Download Free Contractor Invoice Template PDF

Managing payments and maintaining financial records can often be a daunting task for any professional. Having a clear, consistent system in place for creating documents that track work completed and amounts owed is essential for smooth business operations. A well-structured document not only helps maintain accuracy but also builds trust with clients.

Using a pre-designed form to outline project details, payment terms, and totals can save time and reduce errors. This streamlined approach ensures that all necessary information is included and presented in a professional manner. With the right tools, this process becomes quick and efficient, freeing up time to focus on what matters most–delivering quality work.

In this guide, we will explore how to create and use such forms, offering practical tips on customization and how to send these documents to clients in a way that ensures timely payments. Whether you’re just starting out or looking to improve your billing process, these strategies will help you stay organized and efficient.

Why Use a Billing Document Format

Having a standardized method to request payment and record completed work is essential for any business owner. A predefined structure ensures consistency, saves time, and minimizes the risk of missing important details. Using a uniform form allows you to stay organized and present your services professionally to clients.

Here are some reasons why this approach is beneficial:

- Efficiency – Pre-designed forms streamline the process, allowing you to focus on delivering quality work rather than reinventing the wheel each time you need to request payment.

- Accuracy – A consistent format helps ensure that all essential details, such as work description, payment amounts, and deadlines, are included every time.

- Professionalism – Sending a polished, clear document reflects well on your business and increases the likelihood of timely payments.

- Legal Protection – A clear and comprehensive document helps prevent misunderstandings and disputes, offering both parties a reference in case of issues.

By using a well-established method to create your payment requests, you can save time and enhance your business’s credibility, leading to better client relationships and smoother operations.

How to Create a Billing Document

Creating a professional document to request payment is easier than it may seem. With the right tools, you can craft a clear and organized record that outlines the services rendered, amounts due, and payment terms. A well-constructed form ensures accuracy and boosts your credibility with clients.

Step-by-Step Process

Follow these simple steps to create an effective payment request form:

- Choose a Tool – Select a software or online tool that allows you to create and export your document. Popular choices include word processors, spreadsheets, or specialized billing software.

- Include Key Information – Be sure to add the following details:

- Your business name and contact information

- Client name and contact details

- Description of services provided

- Amount due and payment terms

- Invoice number and date

- Due date

- Design for Clarity – Make sure the layout is clean and easy to read. Use clear headings and adequate spacing to avoid confusion.

- Save and Export – Once your document is ready, save it in your chosen format and export it to a universally accessible file type, such as a digital document.

Final Steps

After creating the payment request, double-check the information for accuracy. Ensure that there are no missing details or errors that could cause delays or confusion with the client. Once finalized, you can easily share the document via email or another communication method to get paid on time.

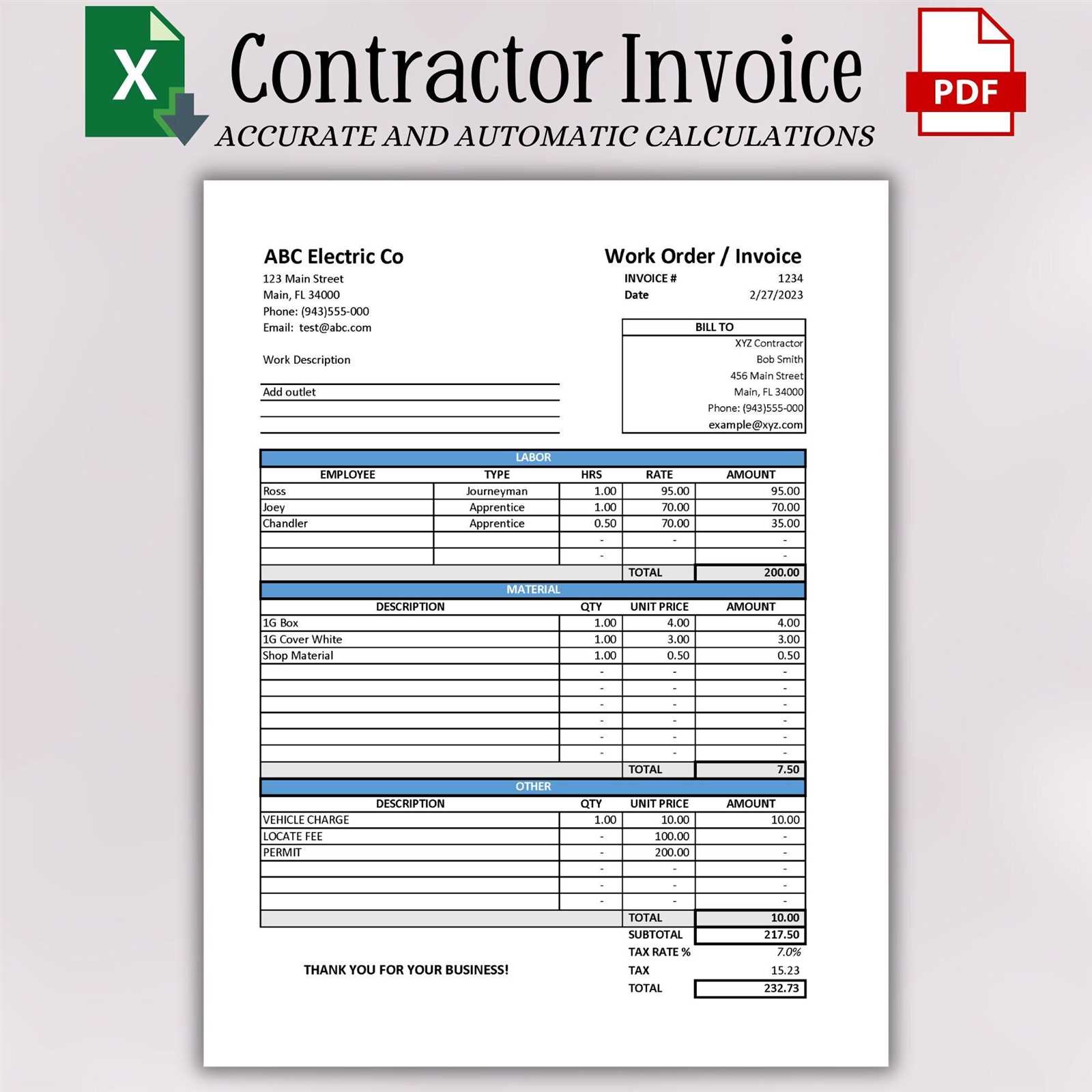

Key Elements of a Billing Document

When requesting payment, it’s important to include all necessary details to ensure clarity and accuracy. A well-organized document helps both you and your client stay on the same page regarding services provided and amounts due. There are several essential components that must be included to avoid confusion and ensure a smooth transaction process.

| Element | Description |

|---|---|

| Header Information | Include your business name, logo, and contact details. The client’s name and contact information should also be clearly stated. |

| Service Description | Provide a detailed breakdown of the services rendered. Be specific about each task to avoid misunderstandings. |

| Dates | List the date the work was completed, as well as the issue date and due date for payment. |

| Amount Due | Clearly state the total amount owed. Include individual prices if applicable, and any discounts or additional charges. |

| Payment Terms | Specify the due date, acceptable payment methods, and any late fees if applicable. |

| Unique Reference Number | Assign a unique number to each document for easy tracking and future reference. |

Including these elements ensures that the document is both comprehensive and professional. A complete billing document not only facilitates timely payments but also establishes a solid foundation for positive relationships with clients.

Advantages of Digital Billing Documents

Using digital documents to request payment has become a preferred choice for many professionals due to their convenience and reliability. With the ability to send, store, and manage these records easily, digital formats offer several benefits that enhance both the billing process and client interactions. Below are some of the key advantages of using this approach.

- Accessibility – Digital records can be accessed anywhere, at any time. This makes it easier for both you and your clients to view, update, or share the document quickly and efficiently.

- Security – Digital files are often more secure than paper documents, as they can be password-protected, encrypted, and backed up to prevent loss or unauthorized access.

- Professional Appearance – A well-formatted, digital payment request looks polished and professional. It’s easier to create a clean, structured layout that reflects well on your business.

- Cost-Effective – By eliminating the need for printing and mailing, digital documents save both time and money. Sending them via email or other digital means is often free or comes at a minimal cost.

- Faster Payments – Digital documents can be sent instantly, allowing for quicker processing and response from clients, which can lead to faster payments.

- Environmental Benefits – Going digital reduces the use of paper and other physical resources, making it a more eco-friendly option for your business.

By switching to a digital format for payment requests, businesses can streamline their operations, enhance client communication, and reduce administrative burdens, all while ensuring greater security and faster payments.

Best Tools for Digital Payment Request Generation

There are numerous software options available today that can help professionals easily create and manage their billing documents. These tools allow you to customize your requests, automate calculations, and ensure accuracy while maintaining a professional appearance. Below are some of the best tools that can streamline the process of generating payment documents.

- QuickBooks – Known for its robust accounting features, QuickBooks offers a simple and efficient way to create, send, and track payment requests. It also integrates seamlessly with other accounting tools for easier financial management.

- FreshBooks – Ideal for small businesses, FreshBooks provides an intuitive interface for creating professional-looking payment requests. It also offers time-tracking features, automatic reminders, and payment processing options.

- Zoho Invoice – Zoho Invoice offers a wide range of customization options, allowing you to tailor your documents to meet your specific business needs. It also includes automated features like recurring billing and expense tracking.

- Wave – This free tool provides an easy way to create and send digital requests. It’s perfect for freelancers and small businesses looking for a simple solution without extra costs.

- Invoicely – With its user-friendly interface, Invoicely allows users to create professional payment requests with ease. It also supports multi-currency invoicing and integrates with various payment gateways.

- Canva – Known for its design capabilities, Canva offers customizable document templates that can be used to create visually appealing payment records. It’s a great choice for those who want to add a creative touch to their requests.

Choosing the right tool depends on your specific needs, whether it’s simple document creation, detailed financial management, or design customization. These options provide a range of features to help you save time and ensure that your records are accurate, professional, and easy to manage.

Customizing Your Payment Request Document

Personalizing your payment request form ensures that it reflects your unique business identity and meets your specific needs. Whether it’s adding a logo, adjusting the layout, or incorporating custom payment terms, tailoring the document can help you maintain professionalism and stand out to your clients. Customization also ensures that all relevant information is easy to find and presented in a way that is consistent with your brand.

Key Areas to Customize

When designing your billing document, consider the following elements for customization:

| Element | How to Customize |

|---|---|

| Header | Add your business name, logo, and contact details. Choose a font style and color that matches your brand. |

| Service Description | Adjust the wording to match the specific types of services you offer. Use bullet points for clarity if needed. |

| Layout | Change the arrangement of sections to suit your preferences. For example, you can place payment terms at the top or add a “Notes” section at the bottom. |

| Payment Terms | Modify the payment methods you accept or add specific conditions, such as late fees or discounts for early payment. |

| Footer | Include your business’s tax identification number, website, or social media handles, if relevant. |

Why Customization Matters

By customizing your payment request documents, you create a professional image while also making the process more efficient. Clients will appreciate the clarity and consistency, and you can ensure that all the necessary details are included without the need for constant revision. A personalized approach helps to avoid misunderstandings and contributes to smoother transactions.

Common Mistakes in Payment Requests

Creating a payment document might seem straightforward, but many professionals make common mistakes that can lead to delays, confusion, or even disputes. These errors often stem from missing information, unclear terms, or formatting issues that affect the clarity of the request. Avoiding these mistakes is essential to ensuring timely payments and maintaining a professional image.

Common Errors to Avoid

Here are some of the most frequent mistakes when preparing payment documents:

- Missing Contact Information – Failing to include your business name, address, and contact details, as well as the client’s, can cause confusion and delay communication.

- Incorrect or Incomplete Descriptions – Not providing a clear and detailed breakdown of services can lead to misunderstandings about what work was completed and how much is owed.

- Wrong Payment Terms – Not specifying payment methods, deadlines, or late fees can create ambiguity and make it difficult for clients to know when and how to pay.

- Errors in Amounts – Simple math mistakes or forgetting to account for taxes, discounts, or extra fees can result in incorrect totals and cause issues during the payment process.

- Not Including a Unique Reference Number – Each document should have a unique number for tracking and reference. Without one, it can be hard to distinguish between different requests, especially for clients with multiple ongoing projects.

How to Prevent These Mistakes

To avoid these issues, always double-check the document for completeness before sending it. Ensure that all necessary details are included, and take the time to review amounts and terms for accuracy. Using a digital system or tool that automates calculations can help reduce human error and speed up the process, giving both you and your clients peace of mind.

How to Track Payments with Billing Documents

Tracking payments effectively is crucial for maintaining a healthy cash flow and keeping your business organized. When you send out payment requests, having a system in place to monitor the status of each payment ensures that no payment is overlooked and that clients pay on time. This process helps you stay on top of your finances and avoid misunderstandings with clients.

Here are some practical ways to track payments efficiently:

- Assign Unique Numbers – Each payment request should have a unique reference number. This makes it easier to track specific documents and payments, especially if you have many outstanding requests.

- Record the Date – Always include both the issue date and the due date on each document. This helps you keep track of when a payment was requested and when it’s expected to arrive.

- Set Payment Status Indicators – Create a system to mark the status of each request, such as “paid,” “pending,” or “overdue.” This could be done manually in a spreadsheet or using accounting software to automate the process.

- Maintain a Payment Log – Keep a separate log of payments made. This log should include the payment method, date received, and any related notes, such as partial payments or adjustments.

- Send Payment Reminders – If a payment is overdue, send a polite reminder to the client. Include the payment request number, amount owed, and a new deadline if applicable.

By implementing these strategies, you can easily keep track of outstanding balances, ensuring that you receive payments on time and manage your business finances with greater ease. Whether you’re using a digital tool or a manual system, staying organized will save you time and reduce the risk of errors.

How to Ensure Accurate Billing

Accurate billing is vital for any business to maintain trust and avoid disputes. Mistakes in the payment request process can lead to delays, dissatisfaction, and even loss of clients. To ensure accuracy, it’s important to establish a solid system for tracking and verifying all relevant details before sending out requests. Below are some steps to help you achieve precise and error-free billing.

- Double-Check Service Details – Before finalizing a payment request, verify that the description of services or products is complete and correct. Ensure that all work completed is accounted for and clearly explained.

- Accurate Pricing – Review the pricing structure to make sure that rates, quantities, and discounts are applied correctly. Double-check the final total, including taxes and any additional fees.

- Track Time and Resources – If your pricing is based on hourly rates or the use of specific resources, keep a detailed log of the time spent and resources used. This helps avoid discrepancies when clients review the request.

- Set Clear Payment Terms – Be specific about payment deadlines, late fees, and accepted methods of payment. This avoids any misunderstandings and ensures that the client knows exactly what is expected.

- Use Automation Tools – Utilize accounting or billing software to automate calculations and reduce the risk of human error. These tools can also help with tracking previous requests and organizing payments.

By carefully following these steps, you can minimize errors and ensure that your payment requests are accurate and professional. Keeping your billing process organized and thorough not only improves client satisfaction but also helps protect your business’s financial stability.

Legal Requirements for Payment Requests

When creating payment requests, it’s essential to ensure that they comply with legal standards. Depending on your location and the nature of the services provided, certain details must be included to meet tax, contract, and business laws. Failing to follow these legal guidelines can lead to issues with payment collection, tax filing, or even legal disputes. Below are key legal aspects to keep in mind when drafting payment documents.

Essential Legal Information

- Business Identification – Your business name, address, and registration number (if applicable) must be included to verify the legitimacy of your operation.

- Tax Identification Number (TIN) – If your business is registered for tax purposes, you are required to include your tax identification number on the document.

- Client’s Details – Include the client’s full name, business name (if applicable), and address to ensure that the request is directed to the correct party.

- Description of Services – Clearly describe the services provided or products delivered, as this helps prevent misunderstandings and establishes a clear record for both parties.

- Terms of Payment – Specify the payment due date, acceptable payment methods, and any penalties for late payment. This establishes clear expectations and prevents disputes.

Additional Legal Considerations

- Compliance with Local Laws – Different regions have different legal requirements regarding business transactions. Familiarize yourself with local laws to ensure compliance.

- Record-Keeping – Legal requirements often include keeping copies of payment requests and payments received for a specified period, usually for tax purposes.

- Clear Payment Terms – Ensure that any terms regarding late fees or interest on overdue payments are clearly stated to avoid future conflicts.

Following these legal guidelines will help protect your business and ensure that your payment requests are valid, transparent, and legally binding. Always consult with a legal or financial expert to stay up-to-date on any changes in the law that could affect your billing process.

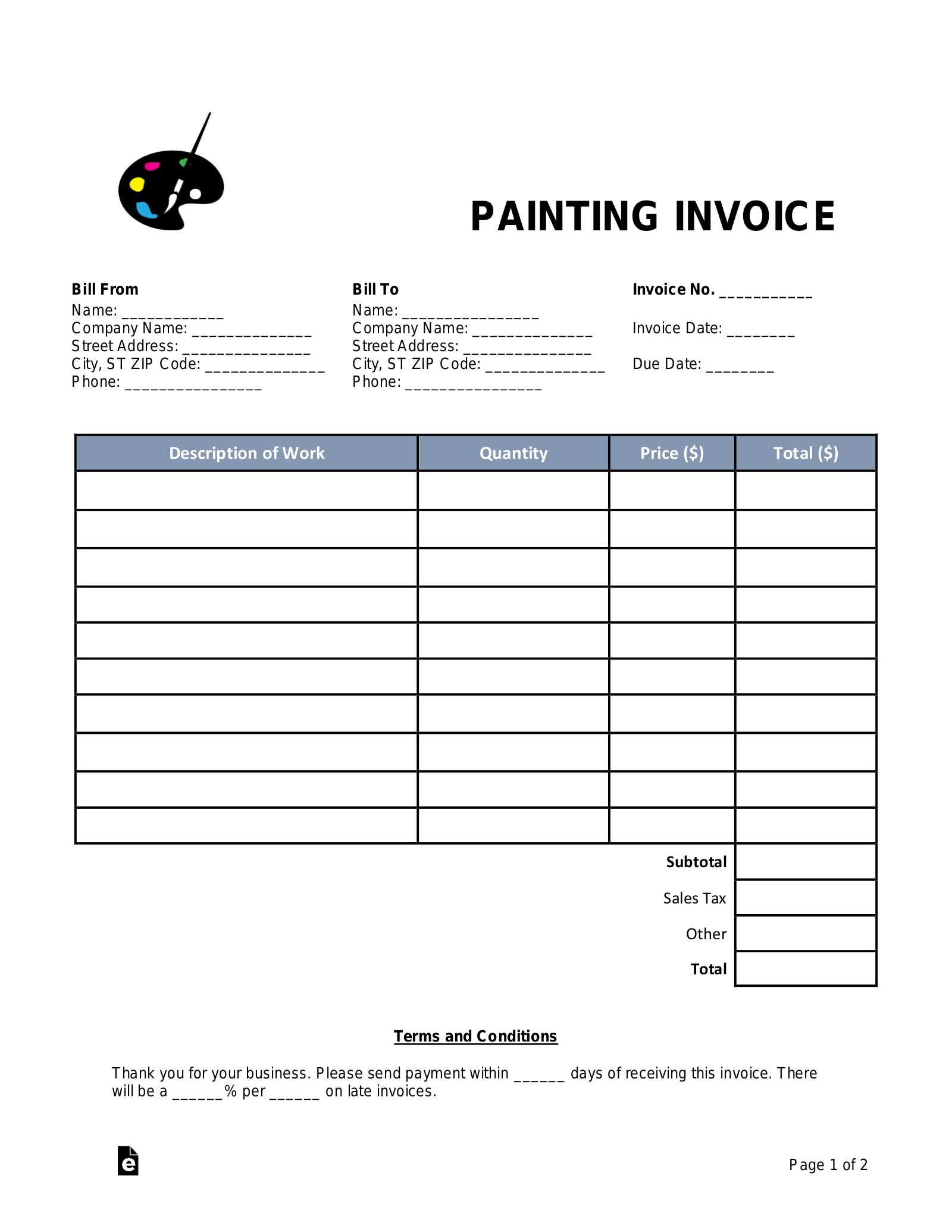

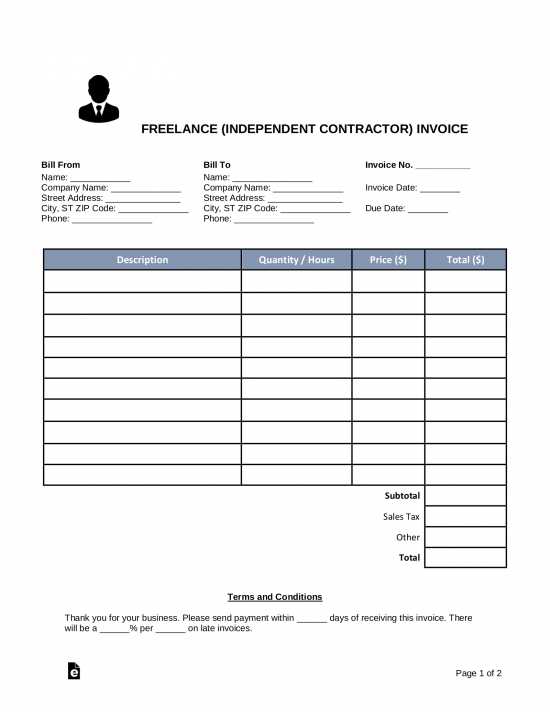

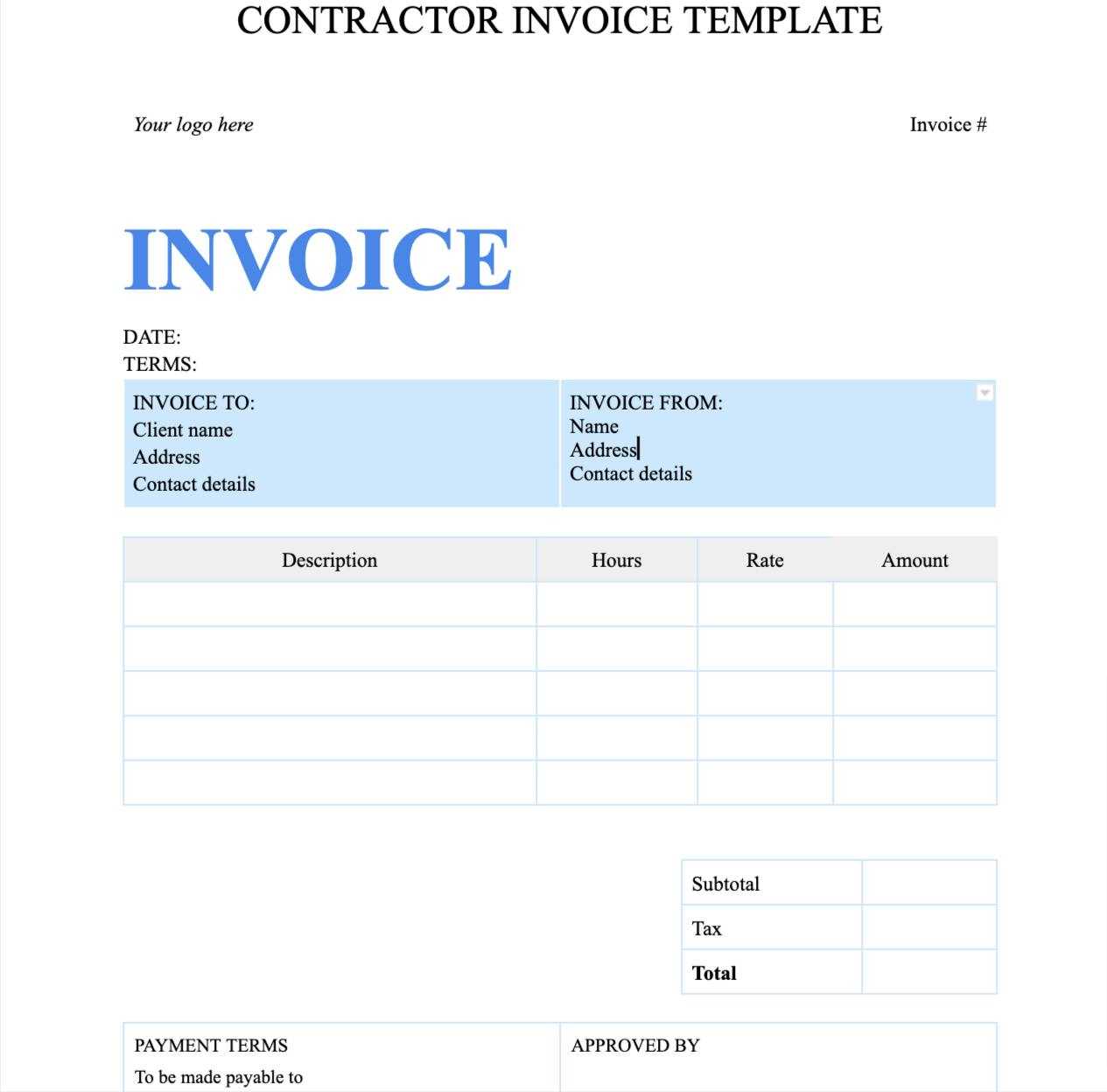

Free Payment Request Templates for Professionals

For many professionals, especially those working on a freelance or project-based basis, having an efficient and cost-effective way to create payment requests is crucial. Using free, customizable forms can save both time and money, while ensuring your documents look professional and meet all necessary requirements. Whether you’re just starting out or looking to simplify your process, free templates can be a great solution.

Here are some advantages of using free payment request forms:

- Cost-Effective – Many online platforms offer free downloadable or customizable forms that allow you to create professional documents without spending money on expensive software.

- Ease of Use – Free templates are often designed to be user-friendly, with pre-filled sections that only require you to add your specific details, such as services rendered and the total amount due.

- Customization – Even free options typically allow for customization, such as adding your business logo, adjusting the layout, or changing the colors to fit your brand.

- Quick and Convenient – With free forms, you can generate and send requests in minutes, helping you maintain a fast and efficient billing process.

There are several online platforms where you can find free payment request forms. Many offer templates that can be downloaded directly or filled out online and emailed to clients. These forms often include all the necessary elements, such as service descriptions, payment terms, and space for client and business information. Some of the most popular resources include:

- Microsoft Office Templates – Offers a variety of free templates that can be downloaded and customized using Word or Excel.

- Google Docs – Free templates available through Google Drive that can be edited and shared online in real-time.

- Zoho Invoice – Provides a free version with basic features that includes customizable request forms.

- Canva – While primarily a design tool, Canva offers free templates for professional-looking documents that can be customized and downloaded in various formats.

By using these free resources, you can create well-designed and functional payment documents without incurring additional costs. This can help you focus on growing your business while ensuring smooth transactions and timely payments.

Tips for Professional Payment Request Design

A well-designed payment request document not only improves professionalism but also enhances clarity, ensuring that clients can quickly understand the details of the transaction. The design of your document should reflect your business’s identity and ensure all essential information is easy to find. Here are some key design tips to help you create clean, organized, and effective payment documents.

Design Elements to Focus On

| Design Element | Best Practices |

|---|---|

| Clear Layout | Ensure that the document has a logical flow, with sections for contact details, services, payment terms, and totals clearly separated. Use headings to create visual distinction. |

| Professional Fonts | Choose easy-to-read fonts such as Arial, Helvetica, or Times New Roman. Keep font sizes consistent and use bold or italics for emphasis rather than using too many different fonts. |

| Branding | Incorporate your business logo, colors, and style to create a cohesive brand identity. This adds a personal touch and makes your documents recognizable to clients. |

| Spacing and Margins | Use adequate white space and margins around the edges of the document. This helps prevent the layout from looking crowded and improves readability. |

| Tables for Details | Use tables to organize service descriptions, rates, quantities, and totals. This makes it easier for clients to see the breakdown of costs and reduces the risk of confusion. |

| Payment Information | Highlight payment terms clearly, including due dates, payment methods, and any late fees. This ensures that clients know exactly when and how to pay. |

Additional Design Tips

Besides the basic design elements, here are a few additional tips for creating a polished and professional document:

- Use High-Quality Images – Ensure that your logo and any other images are high-resolution to maintain professionalism.

- Stay Simple – Avoid cluttering your document with unnecessary design elements. Keep it simple and focused on the important information.

- Proofread – Always double-check the document for spelling errors, missing information, or inconsistencies. A clean, error-free document builds trust with clients.

- Choose the Right Format – When sending a payment document, make sure it is in a widely accepted format, such as PDF, which ensures that the layout and design remain intact across devices.

- Use Email for Digital Delivery – Email is the most common and fastest method for sending payment documents. Attach the document to your email with a clear subject line like “Payment Request for [Project Name]” and include a brief message explaining the attached file.

- Provide Clear Instructions – In the body of your email, include payment instructions. Specify the payment due date, preferred methods, and any necessary details to avoid confusion.

- Use Professional Email Tone – Maintain a polite and professional tone in your communication. Clearly state the amount due and the services provided, and be sure to thank the client for their business.

- Online Payment Platforms – Platforms like PayPal, Stripe, or QuickBooks offer integrated billing services, allowing you to generate and send payment requests directly through their systems. This method often includes features like automatic reminders and payment tracking.

- Mailing a Hard Copy – For clients who prefer physical copies or for legal reasons, you can mail a printed copy of your document. Always ensure the document is securely packed and that you use a reliable mailing service.

- Cloud Storage Sharing – If your client prefers accessing documents from cloud services like Google Drive or Dropbox, upload the payment request and share a secure link. Ensure the document is accessible only to the client to maintain privacy.

- Set Reminders – If the payment is not received by the due date, send a polite reminder with the same document attached. Many online platforms automatically generate reminders to ease this process.

- Confirm Receipt – It’s helpful to confirm that the client has received the document. A simple email asking for confirmation can ensure that the payment process is on track.

- Track Payments – Keep a log of all documents sent and payments received. This helps you stay organized and resolve any issues quickly if there are delays.

- Use Accounting Software – Leverage accounting platforms like QuickBooks, FreshBooks, or Xero to store and manage your payment records. These tools allow for automatic categorization, report generation, and real-time updates, making it easy to stay on top of financial transactions.

- Establish a Consistent Filing System – Create a logical system for organizing records, such as by project, client, or payment period. Ensure that both digital and paper records are kept in an easily accessible format, and regularly back up digital files to avoid loss.

- Track Payment Statuses – Keep track of which payments have been made, which are overdue, and which are pending. Many accounting tools offer features that automatically update payment statuses, which can help you stay organized and avoid missed follow-ups.

- Keep Detailed Documentation – For every payment, store the relevant details, including the amount, date, method of payment, and any supporting correspondence. This will be valuable for resolving discrepancies or if clients need confirmation of past payments.

- Cloud Storage – Store digital copies of your payment records in cloud services like Google Drive, Dropbox, or OneDrive. Cloud storage ensures that your records are easily accessible from anywhere and provides an added layer of security with automatic backups.

- Spreadsheet Management – If you prefer a simpler method, use spreadsheet software (such as Excel or Google Sheets) to track payments manually. Create a table with columns for the client name, payment amount, date, and payment method to help you stay organized.

- Paper Filing – For businesses that need to keep physical records, ensure that you have a secure and organized filing system. Use labeled folders or filing cabinets and sort records by date or client to make retrieval easier.

- Regular Updates – Make it a habit to update your records consistently. Record payments as soon as they are made or received, and ensure that all records are accurate and complete.

- Reconcile

Improving Cash Flow with Payment Requests

Effective cash flow management is crucial for maintaining the health and stability of any business. One of the key factors in ensuring a steady cash flow is the timely and accurate processing of payment requests. By establishing efficient billing practices, businesses can reduce delays, encourage quicker payments, and ultimately improve cash flow. Below are some strategies for improving cash flow through streamlined payment request management.

Strategies for Accelerating Payment Collection

- Set Clear Payment Terms – Be transparent about your payment expectations from the beginning. Clearly state the due date, payment methods, and any late fees in your request documents. This reduces confusion and encourages clients to pay on time.

- Send Requests Promptly – The sooner you send out your payment requests after the completion of a project or delivery of services, the sooner you can expect payment. Set a standard for when requests should be sent and make it a habit to do so immediately upon completion.

- Offer Multiple Payment Options – The more options clients have to pay, the faster they will likely do so. Consider offering various methods such as bank transfers, credit card payments, or digital payment platforms to make the process as convenient as possible for your clients.

- Incentivize Early Payments – Offer discounts or incentives for clients who pay ahead of schedule. This can help create urgency and prompt quicker payments, benefiting your cash flow.

Monitoring and Follow-Up Practices

- Track Outstanding Payments – Keep a detailed record of all payments due and regularly check for overdue payments. This will allow you to follow up with clients promptly before the overdue period extends too far.

- Send Gentle Reminders – If a payment is overdue, send a polite reminder before escalating to more formal actions. Often, a simple reminder email or phone call will suffice to get the payment back on track.

- Use Automated Billing Systems – Many software tools allow for automated billing and reminders. By setting up these systems, you can reduce manual effort and ensure that reminders are sent out without delay.

By implementing these practices, you can improve your cash flow, reduce the chances of late payments, and ensure that your business has the necessary funds to continue operating smoothly. Consistency in billing, clear communication, and timely follow-ups are essential elements in keeping cash flow steady and predictable.

How to Send Payment Requests to Clients

Sending a payment request document to clients is a crucial part of ensuring timely payments and maintaining professionalism. The way you deliver this document can impact how quickly it is processed and paid. Choosing the right method of delivery and following up effectively can help streamline the payment process. Below are some tips on how to efficiently send your payment requests to clients.

Steps for Sending Payment Requests

Alternative Methods of Sending Payment Documents

Follow-Up and Tracking

By using these methods, you can ensure that your payment reque

Maintaining Payment Records Efficiently

Keeping accurate and organized payment records is essential for managing finances and ensuring smooth operations. Proper documentation not only helps track income but also simplifies tax reporting and auditing processes. Efficient record-keeping can save you time, reduce errors, and provide you with the insights needed to make informed business decisions. Below are some strategies to maintain payment records effectively.