How to Use Microsoft Word 2010 Invoice Template for Your Business

For any business, having a streamlined method for generating professional-looking documents is crucial. Whether you’re sending bills to clients or keeping track of payments, using a standardized format can save you time and help you maintain a polished image. Fortunately, there are simple ways to produce these essential papers directly from your computer, even without specialized software.

Customizable forms can be quickly adapted to suit your needs, allowing you to insert key details such as product descriptions, pricing, and payment terms. By taking advantage of pre-designed structures, you can ensure consistency across all your transactions while focusing on other aspects of your business. The process is intuitive and offers flexibility to adjust the design and content as required.

Streamlined processes not only improve productivity but also enhance communication with clients, providing them with clear, concise documents that reflect your professionalism. In the following sections, we’ll explore how to create, modify, and make the most of these powerful tools for managing your financial interactions.

Microsoft Word 2010 Invoice Template Overview

Creating well-structured documents for business transactions is essential for maintaining professionalism and clarity. The tool in question offers a built-in solution that allows users to generate custom forms for recording payments, billing clients, and keeping financial records. With its easy-to-use interface, you can create documents tailored to your needs without requiring advanced design skills or external software.

Key Features of the Document Creation Tool

This tool provides a range of features that make it easy to customize and personalize your financial documents:

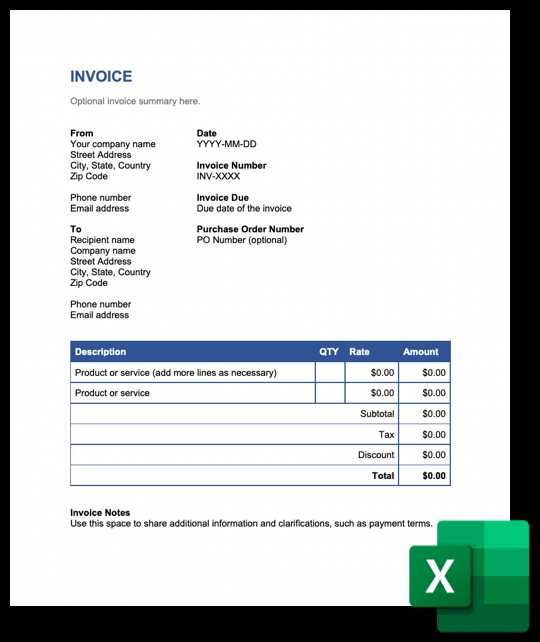

- Pre-made layouts for quick setup, saving you time.

- Customizable fields for entering specific details like amounts, dates, and terms.

- Simple editing options for modifying fonts, colors, and logos to match your brand.

- Automatic calculations for adding totals and taxes, streamlining the process.

- Professional design ensures a polished and clear presentation.

How to Access and Use the Tool

Accessing the form creation option is straightforward. Follow these steps:

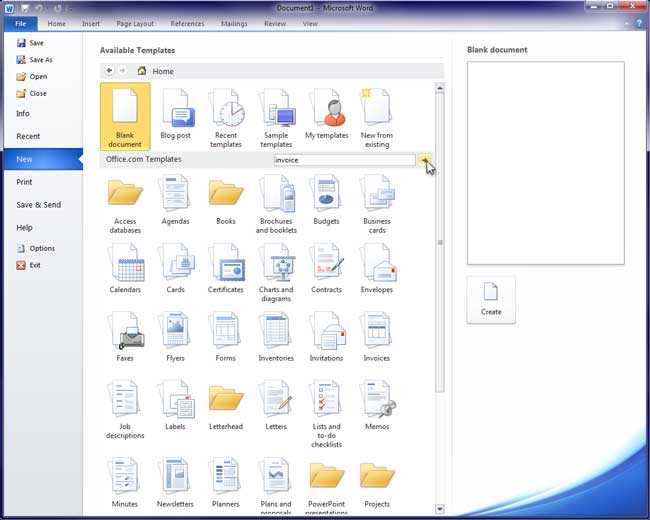

- Open the application and navigate to the File menu.

- Select New and choose from a variety of business forms available.

- Pick a suitable layout, then enter your details into the pre-designed fields.

- Modify text, add company logos, and adjust formatting as needed.

- Save and export your document as needed, ready for printing or sending electronically.

With these simple steps, you can create customized financial documents that reflect your business’s needs and maintain a professional image with minimal effort.

Why Choose Word for Invoices

When managing business transactions, having a reliable and efficient way to create formal documents is essential. Choosing the right tool for generating billing statements can significantly impact the speed and professionalism of your workflow. One popular option for creating such forms is a widely-used word processing program that offers an intuitive interface, ease of customization, and built-in design features.

Here are some reasons why this tool stands out as an excellent choice for preparing financial documents:

| Feature | Benefit |

|---|---|

| Ease of Use | Simple layout and editing options make it accessible to users of all skill levels. |

| Customizability | Ability to adjust fonts, colors, and logos ensures documents reflect your brand identity. |

| Pre-built Designs | Preformatted styles help you quickly create professional documents without starting from scratch. |

| Integration with Other Files | Easily combine data from spreadsheets, text files, or other documents for seamless workflows. |

| Wide Accessibility | Compatible with most devices and operating systems, making it easy to create and share documents on the go. |

By leveraging these advantages, businesses can produce polished and accurate records that streamline financial operations and help maintain a professional image with minimal effort. This straightforward approach allows you to focus on running your business, not worrying about complicated software or formatting issues.

How to Find Invoice Templates in Word

Creating professional billing statements doesn’t have to be a complicated process. One of the easiest ways to get started is by utilizing built-in resources available within the software. There are many pre-designed formats that can be easily accessed and customized to suit your business needs. By using the right tools, you can quickly find the perfect layout for your financial documents.

Accessing Pre-made Documents

To start, open the application and navigate to the document creation section. Once there, you can browse through a variety of pre-designed forms that can be adapted for your business purposes. These are typically available as part of the application’s built-in collection, making it quick and easy to find the ideal structure for your needs.

Follow these steps:

- Open the software and go to the File menu.

- Select New to access the template gallery.

- Use the search bar or browse categories to find options suitable for financial documents or billing purposes.

- Choose the desired layout and click to open.

- Customize the fields, such as payment terms, amounts, and other necessary details.

Using Online Resources

If you can’t find the exact design you’re looking for within the built-in options, there are many online sources offering free or premium formats that can be imported into the application. Simply download the document and customize it to meet your specific requirements. Many of these resources provide a wide range of styles to suit different business types.

By following these simple steps, you can quickly create professional documents tailored to your business’s needs without starting from scratch.

Customizing Your Invoice Template

Once you’ve selected a pre-designed form for creating billing documents, the next step is to personalize it to reflect your business’s unique identity. Customization allows you to tailor the layout, content, and design elements to ensure your documents meet your specific needs while maintaining a professional appearance. With a few simple adjustments, you can transform a generic document into one that perfectly suits your brand and workflow.

Key areas to focus on when customizing:

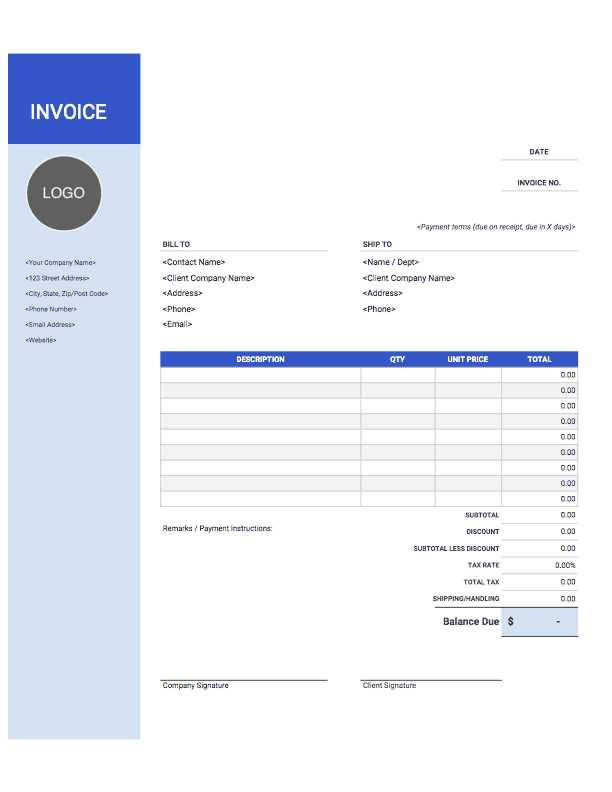

- Business Information: Ensure your company name, address, and contact details are clearly displayed at the top of the document. This helps clients easily identify who the billing is from and how to get in touch if needed.

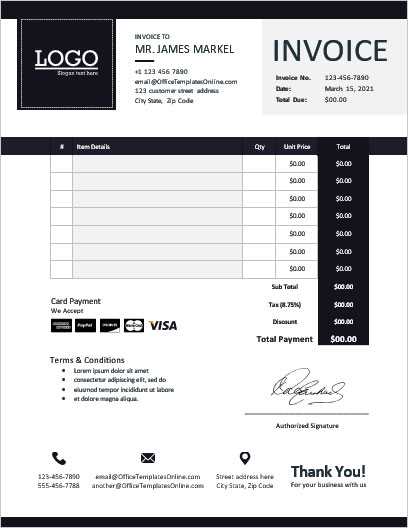

- Logos and Branding: Including your logo and brand colors is essential for consistency across your documents. This not only gives your business a professional image but also reinforces brand recognition.

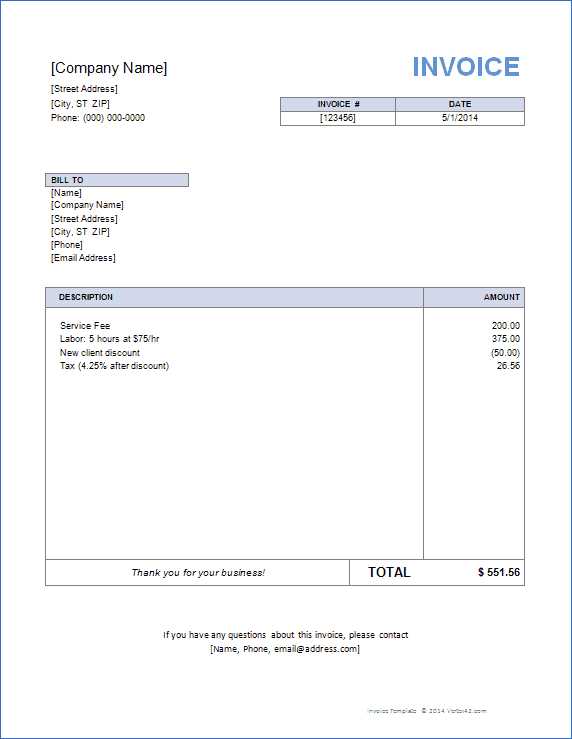

- Item Descriptions: Add detailed descriptions of the products or services being billed. This can include quantities, unit prices, and any relevant terms to avoid confusion.

- Payment Terms and Due Dates: Clearly specify payment instructions, deadlines, and any penalties for late payments. This sets clear expectations for your clients.

- Design and Layout: Adjust font sizes, colors, and alignment to ensure the document is visually appealing and easy to read. Be mindful of spacing and section breaks to avoid clutter.

Effective customization not only ensures that your documents are clear and professional but also helps in building trust with clients by presenting consistent, branded communication. By carefully editing the layout and content, you can create invoices that truly represent your business and facilitate smoother financial transactions.

Adding Company Details to Invoice

Including accurate company information on your billing documents is essential for maintaining professionalism and ensuring clarity for your clients. By adding relevant business details, such as your company name, address, and contact information, you make it easier for clients to verify the authenticity of the document and contact you if needed. This section outlines the key company details you should include and how to effectively format them on your billing forms.

Essential Company Information

At a minimum, your financial documents should display the following details:

| Information | Description |

|---|---|

| Company Name | Ensure your business name is prominently displayed at the top of the document for easy identification. |

| Business Address | List the physical location of your business or the address where invoices should be sent. |

| Contact Number | Provide a phone number for clients to reach you in case they have questions regarding the billing. |

| Email Address | Include a professional email address for correspondence or payment inquiries. |

| Website URL | If applicable, adding your website address can help clients find additional information about your business. |

Formatting Your Company Details

When placing your business information on the document, make sure it is clear and easily visible. Typically, this information is placed in the header section, either centered or aligned to the left or right. Ensure that there is enough spacing around the text to avoid a cluttered look. Using bold or larger fonts for key details, like the company name, can help them stand out.

By providing all necessary company details in a clean and organized manner, you ensure your clients have all the information they need for payment processing and future correspondence.

Formatting Tips for Professional Invoices

Formatting your financial documents correctly is essential for creating a professional appearance and ensuring that all necessary information is clear and easy to understand. Proper layout and structure not only enhance readability but also make it easier for your clients to find key details such as payment amounts, due dates, and terms. This section provides tips on how to format your billing documents to achieve a polished and consistent look.

Key Formatting Considerations

When creating a polished billing statement, focus on the following elements to ensure clarity and professionalism:

| Formatting Element | Tip |

|---|---|

| Font Style | Choose a clean, readable font such as Arial or Times New Roman. Avoid overly decorative fonts that can be hard to read. |

| Font Size | Use a font size of 10-12 points for body text and a larger size (14-16 points) for headings and important information like total amounts. |

| Alignment | Align text to the left for clarity, but use centered alignment for headings and your business name at the top of the document. |

| Spacing | Ensure there is enough space between sections to avoid a cluttered look. Use line breaks and paragraph spacing to separate different sections clearly. |

| Gridlines and Tables | Use gridlines or tables to clearly organize itemized lists, totals, and other key information. This improves legibility and ensures that all items are easy to follow. |

Additional Tips for Professional Appearance

Here are a few additional ways to enhance the overall presentation of your billing statements:

- Use borders around sections like totals or client information to make them stand out.

- Incorporate your company logo at the top to reinforce your brand image.

-

Inserting Payment Terms in Invoice

Clearly outlining payment terms in your billing documents is crucial for ensuring that both you and your clients are on the same page regarding the expectations for payment. By specifying when payment is due, the accepted methods of payment, and any late fees or discounts, you can avoid confusion and improve cash flow management. This section discusses how to effectively incorporate payment terms into your financial documents.

Here are the key elements to include when specifying payment terms:

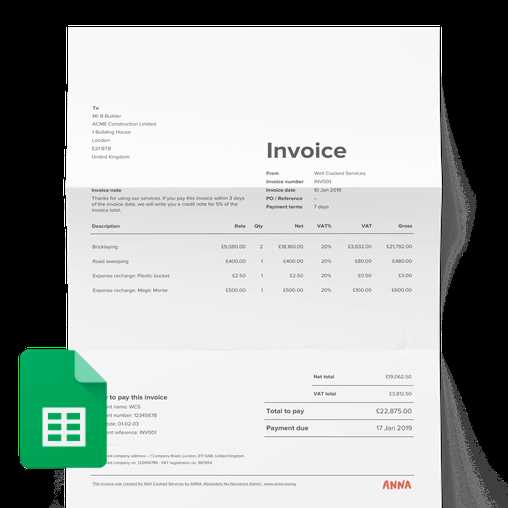

- Payment Due Date: Clearly state when the payment should be made. This could be a specific calendar date or a time frame (e.g., “30 days from the date of issue”).

- Accepted Payment Methods: Specify which methods of payment are acceptable, such as bank transfer, credit card, PayPal, or checks.

- Late Payment Fees: If applicable, include any penalties for overdue payments. For example, “A late fee of 1.5% per month will be applied to overdue balances.”

- Early Payment Discounts: If you offer any discounts for early payments, make sure to mention this as an incentive (e.g., “A 5% discount will be applied if payment is made within 10 days”).

- Invoice Number Reference: Specify the reference to include when making a payment, such as the invoice number or client ID.

Steps to add payment terms:

- Locate the section in the document where payment information is provided (usually near the bottom).

- Use a clear, bold heading such as “Payment Terms” or “Payment Instructions”.

- List the details in bullet points or a short paragraph for easy readability.

- Ensure that all terms are concise, unambiguous, and easy for the client to understand.

By including these payment terms in your documents, you create a transparent agreement that can help facilitate smoother financial transactions and reduce the risk of misunderst

Including Itemized Lists on Invoices

Providing a detailed breakdown of products or services in your financial documents not only enhances clarity but also helps avoid confusion or disputes. Itemized lists allow clients to see exactly what they are being charged for, including quantities, unit prices, and any applicable taxes. This transparency fosters trust and ensures that both parties are in agreement on the details of the transaction.

Key benefits of itemizing charges:

- Clarity: Clients can easily understand what they are being billed for, reducing the chances of misunderstandings.

- Professionalism: A well-organized list gives your documents a polished, transparent look.

- Accountability: It provides a record of the services or products provided, which can be useful for future reference or audits.

What to include in an itemized list:

- Item or Service Description: Provide a brief but clear description of each product or service.

- Quantity: Indicate how many units of a product or hours of a service were provided.

- Unit Price: List the price per unit or hourly rate.

- Subtotal: Include the total cost for each item or service before taxes or discounts are applied.

- Tax and Fees: Specify any applicable taxes or additional charges.

How to create an itemized list:

- Use a table format for easy organization, with columns for description, quantity, price, and total.

- Ensure each item is listed on its own line, with clear labels for each column.

- Calculate the total for each item and ensure that the sums are correct before finalizing the document.

- Double-check any taxes, discounts, or additional fees to ensure they are applied accurately.

Including an itemized list not only helps in

How to Save and Reuse Templates

Once you have created a document with the desired layout and content, it’s important to save it for future use. Reusing the same structure for recurring tasks such as billing or record-keeping can save time and ensure consistency across your documents. By saving your work as a reusable model, you eliminate the need to start from scratch each time, allowing for quick adjustments when necessary.

Steps to save your customized document:

- Save as a New File: After customizing the document, go to the File menu and select Save As. Choose a location on your computer or cloud storage, and save it with a descriptive name.

- Save as a Template: To ensure the document is reusable without overwriting previous work, save it in a special format for templates. This allows you to retain the structure without altering your original content.

- Choose the Right File Format: If you want the template to be universally accessible, choose the appropriate format (e.g., .dotx for templates) that will allow you to open and reuse it in the future with ease.

How to reuse your saved documents:

- Accessing Saved Files: Simply locate the saved template file and open it. You can then make edits, change details, and save it as a new document for each new client or transaction.

- Use Template Options: If you saved the document as a reusable model, select the option to create a new document based on the template. This ensures that the original design and layout are maintained, but you can adjust the specifics.

- Streamlined Workflow: By reusing templates, you reduce the time spent on formatting and design, allowing you to focus on updating essential details like client information and transaction amounts.

Saving and reusing templates helps maintain consistency, enhances efficiency, and ensures that all your documents are professional and aligned with your business standards.

Using Word’s Built-in Invoice Features

Many modern word processing programs come with built-in tools and features designed to simplify the process of creating professional documents. These features can save you time and effort, allowing you to focus on customizing the content rather than worrying about formatting. With a few simple clicks, you can access pre-designed forms and useful functions that enhance your ability to create accurate and polished billing statements.

Key built-in features that simplify document creation:

- Pre-Formatted Layouts: These ready-made layouts are designed specifically for financial documents and allow you to quickly create structured, easy-to-read forms. You can choose from various styles, including basic, detailed, and minimalist designs.

- Automatic Numbering: With automatic number generation, you can easily assign unique reference numbers to each document. This helps with organizing and tracking your transactions.

- Built-in Calculation Tools: Some word processing applications offer features that allow you to perform simple calculations within the document itself. This can be useful for adding up totals or calculating taxes without needing external tools.

- Formatting Consistency: Built-in themes ensure consistent font choices, colors, and alignment, making it easier to maintain a professional look across all your documents without manually adjusting these settings each time.

- Predefined Fields: Some programs have predefined fields for commonly used information, such as payment terms, client details, or business information, making it quicker to complete the document.

How to use these built-in features:

- Accessing Layouts: Start by selecting the “New Document” option and search for available layouts under categories like “Financial,” “Billing,” or “Business.” These templates will include spaces for all necessary information, and you can easily customize them to fit your needs.

- Using Automatic Numbering: Enable the document’s auto-numbering feature from the settings or layout options to keep track of your transactions without manually entering unique reference numbers.

- Utilizing Calculation Tools: For simple calculations like adding totals or applying taxes, use built-in tools or fields that automatically compute numbers based on your inputs, reducing the risk of e

Exporting Invoices as PDF Files

Once your financial documents are ready, it’s essential to save them in a format that preserves their formatting and ensures they can be easily shared with clients. Exporting your completed forms as PDF files allows you to maintain the integrity of the layout, while also making the document universally accessible and easy to view on any device. PDFs are widely recognized for their compatibility and security, making them an ideal choice for official documents.

Benefits of saving documents as PDFs:

- Consistent Formatting: PDFs preserve the exact layout, fonts, and images in the document, ensuring that the recipient sees the document exactly as you intended.

- Universal Compatibility: PDF files can be opened on nearly any device or operating system without the need for special software, making it a convenient choice for sharing.

- File Security: You can password-protect or encrypt PDFs to add an extra layer of security, ensuring sensitive information remains safe.

- Easy Sharing: PDFs are compact and easy to email or upload, ensuring hassle-free delivery to clients or colleagues.

Steps to export your document as a PDF:

- Complete Your Document: Ensure that all details are correct and the layout is as desired before exporting.

- Select “Save As”: Go to the File menu and choose Save As or Export, depending on the software you are using.

- Choose PDF Format: From the list of available file formats, select PDF as the output option.

- Save and Name the File: Choose a location to save the file, and give it a descriptive name (e.g., “Client_Name_Invoice_April2024.pdf”).

- Confirm Settings: Review any settings related to compression, quality, or security before finalizing the export.

Exporting your documents as PDF files ensures they are easy to share, secure, and professionally formatted. It also helps maintain consistency across various platforms and devices.

Common Mistakes in Invoice Creation

Creating billing documents can sometimes be a complex process, and even small errors can lead to confusion or delayed payments. It is crucial to ensure that every detail is accurate and clearly presented. Common mistakes often arise from overlooked details or rushed work, which can impact both the professionalism of the document and the overall payment process.

Frequent Errors in Billing Documents

- Incorrect or Missing Contact Information: Failing to include accurate client or business details, such as the company name, address, or contact number, can delay communication and payment processing.

- Missing Payment Due Dates: Not specifying a clear due date for payment can lead to confusion or delayed responses. Always include a specific payment term to set expectations.

- Unclear Payment Terms: Vague descriptions of payment methods, such as “pay when you can,” can create misunderstandings. Be explicit about due dates, late fees, and accepted payment methods.

- Omitting Tax or Additional Charges: Forgetting to include taxes or extra charges, such as shipping fees, can cause discrepancies in the final amount due. Always double-check that these figures are added.

- Not Using Unique Invoice Numbers: Using the same number for multiple documents can lead to confusion and difficulty in tracking payments. Make sure each document has a unique reference number for easy identification.

- Errors in Totals or Calculations: Simple mathematical errors can lead to incorrect billing. Always double-check subtotals, taxes, and the final total before sending the document.

- Unprofessional Formatting: A cluttered or difficult-to-read layout can make it hard for clients to find essential information. Ensure the document is clean and well-organized, with adequate spacing and clear headings.

How to Avoid These Mistakes

- Double-Check Details: Before sending any document, take time to review all the client information, dates, and amounts.

- Use Pre-Formatted Layouts: Templates or preset formats can help you ensure consistency and minimize errors by providing a clear structure to follow.

- Automate Calculations: Use built-in tools to automate subtotals and tax calculations, ensuring accuracy and reducing the risk of errors.

By being mindful of

Integrating Logos and Branding in Word

Including your company’s logo and brand elements in your documents not only enhances their professional appearance but also reinforces brand identity. By strategically placing your logo and using consistent colors, fonts, and design elements, you create a cohesive and recognizable experience for clients. This helps in establishing a strong visual presence and promotes trust in your business.

Benefits of incorporating branding elements:

- Professional Appearance: A branded document looks polished and well-prepared, making a positive impression on clients and business partners.

- Consistency: Consistently using your logo and brand colors across all communications ensures that your business is easily recognizable.

- Increased Trust: A professional, branded document adds credibility and signals that your business is established and trustworthy.

Steps to integrate logos and branding in your documents:

- Insert Your Logo: To insert a logo, go to the Insert menu and select Picture or Logo. Choose the file from your computer or cloud storage, and position it where it fits best, such as in the header or at the top of the page.

- Apply Brand Colors: Use your company’s color palette to customize headings, borders, and other design elements. This can be done by adjusting the Theme or Color settings in the design options.

- Choose Consistent Fonts: Select fonts that align with your brand’s style guide. Consistent font choices across your documents will further strengthen your brand identity.

- Use a Header/Footer: Place your logo in the header or footer of your document to ensure it appears on every page, giving the document a consistent look.

Tips for effective logo and branding integration:

- Keep It Simple: Avoid cluttering the document with excessive branding elements. Your logo and key design elements should be clear and uncluttered.

- Make it Readable: Ensure your brand colors and logo do not interfere with the readab

Ensuring Accuracy and Completeness in Documents

Creating precise and comprehensive financial documents is crucial for maintaining smooth transactions and fostering trust with clients. Any missing or incorrect details can lead to misunderstandings, payment delays, or even disputes. It’s important to double-check every section of your document to ensure all necessary information is included and that the content is correct before sending it out.

Key Areas to Focus on for Accuracy:

- Client and Business Information: Double-check the recipient’s name, address, and contact details, as well as your own company’s information. Mistakes in these areas can lead to confusion or payments being sent to the wrong address.

- Dates and Deadlines: Ensure that both the issue date and payment due date are clearly stated and accurate. Incorrect or vague dates can cause delays or miscommunication about when payments are expected.

- Payment Terms and Methods: Be specific about how payments can be made (e.g., bank transfer, credit card, online payment) and include any relevant payment terms, such as late fees or discounts for early payments.

- Accurate Pricing: Double-check that all unit prices, quantities, and totals are correct. Simple errors in numbers can lead to overcharging or undercharging your clients.

Steps to Ensure Completeness:

- Include All Relevant Information: Make sure to include everything necessary for the transaction, such as a detailed breakdown of services or products, applicable taxes, shipping costs, and any additional charges.

- Use Clear Descriptions: Be specific about what is being charged for, whether it’s products, services, or both. Avoid using vague terms that could be misinterpreted.

- Check for Consistency: Ensure that all figures, such as totals and discounts, match the information throughout the document. Cross-reference the amounts with any internal records to avoid discrepancies.

Best Practices for Verifying Documents:

- Review and Proofread: Always take time to carefully review and proofread your document. Even minor spelling or grammatical errors can create an impression of carelessness.

- Use Automation Tools: If available, leverage automatic calculation tools to minimize the chance of human error when adding or subtracting figures.

Document Security and Protection

When dealing with financial documents, ensuring their security is essential. These documents often contain sensitive information that could be misused if accessed by unauthorized individuals. Protecting your documents not only preserves the confidentiality of your business but also safeguards against potential fraud and misuse. It’s important to take steps to limit access to these files and ensure their integrity, especially when sharing them with clients or other parties.

Methods to Protect Your Documents:

- Password Protection: Adding a password to your document is one of the easiest and most effective ways to prevent unauthorized access. This ensures that only those with the password can open or make changes to the file.

- File Encryption: For added security, you can encrypt your document. This makes it nearly impossible for unauthorized users to view or modify the contents, even if they have access to the file.

- Limit Editing Permissions: You can restrict editing rights in the document, allowing others to only view the file without making changes. This is especially useful for preventing unauthorized modifications.

- Digital Signatures: Digital signatures provide a way to verify the authenticity of your document. By signing your file electronically, you can ensure that the document hasn’t been tampered with after it was created.

Tips for Safe Document Sharing:

- Use Secure Channels: When sending documents, ensure that you use encrypted email or secure file-sharing platforms. This minimizes the risk of your file being intercepted during transmission.

- Regularly Backup Files: Keep secure backups of your important documents to prevent data loss in case of a system failure or accidental deletion.

- Monitor Access: If you are working with a team, monitor who has access to your documents and regularly update permissions to ensure that only authorized personnel can view or edit sensitive files.

Preventing Unauthorized Sharing:

- Watermarking: Adding a watermark to your document can discourage unauthorized copying or distribution. This visual cue reminds recipients of the document’s confidential nature.

- Set Expiry Dates: For extra security, set expiration dates on documents or access permissions, ensuring that they are no longer available after a certain time period.

By implementing these secu

Why Invoice Templates Save Time

Creating financial documents from scratch can be a time-consuming task, especially when you need to generate them regularly. However, by using pre-designed formats, much of the work can be automated, allowing you to focus on other aspects of your business. These ready-made structures eliminate the need to repeatedly format and arrange the same sections, significantly speeding up the process.

Key Time-Saving Benefits of Pre-Formatted Documents

- Consistent Structure: Using a standard layout ensures that every document follows the same structure, making the creation process faster and reducing the chances of forgetting important details.

- Automatic Calculation: Many pre-designed formats include built-in fields for adding prices, taxes, and totals. This automation helps to avoid manual calculations, saving both time and reducing the risk of errors.

- Customizable Elements: While the layout is set, these formats often allow you to easily update client details, payment terms, or other specific information without having to adjust the overall design every time.

How Pre-Made Structures Help You Work More Efficiently

- Faster Document Creation: With predefined sections, you no longer need to spend time reformatting or rearranging content. Simply input the necessary data, and the document is ready to send.

- Reduced Errors: A consistent design minimizes the chances of overlooking critical information, ensuring that important details such as due dates or payment methods are always included correctly.

- More Time for Core Activities: By speeding up the process of creating financial documents, you free up time to focus on more valuable business tasks, such as customer relations or business development.

By adopting a streamlined approach through pre-formatted designs, you save valuable time while ensuring that your documents remain accurate, professional, and consistent with each use.

Best Practices for Sending Invoices

Sending professional financial documents is an important aspect of maintaining good relationships with clients and ensuring timely payments. It’s crucial to follow certain guidelines to ensure your documents are clear, accessible, and processed efficiently. By adopting best practices for delivering these records, you can reduce delays and avoid confusion, ultimately enhancing the overall client experience.

Key Steps for Effective Document Delivery:

- Use a Professional Format: Ensure that your document is clearly organized, with all necessary details such as the recipient’s information, payment terms, and itemized charges. A well-structured document will make it easier for your client to review and approve the payment.

- Double-Check Accuracy: Before sending any document, carefully verify all details, such as amounts, dates, and payment instructions. Sending incorrect information can delay payments and harm your professional reputation.

- Choose the Right Delivery Method: Select the most appropriate and secure way to send the document based on your client’s preferences. This could be through email, secure file-sharing platforms, or even traditional mail. Electronic methods are generally quicker, but some clients may prefer printed copies.

- Provide Clear Payment Instructions: Always specify how payments should be made, whether by bank transfer, credit card, or another method. The easier it is for clients to understand how to pay, the faster the transaction will be completed.

Additional Tips for Successful Document Distribution:

- Send Early: Whenever possible, send your documents well in advance of the due date. This gives the recipient plenty of time to review and process the payment without feeling rushed.

- Follow Up: If you haven’t received a response by the due date, don’t hesitate to send a polite reminder. A courteous follow-up can help keep payments on track and maintain positive relationships.

- Ensure Accessibility: When sending electronic files, make sure they are in an easy-to-access format (such as PDF) that can be opened across different devices and operating systems. Avoid using uncommon file types that may cause issues for the recipient.

By implementing these best practices, you streamline the process of sending financial records, ensuring clarity, efficie