Commercial Invoice Template for International Shipping

When conducting cross-border trade, one of the most critical aspects is ensuring that your paperwork is in order. Accurate and well-prepared documentation plays a significant role in avoiding delays, fines, and complications. Understanding the necessary forms and how to complete them correctly is key to a smooth transaction between sellers and buyers in different countries.

The main document needed for customs clearance and to guarantee the safe passage of goods across borders includes details about the value, description, and origin of the products being transported. Without this essential record, shipments might be delayed or even rejected. Knowing how to format this paperwork correctly can save both time and money, ensuring that goods reach their destination without unnecessary setbacks.

This guide will walk you through the process of creating the right form for your exports, including the core elements it should contain and tips on how to customize it to your specific needs. From providing accurate product descriptions to including the right payment terms, mastering this document is crucial for efficient and hassle-free deliveries.

Commercial Invoice Basics for Shipping

When sending goods abroad, the right documentation ensures smooth processing through customs and avoids unnecessary delays. This critical paperwork provides authorities with detailed information about the contents, value, and origin of the products being transported. Without this form, your items might face complications that could delay their journey or even result in fines.

Key Information to Include

To ensure your documents are complete, several key pieces of information must be accurately provided. These details help customs officials assess the shipment and ensure compliance with local regulations:

- Sender and Recipient Details: Names, addresses, and contact information of both the sender and the recipient are essential.

- Product Description: A clear and concise description of the goods being exported.

- Quantity and Weight: Precise details about the amount and weight of the items, including any packaging.

- Value of Goods: The declared value for customs and taxation purposes.

- HS Code: Harmonized System code to classify the goods according to international standards.

- Terms of Sale: The agreed-upon payment terms, such as “FOB” (Free On Board) or “CIF” (Cost, Insurance, and Freight).

Why Accuracy Matters

Ensuring that all the necessary fields are filled out correctly reduces the risk of your shipment being held up or delayed. Mistakes or incomplete information could lead to incorrect tariffs being applied, resulting in delays and additional costs. Moreover, inaccurate forms may cause customs to reject the shipment entirely. Always double-check that every field is completed with up-to-date and truthful data.

What is a Commercial Invoice?

In global trade, specific documentation is required to ensure the smooth movement of goods across borders. This form serves as a detailed record of the transaction between the seller and the buyer, offering customs authorities necessary information to process the shipment. It contains vital data, such as product descriptions, quantities, and values, helping facilitate the clearance of goods through customs and ensuring that the right duties and taxes are applied.

Purpose and Importance

The main purpose of this document is to provide proof of the transaction and assist customs officials in evaluating the proper duties and taxes owed. It also serves as a declaration to confirm the legitimacy of the products being exported and helps avoid misunderstandings or legal complications. Properly completed paperwork can significantly speed up the delivery process and reduce the likelihood of delays or fines.

Key Features

Typically, this form includes the following key elements:

- Details of the Seller and Buyer: Contact information for both parties involved in the transaction.

- Product Descriptions: Clear, precise information about the goods being sold, including their quantity and value.

- Price and Payment Terms: The agreed-upon price of the items, including payment conditions.

- Customs Classification: A classification code for the goods, used to determine tariffs and taxes.

Understanding this document’s role is essential for ensuring a seamless cross-border exchange, reducing potential issues during customs processing and delivery.

Why You Need a Commercial Invoice

When sending goods across borders, certain documents are essential for ensuring that everything runs smoothly and legally. Without the proper paperwork, your shipment could be delayed, rejected, or subjected to unnecessary fees. This specific document serves as an official declaration that provides customs officials with detailed information about the products being transferred, including their value, origin, and purpose. Understanding why this form is necessary will help ensure the timely delivery of your goods.

Key Reasons for the Document

- Customs Clearance: This document is required by customs authorities to verify the contents of the shipment, allowing goods to pass through borders without issues.

- Accurate Taxation: It ensures the correct duties and taxes are applied, based on the declared value of the goods.

- Legal Protection: It acts as a record of the transaction, protecting both parties in case of disputes regarding the sale.

- Faster Processing: Proper documentation helps speed up the customs process, reducing the chance of delays.

Consequences of Not Using It

- Shipment Delays: Without this essential document, your goods may be held up at customs or sent back to the origin.

- Additional Costs: Missing or incorrect paperwork could result in fines, additional taxes, or the need to submit new forms.

- Customs Rejection: In some cases, failure to provide the necessary paperwork may lead to the complete rejection of the shipment.

Having the right documentation in place ensures smoother cross-border transactions and helps avoid costly delays and penalties.

Essential Elements of a Commercial Invoice

When preparing documentation for cross-border trade, certain key details must be included to ensure smooth customs processing and legal compliance. This essential paperwork requires specific information to be filled out correctly, covering everything from the identities of the parties involved to detailed descriptions of the goods. Without these critical elements, your shipment could face delays or complications in clearing customs.

Key Components to Include

Below are the crucial sections that should be present in every document of this nature:

- Seller and Buyer Information: Full names, addresses, and contact details of both the sender and the recipient. This is necessary for identification and communication purposes.

- Product Description: A detailed description of the goods being transferred, including quantity, type, and specifications. The description must be clear and accurate to avoid confusion during inspection.

- HS Code (Harmonized System Code): A standardized classification code used to identify goods and determine applicable duties and taxes. Including the correct HS code ensures proper tariff application.

- Price and Total Value: The unit price of each item and the total value of the shipment. This helps customs authorities calculate the appropriate taxes and ensures transparency in the transaction.

- Payment Terms: The agreed-upon terms between the buyer and seller, such as payment method, currency, and due dates. This section clarifies the financial arrangement between both parties.

- Shipment Details: Information about the mode of transport, including carrier details and tracking number, if available. This ensures that the movement of goods is easily traceable.

Why Accuracy Matters

Each of these components must be completed with care to avoid delays or complications. Inaccuracies or omissions can lead to shipment rejections, fines, or additional scrutiny from customs. By ensuring all the required information is provided and correctly formatted, the process of exporting goods becomes more efficient and reliable, ensuring timely delivery and minimizing the risk of unexpected costs.

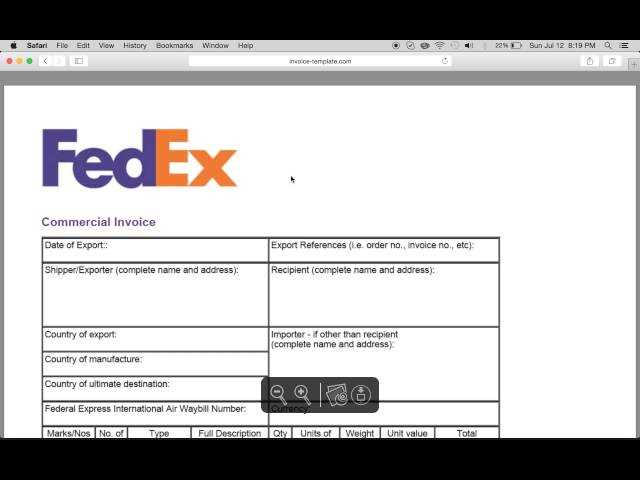

How to Fill Out a Commercial Invoice

Creating accurate documentation for cross-border transactions is essential for ensuring smooth customs clearance and efficient processing. Filling out this form correctly not only prevents delays but also avoids costly mistakes. Each section of the document serves a specific purpose and requires precise information. Below is a step-by-step guide to help you complete the required fields properly.

Step-by-Step Process

Follow these steps to ensure that all the necessary details are included in your form:

- Enter Sender and Recipient Details: Start by including the full names, addresses, and contact details of both the seller and the buyer. Double-check that the information is correct to avoid delivery issues.

- Provide a Clear Product Description: Describe each item in detail. Include the quantity, model, and any relevant specifications. Make sure the description is clear enough for customs officers to understand what is being sent.

- Include the Harmonized System (HS) Code: Look up the correct HS code for your goods to ensure proper classification. This code helps determine applicable duties and taxes.

- List the Price and Total Value: Provide the unit price of each item and the total value of the shipment. This is critical for customs to determine the appropriate taxes and duties.

- State the Payment Terms: Clearly outline the terms of sale, such as payment method, currency, and any other agreed-upon financial conditions.

- Detail the Mode of Transport: Include information on how the goods will be transported, such as the shipping carrier, tracking number, and shipping date.

Final Checks

Before submitting the document, it’s important to double-check the following:

- Ensure that all fields are filled out completely and accurately.

- Verify the descriptions and values are correct, as errors can lead to customs delays or additional charges.

- Check that the payment terms are clearly stated and agreed upon by both parties.

By following these steps and reviewing the form carefully, you can ensure that the transaction proceeds without unnecessary delays or complications. Properly completed paperwork is key to smooth cross-border trade and efficient customs processing.

Common Mistakes to Avoid in Invoices

While preparing documents for cross-border transactions, it’s crucial to ensure that all details are accurate and complete. Small errors or omissions can cause significant delays in the customs clearance process and result in additional costs. Understanding the most common mistakes and how to avoid them can help prevent unnecessary complications and ensure a smooth transaction.

Typical Errors to Watch Out For

Here are some of the most frequent mistakes that exporters make when completing their paperwork:

- Incorrect or Missing Contact Information: Failing to include accurate names, addresses, and contact details of both the sender and the recipient is one of the easiest mistakes to make. Ensure this information is clear and up to date to avoid delivery issues.

- Unclear or Incomplete Product Descriptions: Providing vague or incomplete descriptions of the goods can lead to confusion at customs. Always include specific details such as item names, quantities, model numbers, and any distinguishing features.

- Wrong Harmonized System (HS) Codes: Using an incorrect HS code can result in incorrect tariffs being applied, leading to delays or unexpected charges. Verify the appropriate code for your products before completing the document.

- Omitting the Total Value: Forgetting to state the value of the goods, or providing an incorrect value, can cause customs to halt the shipment. Always list the total value, including unit prices and quantities, clearly and accurately.

- Missing Payment Terms: Failing to outline payment terms, such as the method, currency, and due date, can lead to confusion between the seller and buyer. Make sure all financial agreements are clearly stated in the document.

- Incorrect Shipping Information: It’s essential to provide precise details about how the goods will be transported, including the carrier, shipping date, and tracking number. Missing or inaccurate shipping information can result in delays or difficulty tracking the shipment.

How to Avoid These Mistakes

To avoid these common pitfalls, always take the time to double-check every detail before submitting your form. Verify the accuracy of the information, especially with regards to product descriptions, value, and shipping details. Using a checklist can help ensure that you don’t overlook any key points. Additionally, it may be helpful to consult with a customs expert or use an online tool to assist with HS code classification and other legal requirements.

By paying attention to these details, you can prevent unnecessary complications, ensuring your goods move through customs swiftly and without added costs or delays.

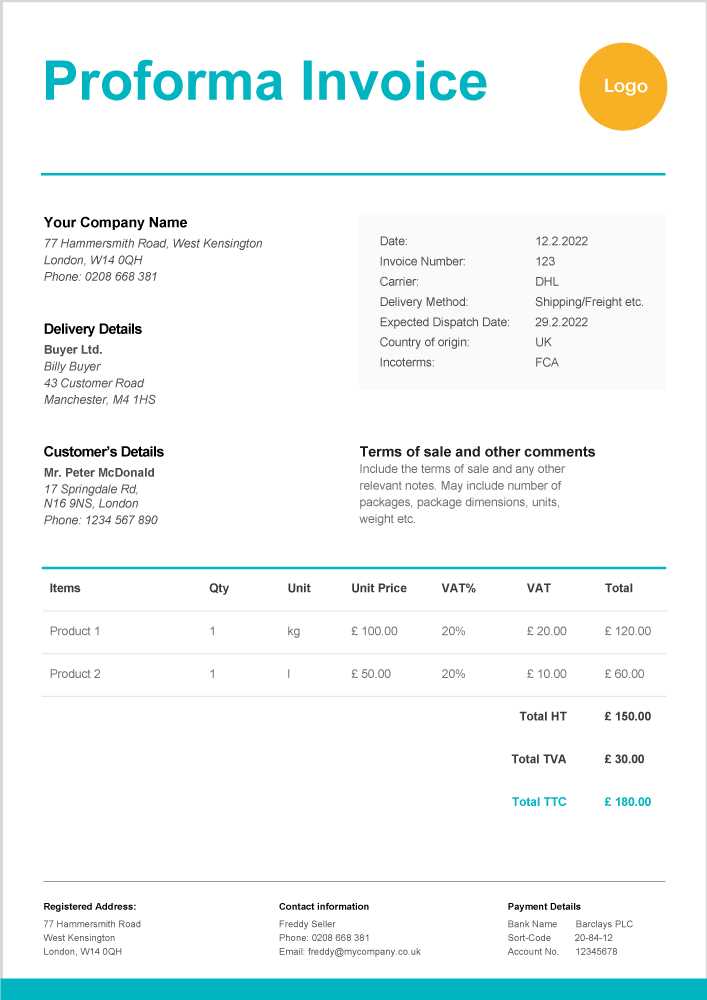

Commercial Invoice vs Proforma Invoice

When it comes to cross-border transactions, two common types of documents are often used to record the details of a sale: one serves as a legal record of the transaction, while the other acts as an estimate or preliminary statement of terms. Though they both provide similar information, the key difference lies in their purpose and function. Understanding how these documents differ is essential for ensuring proper customs processing and smooth trade operations.

Key Differences

The primary difference between these two documents is that one is used as a final record of the sale, while the other serves as a preliminary agreement. Below is a comparison of their key attributes:

| Aspect | Commercial Record | Preliminary Record |

|---|---|---|

| Purpose | Final proof of the transaction between seller and buyer. | Estimates and outlines the expected costs and terms before the sale is finalized. |

| Legal Standing | Used for customs clearance and tax calculation, considered a legal document. | Not a legal document, used for quotation purposes and preliminary customs processing. |

| Use in Customs | Required for customs clearance, helps determine the applicable duties and taxes. | Can be used for customs, but it may not be accepted in place of a final transaction record. |

| Binding Terms | Binding, includes final prices and terms agreed upon by both parties. | Non-binding, subject to change once the final sale is made. |

| When Issued | Issued after the sale is completed, before goods are shipped. | Issued before the sale is finalized, often before payment is made or goods are dispatched. |

When to Use Each Document

Use the final transaction record when goods are ready to be dispatched and all terms of sale have been agreed upon. This document is required for customs clearance, as it provides the definitive details of the sale and value of the goods. On the other hand, the preliminary estimate is useful for providing potential buyers with an outline of the sale terms, helping both parties agree on the expected price and terms before committing to the transaction.

Understanding the difference between these two documents ensures that you use the right one at the appropriate stage in th

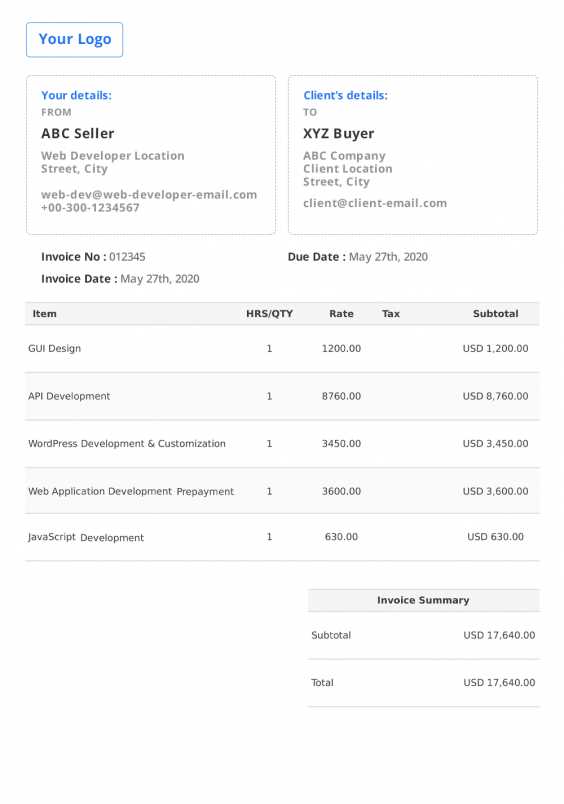

Customizing Your Commercial Invoice Template

When preparing export documentation, it’s important to tailor your paperwork to meet both your business needs and the specific requirements of the destination country. Customizing the form allows you to include all the necessary details and ensure accuracy, minimizing the risk of delays or issues during customs clearance. Adjusting the layout, adding specific fields, and incorporating your branding are just a few ways to make the document fit your transaction.

Key Customization Options

Here are several key ways to adjust your form to ensure it meets the requirements of both the seller and the buyer:

- Personalize the Header: Include your company logo, address, and contact information at the top of the form. This ensures that the buyer and customs authorities can easily identify the seller.

- Product Descriptions and Specifications: Tailor the description section to include more detailed information about the goods being sold, such as size, weight, and model numbers. This helps avoid confusion or questions during inspection.

- Additional Payment Terms: Customize the payment terms section to reflect specific agreements between you and the buyer. This might include the method of payment, currency, and the due date for the transaction.

- Shipping Information: Add fields to detail the transportation method, including carrier, tracking number, and estimated delivery date. Providing complete shipping details helps ensure transparency and smooth tracking of the goods.

- Tax and Duty Information: Include relevant fields that reflect any applicable taxes or duties, especially if they differ depending on the destination country or the nature of the goods. This helps clarify costs for both parties involved.

Benefits of Customization

Customizing your form offers several advantages. Not only does it help streamline the process by ensuring that all necessary information is included, but it also allows you to present your brand professionally. By incorporating your company details, you give the buyer and customs authorities a clear, concise document that meets all required standards. Additionally, customizing allows you to avoid common mistakes, ensuring that the document is tailored to the specific terms of the sale and regulations of the country receiving the goods.

Ultimately, making your form fit your business needs and legal requirements is a crucial step in ensuring a smooth transaction, reducing the chances of customs issues, and facilitating faster processing.

Using Templates for International Shipments

When managing cross-border transactions, consistency and accuracy in paperwork are essential. Using pre-designed forms can help streamline the process by providing a ready-made structure that ensures all required fields are included. This approach saves time, reduces the risk of mistakes, and helps meet the specific documentation needs of customs authorities. Templates can also simplify the customization process, allowing you to quickly adjust the document to suit different types of goods or transactions.

Advantages of Using Pre-Designed Forms

Utilizing a template offers several benefits that can help optimize the preparation of your export documents:

- Efficiency: With a template, the core structure is already in place, allowing you to simply fill in the necessary details, saving valuable time during preparation.

- Consistency: Templates ensure that all required information is consistently included in each shipment, reducing the risk of missing important details that could cause delays at customs.

- Accuracy: Many templates are designed with regulatory requirements in mind, so using one helps ensure that the document meets legal and customs standards, minimizing errors.

- Customization: Pre-designed forms can easily be customized to fit specific needs, whether it’s adjusting the layout, adding product details, or including special terms and conditions.

How to Effectively Use a Template

While templates are extremely useful, it’s important to ensure that they are adapted to your specific situation. Here are a few tips on how to make the most of pre-designed forms:

- Review the Form: Before using a template, carefully review it to ensure it aligns with the specific requirements of the goods being shipped and the destination country.

- Fill in Accurate Details: Double-check the information you enter, including product descriptions, values, and shipping details. Even with a pre-designed template, the accuracy of the data is key to avoiding customs issues.

- Stay Up-to-Date: Ensure that the template is current and meets the latest regulations. Templates should be updated regularly to reflect any changes in laws or customs procedures.

By using templates, you can streamline the paperwork process, reduce the chance of errors, and ensure that all necessary information is included in a standardized, efficient way. This approach helps facilitate smoother cross-border transactions and quicker customs clearance.

How to Handle Customs Declarations

When sending goods across borders, proper customs declarations are crucial for ensuring that your shipment clears smoothly and without delay. Customs authorities require detailed information about the goods being transported to assess duties, taxes, and compliance with import/export regulations. Handling these declarations accurately helps avoid penalties, shipment rejection, or unnecessary hold-ups. Below is a guide on how to effectively manage this process to ensure a seamless transaction.

Steps to Prepare Customs Declarations

To properly handle customs declarations, follow these key steps:

- Provide Accurate Product Descriptions: Customs requires a detailed description of the goods being shipped, including their purpose, value, and any distinguishing features. Be as specific as possible to avoid confusion or delays during inspection.

- Declare the Correct Value: Accurately declare the total value of the goods, including their market price and any additional fees. This value will be used to calculate the applicable duties and taxes. Under-declaring the value can lead to fines and delays.

- Include Relevant Documentation: Submit the necessary forms and documents along with the goods. These may include receipts, export licenses, certificates of origin, or other supporting documents depending on the type of goods and the destination country.

- Ensure Correct Classification: Goods must be classified according to the Harmonized System (HS) codes, a system used to determine appropriate duties and taxes. Use the correct HS code for each item to avoid discrepancies with customs authorities.

- List the Correct Payment Terms: Be clear about the payment terms for the transaction, including the method and currency of payment. This will help clarify any financial obligations and prevent disputes.

Common Mistakes to Avoid

While handling customs declarations, it’s important to avoid certain common mistakes that can cause issues:

- Inaccurate Descriptions: Vague or incorrect descriptions of the goods can lead to customs rejections. Always provide a clear, precise description of each item.

- Failure to Include Required Documentation: Missing or incomplete documentation can result in delays. Always double-check that all necessary forms are included with the shipment.

- Incorrect Value Declaration: Underestimating the value of the goods to reduce duties can result in fines, penalties, or even confiscation. Always declare the true value of the items.

- Missing HS Code: Not including or misclassifying the HS code can cause customs delays. Ensure that the proper code is listed for each product in the shipment.

By taking the time to accurately prepare your customs declarations, you ensure that your shipment is processed quickly and efficiently, minimizing the risk of complications. Proper documentation, clear descriptions, and adherence to regulations help avoid unnecessary delays and additional costs.

Best Practices for Invoice Accuracy

Ensuring the accuracy of documentation when conducting cross-border transactions is crucial for smooth operations. Mistakes or discrepancies in the paperwork can lead to delays, fines, or even rejection of goods by customs authorities. To prevent these issues, it’s important to follow established best practices when preparing the necessary documents. By adopting careful procedures and double-checking the details, you can minimize the risk of errors and ensure a seamless process.

Steps to Achieve Accurate Documentation

Below are key practices to help maintain the accuracy of your export forms:

- Double-Check All Information: Before submitting the form, carefully review all details such as the names, addresses, and contact information of both parties. Ensure that all spelling and numbers are correct to avoid issues during processing.

- Provide Clear Product Descriptions: Include a detailed description of each item, such as its name, model, material, and use. Vague or inaccurate descriptions can confuse customs officers and delay clearance.

- Use Correct Harmonized Codes: Accurate classification of goods using the correct Harmonized System (HS) codes is vital for customs processing. Make sure each item is listed with its proper code to avoid customs delays or misclassification.

- Verify Product Value: Accurately declare the value of each item in the shipment. This is essential for calculating applicable duties and taxes and preventing disputes over pricing.

- Include Payment Terms: Clearly outline the agreed-upon payment terms, such as method, currency, and due date. This helps avoid misunderstandings between the buyer and seller.

Additional Tips for Accurate Documentation

- Stay Organized: Keep a checklist of required fields and documents. This will ensure that nothing is missed and will help you stay on track during the preparation process.

- Maintain Consistency: Use consistent terminology throughout the document. For example, the same product names and descriptions should be used consistently to avoid confusion.

- Update Forms Regularly: Make sure the forms you’re using are up-to-date with the latest regulations and any changes in tax laws or customs rules.

- Consult an Expert: If you’re unsure about any part of the documentation, it’s worth consulting with a customs expert or legal advisor to ensure compliance and accuracy.

By following these best practices, you can significantly reduce the likelihood

How to Calculate Total Value on Invoice

Accurately calculating the total value of goods being traded is a fundamental aspect of cross-border transactions. This value is used not only for financial purposes but also for determining applicable duties, taxes, and compliance with regulations. The total value must reflect the actual cost of the goods and any additional charges that may apply, such as shipping, insurance, and handling fees. Knowing how to calculate this correctly ensures transparency and avoids unnecessary complications during customs clearance.

Components of Total Value

When calculating the total value of goods, there are several key elements to consider:

- Product Cost: The base price of the goods as agreed upon between the buyer and seller. This is the amount before any additional fees or taxes are added.

- Shipping and Freight Charges: Any costs associated with transporting the goods from the seller to the buyer. This could include ocean freight, air freight, and other delivery charges.

- Insurance: If the goods are insured during transit, the cost of the insurance should be added to the total value. This covers potential risks like damage or loss during transportation.

- Packaging Fees: If there are specific charges for packaging materials or custom packaging, these should be included in the calculation of the total value.

- Handling and Administrative Fees: Any fees related to the handling of goods, such as loading, unloading, or customs processing, should be accounted for as well.

Calculation Formula

To calculate the total value of the goods, simply add together all the components outlined above. The formula can be expressed as:

Total Value = Product Cost + Shipping Charges + Insurance + Packaging Fees + Handling Fees

Make sure that each element is clearly stated and supported by invoices, receipts, or agreements to avoid discrepancies or misunderstandings. A well-documented total value ensures that customs can accurately assess the correct duties and taxes, helping the transaction proceed smoothly without delays.

Invoice Language and Currency Considerations

When preparing documentation for cross-border transactions, it’s crucial to ensure that the language and currency used are suitable for both the buyer and the seller, as well as compliant with customs requirements. The choice of language and currency can impact the clarity of the transaction and the smooth processing of goods through customs. It’s essential to consider these factors carefully to avoid misunderstandings and delays in the transaction process.

Language Selection

The language used in the documents must be clear and understandable for both parties involved, as well as for customs authorities. Consider the following:

- Local Language Requirements: Many countries have specific language requirements for documentation. Ensure that the form is presented in the language of the importing country or a widely accepted international language, such as English.

- Consistency: Use consistent terminology throughout the document to avoid confusion. If technical terms are necessary, include clear definitions or explanations where applicable.

- Translation Considerations: If needed, provide certified translations of important details or legal clauses to ensure that all information is accurately understood by all parties.

Currency Selection

Choosing the correct currency for the transaction is just as important as the language. The currency used should be mutually agreed upon by both parties and suitable for the country in which the goods are being delivered. Consider these points:

- Agreed Currency: Clearly state the agreed currency in the document. If the buyer and seller are located in different regions, ensure that the currency used is acceptable in both countries, or agree on an internationally recognized currency like USD or EUR.

- Exchange Rates: If the transaction involves different currencies, it is essential to specify the exchange rate used on the date of the transaction. This helps avoid confusion or disputes regarding the actual value of the goods.

- Currency Symbols: Always use the appropriate currency symbol (e.g., $, €, £) and avoid ambiguous abbreviations to ensure clarity and prevent misunderstandings.

By addressing both language and currency considerations properly, you ensure that all parties involved have a clear understanding of the transaction, which reduces the risk of errors, delays, or disputes. This careful attention to detail is essential for a smooth cross-border exchange of goods.

Export Documentation Requirements for Invoices

When sending goods across borders, there are specific documentation requirements that must be met to ensure compliance with customs regulations. Properly prepared documents help facilitate the smooth transit of goods and reduce the chances of delays, fines, or shipment rejections. Export documentation varies by country, but some common documents and details are universally required for the clearance of goods through customs. It’s essential to understand what needs to be included and how to prepare these documents accurately.

Common Export Documentation

To meet the documentation requirements for cross-border transactions, the following documents are typically necessary:

- Detailed Product Descriptions: A clear description of each product being shipped, including its purpose, quantity, weight, and value. This information is essential for customs authorities to classify and assess the goods appropriately.

- Certificates of Origin: This document certifies the country where the goods were produced or manufactured. It is often required for customs clearance and can influence duty rates or eligibility for trade agreements.

- Export Licenses: Depending on the type of goods and their destination, an export license may be required. This is particularly common for restricted or controlled items, such as technology or certain chemicals.

- Customs Declaration Forms: These forms provide detailed information about the goods, their value, and the destination. This is used to calculate applicable duties and taxes. They must be submitted to the customs office of the destination country.

- Packing List: A detailed list of all the items in the shipment, along with packaging details such as box numbers and dimensions. This helps customs officers quickly verify the contents of the shipment.

Additional Considerations

In addition to the basic documentation, the following points should be kept in mind to avoid any complications:

- Accuracy: Ensure that all details in the documents are accurate, including product descriptions, quantities, and values. Incorrect or incomplete documentation can lead to delays, fines, or customs holds.

- Required Signatures: Many documents, such as certificates of origin and export declarations, may need to be signed by the exporter or a customs authority. Be sure to check the specific requirements for each document.

- Language Compliance: Some countries require that documents be submitted in their official language or in a widely accepted international language, such as English. Make sure the language requirements are met to avoid delays.

Understanding and following the required export documentation can prevent many issues in the export process. Ensuring that all necessary forms are complete and accurate is key to a smooth customs experience and timely delivery of goods to the destination country.

How to Save Time with Invoice Templates

Streamlining business processes is essential for increasing efficiency and saving valuable time, especially when managing repetitive tasks like preparing documentation for transactions. One of the most effective ways to achieve this is by using pre-designed forms that can be customized quickly for each transaction. These forms eliminate the need to start from scratch every time, providing a quick and standardized method for recording essential details.

Advantages of Using Pre-Designed Forms

By incorporating pre-made forms into your workflow, you can significantly reduce the time spent on preparing documents. Here are some of the key benefits:

- Consistency: Pre-designed forms ensure that the same structure and formatting are used every time, reducing the chances of errors or missing information. This consistency can also help improve the professionalism of your business communications.

- Faster Preparation: Instead of entering the same data over and over, you can quickly fill in the relevant details for each transaction. Fields like addresses, product descriptions, and pricing are often reusable, saving you from retyping the same information.

- Automated Calculations: Many pre-designed forms allow for automatic calculations, such as totals, taxes, and discounts. This feature helps avoid human error and saves time on manual math.

- Customization: Templates are flexible and can be adapted to suit different business needs. You can modify them to include specific information required by your company or the destination country’s customs requirements.

Time-Saving Tips for Using Pre-Designed Forms

Here are a few tips to maximize the time-saving potential of using pre-made forms:

- Store Common Information: Save standard data like company name, address, and contact details in your form templates, so you don’t have to re-enter them every time.

- Standardize Product Descriptions: If you frequently ship the same items, create a list of standard product descriptions or SKUs. This will allow you to quickly select from a pre-written list instead of typing the information manually each time.

- Integrate with Accounting Software: Many businesses integrate their documentation forms with accounting or order management software. This integration ensures that data is automatically transferred, reducing manual data entry and improving accuracy.

- Use Cloud Storage: Store your templates and completed forms in a cloud-based system. This makes it easy to access, update, and share them without the risk of losing important documents.

Incorporating pre-designed forms into your workflow is a smart way to save time and reduce the complexity of managing documentation. With just a few modifications, you can streamline the process, ensuring that each transaction is handled efficiently while maintaining accuracy and professionalism.

Where to Find Free Invoice Templates

When you need to create documents for a transaction, finding the right resources can save you time and effort. Thankfully, there are many platforms that offer free, customizable forms designed to meet the needs of small businesses and individual entrepreneurs. Whether you are looking for basic forms or something more specific, there are numerous places to find templates that are easy to use and adapt to your requirements.

Top Sources for Free Forms

Here are some great resources where you can find free forms to streamline your documentation process:

- Microsoft Office Templates: Microsoft Office offers a wide range of free forms through its Word and Excel programs. These templates can be easily customized to suit different types of transactions and industries. Simply download the template and start filling in the details.

- Google Docs and Sheets: Google’s suite of free tools also includes document templates. Their cloud-based nature makes them easy to access from anywhere, and you can share them directly with clients or colleagues for collaboration.

- Online Accounting Tools: Platforms such as Wave, Zoho, and QuickBooks often provide free, downloadable forms as part of their suite of services. These forms are designed for ease of use and are regularly updated to reflect the latest best practices.

- Online Template Libraries: Websites like Template.net, Vertex42, and Invoice Home offer a range of free forms. They are organized by category, so you can quickly find what you need, whether it’s a basic document or something more specialized.

Things to Consider When Choosing a Template

While many free resources are available, it’s important to choose the right one to ensure that it fits your business needs. Consider these factors:

- Customization Options: Make sure the form you choose can be easily modified to include all the necessary details, such as product descriptions, pricing, and taxes.

- Compatibility: Check that the template works with the software or platform you’re using, whether it’s Excel, Google Sheets, or another format.

- Legal Compliance: Ensure the template meets the legal and regulatory requirements of your country or the destination country, especially if you’re dealing with cross-border transactions.

Using free forms can significantly reduce the time and effort involved in preparing documents. By selecting a suitable resource, you can create professional, accurate records without the need for expensive software or custom solutions.