’t have to be time-consuming or complex. By following a few simple steps, you can easily generate accurate and customized records for your clients. This process allows you to maintain a smooth cash flow and ensures that your clients receive clear, well-organized billing information.

Here’s a step-by-step guide to help you create your own custom billing forms with ease:

- Log into Your Account: Access your account and navigate to the section where you can manage financial documents.

- Select a New Document: Choose the option to create a new financial form. You’ll typically find a selection of pre-designed formats that you can modify.

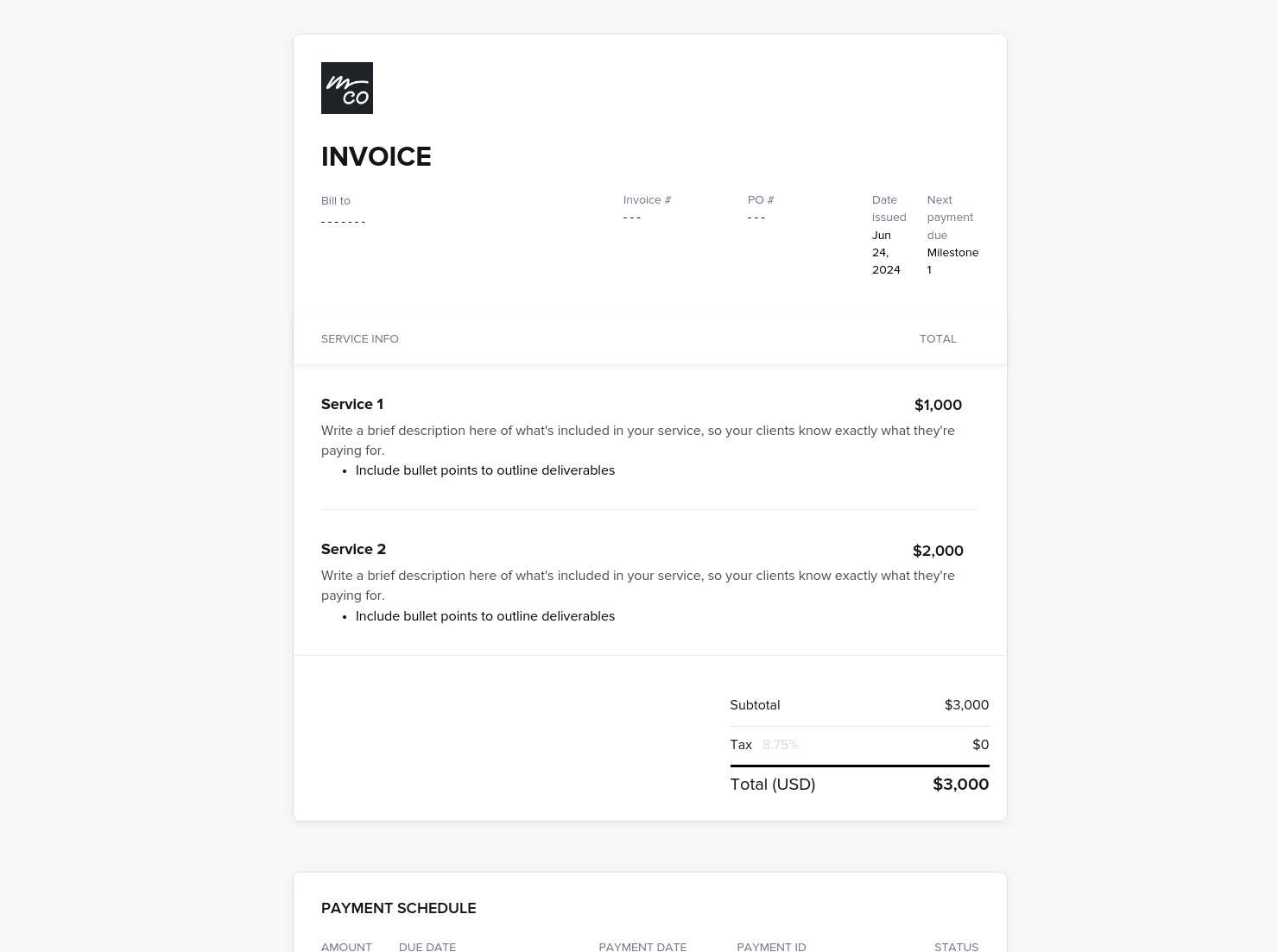

- Enter Client Information: Fill in the client’s name, address, and other relevant details, ensuring that everything is accurate and up to date.

- List Services or Products: Clearly itemize the services or products provided, including pricing, quantity, and any applicable discounts or taxes.

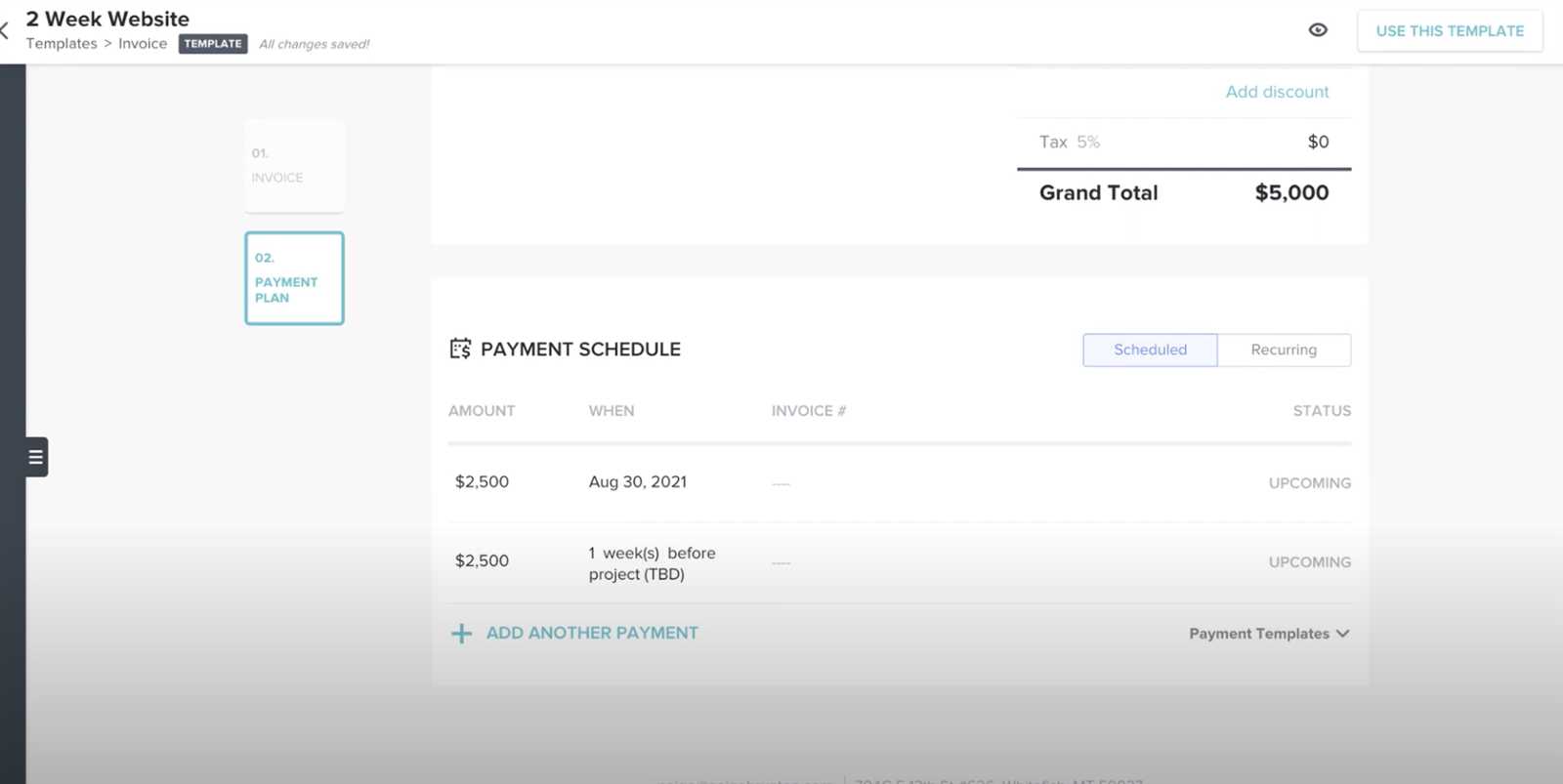

- Set Payment Terms: Define the payment due date, and include any terms or conditions related to late fees, deposits, or payment schedules.

- Review and Edit: Double-check all information, ensuring that the document is clear, professional, and error-free.

- Send to Client: Once everything looks good, send the document to your client via email or another preferred method, along with any instructions for payment.

By following these straightforward steps, you can efficiently create customized financial documents that reflect your business’s professionalism and make the billing process easier for both you and your clients.

Benefits of Using Honeybook for Billing

Using an all-in-one platform for managing your client payments can significantly improve your workflow and overall efficiency. With the right tools, you can automate tedious tasks, ensure accuracy, and stay organized–all while maintaining a professional appearance. A seamless solution for managing financial records can help you focus more on growing your business and less on the complexities of manual paperwork.

Key Advantages of an Integrated Billing System

- Time Savings: Automating repetitive tasks such as sending reminders or generating new records can save hours of manual work, allowing you to focus on more important tasks.

- Customization: Tailor each document to meet your clients’ specific needs, reflecting your branding and making sure each transaction aligns with your business’s standards.

- Professional Appearance: With professionally designed formats, you can create polished and clear documents that leave a lasting impression on your clients.

- Accuracy: Automated calculations and error-checking ensure that every detail is correct, reducing the likelihood of mistakes that could impact your cash flow.

- Real-Time Tracking: Easily monitor the status of payments, track outstanding balances, and keep an eye on overdue amounts, ensuring you never miss a payment.

- Easy Integration: With built-in payment gateways, clients can pay directly from the document, speeding up the payment process and reducing administrative overhead.

Improved Client Relationships

In addition to streamlining your billing processes, using an integrated platform helps foster trust with your clients. By offering an easy, efficient, and transparent way for clients to view and pay for your services, you enhance their experience, contributing to stronger, long-term professional relationships.

Integrating Payments with Honeybook Invoices

One of the most powerful features of a comprehensive billing system is the ability to accept payments directly through your financial documents. By integrating payment gateways into your records, you simplify the process for both you and your clients. This seamless connection reduces friction, speeds up transactions, and improves cash flow management.

Setting up payment processing with your documents can be done in just a few easy steps. Once integrated, clients can easily pay their balances online, giving them a more convenient way to settle their accounts. Below are some key benefits of integrating payments with your billing system:

- Faster Payments: Clients can make payments instantly by simply clicking a link within the financial document, speeding up the entire transaction process.

- Multiple Payment Methods: Accept a wide range of payment options, such as credit cards, debit cards, and online wallets, making it easy for clients to pay in their preferred method.

- Automatic Payment Tracking: Payment status is automatically updated, helping you track whether a client has paid, is overdue, or has made partial payments without manual input.

- Secure Transactions: Payment gateways ensure that all transactions are secure, giving clients confidence in making online payments.

- Convenient Reminders: Automatically send reminders or follow-up notifications when payments are due, ensuring timely collections.

- Reduced Administrative Work: With automatic payment processing, you eliminate the need to manually enter payment details or chase clients for payments, saving time and reducing errors.

Integrating payment options directly into your financial documents not only improves efficiency but also creates a more professional experience for your clients. By offering a fast, secure, and seamless payment process, you build trust and streamline your revenue collection process.

Saving Time with Honeybook Templates

Time is a valuable resource, and finding ways to streamline routine tasks can have a significant impact on your overall productivity. Using pre-built and customizable tools to manage your business documents allows you to complete repetitive tasks quickly and with minimal effort. These systems help eliminate the need to create documents from scratch, saving you time and reducing the risk of errors.

By utilizing ready-made structures, you can focus more on your core work and less on administrative duties. Whether it’s generating client records, tracking payments, or sending reminders, automating these tasks can free up hours each week. Here are some ways you can save time with a system that offers customizable business forms:

- Pre-set Formats: Access a variety of pre-designed layouts that are ready to use, requiring only minimal adjustments to suit your specific needs.

- Automated Calculations: Automatic total and tax calculations reduce manual data entry and ensure accurate figures with every document.

- Quick Client Information Import: Automatically pull client details from your database, eliminating the need to manually enter contact information for each new document.

- Recurring Documents: Set up recurring documents for long-term projects or regular services, so you don’t need to manually recreate forms every time.

- Bulk Actions: Send multiple documents or reminders at once, making it easier to manage multiple clients simultaneously without extra effort.

By integrating these features into your workflow, you can cut down on administrative time and spend more energy on the tasks that matter most to your business’s success. Automation and ease of use turn complex processes into simple tasks, improving both efficiency and consistency.

How to Track Payments in Honeybook

Keeping track of client payments is essential for maintaining cash flow and ensuring that your business remains financially healthy. By using an integrated system, you can easily monitor when payments are made, which are still pending, and which are overdue. This makes it much easier to follow up with clients, manage accounts, and stay on top of your finances without having to manually track every transaction.

Many platforms offer built-in features for tracking payment statuses, automatically updating your records in real-time as clients make payments. Below are the steps and benefits of tracking payments with an automated system:

- Real-Time Updates: When a payment is made, your system instantly updates the status of the corresponding document, so you always know if it’s been settled or not.

- Payment Reminders: Set up automatic reminders for overdue payments, helping you stay on top of collections without having to send manual follow-ups.

- Client Payment History: Easily access the payment history for each client, allowing you to review past transactions and confirm any pending balances.

- Automatic Notifications: Receive instant notifications when a payment is processed, ensuring that you’re always aware of changes in payment status.

- Payment Reports: Generate detailed reports to analyze payment trends, outstanding amounts, and other financial metrics for better decision-making.

By automating payment tracking, you not only save time but also minimize the chance of errors or missed payments. This helps keep your business organized and ensures that your clients are properly billed for the services they’ve received.

Organizing Client Invoices Efficiently

Efficient organization of client billing records is key to maintaining a smooth workflow and ensuring timely payments. When client documents are scattered or not properly categorized, it can lead to confusion, missed deadlines, and administrative headaches. A well-organized system allows you to quickly find, review, and manage all client financial documents, helping you stay on top of your business’s cash flow.

By implementing a structured approach to managing client records, you can improve both your efficiency and professionalism. Here are some strategies to keep your financial documents organized and easy to access:

- Categorize Documents: Sort documents by client name, project, or payment status to easily locate them when needed. Creating folders or tags can help organize by these categories.

- Use a Centralized System: Store all client records in one platform, where you can quickly access and track each document’s status, such as paid, pending, or overdue.

- Label and Date Properly: Label each document clearly with client details and the date of issue. This way, you’ll always know when the document was created and its relevance.

- Set Up Automated Alerts: Use reminders or automatic notifications for overdue payments to ensure that follow-ups are sent on time without manual tracking.

- Utilize Reporting Features: Regularly generate reports to review outstanding balances, completed transactions, and client payment histories. This helps you spot trends and make informed decisions.

By establishing a method for organizing and tracking your financial documents, you create a streamlined process that not only saves you time but also builds trust with your clients. A well-organized system helps you maintain control of your business finances and reduces the risk of missed payments or confusion.

Design Tips for Professional Invoices

The appearance of your financial documents plays a crucial role in creating a strong, professional impression on your clients. A clean, well-organized layout not only makes it easier for clients to understand the details but also reflects your business’s attention to detail and professionalism. The right design can streamline communication, reduce confusion, and encourage prompt payment.

When designing your documents, consider the following tips to ensure they look polished and meet your business needs:

- Keep it Simple: A cluttered document can overwhelm the client. Focus on essential information and use a clean, easy-to-read layout with plenty of white space.

- Use Your Branding: Incorporate your logo, colors, and font styles to make your documents consistent with your brand identity. This helps reinforce your professionalism and keeps your communications cohesive.

- Organize Information Logically: Structure the document so that the most important information, such as payment amount and due date, is easy to find. Group similar information together to make it user-friendly.

- Highlight Key Details: Use bold text, color, or larger font sizes to emphasize key information like the total amount due or the payment deadline.

- Be Clear and Concise: Use simple language and avoid unnecessary jargon. Ensure that payment instructions and terms are straightforward and easy to understand.

Here’s an example of a well-organized document layout:

| Item | Description | Amount |

|---|---|---|

| Service 1 | Consultation for project X | $500 |

| Service 2 | Design work for project Y | $1,000 |

| Total | $1,500 | |

By following these design tips, you can create a professional document that reflects your business’s commitment to quality and makes the billing process easier for your clients. A well-designed document not only helps with client understanding but also makes a positive impression that can strengthen your business relationships.

Using Honeybook for Recurring Invoices

Managing recurring payments can be time-consuming if handled manually, especially when you have clients on long-term contracts or subscription-based services. Automating the process of generating and sending regular billing documents can save you significant time and reduce the risk of errors. A system that allows you to set up recurring transactions ensures that you can focus on your core business while keeping cash flow consistent.

With the right platform, setting up recurring payments is straightforward and can be done with just a few steps. Here’s how to efficiently manage repetitive billing tasks:

- Set Up Recurring Schedules: Define the frequency of payments, whether they are weekly, monthly, quarterly, or annually. The platform will automatically create and send new documents on the specified dates.

- Automate Client Reminders: Use automated reminders to notify clients before their payment is due. This reduces the chances of overdue payments and keeps clients informed.

- Adjust for Changes: Easily make adjustments to payment amounts, services, or terms as needed. The system allows you to edit recurring records without starting from scratch.

- Track Payment History: Monitor the payment status of all recurring records in one place. This helps you quickly spot any missed payments and follow up when necessary.

- Provide Convenient Payment Options: Integrate online payment gateways directly within the documents, allowing clients to pay with ease, directly from the billing statement.

- Maintain Consistency: Automatically create and send identical records for each billing cycle, ensuring your documents are always professional and error-free.

By automating recurring payments, you can eliminate the hassle of manual tracking and ensure that your billing process runs smoothly. This not only saves time but also provides a seamless experience for your clients, building trust and enhancing client retention.

Managing Taxes with Honeybook Templates

Accurately calculating and applying taxes to your financial documents is crucial for staying compliant with local regulations and ensuring that you are charging your clients the correct amount. A well-designed system allows you to easily manage tax rates and apply them to your records, reducing the chances of errors and simplifying your overall accounting process.

By integrating tax management directly into your billing process, you can save time, ensure accuracy, and stay organized. Below are several ways you can streamline the tax calculation process and manage taxes efficiently:

Setting Up Tax Rates

- Define Tax Rates: Set up various tax rates for different regions or services, allowing the system to automatically apply the correct rate based on the location or product type.

- Use Custom Tax Categories: Categorize taxes by type (sales tax, VAT, service tax, etc.) to ensure that the correct tax is applied based on the specific services you offer.

- Automatic Tax Calculation: Once the tax rates are set, the platform automatically calculates the applicable taxes for each document, removing the need for manual calculations and reducing errors.

Managing Tax Exemptions

- Apply Tax Exemptions: For clients or services that are tax-exempt, easily apply exemptions directly within your system, ensuring that no tax is mistakenly charged.

- Track Exemptions: Keep track of any clients who qualify for tax exemptions and ensure their records reflect this status for future documents.

With these features, you can simplify tax management, making your financial documentation process more efficient and compliant. This not only reduces the administrative burden but also provides clarity to your clients regarding the taxes they are being charged.

Exporting and Sharing Honeybook Invoices

Being able to easily export and share financial documents is essential for smooth client communication and efficient record-keeping. Whether you’re sending a payment request to a client or sharing a report with your accountant, having the flexibility to export documents in various formats and share them securely can save you time and streamline your workflow.

Here are some key benefits and methods for exporting and sharing your business documents:

- Multiple Export Formats: Export your documents as PDFs, Excel files, or other popular formats to ensure compatibility with the software your clients or colleagues use.

- Direct Sharing: Share documents directly via email or through a link, allowing clients to view or download the document at their convenience without the need for attachments.

- Track Sharing Status: Some platforms allow you to monitor when a document has been viewed or downloaded, giving you insight into whether your client has received and reviewed it.

- Maintain Data Security: When sharing documents online, ensure that your system provides secure sharing options, such as password protection or encrypted links, to safeguard sensitive financial information.

For example, once you have finalized a financial document, you might choose to export it and send it to a client. Here’s a sample of a document that could be shared:

| Service | Description | Amount |

|---|---|---|

| Consulting | Consultation on marketing strategy | $400 |

| Design | Website design package | $800 |

| Total | $1,200 | |

By exporting and sharing documents efficiently, you can make sure that your clients receive all necessary information promptly, helping to keep the business relationship transparent and professional.

Honeybook Mobile App for Invoices

Managing your business documents on the go has never been easier. With a mobile app designed for efficient document handling, you can access, create, and send financial records directly from your phone, wherever you are. This level of flexibility ensures that you never miss an opportunity to stay on top of payments and client communications, even when you’re away from your desk.

Key Features of the Mobile App

- Access Anywhere: View and manage all your financial documents and client details from your mobile device, whether you’re in a meeting, traveling, or working remotely.

- Instant Updates: Make real-time updates to your documents and immediately reflect changes across all platforms, ensuring that your records are always up to date.

- Quick Creation: Generate new documents quickly from your phone, saving time by using pre-set data and client details for easy document generation on the fly.

- Send and Track: Email documents or share links directly from the app and track when clients view or pay, so you can follow up promptly and professionally.

- Client Communication: Manage client messages and send reminders, all within the same app, ensuring seamless communication and a professional experience for your clients.

Advantages of Using a Mobile App

- Increased Flexibility: Whether you’re meeting clients, attending events, or traveling, having access to your business documents ensures you stay productive no matter where you are.

- Time Savings: The app’s intuitive design and quick access to templates make creating and sending records faster, allowing you to focus on more important tasks.

- Improved Client Relationships: Immediate access to documents means you can address client inquiries or concerns more promptly, improving overall client satisfaction.

With a mobile app, you gain full control over your business finances and client relationships while staying mobile and efficient. Managing documents from anywhere ensures that your business continues to run smoothly, even when you’re away from your office.

Common Mistakes to Avoid with Invoices

Managing financial records for your business can be a delicate process, and even small mistakes in your billing documents can cause confusion, delays, or even damage client relationships. It’s essential to avoid common errors that can undermine the professionalism and accuracy of your transactions. Here are some of the most frequent mistakes businesses make when handling payment requests and how you can avoid them:

- Incorrect or Missing Payment Details: Always double-check the payment amount, due date, and any applicable taxes or discounts. Missing or inaccurate details can lead to misunderstandings or delayed payments.

- Unclear Payment Instructions: Make sure your payment instructions are clear and simple to follow. Specify the preferred payment methods, account details, and any other relevant information so clients don’t encounter difficulties.

- Failure to Include a Due Date: Not specifying a payment deadline can result in delayed payments. Always include a clear due date to ensure your clients understand when payment is expected.

- Omitting Contact Information: Clients need a way to reach you in case they have questions about their payment. Always include your contact details, including email and phone number, on the document.

- Not Customizing for Each Client: Sending generic, one-size-fits-all documents can lead to confusion or frustration. Personalize your documents to reflect the specific services rendered, the correct client details, and the agreed-upon terms.

- Ignoring Late Payment Fees: If you have terms for late payment penalties, be sure to include them clearly in your documents. Not outlining late fees can result in delayed payments without any recourse.

- Forgetting to Send the Document: Sometimes, businesses create a document but forget to send it. Always ensure that you follow through and confirm that the client has received it in a timely manner.

By avoiding these common mistakes, you ensure that your financial records are clear, professional, and effective. This not only speeds up payment processing but also fosters better relationships with your clients and helps maintain smooth business operations.

Maximizing Honeybook for Small Business Billing

For small businesses, managing payments and client billing efficiently can be a major challenge. Streamlining your financial processes not only saves time but also ensures consistent cash flow and professional client interactions. Leveraging the right platform can help you automate tasks, track transactions, and keep everything organized with minimal effort.

To fully maximize the potential of your billing system, here are several strategies that can help small businesses get the most out of their tools and processes:

- Automate Recurring Payments: Set up recurring billing for subscription-based services or long-term contracts to save time and reduce the risk of missed payments. Automating this process ensures timely transactions without manual effort.

- Use Customizable Templates: Take advantage of pre-designed formats that can be customized to match your branding. Personalize documents for each client with specific services, payment terms, and other details that make the document unique to their needs.

- Track Payment Status: Keep track of which payments have been made and which are still pending. Use automated reminders or notifications to follow up on overdue payments and stay on top of your financial status.

- Offer Multiple Payment Methods: Provide clients with various options to pay, such as credit card, bank transfer, or digital payment systems. The more flexible you are with payment methods, the easier it is for clients to pay promptly.

- Set Clear Payment Terms: Establish clear payment terms, including due dates and late fees. Make sure your clients understand when payments are expected and what penalties may apply if they are late.

- Keep Everything in One Place: Use your platform to consolidate client communication, payments, and billing records in one central location. This eliminates the need to juggle multiple systems and makes it easier to access everything you need for efficient management.

- Stay Organized with Client Information: Store client details, previous transactions, and payment preferences securely in your system. This allows you to quickly retrieve important information whenever necessary.

By incorporating these strategies into your billing workflow, you can simplify your accounting process, reduce administrative overhead, and create a more seamless experience for your clients. Streamlined billing allows you to focus more on growing your business and providing exceptional service, all while maintaining financial stability.