Lawn Service Invoice Template for Simple and Professional Billing

Managing payments and keeping track of transactions is a vital part of running any landscaping business. Whether you’re offering grass cutting, plant maintenance, or general yard care, providing your clients with clear and professional documents is essential for smooth operations. A well-structured billing document helps maintain transparency, reduces misunderstandings, and ensures timely payments.

Instead of manually creating documents from scratch, using a pre-designed format can save time and effort. By customizing a document to fit your specific services, you can ensure that every detail is accurately reflected. This not only looks more professional but also helps in maintaining consistent records across multiple clients and projects.

In this guide, we’ll explore how utilizing a ready-made document for billing can streamline your business processes. We’ll cover how to personalize it, the essential details to include, and how to make sure the format meets your legal and financial requirements. With the right approach, these documents can be a powerful tool in simplifying your business’s financial management.

Why Use a Lawn Service Invoice Template

Having a well-organized billing system is crucial for any business. A professional, standardized document ensures that all necessary information is provided clearly and consistently. When working with multiple clients, using a ready-made document for your transactions can streamline the entire process, making your work more efficient and reducing the risk of errors. Instead of creating a new document for each project, a pre-structured format allows you to focus on providing quality work while handling the administrative side more effectively.

These customizable documents not only save time but also enhance your credibility with clients. By presenting a polished and professional format, you show attention to detail and a high level of organization, which builds trust and encourages repeat business.

The table below outlines some of the key advantages of using such a ready-made format:

| Benefit | Description |

|---|---|

| Time-Saving | Ready-made formats reduce the need to start from scratch, allowing for quicker document creation. |

| Consistency | Using a standardized document ensures that all essential information is included and formatted uniformly. |

| Professionalism | A clean, well-structured document creates a positive impression and adds to your business’s credibility. |

| Customizability | The format can be easily adjusted to fit your specific services, pricing, and client details. |

| Accuracy | Pre-designed documents minimize the risk of missing essential information or making errors in calculations. |

Benefits of Customizable Invoice Formats

Having the ability to modify your billing documents provides numerous advantages for any business owner. A customizable format allows you to tailor the layout and content to match your specific needs, ensuring that all relevant details are clearly presented and easy to understand. Whether you want to highlight particular services or include unique payment terms, customization enables flexibility in how you manage transactions.

One of the key benefits of using a flexible format is the ability to maintain a consistent and professional look across all your transactions. You can adjust the design to reflect your branding, such as adding your logo or company colors, creating a cohesive experience for clients. This attention to detail can increase trust and demonstrate your commitment to professionalism.

Furthermore, a customizable document allows you to quickly adapt to changes in your pricing structure or service offerings without having to redesign the entire document. Whether you’re adding new types of work or adjusting rates, you can easily update your format to reflect these changes. This flexibility helps keep your business operations smooth and reduces the time spent on administrative tasks.

Key advantages include:

- Flexibility: Adjust content and design to fit specific needs or branding preferences.

- Efficiency: Quickly update documents when pricing or service offerings change.

- Professionalism: Create polished, branded documents that enhance your business image.

- Accuracy: Ensure all essential details are included, minimizing errors and misunderstandings.

- Consistency: Maintain a uniform look across all transactions, reinforcing trust with clients.

How Lawn Service Invoices Simplify Billing

Managing financial transactions and ensuring timely payments can be a complex and time-consuming task for any business. However, using a structured document designed for billing purposes significantly streamlines the entire process. By presenting all the necessary details in a clear and consistent manner, businesses can reduce errors, avoid confusion, and speed up payment cycles. This level of organization helps both businesses and clients stay on the same page, making financial interactions smooth and straightforward.

Clear and Concise Communication

One of the main reasons why using a formalized billing document simplifies payment processing is that it eliminates any ambiguity. Each document can be customized to include all the required information, such as the services rendered, rates, taxes, and due dates. Clients can quickly review the details and make payments without needing to ask for clarification. This reduces the back-and-forth communication often associated with misunderstandings in billing, ensuring everyone is on the same page.

Faster Payments and Fewer Disputes

With a professional, easy-to-understand format, clients are more likely to pay promptly. The structured layout makes it simple for them to see exactly what they owe and why, which can lead to fewer payment delays. Additionally, by providing a clear breakdown of the work done, businesses can minimize the potential for disputes over charges. This results in quicker payments, fewer conflicts, and a more efficient cash flow for your company.

Key benefits:

- Efficiency: Clear, organized documents lead to faster processing of payments.

- Transparency: Clients can easily see the charges and understand the billing details.

- Reduced Errors: A structured format helps avoid mistakes in calculations and missing information.

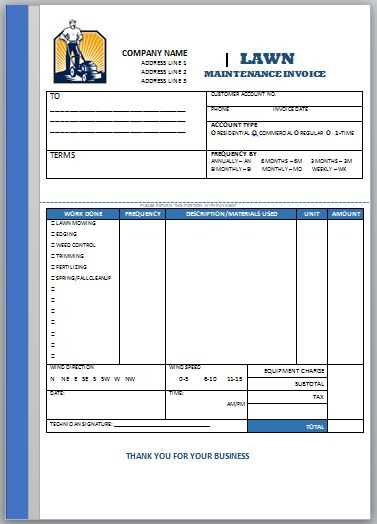

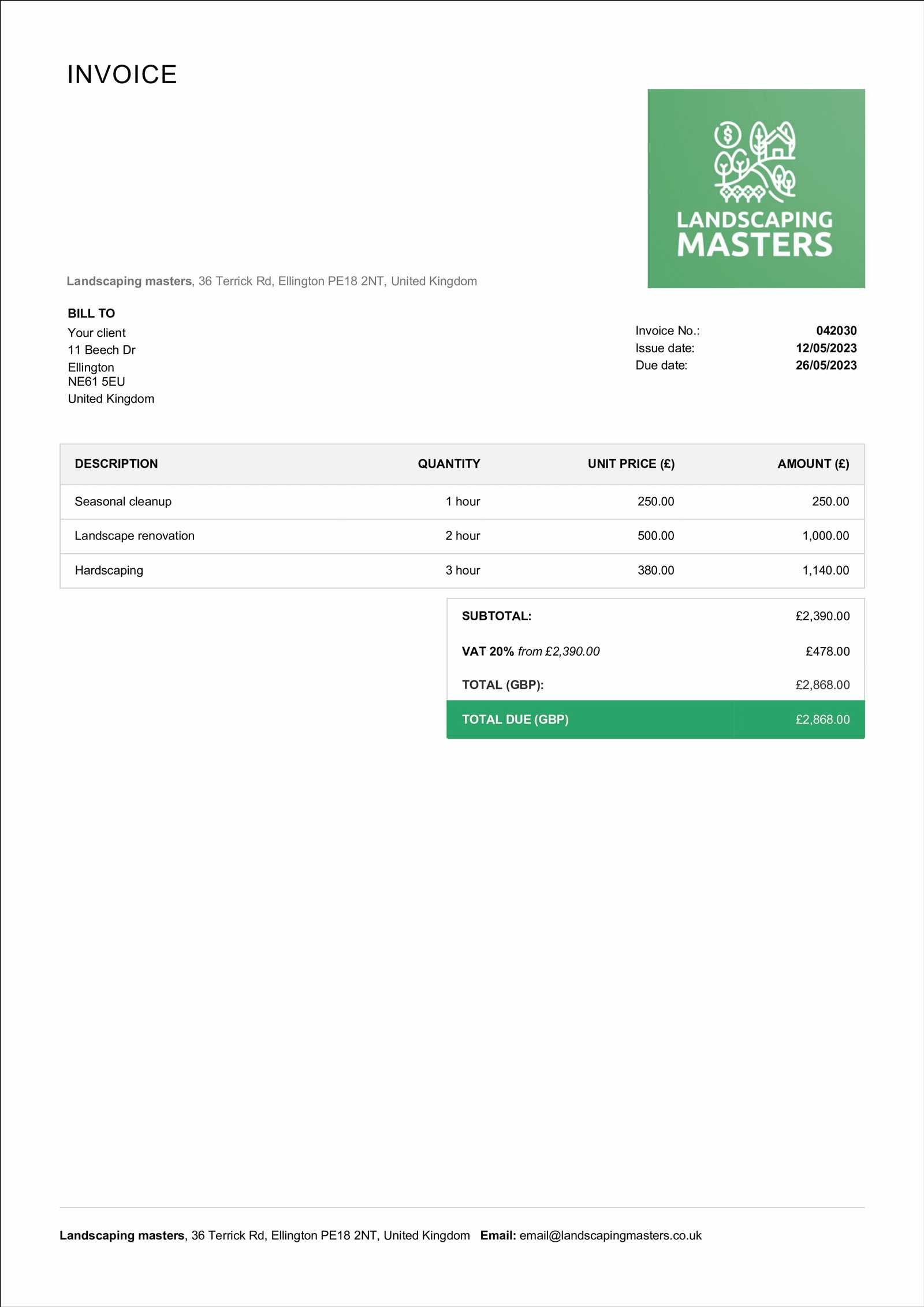

Essential Elements of an Invoice Template

A well-structured billing document is more than just a tool for requesting payment; it’s a professional representation of your business. For it to be effective, certain key components should be included to ensure clarity, accuracy, and compliance. These elements help prevent misunderstandings, streamline the payment process, and enhance the credibility of your business.

Key Components to Include

- Business Information: Your company’s name, address, and contact details should be clearly visible at the top of the document. This helps clients easily identify who the bill is from and how to get in touch if they have any questions.

- Client Details: Include the client’s full name or business name, address, and contact information. This ensures the bill is correctly attributed and helps with organization.

- Unique Invoice Number: Every document should have a unique reference number for easy tracking and future reference. This is especially important for accounting and record-keeping purposes.

- Date of Issue: Clearly display the date the bill is issued to avoid confusion about when payment is due.

- Due Date: Specify the payment deadline. This helps clients prioritize their payments and ensures that you’re paid on time.

Detailed Breakdown of Charges

- List of Services Rendered: Provide a detailed description of the work performed, including quantities, hourly rates, or fixed costs. This breakdown ensures transparency and allows clients to verify the charges.

- Itemized Costs: Include the cost for each service or product, as well as any applicable taxes or discounts. This detailed breakdown makes it easier for clients to understand how the total amount was calculated.

- Payment Terms: State your preferred payment methods and any terms, such as late fees or early payment discounts. This ensures clients know how and when to pay and the consequences of overdue payments.

By incorporating these essential components, you create a clear, professional, and accurate billing document that enhances your relationship with clients and supports efficient payment collection.

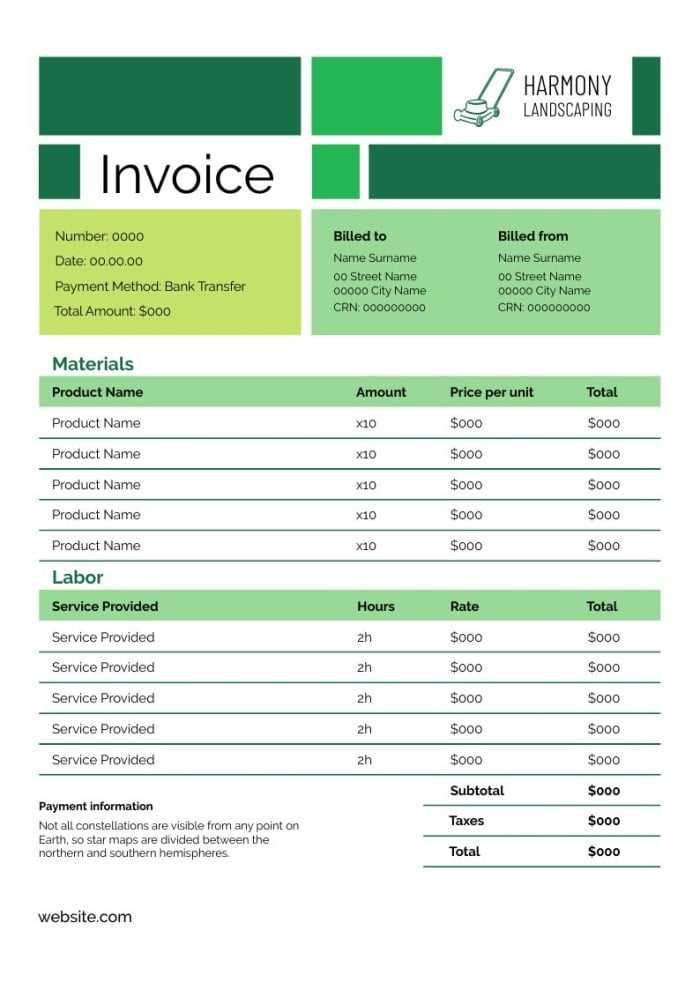

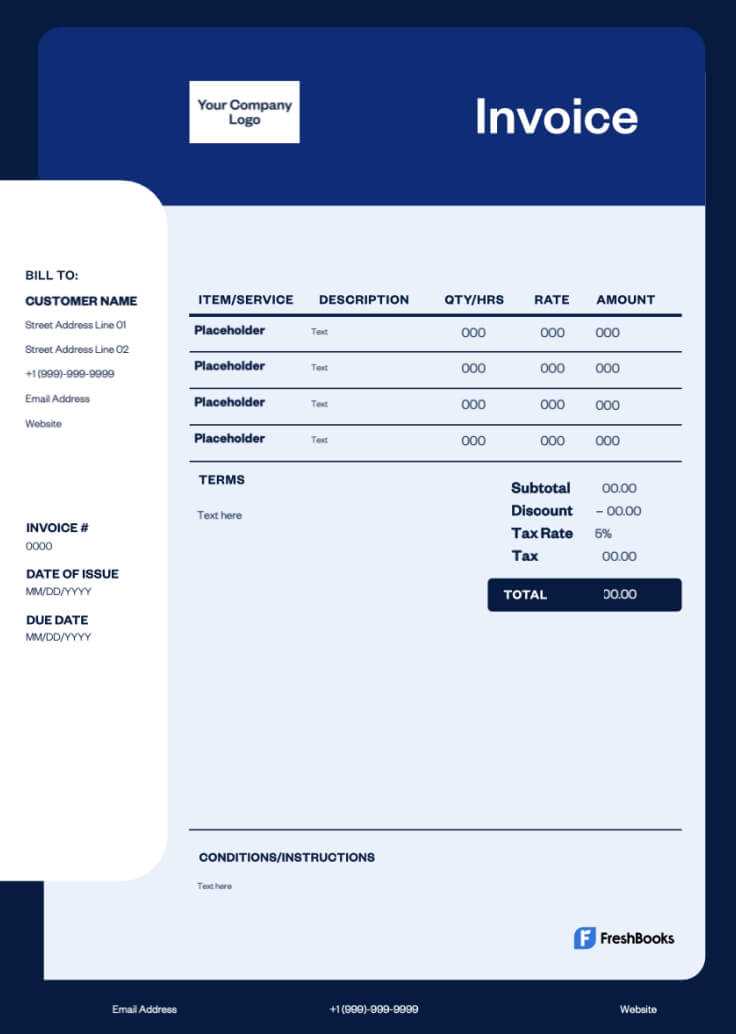

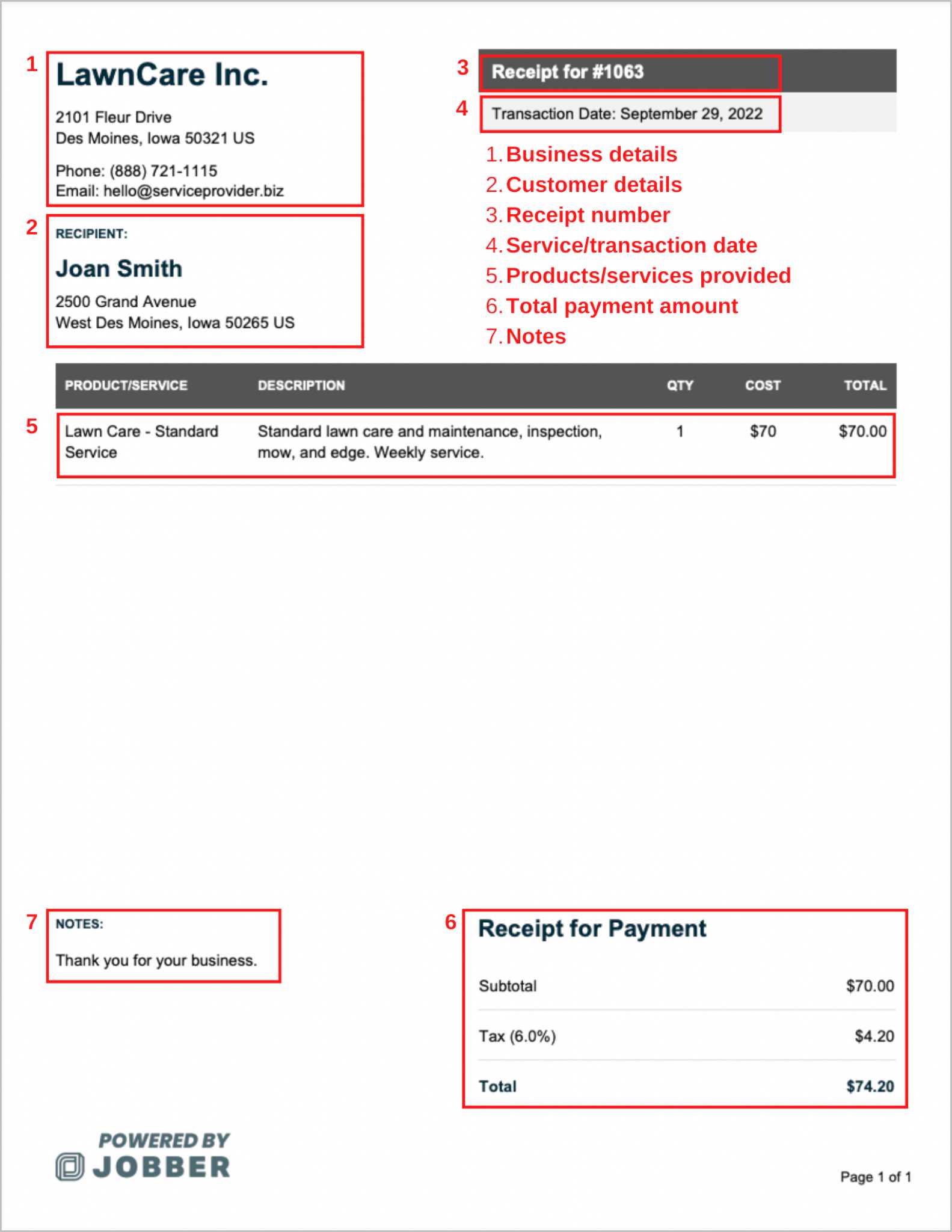

Designing a Professional Lawn Service Invoice

Creating a polished and professional billing document goes beyond simply listing charges; it’s an opportunity to showcase your business’s attention to detail and commitment to quality. A well-designed document not only ensures accuracy but also strengthens your brand image. When designing your billing document, it’s important to strike a balance between clarity, professionalism, and ease of use. The layout should be clean, organized, and visually appealing to create a positive impression on your clients.

Key Design Considerations

- Branding: Incorporate your company’s logo, colors, and fonts to align the document with your business identity. This helps establish a cohesive, professional appearance that clients will recognize and trust.

- Readable Layout: Use a clear, structured format with appropriate spacing. Clients should be able to easily read and navigate the document without confusion. Avoid clutter and make sure key sections, like payment terms and charges, are easy to find.

- Consistent Font Style: Choose legible fonts and use them consistently throughout the document. Stick to professional fonts, such as Arial or Times New Roman, and avoid excessive font sizes or styles that can make the document look unorganized.

Essential Visual Elements

- Clear Sectioning: Use headers and subheaders to clearly define each section, such as client details, itemized charges, and payment instructions. This helps guide the client through the document in a logical order.

- Highlight Important Information: Make key details like the total amount due, due date, and payment methods stand out. You can use bold text, underlines, or borders to draw attention to these crucial pieces of information.

- Professional Footer: Include your business’s contact information and website in the footer to make it easy for clients to reach out with questions or comments. Adding social media links or payment options in this section can also enhance accessibility.

By paying attention to these design elements, you create a billing document that not only functions efficiently but also represents your business in the best possible light, enhancing client trust and facilitating smoother transactions.

Choosing the Right Invoice Software

Selecting the appropriate software for creating and managing your billing documents can greatly simplify the process of handling payments. The right tool can save time, reduce errors, and ensure that your business remains organized and efficient. With so many options available, it’s important to consider various features and functions that will best suit your needs and help streamline your financial operations.

When choosing software for your billing system, look for features that allow easy customization, automated calculations, and integration with other tools, such as accounting software or payment gateways. The ideal solution should align with your business size, service complexity, and overall workflow. Below is a comparison of key factors to consider when evaluating different options:

| Feature | Importance | Considerations |

|---|---|---|

| Customization Options | High | Choose software that lets you customize the layout, logos, and content to match your brand. |

| Ease of Use | High | Ensure the software has an intuitive interface for easy navigation and quick document creation. |

| Automation Features | Medium | Look for options like automatic tax calculations and recurring billing to save time on manual tasks. |

| Integration with Other Tools | Medium | Ensure it works well with other business tools like accounting software, payment gateways, and CRM systems. |

| Mobile Access | Low | If you need flexibility, check for mobile-friendly versions or apps for creating and managing documents on-the-go. |

By selecting the right software, you can improve efficiency, reduce manual errors, and ensure your business handles financial transactions smoothly. Always weigh the features and costs to find the best solution that fits your specific needs.

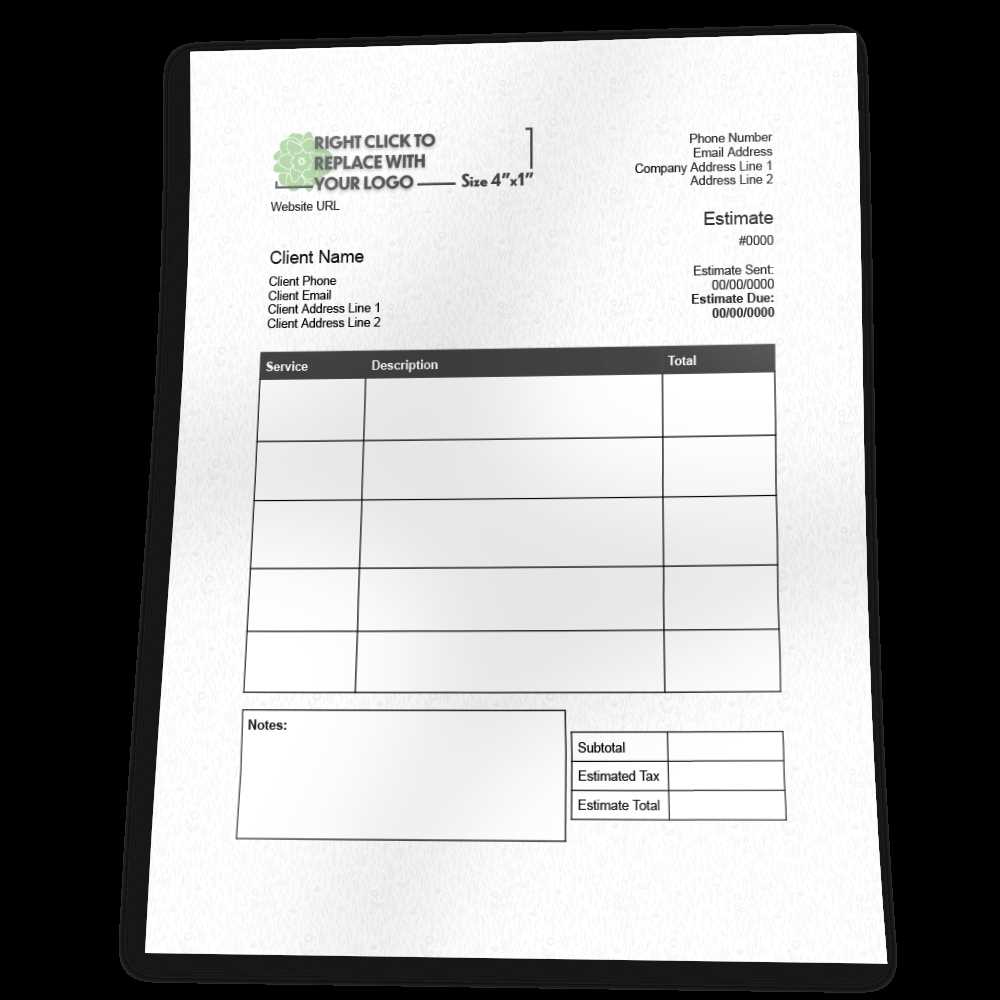

Free vs Paid Lawn Service Templates

When choosing a solution for creating your billing documents, one of the first decisions you’ll need to make is whether to go with a free or paid option. Both have their advantages and drawbacks, and understanding these can help you make the best choice for your business. Free options are great for startups or small businesses with limited budgets, while paid versions often provide more advanced features and greater customization.

Advantages of Free Options

Free solutions can be a great starting point for small businesses or those just beginning to manage financial transactions. These templates typically offer basic features like customizable fields and standard layouts. They are easy to access and can be used immediately, without any financial commitment. Many free versions also come with the ability to download and edit documents in various formats, such as Word or PDF, making them versatile for different use cases.

- Cost-effective: No financial investment required, which is ideal for businesses just starting out.

- Basic Customization: Allows you to add essential details like client information, dates, and services.

- Ease of Use: Often simple to use, with minimal learning curve.

Benefits of Paid Options

Paid solutions typically provide more robust features that help businesses manage their transactions more efficiently. These platforms often come with advanced customization options, integrations with accounting software, and automation tools like recurring billing and payment reminders. Additionally, paid templates tend to offer more professional and polished designs, which can improve the overall look of your documents and help build trust with clients.

- Advanced Features: Includes tools for automating processes, managing payments, and integrating with other software.

- Better Customization: More options for adjusting the design and layout to match your brand.

- Ongoing Support: Paid options typically offer customer support to help you troubleshoot any issues.

Ultimately, the choice between free and paid solutions depends on the complexity of your business needs and your budget. If you require a simple and cost-effective option, a free solution may suffice. However, if your business is growing and you need more advanced features to streamline your billing and financial management, investing in a paid version could save you time and effort in the long run.

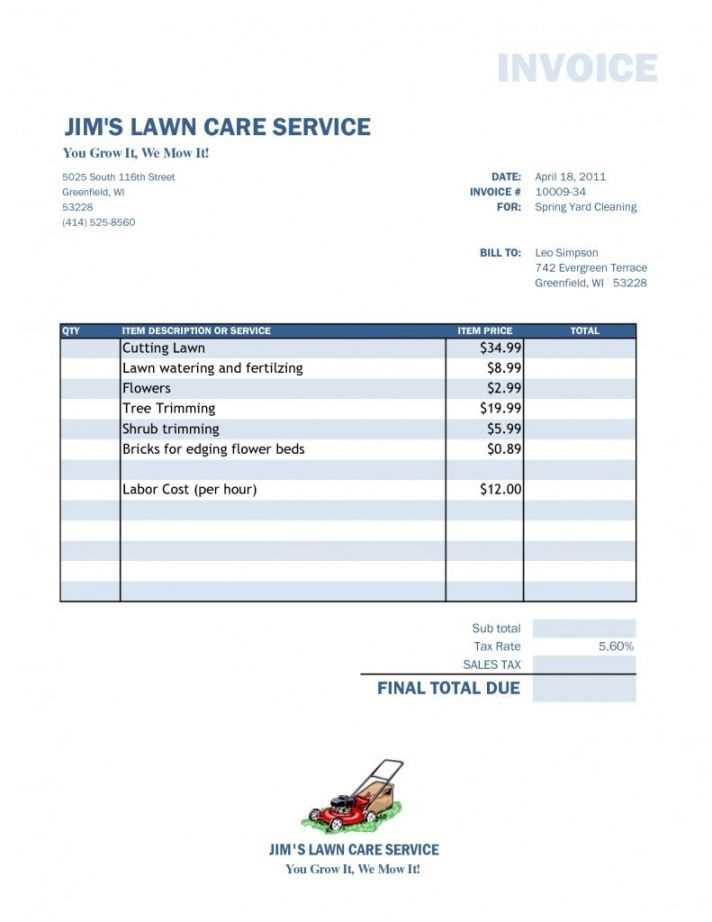

How to Fill Out Your Lawn Service Invoice

Creating a billing document requires attention to detail to ensure accuracy and professionalism. Whether you’re generating your first document or managing regular transactions, understanding the essential fields and how to properly fill them out is crucial. By ensuring that every piece of information is correct and clear, you can avoid misunderstandings and ensure prompt payment from your clients.

Step-by-Step Guide to Completing the Document

To begin, you’ll need to enter the basic information that identifies both your business and the client. This includes your company name, address, contact information, and any identification numbers, such as tax or business registration numbers. Similarly, be sure to include your client’s name, address, and contact details. This ensures both parties know exactly who the document is from and who it’s for.

Next, fill in the details of the work completed:

- Description of Work: Clearly list the services provided, including any specifics about the tasks, quantities, or durations. This will help your client understand exactly what they are being charged for.

- Pricing Information: Include the agreed-upon rates or flat fees, as well as any discounts or special pricing applied. This helps clients verify the costs and prevents confusion.

- Tax Information: If applicable, include any taxes that need to be added to the total cost. Ensure the tax rates are accurate according to local regulations.

Additional Details to Ensure Accuracy

Payment Terms: Clearly outline when the payment is due, preferred payment methods, and any penalties for late payments. You may also want to include a note about early payment discounts, if applicable.

Total Amount Due: After including all the services, taxes, and any applicable discounts, make sure the total amount due is easy to locate. This should be prominently displayed at the bottom of the document.

Once all sections are filled in, double-check for any errors in pricing, spelling, or contact information. An accurate, well-organized document will build trust with clients and facilitate timely payments.

Best Practices for Invoice Accuracy

Ensuring that your billing documents are accurate is critical to maintaining a professional reputation and avoiding payment delays. An error-free document not only speeds up the payment process but also reduces the risk of disputes with clients. By following a few best practices, you can minimize mistakes, provide clear details, and create a seamless experience for both you and your clients.

Double-check all information: One of the most important practices for maintaining accuracy is to thoroughly review all the details before sending out any document. Verify your business and client details, including names, addresses, and contact information, as errors here can lead to confusion or payment delays. Double-check service descriptions, quantities, rates, and any applicable discounts or taxes to ensure they are correct.

Use automated tools: Leveraging digital tools or software can help automate calculations, tax rates, and itemized lists, reducing the chances of human error. These tools often include built-in checks to ensure that your totals are calculated correctly, taxes are applied properly, and that there are no discrepancies in the amounts.

Clearly state terms and deadlines: Including clear and precise payment terms, such as the due date and penalties for late payments, helps avoid confusion. Clearly outlining expectations from the start makes it easier for clients to understand when and how they need to pay, further reducing the chance of errors or misunderstandings.

Break down charges: Provide a detailed breakdown of services and charges. Instead of a lump sum, itemize each service provided, its cost, and the quantity. This way, your client can easily review what they are paying for and verify that everything matches up with the agreement, which also reduces the chance of questions or disputes.

By following these simple steps, you can ensure that your billing documents are accurate, professional, and hassle-free for both you and your clients. Consistent accuracy helps build trust, supports timely payments, and fosters long-term relationships with your customers.

Common Mistakes to Avoid on Invoices

While creating billing documents might seem straightforward, small errors can have a significant impact on your business operations. Mistakes in the details of a document can lead to confusion, delays in payments, or even damage to your professional reputation. Being aware of common pitfalls can help you avoid these issues and ensure your documents are always accurate and clear.

Incorrect Client Information: One of the most common mistakes is listing incorrect client details, such as names, addresses, or contact information. If the client cannot recognize their information on the document, they may delay payment or even question the legitimacy of the charges. Always verify your client’s information before sending out any billing document.

Missing or Incorrect Dates: Forgetting to include the issue date or providing an incorrect due date can cause confusion about when payment is expected. Missing dates can make it difficult to track payments and create ambiguity around deadlines. Always double-check that both the date of issue and due date are correct.

Failure to Itemize Charges: A vague or lump-sum amount without itemization can make clients unsure about the validity of the charges. Failing to provide a breakdown of each service or product can lead to disputes. Always itemize your charges, specifying the type of service, quantity, rate, and any additional fees. Transparency is key.

Incorrect Calculations: Mistakes in adding up totals or misapplying tax rates are some of the most common errors. Inaccurate totals can cause delays in payment or prompt clients to question the charges. Using automated tools or double-checking all calculations before finalizing the document can prevent this issue.

Omitting Payment Instructions: It’s crucial to clearly communicate how you expect to be paid. Leaving out payment methods, bank account details, or instructions on how to proceed with the payment can lead to confusion. Always include clear and concise payment instructions, ensuring your client knows exactly how to settle their bill.

Failure to Include Terms and Conditions: If payment terms, such as late fees or early payment discounts, are not clearly stated, it can lead to misunderstandings and late payments. Always outline the payment terms to avoid these issues, ensuring that both you and your client understand the expectations.

By being mindful of these common mistakes, you can create clear, accurate, and professional documents that foster trust with clients and ensure timely payments. A small amount of attention to detail can save you a great deal of time and hassle in the long run.

Managing Multiple Invoices for Clients

Handling multiple billing documents for different clients can quickly become overwhelming without a proper system in place. Whether you are managing recurring projects or working with multiple customers at once, staying organized is essential for maintaining a smooth workflow. Using effective strategies and tools to track and manage these documents ensures you can stay on top of payments and avoid confusion.

Implement a Centralized System: To effectively manage multiple documents, it is crucial to have a centralized tracking system. This could be a digital file management system, cloud storage, or accounting software that allows you to organize and access all client billing details in one place. By keeping everything in a single location, you can avoid the risk of losing documents or mixing up payment schedules.

Use Unique Reference Numbers: Assigning a unique reference number to each document is one of the simplest and most effective ways to keep track of your billing history. These numbers can help you easily locate past documents and distinguish between multiple transactions with the same client. Always make sure your numbering system is consistent and logical to avoid confusion.

Set Clear Payment Terms for Each Client: If you’re handling multiple clients, ensure each document has clearly defined payment terms tailored to their specific needs. Some clients may require different payment deadlines, amounts, or methods. Clearly communicate these terms in each document to prevent any misunderstandings and ensure timely payments.

Automate Recurring Payments: If you work with clients on a regular basis, consider automating recurring billing. Many software solutions allow you to set up automated recurring transactions for services rendered at fixed intervals. This saves you time, minimizes the risk of forgetting to send out bills, and helps streamline cash flow management.

Track Payment Status: Keeping a record of which clients have paid and which still owe can help you stay organized and avoid late payments. Many invoicing tools offer payment tracking features, so you can quickly see if any payments are overdue and send reminders. Stay proactive by checking your payment status regularly to keep cash flow consistent.

Maintain Professional Communication: When handling multiple transactions, always keep the lines of communication open with your clients. Send regular updates on the status of their payments, and inform them about any changes in pricing or terms. Clear communication not only reduces confusion but also helps to maintain strong client relationships.

By implementing these strategies, managing multiple client transactions becomes a more manageable and efficient task. An organized approach ensures that you stay on top of your billing, reduce errors, and build a more professional reputation.

Tracking Payments with Invoice Templates

Efficiently tracking payments is a crucial aspect of managing your business finances. By utilizing a structured document that clearly records each transaction, you can easily monitor which clients have paid and which still owe. Accurate payment tracking ensures timely follow-ups and helps maintain a healthy cash flow, while also minimizing the risk of missed payments or disputes.

To effectively track payments, consider using a document format that allows you to record payment statuses, due dates, and amounts. Incorporating a payment tracking system within your documents can simplify the process, making it easier to stay organized and on top of your financial records. Here’s how you can structure your payment tracking:

| Client Name | Amount Due | Amount Paid | Payment Status | Due Date |

|---|---|---|---|---|

| Client A | $150.00 | $150.00 | Paid | 10/15/2024 |

| Client B | $200.00 | $100.00 | Partial Payment | 10/20/2024 |

| Client C | $300.00 | $0.00 | Unpaid | 10/25/2024 |

As illustrated in the table above, a clear breakdown of payment details, such as the amount due, amount paid, and payment status, helps you keep track of each client’s payment history. By including these details in your documents, you can quickly identify overdue payments and follow up with clients who have yet to settle their accounts.

Benefits of Payment Tracking:

- Organized Recordkeeping: Helps you maintain a clear and accurate financial record for all clients.

- Improved Cash Flow Management: Easier to track and predict when payments will come in, improving budgeting and planning.

- Timely Follow-ups: Automatically identifies overdue payments, allowing you to follow up promptly.

Incorporating a payment tracking system into your billing documents streamlines the entire process, reduces errors, and ensures you are always on top of your business’s financials.

Setting Payment Terms on Lawn Service Invoices

Establishing clear payment terms is an essential step in ensuring smooth transactions with your clients. By defining when and how payments should be made, you can avoid misunderstandings, streamline the billing process, and improve cash flow. Whether you prefer upfront payments, net terms, or other arrangements, it’s important to communicate these expectations clearly in your documents.

Common Payment Terms to Include

There are several common payment terms that businesses use, depending on their preferences and industry standards. Each of these terms specifies when the payment is due and may include penalties for late payments or discounts for early settlements. Here are some popular options:

| Payment Term | Explanation | Example |

|---|---|---|

| Due on Receipt | Payment is due immediately upon receiving the document. | Payable within 24 hours of receipt of the document. |

| Net 30 | Payment is due 30 days after the document is issued. | Full payment due by 11/15/2024, 30 days from the issue date. |

| Net 60 | Payment is due 60 days after the document is issued. | Full payment due by 12/15/2024, 60 days from the issue date. |

| Deposit Required | Client must pay a portion upfront before work begins. | 50% due upfront, 50% upon completion. |

| Early Payment Discount | Offer a discount for paying before a specified due date. | 5% discount for payment within 10 days of receipt. |

Why Clear Payment Terms Matter

Clarity and Transparency: Clearly stating the payment terms removes ambiguity, helping clients understand when and how they need to pay. This avoids confusion and ensures both parties are aligned on expectations.

Improved Cash Flow: By setting specific payment deadlines, you can better forecast when funds will be available and plan accordingly. Offering early payment discounts can also encourage quicker payments and improve cash flow.

Reducing Late Payments: Including penalties or interest charges for late payments creates an incentive for clients to pay on time. Having a clear policy in place helps mitigate the risk of

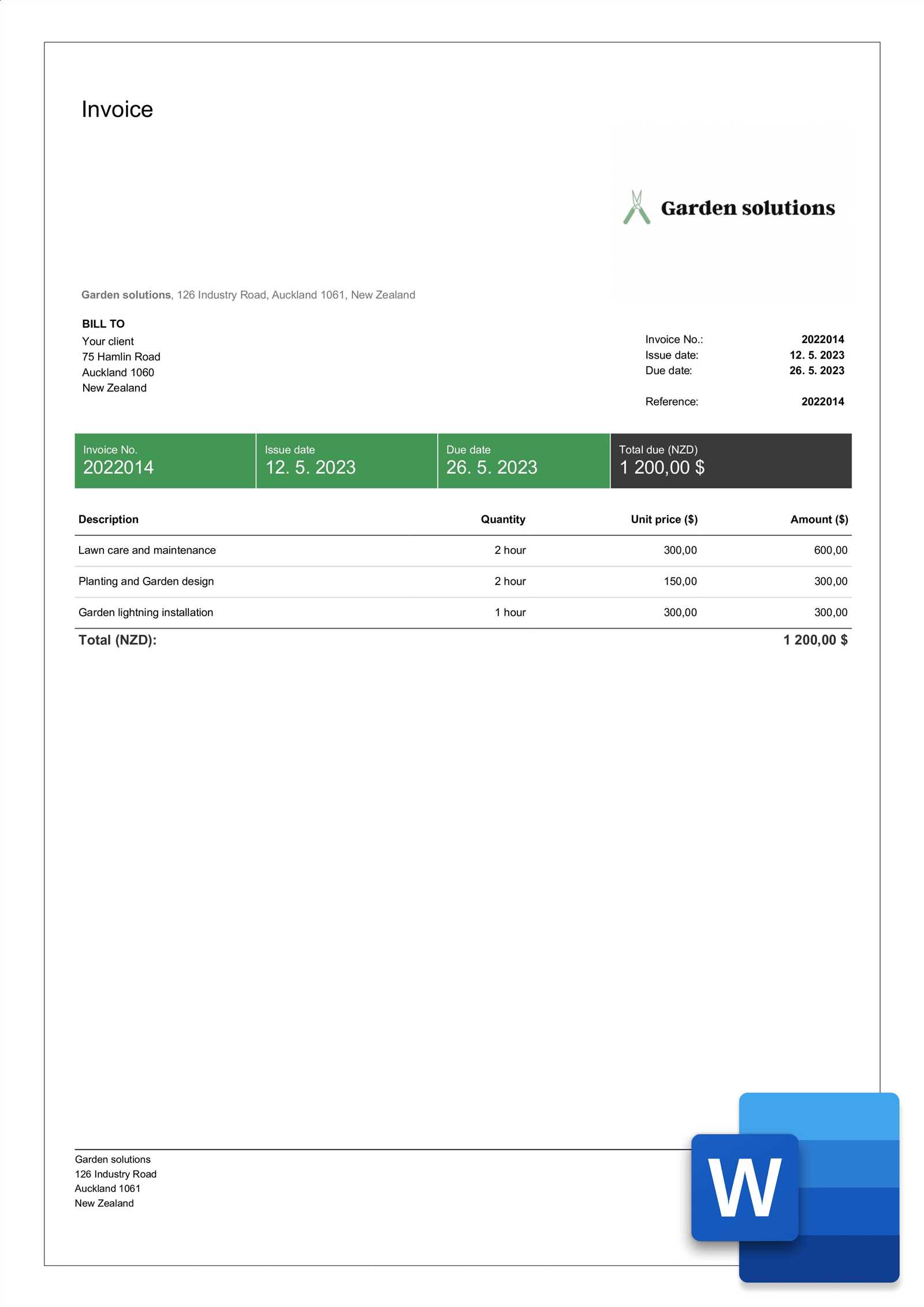

How to Add Taxes to Lawn Service Invoices

Incorporating taxes into your billing documents is a crucial part of ensuring compliance with local tax laws and providing clients with accurate cost breakdowns. When adding taxes, it’s important to specify the correct rate and apply it to the appropriate items or services. Whether you’re charging sales tax, VAT, or another type of tax, clearly showing these details helps maintain transparency and professionalism.

Steps to Add Taxes

Here’s a step-by-step guide to properly adding taxes to your billing documents:

| Step | Action | Example |

|---|---|---|

| 1. Identify Tax Rate | Check your local tax laws to determine the applicable tax rate for your services or products. | Sales tax rate is 8% in your area. |

| 2. Calculate Tax Amount | Multiply the total amount of the sale by the tax rate to calculate the tax due. | If the total before tax is $200, tax would be $16 (200 x 0.08). |

| 3. Add Tax to Total | Include the calculated tax on the document, adding it to the original cost. | Subtotal: $200 + Tax: $16 = Total: $216. |

| 4. Provide Clear Breakdown | Ensure that tax is clearly listed as a separate line item, so clients can see the amount they are paying for taxes. | Subtotal: $200, Tax: $16, Total: $216. |

Best Practices for Tax Handling

List the Tax Separately: Always separate the tax amount from the base cost. This makes it easy for clients to see exactly what they are paying for, and it also ensures you comply with tax regulations, which often require clear tax documentation.

Include Tax Information: In addition to the tax amount, include information such as the tax rate and the applicable jurisdiction. This ensures that both you and your client are clear on how the tax is calculated.

Be Aware of Tax Exemptions: Some products or services may be tax-exempt depending on local regulations. If applicable, make sure to include the necessary exemptions and state them clearly on the document.

By following these steps, you can ensure that taxes are correctly applied and clearly communicated in your documents, helping you maintain legal compliance while providing clients with a transpare

How Invoice Templates Improve Client Trust

Providing well-structured and professional billing documents is an effective way to build trust with clients. When clients receive clear, organized, and consistent payment requests, they feel more confident in their business relationship with you. By using a standardized document format, you demonstrate professionalism, transparency, and a commitment to accuracy, all of which contribute to strengthening client trust.

Professionalism and Consistency

First impressions matter: A polished and professional document gives clients the assurance that you take their business seriously. By consistently using the same layout and format for all transactions, you establish a sense of reliability. Clients are more likely to return to businesses that display professionalism in every aspect of their interactions, including billing.

Consistency fosters confidence: When your documents follow a consistent pattern, clients can easily recognize and understand the key details. This consistency reduces the likelihood of confusion, helping clients to feel more comfortable and secure when it comes time to make a payment.

Transparency and Accuracy

Clear breakdowns enhance trust: When each charge is clearly listed and explained, it reduces the chance of disputes. Transparent billing shows clients that you are open about your pricing, fostering a sense of fairness. A detailed document that includes dates, services rendered, and the total amount due demonstrates your attention to detail, which in turn builds trust.

Minimize errors: The structure of a well-designed document minimizes the chances of errors such as incorrect amounts or missing details. When your billing records are accurate, clients are more likely to trust that you are delivering high-quality work, and they are less likely to question the charges.

Incorporating a well-organized, clear, and professional document format into your business practices helps reinforce a positive image and improve relationships with your clients. It shows that you are committed to transparency and precision, all of which contribute to establishing lasting trust and fostering long-term business success.

Legal Requirements for Lawn Service Invoices

Understanding the legal requirements for your billing documents is crucial for maintaining compliance and protecting your business. Different regions have specific rules that govern what needs to be included on payment requests, and failing to follow these regulations can result in penalties or disputes with clients. Knowing the essential legal elements to include ensures that your records are both professional and legally sound.

Key Legal Information to Include

When creating a payment request, make sure to include certain information that is required by law. The following elements are often necessary to comply with regulations:

| Element | Description | Example |

|---|---|---|

| Business Name and Address | Your business name, physical address, and contact details should be clearly stated. | XYZ Landscaping, 123 Green St, City, State, ZIP |

| Client Information | Include the client’s full name and address for proper identification. | John Doe, 456 Oak St, City, State, ZIP |

| Date of Transaction | The date on which the work was completed or the payment request was issued. | October 10, 2024 |

| Unique Identification Number | Each payment request should have a unique number for tracking purposes. | Invoice #12345 |

| Itemized List of Charges | Provide a detailed breakdown of the services rendered or products provided. | Service: Lawn Mowing, Quantity: 1, Price: $50 |

| Tax Information | If applicable, include any relevant tax charges, including the tax rate. | Sales Tax: 8%, Total Tax: $4.00 |

| Payment Terms | State when the payment is due and any late fees or discounts. | Due within 30 days of receipt, late fee 2% per month. |

Why Legal Compliance Matters

Protect Your Business: Including the required information helps protect your business from legal disputes. If a client challenges your payment request, having all necessary details can demonstrate that your charges are legitimate and in compliance with local laws.

Avoid Penalties: Failure to comply with legal requirements can result in fines or penalties. Ensuring that your payment requests meet the legal standards set by your local jurisdiction is a simple way to avoid costly mistakes.

Ensure Smooth Transactions: Properly documenting all transactions fosters trust and transparency with clients. When clients can clearly see all the necessary details, they are less likely to question the charges, leading to smoother and faster payments.

By understanding and adhering to the legal requirements for billing, you ensure that your business operates within the law while also providing clients with clear, accura

Saving Time with Invoice Automation

Automating your billing process can significantly reduce the time spent on administrative tasks, allowing you to focus more on growing your business. By using software tools or online platforms to automatically generate and send payment requests, you eliminate the need for manual data entry, reducing errors and speeding up the overall workflow. Automation streamlines your operations, saving both time and effort in the long run.

How Automation Streamlines Billing

Automated systems can handle several aspects of the billing process, making it more efficient and accurate. Here’s how it works:

- Automatic Generation: Once you enter the basic details of the transaction, the system can automatically generate a professional document with all necessary information.

- Recurring Billing: For regular clients, automation allows you to set up recurring payments, automatically generating and sending new documents without extra effort each time.

- Error Reduction: By minimizing manual input, automation reduces the risk of human errors, ensuring that every document is accurate and consistent.

- Faster Processing: Payment requests are sent automatically, speeding up the process and reducing the time between completing the work and receiving payment.

Benefits of Invoice Automation

Improved Efficiency: Automation allows you to create and send multiple billing documents in just a few clicks, without the need to manually create each one. This efficiency frees up time for other tasks.

Consistency and Professionalism: Automated systems ensure that every document follows the same format, helping you maintain a consistent, professional appearance that clients can trust.

Better Cash Flow Management: With recurring payments and automatic reminders, clients are more likely to pay on time, improving cash flow and reducing late payments.

By automating your billing process, you not only save valuable time but also enhance your operational efficiency, allowing your business to run smoothly while providing clients with the reliability and professionalism they expect.

Where to Find Lawn Service Invoice Templates

Finding a reliable source for creating professional billing documents is essential for any business owner. There are several platforms and tools available that offer easy access to pre-designed formats. Whether you prefer using free resources or are looking for more advanced features in a paid version, there are multiple options to suit your needs. Below, we explore different sources where you can find these useful documents to help streamline your billing process.

Popular Platforms for Billing Documents

Here are some common platforms that offer customizable formats for businesses:

| Platform | Type | Features |

|---|---|---|

| Microsoft Office Templates | Free | Pre-designed formats for quick customization, easy integration with Office tools. |

| Google Docs | Free | Accessible online, simple customization, cloud-based for easy sharing and collaboration. |

| FreshBooks | Paid | Comprehensive billing software, automated recurring bills, professional templates. |

| Zoho Invoice | Free and Paid | Customizable formats, automatic payment reminders, mobile access. |

| Canva | Free and Paid | Highly customizable designs, user-friendly interface, professional templates. |

Other Resources for Custom Forms

Besides these platforms, you can also find customizable options through freelance websites, specialized software, or accounting services. Many accounting firms offer customizable billing document options as part of their services. Additionally, several online document marketplaces provide both free and paid designs, which you can easily download and modify.

By utilizing these resources, you can quickly find the right format that meets your needs and makes the billing process efficient and professional.