How to Use the Wave Free Invoice Template for Easy Billing

Managing financial transactions and ensuring timely payments is essential for any business. Having a well-structured and professional billing system can save time and reduce errors. Instead of creating documents from scratch, using ready-made solutions can make the process faster and more efficient.

With the right tools, you can easily generate polished and tailored documents that reflect your brand while including all necessary details for your clients. These pre-designed solutions offer flexibility and are often customizable, allowing you to adjust the format and information to fit your specific needs.

Whether you are a freelancer, a small business owner, or someone looking for a simpler way to handle financial documentation, these resources can simplify your workflow. With minimal effort, you can ensure that your billing is organized, professional, and hassle-free, improving both your efficiency and customer satisfaction.

Wave Free Invoice Template Overview

For businesses and freelancers, having an efficient way to create professional billing documents is crucial. A well-designed document helps ensure accuracy and clarity while saving time. By utilizing ready-made formats, you can quickly generate the necessary paperwork without worrying about formatting issues or missing details.

These customizable document options offer a practical solution for anyone who needs a simple yet effective way to manage transactions. Whether you’re dealing with clients on a regular basis or creating occasional bills, this resource provides a streamlined approach to documentation, making the process much easier.

Key Features of the Tool

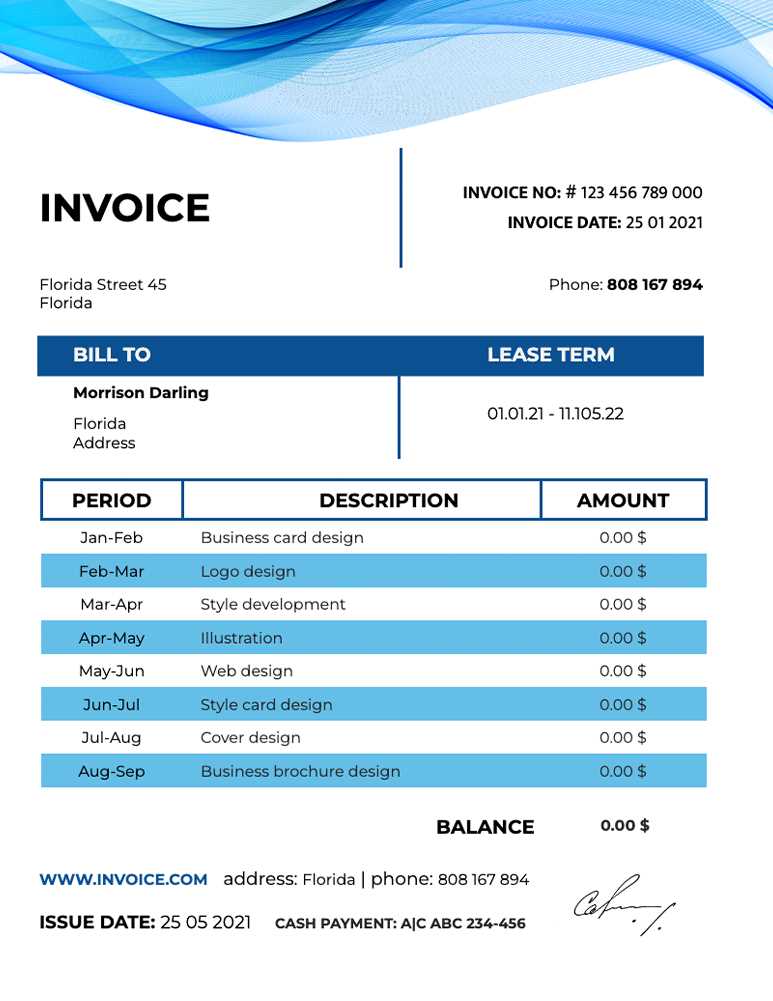

The tool allows users to personalize documents with their business details, including company name, logo, and contact information. It also offers various fields for specifying payment terms, services rendered, and due dates, ensuring that each document is comprehensive and tailored to the client’s needs.

Why Choose This Tool

For those looking to avoid the complexity of traditional accounting software, this resource stands out for its ease of use and accessibility. It is ideal for small business owners, freelancers, and even large companies seeking a no-cost solution to generate high-quality, professional billing paperwork.

Benefits of Using Free Invoice Templates

Using pre-designed documents for financial transactions offers several advantages, especially for businesses that need to maintain accuracy while saving time. These customizable solutions provide a fast way to create professional-looking records, without the need to design each one from scratch. As a result, companies can focus more on their core activities rather than on administrative tasks.

Time Efficiency

One of the key benefits is the time saved in preparing documents. With a pre-made structure, all that’s needed is to input specific details, such as client information and services provided, and the document is ready to be sent. This eliminates the time-consuming task of manually creating the layout and organizing content from the ground up.

Cost Savings

Another significant advantage is the cost savings. Using ready-made solutions eliminates the need for expensive software or hiring professionals to design custom documents. It’s a budget-friendly option, especially for small businesses and freelancers who may not have the resources for complex tools or design services.

| Benefit | Explanation |

|---|---|

| Time-Saving | Ready-made documents help create billing records quickly, reducing preparation time. |

| Cost-Effective | No need for expensive software or professional design services, making it ideal for small budgets. |

| Professional Appearance | Ensures a polished, consistent look across all documents, enhancing your business image. |

How to Download the Wave Invoice

Downloading a customizable billing document from an online platform is a straightforward process that can be done in just a few steps. These platforms provide easy access to the necessary files, allowing users to begin creating their financial records without delays. All that’s required is a basic understanding of how to navigate the platform and select the desired format.

Step-by-Step Process

First, you’ll need to sign up or log into the platform that offers these customizable billing options. Once logged in, navigate to the document section, where you will find various options available for download. Choose the one that best suits your needs, and click on the download button. The file will be saved to your device, ready to be customized and filled out with client information.

File Formats and Compatibility

The downloaded document typically comes in a format that is compatible with most common word processors or spreadsheet software. This makes it easy to edit and adjust the layout, ensuring that it meets the specific requirements of your business. You can also save the document in different formats, such as PDF or Excel, depending on your preference.

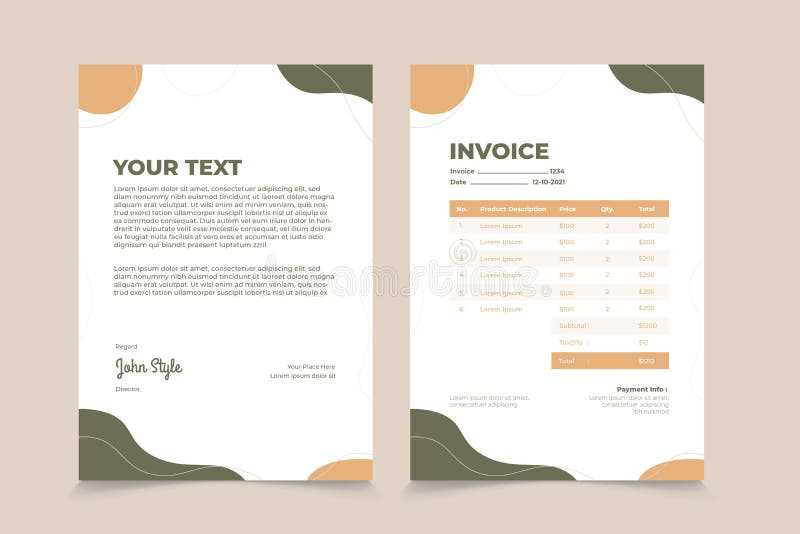

Customizing Your Wave Invoice Template

When creating professional billing documents, it’s essential to tailor them to your business’s unique needs. Customization allows you to reflect your brand’s identity, include specific terms, and ensure that the document conveys all the necessary details. Whether it’s adjusting the layout or adding custom fields, these features enable you to make each document truly your own.

Here are the key areas where you can customize your billing documents:

- Branding: Add your company logo, adjust the font style, and choose colors that align with your brand’s look.

- Client Information: Enter specific client details such as name, address, and contact information for a personalized touch.

- Payment Terms: Set payment due dates, late fees, or early payment discounts to match your business terms.

- Line Items: Customize the description of services or products provided, including quantity, rate, and total amounts.

To customize the document, open the file in your preferred editing tool, and make changes directly in the fields provided. You can easily adjust text, delete sections, or add new ones as required. Once you’ve completed the customization, save the document in your desired format for printing or digital sending.

By personalizing these documents, you enhance your professional image and provide clients with clear, easy-to-read records that reflect your business standards.

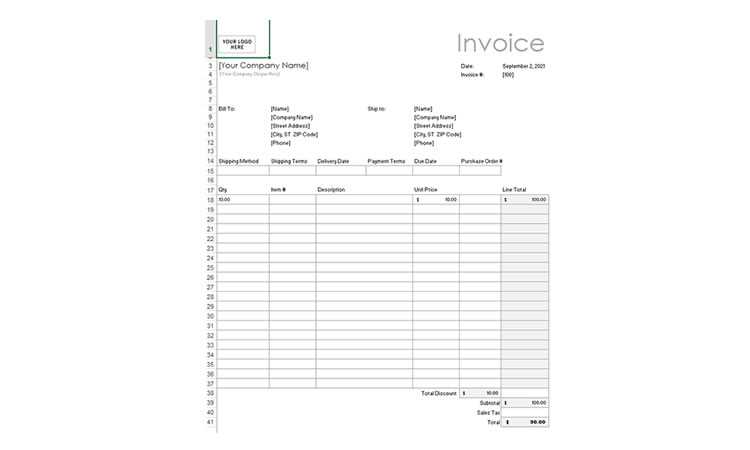

Step-by-Step Guide for Invoice Creation

This guide walks you through the essential steps to create a professional document for billing clients. You’ll learn how to structure, customize, and finalize a billing document effectively for any type of service or product.

1. Start with Essential Details

- Begin by including your company or personal contact details at the top. This typically includes your name, address, and phone number.

- Next, add the recipient’s information clearly, including their name, address, and contact number, to ensure they receive the document.

- Assign a unique tracking number or identifier to each document, helping both you and the client keep organized records.

2. Add Service or Product Descriptions

- List each item or service separately, providing a short description that makes it clear what was provided or completed.

- Specify quantities, rates, and any a

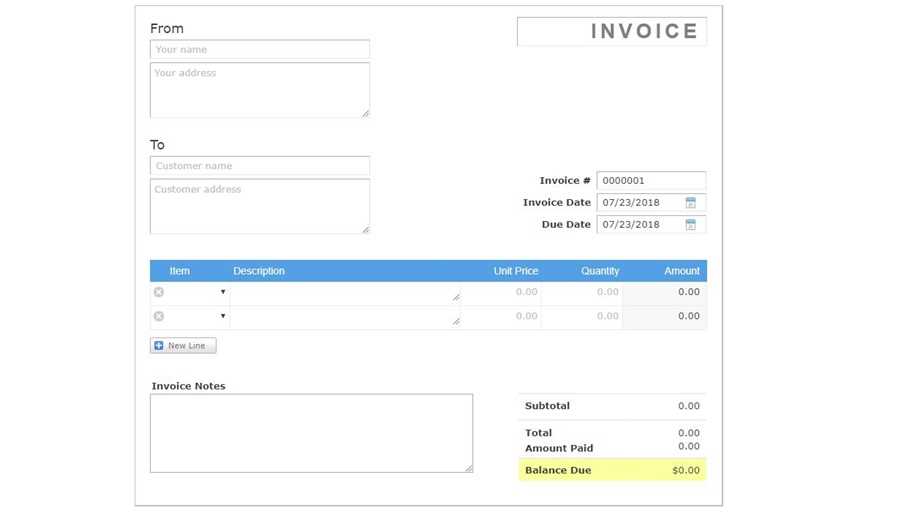

How to Add Client Details in the System

Adding client information accurately is essential for smooth communication and efficient record-keeping. This guide explains how to input relevant client data, ensuring each profile includes all necessary contact and billing details.

Step 1: Navigate to the Client Section

Go to the section designated for managing customer information. Here, you can find an option to add new clients or edit existing profiles. This feature helps organize client records and keep everything updated.

Step 2: Enter Essential Client Information

When adding a new client, include the full name or company name, accurate address, and contact information such as phone number and email address. This information is crucial for sending documents and maintaining proper communication.

For additional details, consider including notes about each client, preferred payment terms, and any special requirements they might have. Save the

Setting Up Payment Terms in the System

Defining clear payment terms is essential for establishing transparent expectations with clients. By setting specific conditions for payments, you help ensure timely and accurate transactions. This section provides a guide to setting up structured payment timelines and conditions.

When setting up your terms, consider aspects like due dates, accepted payment methods, and any penalties for late payments. The table below outlines key fields you may need to configure:

Field Description Due Date Specify the exact deadline by which payment is expected, such as 30 days from the document date. Accepted Payment Methods List the preferred methods for receiving payments, such as bank transfer, credit card, or online platforms. Tracking Payments with Custom Billing Documents

Efficient tracking of client payments is essential for maintaining financial accuracy and monitoring cash flow. By keeping a record of each transaction, you can ensure timely payments, recognize any overdue amounts, and have a clear overview of your financial status.

Steps for Monitoring Client Payments

- Review outstanding balances: Begin by checking any unpaid items listed in your records to see which clients still have amounts due.

- Mark payments received: As payments come in, update the status of each transaction to accurately reflect which items have been fulfilled.

- Send reminders: For overdue payments, consider sending automated reminders or personalized messages to clients, helping them stay on schedule.

Key Elements to Include in Payment Tracking

- Payment

Incorporating Your Branding into Billing Documents

Integrating your brand’s identity into billing documents helps create a professional and recognizable impression. Customizing elements to reflect your unique style enhances brand consistency and promotes trust with clients. Below is a guide to key areas where branding can be applied.

Brand Element Application Logo Place your company’s logo at the top of the document. This immediately signals to the client who the document is from and reinforces brand identity. Color Scheme Choose colors that align with your brand’s palette. Apply these to headings, borders, or other highlights to maintain visual consistency. Saving and Exporting Your Billing Document

Ensuring your billing documents are saved and exported correctly is essential for efficient record-keeping and professional client communication. This guide covers how to securely store completed files and export them in formats suitable for sharing or archiving.

Saving Your Document: After completing all necessary details, save the file in the system to prevent any data loss. This stored version can be accessed or edited later as needed. Double-check that all client and payment details are accurate before finalizing the save.

Exporting Options: When ready to share, export the document in a widely accessible format, like PDF, to ensure compatibility across devices. This format maintains the layout and styling, presenting a polished, uneditable version to clients.

After exporting, review the document one last t

Advantages of This Platform Over Other Options

Choosing the right platform for generating billing documents can significantly streamline your business operations. This particular solution offers distinct features that set it apart from other alternatives, enhancing both ease of use and efficiency in managing client transactions.

User-Friendly Interface

The platform is designed with an intuitive layout, making it accessible for users of any skill level. Its straightforward navigation allows you to quickly set up documents, add client details, and customize elements without a steep learning curve. This simplicity is especially beneficial for small businesses and freelancers looking for efficient solutions.

Comprehensive Financial Tracking

One of the main strengths of this system is its built-in tracking capabilities. You can monitor all client transactions in one place, easily viewing statuses of payments and outstanding balances. This organized approach to financial management helps reduce manual errors and ensures you always have an accurate overview of your income flow.

Overall, this platform provides a balanced mix of functionality and accessibility, making it a practical choice for professionals seeki

How to Send Billing Documents to Clients

Sending completed billing documents efficiently ensures timely payments and clear communication with clients. This guide covers the simple steps for delivering finalized documents through the platform’s built-in options, making it easy to manage your transactions professionally.

Select the Document to Send: Begin by accessing the saved document within your records. Review all details carefully, ensuring accuracy in the amounts, client information, and payment terms. This step is crucial to avoid any misunderstandings or delays.

Choose Your Delivery Method: The platform provides various options for sending documents. You can send them directly via email, allowing the client to receive the file instantly. Alternatively, you can generate a downloadable link, giving clients easy access to their documents from any device.

Confirm Delivery: Once sent, check the delivery status to verify that the document reached the client. Most systems offer confirmation notifications or tracking options to ensure your file was successfully delivered.

Following these

Common Mistakes to Avoid in Invoicing

Ensuring that billing documents are accurate and clear is essential for maintaining professional relationships and timely payments. Here are some of the most common pitfalls to watch out for when preparing and sending your documents.

- Incorrect Client Information: Double-check all client details, such as names, addresses, and contact information. Errors here can lead to confusion and delay payments.

- Missing Due Dates: Clearly stating the payment due date helps clients understand when payment is expected, reducing chances of overdue payments.

- Unclear Item Descriptions

Integrating Your Billing System with Accounting Tools

Connecting your billing system to other accounting platforms can streamline financial management, improving both efficiency and accuracy. This section outlines key integration methods, offering insights into how this setup can enhance overall accounting workflows.

Below is a comparison of essential features offered by different accounting tools and how they interact with your billing system:

Accounting Tool Integration Capabilities Integrating Your Billing System with Accounting Tools

Connecting your billing system to other accounting platforms can streamline financial management, improving both efficiency and accuracy. This section outlines key integration methods, offering insights into how this setup can enhance overall accounting workflows.

Below is a comparison of essential features offered by different accounting tools and how they interact with your billing system:

Accounting Tool Integration Capabilities Benefits QuickBooks Automatic data synchronization Simplifies expense tracking and report generation Xero Real-time transaction updates Offers a clear overview of cash flow and outstanding payments FreshBooks Client and project synchronization Improves project-based billing accuracy To set up integration, locate the integration or connection options within your billing system’s settings. Select your preferred accounting tool and follow the prompts to allow data sharing. This automated link will save time on manual entries and minimize errors, making your financial management smoother and more reliable.