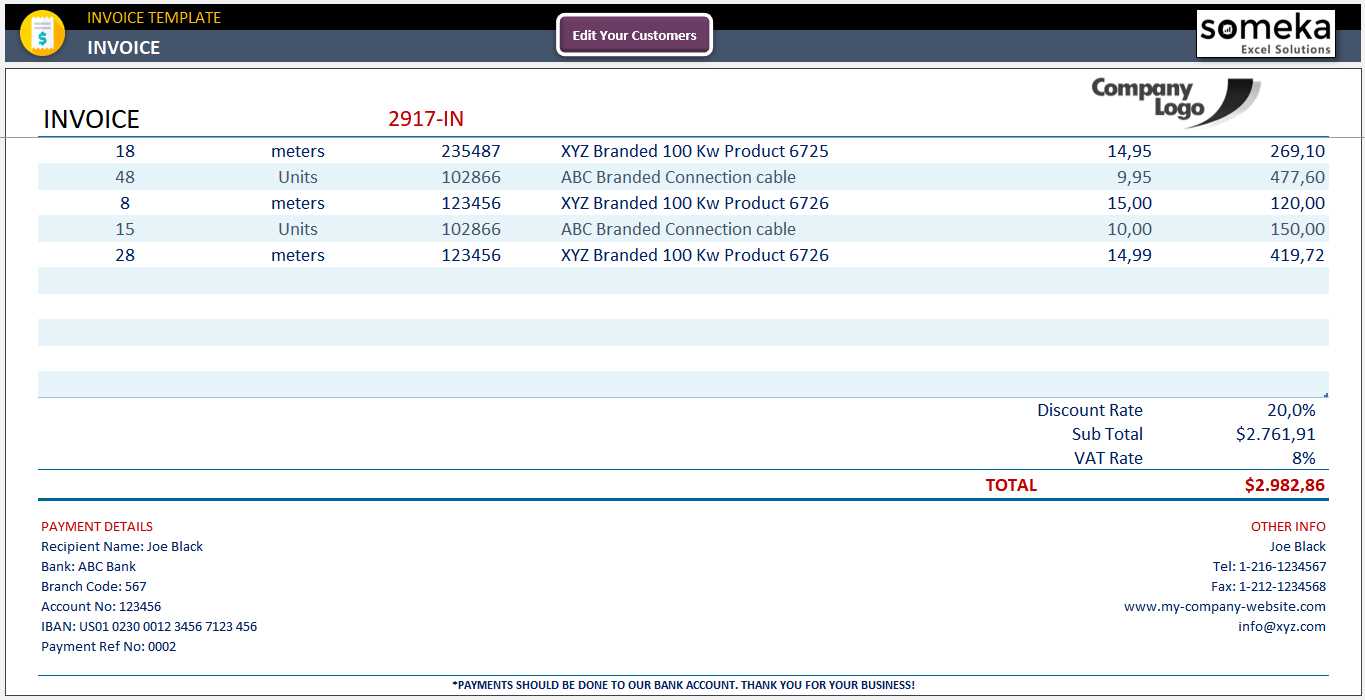

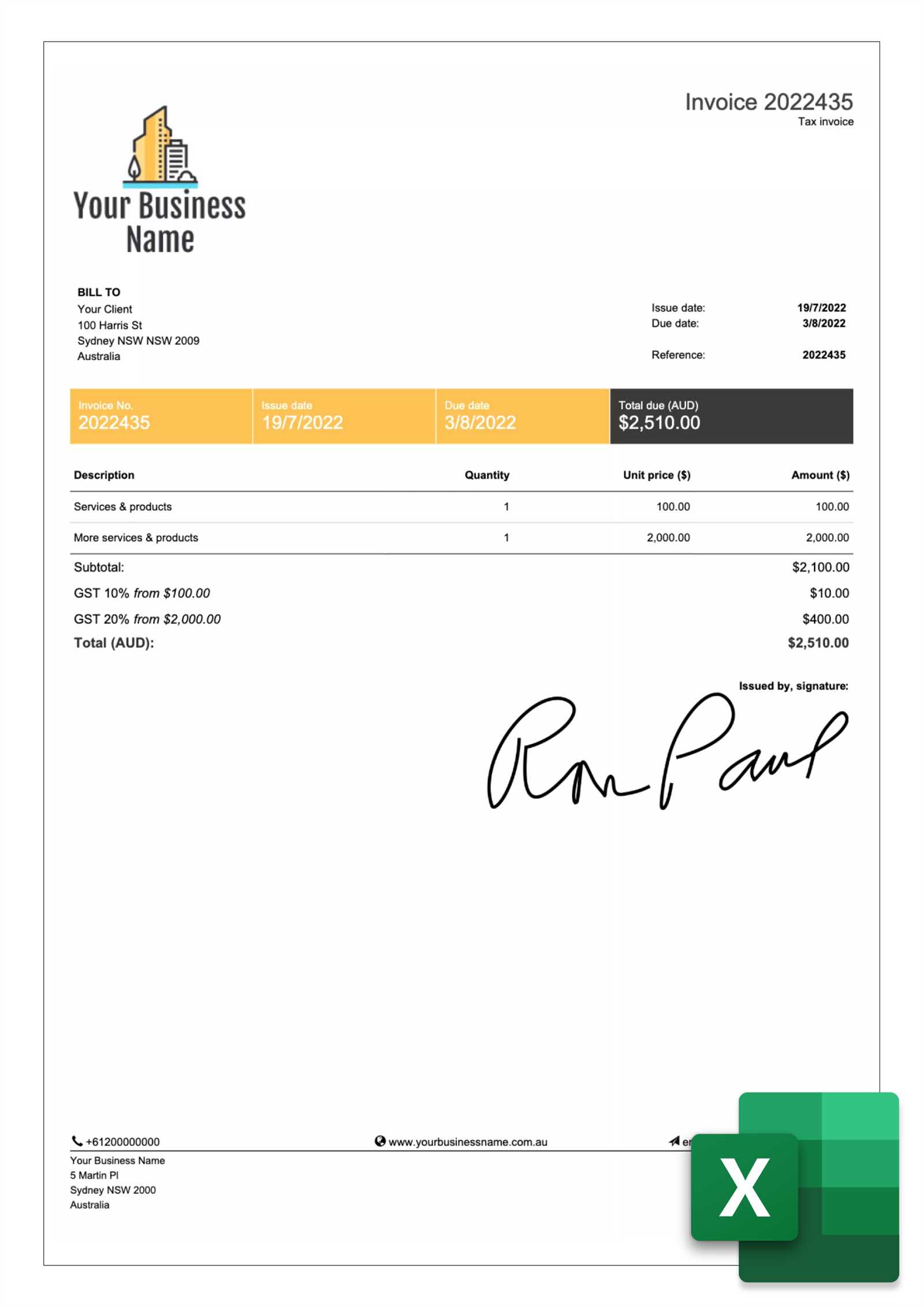

Invoice Template with Logo for Excel

Creating customized financial documents is essential for presenting a professional image to clients and ensuring smooth business transactions. Tailoring these documents to include important details such as your company’s branding and contact information helps establish trust and clarity. With the right tools, it’s possible to easily create documents that reflect your brand’s identity while maintaining functionality.

Many businesses rely on digital tools to simplify document creation, especially when it comes to tracking payments, managing transactions, and sending professional correspondence. By adapting commonly available software to fit your needs, you can save time and reduce the risk of errors. Customizing these documents can be an efficient way to streamline your processes and improve communication with clients and partners.

Invoice Template with Logo for Excel

Creating personalized business documents that carry your company’s identity is an essential part of professional communication. This process involves integrating your brand’s design elements into financial records to create consistency and enhance recognition. The ability to include your branding in these files helps establish your company’s presence and trustworthiness when dealing with clients.

Why Customization Matters

Tailoring your financial documents to represent your business not only provides a polished appearance but also reinforces your brand’s message. Whether it’s for internal use or client-facing purposes, a professional look adds value to the entire experience. Below are some of the key reasons to invest in custom document creation:

- Brand Recognition: A consistent visual presence helps clients quickly associate your company with the services you offer.

- Professionalism: Customization ensures that your communications appear more formal and trustworthy, leading to greater client confidence.

- Consistency: Using similar styles across all documents maintains a cohesive and reliable brand identity.

- Easy Updates: Personalizing documents ensures you can easily update contact details or design elements when necessary.

Steps to Personalize Your Documents

Follow these simple steps to integrate your branding into financial documents:

- Select a Compatible Platform: Choose a tool that allows for easy customization, such as a spreadsheet program or document editor.

- Incorporate Design Elements: Include your business’s color scheme, fonts, and other visual components that align with your brand’s style.

- Add Essential Details: Ensure that your contact information, payment terms, and service descriptions are clearly displayed.

- Maintain Simplicity: While customization is key, avoid cluttering the document with too many design elements that could distract from the key information.

- Save and Reuse: Once personalized, save the document as a template that can be reused for future transactions.

By following these steps, you can easily create business documents that not only serve their intended purpose but also convey your brand’s professionalism and reliability. Customization offers both aesthetic and functional benefits that improve the overall quality of your financial communications.

Benefits of Using Excel for Invoices

Utilizing spreadsheet software for creating business documents offers a range of advantages, especially when it comes to managing financial transactions. This tool enables users to streamline data entry, automate calculations, and easily modify document formats to suit specific needs. With its user-friendly interface and versatile features, it’s an ideal choice for businesses looking to save time and improve accuracy.

Here are some of the main benefits of using spreadsheet software for your business documents:

- Flexibility and Customization: The ability to fully customize the layout and design ensures that documents reflect your specific business requirements, making them suitable for various industries and purposes.

- Automation of Calculations: Built-in formulas and functions allow for quick and accurate calculations, reducing the risk of errors and manual input.

- Ease of Use: The intuitive interface and simple structure make it easy for users to create and modify documents without advanced technical skills.

- Cost-Effective: Most spreadsheet tools are affordable or even free, offering a low-cost solution for businesses of any size.

- Data Management: Spreadsheet software allows you to efficiently track, sort, and analyze information, making it easy to manage transactions and monitor financial records.

By using spreadsheet software, businesses can significantly enhance their efficiency, accuracy, and professionalism in handling various documentation tasks, especially when dealing with financial matters. The customizable nature of the tool allows for a personalized approach while maintaining a high level of organization and consistency.

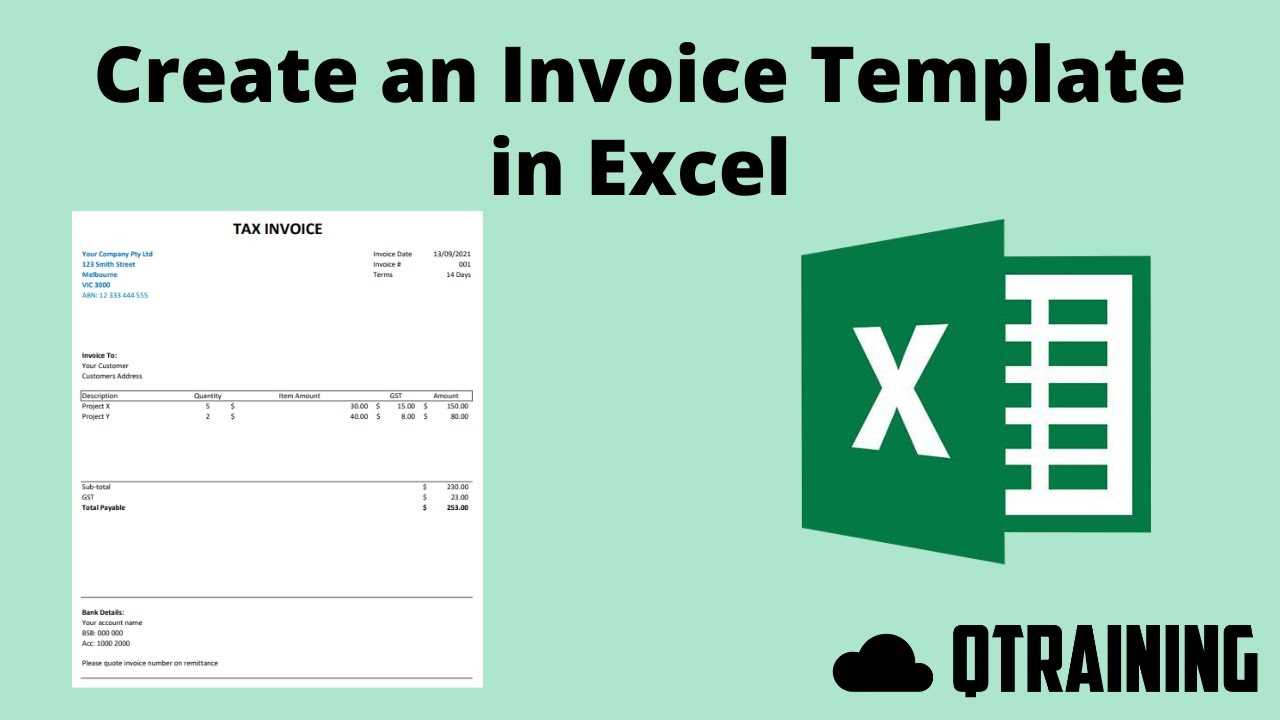

How to Add Your Logo to Excel

Incorporating your brand’s visual identity into your documents is an effective way to strengthen your company’s professional image. By including design elements such as your business’s emblem or symbol, you create a cohesive and recognizable presence. Adding these elements to your digital documents is a simple process that can significantly improve their appearance and impact.

Follow these steps to easily insert your branding into your documents:

- Prepare Your Image: Ensure your design element is in an appropriate file format, such as PNG or JPEG, and is high resolution for clarity.

- Open Your Document: Launch the spreadsheet software and open the document where you want to add your design.

- Insert the Image: Navigate to the “Insert” tab in the menu, then choose the “Picture” option. Select the file from your computer and click “Insert.”

- Position the Image: Once inserted, you can move and resize the image to fit the desired area, such as the top or bottom of the page, or within a header section.

- Adjust the Layout: Use layout options to wrap the text around the image or adjust transparency if needed, ensuring the content remains clear and readable.

By following these steps, you can easily incorporate your brand’s visual elements into your documents, giving them a polished and professional look. Whether for customer-facing communications or internal records, this small addition can make a big difference in how your business is perceived.

Customizing an Invoice Template in Excel

Adapting your business documents to meet specific needs is a valuable skill that enhances both efficiency and professionalism. Personalizing these documents allows you to present key details in a clear, organized manner while aligning them with your company’s branding. Customizing a document ensures that it fits your business’s particular style, making it easily recognizable and functional for everyday use.

Here’s how you can easily tailor a document for your business needs:

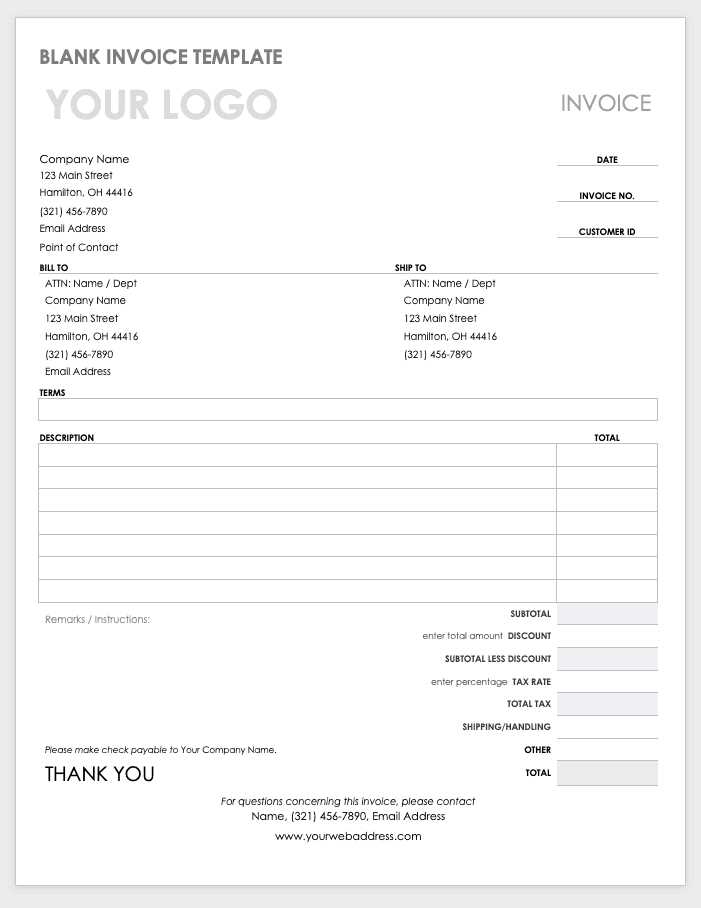

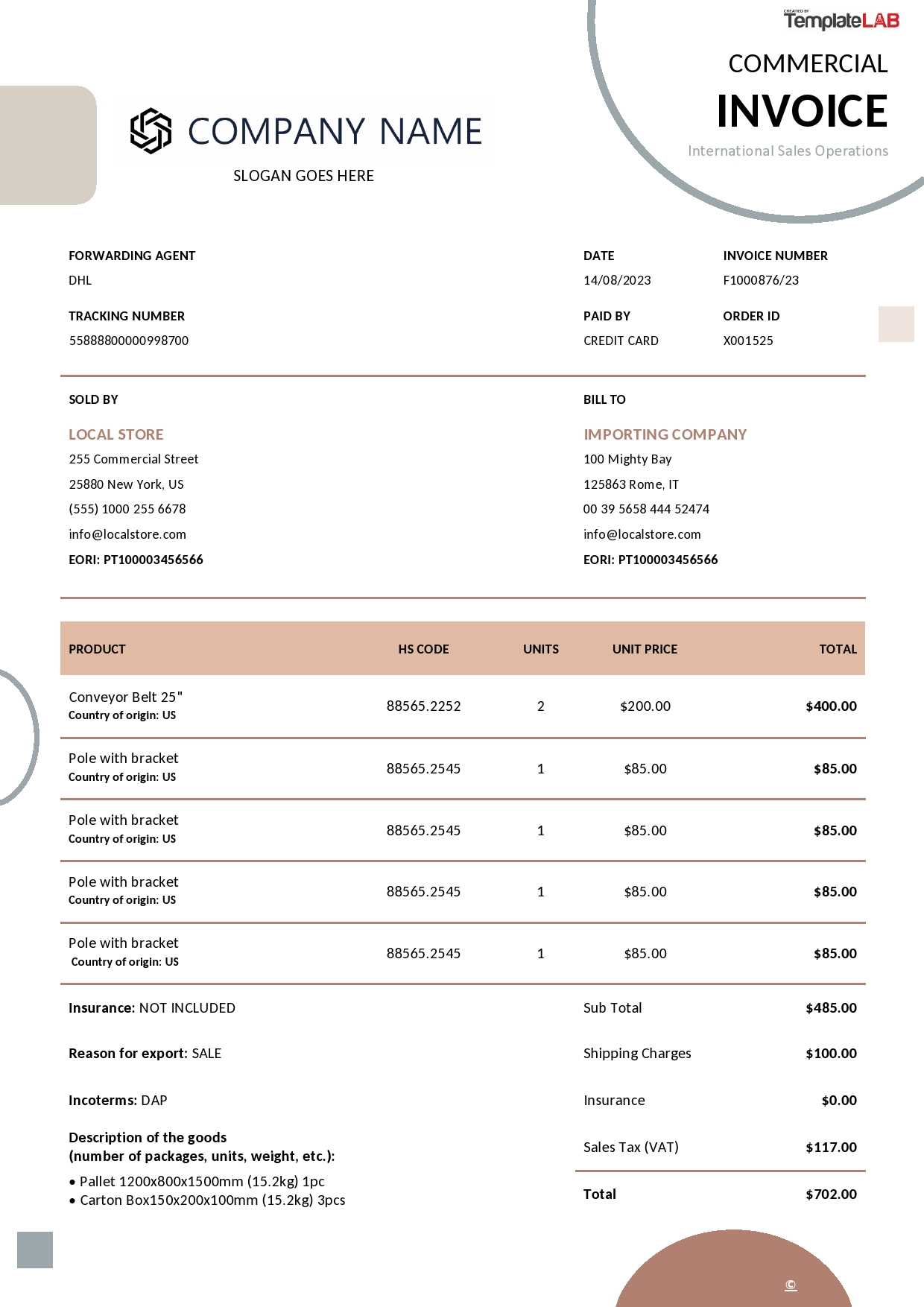

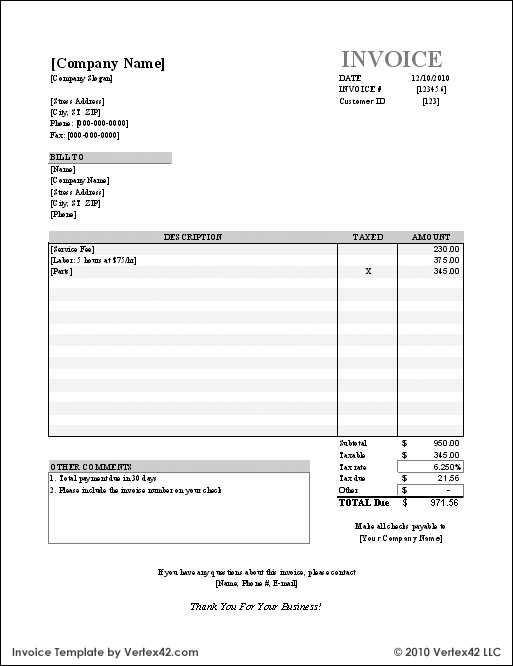

- Choose a Basic Layout: Start with a simple structure that includes essential fields like client details, items or services provided, and payment terms.

- Modify Fields: Adjust the columns and rows to reflect the information you need to include. You can add or remove sections based on what’s most relevant to your business.

- Format for Clarity: Use bold or colored text to highlight important sections, such as totals or due dates, making them easy to find at a glance.

- Incorporate Design Elements: Add your branding, such as colors, fonts, and borders, to create a cohesive look that matches your company’s identity.

- Set Up Calculations: Implement basic formulas to automatically calculate totals, taxes, or discounts, reducing the chances of errors and saving time.

By customizing your documents in this way, you can ensure they are not only functional but also professional and consistent with your brand’s image. Personalization adds value and helps create a stronger connection with clients while maintaining efficiency in your business operations.

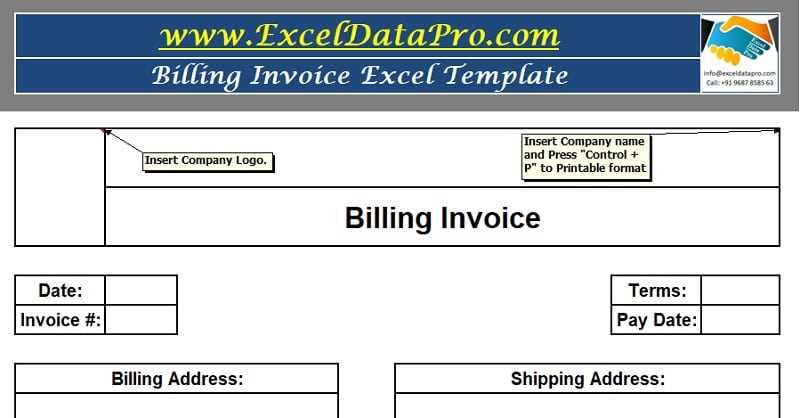

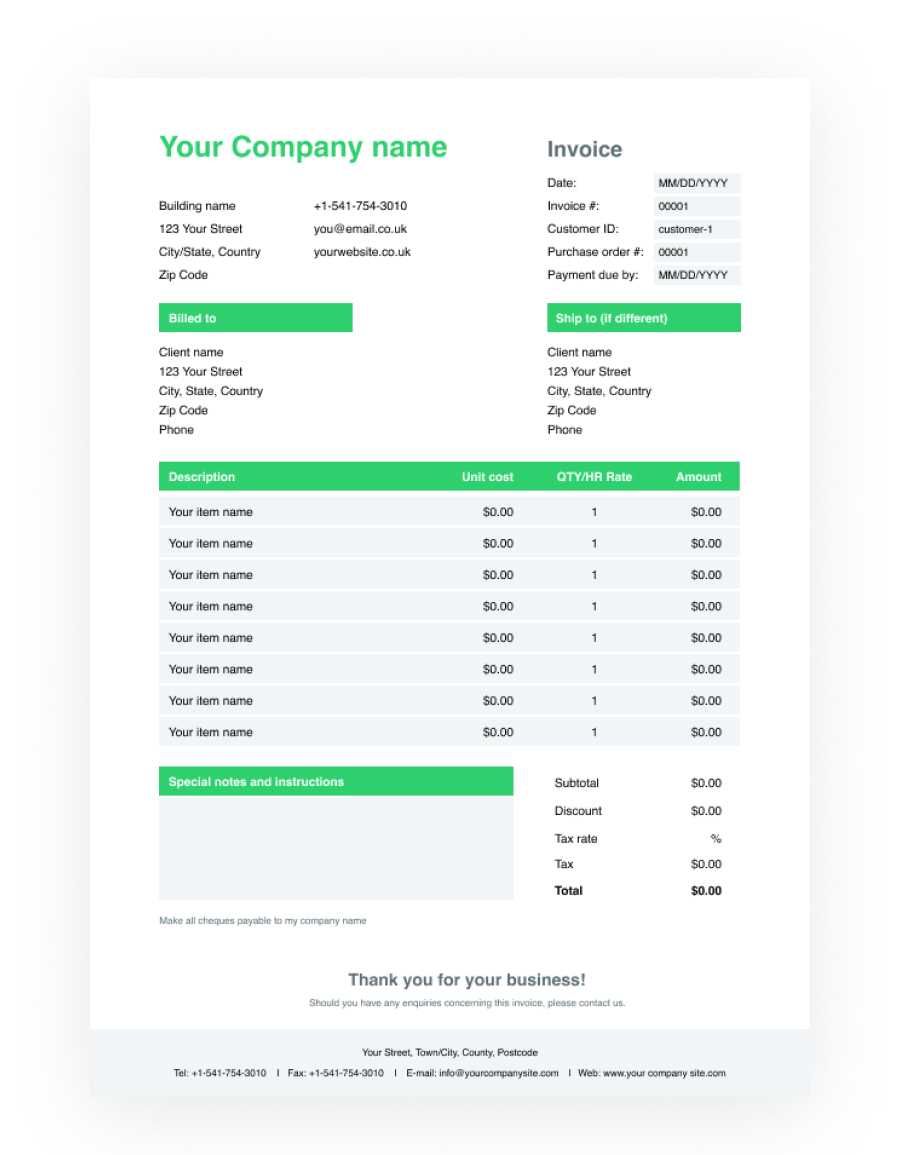

Free Invoice Templates for Excel

For businesses looking to create professional financial documents without investing in expensive software, free resources are an excellent solution. There are numerous customizable layouts available that can help streamline the process of creating detailed and organized records. These resources often provide a solid starting point, allowing you to tailor them to your specific needs while saving both time and money.

Here are some benefits of using free resources for your business documents:

- Cost-Effective: Many websites offer free, ready-made designs that save you the expense of purchasing expensive software or templates.

- Easy Customization: These designs are simple to modify, allowing you to add your own details and adjust the layout according to your needs.

- Variety of Styles: There are numerous designs available, ranging from simple to more sophisticated formats, ensuring you find one that fits your business image.

- Time-Saving: Pre-made designs can save you time by eliminating the need to create documents from scratch, allowing you to focus on other important tasks.

Using free resources to generate your documents provides flexibility, simplicity, and affordability, helping you produce professional-quality results quickly and easily. These ready-to-use options are a practical choice for small businesses, freelancers, or anyone who needs to create documents on a budget.

Why Logos Matter on Invoices

Including your brand’s visual identity on official documents is more than just an aesthetic choice. It plays a crucial role in reinforcing your company’s presence and building trust with clients. When your design elements are visible on key documents, they serve as a constant reminder of your business and its professional image.

Here are a few reasons why adding your brand’s visual representation to official records is important:

- Brand Recognition: A consistent visual presence helps clients quickly identify your business, even among a stack of paperwork. It ensures your company stands out and leaves a lasting impression.

- Professionalism: Including your branding elements conveys attention to detail and professionalism, signaling to clients that your business is established and reliable.

- Trust and Credibility: When clients see your design prominently displayed, it reinforces the legitimacy of the transaction and your business, creating a sense of security.

- Consistency: Using the same colors, fonts, and design elements across all documents creates a cohesive brand image, making your communications more recognizable and uniform.

By incorporating your brand’s visual elements, you not only enhance the professionalism of your documents but also build a stronger connection with clients. It turns an ordinary document into a marketing tool that reflects your business values and helps establish long-term client relationships.

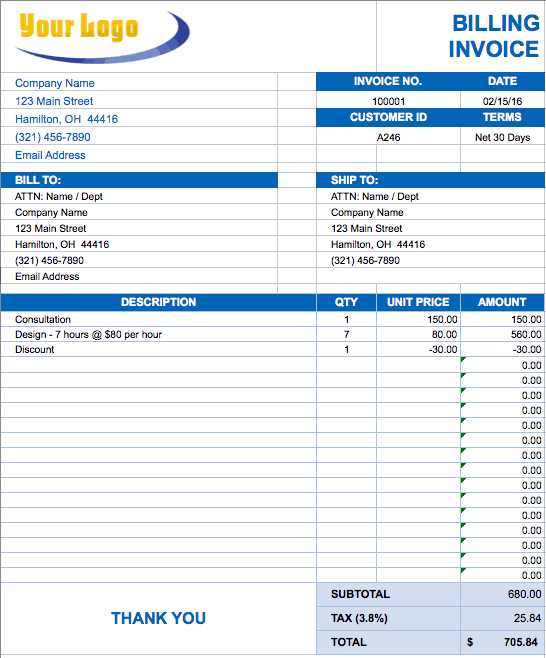

Creating a Professional Invoice Look

Crafting a polished and professional appearance for your business documents is essential for establishing trust and credibility with clients. A well-designed format not only improves readability but also conveys attention to detail and care. A professional document reflects the quality of your services and sets a positive tone for your business interactions.

Key Elements of a Professional Design

When designing your business paperwork, there are several elements to keep in mind to ensure your document looks polished:

- Clean Layout: Use a clear and organized structure with sufficient spacing to separate different sections, making it easy for clients to find key information.

- Consistent Branding: Incorporate your business colors, fonts, and visual elements to create a cohesive design that reflects your company’s identity.

- Readable Fonts: Choose simple, professional fonts that are easy to read. Avoid using too many different font styles that can make the document appear cluttered.

How to Automate Calculations in Excel

Automating calculations in business documents can save you significant time and reduce errors. By setting up formulas, you can ensure that totals, taxes, and discounts are calculated instantly, allowing you to focus on more important tasks. This functionality is especially useful for keeping records organized and up-to-date without having to manually input numbers each time.

Here’s how to automate key calculations efficiently:

Step-by-Step Guide to Set Up Automatic Calculations

- Enter Basic Formulas: To calculate sums, simply use the SUM formula. For example, typing “=SUM(A2:A10)” will add up the values in cells A2 through A10.

- Apply Percentage Calculations: Use formulas like “=B2*0.15” to calculate percentages, such as a 15% discount or tax.

- Use AutoFill for Multiple Cells: If you want to apply the same formula across multiple cells, drag the small square at the bottom right corner of the cell with the formula to fill other cells automatically.

- Subtotals and Totals: To quickly calculate a subtotal, use the SUM function for each category. For the grand total, sum all subtotals together to ensure accuracy.

Advanced Features for Automating Calculations

- Conditional Calculations: Use IF statements to calculate based on specific conditions, such as “=IF(A2>100, A2*0.1, 0)” to apply a 10% discount if the total is over 100.

- Using Named Ranges: You can name specific cells or ranges for easier reference in formulas. For example, name a column “Item_Price” and refer to it in calculations, making the formulas more intuitive.

- Pivot Tables: These can be used to quickly summarize large datasets and calculate totals, averages, or other statistical data with minimal effort.

Automating calculations in your business documents not only saves time but also ensures that your numbers are accurate, reducing the risk of manual errors. Once set up, these automatic calculations will update in real-time, keeping your records precise and current.

Choosing the Right Invoice Design

When creating professional business documents, the design you choose plays a vital role in reflecting your brand’s image and ensuring clarity. A well-organized and visually appealing layout not only makes the document easier to read but also enhances the professionalism of your communication. Choosing the right structure can make a significant difference in how your clients perceive your business.

Factors to Consider When Selecting a Design

- Brand Consistency: Ensure the design aligns with your company’s visual identity, including colors, fonts, and overall style. A consistent look helps reinforce your brand and builds recognition.

- Readability: The layout should prioritize legibility. Clear headings, adequate spacing, and a simple structure are essential to ensure the information is easy to find and understand.

- Functionality: Choose a format that suits the way you operate. Some designs work better for itemized lists, while others might be more suitable for simple services or fixed pricing structures.

- Customization: Look for a design that can be easily adapted to fit specific needs. Whether it’s adding more details, adjusting the layout, or including additional sections, flexibility is key.

Common Design Styles to Consider

- Minimalist: Simple and clean, focusing on clarity without unnecessary decorations. Ideal for businesses that want to project professionalism and focus on important details.

- Modern: Features contemporary elements like bold fonts, dynamic lines, and large headings. Perfect for startups or creative businesses that want to show innovation.

- Classic: Traditional designs with a formal appearance. This style is often preferred by industries that value tradition, such as law firms or accounting services.

By carefully considering these factors and design styles, you can choose a layout that not only looks good but also serves its functional purpose, making it easier for clients to review and understand the information presented. A thoughtfully selected design contributes to a lasting impression and encourages prompt responses from clients.

Adding Contact Information on Invoices

Including accurate and clear contact details in your business documents is essential for maintaining effective communication with clients. Providing your contact information ensures that clients can easily reach you with questions or for follow-up regarding payments. It also reinforces professionalism and fosters trust in your business dealings.

Here’s a simple way to display your contact information:

Detail Information Company Name Your Business Name Address 1234 Business Street, City, Country Email [email protected] Phone +123-456-7890 Website www.yourbusiness.com By clearly outlining your contact information, you ensure that your clients know exactly how to get in touch with you if necessary. This small addition can significantly enhance the overall professionalism of your documents and contribute to smoother business transactions.

How to Track Payments with Excel

Managing payments effectively is crucial for maintaining accurate financial records and ensuring timely follow-ups. By tracking payment statuses in a spreadsheet, you can easily monitor outstanding balances, due dates, and received payments. This method allows for quick access to financial information and minimizes the risk of overlooking any payments.

To set up a payment tracking system, you can organize the data in a clear and structured manner. Below is an example of how to track payments using simple columns:

Date Client Name Amount Due Amount Paid Payment Status Due Date 01/01/2024 John Doe $500.00 $500.00 Paid 01/15/2024 01/05/2024 Jane Smith $750.00 $0.00 Best Practices for Invoice Formatting Properly structuring business documents is essential for clear communication and to ensure clients can easily understand the terms of payment. Well-organized documents can help avoid misunderstandings, promote professionalism, and speed up the payment process. By following a few key formatting guidelines, you can create documents that are both functional and aesthetically pleasing.

Here are some best practices to consider when formatting your business documents:

Best Practice Description Clear Structure Ensure the layout is easy to follow. Important sections, such as contact information, amounts due, and payment terms, should be clearly separated for quick reference. Consistent Fonts Use simple and professional fonts. Avoid using too many different types of text styles. Stick to one or two fonts for the body text and headings. Legible Font Size The font size should be large enough to be easily readable. Typically, a font size of 10-12 points for the body text is ideal. Highlight Important Information Make key details, such as total amounts, due dates, and payment terms, stand out by using bold text or a larger font size. Avoid Clutter Keep the design simple. Use enough white space to separate different sections and make the document easier to read. Proper Alignment Ensure that all text is aligned consistently. Left-aligned text is usually easier to read, but center-aligned headings can make the document look neat. By following these practices, you can create professional, well-organized documents that clients can easily interpret, helping to build trust and ensure timely payments. A clean, structured layout is crucial for effective business communication.

Creating Multiple Invoice Templates

When managing various types of transactions or working with different clients, it may be helpful to have multiple document formats to suit each specific need. Customizing different layouts for each type of service or product ensures consistency and professionalism, while also allowing flexibility in managing diverse business needs.

Having various document formats can streamline your processes, reduce errors, and help maintain clarity when dealing with multiple clients or projects. Here are some key steps for creating different formats:

Consider Your Business Needs

Different types of transactions or clients may require tailored formats. Think about the following elements when creating new layouts:

- Service or Product Type: Does the client need a detailed breakdown or a simple summary of charges?

- Client Preferences: Does the client require specific information, such as additional payment terms or custom fields?

- Frequency of Billing: Are you billing clients regularly, or is it on a one-time basis?

Steps to Create Multiple Formats

Here are steps you can take to create various document formats to suit your business needs:

- Design Your Base Format: Start with a basic layout that includes all essential details like client information, payment terms, and amounts.

- Modify for Specific Needs: Customize each version by adding or removing fields based on client or project requirements.

- Save Different Versions: Once customized, save each version as a separate file for easy access and management.

- Maintain Consistency: Keep elements like branding, font style, and layout consistent across all versions to maintain professionalism.

By following these steps, you can ensure that your documents meet the specific needs of each client while maintaining a high standard of clarity and organization.

Exporting Your Invoice from Excel

Once you’ve created your document and are ready to share it with clients, exporting it into a universally accessible format is essential. Converting your file ensures that the recipient can open it easily, regardless of the software they are using, while preserving the layout and formatting you’ve carefully designed.

Exporting allows you to share your document securely and professionally. The most common formats for sharing are PDF and other image-based formats. Below are the steps to export your file:

Steps to Export Your Document

Follow these simple steps to save and share your document in a different format:

- Choose the Right Format: Decide whether you need a PDF for easy viewing or another format based on your client’s needs.

- Save as PDF: In the “File” menu, select “Save As” and choose PDF from the dropdown list to ensure your formatting remains intact.

- Check Page Layout: Before exporting, double-check that the document fits within the printable area and that no information is cut off.

- Save and Send: Once exported, save the file on your computer or cloud storage, then send it to the client via email or other preferred methods.

Advantages of Exporting

Exporting your document into a widely accepted format offers several advantages:

- Consistency: Exporting ensures that the layout, fonts, and images stay intact when opened on any device.

- Professionalism: Sharing a clean, easy-to-read document in PDF format shows your clients that you take your business seriously.

- Security: PDF files can be encrypted or password-protected, adding an extra layer of security for sensitive financial information.

By exporting your document, you make it easier for clients to view, save, and even print it as needed, providing them with a seamless experience. It’s a simple but effective way to enhance your workflow and client relations.

Security Tips for Invoice Documents

Protecting sensitive business documents is essential for both legal and financial security. These files often contain personal, financial, and transaction details that could be exploited if compromised. Ensuring that your documents are safeguarded against unauthorized access and potential fraud is crucial for maintaining trust with clients and partners.

Here are some key practices to follow when securing your business documents:

Best Practices for Securing Documents

- Use Strong Passwords: Always password-protect your files, especially if they contain sensitive information. Choose complex passwords that are difficult for others to guess.

- Enable Encryption: Encrypt your files to ensure that only authorized recipients can open and view the contents, even if the file is intercepted during transmission.

- Limit Access: Only share documents with individuals who need them. Avoid sending files to general email addresses and ensure that access permissions are strictly controlled.

- Regularly Update Software: Keep your software and security systems up to date. This reduces the risk of security vulnerabilities that hackers might exploit to gain unauthorized access to your files.

Additional Steps to Enhance Security

- Use Secure File Transfer Methods: When sending important files, use secure file transfer protocols such as encrypted email or cloud storage services that offer advanced security features.

- Avoid Public Wi-Fi: Do not access or transmit confidential documents over public or unsecured networks, as they are vulnerable to hacking.

- Backup Regularly: Store copies of your important documents in secure locations, such as encrypted cloud storage, to prevent loss due to accidental deletion or system failure.

By following these steps, you can significantly reduce the risk of unauthorized access, ensuring that your business documents remain secure and confidential. The integrity of your financial transactions depends on how well you protect this sensitive information.

How to Share Invoices via Email

Sending business documents through email is one of the most efficient ways to share important files with clients and partners. However, ensuring that the files are transmitted securely and professionally is crucial for maintaining trust and confidentiality. By following a few simple steps, you can easily send your documents to recipients while safeguarding sensitive information.

Here’s a step-by-step guide on how to effectively share your documents via email:

1. Prepare Your Document for Sending

- Double-check the content: Before sending, ensure that all details are accurate and up-to-date. This includes verifying numbers, dates, and recipient information.

- Save in a secure format: Save your file as a PDF or password-protected document to prevent unauthorized edits. PDFs are widely accepted and preserve the layout.

- Compress large files: If your document is too large to send as an attachment, compress it into a .zip file for easier transmission without compromising quality.

2. Send the Document via Email

- Compose a clear message: In the body of your email, provide a brief, professional message to the recipient, explaining the purpose of the document and any actions required.

- Attach the file securely: Use the “Attach file” feature in your email client to add the document. Ensure that the file size is within the email provider’s limits.

- Verify recipient’s email address: Before sending, double-check that the email address is correct to avoid accidental misdelivery.

3. Add Extra Security Measures

- Encrypt the file: If you’re sending sensitive information, consider using encryption tools to secure the document. This ensures that only the intended recipient can access the content.

- Use password protection: For added security, you can password-protect the file and share the password through a different communication channel (e.g., phone).

- Request a read receipt: Enable the “read receipt” feature in your email client to confirm that the recipient has received and opened the document.

4. Follow Up After Sending

- Confirm receipt: If you haven’t received a confirmation or response, it’s a good idea to follow up after a reasonable period to ensure that the recipient has received the file and everything is in order.

- Offer assistance: In your follow-up email, offer assistance if the recipient encounters any issues opening or viewing the document.

By adhering to these steps, you can ensure that your documents are sent securely and professionally, minimizing the risk of errors or unauthorized access. Prop

Updating Your Invoice Template Regularly

Maintaining accurate and up-to-date business documents is essential for smooth operations and client relationships. As your business evolves, it’s important to regularly review and revise your documents to reflect changes in your services, pricing, and other relevant details. Regular updates ensure that all information remains correct, professional, and aligned with your current business practices.

1. Review Your Information Periodically

As your business grows or changes, so do the details on your documents. This could include updates to:

- Your company name, address, and contact details

- Pricing or service rates

- Payment terms and conditions

- Tax rates or applicable discounts

Checking these details at least quarterly or whenever a significant change occurs helps avoid any discrepancies when communicating with clients.

2. Improve Visual Appeal and Functionality

In addition to updating the information, it’s also beneficial to periodically assess the visual design and functionality of your documents. This can include:

- Improving the layout for better readability

- Adding new elements, like payment methods or additional notes sections

- Ensuring that the design aligns with your brand’s aesthetic

By keeping your documents visually appealing and easy to understand, you enhance the overall customer experience and maintain a professional image.

Updating your documents regularly is a simple yet effective way to ensure that your business communications remain efficient, accurate, and in line with your company’s evolving needs. A little time spent on updates can go a long way in maintaining smooth business operations and strong client relationships.

Ensuring Compliance with Invoice Standards

Maintaining proper documentation that adheres to industry standards and legal requirements is critical for businesses. Ensuring compliance not only protects your company from potential legal issues but also ensures transparent and professional dealings with clients. By following set guidelines, you create documents that are recognized and trusted by both regulatory bodies and customers alike.

1. Include Required Information

To meet industry standards, certain details must be present on every document you issue. These typically include:

- Business name and contact information

- Client details, including name and address

- Unique reference number or identifier

- Clear itemization of services or products

- Total amount due and applicable taxes

- Payment terms and due dates

These essential elements ensure that your records are both clear and legally binding, making transactions smoother for all parties involved.

2. Adhere to Local and International Tax Laws

Compliance also involves understanding the tax laws applicable in your jurisdiction. This can include:

- Properly stating tax rates

- Including tax identification numbers if required

- Correctly applying discounts and exemptions where applicable

Failure to comply with tax regulations can result in penalties, so regularly reviewing your documents for accuracy and compliance is a good practice.

By aligning your records with the required standards, you not only