Expert Invoice Template for Professional Billing

Creating professional and accurate financial documents is essential for maintaining clear communication with clients and ensuring timely payments. By using a structured format for your charges, you can simplify your workflow, reduce errors, and build trust with your customers.

Having the right tools in place to manage your transactions can save valuable time. Pre-designed formats provide a convenient way to present your services, payment terms, and due amounts in a clean and understandable manner. This approach helps both businesses and freelancers stay organized and efficient.

Whether you’re looking to enhance your billing system or improve client relationships, a well-organized document plays a crucial role in achieving those goals. It’s more than just a request for payment–it’s a reflection of your professionalism and attention to detail.

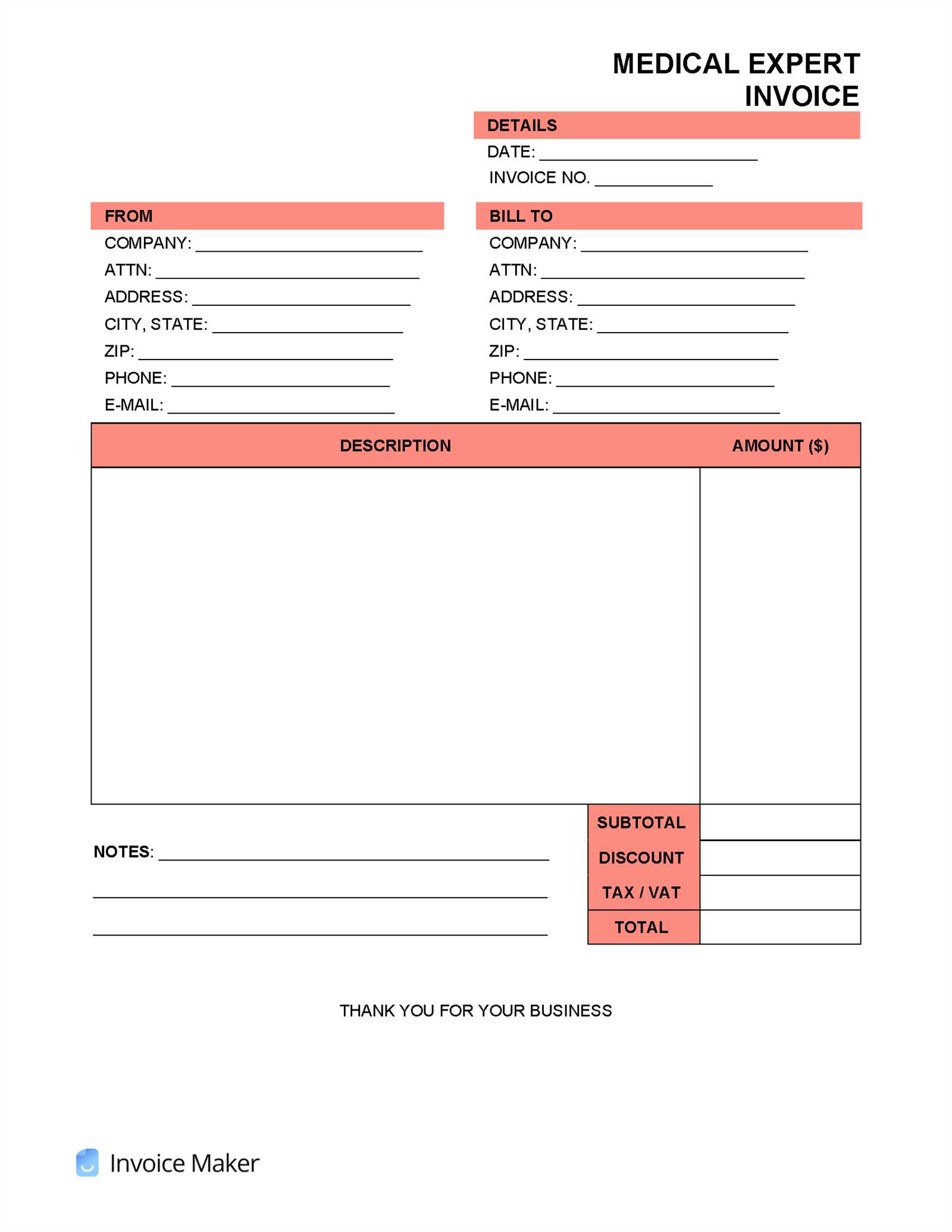

Expert Invoice Template Overview

Having a professional and organized structure for documenting transactions is essential for businesses and freelancers alike. A well-crafted billing document ensures that both the provider and the client have clear expectations about services rendered, payment amounts, and due dates. The right framework not only reduces errors but also improves your overall efficiency in financial matters.

Key Components of a Professional Billing Document

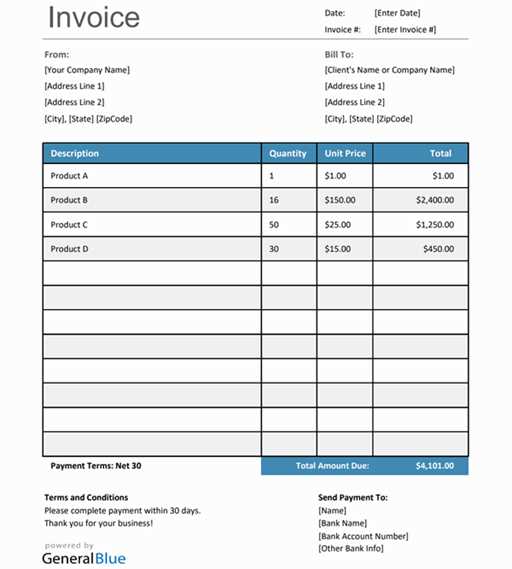

To create a comprehensive and easy-to-understand record, certain elements are essential. These components ensure that the document is both functional and informative:

- Client Information: Names, addresses, and contact details.

- Service Description: Clear breakdown of the products or services provided.

- Pricing and Amounts: Detailed costs for each item or service.

- Payment Terms: Due dates, late fees, or discounts.

- Contact Information: How to reach the service provider for any questions.

Advantages of Using a Structured Format

Using a consistent structure for every transaction brings several benefits:

- Time Efficiency: A predefined structure reduces the time spent creating new documents from scratch.

- Accuracy: Ensures that all relevant information is included and presented clearly, reducing the risk of mistakes.

- Professionalism: A consistent, polished format helps convey credibility and reliability.

- Client Trust: A clear and transparent record of services builds confidence and strengthens business relationships.

Why Use an Expert Invoice Template

Using a well-structured document for requesting payments offers numerous advantages for businesses and independent professionals. Instead of creating a new billing form from scratch each time, a ready-made layout provides an efficient, consistent, and accurate way to handle financial transactions.

One of the primary reasons to adopt a predefined format is the time savings. Rather than spending valuable hours formatting and ensuring all necessary information is included, you can focus on providing your services and meeting your clients’ needs. With a standardized design, you can generate clear, professional records in a matter of minutes.

Additional Benefits Include:

- Consistency: A uniform structure ensures all important details are captured every time, reducing errors.

- Professional Appearance: Clients are more likely to trust and respond positively to well-organized documents.

- Easy Customization: Pre-designed forms can be tailored to your specific needs, whether you’re a freelancer or managing a larger business.

- Legal Protection: A clear and professional record of transactions can help resolve disputes or clarify terms if necessary.

By streamlining your billing process, you not only save time but also present yourself as a professional who pays attention to detail–qualities that are highly valued by clients and partners alike.

Key Features of a Professional Invoice

A well-designed payment request document should be clear, concise, and complete. The goal is to ensure both the provider and the client have all the necessary information to facilitate a smooth and timely transaction. Key elements of such a document help to establish transparency and professionalism, leading to better business relationships and fewer disputes.

To create an effective and reliable payment document, several essential components must be included. These features not only serve as a reminder of the transaction but also clarify important details such as amounts owed, deadlines, and terms of payment.

Essential Elements to Include

- Unique Identification Number: Assigning a reference number helps both parties track and organize transactions easily.

- Clear Breakdown of Services or Products: Providing a detailed description of each item or service helps avoid misunderstandings.

- Accurate Payment Amount: Make sure to list the exact cost, including taxes, fees, or discounts.

- Payment Terms: Include due dates, late fees, and accepted payment methods.

- Contact Information: Always list relevant details for easy communication in case questions arise.

- Legal Information: Ensure that the document complies with applicable laws and includes required business registration numbers or VAT IDs, if necessary.

Why These Features Matter

- Clarity: Clear and straightforward details prevent confusion and make it easier for clients to process payments.

- Professionalism: A polished, complete document builds trust and portrays your business as organized and reliable.

- Efficiency: Ensuring all necessary elements are included speeds up the payment process, reducing the likelihood of delays or disputes.

How to Create an Expert Invoice

Creating a professional billing document requires careful attention to detail and proper organization. It’s essential to ensure that all necessary information is included to avoid confusion and streamline the payment process. By following a clear structure, you can create a reliable record that clients will find easy to understand and process.

The process of creating such a document is simple if you break it down into manageable steps. Each section of the document serves a distinct purpose and should be filled out accurately to ensure the document fulfills its role in the transaction process.

Steps to Craft a Professional Payment Request

- Start with Business Information: Include your company name, address, contact details, and registration information if applicable. This establishes legitimacy.

- Client Details: Clearly list the client’s name, address, and contact information for reference and future correspondence.

- Assign a Unique Reference Number: This makes it easier to track and organize records. Each document should have its own identification number.

- Describe the Products or Services: Break down each item or service provided. Be specific to avoid confusion and potential disputes.

- Include Pricing Information: List the price for each product or service, including taxes, discounts, and additional fees if applicable.

- Set Payment Terms: Specify the payment due date, late fees, and any other terms related to the payment process. This ensures clarity for both parties.

- Provide Payment Methods: Outline how the client can pay (bank transfer, online payment, check, etc.), along with necessary account details.

Final Steps

Before sending the document, double-check that all information is accurate and clear. A well-organized and error-free document helps avoid delays and builds professionalism.

Customizing Your Invoice Template

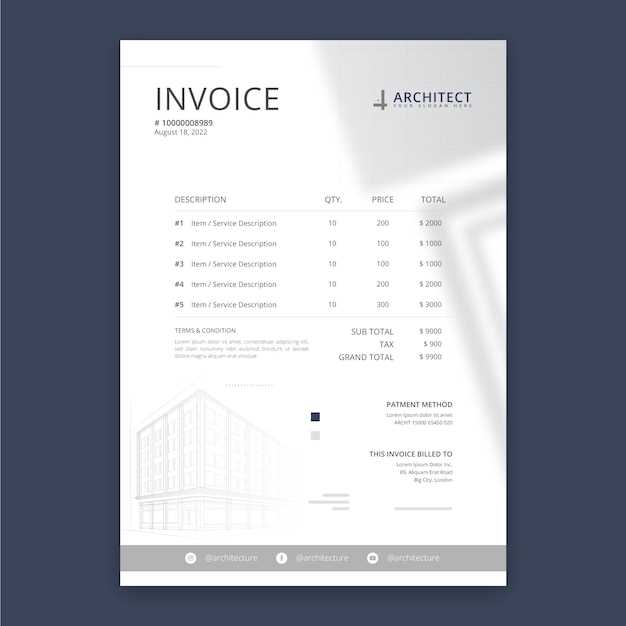

Customizing your billing document allows you to align it with your brand identity while ensuring it meets your specific business needs. By tailoring the layout, content, and design, you can create a unique and professional document that enhances your reputation and streamlines the transaction process.

Personalizing this document doesn’t just make it look professional–it also ensures that it includes all relevant details for your clients. Customization can range from adjusting the color scheme to adding specific fields that are unique to your industry or services.

Key Customization Options

- Branding Elements: Incorporate your logo, brand colors, and fonts to create a cohesive visual identity.

- Service or Product Descriptions: Modify the categories and descriptions to match the services or goods you offer, making the document clearer for clients.

- Payment Terms and Conditions: Adjust the terms section to include specific deadlines, discounts for early payments, or penalties for late fees.

- Additional Fields: Add custom fields like project numbers, order IDs, or other relevant information that can help with client tracking and internal organization.

- Legal Information: Include your business’s registration number, tax identification, or other legal requirements that may vary depending on your location or industry.

Benefits of Customization

- Consistency: Maintaining a unified look across all documents builds trust and reinforces your brand’s identity.

- Clarity: Tailoring the layout to your business helps highlight the most important details, ensuring both parties are on the same page.

- Professional Appearance: A personalized document stands out and conveys a sense of professionalism, which can lead to stronger client relationships.

Benefits of Using Templates for Billing

Utilizing a pre-designed structure for your payment requests offers numerous advantages, from saving time to ensuring accuracy. With a consistent format, businesses can avoid errors, streamline their processes, and present a more professional image to clients. In addition, these ready-to-use documents provide a clear and organized way to handle transactions, ensuring that all necessary information is included every time.

Here are some key benefits of using a standardized structure for your billing needs:

| Benefit | Description |

|---|---|

| Time Savings | Pre-made formats eliminate the need to create a new document from scratch each time, allowing you to focus on other important tasks. |

| Consistency | A uniform structure ensures that all necessary details are included, reducing the likelihood of missing important information. |

| Accuracy | With a fixed layout, the chances of making errors in calculations, formatting, or missing fields are minimized. |

| Professionalism | Using a polished, organized document enhances your image and makes your business appear more reliable and well-managed. |

| Legal Compliance | Many templates are designed to comply with local laws and regulations, ensuring your documents meet all legal requirements. |

By adopting a pre-made structure for your payment requests, you not only enhance efficiency but also improve the overall experience for your clients, making the transaction process smoother and more transparent.

Types of Expert Invoice Templates

There are various types of payment request documents designed to cater to different industries, business sizes, and transaction requirements. Depending on your needs, you can choose a layout that best suits your services, whether you’re a freelancer, a small business owner, or part of a large organization. These forms are available in multiple styles and formats, each tailored to streamline the process and ensure all necessary details are captured.

Common Document Formats

- Simple Billing Forms: Basic and easy to use, these documents are typically used by freelancers or small businesses that offer a limited number of services or products.

- Itemized Payment Requests: These are more detailed forms that break down each service or product separately, making them ideal for larger transactions or clients that require a thorough description of what they’re paying for.

- Recurring Payment Requests: For businesses that offer subscription-based services or ongoing projects, this layout automatically adjusts for regular billing cycles, making it easy to manage repeat transactions.

- Credit Billing Forms: Used when issuing credit or refunds, these forms help track any adjustments made to previous bills and ensure the client receives the correct balance.

- Proforma Payment Requests: These are used for estimates and advance payments before services are completed, providing clients with a breakdown of projected costs.

Industry-Specific Document Designs

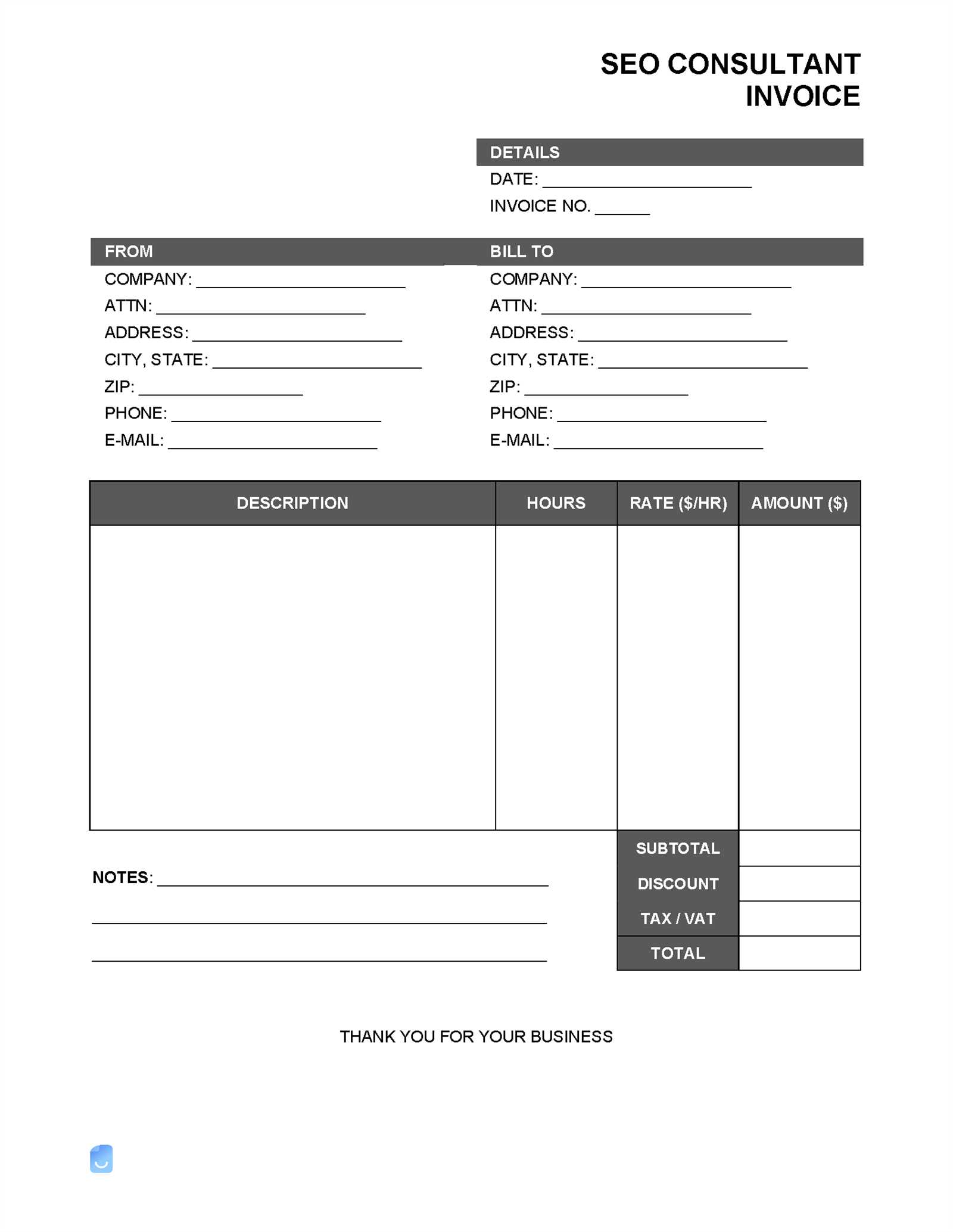

- Consultant Forms: These documents often include hourly rates, consultation details, and a breakdown of the time spent on each task.

- Retail Forms: These are designed to include a detailed list of products sold, quantities, and unit prices, often used by retailers and wholesalers.

- Construction and Project-Based Forms: These are tailored to track milestones, materials, labor costs, and other project-specific elements, commonly used by contractors and construction companies.

- Service-Based Billing Forms: Professionals offering services, such as legal advice, marketing, or design, use this format to list hourly rates, work performed, and time spent on specific tasks.

By selecting the right format for your business or industry, you can ensure that your payment requests are not only functional but also tailored to meet both your needs and your clients’ expectations.

Free vs Paid Invoice Templates

When it comes to selecting a format for your payment requests, one of the first decisions you’ll face is whether to go with a free option or invest in a paid version. Both options have their advantages, but they cater to different needs and priorities. Understanding the differences can help you make an informed decision based on your business size, budget, and specific requirements.

Free solutions are often a great starting point for individuals or small businesses that are just getting started or need a simple, no-cost option. Paid options, on the other hand, generally offer more features, flexibility, and support, making them ideal for growing businesses with more complex needs.

Benefits of Free Billing Documents

- No Cost: The biggest advantage is that these forms are free to use, making them ideal for startups or businesses on a tight budget.

- Basic Functionality: Free options typically offer the basic elements required for simple transactions, such as payment amounts, due dates, and descriptions.

- Easy to Use: Most free versions are simple and intuitive, making them easy to set up and use without much technical knowledge.

- Accessible: Many free solutions are available online, allowing you to quickly download or customize a document without needing to install special software.

Advantages of Paid Billing Documents

- Customization Options: Paid versions often offer advanced features, such as the ability to fully customize the layout, design, and content to match your brand’s identity.

- Advanced Features: Paid options may include additional functionality like automated payment tracking, integration with accounting software, or advanced reporting tools.

- Professional Support: With a paid plan, you often have access to customer support in case you encounter any issues or need assistance with specific features.

- Security and Compliance: Paid solutions are more likely to offer secure data management and ensure compliance with legal requirements such as tax regulations and local laws.

Choosing between free and paid options ultimately depends on your business needs and goals. If you’re just starting out or have minimal invoicing requirements, a free solution might be sufficient. However, as your business grows and your needs become more complex, investing in a paid option could provide the tools and support to help you scale more efficiently.

Common Mistakes in Invoicing

When it comes to creating payment requests, even small mistakes can lead to delays or confusion, and in some cases, even financial loss. Many businesses and freelancers make common errors when drafting these documents, whether it’s forgetting key details or miscommunicating payment terms. Recognizing and avoiding these mistakes can help ensure smooth transactions and stronger client relationships.

Understanding the potential pitfalls allows you to take proactive steps to avoid them. This not only improves the accuracy of your documents but also enhances your professionalism in the eyes of your clients.

Frequently Made Errors

- Missing Client Information: Failing to include full client details, such as their name, address, or contact info, can cause confusion or delay in payments.

- Incorrect Dates: A common mistake is listing the wrong issue date or payment due date, leading to misunderstandings about when payment is expected.

- Unclear Payment Terms: Not clearly stating payment deadlines, late fees, or acceptable payment methods can create ambiguity and delays in the payment process.

- Failure to Include Reference Numbers: Without a unique identifier for each transaction, both parties may have trouble tracking and organizing payment records.

- Omitting Tax or Fees: Forgetting to include sales tax, VAT, or other relevant fees can result in discrepancies and may require follow-up communication.

How to Avoid These Mistakes

- Double-Check Details: Always review client information, dates, and pricing before sending the document.

- Clarify Payment Terms: Make sure all payment conditions are explicitly stated and easy for clients to understand.

- Use Templates: Using a consistent structure for all documents helps you ensure no details are overlooked.

- Include All Costs: Be thorough in listing all products, services, taxes, and fees to avoid confusion later on.

By addressing these common mistakes, you can improve your billing process, reduce the risk of errors, and ensure your clients have all the information they need to make timely payments.

How to Add Taxes and Discounts

Including taxes and discounts in your payment documents is essential for providing a clear breakdown of the total amount due. These elements not only reflect the actual cost of the goods or services provided but also ensure transparency and avoid confusion for both you and your clients. Understanding how to properly apply taxes and discounts helps to maintain accurate financial records and build trust with your clients.

Adding taxes and discounts to a payment request involves knowing the correct rates to apply, clearly displaying these adjustments, and ensuring that the final total reflects the agreed-upon terms. Let’s look at how to do this step by step.

Adding Taxes

- Determine the Tax Rate: Identify the applicable tax rate based on the location of your business or the client’s location. This may vary by country, state, or industry.

- Apply the Tax: Once the tax rate is known, calculate the tax amount based on the price of the goods or services provided. This can either be a percentage of the total or a fixed amount, depending on your business model.

- Display the Tax Clearly: Clearly list the tax amount as a separate line item on the document. This helps your client understand the tax calculation and avoid any confusion.

Applying Discounts

- Identify Discount Type: Determine whether the discount is a percentage (e.g., 10% off) or a fixed amount (e.g., $50 off) and ensure this is clearly stated.

- Apply the Discount: Subtract the discount amount from the total cost of the goods or services provided. If it’s a percentage, calculate the discount based on the original price before applying it.

- Show Discount Details: Include a line item on the document that shows the discount applied, so the client can clearly see how the total was reduced.

Incorporating taxes and discounts into your payment documents ensures that your clients are fully informed of any adjustments to the price and allows you to maintain a professional and transparent approach to financial transactions.

Incorporating Branding in Your Invoice

Integrating your company’s branding into your payment requests is an important step in creating a consistent and professional image for your business. When clients receive a document that reflects your brand’s identity, it not only adds to the overall professionalism but also reinforces recognition and trust. A well-branded document enhances the perception of your business and makes your communication feel more cohesive and personalized.

Branding doesn’t just refer to the logo; it encompasses your business’s color scheme, fonts, and overall design. By thoughtfully incorporating these elements into your payment documents, you ensure that every interaction with your clients reflects your business’s values and aesthetic.

Key Elements of Branding to Include

- Logo: Adding your company’s logo at the top of the document makes it instantly recognizable and aligns your document with your overall brand identity.

- Color Scheme: Use your brand’s colors throughout the document. This can include headers, borders, and accents to create a cohesive look that matches your website or other business materials.

- Typography: Choose fonts that reflect your business’s style. Whether it’s a modern sans-serif or a more traditional serif font, maintaining consistency in typography helps reinforce your brand image.

- Contact Information: Include your company’s contact details in a clearly visible area, such as the footer, to ensure clients know how to reach you for further communication.

- Tagline or Slogan: If your business has a memorable tagline, consider including it in your documents. This can further communicate your brand’s values or mission.

Benefits of Incorporating Branding

| Benefit | Explanation |

|---|---|

| Professionalism | Using your branding throughout the document makes your business appear more professional and polished. |

| Brand Recognition | Clients are more likely to remember your brand when your documents are clearly branded, which can lead to repeat business and referrals. |

| Consistency | When your payment requests match the look and feel of your other business materials, it creates a seamless experience for the client. |

| Trust and Credibility | Well-branded documents instill trust and give the impression that your business is reliable and established. |

By paying attention to how you incorporate branding into your payment documents, you can enhance your business’s professional image and leave a lasting impression on your clients.

Tracking Payments with Invoice Templates

Effectively managing payments is crucial for maintaining a healthy cash flow and ensuring timely receipt of funds. Using a structured document to track payments not only helps keep everything organized but also provides a clear record for both you and your clients. By incorporating tracking features, you can stay on top of overdue payments and monitor the status of each transaction efficiently.

There are several ways to integrate payment tracking into your documents, whether through manual updates or automated systems. Regardless of the approach, having a clear and consistent method to track each payment will improve your financial management and reduce the likelihood of missed payments.

Key Features for Payment Tracking

| Feature | Purpose |

|---|---|

| Payment Status | Track whether a payment has been made, is pending, or is overdue. This helps you stay informed about outstanding amounts. |

| Payment Date | Record the exact date on which the payment is made to avoid confusion or disputes about due dates. |

| Balance Remaining | Show the remaining balance after each payment, helping both you and your client track how much is still due. |

| Payment Method | Indicate the method through which the payment was made (e.g., bank transfer, credit card, PayPal), providing additional transparency. |

| Transaction ID | Including a transaction ID or reference number for each payment can be useful for reconciliation and resolving any payment issues. |

By incorporating these features into your payment requests, you can easily monitor the status of each transaction, address overdue payments promptly, and ensure a more organized financial system. This level of tracking also builds trust with your clients, as they can see exactly where their payments stand and how they are applied to their balance.

How to Format Your Invoice Professionally

Creating a well-organized and professional-looking payment request is essential for making a positive impression on clients. A properly formatted document not only reflects your attention to detail but also ensures clarity in terms of what is being charged, when payments are due, and how clients can make their payments. Proper formatting helps prevent misunderstandings and facilitates timely payments.

To achieve a polished and clear presentation, there are several key components and formatting techniques that you should incorporate. Below are the essential elements to consider when preparing your document.

Essential Formatting Tips

- Header with Your Business Information: Always include your business name, logo, and contact details at the top of the document. This ensures that your clients know who the payment request is from and how they can reach you.

- Clear Client Details: Include the recipient’s name, address, and contact information. Make sure these details are accurate to avoid any confusion.

- Invoice or Reference Number: Assign a unique number to each document. This helps you and your clients track and refer to the payment request easily.

- Detailed Breakdown of Charges: Clearly list each service or product provided, including descriptions, quantities, unit prices, and totals. This helps your clients understand exactly what they are being charged for.

- Payment Terms: Include the payment due date, any late fees, and acceptable payment methods (bank transfer, PayPal, etc.). Ensure that the terms are clear and easy to understand.

- Total Amount Due: Make sure the total is highlighted, often in bold or at the bottom of the document. This draws attention to the amount the client is expected to pay.

- Legal or Tax Information: If applicable, include any required legal or tax-related information, such as tax identification numbers or VAT details.

Design and Layout Tips

- Consistent and Clean Design: Use a simple, clean layout that’s easy to read. Avoid cluttered pages and use sufficient white space between sections to give your document a professional look.

- Readable Font Choices: Stick to standard, easy-to-read fonts like Arial, Times New Roman, or Calibri. Use font sizes that make headings stand out without overwhelming the body text.

- Use Tables for Clarity: Organize service details, rates, and totals using tables for easy readability. Ensure that all columns are aligned and there is consistency in the presentation of numbers.

- Align Your Text: Keep text aligned to the left for easy readability, and use bold or italics for emphasis where necessary.

By following these formatting guidelines, you can ensure that your payment request looks professional, is easy to understand, and helps maintain smooth communication between you and you

Integrating Invoices with Accounting Software

Integrating your payment requests with accounting software can streamline your financial processes, reduce errors, and save you valuable time. By syncing your billing system with accounting tools, you can automate record-keeping, track payments more effectively, and generate reports with ease. This integration ensures that all your financial data is stored in one place, providing a clearer picture of your business’s cash flow and financial health.

When invoices are automatically transferred to your accounting system, you can avoid manual data entry, which reduces the chances of mistakes and increases overall efficiency. In this section, we’ll discuss how to make this integration seamless and the benefits it offers to your business.

How to Integrate Payment Requests with Accounting Tools

- Choose Compatible Software: Ensure that your accounting software supports integration with your billing system or any document-generating tools you use. Many popular platforms like QuickBooks, Xero, and FreshBooks offer built-in integrations or third-party add-ons.

- Enable Syncing Features: Most accounting platforms allow you to automatically sync your documents. Look for settings in your software that enable this feature, ensuring your payment records are updated every time a new request is created.

- Connect Payment Gateways: Many accounting tools allow you to link your payment processing systems (e.g., PayPal, Stripe). This lets you automatically update your records when payments are received.

- Customize Data Mapping: Set up your accounting software to correctly map fields from your payment requests to the corresponding financial categories in your accounting system. This ensures accurate categorization of income, taxes, and expenses.

Benefits of Integration

- Time Savings: Automating the transfer of data between your billing and accounting systems eliminates the need for manual data entry, freeing up time for other important tasks.

- Reduced Errors: Automatic syncing reduces the risk of errors that can occur when entering payment details manually.

- Better Financial Visibility: Integration provides a real-time view of your financial situation, helping you make informed business decisions.

- Improved Reporting: With integrated systems, generating financial reports becomes effortless, allowing you to analyze cash flow, revenue trends, and outstanding payments more effectively.

By integrating your payment request process with accounting software, you can simplify your financial management, reduce administrative overhead, and ensure accurate financial records. This integration not only enhances your operational efficiency but also contributes to better decision-making and growth opportunities for your business.

Best Practices for Sending Invoices

Sending payment requests in a timely and professional manner is a key part of maintaining smooth business operations and strong client relationships. Properly managing how and when you send these documents can help ensure quick processing, reduce errors, and encourage prompt payments. Adopting best practices in sending requests not only shows professionalism but also helps prevent misunderstandings and delays.

Whether you send your payment requests manually or automate the process, there are several important guidelines that can help you maintain consistency, accuracy, and efficiency in your financial communications.

Timely Delivery

- Send Promptly: Always send payment requests as soon as the work is completed or the product is delivered. Sending them right away helps your client to manage their finances and ensures that your request is processed without delay.

- Set Clear Deadlines: Clearly state the payment due date in the document. This sets expectations and helps clients plan accordingly. It’s also a good practice to remind them a few days before the payment is due.

- Avoid Delays: If your terms require sending reminders or following up, do so promptly. The longer you wait, the more likely you are to experience delayed payments.

Professional Communication

- Personalize the Message: When sending a request, always include a personalized message. Address the client by name and include details of the work or product provided to show that the request is specific to their order.

- Provide Clear Instructions: Include clear and simple instructions on how clients can make the payment. Provide payment options and ensure they are easy to follow.

- Be Courteous: Always maintain a polite and professional tone. Clear communication builds trust and encourages positive working relationships with your clients.

Methods of Sending

- Use Digital Delivery: Sending digital documents through email or secure online platforms makes the process faster and more reliable. It also allows you to easily track when the document was received.

- Include a Payment Link: If possible, include a direct payment link in your document. This simplifies the payment process for your client and may result in faster payments.

- Follow Up Efficiently: If the payment request is not acknowledged within a reasonable time, follow up with a polite reminder. Some accounting software can send automatic reminders, saving you time.

By following these best practices, you ensure that your payment requests are delivered efficiently and professionally. Timely communication and clear instructions can help maintain positive relationships with clients, improve cash flow, and keep your business running smoothly.

Legal Considerations in Invoice Design

When creating documents to request payments, it’s essential to ensure that they comply with relevant laws and regulations. A well-structured payment request should not only reflect professionalism but also meet legal requirements to protect both you and your clients. By including the necessary legal elements, you help prevent disputes, avoid penalties, and ensure smooth business transactions.

In this section, we’ll outline the key legal aspects to consider when designing a payment request, from including mandatory details to adhering to tax and reporting standards.

Key Legal Elements to Include

- Business Information: Always include your full business name, address, and contact details. If applicable, also list your tax identification number (TIN) or VAT registration number. This information is important for transparency and compliance with tax laws.

- Clear Payment Terms: Include the due date for payment, as well as any late fees or interest charges that may apply if payment is not received on time. Clearly outline these terms to avoid confusion or potential legal issues.

- Accurate Descriptions of Goods or Services: Provide a detailed description of the products or services rendered. This not only helps in case of disputes but also ensures that the transaction is fully documented for tax and audit purposes.

- Legal Disclaimers: Depending on your jurisdiction and the nature of your business, certain legal disclaimers or clauses may be required, such as a statement on refund policies or warranties. Be sure to include any necessary legal terms that apply to your services or products.

Compliance with Tax Laws

- Tax Calculation: If your business is subject to sales tax or VAT, ensure that the correct tax rate is applied and that the tax amount is clearly itemized on the document. Failure to do so can lead to issues with tax authorities.

- Invoice Numbering: Use a unique number for each payment request to maintain proper records and comply with tax reporting requirements. This is especially important for businesses that need to submit tax filings or audits.

- Proper Currency Representation: If you do business internationally, always indicate the currency in which the payment is expected, along with any applicable exchange rates, if necessary. This ensures clarity for clients and compliance with international trade laws.

By following these legal considerations, you ensure that your payment requests are both professional and legally compliant. This minimizes the risk of misunderstandings or legal complications, creating a smoother transaction process for both you and your clients.

Improving Client Relations with Invoices

Payment requests are more than just a means of securing payment–they are an opportunity to reinforce your relationship with clients. How you present and communicate these requests can significantly impact how clients perceive your professionalism and trustworthiness. By crafting clear, respectful, and efficient documents, you not only encourage timely payments but also strengthen the client’s overall experience with your business.

Effective communication through your billing process can build trust, reduce disputes, and enhance long-term relationships. Below are some strategies that can help you use payment requests as a tool for improving client relations.

Clarity and Transparency

- Clear Breakdown of Charges: Always provide a detailed and transparent list of services or products, along with associated costs. When clients understand what they are being charged for, they are less likely to question or dispute the request.

- Accurate Dates and Deadlines: Clearly state the dates of services provided and payment due dates. This shows respect for your client’s time and reduces the chances of misunderstandings regarding timing.

- Tax and Additional Fees: Clearly itemize any taxes, shipping fees, or additional charges. Transparency in these areas prevents clients from feeling blindsided and helps maintain positive interactions.

Respectful Communication

- Polite Language: Even though the purpose of the document is to request payment, always maintain a professional and courteous tone. A polite approach makes clients feel respected and valued, which can foster goodwill.

- Personalized Messages: Include a personal note or message thanking the client for their business. This small gesture makes the transaction feel more like a partnership than a simple business exchange.

- Prompt Reminders: If follow-ups are necessary, send reminders in a timely but gentle manner. Offering reminders that are non-confrontational helps maintain a professional rapport with clients.

Efficient and Convenient Payment Methods

- Multiple Payment Options: Offering a variety of payment methods (e.g., bank transfer, credit card, or online payment platforms like PayPal) provides convenience for clients and makes it easier for them to settle bills promptly.

- Easy-to-Use Online Systems: If possible, provide clients with an online system where they can view, pay, and track their payment history. An easy-to-navigate payment platform adds to the overall client experience.

- Payment Flexibility: If you offer any payment terms or installment plans, make sure these are clearly explained. Flexible terms can improve client satisfaction and build long-term loyalty.

By ensuring that your payment requests are clear, respectful, and convenient, you demonstrate your commitment to providing excellent service, which in turn enhances client satisfaction and strengthens your business relationships. Remember, every interaction–whether it’s about payment or service delivery–shapes your clients’ perceptions and influences their decision to continue working with you.