Telecom Invoice Template for Streamlined Billing and Record Keeping

Managing billing for communication-related services can be a complex task for businesses. With numerous charges, varying rates, and additional fees, keeping track of financial records becomes challenging. An efficient system for documenting and organizing these charges is essential for smooth operations and accurate financial reporting.

Using a structured document to outline all service-related costs provides clarity and reduces the risk of errors. A well-designed billing document allows businesses to present their charges professionally, ensuring transparency and minimizing confusion with clients. Additionally, it simplifies the process of tracking payments and outstanding balances.

In this article, we will explore how to create an effective system for documenting service costs, ensuring consistency and efficiency. We will also look at the tools and methods available to customize your billing documentation to fit your specific needs and improve overall management of finances.

Telecom Invoice Template Overview

Effective billing documentation is crucial for businesses providing communication services. It ensures clarity, consistency, and accuracy in presenting charges to clients, which helps avoid misunderstandings and streamline payment processes. A well-structured billing form is designed to cover all essential details while remaining easy to understand for both the service provider and the customer.

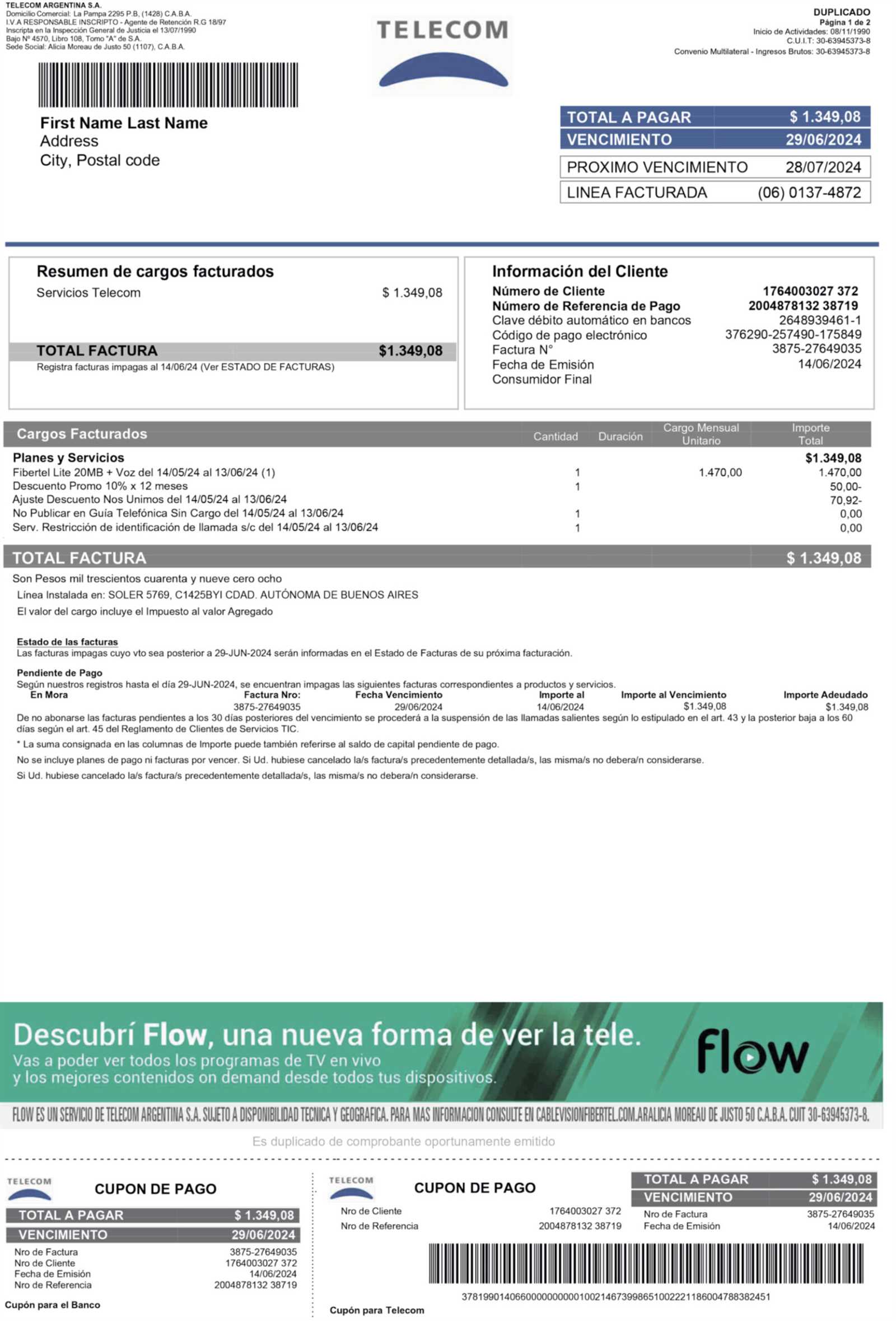

A standard document for service charges typically includes key components such as the service provider’s contact information, a detailed breakdown of services provided, payment terms, and applicable taxes. The layout should be clear, with sufficient space to list all charges and adjustments. Customizing these documents for specific needs can improve overall billing efficiency and professionalism.

Below is an example of the typical sections included in such a billing form:

| Section | Description |

|---|---|

| Provider Information | Details of the company providing the service, including name, address, and contact information. |

| Client Information | Client name, address, and contact details. |

| Service Breakdown | List of services rendered, with dates, descriptions, and unit prices. |

| Additional Fees | Any additional charges such as late fees, setup costs, or taxes. |

| Payment Terms | Details regarding payment due dates, acceptable payment methods, and late payment policies. |

| Total Amount | Final total after all services and fees have been calculated. |

By incorporating these essential elements, businesses can ensure they create clear, professional, and reliable billing documents that benefit both the company and the customer. Customization options allow for flexibility in meeting specific service needs and client expectations.

Benefits of Using an Invoice Template

Adopting a standardized billing document can significantly enhance the efficiency and professionalism of a business’s financial operations. By utilizing a pre-designed form, businesses can ensure consistency in their billing process, reduce the risk of errors, and save valuable time. This structured approach allows service providers to quickly generate accurate records for every transaction, facilitating smoother financial management.

One key advantage is the reduction of manual errors. Pre-set fields and clear formatting minimize the chances of missing or incorrect information. This leads to fewer disputes with clients and a more seamless payment process. Additionally, the use of such a form can help businesses maintain a professional image, presenting clients with organized and easy-to-read documentation.

Another significant benefit is time efficiency. With a ready-made format, service providers do not need to start from scratch for each billing cycle. They can simply input relevant details, customize where necessary, and generate the document quickly. This is particularly useful for businesses handling a high volume of clients or recurring services.

Moreover, using a customizable format allows for better record-keeping and tracking. All necessary elements, from services provided to payment terms, are included in one document, making it easier to monitor outstanding payments, taxes, and other important financial details. This also simplifies reporting and reconciliation processes for accounting purposes.

How to Customize a Telecom Invoice

Customizing your billing document is essential for aligning it with your business needs and creating a professional image. The key to effective customization lies in tailoring the content, design, and structure of the document to reflect the specific services provided and the preferences of your clients. A personalized approach helps ensure clarity, accuracy, and a better overall experience for both parties.

Adjusting the Layout and Design

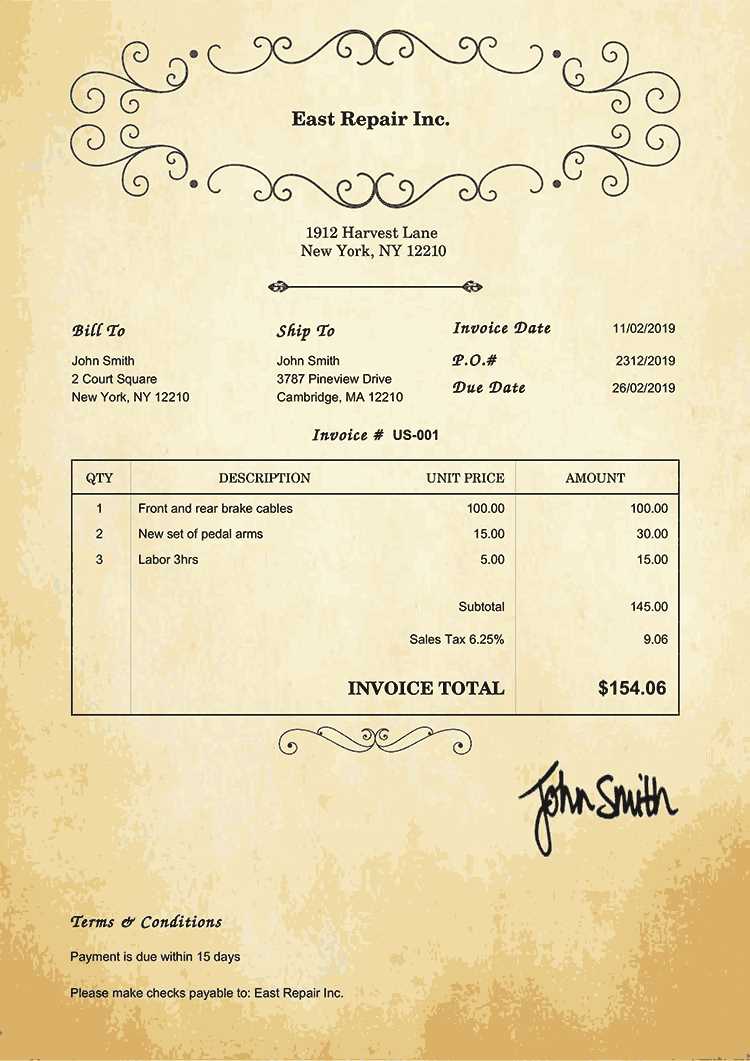

The layout and design of your billing document should reflect your brand identity. This includes incorporating your company logo, colors, and contact information in a clear and accessible way. A simple, clean design can improve readability, making it easier for clients to understand the details of the charges. Additionally, adjusting the document’s structure to fit the type of service offered–such as adding space for special discounts or service tiers–can be particularly useful.

Incorporating Specific Service Details

Another important aspect of customization is the inclusion of detailed service information. Depending on your business model, you may need to adjust the fields to capture various service charges, usage details, and applicable taxes. Make sure to include clear descriptions of each service rendered, as well as the associated costs, to avoid any confusion. Including payment terms, due dates, and other critical details ensures both parties are on the same page regarding financial obligations.

Additional customizations might include adding notes or terms specific to your business practices, such as late payment penalties or discounts for early payments. These small adjustments can provide added value, help manage client expectations, and maintain smooth communication.

Key Elements of a Telecom Invoice

For any service provider, a well-structured billing document is essential for accurate financial transactions and clear communication with clients. A comprehensive billing form should include all the necessary details to ensure both the service provider and the customer are on the same page. Key elements ensure that the document is complete, easy to understand, and legally compliant.

Basic Information

The foundational elements of any billing document include the contact details of both the service provider and the client. This includes the company name, address, phone number, and email for the provider, as well as the client’s contact information. Additionally, a unique reference number for the document should be included, which helps in tracking payments and managing records.

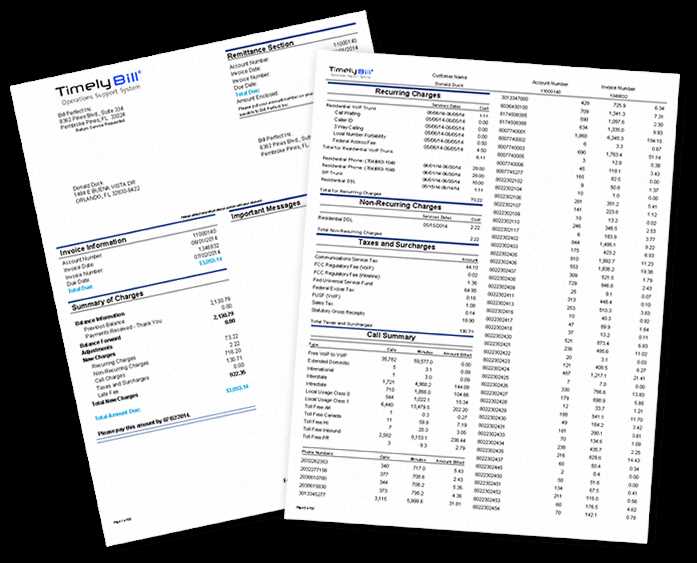

Service Breakdown and Charges

A detailed breakdown of the services provided is crucial for clarity and transparency. This section should list the specific services rendered, along with the corresponding rates, quantities, and dates of service. It is important to clearly differentiate between the various types of services offered and any associated charges, such as setup fees, recurring costs, or one-time charges. This helps to avoid confusion and ensures that clients understand exactly what they are paying for.

Lastly, the total amount due should be clearly indicated, accounting for any taxes, discounts, or additional fees. This section should also outline payment terms, including the due date and any applicable late fees.

Common Mistakes in Telecom Invoicing

Inaccurate or incomplete billing documents can lead to confusion, disputes, and delays in payment. It’s crucial for service providers to avoid common errors that could undermine trust with clients and impact financial operations. Understanding these common mistakes can help businesses streamline their billing processes and ensure that payments are received promptly and accurately.

- Missing Client Details: Failing to include correct contact information for the client or service provider can delay communication and create confusion.

- Inaccurate Service Descriptions: Listing incorrect or vague service descriptions can lead to misunderstandings. Ensure each service is clearly defined, with precise dates and charges.

- Incorrect Pricing or Rates: Using outdated or incorrect pricing can lead to billing errors. Always ensure the most current rates are applied, and verify quantities and prices before finalizing the document.

- Omitting Taxes or Fees: Forgetting to add applicable taxes, handling fees, or discounts can result in discrepancies and payment delays. Make sure all additional charges are clearly outlined.

- Unclear Payment Terms: Not specifying the payment due date, late fees, or acceptable payment methods can cause confusion about when and how the bill should be paid.

- Lack of Unique Reference Numbers: Without a unique identifier, tracking payments or resolving disputes becomes difficult. Always assign a specific number to each billing document for easy reference.

Avoiding these common mistakes ensures that your billing process remains efficient and professional, leading to better client relationships and improved cash flow. Always double-check each document before sending it to ensure accuracy and completeness.

Best Practices for Accurate Billing

Ensuring accuracy in billing is essential for maintaining healthy client relationships and streamlining business operations. By following a set of best practices, service providers can reduce errors, improve efficiency, and enhance customer satisfaction. These practices help guarantee that each transaction is documented correctly, reducing the risk of disputes or delayed payments.

- Keep Detailed Records: Maintain accurate records of all services rendered, including dates, descriptions, and quantities. Detailed documentation is essential for creating transparent billing statements and resolving any issues quickly.

- Use Clear and Consistent Pricing: Ensure that pricing is consistent across all documents and reflects current rates. Avoid sudden price changes without prior communication to clients, and always provide detailed breakdowns of costs.

- Double-Check All Calculations: Before sending out any bills, double-check the totals, taxes, and any applicable discounts or fees. Small errors in calculation can lead to payment delays and confusion.

- Ensure Timely Billing: Issue bills on a regular schedule and avoid delays in sending them out. Consistent billing cycles help clients plan their payments and ensure that your business maintains a steady cash flow.

- Clearly Communicate Payment Terms: Always specify payment due dates, accepted payment methods, and any penalties for late payments. Clear terms help clients understand their obligations and reduce the likelihood of payment disputes.

- Automate Where Possible: Use automation tools for recurring charges or regular clients. Automation reduces the chances of human error, increases speed, and ensures consistency in billing practices.

- Review Documents Before Sending: Always review each document for completeness and accuracy before submitting it to clients. A quick second review can catch mistakes that may have been missed initially.

By implementing these best practices, businesses can ensure that their billing processes are streamlined, transparent, and free of errors. This not only helps with maintaining good relationships with clients but also enhances the overall efficiency of the financial workflow.

Automating Your Billing Process

Automating the billing process can significantly improve efficiency, reduce errors, and save valuable time for businesses. By leveraging automated systems, service providers can streamline the creation, delivery, and tracking of financial documents, ensuring that everything runs smoothly without manual intervention. Automation also helps ensure that charges are consistently applied and payments are tracked in real-time.

One of the main advantages of automation is the reduction of human error. Manual entry of billing details can lead to mistakes, such as incorrect charges or missed information. With automated systems, all the necessary data is pulled from existing records, reducing the risk of such errors. This ensures that clients receive accurate statements every time.

Additionally, automation allows businesses to set up recurring billing schedules for clients, ensuring that charges are generated on time without the need for constant attention. Whether it’s monthly, quarterly, or yearly charges, an automated system ensures that the billing cycle is maintained without any oversight. This consistency helps both the business and the client keep track of payments and ensures timely receipts.

Automation also enables faster processing. Once a billing cycle is established, the system can automatically generate and send documents to clients, eliminating the need for manual intervention. This speeds up the overall process and helps businesses maintain a steady cash flow.

Another key benefit is the ability to easily integrate automation tools with existing accounting or customer relationship management (CRM) software. This integration ensures that all billing records are synchronized with financial systems, providing a comprehensive view of outstanding payments and revenue, which can be accessed instantly. It also improves reporting accuracy, making it easier for businesses to track performance and manage financial records.

By automating the billing process, businesses can focus more on customer service and growing their operations, while maintaining a highly efficient and error-free financial system.

Choosing the Right Template for Your Business

Selecting the appropriate billing format is a crucial step in ensuring efficient and professional financial management. The right document not only reflects your business identity but also streamlines the process of generating accurate statements and collecting payments. A customized format should meet both your business’s needs and your clients’ expectations, helping to maintain clear communication and reduce administrative errors.

Consider Your Business Type

When choosing a billing document format, it’s important to consider the nature of your services. Businesses offering subscription-based services may need a template that supports recurring charges, while those offering one-time services might prefer a simpler format. The document should include all necessary fields that reflect your service model, including space for detailed descriptions, pricing, and applicable taxes or fees. A flexible structure allows you to tailor the document for various types of transactions while ensuring consistency.

Customization and Flexibility

Look for a format that allows easy customization to match your branding. The right document should allow you to add your company logo, contact details, and personalized color schemes to reinforce your brand identity. Additionally, consider the layout–ensure it is clean, well-organized, and easy to navigate. Flexibility in design will allow you to adapt the format to any future changes in your service offerings or billing requirements, making it scalable as your business grows.

Choosing the right billing structure involves evaluating your specific needs, whether it’s recurring payments, detailed service breakdowns, or simple one-time transactions. With the correct setup, you can save time, reduce errors, and improve the customer experience, ensuring smoother financial operations for your business.

Managing Billing Payments Efficiently

Efficiently managing payment collection is key to maintaining healthy cash flow and avoiding delays in revenue. By implementing structured processes and leveraging digital tools, businesses can ensure that all payments are tracked accurately and received on time. A well-organized system not only reduces administrative overhead but also improves client satisfaction by making the payment process smooth and straightforward.

One of the most effective ways to manage payments is by setting clear and consistent payment terms. Specify due dates, acceptable payment methods, and any penalties for late payments in your financial documents. This helps clients understand their obligations and reduces confusion. Sending reminders before the payment due date can also help ensure timely collection, particularly for recurring charges.

Automated Payment Systems are another valuable tool for improving payment efficiency. By offering clients the option to set up automatic payments, businesses can reduce the time spent on manually processing transactions. Automated systems ensure that payments are processed on time, every time, minimizing the risk of human error and late fees.

Tracking and Reporting tools can also aid in monitoring payments effectively. Using accounting software or a payment management system allows businesses to track which invoices have been paid, which are overdue, and which are pending. This real-time visibility into payment status enables quick follow-ups on any outstanding balances, reducing the time spent on chasing overdue payments.

Finally, providing multiple payment options, such as credit cards, bank transfers, and online payment portals, can increase convenience for clients and improve the likelihood of receiving payments promptly. The more flexible and convenient the payment process, the more likely clients are to adhere to agreed-upon payment schedules.

By implementing these strategies, businesses can streamline their payment processes, reduce administrative burden, and maintain a steady and reliable cash flow.

Legal Requirements for Billing Documents

Understanding the legal requirements for billing documentation is essential for ensuring compliance with tax laws and maintaining transparency in financial transactions. Different regions and industries have specific rules regarding what must be included in service statements. By adhering to these regulations, businesses can avoid potential disputes, penalties, and ensure that their financial records are legally sound.

One key legal aspect is the inclusion of essential information, such as the name and contact details of both the service provider and the client. This helps establish clear communication and accountability for all transactions. Additionally, service details must be precise and accurate, outlining the nature of the services provided, their pricing, and the dates of service. This clarity prevents misunderstandings and supports the documentation in case of audits or legal inquiries.

Tax Information is another critical element. Many jurisdictions require the inclusion of applicable tax rates, including VAT or sales tax, along with a breakdown of these charges. Failure to properly document taxes can lead to legal issues, so it’s important to ensure that all required tax details are clearly stated on the document.

Payment Terms and Deadlines must also be clearly defined to avoid misunderstandings between businesses and clients. The document should specify the due date for payment, any late fees that may apply, and acceptable methods of payment. These terms not only provide transparency but also offer legal protection in case of overdue payments or disputes over payment amounts.

Finally, businesses should be aware of any specific industry regulations or standards that may apply to their sector. For example, some countries or regions require additional disclosures for certain types of services or industries. Staying informed about these requirements helps ensure compliance and reduces the risk of penalties or legal challenges.

By understanding and following these legal requirements, businesses can protect themselves and their clients, fostering a trustworthy and legally compliant billing process.

Integrating Billing Documents with Accounting Software

Integrating your financial documents with accounting software is a crucial step towards streamlining your business’s financial operations. By linking the creation of billing records directly to your accounting system, you can eliminate the need for manual data entry, reduce the risk of errors, and save time. This integration ensures that all transactions are accurately reflected in your financial reports, leading to more efficient bookkeeping and better overall financial management.

One of the main benefits of integration is the seamless synchronization between your billing system and your accounting records. When a new transaction is created, the details are automatically transferred to the accounting software, updating your financial reports in real-time. This reduces the risk of discrepancies between what has been billed and what has been recorded, ensuring that your business maintains accurate and up-to-date financial statements.

Automatic Tax Calculations and Reporting are another advantage of integrating your billing system with accounting software. Many accounting tools have built-in features that can automatically calculate taxes based on the provided details, eliminating the need for manual adjustments. These tools also make tax reporting more straightforward, as they generate accurate tax summaries and reports for filing purposes.

Efficient Payment Tracking is also greatly improved with integration. When payments are received, the accounting software can automatically mark the transaction as paid, update the balance, and generate receipts. This not only saves time but also provides real-time visibility into your business’s cash flow, helping you track outstanding payments and identify any overdue accounts with ease.

Moreover, integration allows for better data security and backup. When billing records are stored directly in your accounting software, they are automatically backed up, reducing the risk of data loss. This provides peace of mind, knowing that your financial documents are safely stored and easily accessible when needed.

Incorporating automation through integration between your financial document system and accounting software is a smart step towards optimizing your business’s financial operations. By minimizing manual processes, reducing errors, and improving reporting accuracy, you can focus more on growth while ensuring a smooth and efficient billing process.

Customizing Billing Documents for Different Services

Adapting your billing forms to suit the specific needs of various services is essential for clarity, accuracy, and customer satisfaction. Different services require different levels of detail, pricing structures, and payment terms, which should be reflected in the billing documents. Customizing these records allows businesses to offer a more tailored experience for their clients while maintaining consistency and professionalism in every transaction.

Key Customization Areas

When adjusting your billing forms for various services, consider the following key elements:

- Service Descriptions: Different types of services require specific descriptions. For example, recurring subscriptions might need to include billing cycles, while one-time services could benefit from more detailed service breakdowns.

- Pricing Structures: Service-based pricing can vary greatly. Customize your documents to reflect hourly rates, flat fees, or tiered pricing models, depending on the service type.

- Payment Terms: Different services might have different payment expectations. For example, a one-off project might require immediate payment, while ongoing services may allow for monthly billing and longer payment terms.

- Additional Charges or Discounts: Some services may include extra charges, such as setup fees or special service charges, that need to be clearly outlined in the billing document.

Customization for Specific Service Types

Here are some examples of how different services may require unique billing approaches:

- Subscription-Based Services: Include fields for the start and end date of the billing cycle, recurring payment details, and applicable discounts for long-term commitments.

- Consulting Services: Include hourly rates, total hours worked, and project milestones. If the services are billed in phases, make sure the document reflects this breakdown.

- Project-Based Services: For services delivered in stages, such as design or construction projects, break down the costs by phase and include a section for progress payments.

- Product-Based Services: If you’re offering a service related to physical products, such as installation or maintenance, include product details, serial numbers, or warranty information along with the service charge.

By customizing your billing forms based on the type of service provided, you ensure that your clients receive clear and accurate documents that reflect their unique agreements. This not only enhances transparency but also improves payment collection and client satisfaction.

How to Track Billing Status Effectively

Tracking the status of your financial records is vital for maintaining accurate cash flow and ensuring that payments are collected on time. Having a clear system in place to monitor whether payments have been made, are overdue, or are still pending can save a significant amount of time and prevent issues down the line. This allows businesses to quickly follow up on overdue payments and maintain a steady financial operation.

One effective way to track the status of each billing record is by using a clear status tracking system. Typically, financial documents can be categorized into three main stages: “Pending,” “Paid,” and “Overdue.” By keeping track of each document in these categories, businesses can easily identify which records need attention and which are successfully processed.

Key Tools for Tracking include accounting software, spreadsheets, and cloud-based management systems that allow you to track payments in real-time. These tools help automate much of the process, sending reminders for overdue payments and updating the status as payments are received. For those who prefer manual methods, maintaining a physical ledger or a digital tracking sheet can also provide visibility into the payment status of each transaction.

Common Tracking Indicators can include the following stages:

| Status | Description | Action Required |

|---|---|---|

| Pending | The payment has been issued but not yet received. | Send reminders as the due date approaches. |

| Paid | The payment has been successfully received. | Mark the record as closed and update financial records. |

| Overdue | The payment has not been received by the due date. | Contact the client for follow-up and discuss possible penalties or payment plans. |

By consistently tracking the status of each transaction and following up promptly on overdue payments, businesses can avoid delays and ensure timely financial management. A well-organized tracking system is an essential tool for staying on top of financial obligations and maintaining strong business relationships.

Tips for Creating Professional Billing Documents

Creating well-organized, clear, and professional billing records is essential for any business. These documents not only represent your business’s credibility but also ensure that clients can easily understand the charges and payment terms. A professional format helps maintain a positive relationship with clients and streamlines the payment process, reducing confusion and delays.

Key Elements for Professional Documents

To create a polished and professional record, make sure to include the following elements:

- Business Information: Always include your company name, address, phone number, and email, as well as your client’s information. This ensures clarity and allows for quick communication if needed.

- Unique Reference Number: Each document should have a unique reference or serial number for easy tracking and to avoid duplication.

- Clear Descriptions: Provide detailed descriptions of the services or products provided. This helps clients understand exactly what they are being charged for.

- Payment Terms: Include the payment due date, acceptable payment methods, and any late fees or discounts for early payment.

- Tax Information: Ensure that taxes are clearly indicated, including tax rates and total amounts due, to avoid confusion regarding final amounts.

Design and Layout Tips

A professional design is equally important for ensuring clarity and fostering trust. Here are some layout tips:

- Keep It Clean: Use a simple, clean layout that makes it easy for clients to read and understand. Avoid clutter and too much information in one space.

- Brand Consistency: Ensure your company logo and color scheme are consistently applied to reinforce your brand identity.

- Easy-to-Read Fonts: Choose professional and legible fonts. Stick with fonts like Arial or Times New Roman, and ensure that font sizes are large enough for readability.

- Organized Sections: Break the document into clear sections such as service breakdown, payment details, and terms. This improves the overall flow and makes it easier for clients to navigate.

By following these tips, you can ensure that your billing documents not only meet legal and financial standards but also reflect your business’s professionalism. A well-designed document not only improves payment processing but also strengthens your brand’s reputation in the eyes of clients.

Frequently Asked Questions About Billing Documents

When it comes to billing documents, businesses and clients alike often have many questions regarding the process, structure, and legal requirements. Understanding these key aspects can help ensure that transactions are handled smoothly and efficiently. This section addresses some of the most common questions related to billing, payment terms, and best practices for creating accurate and professional records.

General Questions

Here are some of the most frequently asked questions about financial documents:

| Question | Answer |

|---|---|

| What information must be included in a billing document? | A proper billing document should include your business name and contact details, client information, a description of services rendered, the total amount due, payment terms, and due date. |

| What should I do if a client disputes a charge? | If a dispute arises, review the billing record with the client to clarify the details. Provide supporting documentation such as contracts or service agreements to resolve the issue promptly. |

| Can I include late fees in the billing record? | Yes, it’s important to include any late fees or penalties if your payment terms specify them. Be sure to clearly state the late fee policy in your payment terms section. |

| How should I handle partial payments? | When receiving partial payments, update the billing document to reflect the remaining balance. Include details of the amount received and the new due date for the outstanding balance. |

Legal and Compliance Questions

Here are some commonly asked questions regarding legal and compliance aspects of billing documents:

| Question | Answer |

|---|---|

| Do I need to include tax details on my billing documents? | Yes, it’s essential to include the correct tax information, such as VAT or sales tax, if applicable. This is not only important for transparency but also for tax reporting purposes. |

| Are digital billing records legally valid? | Yes, digital billing records are legally valid, provided they meet the same requirements as paper records and comply with local laws regarding electronic documentation. |

| How long should I keep billing records? | It’s advisable to retain billing documents for at least 3 to 7 years, depending on your jurisdiction and business needs. This helps ensure compliance with tax regulations and allo |