Download Finance Invoice Template for Easy Billing

Managing payments and ensuring smooth transactions are crucial for businesses of any size. A well-organized approach to documenting charges can help save time, avoid errors, and maintain professionalism. Using a well-structured document for billing simplifies the entire process and ensures that all necessary details are clearly communicated to clients or customers.

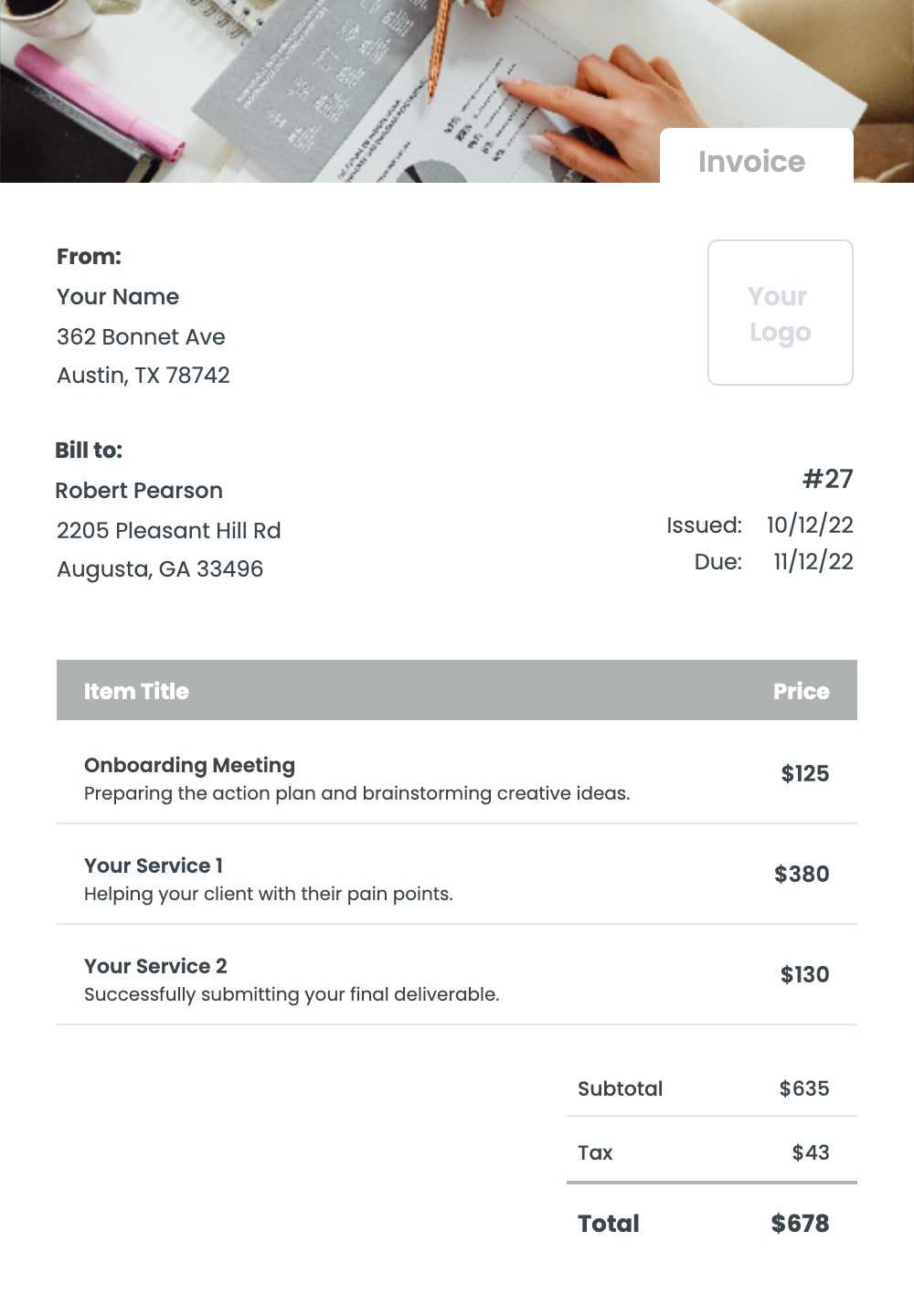

Customizable formats allow for easy adjustments based on specific needs, making it simpler to track what has been billed and the terms of payment. These documents can include sections for important data such as amount due, payment methods, and due dates, all tailored to fit your unique business model.

Whether you are a freelancer or part of a larger organization, adopting a streamlined approach to financial documentation is essential for maintaining good relationships with clients and improving your cash flow management. With a little preparation, you can create professional records that will reflect the standards of your business.

Complete Guide to Billing Document Design

Creating an organized and effective billing document is essential for clear communication between businesses and their clients. This guide provides a step-by-step approach to designing a functional record for transactions that ensures all necessary information is present and easy to understand. A well-crafted document can prevent misunderstandings and expedite payments, improving your overall business workflow.

Essential Components to Include

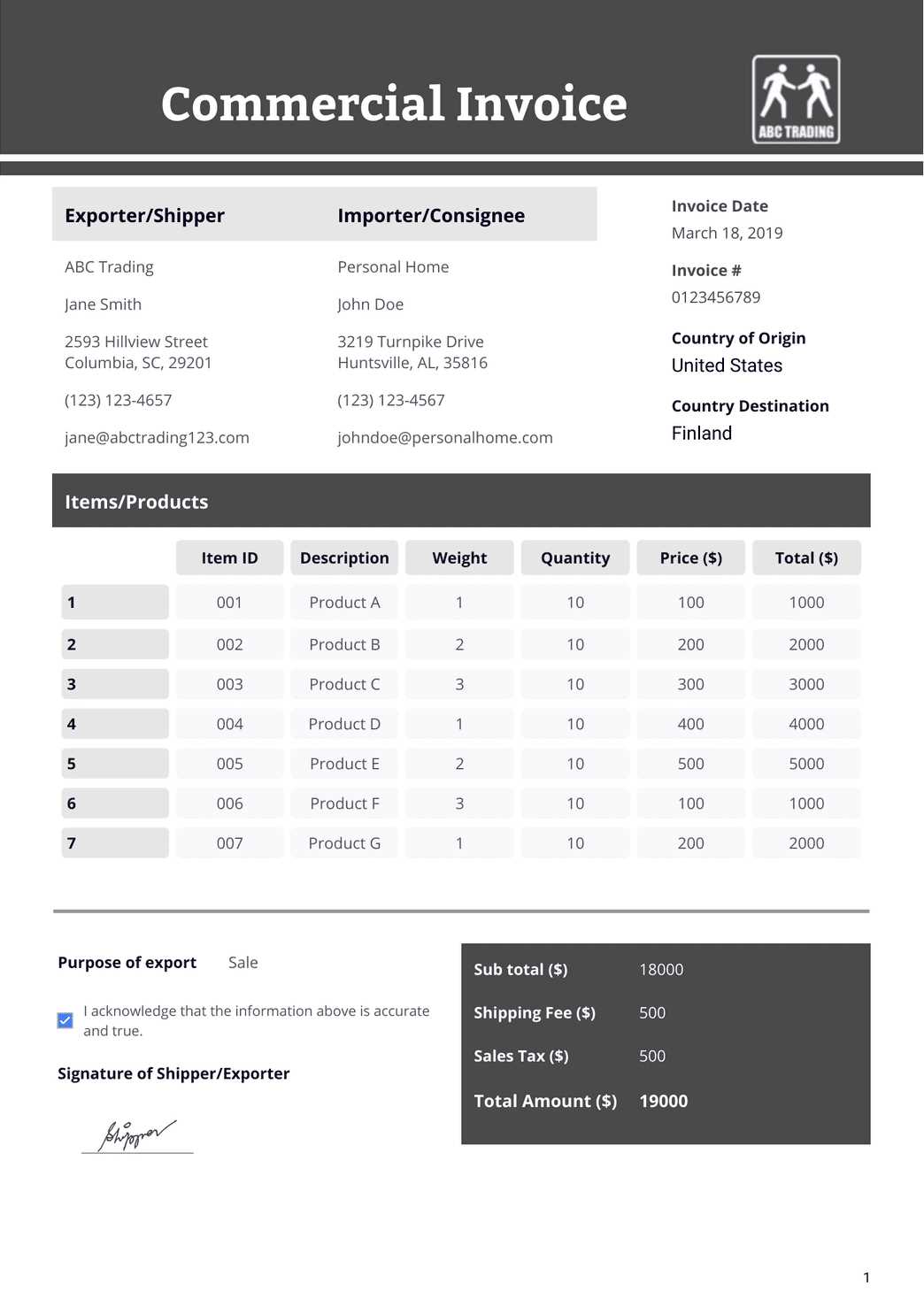

When designing a billing record, it is important to include several key elements that will make it easy for clients to process payments. The document should clearly outline the following:

| Component | Description |

|---|---|

| Business Information | Include the company name, contact details, and any relevant identification numbers. |

| Client Information | Ensure the client’s name, address, and contact details are correctly listed. |

| Transaction Details | List the services or products provided along with their prices and quantities. |

| Payment Terms | Specify payment methods, deadlines, and any late payment penalties if applicable. |

| Total Amount | Provide the total amount due, including any taxes or additional charges. |

How to Customize for Your Business

Depending on the nature of your business, you may need to customize your document to suit specific needs. For example, freelancers might focus on clear itemizations of services rendered, while larger companies may include more detailed terms and conditions. The key is to ensure that the format is both professional and adaptable to any situation, allowing you to communicate effectively with clients and maintain a smooth transaction process.

Why Use a Billing Document Format

Adopting a consistent and organized approach to creating billing records brings several advantages for both businesses and clients. By using a standardized structure, you can ensure that all essential details are included, minimizing the risk of errors and confusion. A clear and professional-looking document can enhance trust with clients and streamline the payment process.

Time Efficiency and Consistency

Using a pre-designed structure for your documents saves time and effort by eliminating the need to start from scratch each time you need to bill a client. Once you have a well-organized format in place, it becomes easier to generate new records quickly. This consistency also ensures that each document includes the same key elements, reducing the chance of missing critical information.

Professional Appearance

A well-structured billing document reflects a professional image, which can enhance your business’s reputation. Clients are more likely to trust a business that provides clear, well-organized records. Additionally, a clean format helps avoid misunderstandings regarding charges, terms, and payments, further promoting a positive business relationship.

Benefits of Customizing Your Billing Document

Personalizing your billing records offers several advantages that go beyond simple customization. By tailoring the layout and content to fit the specific needs of your business, you can create a document that is not only professional but also aligned with your brand identity. This flexibility allows you to ensure that important information is highlighted and presented in the most effective way possible.

Improved Client Communication: Customizing allows you to clearly communicate essential details such as payment terms, due dates, and itemized charges. This reduces the chances of misunderstandings and ensures both parties are on the same page.

Branding Opportunities: Customization also offers a chance to incorporate your business’s logo, colors, and contact information, which helps reinforce your brand identity and adds a personal touch to each transaction.

By adapting the document to suit your business’s needs, you can streamline the billing process and create a lasting impression on your clients, contributing to both efficiency and professionalism in your financial dealings.

Key Elements of a Billing Document Structure

When creating a structured document for billing purposes, it is essential to ensure that specific elements are included to make the process smooth and effective. These components ensure the document is complete, professional, and clear, helping both businesses and clients manage financial transactions with ease. A well-constructed format improves communication and reduces the likelihood of errors.

Crucial Information to Include

There are several critical components that every billing document should contain to provide clarity and transparency. Below is a table outlining these necessary elements:

| Component | Description |

|---|---|

| Contact Details | Include both the service provider’s and client’s full name, address, phone number, and email. |

| Itemized List | Detail the goods or services provided, including quantities, descriptions, and unit prices. |

| Total Amount Due | Clearly state the total amount owed, including applicable taxes, discounts, and additional charges. |

| Payment Terms | Specify the due date, accepted payment methods, and any late fees or penalties for overdue payments. |

| Unique Reference Number | Assign a unique number to each document for tracking and record-keeping purposes. |

Additional Customization Options

Depending on your business type, additional sections may be necessary to address specific needs, such as providing detailed descriptions of terms and conditions or offering space for multiple payment installments. Customizing these elements ensures the document fits your business and client relationship while maintaining a professional appearance.

How to Create a Billing Document

Creating a professional billing document is an essential skill for any business. A well-designed record helps both you and your clients stay organized and ensures that payments are processed efficiently. The process of crafting a billing document involves including essential information, customizing it to your needs, and ensuring clarity in every section.

Step-by-Step Process

To create an effective billing document, follow these steps:

- Gather Client Information: Ensure you have the correct details for both your business and the client, such as names, addresses, and contact details.

- List the Services or Products: Provide a detailed list of all goods or services provided, including descriptions, quantities, and prices.

- Calculate the Total Amount: Add up all charges, including taxes or any additional fees, to determine the total amount due.

- Set Payment Terms: Specify payment methods, due dates, and any late payment policies or penalties.

- Assign a Unique Reference Number: For tracking purposes, give each document a unique number that corresponds to that specific transaction.

Tips for Customization

Once you have included the essential components, consider customizing the document to suit your business needs:

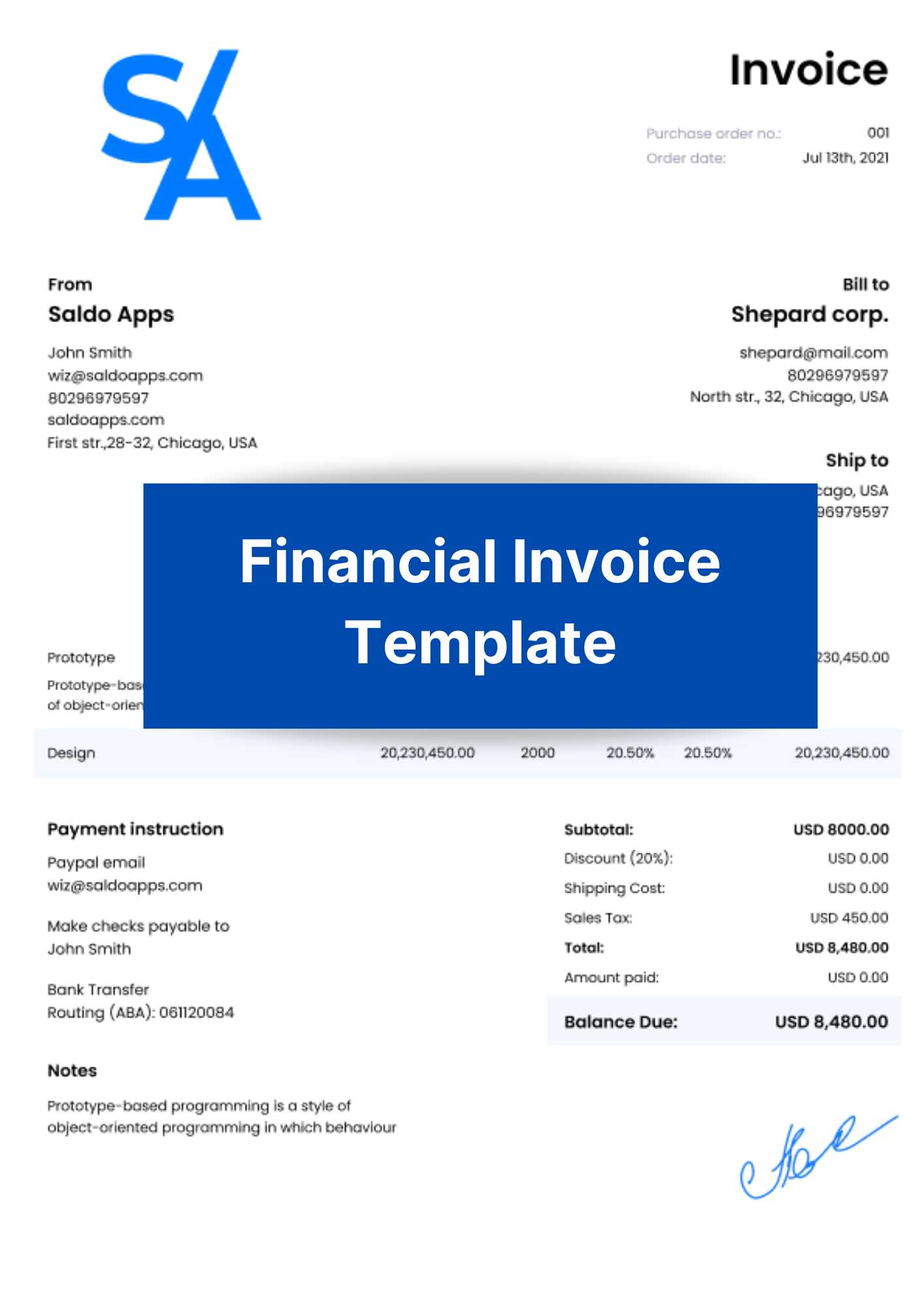

- Include Your Branding: Add your business logo, colors, and other branding elements to make the document more personalized and professional.

- Provide Clear Instructions: Offer clear instructions on how the client can make a payment, especially if there are multiple payment methods available.

- Be Transparent: Make sure all charges are itemized and easy to understand, preventing any confusion for the client.

By following these steps and tailoring the document to your needs, you can create a professional and functional billing record that will streamline your payment processes and help maintain good client relationships.

Top Features in a Billing Document Format

When creating a professional billing record, it is important to include specific features that enhance clarity, accuracy, and efficiency. The right components ensure that all necessary information is presented clearly, reducing confusion for both businesses and clients. The following list outlines the key features that make a billing document effective and professional.

Essential Features for a Professional Billing Record

- Client and Business Information: Include both the service provider’s and client’s full names, addresses, and contact details. This ensures accurate identification and communication.

- Itemized List of Products or Services: Detail each product or service provided, including quantities, descriptions, and unit prices. This transparency helps prevent misunderstandings.

- Total Amount Due: Clearly display the total amount owed, including applicable taxes, discounts, and additional fees, to make the final sum easily understandable.

- Payment Terms and Due Dates: Specify the due date for payment and any terms or conditions regarding late fees, interest, or payment methods.

- Unique Document Number: Assign a unique number to each document for tracking and organizational purposes. This helps maintain proper records.

- Clear and Readable Layout: Use a clean, easy-to-read format with consistent fonts and ample spacing to ensure all information is easily accessible.

Additional Features for Customization

- Business Branding: Incorporate your business’s logo, colors, and other branding elements to personalize the document and enhance professionalism.

- Notes or Terms Section: Include a section for any special instructions or additional terms that may apply to the transaction, such as return policies or special discounts.

- Multiple Payment Methods: Offer different payment methods (bank transfer, credit card, etc.) and include relevant details for each option.

By incorporating these essential and customizable features, you can create a billing document that is both effective and tailored to your business needs, ensuring clarity and professionalism in every transaction.

Choosing the Right Billing Document Format

Selecting the proper format for your billing record is crucial for ensuring clarity, professionalism, and efficiency in transactions. A well-chosen structure helps present all essential information in a clear, easy-to-understand manner, which benefits both the business and the client. The format you choose can influence the speed of payment processing, as well as how well your clients can follow the details of the transaction.

Factors to Consider

When determining the best format for your billing document, several factors should be considered:

- Clarity and Readability: Ensure the format is simple to read and visually appealing. A clear layout prevents confusion and makes it easier for the client to find key details.

- Customization: Choose a format that can be tailored to your business’s branding and specific needs. This might include adding logos, adjusting layout, or including specific terms relevant to your industry.

- Client Preferences: Some clients may prefer a more detailed record, while others might find a concise version more effective. Knowing your client’s preferences can help you tailor the format.

- Legal Requirements: Ensure the format adheres to any local regulations or industry standards regarding what information must be included in a billing document.

Common Format Types

Here are a few popular format types to consider:

- Traditional Layout: A simple, straightforward format with sections for services/products, costs, and payment terms. Ideal for smaller businesses or simple transactions.

- Itemized Format: This format provides a detailed list of every product or service provided, ideal for businesses with multiple offerings or complex transactions.

- Online Billing Format: If your business operates online, an electronic format can be created that allows clients to easily pay through various methods and access their billing records digitally.

Choosing the right format for your billing document helps ensure both clarity and professionalism, contributing to smoother transactions and stronger client relationships.

How to Save Time with Pre-designed Formats

Using pre-designed formats can significantly reduce the time spent on creating billing documents from scratch. With the right structure in place, you can quickly input relevant details without worrying about design or layout, allowing you to focus on more important tasks. Pre-made formats simplify the process and ensure consistency across all your documents, making it easier to manage your business operations.

Benefits of Using Pre-designed Formats

- Consistency: By using a standardized format, you ensure that all your billing records follow the same structure, making them easily recognizable for clients and reducing the chance of errors.

- Efficiency: Templates save you time by eliminating the need to create a new document every time you need to bill a client. You can quickly fill in the necessary details and send it out without having to start from scratch.

- Professional Appearance: Pre-designed formats are often designed to look polished and professional, giving your business a more credible and reliable appearance.

- Customization: Many templates allow you to adjust certain sections to fit your specific needs, so you can still personalize them for different clients or projects.

How to Implement Pre-designed Formats

To get the most out of pre-made formats, follow these steps:

- Choose the Right Format: Select a format that aligns with your business needs and offers the flexibility to customize key sections.

- Use Digital Tools: Utilize software or online platforms that offer easy access to customizable formats, allowing you to generate and store your records digitally.

- Automate Repetitive Tasks: Many tools allow you to save client information and reuse it, further speeding up the process for future transactions.

By integrating pre-designed formats into your workflow, you can streamline your document creation process, reduce time spent on administrative tasks, and focus on growing your business.

Common Mistakes to Avoid in Billing Documents

When creating billing records, it’s essential to ensure all the details are correct and clearly presented. Small errors can cause confusion, delays in payment, and damage to your professional reputation. Understanding common pitfalls can help you avoid these mistakes and streamline your billing process.

Common Errors in Billing Records

- Missing Contact Information: Forgetting to include accurate contact details for both you and the client can result in confusion and hinder communication.

- Incorrect Payment Terms: Ensure that the payment due date and terms are clearly stated. Vague or incorrect terms may delay payments or create misunderstandings.

- Failure to Itemize Services: Not breaking down the services or products provided can lead to disputes. Always detail what has been delivered and the corresponding costs.

- Overlooking Tax Information: Leaving out taxes or incorrectly calculating them can cause financial discrepancies and complicate the payment process.

- Unclear or Incomplete Descriptions: Ambiguous or incomplete descriptions of services can confuse the recipient, leading to delayed payments or requests for clarification.

How to Prevent These Errors

- Double-check Information: Always review your document for accuracy before sending it. Confirm that all fields are filled correctly and consistently.

- Be Specific: Provide clear and detailed descriptions of each service or product provided. Itemizing everything helps avoid confusion.

- Use Reliable Tools: Use digital tools that allow for easy editing and review to minimize human error.

- Clarify Payment Instructions: Clearly define the payment due date and methods to avoid ambiguity and ensure smooth transactions.

Avoiding these mistakes ensures your billing process runs smoothly, improves your professional image, and encourages timely payments from clients.

Best Software for Billing Documents

Choosing the right software for creating and managing your billing records can greatly improve efficiency and reduce errors. With numerous tools available, it’s important to select one that fits your business needs and helps streamline the entire process, from creation to payment tracking.

Top Software Options for Billing

- QuickBooks: Known for its comprehensive features, QuickBooks allows you to create customized billing records, track payments, and manage finances all in one platform.

- FreshBooks: FreshBooks offers an intuitive interface for generating detailed documents quickly, making it ideal for small business owners and freelancers.

- Zoho Invoice: Zoho Invoice is a great option for those seeking a free, customizable tool. It offers automation features like reminders and recurring billing.

- Wave: Wave provides free billing software with strong capabilities, including customizable templates and payment tracking features, making it ideal for startups.

- Invoicely: This platform is perfect for businesses that need an affordable option with essential features like time tracking, recurring billing, and multi-currency support.

How to Choose the Right Software

- Assess Your Business Needs: Determine the size of your business and the specific features you require, such as recurring billing, project tracking, or integration with other software.

- Consider User Interface: Choose software with an easy-to-navigate interface that will make generating documents and managing payments a simple process.

- Check for Integration: Ensure that the software can integrate seamlessly with your existing systems, such as accounting platforms or CRM tools.

Investing in the right software can save time, improve accuracy, and help ensure that your billing operations run smoothly and efficiently.

Understanding Numbering Systems for Billing Documents

Using a consistent and organized numbering system for your billing records is essential for maintaining clear and efficient business practices. It helps in tracking transactions, ensuring accuracy, and complying with legal and financial requirements. The right system can streamline your accounting process and make document management easier.

Common Numbering Methods

- Sequential Numbering: This is the most common approach where each document gets a unique number in a continuous sequence. It simplifies tracking and reduces confusion, ensuring each record is easily identifiable.

- Year-Based Numbering: This system uses the year as part of the number, often followed by a sequential number. For example, documents for 2024 might start with “2024-001” and continue throughout the year.

- Client-Based Numbering: In this system, the numbers include a client identifier. This is useful for businesses that deal with multiple clients, helping them track and manage their records per customer.

- Custom Numbering: Some businesses create a hybrid system that combines sequential, year-based, and client-specific identifiers, offering even more organization and flexibility.

Why a Proper Numbering System is Important

- Compliance and Legal Requirements: Certain regulations may require businesses to use specific numbering systems to maintain proper records for audits and tax purposes.

- Efficient Record Keeping: A well-structured system allows for quicker searches and retrieval of past documents, enhancing productivity.

- Minimizing Errors: An organized numbering system helps reduce the risk of duplicate or missed records, ensuring all transactions are accounted for.

By selecting the right numbering system, businesses can simplify their record-keeping and ensure their documentation process is both organized and reliable.

How to Include Tax Information

Including accurate tax details in your billing documents is crucial for both compliance and clarity. Whether you’re required to collect sales tax, VAT, or other duties, ensuring that these amounts are clearly itemized helps to avoid misunderstandings with your clients and meets legal requirements. Properly documenting tax-related data also simplifies record-keeping and auditing processes.

Key Information to Include

When detailing tax information in your records, it’s important to include the following elements:

- Tax Rate: Clearly state the applicable tax rate, such as 5%, 10%, or a regional rate if different rates apply depending on the location.

- Taxable Amount: Indicate the total amount that is subject to tax before applying any deductions or exemptions.

- Tax Amount: The actual tax charged, which is calculated by applying the tax rate to the taxable amount.

- Exemptions or Discounts: If certain items are exempt from tax or if discounts affect the taxable amount, this should be noted explicitly.

- Total Amount After Tax: After the tax is applied, provide the total cost that the customer needs to pay.

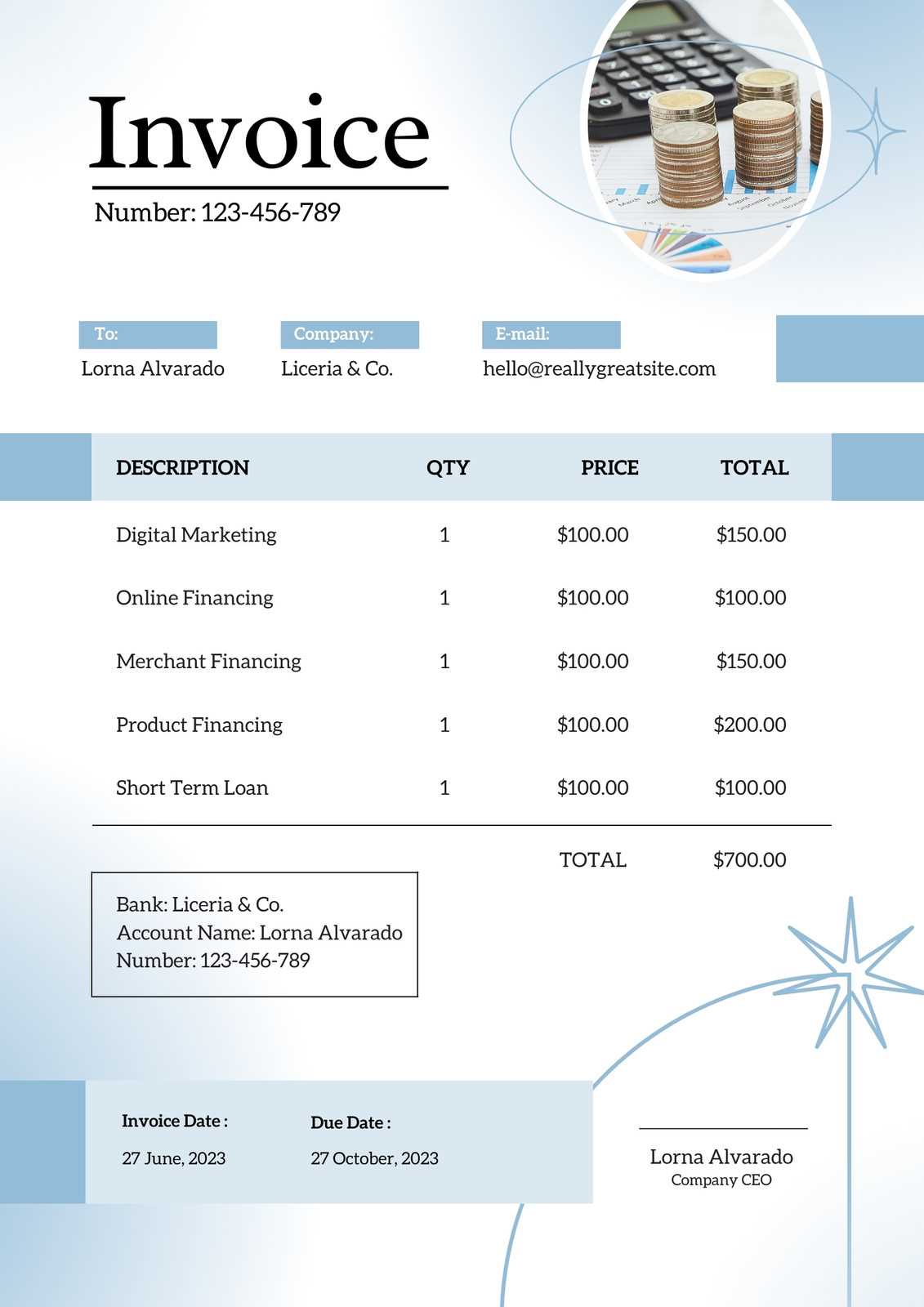

Example of Tax Breakdown

| Description | Amount |

|---|---|

| Product/Service Cost | $100.00 |

| Sales Tax (10%) | $10.00 |

| Total Amount Due | $110.00 |

By including all relevant tax information, you ensure transparency in your billing and provide your clients with a clear understanding of the charges they are responsible for.

Design Tips for Professional Invoices

Creating visually appealing and well-structured billing documents is essential for maintaining a professional image. A clean, organized design not only enhances the user experience but also ensures that all important details are easy to read and understand. Proper design can make your documents look more polished and instill confidence in your clients.

Here are some key tips to help you design professional and effective billing documents:

- Keep it Simple: Use a minimalist design with ample white space. Avoid clutter and make sure the most important details, such as the total amount and due date, stand out.

- Consistent Branding: Include your company logo, brand colors, and fonts. This creates a cohesive look that reflects your brand’s identity and builds trust with clients.

- Use Clear Headings: Organize your content using clear and distinct headings. This helps clients easily locate essential information such as the date, amount due, and payment terms.

- Readable Fonts: Choose fonts that are easy to read, and keep the font size large enough for comfort. Avoid overly decorative fonts that may hinder legibility.

- Highlight Important Information: Use bold or italicized text to emphasize key details, such as payment terms, due dates, or special instructions. This draws attention to the most important items.

- Provide Clear Payment Instructions: Ensure your payment instructions are clearly visible and easy to understand. Include your preferred payment methods, bank details, or links to online payment systems.

By focusing on clarity and simplicity, you can ensure that your billing documents look professional and are easy for clients to navigate. These design elements will help improve communication and reduce the chance of mistakes or misunderstandings.

Integrating Payment Methods in Invoices

Incorporating various payment options in billing documents is essential for streamlining the transaction process. Providing multiple ways for clients to pay makes it easier for them to settle their dues and can help improve cash flow. The key is to make payment instructions clear, concise, and easily accessible.

Here are some important considerations when including payment methods in your billing documents:

- Offer Multiple Payment Methods: Include options such as credit/debit cards, bank transfers, online payment systems, or even checks. Offering a variety of methods allows clients to choose the one most convenient for them.

- Provide Clear Payment Instructions: Ensure that payment details, such as bank account numbers, online payment links, or specific instructions for credit card payments, are clearly listed and easy to understand.

- Specify Payment Terms: Include payment deadlines and any late fees that may apply. This encourages timely payments and sets clear expectations for your clients.

- Use Secure Payment Options: Highlight any secure payment methods you offer, such as encrypted online payment systems. Clients will appreciate knowing their payment information is protected.

- Clarify Currency: If you are working internationally, be sure to specify the currency in which the payment should be made. This helps avoid confusion and potential payment delays.

By incorporating clear payment options and instructions into your billing documents, you create a seamless experience for your clients. Making the payment process as simple and transparent as possible can result in faster payments and better client satisfaction.

How to Add Terms and Conditions

Including clear terms and conditions in your billing documents is essential for setting expectations and protecting both parties involved in the transaction. These guidelines outline the rules for payment, delivery, and other key aspects of the agreement, ensuring that both the seller and buyer are on the same page.

Key Elements to Include

When adding terms and conditions, focus on clarity and comprehensiveness. Here are some key elements to consider:

- Payment Terms: Specify the due date for payments, any applicable late fees, and accepted payment methods.

- Delivery Terms: Detail the delivery timelines, shipping methods, and associated costs, if any.

- Refund and Return Policy: Clearly explain the process for returns or refunds, including any eligibility criteria and deadlines.

- Dispute Resolution: Outline the steps for resolving conflicts, including preferred methods such as mediation or arbitration.

- Confidentiality and Data Protection: Include clauses related to the protection of sensitive information and any data security measures in place.

Best Practices for Writing Terms and Conditions

Keep the language simple and free of legal jargon to make it accessible for all readers. Use bullet points or numbered lists for easy reading, and ensure that the terms are prominently placed on the document for visibility. It’s also recommended to keep a copy of the terms for future reference, and to have both parties agree to them before proceeding with the transaction.

How to Handle Late Payments on Invoices

Dealing with overdue payments is a common challenge in business transactions. It’s essential to have a clear strategy in place to address such situations while maintaining professionalism and preserving client relationships. By setting expectations upfront and following a structured approach, you can manage late payments efficiently.

Steps to Take When Payments Are Late

When a payment becomes overdue, it’s important to act promptly. Here are some steps to help you manage the situation:

- Send a Reminder: After the due date passes, send a polite reminder to the client. This can be done through email or a phone call, depending on your relationship.

- Follow Up with a Formal Letter: If the initial reminder goes unanswered, follow up with a more formal communication that outlines the payment terms and the outstanding balance.

- Offer Payment Plans: In some cases, the client may be facing financial difficulties. Offering a payment plan can help facilitate partial payments, easing the burden on both sides.

- Charge Late Fees: If your agreement includes a clause for late fees, it’s important to enforce it consistently. This can help encourage timely payments.

- Consider Legal Action: As a last resort, if the payment is still not received, you may need to consider legal action or working with a collection agency to recover the outstanding amount.

Tips for Preventing Late Payments

To minimize the risk of overdue payments in the future, implement clear payment terms in all agreements and documents. You may also want to offer multiple payment methods, provide early payment discounts, or set reminders for your clients. Establishing a professional, transparent process can help ensure that payments are made on time.

Making Your Invoice Legally Compliant

Ensuring that your payment requests are legally compliant is essential for both protecting your business and maintaining professional credibility. A legally sound document not only provides clarity but also minimizes the risk of disputes and ensures that your rights are upheld in case of any issues. It’s important to incorporate the necessary details that meet legal and regulatory requirements.

Key Elements for Legal Compliance

Here are the fundamental components that should be included to make sure your payment requests comply with legal standards:

- Clear Identification: Include your full business name, address, and contact details, along with the recipient’s information. This provides transparency and traceability for both parties.

- Unique Reference Number: Each document should have a unique number to help with tracking and organization, ensuring you can easily refer to past transactions if needed.

- Detailed Itemization: List all goods or services provided, along with their respective quantities and prices. Clear descriptions help avoid confusion and provide legal clarity in case of disputes.

- Tax Information: Ensure you include the correct tax rates and amounts applied to the transaction. This is especially important in regions where tax laws require explicit reporting on all transactions.

- Payment Terms: State the payment deadline and any late fee policies. This sets clear expectations and gives your client guidelines for fulfilling the transaction.

- Legal Disclaimers: If applicable, include any legal disclaimers relevant to your industry or services. These help outline your responsibilities and limitations.

Ensure Compliance with Local Laws

Different regions have specific legal requirements, such as mandatory tax registration numbers, or certain formats for specific industries. Always research and adhere to the regulations that apply in your jurisdiction to avoid legal issues.

Saving and Sending Your Invoice Efficiently

Efficiently managing payment requests is crucial to ensure that you stay organized and maintain smooth communication with clients. By utilizing the right processes for storing and transmitting these documents, you can save time and reduce the chances of errors or delays. Proper handling of these requests not only helps you maintain professionalism but also streamlines your accounting processes.

Best Practices for Saving Payment Requests

Properly saving your documents ensures easy retrieval and organization, especially when tracking payments or preparing for audits. Consider the following tips for efficient storage:

- Use Digital Formats: Save your payment requests in digital formats such as PDF or Excel to reduce paper clutter and make it easier to access, share, and store files securely.

- Organize by Date or Client: Create a systematic folder structure to keep track of each request by date or client. This will make it easy to locate specific documents when needed.

- Cloud Storage: Cloud-based services offer secure and easily accessible storage, allowing you to store your documents remotely and access them from any location.

- Back Up Regularly: Ensure that all your stored documents are backed up regularly to prevent data loss in case of hardware failure or accidental deletion.

Efficient Ways to Send Payment Requests

Sending payment requests in a timely and organized manner is just as important as saving them. Here are some methods for efficiently sending your documents:

- Email: Sending documents via email is fast and effective. Make sure to attach your document and provide a clear subject line and message explaining the purpose of the request.

- Use Online Platforms: Many digital platforms allow you to send requests directly to clients. These services can automatically track payment status and send reminders for overdue payments.

- Automate Reminders: Automating reminders through your email system or payment platform can help you stay on top of late payments without manual follow-up.

- Include Payment Links: For faster processing, include links to payment gateways in your documents, allowing clients to make payments directly from their email or document view.