Downloadable Invoice Template for Quick and Easy Billing

Managing business finances often requires creating well-organized, clear, and professional billing documents. For many entrepreneurs and small business owners, designing these from scratch can be a time-consuming task. Fortunately, there are various resources available that simplify this process, offering pre-made solutions that can be easily customized to meet specific needs.

Using a ready-to-edit document for invoicing can save valuable time and ensure consistency across all business transactions. With the right tool, you can quickly generate accurate and aesthetically pleasing bills, helping you maintain a professional image and ensuring timely payments from clients. These ready-to-use solutions offer various formats and styles to suit different industries and business types, making them a versatile option for any organization.

Streamlining the billing process allows business owners to focus on what matters most–growing their business–while still maintaining a polished, professional appearance in financial dealings. Whether you’re a freelancer, a small business owner, or running a larger company, having an easy-to-use system in place can improve efficiency and save resources.

Downloadable Invoice Template Benefits

Utilizing pre-made document formats for billing offers a range of advantages for businesses of all sizes. By adopting a solution that is easy to access and customize, companies can streamline their financial processes and ensure consistency in their transactions. This not only reduces the time spent on creating new bills but also helps maintain a professional appearance across all communications with clients.

Time and Effort Savings

One of the most notable benefits is the significant reduction in the time and effort required to create detailed financial records. With a pre-designed layout, you can quickly adjust the fields for your specific needs, such as client names, services, amounts, and due dates. This eliminates the need to start from scratch every time you issue a bill, allowing you to focus on other important tasks in your business.

Consistency and Professionalism

Having a standardized format for all billing documents ensures that every client receives a consistent experience. A well-structured bill reflects your business’s commitment to quality and professionalism, which can help build trust with customers. The ability to tailor the document to reflect your brand’s identity further enhances the sense of reliability and organization in your business dealings.

Overall, using pre-made financial documents creates a more efficient and cohesive workflow, contributing to smoother operations and better client relationships. With minimal effort, you can maintain an organized, professional approach to managing your financial transactions.

How to Choose the Right Template

Selecting the right document format for billing is essential to ensure clarity, accuracy, and professionalism. A well-chosen layout can enhance your workflow and improve client interactions. However, with so many available options, it’s important to consider several factors before making a decision.

- Business Type: Different industries often have specific requirements for their billing documents. For example, a freelancer might need a simple structure, while a large company may require more detailed layouts with multiple sections.

- Customization Options: Look for formats that allow easy modification. You should be able to adjust fields like client names, services, amounts, and due dates without hassle.

- Design and Aesthetics: The design should align with your brand’s identity. Choose a style that looks professional but also matches your business image, whether minimalistic or more formal.

- Legal and Tax Requirements: Ensure the layout includes all necessary sections for legal compliance, such as tax rates, payment terms, and other required information specific to your region.

- Ease of Use: The document should be user-friendly, allowing you to generate bills quickly and efficiently without complicated steps or technical skills.

By considering these factors, you can make an informed choice and select a solution that not only meets your business needs but also presents your services in a professional light.

Customizing Your Invoice Template

Personalizing your billing documents ensures that they align with your business’s unique needs and branding. Whether you are adding your company logo, modifying the structure, or adjusting the layout, customization helps create a more professional and cohesive appearance for your clients. Tailoring these documents can also streamline your internal processes and make them easier to manage.

Adjusting Design Elements

One of the first steps in customization is adjusting the visual elements to reflect your brand’s identity. This includes adding your company logo, choosing brand colors, and selecting a font that matches your business’s style. A well-designed document not only looks more professional but also strengthens your brand’s recognition among clients.

Modifying Layout and Fields

Another important aspect is modifying the layout to suit your specific requirements. You may need to add extra fields for special client requests, or adjust the sections for more detailed billing, such as hourly rates, discounts, or itemized lists of services. It’s important that the format is flexible enough to accommodate these changes while still remaining clear and easy to read.

Tailoring your documents in this way ensures they are both functional and representative of your business. A personalized layout can help improve communication with clients and enhance the efficiency of your financial management process.

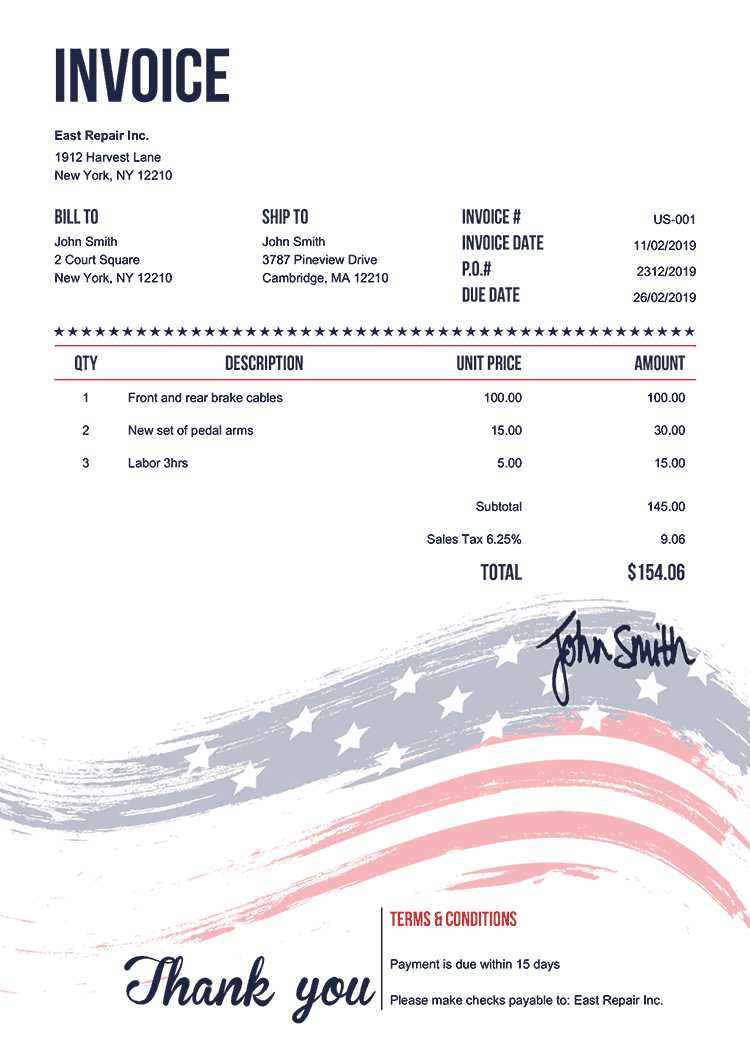

Top Features of Professional Invoices

A well-crafted billing document is essential for maintaining professionalism and ensuring clarity in business transactions. Key features not only enhance the readability of the document but also ensure it meets legal and business standards. Including these elements in your documents can help avoid confusion and promote timely payments.

Clear and Concise Layout

One of the most important characteristics of a professional document is a clean and organized layout. This includes clearly marked sections for essential information such as client details, services rendered, amounts due, and payment terms. A visually appealing design with logical organization makes it easier for clients to process the information quickly, minimizing the chance of errors or delays.

Comprehensive Information Sections

Every document should contain key details that ensure accuracy and legal compliance. These include:

- Business Details: Your company name, address, and contact information should be easy to find.

- Client Information: Include the client’s name, address, and any reference numbers.

- Itemized List: Clearly list the services or products provided, with corresponding quantities, prices, and total amounts.

- Payment Terms: Specify due dates, late fees, and accepted payment methods.

Including these elements ensures that both parties have a clear understanding of the transaction and can avoid potential disputes. A complete, well-organized document conveys professionalism and establishes trust with your clients.

Why Use a Downloadable Invoice Template

Using pre-designed documents for billing is an efficient way to streamline your business processes. Instead of creating a new document from scratch each time, ready-to-use formats offer an easy solution that saves time and ensures consistency. These formats provide a reliable structure that reduces the risk of errors while presenting a professional image to clients.

- Time Efficiency: A ready-made layout eliminates the need to start from zero. Simply fill in the required details, and your document is ready to go.

- Consistency: Using the same structure for every transaction ensures that all documents are uniform, helping clients easily recognize and process them.

- Professional Appearance: Pre-designed formats are tailored to look polished, which helps strengthen your brand’s reputation and credibility.

- Customization Options: Many options allow for easy editing, so you can adapt the layout to your business needs while maintaining a professional look.

- Legal Compliance: Pre-made documents often include sections for tax information, payment terms, and other essential details, ensuring you meet legal requirements without missing key information.

Ultimately, using a structured format simplifies the billing process, saves valuable time, and helps maintain a polished, consistent approach to client transactions.

Saving Time with Pre-made Templates

Utilizing ready-to-use billing documents allows businesses to save significant time compared to creating each one from scratch. These pre-designed solutions come with all the essential sections and layouts already set up, so you can focus on entering the specific details for each transaction. This streamlined approach reduces the amount of time spent on administrative tasks and increases overall productivity.

By using a predefined structure, you eliminate the need to manually format each document, ensuring consistency and accuracy across all communications. Instead of worrying about design or layout, you can quickly adjust fields like client names, services provided, and amounts due. This process is not only faster but also reduces the likelihood of making errors, which can cause delays in payment and lead to client dissatisfaction.

Increased efficiency is a key benefit of using pre-made formats. The more time you save on repetitive tasks, the more time you can allocate to growing your business or focusing on other important aspects of client relationships. Whether you’re a freelancer, a small business owner, or part of a larger organization, this approach significantly enhances your workflow.

Common Invoice Mistakes to Avoid

Even with the best tools at your disposal, it’s easy to make mistakes when creating billing documents. These errors can lead to confusion, delays in payments, or even disputes with clients. Understanding common pitfalls can help you avoid costly mistakes and ensure your financial documents are both accurate and professional.

One frequent mistake is neglecting to include all necessary details, such as payment terms, due dates, or a breakdown of services. Missing this information can cause clients to be unsure about what they owe or when it’s due, leading to delays in payments.

Another common issue is inconsistent formatting. Whether it’s using different fonts, sizes, or colors, a document that lacks a uniform style may confuse clients and give a negative impression of your business. Consistency not only improves readability but also conveys professionalism.

Finally, errors in calculations, such as incorrect totals or tax rates, can damage trust with clients and delay payments. Always double-check your math and ensure that the correct tax rates and discounts are applied to each bill.

By paying attention to these details, you can avoid these mistakes and create clear, professional documents that help your business run smoothly and maintain positive client relationships.

How to Add Payment Terms to Invoices

Clearly outlining payment terms in your billing documents is essential for avoiding misunderstandings and ensuring timely payments. Payment terms specify when payments are due, what methods are accepted, and any late fees or discounts. Including these terms helps set expectations and provides a reference for both you and your client throughout the payment process.

To add payment terms effectively, consider the following key elements:

- Due Date: Specify the exact date when payment is expected. This helps prevent delays and ensures that both parties are clear about the timeframe for completing the transaction.

- Accepted Payment Methods: List all acceptable methods of payment, such as bank transfers, credit cards, or online payment platforms. This reduces confusion and streamlines the payment process.

- Late Payment Fees: If you charge late fees, make sure to clearly outline the penalty for overdue payments. Specify how much the fee is, how it’s calculated, and the conditions under which it applies.

- Early Payment Discounts: If applicable, include any discounts for early payments. This can encourage clients to settle their bills sooner and improve cash flow.

- Currency and Taxes: Clearly indicate the currency in which the payment is expected, as well as any taxes that are included or added to the total amount.

By including these details, you ensure that your clients know exactly what is expected, which reduces the likelihood of payment disputes and helps maintain smooth business operations.

Understanding Invoice Layout and Design

The layout and design of your billing document play a crucial role in ensuring clarity and professionalism. A well-organized structure not only makes the document easy to read but also ensures that all the necessary information is included and easy to find. The design should reflect your brand identity, while the layout should prioritize functionality and readability.

Key Elements of Layout

When designing your billing document, certain sections should be prominently featured to avoid confusion. These include:

- Business Information: Your company’s name, contact details, and logo should be placed at the top for easy recognition.

- Client Information: Clearly display the client’s name, address, and any reference or order numbers associated with the transaction.

- Itemized List of Services or Products: A detailed breakdown helps clients understand exactly what they are being charged for.

- Payment Terms: This section outlines due dates, payment methods, and any late fees or discounts.

Design Considerations

While layout focuses on structure, design emphasizes visual elements that enhance readability and brand consistency. Choose a clean, professional font and ensure that there is sufficient spacing between sections for easy navigation. Consistent use of color can highlight important information, such as due dates or payment amounts, without overwhelming the viewer.

Overall, a balanced combination of design and layout creates a document that is not only functional but also reinforces your business’s credibility and professionalism.

How to Include Tax Information

Including accurate tax information in your billing documents is essential for legal compliance and transparency. It ensures that both you and your client understand the total amount due, including any applicable taxes. Properly outlining tax rates and charges helps avoid confusion and ensures that your business remains compliant with local tax laws.

Key Tax Information to Include

When adding tax details, make sure to include the following key elements:

- Tax Rate: Clearly specify the percentage rate applied to the total amount. For example, if your service is subject to a 10% sales tax, list this rate alongside the subtotal.

- Tax Amount: Show the actual amount of tax being charged. This should be a separate line item so the client can see how the tax was calculated.

- Tax Identification Number: Depending on local regulations, you may need to include your business’s tax ID number or VAT number on the document.

- Tax Breakdown by Item: If your business sells different types of products or services, break down the tax for each item or service to avoid confusion.

Where to Place Tax Information

Tax information should be prominently displayed in the document, typically right before the total amount due. This allows the client to easily see the breakdown of the cost and any taxes added. You can also include a separate section labeled “Tax Details” for a more structured approach.

By clearly presenting tax information, you maintain transparency with your clients and ensure that your business complies with all relevant tax requirements.

Incorporating Branding in Invoices

Embedding your brand’s identity into your billing documents is a powerful way to reinforce your company’s image and create a cohesive experience for your clients. The way your financial documents look can directly impact how your business is perceived. A well-branded document reflects professionalism, attention to detail, and a sense of consistency across all your communications.

One of the most effective ways to integrate branding is through the design elements of the document. Here are several ways to incorporate your brand into your billing documents:

- Logo Placement: Position your company logo at the top of the document, where it’s easily visible. This makes it immediately recognizable and sets a professional tone.

- Brand Colors: Use your business’s color scheme throughout the document, such as in the header, footer, and section borders. This creates a unified and visually appealing design that aligns with your branding.

- Consistent Typography: Choose fonts that match your branding guidelines. A consistent use of typefaces helps maintain a professional appearance and strengthens your brand’s identity.

- Tagline or Slogan: If your company has a tagline or slogan, consider adding it beneath your logo or in the footer to remind clients of your unique value proposition.

- Customizable Fields: Some solutions allow you to customize field labels and categories to match your company’s specific language or tone, further aligning the document with your branding.

Incorporating your branding not only makes your billing documents look more polished but also helps improve client recognition and trust. The more consistent and professional your business appears in all aspects, the more likely clients will perceive your services as reliable and high-quality.

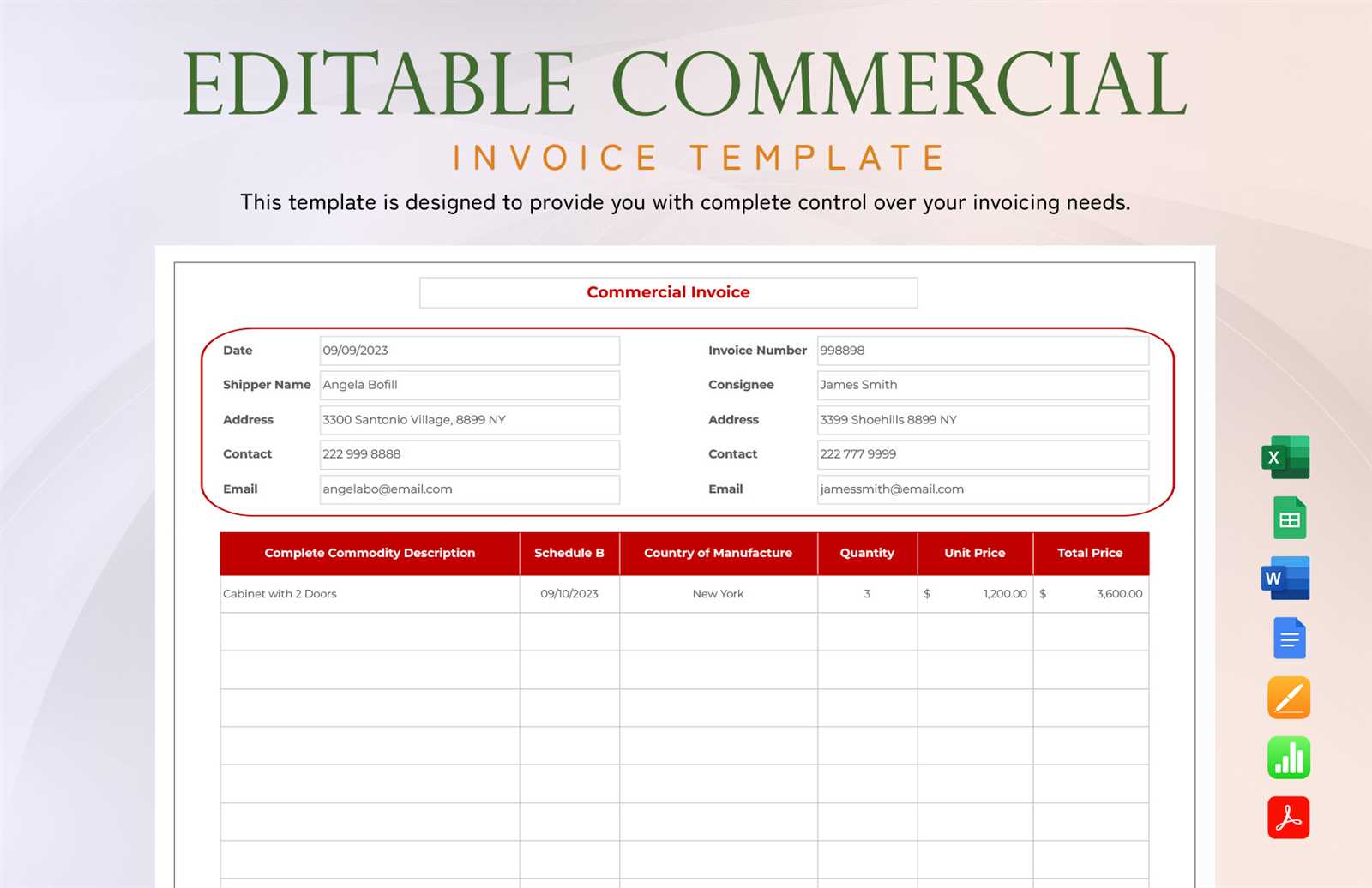

Invoice Templates for Different Businesses

Different types of businesses have distinct needs when it comes to their billing documents. A one-size-fits-all approach often doesn’t work, as each industry may require specific information or formatting. Whether you’re a freelancer, a retailer, or a service provider, customizing your billing layout to reflect your business type can enhance clarity, professionalism, and efficiency in the payment process.

Below are some examples of how different industries can tailor their billing documents to better suit their unique requirements:

| Business Type | Key Features | Additional Sections |

|---|---|---|

| Freelancers | Simple layout, hourly rates, project-based billing | Project name, delivery date, hours worked, rate per hour |

| Retailers | Itemized list of products, quantities, unit prices | Discounts, product codes, SKU numbers, returns policy |

| Consultants | Detailed service descriptions, flat rate or hourly rates | Consultation duration, service terms, tax rates |

| Agencies | Complex project pricing, retainer fees, recurring charges | Monthly breakdown, campaign details, client milestones |

Each business type benefits from specific document features that streamline the billing process and ensure all necessary information is clearly presented. Customizing your financial documents not only saves time but also makes the client experience smoother and more professional.

Where to Find Free Templates

For businesses looking to save time and resources, finding free, pre-designed billing documents is an excellent option. There are many online platforms that offer free resources that can be easily customized to meet your specific needs. These tools not only help you maintain a professional appearance but also ensure accuracy in your financial transactions.

Here are some of the best places where you can find free options for your billing needs:

| Website | Features | Customization Options |

|---|---|---|

| Microsoft Office Templates | Wide variety of professional designs for different industries | Full customization with Word or Excel; add logos, change colors |

| Google Docs | Free and easy-to-use templates accessible from any device | Customizable through Google Docs or Sheets with drag-and-drop editing |

| Canva | Modern, visually appealing designs for businesses of all sizes | Highly customizable with design tools for color schemes, fonts, and logos |

| Zoho Invoice | Free online invoicing tool with customizable designs | Can edit layouts and content directly on the platform; save as PDF |

By using these free resources, you can quickly create professional billing documents without the need for complex software. Whether you’re a freelancer or a small business, these platforms offer flexibility and ease of use to help you get started on the right foot.

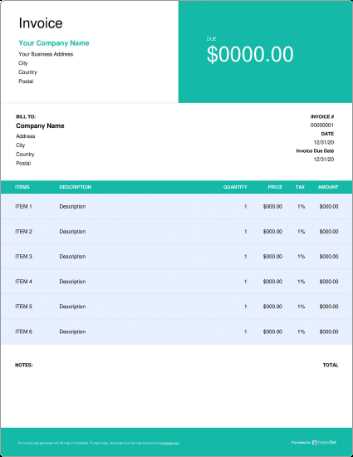

Editable Invoice Templates for Any Industry

Every business, regardless of industry, has unique billing needs. Whether you’re a freelancer, a retailer, or a service provider, the ability to customize your billing documents ensures that they reflect your brand and industry requirements. Editable formats offer flexibility, allowing you to modify details like pricing, services, and payment terms, making them suitable for any sector.

Here are some editable billing solutions tailored to different industries:

| Industry | Key Features | Customization Options |

|---|---|---|

| Freelancers | Simple layout, hourly rates, project descriptions | Adjust hourly rates, add client details, modify service descriptions |

| Retailers | Itemized list, product codes, quantities, taxes | Modify product names, prices, apply discounts or offers |

| Consultants | Flat rates, service terms, detailed descriptions | Update consultation services, adjust flat fees, add tax rates |

| Contractors | Project-based billing, materials, labor rates | Adjust project phases, labor costs, material prices |

Editable billing formats provide versatility, enabling businesses to tailor their documents according to specific client requirements. This flexibility ensures accuracy and professionalism across all transactions, regardless of the business type.

Benefits of Digital vs. Printed Invoices

With the rise of technology, businesses now have the option to choose between sending billing documents digitally or through traditional printed copies. Each method has its own set of advantages, and the choice largely depends on factors like efficiency, cost, and environmental impact. Understanding the benefits of each can help businesses make an informed decision about how to handle their billing processes.

Benefits of Digital Invoices

Digital billing documents are becoming increasingly popular due to their convenience and cost-effectiveness. Here are some of the main advantages:

- Faster Processing: Digital documents can be created, sent, and received almost instantly, speeding up the payment cycle.

- Cost-Effective: There are no costs for paper, ink, or postage, making digital formats a more affordable option in the long run.

- Environmental Impact: By eliminating paper usage, digital bills reduce waste and are a more sustainable choice.

- Easy Record Keeping: Digital documents can be easily stored, organized, and accessed without the need for physical storage space.

- Improved Accuracy: Electronic formats often include built-in checks and calculations that help reduce errors.

Benefits of Printed Invoices

While digital documents are convenient, there are still reasons why some businesses may prefer printed copies. Here are some of the advantages:

- Personal Touch: Printed documents can add a sense of formality and professionalism, especially for businesses that want to create a more personal interaction with their clients.

- Physical Record: Some clients or industries may prefer tangible documents for their records or for legal reasons.

- Accessibility: Not all clients are comfortable with digital tools or may not have access to email or the internet, making printed copies necessary in certain situations.

Ultimately, the choice between digital and printed billing documents depends on your business’s needs, your clients’ preferences, and your commitment to sustainability. Both options offer valuable benefits that can improve your billing processes and customer experience.

How to Track Invoice Payments

Effectively tracking payments for your billing documents is crucial for maintaining cash flow and ensuring timely transactions. Having a clear system in place to monitor payments helps prevent errors, reduces the risk of missed payments, and allows you to keep both clients and finances organized. There are several strategies and tools available to help you track payments efficiently.

Methods for Tracking Payments

Here are some common ways to track payments and keep accurate records:

- Manual Record Keeping: Using spreadsheets or ledgers to manually track each payment and its due date. This method is simple but requires constant updating and attention to detail.

- Accounting Software: Tools like QuickBooks, Xero, or FreshBooks allow you to input payment data and automatically update your records. They can send reminders and offer detailed reports for easy tracking.

- Payment Platforms: Many online payment platforms (e.g., PayPal, Stripe, or Square) provide built-in tools to track the status of payments and generate reports on completed and outstanding transactions.

- Bank Reconciliation: Regularly comparing your bank statements with your recorded payments can help you spot discrepancies and ensure that all funds have been received and recorded accurately.

Best Practices for Effective Tracking

To streamline your payment tracking process, consider the following best practices:

- Set Clear Payment Terms: Make sure your clients know when payments are due, how they can pay, and the consequences of late payments.

- Issue Payment Receipts: Always send a receipt or acknowledgment when a payment is made to confirm the transaction for both parties.

- Automate Reminders: Use software or automated email systems to send reminders about upcoming or overdue payments to clients.

- Keep Backup Records: Maintain a copy of each payment confirmation, receipt, or transaction record in case of disputes or discrepancies in the future.

By following these methods and practices, you can stay on top of your financial records, avoid errors, and ensure smoother cash flow for your business.

Integrating Invoice Templates with Accounting Software

For businesses looking to streamline their billing and financial management processes, integrating billing documents with accounting software can significantly increase efficiency. This integration allows for seamless data transfer, automatic updates, and reduced manual entry errors, ultimately saving time and minimizing discrepancies in your financial records.

By syncing your financial documentation with accounting tools, you can ensure accurate tracking of transactions and easily generate reports. This integration is especially valuable for businesses that manage multiple clients or have complex billing structures. Let’s explore the benefits and steps involved in integrating your billing documents with accounting software.

Benefits of Integration

- Time-Saving Automation: Automatically importing data into your accounting software reduces the need for manual entry, allowing for quicker updates to your financial records.

- Improved Accuracy: By eliminating manual data transfer, the risk of human error is minimized, ensuring that all financial information is accurate and up-to-date.

- Easy Financial Reporting: Integration allows for easy generation of detailed financial reports, helping you monitor cash flow, outstanding payments, and overall business performance.

- Better Cash Flow Management: Syncing payment statuses between your accounting software and billing records enables you to track outstanding payments more efficiently, helping you manage cash flow more effectively.

How to Integrate Billing Documents with Accounting Software

Integration with accounting software can be a straightforward process if you follow the right steps. Here’s a guide to get you started:

| Step | Description |

|---|---|

| Step 1 | Choose the Right Accounting Software |

| Step 2 | Ensure Your Accounting Software Supports Integration |

| Step 3 | Upload Your Billing Documents to the Platform |

| Step 4 | Customize Fields and Categories for Seamless Data Transfer |

| Step 5 | Automate Updates and Synchronization |

Once your billing system is integrated with accounting software, you can enjoy the benefits of automated processes, accurate records, and time savings that will ultimately help your business grow and thrive.