Equipment Rental Invoice Template for Simple Billing

When managing a business that involves lending items or services, having a structured approach to financial transactions is crucial. Clear and professional billing ensures smooth operations, timely payments, and helps maintain a positive relationship with clients. One of the most effective ways to manage these transactions is by using well-organized financial documents that outline all necessary details of the agreement.

In this guide, we will explore how to create efficient billing documents for temporary item leasing. You’ll learn the essential components to include, how to customize your documents for different situations, and how to ensure everything is legally compliant and clear for your clients. A well-crafted document can save time, prevent confusion, and ensure all aspects of the agreement are transparent.

By the end of this article, you’ll have the tools to produce clear, concise, and effective billing records that can streamline your business operations and enhance your financial management process.

Comprehensive Guide to Equipment Rental Invoices

When managing a business that involves leasing items, it’s essential to have a clear and well-structured way to document transactions. These documents serve not only as proof of the agreement but also help track payments, terms, and any additional charges. A detailed document provides both the service provider and the client with clarity on their responsibilities, ensuring smooth business operations and reducing the likelihood of disputes.

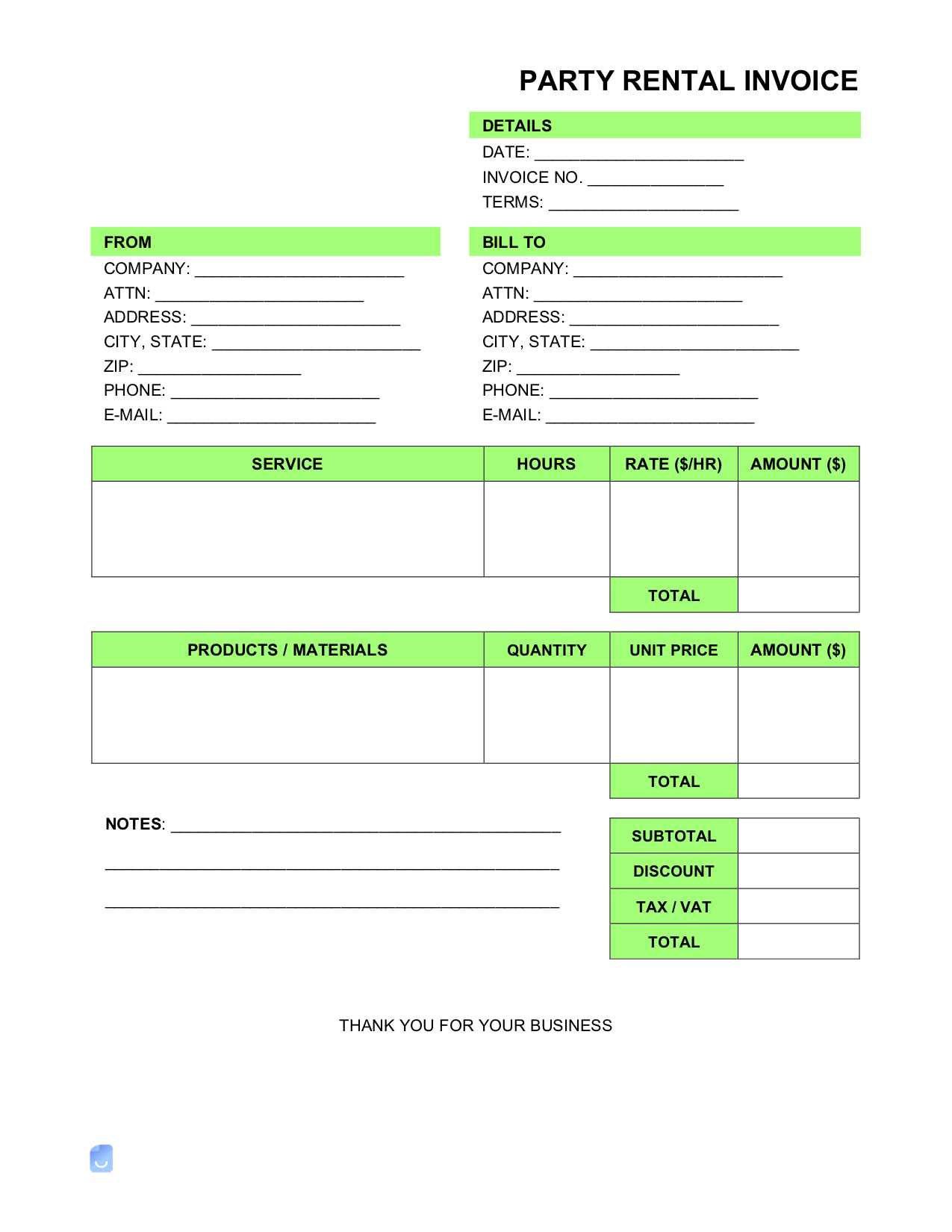

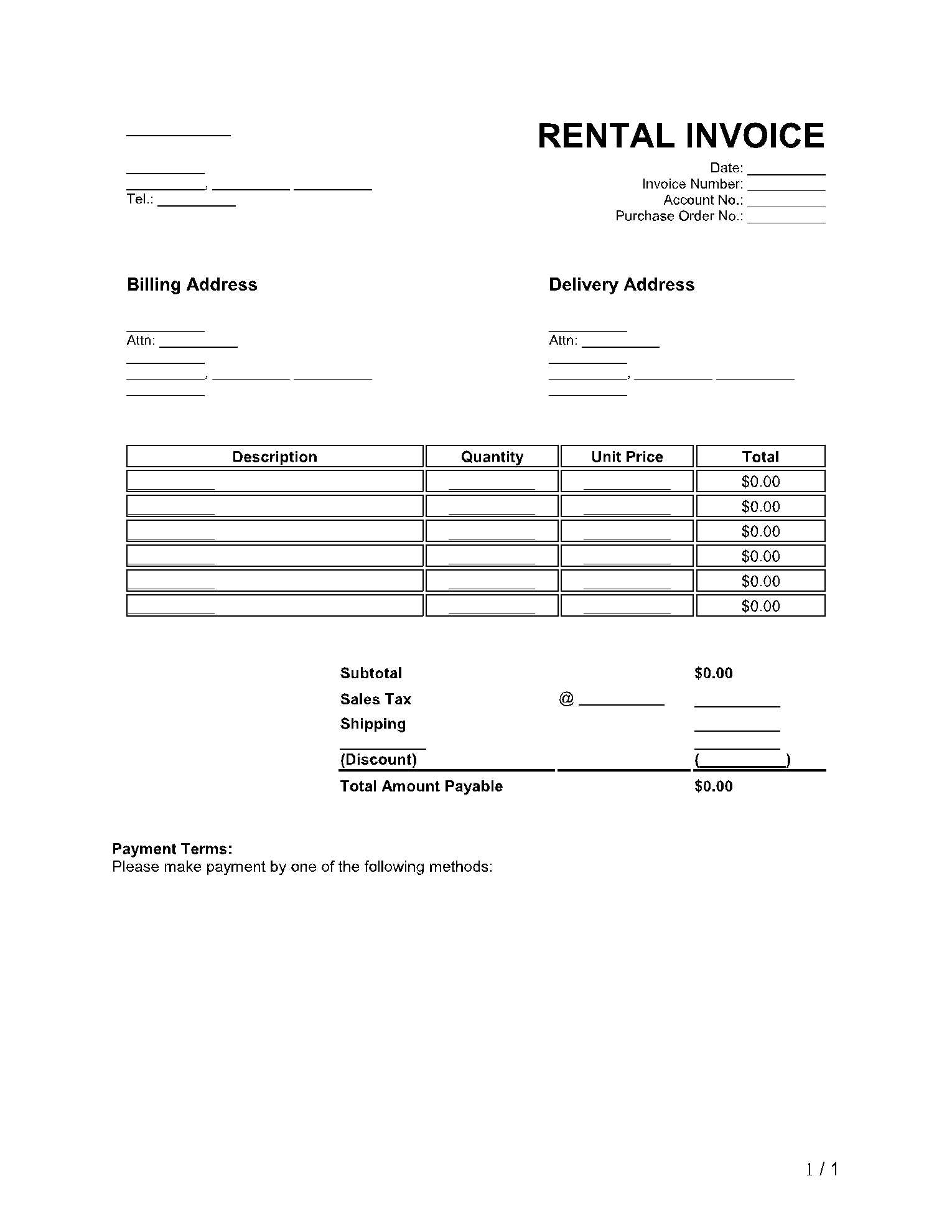

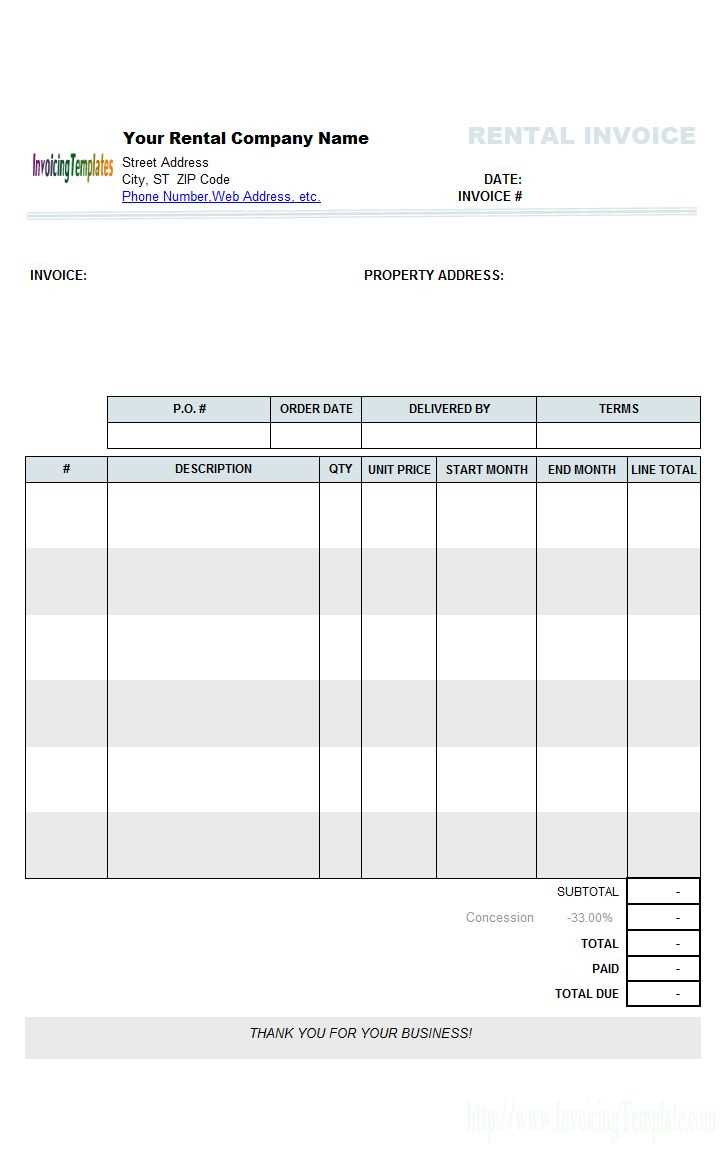

Key Elements of a Billing Record

To create an effective record for your transactions, certain details must always be included. These components ensure transparency and avoid confusion:

- Client Information: Name, address, and contact details of the person or business renting the items.

- Item Details: Description of the items or services provided, including quantities and specifications.

- Rental Period: Start and end dates of the agreement.

- Charges and Fees: The agreed-upon price, including any taxes, service charges, or late fees if applicable.

- Payment Terms: Information on how and when payment should be made, including accepted methods.

- Legal Conditions: Any terms and conditions related to the use of the items and penalties for non-compliance.

Steps to Create a Clear Billing Record

Creating a clear document can be done efficiently if you follow these basic steps:

- Start with a professional header that includes your company name and logo.

- Include the client’s details clearly at the top to avoid confusion.

- Provide a breakdown of all items or services being provided, including prices and terms.

- Ensure payment terms are visible and easy to understand.

- Make space for signatures or approval from both parties to confirm the agreement.

By following these steps, you can ensure that all necessary details are included, providing a comprehensive document that benefits both your business and your clients.

Why Use an Equipment Rental Invoice?

Having a structured document to confirm the terms of a leasing arrangement is crucial for both parties involved. It not only ensures clarity in financial transactions but also serves as a legal record of the agreement. Without such a document, misunderstandings can arise, leading to delays in payment or disputes about terms and conditions. A detailed statement helps streamline the process, promoting trust and professionalism between the service provider and the client.

Benefits of Using a Structured Billing Document

There are several key reasons why using a formal statement is essential in leasing transactions:

- Clear Payment Terms: It ensures both parties agree on the amount owed and the payment timeline, reducing confusion.

- Legal Protection: The document serves as evidence of the transaction, protecting both the service provider and the client in case of disputes.

- Professionalism: A well-organized document enhances the image of your business, showing clients that you are serious and reliable.

- Record Keeping: It allows for easy tracking of all financial transactions and can be used for future reference or audits.

- Tax Compliance: A formal document helps you maintain accurate records for tax purposes, ensuring that all applicable taxes are included and properly calculated.

How It Enhances Business Efficiency

By using a structured billing document, you streamline your financial processes. It reduces the time spent clarifying terms with clients and helps avoid errors in payment. With everything clearly outlined, both parties can focus on the successful completion of the leasing arrangement without the need for back-and-forth negotiations.

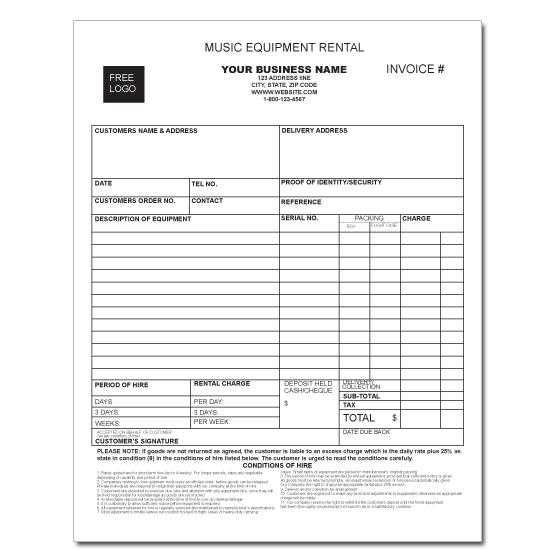

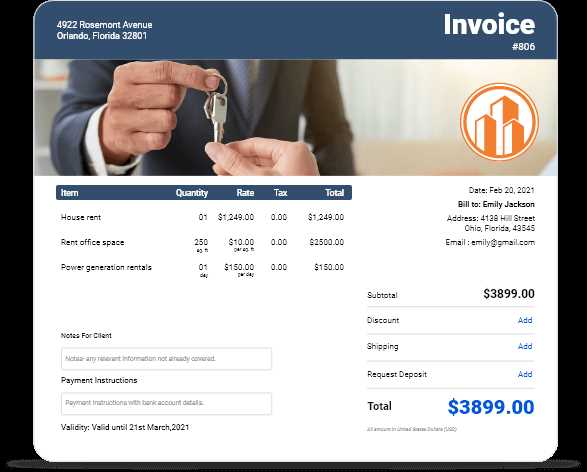

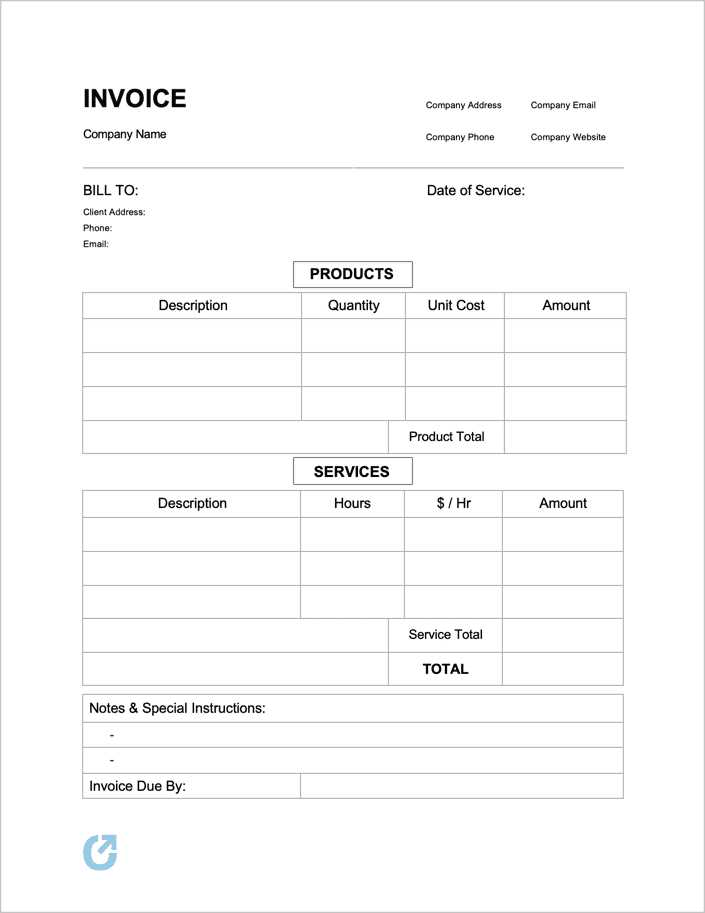

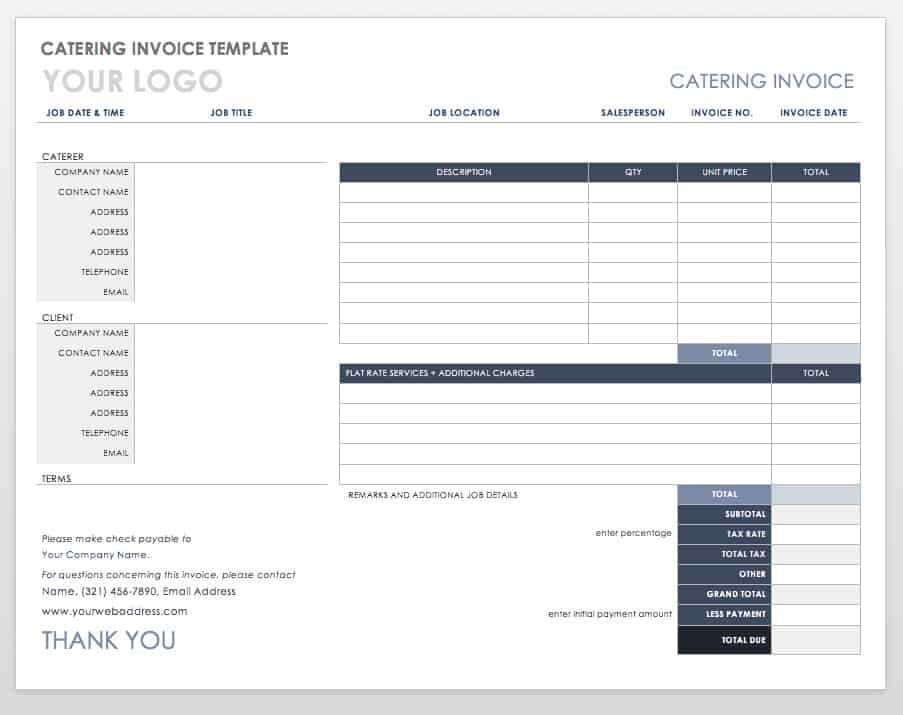

Key Elements of a Rental Invoice Template

When creating a document for leasing transactions, it is essential to include all relevant information to ensure clarity and avoid misunderstandings. A well-structured document covers all necessary details that both the provider and the client need to understand the agreement fully. From basic contact information to the specifics of the service, each element plays a crucial role in maintaining transparency and professionalism.

Important Components to Include

Here are the key elements that should be present in every leasing document to ensure it serves its purpose effectively:

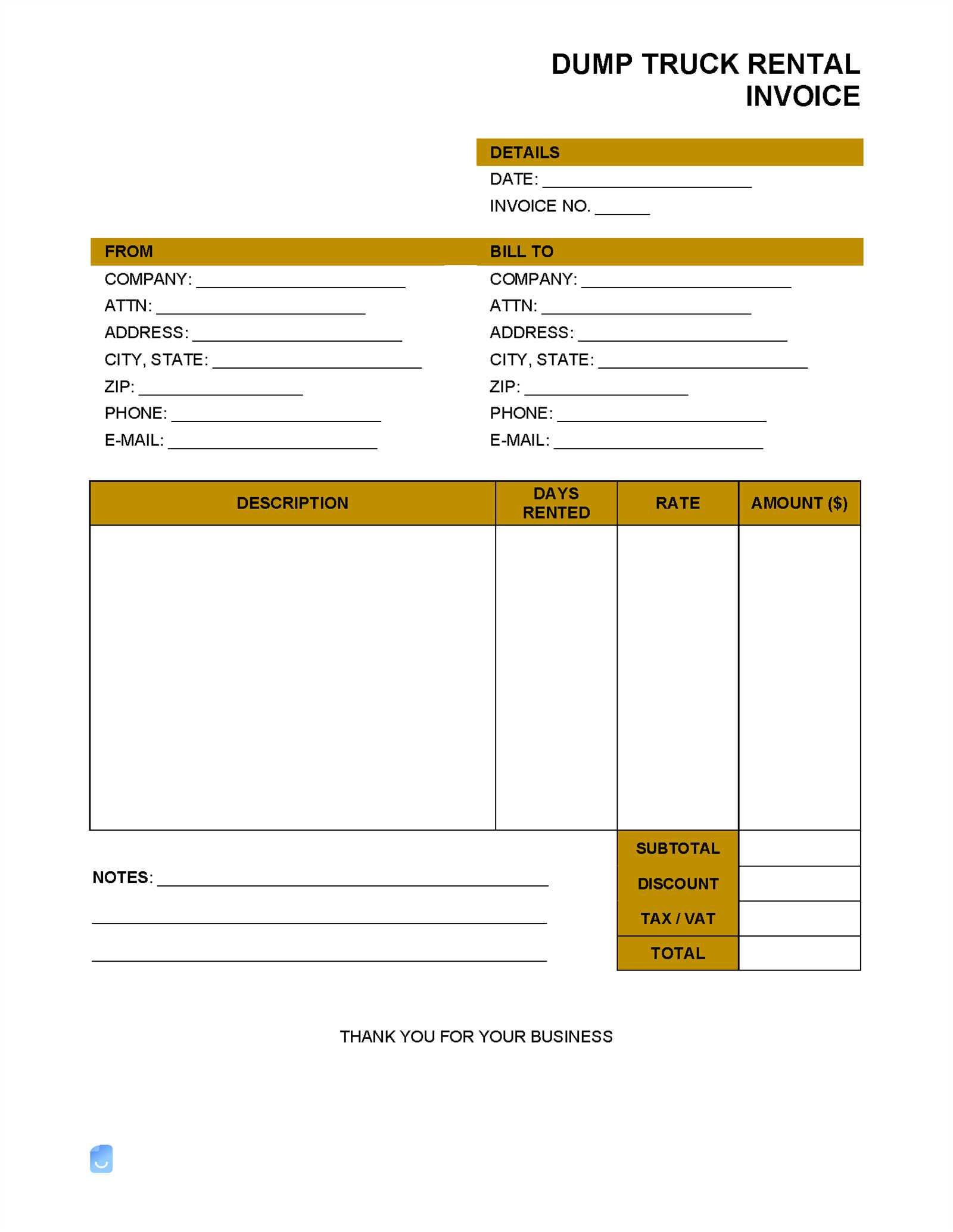

- Service Provider Information: Include your business name, address, phone number, and email so that the client can contact you if needed.

- Client Information: Clearly list the name and contact details of the client or business renting the item or service.

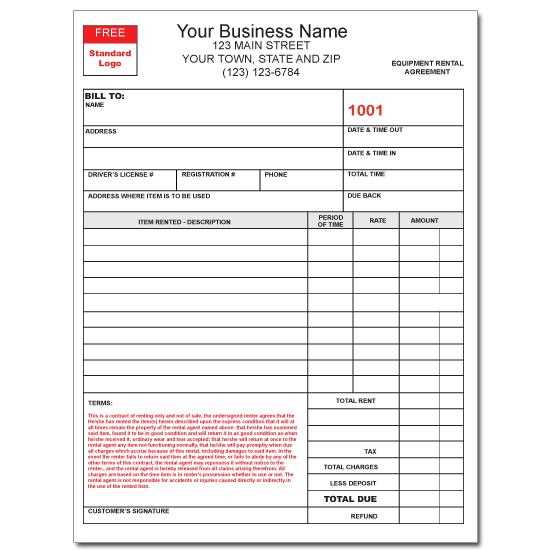

- Item Description: Provide a detailed list of the items or services being leased, including model numbers, quantities, and any distinguishing features.

- Leasing Dates: Specify the start and end dates of the leasing period, ensuring there is no ambiguity regarding the terms.

- Price Breakdown: Itemize the charges, including the base price, taxes, additional fees, and any discounts applied.

- Payment Terms: Outline the payment schedule, including when payments are due, how they can be made, and any late fees or penalties.

- Terms and Conditions: Include any special conditions, such as maintenance responsibilities, penalties for damage, and insurance requirements.

Additional Details to Consider

In some cases, additional information may be necessary to fully capture the agreement:

- Late Payment Policy: Clearly state any consequences for missed or delayed payments, including interest charges or service suspension.

- Signatures: Space for both parties to sign, acknowledging the terms and confirming the agreement.

- Delivery and Return Instructions: If applicable, include guidelines on how the items should be delivered or returned and who is responsible for transportation.

By ensuring that all of these key elements are included, you can create a comprehensive and clear document that protects both the service provider and the client.

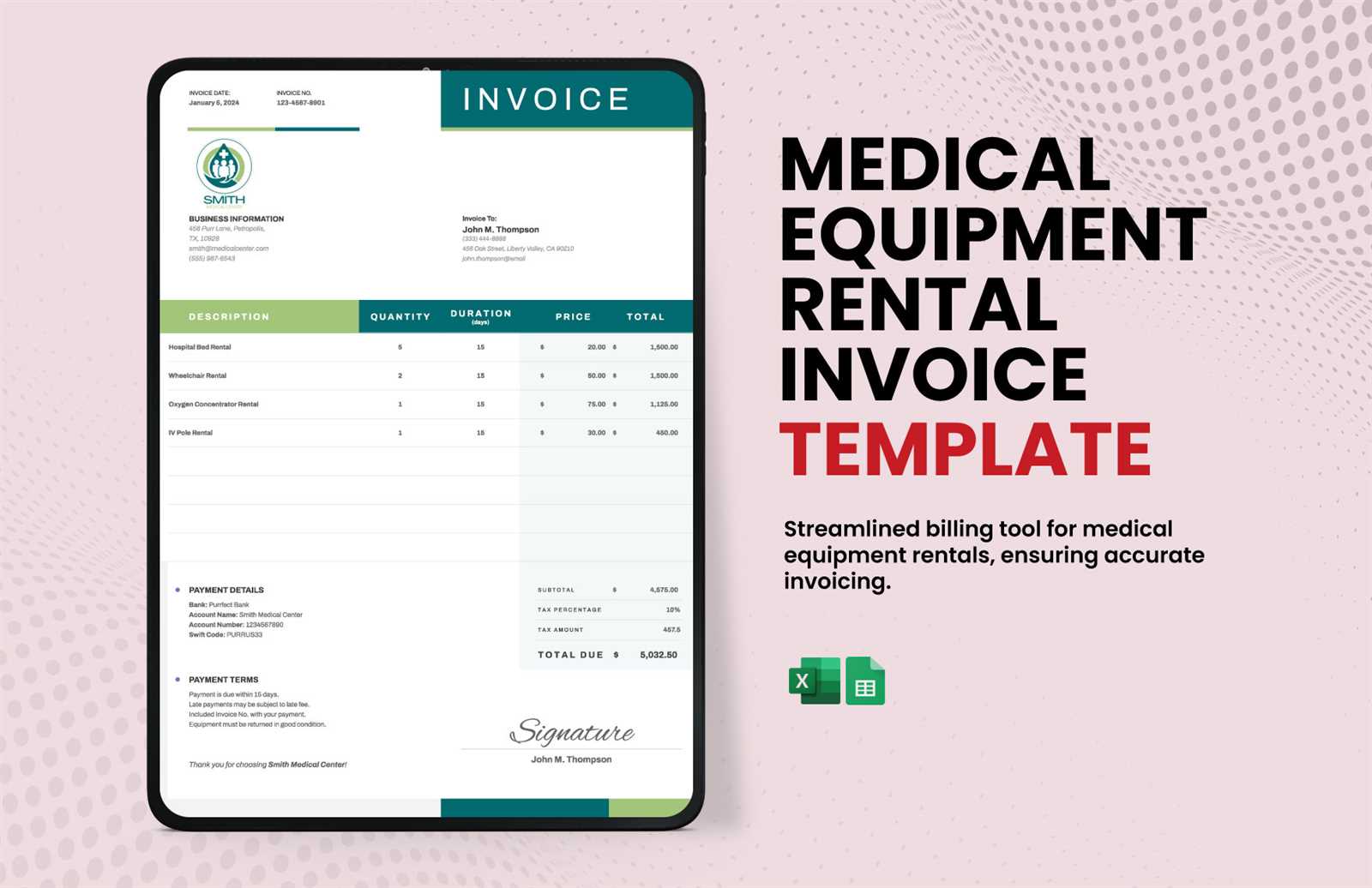

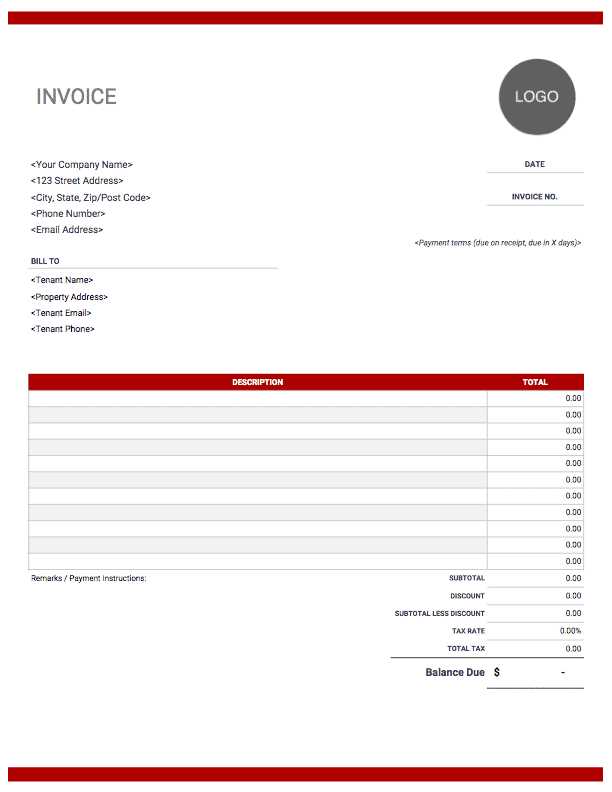

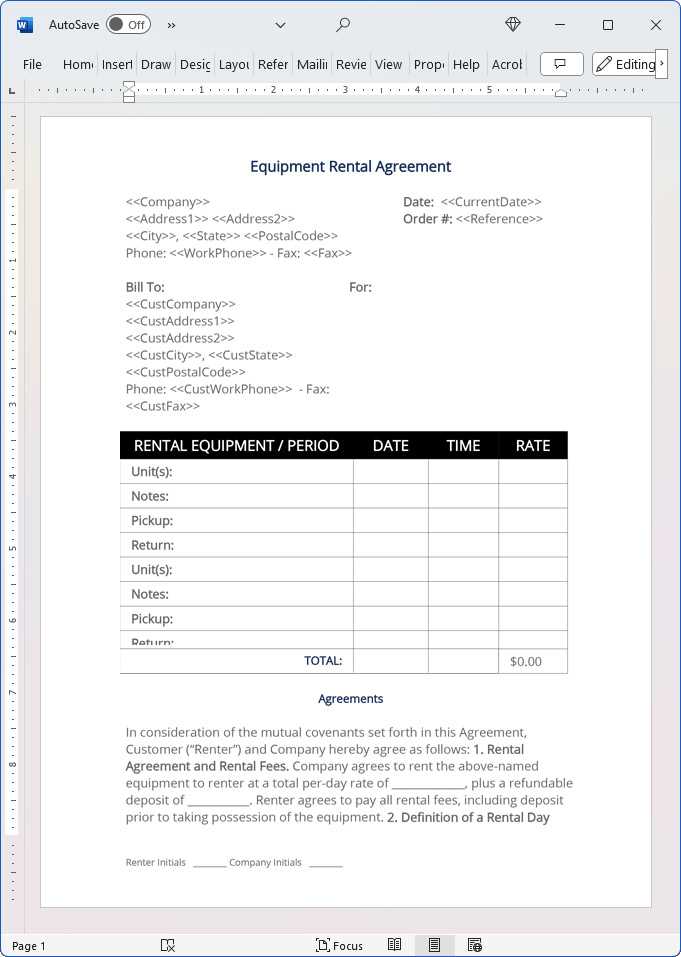

How to Customize Your Invoice Template

Tailoring your billing document to fit your specific business needs ensures that all relevant details are accurately reflected, and helps maintain a professional image. Customizing allows you to adapt the format, content, and style to best suit your brand, services, and client preferences. By doing so, you can create a document that is not only functional but also aligned with your company’s identity and operational requirements.

Steps to Personalize Your Billing Record

Follow these steps to create a customized document that meets your unique needs:

- Choose a Layout: Decide on a clean, easy-to-read layout. Whether you opt for a simple format or a more detailed design, make sure it highlights important information like charges, terms, and payment due dates.

- Add Your Branding: Include your business logo, colors, and font style to match your brand identity. This adds a professional touch and ensures consistency across all communication materials.

- Update Business Information: Ensure your contact information, such as your business address, phone number, and email, are always up-to-date and easily visible at the top of the document.

- Specify Payment Details: Customize the payment methods you accept, whether it’s bank transfers, checks, or online payment options, and provide any necessary instructions or account details.

- Adjust Terms and Conditions: Edit any legal conditions to reflect your specific business rules, such as late fees, damage clauses, or cancellation policies.

Customizing for Different Client Needs

In some cases, you may need to adjust the document for different types of clients or services. Consider the following options:

- Multiple Item Types: If you provide a variety of items or services, break down the charges for each type clearly to avoid confusion.

- Discounts and Special Offers: If you offer promotional rates or discounts, include specific details and how they apply to the final charges.

- Multiple Payment Installments: For long-term agreements, you may want to include installment options or payment plans to suit the client’s budget.

By personalizing your document, you ensure that it not only reflects the terms of the agreement but also enhances your business’s professionalism and client experience.

Common Mistakes to Avoid in Invoices

When preparing documents for a transaction, it’s easy to overlook important details that could lead to confusion or delays in payment. Mistakes in these documents can cause misunderstandings with clients, disrupt cash flow, and even damage your business reputation. By being aware of the common pitfalls, you can ensure that all essential information is presented clearly and professionally.

Frequent Errors to Watch For

Avoid these common mistakes to maintain accuracy and professionalism in your records:

- Missing Contact Information: Failing to include clear details for both the service provider and the client can make it difficult to resolve any issues or clarify questions later.

- Unclear Payment Terms: If payment deadlines, methods, or late fees are not specified, clients may delay payments or misunderstand the requirements.

- Incorrect Amounts: Double-check all amounts, including taxes, discounts, and additional fees, to ensure that totals are calculated correctly. Errors in pricing can lead to disputes or loss of trust.

- Omitting Terms and Conditions: Not including specific conditions, such as responsibility for damages or return policies, can result in confusion or legal issues later on.

- Unprofessional Formatting: A cluttered or disorganized document can cause confusion and make it harder for clients to understand the terms of the agreement. A clean, easy-to-read layout is essential.

How to Avoid These Pitfalls

To prevent these mistakes, always double-check your records for accuracy before sending them out. Make sure all fields are filled out correctly, from the client’s information to the payment details. It’s also a good practice to have a colleague review your documents to catch any potential errors you might have missed. Consistency and attention to detail will help maintain smooth transactions and build stronger relationships with your clients.

How to Track Equipment Rentals Efficiently

Effectively managing leased items or services is crucial for maintaining smooth business operations and ensuring that all transactions are accounted for. Keeping track of each agreement, from start to finish, helps avoid confusion, ensures timely payments, and provides a clear overview of assets in use. By implementing organized tracking methods, you can streamline your workflow and reduce the risk of errors.

Best Practices for Tracking Leased Items

To ensure that your tracking system is efficient and effective, consider the following steps:

- Create a System for Logging Transactions: Maintain a centralized record that logs all transactions. This can be a digital file or database that includes information such as client details, lease dates, and item descriptions.

- Use Unique Identifiers: Assign each leased item a unique number or code. This makes it easier to track individual assets and ensures that there’s no confusion when managing multiple agreements.

- Set Reminders for Key Dates: Implement a reminder system to track when items are due for return or payment. This helps prevent missed deadlines and ensures timely follow-ups with clients.

- Track Payment History: Keep a record of all payments made, including partial or full settlements. This will help you manage outstanding balances and provide clients with accurate billing information.

Leveraging Technology for Tracking

In addition to manual tracking, you can enhance efficiency by using software tools or apps designed to help manage leasing agreements:

- Rental Management Software: Specialized tools offer comprehensive features like automatic reminders, customizable reports, and detailed tracking of both items and payments.

- Cloud-Based Systems: Cloud storage allows you to access your records from anywhere, ensuring that you have up-to-date information at your fingertips.

- Mobile Apps: Some apps allow you to track rentals on the go, making it easy to update agreements or check statuses while away from the office.

By adopting these strategies and leveraging available technology, you can create a streamlined, efficient process for tracking your leased items, which will ultimately improve your workflow and client satisfaction.

Best Software for Rental Invoices

Choosing the right software can significantly enhance the efficiency and accuracy of managing payment records and agreements. With the right tools, businesses can automate billing, track transactions, and generate professional documents with ease. There are several software options available that cater to different business needs, making it important to select one that best fits your operation.

Top Software Options for Managing Leased Agreements

Below is a list of some of the best software solutions available for managing rental transactions and generating accurate financial records:

| Software | Key Features | Best For |

|---|---|---|

| QuickBooks | Automated billing, customizable reports, payment tracking, cloud-based. | Small to medium-sized businesses looking for a comprehensive financial solution. |

| FreshBooks | Easy-to-use interface, recurring billing, expense tracking, invoicing, client management. | Freelancers and small businesses in need of simple but effective billing software. |

| Rentec Direct | Specialized for rental property management, payment tracking, and tenant communication. | Businesses focused on managing property leases and rentals. |

| Zoho Books | Automated invoicing, payment reminders, expense management, reporting. | Small businesses requiring a cloud-based solution with customizable features. |

| Wave | Free to use, accounting software, invoice creation, expense tracking, and report generation. | Small businesses and startups looking for a cost-effective solution. |

Choosing the Right Solution for Your Needs

The right software will depend on the size of your business, the complexity of your transactions, and the level of automation you require. For instance, QuickBooks is ideal for businesses with complex financial needs, while Wave may be more suitable for smaller businesses on a budget. When evaluating software, look for features like customizable reporting, payment tracking, and ease of use to ensure that your solution fits your unique needs.

Legal Requirements for Rental Invoices

When providing services or leasing items, it’s crucial to ensure that all financial documents comply with local regulations. This not only helps in maintaining transparency but also ensures that both the provider and the client are protected legally. There are specific legal requirements that must be met when generating billing records for leased goods or services to avoid potential issues with tax authorities or disputes with clients.

Essential Elements for Legal Compliance

To ensure that your financial records are legally compliant, here are some key elements that must be included:

- Business Information: Include the name, address, and contact information of your business, as well as any relevant registration or tax identification numbers.

- Client Information: Provide the name and contact details of the client, along with any specific identifiers (such as client ID or account number) to clearly identify the recipient.

- Clear Description of Services: Specify the goods or services provided, including the dates of the transaction, duration of use, and any applicable terms or conditions. This avoids ambiguity and provides clarity.

- Payment Terms: Clearly outline the payment terms, including due dates, accepted payment methods, late fees, and any installment arrangements.

- Tax Information: Include applicable taxes, such as sales tax, VAT, or other relevant taxes, along with the tax rate used and the total tax amount charged. Ensure that this is in line with local tax laws.

- Legal Terms and Conditions: Include any clauses required by law, such as payment policies, refund procedures, liability terms, or cancellation conditions that may be specific to the jurisdiction.

Regulations Across Different Regions

Legal requirements can vary depending on the country or even the local region where your business operates. For example, some regions may require specific formatting or additional disclosures. Therefore, it’s important to stay updated on local laws to ensure full compliance. Common regulations include:

- Tax Reporting Requirements: Certain countries mandate the inclusion of tax registration numbers or the need for invoices to be numbered sequentially for proper tax reporting.

- Digital Documentation: In some jurisdictions, businesses may be required to issue electronic billing records for certain transactions or offer digital copies upon request.

- International Transactions: If conducting business internationally, be sure to comply with both local and international tax laws, currency exchange, and invoicing standards.

Ensuring your financial records meet these legal requirements not only avoids potential legal issues but also promotes trust with your clients by maintaining professionalism and transparency.

How to Handle Late Payments on Rentals

Late payments are an unfortunate but common issue in business transactions, especially when it comes to leased goods or services. Addressing this problem effectively requires clear communication, a structured approach, and understanding the steps that can help recover payments without harming business relationships. Implementing a solid payment management system can prevent delays, but when they occur, having a clear plan in place is crucial.

The first step in handling overdue payments is to ensure that the payment terms are well-defined upfront, including due dates, penalties, and acceptable payment methods. However, if payments are delayed, you need to act promptly and professionally to resolve the situation.

Steps to Take When Payments Are Late

- Send a Reminder: Begin by sending a polite reminder shortly after the payment due date has passed. Sometimes, clients simply forget, and a gentle nudge can often resolve the issue without further action.

- Review the Terms: If the payment is still not received, review the original agreement and check if there are any clauses regarding late fees or interest for overdue amounts. Reference these in your communication to reinforce the importance of adhering to the agreed terms.

- Offer Payment Plans: If the client is struggling with financial difficulties, consider offering an installment or payment plan. This shows flexibility and can increase the chances of receiving payment over time.

- Apply Late Fees: As stipulated in your agreement, consider implementing late fees or interest charges after a certain period of non-payment. This should be clearly communicated and calculated according to your original terms.

- Escalate the Issue: If the client continues to delay payment, escalate the situation by involving your legal team or hiring a collection agency. This should be a last resort after all other attempts have failed.

Preventive Measures to Avoid Late Payments

While it’s important to know how to handle late payments, it’s even more beneficial to prevent them in the first place. Some proactive steps to reduce the likelihood of overdue payments include:

- Clear Payment Terms: Always ensure that payment terms are clearly stated in every agreement, including due dates, fees, and penalties for late payments.

- Regular Follow-Ups: Implement a system for sending regular reminders, even before the payment due date arrives, to encourage timely payments.

- Automated Billing: Utilize automated billing systems that send out reminders and track payments, reducing the chances of missed payments.

By handling late payments effectively, you not only recover the funds owed to you but also foster better relationships with your clients by showing p

Benefits of Digital Rental Invoice Templates

In today’s fast-paced business environment, efficiency is key. Digital billing systems and documents offer a range of advantages that traditional paper-based records cannot match. These benefits streamline processes, reduce errors, and enhance overall productivity, making it easier to manage financial transactions and improve client relations.

Increased Efficiency and Speed

Digital records enable businesses to quickly generate, send, and track transactions. Unlike manual processes, which may require time-consuming calculations or printing, digital options allow for instant creation and delivery of documents, significantly speeding up the workflow.

- Instant Delivery: Once a document is finalized, it can be emailed directly to clients, cutting down on postal delays and ensuring faster receipt of payment requests.

- Quick Adjustments: Changes to details, such as dates or amounts, can be made instantly without needing to reprint or reprocess physical copies.

Improved Accuracy and Reduced Errors

Manual entries are prone to human errors, which can lead to discrepancies in records and potential misunderstandings with clients. Digital solutions offer built-in checks, reducing the chance of mistakes and ensuring that all data is accurate.

- Automated Calculations: Built-in tools can automatically calculate totals, taxes, and discounts, ensuring consistency and accuracy in all documents.

- Standardized Formats: Using digital formats ensures that all documents are presented uniformly, reducing the risk of confusion caused by inconsistent layouts or designs.

Better Organization and Record-Keeping

Digital documents are easier to store, manage, and retrieve compared to physical paperwork. With the right software, business owners can track past transactions, monitor payment statuses, and access records with just a few clicks, improving overall organizational efficiency.

- Searchable Records: Documents can be tagged and stored digitally, allowing for easy searching and retrieval whenever needed.

- Cloud Storage: Storing files in the cloud ensures that records are safe, secure, and accessible from anywhere, reducing the risk of data loss due to physical damage or misplacement.

Switching to digital billing methods provides clear advantages in speed, accuracy, and organization. These improvements not only save time but also help to maintain smooth business operations and enhance the client experience.

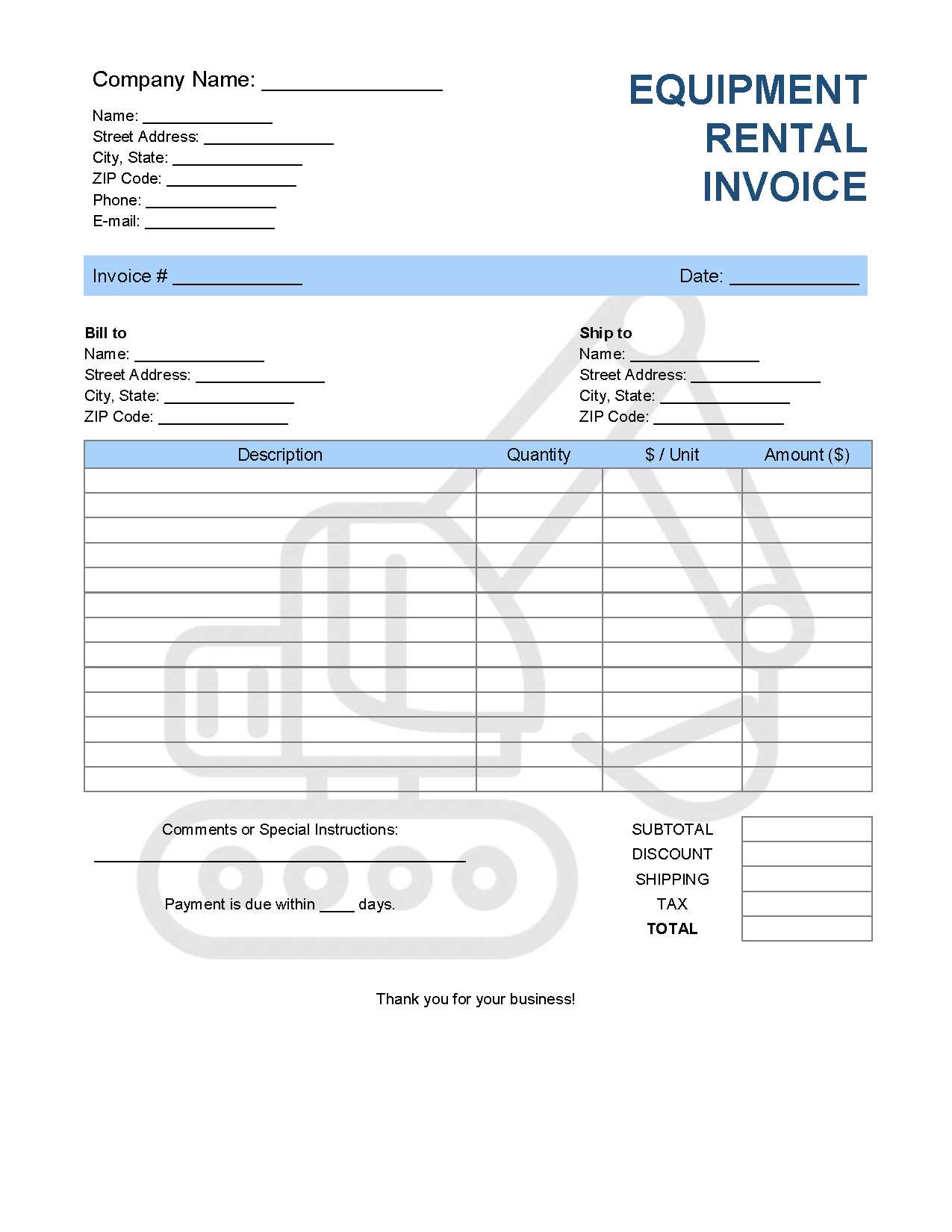

Creating Professional Invoices for Rentals

Producing clear, accurate, and professional financial documents is an essential aspect of business operations. Whether you’re providing temporary goods or services, an effective document ensures that your clients understand what they owe, why, and when. A well-crafted document reflects the professionalism of your business and facilitates smoother transactions and faster payments.

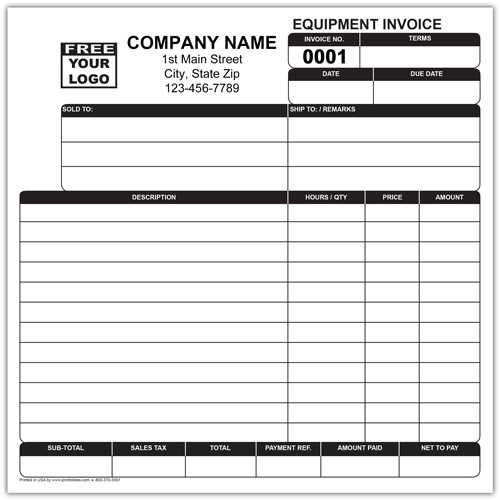

Key Elements of a Professional Document

A well-designed document must include several essential elements to be both clear and legally sound. The following components are critical for creating a document that is easy to read, comprehensive, and professional:

- Business Information: Always include your company name, address, phone number, and email, as well as the client’s contact details.

- Unique Reference Number: Assign a unique number to each document for tracking purposes. This helps both parties to reference the specific transaction easily.

- Itemized List: Clearly outline the services or items provided, along with their respective rates, quantity, and total amount. A detailed breakdown prevents misunderstandings.

- Payment Terms: Specify the payment due date, late fees, and accepted payment methods. This ensures clarity on when payment is expected and what penalties might apply for delays.

- Tax Information: If applicable, include tax rates and totals, along with a clear explanation of how these are calculated.

Designing for Clarity and Professionalism

The layout and design of your documents should be clean and easy to follow. A professional appearance builds trust and makes your communication more effective. Here are some tips for creating an aesthetically pleasing document:

- Consistent Branding: Use your company’s logo, colors, and font to create a branded look that aligns with your overall business identity.

- Readable Format: Ensure that the text is legible, with a logical flow. Break information into sections with headings for easy navigation.

- Space for Notes: Leave room for any additional comments, special conditions, or payment instructions. This can help address unique situations.

By ensuring that every document is clear, accurate, and professionally presented, you not only improve your client’s experience but also enhance the credibility of your business and streamline payment processes.

How to Calculate Rental Charges Accurately

Calculating charges for temporary use of assets or services requires precision to ensure that clients are billed fairly and accurately. Proper calculation involves factoring in various elements such as duration, usage rates, taxes, and additional fees. An error in any of these areas can lead to confusion or disputes, affecting business relationships. Here’s a guide to help you calculate charges with confidence.

Essential Elements for Accurate Calculation

Before determining the final charge, make sure to account for the following components:

- Base Rate: This is the standard cost for using the asset or service for a set period, whether it’s by the hour, day, week, or month.

- Duration of Use: Track the length of time the item or service is utilized, as this directly impacts the final price. Always use consistent time units (e.g., hours, days) to avoid confusion.

- Additional Services or Features: If any extra features or services are provided, such as delivery, setup, or maintenance, make sure to include these in the final calculation.

- Discounts or Promotions: If applicable, subtract any discounts or promotional rates from the base total to adjust the final amount due.

- Taxes: Calculate applicable taxes based on the local rates and include them in the final amount. Ensure that tax calculations are based on the correct jurisdiction and regulations.

Calculation Examples

Here’s how to put the above elements into practice with some simple calculations:

- Example 1: If the base rate for an asset is $50 per day, and the client uses it for 3 days, the base charge would be $150. If there’s a 10% tax, the final total would be $165.

- Example 2: If the client opted for an additional service costing $30, the base rate for 3 days would remain $150, but the final charge would increase to $195, plus tax.

Accurate calculation of charges ensures fairness, transparency, and smooth transactions. By taking the time to carefully factor in all aspects, you can prevent errors and provide your clients with clear, detailed billing information.

Importance of Clear Rental Terms in Invoices

Clear and concise terms in financial documents are crucial for preventing misunderstandings between businesses and clients. When outlining the conditions of temporary agreements or usage of assets, clarity ensures that both parties are on the same page regarding expectations, payment schedules, and responsibilities. Properly structured terms not only build trust but also facilitate smoother transactions and timely payments.

Key Aspects of Clear Terms

Including well-defined conditions in your financial documents helps prevent confusion and establishes a solid foundation for your business relationship. Here are some essential elements to cover:

- Payment Due Dates: Clearly state when the payment is due to avoid delays. Including late fees and penalties for overdue payments can also encourage timely settlement.

- Duration of Use: Define the exact length of time the service or asset will be provided. Whether it’s per day, week, or month, specifying the time frame eliminates any ambiguity.

- Additional Charges: Highlight any extra costs such as service fees, taxes, or charges for exceeding the agreed-upon usage period. This helps prevent disputes when the final payment is calculated.

- Termination or Extension Clauses: Include information on how either party can extend or terminate the agreement. This will ensure that both parties understand the process and consequences if the terms are altered.

Benefits of Clear Terms

Clearly defined terms provide numerous advantages for businesses, including:

- Prevention of Disputes: When both parties understand the conditions upfront, it reduces the chances of disagreements over payments or usage terms.

- Streamlined Operations: Clear expectations allow for smoother processing of transactions and quicker resolution of any issues that arise.

- Improved Professionalism: Transparent terms in your financial documents reflect well on your business, showcasing your commitment to clarity and professionalism.

By ensuring your terms are easy to understand and thoroughly explained, you not only improve customer satisfaction but also protect your business interests in the long term.

How to Include Taxes on Rental Invoices

Incorporating taxes into financial documents is essential for ensuring compliance with local laws and maintaining transparency with clients. When billing for temporary asset usage, it’s important to account for taxes in a clear and precise manner. Doing so not only helps avoid any legal issues but also provides your customers with a detailed breakdown of the total charges they are responsible for paying.

Steps to Include Taxes Correctly

To ensure taxes are properly added to your financial documents, follow these essential steps:

- Determine Applicable Tax Rate: Identify the correct tax rate based on the location of the transaction or service. Different regions may have varying tax percentages, so make sure you’re applying the correct one.

- Calculate the Taxable Amount: Assess the total charge for the service or asset usage before tax. This is typically the base rate agreed upon for the period of use, excluding any additional charges.

- Apply the Tax Rate: Multiply the taxable amount by the applicable tax rate. This will give you the tax amount that needs to be added to the total charge.

- Display the Tax Clearly: Ensure that the tax is shown separately on the document, indicating both the percentage and the total amount. This transparency helps customers understand what they are paying for.

Best Practices for Including Taxes

Follow these best practices to ensure clarity and prevent misunderstandings:

- Use Consistent Tax Rates: Ensure the tax rate is consistent across all transactions within the same region to avoid discrepancies.

- Clarify Exemptions: If certain charges or services are exempt from tax, make sure to note this on the document, explaining why taxes are not applied to them.

- Highlight Total Amount: At the end of the document, clearly state the total amount due, including both the pre-tax and tax amounts to make it easy for clients to see the full payment required.

By properly including taxes in your financial documents, you not only comply with tax regulations but also provide clear and accurate billing, fostering trust with your clients and ensuring smooth transactions.

Sending and Storing Rental Documents

Efficiently managing the distribution and storage of billing documents is crucial for both operational efficiency and compliance. Properly sending and organizing these records not only ensures timely payments but also helps maintain accurate financial records. Whether you’re using digital or physical copies, the process should be seamless and secure for both your business and your clients.

Sending Billing Documents Effectively

Once the financial record is created, the next step is ensuring it reaches the customer promptly. Here are some best practices for sending:

- Digital Distribution: Sending records via email or through a secure online portal is often the fastest and most efficient way. Make sure the document is in a commonly accessible format, such as PDF, to ensure the client can view and save it easily.

- Physical Copies: If you need to send physical copies, use reliable postal or courier services to ensure that the documents reach your client without delay. Include any necessary instructions or information to help them process the document correctly.

- Confirm Delivery: Whether digital or physical, confirm that the customer has received the document. For email, consider requesting a read receipt, or for physical delivery, use a tracking service to verify receipt.

Storing Rental Documents Securely

Once the documents are sent, they must be stored properly for future reference, tax purposes, and any potential disputes. Consider these storage options:

- Cloud Storage: Cloud services offer secure and organized storage solutions, allowing you to easily retrieve documents whenever needed. Make sure to use a trusted service that provides backup and security measures.

- On-Site Storage: For businesses that prefer to keep physical records, ensure that all documents are stored in a safe, organized space. Use labeled folders or filing cabinets to maintain easy access and avoid misplacement.

- Data Protection: Whether digital or physical, ensure that all stored records are protected from unauthorized access. Implement strong passwords, encryption, and other security measures for digital records, while keeping physical copies in secure locations.

By following these best practices for sending and storing billing documents, businesses can streamline their accounting processes, improve customer experience, and maintain organized financial records that are easy to access when needed.

Improving Payment Speed with Effective Billing

Ensuring fast payment processing is essential for maintaining a healthy cash flow and efficient business operations. The key to speeding up payments lies in how you manage and deliver the financial records to your clients. Clear, professional, and well-structured documentation can reduce delays and eliminate confusion, ultimately helping to expedite the payment cycle.

Strategies for Quick Payment Processing

Implementing the following strategies can help ensure that your clients pay promptly and without issues:

- Clear Payment Terms: Clearly state payment deadlines, late fees, and available discounts on early payments. Transparency helps clients understand expectations and avoids any surprises that could delay payment.

- Easy-to-Understand Breakdown: Make sure your document includes a clear breakdown of all charges, ensuring there are no misunderstandings about what is being paid for. Avoid using jargon or complex language that could confuse the customer.

- Digital Methods for Submission: Opt for digital delivery of documents, as it can be faster than traditional mail. Email or secure online portals allow clients to receive and process documents instantly.

- Multiple Payment Options: Offering various ways for clients to pay, such as credit card, bank transfer, or payment apps, increases convenience and the likelihood of faster payments.

Leveraging Technology for Faster Payments

There are numerous tools available that can help accelerate the payment process:

- Automated Payment Reminders: Set up automated reminders that notify clients about upcoming or overdue payments. Automated systems can send notifications via email or text, keeping payment deadlines top of mind.

- Online Payment Systems: Integrate online payment solutions directly into your billing process. This allows clients to pay immediately upon receiving the document, reducing the time spent waiting for checks or bank transfers.

- Instant Confirmation: Provide immediate confirmation upon receiving payment, ensuring clients feel their transaction has been processed smoothly and successfully.

By adopting these strategies and leveraging technology, businesses can improve payment speed, reduce delays, and enhance cash flow, all while maintaining positive customer relationships.