Free Basic Service Invoice Template for Simple Billing

Handling payments and managing financial records is a key part of running a business. For many professionals, creating organized and accurate payment documents ensures that both client and provider have clear expectations. A straightforward layout can make the billing process smooth and reduce misunderstandings.

Using a pre-designed format for these financial documents can save time and effort, allowing professionals to focus more on their work and less on administrative details. With a clear, easy-to-fill structure, these documents help businesses maintain a professional image while making the payment process easier for clients.

Creating a payment document that suits specific needs can also simplify tracking and managing income. An adaptable design can cater to various industries, making it versatile and helpful for many. Whether working independently or with a small team, a well-crafted billing format helps ensure every transaction is clearly documented.

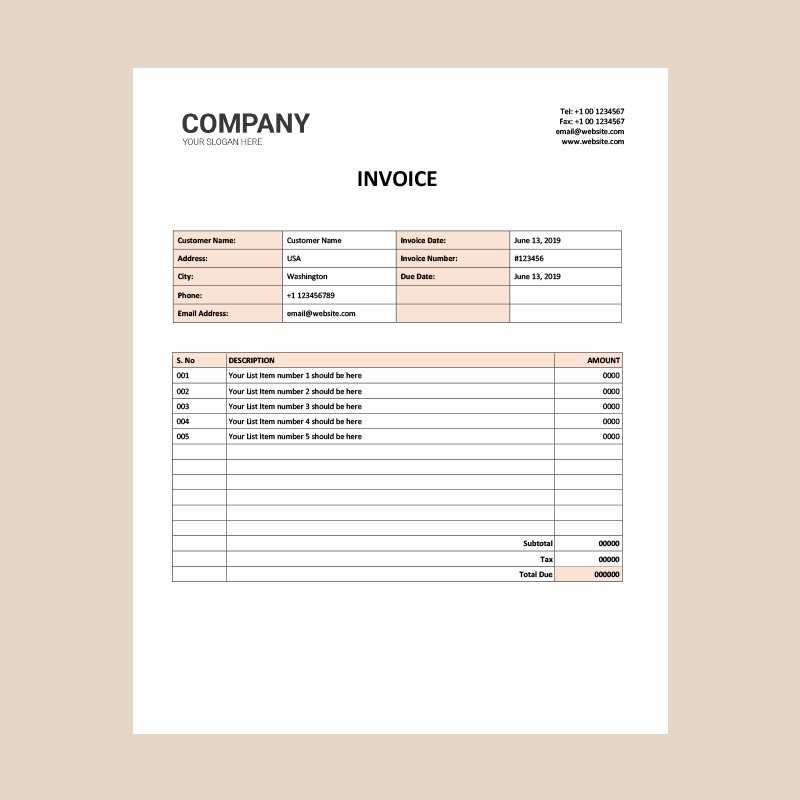

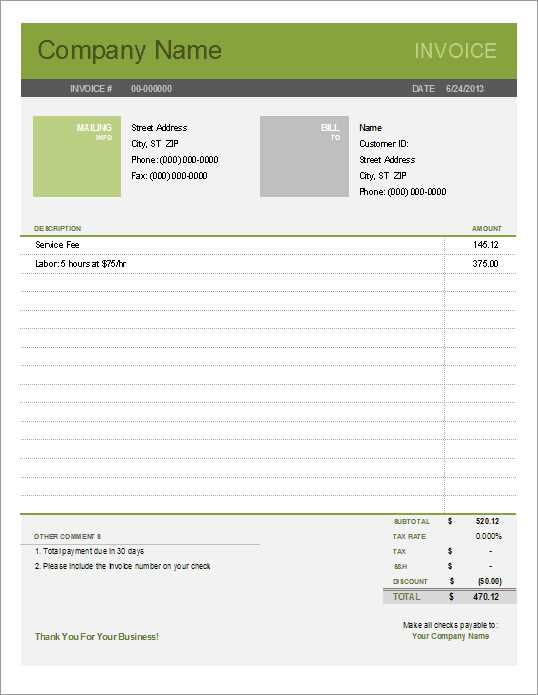

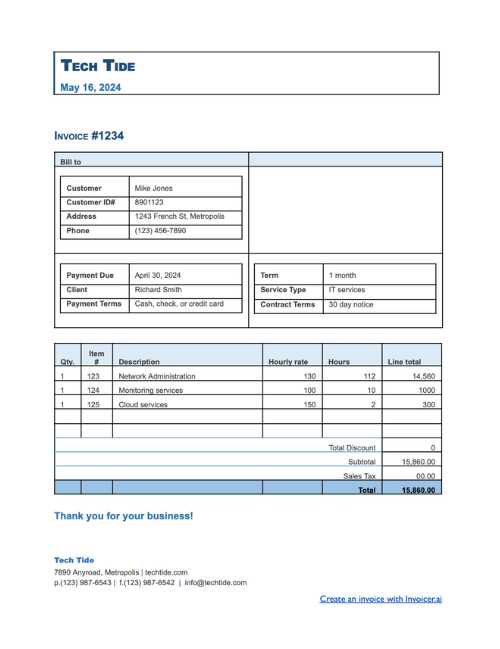

Creating a Simple Service Invoice Template

Crafting a structured billing document doesn’t need to be complex. A clear, concise format can streamline the payment process for both the business and its clients, ensuring that all relevant details are easily accessible. An effective document captures essential transaction details in a way that is both professional and straightforward.

Key Elements to Include

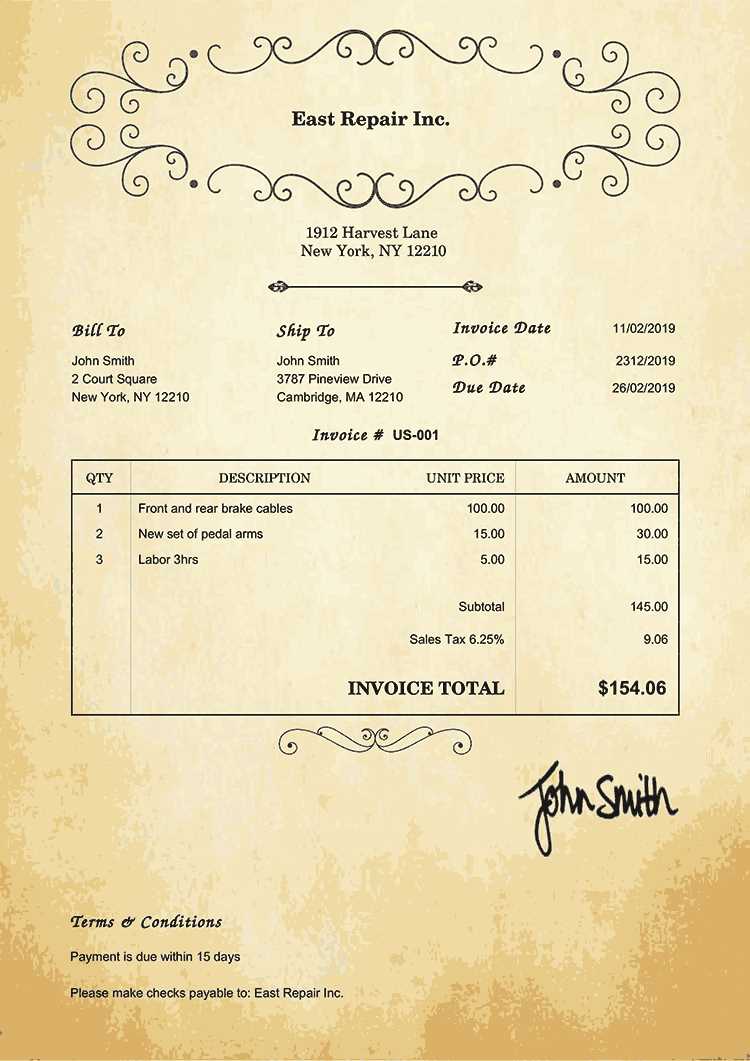

When designing this type of document, several core elements should be included to ensure clarity and completeness:

- Contact Information: Both your business information and the client’s details, such as names, addresses, and phone numbers, should be clearly presented.

- Service Description: List each item or service provided, along with a brief description, so that clients understand what they’re being charged for.

- Amount Due: Show the total amount, including any additional charges or discounts applied, so there are no surprises for the client.

- Time Savings: A pre-made layout removes the need to design a new document from scratch, allowing you to complete your billing tasks quickly and move on to other priorities.

- Consistency: Using the same format for each transaction adds a professional touch, reinforcing your brand identity and maintaining a clear, consistent look for your records.

- Accuracy: With designated fields for each necessary detail, pre-designed formats help prevent overlooked information and improve the accuracy of each document.

- Easy Customization: These layouts are often adaptable, allowing you to adjust fields, colors, and fonts to align with your branding without extensive effort.

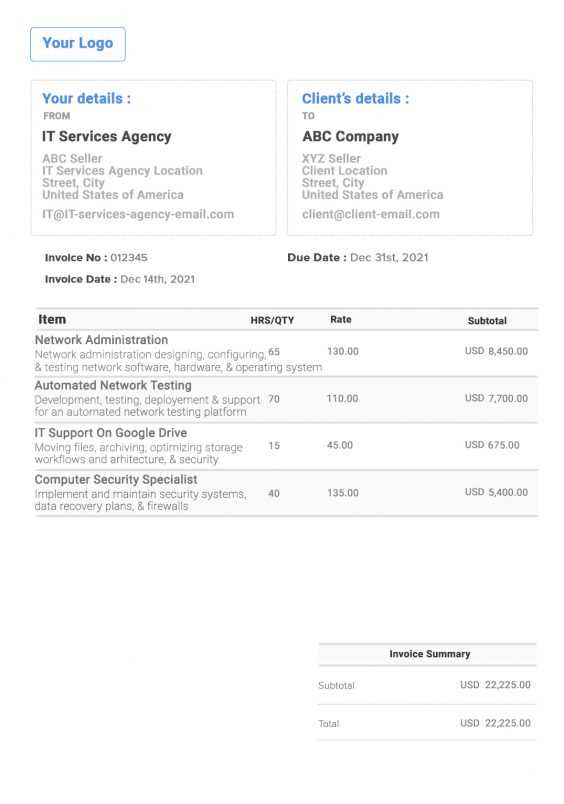

Essential Elements of a Service Invoice

A well-crafted billing document not only communicates charges clearly but also establishes a professional standard for business transactions. It is important to include specific details that help both you and your client understand the nature of the work provided, the cost breakdown, and any payment expectations. These elements work together to reduce confusion and enhance trust in financial exchanges.

Contact Details: Always include your business name, address, phone number, and email, along with your client’s contact information. This ensures both parties have the information needed for communication and record-keeping.

Description of Work: A detailed list of provided work or items is essential. Include descriptions that outline each service or product, providing a clear view of what each cost covers.

Pricing and Totals: List individual charges for each item or service, followed by a subtotal and a final amount due. Be sure to include any taxes, discounts, or additional fees for transparency.

Payment Instructions: Specify how clients can settle their balance, whether by bank transfer, credit card, or another method. Clear instructions help streamline the process and avoid payment delays.

Due Date: Adding a payment deadline encourages timely responses and keeps financial plans on track. Highlight this date to ensure it’s easily noticed.

Document Number: A uni

Why Use a Free Template for Billing

For businesses and freelancers, keeping track of financial records and managing payments efficiently is essential. Using a pre-designed billing layout can simplify the process, saving time and reducing the likelihood of errors. A ready-made structure provides an organized framework that ensures all necessary details are included, helping you focus more on your work and less on paperwork.

Benefits of Pre-Designed Billing Layouts

Opting for a structured format offers several advantages that can make a big difference in everyday business management:

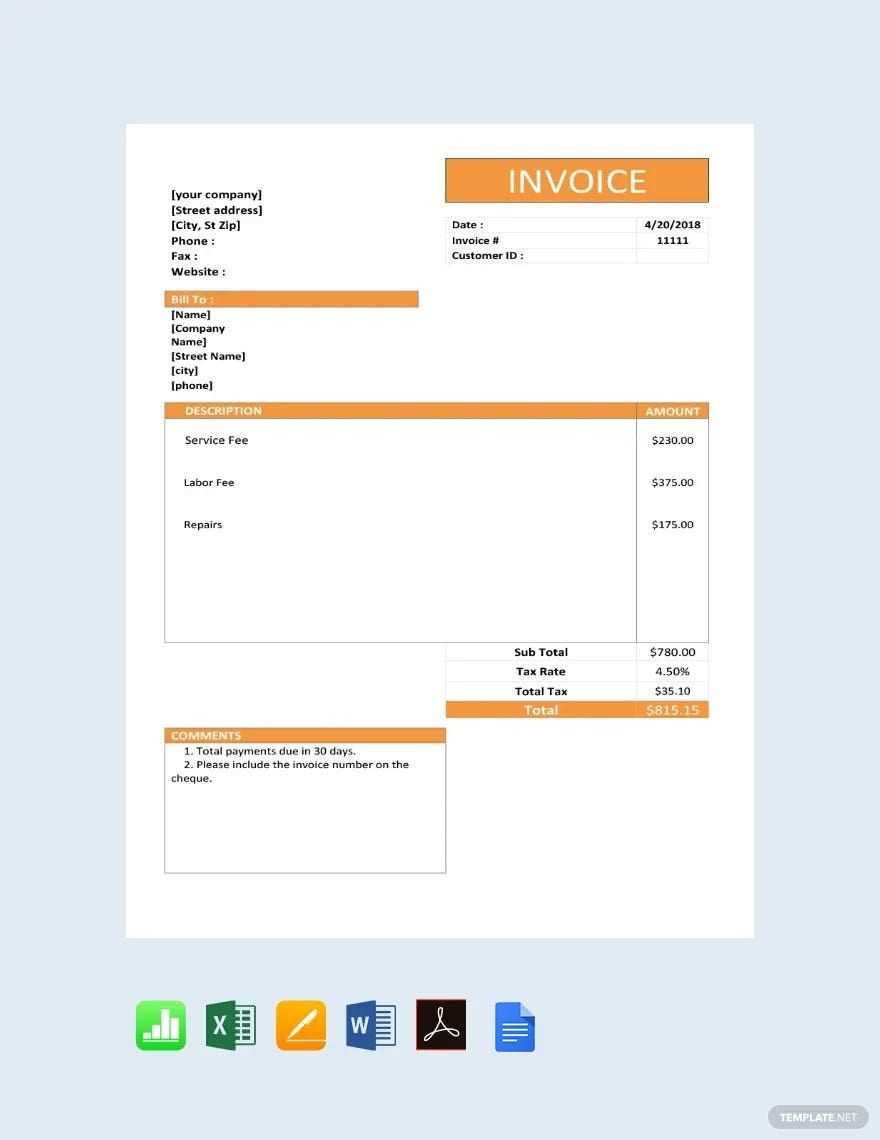

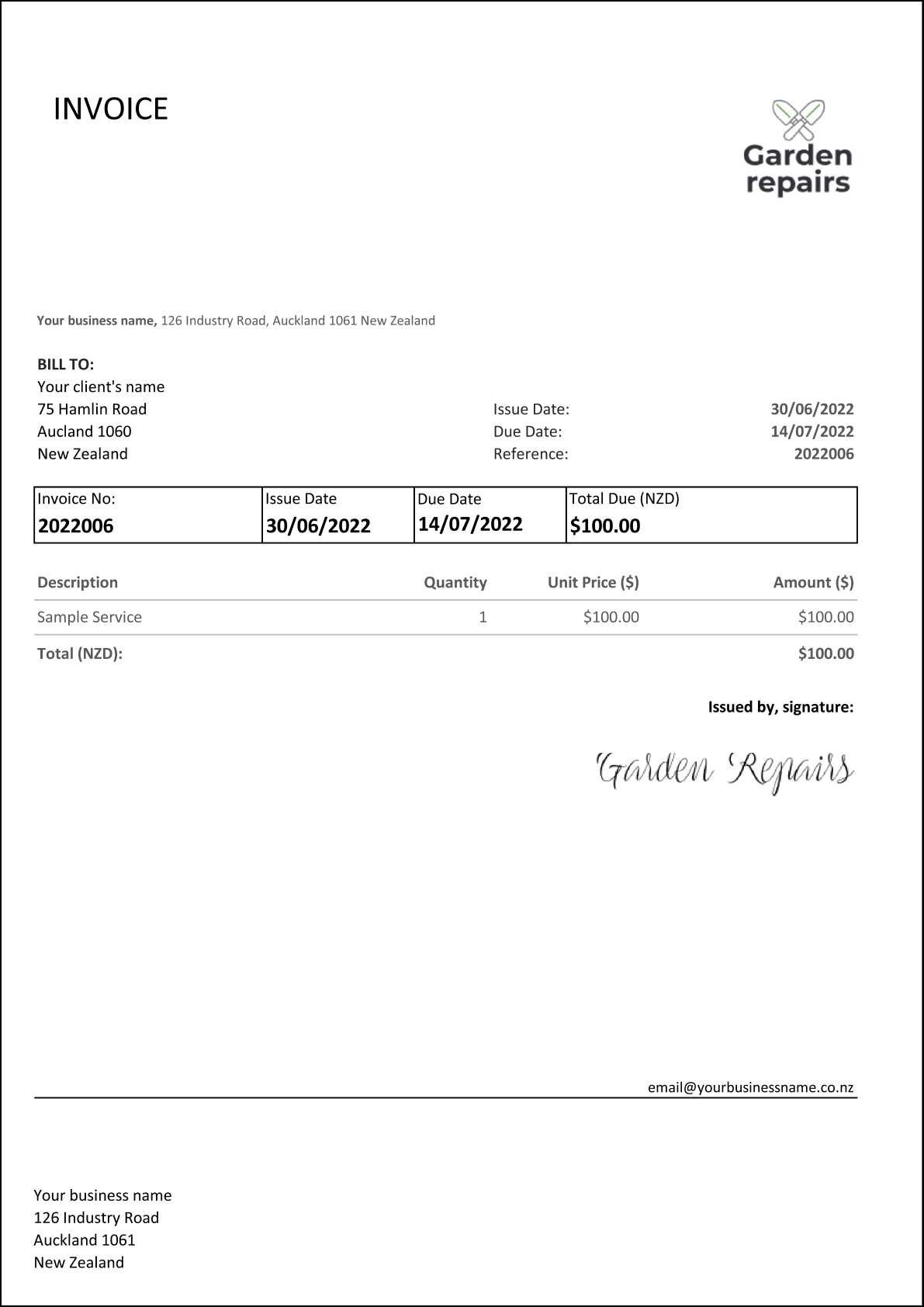

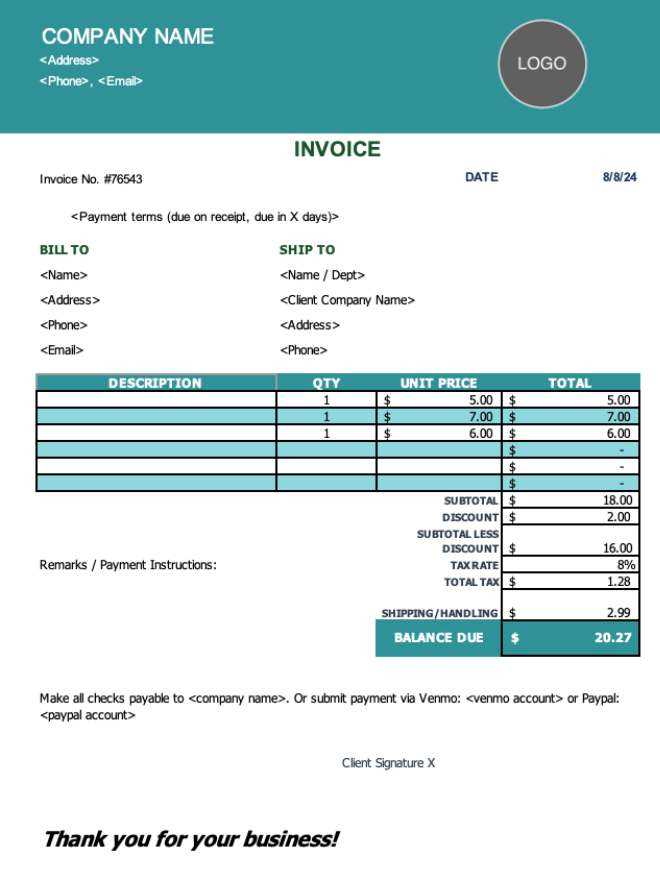

How to Customize Your Invoice Layout

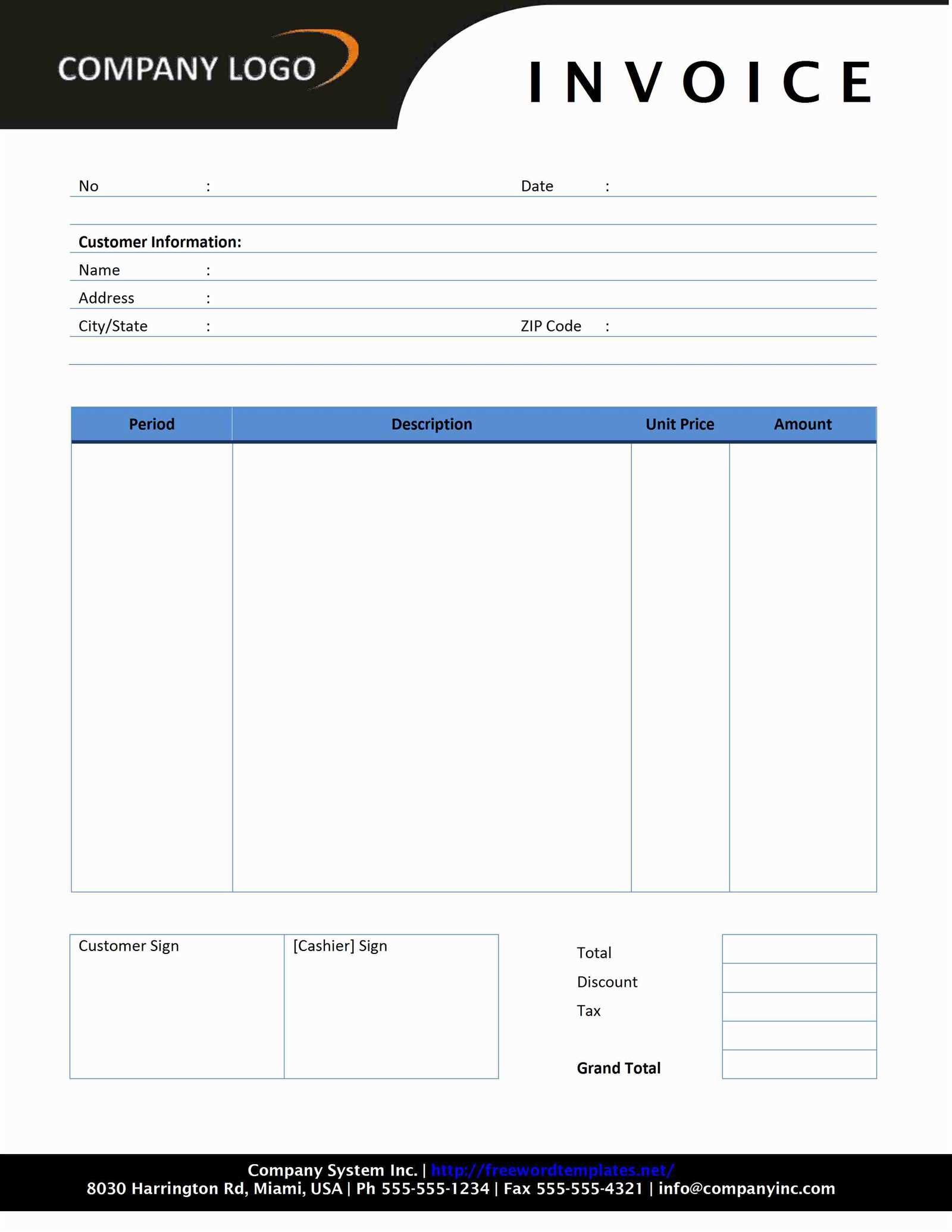

Personalizing your billing document layout can enhance your brand’s professionalism and ensure that each detail aligns with your business’s unique needs. Customization options allow you to create a look that not only represents your brand but also makes it easier for clients to understand and follow the document.

Steps for Tailoring Your Document

Here are some practical ways to adjust your layout to fit your style and requirements:

- Add Your Branding: Incorporate your logo, brand colors, and fonts to make the document recognizable. Consistent branding reinforces your business identity and adds a professional touch.

- Organize Key Details: Structure sections such as contact information, itemized lists, and payment details for easy reading. Placing essential sections in a logical order can streamline the review process for clients.

- Adjust Fonts and Colors:

How to Customize Your Invoice Layout

Personalizing your billing document layout can enhance your brand’s professionalism and ensure that each detail aligns with your business’s unique needs. Customization options allow you to create a look that not only represents your brand but also makes it easier for clients to understand and follow the document.

Steps for Tailoring Your Document

Here are some practical ways to adjust your layout to fit your style and requirements:

- Add Your Branding: Incorporate your logo, brand colors, and fonts to make the document recognizable. Consistent branding reinforces your business identity and adds a professional touch.

- Organize Key Details: Structure sections such as contact information, itemized lists, and payment details for easy reading. Placing essential sections in a logical order can streamline the review process for clients.

- Adjust Fonts and Colors: Choose fonts and color schemes that align with your brand, but keep readability in mind. A clean, readable design is key to ensuring clients can navigate the document easily.

- Include Personalized Notes: Adding a custom message, like a thank-you note or brief payment reminder, can improve client relations and make the document feel more personal.

Enhancing Functionality with Custom Fields

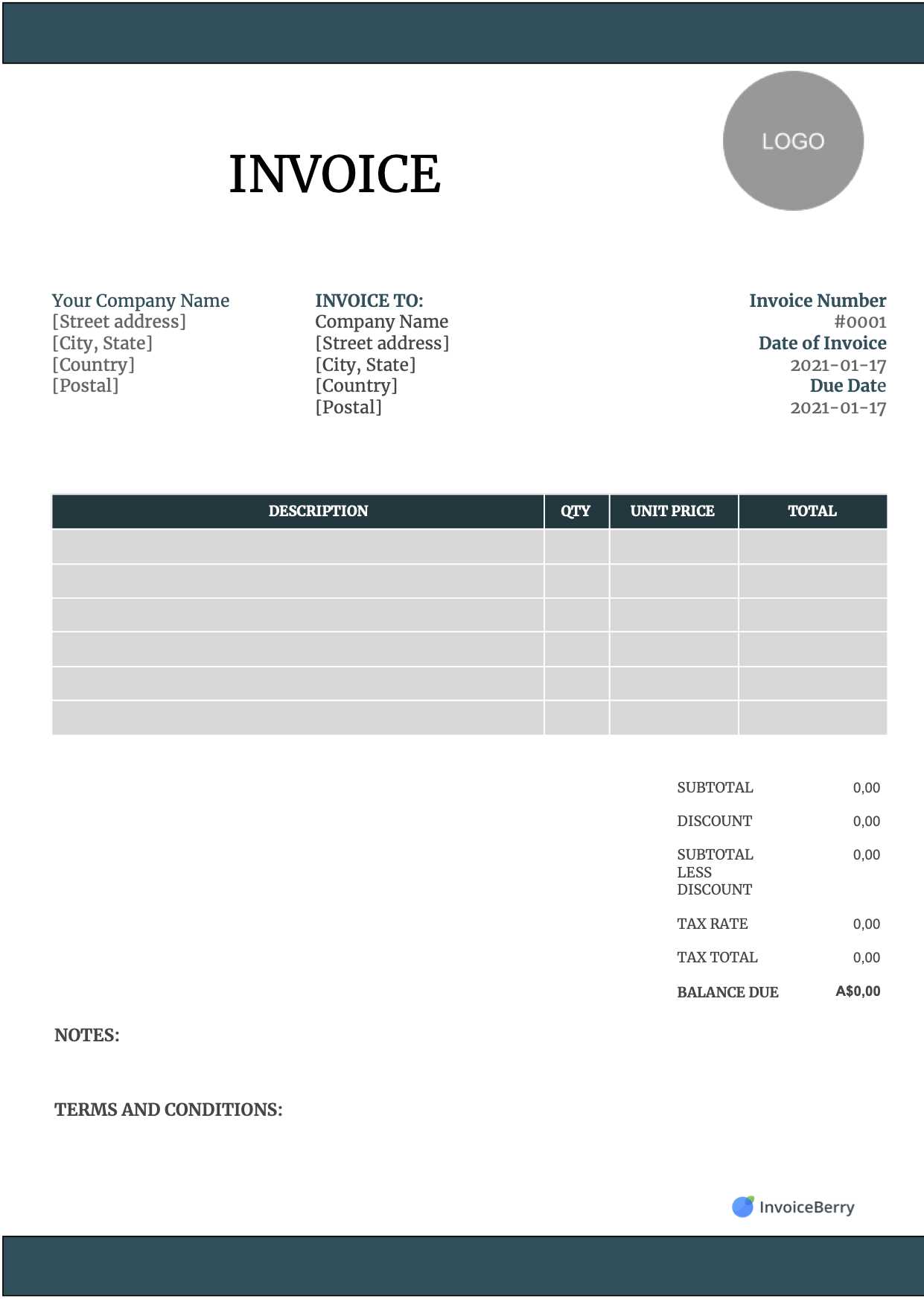

To make your layout even more useful, consider adding fields that reflect your specific business needs:

- Project Details: For service-based businesses, including a section for project descriptions or hours worked can clarify the services provided.

- Terms and Policies: Customize a section for payment terms, late fees, or refund policies, so clients are informed about any conditions related to the payment.

- Payment Links: If you accept digital payments, adding a link or QR code for direct payment can simplify the process for clients and speed up the transaction.

Customizing your billing document allows you to create a professional, functional, and on-brand layout that meets your needs while enhancing your clients’ experience. Thoughtful adjustments not only improve organization but also showcase your business’s commitment to detail.

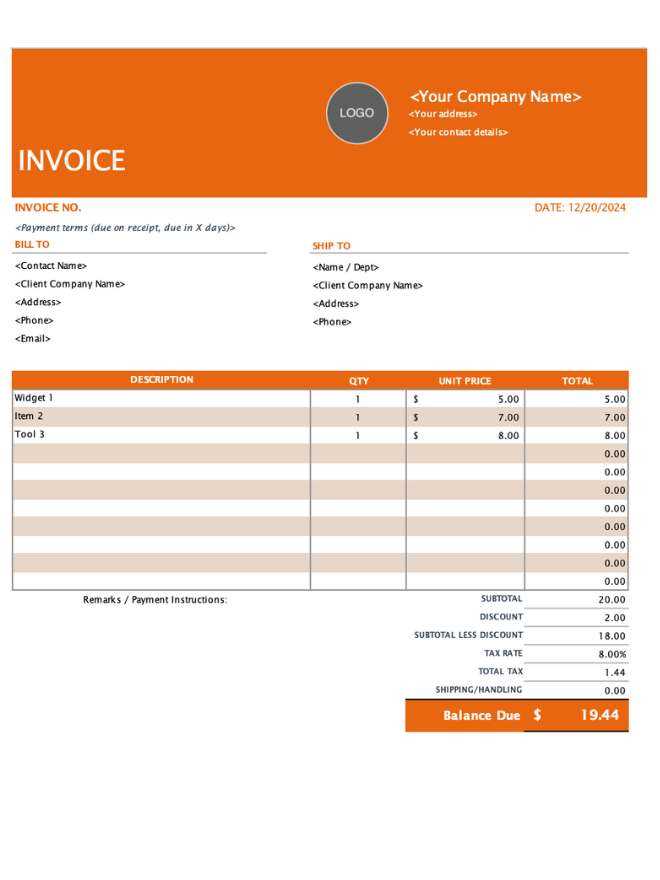

Streamlining Payments with a Clear Invoice

A well-organized billing document helps simplify the payment process, ensuring clients can easily understand charges and payment expectations. By arranging information clearly, you can prevent misunderstandings and encourage prompt responses. A thoughtfully structured layout with defined sections allows clients to quickly review the document and make timely payments.

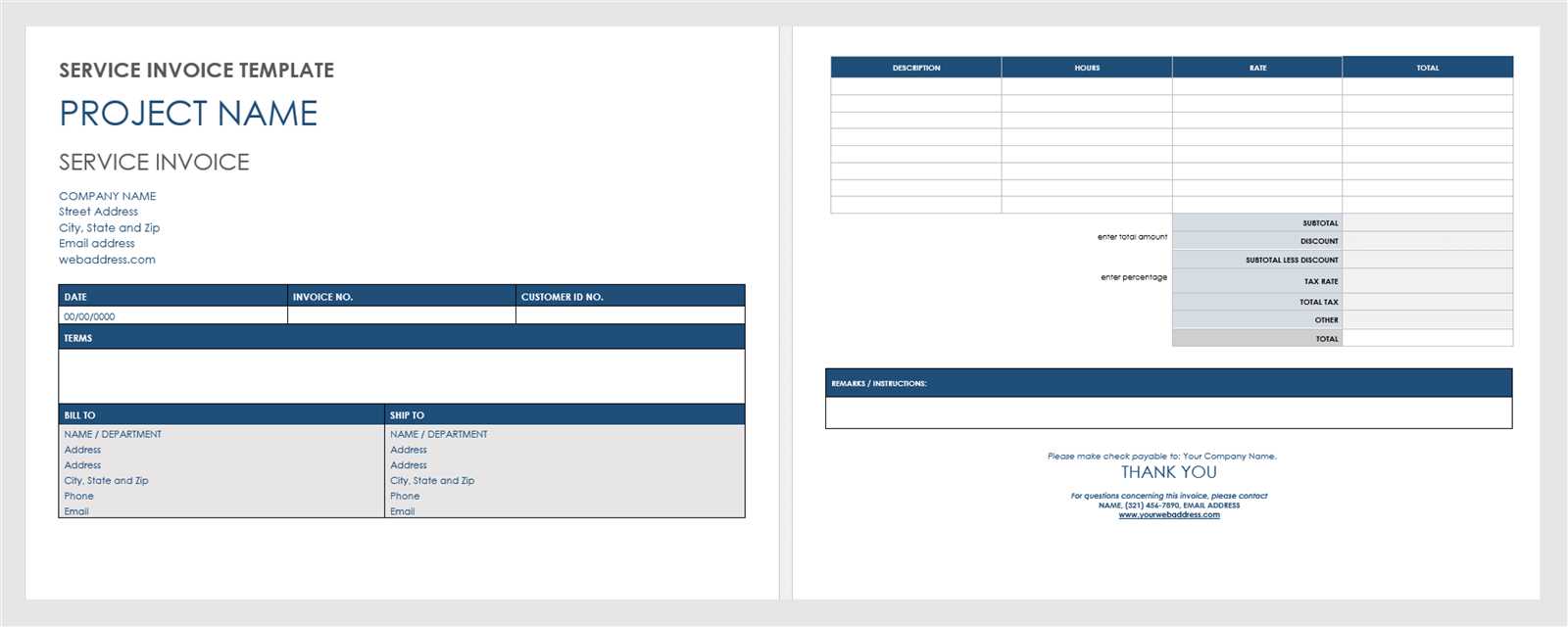

Using a table can be especially effective for organizing detailed charges, making each item and its cost easy to identify at a glance. Here’s an example of how to organize key sections for a clear, professional look:

Description Quantity Unit Price Total Consulting Hours 10 $50 $500 Materials 1 $200 $200 Streamlining Payments with a Clear Invoice

A well-organized billing document helps simplify the payment process, ensuring clients can easily understand charges and payment expectations. By arranging information clearly, you can prevent misunderstandings and encourage prompt responses. A thoughtfully structured layout with defined sections allows clients to quickly review the document and make timely payments.

Using a table can be especially effective for organizing detailed charges, making each item and its cost easy to identify at a glance. Here’s an example of how to organize key sections for a clear, professional look:

Description Quantity Unit Price Total Consulting Hours 10 $50 $500 Materials 1 $200 $200 Subtotal $700 Tax (5%) $35 Total Due $735 By breaking down each part of the cost, you provide transparency and avoid potential questions regarding the payment amount. This format not only improves readability but also helps clients feel assured that they understand what they are paying for. Additionally, ensuring consistency in your layout across all documents fosters a professional image that reinforces trust and reliability.

In summary, clarity and organization in your billing approach can significantly reduce delays and streamline the payment process, leading to improved cash flow and stronger client relationships.

Making Your Invoice Client-Friendly

Creating a document that is easy for clients to understand and navigate can greatly improve communication and payment efficiency. A clear and well-structured layout ensures that clients can quickly locate the details they need, reducing confusion and the likelihood of delays. Prioritizing simplicity and clarity fosters a positive experience and encourages prompt payment.

Here are some key elements that can make your billing document more accessible to clients:

- Clear Formatting: Use a simple and organized structure with easily distinguishable sections. Bold headings and ample spacing make the document easier to read and navigate.

- Itemized Breakdown: Clearly list the individual charges, including any applicable taxes or fees. This transparency helps clients understand exactly what they are paying for and can prevent misunderstandings.

- Easy-to-Find Payment Details: Place the payment instructions and due date in a prominent position. Clients should have no trouble locating this information to ensure timely payment.

- Contact Information: Ensure that your contact details are clearly visible. This gives clients an easy way to reach out in case they have questions or need assistance.

- Personalized Messages: Adding a friendly note, such as a thank-you message or a reminder about payment terms, can make the document feel more personal and approachable.

By focusing on simplicity and accessibility, you can create a more client-friendly document that reduces confusion and enhances your business’s professionalism. A well-crafted billing document builds trust with clients, ensuring that they feel comfortable and confident throughout the transaction process.

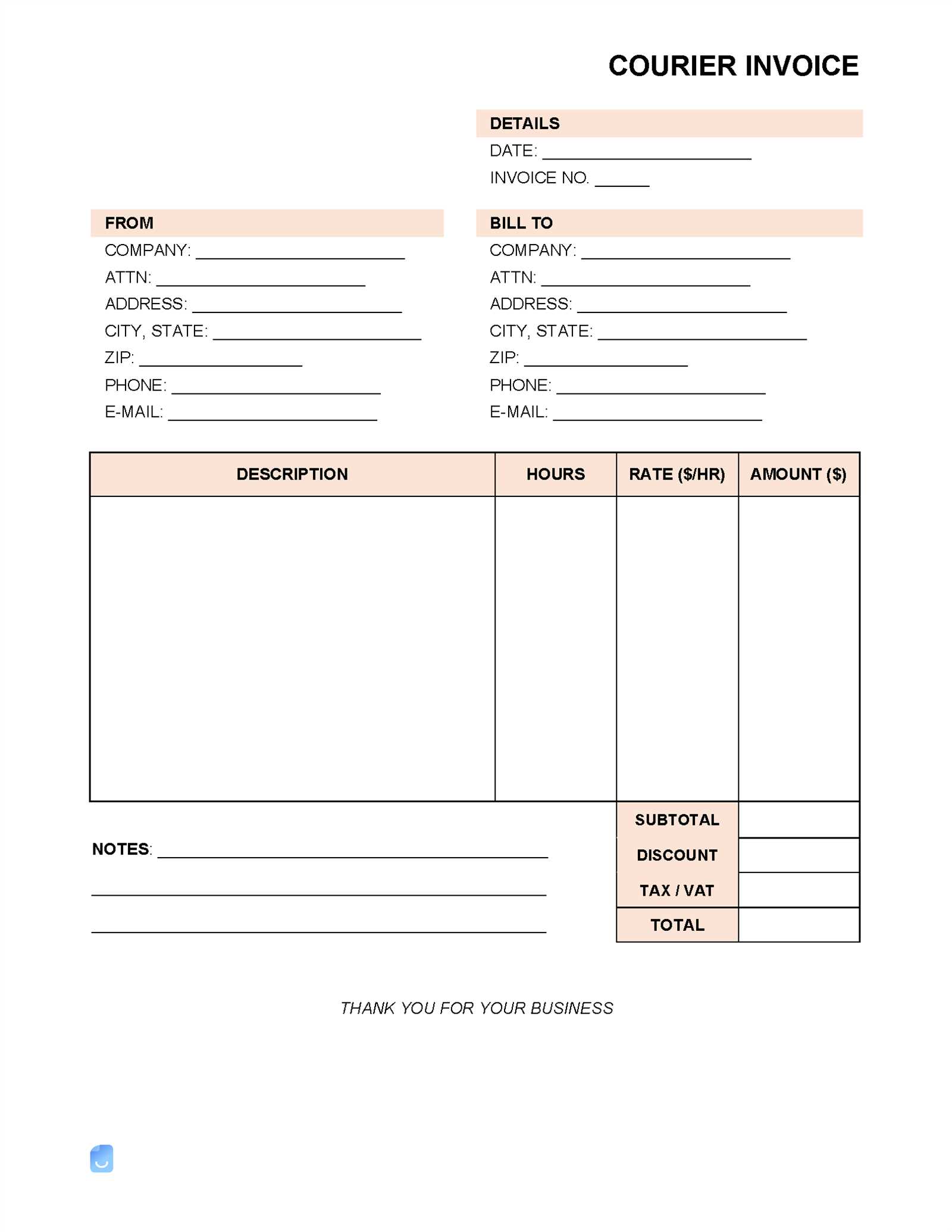

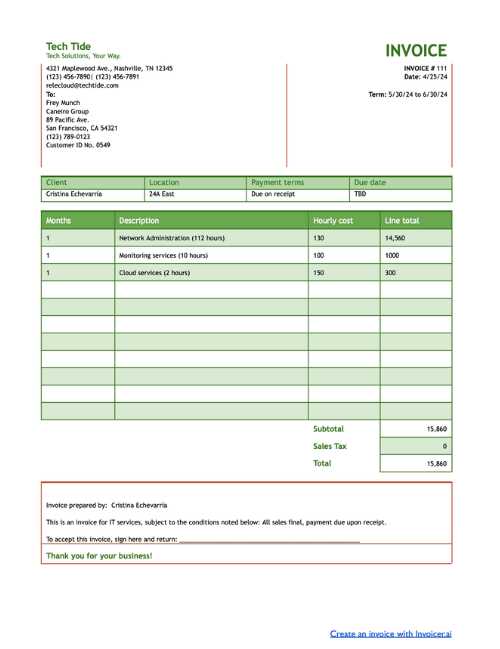

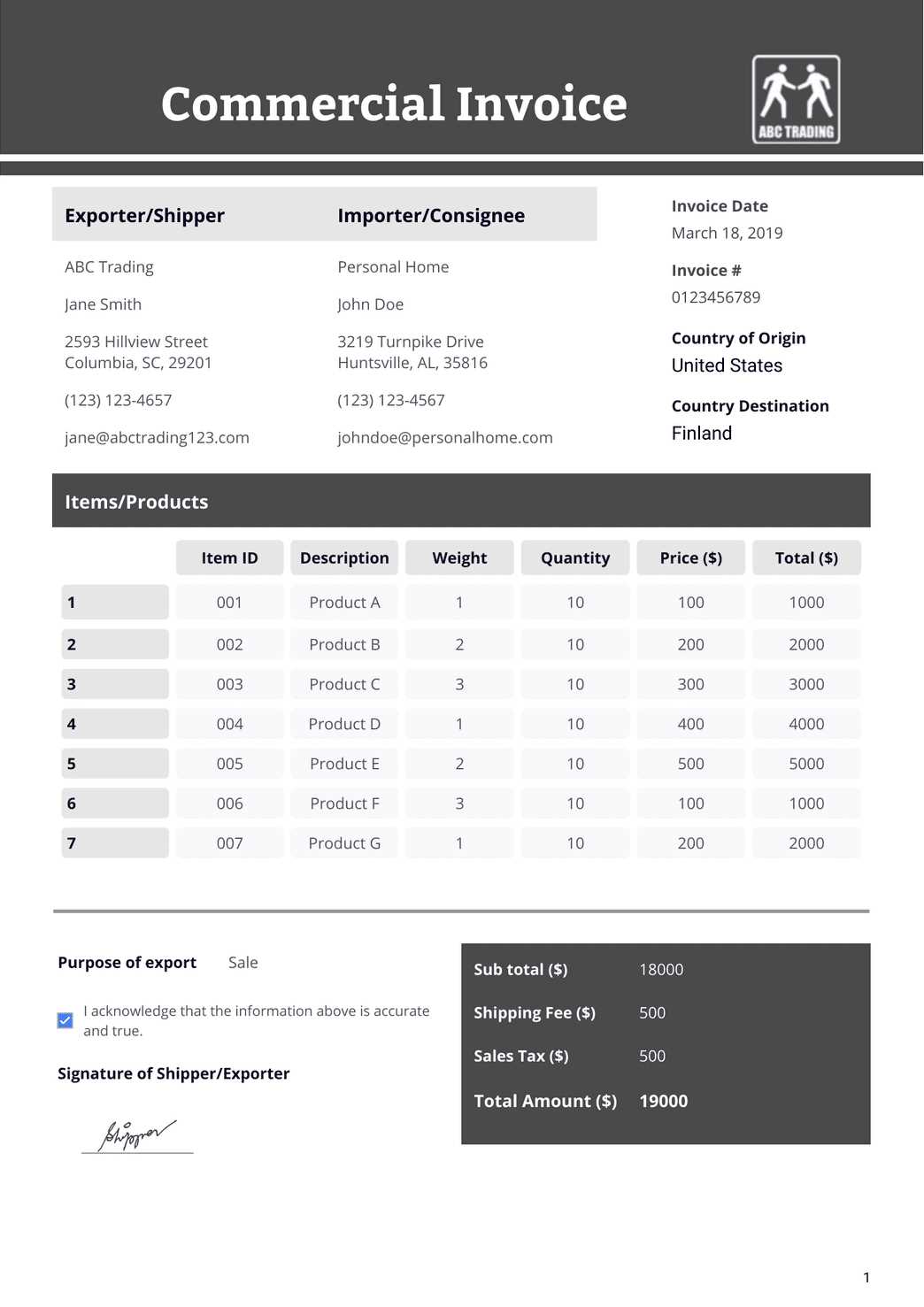

How to List Services and Prices

Clearly presenting the tasks provided and their associated costs is essential for both transparency and smooth transactions. By organizing the offerings and pricing in an easy-to-read format, you help clients understand what they are paying for, which can reduce confusion and improve their experience. A well-structured list not only clarifies the scope of work but also ensures that clients can quickly find all the necessary details.

Step-by-Step Process for Listing Charges

Follow these steps to effectively display your offerings and pricing:

- Provide a Clear Description: Start by detailing each task or product with a concise, straightforward description. Be specific about what is included to avoid any ambiguity.

- Include Quantities and Rates: Where applicable, list the quantity (e.g., hours, items) and rate per unit. This ensures clients understand how the total is calculated.

- Use Simple Language: Avoid complex terms or jargon. Your goal is to make the details easy for any client to comprehend without confusion.

- Break Down Costs: If necessary, break down the total cost into smaller sections for better clarity, especially if it includes materials, labor, and additional fees.

- Highlight Discounts or Special Offers: If you offer discounts, make sure to clearly state these in the breakdown, so clients can easily see the benefits they are receiving.

Example Layout for Listing Charges

Here’s how you might organize this information in your document:

- Consultation – 2 hours @ $50/hour = $100

- Materials – $150

- Travel Fee – $30

- Total – $280

By following this structure, you help ensure that your client has a comprehensive understanding of the costs involved, making it easier for them to review and process the payment.

Adding Payment Terms to Invoices

Incorporating clear payment terms in your billing documents is essential to set expectations for both you and your clients. These terms outline when payments are due, any applicable late fees, and the preferred payment methods. Clear and concise terms help avoid misunderstandings and ensure that transactions are completed in a timely manner.

When adding payment conditions, it is important to consider the following details:

- Due Date: Clearly specify the date by which the payment should be made. A common practice is to set a 30-day payment period, but this can vary depending on your business practices.

- Late Fees: Indicate whether you charge interest or late fees if the payment is not made on time. Make sure to define the amount or percentage applied for overdue payments.

- Accepted Payment Methods: List the various ways clients can pay, such as bank transfer, credit card, or online payment platforms. Providing options makes it easier for clients to settle the bill promptly.

- Early Payment Discounts: If you offer discounts for early payments, include that information clearly to incentivize quicker transactions.

Here’s an example layout for how to display payment terms:

Payment Terms Details Due Date Within 30 days from the date of issue Late Fee 5% per month after the due date Accepted Payment Methods Bank Transfer, Credit Card, PayPal Early Payment Discount 5% discount for payments made within 10 days Including payment conditions upfront ensures that your clients know exactly when and how to pay, reducing the chances of delayed payments and fostering a smooth business relationship.

Benefits of Using Digital Invoices

Switching to digital documents for requesting payments offers a variety of advantages for both businesses and clients. With the increasing reliance on technology, electronic billing systems streamline processes and improve overall efficiency. Whether you’re sending bills for your products or services, digital records can greatly enhance the way you manage transactions.

Increased Efficiency and Speed

One of the most significant benefits of using digital documents is the speed at which transactions can be processed. With just a few clicks, you can send a payment request directly to the client, reducing the time it takes for them to receive and process the document. This also eliminates the need for physical mailing, saving time and resources.

Improved Accuracy and Tracking

Electronic records reduce the risk of errors that often occur with manual processes. By automating calculations and data entry, digital documents ensure that all information is accurate and up to date. Additionally, digital files allow for easy tracking and archiving, enabling you to quickly access previous transactions whenever needed.

Environmental Impact

Digital billing also helps reduce paper waste, contributing to a more sustainable environment. By moving away from physical paperwork, businesses can cut down on the resources required for printing and mailing, while clients can benefit from more eco-friendly practices.

Enhanced Payment Options

With electronic billing systems, clients can often pay through a variety of platforms, including online payment processors and bank transfers. This flexibility makes it easier for clients to pay their bills on time, improving your cash flow and reducing the likelihood of overdue payments.

Incorporating digital methods for requesting payment can help your business stay modern, efficient, and client-friendly, making it a worthwhile investment for businesses of all sizes.

Including Contact Information on Invoices

Clear and accurate contact details are essential in any billing document. They ensure that clients can reach out for clarification or resolve any issues quickly. Including the right contact information helps streamline communication and facilitates smoother transactions.

Key Contact Details to Include

When adding contact information to your billing document, it’s important to include the following details:

- Business Name: Clearly state your company’s name to establish identity.

- Email Address: Provide a reliable email for inquiries and correspondence.

- Phone Number: A contact number ensures that clients can reach you by phone if needed.

- Physical Address: Including your office or business address can be helpful for clients who may need to send physical documents or visit in person.

- Website (Optional): A link to your company website can provide clients with additional information about your offerings.

Why Contact Information Matters

By providing comprehensive contact details, you create an opportunity for prompt communication, whether the client needs to ask questions, request revisions, or discuss payment terms. It also ensures professionalism and fosters trust with your clients, as they can easily find ways to reach you in case of any concerns.

Managing Invoice Records Efficiently

Effective management of billing records is crucial for maintaining an organized financial system. By keeping track of all transactions accurately, businesses can streamline their accounting processes, avoid mistakes, and ensure that payments are processed in a timely manner. Proper record management also helps in quickly retrieving information for audits or financial reviews.

To manage your records efficiently, it is essential to establish a system that allows for easy storage, tracking, and access. Using digital tools for record-keeping can greatly enhance this process, offering features such as automated reminders, categorization, and quick search capabilities.

Here are some tips for better record management:

- Keep detailed records of each transaction, including dates, amounts, and descriptions of the services or products provided.

- Organize records by client or project to make it easier to track outstanding payments and monitor financial trends.

- Ensure all documents are backed up and securely stored, preferably in the cloud, to prevent data loss.

- Set reminders for follow-up on overdue payments and review records regularly to ensure everything is up to date.

By staying organized and proactive with your billing records, you can reduce administrative tasks and focus more on growing your business.

How Invoices Improve Cash Flow

Proper billing plays a crucial role in maintaining a steady cash flow for any business. By ensuring that payments are requested in a clear and timely manner, businesses can keep operations running smoothly. Structured records of transactions encourage clients to settle amounts promptly, which directly impacts financial stability.

When businesses issue clear and accurate payment requests, it reduces the risk of confusion or delayed payments. A well-crafted billing process allows clients to understand exactly what they owe, minimizing disputes and ensuring that funds are transferred within the expected timeframe.

Here are some ways that billing improves cash flow:

- Clarity and transparency: Clearly stated terms and amounts on payment requests help clients understand their obligations, leading to quicker payments.

- Timeliness: Promptly sending out requests ensures that businesses receive payments in a timely manner, improving financial liquidity.

- Record tracking: Efficiently tracking each request helps identify overdue payments, allowing for better follow-up and reducing the chance of late settlements.

- Financial forecasting: Accurate billing records help businesses predict future cash inflows, enabling better financial planning.

By maintaining an organized and professional billing system, companies can enhance their financial performance and reduce the likelihood of cash flow issues.

Integrating Billing with Accounting Software

Integrating payment requests with accounting software can streamline financial management and improve efficiency. This integration allows businesses to automate data entry, reduce human error, and maintain accurate financial records. By syncing payment details directly into the accounting system, companies can save time and reduce the likelihood of discrepancies between financial documents and actual transactions.

With the right tools, businesses can automate various tasks such as tracking payments, generating reports, and sending reminders for overdue amounts. This integration not only improves workflow but also provides real-time insights into financial health, making it easier to manage cash flow and plan for the future.

Key Benefits of Integration

- Time-saving: Automates the process of recording payments and generating financial reports, reducing manual input.

- Accurate records: Ensures that all financial transactions are captured in the accounting system without errors.

- Real-time updates: Provides immediate access to financial data, helping businesses stay on top of their financial position.

- Improved financial forecasting: With integrated data, businesses can better predict future income and expenses.

How to Set Up the Integration

To set up integration, businesses can either use built-in integration features from their accounting software or utilize third-party tools that connect their billing system with accounting platforms. Most modern accounting solutions support seamless syncing with popular billing and invoicing systems, making the setup process straightforward.

Setting Up Recurring Billing

Automating regular payment requests is an efficient way to manage ongoing transactions with clients. By setting up automated billing schedules, businesses can ensure consistent cash flow while reducing the time spent on manual processes. This setup allows for the easy generation of recurring charges at specified intervals, eliminating the need for repeated data entry and improving overall operational efficiency.

Many businesses benefit from recurring payments, whether for subscriptions, memberships, or long-term agreements. With the right configuration, automatic billing can simplify customer interactions and reduce the risk of missed payments, offering both convenience to clients and stability to business owners.

Steps to Set Up Recurring Billing

- Choose billing software: Select a platform that supports recurring transactions and integrates with your accounting system.

- Define billing intervals: Determine the frequency of payments (e.g., weekly, monthly, annually) based on your agreement with the customer.

- Set up client information: Store customer details securely to ensure accurate billing, including payment methods and contact information.

- Automate reminders: Configure reminders for both you and the customer to ensure timely payments and prevent any issues.

Benefits of Automating Regular Charges

- Time savings: Reduces the need for manual entry of recurring transactions.

- Consistency: Ensures payments are collected on time without the need for constant follow-ups.

- Improved customer experience: Clients appreciate the convenience of automated, predictable payments.

- Financial stability: Guarantees a more predictable revenue stream, making it easier to manage cash flow.

Using Templates for Small Businesses

For small businesses, maintaining consistency and efficiency is key to success. One of the best ways to streamline operations is by using pre-designed formats for everyday tasks. These ready-made formats save time, reduce errors, and ensure professional presentation across all customer-facing materials. Whether it’s for billing, proposals, or reports, having standardized formats makes managing administrative tasks much simpler and faster.

For many small business owners, the ability to customize these formats based on their unique needs offers flexibility while maintaining structure. By incorporating your branding and specific details, you can ensure that each document remains aligned with your business image while still enjoying the benefits of using a consistent system.

Advantages of Using Pre-Designed Formats

- Time efficiency: Templates reduce the time spent creating documents from scratch, allowing you to focus on other important aspects of your business.

- Professional appearance: Using a well-designed structure gives your business a polished look, which helps build trust with customers.

- Consistency: Pre-made formats ensure that all documents follow the same layout, making your business processes more predictable and easy to manage.

- Customization: You can personalize these formats to reflect your business’s branding, making them unique and tailored to your specific needs.

How to Make the Most of Pre-Made Formats

- Adapt to your needs: Choose formats that align with your business requirements and adapt them as necessary.

- Incorporate your branding: Modify fonts, colors, and logos to reflect your business identity, ensuring your documents stand out.

- Update regularly: Keep your formats up to date with any new policies or changes in your business operations to maintain relevance and accuracy.