Download Free Taxi Invoice Template in Word Format

Creating accurate and clear billing documents is essential for any service-based business. A well-structured receipt not only ensures you get paid on time but also builds trust with your clients. With the right tools, you can easily generate professional-looking records that meet both your business needs and your clients’ expectations.

By utilizing a customizable format, you can quickly adapt your statements to suit different payment methods, rates, and service details. This flexibility allows you to maintain consistency in your business while saving time on administrative tasks. Whether you are self-employed or managing a larger operation, having an efficient system for creating financial records is crucial to staying organized and transparent.

Getting started with a digital document generator is the best way to simplify your workflow. With the ability to make adjustments as needed, you can tailor each document to reflect the unique nature of each transaction. In the next sections, we will explore how you can create, edit, and manage your billing documents with ease.

Taxi Invoice Template Word: Overview

For service-based businesses, having a standardized method for creating financial records is essential. A reliable document system allows you to provide clients with clear, professional receipts that accurately reflect the services rendered and payment details. This not only ensures smooth transactions but also contributes to maintaining a well-organized and transparent business model.

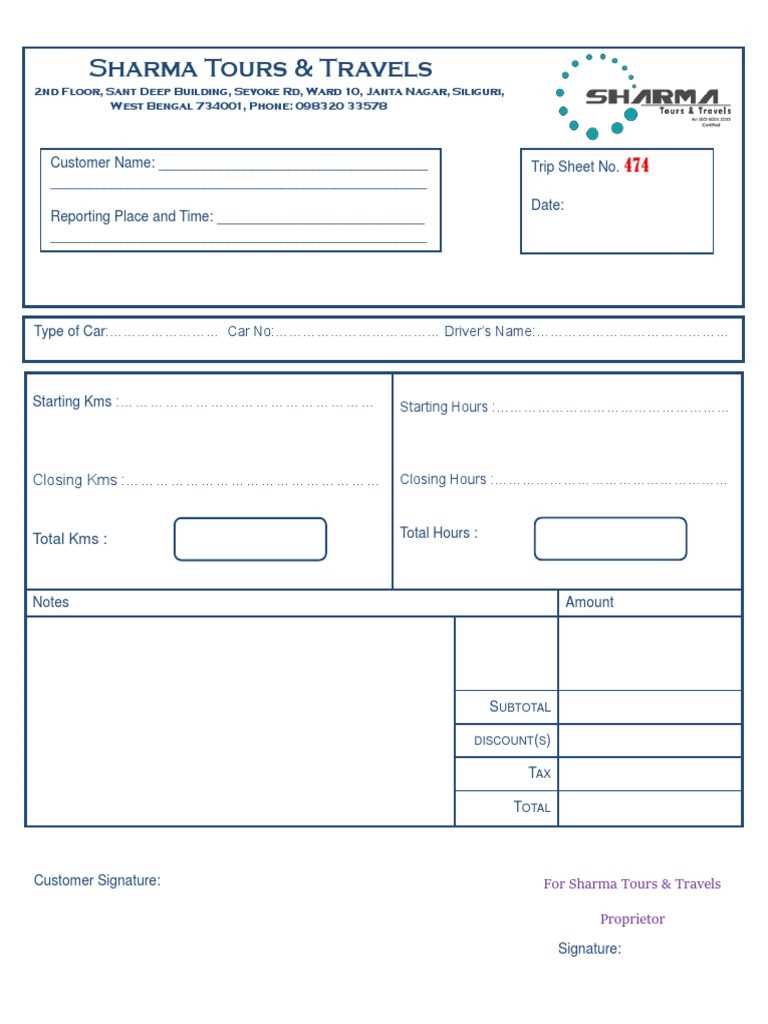

Utilizing an editable format for generating such documents simplifies the entire process. These flexible formats allow for quick customization, letting you adjust for specific details such as service rates, distance, time, or any additional fees. This makes it easy to create personalized records without starting from scratch each time.

Customizable options also help streamline your workflow by offering pre-set sections for common information, such as client name, date, and payment terms. This reduces the need for manual data entry, saving time and minimizing the chance for errors. With the right digital tool, managing financial records becomes a more efficient and straightforward task.

Why Use a Taxi Invoice Template

Creating accurate and professional billing records is essential for any business that provides on-demand services. Using a pre-designed structure for these documents simplifies the process, ensures consistency, and saves valuable time. By adopting a standardized system, you can quickly generate customized receipts that meet your business needs while maintaining a high level of professionalism.

Benefits of Using a Structured Billing Format

- Efficiency: A pre-made format speeds up the document creation process, allowing you to focus on your core business activities.

- Consistency: Using the same structure for every transaction ensures uniformity and makes your records look professional.

- Customization: You can easily adjust the template to suit your pricing model, services, and specific client needs.

Key Advantages for Your Business

- Time-saving: No need to create a new document from scratch each time. Simply fill in the relevant information and generate the receipt.

- Accuracy: Reduce human error by using a structured format that prompts you to enter all the required details.

- Legal Compliance: A well-organized document helps ensure you meet industry regulations and local tax requirements.

With a structured approach, you can maintain a clear and organized record of your transactions while offering clients a seamless and professional experience.

How to Customize Taxi Invoices in Word

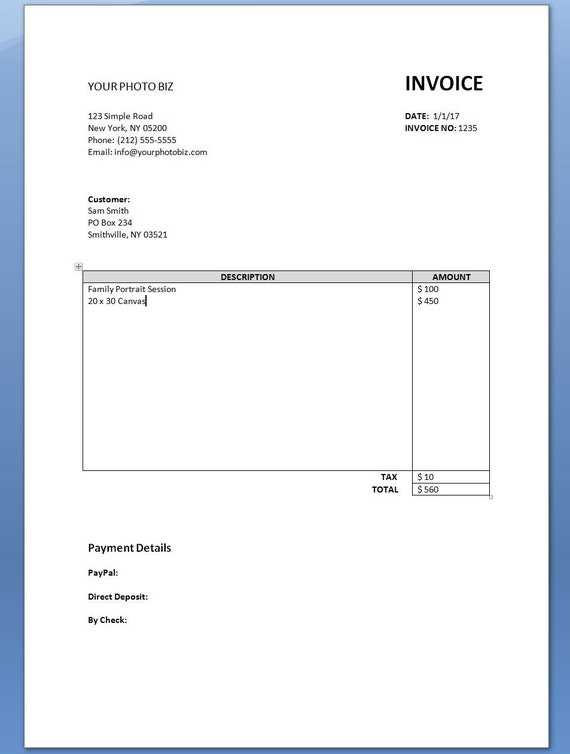

Customizing billing documents allows you to tailor each record to reflect the unique details of every transaction. By adjusting certain elements, you can ensure that your receipts are both professional and aligned with your business model. With the right tools, it becomes easy to personalize every aspect of your financial statements, from logos and payment terms to service descriptions and rates.

Step-by-Step Process for Customization

- Insert Business Information: Start by adding your company’s name, contact details, and logo at the top of the document to make it personalized and professional.

- Modify Service Details: Update the description of the services provided, including the type of service, duration, or distance covered. This ensures clarity for the client.

- Adjust Payment Terms: Include the payment method, due date, and any applicable taxes or additional charges to reflect your specific business terms.

Advanced Customization Options

- Change Fonts and Colors: You can easily adjust fonts and color schemes to align with your brand identity, giving the document a polished look.

- Include Discounts or Special Offers: If applicable, you can add sections for discounts or special pricing to reflect any promotions or loyalty programs.

- Save as a Reusable Document: Once customized, save the file as a template so you can reuse it for future transactions, saving time and ensuring consistency.

With these simple customization options, you can create a document that is both functional and reflective of your business identity, enhancing both efficiency and client satisfaction.

Top Features of Taxi Invoice Templates

A well-designed document structure offers several key elements that can greatly improve the billing process. These features help ensure that all necessary information is included and presented in a clear and professional manner. With the right layout, creating and managing financial records becomes easier, faster, and more efficient.

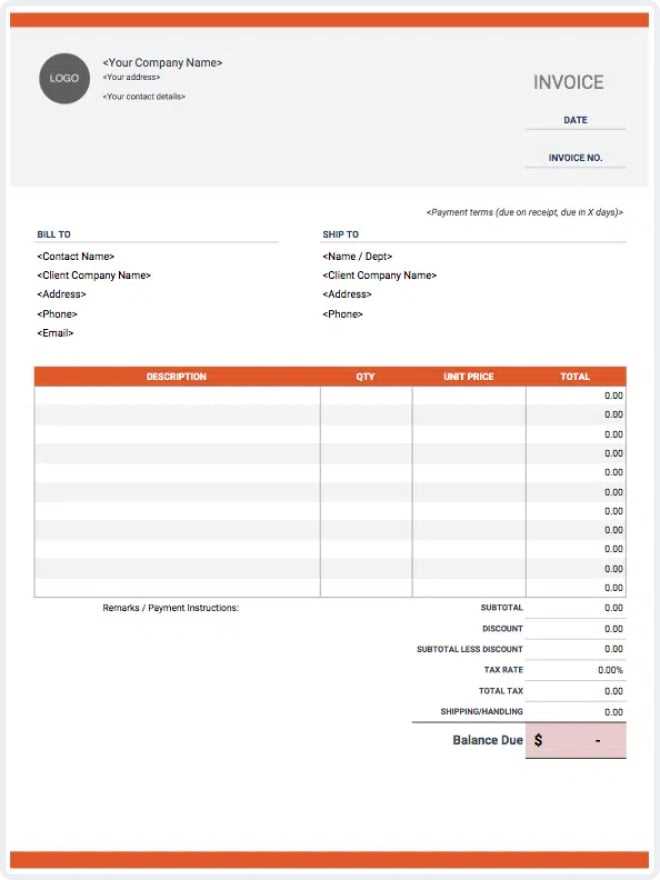

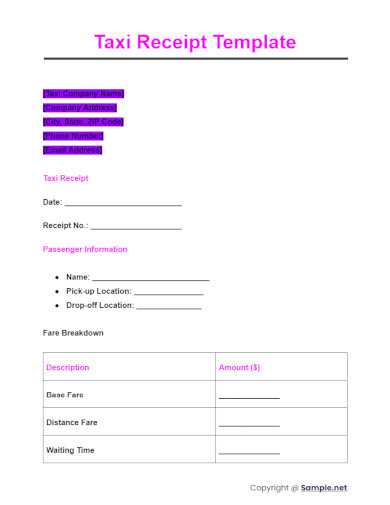

Essential Components of a Billing Record

- Client Information: Clearly displaying the client’s name, address, and contact details helps maintain organized records and ensures accuracy in every transaction.

- Service Breakdown: A detailed description of the services provided, including time, distance, or any extra charges, ensures transparency for the customer.

- Payment Terms: Including payment due dates, accepted methods, and any late fees helps set clear expectations for both parties.

Additional Customizable Options

- Tax Calculations: Pre-set tax fields allow for quick and accurate calculations of any applicable taxes, reducing errors and ensuring compliance.

- Logo and Branding: The ability to add your company’s logo and adjust colors and fonts lets you maintain a consistent and professional brand identity.

- Automatic Total Calculation: Many document formats include built-in formulas for automatically calculating totals, ensuring no details are missed.

These features not only save time but also help maintain a professional and consistent approach to client billing, ensuring that all essential details are included and presented clearly.

Step-by-Step Guide to Create an Invoice

Creating a well-structured billing document is crucial for any business that provides services. It ensures that both you and your clients have a clear understanding of the payment terms, services rendered, and any additional charges. Below is a simple guide to help you craft a professional and accurate record of the transaction.

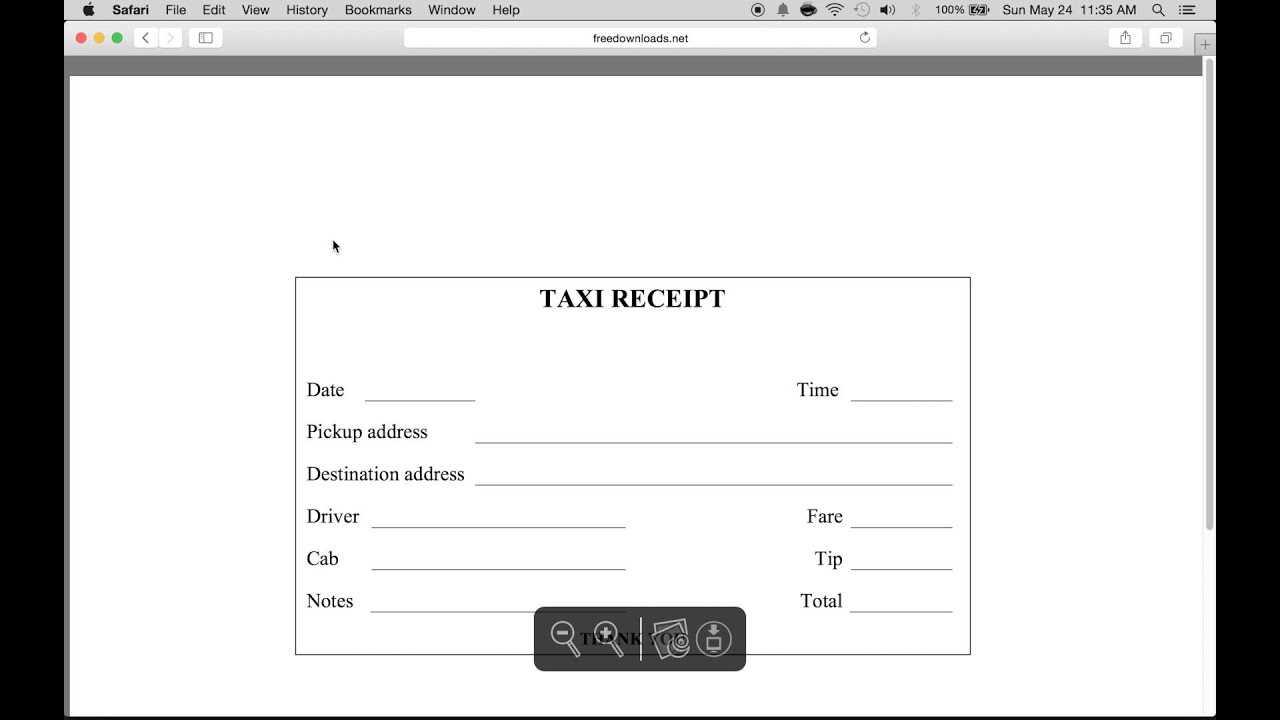

1. Gather Necessary Information

Before you start, make sure you have all the required details at hand. This includes your business name, the client’s details, the services provided, and the agreed-upon pricing structure. Having everything prepared in advance will help you complete the document quickly and accurately.

2. Organize the Document Structure

Set up your document with clear sections. Most billing documents include the following components:

| Section | Description |

|---|---|

| Business Information | Your name, logo, and contact details |

| Client Information | Client’s name, address, and contact details |

| Services Rendered | List the services provided with relevant details (e.g., time, distance, charges) |

| Payment Terms | Due date, accepted payment methods, and payment instructions |

| Total Amount | Final calculated total, including any taxes or fees |

3. Fill in the Details

Now, enter the relevant information in each section. Make sure the amounts, dates, and descriptions are accurate. Include any additional charges, taxes, or discounts to ensure a comprehensive record.

4. Final Review and Adjustments

Once the details are filled in, carefully review the document to ensure there are no errors. Check for any missing information, incorrect totals, or formatting issues. After confirming everything is accurate, you can finalize the document and send it to your client.

Following these steps will help you generate clear, professional documents that streamline your billing process and help maintain good client relationships.

Benefits of Using Word for Invoices

Using a popular word processing software for creating billing documents offers numerous advantages. It provides an accessible, flexible, and efficient way to design professional records while ensuring that important details are clearly communicated to clients. The software’s ease of use and customizable features make it an ideal tool for businesses of any size.

Accessibility and Ease of Use

One of the primary benefits of using a word processor for your billing documents is its accessibility. Most people are already familiar with the software, and it is available across multiple platforms, making it easy to create and edit documents anywhere. Additionally, templates can be quickly modified without the need for advanced technical skills, making it user-friendly for business owners or employees with limited experience in document design.

Customization and Flexibility

Another key advantage is the high level of customization the software offers. You can easily adjust fonts, colors, layouts, and even include logos and branding elements, ensuring each document aligns with your business’s identity. Additionally, it allows you to personalize every record based on specific client needs, service details, or special pricing.

Efficient Document Management

Using a word processor allows you to save and store your documents in an organized manner. You can create a template to reuse for future records, eliminating the need to recreate the format each time. This not only saves time but also ensures consistency across all your transactions.

By leveraging these benefits, you can streamline the process of generating billing records, ensuring they are accurate, professional, and tailored to your business needs.

Free Taxi Invoice Templates for Word

Access to free, customizable document formats can greatly simplify the process of generating professional billing records for your business. These pre-designed structures are easy to download, modify, and use, saving you both time and effort. Whether you are just starting or looking to improve your existing process, free templates provide a straightforward solution to meet your needs.

Advantages of Free Templates

Cost-effective: Using free formats eliminates the need for expensive software or hiring professionals to create custom documents. With just a few clicks, you can have access to a variety of designs suitable for your business needs.

Quick Setup: Free document structures come with built-in fields and formatting, allowing you to start generating records immediately without the need for extensive customization or design skills.

Where to Find Free Formats

Many websites offer a wide range of free templates tailored for different industries and business models. Simply search for “free billing document formats” or “customizable receipts,” and you’ll find several options that suit your needs. These are typically available in easy-to-download formats like DOC or DOCX, which can be edited in any standard word processing software.

Customization for Your Business

Personalization: Free templates are fully customizable, allowing you to adjust them according to your specific pricing, branding, and services. You can add your company logo, change color schemes, and update content to reflect each transaction accurately.

By utilizing free, ready-made formats, you can ensure a smooth, professional experience for your clients while keeping the administrative process efficient and affordable.

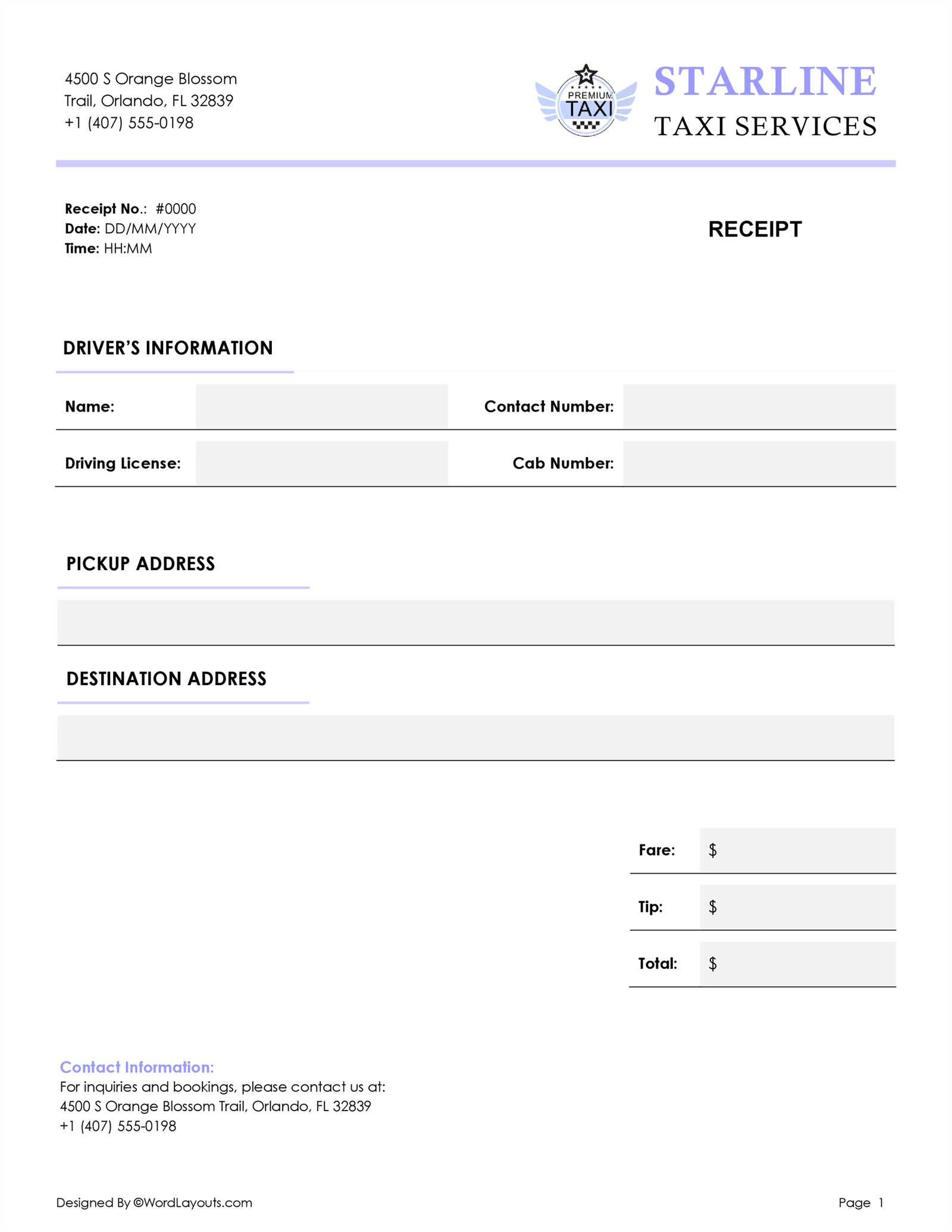

What to Include in a Taxi Invoice

When creating a billing document, it’s important to include all relevant details to ensure clarity and transparency for your clients. A well-organized record not only helps maintain professionalism but also ensures that both you and your clients understand the terms of the transaction. Below are the key components to include in any service billing document.

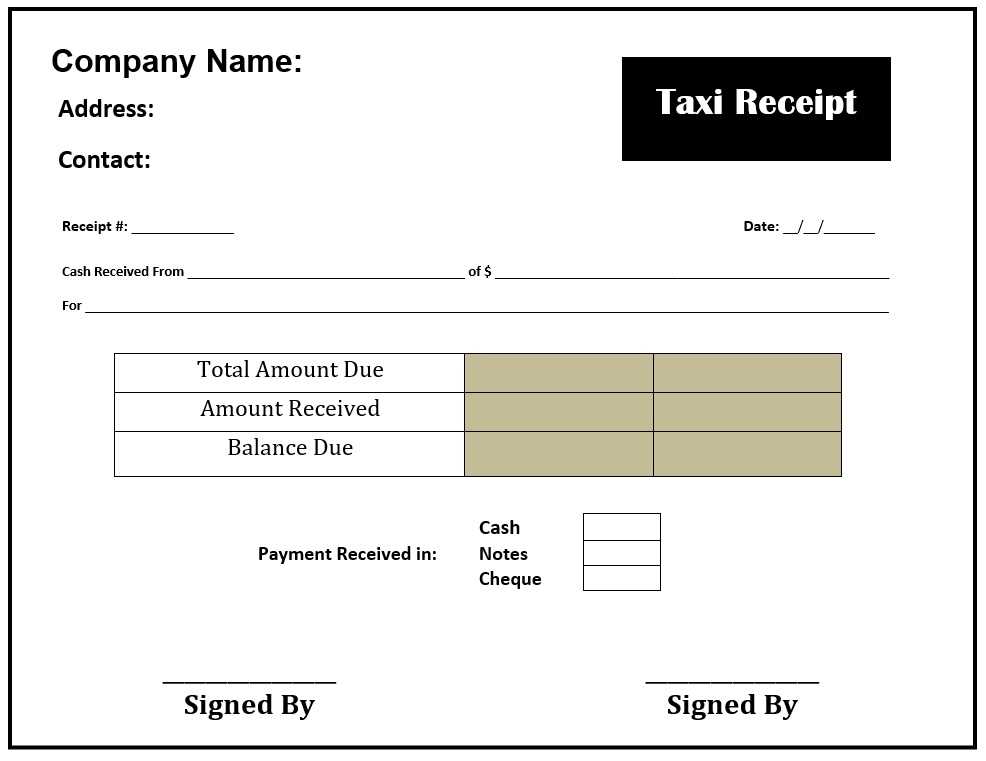

1. Business Information: Start by including your business name, address, and contact details at the top of the document. This helps clients quickly identify the source of the bill and how to reach you for any questions.

2. Client Information: Clearly list the client’s name, address, and any relevant contact details. This ensures that both parties are correctly identified and avoids confusion, especially in case of disputes or queries.

3. Service Description: Provide a detailed description of the services provided, including the type of service, the duration, or distance covered. If applicable, include additional charges for waiting times or extra services provided. This level of detail helps avoid misunderstandings and clarifies how the final amount is calculated.

4. Pricing and Payment Terms: Break down the costs for each service provided and clearly state the total amount due. Specify any taxes or fees, as well as the payment method and due date. Make sure to include information on accepted payment options, such as cash, credit card, or electronic transfer.

5. Additional Details: If relevant, include a section for discounts, special offers, or promotional pricing that may apply to the client. This allows you to provide incentives and encourages repeat business.

6. Invoice Number and Date: Every billing document should have a unique reference number for easy tracking and record-keeping. The date of issue should also be clearly stated to avoid confusion about payment deadlines.

Including these key elements ensures that your billing documents are clear, complete, and professional, helping to foster trust and satisfaction with your clients.

How to Calculate Taxi Fares on Invoices

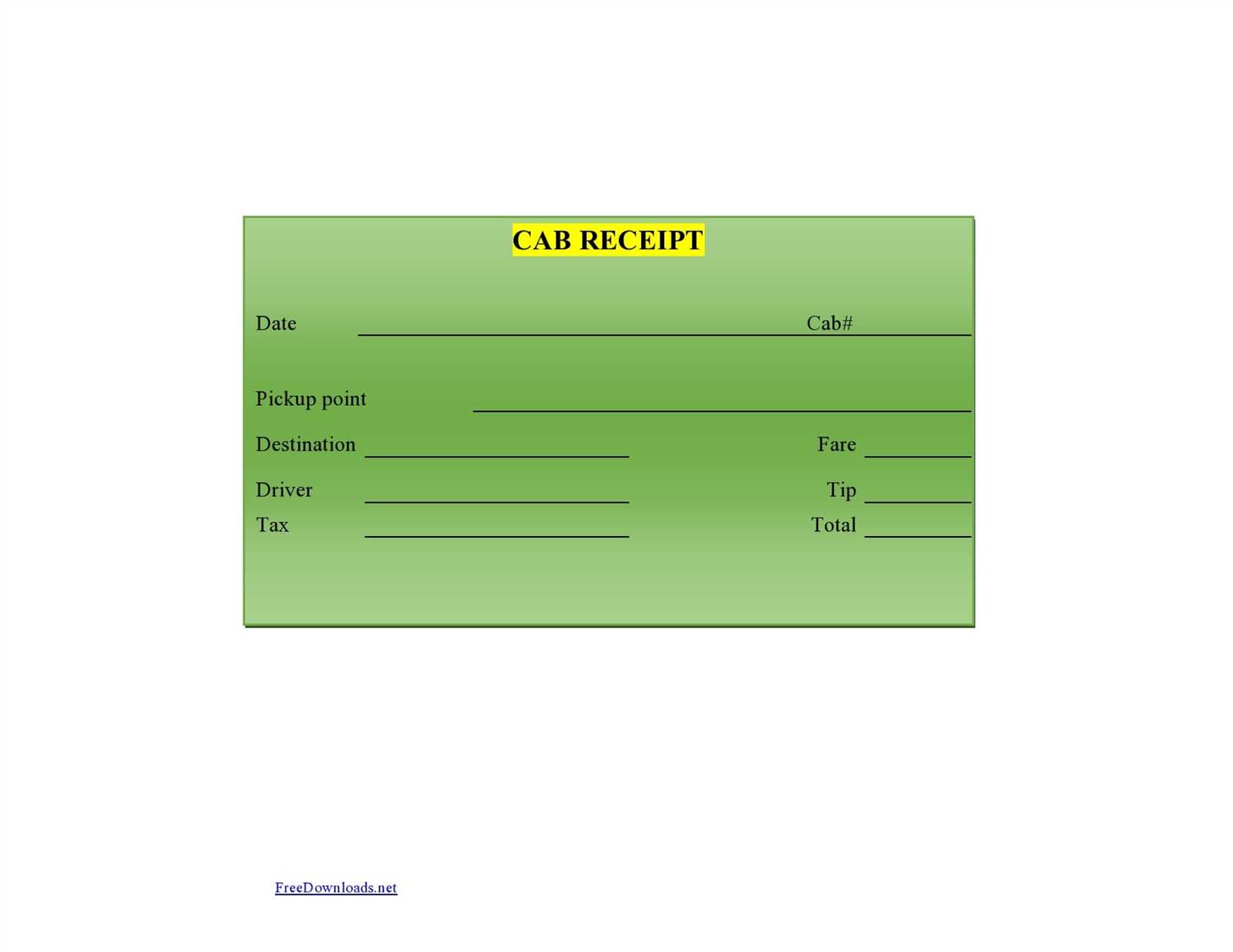

Calculating fares accurately is a key part of creating clear and professional billing records. Whether you charge by distance, time, or a combination of both, it’s important to ensure that all the elements are calculated correctly and presented transparently. Here’s a guide to help you calculate the total amount due for any ride.

Step-by-Step Process for Fare Calculation

- Base Fare: Start by applying the base fare, which is the fixed charge for starting the service. This is usually a flat rate that covers the initial distance or time.

- Distance or Time Charges: Add the charges for the distance traveled or the time spent on the service. You may have a rate per mile or per minute, depending on how your pricing model is structured.

- Additional Fees: Include any additional charges such as surcharges for waiting time, extra passengers, or peak-time rates. Make sure these are clearly specified to avoid confusion.

- Discounts or Promotions: If applicable, subtract any discounts or promotional offers from the total. Be sure to indicate the reason for the discount (e.g., loyalty program or special offer).

- Taxes: Apply any relevant taxes or VAT to the fare total. Make sure to calculate these based on your local tax rate and clearly list the tax amount.

Example Calculation

Here is an example of how to break down the charges:

- Base Fare: $5.00

- Distance Charge (10 miles at $2 per mile): $20.00

- Waiting Time (15 minutes at $1 per minute): $15.00

- Discount (5% off total): -$2.00

- Taxes (10%): $3.80

- Total Fare: $41.80

By following these steps and clearly breaking down the charges, you ensure that your clients can easily understand how the fare is calculated and have confidence in the accuracy of your billing records.

Saving and Printing Your Taxi Invoice

Once you’ve created and customized your billing document, the next important steps are saving it for future reference and printing a hard copy for your client. Proper file management ensures that you can easily access past records, while printing allows you to provide a professional document for physical submission. Below is a guide to help you save and print your billing documents efficiently.

Saving Your Document

Choose the Right File Format: After finalizing the details of your document, it’s important to save it in a widely accessible format. Most commonly, you can save your document as a .docx file for future edits or a PDF for a finalized, uneditable version that can be easily shared and printed.

Organize Your Files: To keep everything organized, create a folder on your computer or cloud storage dedicated to financial records. Name the document appropriately (e.g., “Client Name – Service Date”) so you can easily search for it when needed. It’s also helpful to include an invoice number or reference code for easy tracking.

Printing Your Document

Check the Layout: Before printing, ensure that the document layout appears properly on the page. Adjust margins, fonts, and spacing to ensure the content is clear and looks professional when printed. Most word processing software allows you to preview the layout before sending it to the printer.

Choose the Right Printer: Select a printer that offers good quality output. If you’re printing on standard paper, make sure the text is clear and easy to read. For better presentation, consider using letterhead or special paper if it aligns with your branding.

By following these steps, you can easily save and print your billing documents while maintaining a professional and organized approach to record-keeping and client communication.

Best Practices for Taxi Invoices

Creating clear, accurate, and professional billing records is essential for maintaining strong relationships with clients and ensuring smooth transactions. Implementing best practices can help streamline the process and prevent common mistakes. Below are some of the most important practices to follow when preparing your financial documents.

Key Elements to Include

To ensure your document is both comprehensive and easy to understand, it’s important to include the following core elements:

| Element | Description |

|---|---|

| Business Details | Include your company name, address, phone number, and email to make sure your client knows how to contact you. |

| Client Information | Ensure you list the client’s full name, address, and contact details so the bill is clearly attributed. |

| Service Breakdown | List all services provided, including the type, duration, and any extra charges. This adds transparency to the billing process. |

| Payment Terms | Clearly state the due date, accepted payment methods, and any additional fees (such as late payment charges). |

| Total Amount | Ensure the final total is clearly indicated, with a breakdown of all fees and taxes. |

Best Practices for Clarity and Accuracy

1. Be Clear and Concise: Avoid unnecessary jargon and keep the language simple to ensure your clients can easily understand the charges. Use straightforward descriptions for services rendered.

2. Use Sequential Numbering: Always assign a unique number to each billing document. This helps with tracking payments and ensuring you don’t lose records of previous transactions.

3. Double-Check for Accuracy: Before sending, always review the document to verify that the details are correct, including the service charges, client information, and payment terms. Small errors can lead to confusion and delay payments.

4. Provide Payment Instructions: Include clear instructions on how the client should make the payment, including bank account details or links to online payment platforms, if applicable.

By following these best practices, you can ensure that your financial documents are professional, easy to understand, and free of errors, helping to build trust and keep the payment process smooth for both parties.

Ensuring Accuracy in Taxi Billing

Accurate billing is essential for maintaining trust and transparency with clients. Ensuring that all the details in your payment records are correct not only avoids confusion but also helps in managing finances effectively. Below are some key steps and tips to ensure your billing documents are always precise and error-free.

Key Steps to Ensure Accuracy

1. Double-Check All Figures: Before finalizing any billing document, it’s crucial to review all numbers, including rates, distances, time, taxes, and total amounts. A small mistake, such as a misplaced decimal point, can lead to misunderstandings and client dissatisfaction.

2. Verify Client Information: Always ensure that the client’s name, contact details, and address are correct. This reduces the chances of sending documents to the wrong recipient, and it also ensures that your records are up-to-date for future transactions.

Tools for Accuracy and Consistency

1. Use Predefined Formats: Using predefined document structures can help reduce human error. These formats typically include all the necessary fields, such as service descriptions, pricing, and payment terms, ensuring that no important information is missed.

2. Implement Automated Calculations: Many word processing or spreadsheet tools offer features like automatic calculations for totals, taxes, and discounts. Using these features can help avoid simple math errors and ensure that your calculations are always accurate.

3. Keep Detailed Records: Maintaining a detailed log of every service provided, including the time, route, and cost breakdown, can help you verify the accuracy of each charge. This ensures consistency across all documents and allows you to quickly resolve any discrepancies that may arise.

By adopting these practices and using the right tools, you can ensure that your billing documents are accurate, transparent, and professional, thereby fostering stronger client relationships and reducing the chances of payment issues.

How to Add Discounts on Taxi Invoices

Incorporating discounts into your billing records is a great way to incentivize repeat business and reward loyal customers. Whether you offer promotional discounts, loyalty rewards, or seasonal offers, it’s important to clearly reflect these deductions in your documents. Below are a few effective ways to include discounts and present them transparently to your clients.

Types of Discounts to Consider

- Percentage Discount: This type of discount involves reducing the total charge by a certain percentage. For example, you may offer a 10% discount for first-time customers or a seasonal promotion.

- Fixed Amount Discount: A fixed amount discount subtracts a specific dollar or currency amount from the total. This type of discount is commonly used for loyalty programs or for clients who make large purchases or use your services regularly.

- Special Offer or Bundle Discount: Offering discounts for bundled services or package deals can encourage customers to use more of your services at a reduced rate.

Steps to Apply Discounts in Your Billing Document

1. Clearly State the Discount: Always specify the type of discount applied, whether it’s a percentage or fixed amount. Include a brief description next to the discount line so the client understands the reason behind the deduction.

2. Deduct the Discount from the Total: After applying the discount, update the total amount due. Ensure that the discount is subtracted from the original sum before calculating taxes or final amounts.

3. Include Terms and Conditions: If the discount is part of a promotion or has specific conditions (such as limited validity or usage), make sure to clearly state these terms on the document to avoid confusion.

Adding discounts correctly is crucial for building goodwill and ensuring a smooth transaction process. By following these steps, you can easily apply discounts and maintain a transparent and professional relationship with your clients.

Legal Requirements for Taxi Invoices

When creating billing documents for services rendered, it is essential to comply with local laws and regulations to ensure that your records are valid and legally binding. Adhering to legal requirements not only prevents potential issues with tax authorities but also helps establish trust and professionalism with clients. Below are the key legal elements to consider when preparing your payment records.

Key Legal Elements to Include

1. Business Registration Information: Many jurisdictions require businesses to include their official registration details on billing documents. This typically includes the company’s legal name, registration number, and the address of its registered office. These details help establish the legitimacy of the transaction.

2. Tax Identification Number: If your business is registered for tax purposes, you are usually required to display your tax ID number on the bill. This number helps authorities track and verify your transactions for tax reporting.

3. Clear Breakdown of Charges: To ensure transparency, most regions require that you clearly outline all charges. This includes the cost of services rendered, taxes applied, and any other fees. A breakdown of each element helps avoid confusion and ensures compliance with consumer protection laws.

Other Important Considerations

1. Legal Language: Some jurisdictions may require certain phrases or disclaimers to be included on the document, such as terms of payment, late fees, or refund policies. Ensure that these are clearly stated and in accordance with local laws.

2. Dates and Terms: Always include the date the document was issued and, if applicable, the payment due date. In many cases, regulations require businesses to specify clear payment terms to avoid confusion regarding when the amount is considered overdue.

Ensuring that your billing records meet legal standards is crucial for both operational success and maintaining good relationships with your clients. By including all required information and following the appropriate regulations, you can avoid legal issues and demonstrate professionalism in your business practices.

How to Send Taxi Invoices to Clients

Once you’ve created your billing document, it’s important to send it to your clients in a professional and timely manner. The way you deliver the document can affect how quickly you get paid and how your business is perceived. Below are some methods for sending your billing records, as well as tips for making sure your clients receive them without any issues.

Methods of Sending Billing Documents

- Email: The most common and fastest way to send a billing document is via email. You can attach the document as a PDF or other file format, making it easy for the client to download, review, and pay. Make sure to include a clear subject line, such as “Billing Record for [Service Date] – [Client Name].”

- Postal Mail: If your client prefers physical copies or if digital delivery is not an option, sending a printed copy by postal mail is another method. Ensure that you use reliable mailing services to guarantee the document reaches the client promptly.

- Online Payment Platforms: Some businesses integrate online payment systems where clients can both view and pay their bills. Services like PayPal or Stripe allow for immediate electronic billing and streamline the process for both parties.

- Client Portals: If you have a customer portal or account system, you can upload the billing document directly there, giving your clients easy access to their records. Make sure to notify them when a new document is available for review.

Best Practices for Sending Billing Records

- Include a Clear Subject Line and Message: If you’re emailing the document, make sure the subject line is concise and informative. In the email body, provide a brief overview of the bill and mention the payment due date. This will help clients know immediately what the email is about.

- Verify the Client’s Contact Information: Before sending the document, double-check that you have the correct email address or physical address. A minor error can cause delays in receiving payment.

- Follow Up if Necessary: If you haven’t received payment within the agreed-upon timeframe, it’s a good idea to send a polite reminder. You can also inquire if the client had any questions or concerns regarding the charges.

- Keep a Record of Sent Documents: Maintain a log of all documents sent to clients, whether by email or post. This can help resolve any disputes and serve as a backup in case the client claims not to have received the bill.

By following these best practices, you ensure that your clients

Common Mistakes to Avoid with Invoices

While preparing billing records for clients, it’s easy to overlook important details, which can lead to misunderstandings or payment delays. Avoiding common mistakes can help you maintain professionalism and streamline the process. Here are some frequent errors that can cause problems when creating your payment documents.

1. Incorrect or Missing Client Information: Always verify that the client’s name, address, and contact details are accurate. Failing to do so can cause confusion and delays in payments. Double-check for any typos or outdated information before sending out the document.

2. Not Including a Unique Reference Number: Every billing document should have a unique reference number for easy tracking. Without this, it becomes harder to manage payments and could lead to difficulties if there are multiple transactions with the same client.

3. Miscalculating Charges: Incorrectly calculating the total amount due is one of the most common mistakes. Always double-check your math and ensure that taxes, discounts, and additional charges are correctly calculated. Many programs can help automate calculations to reduce human error.

4. Missing Payment Terms and Conditions: Clearly outlining payment terms, including due dates and accepted payment methods, is essential. Failing to include this information may cause confusion and lead to late payments. Make sure your terms are straightforward and visible on the document.

5. Failing to Include a Breakdown of Services: Clients need to know what they are paying for. A detailed breakdown of services provided, including rates and descriptions, builds transparency and trust. Avoid using vague terms that could lead to disputes.

6. Sending Documents Too Late: Timing is key. Sending out billing records immediately after providing the service helps ensure timely payments. Delays in sending the documents can give the impression of disorganization and cause unnecessary delays in payment processing.

By avoiding these common mistakes, you can ensure a smooth billing process that fosters trust and encourages timely payments from clients.

Alternatives to Word for Taxi Invoices

While word processing software is a popular option for creating billing records, there are several other tools and platforms that can make the process more efficient. These alternatives offer additional features, such as easier formatting, automation, and direct integration with payment systems. Below are some options that can help you create professional billing documents with minimal effort.

Online Invoicing Software

- FreshBooks: FreshBooks is a cloud-based accounting tool that allows you to easily create, send, and track billing documents. It also offers features like time tracking and payment reminders.

- Zoho Invoice: Zoho Invoice is an intuitive platform for generating invoices. It offers a variety of customizable templates, automated reminders, and integrates seamlessly with payment gateways.

- QuickBooks: Known for its accounting features, QuickBooks also offers an invoicing solution that makes it simple to generate and send professional bills. It integrates with bank accounts and payment systems for easy transaction tracking.

Spreadsheet Software

- Google Sheets: Google Sheets is a free, web-based tool that can be used to create customized billing records. You can share the document directly with clients or download it in multiple formats, including PDF.

- Microsoft Excel: Excel is another popular option for creating bills. With its powerful calculation and formatting features, you can create tailored billing sheets and automate calculations with formulas.

Accounting Apps

- Wave Accounting: Wave is a free accounting software that includes invoicing features. It allows you to create custom bills, track payments, and send reminders–all within an easy-to-use interface.

- Xero: Xero is a cloud-based accounting platform with an invoicing tool. It’s particularly useful for small businesses and offers integration with a variety of financial services.

While word processing software is a viable option for creating billing documents, these alternatives provide added functionality that can save time and help streamline your business operations. By exploring other tools, you can find the best solution for your invoicing needs and improve the overall efficiency of your billing process.