Microsoft Access Invoice Template for Easy and Efficient Billing

In today’s fast-paced business world, managing finances efficiently is crucial for smooth operations. One of the key aspects of this is creating clear and professional documents for transactions. Using digital solutions to automate and organize billing tasks can save valuable time while ensuring accuracy. With the right tools, even complex billing workflows can be simplified, allowing you to focus on growing your business.

There are various tools available that allow you to create custom documents tailored to your specific needs. These solutions often come with built-in features that help automate calculations, track payments, and store important client information. By integrating these tools into your business routine, you can enhance productivity and reduce the chances of errors that might arise from manual methods.

Customization is one of the biggest advantages of using such solutions. Whether you’re a freelancer, small business owner, or part of a larger organization, having a system that adapts to your requirements is essential. With the right setup, you can quickly generate detailed statements, track due amounts, and maintain a consistent professional appearance for all your client interactions.

Microsoft Access Invoice Template Overview

Creating professional billing documents can be a time-consuming task, but using the right tools can greatly streamline this process. There are digital solutions available that allow users to design, customize, and automate billing forms tailored to their specific needs. These systems are especially useful for businesses that require consistency and accuracy when managing customer transactions.

The main advantage of using such a solution is its ability to store and process all necessary information in one place, making it easier to track payments, generate reports, and maintain records. These solutions often come with built-in features that automate calculations, saving users time and reducing the risk of human error.

| Feature | Description |

|---|---|

| Customization | Easily tailor the document’s layout, fields, and design to fit your business needs. |

| Automation | Automatically calculate totals, taxes, and discounts based on the input provided. |

| Data Storage | Store customer and transaction data in a centralized system for quick access and reference. |

| Tracking | Monitor payment statuses and outstanding balances with built-in tracking features. |

| Reports | Generate detailed financial reports for analysis and record-keeping. |

Whether you’re a freelancer managing a few clients or a growing company handling large volumes of transactions, this approach helps maintain organization and professionalism. It simplifies not only the billing process but also other related administrative tasks, allowing you to focus on what matters most: running your business efficiently.

Why Choose Access for Invoicing?

When it comes to creating and managing billing documents, using the right platform can make a significant difference in both efficiency and accuracy. Some software solutions offer the flexibility and power needed to streamline the entire process, from creating detailed statements to tracking payment statuses and storing client data. These platforms are designed to handle large amounts of information while maintaining high performance, which is essential for businesses of all sizes.

Choosing such a platform offers a variety of benefits, especially for those looking for a reliable, customizable, and scalable solution. Here are some reasons why it stands out as a preferred choice:

- Customization: You can easily design and adjust the layout to suit your business’s unique needs, ensuring that your documents are both professional and functional.

- Centralized Data Management: All client and transaction details can be stored in one place, making it easy to access and update information as needed.

- Automation: Automatic calculations for totals, taxes, and discounts can save valuable time and reduce the risk of human error.

- Improved Accuracy: Pre-configured fields and formulas help eliminate common mistakes, ensuring that all data is accurate.

- Scalability: As your business grows, the platform can adapt to handle more clients, transactions, and data without compromising performance.

Additionally, this software provides a user-friendly interface that allows both novice and experienced users to quickly learn and implement it in their daily operations. The flexibility of the platform also means that you can integrate it with other business systems, further enhancing its utility.

By leveraging this tool for managing financial documents, you can increase efficiency, reduce administrative burden, and maintain a higher level of professionalism in your business operations.

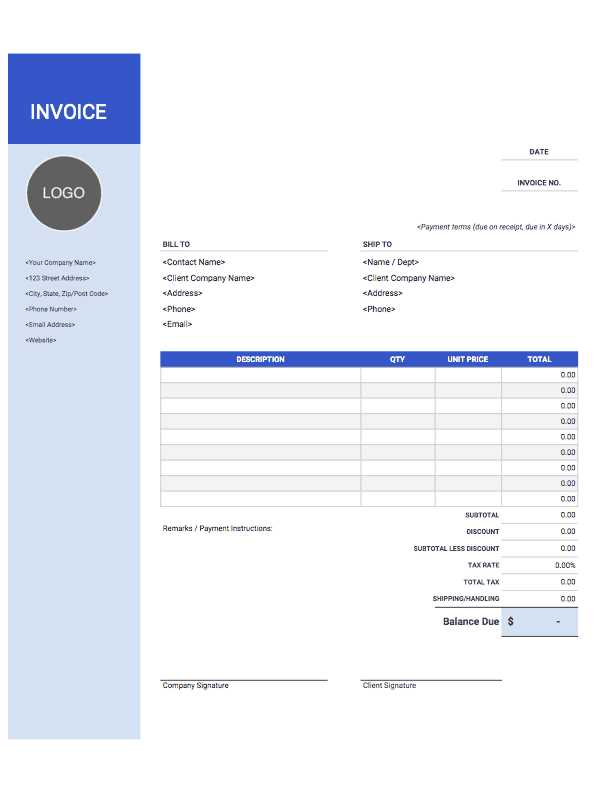

Key Features of an Invoice Template

When creating billing documents for your business, it’s important to ensure that they are both functional and professional. The right document format should not only look polished but also include essential features that simplify the creation process and ensure accuracy. By using a customized solution, you can streamline administrative tasks, save time, and improve the overall billing experience for both you and your clients.

Essential Elements for Effective Billing Documents

There are several key components that should be present in any effective billing document. These elements help you track transactions, ensure clear communication with clients, and maintain organization. Some of the most important features include:

- Business Information: Clearly displaying your company name, address, and contact details at the top of the document is essential for branding and communication.

- Client Details: Including the client’s name, address, and contact information ensures that each document is specific to the individual or business receiving the bill.

- Unique Identification Number: A reference number or invoice ID allows for easy tracking and quick identification of documents, especially when reviewing past transactions.

- Itemized List of Products or Services: Providing a clear breakdown of what is being billed, along with prices, helps avoid misunderstandings and gives transparency to the transaction.

- Payment Terms and Due Date: Clear instructions on how and when the payment should be made, including any penalties or discounts, help set expectations and encourage timely payment.

Advanced Features to Enhance Functionality

Beyond the basic elements, more advanced features can be added to further streamline and automate the invoicing process. These features are particularly useful for businesses that need to handle a larger volume of transactions or want to improve efficiency. Some of these advanced functionalities include:

- Automatic Calculations: Built-in formulas that automatically calculate totals, taxes, and discounts save time and minimize errors.

- Payment Tracking: A system to monitor outstanding balances and payment statuses, ensuring you can quickly follow up with clients as needed.

- Customizable Layouts: The ability to adjust the design, color scheme, and fonts to match your brand’s identity and maintain a professional appearance.

- Integrated Data Storage: Storing client and transaction data in one place for easy access and reporting is essential for maintaining accurate records.

Incorporating these features into your business processes not only enhances efficiency but also contributes to a higher level of professionalism in your financial dealings.

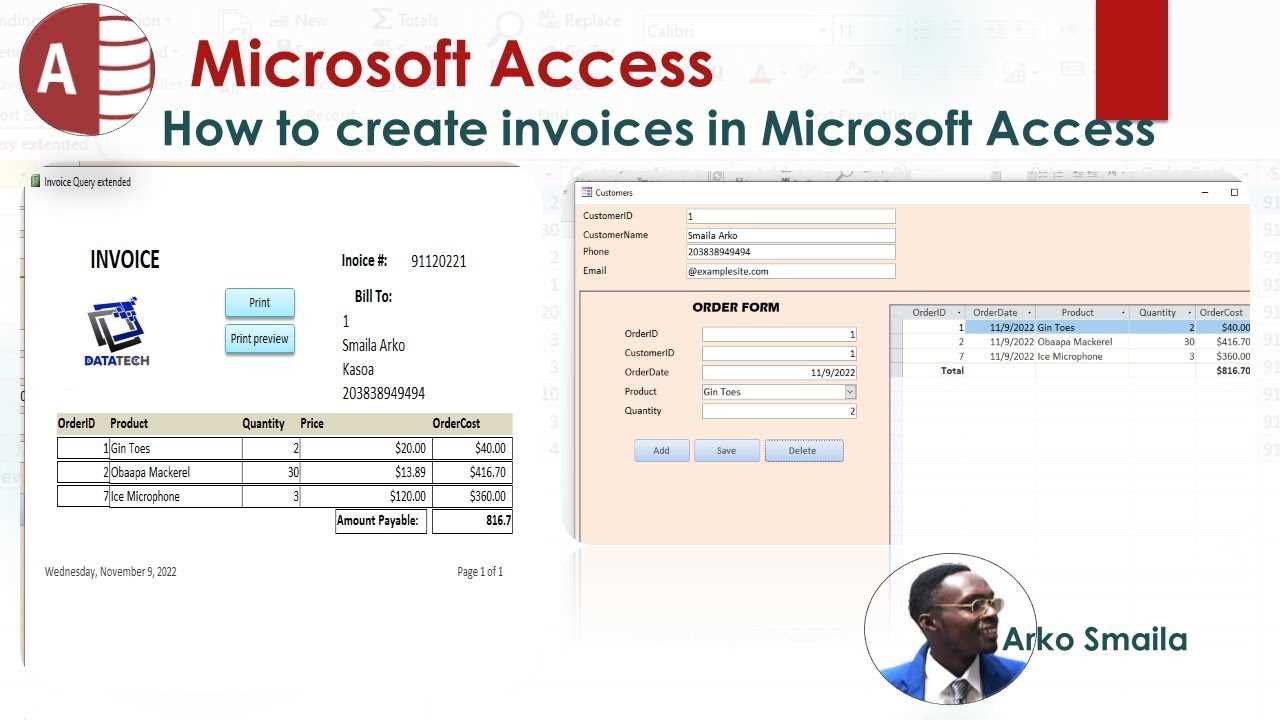

How to Create an Invoice in Access

Creating detailed billing documents using a database application can significantly improve the efficiency of your accounting process. The process allows for the automation of calculations, easy organization of client data, and quick generation of professional statements. By setting up the right structure within your database system, you can quickly generate accurate documents that reflect your business transactions.

Follow these simple steps to create an effective billing document:

- Set Up Your Database: Begin by creating a new database. This will serve as the foundation for storing all of your client and transaction data. You can organize the information into tables, such as “Clients,” “Products or Services,” and “Payments,” ensuring that all necessary details are captured in one place.

- Design the Layout: Use the built-in tools to design the document’s layout. This includes adding fields for the client’s details, product/service descriptions, quantities, rates, and payment terms. Arrange the elements in a clear and professional format to ensure the document is easy to read.

- Create Calculation Fields: To automate the process, set up fields that calculate totals, taxes, and any applicable discounts. This will save time and reduce errors, ensuring that each document is accurate and consistent.

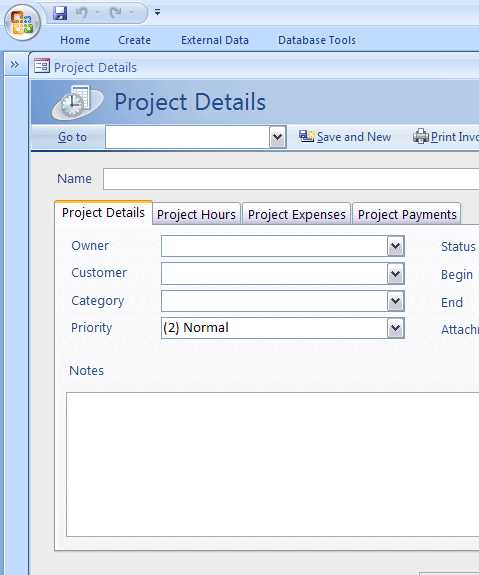

- Customize Data Entry Forms: Build forms that allow for quick data entry. These forms should be easy to navigate and should automatically pull relevant information from the database, such as client names or service descriptions, based on the invoice number or client ID.

- Generate the Document: Once the form is set up, use it to create a new billing statement. The system will pull the data from your database and populate the document automatically. Ensure that the document includes all required elements, such as business contact information, itemized lists, and due dates.

- Save and Export: After generating the billing document, save it for your records. You can also export it to different formats (such as PDF or Word) to send to clients or store it digitally for future reference.

By setting up this process, you can easily create, manage, and track all of your business transactions with greater speed and accuracy. Automation eliminates many of the manual tasks, allowing you to focus more on growing your business while ensuring that your financial documents remain professional and organized.

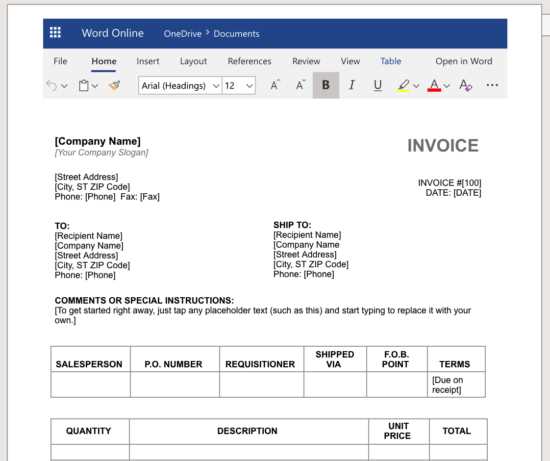

Customizing Your Access Invoice Template

Personalizing your billing documents is essential to ensure they reflect your business’s unique identity and meet your specific needs. Customization allows you to modify both the appearance and functionality of the document, making it more aligned with your brand while improving efficiency. Whether it’s adjusting the layout, adding fields, or automating calculations, tailoring the design can save time and enhance professionalism.

To customize your billing system, follow these steps:

- Modify Layout and Design: Start by adjusting the layout of the document. Change font styles, colors, and logos to match your branding. You can also arrange sections to ensure the most important information is displayed prominently, such as customer details, payment terms, and due dates.

- Add Custom Fields: Depending on your business, you may need additional fields that are not included in the standard form. These could be specific product descriptions, special discounts, or any extra notes you want to provide to clients. Adding custom fields allows you to tailor the form to your unique requirements.

- Set Up Automatic Calculations: Customize the fields to automatically calculate totals, taxes, and any discounts applied. This reduces errors and saves time, as all the financial figures will update automatically when you enter new data.

- Organize Data Entry: Customize data entry forms to streamline the process. By organizing the forms with drop-down menus and pre-filled options, you make it easier for yourself or your staff to enter consistent data quickly and accurately.

- Include Business Branding: Customize the header and footer sections to include your company’s logo, contact information, and any legal disclaimers or terms and conditions. This ensures that each document sent to a client reflects your company’s professional image.

By personalizing these aspects, you can ensure that your billing process is efficient, accurate, and consistent. A well-customized document also builds credibility with your clients, enhancing their trust in your services while maintaining a professional look across all your communications.

Saving and Storing Your Invoice Data

Efficient data storage is critical for any business that wants to maintain accurate records and ensure smooth operations. When managing billing documents, it’s important not only to create them but also to store them in a way that allows easy retrieval, organization, and analysis. Proper data storage systems help you track payments, generate reports, and quickly find any relevant information when needed.

Here are some best practices for saving and organizing your transaction data:

- Centralized Storage: Keep all billing records in one centralized location, such as a database or a cloud-based storage system. This ensures that all documents are easily accessible and reduces the risk of losing important data.

- Organize by Categories: Group your data by categories such as client names, dates, and payment status. Using folders or tags for categorization makes it easier to locate specific records when needed.

- Automatic Backups: Regularly back up your data to prevent loss in case of system failure. Automated backup systems can ensure that your records are consistently saved without requiring manual intervention.

- Secure Storage: Ensure that your data is stored securely, especially if it contains sensitive information. Use encryption methods or password-protected systems to protect client details and financial records from unauthorized access.

- Data Retention Policy: Establish a clear policy for how long you will keep financial documents. Some businesses are required to retain records for a certain number of years for tax or compliance reasons, so it’s important to have a system in place for archiving and deleting outdated files.

By properly saving and storing your data, you ensure that your business remains organized and compliant with legal requirements. Having quick access to past transactions also makes it easier to resolve any disputes, follow up on overdue payments, or generate reports when needed.

Access Template vs Excel for Invoicing

When it comes to creating and managing billing documents, two popular options are often considered: using a database solution or utilizing a spreadsheet. Both tools offer unique features that can simplify the billing process, but the choice between them depends on the specific needs and scale of your business. Understanding the strengths and limitations of each option can help you make an informed decision on which is best suited for your invoicing requirements.

Here’s a comparison between the two tools to help you determine which one fits your needs:

- Data Management: A database solution is designed to handle large amounts of structured data efficiently. It allows you to store and manage customer information, transaction records, and payment details in an organized manner. In contrast, a spreadsheet can be useful for smaller datasets but may become cumbersome as the volume of records increases.

- Automation: Database solutions typically offer more advanced automation features. For example, you can set up automatic calculations for totals, taxes, and discounts, and even automate data entry through linked forms. While spreadsheets like Excel also allow for formula-based automation, it requires more manual setup and can be prone to errors if not managed carefully.

- Customization: Both options allow for customization, but the flexibility of a database is greater in terms of design and functionality. You can tailor the layout, fields, and forms to fit your business needs, creating a more streamlined and professional experience. Excel offers customization through templates and formulas, but its layout and design capabilities are more limited compared to a database solution.

- Scalability: As your business grows, so will your invoicing needs. A database is more scalable and can handle an increasing number of transactions and customers without performance issues. On the other hand, while Excel is suitable for small businesses or individual use, it may become slow and unwieldy with a larger volume of data.

- Collaboration: For businesses that need multiple users to access and edit invoicing documents, a database solution typically provides better support for collaboration. Multiple users can access the same system simultaneously, with permissions and restrictions in place. Excel, while it offers collaboration features through cloud services like OneDrive, may require more effort to manage and sync data across multiple users.

In summary, both tools can help with invoicing, but the right choice depends on the scale of your operations, the need for automation, and how you manage and access your data. A spreadsheet may be sufficient for small businesses or individual users, but a database solution offers better long-term scalability, automation, and customization for growing businesses.

Automating Calculations in Your Template

One of the most effective ways to streamline your billing process is by automating the calculations within your documents. Automation reduces the need for manual entry, minimizing errors and saving time. Whether you’re calculating totals, applying discounts, or determining taxes, setting up automatic formulas ensures that your financial documents are accurate and consistent every time.

To get started with automating calculations, here are some key steps to follow:

- Set Up Basic Formulas: The first step is to define the basic calculations such as unit price multiplied by quantity to determine the subtotal. Most systems allow you to input simple formulas to perform these calculations automatically.

- Include Tax and Discount Calculations: Add formulas that automatically calculate sales tax or any applicable discounts. For instance, a formula can be set to calculate a fixed percentage of the subtotal for tax or apply a discount based on certain criteria.

- Calculate Total Amount: Once individual items, taxes, and discounts are calculated, the next step is to sum up all the amounts to get the final total. Automating this ensures that every line is accounted for correctly, without the need for manual addition.

- Dynamic Updates: With automation, any change made to the quantity, price, or discount will automatically update the total and tax calculations. This dynamic approach ensures that all adjustments are reflected instantly, eliminating the need to recalculate manually each time.

- Use Conditional Formatting: For advanced automation, you can use conditional formulas to adjust prices, apply specific tax rates, or offer discounts based on certain conditions (such as a total amount threshold). This feature adds a layer of flexibility, adapting the document based on the data entered.

Automating these calculations not only makes your billing process faster but also ensures greater accuracy and consistency across all your documents. It reduces human error and allows you to handle complex billing scenarios with ease. Once the system is set up, you can focus more on managing your business rather than worrying about manual calculations.

Improving Accuracy with Access Invoices

Ensuring accuracy in billing documents is crucial for maintaining professional relationships and avoiding costly mistakes. By leveraging the right tools and processes, you can significantly reduce the likelihood of errors in your financial records. Automation and structured data management play a key role in improving the precision of your business transactions.

Here are several ways to enhance the accuracy of your billing documents:

- Automated Calculations: Setting up automated formulas for totals, taxes, and discounts eliminates the risk of manual errors. Once the initial data is entered, all calculations are done automatically, ensuring consistent and accurate results.

- Data Validation: Implementing validation rules in your system ensures that the data entered is correct before it is processed. For example, you can set rules to check that only valid quantities and prices are entered, or prevent negative numbers in fields where they don’t make sense.

- Predefined Templates: Using predefined document structures with standard fields minimizes human error by guiding users to fill in only the required information. This structure reduces the chance of omitting important details such as client addresses, payment terms, or item descriptions.

- Integrated Data Management: Storing customer and transaction data within a centralized database allows for quick and consistent retrieval. This ensures that client information is always up-to-date and accurate, reducing the chances of entering outdated or incorrect details.

- Real-Time Updates: With real-time data synchronization, any change made to a billing record will be reflected across the system instantly. This keeps your documents aligned with the latest information and ensures no discrepancies arise from outdated data.

By focusing on automation, data validation, and structured data entry, you can significantly reduce errors and improve the overall quality of your financial documents. Accurate billing not only enhances professionalism but also helps prevent payment disputes and customer dissatisfaction.

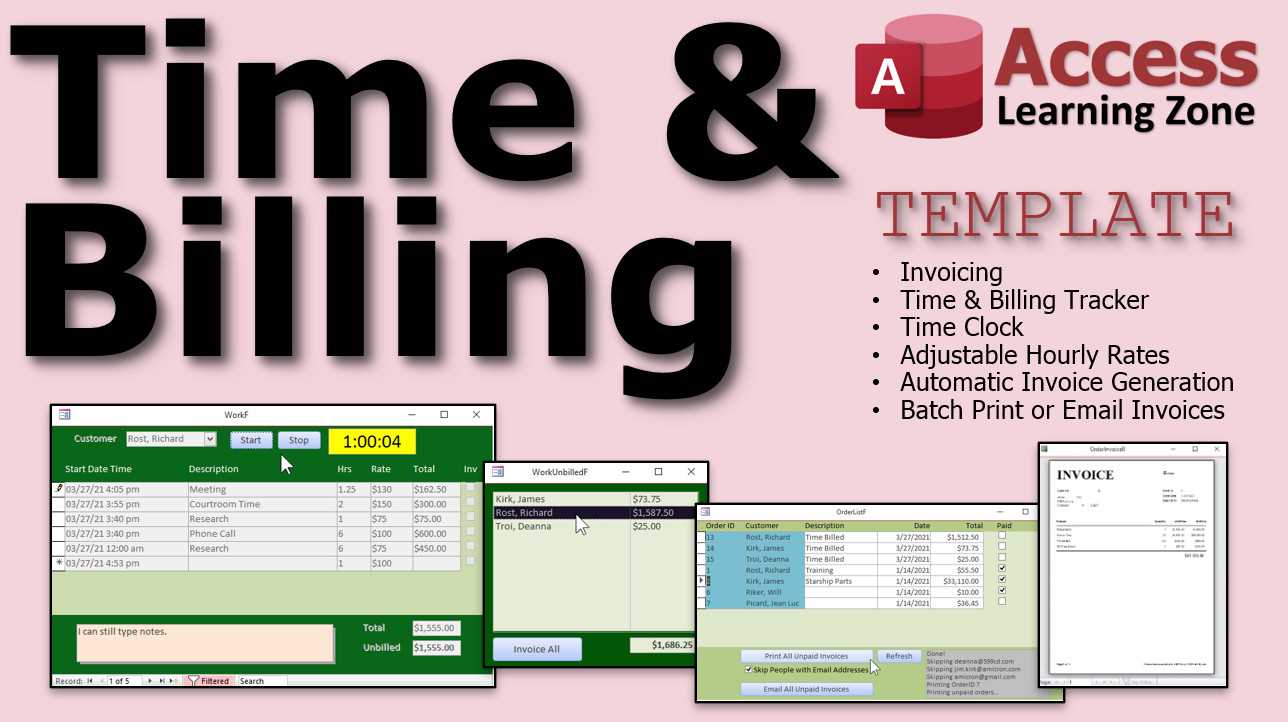

Using Macros for Streamlined Invoicing

Macros can greatly enhance your ability to automate repetitive tasks and streamline the creation of billing documents. By programming a set of predefined actions, you can simplify processes such as generating new records, applying specific calculations, or even sending out documents to clients. This saves time, reduces human error, and ensures consistency across all of your billing operations.

Here are several ways macros can be used to improve the efficiency of your billing system:

- Automating Data Entry: You can set up macros that automatically fill in repetitive information such as client names, addresses, and item details. This speeds up the document creation process and reduces the risk of entering incorrect or outdated data.

- Generating New Documents: Macros can be programmed to automatically create new billing documents based on existing data. For example, when a new transaction is logged, a macro could generate a new record with all the relevant information, including itemized charges, tax calculations, and due dates.

- Applying Calculations: Set up macros to automatically perform necessary calculations like adding up subtotals, applying discounts, and calculating taxes. This ensures that the totals are always accurate and up-to-date without requiring manual input.

- Standardizing Format: Macros can also be used to ensure that each document follows a consistent format. This includes applying standard fonts, colors, and layouts across all your records, helping to maintain a professional and cohesive appearance for your business communications.

- Sending Documents Automatically: For businesses that need to send invoices to clients regularly, macros can automate the process of exporting the document and emailing it to the appropriate recipient. This saves time and ensures that no document is overlooked or delayed.

By integrating macros into your billing workflow, you can streamline many aspects of the process and improve overall productivity. Not only will this help you save time, but it will also help you maintain more accurate and consistent records, giving you the flexibility to focus on other important tasks within your business.

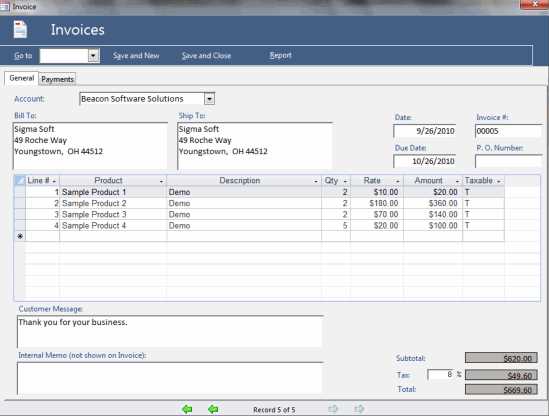

Tracking Payment Status with Access Templates

Efficiently tracking the status of payments is essential for any business. By organizing and monitoring payment progress, you can ensure timely collections, reduce the risk of overdue accounts, and maintain better cash flow management. With the right system in place, you can easily monitor whether a payment has been made, is pending, or is overdue, all from a central location.

Here are several key ways to track payment status effectively:

- Assign Payment Status Categories: Categorize each transaction by its payment status. Common categories include “Paid,” “Pending,” “Overdue,” and “Partially Paid.” This simple classification helps you quickly assess which accounts need attention and which are up to date.

- Automate Status Updates: Set up automatic triggers to update the payment status when certain conditions are met. For example, when a payment is recorded, the system can automatically mark the associated billing document as “Paid.” Similarly, overdue accounts can be flagged for follow-up based on predefined terms.

- Use Payment Due Dates: Incorporate due dates into your tracking system. By monitoring the due dates for each payment, you can proactively follow up on upcoming or overdue payments, reducing the risk of missed collections.

- Link Payments to Client Accounts: For better tracking, link payments to specific client accounts within your system. This enables you to view a comprehensive payment history for each customer, helping to identify repeat issues or clients who may require special attention.

- Generate Payment Reports: Create custom reports that summarize payment statuses, highlighting overdue or outstanding payments. Regularly generating these reports can help you stay on top of collections and make informed decisions about follow-up actions or potential changes in credit terms.

By incorporating these tracking methods into your system, you can streamline your payment management process, reduce late payments, and maintain healthier financial records. With everything centralized and automated, you can focus on growing your business while ensuring that your cash flow remains stable and predictable.

Benefits of Invoice Templates for Small Businesses

For small businesses, managing administrative tasks efficiently can be a key factor in ensuring smooth operations. One of the most important aspects of this is streamlining the billing process. Having a ready-made structure for creating billing documents offers numerous advantages, allowing business owners to save time, reduce errors, and maintain a professional image with their clients.

Here are some of the key benefits of using pre-designed billing systems for small businesses:

Time Savings

Predefined billing formats allow small businesses to generate professional documents quickly. Rather than creating each document from scratch, business owners can fill in the necessary details like client names, product or service descriptions, and pricing. This efficiency frees up valuable time that can be better spent on core business operations.

Consistency and Professionalism

Using structured formats ensures that each document adheres to a consistent layout and includes all necessary elements, such as payment terms, due dates, and company branding. This consistency not only saves time but also helps maintain a professional appearance, which builds trust and credibility with clients.

- Accuracy: With built-in fields and automated calculations, these systems reduce the likelihood of human error in calculations, such as incorrect totals or missing information.

- Legal Compliance: Pre-made structures often include required legal disclaimers or terms and conditions, helping small businesses stay compliant with industry standards and regulations.

- Customizability: Despite being pre-designed, these systems are often customizable, allowing business owners to tailor them according to their specific needs, whether it’s adding custom fields or adjusting branding elements.

- Better Cash Flow Management: With standardized and clear billing documents, businesses are more likely to receive payments on time, helping to improve cash flow and maintain financial stability.

By utilizing these systems, small businesses can not only improve operational efficiency but also create a more organized and professional approach to handling financial transactions. Whether it’s managing client accounts, ensuring timely payments, or minimizing administrative workload, predefined billing systems offer a valuable solution for growing companies.

Access Invoice Template for Freelancers

For freelancers, managing payments and client relationships efficiently is key to maintaining a successful business. Using a well-organized billing document system can make this process much simpler. With the right structure in place, freelancers can easily track their work, calculate amounts, and present professional-looking records to clients, ensuring timely payments and clear communication.

Key Features for Freelancers

Freelancers often deal with various clients, different project types, and sometimes fluctuating rates. A flexible document system can handle these variations and help maintain consistency. Here are some important features for freelancers:

- Client Information: Having a section to store detailed client information, such as their name, address, and contact details, saves time and ensures all documents are personalized and accurate.

- Itemized List of Services: Clearly itemizing services allows freelancers to break down charges by individual tasks or projects. This transparency makes it easier for clients to understand what they are paying for and can help avoid disputes.

- Hourly Rate or Project Fee: Freelancers often charge by the hour or on a per-project basis. Having fields that automatically calculate these rates based on hours worked or milestones achieved can save valuable time and eliminate errors.

- Tax and Discount Calculation: Automated tax calculations and customizable discount options are important to ensure that rates and final totals are always accurate, regardless of the complexity of the billing arrangement.

- Due Dates and Payment Terms: Clear due dates and payment terms help set expectations upfront and ensure that clients are aware of when payment is required, reducing delays in receiving payment.

Example of a Freelancer Billing Structure

| Service | Hours/Quantity | Rate | Total |

|---|---|---|---|

| Web Design | 10 | $50/hour | $500 |

| SEO Optimization | 5 | $40/hour | $200 |

| Subtotal | $700 | ||

| Sales Tax (5%) | $35 | ||

| Total Due | $735 |

With this structure, freelancers can easily create invoices that are not only clear and professional but also help them stay organized and reduce administrative overhead. This kind of systematic approach helps to ensure that each client receives the correct bill and that all details are easy to track and update as needed.

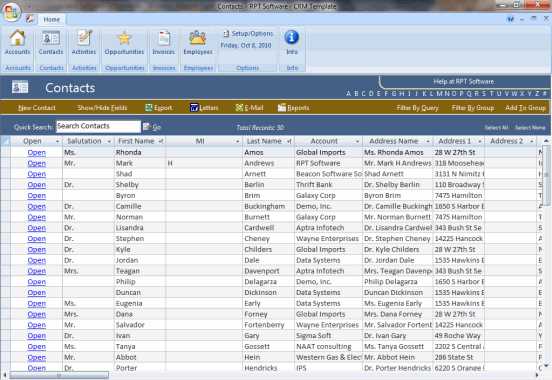

Importing Client Data into Access Templates

Efficiently managing client data is essential for creating accurate and professional documents. Importing client details directly into your billing system can save time, reduce errors, and ensure consistency across all your documents. This process allows you to automate data entry and focus on the work that matters most–providing quality services to your clients.

Steps to Import Client Data

When importing client information into your billing system, following a systematic process ensures that data is correctly populated across all relevant fields. Here are the main steps to help you import and organize client data seamlessly:

- Prepare the Data File: Before importing, make sure your client data is well-organized in a file format compatible with your system, such as CSV or Excel. Ensure that each column corresponds to a specific field (e.g., client name, email address, phone number) to avoid confusion during the import process.

- Choose the Import Method: Most systems offer different import methods, including direct uploads or integration with other software. Choose the method that works best for your needs, ensuring that the client data is mapped correctly to the fields in your system.

- Map Fields Correctly: When importing, it’s crucial to map the fields from the data file to the appropriate fields in your system. This ensures that the client name, address, phone number, and other details are placed in the correct spots within your document template.

- Verify Imported Data: After the import, take the time to review the client data to ensure that everything has been correctly entered. Look for any discrepancies, such as missing or incorrect information, to maintain accuracy across your records.

- Automate Future Imports: If you regularly add new clients, consider setting up an automated import process. This will save time by allowing the system to automatically update client information without manual intervention.

Benefits of Importing Client Data

Importing client data into your billing system offers several key advantages:

- Time Efficiency: Automated data import saves time compared to manually entering client information for each document. This allows you to focus on other important tasks in your business.

- Consistency: With client data stored in one central location, you can ensure that all documents reflect the same, up-to-date details without needin

Managing Multiple Invoices in One File

Handling multiple billing documents in a single file can significantly improve organization and make managing client transactions more efficient. By centralizing all your billing records in one location, you can easily track payments, make updates, and avoid duplicating effort. This method is particularly useful for businesses with numerous clients or ongoing projects, ensuring that all related documents are accessible and well-structured.

Advantages of Centralized Document Management

Centralizing multiple billing records within one system offers several benefits for businesses looking to streamline their operations:

- Improved Organization: Storing all client billing information in a single file reduces the chances of losing or misplacing individual records. You can quickly locate and review any document when needed.

- Efficient Data Management: When all records are in one place, making bulk updates or modifications becomes easier. If pricing structures or tax rates change, you can apply those updates across all records in the file at once, instead of manually adjusting each one.

- Faster Access to Historical Data: Having all documents in one place means you can instantly retrieve past transactions, making it simpler to address any client inquiries or perform financial reviews.

- Reduced Redundancy: Centralized management ensures that you’re not duplicating efforts across multiple files. This saves time and avoids errors, as you’re dealing with one version of the document rather than several scattered files.

How to Structure Multiple Records in One File

To effectively manage multiple records within a single file, a structured approach is necessary. Here’s how you can organize your documents:

Client Name Service Provided Amount Due Due Date Status Client A Web Design $500 2024-11-30 Paid Client B SEO Services $300 2024-12-10 Pending Client C Graphic Design $450 2024-11-25 Paid In this example, each row represents an individual billing record, with columns for client names, services provided, amounts, due dates, and payment statuses. This layout helps you easily manage and update client information in one centralized file, ensuring that all relevant details are in one place for quick reference.

By structuring your rec

Common Issues with Access Invoice Templates

While using structured systems for generating billing documents can streamline your workflow, there are several challenges that users may encounter. These issues can range from formatting problems to data errors, and addressing them promptly can prevent delays in payment processing and maintain a professional appearance for your business.

Common Issues and Their Solutions

Here are some of the most frequent challenges users face when working with pre-designed billing systems and ways to resolve them:

- Incorrect Field Mapping: One common issue is incorrect mapping of fields during setup. This happens when the data from external sources (e.g., client databases or spreadsheets) doesn’t align correctly with the fields in the billing system. To resolve this, carefully review the field mappings before importing or syncing the data. Double-check the names, addresses, and other relevant information to ensure accuracy.

- Formula Errors: Automated calculations may not always work as expected, leading to incorrect totals or tax calculations. If formulas aren’t set up correctly, users may find that the totals are either over- or under-represented. To fix this, test formulas with different input values and ensure that the calculation logic is properly configured, including tax rates, discounts, and currency formatting.

- Formatting Issues: Sometimes, billing documents may not display correctly, especially when switching between different software or exporting to various formats like PDFs or Excel. This can result in misaligned text, overlapping elements, or missing data. To avoid this, check the layout settings regularly, especially when updating or modifying your billing document design. Use consistent margin settings and make sure that text fields are wide enough to accommodate longer client names or descriptions.

- Data Duplication: If client information is manually entered multiple times or if there’s a failure in the data syncing process, you might experience data duplication. This can lead to confusion and potential errors in records. To fix this, regularly audit your data and use automated systems that check for duplicates before allowing new entries.

- Version Compatibility: Another common problem is compatibility between different software versions. If you are using an older version of the system or working with other programs that aren’t compatible with your current system version, you might face difficulties in opening, editing, or sharing billing documents. To resolve this, ensure that your software is updated and check for any necessary patches or fixes to improve compatibility with other programs.

Preventing Future Problems

To avoid these issues in the future, consider the following best practices:

- Regular Updates: Keep your billing system up to date with the latest software versions, templates, and patches to prevent issues related to outdated features or compatibility problems.

- Training and Support: Ensure that all team members are well-trained on how to use the system. Regular training sessions can help minimize mistakes and ensure that everyone is familiar with the features of the system.

- Backup Systems: Regularly back up your data

Where to Find Invoice Templates for Database Management

For businesses looking to streamline their billing process, using pre-designed systems can save valuable time and ensure accuracy. These systems can help create and manage detailed records of financial transactions, including billing, payments, and client information. Finding the right system for generating these documents is essential to maintaining smooth operations, especially when you’re dealing with multiple clients or projects at once.

Online Template Marketplaces

One of the easiest ways to find pre-built systems for billing and financial records is by browsing online marketplaces. Many platforms offer customizable solutions that can fit different business needs. Here are a few popular options:

- Template Libraries: Websites such as Template.net, Vertex42, and Envato Elements offer a wide range of pre-made systems that can be easily adapted for your specific needs. These platforms typically provide both free and paid options, ensuring you find something within your budget.

- Specialized Business Software Websites: Some platforms that specialize in business tools and software also offer specific templates for creating financial documents. Examples include Zoho, QuickBooks, and FreshBooks, which offer customizable templates designed for seamless integration into your workflow.

Customizable Systems and Software

If you need a more specialized or robust solution, some software programs come with built-in systems for generating billing documents. These can often be customized to meet your needs and can be found through the software’s marketplace or support resources:

- Database Management Systems: Some database platforms come with built-in systems for invoicing and client management. These systems can be customized to track specific types of financial data and generate reports tailored to your business.

- Industry-Specific Platforms: If you’re in a niche industry, there are often platforms designed specifically for your type of business that include invoicing systems as part of their package. These platforms may offer specialized templates that meet the unique needs of your industry, such as construction, legal services, or consulting.

By exploring these options, you can easily find the right system to manage your billing, ensuring consistency and professionalism in all your financial documentation. Whether you opt for a ready-made solution or a more tailored system, these resources provide the flexibility needed to meet your business’s specific requirements.