House Rental Invoice Template for Efficient Tenant Billing

Managing payments for rental properties can be complex, but a well-structured billing document can simplify the process. Whether you’re dealing with short-term leases or long-term agreements, having a clear and professional record of each transaction is essential for both landlords and tenants. A streamlined approach to creating these documents ensures that all details are correctly noted and can help avoid misunderstandings down the line.

By utilizing an organized system for tracking and issuing charges, property owners can maintain accurate financial records, facilitate easy communication, and ensure timely payments. A properly designed form can also serve as a legal document in case of disputes, offering clarity on the terms of the lease and the amounts due.

Creating and customizing these billing documents can save valuable time and effort. With the right tools, property managers can produce professional and compliant statements that meet all necessary requirements while keeping both parties satisfied. Using the right format and including all relevant details can significantly reduce the risk of errors and delays.

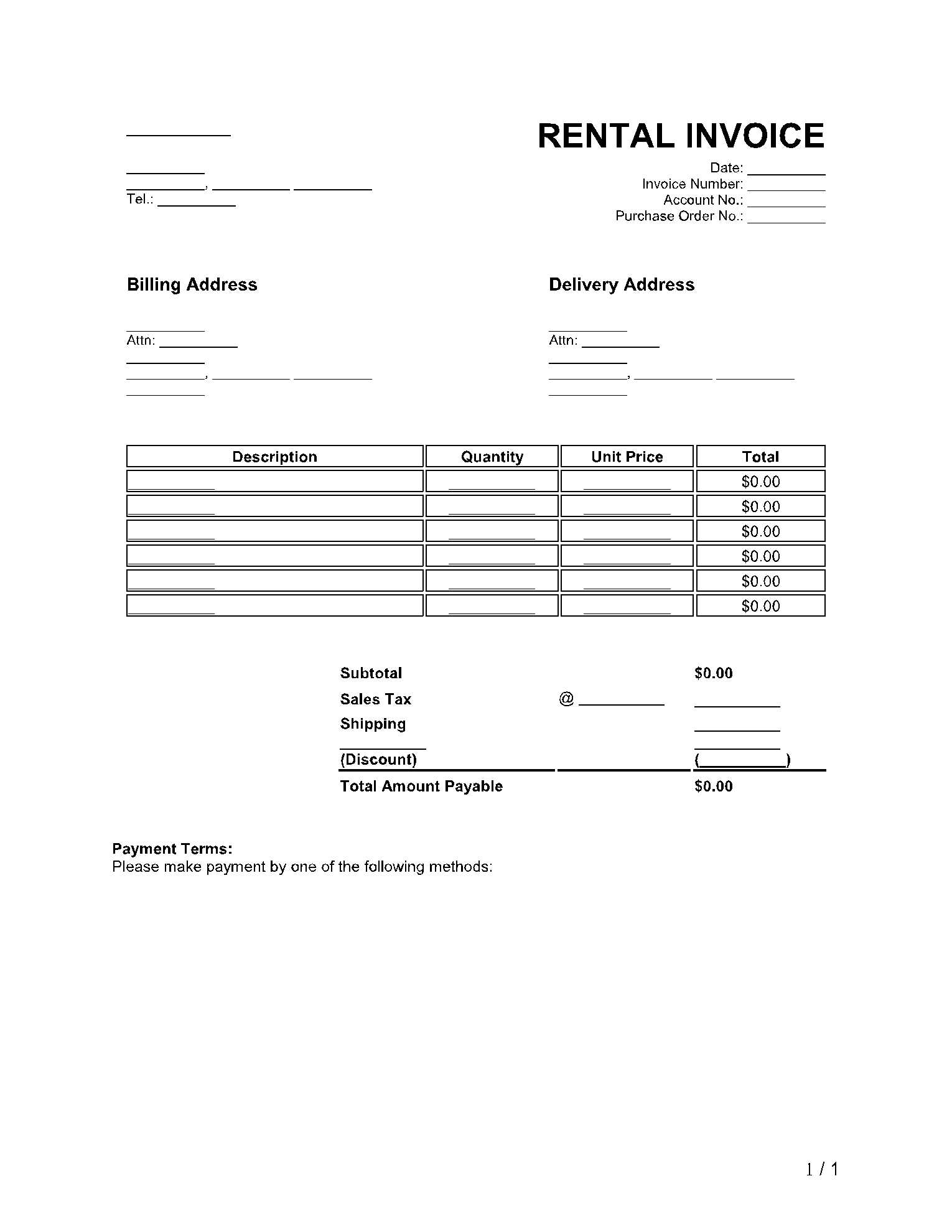

House Rental Invoice Template Overview

When managing properties, it’s crucial to have a consistent method for documenting charges and payments. This tool allows property owners to keep track of financial transactions in a professional manner, ensuring clarity for both the landlord and tenant. By adopting a standardized structure, landlords can simplify administrative tasks, reduce errors, and provide transparent records to tenants.

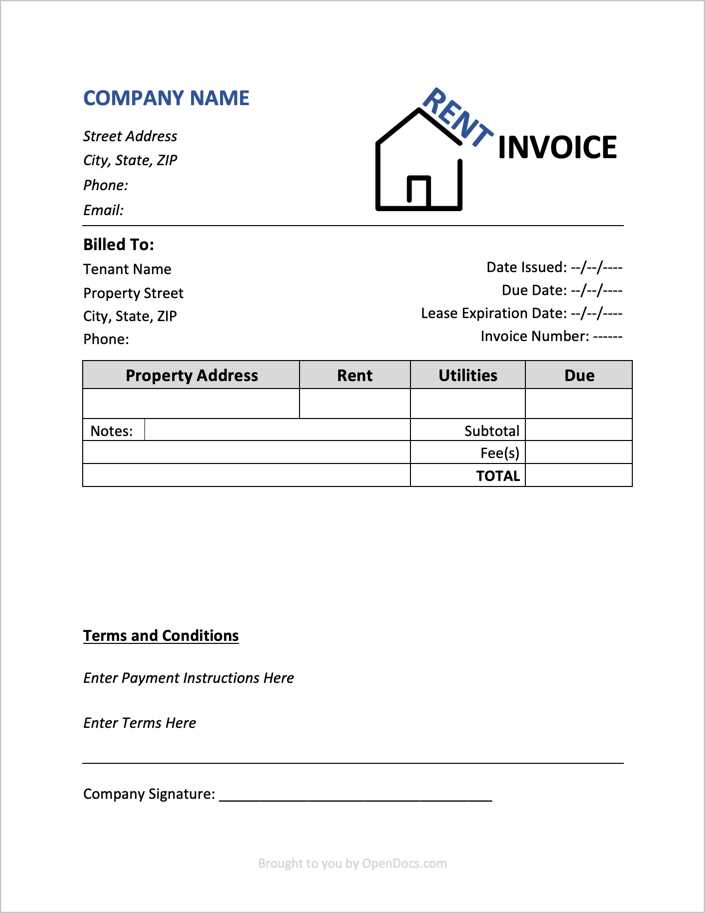

The key to an effective billing document lies in its ability to cover all necessary details while remaining simple to understand. The main elements typically include:

- Tenant information

- Property details

- Amount due and payment terms

- Payment method and due date

- Late fees (if applicable)

- Contact information for queries

Having this type of document in place can also help landlords stay organized, keeping all transactions clearly recorded for accounting or tax purposes. Whether using a physical or digital version, this structured approach minimizes confusion and promotes prompt payments.

Additionally, a well-designed form can be easily customized to suit individual needs, whether it’s for different types of properties, lease agreements, or specific payment schedules. By ensuring that all necessary information is included, property owners can avoid misunderstandings and streamline their billing process.

Why You Need a Rental Invoice

Proper documentation of financial transactions is essential when managing a property. Without a clear and organized way to track payments, misunderstandings and disputes can arise between landlords and tenants. A structured payment record serves not only as a reminder of outstanding balances but also as a formal agreement that can protect both parties in case of disagreements.

Benefits of Using a Formal Billing Document

- Clarity – A detailed record ensures both parties understand the amounts due, payment terms, and deadlines.

- Legal Protection – In case of disputes, a properly formatted document can serve as evidence in legal matters.

- Financial Organization – It helps property owners maintain clear, accurate records for tax reporting and accounting purposes.

- Professionalism – Sending a well-organized statement reflects professionalism and can improve tenant relationships.

How It Helps Avoid Conflicts

When tenants receive a well-detailed statement outlining the amount owed, payment due date, and any additional charges (such as late fees), it minimizes confusion. A clearly defined payment process also encourages timely payments and allows tenants to address any issues before they escalate.

Moreover, having an official document protects the landlord’s interests. It ensures there is a transparent record of all transactions and agreements, preventing potential challenges about payments or terms. In this way, it provides peace of mind for both the property owner and the tenant.

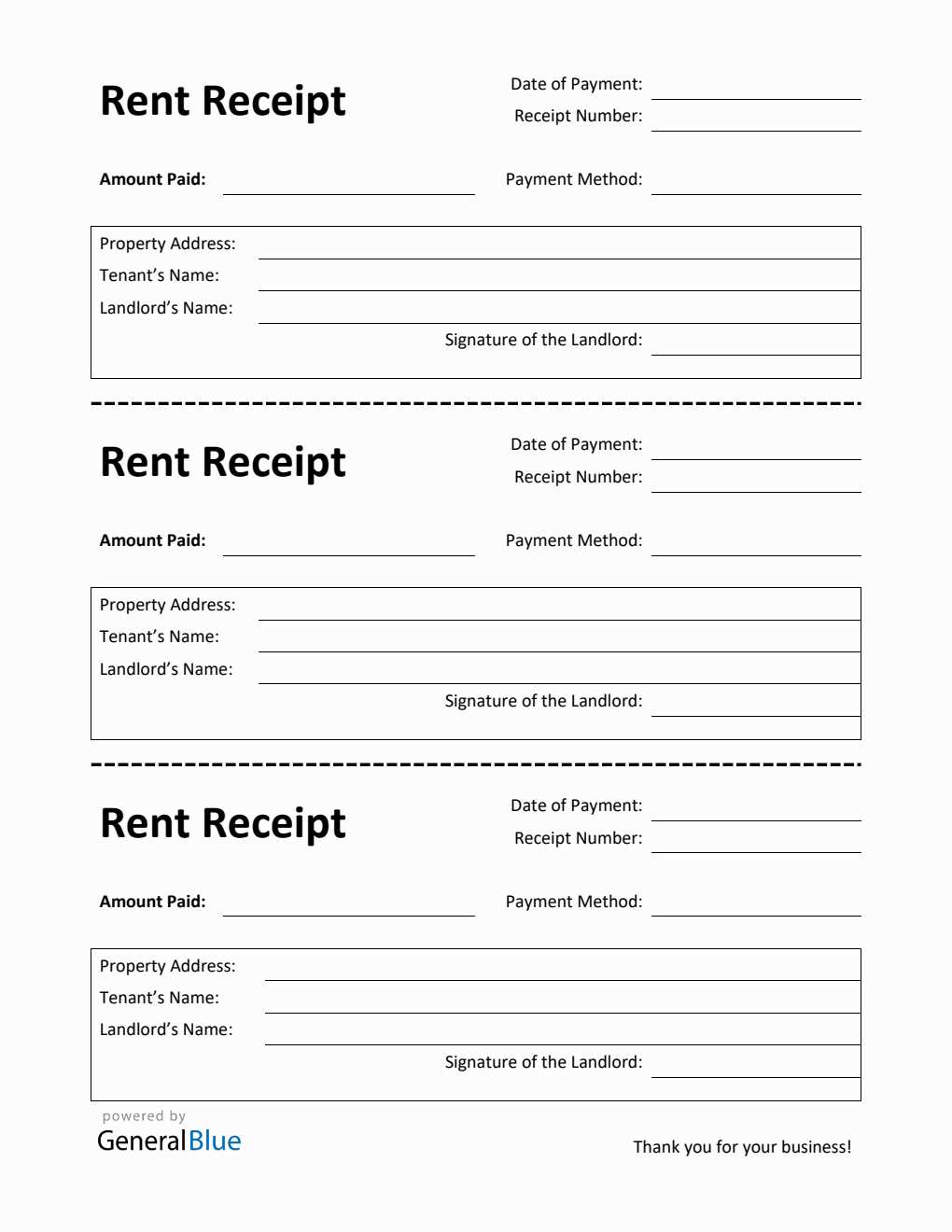

Key Elements of a Rental Invoice

For a billing document to be effective, it must include all the essential information that both the property owner and the tenant need to understand the terms of payment. Clear and accurate details ensure smooth communication, minimize confusion, and promote timely settlements. Each component of the document serves a specific purpose, helping both parties stay on the same page and avoid potential disputes.

Core Components to Include

- Tenant Information – Name, address, and contact details of the person responsible for the payment.

- Property Details – Address of the leased property to avoid any ambiguity regarding which property the charges apply to.

- Amount Due – The total sum that must be paid, including any additional charges like maintenance fees or utilities.

- Payment Due Date – The specific date by which the payment should be made to avoid penalties.

- Payment Terms – Any relevant information regarding installment options, discounts, or penalties for late payment.

- Late Fees – A clear explanation of any additional charges that may apply if the payment is not made by the due date.

- Payment Method – Accepted payment methods, such as bank transfer, check, or online payment systems.

- Contact Information – Details for reaching out to the property owner or manager for any questions or issues regarding the payment.

Optional but Helpful Details

- Lease Period – The dates for which the payment is being made, especially if the payment is covering multiple months.

- Discounts or Adjustments – Any applicable reductions or credits that the tenant may have received, such as for early payment or special agreements.

By including these critical elements, property managers can create a comprehensive and professional billing document that ensures all necessary information is conveyed. This reduces the risk of misunderstandings and enhances the overall experience for both parties involved.

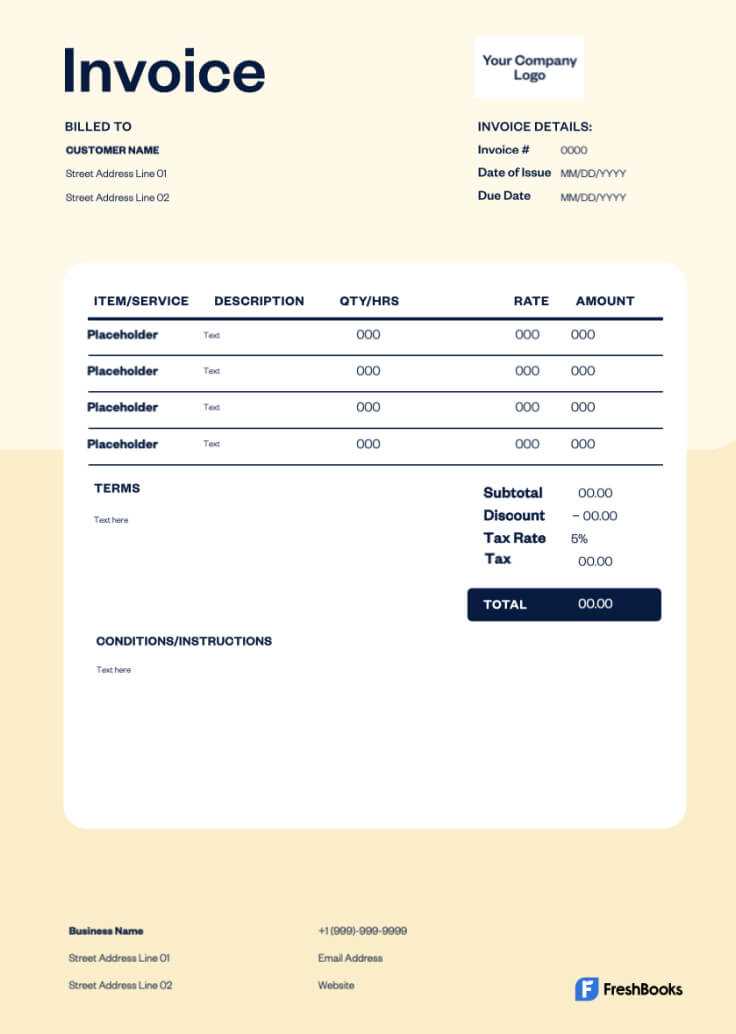

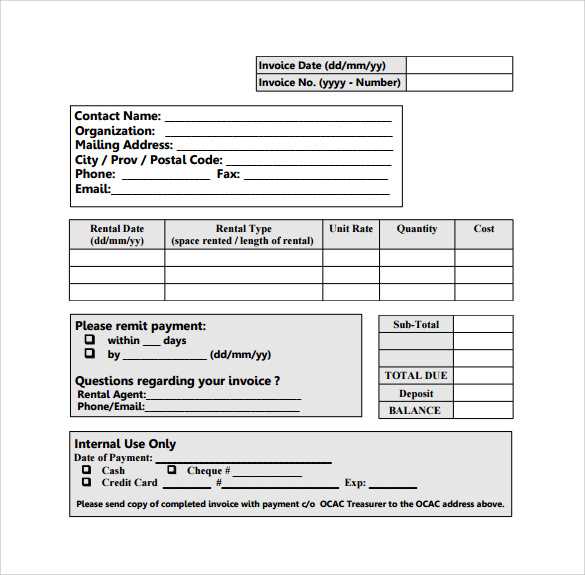

How to Create a Rental Invoice

Creating a clear and professional billing document is essential for any property owner. The process involves gathering necessary details, organizing them effectively, and presenting the information in a way that ensures both parties understand the terms of payment. By following a few simple steps, you can generate a document that is both informative and easy to read, helping to facilitate timely payments and avoid confusion.

Step-by-Step Process

- Collect Tenant Information – Start by gathering the tenant’s full name, address, and contact details.

- Include Property Details – Clearly state the address of the property that the charges apply to.

- Specify the Amount Due – Include the total amount the tenant needs to pay, including any applicable fees.

- Set the Payment Due Date – Indicate the exact date by which the payment must be made.

- Outline Payment Terms – Include payment options, late fees, or discounts for early payments.

- Provide Contact Information – Make sure to list a way for the tenant to reach out with any questions or issues.

Using Digital Tools

For added convenience, consider using software or online tools that allow you to create and send billing documents quickly. Many platforms offer pre-designed formats, so you simply need to input the relevant details. This can save time, reduce errors, and help maintain a professional appearance.

Once all the information is entered, review the document for accuracy and clarity before sending it to the tenant. Whether you’re using a manual method or digital tool, the goal is to provide a clear, detailed statement that helps both you and your tenant stay organized.

Customizing Your Invoice Template

Tailoring your billing document to fit your specific needs can greatly improve its effectiveness and clarity. Customization allows property owners to reflect their unique business style while ensuring all relevant details are included. Whether you’re managing multiple properties or offering different payment plans, a personalized approach helps you stay organized and enhances communication with tenants.

Adjusting for Different Property Types

If you manage various types of properties, it’s essential to customize the billing format to suit each one. For example, if you’re dealing with short-term leases, the document might need to include specific terms like check-in/check-out dates, while long-term agreements would focus more on monthly payment schedules. Consider the following when customizing:

- Property Address – Clearly identify which property the charges apply to, especially if you manage multiple locations.

- Payment Frequency – Adjust the payment cycle to reflect whether you’re charging weekly, monthly, or quarterly.

- Special Charges – Add any additional fees like maintenance, parking, or utilities that may apply to a specific property.

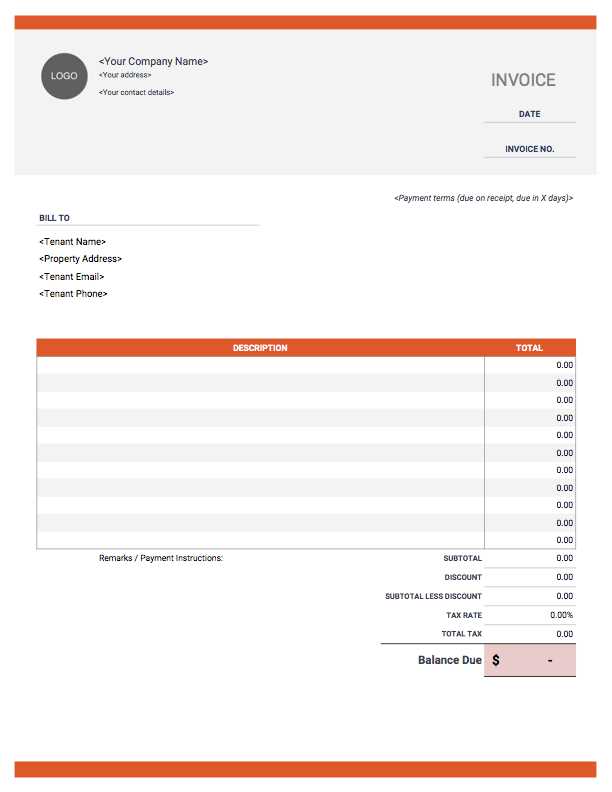

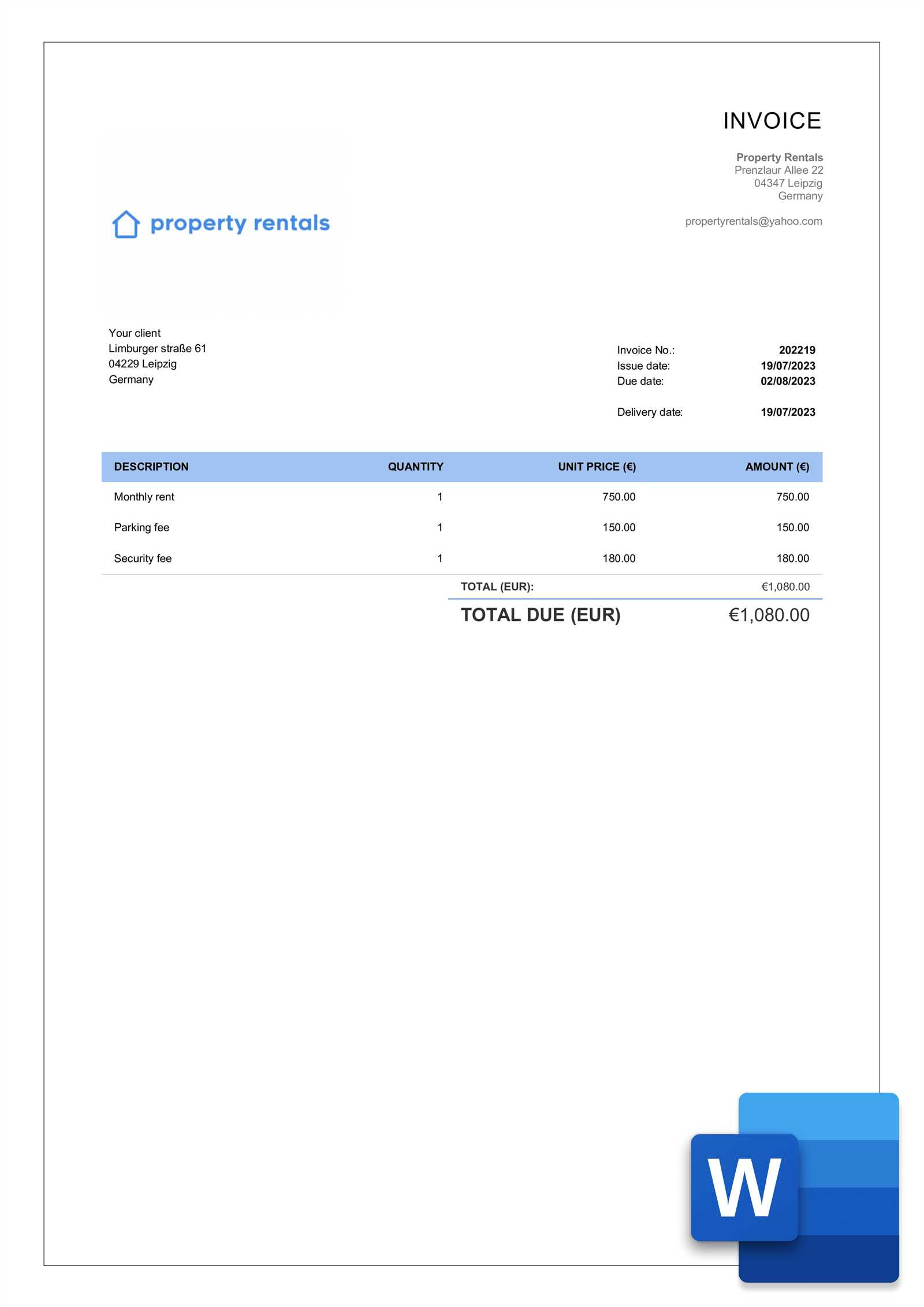

Adding Personal Branding

Incorporating your branding into the billing document can enhance professionalism. By adding your company logo, color scheme, or business name at the top, you create a consistent and professional appearance. This simple adjustment makes the document feel more official and establishes a sense of trust with your tenants.

Customization can also extend to the design and layout of the document. Using clear headings, bullet points, and appropriate spacing makes the document easier to read and understand. Focus on clarity and simplicity while ensuring all necessary details are easy to locate.

Common Mistakes in Rental Invoices

Even the most organized property managers can make errors when preparing billing documents. These mistakes can lead to confusion, delayed payments, and potential conflicts with tenants. Understanding the most common errors can help you avoid them and ensure that your documents are clear, accurate, and professional. Below are some of the frequent mistakes made when creating these financial statements:

| Common Mistake | Description |

|---|---|

| Missing Payment Due Date | Failing to specify when the payment is due can lead to confusion about deadlines and late fees. |

| Incorrect Payment Amount | Errors in the total amount due, such as forgetting to add service fees or maintenance costs, can cause disputes. |

| Unclear Payment Terms | Not outlining clear terms for payment, such as installment options or late fees, may cause delays in payment or misunderstandings. |

| Omitting Property Details | Not including the exact property address or identifying the specific unit can create confusion, especially when managing multiple properties. |

| Inaccurate Tenant Information | Incorrect tenant details, such as name or contact information, can lead to payment issues or communication breakdowns. |

By double-checking for these common errors and ensuring that all the relevant details are included, you can prevent misunderstandings and foster better relationships with tenants. Clear, accurate documents promote timely payments and minimize the likelihood of disputes.

Using Rental Invoices for Tax Purposes

Accurate financial documentation is crucial when it comes to preparing taxes for property owners. A well-organized billing document not only serves as proof of transactions but also helps track income and deductible expenses. These records can significantly simplify the tax filing process, providing clarity and ensuring compliance with tax regulations. Below are some ways these documents can be used effectively for tax purposes:

| Purpose | Description |

|---|---|

| Income Reporting | Billing records help track the total income earned from leased properties, ensuring accurate reporting to tax authorities. |

| Expense Documentation | Invoices that include maintenance, repairs, or utility charges can be used to document deductible business expenses. |

| Proof of Transactions | These documents serve as legal proof of income and expenses in case of audits or tax disputes. |

| Depreciation Tracking | By maintaining a record of payments and related expenses, property owners can track asset depreciation for tax deductions. |

| Tax Compliance | Using detailed billing statements ensures that all financial transactions are in line with local and federal tax laws, reducing the risk of errors or audits. |

By carefully maintaining these records, property managers can ensure that all relevant income and expenses are accounted for during tax season. Proper documentation not only helps reduce the chance of errors but also maximizes allowable deductions, potentially lowering the overall tax liability.

Benefits of Digital Rental Invoices

In today’s digital world, using electronic billing documents has become a game-changer for property managers. Digital records offer a wide range of advantages over traditional paper-based ones. From faster processing to better organization, they can streamline the management of payments and enhance the overall experience for both landlords and tenants. Below are some of the key benefits of using digital billing documents:

Efficiency and Time-Saving

- Instant Delivery: Digital documents can be sent and received instantly via email or online platforms, eliminating delays associated with mailing paper copies.

- Automated Reminders: Set up automatic reminders for upcoming payments or overdue balances, reducing the need for manual follow-ups.

- Easy Updates: Modify and update billing details quickly without the need for printing new copies, making it easy to address mistakes or changes in terms.

Improved Organization and Security

- Centralized Storage: Keep all records organized in one secure location, reducing the risk of losing important documents.

- Enhanced Security: Digital files are less likely to be lost, damaged, or misplaced compared to physical copies. Additionally, they can be encrypted or password-protected for added security.

- Easy Search and Access: Quickly find past billing documents by searching through digital folders or using specialized software to track all transactions.

Switching to digital records not only improves the efficiency of your billing process but also enhances communication and transparency. With the ability to track payments, send reminders, and access documents with ease, both property owners and tenants benefit from a more seamless and organized approach to managing payments.

Free vs Paid Rental Invoice Templates

When it comes to choosing a format for your billing documents, property managers often face the decision of whether to use a free or paid solution. Both options offer distinct advantages and limitations, depending on the needs of the property owner. While free options might seem appealing, paid solutions can provide enhanced features and support. Understanding the differences between them can help you select the best option for your specific situation.

Comparison of Features

| Feature | Free Option | Paid Option |

|---|---|---|

| Customization | Limited customization, basic layout options | Extensive customization, fully adjustable designs |

| Ease of Use | Simple, but may lack advanced features | User-friendly with added functionalities |

| Support | Minimal or no customer support | Access to customer service and technical support |

| Additional Features | Basic fields and limited capabilities | Advanced features like automatic calculations, recurring billing, integration with accounting software |

| Cost | Free | Monthly or one-time payment |

Choosing the Right Solution

The choice between free and paid options depends on your specific needs. If you manage a small number of properties and require only basic functionality, a free solution may be sufficient. However, if you oversee multiple properties or need more advanced features like automated payment reminders, custom branding, and seamless integration with other tools, a paid solution might be worth the investment. Ultimately, the right choice will help improve your efficiency, save time, and ensure accurate and professional billing.

How to Format Your Rental Invoice

When creating a billing document for property transactions, formatting plays a key role in ensuring clarity and professionalism. Properly structured documents are easier to read and ensure that all important information is included in a logical sequence. A well-formatted document not only helps prevent confusion but also reflects well on your business. Here’s how to format your statement for maximum efficiency and readability:

1. Include Essential Information at the Top

Start by clearly identifying the document. Include your business name, address, and contact information at the top, followed by the tenant’s details. This makes it easy to determine the document’s origin and recipient.

2. Use a Clear and Organized Layout

Separate each section with headings or clear lines. This will allow both you and the tenant to quickly locate important details like the payment amount, due date, and terms of the agreement. Utilize headings such as “Payment Summary,” “Due Date,” or “Additional Charges” for easier navigation.

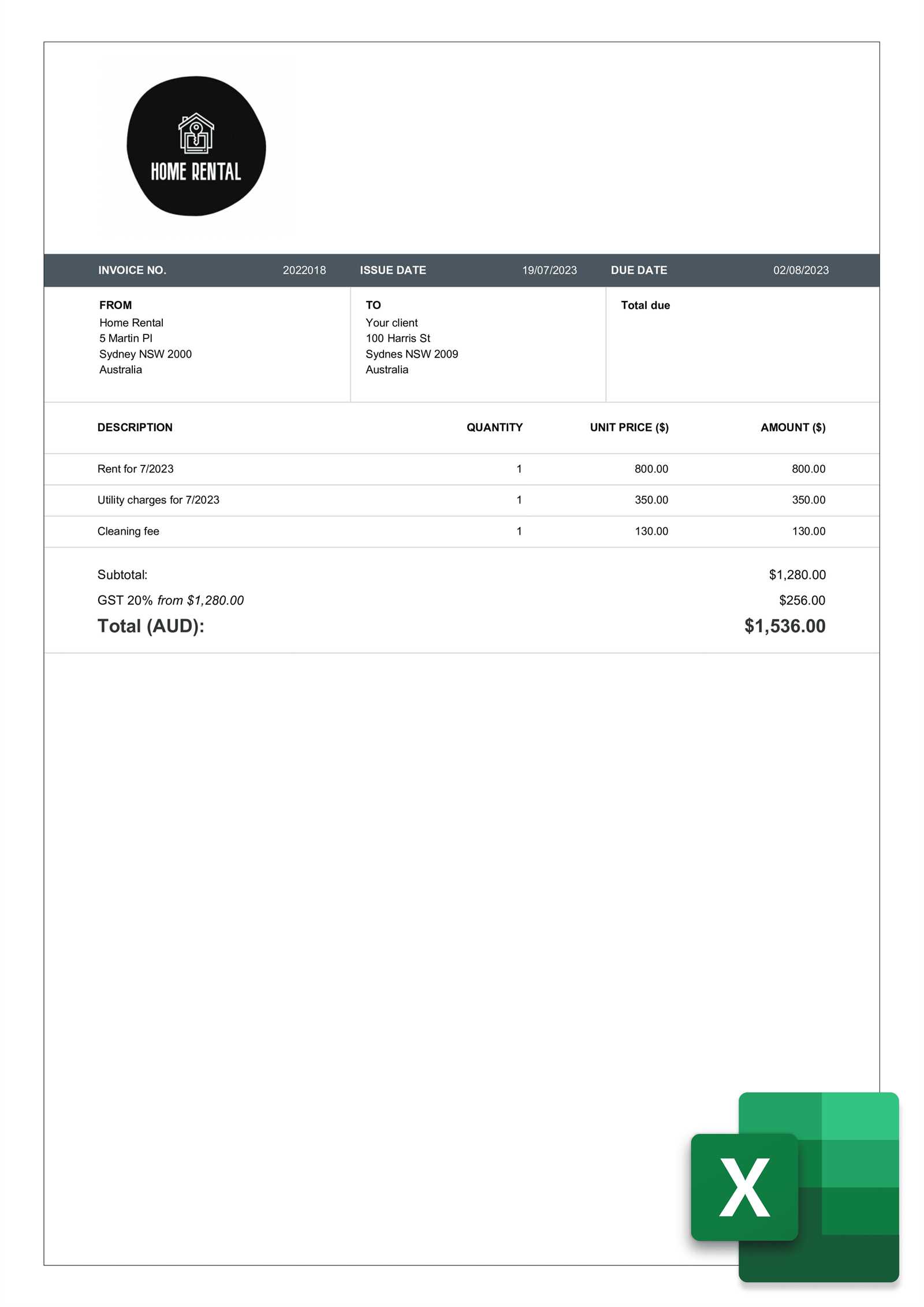

3. List All Charges in a Table

A table format is ideal for clearly listing all charges, including the base amount, additional services or fees, and any applicable taxes. Each charge should be detailed in separate rows, with the total clearly indicated at the bottom.

| Description | Amount |

|---|---|

| Base Amount | $1,200 |

| Maintenance Fee | $50 |

| Utilities | $100 |

| Total Amount Due | $1,350 |

4. Specify Payment Terms and Due Date

Clearly state the payment terms, including the due date and any late fees if applicable. Having this information visible helps avoid any misunderstandings regarding when the payment is expected.

5. Keep It Professional

Maintain a clean, professional design by using a simple font and consistent formatting. Avoid unnecessary graphics or clutter, as this can detract from the document’s clarity and seriousness.

By adhering to these formatting guidelines, you can create clear, professional billing statements that streamline communication and reduce the likelihood of errors or disputes.

Essential Details for Rental Invoices

To ensure that your billing documents are both professional and effective, it’s crucial to include all necessary information. Each detail plays a significant role in ensuring transparency and preventing confusion between you and the tenant. Missing or unclear details can lead to delays in payment or misunderstandings. Below are the most important elements that should be included in every statement.

Key Information to Include

- Property Information: Always specify the address or unit number to clearly identify the property that the charges apply to.

- Tenant’s Information: Include the tenant’s full name and contact details to ensure they can be easily reached in case of any issues or questions.

- Amount Due: Clearly state the total amount owed, breaking it down into individual charges, such as rent, utilities, maintenance fees, etc.

- Due Date: Mention the exact date by which the payment must be made to avoid late fees or penalties.

- Payment Terms: Indicate the methods of payment accepted, such as bank transfer, online payment, or check. Also, specify if there are any late fees or discounts for early payments.

Additional Helpful Details

- Lease Period: Include the start and end date of the leasing period for which the charges are being applied.

- Contact Information: Ensure your contact details are easily visible, so tenants can reach you if they need clarification or assistance.

- Late Fees and Penalties: If applicable, clearly outline any late fees or penalties for payments that are overdue.

By including these essential elements, you ensure that both you and your tenant are clear on the terms of the agreement, which helps maintain a smooth and professional relationship. Comprehensive, detailed billing documents also reduce the risk of payment delays or disputes.

Choosing the Right Invoice Template

Selecting the right format for your billing documents is essential for ensuring clarity, professionalism, and accuracy. The right structure will make it easier for both you and your tenants to track payments, understand terms, and avoid confusion. Choosing an appropriate document layout depends on the complexity of your leasing situation, the number of properties you manage, and the features you require. Below are key considerations to help you make the best choice.

Factors to Consider

- Business Needs: Assess whether you require a simple document or one that includes advanced features, such as payment tracking or automatic calculations. This will help determine if a basic or more complex format is suitable.

- Customization Options: Choose a layout that allows customization to match your branding, whether that’s adding your logo, adjusting colors, or modifying sections to fit your business model.

- Ease of Use: Consider a design that’s easy to navigate and fill out, both for you and your tenants. Simplicity and clarity are key to ensuring there are no misunderstandings.

- Compatibility: Ensure the document format is compatible with your preferred software tools or platforms, especially if you plan to integrate it with accounting or payment systems.

Types of Formats to Choose From

- Basic Format: Ideal for smaller property managers or those with a straightforward billing structure. These documents usually include essential fields like payment amount, due date, and tenant details.

- Advanced Format: Suitable for larger property owners or managers handling multiple tenants or units. These might include features like automated fee calculations, recurring billing options, or integration with accounting software.

- Professional and Branded Formats: For property managers who want to project a more polished and professional image. These layouts typically allow full customization of logos, color schemes, and design elements.

By evaluating your specific needs and the level of detail you require, you can select the right billing document format that will streamline payment collection and help maintain a clear and professional relationship with your tenants.

Automating Rental Invoices with Software

Managing financial documentation for property transactions can be a time-consuming task, especially when dealing with multiple tenants and properties. Automating the creation and management of billing statements using specialized software can significantly reduce the administrative burden. By integrating automation, property managers can ensure consistency, accuracy, and efficiency in their billing processes. Below are the benefits and features of using software to streamline the billing procedure.

Benefits of Automation

- Time-Saving: Automating the process means you no longer have to manually create and send out each billing document. Software can generate statements on a set schedule, freeing up valuable time for other tasks.

- Accuracy: Automation reduces human error, ensuring that all details such as amounts due, payment terms, and due dates are correct every time.

- Consistency: With automated software, every document follows a consistent format, maintaining a professional appearance and making it easier for tenants to understand the charges.

- Improved Cash Flow: Timely and accurate billing helps ensure that payments are received on time, improving overall cash flow for property managers.

Key Features of Billing Automation Software

- Recurring Billing: For tenants with ongoing agreements, software can automatically generate and send monthly or periodic bills without manual input.

- Payment Reminders: The software can send automated reminders to tenants before payments are due or notify them of overdue balances, reducing late payments.

- Integration with Accounting Tools: Many automation platforms integrate seamlessly with accounting software, allowing for streamlined financial reporting and bookkeeping.

- Customizable Templates: While the software handles the automation, most tools allow customization of the billing format to suit your specific needs, from adding logos to adjusting payment terms.

By adopting software for automating your billing process, property managers can increase efficiency, improve accuracy, and reduce the time spent on administrative tasks. This not only enhances operational productivity but also strengthens the relationship with tenants through clear and timely communication.

Rental Invoice Payment Terms Explained

Understanding the payment terms associated with a billing statement is essential for both property owners and tenants. Clear payment terms help to set expectations and ensure that both parties are on the same page regarding due dates, late fees, and accepted methods of payment. This section will explain common payment terms that are typically included in billing documents for property agreements.

Common Payment Terms

- Due Date: This is the date by which the tenant is required to make the payment. It’s important for both parties to know exactly when the payment is due to avoid any misunderstandings.

- Late Fees: If a payment is not made by the due date, a late fee may be applied. The amount of this fee should be clearly specified in the terms. For example, “A fee of $50 will be charged for payments made after the due date.”

- Grace Period: Some agreements allow for a grace period, which is a specified time after the due date during which a tenant can make the payment without incurring late fees. For instance, a 5-day grace period means the tenant has five extra days to pay before penalties are applied.

- Partial Payments: If the tenant is unable to pay the full amount at once, the payment terms might allow for partial payments. The terms should specify if this is acceptable, and any conditions regarding how the payment will be applied.

- Accepted Payment Methods: The document should indicate which payment methods are accepted, such as checks, bank transfers, credit card payments, or online payment platforms.

Payment Terms Table

| Payment Term | Description |

|---|---|

| Due Date | The specific date by which payment must be made. |

| Late Fees | Additional charges applied if payment is made after the due date. |

| Grace Period | A set number of days after the due date during which payment can be made without penalty. |

| Partial Payments | Terms outlining whether tenants can make partial payments and under what conditions. |

| Accepted Payment Methods | Specifies which forms of payment are accepted, such as bank transfers, checks, or online platforms. |

Clearly stating payment terms is vital for both parties to avoid confusion and potential disputes. By outlining due dates, late fees, and accepted payment methods, property owners can ensure a smooth and professional financial exchange, while tenants will understand exactly what is expected of them.

Best Practices for Sending Invoices

Sending billing statements in a timely and professional manner is crucial for ensuring smooth financial transactions. How you present and deliver these documents can impact the payment process and the overall relationship with your tenants. Adhering to best practices will help minimize confusion, prevent delays, and maintain a professional image. Below are key strategies to ensure your billing process is efficient and effective.

Timing and Delivery

- Send on Time: Always send your billing statements promptly. The earlier you send them, the more likely tenants will pay on time. Aim to issue the statement at least a week before the due date to give tenants ample time to make the payment.

- Use Digital Methods: Consider using email or online payment platforms to send statements. This is faster, more efficient, and provides a clear record of communication. If your tenants prefer paper copies, you can also offer that option, but ensure it doesn’t delay the process.

- Send Reminders: It’s helpful to send a reminder a few days before the due date. This can reduce the chances of late payments and remind tenants about upcoming financial obligations.

Content and Clarity

- Clear and Detailed Breakdown: Ensure your billing document clearly outlines all charges, fees, and the total amount due. Include a breakdown of the payment for easy reference, as this will help prevent confusion and disputes.

- Consistent Format: Maintain consistency in the format of your billing statements. This allows tenants to quickly recognize the document and know where to find important information. Consistency in your branding (e.g., logo, contact details) also helps reinforce your professionalism.

- Clear Payment Instructions: Provide clear instructions on how to make the payment, including accepted methods and any necessary details (e.g., bank account numbers, online payment links, etc.).

By following these best practices, you ensure that your billing process remains efficient, professional, and transparent. Clear communication and timely delivery not only improve your cash flow but also strengthen the trust and relationship between you and your tenants.

Managing Multiple Rental Invoices Efficiently

When managing several tenants or multiple properties, keeping track of payments and related documents can become overwhelming. Efficiently handling multiple billing statements requires organization, automation, and attention to detail. Implementing the right strategies and tools can make managing numerous accounts much easier and help ensure that payments are processed on time. Below are key practices for streamlining this process and staying organized.

Effective Organization Methods

- Create a Centralized System: Use a single platform or software to store all payment records. This can be a spreadsheet, a cloud-based system, or accounting software that consolidates all billing data, making it easier to track due dates, payments received, and outstanding balances.

- Group Tenants by Categories: If managing different types of agreements (e.g., long-term vs. short-term), categorize tenants or properties accordingly. This way, you can generate reports or documents specific to each category, making the process more manageable.

- Set Automatic Reminders: Automate reminder notifications to both you and your tenants. Alerts a few days before payment is due or after a payment is overdue will keep everyone on track and reduce the chance of missed payments.

Utilizing Technology for Automation

- Automated Billing Software: Consider using billing and accounting software that can automatically generate and send payment statements. Many platforms also allow for recurring payments and invoice scheduling, saving you significant time and effort.

- Batch Processing: If using an electronic system, you can create multiple billing statements in batches, making it quicker to process all tenants at once, rather than generating individual documents manually.

- Integration with Payment Systems: Many modern software tools allow integration with online payment systems, where tenants can pay directly through the document or a payment link. This eliminates the need for manual tracking of received payments.

By organizing your billing system effectively and leveraging automation tools, you can manage multiple tenant accounts with greater ease and reduce administrative workload. Not only does this help maintain accuracy and efficiency, but it also ensures a smooth financial operation for your business.