Creating a Professional Invoice Template for Your Business

In business, ensuring a streamlined and clear system for tracking payments is essential. Organizing your transactions not only fosters trust with clients but also simplifies record-keeping and accounting. An effective billing format plays a vital role in maintaining this clarity, helping avoid misunderstandings and ensuring a smooth workflow.

Crafting a billing document that communicates all necessary information in a professional manner requires attention to detail. From listing relevant information to structuring payment terms, a well-organized format supports transparent communication with clients. When done right, this approach not only enhances the appearance of your records but also reflects positively on your brand’s professionalism.

By using an optimized billing layout, you’re able to emphasize your brand, maintain consistency across transactions, and improve payment timelines. It’s an invaluable tool that saves time and reduces errors, making it easier for both your team and clients to manage and understand the payment process. This article will walk you through the steps to develop a thorough and effective structure for managing financial exchanges.

Guide to Crafting an Invoice Template

Building a professional billing format is essential for smooth business operations. By creating a well-structured document, you ensure both clarity and efficiency in your financial exchanges, helping to maintain a strong and reliable reputation with clients. A comprehensive layout not only reflects the professionalism of your brand but also makes each transaction easy to follow and process.

Structuring Key Information

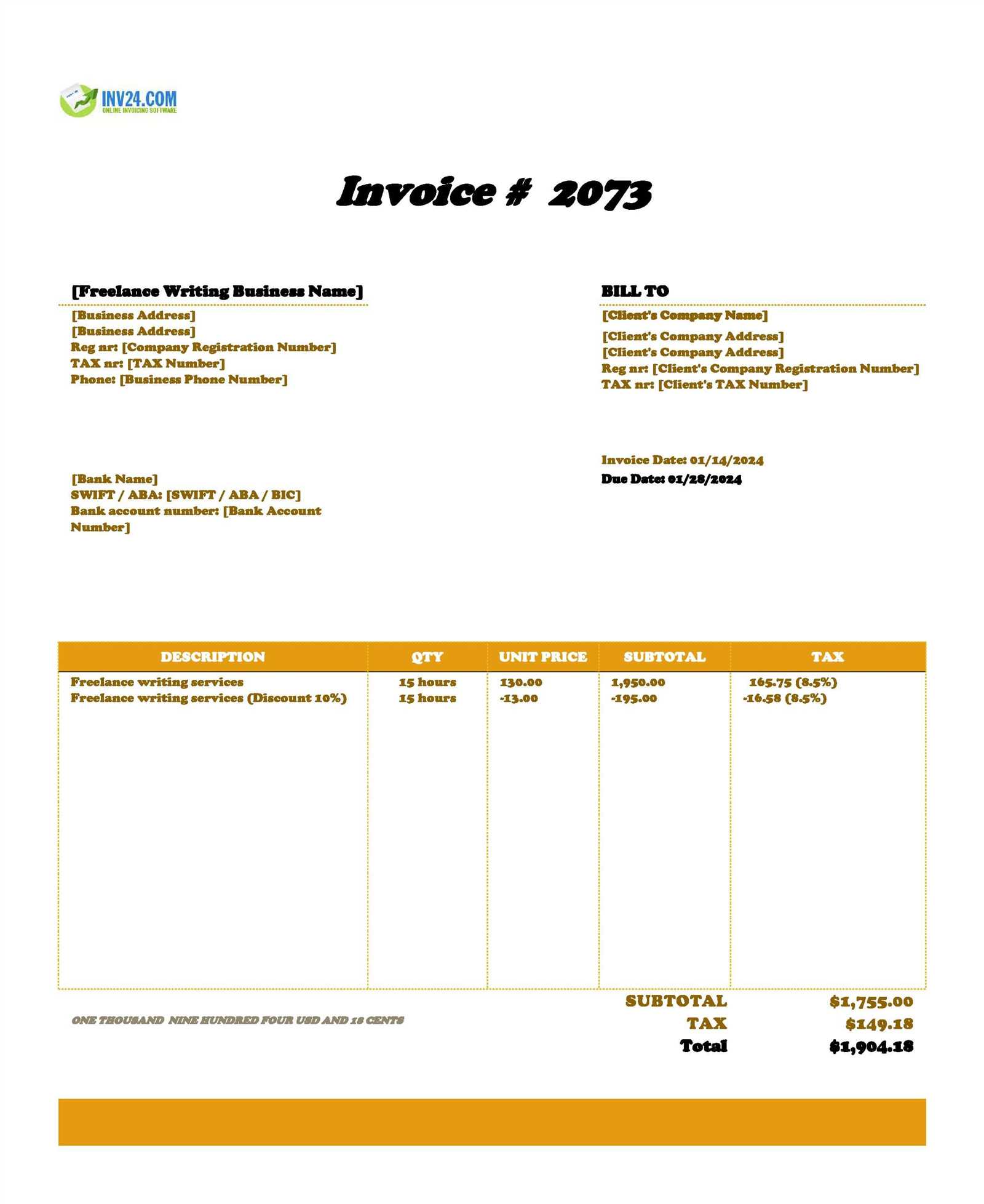

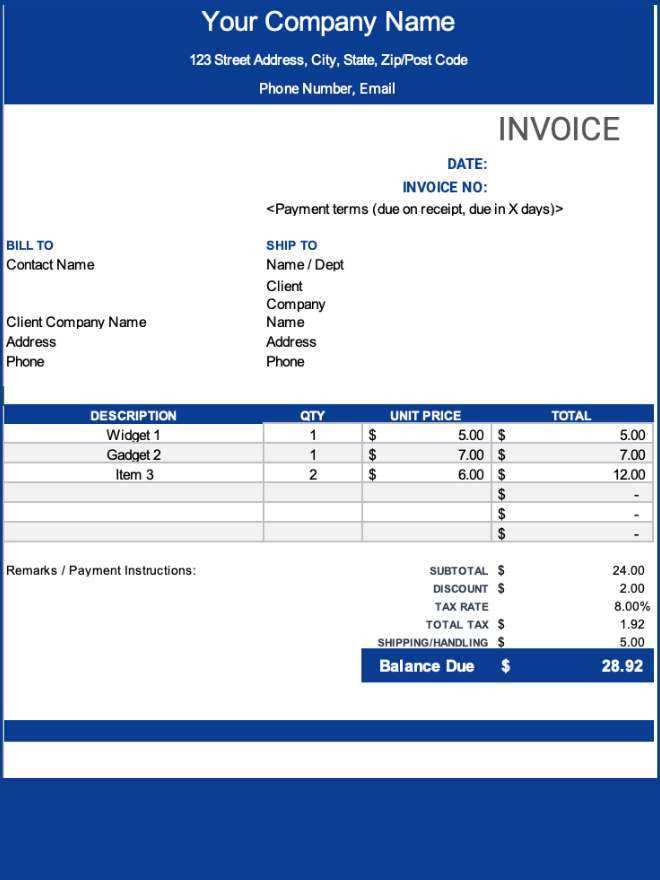

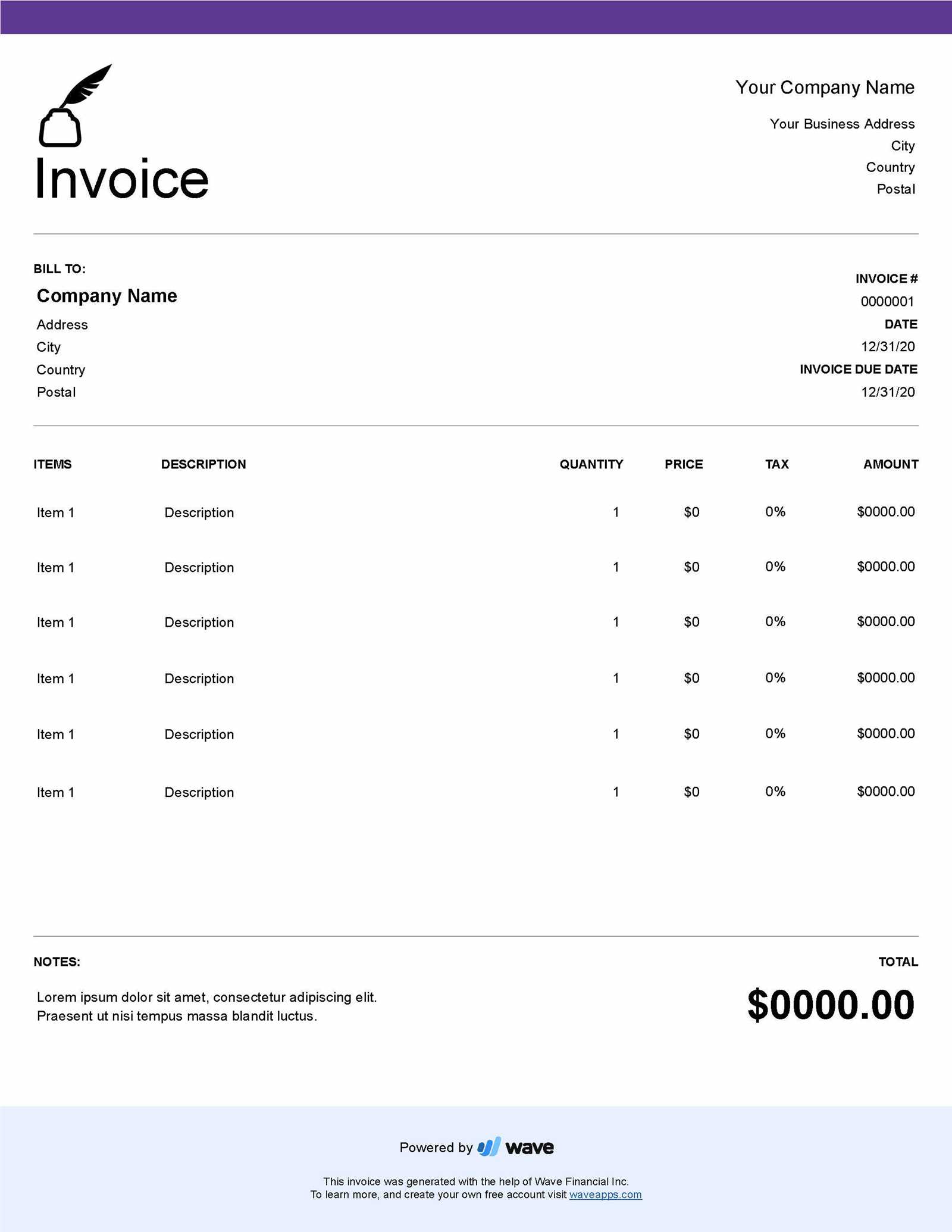

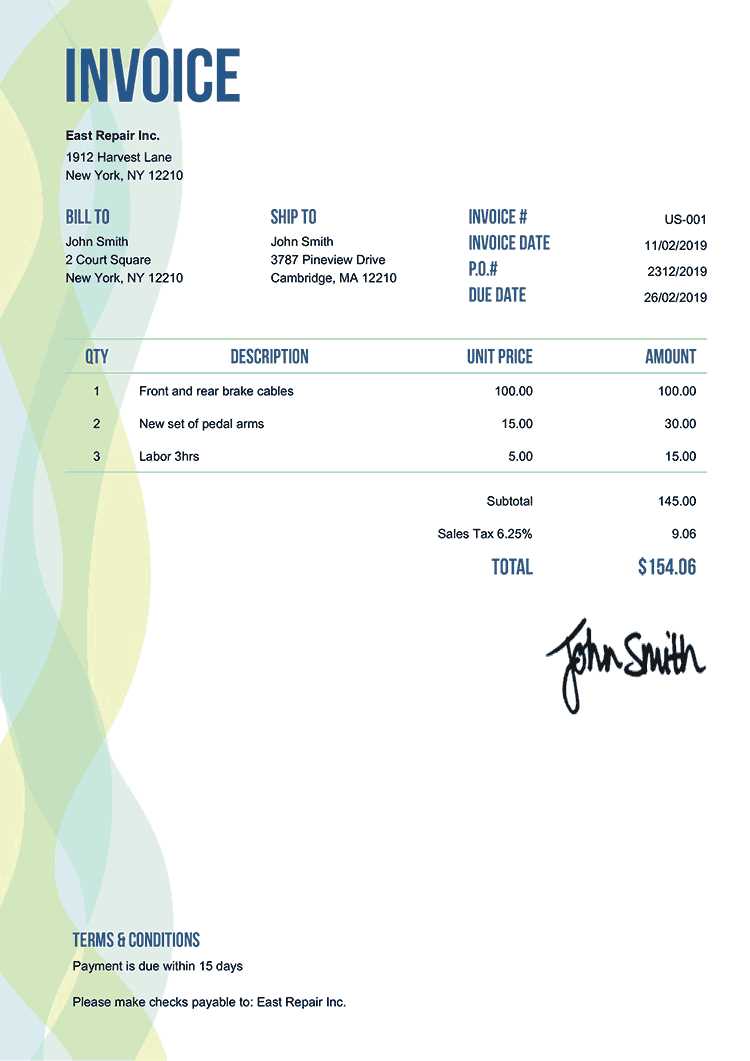

To create a clear and effective layout, focus on organizing the essential details. Include a section for company branding, which strengthens brand identity and ensures clients recognize who the payment is from. Next, add space for transaction-specific details like the client’s information, service descriptions, and payment terms. This structure allows clients to easily identify the key components of each transaction.

Enhancing Clarity and Usability

Clear organization is crucial to make your document easy to understand at a glance. Use concise descriptions, emphasiz

Understanding the Purpose of Invoices

At its core, a structured billing document serves as a formal request for payment, laying out the essential details of a transaction between a business and a client. This record is not only a financial tool but also an effective way to keep all parties aligned regarding the terms of the exchange. By clearly defining payment expectations, you ensure that both sides have a transparent understanding of what was provided and the corresponding obligations.

Such documents also play a significant role in financial tracking, making it easier to monitor cash flow and maintain organized records. They contribute to smooth business operations by establishing a paper trail, which can be essential for accounting and auditing purposes.

| Purpose | Description | ||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Request for Payment | Provides clients with a formal record detailing the amount due, due date, and payment method. | ||||||||||||||||||||||

| Record-Keeping | Acts as a documented trail of

Essential Components of a Good InvoiceA clear and comprehensive billing document ensures that both the business and client have a mutual understanding of the transaction details. A well-constructed format includes all necessary information, making it easy for clients to recognize the source of the request, verify details, and complete payments accurately. Including specific elements also reduces the chance of errors and contributes to a smooth payment process. Contact Information and BrandingThe document should prominently display your company’s details, such as name, address, and contact number, as well as any relevant branding, including logos and slogans. This identification not only strengthens brand presence but also helps clients quickly recognize where the request originated. Adding contact information facilitates easy communication if any clarification is needed. Itemized List and Payment TermsFor transparency, include a detailed list of the products or services provided, along with their corresponding costs. Each item should be clearly labeled to avoid misunderstandings, especially if different services or products were part of the transaction. Additionally, payment terms, such as due dates and accepted methods, should be clearly outlined to ensure clients Choosing the Right Format for Your InvoiceSelecting an appropriate layout for your billing document is crucial for ensuring clarity and ease of use. The format you choose impacts how clients interpret and process the details, which can significantly affect payment timelines and overall satisfaction. A thoughtfully chosen structure aligns with your business’s needs and the preferences of your clients. When deciding on a structure, consider the following aspects:

|