Free Custom Invoice Template for Your Business

When running a business, having a reliable way to manage payments is essential. The ability to generate professional documents that request payment from clients can save both time and effort, ensuring smooth financial transactions. Whether you’re a freelancer or managing a larger company, having a streamlined process in place is key to maintaining a strong business foundation.

Many entrepreneurs turn to ready-made solutions that simplify the task of billing. With easy-to-use formats, these tools provide a quick and organized method to detail services, products, and costs. By utilizing these resources, you can create polished, clear requests for payment without needing advanced software or design skills.

What makes these tools even more valuable is their accessibility. You don’t need to spend a fortune to have professionally designed forms. In fact, numerous options are available at no cost, offering both functionality and flexibility for businesses of all sizes. These options can be tailored to your specific needs, helping you create the right look and feel for your brand.

Why Use a Custom Invoice Template

Having a well-structured document to request payment from clients is crucial for maintaining professionalism and organization. A personalized payment request form ensures clarity, helps avoid errors, and reflects your brand’s identity. When you design your own, you gain control over the layout, content, and style, which can contribute to your overall business image.

Enhanced Professionalism

Creating your own format helps you present a polished, businesslike appearance. With consistent branding and clear details, clients will feel confident that their transactions are in good hands. Key benefits include:

- Consistent look that aligns with your company’s identity

- Clear breakdown of services, costs, and terms

- Fewer errors and misunderstandings in the billing process

Time-Saving Efficiency

Using a ready-to-use structure allows you to quickly generate documents whenever needed. This eliminates the hassle of starting from scratch each time, streamlining your workflow and freeing up time for other tasks. By selecting a pre-made format that suits your business, you:

- Save valuable time on document creation

- Minimize the need for repetitive work

- Focus on other aspects of your business

Advantages of Free Invoice Templates

Using accessible and ready-made solutions for generating payment requests offers numerous benefits to businesses of all sizes. These tools provide a fast and efficient way to create well-structured documents without the need for extensive design or software expertise. By opting for these cost-effective options, companies can maintain a professional appearance while saving time and resources.

One of the key advantages is the immediate availability. These resources can be downloaded and used right away, eliminating the need for any additional investment. Many offer features such as:

- User-friendly formats that require minimal effort to personalize

- Pre-designed layouts with essential fields already included

- Quick access to ready-to-use materials, saving valuable time

Additionally, they often come with a variety of styles and formats that can be adapted to suit different business needs. Whether you need a simple layout or something more complex, there’s usually a suitable option available to match your requirements.

How to Create Custom Invoices

Creating a personalized billing document is an important task for any business. It ensures that clients understand the charges, payment terms, and other relevant details clearly. By following a few simple steps, you can create a professional document that meets your specific needs, reflecting both your brand and the services or products offered.

First, gather the essential information that needs to be included in the document. This typically consists of:

- Your business name, address, and contact information

- Client’s name, address, and contact details

- A description of the products or services provided

- The total amount due and payment terms

- The due date and any relevant tax or discount details

Once you have all the necessary details, you can begin organizing the layout of your document. Ensure that each section is clearly marked and easy to read. You can then personalize it with your company’s branding, such as logos and color schemes, to give it a professional touch. Many tools and programs offer simple ways to add these elements, even if you don’t have extensive design skills.

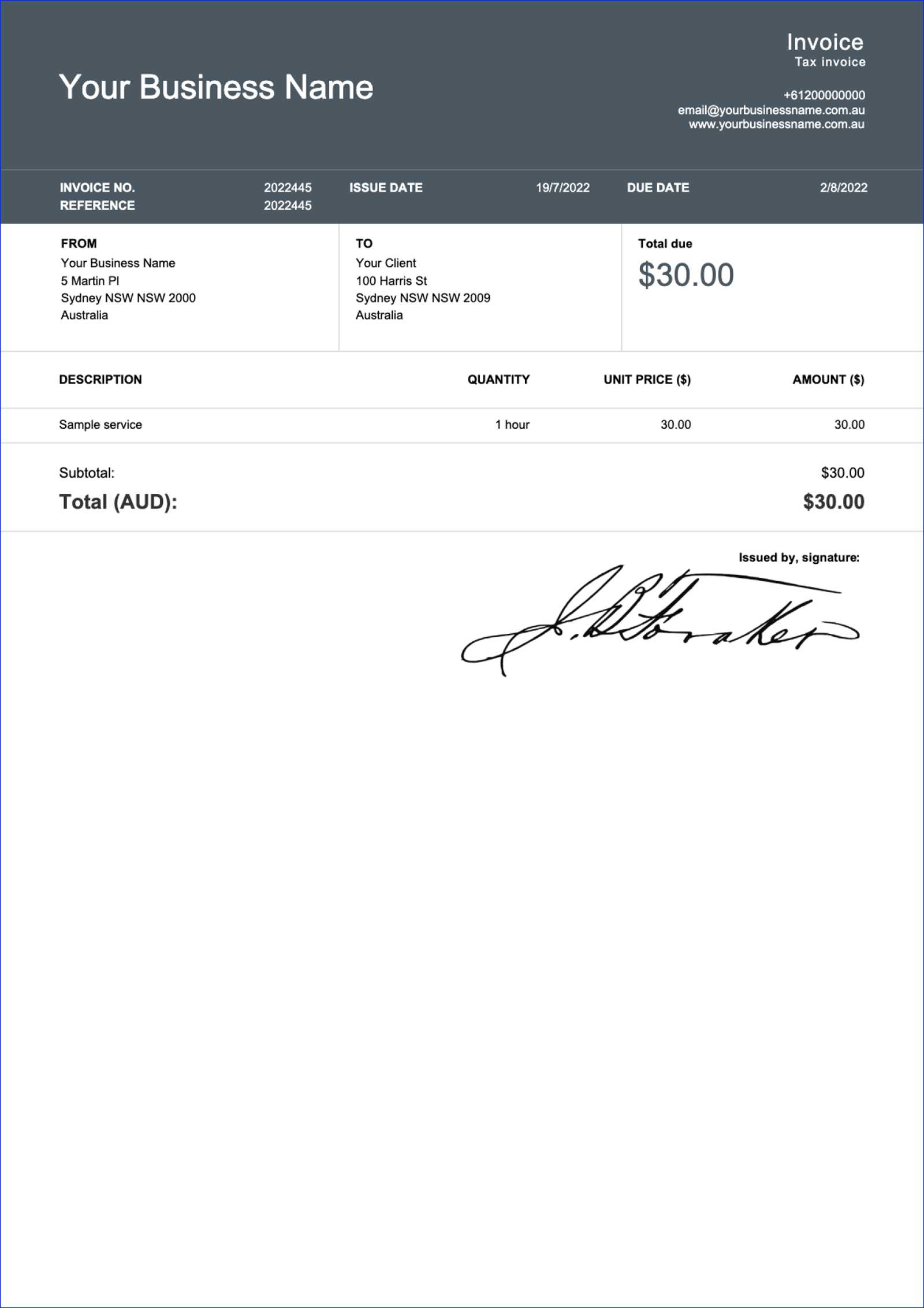

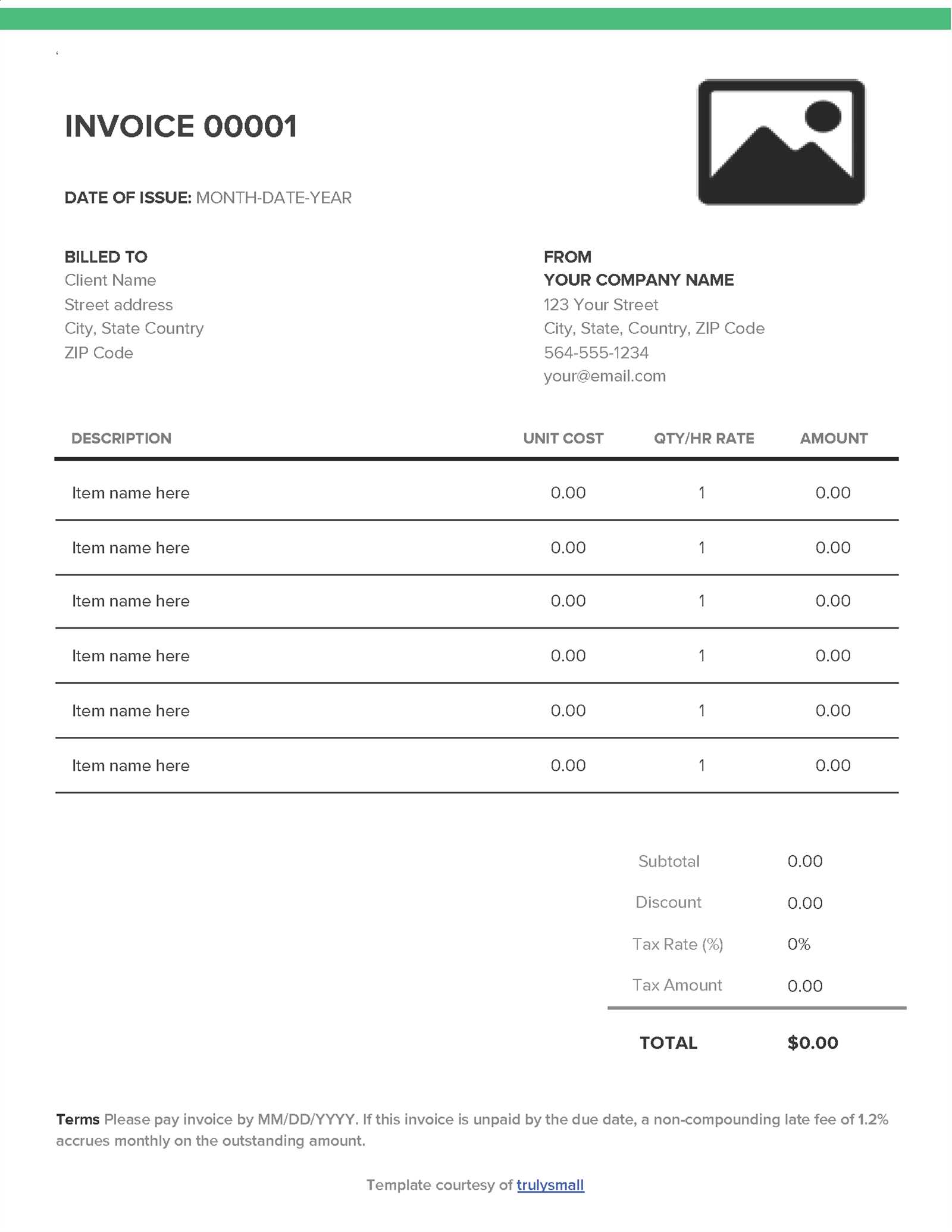

Key Features of an Invoice Template

A well-structured document designed for requesting payments should include several essential components that ensure clarity and professionalism. These elements help both the business and the client understand the details of the transaction, such as services rendered, amounts due, and payment terms. A good design makes this information easy to read and navigate.

Essential Details

The most important aspect of any document is the accuracy of the information it contains. Key fields should include:

- Business Information: Your company name, address, and contact details should be clearly visible.

- Client Information: Ensure that your client’s name, address, and contact details are accurate.

- Services or Products: A clear description of the items or services provided, along with their individual costs.

- Total Due: The total amount due for payment, including any taxes, discounts, or additional fees.

Design and Layout

In addition to the essential information, a well-designed structure is vital for readability. A clean, organized layout makes the document easier to understand. You should:

- Use clear headings for each section

- Ensure the amounts are easy to find and read

- Incorporate branding elements like logos and colors to reflect your company’s image

Where to Find Free Templates

For businesses looking to create professional payment request documents, there are numerous online resources offering ready-to-use designs. These platforms provide accessible solutions for those who need an effective, polished look without the cost of expensive software or professional design services. With just a few clicks, you can find a variety of options that suit your specific business needs.

Many websites offer downloadable files that can be easily edited to match your brand’s identity. Some of the best places to explore include:

- Online Design Tools: Platforms like Canva or Adobe Express allow you to design and personalize documents with drag-and-drop features.

- Document Libraries: Websites like Google Docs or Microsoft Office offer a selection of ready-made formats that can be customized directly in the browser.

- Business Websites: Many business-related blogs and resource sites provide free downloadable documents as part of their service offerings.

These resources give you the flexibility to download and use materials that are simple to modify, enabling you to generate professional forms tailored to your needs.

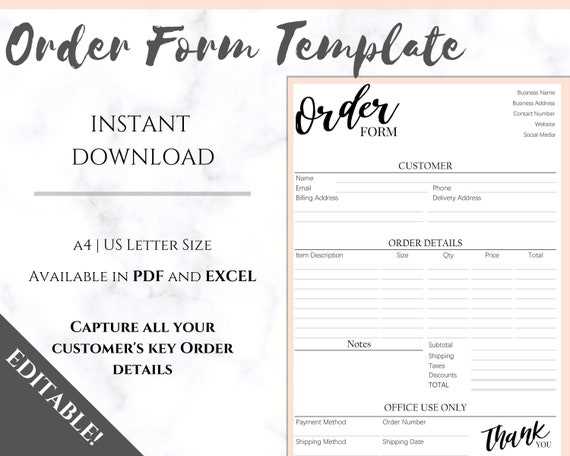

Choosing the Right Template for Your Needs

Selecting the right design for your payment requests is crucial to ensuring clarity and professionalism. A well-chosen format can enhance your brand’s image, streamline communication with clients, and make the entire process more efficient. Understanding your specific business requirements will guide you in choosing a layout that suits your style and needs.

Consider Your Business Type

Different businesses have different billing requirements. For instance, a freelance graphic designer may want a more creative, visually appealing format, while a service provider like a plumber may prefer a straightforward, easy-to-read layout. Consider the following when choosing:

- Industry Requirements: Some industries require more detailed billing information, such as taxes or specific codes for services.

- Client Expectations: Know your client’s preferences–some may prefer a more formal look, while others may appreciate a personalized touch.

Look for Flexibility and Functionality

Ensure the design you select allows for easy customization. You want a structure that lets you modify details such as pricing, due dates, and service descriptions without difficulty. A flexible design will also make future updates or revisions easier to implement.

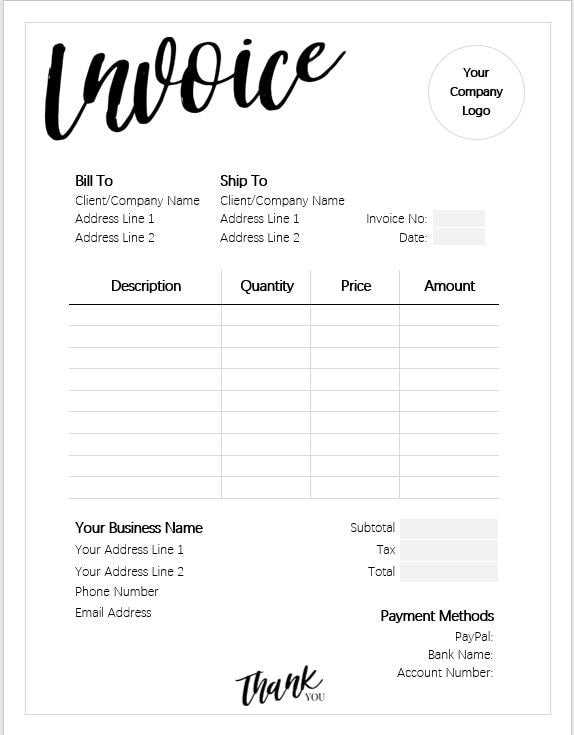

Customizing Your Invoice Design

Personalizing the appearance of your billing documents allows you to create a unique and professional look that reflects your business identity. With the right design choices, you can make sure your documents are not only functional but also visually appealing. Customizing elements such as colors, logos, and fonts helps you stand out while maintaining clarity and professionalism.

Key Design Elements to Personalize

Several components of your document can be adjusted to align with your business’s image and style. Consider the following options when making changes:

- Branding: Add your company logo and brand colors to make the document consistent with your marketing materials.

- Typography: Select fonts that are easy to read and align with your brand’s tone, whether formal or casual.

- Layout: Modify the placement of key details, such as contact information, pricing, and payment terms, to make sure the document is clear and easy to navigate.

Adding Personal Touches

To make your documents more personalized and memorable, consider including unique design features that reflect your business’s personality. Options may include:

- Special Backgrounds: A light background or border can add a touch of elegance without cluttering the page.

- Custom Fields: Add extra sections or notes that are specific to your business or industry.

Adding Your Business Details

Including your business details is an essential part of creating a professional document. These details not only establish your identity but also ensure that your clients have the necessary information to reach out to you or process the payment. Including accurate and consistent contact information helps build trust and facilitates smoother transactions.

Here are the key business details you should include:

| Business Name | Your company or personal name |

|---|---|

| Address | Your physical or mailing address |

| Phone Number | Your business contact number |

| Email Address | Your official business email |

| Website | Your company’s website URL (optional) |

Ensure that these details are easy to find and read on the document. Positioning them at the top or in a header section is often a good practice to ensure visibility. This makes it easy for clients to quickly access your contact information when needed.

Setting Up Payment Terms Effectively

Establishing clear and concise payment terms is crucial for maintaining smooth cash flow and avoiding misunderstandings with clients. Clearly outlined conditions ensure that both parties know when and how payments should be made. By setting up these terms effectively, businesses can improve financial management and create a professional impression.

Key Elements to Include in Payment Terms

When defining payment conditions, ensure all the critical details are included to avoid confusion. Consider the following:

- Due Date: Clearly state the exact date by which payment is expected, whether it’s a specific calendar date or a number of days after the service is completed.

- Late Fees: If applicable, mention any penalties for late payments. Be specific about the rate or flat fee that will apply.

- Accepted Payment Methods: Specify which payment methods you accept, such as bank transfer, credit card, PayPal, etc.

- Discounts for Early Payment: Offering a discount for early settlement can encourage prompt payments. Be sure to include the percentage and timeframe.

Best Practices for Clear Payment Terms

To ensure that your payment terms are easy to understand and enforce, follow these best practices:

- Use clear, simple language without ambiguity or complex terms.

- Highlight important details like due dates and late fees in bold or with an easy-to-read format.

- Include a reminder or follow-up procedure for overdue payments to ensure consistent cash flow.

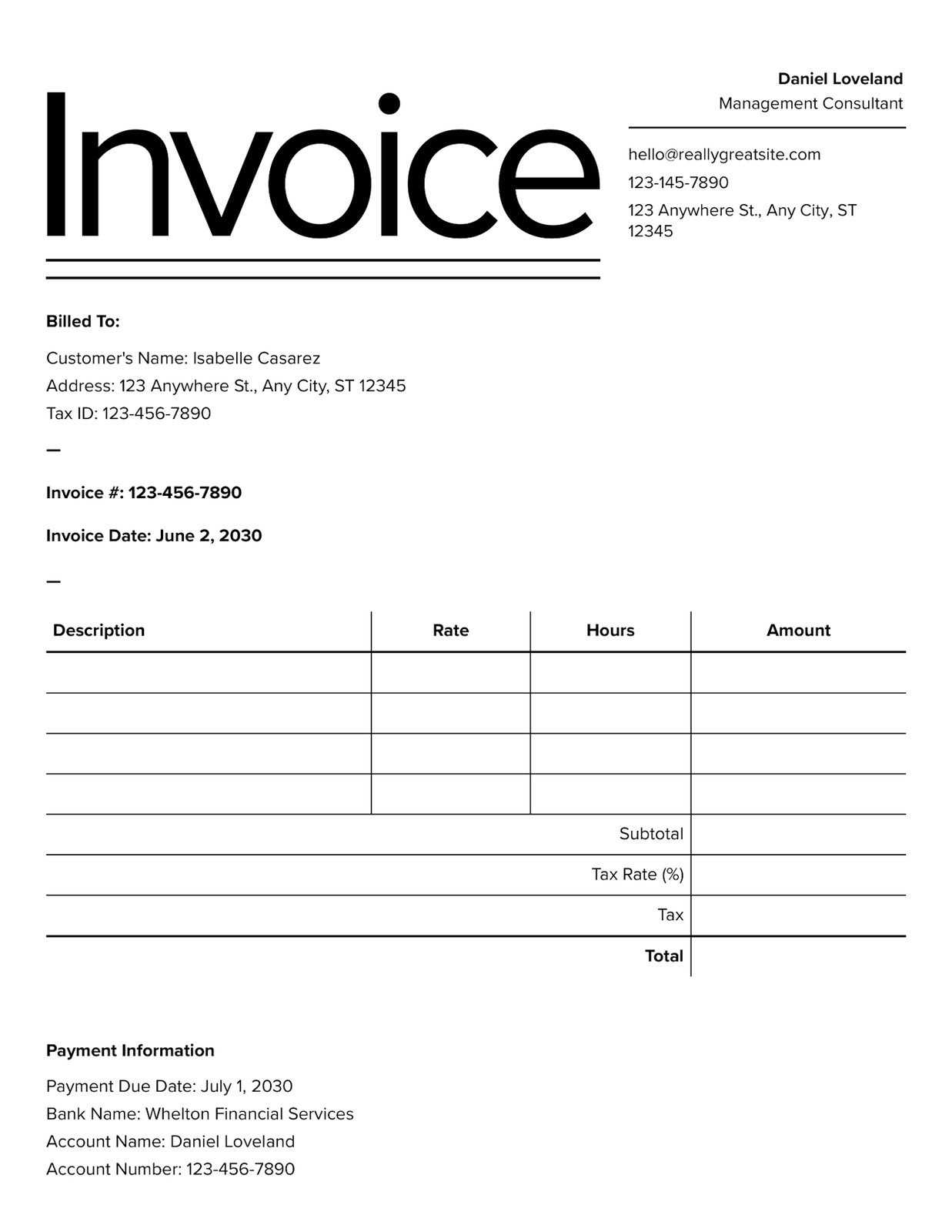

Best Practices for Invoice Layout

A well-organized layout is key to creating documents that are both functional and professional. An effective design not only makes the content easy to read, but also enhances the overall user experience. By following best practices for organizing information, you can ensure that all important details are clearly visible, reducing confusion and increasing the likelihood of prompt payment.

Essential Elements to Prioritize

When designing your billing documents, prioritize the placement of key details. Here are some essential elements to consider:

- Business Information: Ensure that your company’s name, logo, and contact details are placed prominently at the top.

- Client Information: Include the client’s name, address, and contact information in a clear and easy-to-read section.

- Service Breakdown: Provide a detailed list of the services or products provided, along with corresponding prices and quantities.

- Total Amount Due: Highlight the final amount due in a bold and easily noticeable font.

- Payment Instructions: Clearly outline payment methods, due dates, and any other relevant instructions or terms.

Design Tips for Maximum Clarity

Keep the layout clean and simple by following these tips:

- Use White Space: Proper spacing between sections makes the document easier to navigate and less cluttered.

- Align Text Properly: Make sure the text is aligned correctly for each section, such as aligning the amounts right and descriptions left.

- Font Consistency: Stick to a couple of readable fonts and avoid excessive styles to maintain professionalism.

- Visual Hierarchy: Use bold text for important figures, like the total amount, and ensure the document flows logically from top to bottom.

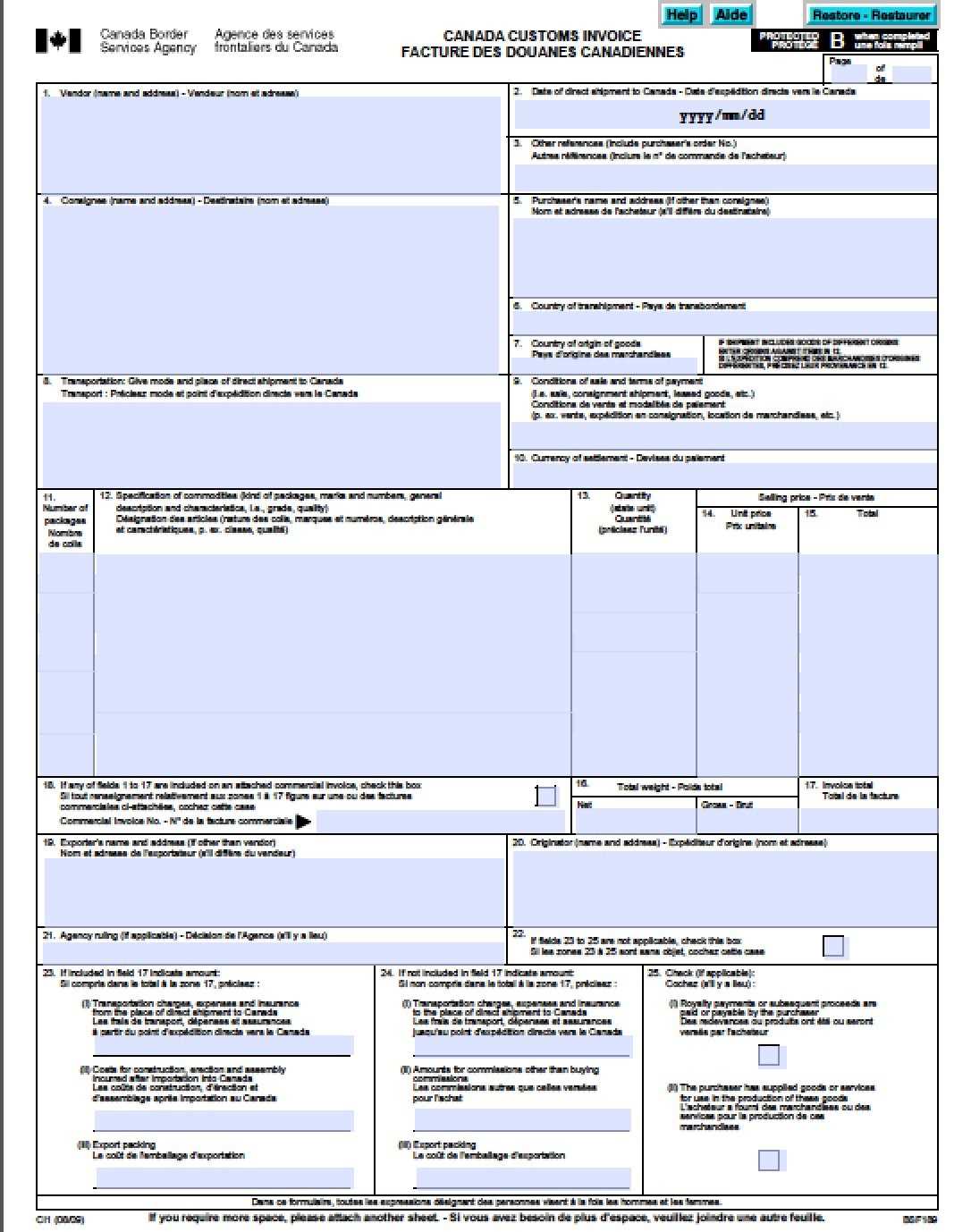

Ensuring Legal Compliance with Invoices

Maintaining legal compliance when creating billing documents is essential for protecting both your business and clients. Certain regulations and requirements must be followed to ensure that your documents meet legal standards. This includes providing necessary information, adhering to tax laws, and following local business regulations, which can vary depending on the location and industry.

Here are some key considerations to ensure compliance:

- Tax Information: Ensure that the applicable tax rates are clearly listed, including any VAT or sales tax. You should also include your tax identification number if required by law.

- Company Registration: If your business is legally required to be registered, include your registration number and relevant details about your company.

- Legal Terms: Include any necessary disclaimers or terms and conditions that apply to the transaction, such as refund policies or delivery terms.

- Accurate Dates: Clearly indicate the date of issuance and the due date for payment to avoid confusion regarding deadlines.

- Client Details: Ensure that the client’s name and contact details are correct, as inaccuracies may lead to legal disputes or payment issues.

By adhering to these guidelines, you can ensure that your documents meet legal standards, minimizing the risk of disputes and ensuring a smooth transaction process for both parties.

Why Invoice Templates Save Time

Using pre-designed formats for billing documents can significantly reduce the time spent on administrative tasks. Instead of creating a new document from scratch for every transaction, a reusable structure allows you to quickly input essential details and generate professional documents in minutes. This streamlined process frees up time for other important aspects of running a business.

Benefits of Using Pre-Designed Formats

Here are some of the key reasons why these ready-made formats are a time-saver:

- Consistency: Using a consistent format ensures that every document follows the same layout, reducing the need for customization each time. This consistency saves time and makes managing your documents easier.

- Quick Fill-in: You can easily fill in client details, dates, and amounts, eliminating the need to format everything manually each time.

- Eliminates Errors: Pre-built formats reduce the chances of missing important information or making formatting mistakes, which can cause delays and confusion.

- Professional Appearance: With little effort, you can generate professional-looking documents, which might take longer to design from scratch.

How It Benefits Business Operations

By saving time on document creation, businesses can focus on more value-adding tasks, such as customer service, product development, or marketing. Reducing administrative burden can also improve overall efficiency and productivity within the team.

How to Save and Export Invoices

Once you have created a billing document, it’s important to know how to save and export it efficiently. Properly storing and sharing these documents ensures that they are easily accessible for future reference and can be sent to clients or colleagues without delays. Whether you’re using a digital format or a physical one, understanding how to manage these files is essential for keeping your workflow organized.

Saving Your Billing Documents

To ensure that you can quickly find and use your documents, follow these steps for saving them properly:

- Choose a Clear File Name: Use descriptive file names that include details like the client’s name and the date of the transaction (e.g., “ClientName_March2024”).

- Use Organized Folders: Create folders based on categories such as clients, dates, or transaction types to keep everything in order.

- Cloud Storage: Store your documents in cloud-based services like Google Drive, Dropbox, or OneDrive for easy access from any device.

- Backup Files: Regularly back up your documents to an external hard drive or cloud service to avoid losing important records.

Exporting Billing Documents

Once your document is saved, you’ll likely need to export it in a format that’s easily shareable with clients or accounting teams. Here’s how:

- Export as PDF: PDFs preserve the formatting and layout of your document, making them ideal for sharing with clients and colleagues. Most software allows you to save or export files as PDFs with just a click.

- Export to Excel or CSV: For more detailed data tracking, exporting as Excel or CSV files allows you to work with the information in spreadsheets for better analysis and reporting.

- Email Directly: Many invoicing systems allow you to email documents directly from the platform. Ensure you use a professional email format when sending documents to clients.

By following these tips, you can easily manage your billing documents, ensuring they are saved correctly and exported in the right formats for sharing or record-keeping purposes.

Common Mistakes to Avoid When Creating Invoices

When preparing billing documents, it’s easy to overlook key details or make errors that can lead to confusion or delays in payment. Avoiding common pitfalls ensures that your paperwork is professional, accurate, and clear to your clients. Properly crafted documents reflect well on your business and help maintain smooth financial operations.

Typical Mistakes to Watch Out For

Here are some of the most frequent errors people make when preparing their billing documents:

- Missing Contact Information: Always include your business name, address, and contact details. Failing to do so makes it difficult for clients to reach out if they have questions.

- Incorrect Payment Terms: Clearly state the due date and any payment terms, such as late fees. Omitting this information can lead to confusion and delayed payments.

- Inaccurate or Missing Amounts: Double-check that all figures, including taxes, discounts, and total amounts, are correct. Mistakes here can lead to disputes with clients.

- Wrong Client Details: Ensure that the recipient’s name, address, and other contact details are accurate to avoid sending the wrong document to the wrong party.

- Not Including Purchase Details: Include a clear description of the goods or services provided, along with the quantities and rates, to avoid any misunderstandings about what is being billed.

How to Prevent These Mistakes

To minimize errors, take these precautions:

| Step | Action |

|---|---|

| 1 | Double-check all information, including client details, amounts, and payment terms before finalizing the document. |

| 2 | Use professional tools or systems to automatically generate documents, reducing the chance of human error. |

| 3 | Review previous documents for consistency, ensuring that your formatting, terms, and details match across all records. |

By staying vigilant and reviewing your work, you can avoid these common mistakes and ensure your billing documents are accurate, professional, and clear for your clients.

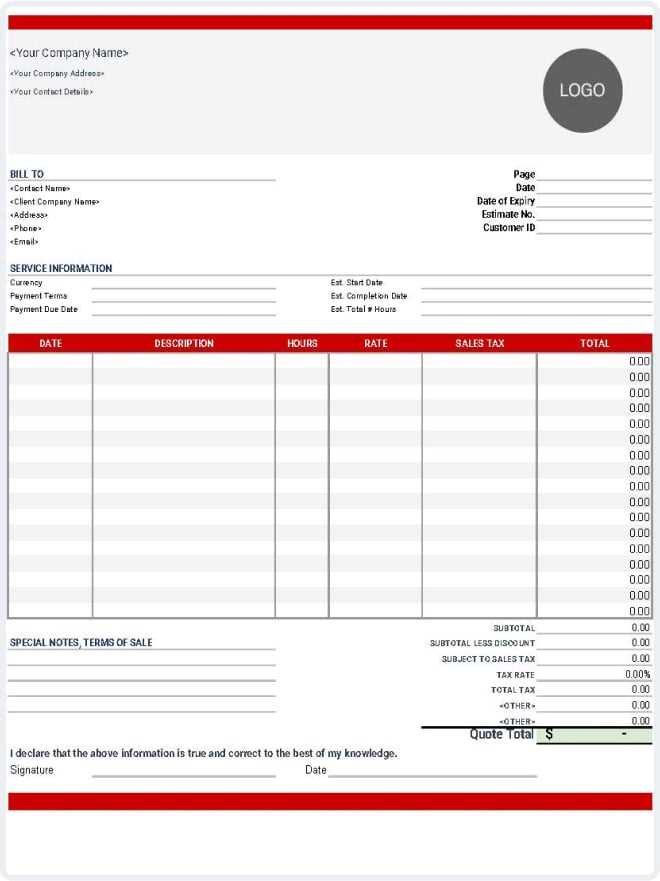

Using Invoice Templates for Branding

Billing documents are not only a tool for financial transactions but also an opportunity to showcase your business’s identity. By using professionally designed formats, you can create documents that reflect your brand’s values and style. This approach not only enhances the customer experience but also helps reinforce your brand’s image with every transaction.

Integrating Branding Elements

One of the most effective ways to use these documents for branding is by incorporating key elements of your business identity. Here are some suggestions for branding:

- Logo: Include your company logo prominently at the top of the document. This simple step ensures that your business is instantly recognizable.

- Color Scheme: Use your brand’s color palette for text, headings, and borders to create a cohesive look that matches your overall branding.

- Typography: Choose fonts that align with your brand’s style. Whether you prefer modern, classic, or minimalistic typography, consistency is key.

- Tagline: If you have a catchy tagline or slogan, consider adding it in a subtle way at the bottom of the page, reinforcing your message to clients.

Benefits of Branding Billing Documents

By incorporating these elements, you achieve several key benefits:

- Increased Professionalism: A well-branded document makes your business appear more professional and trustworthy in the eyes of your clients.

- Enhanced Customer Experience: Clients are more likely to remember a visually appealing document and associate it with a positive transaction.

- Consistency Across Communication: Using branded documents ensures consistency in all your business communications, helping to build brand recognition and loyalty.

Incorporating branding into your documents goes beyond just aesthetics. It’s about creating a consistent, memorable experience for your clients that reflects your business’s values and professionalism.

How Custom Invoices Improve Professionalism

Professional billing documents play a significant role in establishing a trustworthy relationship with clients. When these documents are well-structured and tailored to reflect your business’s unique identity, they not only streamline the transaction process but also enhance the perception of your business. Creating personalized documents allows you to present your services in a polished and coherent manner, building credibility and instilling confidence in your clients.

Key Elements of Professional Billing Documents

Here are several factors that contribute to a more professional appearance and how they impact your business:

| Element | Impact |

|---|---|

| Consistent Branding | Incorporating your company logo, colors, and fonts reinforces brand recognition and professionalism. |

| Clear Layout | A well-organized document that’s easy to read and follow demonstrates that you pay attention to detail. |

| Accurate Information | Ensuring that all the necessary details such as payment terms, dates, and services are clearly displayed prevents confusion and delays. |

| Timely Delivery | Sending well-designed, detailed documents promptly indicates efficiency and reliability. |

Benefits of Professional Billing Documents

- Trustworthiness: A polished, personalized document signals to clients that your business is serious and competent.

- Consistency: Consistent formatting and branding across your business communications help establish a recognizable image and enhance client loyalty.

- Efficient Transactions: Clear and precise billing documents reduce the chances of disputes, making transactions smoother and faster.

Overall, creating professional, tailored billing documents sets your business apart and builds a lasting, trustworthy relationship with clients, improving your overall image and efficiency.

Integrating Invoices with Accounting Software

Connecting your billing documents with accounting systems can significantly improve the efficiency of your financial processes. This integration helps automate tasks such as tracking payments, generating reports, and reconciling accounts, reducing the chances of errors and ensuring that your financial data is consistently updated. By linking your billing system with accounting software, you create a streamlined workflow that saves time and resources.

Key Advantages of Integration:

- Automation: Once set up, the system can automatically record transactions, reducing manual entry and the risk of human errors.

- Real-Time Updates: Any changes made to billing documents are immediately reflected in the accounting system, keeping your financial records accurate and up-to-date.

- Efficient Reporting: Integrated systems can generate detailed financial reports, making it easier to track cash flow, identify trends, and make informed business decisions.

- Time Savings: Automation and seamless synchronization between systems save you time that would otherwise be spent managing separate processes.

Popular Accounting Software Integrations:

- QuickBooks: Known for its user-friendly interface, QuickBooks allows for easy integration with most billing systems, ensuring smooth synchronization.

- Xero: Xero’s cloud-based platform offers excellent integration options, providing real-time financial updates and seamless invoicing features.

- FreshBooks: FreshBooks simplifies financial tracking by connecting with billing documents, helping you monitor expenses and generate financial reports effortlessly.

Integrating your billing processes with accounting software ensures greater accuracy, saves time, and supports better decision-making for your business. By automating these tasks, you can focus more on growing your business rather than managing paperwork.