Professional Template for Outstanding Invoice Creation

Every business needs a clear and organized way to request payment for goods and services. Properly structured payment requests not only ensure you get paid on time, but they also enhance your professional image. A well-designed form helps both the client and the service provider stay on the same page regarding payment terms and expectations.

Efficient billing is essential to maintaining healthy cash flow. It reduces confusion, minimizes errors, and sets the tone for a smooth transaction. A solid approach to billing documents can streamline your workflow and save valuable time, whether you’re a freelancer, a small business owner, or a large enterprise.

In this guide, you’ll discover the elements that make up an effective payment request document and learn how to customize it to suit your specific needs. By the end, you’ll be ready to create or modify a document that reflects your business style while ensuring clarity and accuracy in every transaction.

Template for Outstanding Invoice

Having a ready-made document to request payment is essential for any business. It not only helps maintain professionalism but also ensures that all necessary details are communicated clearly. An effective structure can prevent misunderstandings and facilitate faster payments, while also reducing administrative work.

Key Components of a Payment Request

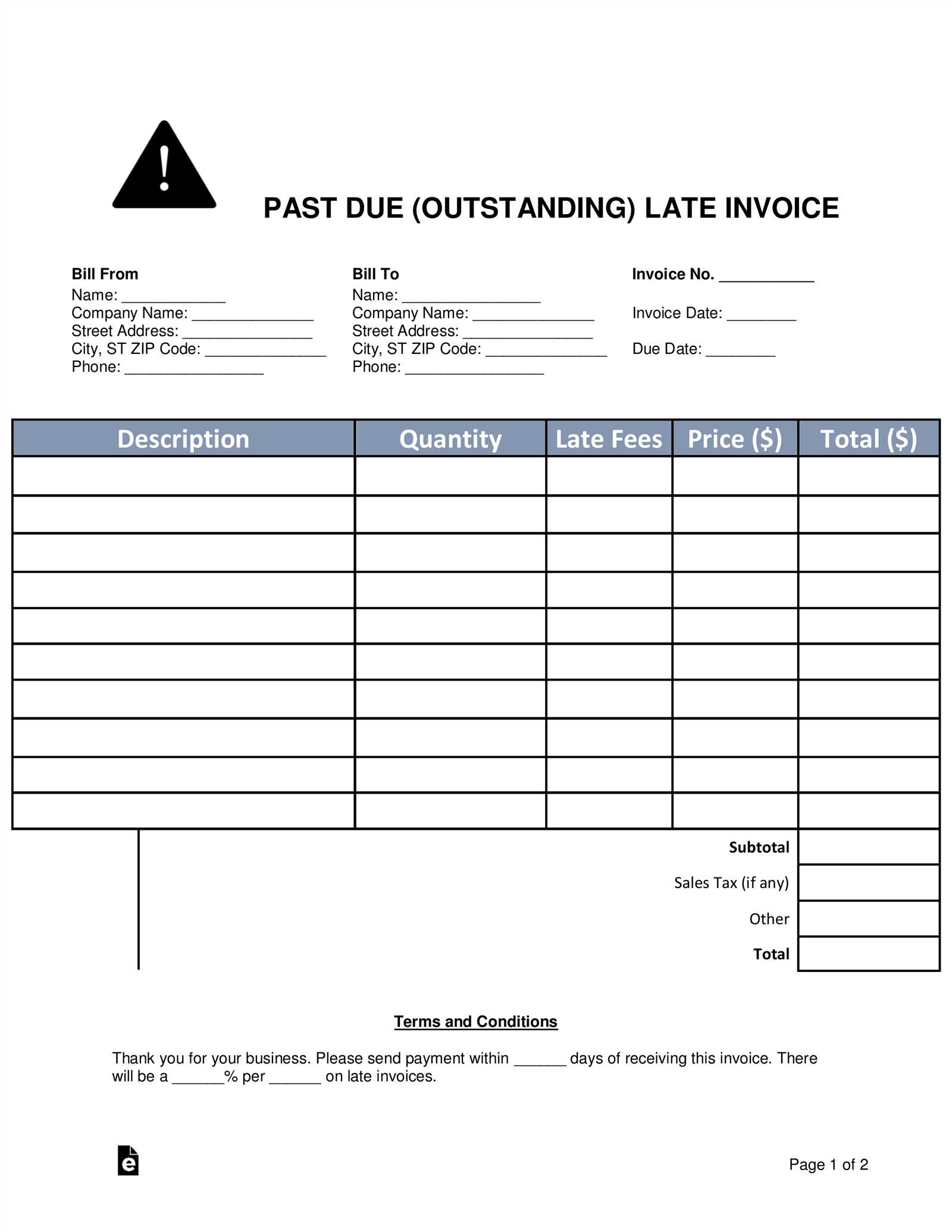

To ensure your document covers all necessary information, include the following elements:

- Contact Information: Include both your business details and the client’s, such as names, addresses, and phone numbers.

- Transaction Details: Clearly describe the product or service provided, with a breakdown of quantities, rates, and total amounts.

- Payment Terms: Specify due dates, late fees (if applicable), and accepted payment methods.

- Unique Identifier: Each document should have a unique number or reference code for easy tracking.

- Notes and Terms: Include any other relevant information, such as discounts, taxes, or special instructions.

Benefits of a Standardized Format

Using a uniform structure offers several advantages:

- Consistency: Helps maintain a professional and cohesive image across all transactions.

- Clarity: Reduces confusion by clearly outlining the payment expectations and details.

- Time-saving: A reusable structure saves time by eliminating the need to create a new document for every transaction.

What is an Outstanding Invoice?

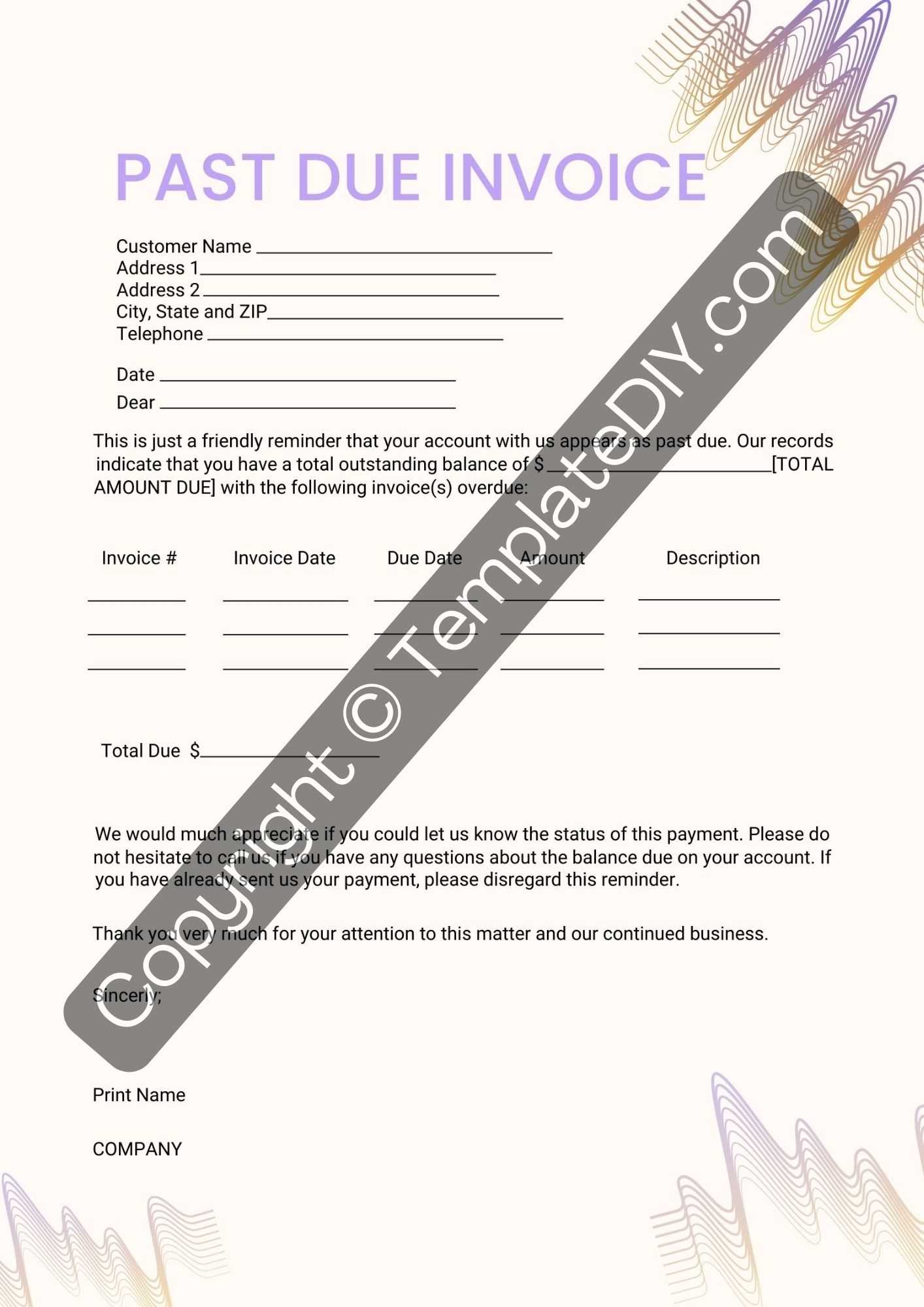

When a business completes a service or delivers goods to a client, it often requires payment. However, sometimes payments are not received by the agreed-upon date, and the amount remains unpaid. This is commonly referred to as an overdue amount, which signifies that the business is still awaiting compensation for the provided goods or services.

Key Indicators of Unpaid Transactions

There are several clear signs that a payment has not been made on time:

- Past Due Date: When the due date has passed without receiving the agreed-upon amount.

- Unpaid Balance: The remaining sum after the expected payment has not been settled.

- Lack of Acknowledgment: If no payment has been processed or no communication about the delay has been made.

Importance of Tracking Unpaid Amounts

Properly identifying and managing unpaid amounts is crucial for maintaining cash flow. Delays in payment can disrupt business operations and lead to unnecessary administrative work. By recognizing overdue transactions, businesses can follow up effectively, ensuring that they maintain financial stability.

Why Use an Invoice Template?

Having a pre-designed document for payment requests can save time and eliminate errors. It provides a structured format that ensures all necessary information is included, helping to maintain professionalism and avoid missing important details. By relying on a consistent approach, businesses can streamline their billing process and reduce the risk of confusion or mistakes.

Efficiency and Time Savings

One of the key benefits of using a standardized document is efficiency. Instead of starting from scratch each time, you can quickly fill in the necessary details and send it to the client. This speed allows you to focus on other important tasks while ensuring that payments are processed without delay.

Consistency and Professionalism

With a ready-to-use structure, every billing document looks polished and follows the same format, which enhances consistency. This consistency not only strengthens your brand’s image but also conveys professionalism, building trust with clients and making your business appear more organized and reliable.

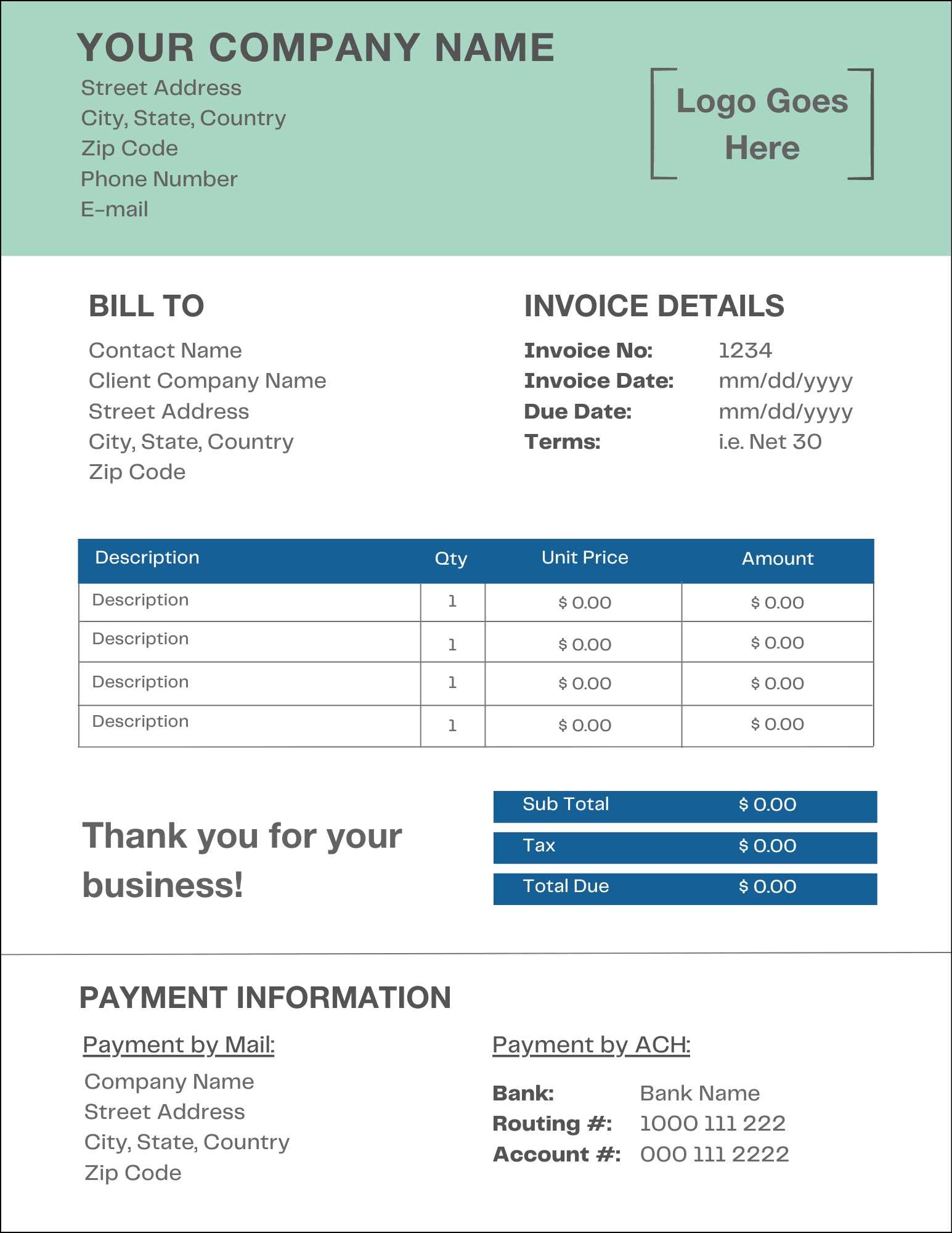

Key Elements of an Invoice Template

A well-structured document requesting payment contains several important elements that ensure both clarity and professionalism. Each section plays a critical role in communicating the necessary details to the client, helping to avoid misunderstandings and ensuring timely payments. From basic contact information to clear payment terms, every component contributes to the overall effectiveness of the billing process.

Essential Information to Include

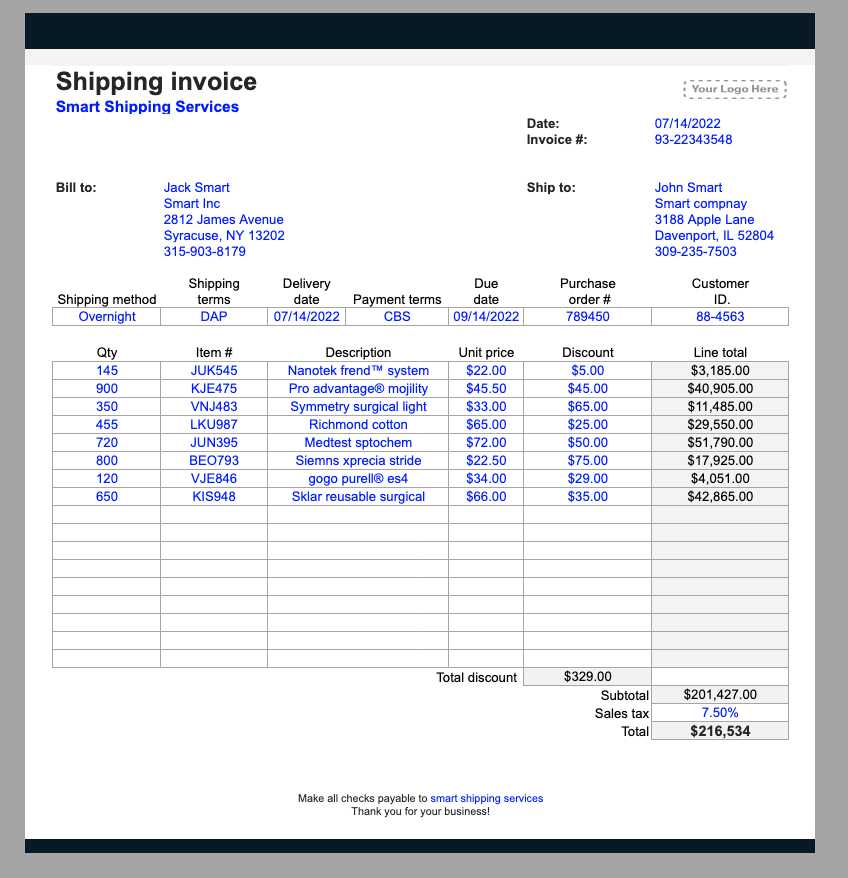

Here are the core elements that should be present in any payment request document:

- Business and Client Details: Clearly state both your business’s and the client’s name, address, and contact information.

- Unique Reference Number: Each document should have a unique identifier for easy tracking and record-keeping.

- Itemized List of Services or Goods: Provide a detailed description of the products or services, including quantities, rates, and subtotals.

- Total Amount Due: Clearly state the total amount due, including any applicable taxes, fees, or discounts.

- Payment Terms: Specify the due date, accepted payment methods, and any late fees or penalties for overdue payments.

Additional Useful Information

To further enhance the clarity of your document, you may also consider including the following:

- Payment Instructions: Provide easy-to-follow steps for how the client can make the payment.

- Notes Section: Include any special terms, conditions, or additional information relevant to the transaction.

How to Create an Invoice from Scratch

Creating a payment request document from the ground up can be a straightforward process if you follow a few essential steps. By ensuring all necessary details are included and properly organized, you can create a professional document that clearly communicates your expectations and facilitates smooth transactions. Here’s a simple guide to help you get started.

Follow these steps to build your own billing document:

- Step 1: Begin with your business information at the top, including your name, address, and contact details.

- Step 2: Add the client’s details, ensuring accuracy in their name and address.

- Step 3: Assign a unique reference number to the document for easy tracking.

- Step 4: List the products or services provided, including quantities, rates, and any applicable taxes.

- Step 5: Clearly state the total amount due, including any discounts or additional fees.

- Step 6: Specify the due date and payment terms, such as methods of payment and late fees, if any.

To illustrate, here’s an example of how the itemized section of your document might look:

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consulting Service | 5 hours | $100 | $500 |

| Web Design | 1 project | $1500 | $1500 |

| Total Due | $2000 | ||

Once all the necessary information is filled in, review your document for accuracy and completeness before sending it to your client.

Customizing Your Invoice Template

Personalizing your payment request document can significantly enhance its impact and professionalism. By adjusting the structure and design to fit your brand, you can make the document not only functional but also a reflection of your business identity. Customization allows you to include specific details, branding elements, and other relevant information that make your communication stand out.

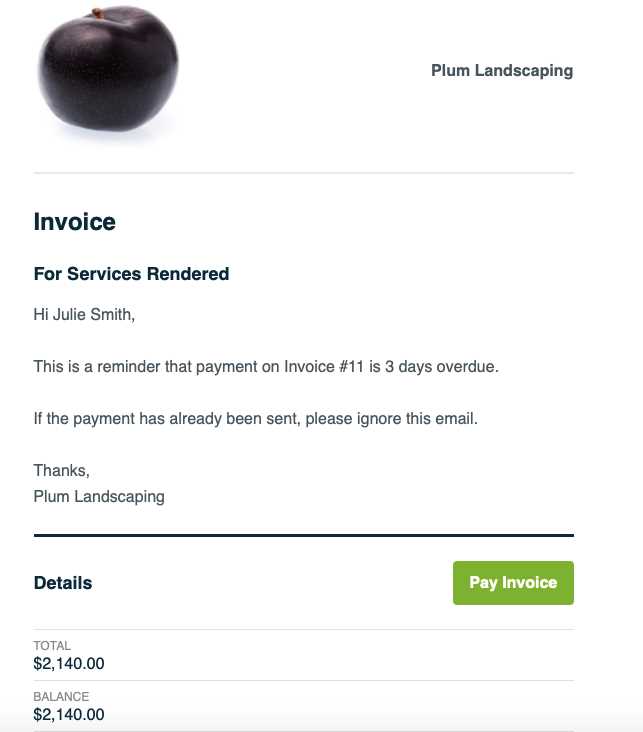

Branding Your Document

Adding your company’s logo, color scheme, and fonts to the document ensures consistency with your overall brand. Here’s how you can incorporate these elements:

- Logo: Place your business logo at the top to create immediate brand recognition.

- Colors: Use your brand’s colors for headings, borders, and accents to give the document a cohesive look.

- Fonts: Choose professional fonts that are easy to read while staying in line with your brand’s style.

Adding Personal Touches

While maintaining professionalism, you can also make the document more personal by:

- Personalized Messages: Include a thank you note or a personalized message to show appreciation for the client’s business.

- Custom Terms: Tailor the payment terms and conditions to reflect any specific agreements with the client.

- Discounts or Promotions: Highlight any applicable discounts or promotional offers to make the document more attractive.

By customizing your documents in these ways, you not only enhance their aesthetic appeal but also improve the clarity and relevance of the information presented to your clients.

Best Practices for Professional Invoices

To ensure your payment requests are both clear and effective, it’s important to follow certain best practices that maintain professionalism and reduce confusion. Adopting a consistent approach not only streamlines the billing process but also builds trust with clients, helping to ensure timely payments and strong business relationships.

Maintain Clarity and Simplicity

Keep your document simple and easy to understand. Avoid cluttering it with unnecessary details, and ensure that all information is clearly presented. Here are a few tips:

- Use clear headings: Organize the document with clear sections, such as “Services Provided,” “Total Amount Due,” and “Payment Terms.”

- List all charges: Provide a breakdown of products or services with their corresponding costs, so clients can easily understand what they’re being charged for.

- Highlight key information: Make the total amount due, due date, and payment instructions stand out by using bold text or larger fonts.

Timeliness and Accuracy

Sending your payment request promptly and ensuring it is free from errors is essential for maintaining professionalism. Double-check all the details, including the client’s information, amounts, and payment terms. Additionally:

- Send invoices promptly: Ensure that documents are sent as soon as possible after the service or product delivery.

- Follow up on overdue payments: Send polite reminders for overdue amounts to keep payments on track.

- Track documents: Keep a record of all sent documents and follow up on any unpaid balances as needed.

By following these best practices, you can create a professional and efficient billing system that enhances your reputation and encourages timely payments.

Common Mistakes in Invoice Design

While creating a payment request document, it’s easy to overlook certain design aspects that can negatively impact its effectiveness. These common errors can lead to confusion, delays in payment, or a lack of professionalism. Identifying and addressing these issues early can ensure that your document is clear, professional, and easy to process.

Key Design Errors to Avoid

- Unreadable Font Choices: Using fonts that are too small, fancy, or hard to read can make the document difficult for clients to understand. Stick to clean, simple fonts like Arial or Times New Roman.

- Lack of Structure: A disorganized or cluttered layout makes it hard for clients to quickly find key information, such as the total due or payment terms. Make sure to separate sections clearly and use headings.

- Missing or Incorrect Contact Information: Not including complete contact details, or providing inaccurate information, can cause confusion and delays in communication.

- Omitting Clear Payment Terms: Failing to specify due dates, late fees, and payment methods can create ambiguity. Always ensure these details are easy to find and understand.

- Not Including Unique Identifiers: Without a reference number or unique code, tracking and reconciling payments becomes challenging. Every document should have a unique identifier for easy management.

Layout and Aesthetic Pitfalls

- Too Many Colors: Overuse of different colors can make the document look unprofessional and distracting. Stick to a minimal color palette that aligns with your brand.

- Inconsistent Formatting: Using different text sizes, styles, or alignment throughout the document can make it appear messy. Consistency in design creates a more polished and organized look.

- Unclear Item Descriptions: If the list of products or services is vague or poorly worded, clients may question what they’re being charged for. Be specific and detailed with each item.

Avoiding these mistakes will help create a clean, effective payment request document that not only conveys professionalism but also makes the payment process smoother for both you and your client.

Free vs Paid Invoice Templates

When it comes to creating a billing document, one of the first decisions you’ll face is whether to use a free or paid solution. Both options have their advantages and drawbacks, depending on your business needs, the complexity of your transactions, and the level of customization you require. Understanding the differences between these two options can help you make an informed decision that best suits your business.

Advantages of Free Templates

- Cost-Effective: The most obvious benefit of free documents is that they come at no cost, making them an ideal choice for small businesses or freelancers with tight budgets.

- Quick and Easy Setup: Free options are usually straightforward to use. You can find ready-made designs online, which you can customize with minimal effort.

- Good for Basic Needs: If you only need a simple document to request payment, free solutions are usually sufficient. They cover the basics like itemization, due dates, and contact details.

Drawbacks of Free Options

- Limited Customization: Free documents may not offer advanced customization options. If you want to align the document with your brand or require specific features, you might find the free versions lacking.

- Lack of Support: Many free solutions do not come with customer support. If you run into issues or need help, you’re often on your own.

- Generic Design: Free solutions are often used by many businesses, which means your documents may look similar to others, making it harder to stand out.

Advantages of Paid Solutions

- Customization and Branding: Paid options typically allow more flexibility, enabling you to personalize your document to reflect your company’s branding, including logos, colors, and fonts.

- Professional Features: Many premium solutions offer advanced functionalities like recurring billing, automatic calculations, tax inclusion, and even integration with accounting software.

- Customer Support: Paid options often come with dedicated customer support, which can be useful if you encounter any issues or need assistance with features.

Drawbacks of Paid Solutions

- Cost: The primary drawback of paid solutions is the price. If you’re a small business or a freelancer, the subscription or one-time fee might be an unnecessary expense.

- Learning Curve: Some premium options can be complex and may require time to learn and adjust to, especially if they come with a variety of advanced features.

Ultimately, the choice between free and paid options depends on your specific needs. If you require a simple, no-frills document, a free solution may be adequate. However, if you’re looking for greater flexibility, advanced features, and a more professional presentation, investing in a paid option might be the best choice.

How to Ensure Invoice Accuracy

Ensuring that your payment request document is accurate is crucial for avoiding disputes, delays, and confusion. Small errors in amounts, dates, or descriptions can lead to frustration on both sides and may even delay payments. By double-checking the details and following a systematic approach, you can improve the accuracy of your documents and ensure smooth transactions.

Steps to Verify Accuracy

- Double-check Client Details: Verify that the client’s name, address, and contact information are correct to avoid sending the document to the wrong recipient.

- Review Product or Service Descriptions: Ensure that the descriptions of goods or services are detailed and correct, with the right quantities, rates, and totals.

- Confirm Payment Terms: Double-check the payment due date, accepted methods, and any penalties for late payments to avoid confusion later.

- Cross-verify Calculations: Ensure that the subtotal, taxes, discounts, and final total are calculated correctly. Use a calculator or accounting software to avoid human error.

Example of Checking Accuracy

Here’s an example of what to check when reviewing a payment request document:

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consulting Service | 5 hours | $150 | $750 |

| Web Development | 1 project | $2000 | $2000 |

| Discount | – | – | –$250 |

| Total Due | $2500 | ||

In the example above, ensure that the calculations for the subtotal, discount, and final total are correct, and all other details are aligned properly.

By following these steps and taking the time to review your documents, you can minimize errors and present a professional, accurate payment request that builds trust and promotes timely payments.

Automating Invoice Creation for Efficiency

Manually creating payment request documents can be time-consuming, especially as your business grows. Automating the process can save valuable time, reduce human error, and ensure consistency. By implementing automation tools, you can streamline the billing process, allowing you to focus on other important aspects of your business.

Benefits of Automation

- Time Savings: Automation eliminates the need for repetitive tasks, such as entering client details or calculating totals. This allows you to generate documents quickly and efficiently.

- Consistency: Automated systems ensure that each document follows the same format, reducing the risk of inconsistencies in your billing.

- Minimized Errors: By relying on software for calculations and data entry, you significantly reduce the chances of making mistakes in amounts, dates, or client details.

- Improved Cash Flow: Automation often includes features like automatic reminders, making it easier to stay on top of payments and follow up on overdue balances.

How to Automate the Billing Process

- Use Accounting Software: Many accounting tools, such as QuickBooks, FreshBooks, or Xero, offer automated billing features. These tools can generate customized documents, track payments, and even send reminders to clients.

- Set Up Recurring Billing: If you offer subscription-based services or have clients with regular payments, set up recurring billing. This ensures that clients are automatically billed on a set schedule without needing to manually create a new document each time.

- Integrate with Payment Systems: Some automation platforms integrate directly with payment gateways, allowing clients to pay immediately upon receiving the request, further speeding up the process.

- Template Customization: Even when automating, ensure the design and layout of your payment request documents reflect your business brand. Many automated tools allow you to customize templates with logos, colors, and personalized messages.

By adopting automation, you not only improve your efficiency but also enhance the professional appearance of your billing process, which can positively impact your relationships with clients.

How to Include Payment Terms on Invoices

Clearly stating the payment terms on your billing documents is essential to ensure both parties understand the expectations for payment timing, methods, and penalties. Defining these terms reduces the likelihood of confusion, disputes, or delays. Being transparent about your terms can also help encourage timely payments and maintain healthy business relationships.

Key Elements to Include in Payment Terms

- Due Date: Clearly specify when the payment is due. This could be a specific calendar date or a number of days after the service or product delivery (e.g., “Due 30 days from the issue date”).

- Accepted Payment Methods: Indicate how you prefer to receive payments (e.g., bank transfer, credit card, PayPal). The more options you provide, the easier it is for your client to pay.

- Late Payment Penalties: Include any penalties or interest charges that will apply if payment is not received by the due date. For example, “A late fee of 2% per month will be applied to overdue balances.”

- Early Payment Discounts: If you offer a discount for early payment, make sure to specify the percentage and the time frame. For example, “5% discount if paid within 10 days.”

- Currency and Tax Information: If applicable, specify the currency in which payments should be made and any relevant tax details (e.g., VAT or sales tax) that may apply to the total amount due.

Example of Payment Terms on a Billing Document

Here is an example of how you might include payment terms in your document:

| Payment Term | Description |

|---|---|

| Due Date | Payment is due 30 days from the date of the document. |

| Accepted Methods | We accept payments via bank transfer, PayPal, and credit card. |

| Late Payment Fee | 2% interest will be added to the total amount due after 30 days. |

| Early Payment Discount | 5% discount for payments made within 10 days of the issue date. |

| Tax | All amounts are

Incorporating Branding into Your InvoiceYour payment request documents are not just functional–they also serve as an extension of your business identity. By incorporating your brand elements, such as logos, colors, and typography, you can make your billing documents visually appealing and consistent with your overall brand image. This approach not only enhances professionalism but also helps to reinforce brand recognition with clients. Key Branding Elements to Include

Practical Examples of Branding on Documents

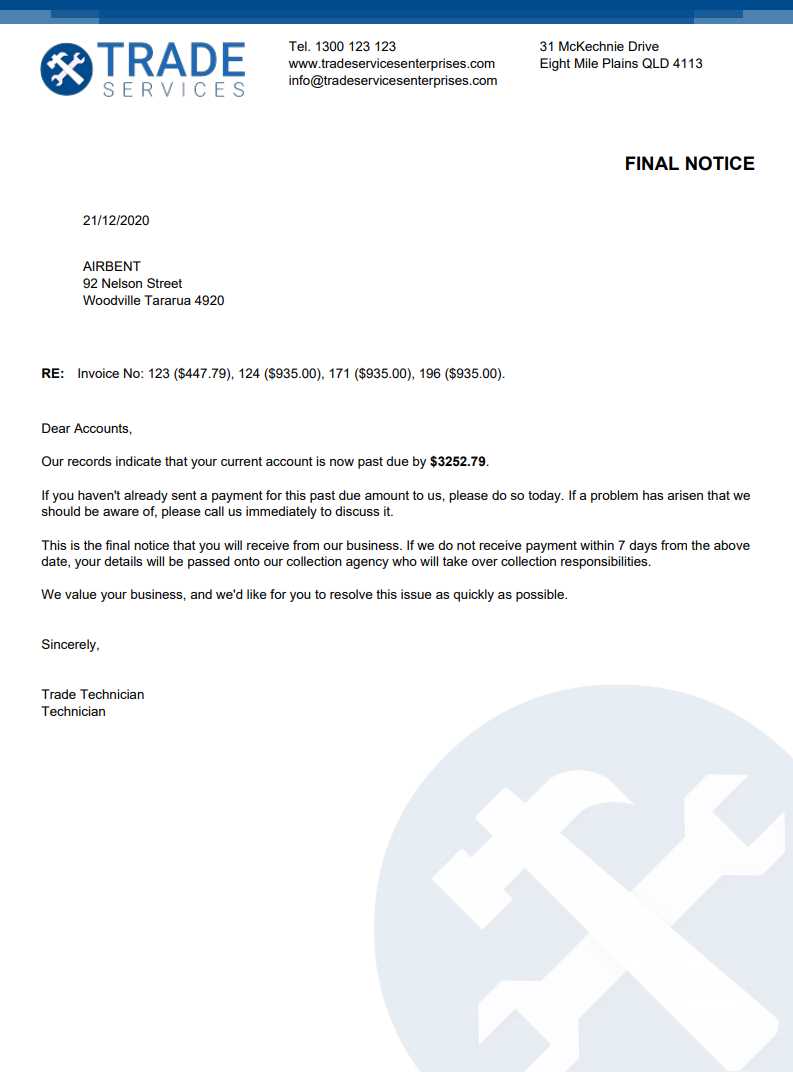

Incorporating these branding elements into your payment request documents not only improves their appearance but also helps maintain a strong and memorable presence with your clients. A professional and well-branded document enhances your business’s credibility and can set you apart in a competitive marketplace. When to Send an Outstanding InvoiceTiming is crucial when it comes to sending payment requests. Sending them at the right moment can help ensure prompt payment and prevent misunderstandings. If a document is sent too early, the client might not have enough time to process the payment, while sending it too late could lead to delays or missed deadlines. Understanding the optimal time to issue these documents is key to maintaining a healthy cash flow. Best Times to Issue a Payment Request

When to Send Reminders

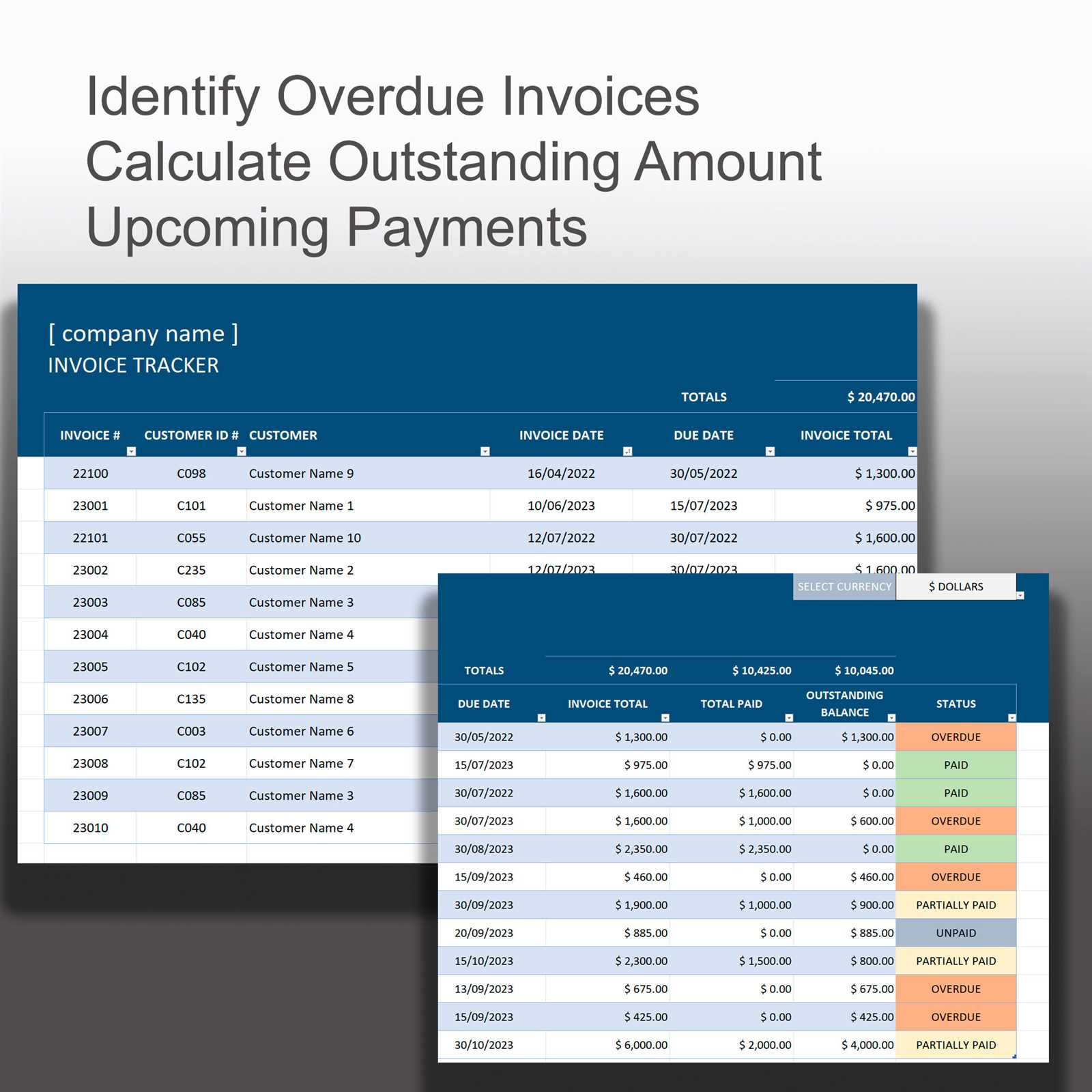

By sending these documents at the right time, you help facilitate timely payments and maintain positive relationships with your clients. The key is to be proactive, clear, and professional in your approach to billing and follow-up communications. Tracking Unpaid Invoices Effectively

Tracking unpaid payments is essential to maintain a steady cash flow and avoid financial issues in your business. It can be easy to overlook or forget about pending payments, especially when dealing with multiple clients and numerous transactions. Implementing an effective tracking system ensures that no outstanding amounts slip through the cracks and that your business remains financially healthy. Methods for Monitoring Unpaid Amounts

Steps to Take When Payments Are Late

Automation for Streamlining the Process

By tracking unpaid amounts efficiently and taking the right steps to follow up, you help ensure that your business receives payments on time and that you maintain a professional relationship with your clients. Legal Requirements for Invoices

Understanding the legal requirements for creating payment requests is essential for ensuring that your business remains compliant with tax laws and regulations. Different countries and regions may have varying requirements, but certain elements must be included to ensure the document is considered valid and enforceable. Proper documentation protects both you and your clients, preventing potential disputes and legal issues. Essential Elements to Include

Additional Considerations

Complying with these legal requirements not only helps you avoid potential penalties but also fosters trust with your clients by demonstrating professionalism and transparency. Regularly reviewing your documentation practices ensures that you stay compliant with changing laws and regulations. Tools for Managing Outstanding InvoicesEfficiently managing unpaid balances is essential for maintaining healthy cash flow and ensuring that your business operates smoothly. A variety of tools are available to help you track, follow up, and organize pending payments. These tools can streamline your workflow, reduce administrative effort, and improve payment recovery times. Using the right tools allows you to automate reminders, monitor payment status, and create reports to track your business’s financial health. Accounting Software and Platforms

Dedicated Payment Management Tools

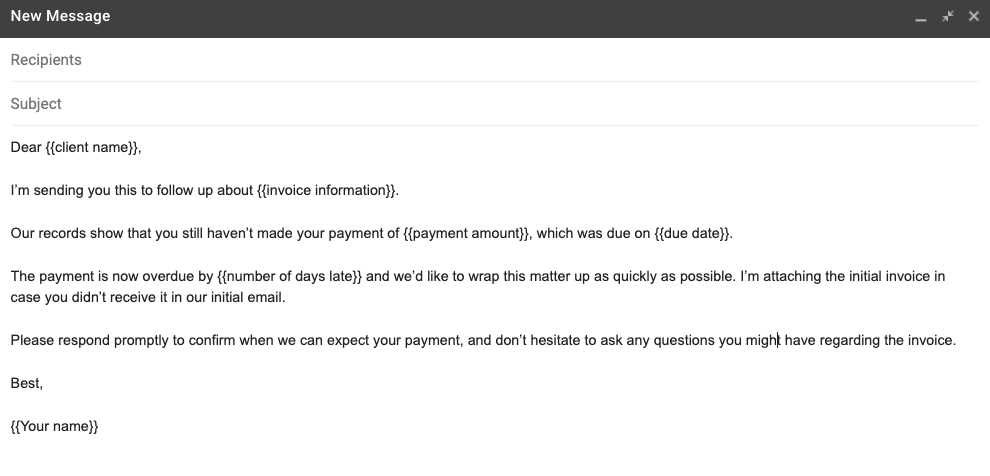

These tools can simplify the process of managing unpaid balances, ensuring that your business remains on top of payments and reducing the risk of overdue amounts. By utilizing technology, you can automate repetitive tasks and focus more on growing your business. How to Follow Up on Unpaid InvoicesWhen payments are delayed, following up promptly and professionally is crucial to maintaining cash flow and positive client relationships. However, how you approach these follow-ups can make all the difference in ensuring timely payments without causing tension. A well-organized follow-up strategy not only reminds clients of their obligations but also maintains professionalism throughout the process. Steps to Take When Payment Is Overdue

Effective Communication Techniques

By following a systematic and professional approach, you can increase the chances of receiving payments promptly while keeping your client relationships intact. Following up is an essential part of managing any business, and doing it effectively will help ensure your financial stability. |