Free Service Invoice Template for Word

For any business, providing clear and well-structured payment requests is essential to maintaining professionalism and ensuring smooth financial transactions. Instead of manually drafting each document from scratch, using pre-designed formats can save time and ensure consistency. These ready-made formats can be easily customized to suit the specific needs of your company and the services you provide.

With the right document structure, you can quickly generate professional-looking receipts that detail the services offered, the amount due, and the payment terms. Whether you’re a freelancer or a small business owner, having a consistent billing process helps build trust with your clients. The availability of customizable formats makes this task even easier, allowing you to focus on your work while ensuring accuracy and professionalism in your financial communications.

Access to editable files means you can make adjustments with just a few clicks, adding your branding or specific payment details. These documents are designed to look clean and clear, minimizing errors and improving your financial workflow. Additionally, the flexibility of digital formats means you can send them instantly via email or print them out for physical records.

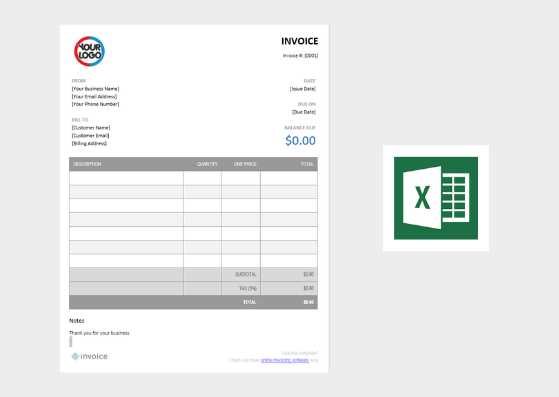

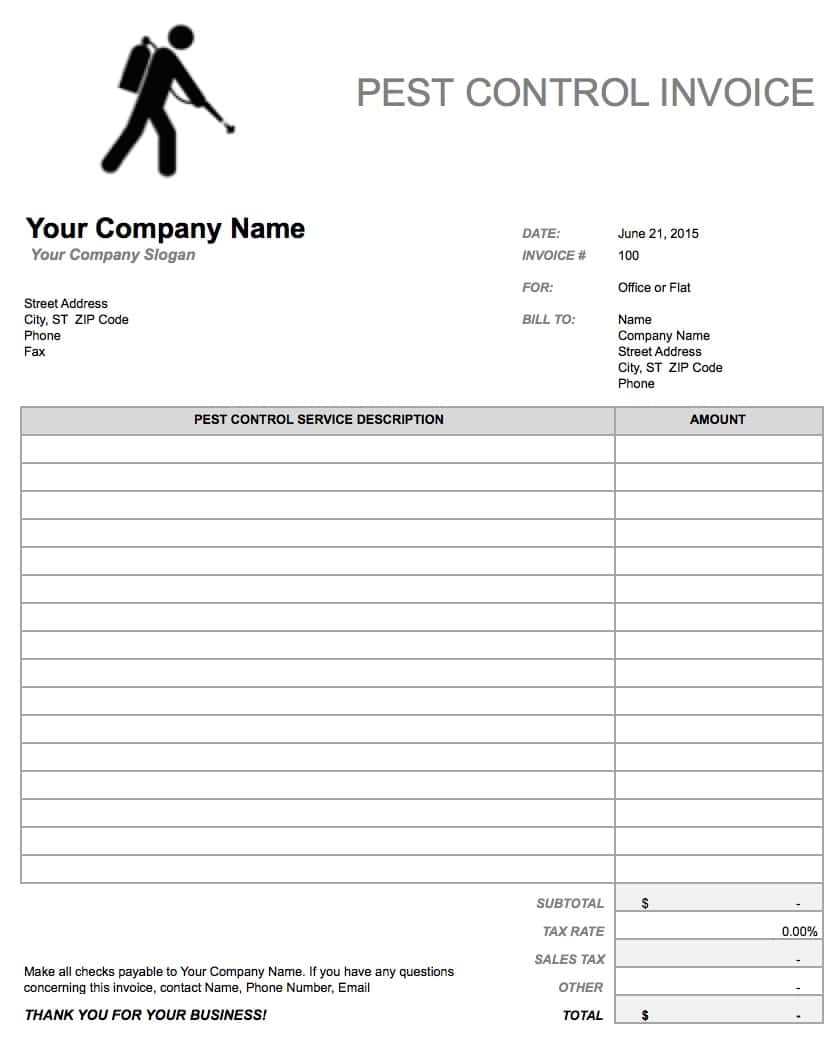

Service Invoice Template Free Word

When managing financial transactions with clients, having a reliable and easily accessible document is crucial for smooth operations. A well-structured billing document helps ensure that all relevant details are included, providing clear information regarding the work completed and the payment expected. Customizable formats are available, which allow you to adapt the content to your specific needs and preferences.

Many business owners and freelancers rely on digital files that can be adjusted quickly to match the details of each project. These formats are simple to use and provide a professional layout that can enhance your company’s image. They are particularly useful for those who require frequent updates to their billing records, as they save time and prevent errors compared to starting from scratch each time.

Editable documents are often available in popular formats like Microsoft Office, making them compatible with the majority of systems. This flexibility allows you to update the document with the necessary details, such as the amount due, client information, or specific terms. In addition, these files can be easily shared via email or printed for personal records, making the billing process efficient and organized.

Why Use an Invoice Template

Using a pre-designed document for billing purposes offers numerous benefits, making it easier to manage financial transactions and maintain consistency across all client communications. When you rely on a set structure, you ensure that every necessary detail is included, reducing the risk of missing important information. This approach can save both time and effort, allowing you to focus on your business rather than on administrative tasks.

Time Efficiency

One of the biggest advantages of using a ready-made billing structure is the time saved. Instead of creating a new document each time, you can simply open a template, fill in the details, and quickly generate a professional-looking document. This efficiency allows you to streamline your workflow and avoid repetitive tasks.

Accuracy and Consistency

When you use a consistent structure for every transaction, you reduce the chances of errors or omissions. A set format ensures that the important fields, such as payment amount, due date, and services rendered, are always included and clearly presented. This consistency enhances your business’s professionalism and can help build trust with clients.

- Ensures all necessary information is included

- Reduces the risk of errors

- Helps maintain a professional appearance

With an easy-to-follow layout, you can also avoid confusion when managing multiple clients or projects. This makes tracking payments and following up on outstanding balances much simpler, providing a clear record for both you and your clients.

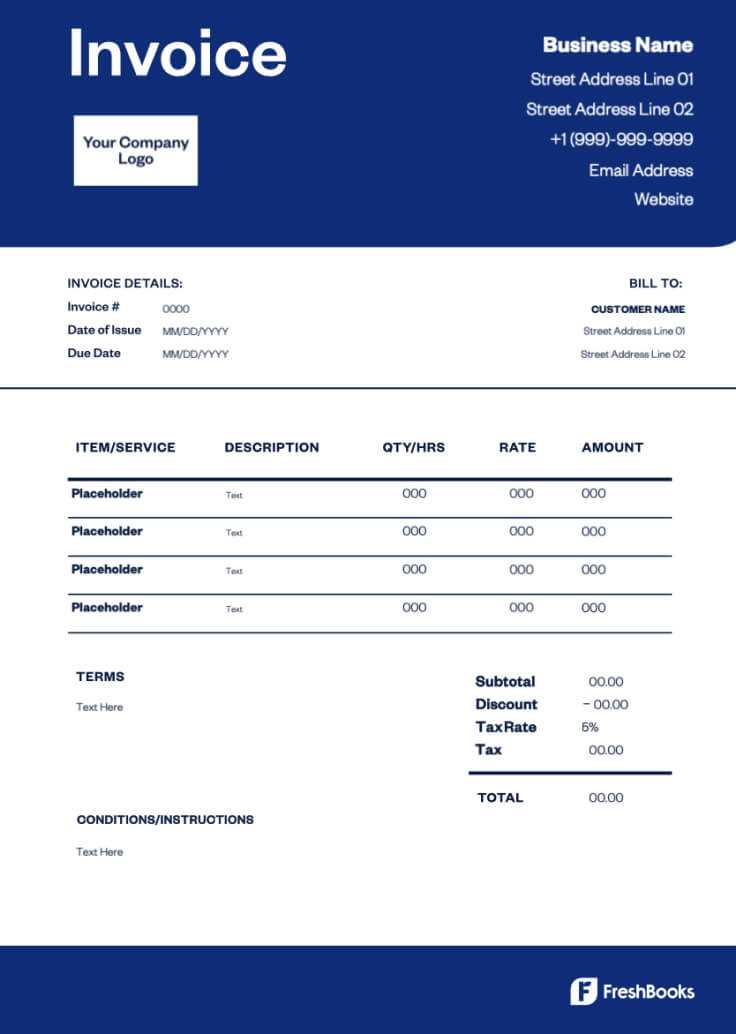

Benefits of Word Format for Invoices

Using a text-based document format for creating payment requests offers several significant advantages, especially for businesses seeking simplicity and flexibility. This format allows users to easily modify content, adjust layout, and personalize the appearance of their billing documents. Whether you are sending a receipt or a request for payment, the ability to quickly edit details ensures efficiency and accuracy in every transaction.

One of the main reasons businesses prefer this format is its compatibility with a wide range of devices and software. Most operating systems can open and edit this type of document, making it accessible and easy to share across different platforms. Additionally, these files are lightweight and can be transmitted quickly via email, making them ideal for digital communications.

| Advantage | Description |

|---|---|

| Easy Editing | Quickly update payment amounts, client details, and other necessary fields without starting from scratch. |

| Wide Compatibility | Compatible with most software programs, making it accessible to anyone using different systems. |

| Customizability | Easily add logos, change fonts, or modify the layout to match your business branding. |

| Efficiency | Save time by using pre-made layouts, reducing the need for manual creation each time. |

Additionally, the flexibility of this format allows businesses to design documents that suit their specific needs, from simple requests to more detailed billing records. This level of customization is ideal for companies that want their documents to reflect a professional image while keeping the process streamlined and simple.

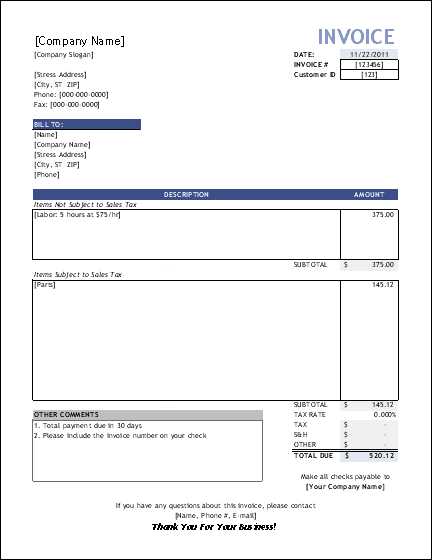

How to Customize Your Billing Document

Personalizing your payment request document ensures that it reflects your unique business identity and meets your specific needs. Customization allows you to include important details such as your branding, payment terms, and service descriptions, giving your document a professional and tailored look. With a few simple adjustments, you can create a document that’s not only functional but also aligned with your company’s style and requirements.

Adding Your Business Branding

One of the first steps in personalizing your document is to incorporate your business’s logo, contact information, and any other branding elements. This helps to create a cohesive image for your company, making your documents immediately recognizable to clients. Including your logo and brand colors adds a professional touch, reinforcing your business identity with every transaction.

Customizing Payment Terms and Details

Another essential part of customization is adjusting the content to match the nature of your transactions. You can easily modify fields to include specific details like payment deadlines, discounts, or late fees. This ensures that the terms of payment are clear, reducing the chances of confusion or delayed payments.

Additional Customization Tips:

- Adjust the layout to prioritize the most important information, such as amounts due and client contact details.

- Change fonts and colors to match your brand’s style and improve readability.

- Include personalized messages or thank-you notes to enhance client relationships.

By making these small but impactful changes, you can create a billing document that serves not only as a record of a transaction but also as a tool to strengthen your business relationships and project a professional image.

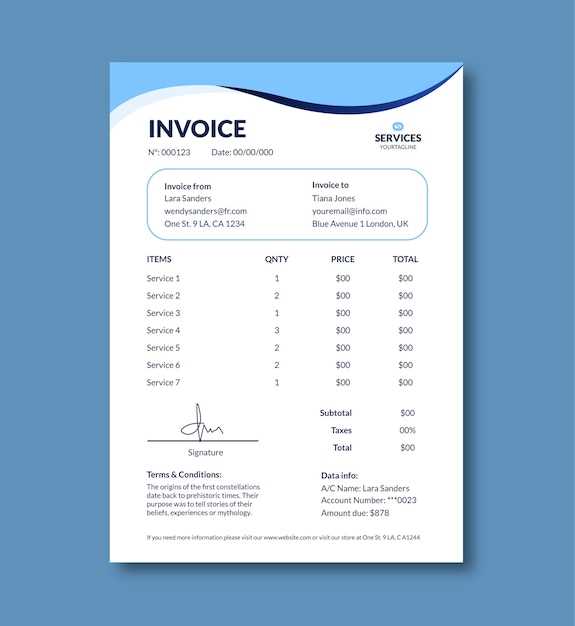

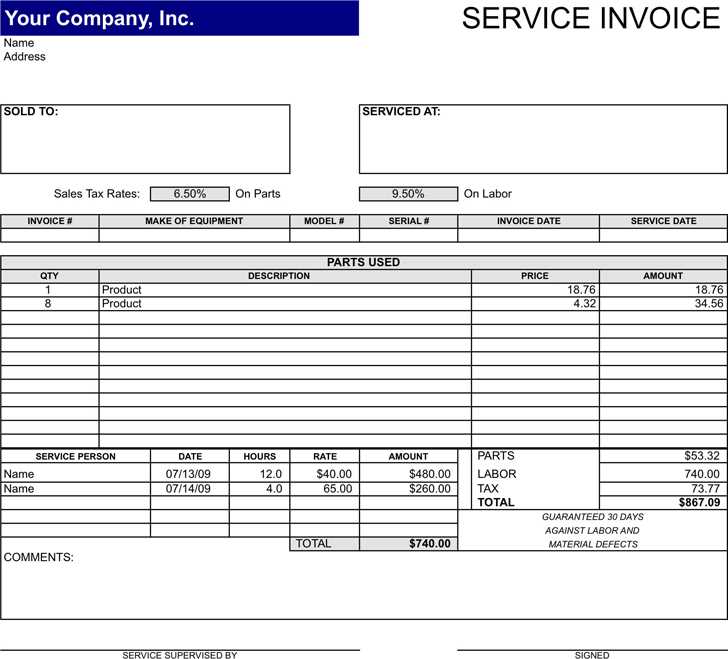

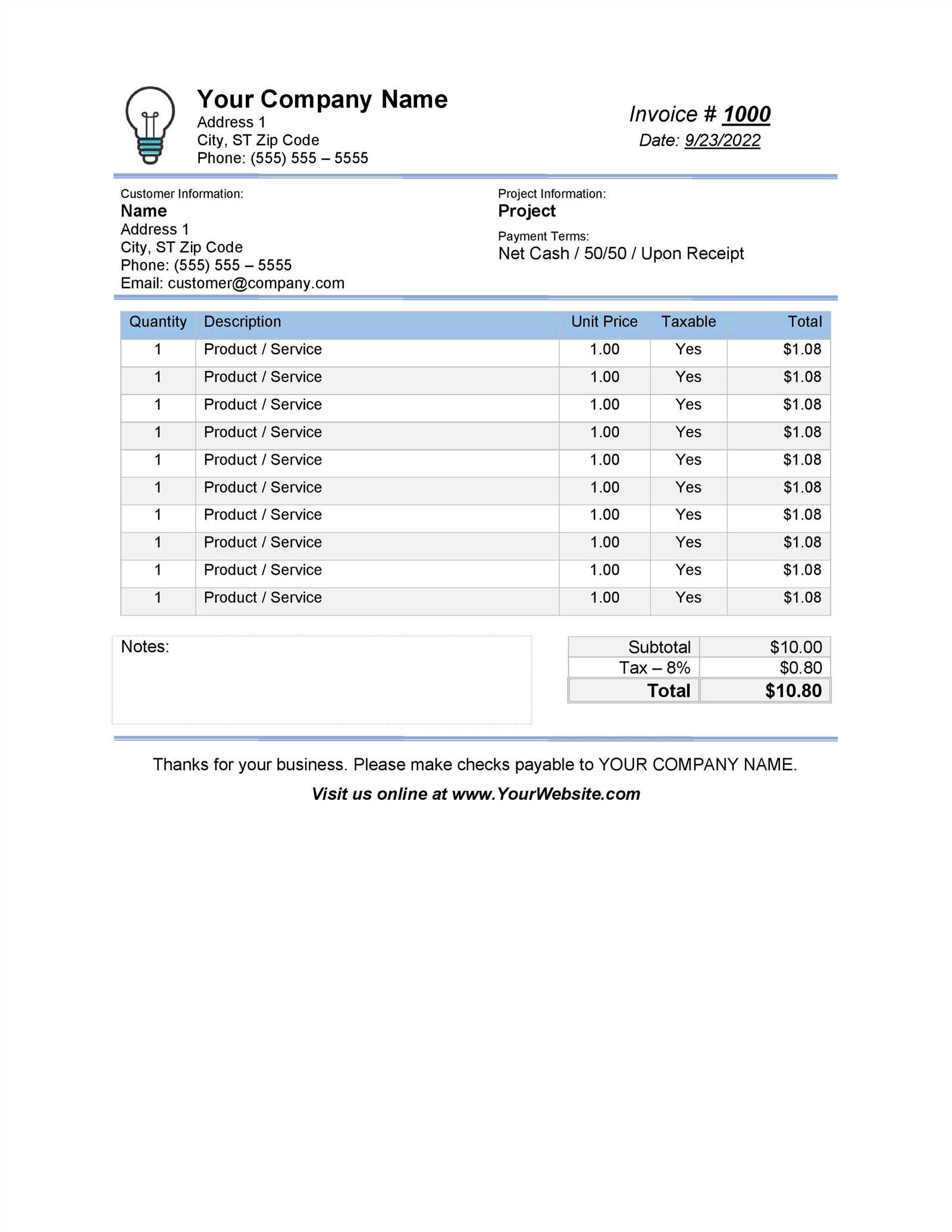

Key Elements of a Billing Document

A well-structured payment request includes several key components that ensure clarity and completeness. These elements are essential for both the business and the client, as they provide clear information about the transaction, the services provided, and the payment terms. By including all necessary details, you help avoid misunderstandings and maintain a professional standard for your business.

Client and Business Information

Every billing document should begin with the contact details of both the business and the client. This typically includes the business name, address, and contact information, as well as the client’s name, address, and other relevant details. Having this information at the top of the document makes it easy for both parties to identify the involved parties quickly.

Transaction Details

Clearly outlining the specifics of the transaction is crucial. This includes the description of the work performed, the hours worked (if applicable), and the cost for each service or product. These details should be broken down in an easy-to-understand format so that the client knows exactly what they are being charged for. Additionally, including the total amount due and any applicable taxes ensures transparency.

Essential Components:

- Unique document number for tracking purposes

- Date of issue and due date for payment

- Breakdown of charges and payment terms

Including these key elements in your document helps maintain a professional image and ensures smooth communication with clients, making it easier to track payments and avoid disputes.

Where to Find Free Billing Document Formats

Finding customizable and professional billing documents doesn’t have to be difficult or costly. There are numerous resources available online that offer ready-to-use formats, allowing you to quickly generate documents that meet your business needs. Whether you’re looking for simple designs or more complex layouts, these resources can help you get started without the need to create one from scratch.

Many websites offer downloadable files that you can edit to match your business information and services. These formats are typically available in commonly used software formats, ensuring compatibility with most systems. Additionally, some platforms offer cloud-based solutions that allow you to create and manage billing records online, making the process even more efficient.

Popular places to find these resources include:

- Business-focused websites offering free document tools

- Cloud storage platforms that provide built-in templates

- Freelancer and small business blogs with downloadable resources

- Accounting software websites that offer document solutions as part of their services

By using these accessible resources, you can easily obtain a well-designed layout, saving both time and effort in creating your own documents while maintaining a professional appearance for your business.

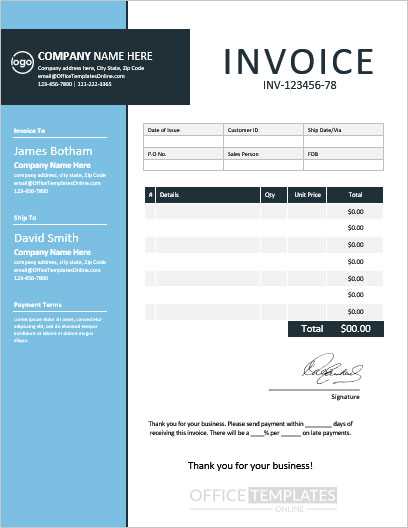

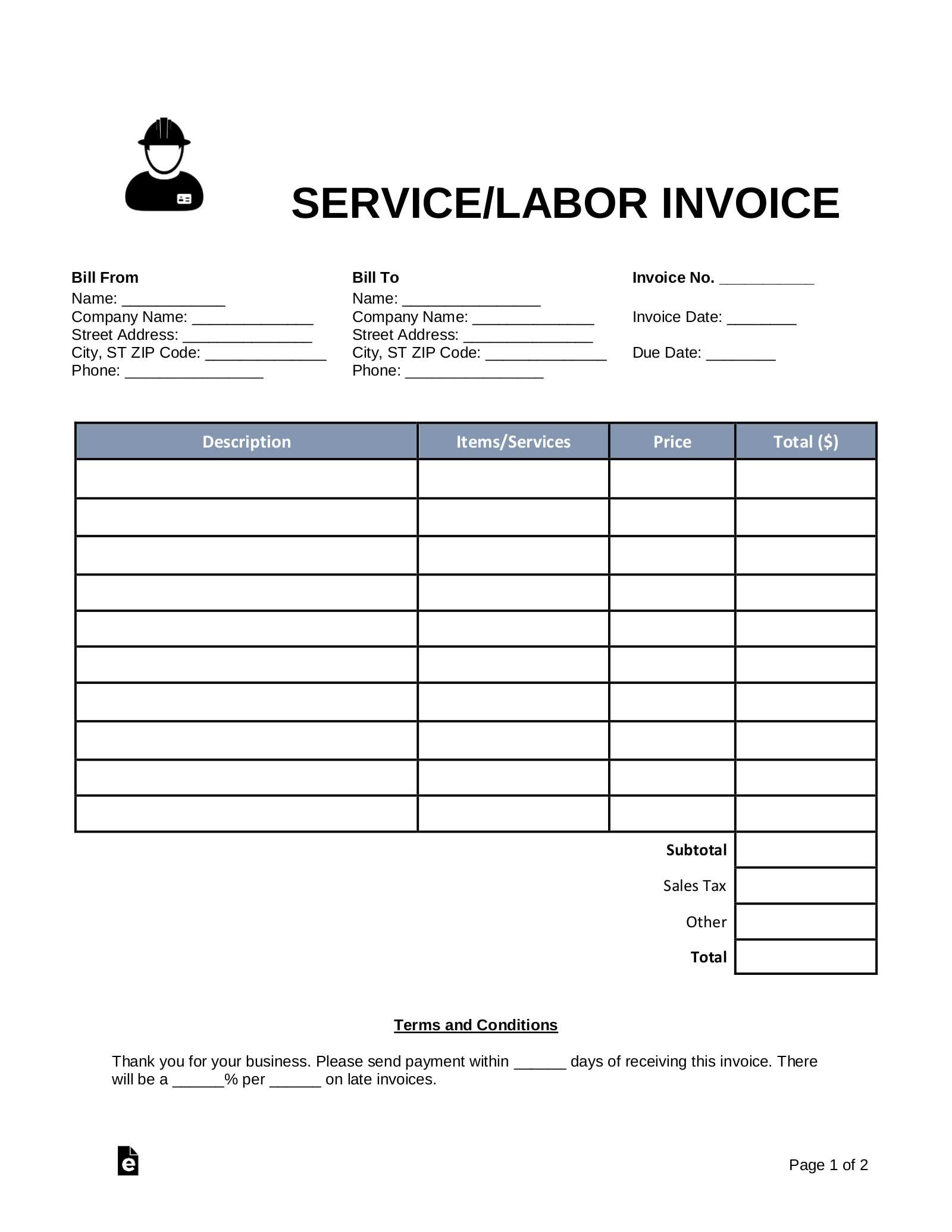

Creating a Professional Billing Document in Word

Designing a professional payment request using a text editor is simple and effective. By using a reliable and flexible format, you can craft a document that looks polished and meets all your business requirements. Whether you’re new to creating such documents or need a refresher, understanding the steps can help you achieve a professional and functional result every time.

Here are the essential steps to create a well-organized payment request:

- Choose a Layout: Start by selecting a clean, easy-to-read layout. A simple, organized structure is key to making sure the document is clear and professional.

- Include Your Business Details: Make sure to add your company’s name, address, phone number, and email at the top. This ensures that the client can quickly contact you if necessary.

- Add Client Information: Include the client’s name, address, and contact details for proper identification. This helps avoid confusion and ensures the document is personalized.

- Describe the Work: Provide a detailed description of the work done or products provided. Break down the costs, including hours worked or unit prices if applicable.

- Specify Payment Terms: Clearly state the due date, accepted payment methods, and any late fees or discounts. This avoids potential confusion about payment expectations.

- Summarize the Total: Add up all the charges, taxes, and discounts, providing a clear total amount due at the bottom of the document.

Additional Tips:

- Consider adding your logo or branding elements to reinforce your company identity.

- Use bold or italic text for key details, such as the total amount due or payment deadline.

- Save your document in a format that’s easy to share, like PDF, for professional delivery via email.

By following these steps and paying attention to detail, you can create a document that looks professional and leaves a positive impression on your clients. A well-crafted payment request is not just about getting paid; it’s also about maintaining a strong and professional relationship with your clients.

How to Add Your Branding to Billing Documents

Incorporating your company’s branding into billing documents is an effective way to reinforce your identity and create a professional image. By customizing these documents with your logo, colors, and fonts, you ensure that every interaction with clients reflects your business’s unique style. This not only makes the document easily recognizable but also helps establish trust and consistency in all your communications.

Using Your Company Logo

The most obvious way to add your branding is by including your logo at the top of the document. This immediately establishes your business identity and makes the document feel official. Ensure the logo is placed prominently but not in a way that distracts from the content of the document. A clean, well-positioned logo contributes to the professional appearance of the billing document.

Customizing Colors and Fonts

Along with your logo, incorporating your brand colors and fonts helps create a cohesive design. Use your brand’s primary colors for headings, borders, and accent details. This keeps the document visually aligned with your other marketing materials. Additionally, choose fonts that reflect the style of your business–whether it’s modern, traditional, or casual–while making sure the text remains legible and professional.

Additional Branding Elements:

- Include a slogan or tagline that reflects your business’s values or mission.

- Use your brand’s color scheme for the background or header sections to create a cohesive look.

- Place your business’s social media links or website at the bottom to increase visibility and encourage online engagement.

By adding these simple yet effective branding elements to your billing documents, you not only enhance their appearance but also reinforce your business’s identity every time a client receives a payment request. This attention to detail can have a positive impact on client relationships and your company’s reputation.

How to Save and Share Your Billing Document

Once you have completed your payment request, saving and sharing it efficiently is key to ensuring timely communication with your clients. Whether you’re sending it digitally or printing it for physical delivery, it’s important to choose the right format and method for easy access and secure transmission. Properly saving and sharing your documents not only streamlines your workflow but also helps maintain a professional image.

Saving Your Document: When saving your document, it’s important to choose a file format that is both easy to edit and share. Common formats such as PDF or DOCX are ideal because they ensure compatibility across different devices and software. Additionally, saving the document with a clear and descriptive name, such as “ClientName_ProjectName_Date,” helps you stay organized and easily locate the document later.

Sharing Your Document: Sharing your billing record with clients can be done via email, cloud services, or physical mail. The most efficient way is to send the document electronically, either as an email attachment or through a secure cloud link. If you choose to send it via email, ensure the subject line is clear and relevant, such as “Payment Request for [Project Name].” This makes it easier for clients to locate the document in their inbox.

- Email: Attach the document and include a brief message outlining the purpose of the communication.

- Cloud Services: Upload the document to a cloud platform like Google Drive, Dropbox, or OneDrive, and share the link with your client.

- Physical Mail: If necessary, print the document and send it via traditional mail, ensuring it’s professionally printed and well-packaged.

Tips for Effective Sharing:

- Always double-check that the correct document is attached before sending it.

- Consider including a message that confirms the due date and any payment instructions.

- Ensure that the format is compatible with your client’s devices to avoid issues when they open the document.

By following these best practices, you ensure that your billing records are easy to access, share, and track, while maintaining a level of professionalism that reflects positively on your business.

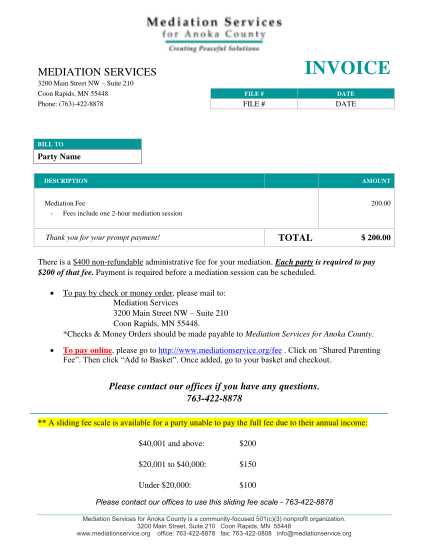

Choosing the Right Document Format for Your Business

Selecting the right layout for your payment requests is crucial for ensuring clarity and professionalism. The design of your document should align with your brand image, while also meeting the specific needs of your business and clients. Whether you’re a freelancer, a small business owner, or part of a larger organization, choosing the right document structure can improve both your efficiency and your clients’ experience.

Consider Your Business Type

Different types of businesses may require different document styles. For example, a freelance graphic designer may want a visually striking layout that showcases their creativity, while a law firm might prefer a more formal, clean design to convey professionalism. Consider the tone and nature of your business when selecting a layout that fits your brand’s image.

Key Features to Look for

When choosing a format, there are a few key features to keep in mind:

- Clear Structure: Choose a layout that organizes the information logically, making it easy for clients to understand the details.

- Customizability: Ensure the format allows you to easily adjust fields such as client name, project description, and payment terms.

- Compatibility: Make sure the file can be opened and edited on various devices and software programs, so you can work seamlessly from any location.

- Professional Appearance: Look for a clean, polished design that reflects the quality of your business.

By selecting a format that matches your business needs and aesthetic, you create a consistent, professional image across all your client communications, helping to build trust and credibility with every transaction.

Common Mistakes to Avoid in Billing Documents

When creating payment requests, it’s easy to overlook certain details that can lead to confusion or delays in payment. Small errors, such as missing information or unclear terms, can cause frustration for both the business and the client. To ensure your documents are clear, accurate, and professional, it’s important to avoid common mistakes that could affect your credibility or payment timelines.

Omitting Key Details

One of the most common mistakes is failing to include essential information. This can range from missing contact details, payment terms, or the due date. Without this information, clients may not know how to proceed with the payment or may delay it due to confusion. Always ensure the following are included:

- Client’s full name and contact information

- Business name and contact details

- Clear payment terms, including the due date

- Breakdown of charges and applicable taxes

Unclear Payment Instructions

Another common issue is vague or missing payment instructions. Always specify how clients can pay, whether it’s through bank transfer, credit card, or another method. Including detailed instructions helps avoid confusion and ensures prompt payment. Additionally, make sure any late fees or discounts for early payments are clearly stated to encourage timely transactions.

Other Mistakes to Watch Out For:

- Using inconsistent fonts or layouts that may appear unprofessional.

- Failure to number the document or track multiple requests for the same client.

- Not double-checking for spelling errors or inaccuracies in the amounts listed.

By paying attention to these common mistakes, you can create billing documents that are clear, accurate, and professional, helping you maintain smooth client relationships and avoid delays in payments.

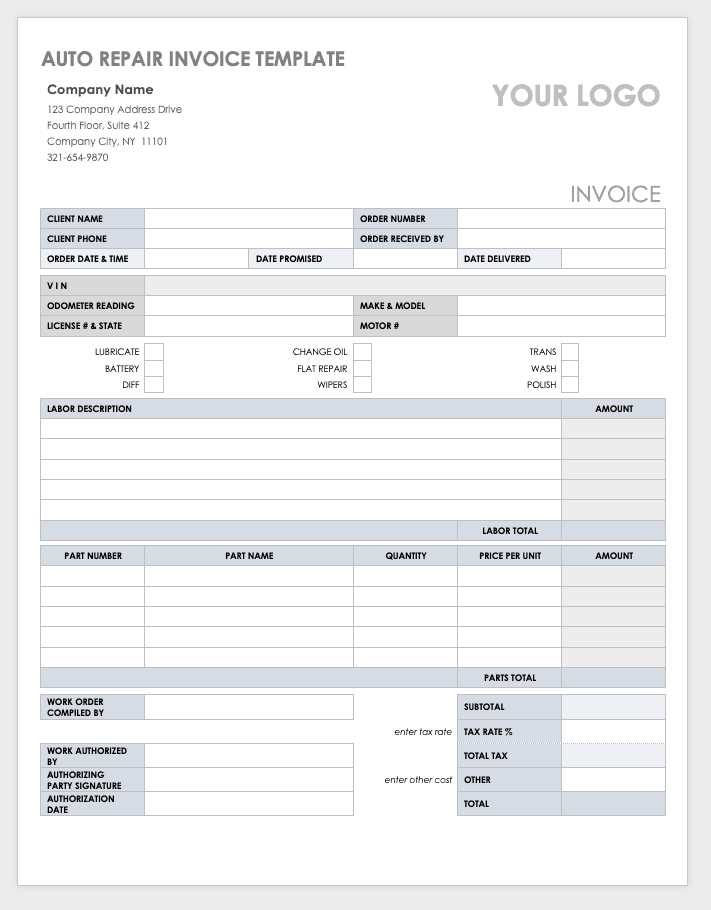

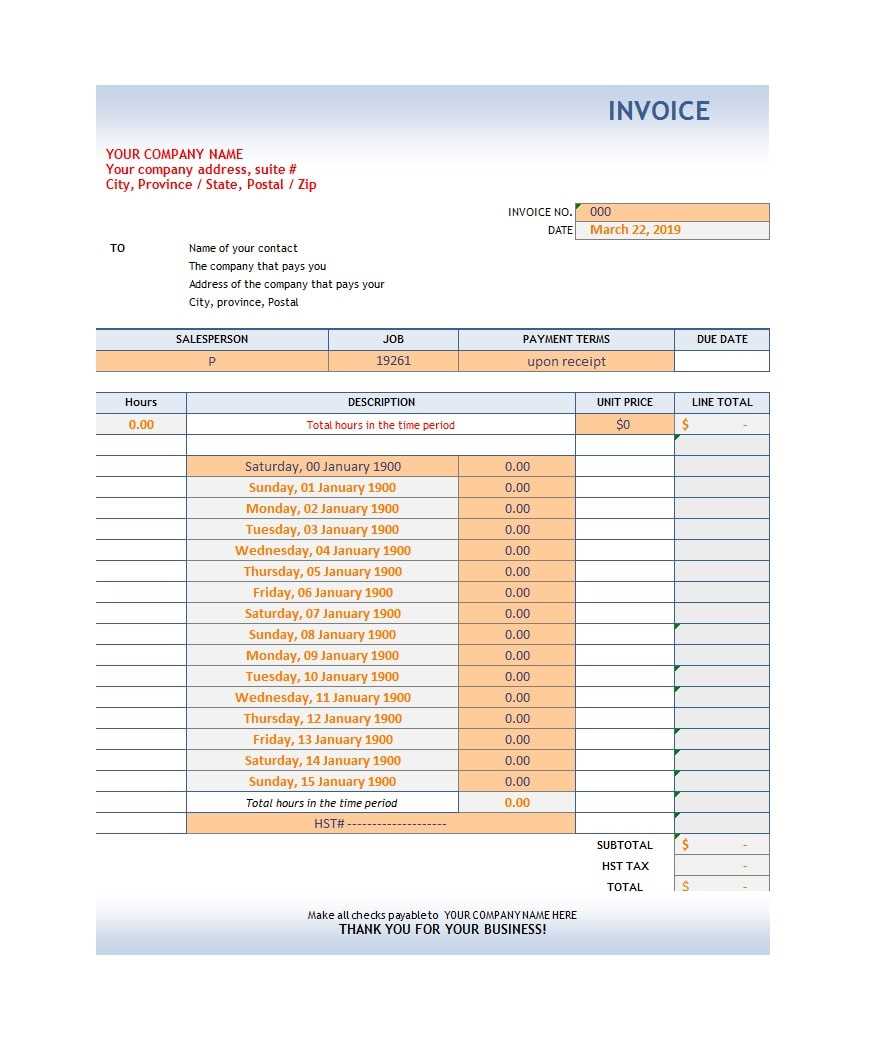

How to Organize Charges in a Billing Document

Organizing charges clearly in your payment request is essential to ensure that clients understand exactly what they are being billed for. A well-structured breakdown helps avoid confusion, ensures transparency, and contributes to a smooth payment process. Properly categorizing your charges can also improve your professionalism and make the document easier to navigate.

Itemizing the Charges

The first step in organizing charges is to break down the costs into individual line items. Each item should have a clear description, such as the specific work completed, hours worked, or product delivered. Additionally, ensure that the cost associated with each item is easy to locate and read. This allows clients to see exactly what they are paying for without any ambiguity.

Grouping Similar Charges

For larger or more complex projects, it’s helpful to group similar charges together. For example, if you’re charging for different stages of a project, you can list each stage under a category like “Design Phase” or “Consultation.” Grouping helps to make the document more readable and allows clients to see the overall structure of the work, which can help in understanding the final total.

Additional Tips for Organizing Charges:

- Include dates for each service or product delivered to avoid confusion about when the charges were incurred.

- Clearly label any applicable taxes or additional fees, such as handling charges or rush fees.

- Use bold text or bullet points to highlight totals, making them easy for clients to locate quickly.

By organizing the charges in a logical, clear manner, you help ensure that your payment request is easy to read, transparent, and professional, which ultimately leads to faster and more accurate payments.

Understanding Numbering Systems for Billing Documents

A well-organized numbering system is essential for keeping track of your billing records and ensuring that each payment request is uniquely identified. A clear and consistent system helps both you and your clients keep track of transactions, avoid duplication, and maintain an organized accounting system. Having a proper numbering method can also aid in maintaining professionalism and ensuring your records are easy to audit when necessary.

There are several common approaches to numbering your billing records, each offering different levels of customization and complexity. The key is to choose a system that makes sense for your business operations and provides clarity in tracking payments.

Common Numbering Systems:

- Sequential Numbering: This is the simplest and most common method, where each document is assigned a unique number in a continuous sequence. For example, the first document would be #001, the next #002, and so on. This system is easy to implement and works well for businesses with a moderate volume of transactions.

- Year-Based Numbering: Another method is to include the year as part of the numbering system. For example, #2024-001 for the first document of the year. This is helpful for businesses that deal with a high volume of documents, as it provides an easy way to sort and categorize records by year.

- Client-Specific Numbering: Some businesses prefer to assign unique numbers for each client. For example, a client might have invoices numbered as “Client001-001” for their first request. This approach is useful for businesses with multiple clients and ensures each client’s documents are easily distinguishable.

Choosing the right numbering system depends on your business’s size and needs, but the key is consistency. Using a structured and logical numbering system helps you keep organized records, simplifies accounting, and builds a more professional image with your clients.

When to Use a Billing Document

Knowing when to issue a billing document is essential for maintaining a smooth and efficient financial process. These records are used to request payment for completed work or provided goods, and understanding the right time to create one ensures that your cash flow remains steady. Timing is critical, as sending payment requests too early or too late can lead to confusion or delayed payments.

Typically, a billing document should be issued when the agreed-upon work has been completed, or the goods have been delivered, and it’s time to request payment. However, the exact timing can vary depending on the nature of the transaction and your agreement with the client.

Common Scenarios to Issue a Payment Request:

- Upon Completion of Work: Once you finish a project or a task for a client, it’s time to issue a document detailing the completed work and the amount due. This ensures that your client is aware that the work has been completed and the payment is now expected.

- At Pre-Determined Milestones: For long-term projects or contracts, you might agree on specific milestones for billing. For example, after the completion of a particular phase, you would issue a document for that portion of the work.

- For Recurring Charges: If you provide ongoing services or subscriptions, you should issue billing records at regular intervals, such as weekly, monthly, or quarterly, to reflect the agreed-upon payment schedule.

Other Considerations:

- Make sure you include all the relevant details of the work completed, including descriptions, dates, and quantities, so the client can easily verify the charges.

- If your client has specific payment terms, such as net-30 or net-60, make sure to adhere to those timelines when issuing the document.

By carefully considering the right time to send out a billing document, you can streamline your payment process and maintain clear communication with your clients.

Standard Formats vs Custom Billing Documents

When it comes to requesting payment for your goods or services, you have two primary options: using a pre-designed format or creating a custom document tailored to your specific needs. Both approaches have their advantages, depending on the complexity of the transaction and your business requirements. Understanding the difference between the two can help you choose the most efficient and professional solution for your business.

Advantages of Using a Standard Format

A pre-designed format is an excellent choice for businesses that need a quick, straightforward way to request payment. These formats typically come with a consistent structure, making it easy to input your information and send it out without worrying about design or layout. Here are some benefits:

- Time Efficiency: With a pre-made structure, you can quickly create and send billing documents without having to start from scratch.

- Consistency: Standardized formats ensure that your documents always look professional and follow a consistent layout, which can help reinforce your brand identity.

- Ease of Use: Most pre-made formats are simple to edit, even for those with minimal design experience, making them a good choice for small businesses or freelancers.

Advantages of Customizing Your Billing Documents

On the other hand, custom billing documents offer greater flexibility. If your business has specific needs or you want to incorporate your branding, a personalized document may be the better option. Here are some reasons to consider creating a custom solution:

- Tailored to Your Brand: Custom documents allow you to incorporate logos, brand colors, and personalized design elements that help you stand out and create a lasting impression.

- Adaptability: With custom documents, you can add or remove any fields as needed, offering flexibility to fit the unique nature of each transaction.

- Enhanced Professionalism: A custom document can better reflect the specific services or goods provided, demonstrating attention to detail and reinforcing your business’s professionalism.

Ultimately, the choice between a pre-designed format and a custom document depends on your business’s needs and the nature of the work. For simple transactions, a standard format may be sufficient, while for more complex or high-value projects, customizing the document could help convey professionalism and attention to detail.

How to Automate Billing Document Creation

Automating the creation of your billing documents can save time, reduce human error, and improve efficiency. With automation tools, you can streamline the process of generating payment requests, ensuring that they are consistent, accurate, and sent out promptly. By implementing automation, you can focus more on your core business activities while leaving the administrative tasks to the software.

Using Software for Automation

One of the easiest ways to automate the creation of payment requests is by using accounting software or dedicated billing tools. These platforms often come with built-in templates and customization options, allowing you to set up recurring billing cycles, calculate totals, and generate professional-looking documents with just a few clicks. Many of these tools also integrate with your financial systems, making it simple to track payments and manage records.

Setting Up Automated Billing Processes

To fully automate the process, you can follow these steps:

- Choose an Automation Tool: Select a tool that meets your needs. Many platforms offer free or subscription-based plans, depending on the complexity of your business.

- Integrate with Your System: Link the software with your existing accounting or customer management system to automatically pull client details and service records.

- Set Billing Schedules: Configure the tool to automatically generate and send documents on a predefined schedule, whether it’s weekly, monthly, or upon completion of specific milestones.

- Customize Your Documents: Even in automated systems, you can often tailor the layout and include your branding elements, such as logos or specific payment instructions.

Benefits of Automation:

- Time-Saving: Automation eliminates the need for manual data entry and document creation, allowing you to focus on more important tasks.

- Accuracy: By automating calculations and the inclusion of client details, you reduce the chances of errors that could cause confusion or payment delays.

- Consistency: Automation ensures that all your documents follow the same structure and include the necessary elements, creating a professional and reliable image.

By automating your billing process, you can create a more efficient workflow, minimize the risk of mistakes, and ensure that your payment requests are always timely and professional.

Legal Considerations for Billing Documents

When issuing a billing document to request payment, it is crucial to ensure that it complies with legal requirements. Depending on the region and type of transaction, certain information must be included, and specific rules must be followed. Understanding these legal considerations will not only protect your business but also help establish clear, enforceable payment terms with your clients.

Required Information for Legal Compliance

In many jurisdictions, specific details are legally required to be included in billing documents. These elements ensure transparency, help in resolving disputes, and assist with tax reporting. Common required details may include:

- Client Information: The full name or business name of the client, along with their contact details, is essential for identifying both parties involved in the transaction.

- Business Information: Your business name, address, and contact details should be clearly listed to identify the party issuing the document.

- Unique Document Number: Each document should be assigned a unique reference number to maintain proper records and avoid confusion.

- Detailed Breakdown of Charges: A detailed list of the goods or services provided, including dates, quantities, and individual costs.

- Payment Terms: Clear payment terms, such as due dates, penalties for late payments, or early payment discounts, should be specified.

Tax Implications and Regulations

Different regions have specific tax regulations that affect billing documents. Depending on your location and the nature of the transaction, you may be required to include tax information, such as:

- Sales Tax: Indicate the applicable sales tax rate and the amount charged, if relevant.

- Tax Identification Numbers: In some countries, both the seller and the buyer must include their respective tax identification numbers for proper reporting.

- Tax Exemptions: Certain products or services may be exempt from tax, and these exemptions must be properly documented.

By adhering to these legal requirements, you protect both your business and your clients from potential legal issues, ensuring smooth transactions and compliance with local laws.