How to Create a Daycare Invoice Template for Efficient Billing

Managing finances for a childcare business can be complex, but having a streamlined billing system is essential for smooth operations. Clear and accurate payment requests help ensure you receive timely compensation for your services while keeping your records organized. By using a structured approach to invoicing, you can save time, avoid errors, and maintain a professional relationship with your clients.

Creating a well-designed document for charging parents is one of the most important steps in this process. A properly formatted bill includes all necessary details, such as the dates of service, charges, and payment terms. It also provides your clients with a clear understanding of what they owe, making it easier for both parties to stay on track.

Whether you are looking to create a custom version or download a pre-made solution, using an effective billing tool can significantly improve your business’s financial workflow. In this guide, we’ll explore the best practices for crafting an efficient and easy-to-use system for your childcare services, helping you stay organized and ensure smooth transactions with your clients.

Daycare Invoice Template Essentials

Creating a clear and efficient billing system for your childcare services is vital to maintaining smooth financial operations. A well-structured document not only ensures timely payments but also enhances communication with parents. When designing such a tool, it’s crucial to include the key components that make it easy to understand and legally sound. Below are the essential elements that should be included in every billing document for childcare services.

Key Components of a Billing Document

Each billing request should clearly outline the services provided, payment terms, and other important details. A professional document typically includes the following sections:

| Section | Description |

|---|---|

| Service Description | Clearly state the services rendered, such as hourly care, meals, and extra activities. |

| Dates of Service | Include the specific start and end dates for the billing period to avoid confusion. |

| Charges and Rates | Specify the rates per hour, day, or week, and the total charge for each service provided. |

| Payment Terms | Indicate when payment is due and the accepted methods of payment, such as cash or bank transfer. |

| Late Fees | If applicable, include any penalties for late payments to encourage timely settlement. |

| Parent Information | Ensure the parent’s contact details are correctly listed to avoid any communication issues. |

Why These Elements Matter

Including all of these sections ensures that your payment requests are professional and legally enforceable. It also provides transparency to your clients, reducing the likelihood of misunderstandings or disputes. By using a comprehensive and well-organized structure, both you and the parents can quickly reference the details of the services and payments, ensuring a smooth transaction process.

Why You Need an Invoice Template

In any service-based business, having a standardized document for payment requests is essential to ensure consistency and professionalism. This tool not only simplifies the billing process but also helps in keeping track of payments, preventing misunderstandings with clients. By using a pre-designed format, you save time and reduce errors that could otherwise affect your financial records.

Here are some key reasons why it’s crucial to have a well-organized billing system:

| Benefit | Description |

|---|---|

| Time Efficiency | A ready-made structure allows you to generate payment documents quickly without starting from scratch each time. |

| Professionalism | Using a consistent format gives a polished, professional image to your business, building trust with clients. |

| Accuracy | A clear and structured approach minimizes errors in calculations and service details, leading to fewer disputes. |

| Organization | By regularly using the same format, you can easily track past payments, due amounts, and outstanding balances. |

| Legal Protection | A proper document protects both parties in case of any financial disagreements or legal matters, ensuring clarity on payment terms. |

Incorporating a structured approach to payment requests not only ensures smooth operations but also builds a solid foundation for your business’s financial health. With an organized document, you are better prepared to manage transactions and maintain positive relationships with clients.

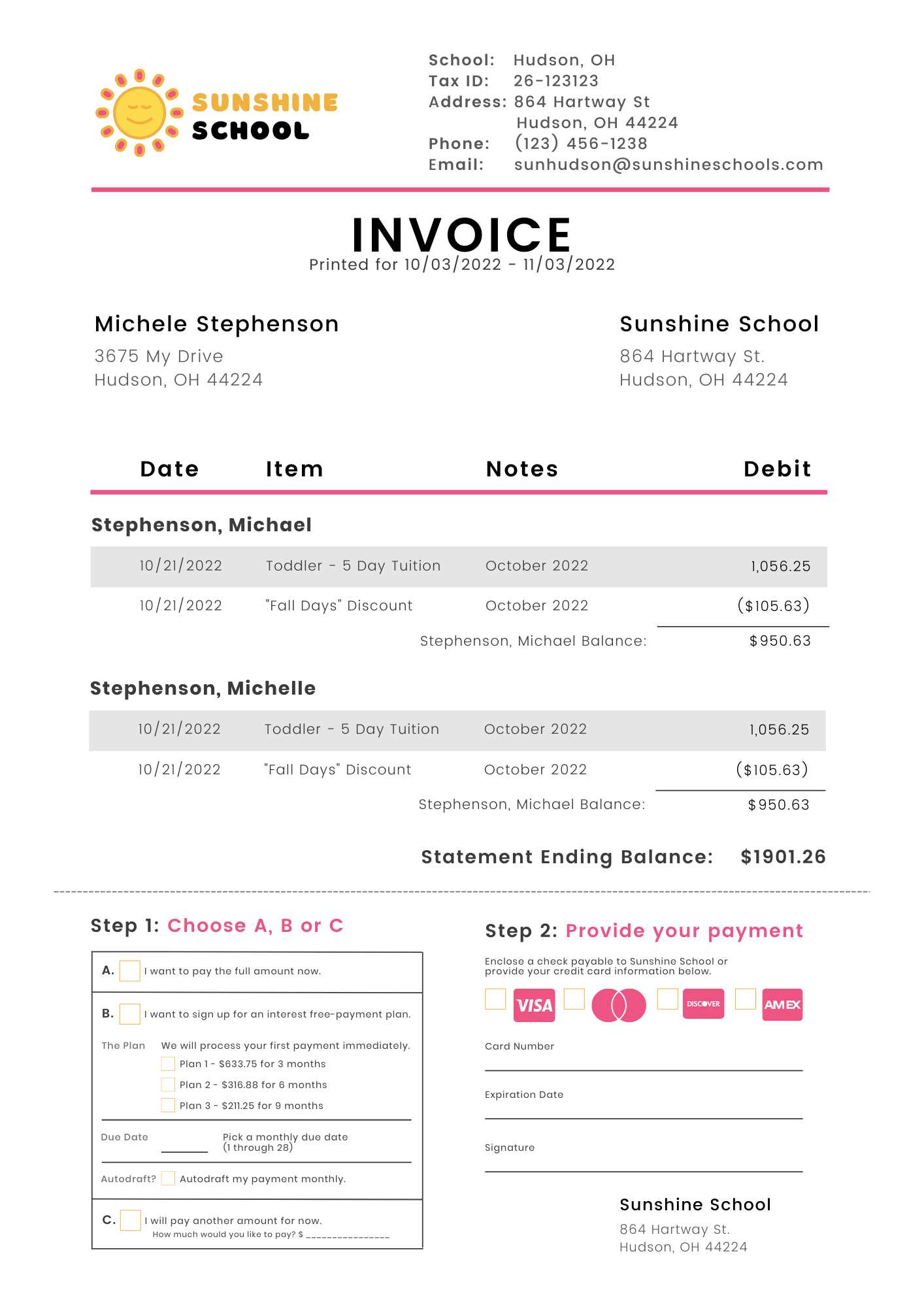

Key Elements of a Childcare Billing Document

When preparing a payment request for childcare services, it is essential to include certain key details that ensure clarity and prevent confusion. A well-organized document not only outlines the services provided but also includes all necessary information to ensure both parties understand the payment terms. Here are the core components that should be featured in every payment statement.

Important Sections to Include

- Service Details – Clearly describe the services rendered, such as hours of care, meals, transportation, or special activities.

- Service Dates – Include the exact start and end dates of the service period to avoid misunderstandings.

- Rate Information – Specify the rate charged for each service or time period (e.g., hourly, daily, weekly).

- Total Amount Due – Calculate and display the total amount payable, based on the services provided.

- Payment Terms – Include details about when the payment is due, accepted methods (e.g., bank transfer, cash), and any late fees that may apply.

- Client Information – Ensure the parent’s name, contact details, and address are clearly listed for proper communication.

Additional Information to Consider

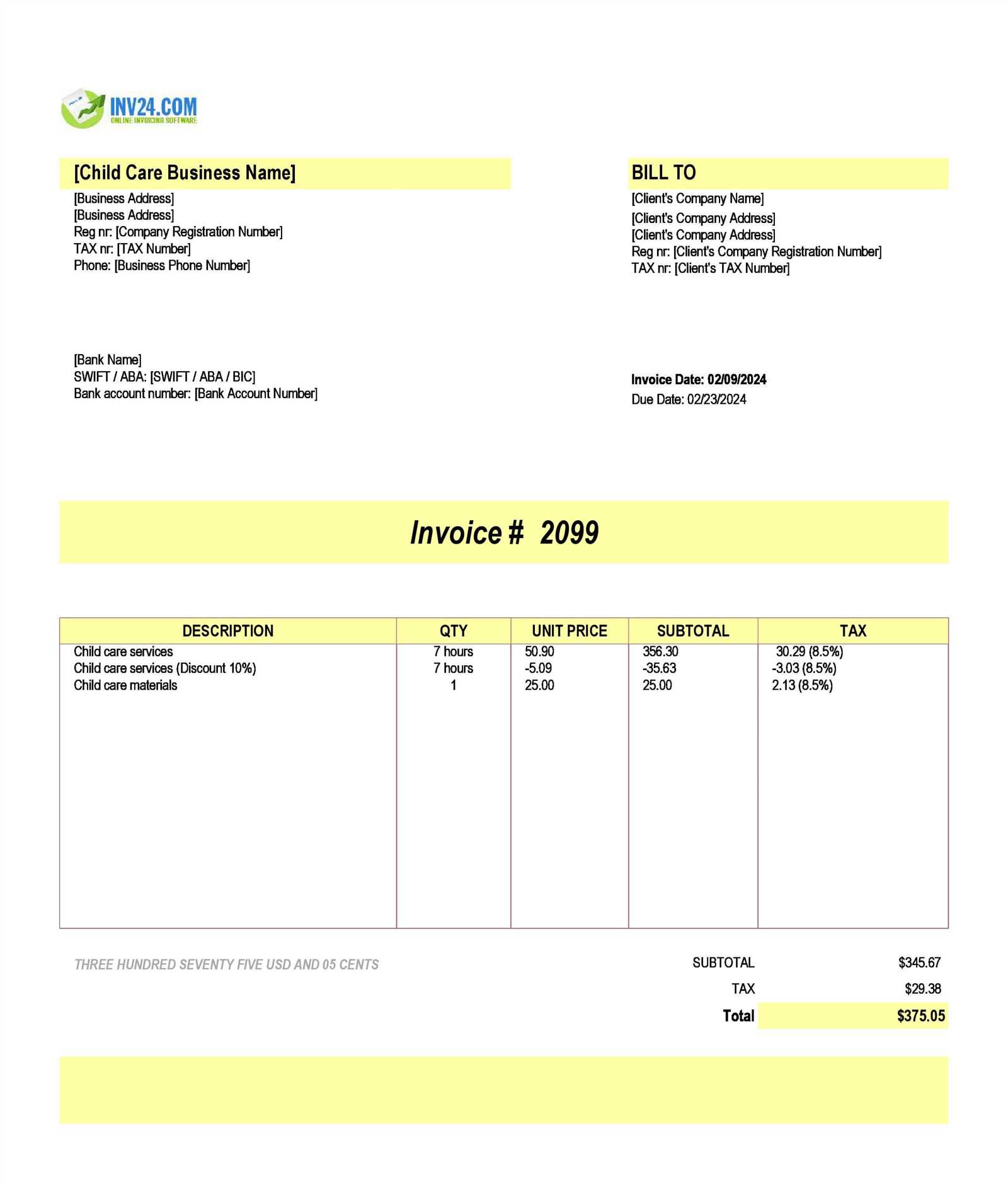

- Discounts or Adjustments – If applicable, include any discounts, credits, or adjustments for special cases.

- Payment Instructions – Provide clear instructions on how to submit payment to avoid delays.

- Notes or Terms – Any additional terms, such as refund policies or agreed-upon conditions, should be clearly stated.

Including these critical details ensures that the payment request is comprehensive and transparent, helping to build trust with clients while making it easier to manage finances. A structured and accurate approach to billing minimizes errors and misunderstandings, contributing to a smooth and professional experience for both parties.

Customizing Your Childcare Billing Design

Personalizing your billing document not only makes it stand out but also reflects the professionalism of your business. A unique design can enhance the client experience by making the payment request clearer and more visually appealing. Customizing the format ensures that all important details are easy to find, while also aligning the document with your branding. Here are some key elements to consider when creating a personalized design for your payment documents.

Design Elements to Focus On

- Logo and Branding – Include your business logo and use brand colors to create a cohesive and professional look.

- Font Selection – Choose clean, readable fonts to ensure that all information is easy to understand.

- Header Information – Design a prominent header with your business name, contact details, and any relevant legal information (such as your tax ID or business registration number).

- Clear Section Dividers – Use lines or blocks to separate sections such as service details, payment terms, and client information for easy navigation.

- Client Personalization – Include the client’s name and any specific information about their child to give the document a personal touch.

Functional Features to Incorporate

- Itemized Charges – Break down the costs for each service or item so clients can clearly see what they are being billed for.

- Payment Due Date – Make the due date stand out by using bold text or a different color to ensure clients do not miss it.

- Payment Instructions – Include easy-to-follow instructions for payment methods, such as bank transfer details or links to online payment portals.

- Late Fee Information – If applicable, highlight late payment penalties to encourage timely payments.

Customizing the design of your billing documents creates a positive impression and can improve the clarity of your financial communications. A well-designed document that is both functional and aesthetically pleasing helps reinforce the professionalism of your childcare services while ensuring clients understand the charges and payment expectations.

How to Add Payment Terms Effectively

Clearly outlining payment terms is crucial for maintaining smooth financial transactions and avoiding misunderstandings. By setting expectations upfront, both you and your clients will have a clear understanding of when and how payments should be made. Including precise payment terms in your billing document ensures that your clients know exactly what is expected and when, which helps foster trust and timely payments.

Key Elements to Include in Payment Terms

- Due Date – Clearly state the date by which payment is expected. You can use bold or highlighted text to make this stand out.

- Accepted Payment Methods – Specify the ways clients can pay, such as bank transfer, credit card, cash, or online payment platforms.

- Late Fees – Include any penalties for late payments, such as a percentage of the total amount or a fixed fee, to encourage timely settlement.

- Early Payment Discounts – If you offer a discount for early payments, outline the percentage or fixed amount off and the deadline for receiving the discount.

- Partial Payments – If applicable, explain if partial payments are allowed and any conditions or limits associated with them.

Tips for Clear Payment Terms

- Keep It Simple – Use clear, concise language to avoid confusion. Ensure that your terms are easy to read and understand.

- Highlight Important Information – Make payment deadlines and penalties prominent so they are easy to locate at a glance.

- Be Flexible but Firm – While it’s important to be accommodating when necessary, make sure the terms are enforceable and fair to protect your business.

Including well-defined payment terms helps prevent late payments, reduces disputes, and ensures that clients are aware of their financial obligations. By making payment expectations clear from the beginning, you create a more transparent and efficient billing process.

Best Practices for Childcare Billing

Effective billing is essential for any childcare provider to ensure consistent cash flow and maintain a healthy relationship with clients. Implementing best practices not only makes the billing process smoother but also reduces the likelihood of errors and disputes. By following a few key strategies, you can streamline your billing process, encourage timely payments, and maintain professionalism in all financial communications.

Establish Clear Payment Policies

- Define Payment Due Dates – Clearly communicate the deadline for payments, whether it’s weekly, bi-weekly, or monthly. Set a consistent due date so clients know when to expect a payment request.

- Offer Multiple Payment Options – Make it easy for clients to pay by offering various payment methods, such as online transfers, checks, or mobile payment apps.

- Clarify Late Fees – Specify any penalties for late payments in your documentation. This encourages clients to settle their dues on time and minimizes delays in your income.

Maintain Detailed Records

- Itemize Services Provided – Break down charges for each service, such as hourly care, meals, or transportation, to ensure transparency.

- Track Payment History – Keep a record of all payments made by each client, including the amount and date, to monitor any outstanding balances.

- Send Timely Reminders – Before the due date, send reminders to clients to ensure they are aware of upcoming payments, reducing the chances of forgotten or late payments.

Communicate Effectively with Clients

- Provide Clear and Professional Documents – Ensure that all billing documents are easy to read, include all necessary details, and reflect your business’s professionalism.

- Be Transparent About Rates and Charges – Avoid misunderstandings by being upfront about your pricing and any additional fees (e.g., late charges, special activity costs).

- Keep Open Lines of Communication – If a client is having trouble with payments, offer solutions and discuss flexible options where possible.

By implementing these best practices, you can avoid common billing issues, reduce administrative work, and maintain positive relationships with clients. A streamlined and professional billing process not only ensures timely payments but also promotes trust and satisfaction with your services.

How to Include Tax Information on Payment Documents

Including accurate tax details on your billing documents is essential for compliance and transparency. It helps your clients understand the total cost of services, including any applicable taxes, and ensures that you meet local legal requirements. Properly including tax information also makes it easier for both you and your clients to manage financial records and filings, especially for business expenses and tax returns.

Here’s how to effectively include tax information in your payment documents:

- Clearly State the Tax Rate – Specify the applicable tax rate (e.g., local sales tax or VAT) clearly on the document. Mention the percentage or fixed amount for transparency.

- Itemize Tax Charges – Break down the tax separately from the base charges. This makes it easy for clients to see how much of the total amount is due to taxes.

- Include Your Tax Identification Number – If required by your local tax authority, include your tax ID number or business registration number to validate the charges.

- Specify the Taxable Services – Indicate which services or products are subject to tax, especially if some are exempt. This avoids confusion about which costs are taxable.

- Provide Total with and without Tax – Show the subtotal of your services before tax, then clearly indicate the tax amount and the final total, so the client can easily understand the breakdown.

Accurate tax information not only ensures compliance with local regulations but also helps build trust with clients by providing clarity on what they are being charged. By including all relevant tax details, you simplify the financial process for both parties and reduce the chance of errors or misunderstandings.

Creating Reusable Billing Documents

Establishing a system for reusable payment documents can save you significant time and effort in the long run. By creating a standardized format that can be easily updated for each client or billing period, you streamline your workflow and ensure consistency in all of your financial communications. A reusable billing system allows you to quickly generate new requests without needing to recreate the structure from scratch each time.

Here are some key benefits of creating reusable billing documents:

| Benefit | Description |

|---|---|

| Time-Saving | Once you create a standard layout, you can quickly update the details for each new billing cycle without having to start from scratch. |

| Consistency | A uniform format ensures that all your documents look professional and contain all the necessary information, reducing errors or omissions. |

| Improved Efficiency | Having a reusable structure makes it easier to manage your records, track payments, and maintain organized financial files. |

| Customization | Although the structure remains the same, you can easily customize each document with specific client details and services provided. |

To create a reusable structure, follow these simple steps:

- Design a Clear Layout – Ensure your document includes all key sections such as client information, services provided, payment terms, and tax details. This format should remain the same across all requests.

- Use Fillable Fields – Design the document so that only the variables, such as the client’s name, services rendered, and amounts, need to be updated each time.

- Store Templates in a Centralized Location – Keep your base layout saved in a cloud storage or document management system, so it’s easy to access and edit whenever you need to create a new one.

Creating a reusable billing structure not only improves the efficiency of your administrative tasks but also ensures that every document is consistent, clear, and professional. By standardizing your approach, you can focus more on providing great service to your clients while keeping your financial processes running smoothly.

Common Mistakes in Childcare Billing

Accurate and timely billing is essential for maintaining a successful childcare business. However, there are several common mistakes that can complicate the billing process, leading to confusion, delayed payments, or even disputes with clients. Understanding these errors can help you avoid them and streamline your financial operations.

Frequent Errors to Watch Out For

- Missing or Incorrect Client Information – Not including the correct client name, address, or contact information can cause delays in payment or confusion over who the bill is for.

- Incorrect or Unclear Service Descriptions – Failing to itemize the services provided or listing them ambiguously can lead to misunderstandings about what clients are being charged for.

- Forgetting to Include Tax Information – Omitting tax charges or not clearly showing them separately can lead to confusion and potential compliance issues.

- Not Specifying Payment Terms – Leaving out payment due dates, accepted methods, or late fees can result in clients not paying on time or misunderstanding your payment expectations.

- Calculating Errors – Miscalculating the total due, whether from incorrect hourly rates or missed charges, can cause unnecessary delays and confusion.

- Lack of Clear Payment Reminders – Failing to send reminders before or after a payment is due may result in missed payments or late fees.

How to Avoid These Mistakes

- Double-Check Client Information – Always verify client details before generating a payment request to ensure accuracy.

- Provide Clear Service Details – Be specific about the services rendered and include dates, rates, and quantities when applicable.

- Include Tax Information – If applicable, clearly show taxes separately and ensure the correct tax rate is used.

- Specify Payment Terms Upfront – Clearly state when payments are due, what methods are accepted, and any penalties for late payments.

- Use Automatic Calculations – Leverage digital tools or software that help reduce human error when calculating totals, taxes, and discounts.

- Send Regular Reminders – Set up automated reminders to notify clients of upcoming or overdue payments to avoid delays.

Avoiding these common mistakes will not only make the billing process smoother but also enhance the professionalism and reliability of your business. By ensuring all details are correct and transparent, you will foster stronger client relationships and ensure more timely payments.

How to Track Payments with Billing Documents

Tracking payments accurately is essential for maintaining cash flow and ensuring that your business operations run smoothly. By including specific tracking features in your payment requests, you can easily monitor the status of each transaction, reduce confusion, and prevent overdue payments. This process not only helps you stay organized but also builds trust with clients by offering them a transparent overview of their payments.

Essential Details to Track Payments

- Unique Payment Reference – Assign a unique reference number to each payment document to easily identify and match payments with specific clients or transactions.

- Payment Status – Indicate whether the payment has been made, is pending, or overdue. This helps you track which payments still need to be processed.

- Payment Amount – Clearly show the amount paid, the total due, and any remaining balance to avoid confusion.

- Payment Date – Record the exact date when the payment was made to monitor whether clients are meeting deadlines.

- Payment Method – Note how the payment was made, whether through bank transfer, check, credit card, or cash, to track payment channels.

How to Organize Payment Tracking

| Reference Number | Client Name | Total Due | Amount Paid | Payment Date | Remaining Balance | Status |

|---|---|---|---|---|---|---|

| 12345 | John Doe | $500 | $500 | 01/05/2024 | $0 | Paid |

| 12346 | Jane Smith | $400 | $200 | 01/06/2024 | $200 | Partial |

| 12347 | Tom White | $600 | $0 | 01/07/2024 | $600 | Pending |

By keeping track of these key details in each payment document, you will be able to efficiently manage outstanding balances, monitor client payment histories, and stay on top of overdue payments. Additionally, maintaining a system for tracking payments improves your ability to quickly generate reports and keep your business’s financial records organized.

Choosing the Right Billing Software

When managing payments for your services, selecting the right software is crucial for streamlining your financial processes. The right tool can automate tasks, reduce errors, and save you time, while also helping you maintain organized, professional documents. With numerous options available, it’s important to evaluate your business needs and find software that suits your workflow, budget, and growth plans.

Factors to Consider When Choosing Software

- Ease of Use – The software should be intuitive and easy to navigate, so you don’t waste time on complex setups or training. A user-friendly interface will make managing payments and generating documents quick and efficient.

- Customization Options – Ensure the software allows you to personalize billing documents with your logo, business details, and specific payment terms. Customization ensures consistency and professionalism across all your communications.

- Integration with Other Tools – Look for software that integrates seamlessly with other platforms you use, such as accounting systems, banking apps, or customer management tools. Integration minimizes manual data entry and errors.

- Automated Features – Consider tools that offer automatic reminders, recurring billing, and payment tracking. Automation will help reduce administrative tasks and keep your billing process on track.

- Security – Ensure the software has strong data protection features, such as encryption and secure payment processing. Protecting client information is essential for maintaining trust and complying with regulations.

- Customer Support – Opt for software that offers reliable customer support in case you encounter issues or need assistance. Accessible support ensures that you can resolve problems quickly and keep your business running smoothly.

Popular Billing Software Options

- QuickBooks – Known for its comprehensive accounting features, QuickBooks offers customizable billing options, easy payment tracking, and excellent integration capabilities.

- FreshBooks – This cloud-based software is perfect for small businesses, offering simple billing, automated reminders, and seamless integration with other financial tools.

- Zoho Invoice – Zoho provides a robust platform for creating and managing billing documents, with options for customizing invoices, setting up recurring payments, and generating detailed reports.

- Wave – A free software with essential features for billing, payment tracking, and reporting. It’s ideal for small businesses with straightforward billing needs.

Choosing the right billing software can significantly improve your operational efficiency and financial accuracy. By considering these factors and reviewing your business’s specific needs, you can find a solution that not only saves time but also contributes to the long-term success of your business.

How to Handle Late Payments in Childcare

Late payments can pose a significant challenge for childcare providers, affecting cash flow and causing unnecessary stress. It’s important to address late payments in a way that is professional, transparent, and firm, while maintaining positive relationships with your clients. Establishing clear policies and communication strategies can help prevent late payments and ensure that overdue balances are handled efficiently.

Steps to Manage Late Payments Effectively

- Set Clear Payment Terms – Clearly communicate payment due dates, accepted methods, and late fees from the start. Include this information in your contracts, payment documents, and any communications with clients.

- Send Friendly Reminders – Before the payment due date, send a gentle reminder. After the due date has passed, follow up with a polite but firm reminder email or phone call, letting clients know their payment is overdue.

- Offer Payment Plans – If a client is experiencing financial difficulties, offer flexible payment options. Breaking the balance into smaller, more manageable installments can help them settle the debt while keeping your business running smoothly.

- Implement Late Fees – Consider enforcing a reasonable late fee policy. Make sure the client is aware of these charges beforehand so they understand the consequences of late payments.

- Track All Payments – Keep accurate records of each payment and communicate clearly with clients about what has been paid and what remains. Use digital tools to easily track outstanding balances and send reminders when necessary.

- Maintain Professionalism – While it’s important to be firm, always remain polite and professional in your communications. Avoid confrontations, but let clients know that timely payments are necessary for the continued provision of services.

When to Take Further Action

- Review Your Contract – If a client repeatedly fails to make payments, refer to the terms outlined in your service agreement. Depending on your policies, you may need to suspend services until the balance is settled.

- Send a Formal Letter – If reminders and late fees don’t resolve the issue, send a formal letter outlining the outstanding balance and possible consequences, such as a suspension of services or legal action.

- Consider Legal Action – As a last resort, if a payment issue remains unresolved, you may need to consult with a collections agency or attorney to recover the debt.

By having a clear policy in place and maintaining open communication with clients, you can reduce the impact of late payments and ensure that your business remains financially stable. While late payments are an unfortunate reality, handling them properly can help you maintain strong relationships with your clients and keep your services running smoothly.

Integrating Your Billing System with Accounting

Integrating your billing process with your accounting system is a crucial step in streamlining your financial operations. By connecting these two areas, you eliminate the need for manual data entry, reduce errors, and ensure that your records are always up to date. This integration allows you to automate financial tracking, improve reporting accuracy, and create a seamless workflow for both invoicing and bookkeeping.

Benefits of Integration

- Reduced Manual Work – Automating the flow of data between your billing system and accounting software saves time and effort, minimizing human errors.

- Real-Time Financial Updates – As payments are processed and invoices are issued, your accounting records will automatically update, giving you a clear, real-time view of your financial status.

- Improved Accuracy – With integration, data entered into your billing system is directly reflected in your financial reports, reducing the risk of discrepancies between invoicing and accounting records.

- Efficient Tax Management – Integrated systems can help you accurately track tax-related information, making it easier to generate tax reports and ensure compliance with local regulations.

- Streamlined Reporting – With integrated tools, you can generate comprehensive financial reports that include both income and expenses, helping you make informed decisions and manage cash flow effectively.

How to Integrate Your Systems

- Choose Compatible Software – Ensure the billing system you use can integrate seamlessly with your accounting software. Many modern platforms offer built-in integrations or plugins to facilitate this connection.

- Link Payment Methods – Set up your payment processing system so that payments are automatically recorded in your accounting system once a transaction occurs. This includes linking credit card payments, bank transfers, and other payment gateways.

- Enable Automatic Syncing – Most software solutions allow for automatic syncing between your billing and accounting platforms. Ensure this feature is activated so that your data is constantly updated without needing to manually transfer information.

- Train Your Team – Make sure your staff is familiar with the integrated system to take full advantage of the automated features. Proper training ensures that the system is used efficiently and correctly.

- Monitor for Issues – After integration, regularly check both systems to ensure they are syncing correctly and there are no discrepancies between billing and financial records.

Integrating your billing system with your accounting software is a smart way to improve the efficiency and accuracy of your financial management. This setup not only saves time but also ensures that your business stays organized, compliant, and ready for growth.

Why Professional Billing Documents Matter

Creating professional and well-organized billing documents is crucial for maintaining a strong business reputation. These documents not only provide a clear record of services rendered but also establish trust and credibility with clients. A professionally designed billing statement reflects your business’s values and ensures that both parties understand the financial terms and expectations.

Key Reasons Professional Documents Are Important

- Builds Trust with Clients – A clear, detailed, and professionally presented document reassures clients that they are dealing with a reliable and competent business. It shows that you take your work seriously and value transparency in financial matters.

- Promotes Timely Payments – A well-organized document makes it easy for clients to understand exactly what they are paying for, which reduces confusion and encourages prompt payments. When clients feel informed, they are more likely to settle bills on time.

- Reduces Disputes – Clear breakdowns of services, fees, and payment terms minimize misunderstandings between you and your clients. Professional documents provide a concrete reference point in case of any disagreements or questions regarding payments.

- Improves Financial Tracking – By maintaining consistency in your billing format, you can more easily track payments and monitor your cash flow. It also simplifies the process of generating reports for tax purposes or business analysis.

- Enhances Brand Image – Every interaction with clients, including financial transactions, is an opportunity to strengthen your brand. A polished, professional billing document communicates a high level of professionalism and attention to detail.

How Professional Billing Documents Benefit Your Business

- Increases Efficiency – Well-structured documents reduce the time spent on resolving billing issues or explaining charges. Clients can quickly see what they owe, how to pay, and when payment is due.

- Ensures Compliance – Properly formatted billing documents help ensure that your business complies with local laws, tax regulations, and financial reporting requirements. Accurate and detailed documents can protect you in case of audits or legal matters.

- Supports Business Growth – As your business grows, having a standardized system for generating billing documents ensures that you can scale your operations without compromising professionalism or efficiency.

Ultimately, using professional billing documents is an investment in the long-term success and reputation of your business. They provide clarity, build trust, and help keep your financial operations running smoothly.

How to Manage Client Billing Information

Properly managing client billing information is essential for maintaining accurate financial records and ensuring timely payments. By organizing and safeguarding client details, you can streamline your payment processes, reduce errors, and build strong, professional relationships with your clients. Whether you are a small business owner or part of a larger organization, having a structured system for managing this information helps you stay organized and efficient.

Best Practices for Managing Billing Data

- Store Information Securely – Always keep client billing details in a secure system. Whether using physical records or digital software, ensure that sensitive information like credit card numbers, addresses, and payment history is protected by encryption and other security measures.

- Organize Client Records – Keep billing records organized by client. This helps quickly locate payment history, outstanding balances, and any special instructions related to payments. Use a consistent system to categorize and label client records.

- Regularly Update Information – Periodically check and update your client’s contact information, billing preferences, and payment methods. If a client moves or changes their payment method, make sure these changes are reflected in your records to avoid delays in payments.

- Monitor Outstanding Balances – Track unpaid bills and follow up promptly with clients. Keeping track of due dates and overdue balances allows you to take action quickly and ensure that payments are received on time.

- Use Software for Automation – Leverage accounting or billing software to automate tasks such as sending reminders, issuing receipts, and tracking payments. Automation reduces human error and saves time, while also improving accuracy.

How to Maintain Client Trust

- Communicate Clearly – Make sure clients are always aware of their payment terms, due dates, and any charges they might incur. Clear communication prevents misunderstandings and builds trust.

- Offer Payment Options – Providing clients with flexible payment options, such as credit card payments, bank transfers, or installment plans, makes it easier for them to pay and increases the likelihood of on-time payments.

- Respect Client Privacy – Handle all billing information with the utmost care and confidentiality. Let clients know that you take their privacy seriously and have systems in place to protect their data.

Efficiently managing client billing information not only keeps your financial processes in order but also fosters positive client relationships. By ensuring that all details are accurate, up-to-date, and securely stored, you create a foundation for smooth transactions and long-term business success.

Tips for Organizing Your Billing Process

Organizing your billing process is essential to maintaining a smooth workflow and ensuring that payments are processed efficiently. A well-structured system helps reduce errors, save time, and keep your finances on track. Whether you’re managing a small business or a larger operation, following a few simple practices can greatly enhance your invoicing efficiency and professionalism.

Key Strategies for Efficient Billing Management

- Automate Where Possible – Use software to automate tasks such as generating billing documents, sending reminders, and tracking payments. Automation reduces human error and ensures consistency in your process.

- Establish a Standardized Format – Create a consistent format for all your billing documents. Whether you’re using a software system or a manual approach, having a uniform format makes it easier to track payments and minimizes confusion for clients.

- Set Clear Payment Terms – Clearly define payment terms such as due dates, accepted payment methods, and any applicable late fees. Communicate these terms upfront to avoid misunderstandings and ensure timely payments.

- Track Outstanding Balances – Regularly monitor overdue payments and follow up promptly with clients. Keeping a clear record of who owes what, and when, is essential for maintaining cash flow.

- Keep Client Records Organized – Maintain an organized system for storing client details and payment history. Use digital tools or spreadsheets to keep track of transactions, contact information, and any special billing arrangements.

Tips for Streamlining Your Process

- Batch Your Billing – Set specific days for issuing billing documents, rather than issuing them ad hoc. Batch processing helps ensure that you don’t forget clients or miss deadlines.

- Use Cloud-Based Tools – Cloud-based accounting or billing software can help you access and manage your records from anywhere. This flexibility improves accessibility and ensures that your data is safely backed up.

- Regularly Reconcile Your Accounts – Perform regular checks to reconcile your records and ensure that your billing system matches your bank statements. This reduces the likelihood of errors and makes auditing easier.

- Keep Communication Open – Always communicate with clients if there are any issues with their payments or billing. Proactive communication prevents disputes and helps resolve issues before they escalate.

Sample Billing Process Flow

| Step | Action | Tools |

|---|---|---|

| 1. Client Information | Collect and store client contact and payment details | CRM software, spreadsheets |

| 2. Billing Schedule | Set specific days for generating and sending billing documents | Calendar, automated software |