CRA Compliant Invoice Template for Canadian Businesses

Maintaining accurate financial records is essential for any business, especially when it comes to generating documents that comply with government regulations. When it comes time to request payment for goods or services, it’s crucial that the documents you provide meet the standards set by tax authorities. These documents not only ensure smooth transactions with clients but also help you stay on top of your tax obligations.

Businesses in Canada must follow specific guidelines when issuing payment requests. Adhering to these rules helps to avoid costly mistakes and penalties. By using the right format and including the necessary information, companies can streamline their processes and ensure transparency in their financial dealings. This is particularly important for businesses that deal with taxes such as GST and HST, as the government requires clear, accurate records for tax reporting.

Whether you’re a freelancer, a small business owner, or part of a larger organization, knowing how to create an official document that meets all legal requirements is vital. This guide will explore how to design and implement an efficient, tax-friendly billing document that keeps you compliant and organized.

CRA Compliant Invoice Template Overview

For any business, ensuring that financial documents align with regulatory standards is crucial. Tax authorities require that payment requests meet specific guidelines to ensure transparency and facilitate accurate tax reporting. A well-structured document serves as proof of transaction and supports a smooth financial process, minimizing the risk of errors or audits.

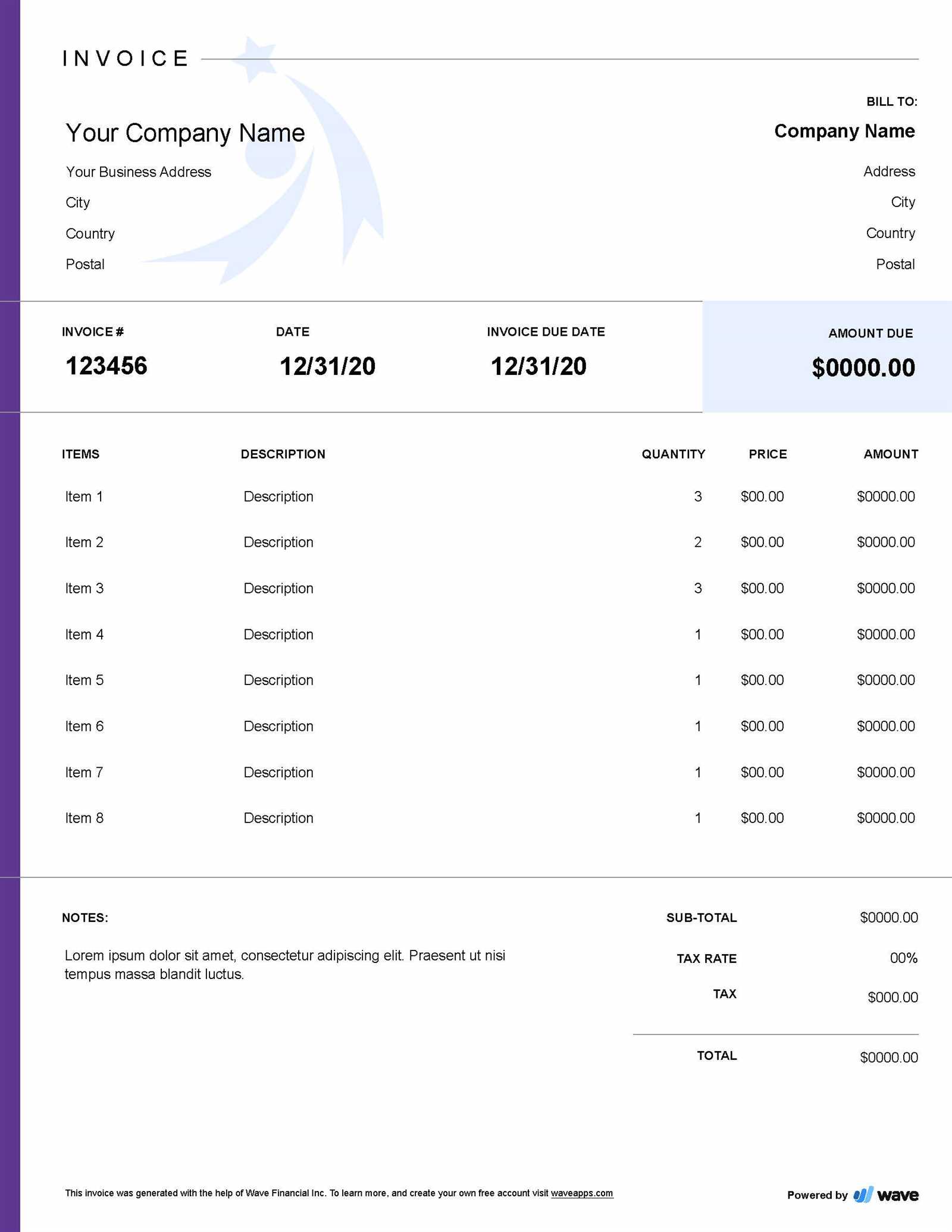

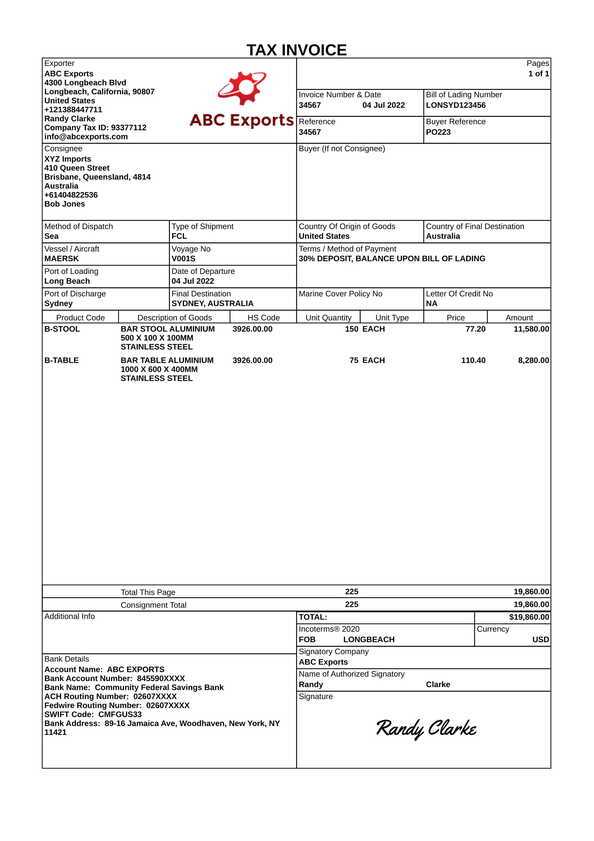

When preparing these documents, it is important to include all the necessary elements that comply with local tax regulations. A well-organized structure not only helps with legal compliance but also makes it easier for clients to process payments efficiently. Below are the key components that should be included in any official payment request document:

- Business Information: Name, address, and contact details of the company issuing the document.

- Client Information: Name, address, and contact details of the person or business receiving the goods/services.

- Date and Unique Identifier: Date of issuance and a unique number or code to identify the document.

- Description of Goods or Services: Clear details of the products or services provided, including quantities and rates.

- Tax Information: Tax rates applied, including GST or HST, where applicable.

- Total Amount Due: Clear calculation of the total amount, including taxes and any applicable discounts or fees.

Having a standard format for creating these documents helps businesses stay organized and avoid missing critical details. It ensures that all necessary information is provided in a clear, professional manner, which is essential for both clients and regulatory authorities.

Why You Need a CRA Compliant Template

For any business, ensuring that financial records and billing documents meet regulatory standards is essential to avoid complications during tax filing and audits. Using a standardized format that follows specific guidelines helps ensure accuracy and transparency in every transaction. This not only protects your business from potential legal issues but also streamlines communication with clients and tax authorities.

Legal Protection and Avoiding Penalties

Failure to adhere to tax regulations can lead to penalties, fines, or even audits. By using a properly structured payment request document, you reduce the risk of making errors that could lead to non-compliance. Clear documentation that meets the required standards helps protect your business from legal issues, ensuring you remain in good standing with tax authorities.

Efficiency in Managing Financial Records

Having a standard approach for creating your documents ensures that you don’t miss essential details, such as tax rates or business information, which could result in delays or confusion. A well-structured document saves time during the billing process and ensures that clients can easily process their payments. Moreover, keeping organized records simplifies the preparation of tax reports and audits, making your financial management more efficient and less stressful.

In summary, adopting the right format not only helps you meet legal obligations but also makes your business more efficient and organized in managing financial transactions.

Key Features of a CRA Invoice

When creating official billing documents, it is important to include certain elements that ensure both legal compliance and clarity. These documents must follow specific guidelines set by tax authorities to ensure accuracy and to avoid issues during audits or tax reporting. Below are the essential features that should be included in any billing document to meet regulatory requirements.

- Business Information: The full name, address, and contact details of the business issuing the document, including any registration number if applicable.

- Client Details: The recipient’s name, address, and contact information to clearly identify the party being billed.

- Unique Identifier: A distinct number or code for each document, making it easy to track and reference in the future.

- Issue Date: The date when the document is generated, ensuring there is a clear record of when the transaction occurred.

- Description of Goods or Services: A detailed list of the items or services provided, along with the quantity, rate, and unit of measure, if applicable.

- Tax Information: Clear indication of applicable taxes (e.g., GST or HST), showing the rate applied and the total tax amount.

- Total Amount Due: The final amount that needs to be paid, including the breakdown of costs, taxes, and any discounts or fees applied.

- Payment Terms: A section outlining payment instructions, including due dates, accepted payment methods, and any penalties for late payment.

Including these key elements not only ensures that your business meets legal standards but also provides clients with a clear, professional document that simplifies the payment process and ensures transparency.

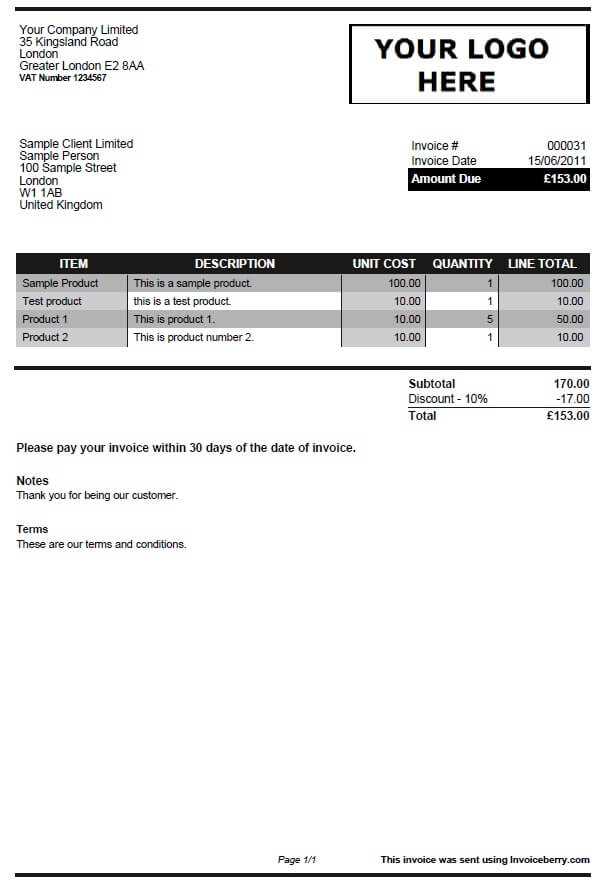

How to Customize a CRA Invoice

Personalizing your official billing documents ensures that they not only meet legal standards but also reflect your brand and business style. Customization can help you create a document that is both professional and easy to understand for your clients. Below are the key steps to take when tailoring these documents to fit your specific needs.

- Choose a Layout: Select a clean, organized layout that suits your business. This could include adjusting the positioning of business information, client details, or payment terms to ensure clarity.

- Branding Elements: Incorporate your company’s logo, colors, and fonts to make the document reflect your brand identity. This adds professionalism and helps clients recognize your documents easily.

- Add Custom Fields: Depending on your industry, you might need additional fields such as project names, order numbers, or specific service details. Ensure that all necessary details are included in a clear and readable format.

- Adjust Payment Terms: Include specific payment instructions or conditions that are relevant to your business, such as early payment discounts or late fees. Customizing this section can ensure smooth transactions.

- Tax Information Customization: Modify tax details based on the services or products offered. Ensure that the tax breakdown aligns with the applicable local rates, such as GST or HST, and include a detailed summary.

By tailoring these elements, you ensure that your documents meet regulatory standards while also aligning with your business practices and making them user-friendly for clients. Customizing these documents can save time, reduce confusion, and ultimately enhance the professionalism of your business.

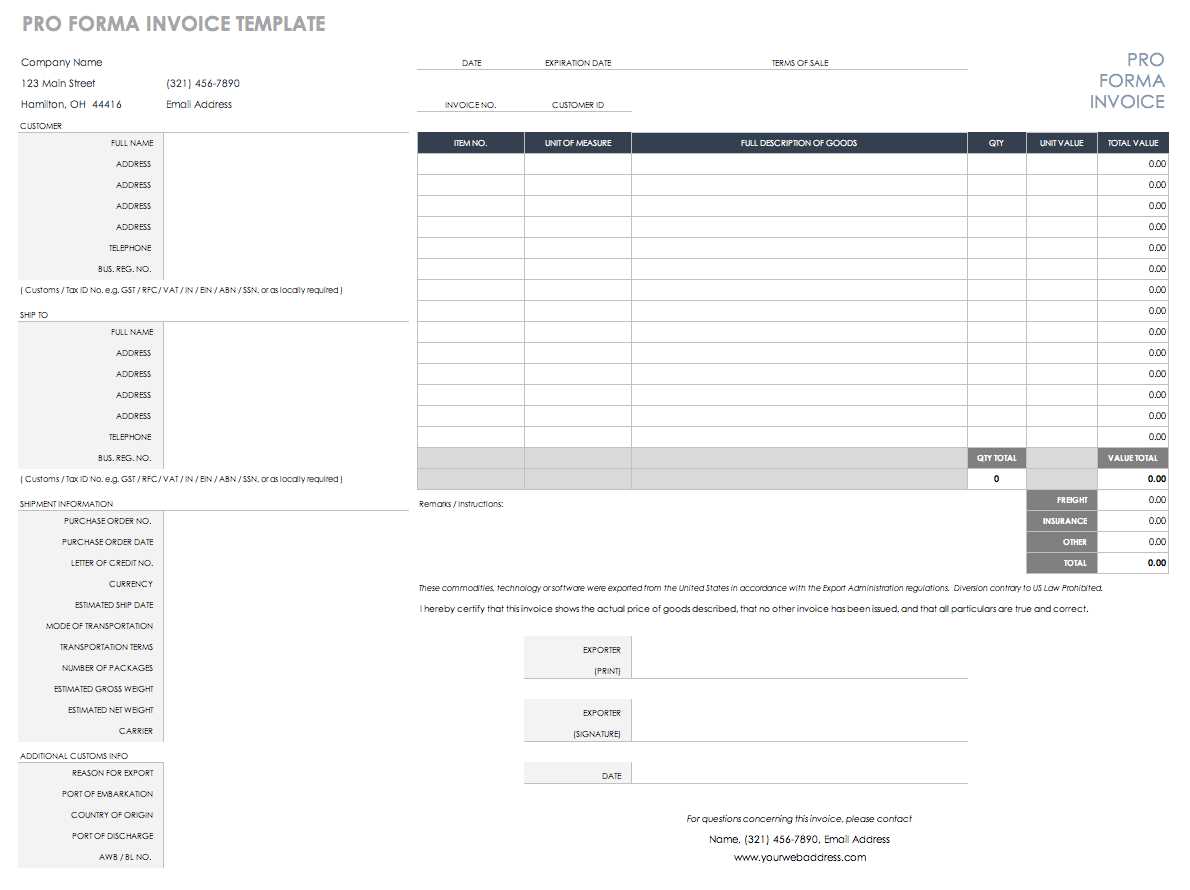

CRA Requirements for Canadian Invoices

In Canada, businesses must follow specific guidelines when creating documentation for goods and services provided to clients. These regulations ensure that businesses maintain proper records for tax purposes and facilitate accurate reporting to the government. Understanding the necessary elements and formats for these records is crucial for both legal compliance and business efficiency.

Essential Elements to Include

When preparing documents for transactions, there are several key pieces of information that must be clearly stated. These details help in the proper calculation of tax obligations and ensure transparency between the service provider and client. Below is a list of required information:

| Required Information | Description |

|---|---|

| Business Name and Address | Clear identification of the entity issuing the document, including the official business address. |

| Date of Transaction | The specific date when the goods or services were provided to the client. |

| Client Information | Full name and address of the customer receiving the product or service. |

| Transaction Amount | Total value of the goods or services provided, excluding applicable taxes. |

| Tax Breakdown | Clear indication of any taxes applied to the total amount, including applicable rates. |

| Unique Reference Number | A unique number assigned to each document to help with tracking and future reference. |

Additional Compliance Considerations

In addition to the basic requirements, there are certain standards regarding the format and presentation of these records. For example, it is essential to use clear and accurate language, and any tax calculations should be easy to follow. Furthermore, businesses may need to issue specific records for different types of transactions or industries. Ensuring these practices are followed can reduce the risk of errors and simplify reporting obligations.

Common Mistakes to Avoid in Invoices

Even small errors in transaction records can lead to significant problems, including delays in payments or complications with tax reporting. By paying attention to detail and understanding the most frequent mistakes, businesses can ensure smooth transactions and avoid unnecessary confusion with clients or tax authorities.

Typical Errors to Watch Out For

There are several common issues that can occur when preparing records for transactions. Recognizing these mistakes early can help prevent them from becoming bigger problems down the line. Below are some of the most frequent oversights:

- Incorrect or Missing Business Information: Failing to include the complete name, address, and contact details of the business can lead to issues with legitimacy and customer confusion.

- Omitting the Date of Transaction: Without a specific date, it’s difficult to track when services were rendered or products were delivered, which can complicate accounting and tax reporting.

- Ambiguous Payment Terms: Vague or unclear payment deadlines can result in delays, misunderstandings, or disputes regarding when payments are due.

- Errors in Pricing or Calculations: Mistakes in adding up totals, applying discounts, or calculating taxes can result in incorrect amounts owed, leading to mistrust with clients.

- Not Including Unique Identifiers: Missing reference numbers make it harder to track transactions, causing confusion and difficulties in case of audits or disputes.

How to Avoid These Pitfalls

To ensure accuracy and professionalism, take the following steps:

- Double-Check All Details: Before finalizing the document, verify that all information is correct, including business name, client details, and amounts.

- Clearly Define Payment Terms: Always specify due dates and any late fees to avoid future misunderstandings.

- Review Tax Calculations: Ensure tax rates are correctly applied and clearly broken down for easy understanding by the client.

- Include Reference Numbers: Assign a unique identifier to each document to ensure easy tracking and organization.

- Maintain Consistency: Use consistent formatting, fonts, and terminology across all transaction records to make them professional and easy to follow.

How to Ensure Tax Compliance with Invoices

Maintaining accurate records of transactions is vital for businesses to fulfill their tax obligations. Properly structured documents help avoid errors in tax calculations and reporting. By understanding the necessary steps to ensure tax compliance, companies can streamline their processes and avoid legal issues.

One of the main aspects of tax compliance is ensuring that taxes are correctly applied, documented, and reported. Here’s a closer look at how to make sure the necessary tax details are included in your records:

| Tax Compliance Element | Description |

|---|---|

| Tax Registration Number | Include the business’s tax registration number, which proves the company is authorized to collect taxes. |

| Tax Rates Applied | Clearly state the tax rates applicable to each item or service, whether it’s the standard rate, reduced rate, or exempt. |

| Tax Breakdown | Provide a clear breakdown of the tax for each item or service sold, ensuring that it is easily distinguishable from the base amount. |

| Inclusive and Exclusive Pricing | Specify whether the price listed includes tax or if it is added separately. This helps in calculating the exact amount owed. |

| Correct Documentation | Ensure all transactions are documented in a way that can be easily reviewed and cross-referenced in case of audits or disputes. |

By carefully following these guidelines, businesses can help ensure that their tax filings remain accurate and in line with government regulations. This reduces the risk of penalties or errors during tax reporting and audits.

Difference Between CRA and Non-CRA Invoices

The key distinction between transaction records that meet government standards and those that do not lies in the level of detail and accuracy in the information provided. Certain documents must adhere to specific guidelines to ensure they can be used for tax reporting, while others may lack these necessary elements. Understanding these differences is essential for businesses to ensure they remain compliant with legal requirements and avoid potential penalties.

Documents that are structured to meet tax regulations include all necessary details such as tax registration numbers, proper tax rates, and clear breakdowns of the transaction amounts. These elements are crucial for businesses that need to report sales tax or other levies to the government. On the other hand, records that do not follow these standards may still serve as proof of a transaction, but they lack the required components for accurate tax reporting.

The main differences typically involve the inclusion of specific information and the format in which it is presented. A record that meets the necessary standards will be formatted in a way that makes tax calculations straightforward, while a more basic document may not provide enough clarity or detail for tax purposes.

Essential Information for CRA Invoices

To ensure that transaction records are fully aligned with government standards, businesses must include specific details that are required for tax reporting purposes. These crucial components help facilitate accurate calculations, prevent misunderstandings, and ensure smooth interactions with tax authorities. Without the proper information, businesses may face challenges when it comes to tax audits or other regulatory checks.

Key Elements to Include

When preparing these documents, it’s important to incorporate the following essential information:

- Business Details: The name, address, and contact information of the business issuing the document must be clearly visible. This establishes the identity of the seller.

- Client Information: The name and address of the customer receiving the goods or services are necessary for record-keeping and to verify the transaction.

- Transaction Date: Clearly stating the date of the transaction is vital for tracking and determining when taxes are due or how long records should be kept.

- Unique Reference Number: Each record should have a unique identifier to make it easy to track and reference in case of inquiries or audits.

- Amount Breakdown: A detailed list of each item or service provided, along with their individual prices and the total amount, helps ensure clarity.

Tax and Legal Requirements

In addition to the basic transaction details, tax calculations are a key part of ensuring compliance:

- Tax Registration Number: This number proves that the business is authorized to collect taxes on behalf of the government. It should be included on all official documents related to taxable transactions.

- Tax Rates Applied: The applicable tax rates for each product or service, including any federal or provincial taxes, must be clearly outlined. This helps avoid confusion and ensures that both the buyer and seller understand the exact amounts being paid.

- Tax Breakdown: A detailed breakdown of how taxes are calculated, showing the base amount and tax amount separately, helps ensure transparency and accuracy.

By ensuring these details are included, businesses can not only stay compliant with government regulations but also create clear and professional records that protect both the buyer and the seller in the event of an audit or review.

Understanding GST/HST on Invoices

For businesses operating in Canada, collecting and remitting Goods and Services Tax (GST) or Harmonized Sales Tax (HST) is a crucial part of the sales process. These taxes are applied to most goods and services, and it’s important for businesses to correctly include them in transaction records. Failing to do so can lead to errors in reporting and potential issues with tax authorities. Understanding how to calculate and display GST/HST is essential for maintaining proper tax compliance.

What is GST/HST?

GST is a federal tax applied to the supply of most goods and services in Canada, while HST is a combined tax that includes both federal and provincial portions, applicable in certain provinces. Depending on the province in which a business operates or a product is sold, either GST or HST will apply. Here’s a breakdown of how these taxes work:

- GST: The standard rate of GST is 5%, and it is applied in provinces and territories that do not use HST.

- HST: In provinces like Ontario, Nova Scotia, and New Brunswick, HST is applied instead of GST. The HST rate varies from 13% to 15% depending on the province.

- Exempt and Zero-Rated Goods/Services: Some products and services, such as basic groceries, medical supplies, and residential rent, are either exempt or zero-rated, meaning they are not subject to GST/HST.

How to Include GST/HST on Transaction Records

When preparing documentation for a transaction, businesses must ensure that the GST/HST is accurately calculated and displayed. Here’s how to properly include these taxes:

- Calculate the Tax: Multiply the taxable amount by the applicable GST or HST rate. For example, if an item costs $100 and the GST rate is 5%, the tax would be $5.00.

- Display the Tax Amount: Clearly show the tax applied as a separate line item on the document. This helps customers see exactly how much tax they are paying.

- Indicate the Tax Rate: Specify the tax rate used (e.g., 5% GST, 13% HST) to ensure transparency and prevent confusion.

- Provide Your Tax Registration Number: Businesses must include their GST/HST registration number to confirm that they are authorized to collect and remit tax.

By ensuring that GST/HST is properly calculated and displayed, businesses can stay compliant with tax laws and help their clients understand the full cost of the transaction.

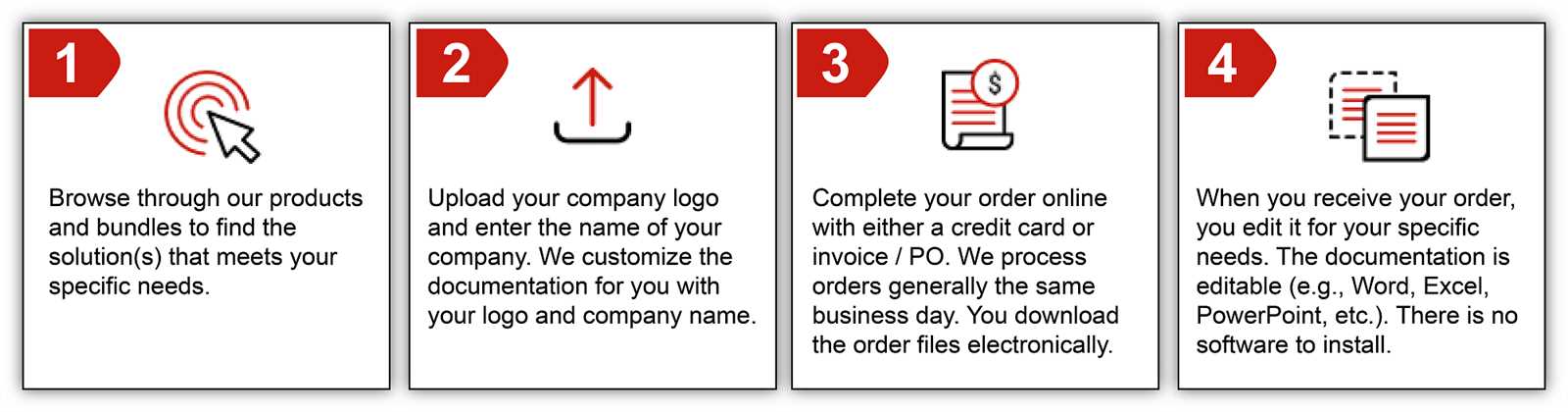

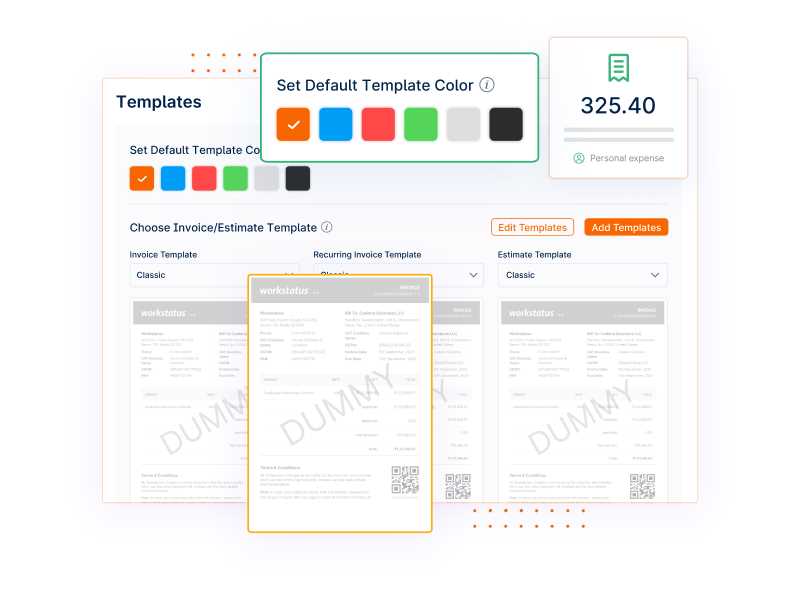

How to Create Invoices Using Templates

Creating professional records for transactions can be made easier by using structured formats designed to ensure all necessary information is included. These ready-made designs can help simplify the process, ensuring accuracy and consistency in your documentation. By using pre-designed formats, businesses can save time and reduce the risk of missing critical details required for tax reporting and client transparency.

Choosing the Right Format

There are several key factors to consider when selecting a pre-designed format for transaction records. Here are a few important elements to keep in mind:

- Customization Options: Ensure that the design allows for customization, so you can adjust it to your business needs, including adding your logo, adjusting fields, or incorporating your specific tax rates.

- Clear Structure: Choose a format that clearly separates all necessary components, such as business details, client information, itemized costs, and tax breakdowns.

- Professional Appearance: Select a design that looks professional and aligns with your brand. This reflects your business’s credibility and can enhance client trust.

Steps to Create Transaction Records Using a Pre-Designed Format

Once you have selected an appropriate format, follow these simple steps to generate accurate and professional records:

- Fill in Business and Client Information: Enter your business name, address, and contact details. Also, include your client’s full name and contact details.

- List the Products or Services: Provide a detailed list of what was sold, including item descriptions, quantities, and individual prices. This ensures transparency for the client.

- Include Tax Information: Make sure to calculate and list the applicable taxes (GST, HST, etc.) clearly. Break down the tax amount separately from the total cost.

- Add Payment Terms: Specify the due date for payment, any late fees, and the preferred payment methods to avoid future confusion.

- Generate a Unique Identifier: Assign a unique reference number to each transaction for easy tracking and future reference.

By using a structured format, businesses can ensure that all the required information is present, organized, and professional. This not only helps in maintaining clear records but also builds trust with clients, streamlining the overall transaction process.

Tracking Payments with CRA Invoices

Effective tracking of payments is essential for maintaining financial accuracy and ensuring that businesses can manage cash flow efficiently. Keeping a record of all transactions, including when payments are made and how much is owed, helps businesses stay organized and prepared for tax reporting. Proper documentation allows for quick resolution of any discrepancies and supports smooth financial management.

When preparing detailed transaction records, it’s important to include specific elements that allow businesses to track payments accurately. This includes payment due dates, amounts paid, and outstanding balances. Below is a guide to the critical components needed to monitor payments effectively:

| Payment Tracking Element | Description |

|---|---|

| Payment Due Date | Clearly specify the date by which the payment is expected. This helps both parties stay on track and avoid late fees. |

| Amount Owed | The total amount of the transaction, excluding any taxes. This figure should match the agreed-upon amount for the product or service. |

| Payments Made | List all payments received, including dates and amounts. This helps track the status of the debt and keeps the customer informed. |

| Outstanding Balance | If the full amount has not been paid, include the remaining balance. This allows for easy tracking of overdue payments and helps in reconciling accounts. |

| Transaction Reference Number | Each transaction should have a unique identifier to link all related records and payments together. This ensures easy access to the history of the transaction. |

By including these details in every transaction record, businesses can easily track incoming payments, identify overdue amounts, and ensure proper financial reporting. This is key to managing accounts receivable and maintaining good relationships with clients.

Importance of Accurate Invoice Records

Maintaining precise and detailed records of all financial transactions is critical for businesses, both for operational efficiency and compliance with tax regulations. Clear and accurate documentation helps prevent errors in accounting, ensures timely payments, and fosters trust between businesses and their clients. These records also play a significant role in simplifying audits, tax filings, and resolving disputes.

Ensuring Financial Accuracy

Accurate transaction records provide a solid foundation for financial management. They allow businesses to track revenues and expenses with precision, making it easier to assess cash flow, profitability, and overall financial health. Without accurate documentation, it becomes challenging to spot discrepancies, manage budgets, or make informed decisions about the business’s financial future.

- Preventing Mistakes: Errors in calculations or missing information can lead to financial discrepancies that can be difficult to resolve.

- Streamlining Accounting: Well-organized records save time and reduce the likelihood of mistakes, making accounting tasks more efficient.

- Improving Cash Flow Management: Timely and accurate tracking of payments ensures that cash flow is managed effectively, reducing the risk of overdue payments and late fees.

Compliance and Legal Protection

Inaccurate or incomplete records can result in serious legal and financial consequences, especially during audits or tax reviews. By maintaining proper documentation, businesses ensure they are in line with the regulations set by tax authorities and protect themselves from potential fines or penalties.

- Meeting Tax Obligations: Proper documentation helps businesses accurately report taxes, ensuring they pay the correct amount and avoid issues with tax authorities.

- Protecting Against Audits: In case of an audit, detailed and accurate records serve as proof of transactions and help resolve any disputes quickly.

- Building Credibility: Transparent and reliable records enhance the reputation of a business, fostering trust with clients, vendors, and partners.

In conclusion, maintaining accurate records of all transactions is not only essential for smooth business operations but also for protecting the business from legal and financial risks. By ensuring that every detail is documented correctly, businesses can operate with confidence, knowing they are in full compliance with applicable laws and regulations.

CRA Invoice Template for Small Businesses

For small businesses, ensuring proper documentation of all transactions is crucial for maintaining financial transparency and fulfilling tax obligations. Using a structured format for recording sales and services helps streamline the process, reduce errors, and make it easier to manage accounts. A well-organized design not only aids in tax reporting but also improves professional relationships with clients, ensuring clarity and trust in every transaction.

For small businesses, a standard format that includes all necessary details is essential for staying organized. These formats should cover basic transaction information, tax calculations, and payment terms, all of which play a role in ensuring compliance with the applicable rules. Having a clearly defined structure allows businesses to issue records quickly while avoiding mistakes that could lead to delays or financial issues.

Key Components for Small Business Transaction Records

When creating transaction records, small businesses should ensure the inclusion of the following essential elements to stay in line with tax requirements:

- Business Information: Include your business name, address, and contact details to ensure the recipient can easily identify the source of the transaction.

- Client Details: The client’s name and address should be recorded clearly, providing a reference for both parties.

- Transaction Date: This is necessary for tracking when the service or product was delivered, as well as for accurate tax reporting.

- Detailed Itemization: Each product or service sold should be listed separately with descriptions, quantities, and individual prices, making the total amount clear.

- Tax Information: The applicable tax rate (such as GST or HST) should be clearly stated, with a breakdown showing the tax amount and total after tax.

- Unique Reference Number: Assign a unique identifier to each record for easy tracking and future reference.

- Payment Terms: Specify the due date for payment, any late fees, and accepted payment methods to avoid misunderstandings.

Benefits of Using a Standard Format

Adopting a consistent structure for all transactions offers several advantages for small businesses:

- Time Savings: Having a standardized format allows for quick generation of transaction records without having to create a new document each time.

- Enhanced Accuracy: A template reduces the risk of forgetting important details, ensuring that all required information is included every time.

- Professional Appearance: A consistent format helps maintain a professional image, making it easier to build trust with clients and vendors.

- Better Financial Management: A well-organized sys

Digital Tools for Generating CRA Invoices

In today’s digital age, businesses have access to a wide range of tools designed to simplify the process of creating transaction records. These tools can automate many aspects of document creation, from calculations to formatting, ensuring that all necessary details are included accurately and efficiently. By using the right digital resources, businesses can save time, reduce errors, and enhance overall productivity while ensuring they meet the necessary tax and legal requirements.

Whether you’re a small business owner or part of a larger enterprise, using digital platforms to generate structured transaction records can help streamline your operations. Many of these tools come with built-in features for calculating taxes, tracking payments, and customizing document layouts, making them a valuable asset for managing business finances and keeping clients satisfied.

Popular Digital Tools for Creating Transaction Records

There are several widely used platforms available for businesses to generate well-organized transaction records, each with different features suited to various business needs. Here are a few options:

- Accounting Software: Platforms like QuickBooks, Xero, and FreshBooks allow businesses to create and manage financial records with ease. They offer templates, automated tax calculations, and the ability to track payments.

- Online Document Generators: Tools like Zoho Invoice and Invoice Ninja provide easy-to-use templates where businesses can input data and instantly generate structured documents. These platforms often include customizable designs and allow you to store past transactions for future reference.

- Spreadsheet Software: Excel or Google Sheets can also be used to create custom transaction documents. By using pre-made formulas or custom templates, businesses can create professional records while maintaining flexibility and control over the format.

- Cloud-Based Platforms: Google Docs and Microsoft Office 365 provide templates and collaborative features that allow teams to generate and manage documents efficiently. With cloud storage, it’s easy to access, update, and share transaction records securely.

Benefits of Using Digital Tools

Utilizing digital tools offers numerous advantages over manual record-keeping:

- Efficiency: Automated calculations and formatting reduce the time spent on creating each document, allowing businesses to focus on other important tasks.

- Accuracy: Digital tools minimize human errors by automating tax calculations and ensuring that all required fields are filled out correctly.

- Customization: Many platforms allow businesses to customize the layout, logo, and design of documents, which helps maintain a consistent brand image.

- Record Management: Digital tools often provide cloud storage options, making it easier to track and access historical records when needed.

By leveraging these digital tools, businesses can not only simplify their record-keeping processes but also enhance their overall operational efficiency, ensuring they remain compliant and professional

How CRA Invoices Benefit Your Business

Properly structured transaction records offer businesses numerous advantages, from enhancing professional credibility to ensuring financial accuracy. By creating well-documented records, businesses can streamline their operations, improve client relationships, and simplify their accounting processes. A well-organized approach to financial documentation not only helps meet legal obligations but also fosters trust and transparency with customers, contributing to long-term success.

Improved Financial Management

Accurate and well-organized transaction records help businesses maintain a clear overview of their financial situation. By tracking sales, payments, taxes, and outstanding balances, businesses can ensure they are staying on top of their finances and avoiding costly mistakes. The benefits include:

- Cash Flow Management: With proper documentation, businesses can track incoming payments and outstanding balances more effectively, ensuring steady cash flow.

- Expense Tracking: Well-documented transactions allow businesses to easily monitor expenses, helping to identify areas where costs can be reduced or optimized.

- Accurate Financial Reports: Consistent and clear records make it easier to generate accurate financial reports for budgeting, forecasting, and year-end summaries.

Legal Compliance and Protection

Having structured and detailed transaction records is crucial for meeting legal and tax obligations. By maintaining proper documentation, businesses ensure they comply with tax regulations, reduce the risk of audits, and avoid penalties. Key benefits include:

- Tax Reporting: Accurate records allow businesses to report taxes correctly, avoiding errors that could lead to fines or issues with tax authorities.

- Audit Protection: In case of an audit, businesses with organized records can quickly provide the necessary documentation, reducing stress and potential legal issues.

- Transparency and Trust: Transparent records help build trust with clients, suppliers, and partners by clearly showing transaction details and demonstrating professionalism.

In summary, having structured and precise financial records benefits businesses by enhancing financial management, ensuring legal compliance, and fostering trust with stakeholders. By adopting a system that includes all essential details, businesses can work more efficiently, reduce risks, and build stronger relationships with clients and partners.