Easy to Use Doctors Invoice Template for Accurate Billing

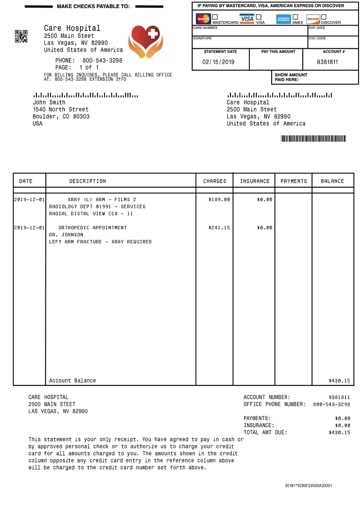

Managing billing in healthcare can be a complex and time-consuming task. Having a well-organized document to capture the necessary details of a medical service ensures that the process is smooth, transparent, and accurate for both practitioners and patients. The right tools not only save time but also reduce the likelihood of errors that could lead to delayed payments or disputes.

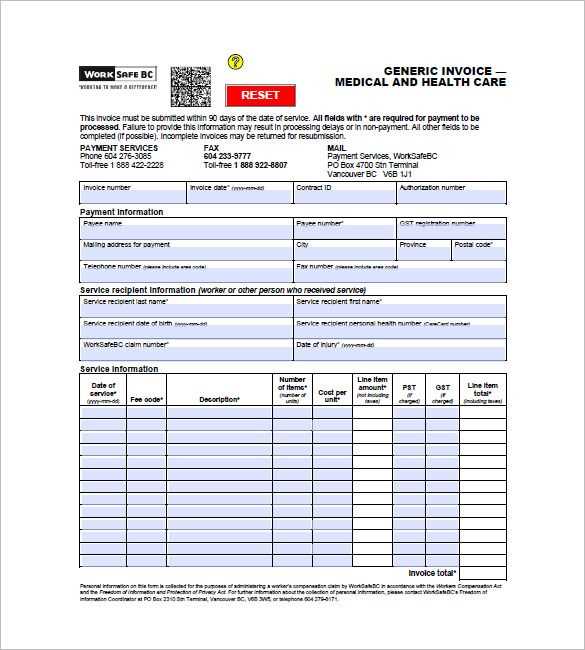

For medical professionals, adopting a structured and customizable billing form is crucial. Such documents can be tailored to suit different services, allowing for a more efficient workflow. By integrating the correct elements, including patient information, treatment details, and costs, this tool simplifies the process of generating clear, professional, and legally compliant records.

Whether you are a solo practitioner or part of a larger healthcare facility, having a reliable system in place helps streamline administrative tasks. With the right resources, you can focus more on patient care while maintaining financial accuracy. Additionally, embracing digital solutions for billing reduces paper usage and allows for easier storage and retrieval of important financial records.

Doctors Invoice Template Overview

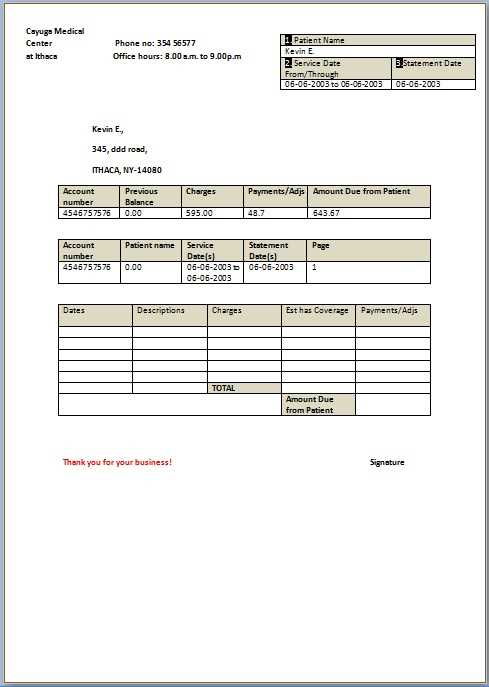

In the healthcare industry, efficient billing is crucial for ensuring accurate and timely payments for services rendered. A well-structured billing document provides the necessary details in a clear and organized manner, helping to streamline the financial side of medical practice. These documents serve as the foundation for managing patient accounts and tracking payment histories.

By using a standardized billing document, medical professionals can maintain consistency in their records and reduce errors. This allows for a more effective way to communicate charges and services with patients and insurance companies. Such forms typically include a variety of important fields designed to capture relevant details for proper billing and record-keeping.

- Contact information: Includes both the provider’s and the patient’s details for identification and communication.

- Service details: Lists the medical services or treatments provided, along with the corresponding costs.

- Payment terms: Clearly defines when payment is due and any late fees or payment schedules.

- Legal and tax information: Ensures compliance with relevant regulations, including any applicable taxes or insurance claims.

Overall, a well-designed billing document not only helps with day-to-day operations but also supports financial transparency and professionalism. These documents are essential for keeping track of payments and maintaining a smooth financial workflow in any medical practice, whether small or large.

Why Use a Doctors Invoice Template

Using a structured billing document simplifies the entire process of charging for medical services. Instead of relying on ad-hoc methods or inconsistent formats, a standardized form ensures clarity, accuracy, and efficiency. By providing a clear and professional record, it minimizes the risk of misunderstandings or disputes regarding fees.

Having a ready-made solution allows healthcare providers to focus more on patient care rather than administrative tasks. With the right structure, this document helps organize essential details, making it easier to track payments, create records, and comply with regulations. Here’s how such a form can be beneficial:

| Benefit | Explanation |

|---|---|

| Time Efficiency | Ready-to-use formats save time on creating each bill from scratch, allowing quicker turnaround on administrative tasks. |

| Professional Appearance | Standardized forms give a polished, consistent look to all billing documents, enhancing the perception of professionalism. |

| Improved Accuracy | Minimizes errors in data entry, ensuring correct charges, patient details, and other important information. |

| Better Organization | Keeps billing records organized in a way that makes it easier to retrieve and track payments or outstanding balances. |

| Compliance | Ensures that all legal requirements, such as tax information and insurance details, are included and properly formatted. |

Overall, using a standardized billing form makes the entire billing process smoother, reducing the administrative burden while ensuring that everything remains accurate and professional. This is especially important in a field where trust and clarity are essential to both providers and patients alike.

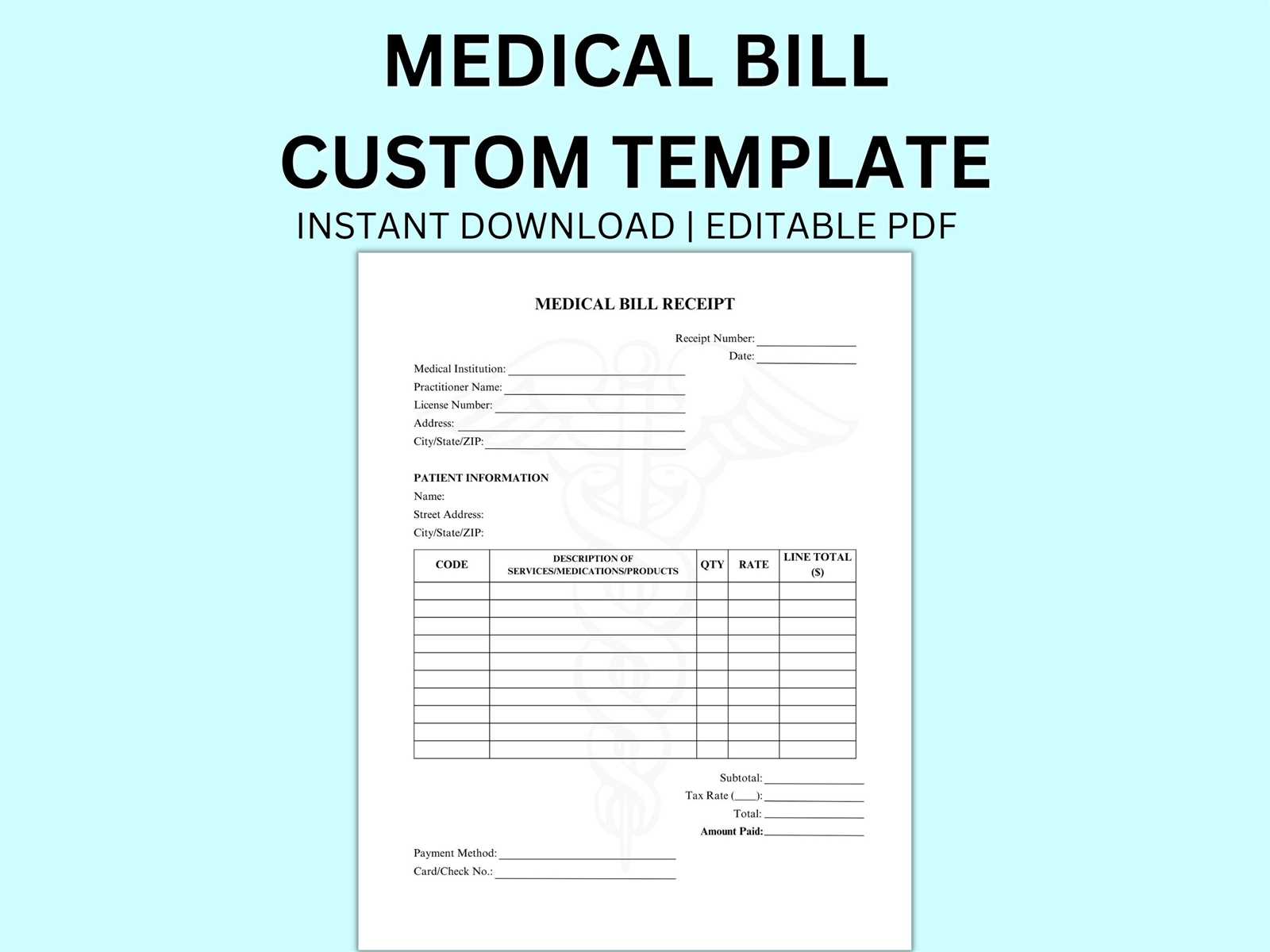

Key Features of an Effective Template

An effective billing form should include essential elements that allow for clear communication and easy processing of payments. These key features ensure that all necessary information is captured accurately and presented in a professional manner. A well-structured document also minimizes errors and enhances the efficiency of the financial workflow in any healthcare practice.

The following are the core components that make a billing form effective and user-friendly:

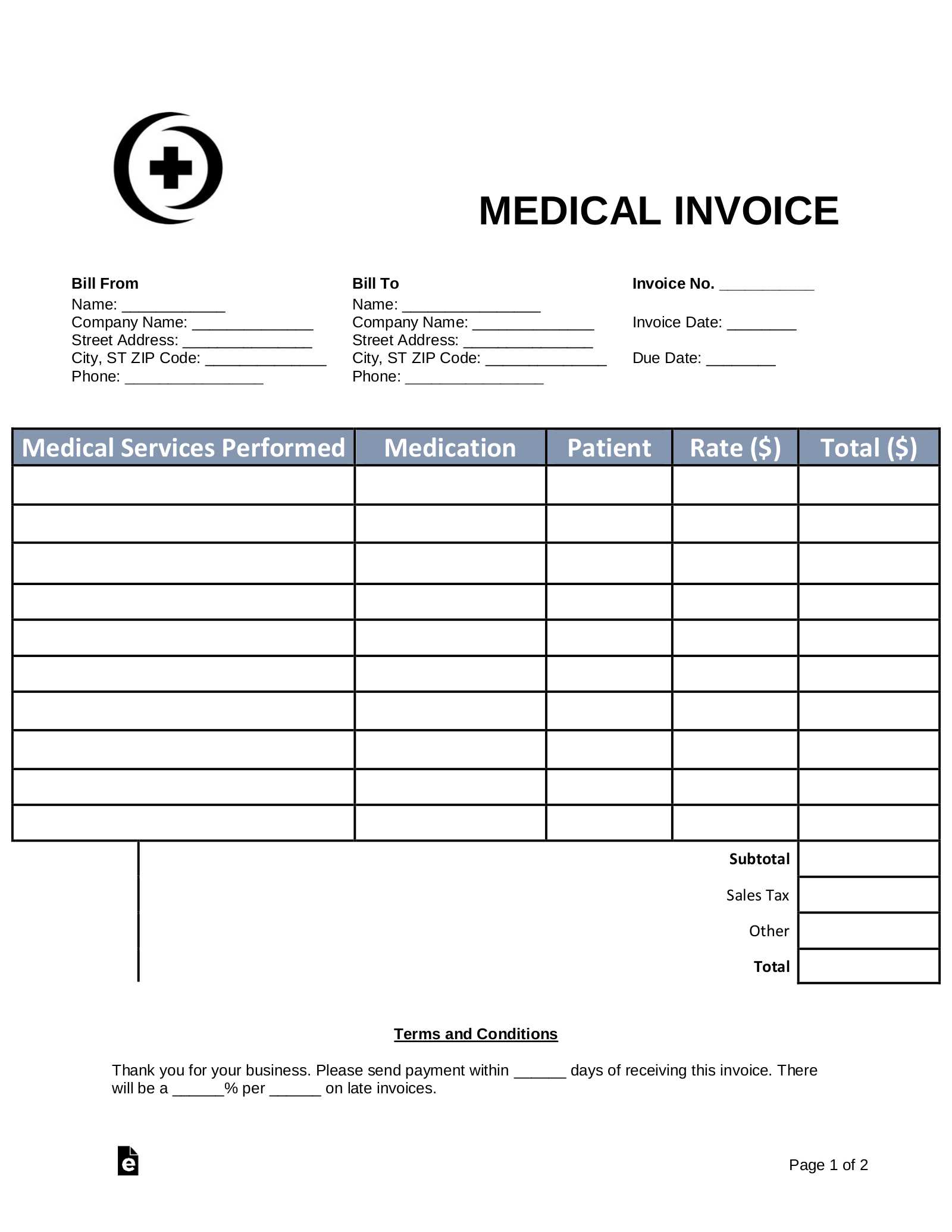

- Clear Patient Information: Contact details such as name, address, and insurance information must be easily identifiable to avoid confusion.

- Service Descriptions: Each service or treatment provided should be clearly listed with a detailed description and the associated cost, ensuring transparency for both the provider and the patient.

- Itemized Costs: Providing a breakdown of each charge, including consultations, procedures, and any additional fees, allows for a better understanding of the total amount due.

- Payment Terms: Include clear instructions on payment deadlines, accepted methods, and any penalties for late payments to ensure mutual understanding.

- Tax and Legal Compliance: Accurate tax calculations and any other necessary legal details (such as applicable medical codes) help ensure that the document meets industry standards and regulations.

- Professional Design: A clean, organized layout with appropriate headings, fonts, and spacing enhances readability and portrays professionalism to patients and insurance companies alike.

- Easy Customization: The ability to adapt the document to fit various scenarios, such as different types of services or payment schedules, adds flexibility and saves time.

- Payment Tracking: The form should include a section to indicate payment status or a tracking number, enabling easy follow-up on unpaid balances.

By incorporating these key features, a billing form not only becomes a powerful tool for financial management but also ensures that all parties involved have a clear understanding of the charges and payment expectations.

How to Customize Your Invoice

Customizing your billing document allows you to tailor it to your specific practice needs, ensuring it reflects both the services provided and your professional brand. Personalization makes the document more relevant and efficient, while also maintaining consistency across your records. By adjusting various elements, you can create a form that works seamlessly for both you and your patients.

Here are the key areas to focus on when customizing your billing document:

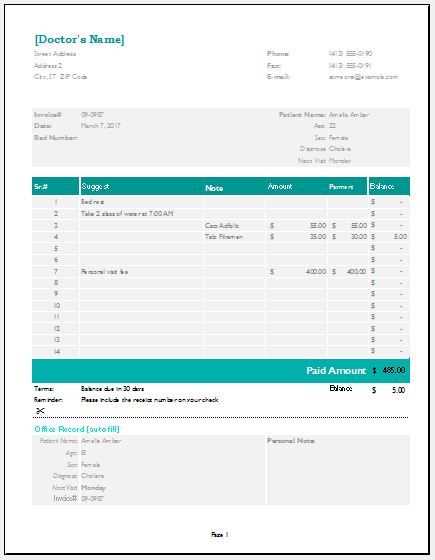

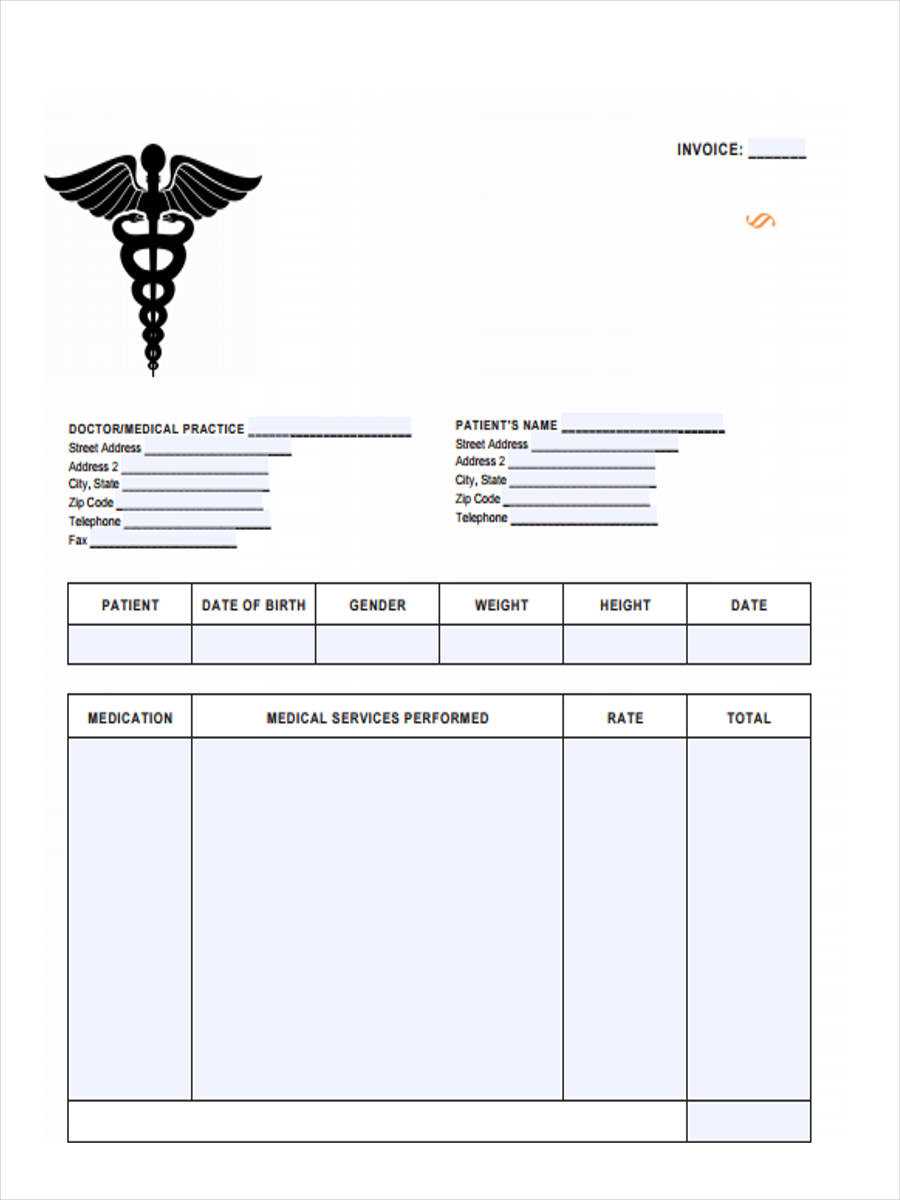

- Header Section: Add your practice name, logo, and contact information at the top. This not only gives the document a professional look but also makes it easy for patients to identify where it comes from.

- Service Details: Modify the descriptions of the treatments or services to reflect what you offer. You may want to include specific codes or terms that are unique to your specialty.

- Pricing Structure: Adjust the pricing format to align with your fee schedule. This can include hourly rates, flat fees, or packages, depending on your practice model.

- Payment Instructions: Clearly state the available payment methods, due dates, and any late fees or discounts for early payment. You may also include your payment policies or insurance details.

- Legal and Tax Information: Ensure that your form reflects any applicable taxes or legal requirements. This may include specific medical codes, tax identification numbers, or disclaimers for insurance claims.

- Design and Layout: Choose a layout that fits your brand and is easy to read. Ensure there is adequate white space and clear headings for each section to improve readability.

By carefully customizing these sections, you can ensure that your billing document is both functional and representative of your practice’s unique identity. A personalized approach helps improve patient experience and makes your financial transactions smoother and more professional.

Free vs Paid Invoice Templates

When choosing a billing document for your practice, you’ll often face the decision between using a free or a paid solution. Each option comes with its own set of advantages and limitations, depending on your specific needs. Understanding the differences can help you select the best fit for your practice, ensuring both efficiency and professionalism in managing payments.

Advantages of Free Billing Documents

Free options are typically a great starting point for small practices or those just beginning to manage their billing process. Here are some benefits:

- No initial cost: Free resources are, of course, available at no charge, making them an attractive option for new or budget-conscious practices.

- Basic customization: While often more limited than paid versions, free solutions still allow for some level of personalization, like adding your practice’s contact information and adjusting service descriptions.

- Quick setup: Most free documents are easy to download and use right away, without the need for lengthy setup or training.

- Good for small-scale use: If you’re handling a low volume of transactions, a free document can be a simple way to get started without a significant investment.

Advantages of Paid Billing Documents

Paid options, while often more expensive, come with a wider range of features and customization. These are typically better suited for practices that need more advanced functionality or design. Here’s why you might choose a paid solution:

- Advanced features: Paid solutions often include advanced options like automatic tax calculations, integration with accounting software, and built-in payment tracking.

- Higher customization: More flexibility in design and content, such as adding custom fields, specialized service descriptions, and creating templates for specific types of patients or treatments.

- Support and updates: Paid options usually offer customer support and regular updates to ensure the document stays up to date with current regulations and features.

- Professional look: With more design options, paid solutions tend to produce higher-quality, polished documents that enhance the overall image of your practice.

Ultimately, the decision comes down to your practice’s needs. For small operations with straightforward billing, a free option may be sufficient. However, for larger practices or those with more complex billing structures, investing in a paid document could provide significant long-term benefits.

Benefits of Digital Invoices for Doctors

As technology continues to evolve, transitioning from paper-based billing systems to digital solutions has become an essential step for modern medical practices. Digital records offer numerous advantages, ranging from increased efficiency to better organization. Adopting electronic documents for billing not only simplifies the process but also contributes to more accurate and timely payments.

Increased Efficiency and Speed

One of the primary benefits of using digital solutions is the speed at which transactions can be processed. With automated features, healthcare providers can generate, send, and track billing records much faster than manual methods. This improves workflow and reduces administrative time.

Improved Accuracy and Tracking

Digital systems minimize human error, ensuring that all details–such as service descriptions, costs, and patient information–are accurately recorded. Furthermore, electronic records are easier to track, making it simpler to follow up on outstanding balances or address any discrepancies.

| Benefit | Explanation |

|---|---|

| Time Savings | Digital documents allow for quick generation, editing, and sharing, significantly reducing the time spent on paperwork. |

| Cost Reduction | Eliminates the need for paper, ink, and postage, leading to reduced operational costs. |

| Environmental Impact | By moving to digital documents, practices can reduce their environmental footprint through less paper usage. |

| Accessibility | Electronic records can be accessed from anywhere, enabling healthcare providers to manage billing while on the go or from multiple locations. |

| Integration with Accounting Systems | Digital formats can be easily integrated with other software, streamlining the financial management of the practice. |

Incorporating digital solutions for billing not only improves operational efficiency but also enhances patient satisfaction. With faster processing times, more accurate records, and easier access to information, medical professionals can focus more on providing care and less on administrative tasks.

Essential Information for Doctor Invoices

When preparing billing records for medical services, it’s crucial to include all necessary details to ensure clarity and accuracy. These essential elements help to avoid misunderstandings with patients and facilitate smooth payment processing. A comprehensive document should cover not only the services provided but also the financial terms and any relevant legal information.

The following are the key pieces of information that must be included in any medical billing document:

- Provider Information: Your practice’s name, address, phone number, and tax identification number should be clearly listed for identification and communication purposes.

- Patient Details: Include the patient’s full name, address, contact information, and any insurance details to ensure proper identification and billing.

- Detailed Description of Services: Each treatment, consultation, or procedure should be described in detail, along with the date it was provided and the associated cost.

- Payment Terms: Clearly specify payment deadlines, accepted methods of payment, and any penalties for late payments to set expectations with patients.

- Tax Information: If applicable, include any taxes on services provided, including sales tax or other charges required by law.

- Insurance Information: If the patient is using insurance to cover part of the costs, include any relevant policy numbers or insurance claim details.

- Unique Reference Number: A reference number or code should be included to help both the provider and patient track the payment for each service or treatment.

Including these details in your billing records ensures that patients receive clear and accurate documentation, making the payment process more transparent and less prone to errors. Whether it’s for a one-time service or ongoing care, having all relevant information laid out professionally can significantly improve the administrative flow of your practice.

Design Tips for a Professional Look

When creating a billing document, the design plays a crucial role in how it’s perceived by patients and insurance companies alike. A well-designed form enhances professionalism and makes the document easier to read and understand. A clean, organized layout not only helps in communicating important information effectively but also reflects the credibility of your practice.

Here are some design tips to ensure your billing document looks polished and professional:

- Keep It Simple: Avoid clutter by using a minimalist design. A clear layout with adequate white space improves readability and prevents the document from feeling overwhelming.

- Use Clear Headings: Use bold, larger fonts for section headings (such as “Patient Details,” “Services Provided,” and “Payment Terms”) to organize the document logically and make it easy to navigate.

- Choose Professional Fonts: Stick to simple, easy-to-read fonts such as Arial, Helvetica, or Times New Roman. Avoid overly decorative fonts that can distract from the content.

- Consistent Branding: Include your practice’s logo, color scheme, and font style to give the document a cohesive look. Consistency with your overall branding helps build trust with patients.

- Highlight Important Information: Use bold or italicized text to draw attention to critical elements like the total amount due or payment deadlines. This helps ensure key details are not overlooked.

- Proper Alignment: Ensure that all text, numbers, and data are neatly aligned to create a structured and balanced appearance. Misaligned content can make the document appear disorganized and unprofessional.

- Include Contact Information: Make sure your practice’s contact details are easily visible, preferably at the top of the document. This ensures that patients know where to reach you if they have any questions or concerns.

- Use Grayscale or Subtle Colors: Opt for neutral tones such as black, grey, or dark blue for text, with occasional accent colors for headings or important figures. This keeps the document professional without overwhelming the reader.

By following these design tips, you can create a polished, professional billing document that enhances the patient experience and reflects the high standards of your practice. A well-crafted form not only aids in communication but also helps reinforce the trust and professionalism that are essential in the healthcare industry.

Common Mistakes in Medical Invoices

Billing errors can create confusion, delays in payment, and even damage the relationship between healthcare providers and patients. It’s important to ensure that every billing document is clear, accurate, and complete. Common mistakes often arise from oversights or inconsistencies that can be easily avoided with attention to detail and a standardized approach.

Here are some of the most common mistakes that can occur in medical billing documents:

- Missing Patient Information: Failing to include complete patient details, such as full name, address, and insurance information, can lead to confusion and delays in payment processing.

- Incorrect Service Descriptions: Using vague or incorrect descriptions for the services provided can lead to misunderstandings and disputes. Each procedure should be described in clear, specific terms that both parties can easily understand.

- Incorrect Billing Codes: If applicable, not using the correct medical or procedural codes can lead to rejected claims or incorrect billing. Make sure to double-check codes and other references for accuracy.

- Omitting or Miscalculating Fees: Failing to list all charges or making mistakes when adding up the total amount due can create confusion and result in unpaid balances. Always provide an itemized list of charges and verify totals before finalizing the document.

- Not Including Payment Terms: Omitting payment instructions or failing to state when payment is due can lead to delays and misunderstandings. Be sure to clearly indicate the deadline for payment and any penalties for late payment.

- Failing to Include Tax Information: Forgetting to include applicable taxes or legal charges can cause issues when submitting claims or receiving payments. Ensure all relevant tax details are accurately calculated and included.

- Lack of Professional Formatting: A poorly formatted document can lead to confusion and make it harder for the recipient to understand the charges. Ensure your billing document is neat, easy to read, and professionally presented.

- Not Keeping Copies: Failing to keep a copy of the billing document can lead to issues if the patient has questions or if follow-up is needed. Always retain a copy of each document for your records.

By avoiding these common mistakes, you can ensure that your billing process runs smoothly, your patients are satisfied, and payments are received promptly. Attention to detail and a thorough review process will help prevent unnecessary errors and make your administrative work more efficient.

How to Automate Your Billing Process

Streamlining the billing process can save significant time and reduce the risk of errors. Automation allows you to generate, send, and track payment requests efficiently, all while maintaining accuracy and consistency. By implementing automated solutions, healthcare providers can focus more on patient care rather than the administrative workload associated with billing.

Integrating Billing Software

The first step in automating your billing is to adopt specialized software designed for medical practices. These platforms often include features such as:

- Automatic Bill Generation: Software can create billing records based on the services rendered, without needing manual input for every detail.

- Pre-set Payment Terms: You can set default payment terms, such as due dates and late fees, which are automatically included in each document.

- Insurance Integration: Some tools can automatically pull in patient insurance information and apply relevant codes for quicker claims processing.

- Tracking and Notifications: Automated reminders can be sent to patients when payment is due or when a payment is overdue, ensuring nothing is missed.

Automating Payment Collection

Automation doesn’t just stop at billing record creation–it can extend to payment collection as well. Many software solutions offer integrations with online payment systems, allowing patients to pay their bills directly from the document they receive. Benefits include:

- Online Payment Options: Patients can quickly and securely pay via credit cards, bank transfers, or digital wallets.

- Automated Payment Reminders: Automated systems can send follow-up reminders via email or SMS to ensure timely payments.

- Payment Tracking: Payments can be automatically recorded and reconciled, saving you from having to manually enter payment information.

By automating the billing and payment process, medical practices can significantly reduce administrative tasks, improve cash flow, and ensure timely payments. The result is a more efficient and streamlined workflow that benefits both providers and patients.

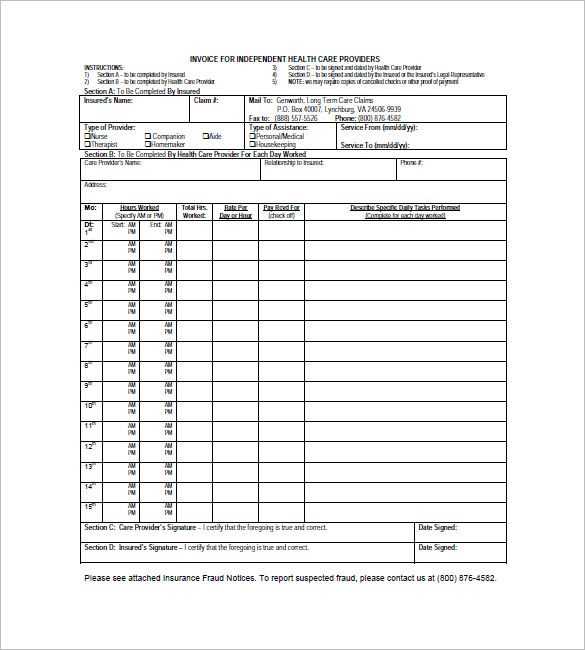

Invoice Templates for Different Medical Fields

Every medical specialty has unique billing needs, and customizing your billing documents for each field ensures clarity and accuracy. Depending on the services provided, the type of care, and the complexity of treatments, different types of records may be required to reflect the specific details of each visit or procedure. Adapting billing forms to suit various medical specialties not only improves efficiency but also streamlines the payment process for both the provider and the patient.

Here’s a look at how medical billing documents can vary across different fields of practice:

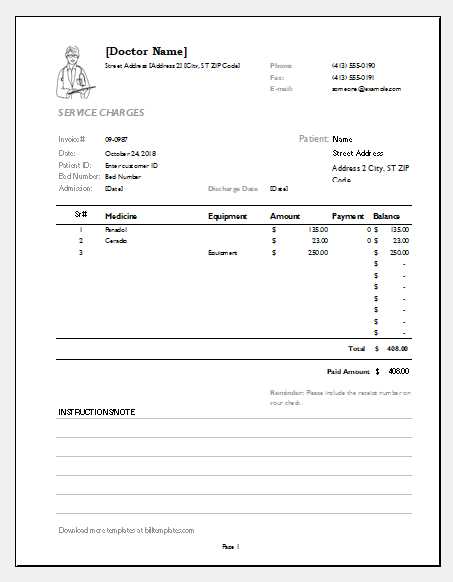

- General Practice: Billing documents for general practitioners usually involve basic services like consultations, check-ups, and routine exams. These forms typically include service descriptions, standard consultation fees, and basic patient information.

- Specialist Care: For specialists, such as cardiologists or orthopedists, the documents may include more detailed descriptions of procedures, diagnostic tests, and follow-up care. The complexity of services usually means that specific codes or terms are required to accurately reflect the treatment provided.

- Dentistry: Dental billing documents often need to include itemized descriptions of procedures such as cleanings, fillings, root canals, and other dental treatments. These forms may also account for the cost of materials or anesthesia used during treatment.

- Physical Therapy: For physical therapists, billing documents might include a breakdown of sessions, treatment techniques used, and any equipment or therapy tools employed. Some practices also offer package rates, which should be clearly reflected in the billing document.

- Psychiatry and Mental Health: In mental health care, billing records often focus on therapy sessions, assessments, and consultations. The documents may include different codes for various types of therapy (individual, group, or family counseling) and may also need to reflect any extended hours or emergency services.

- Chiropractic Care: Chiropractic bills typically include services such as spinal adjustments, physical rehabilitation, and other therapeutic services. Special codes and descriptions for the types of adjustments or therapies provided are often needed.

Tailoring your billing documents to fit the specific requirements of each medical field ensures that you can capture all necessary details and charge appropriately. This not only helps maintain transparency with patients but also ensures smoother insurance claims and faster payments.

Best Software for Creating Invoices

Choosing the right software for generating billing records is essential for improving efficiency, accuracy, and overall workflow in any medical practice. The right tools can help automate the billing process, ensure proper formatting, and reduce the chances of errors. Whether you’re looking for a free solution or an advanced paid option, there are many great software programs available that can streamline your administrative tasks and enhance your professional appearance.

Top Features to Look For

When selecting billing software, look for features that make the process as easy and error-free as possible:

- Customization: Ability to customize your documents to match your practice’s branding, including logos, colors, and payment terms.

- Automation: Features that allow you to automatically generate, send, and track payments.

- Integration with Accounting Systems: The ability to seamlessly integrate with your existing accounting or practice management software for easier financial tracking.

- Compliance: Ensure that the software complies with industry regulations and handles sensitive patient data securely.

- Mobile Access: Some programs allow you to access and send billing records from anywhere, giving you flexibility and convenience.

Best Software Options for Medical Billing

Here are some of the best software tools available for creating professional billing records:

- QuickBooks: A popular accounting tool that offers a user-friendly platform for creating customized billing documents, tracking payments, and managing finances. Ideal for small to medium-sized practices.

- FreshBooks: Known for its intuitive interface, FreshBooks allows users to generate invoices, track billable hours, and integrate with various payment gateways. It’s an excellent choice for independent practitioners.

- Zoho Invoice: A comprehensive invoicing tool with customizable templates, time tracking, and multi-currency support. Zoho Invoice is well-suited for practices with international clients or complex billing needs.

- Wave: A free option for smaller practices, Wave offers essential features like customized billing forms, expense tracking, and integration with bank accounts.

- Practice Fusion: Specifically designed for medical professionals, Practice Fusion integrates electronic health records (EHR) with billing and scheduling features, allowing for smooth workflow management and streamlined payments.

- Medisoft: A comprehensive medical practice management solution with billing functionality, Medisoft is designed for larger medical offices and includes features for insurance claim submission and patient billing.

By selecting the right software for your practice’s needs, you can simplify the billing process, reduce errors, and improve your overall administrative efficiency.

How to Track Payments Efficiently

Keeping track of payments is a critical aspect of managing any healthcare practice. An efficient payment tracking system ensures that you can monitor outstanding balances, reconcile payments quickly, and maintain healthy cash flow. By using the right tools and strategies, you can reduce administrative workload, minimize errors, and improve financial transparency for both you and your patients.

Key Methods for Payment Tracking

There are several effective ways to track payments. Here are a few best practices to help you stay organized:

- Automated Payment Recording: Use billing software that automatically records payments as they come in. Many platforms integrate directly with payment gateways, so when a patient makes a payment, the system updates the record in real time.

- Payment Reminders: Set up automated reminders for patients with outstanding balances. These notifications can be sent via email, SMS, or even within the practice’s patient portal to prompt payment before the due date.

- Use Payment Codes: Implement a system where each payment or charge is assigned a unique reference number. This helps you track which payments have been received, who made them, and what services they were for.

- Reconciliation Reports: Regularly generate and review payment reports to identify discrepancies or missed payments. This process helps ensure that all payments are correctly applied to the patient’s account.

Tools for Efficient Payment Tracking

Several tools can help streamline the payment tracking process. Here are a few options to consider:

- Practice Management Software: Tools like Medisoft and Practice Fusion offer integrated payment tracking features, allowing you to manage billing, payments, and patient information from a single platform.

- Accounting Software: Accounting programs like QuickBooks and FreshBooks allow you to track payments, send receipts, and generate financial reports with ease. Many of these tools can integrate with other systems to keep all financial data in one place.

- Payment Gateways: Services like Stripe and PayPal provide real-time payment tracking, and many offer automatic invoicing and payment updates that can be synchronized with your practice’s records.

By implementing these strategies and tools, you can simplify the process of tracking payments, reduce errors, and improve the financial health of your practice. An organized system not only saves time but also fosters trust with patients, making it easier to manage payments and ensure timely reimbursements.

Legal Considerations for Medical Billing

When handling billing and payment collection in the healthcare industry, it’s crucial to understand and comply with various legal requirements. Failure to do so can result in financial penalties, damaged reputations, and potential legal issues. It is essential to stay informed about the laws and regulations that govern how services are billed, how patient information is handled, and how payments are processed.

Key Legal Considerations

Below are some of the most important legal aspects to keep in mind when managing billing records in a healthcare setting:

- Compliance with HIPAA: The Health Insurance Portability and Accountability Act (HIPAA) mandates the secure handling of patient data. Any billing document or record that contains patient information must be safeguarded to ensure confidentiality and protect against unauthorized access.

- Accurate Billing Practices: Misleading or fraudulent billing practices, such as overcharging or unbundling services, can lead to legal consequences. Always ensure that charges reflect the actual services provided and that any codes used are accurate.

- Insurance Billing Rules: Insurance companies have strict rules about what can be billed and how. Providers must ensure that claims are submitted according to these rules and that all required documentation is included to avoid disputes or claim rejections.

- Transparency and Consent: Patients should be informed about their financial responsibility before receiving services. Written consent or acknowledgment of the charges is often required, particularly for high-cost procedures or treatments not covered by insurance.

- State and Local Laws: In addition to federal regulations, healthcare providers must comply with state and local billing laws, which can vary widely. It’s essential to understand the specific legal requirements in your jurisdiction to avoid non-compliance.

Avoiding Legal Pitfalls

To stay on the right side of the law, healthcare providers should implement the following best practices:

- Regular Training: Ensure that all staff members involved in the billing process are trained on the latest legal and regulatory requirements.

- Use of Proper Documentation: Always keep accurate and detailed records of the services provided, including documentation of patient consent, treatment plans, and communication with insurance companies.

- Seek Legal Advice: When in doubt, consult with a legal professional who specializes in healthcare law to ensure that your practice is fully compliant with all applicable regulations.

By staying informed about legal requirements and maintaining ethical billing practices, healthcare providers can avoid legal complications and ensure that they maintain trust with their patients and the broader healthcare community.

Integrating Invoices with Your Accounting System

Efficient financial management in healthcare requires seamless integration between billing records and your accounting system. By connecting these two areas, you can eliminate manual data entry, reduce the risk of errors, and ensure that your financial reporting is both accurate and up-to-date. Automation of this process allows for smoother workflow and provides a clearer view of your practice’s financial health.

Benefits of Integration

Integrating your billing system with accounting software offers several advantages for healthcare providers:

- Time-Saving: Automation of data transfers from billing records to accounting reduces the time spent on manual entry, allowing you to focus on patient care and other critical tasks.

- Accurate Financial Reporting: Integration ensures that financial records are updated in real time, leading to more accurate reports on revenue, expenses, and overall profitability.

- Consistency: By syncing billing and accounting systems, you ensure that both systems are in alignment, reducing the chances of discrepancies between billed services and recorded payments.

- Improved Cash Flow Management: Automatic updates allow you to monitor accounts receivable more effectively, helping you follow up on outstanding payments faster and reduce the risk of delayed reimbursements.

How to Integrate Billing and Accounting Systems

Here are some strategies for successfully integrating your billing and accounting platforms:

- Choose Compatible Software: Select billing and accounting systems that offer built-in integration or compatibility with each other. Popular platforms such as QuickBooks and FreshBooks offer easy integration options with medical practice management tools.

- Automation Features: Look for software that automates the transfer of data between systems. This can include automatic updates to patient accounts, payment tracking, and the creation of financial reports without manual intervention.

- Cloud-Based Systems: Cloud-based solutions allow for real-time data synchronization, so both your billing and accounting systems are always up to date, no matter where you or your team are working.

- Third-Party Integrators: If your billing and accounting systems do not natively integrate, consider using third-party software that bridges the gap between the two systems. Many integration platforms exist that connect various tools to streamline workflow.

By integrating billing records with your accounting system, you not only streamline your administrative tasks but also improve the overall financial accuracy of your practice. This creates a more efficient and error-free system that enhances both financial and operational management.

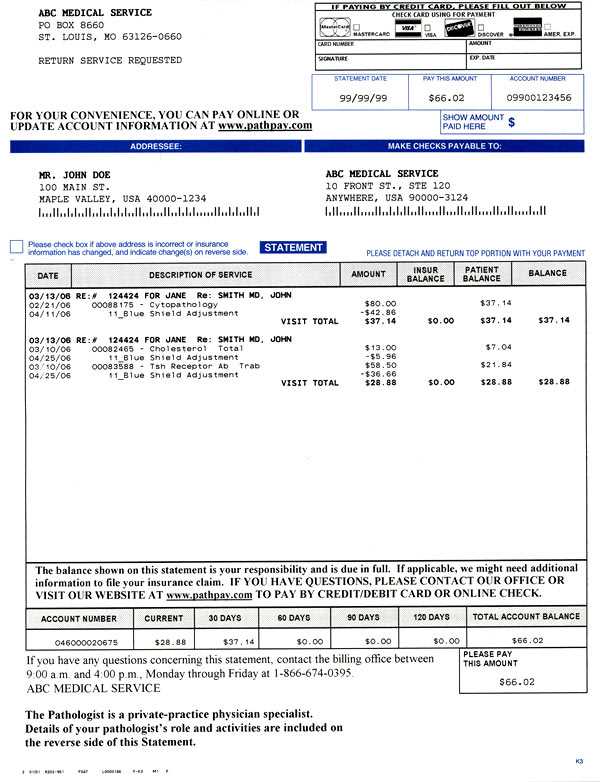

How to Handle Insurance Billing with Invoices

Managing insurance billing efficiently is a critical aspect of financial management in any healthcare practice. When services are provided to patients who are covered by insurance, proper documentation and communication with insurance companies are essential to ensure timely reimbursement. The process involves submitting accurate records, verifying coverage, and following up on claims. Streamlining these steps can reduce delays, minimize errors, and improve cash flow for your practice.

Steps for Handling Insurance Billing

Here are some key steps to follow when handling billing for insurance claims:

- Verify Insurance Coverage: Before providing services, always confirm the patient’s insurance details. This includes confirming their policy number, plan type, and any co-pays or deductibles they may be responsible for. Verifying insurance helps prevent billing mistakes later.

- Accurate Coding: Use the correct medical codes for the services provided. Insurance companies require specific codes to process claims, and incorrect codes can result in denials or delays in payment. Always refer to the latest coding guidelines.

- Submit Complete Documentation: When submitting claims to insurance companies, ensure that all necessary documentation is included, such as detailed descriptions of the services, dates of treatment, and the patient’s medical history when needed. Missing or incomplete information can lead to claim rejection.

- Track Claims: After submitting a claim, it’s essential to track its status. Insurance providers often take time to process claims, and it’s important to follow up on any claims that are taking longer than expected or have been denied. Keep detailed records of all communications with insurance companies.

- Handle Patient Responsibility: Once insurance payments are processed, determine the patient’s responsibility for the remaining balance. This could include co-pays, co-insurance, or deductibles. Ensure this amount is communicated clearly to the patient and billed accordingly.

Tools to Assist with Insurance Billing

Using the right tools can greatly simplify the insurance billing process. Here are a few options to consider:

- Practice Management Software: Tools like Medisoft and CareCloud offer integrated billing and insurance claim submission features. They allow for direct submission to insurance companies and help track the status of claims in real time.

- Claim Tracking Systems: Dedicated claim tracking systems provide real-time updates on the status of insurance claims, allowing you to follow up quickly on any denials or delays. These systems also help ensure that claims are submitted correctly and on time.

- Insurance Clearinghouses: Many practices use clearinghouses to submit claims electronically to multiple insurance companies simultaneously. This helps ensure faster processing and reduces the likelihood of claim rejection due to formatting errors.

By properly handling insurance billing, you can reduce administrative overhead, improve the likelihood of claim approval, and ensure that your practice receives timely payments. An organized and thorough process for submitting and tracking claims can ultimately lead to better financial stability and a smoother workflow.

Saving Time with Ready-Made Templates

In any healthcare practice, time is a valuable resource. One of the most effective ways to save time on administrative tasks is by utilizing pre-designed documents that streamline your workflow. Ready-made solutions can help reduce the time spent on manual entry, eliminate repetitive work, and ensure consistency across all your records and forms. These ready-to-use tools can be especially beneficial when managing patient billing, allowing you to focus more on providing care.

Benefits of Using Pre-Designed Documents

Here are several advantages to using ready-made documents for billing and record-keeping in a medical practice:

- Speed and Efficiency: Pre-designed forms are already set up with the necessary fields, reducing the need for customization. You can quickly fill in patient information and service details, cutting down on the time spent on creating documents from scratch.

- Consistency: Using standardized documents ensures that all records are uniform in format. This consistency helps maintain professional standards and avoids errors that can occur when creating documents manually each time.

- Reduced Errors: Pre-designed documents often come with built-in checks and balances, such as drop-down lists or auto-calculating fields, which reduce the chances of data entry errors and improve accuracy.

- Improved Organization: Ready-made documents typically come with clear, organized layouts, making it easier to track and manage patient information. This organization improves the overall efficiency of your practice and ensures that everything is easy to locate when needed.

How Ready-Made Documents Streamline Administrative Tasks

Here’s how using pre-designed forms can help save time in your practice:

- Easy Customization: Many pre-designed forms allow for simple customization to suit your practice’s needs. You can add your logo, modify fields, or adjust terminology, without needing to create a document from the ground up.

- Quick Updates: When regulations or insurance requirements change, ready-made solutions are often updated by the provider. This means you won’t have to manually adjust your documents each time there’s a change in legal or billing standards.

- Automated Calculations: Ready-made documents often include automated fields for calculations, such as totals or tax percentages. This reduces the time spent on manual calculations and ensures accuracy in financial documents.

- Easy Sharing: Pre-designed forms can often be shared electronically, allowing for faster communication with insurance companies, patients, or administrative staff. This helps reduce delays in payment or approval processes.

By adopting ready-made forms, healthcare providers can significantly reduce the time spent on administrative tasks, improve operational efficiency, and ensure the accuracy of all patient and financial records. This time-saving approach frees up resources to focus on patient care and enhances the o

Ensuring Compliance in Medical Billing

Compliance with regulatory standards is essential when managing billing in healthcare settings. Adhering to guidelines ensures that all claims are processed correctly and that your practice avoids penalties, fines, or issues with insurance providers. Maintaining proper documentation and following the required procedures can help prevent errors, reduce the risk of audits, and ensure that your practice operates within legal frameworks.

Key Compliance Factors to Consider

To ensure compliance in your billing practices, consider the following critical aspects:

- Accurate Coding: Proper coding is the foundation of accurate billing. Using the most up-to-date medical codes ensures that services are billed correctly and that the right reimbursements are received. Familiarity with the latest ICD (International Classification of Diseases) and CPT (Current Procedural Terminology) codes is essential.

- Patient Consent and Authorization: Before providing certain services, it is important to obtain the necessary consent and authorization from patients or their insurance providers. Documentation of these agreements can protect your practice in case of disputes or claims issues.

- Timely Claim Submission: Submitting claims within the allowed timeframes is crucial for reimbursement. Late submissions can result in denied claims or delayed payments. It’s important to keep track of submission deadlines and follow up on claims promptly.

- HIPAA Compliance: Ensure that patient information is protected in compliance with the Health Insurance Portability and Accountability Act (HIPAA). This includes securing patient records, using encrypted communication channels, and ensuring that only authorized personnel have access to sensitive information.

- Medicare and Medicaid Rules: For practices that accept government-funded insurance, it’s vital to follow specific rules related to billing and reimbursement for Medicare and Medicaid patients. Stay updated on changes to these programs to ensure that your claims meet all requirements.

Tools to Support Compliance

There are various tools and strategies that can help you maintain compliance in your billing processes:

- Billing Software with Built-In Compliance Checks: Many billing software systems are designed to help ensure compliance by automatically checking for errors in coding, submission timelines, and patient eligibility. These tools can help reduce the chances of mistakes and make it easier to stay in line with regulations.

- Regular Audits: Conducting internal audits on a regular basis can help identify areas where your billing practices may not be in full compliance. Regular reviews help correct mistakes early and reduce the risk of future compliance issues.

- Training and Education: Ongoing training for your billing and administrative staff is essential to keep them informed of the latest compliance requirements and best practices. Regular educational updates will help your team stay ahead of changes in regulations and billing codes.

Ensuring compliance in your billing practices protects your practice from potential legal and financial co