Free Excel Invoice Template with Automatic Numbering Download

Managing client payments can often feel like a daunting task, but having the right tools can make it significantly easier. Using a well-organized document to track transactions can help you stay on top of your financial activities and maintain a professional appearance. Whether you’re a freelancer or a business owner, having a structured approach to invoicing can save you time and effort.

Efficient tracking of each payment and assignment is essential to ensure that everything is documented properly. By implementing a system that handles sequential entries, you can eliminate the risk of duplication or errors. This method not only simplifies the process but also provides a more polished experience for both you and your clients.

Fortunately, modern tools offer customizable solutions that cater to a variety of needs. They allow you to easily personalize the layout, structure, and flow of the document while ensuring consistent progression of records. This guide will walk you through how to access and set up such a system, enabling you to streamline your billing operations seamlessly.

Free Excel Invoice Template with Automatic Numbering

For anyone who regularly handles client billing, having a well-organized document that automatically handles sequential entry of records is a game changer. This system allows you to efficiently manage each transaction while maintaining consistency. You can customize the structure to fit your specific needs, making it easier to track payments and keep your business organized.

Why Choose a Pre-Formatted Document

Using a pre-made file designed for this purpose saves time and minimizes errors. These documents often come equipped with built-in functionalities that allow for smooth operation from the start. With features like a self-updating record system, you don’t need to worry about tracking each number manually, ensuring a seamless experience for both you and your clients.

How to Access and Set Up the File

Obtaining such a document is simple, and there are plenty of resources available that offer them without any cost. Once you acquire the file, setting it up is straightforward. Most documents come with detailed instructions on how to use the built-in tools, ensuring that you can get started quickly. After customizing the fields to your needs, the document will be ready to handle your record-keeping automatically, saving you valuable time.

Why Use Excel for Invoicing

When it comes to managing finances, selecting the right tool for billing is essential. Spreadsheets offer a structured and reliable way to track transactions and payments, making them highly suitable for business use. The adaptability of these files allows users to organize information in a clear, accessible format that supports professional record-keeping.

Flexibility for Various Business Needs

One of the biggest advantages of using a spreadsheet is its versatility. You can easily adjust columns, rows, and data fields to fit the specifics of each project or client. Whether you need to include detailed breakdowns of services or additional tax fields, this tool can be modified to meet diverse requirements, giving you complete control over your billing format.

Enhanced Accuracy and Organization

Another significant benefit is the ease of tracking and

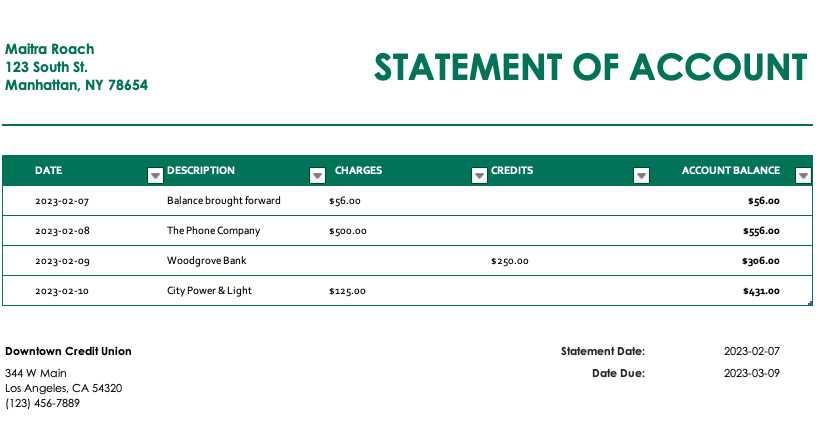

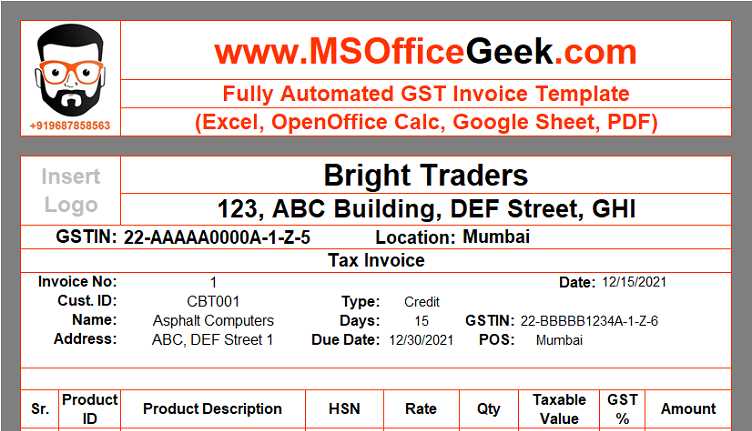

Benefits of Automatic Invoice Numbering

Efficient record-keeping is key to successful billing, and using a system that manages entries automatically provides notable advantages. It ensures that each transaction has a unique identifier, which simplifies organization and minimizes the chance of duplicate records. This feature is particularly valuable for businesses handling multiple clients or frequent transactions.

Enhanced Organization and Tracking

One major benefit of automatic sequential entries is the improvement in organizational flow. Assigning unique identifiers to each record makes it easier to locate specific entries when needed, streamlining financial tracking. This level of organization is essential for both small and large businesses, enabling them to maintain clear and orderly records.

Reduced Risk of Human Error

When managing entries manually, there’s always the potential for mistakes, such as reusing the same identifier or skipping a sequence. Automating this aspect removes these risks, resulting in greater accuracy. Th

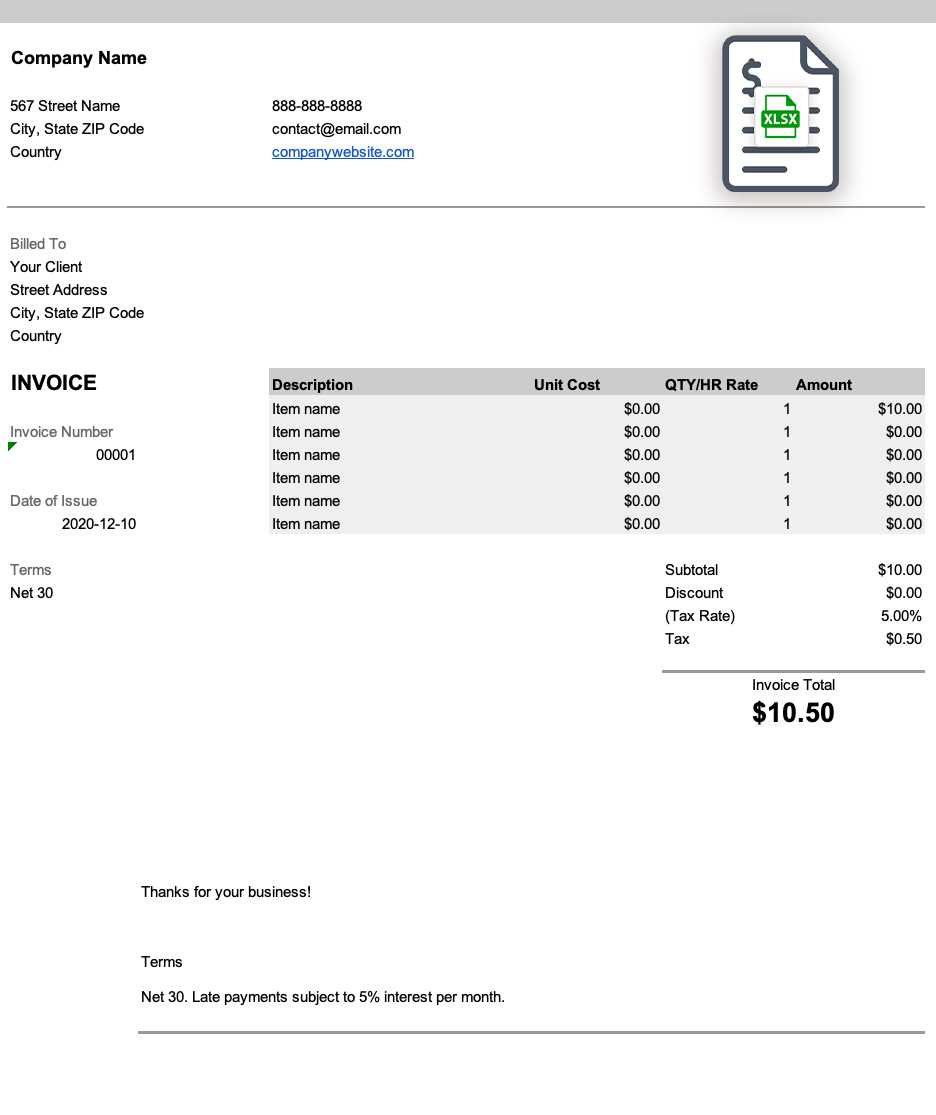

How to Download an Excel Invoice Template

Finding the right resource for your billing documents is the first step toward efficient financial management. Accessing a pre-formatted file can save you time and effort, providing you with a framework ready for customization to suit your specific needs. Many sources offer various file options, allowing you to choose the best fit for your business style.

Where to Find Reliable Sources

There are numerous reputable platforms online that provide structured billing files. These sources often categorize files by business type or document layout, making it easier to locate exactly what you need. It’s essential to select a trustworthy site to ensure that your file is both secure and compatible with your software.

Steps for Easy Access and Setup

Once you’ve chosen a source, accessing the file is typically straightforward. Most sites provide a direct link or button to initiate retrieval, often without requiring any payment. After securing the file, you can open it immediately and begin personalizing fields for your business details, products, and pricing. T

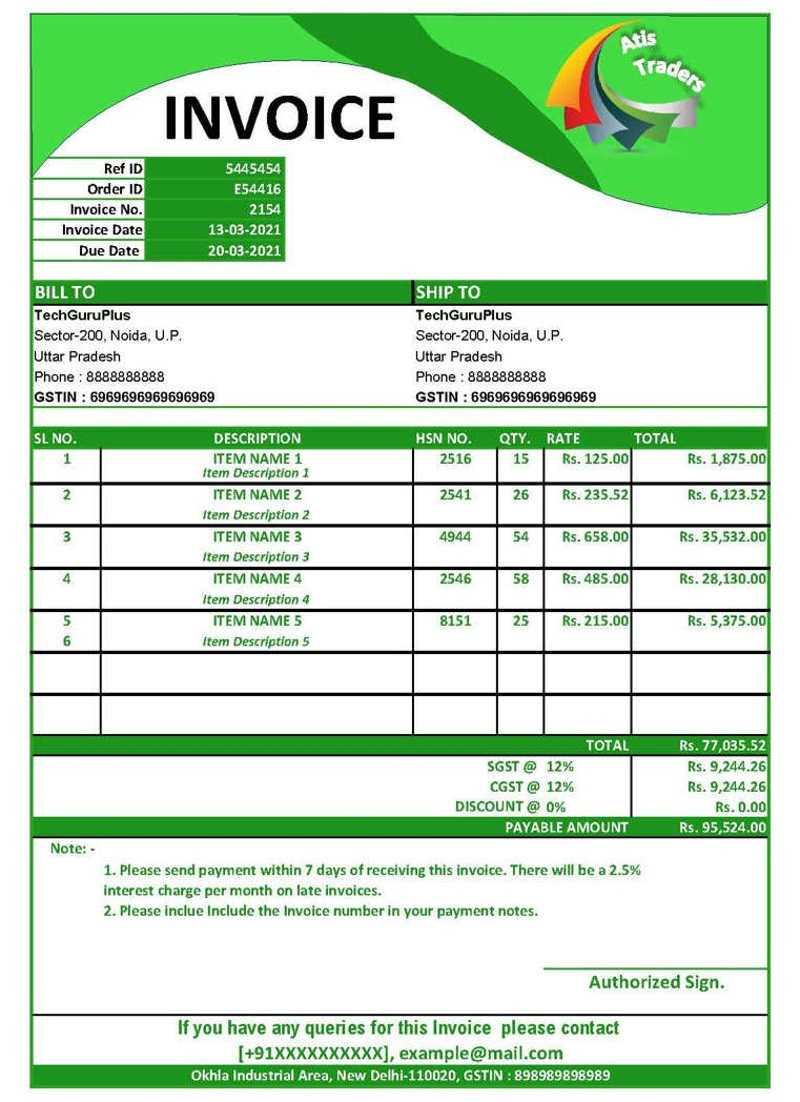

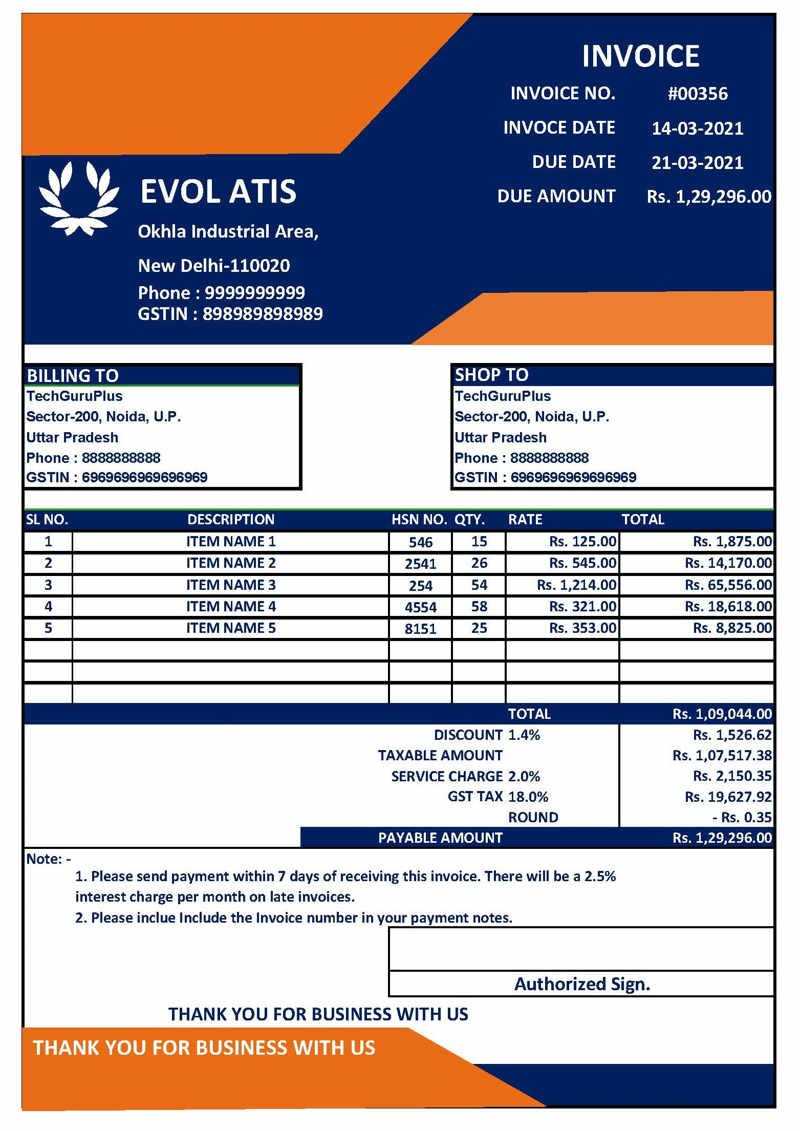

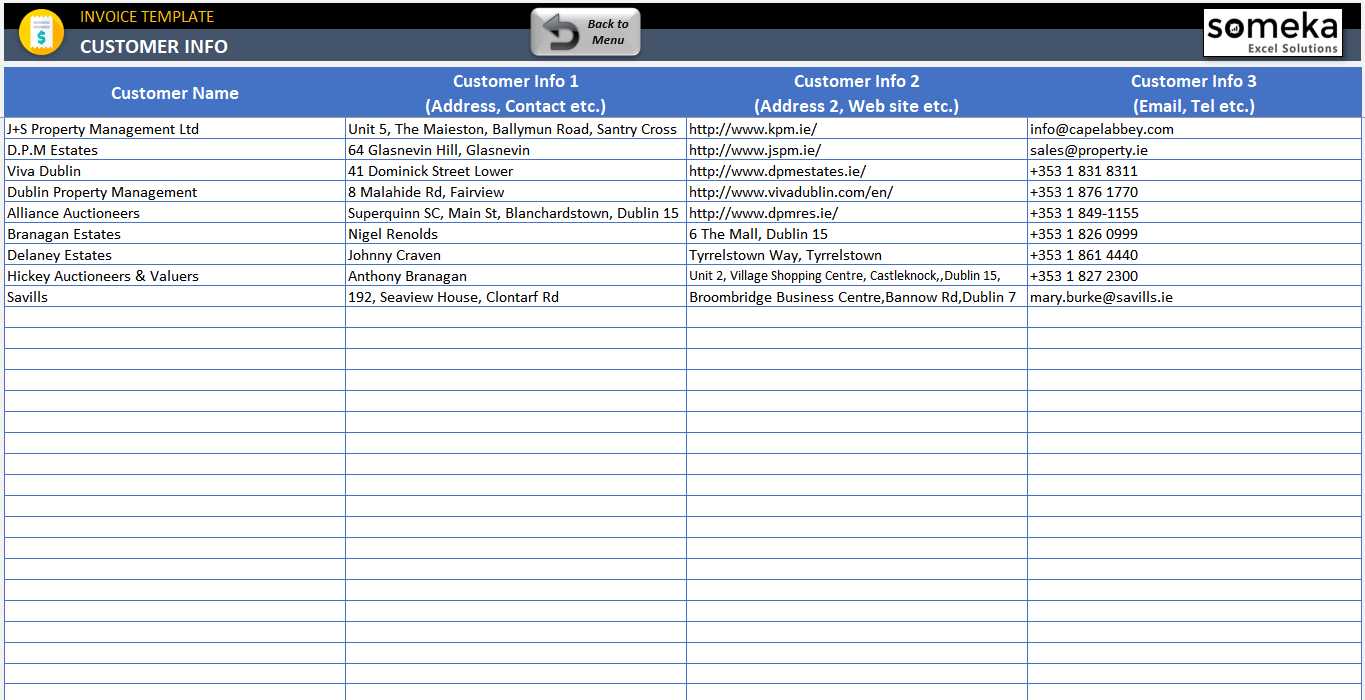

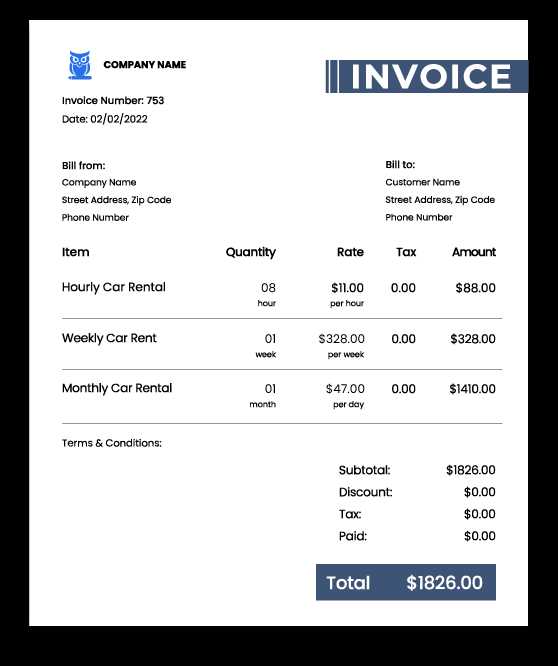

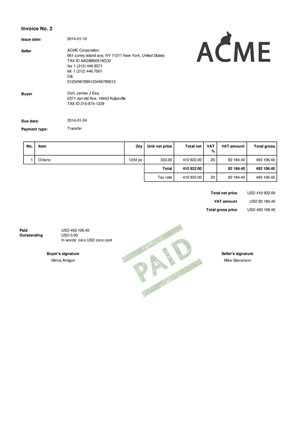

Customizing Your Excel Invoice Template

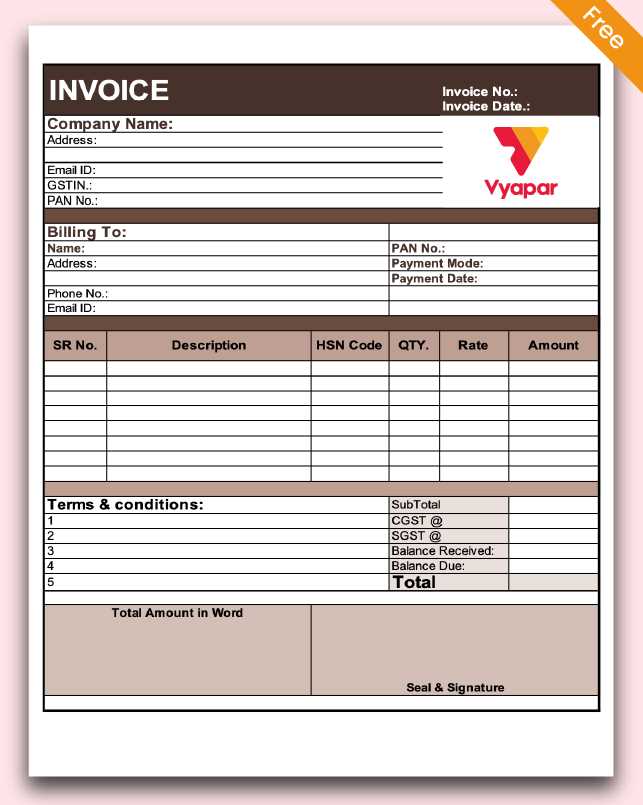

Personalizing a billing document to fit your unique business needs enhances its functionality and professionalism. Adjusting key elements like layout, color scheme, and itemized sections can help create a polished, branded look while ensuring that all necessary information is included. This customization process makes the document a better representation of your services or products.

Adapting Fields for Business Specifics

To tailor the file effectively, begin by modifying core sections to align with your industry. For example, adjust the description fields to detail the specific services or products you provide, add extra columns if needed, or include a section for taxes or discounts. Each field can be customized to capture essential information relevant to your transactions.

Adding Branding and Visual Elements

Incorporating branding elements like your company logo, preferred fonts, and color themes can elevate the document’s appearance. A cohesive design not only looks professional but also reinforces brand recognition. By applying subtle design touches, you can make your document visually appealing and uniquely yours while keeping it functional and easy to read.

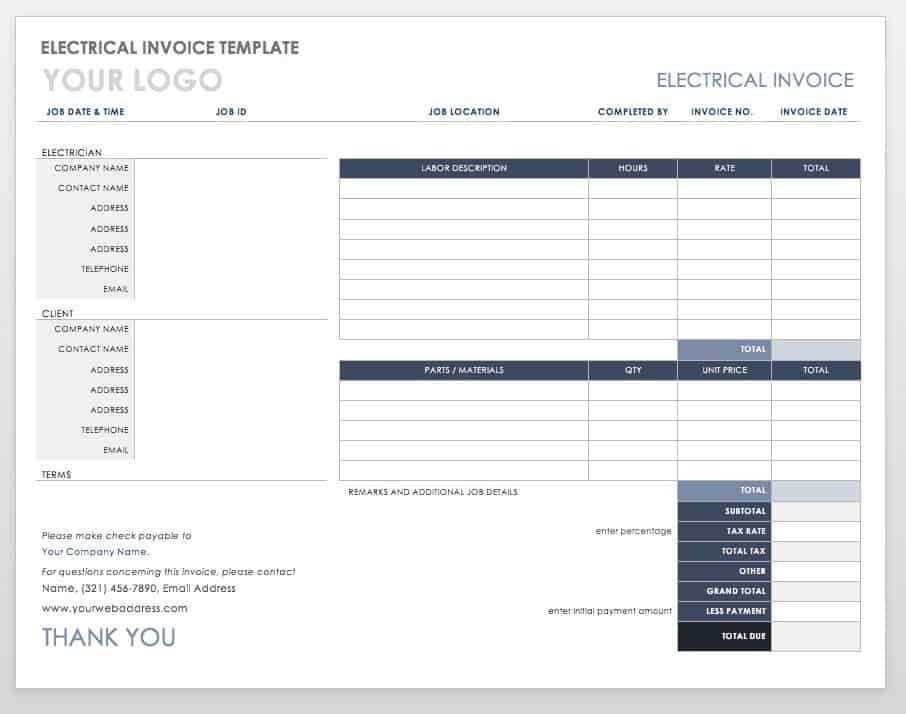

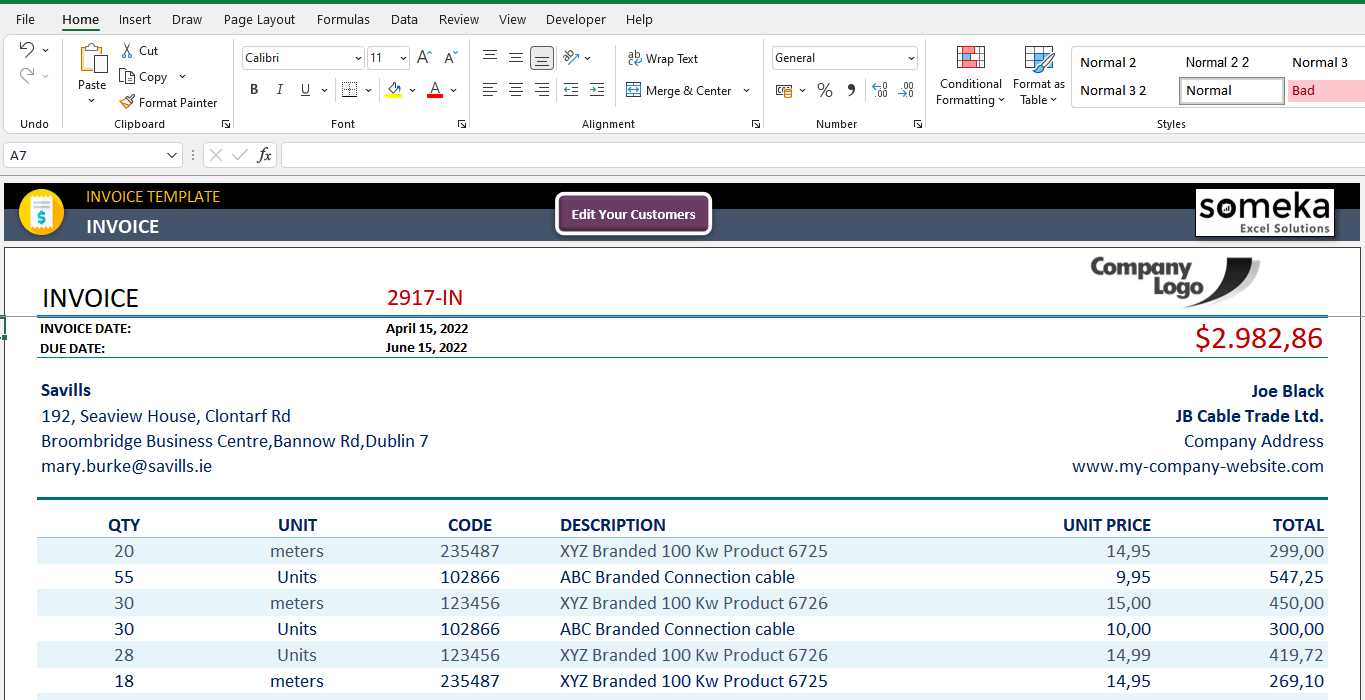

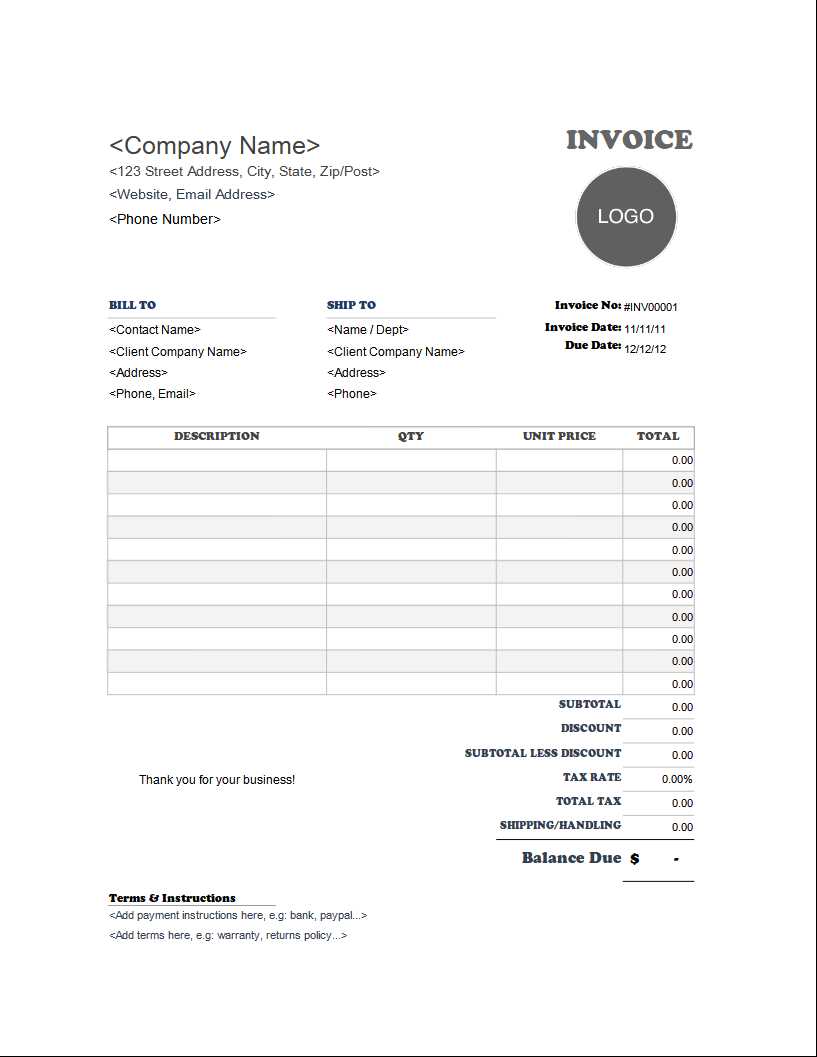

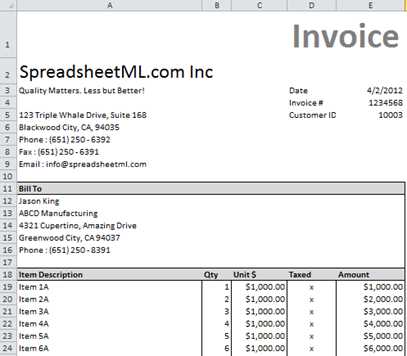

Setting Up Automatic Numbering in Excel

Adding sequential entries automatically to your billing document can greatly simplify record-keeping. This feature ensures that each record is unique and follows the correct order, helping you avoid mistakes and saving time. Setting up this function requires a few adjustments, but once configured, it will enhance the efficiency of your document.

To activate sequential numbering, you can use simple formulas or custom scripts. Below is a guide on how to set up this feature manually using basic functions.

| Step | Action | Description | |||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Select a starting cell for your sequence | Choose the cell where you want your sequence to begin. This could be the first cell in a column dedicated to record identifiers. | |||||||||||||||||||||||||||||||

| 2 | Enter the initial number | Type in the first identifier number. For instance, enter “1” or your preferred starting value.

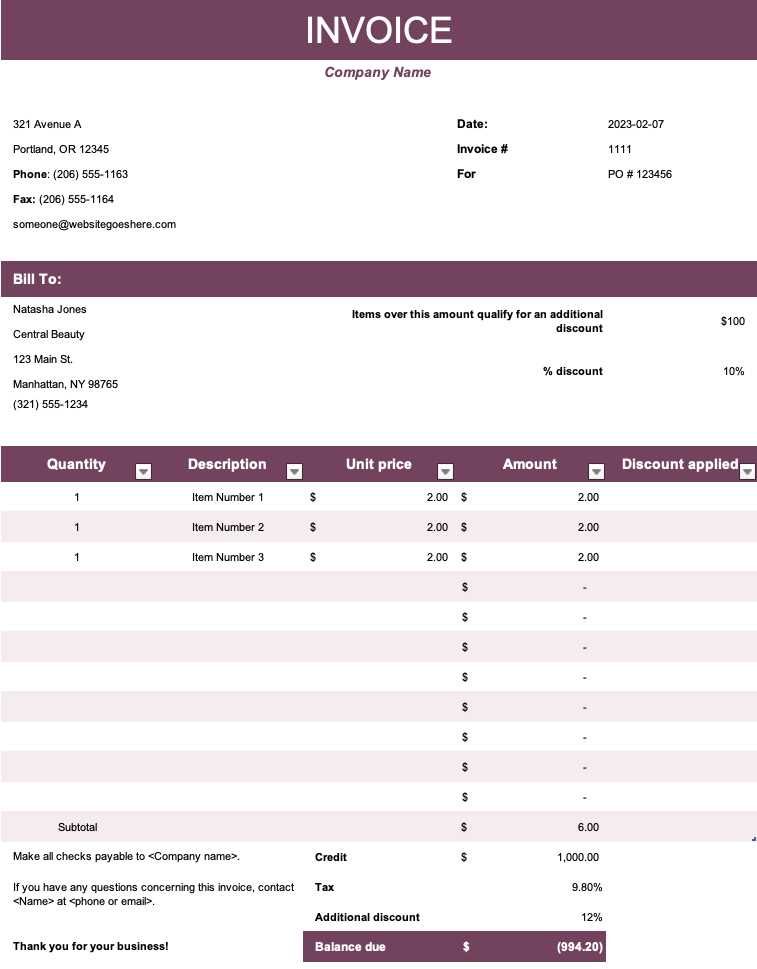

Creating Professional Invoices with ExcelDesigning a polished billing document is crucial for maintaining a professional image and ensuring clear communication with clients. A well-organized format helps present details clearly, making it easy for clients to understand charges, due dates, and payment instructions. This structured approach reflects positively on your business, enhancing trust and reliability. To create a refined document, include essential details such as your company’s name, contact information, and logo. Adding these elements establishes brand identity, giving your document a personalized touch. Additionally, breaking down charges in a concise, itemized manner allows clients to review each aspect of the transaction transparently. Utilize Clear and Consistent Formatting by selecting readable fonts, appropriate text sizes, and alignment that enhances legibility. Grouping information into distinct sections for contact details, item descriptions, and totals helps create a document that is both aesthetically pleasing and functional. Adding options for payment methods and due dates can further streamline the billing process. Clients appreciate clarity on Time-Saving Features of Excel InvoicesUsing organized digital files for billing can significantly reduce the time spent on financial management tasks. Several built-in tools and features make it easy to manage records, calculate totals, and track payments, streamlining the overall process. By automating certain repetitive tasks, you can focus more on core business activities while maintaining a clear and accurate system for tracking revenue. Formulas for Quick Calculations

One of the primary advantages is the ability to use formulas to handle calculations instantly. Rather than manually adding or recalculating amounts, formulas allow you to automatically sum totals, apply taxes, or add discounts. This function eliminates potential errors and ensures accuracy with minimal effort. Customizable Formatting for ConsistencyAnother efficient feature is customizable formatting, which allows you to set consistent visual standards across documents. You can define specific styles for headings, item descriptions, and totals, making it easy to create documents that look polished and are straightforward to read. Additionally, you can save these settings for future use, ensuring that each document follows the same format with just a few clicks, saving time and enhancing professionalism. Understanding Invoice Numbering FormatsEstablishing a clear, logical structure for unique identifiers in your billing system is essential for efficient record-keeping and professional documentation. A structured numbering format not only simplifies organization but also helps to avoid duplicate records and enhances tracking. Choosing the right format can add consistency to your process, making it easier to refer back to past records and manage ongoing transactions. There are various approaches to structuring identifiers, and selecting one depends on your business’s needs and the volume of transactions. Here are some commonly used formats:

|