How to Use the Vertex42 Invoice Template for Easy and Professional Invoicing

Managing billing for your business can be a complex task, but using the right tools can simplify the process significantly. With the help of professionally designed documents, you can ensure accurate and timely transactions with clients. These customizable solutions offer a streamlined approach to tracking payments, calculating totals, and maintaining clear records.

One of the most effective ways to enhance your financial management system is through the use of editable spreadsheets, which allow you to tailor invoices to suit your specific needs. Whether you are a freelancer, small business owner, or large enterprise, having an efficient system in place is essential for maintaining a smooth cash flow and minimizing administrative errors.

In this guide, we will explore a powerful resource that can help you create polished and professional billing statements with ease. By leveraging user-friendly formats, you can save time while ensuring that all necessary details are included. With the right approach, managing financial paperwork can be as easy as filling in a few key details and hitting “send.”

Why Choose Vertex42 for Invoices

When it comes to handling financial documents, efficiency and accuracy are key. Using a well-designed solution can save time and reduce the chances of errors, ensuring that every transaction is recorded properly. A reliable and customizable tool for generating billing statements offers an easy way to stay organized while maintaining a professional appearance with minimal effort.

One of the main reasons to opt for this resource is its user-friendly interface, making it accessible for anyone, regardless of their technical skill level. The straightforward structure allows even beginners to create professional-grade documents without needing advanced software or complicated setups. This simplicity is ideal for small business owners or freelancers who need to focus on their work, not on managing complex invoicing systems.

Additionally, the customization options are plentiful, allowing you to adjust the layout, add branding, and tailor the content to meet your unique needs. This flexibility ensures that you can maintain consistency across your financial documents, aligning them with your brand image and business style. Furthermore, the integration with spreadsheet software like Excel makes it easy to calculate totals, apply taxes, and track payments–all within one efficient system.

Key Features of Vertex42 Templates

Efficient financial management requires tools that are both functional and easy to use. A well-designed document system can make a significant difference in how quickly and accurately you handle your transactions. The following features of this versatile solution provide all the essential elements for creating professional, organized, and effective records.

Customization Options

One of the standout features of this tool is its high level of customizability. Users can adjust almost every aspect of the layout, from fonts and colors to fields and headings. This level of flexibility ensures that each document can be tailored to suit individual preferences or business needs, providing a consistent look that reflects your brand.

Automatic Calculations and Accuracy

Another key advantage is the built-in automatic calculations, which help to eliminate human error. By automatically computing totals, taxes, and discounts, the system ensures that every number is accurate and up to date. This feature saves time and reduces the risk of mistakes, making it especially valuable for those handling multiple transactions or working under tight deadlines.

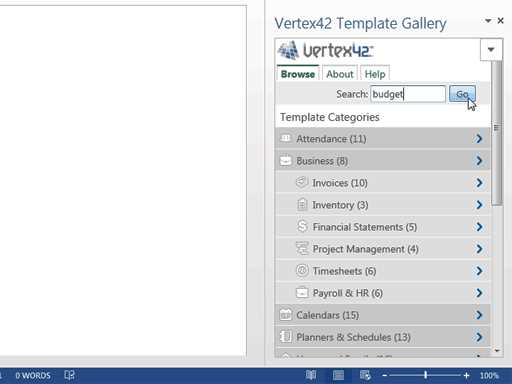

How to Download Vertex42 Invoice

Getting started with a new system for managing your financial documents is simple and quick. With the right platform, downloading a professionally designed document that suits your needs can be done in just a few steps. Below, we’ll guide you through the process of obtaining a customizable, ready-to-use solution for tracking payments and managing transactions.

Step-by-Step Download Process

Follow these easy steps to access and download the necessary file:

- Visit a trusted website offering the solution.

- Locate the section dedicated to the desired document type.

- Select the appropriate format based on your software preferences (Excel, Google Sheets, etc.).

- Click the download button to start the process.

- Save the file to your device.

Checking System Requirements

Before downloading, ensure your device supports the file format and software required to open and edit the document. Most commonly, these solutions are compatible with spreadsheet software like Excel or Google Sheets, both of which offer free versions for easy access.

- Microsoft Excel (desktop or online version)

- Google Sheets (cloud-based, free to use)

- Other compatible spreadsheet applications

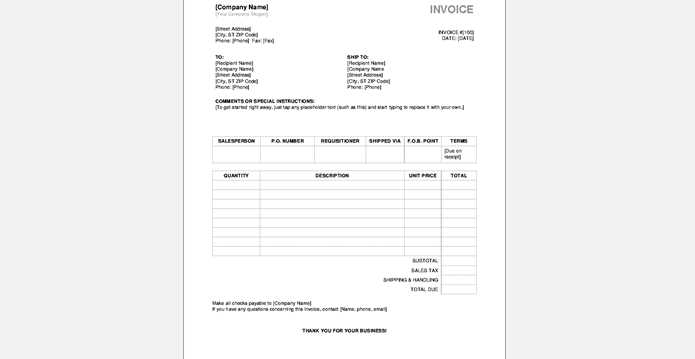

Customizing Your Invoice Template

Personalizing your financial documents is an important step in ensuring they align with your brand and business needs. A well-tailored document not only looks more professional but also improves readability and clarity for your clients. The good news is that customizing these documents is a straightforward process, and the flexibility offered allows you to make a variety of adjustments to suit your style.

Steps to Customize Your Document

Here are the basic steps to personalize your financial document:

- Open the downloaded file in your preferred spreadsheet software.

- Modify the header to include your business name, logo, and contact information.

- Adjust the color scheme to match your brand’s identity.

- Change the default text fields (such as client details or payment terms) to reflect your specific needs.

- Save the customized version for future use or export it as a PDF for easy sharing.

Additional Customization Options

Besides the basic adjustments, there are many other ways to enhance your documents:

- Logo Placement: Add your company’s logo at the top to give the document a personalized, branded look.

- Payment Terms: Tailor the payment terms to your specific business agreements, such as payment due dates, late fees, or discounts.

- Custom Fields: Insert custom fields for additional information, such as project codes, specific services rendered, or reference numbers.

- Font and Style: Adjust the font size and style to ensure the document is easy to read and professional.

Using Vertex42 for Small Businesses

For small business owners, managing finances efficiently is crucial to maintaining steady cash flow and ensuring timely payments. A well-organized financial document can help streamline the process, from tracking transactions to providing clients with clear and professional records. Whether you’re a freelancer or running a small company, having a reliable tool for creating and managing payments is essential to keeping things running smoothly.

Many small businesses benefit from using a customizable and easy-to-use solution for their billing needs. Not only does it save time, but it also ensures that all financial details are presented in a consistent and professional manner. Below is a comparison of how this solution helps small businesses manage their finances:

| Feature | Benefit for Small Businesses |

|---|---|

| Customizable Design | Allows businesses to create documents that align with their brand and image. |

| Automatic Calculations | Reduces human error, ensuring accurate totals, taxes, and discounts. |

| Easy-to-Use Interface | Enables quick and simple document creation without needing advanced software skills. |

| Cost-Effective | Free to use with no ongoing fees, making it a perfect solution for businesses with a limited budget. |

| Spreadsheet Compatibility | Works seamlessly with popular spreadsheet software, making it easy to track payments and update records. |

By using this tool, small businesses can save time and focus more on growing their operations, rather than spending excessive hours on manual financial tasks. It provides a straightforward, professional, and reliable way to handle all your billing needs.

Step-by-Step Guide to Editing Templates

Editing your financial documents is an essential part of tailoring them to meet your specific business needs. Whether you’re updating client information, adjusting payment terms, or changing the layout to reflect your branding, the process can be simple and quick if done step by step. Below is a comprehensive guide to help you customize and personalize these documents for your business.

Step 1: Open the Document

The first step is to open the downloaded file in your preferred spreadsheet application, such as Microsoft Excel or Google Sheets. Once opened, the document will be ready for customization.

Step 2: Update Business Information

Next, update the top section of the document to reflect your business’s name, logo, and contact details. This helps personalize the document and gives it a professional look.

- Insert your company name in the header section.

- Upload your logo to the top of the document if applicable.

- Ensure that your phone number, email address, and physical address are correct.

Step 3: Modify Client Details

Replace the default client information with the relevant details for each transaction or project. Make sure to update the following fields:

- Client name and company name (if applicable).

- Client address and contact details.

- Reference numbers or project details for easy identification.

Step 4: Adjust Payment Terms

Customizing payment terms is important to ensure they reflect your business practices. You can change the default due date, apply late fees, or include discounts for early payment. Make these adjustments to suit your specific needs.

Step 5: Update Line Items

Edit the list of services or products provided to the client. You can add, remove, or modify the line items as needed. Make sure to include:

- Description of the service or product.

- Quantity and unit price (if applicable).

- Total cost for each item.

Step 6: Review and Save

Once you’ve made all necessary changes, review the document for accuracy. Double-check the calculations, client details, and any other critical information. After reviewing, save the updated document for future use or export it as a PDF for easy sharing with clients.

Step 7: Final Adjustments

Lastly, you may want to make any final style or formatting adjustments to enhance the document’s appearance. This could include changing font styles, adjusting cell sizes, or aligning text to ensure everything looks neat and professional.

Saving and Exporting Your Invoice

Once you’ve customized your financial document, the next step is to save and export it in a format that suits your needs. Whether you need to send it digitally or keep it for your records, the process of saving and exporting is simple and flexible. By choosing the right format, you can ensure your document is easy to share, secure, and accessible from any device.

Step 1: Save Your Document Locally

Before exporting, make sure to save your document in its native format so you can make future changes or updates. To do this:

- Click on the “Save” option in your spreadsheet software.

- Choose a location on your computer or cloud storage where you can easily find the document later.

- Name the file appropriately (e.g., ClientName_Invoice_Date) to keep everything organized.

Step 2: Export as PDF

Exporting the document as a PDF is one of the most common ways to share it with clients. This format ensures that the layout remains consistent across devices and that the document can’t be easily altered. To export as a PDF:

- Go to the “File” menu in your spreadsheet software.

- Select “Export” or “Save As” and choose the PDF format.

- Check the settings to ensure that the layout is preserved, especially for multi-page documents.

- Click “Save” and choose a location on your device or cloud to store the PDF.

Step 3: Export to Other Formats

If needed, you can also export your document in other formats, depending on your preferences or the recipient’s needs. Common formats include:

- Excel (.xlsx): Useful if you need to keep a copy for further calculations or modifications.

- CSV (.csv): Ideal for importing data into other financial systems or software.

- Google Sheets: If you’re using cloud-based storage and want to keep your document easily accessible and editable online.

Step 4: Share with Clients

Once your document is saved and exported, you can share it with your clients via email, secure file sharing platforms, or through direct download links. Ensure that the file size is optimized, and choose a method that ensures privacy and security for your sensitive financial data.

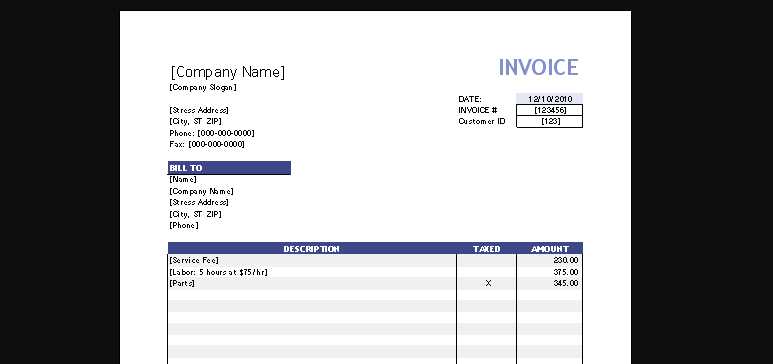

Understanding Invoice Formatting Options

When creating professional financial documents, the way information is presented can significantly impact clarity and readability. Formatting options allow you to structure your document in a way that is not only aesthetically pleasing but also functional, ensuring that key details are easy to find and understand. Customizing your layout gives you the flexibility to highlight the most important elements and align the document with your business style.

Key Formatting Elements to Consider

Several formatting elements play a crucial role in making your document effective and professional. These include:

- Headers and Footers: Including business information, document titles, and page numbers in headers and footers ensures that the document looks organized and contains essential contact details for easy reference.

- Font and Text Style: Clear and easy-to-read fonts enhance the document’s legibility. Choosing the right font size and style helps maintain a professional appearance while ensuring your clients can quickly absorb the key information.

- Alignment and Spacing: Proper alignment and consistent spacing between sections create a neat, organized appearance. Proper margins and consistent use of line spacing ensure that the document doesn’t look cluttered, making it easier for clients to review.

- Color Scheme: While keeping the design professional, adding a color scheme that matches your brand can make the document stand out. However, it is important to avoid using too many colors, as it could distract from the key information.

Tables for Organizing Data

Tables are an essential part of most financial documents, especially when itemizing products or services. They allow you to clearly display quantities, prices, and totals in an easily digestible format. Here are some considerations for formatting tables:

- Column Width: Ensure that columns are wide enough to fit the content without cutting off text or numbers. Adjusting column widths can improve the layout and readability of the table.

- Row Heights: Set appropriate row heights to ensure that the text within each cell is readable. Avoid having rows that are too cramped or too large.

- Bold or Highlighted Headers: Make sure that column and row headers stand out by using bold text or a different background color. This helps users easily identify the different sections of the document.

Using Grids and Borders

Grids and borders can help to visually separate sections and make your document look more polished. However, it’s important not to overuse them. A simple border around key sections (like totals or client information) can make these areas stand out without overwhelm

Benefits of Using Excel for Invoices

Using spreadsheet software like Excel for creating and managing financial documents offers numerous advantages. With its powerful features and easy-to-use interface, Excel provides a flexible and efficient way to create, edit, and track payments. Whether you’re a small business owner or a freelancer, utilizing Excel for your financial records can help save time and reduce errors while keeping everything well-organized.

1. Automation of Calculations

One of the biggest advantages of using spreadsheet software is its ability to automate calculations. With built-in formulas, Excel can automatically compute totals, taxes, discounts, and balances, eliminating the need for manual calculations. This ensures that your financial records are accurate, saves you time, and reduces the risk of human error.

2. Customization and Flexibility

Excel offers a high level of customization, allowing you to adjust the layout, fonts, colors, and even add custom fields to fit your specific business needs. You can create a unique design that reflects your brand, ensuring a consistent and professional look for all your documents. This flexibility makes it easy to tailor your financial records as your business grows or as your needs evolve.

With Excel, you can also easily organize and sort data, such as client details, payment history, and itemized lists. This makes it simple to update, track, and retrieve any information you need with just a few clicks.

3. Easy Data Management and Tracking

Excel’s ability to handle large volumes of data is another major benefit. As your business grows, you’ll accumulate more transactions and records, and Excel makes it easy to track payments, monitor due dates, and manage client details in one central location. You can sort, filter, and categorize your records, making it much easier to stay on top of your finances and ensure timely payments.

Additionally, Excel allows you to generate reports and summaries, giving you a clear overview of your financial performance and helping you make informed decisions for your business.

How to Add Custom Branding

Custom branding helps your financial documents reflect your business identity, making them more professional and recognizable. By incorporating your company’s logo, color scheme, and other brand elements, you ensure that each document communicates a consistent image of your business. This not only enhances your credibility but also creates a stronger connection with your clients.

Adding custom branding to your financial records is straightforward, especially when using tools that offer flexibility and design options. Below are the key steps you can follow to personalize your document:

- Insert Your Logo: Position your logo at the top of the document, typically in the header area. This ensures your brand is visible on every page and immediately identifiable to your clients.

- Customize Fonts and Colors: Adjust the font style, size, and colors to align with your company’s visual identity. Choose fonts that are professional and easy to read, and select colors that match your brand’s color palette.

- Update Contact Information: Ensure that your business address, phone number, website, and social media handles are included and reflect your brand’s tone and style.

- Design Consistency: Keep your design consistent across all documents by using the same layout, color scheme, and fonts. This creates a cohesive look and strengthens brand recognition.

By following these simple steps, you can ensure that your documents not only serve their functional purpose but also present your business in a polished, professional light.

Automating Invoice Calculations with Vertex42

One of the key benefits of using spreadsheet software for managing your financial documents is the ability to automate calculations. This feature not only saves time but also reduces the risk of errors, ensuring accuracy in every transaction. By incorporating simple formulas, you can automatically calculate totals, taxes, and discounts without the need for manual input each time you create a document.

How Automation Improves Efficiency

Automating calculations streamlines the entire process of generating financial documents, especially when dealing with repetitive tasks like totaling itemized lists or applying tax rates. Here’s how automation can enhance your workflow:

- Time-Saving: No need to manually calculate totals or apply formulas every time you create a document–Excel handles it automatically.

- Accuracy: Automated calculations reduce human error, ensuring that all amounts, taxes, and discounts are correct.

- Consistency: Each document generated will use the same formulae, ensuring consistency in your records and reporting.

Key Calculations to Automate

Here are some of the most common calculations that can be automated in your financial documents:

| Calculation | Formula Example | Purpose |

|---|---|---|

| Item Total | = Quantity * Unit Price | Automatically calculates the total cost for each item listed. |

| Subtotal | = SUM(Item Totals) | Calculates the total cost for all items before taxes or discounts. |

| Tax Amount | = Subtotal * Tax Rate | Automatically applies the correct tax rate to the subtotal. |

| Total Amount | = Subtotal + Tax Amount – Discount | Final total after tax and discount are applied. |

By using these automated formulas, you can focus on running your business while ensuring that each document is accurate, consistent, and professional.

Compatible Software for Vertex42 Templates

When using spreadsheet-based documents for business purposes, it’s important to choose software that ensures compatibility with the format of your files. Whether you’re working on a desktop, cloud platform, or mobile device, certain software options offer seamless integration and the tools necessary to efficiently edit and manage your financial documents. Below is an overview of some of the most popular software choices that are compatible with these types of documents.

1. Microsoft Excel

As one of the most widely used spreadsheet applications, Microsoft Excel provides full compatibility with various types of financial documents. It offers a range of powerful features for editing, customizing, and automating your records. Excel supports advanced functions, including data analysis tools, charts, and custom formulas, which make it an excellent choice for handling complex calculations and organizing data.

2. Google Sheets

Google Sheets is a popular cloud-based alternative to Excel. It allows users to create, edit, and share documents online in real-time. Google Sheets offers a similar set of features to Excel, including data manipulation tools, formulas, and collaboration options. Being cloud-based, it also provides the benefit of easy access from any device, making it ideal for businesses with remote teams or those that need constant access to their documents.

3. LibreOffice Calc

LibreOffice Calc is a free, open-source spreadsheet program that provides a solid alternative to paid software. It supports a wide variety of file formats, including those used by Excel, and offers many of the same features, such as formulas, formatting options, and data analysis tools. LibreOffice Calc is a great option for businesses looking for a cost-effective solution without sacrificing functionality.

4. Apple Numbers

Apple Numbers is the default spreadsheet application for macOS and iOS devices. While it is less feature-rich than Excel, it still provides a straightforward and easy-to-use platform for creating and editing financial documents. Numbers is ideal for businesses that are heavily integrated into the Apple ecosystem, offering seamless synchronization across Apple devices.

5. Zoho Sheet

Zoho Sheet is another cloud-based spreadsheet solution that offers strong compatibility with various file formats. It provides collaborative features similar to Google Sheets, enabling multiple users to work on a document at once. With a user-friendly interface and a variety of customization options, Zoho Sheet is an excellent choice for teams looking for a cloud-based solution to manage their business documents.

By selecting the right software, you can ensure smooth integration with your financial records, making it easier to update, manage, and share important documents with clients and colleagues.

Common Issues with Vertex42 Templates

While spreadsheet-based documents are incredibly useful, users may encounter some common issues that can affect their functionality or appearance. These issues often stem from formatting errors, compatibility problems, or user mistakes during customization. Understanding these potential challenges will help you troubleshoot and resolve them quickly, ensuring that your financial records are both professional and accurate.

1. Formatting Errors and Misalignment

One of the most common issues users face is poor formatting or misalignment, especially when importing or exporting files between different software programs. Common problems include:

- Cell Mismatch: When switching between applications, columns and rows might shift, causing data to misalign.

- Font or Style Inconsistencies: Different software applications may interpret fonts and styles differently, leading to inconsistent appearances across devices.

- Inaccurate Calculations: Mismatched or unlinked formulas can result in errors in calculated fields, such as totals, taxes, or discounts.

2. Compatibility Issues with Different Software

Although most modern spreadsheet programs offer compatibility with common file formats, issues may arise when transferring files between different applications. Some compatibility problems include:

- Missing Features: Some features available in Excel may not work correctly in Google Sheets or other alternatives, leading to lost functionality or formatting problems.

- File Conversion Problems: When converting between file formats (e.g., from Excel to CSV or PDF), certain formatting elements, such as borders or color schemes, might not be preserved.

- Formula Loss: Some complex formulas or advanced functions may not carry over correctly between software programs, which can cause data discrepancies.

By being aware of these common issues and knowing how to address them, you can ensure that your documents maintain their accuracy, consistency, and professionalism across different platforms and devices.

Tips for Efficient Invoice Management

Managing financial records efficiently is essential for keeping your business operations smooth and ensuring timely payments. A streamlined approach to handling your financial documents can save time, reduce errors, and improve your cash flow. By adopting a few simple strategies, you can manage your records more effectively and stay organized.

1. Use Clear and Consistent Documentation

One of the most important aspects of managing financial records is consistency. By ensuring that all documents follow a uniform structure and format, you make it easier for clients and team members to understand and process them. Here are a few ways to maintain consistency:

- Standardize Layout: Use a consistent layout with clearly defined sections for business details, items or services, totals, and payment instructions.

- Establish Naming Conventions: Create a naming system for your documents to make them easily identifiable, such as including the client name and date in the file name.

- Include Key Information: Ensure that every document contains essential information like client contact details, payment terms, and due dates.

2. Automate and Track Payments

Keeping track of payments manually can be time-consuming, especially as your business grows. To manage financial documents more efficiently, consider these tips:

- Automate Calculations: Use formulas to automatically calculate totals, taxes, and discounts. This minimizes errors and saves time on manual calculations.

- Set Payment Reminders: Use software that automatically sends payment reminders to clients, reducing the risk of missed payments.

- Use Digital Payment Systems: Integrate digital payment options like PayPal, credit cards, or bank transfers into your documents to make payments easier for clients.

3. Organize and Store Documents Effectively

Keeping your documents organized and easily accessible is crucial for effective management. Implement these strategies for better organization:

- Create Folders: Organize documents by client, project, or payment status (e.g., “Paid,” “Pending,” or “Overdue”) to quickly find what you need.

- Use Cloud Storage: Storing your documents on cloud-based platforms like Google Drive or Dropbox ensures that they are accessible from anywhere and are backed up for security.

- Maintain a Digital Archive: Keep a digital archive of all financial documents to ensure easy retrieval for record-keeping or tax purposes.

By implementing these simple yet effective tips, you can ensure that your financial records are organized, accurate, and easy to manage. This not only improves your efficiency but also helps build trust and professionalism with your clients.

Vertex42 vs Other Invoice Solutions

When choosing a solution for creating and managing business documents, there are various options available, each offering unique features and benefits. Spreadsheet-based tools, such as those used for creating financial records, provide flexibility and simplicity. However, other specialized software solutions often provide more advanced features and integrations that can streamline the overall workflow. Understanding the differences between spreadsheet-based solutions and more dedicated software can help you make an informed decision based on your specific business needs.

Key Differences Between Spreadsheet Tools and Other Solutions

Different software solutions offer a range of features designed to meet the needs of businesses of all sizes. Below is a comparison of spreadsheet-based solutions versus specialized invoice management tools:

| Feature | Spreadsheet-Based Solutions | Dedicated Invoice Software |

|---|---|---|

| Customization | High flexibility, can be tailored for various needs with formulas and formatting. | Often limited to pre-designed templates, but may offer specialized features like branding and recurring billing. |

| Automation | Automation is dependent on formulas and manual setup. | Built-in automation for recurring billing, payment reminders, and invoice generation. |

| Integration | Limited integration with other software or payment platforms. | Strong integrations with payment gateways, accounting software, and CRM tools. |

| Ease of Use | Requires some knowledge of spreadsheet tools and formulas. | Generally designed for ease of use, with intuitive interfaces and guided workflows. |

| Cost | Often free or low-cost, especially with open-source options. | May come with a monthly or annual subscription fee, though often offers more advanced features. |

Which Solution Is Best for Your Business?

The choice between spreadsheet-based tools and specialized software depends on your business size, budget, and needs. If you’re a small business or freelancer, a spreadsheet-based solution offers low-cost, customizable, and flexible document creation. On the other hand, if you require advanced features such as recurring billing, automatic payment reminders, and seamless integration with other business tools, dedicated software might be the better option.

Each solution has its own set of advantages, and understanding the strengths and limitations of each will help you choose the right tool to suit your specific requirements.

Free vs Paid Templates

When looking for solutions to create and manage business documents, you’ll often find two main types of options: free and paid. Both have their merits, but understanding the differences between the two can help you decide which is best for your specific needs. Free options often provide basic features and simplicity, while paid options usually offer more advanced functionality, support, and customization features. Each type can be beneficial depending on your business size, goals, and the complexity of your document management process.

1. Advantages of Free Solutions

Free solutions are an excellent starting point, particularly for small businesses, freelancers, or individuals who only need to create basic documents. The key benefits include:

- Cost-Effective: Free templates eliminate the need for a subscription or one-time payment, making them a budget-friendly choice for businesses just starting out.

- Simplicity: Free templates tend to be straightforward and easy to use, allowing users to create professional-looking documents without a steep learning curve.

- Quick Setup: They typically require little to no customization, allowing you to start using them right away.

2. Benefits of Paid Solutions

On the other hand, paid solutions often come with enhanced features and customization options that can be very valuable as your business grows. Here are some reasons why investing in a paid option might be worth it:

- Advanced Features: Paid options often include automated calculations, advanced formatting options, and more detailed reports, which can save time and reduce errors.

- Customization: With paid options, you often have more control over the look and functionality of your documents, allowing you to create documents that are perfectly aligned with your branding and business needs.

- Support: Premium options often come with customer support, helping you resolve any issues quickly and ensuring a smoother experience.

- Regular Updates: Paid templates tend to receive more frequent updates, adding new features or fixing bugs to ensure compatibility with the latest software versions.

Choosing between free and paid solutions ultimately depends on the specific needs of your business. If you only need basic functionality, a free solution can be a great option. However, if you require more advanced features, frequent updates, or dedicated support, a paid solution may be a better investment.