Best Invoice Template Wording for Professional and Clear Invoices

When it comes to managing business transactions, the language used in payment documents plays a crucial role. Clear, concise, and well-structured communication ensures both parties understand the terms and conditions of the deal, preventing misunderstandings. The right choice of phrases can make a significant difference in the overall professionalism and efficiency of your business operations.

For any company, the format of financial documents should go beyond just numbers and dates. It’s important to include specific details that reflect the professionalism of your brand, while also making it easy for clients to process the information. Properly expressing payment terms, itemized lists, and other relevant data will help maintain a smooth and trustworthy relationship with your customers.

In this guide, we’ll explore how to craft effective statements, focusing on essential elements like payment terms, service descriptions, and important legal clauses. By paying attention to these details, you ensure that your documents are not only functional but also create a positive impact on your clients.

Understanding Billing Document Language

Creating clear and professional payment documents requires careful consideration of the language used. Whether you are issuing a request for payment or confirming completed work, the choice of words can directly influence how clients perceive your business and their experience with your services. The goal is to convey essential details in a simple yet comprehensive manner, ensuring both clarity and accuracy.

Key Elements to Focus On

Several key components need to be addressed when drafting a payment request. This includes itemizing the services provided, specifying payment terms, and offering clear instructions for clients to follow. Each section must be straightforward and easy to understand, allowing recipients to process the information with little effort. Avoiding complex jargon and overly technical terms will help you create a document that clients can read quickly and act on without confusion.

Balancing Professionalism and Simplicity

Maintaining a balance between professionalism and simplicity is critical. While it’s important to present your business in a professional light, overly formal language may confuse or alienate clients. Instead, focus on concise phrases and a friendly tone that still conveys authority and trustworthiness. This approach helps to establish a positive client relationship while ensuring all necessary details are communicated effectively.

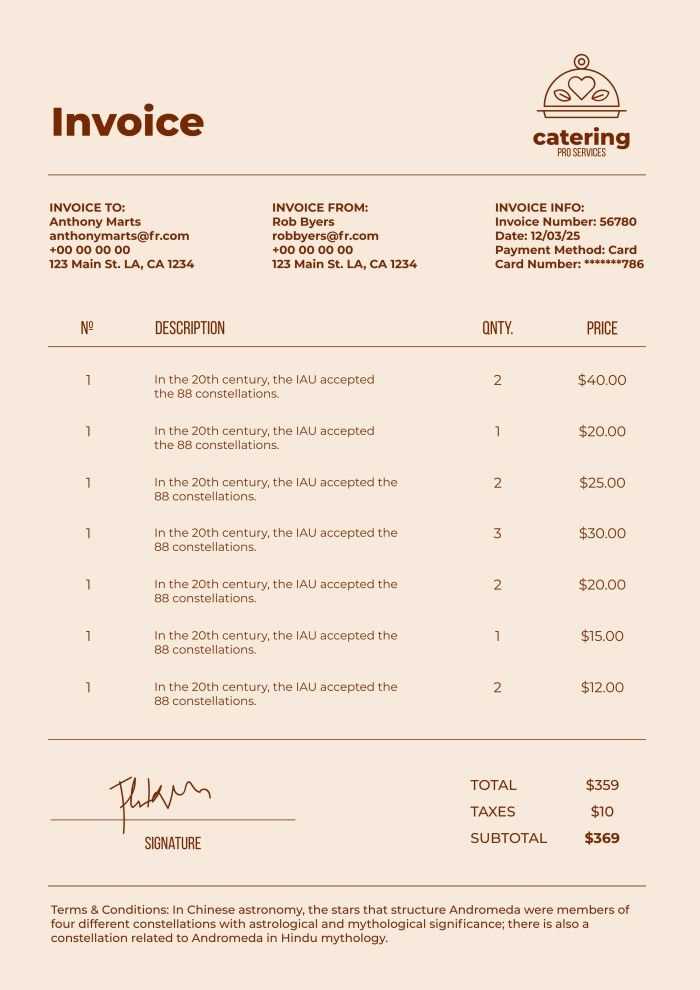

Key Elements of a Billing Document

When drafting a document for payment purposes, it is essential to include specific components that ensure both clarity and efficiency. Each element of the document serves a unique purpose, making it easy for the recipient to understand the transaction details and process payment accordingly. Proper structure and content are key to maintaining professionalism and avoiding any confusion.

The most important elements to include are:

- Contact Information: Both the sender’s and the recipient’s names, addresses, and contact details should be clearly presented at the top.

- Unique Identifier: A distinct reference number or code for easy tracking and organization of records.

- Date of Issuance: The date the document was created, which helps track payment timelines.

- Payment Terms: Clear instructions on when and how payment is expected, including any late fees or discounts for early settlement.

- Detailed Itemization: A clear breakdown of services or goods provided, along with their respective costs, quantities, and descriptions.

- Total Amount Due: The sum of all items and fees, including taxes and discounts, if applicable.

- Payment Instructions: Information on how to make the payment, such as bank details, payment methods, or online payment links.

- Legal or Tax Information: Any relevant tax IDs or legal disclaimers that are required for your region or industry.

By ensuring these elements are present and clearly defined, you create a document that is both professional and easy to navigate, facilitating a smooth transaction process.

Why Billing Document Language Matters

The language used in financial documents plays a vital role in maintaining clear communication between businesses and their clients. How information is presented can influence client satisfaction, payment speed, and the overall professionalism of your company. Clear and precise language ensures that there are no misunderstandings, which can help prevent payment delays and disputes.

Using the right terms and structure not only promotes transparency but also builds trust between the parties involved. When the content is easy to understand, clients are more likely to take prompt action, and you are less likely to encounter questions or issues regarding payment terms.

Here are a few reasons why choosing the right language is crucial:

- Reduces Misunderstandings: Clear, unambiguous language makes it easier for clients to understand the details of the transaction, minimizing the risk of confusion or disputes.

- Speeds Up Payments: Well-structured documents with simple and straightforward terms encourage clients to process payments faster, as they don’t need to seek clarification.

- Builds Professionalism: The right language reflects well on your business, portraying it as reliable and professional. A polished tone builds trust with clients.

- Ensures Compliance: Proper wording ensures that all legal or tax requirements are clearly communicated, helping your business stay compliant with regulations.

- Improves Client Relationships: Consistently using easy-to-understand, professional language strengthens your relationship with clients, contributing to long-term business success.

By carefully considering the language you use, you can make your financial documents more effective and efficient, while also improving your overall business reputation.

Best Practices for Clear Billing Statements

Creating clear and effective billing documents is essential for smooth business transactions. When clients receive documents that are well-organized and easy to understand, it reduces the likelihood of confusion or delays in payment. Following best practices for drafting financial documents ensures accuracy and professionalism, improving client relationships and encouraging timely payments.

Key Practices for Clarity

- Use Simple and Direct Language: Avoid jargon and overly complex terms. Use straightforward language to describe services, fees, and payment terms.

- Maintain a Clean Layout: Organize the document in a logical way, with clear headings, bullet points, and sections that guide the reader through the necessary information.

- Be Specific with Dates: Clearly state the issue date, payment due date, and any relevant deadlines. This helps clients keep track of timelines.

- Itemize Charges: Break down each service or product with a description, quantity, rate, and total. This provides transparency and helps clients understand exactly what they are paying for.

- Include Contact Information: Provide easy-to-find contact details in case clients have questions or need clarification.

Formatting for Ease of Use

- Use Consistent Font and Size: Choose readable fonts and maintain consistent size throughout the document for easy scanning.

- Highlight Important Information: Use bold or italics for key details such as the total amount due, payment instructions, and due dates to ensure they stand out.

- Provide Clear Payment Instructions: Offer multiple payment options, and clearly explain the steps for completing the transaction.

- Check for Accuracy: Ensure all details, such as calculations and client information, are correct before sending the document.

By following these best practices, you will create billing documents that not only look professional but are also easy to read and understand, which can help streamline the payment process and enhance client satisfaction.

Essential Phrases for Billing Document Clarity

Clear communication in financial documents is essential for a smooth transaction process. By using the right phrases, you can ensure that all important information is easily understood by your clients, minimizing confusion and encouraging prompt payment. Certain key expressions help to communicate terms, expectations, and details effectively, making the document both professional and user-friendly.

Key Phrases for Describing Services and Charges

- “Description of Services Provided” – Use this phrase to clearly outline what has been delivered, whether it’s a product, a service, or a combination of both.

- “Quantity” – Specify the number of units or hours, providing clarity on how charges are calculated.

- “Unit Price” – Indicate the cost per individual item or service, making it clear how the total amount is determined.

- “Total Amount Due” – This phrase highlights the final amount that needs to be paid, helping clients quickly identify the sum required.

- “Tax Applicable” – Clearly state any taxes or fees that apply to the transaction, along with the respective rates.

Key Phrases for Payment Terms and Conditions

- “Payment Due By” – Clearly mention the payment deadline to avoid any confusion about when funds should be received.

- “Late Payment Penalties” – If applicable, use this phrase to specify any additional charges for overdue payments, ensuring transparency.

- “Early Payment Discount” – Mention any discounts available for early settlement, offering clients an incentive for prompt payment.

- “Payment Methods Accepted” – List the methods through which payment can be made, such as credit cards, bank transfers, or online platforms.

- “Bank Account Details” – If bank transfer is an option, provide the necessary banking information clearly and accurately.

By using these simple, yet effective phrases, you can ensure your financial documents are easy to read, reducing misunderstandings and making the payment process smoother for both parties.

How to Write Professional Billing Document Details

Writing clear and professional details in a payment request is essential for maintaining a trustworthy and efficient relationship with clients. The information you include must be precise and well-organized to avoid confusion and ensure that clients understand exactly what they are being charged for. By structuring the content logically and using the right language, you can enhance the clarity of the document and ensure prompt payments.

Key Components of a Professional Billing Statement

- Accurate Client Information: Include the client’s full name, address, and contact details at the top. This ensures the document reaches the right person and facilitates communication if needed.

- Clear Service Descriptions: Provide a detailed but concise description of each product or service delivered. This helps clients understand exactly what they are paying for.

- Itemized Breakdown: Clearly separate individual items or services with their respective costs. This provides transparency and helps prevent any disputes over charges.

- Precise Dates: Always mention the date of issue and the due date to avoid any confusion regarding payment deadlines.

- Payment Terms: State the payment terms clearly, including the due date, accepted payment methods, and any discounts or late fees. This ensures that the client knows how and when to pay.

Formatting Tips for Clarity

- Use Clear Headings: Divide your document into logical sections with headings like “Services Provided,” “Total Amount Due,” and “Payment Terms” for easier navigation.

- Simple Language: Avoid jargon and complicated legal terms. Use simple, direct language that is easy to understand.

- Accurate Calculations: Double-check all calculations to ensure that amounts are correct. A small error can undermine your professionalism.

- Highlight Key Information: Use bold text for important details, such as the total amount due or the payment due date, to make them stand out.

- Keep It Organized: Ensure your document is well-spaced and easy to read. A clean, uncluttered design makes a big difference in professionalism.

By following these steps and paying attention to the details, you can create professional billing documents that reflect your business’s reliability and encourage prompt payments.

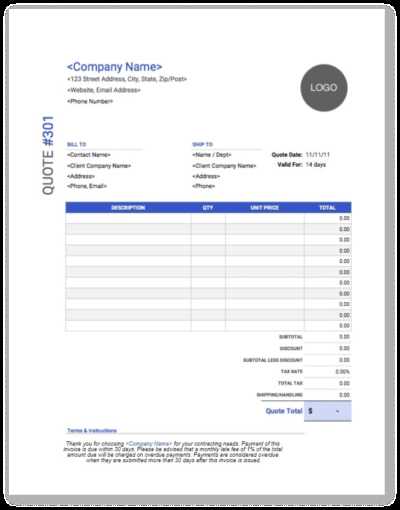

Creating Customizable Billing Documents

When managing financial transactions, having the ability to adjust and personalize your billing statements is key to meeting the unique needs of your business and clients. Customizable payment documents allow you to add or remove sections, adjust terms, and tailor the language according to the specifics of each transaction. This flexibility not only saves time but also ensures that the documents you send are relevant and appropriate for each situation.

By creating a flexible structure, you can easily modify the details based on the type of service provided, the client’s preferences, or any special terms you may have agreed upon. Customization ensures that the document reflects the nature of the deal, making it easier for clients to understand and act upon.

Key Features of Customizable Billing Statements

- Editable Sections: Design your document with clearly defined areas for item descriptions, payment terms, and other essential details that can be updated for each transaction.

- Flexible Payment Terms: Ensure that the payment instructions, deadlines, and methods are adjustable depending on the client or project type.

- Client-Specific Information: Include custom fields where you can add client names, addresses, or contact information. This ensures that each document is properly tailored.

- Variable Service Descriptions: Create placeholders for service or product details that can be modified to suit different offerings. This allows for easy updates while maintaining consistency in format.

- Legal and Tax Information: Customize the inclusion of terms, tax rates, or legal disclaimers based on the client’s location or industry requirements.

Benefits of Customization

- Efficiency: Pre-designed documents with customizable fields save you time when preparing new statements, allowing for faster turnaround.

- Professionalism: Tailored documents convey a more personalized approach, enhancing your business image and reinforcing trust with clients.

- Flexibility: Adapting the language and structure to each situation allows you to better meet clients’ specific needs, whether you’re offering discounts, applying unique terms, or adjusting pricing.

- Consistency: Customizable formats ensure that despite changes to the content, the overall look and feel of your documents remain consistent, promoting a uniform business presence.

By investing time in creating customizable billing documents, you can ensure that each transaction is communicated clearly and professionally, with minimal effort required on your part to make adjustments as needed.

Essential Terms Every Business Should Use

Clear and consistent terminology in financial documents is vital for establishing transparency and ensuring that all parties involved understand the terms of the transaction. Using specific and standardized terms helps avoid misunderstandings and sets clear expectations for both the business and its clients. There are several key phrases that should be included in every payment request, as they help streamline communication and foster a professional atmosphere.

Key Payment Terms to Include

- “Due Date” – Clearly state when the payment is expected. This is crucial to avoid delays and ensure that clients know when they need to make the payment.

- “Payment Terms” – Outline the agreed-upon conditions for payment, such as whether the payment is due immediately, within 30 days, or on a specific date.

- “Late Fees” – If applicable, specify the penalties for late payments, including the interest rate or fixed charge that will be added after the due date has passed.

- “Early Payment Discount” – Offer incentives for clients who pay ahead of schedule. Clearly state the percentage or amount of discount available for early settlement.

- “Amount Due” – This should be prominently stated to ensure the recipient knows the total sum they are expected to pay, including taxes, discounts, or additional charges.

Additional Important Clauses

- “Payment Methods Accepted” – Specify the types of payments you accept, such as bank transfers, checks, credit card payments, or online platforms.

- “Service Description” – Provide clear details about the goods or services rendered. This helps avoid confusion and justifies the amount due.

- “Tax Information” – Include any relevant tax rates or details, especially if the transaction involves sales tax, VAT, or other applicable charges.

- “Refund Policy” – If applicable, outline the terms under which refunds or adjustments can be requested, making it clear how such situations will be handled.

- “Dispute Resolution” – If disputes arise, specify how they will be resolved, whether through negotiation, arbitration, or other methods.

Incorporating these essential terms ensures that your financial documents are both professional and clear, setting the foundation for a smooth transaction process and reducing the potential for disagreements.

How to Format Billing Descriptions

Clear and well-structured descriptions are essential for any payment request. Properly formatting these descriptions ensures that clients can easily understand the services or products provided, helping to avoid confusion and facilitating smooth transactions. Whether you’re outlining services, products, or a combination of both, the way you present the details is just as important as the content itself.

Key Guidelines for Effective Descriptions

- Be Specific: Avoid vague terms. Clearly state what was provided, including quantities, service duration, and any relevant details that help the client understand what they are being charged for.

- Use Simple Language: Opt for clear and straightforward language. Complex terminology or industry jargon may confuse clients, leading to delays or questions about the charges.

- Include Relevant Dates: If applicable, specify the date(s) the service was provided or the product was delivered. This helps clients track the timeline and confirm the validity of the charges.

- Itemize Each Service: Break down services or products into separate line items with clear descriptions and amounts. This provides transparency and allows clients to see exactly what they are paying for.

- Clarify Pricing: State the unit price, quantity, and total for each item or service. This gives clients an immediate understanding of how the total amount is calculated.

Best Practices for Layout and Structure

- Use Bullet Points or Tables: Organize descriptions in an easy-to-read format. Tables or bulleted lists can help present information in a way that is both structured and visually clear.

- Highlight Key Information: Make important details, such as discounts, tax amounts, or special terms, stand out by using bold text or italics.

- Maintain Consistent Formatting: Use a consistent format for all descriptions across different billing statements. This ensures uniformity and a professional appearance.

- Double-Check Accuracy: Verify that each description is accurate and reflects the correct amount for the services or products provided. Mistakes in the descriptions can cause confusion and delay payments.

By following these best practices for formatting billing descriptions, you can ensure that your documents are both professional and easily understandable, helping clients process payments quickly and efficiently.

Common Mistakes in Billing Document Language

When preparing financial documents, even small mistakes in phrasing can lead to confusion, disputes, or delayed payments. Inaccurate or unclear language may cause misunderstandings about payment terms, amounts, or services rendered. Identifying and avoiding these common errors ensures that your documents are professional and that your clients have all the information they need to complete transactions smoothly.

Frequent Mistakes in Descriptions

- Vague Service Descriptions: Using general terms like “services rendered” or “products provided” without further details can leave room for confusion. Always specify what exactly was delivered, including quantities and dates where applicable.

- Ambiguous Payment Terms: If the payment due date, method, or terms are unclear, clients may delay payment or misunderstand the expectations. Be precise about when and how the payment should be made.

- Missing or Incorrect Calculations: Mistakes in pricing, such as omitting taxes or applying incorrect rates, can result in disputes. Double-check all calculations, including any discounts or additional charges, before sending the document.

- Inconsistent Formatting: Inconsistent font sizes, spacing, or alignment can make a document look unprofessional and harder to read. A consistent format enhances the document’s readability and creates a more professional appearance.

- Lack of Contact Information: Failing to include clear contact details can create unnecessary barriers for clients who may have questions or need clarification. Always provide an email address, phone number, and any other relevant contact information.

Errors in Legal and Tax Information

- Incorrect Tax Rates: Using the wrong tax percentage or failing to include applicable taxes can cause problems for both you and the client. Make sure to apply the correct rates and clearly mention the tax amount.

- Omitting Legal Terms: If there are specific legal conditions related to your service or payment terms, leaving them out can lead to future complications. Always include any relevant terms, such as refund policies or dispute resolution clauses.

- Failure to Include Early Payment Discounts or Late Fees: Not mentioning discounts for early payment or penalties for late payment can create misunderstandings. Clearly state any incentives or penalties to ensure clients understand the full terms.

By avoiding these common mistakes, you can ensure that your billing documents are clear, accurate, and professional, minimizing the risk of disputes and promoting timely payments.

Simple Phrases for Payment Terms

Clear and concise payment terms are essential to avoid misunderstandings and ensure that clients know exactly when and how to pay. Using simple, straightforward language in your payment clauses helps to set clear expectations and facilitates timely transactions. Below are some commonly used phrases that can help make payment terms easier to understand for both you and your clients.

Basic Payment Terms

- “Due Upon Receipt” – This term indicates that payment is expected immediately upon receiving the document, without a specified grace period.

- “Net 30” – A commonly used term that means payment is due within 30 days of the document date.

- “Payment Due Within 15 Days” – Specify a clear, short payment period to encourage quicker settlement.

- “Payment Due by [Date]” – Include a specific date to eliminate ambiguity and provide a firm deadline.

- “Upon Completion” – Use this phrase when payment is due as soon as the service or project is completed.

Additional Payment Clauses

- “Late Fees Apply After [Date]” – This phrase clearly communicates that there will be a penalty for late payments after a specified date.

- “Early Payment Discount of [X]%” – Offer a discount for early settlement, making the terms more attractive for clients who pay before the due date.

- “Accepted Payment Methods: [List Payment Methods]” – Specify all accepted payment methods, such as bank transfer, credit card, PayPal, etc., to make the payment process smoother.

- “Please Make Payment to [Bank Details]” – Provide specific payment instructions, such as bank account details, to ensure clients know how to pay.

- “No Refunds After Payment” – Use this phrase if applicable, particularly for services or non-returnable products, to make the refund policy clear from the outset.

Incorporating these simple and clear phrases into your billing statements can eliminate confusion, set clear expectations, and help ensure that payments are made on time and in full.

Including Tax and Discount Information

Accurately including tax and discount details in payment documents is crucial for ensuring clarity and avoiding confusion. These elements not only affect the final amount due but also ensure that your clients are aware of the specific charges or reductions applied to their total. By clearly outlining tax rates and any discounts, you create transparency and establish trust with your clients.

How to Present Tax Information

- Specify the Tax Rate: Always state the exact tax percentage applied to the transaction, such as “Sales Tax: 8%” or “VAT at 20%.” This makes it clear how much tax is being charged.

- Show Tax Amounts Separately: Include a line item that clearly separates the tax amount from the total cost of goods or services. This helps clients see how the tax is calculated and prevents confusion.

- Indicate Tax Exemptions: If any items are tax-exempt, make sure to specify this in the document. You can include a line such as “Tax Exempt: [Item or Service Name]” to clarify which parts of the total do not include tax.

- State Tax Jurisdiction: If applicable, mention the region or jurisdiction that the tax applies to. For example, “Tax applicable for California residents” helps avoid confusion if you deal with clients from different areas.

How to Present Discount Information

- Clearly Mention Discount Rates: Specify the percentage or fixed amount of the discount being offered, such as “10% Discount on Total” or “Discount of $50 for early payment.” This ensures clients know exactly how much they are saving.

- Include Discount Conditions: If the discount is subject to certain conditions, such as an early payment or a specific quantity purchase, make these terms clear. For example, “5% off for payments made within 10 days” or “10% off for orders over $500.”

- Show Discount Before Tax: If the discount is applied before tax, show the amount reduced before calculating the tax. This helps clients understand the tot

Best Invoice Template Wording for Professional and Clear Invoices How to Handle Late Fees on Billing Statements

Late payment fees are a common way to encourage timely payments and ensure that businesses are compensated for any delays. Clearly outlining late fees in your payment terms is essential to avoid confusion and disputes. When applied correctly, late fees can help maintain a professional relationship with clients while protecting your business’s cash flow.

Setting Late Fee Terms

- Specify the Late Fee Amount: Clearly state the amount or percentage that will be charged as a late fee. Common structures include a fixed amount, such as “$25 for late payment,” or a percentage of the overdue balance, such as “2% per month on overdue amounts.”

- Set a Grace Period: Many businesses offer a short grace period before late fees are applied. For example, you might say “Late fee applies after 10 days past due.” This gives clients a reasonable amount of time to process the payment without penalty.

- Indicate When Fees Will Be Applied: Make sure the date or event that triggers the late fee is clearly specified. For example, “Late fees will be assessed after [specific date]” or “A fee will be added to your balance 30 days after the due date.”

- Clarify Maximum Late Fees: In some cases, it’s important to define the maximum late fee that will be applied. For example, “Late fees are capped at $100, regardless of the overdue balance.” This helps manage expectations and prevents excessive penalties.

Communicating Late Fees Professionally

- Be Transparent and Direct: Avoid hidden or unclear charges. Make sure your clients are fully aware of the terms before any fees are applied. Using clear phrases like “A late fee of [amount] will be added to your balance if payment is not received by [due date]” leaves no room for ambiguity.

- Include Late Fee Information in Your Documents: Ensure that your late fee terms are included on all relevant documents, whether it’s a payment request, a contract, or a confirmation letter. This reinforces the terms and helps clients remember their obligations.

- Follow Through Consistently: Apply late fees consistently across all clients who miss the payment deadline. This ensures fairness and upholds the integrity of your terms. If you make exceptions too often, it can undermine the effectiveness of your late fee policy.

By clearly stating late fee terms and applying them consistently, you can encourage prompt payments while maintaining positive relationships with clients. Transparent communication about penalties helps avoid misunderstandings and ensures that your business is paid on time for the services or goods provided.

Incorporating International Terms in Billing Statements

When dealing with international clients or conducting cross-border transactions, it is essential to incorporate terms that account for various currencies, payment methods, and legal regulations. Adapting your payment language to suit international business practices ensures clarity and minimizes misunderstandings, facilitating smoother transactions. Understanding these terms and correctly applying them can help you navigate the complexities of global commerce.

Essential International Terms to Include

Term Description Currency Specification Clearly specify the currency in which payments should be made, such as USD, EUR, GBP, etc. This avoids confusion and ensures clients understand the exact amount due. Payment Method List accepted payment methods, including international options such as wire transfers, PayPal, or credit card payments. Specify if there are any additional fees for particular methods. VAT/GST Details For international transactions, include applicable taxes like VAT (Value Added Tax) or GST (Goods and Services Tax) that are required by the respective countries. Mention the tax rate and whether it is included or excluded from the total amount. International Shipping Charges If applicable, specify any international shipping or handling fees that may apply, ensuring that both the buyer and seller are clear about delivery costs. Payment Terms (Net 30, Net 60, etc.) Specify the payment deadlines clearly (e.g., Net 30 or Net 60), and clarify if there are any international variations or customs that should be observed. Key Considerations for International Clients

- Language and Localization: If dealing with clients in non-English-speaking countries, consider providing translations of key terms or using a local language in the document.

- Time Zone Differences: Be aware of time zone differences when setting deadlines and payment schedules. You may want to specify the time zone to avoid any confusion about due dates.

- Customs and Import Fees: Clarify which party is responsible for any customs duties, import taxes, or fees, especially for physical goods being shipped internationally.

- Bank Details and IBAN: For international wire transfers, include your bank’s IBAN (International Bank Account Number), SWIFT/BIC code, and any other relevant details needed for cross-border payments.

By including these international terms and ensuring they are clearly communicated, you can make cross-border business transactions more efficient and reduce the risk of pay

How to Convey Professionalism in Billing Statements

Presenting a polished and professional appearance in financial documents is key to building trust with your clients and maintaining a positive reputation. When clients receive clear, well-structured statements, they are more likely to view your business as credible and reliable. Using the right tone, formatting, and content can help establish your company’s professionalism and make a strong impression on clients.

Key Elements of Professional Billing Statements

Element How It Conveys Professionalism Clear Layout and Structure A clean, organized layout ensures that clients can easily navigate the document and find the necessary information. This demonstrates attention to detail and respect for the client’s time. Consistent Branding Using your company’s logo, color scheme, and consistent fonts reinforces your brand and adds a level of consistency to all client communications, helping to create a professional image. Polite and Respectful Language Using courteous language in payment terms and communication fosters a respectful business relationship. Phrases like “Thank you for your business” and “We appreciate your prompt payment” leave a positive impression. Accurate Details Ensuring all details, such as amounts, dates, and payment terms, are precise and error-free builds trust and demonstrates a high level of professionalism in managing finances. Clear Payment Terms Clearly outlining payment terms, due dates, and methods of payment helps manage expectations and reduces confusion, contributing to smooth and efficient transactions. Best Practices for a Professional Touch

- Use a Formal Tone: Keep the language polite, formal, and clear, avoiding slang or overly casual expressions. This sets a professional tone and reinforces the seriousness of the transaction.

- Ensure Timely Delivery: Send the document promptly after the service or product has been delivered. Timeliness reflects your reliability and professionalism.

- Include Contact Information: Providing clear contact details, such as phone numbers and emails, shows transparency and makes it easy for clients to reach you with any questions or concerns.

- Proofread for Accuracy: Always proofread your documents to eliminate errors in grammar, spelling, or calculations. Mistakes can undermine the professional appearance of your documents.

- Offer Multiple Payment Methods: Provide a range of convenient payment options, including online methods, to accommodate your clients and enhance their experience.

- Use Client’s Name: Addressing the client by name makes the document feel more personal. Instead of “Dear Customer,” use “Dear [Client Name],” or “Hello [Client Name].” This small touch can go a long way in creating a positive impression.

- Show Appreciation: Acknowledge your clients’ business with phrases like “Thank you for your continued support” or “We greatly appreciate your partnership.” These expressions help show your clients that you value their business beyond just the financial transaction.

- Tailor Payment Terms: Adjust payment terms based on your relationship. For example, for loyal clients, you could say, “As a valued client, we are happy to offer you extended payment terms,” or “Thank you for your prompt payment on every occasion.” This demonstrates flexibility and attentiveness to their needs.

- Include Personalized Notes: If appropriate, add a brief personal message to the document, such as “We hope you’re enjoying the new [product/service],” or “We look forward to continuing to work together in the future.” This small gesture helps make your communication more human and less transactional.

- Maintain a Professional Tone: While personalizing the document, ensure the tone remains professional and respectful. Balance friendliness with formality to ensure the client feels valued but not patronized.

- Be Consistent: Ensure that all client communications, including billing documents, reflect your brand’s voice and style. Whether your tone is formal, friendly, or casual, consistency across all materials strengthens your brand identity.

- Use Custom Phrases: Instead of default phrases, craft language that aligns with your company’s values and relationship with the client. For instance, you could say, “We’re grateful for your trust” or “It’s been a pleasure serving you this year.”

- Keep It Relevant: Only personalize the document when it adds value. Avoid unnecessary small talk and focus on aspects that strengthen your business relationship, such as special offers or specific details about services or products provided.

Personalizing Your Billing Language

Customizing the language used in financial documents can help create a more personalized and engaging experience for your clients. By adjusting the tone and phrasing to reflect your brand and relationship with the client, you can build stronger connections and enhance customer satisfaction. Personalization doesn’t just involve using the client’s name – it’s about tailoring the entire communication to make it more meaningful and memorable.

Why Personalization Matters

Personalized communication demonstrates that you value your clients, which can foster trust and loyalty. Instead of using generic or automated phrasing, incorporating tailored language can make your documents feel more thoughtful and professional. Here are some ways to personalize your billing statements:

Best Practices for Personalizing Billing Statements

Personalizing the language in your financial documents not only enhances the client’s experience but also helps establish a deeper, more meaningful connection. By taking the time to customize each communication, you show that you