How to Use a DHL Proforma Invoice Template for Smooth International Shipping

When shipping goods internationally, proper documentation is crucial for smooth customs clearance and efficient processing. Creating the right forms can help avoid delays and ensure that all relevant details are clearly communicated between parties involved in the transaction.

One of the most common documents used in international shipping is a preliminary customs declaration. This document outlines the details of the shipment, including its value, contents, and origin, which helps customs authorities assess applicable duties and taxes. Using the correct format can make this process much easier, especially when dealing with international logistics companies.

Accurate and standardized forms are essential for both businesses and individuals who frequently send goods abroad. By using a carefully designed structure, shippers can minimize the risk of errors and ensure that all necessary information is included. This guide will help you understand how to properly fill out these documents, how they can benefit your shipping process, and how to avoid common mistakes that can lead to delays.

Understanding the DHL Proforma Invoice Template

When shipping internationally, clear and accurate documentation is vital for both customs clearance and smooth transaction processing. A well-structured form that outlines the shipment details, including item descriptions, values, and the sender and recipient information, is essential. This document serves as a key tool for businesses and individuals who need to comply with customs requirements and avoid potential delays.

The document in question typically includes all the necessary details to help customs officials determine the classification and value of the goods being shipped. It is not a final sale bill but an official statement providing an estimate of the goods’ worth. Using a standard form that captures all relevant information in a clear, consistent way can significantly reduce the risk of confusion during shipping procedures.

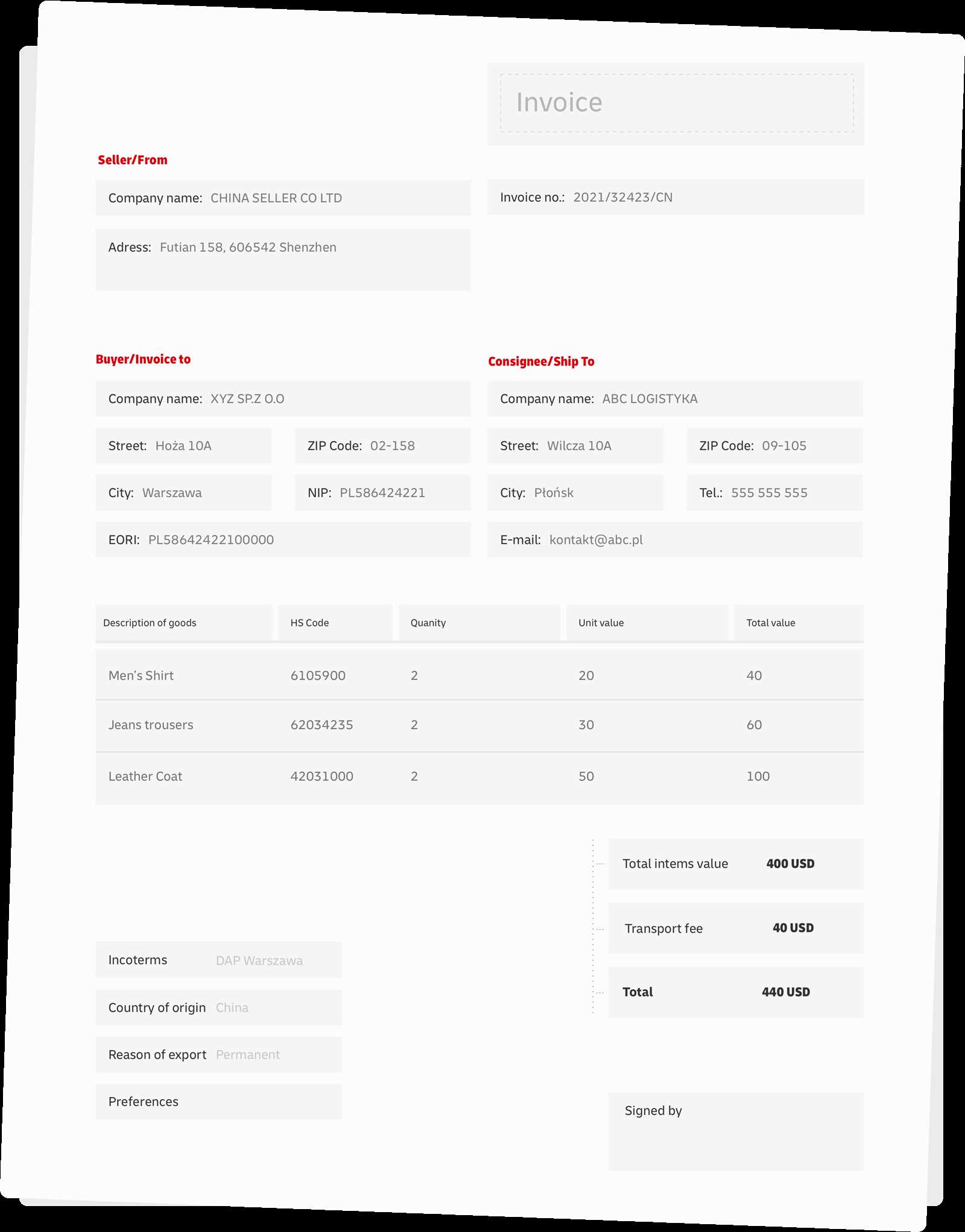

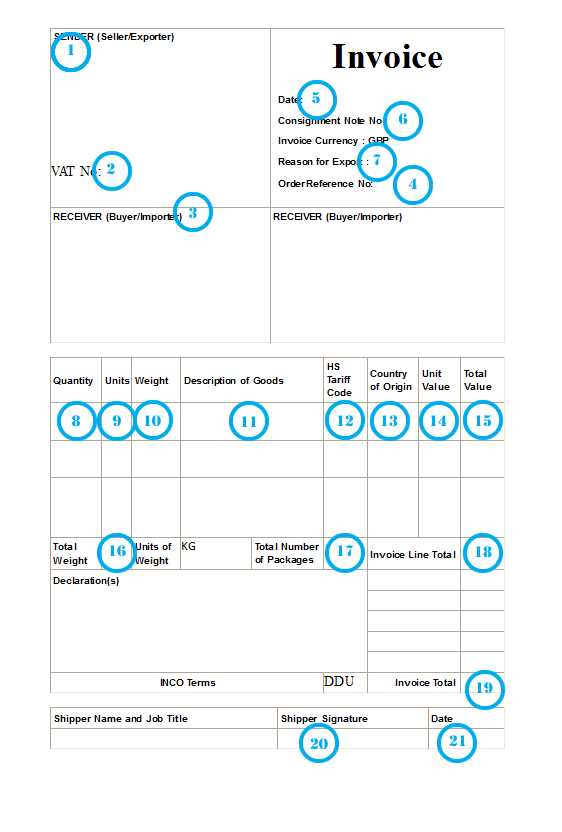

The layout of the document generally follows a fixed structure, ensuring that all relevant data is included in an organized and easily accessible manner. Here’s a breakdown of the most common sections you will encounter in such a shipping declaration form:

| Section | Description |

|---|---|

| Sender Information | Details about the person or company sending the goods, including name, address, and contact information. |

| Recipient Information | Information about the destination, including name, address, and contact details of the recipient. |

| Item Descriptions | A clear list of the items being shipped, including their quantities, values, and a brief description of each product. |

| Value and Currency | The estimated value of each item, typically in the local currency or the destination country’s currency. |

| Shipping Terms | Details regarding shipping conditions, including the responsibility for shipping costs and risks. |

| Declarations | A statement that the information is correct, often signed by the sender, to confirm the accuracy of the document. |

This organized approach ensures that all necessary details are included, making it easier for both the sender and recipient to navigate the customs process and avoid unnecessary delays. By using such a structured format, international shipments can move smoothly from one country to another with minimal complications.

What is a Proforma Invoice

A preliminary document used in international trade serves as a declaration of the shipment’s details, providing essential information to customs and other involved parties. Unlike a final bill, this document does not request payment but outlines the estimated value of the goods being shipped. It acts as an official statement for customs clearance, ensuring that all relevant data is presented in a structured format.

This document includes key details about the sender, recipient, and contents of the shipment, as well as the value of the goods. It is typically used before the final transaction takes place, providing customs authorities with necessary information for the classification of goods, tax assessments, and duty calculations. It can also be used for insurance purposes or as a document to confirm the legitimacy of the shipment.

In essence, this document is not a request for payment but an initial declaration that facilitates the movement of goods across borders, ensuring that all regulations are met and helping to avoid delays in the customs process.

Key Benefits of Using a Proforma Invoice

Using a preliminary shipping document offers several advantages for businesses and individuals involved in international trade. This document serves as an official statement to provide clarity, streamline customs processes, and help prevent potential delays. By outlining critical details about the shipment, it ensures that both senders and recipients can prepare for the transaction and avoid complications with authorities.

1. Simplifies Customs Clearance

One of the primary benefits of using a formal declaration in international shipping is its ability to simplify the customs clearance process. Customs authorities rely on this document to evaluate the value of goods, calculate taxes and duties, and verify shipment details. By providing all necessary information upfront, you reduce the chances of delays and minimize the risk of additional scrutiny from customs officials.

- Clearly outlines the value and classification of goods

- Ensures compliance with local import regulations

- Helps prevent the shipment from being held up at customs

2. Enhances Transparency in International Transactions

Another significant benefit is that it promotes transparency between the sender, recipient, and customs officials. Both parties involved in the transaction can reference the same document, which outlines the shipment’s contents, values, and origin. This clarity helps prevent misunderstandings and ensures that both parties are on the same page when it comes to shipment expectations.

- Provides a clear breakdown of shipment details

- Helps establish trust between buyer and seller

- Ensures that both parties are fully informed about the shipment

By using a structured, standardized format for these types of declarations, shippers can streamline their international transactions, reduce risks, and ensure the entire shipping process proceeds as smoothly as possible.

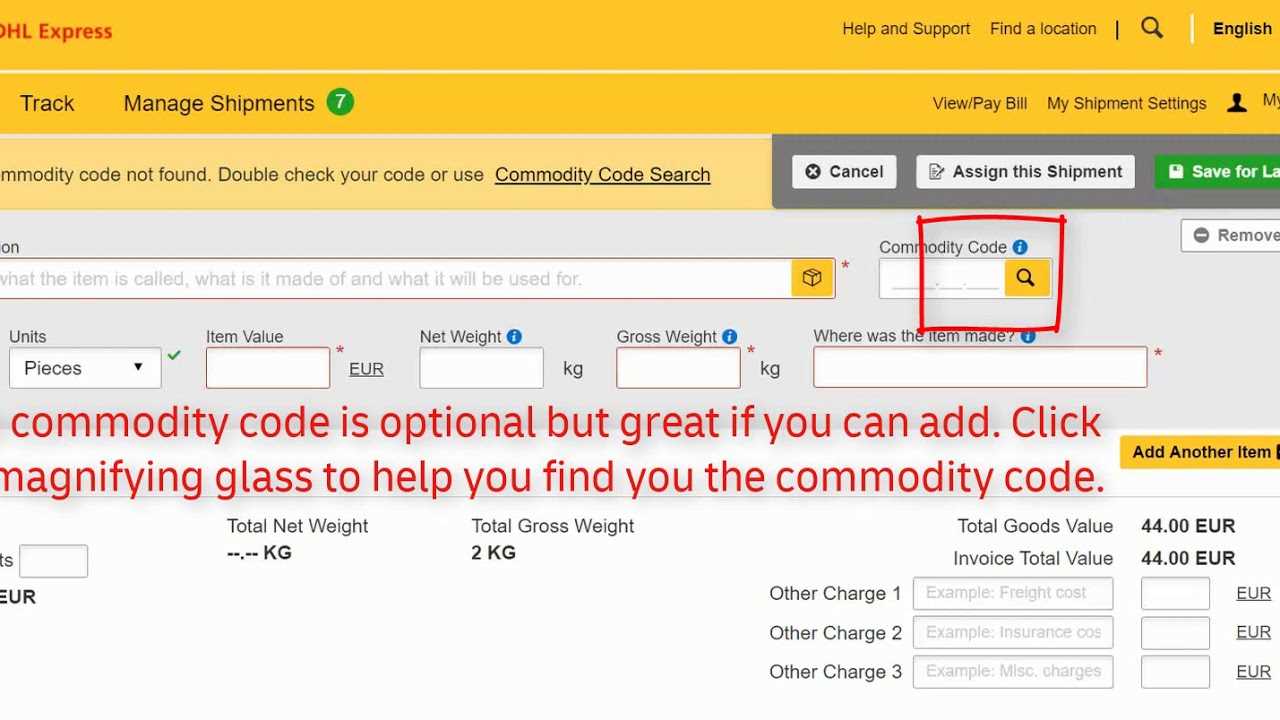

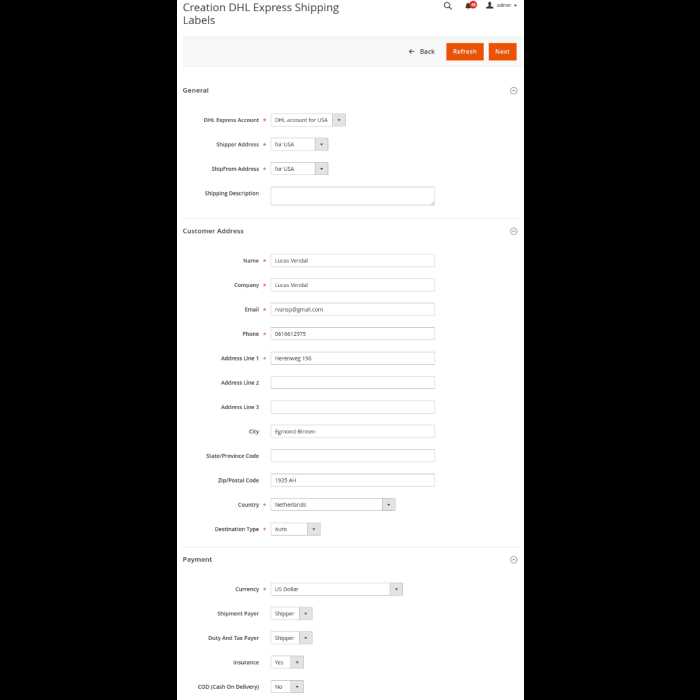

How to Customize DHL Invoice Template

When preparing documentation for international shipments, it’s important to ensure that all required details are correctly included in a clear and organized manner. Customizing the document to suit your specific needs can make the shipping process more efficient, especially when dealing with complex shipments or specific customs requirements. By adjusting the format, layout, and content to match your business requirements, you can simplify and streamline the entire process.

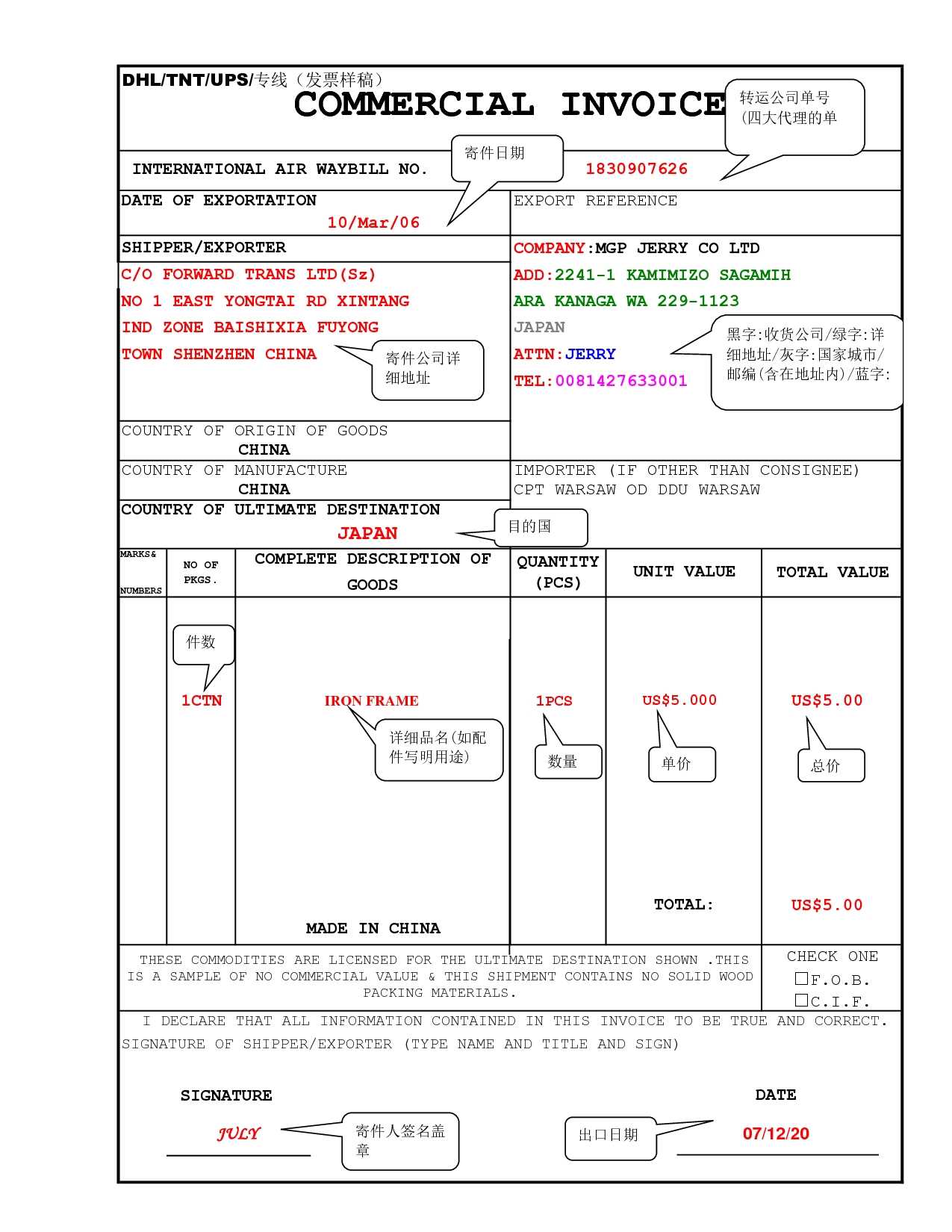

1. Adjusting Basic Information

The first step in customizing the shipping form is to ensure that all sender and recipient information is accurate. This includes not only names and addresses but also contact details and any specific identification numbers that may be needed for customs or tracking purposes. Additionally, make sure that the document reflects the correct shipping terms and conditions as per your agreement with the recipient.

| Section | Customization Details |

|---|---|

| Sender Information | Ensure all fields are filled with the correct name, address, and contact details. |

| Recipient Information | Provide complete details of the recipient, including address and phone number. |

| Shipping Terms | Specify whether the shipping cost is prepaid or if the recipient is responsible for duties. |

2. Including Item Descriptions and Values

Next, you’ll need to list all items included in the shipment. This is a critical section of the document, as it outlines the contents of the shipment for customs authorities. Be specific with the descriptions, and ensure that the quantities, unit prices, and total values are clearly stated. If there are multiple items, organize them in a table for easy reading and clarity.

| Item | Description | Quantity | Value |

|---|---|---|---|

| Item 1 | Example Product | 2 | $100 |

| Item 2 | Example Product 2 | 5 | $250 |

By customizing these sections and ensuring that all the necessary details are present, you ensure that your shipping form is both compliant and easy to process. Tailoring the document to your shipment’s specific needs will ultimately help prevent delays and confusion during the shipping and customs clearance stages.

Step-by-Step Guide to Filling Out the Template

When preparing the necessary documentation for international shipments, it’s important to ensure that each section is completed correctly to avoid delays and complications with customs. By following a clear, systematic approach, you can ensure that all required information is accurately provided and that the document serves its purpose effectively. Below is a step-by-step guide on how to properly fill out this essential shipping document.

- Start with Sender Information:

- Enter the full name and business name (if applicable).

- Provide the complete address, including country and postal code.

- Include a contact phone number and email address for communication purposes.

- Enter Recipient Information:

- Fill in the recipient’s name and company name (if applicable).

- Ensure that the recipient’s full address is listed correctly.

- Provide a phone number for the recipient in case of any issues with the shipment.

- List the Shipment Details:

- Provide a detailed description of each item being shipped.

- Include the quantity, unit price, and total value for each product.

- Ensure that each item is properly categorized (e.g., electronics, clothing, machinery).

- Include Shipping Terms:

- Indicate the shipping method and whether the se

Common Errors When Using Proforma Invoices

Despite the importance of accurate documentation in international shipments, errors are common when filling out preliminary shipping forms. These mistakes can lead to delays, complications with customs, and potential financial consequences. Understanding the most frequent errors and how to avoid them is key to ensuring a smooth process when sending goods abroad.

1. Incorrect or Incomplete Sender and Recipient Details

One of the most frequent mistakes is providing inaccurate or incomplete information about the sender or recipient. Missing or wrong contact details, addresses, or phone numbers can cause delays or even result in the return of the shipment. Additionally, incomplete addresses, especially in international transactions, may prevent customs from processing the shipment efficiently.

- Ensure full names and correct addresses are provided.

- Verify contact phone numbers and emails are up to date.

- Double-check country-specific postal code formats to avoid mistakes.

2. Overlooking Item Descriptions and Values

Another common error is neglecting to provide clear descriptions or accurate values for the goods being shipped. Customs authorities need precise information to assess duties and taxes. Ambiguous descriptions or undervalued goods can lead to customs holds, fines, or shipment delays.

- Provide detailed and accurate descriptions for each item.

- Ensure that the declared value of each item matches its actual market value.

- Avoid generic terms like “miscellaneous” or “assorted goods”; be specific.

Inaccurate shipping values and descriptions not only cause potential delays but also increase the risk of customs penalties. To avoid this, always ensure that the value declared on the form aligns with the transaction’s actual value and the item is clearly identified.

3. Missing Signatures or Declarations

Many overlook the importance of signing the document or including required declarations. A missing signature or absence of a legal declaration stating that the information is true can lead to significant problems with both customs authorities and recipients. The absence of such formalities may result in the document being considered invalid, causing shipment hold-ups.

- Ensure that the document is signed by the sender, and if needed, by the recipient.

- Include any legal declarations or statements as required for your shipment’s specifics.

By carefully reviewing the document before submission and avoiding these common mistakes, you can significantly reduce the chances of delays or issues with your shipment. Accuracy and thoroughness are crucial for ensuring smooth and efficient international transactions.

How to Avoid Customs Issues with Proforma Invoices

International shipments often face delays or complications due to incorrect or incomplete paperwork. Customs authorities require clear and accurate documentation to process shipments efficiently. Ensuring that the necessary details are correctly presented in your preliminary shipping declaration is essential to avoid unnecessary issues. By taking care with the information you provide and following best practices, you can ensure a smoother experience when clearing customs.

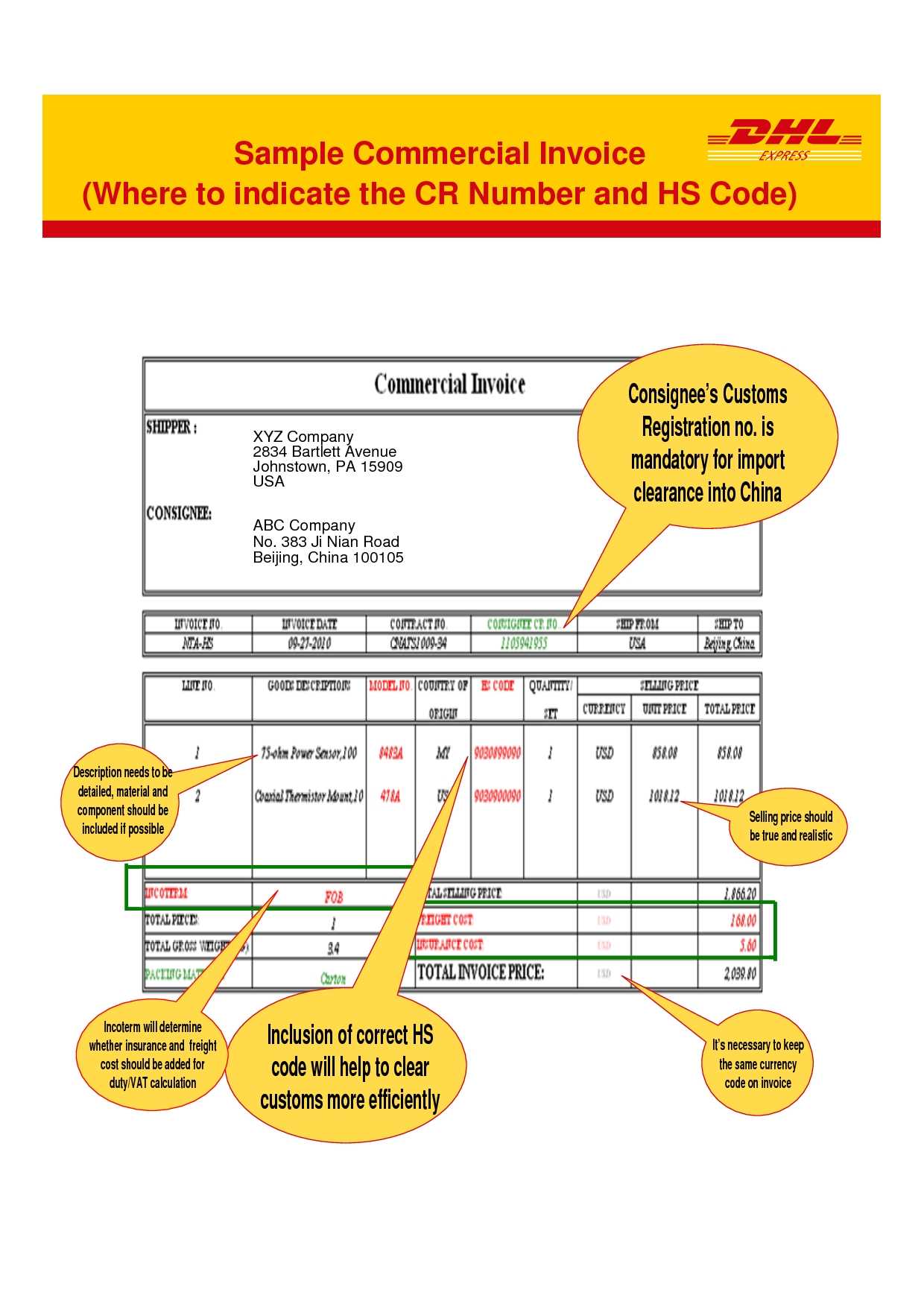

1. Provide Accurate and Detailed Descriptions

Customs authorities rely on detailed item descriptions to classify and assess the value of goods. One of the most common issues is a lack of specificity in item descriptions, which can lead to confusion or delays. Vague terms such as “miscellaneous” or “assorted items” can be flagged, leading to further scrutiny.

- Use clear, detailed descriptions for each item, including material, function, and intended use.

- Ensure that all product details match what is listed in the accompanying purchase documents.

- Avoid generic terms and provide unique identifiers such as model numbers or serial numbers when applicable.

2. Ensure Accurate Valuation of Goods

Another major factor in avoiding customs issues is providing accurate pricing information. Under-declaring the value of goods may result in penalties or delays as customs might suspect fraud or tax evasion. Conversely, over-declaring the value can lead to unnecessarily high duties and taxes. Both can cause delays in the shipment’s release.

- Declare the actual transaction value, including all costs associated with the goods (e.g., shipping, insurance, and handling).

- Ensure that the valuation matches the invoices or purchase orders for the goods being shipped.

- If you are sending samples, provide a “sample” designation and include the value for customs purposes.

3. Verify Sender and Recipient Information

Accurate and up-to-date contact information for both the sender and recipient is essential. Missing or incorrect details can result in customs delays or the return of goods. Customs authorities may need to contact either party to verify information or resolve discrepancies, and incorrect addresses or phone numbers can lead to complications.

- Double-check that all contact details (names, addresses, phone numbers) are complete and accurate.

- Verify that the recipient’s contact information matches what is listed in customs databases.

- Ensure that the shipment is being sent to a location that is eligible for import, based on local regulations.

4. Include All Required Declarations and Signatures

Failure to include the necessary legal declarations or signatures can result in the rejection of the paperwork. Many countries require a statement confirming the authenticity and correctness of the information provided, along with the sender’s signature. Missing these formalities can cause the shipment to be held up or sent back.

- Make sure the document includes a declaration that the information is true and correct.

- Obtain the necessary signatures from both the sender and, if applicable, the recipient.

- Sender’s full name and business name (if applicable)

- Sender’s complete address and contact information

- Recipient’s name, address, and contact details

- Clear product names and descriptions

- Item quantities and units of measure

- Individual and total values for each item

- Accurate unit price and total value for each item

- Currency used for the transaction

- Shipping method and responsibility for costs

- Insurance coverage details, if applicable

- Preliminary Declaration: The first document is typically issued for customs purposes or as a provisional estimate, without an immediate request for payment.

- Final Payment Request: The second is an official request for payment, issued once goods have been delivered or services have been completed, marking the completion of a transaction.

- Preliminary Document: Contains estimated or declared values for customs clearance but does not include a request for payment.

- Final Bill: Lists the actual prices of goods, including terms of payment, taxes, and any applicable discounts. It also serves as the final statement for the transaction.

- Preliminary Declaration: Does not constitute a binding payment request, and may be subject to adjustments once the goods are delivered.

- Final Bill: Forms the basis for the transaction and may be used for legal action in case of non-payment or disputes.

- Preliminary Declaration: Helps the sender estimate shipping costs, customs duties, and taxes for international shipments.

- Final Bill:

Why DHL’s Template Is Ideal for Shipping

When it comes to international shipments, efficiency and accuracy are critical. Using a standardized document format can significantly reduce errors and streamline the process of clearing customs. A well-structured shipping document not only ensures that all necessary details are included but also helps facilitate smoother transactions across borders. The format offered by one of the leading global logistics companies is designed with these principles in mind, offering a solution that simplifies the paperwork process for both senders and recipients.

Here’s why this particular format is ideal for shipping:

1. Streamlined and Easy to Use

The document format is designed to be user-friendly, allowing even those with little experience in international trade to complete it quickly. The fields are clearly marked, and the layout is intuitive, reducing the chance of mistakes. It’s a practical solution that simplifies the process of preparing shipments for international delivery.

2. Comprehensive Yet Simple

It includes all the necessary sections to cover the legal and customs requirements while avoiding unnecessary complexity. The key details such as sender and recipient information, item descriptions, quantities, values, and shipping terms are clearly laid out, making it easy to capture all essential information at once.

3. Customs-Ready Format

The format is designed with customs procedures in mind, ensuring that the information provided meets the requirements of international customs authorities. This includes detailed product descriptions, correct pricing, and accurate classifications. By adhering to these standards, the document minimizes the risk of delays at customs checkpoints.

4. Flexible and Adaptable

Whether you are shipping a single product or multiple items, the format can be easily adapted to fit various needs. Additional rows can be added for more items, and there’s flexibility in terms of adjusting the quantity and value fields, making it suitable for a wide range of shipments.

5. Supports International Shipping Regulations

Global shipping involves navigating a complex set of regulations and requirements, which can vary from country to country. The format is built to comply with a wide range of international shipping standards and regulations, helping ensure that all necessary details are included, thereby reducing the chance of legal complications or delays.

6. Ensures Transparency

Transparency in international shipments is essential for building trust between parties. The template clearly outlines the cost breakdowns, responsibilities, and conditions of shipment, ensuring both the sender and recipient are on the same page. This clarity helps avoid misunderstandings and supports smooth transactions throughout the shipping process.

Sample Layout

To illustrate its practicality, here’s a sample layout of a standard document that follows the essential guidelines for international shipments:

Section Detai How Proforma Invoices Help with Taxes and Duties

When shipping goods internationally, accurate documentation is crucial for determining the applicable taxes, duties, and fees. A well-prepared shipping declaration provides customs authorities with the necessary information to assess the proper charges on imported goods. This helps ensure that the shipment clears customs smoothly without unnecessary delays or additional costs. The preliminary shipping document plays a significant role in making the process transparent and efficient.

1. Establishing the Value of Goods

One of the primary ways this document assists with taxes and duties is by clearly declaring the value of the goods being shipped. Customs authorities rely on the value provided in the shipping paperwork to determine the applicable duties and taxes. If the value is declared accurately, it helps ensure that the correct amount of fees are calculated and paid.

- Accurate Valuation: The value of goods is stated upfront, ensuring that the proper customs duties are applied.

- Detailed Breakdown: All costs associated with the goods, including shipping, insurance, and handling, are clearly listed for calculation purposes.

2. Clarifying Tariff Classifications

Different products are subject to different duty rates based on their classification under international trade regulations. The document typically includes specific product descriptions that help customs officials categorize goods properly. Clear and accurate descriptions ensure that the correct tariff codes are applied, preventing overpayment or underpayment of duties.

- Clear Product Descriptions: Specific details about each product help ensure it is classified correctly under the appropriate customs tariff.

- Avoiding Misclassification: Proper classification helps prevent delays or disputes with customs authorities over incorrect duty rates.

3. Reducing Risk of Customs Delays

Providing a transparent and detailed shipping declaration reduces the chances of shipments being held up by customs. When customs officials have all the necessary information upfront, including the value, classification, and detailed descriptions of goods, they can assess the shipment more quickly and accurately. This prevents unnecessary delays and additional inspections, allowing goods to move faster through customs procedures.

- Complete Documentation: Ensures that all required information is provided to customs, reducing the likelihood of holds or inspections.

- Minimized Delays: Expedites the customs clearance process, which can be crucial for time-sensitive shipments.

4. Assisting with Duty Exemptions and Reductions

In some cases, the proper use of a shipping declaration can help reduce or exempt certain goods from duties or taxes. For example, certain types of goods, like samples or educational materials, may be eligible for duty exemptions or reduced rates. Accurately detailing the goo

How to Save Time Using DHL’s Invoice Template

In the world of international shipping, efficiency is key. Preparing accurate and complete shipping documents can often be time-consuming, especially when it comes to fulfilling all the necessary requirements for customs clearance. A well-structured shipping document, designed to capture all essential information in one place, can save significant time and reduce the likelihood of errors. By using a standardized format, businesses can streamline their workflow and focus on other important aspects of their operations.

1. Predefined Fields for Quick Entry

The format designed for international shipments comes with predefined fields that make it easy to input the necessary details quickly. By simply filling in the required sections for sender and recipient information, item descriptions, and values, you can avoid the hassle of creating a document from scratch. The predefined layout ensures that all the critical fields are included, which reduces the chances of leaving out important details.

- Pre-filled Sections: Key fields such as sender, recipient, and item details are already structured, allowing for faster data entry.

- Clear Guidance: The format clearly marks where to enter information, minimizing confusion and speeding up the process.

2. Minimizing Errors and Corrections

Using a standardized format greatly reduces the chances of errors, which can otherwise lead to delays in processing or even shipment rejection. With an easy-to-follow structure, the likelihood of missing critical information or making data entry mistakes is minimized. This means less time spent on revisions and corrections, ensuring that the document can be submitted right the first time.

- Fewer Revisions: Since the format includes all required fields, there is less room for oversight.

- Built-In Checks: The consistent format reduces the chances of submitting incomplete or incorrect information to customs.

3. Speeding Up Customs Clearance

One of the biggest time-savers when using the correct format is that it helps expedite the customs clearance process. Customs authorities are familiar with standardized shipping documents and prefer them because they contain all the necessary information in a consistent, easily readable format. This helps your shipment move through customs faster, without unnecessary delays or additional requests for clarification.

- Customs-Friendly Format: The structured layout ensures that the relevant customs data is readily available, speeding up processing time.

- Efficient Handling: Clear and organized details reduce the likelihood of the shipment being held up for further inspection.

4. Easy Adaptation to Different Shipments

This standardized format can be adapted to a wide range of shipping needs, whether you’re sending a single

Best Practices for Accurate Invoice Creation

Creating precise shipping documentation is essential for smooth transactions, whether you are sending goods locally or internationally. Properly filled-out paperwork not only ensures that shipments pass through customs without delays but also helps to maintain trust between sellers and buyers. Accurate details in the shipping declaration prevent misunderstandings, reduce errors, and help avoid costly mistakes that could lead to legal issues or financial discrepancies.

1. Double-Check All Information

One of the most important steps in creating accurate shipping documents is verifying all of the information you include. Whether it’s the sender’s and recipient’s details or the descriptions of goods, small errors can lead to larger issues later. Always double-check the following:

- Sender and recipient details: Ensure names, addresses, and contact information are correct and up to date.

- Item descriptions: Provide clear, detailed, and accurate descriptions of all goods to avoid classification errors.

- Quantities and values: Verify the quantities and values of the goods to ensure proper duty and tax calculations.

2. Use Clear and Concise Descriptions

When describing the items being shipped, avoid using vague terms. Clear, concise descriptions not only help customs authorities understand the nature of the goods but also reduce the risk of misclassification. Be as specific as possible regarding the type, material, or purpose of each item. This will help determine the correct duty and tax rates and ensure that the shipment is processed efficiently.

- Be precise: Use specific terms such as “cotton T-shirts” instead of “clothing” or “electronic components” instead of “electronics.”

- Avoid ambiguity: Ensure that each item’s description is clear to anyone unfamiliar with the product.

3. Stay Updated with Customs Regulations

Different countries have different rules for how goods are classified and taxed. It’s crucial to stay informed about the latest customs regulations, tariffs, and any exemptions that might apply to your goods. Being familiar with these requirements will help you create accurate paperwork that complies with both local and international laws, preventing delays or penalties due to non-compliance.

- Research current regulations: Regularly check for updates on tariffs, restrictions, and special allowances for the countries you’re shipping to or from.

- Know duty rates: Familiarize yourself with the duty rates applicable to specific products to ensure correct financial calculations.

4. Include Proper Shipping Terms

Shipping terms play an important role in the document, as they

How to Handle Invoice Disputes in Shipping

In the shipping process, disputes related to financial documents are not uncommon. Whether due to discrepancies in pricing, shipping fees, or customs charges, addressing these issues promptly and professionally is crucial for maintaining positive business relationships. Effective communication, thorough documentation, and understanding the underlying causes of the dispute can help resolve conflicts efficiently and avoid future misunderstandings.

1. Review the Details of the Dispute

Before taking any action, it’s important to carefully review all relevant documents and details related to the dispute. This includes checking the shipping charges, item descriptions, customs assessments, and any terms that were agreed upon by both parties. Having all the facts in hand will allow you to understand the root cause of the issue and determine if there was an error on your part or if it lies with the other party.

- Double-check pricing: Ensure that the rates, fees, and charges listed are accurate based on the initial agreement or contract.

- Verify shipping terms: Confirm whether the delivery conditions were correctly applied and followed, including payment responsibilities and delivery timelines.

2. Communicate Clearly and Professionally

Once you’ve reviewed the dispute, the next step is to open a clear and professional line of communication with the concerned party. Whether it’s the customer, vendor, or shipping carrier, explain the situation calmly and present the facts. Provide supporting documentation to back up your claims, and be prepared to negotiate if there are any misunderstandings. Clear communication can prevent the situation from escalating and help both parties come to an amicable resolution.

- Be proactive: Address the issue as soon as you become aware of it to prevent further delays.

- Stay objective: Focus on the facts and avoid letting emotions cloud your judgment during the discussion.

3. Understand the Terms and Conditions

Understanding the shipping terms, such as payment responsibilities, delivery conditions, and customs regulations, is essential when handling disputes. Both parties must be aware of these terms before the shipment occurs. If a dispute arises over unexpected charges, it’s often due to a misinterpretation of these terms. Reviewing the agreed-upon conditions can help clarify the situation and determine whether any party failed to comply with them.

- Review contract terms: Go over the specific terms and conditions to ensure both sides are in alignment regarding responsibilities and expectations.

- Check for exceptions: Look for any special clauses, fees, or customs exceptions that might have been overlooked during the shipping process.

4. Provide Detailed Documentation

Always keep detailed and accurate records of all shipping transactions. If a dispute arises, having comp

How to Download DHL Proforma Invoice Template

Downloading a shipping document for your business is a simple yet essential step in ensuring that all required information is correctly filled out for international shipments. These documents are designed to streamline the process of declaring goods and avoiding delays during customs clearance. Here’s a step-by-step guide on how to easily obtain the necessary form for your shipment.

1. Visit the Official Website

The first step is to navigate to the official website of the shipping carrier or service provider. Typically, most international shipping companies offer downloadable forms directly on their websites. Look for a section dedicated to resources or forms, which may also include helpful guides or frequently asked questions.

- Access the website: Open the web browser and search for the official page of the shipping carrier.

- Navigate to the resources section: Find the area where official forms and documents are available for download.

2. Select the Correct Document Format

Once you have accessed the relevant section of the website, you will often be provided with various document formats such as PDFs or Word files. Choose the format that is most convenient for your use, ensuring it is compatible with your device and the program you plan to use for editing or filling out the document.

- PDF files: Most commonly used for printable, read-only formats.

- Word or Excel files: If you prefer to edit directly in the file, choose these formats for ease of customization.

3. Download and Save the File

After selecting the desired document format, simply click the download link. The form will be saved to your device, ready for you to fill out as required. It’s always a good practice to store the file in an organized location, such as a specific folder for shipping or business documents, to easily access it when needed.

- Click download: Choose the link to download the file directly to your device.

- Save in an organized folder: Make sure the document is saved in a location that’s easy to find later on.

4. Complete the Document with Relevant Details

After downloading the document, it’s time to fill in the necessary details, such as sender and recipient information, item descriptions, quantities, and values. Many downloadable forms come with pre-structured fields to make the process easier. Be sure to double-check all entries before submitting or printing the document for use in the shipping process.

- Fill in shipping details: Complete the document with accurate sender and recipient information.

- Double-check for errors: Ensure all information is correct to avoid customs

When to Use a Proforma Invoice for Shipping

In international shipping, there are certain circumstances when you may need to provide a document that outlines the details of goods being shipped, but without it being an official sales transaction record. This type of document serves as a preliminary statement of the goods being transported and helps customs authorities assess the value and classification of the shipment. Understanding when to use this document is crucial to ensuring smooth customs clearance and avoiding delays.

1. When Shipping Goods for Customs Clearance

One of the most common uses of this document is during customs procedures, especially when goods are being imported or exported. Since the document is not a true sales invoice, it provides an overview of the goods and their estimated value without triggering tax implications or other duties typically associated with a commercial transaction.

- Customs declaration: Provides authorities with a clear description of the items being shipped and their estimated value.

- Temporary shipments: Commonly used when items are shipped for temporary use or return, such as samples or merchandise for exhibitions.

2. When Shipping Samples or Gifts

If you’re sending goods as samples for promotional purposes or as gifts, you may not wish to generate a full commercial invoice. In such cases, this type of document is ideal as it communicates the nature of the shipment without indicating a financial transaction, which could otherwise result in unnecessary duties or taxes.

- Product samples: Used when sending items for testing, evaluation, or marketing purposes without a direct sale.

- Gifts or donations: Ideal for non-commercial shipments, ensuring that no taxes are levied for personal gifts or charitable contributions.

3. When Finalizing a Commercial Transaction

Another situation where this type of document comes in handy is when goods are being shipped as part of an ongoing transaction that hasn’t been completed yet. For instance, if a sale is agreed upon but the goods are being shipped before the final invoice is issued, this document provides a temporary record of the items and their values, thus facilitating the delivery while waiting for payment or final documentation.

- Pending transactions: Helps move goods before payment is finalized or before an official commercial invoice is generated.

- Facilitating early shipment: Allows for the shipment of items to occur promptly without waiting for final invoicing paperwork.

4. When Shipping Items for Repair or Return

Items sent for repair, replacement, or return are often not considered a sale or purchase, which means they don’t need a full commercial invoice. This type of document can help clarify the nature of the shipment without it being confused wi

Essential Information to Include in Your Invoice

When preparing documentation for international shipments, it is crucial to ensure that all necessary details are provided to prevent delays and complications. Accurate and complete information helps customs authorities assess the shipment, calculate applicable taxes and duties, and ensure smooth clearance. Below are the key elements that must be included to ensure your shipping document meets all necessary requirements.

1. Sender and Recipient Information:

The document should clearly state the contact details of both the sender and the recipient. This includes full names, addresses, and phone numbers. Missing or incorrect information can lead to shipment delays or returns.

2. Detailed Descriptions of Goods:

Each item being shipped must be listed with a clear and accurate description. Avoid vague terms like “miscellaneous” or “assorted items,” as customs authorities require specific details to assess the shipment. Include product names, quantities, and model numbers where applicable.

3. Shipment Value and Currency:

It’s essential to declare the correct value of each item being shipped. This includes the cost of the goods as well as any shipping, handling, or insurance costs. The total value must match the actual transaction and should be stated in the appropriate currency.

4. Shipping Terms and Conditions:

Clearly define who is responsible for shipping costs and duties. This includes whether the shipment is prepaid or if the recipient will bear the cost. Shipping terms such as “FOB” (Free on Board) or “CIF” (Cost, Insurance, and Freight) may also need to be specified based on your agreement with the recipient.

5. Signatures and Declarations:

Finall

Difference Between Proforma and Commercial Invoices

In international trade, two common types of shipping documents are often used to declare the details of goods being shipped: one is typically used for preliminary purposes, while the other serves as a final request for payment. While both documents may contain similar information, they have distinct functions and legal implications, depending on the stage of the transaction. Understanding these differences is crucial for businesses to avoid confusion and ensure compliance with customs regulations.

1. Purpose and Usage

The primary difference between these two types of shipping documents lies in their purpose. One serves as a preliminary document, often issued before the transaction is finalized, while the other is a formal bill for goods delivered or services rendered.

2. Content and Detail

Both documents contain similar basic information, such as descriptions of the goods, quantities, and values. However, there are notable differences in the level of detail and the type of information provided.

3. Legal Implications

The legal standing of these two documents is also a significant difference. The preliminary document holds no obligation for payment, while the final document legally obligates the recipient to settle the amount due.

4. Use in International Shipping

Both documents play a vital role in facilitating international shipments, but they serve different stages of the process. The preliminary document is more common at the beginning of a shipment, particularly for customs clearance, while the final bill is used once the transaction has been completed and payment is due.

- Indicate the shipping method and whether the se