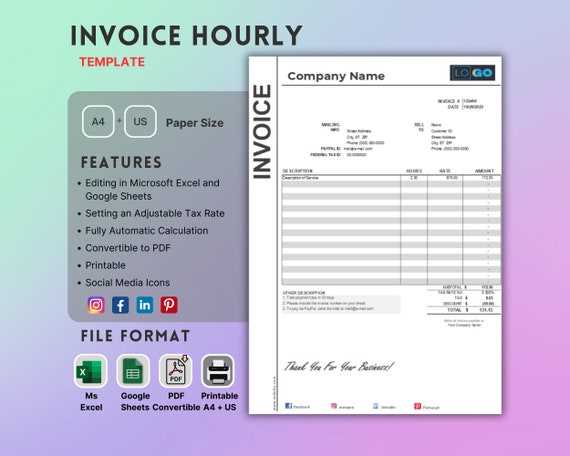

Invoice Template for Hourly Rate Billing

Accurately tracking and charging for work completed is essential for any professional service provider. Whether you are a freelancer, consultant, or contractor, having an efficient method to record the hours worked and ensure fair compensation is crucial. By implementing a structured approach, you can streamline the payment process and avoid confusion with clients.

Setting up a system that reflects your working hours helps maintain transparency and professionalism in all your business transactions. A well-designed document can provide both you and your clients with clarity on services provided and payments owed. It ensures that your work is valued fairly, eliminating potential discrepancies in compensation.

Efficiently managing these documents is not only about making billing easier but also about maintaining a strong, professional relationship with clients. When you simplify and standardize your payment system, you can focus on delivering quality service without worrying about administrative tasks.

Creating an Effective Billing Document

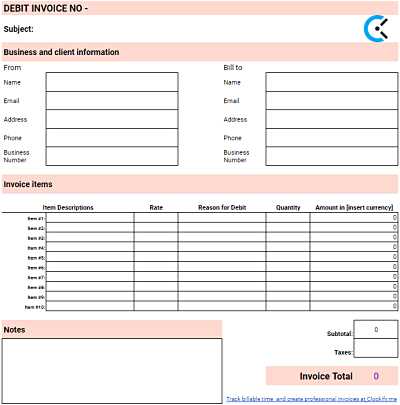

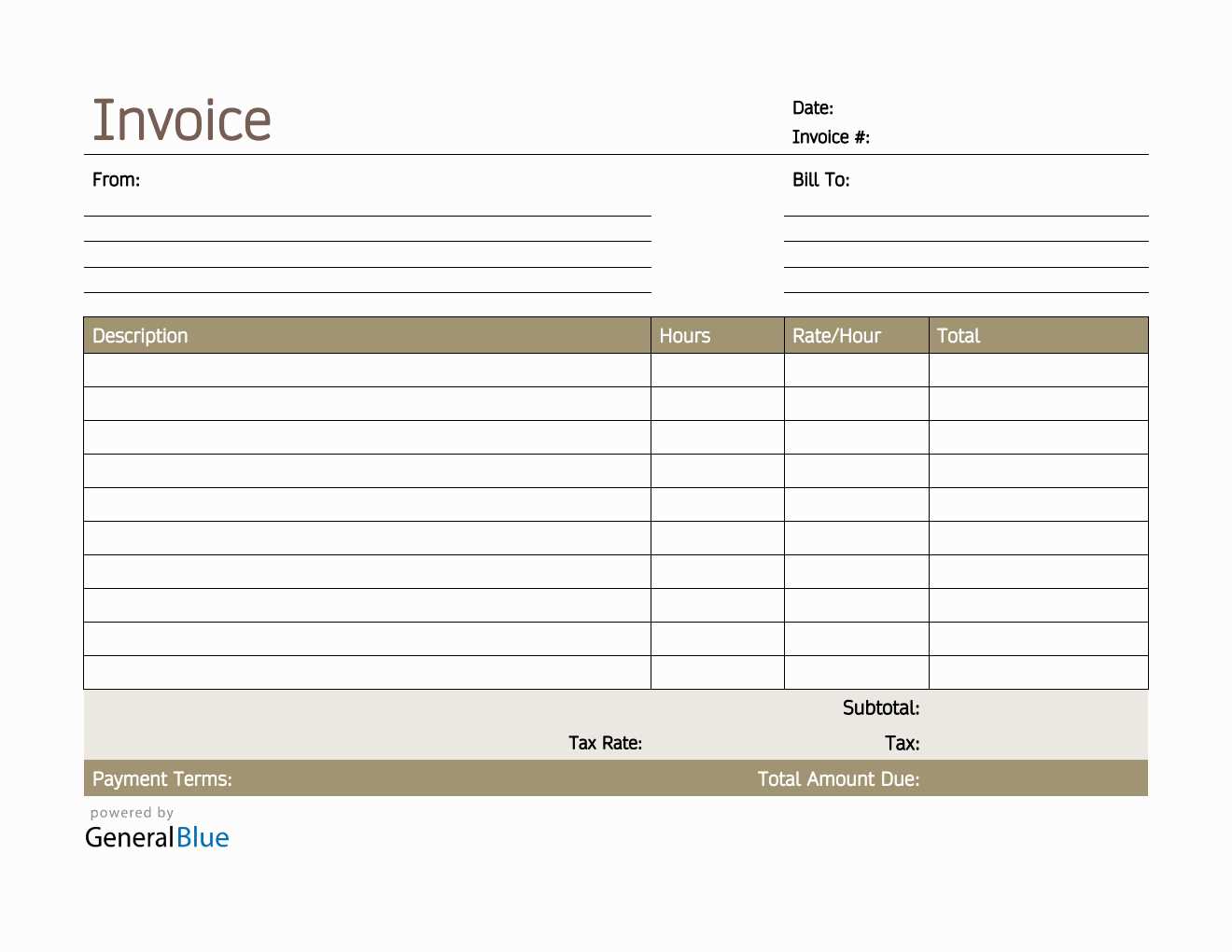

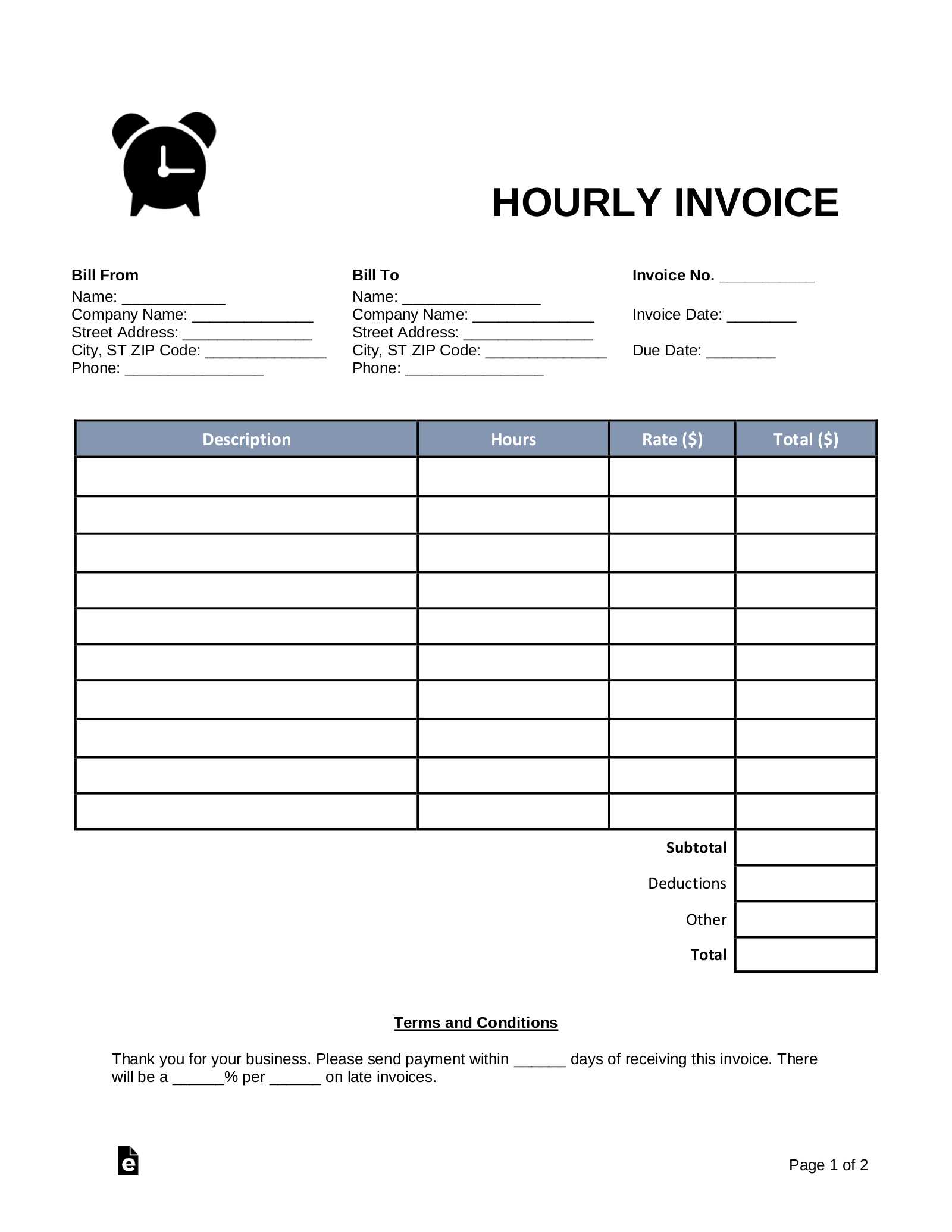

To ensure smooth transactions with clients, having a clear and well-structured document for payments is essential. This document should be designed to capture all relevant information about the services provided, the time spent on each task, and the agreed-upon compensation. A well-crafted structure helps avoid misunderstandings and ensures that all details are transparent and easily understood by both parties.

Key Components of a Payment Document

An effective billing document should include several key elements to guarantee accuracy and professionalism. Below are the critical sections that should be present:

| Section | Description |

|---|---|

| Client Information | Details about the client, including their name, contact information, and address. |

| Service Description | A brief summary of the work performed, including the tasks and services provided. |

| Time Tracking | The exact hours worked or duration of each task completed, including start and end times. |

| Cost Breakdown | Clear pricing for each task or service, including the total amount due. |

| Payment Instructions | Methods for processing payment, such as bank transfer or online payment systems. |

Formatting for Clarity and Professionalism

In addition to the essential information, the visual layout of the document plays a significant role in its effectiveness. A clean, organized format with clear headings and consistent font sizes ensures that the document is easy to navigate. This also enhances its professional appearance, making it more likely to be taken seriously by clients.

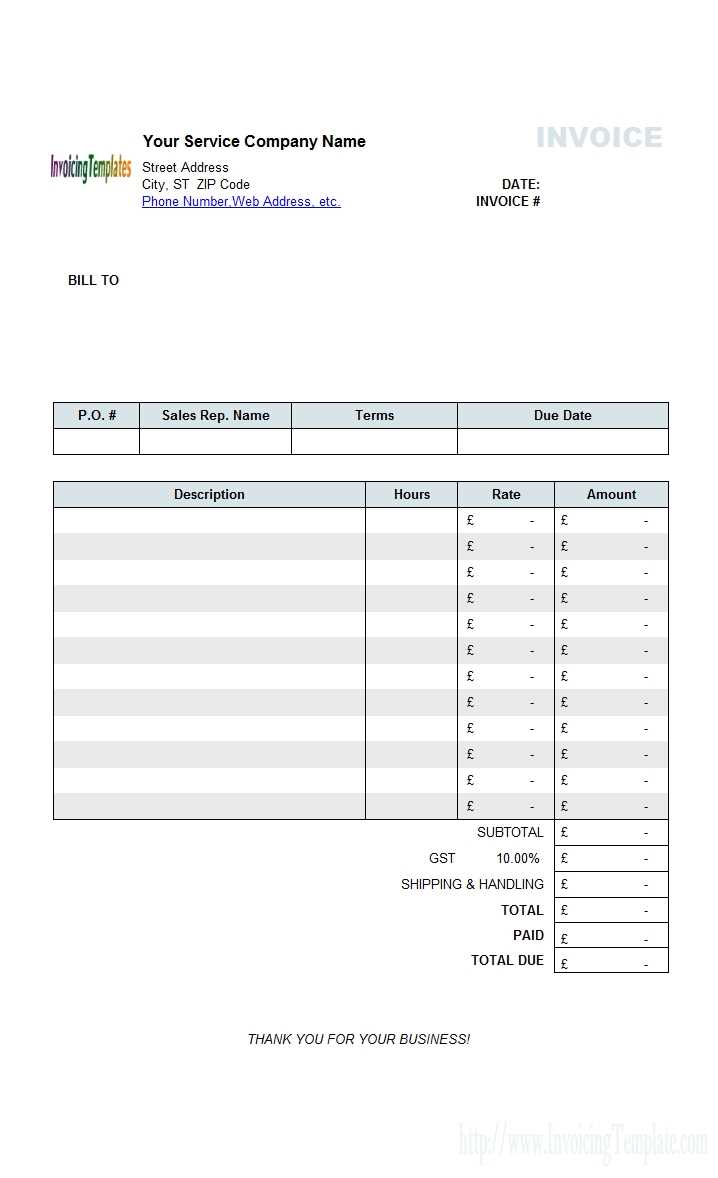

Understanding Time-Based Billing Documents

When working on projects that involve varying hours of work, it is important to properly track and document the time spent to ensure fair compensation. A time-based billing document is essential for outlining the work completed and how much is owed based on the time spent on each task. By clearly breaking down the work and associated costs, both the provider and client can have a transparent understanding of the payment structure.

Such documents are particularly useful in professions where tasks can differ greatly in duration. Whether it’s for consulting, freelancing, or other contract-based work, using a time-based system ensures that compensation aligns with the effort and time invested.

| Section | Description |

|---|---|

| Work Details | A breakdown of the services or tasks performed, specifying what was done during each period of work. |

| Time Entries | Clear documentation of the time spent on each task, showing start and end times to ensure accuracy. |

| Cost Per Hour | The agreed-upon amount to be charged for each hour of work, providing transparency for both parties. |

| Total Payment | The final amount owed, which is calculated based on the total time worked and the agreed cost per hour. |

Benefits of Using a Payment Document Structure

Adopting a standardized document for billing can simplify the process of managing payments and ensure consistency in every transaction. By using a predefined format, businesses can reduce errors, save time, and create a more professional experience for clients. A structured approach not only benefits the service provider but also enhances the client’s trust in the business’s operations.

Improved Accuracy and Consistency

One of the key advantages of using a structured format is the accuracy it brings to billing. By having predefined sections and clear guidelines for documenting work and time, the likelihood of mistakes is minimized. This consistency ensures that every document includes the necessary information and is formatted properly, regardless of the project or client.

Time-Saving and Efficiency

Having a ready-made structure allows businesses to quickly generate billing documents without having to start from scratch every time. This not only saves time but also allows for faster payment processing. The ease of use and quick turnaround benefits both the service provider and the client, creating a smoother financial transaction.

How to Calculate Work Compensation

Determining the appropriate compensation for time spent on tasks is crucial for both service providers and clients. To ensure fair payment, it is necessary to calculate how much should be charged for the work done based on time and effort. There are several methods for determining an appropriate charge, depending on factors such as expertise, project scope, and industry standards.

Steps to Calculate Payment

Follow these steps to accurately calculate the total amount for services rendered:

- Determine the Work Duration: Track the time spent on each task or service provided. Accurate time tracking ensures that clients are billed fairly for the exact amount of time invested.

- Set Your Base Amount: Decide how much you will charge per unit of time. This may depend on factors like experience, industry rates, and the complexity of the work.

- Multiply Time by Rate: Multiply the number of hours worked by your predetermined amount to calculate the total payment.

- Adjust for Additional Costs: If applicable, include additional costs like materials or travel expenses that may have been incurred during the project.

Additional Considerations

- Industry Standards: Ensure that your compensation is in line with what others in your field are charging for similar services.

- Experience and Expertise: Consider adjusting your pricing based on your experience level and the complexity of the tasks you’re performing.

- Overtime or Premium Rates: If applicable, determine whether overtime or premium charges should be added for work beyond regular hours or specific conditions.

Choosing the Right Billing Software

Selecting the right software for managing billing documents is a critical decision for any business. With numerous options available, it’s important to choose one that streamlines the payment process, enhances efficiency, and offers features that meet your specific needs. A well-chosen software solution can save time, reduce errors, and ensure that your financial records are organized and accurate.

Key Features to Look For

When evaluating different software options, consider these essential features to ensure you select the best tool for your business:

| Feature | Importance |

|---|---|

| Ease of Use | Choose software that is intuitive and easy to navigate, reducing the learning curve for your team. |

| Customizability | The ability to adjust the document structure or payment settings to suit your business’s needs. |

| Automation | Automated reminders and recurring payments can save time and ensure consistency in billing. |

| Integration | Ensure the software integrates seamlessly with other systems, such as accounting or CRM tools. |

| Security | Look for software with strong encryption and secure payment processing to protect sensitive information. |

Additional Considerations

- Cost: Compare pricing plans to ensure the software fits within your budget while offering the necessary features.

- Customer Support: Choose a provider that offers reliable support in case you encounter any issues.

- Mobile Access: Some software options offer mobile apps, allowing you to manage documents and payments on the go.

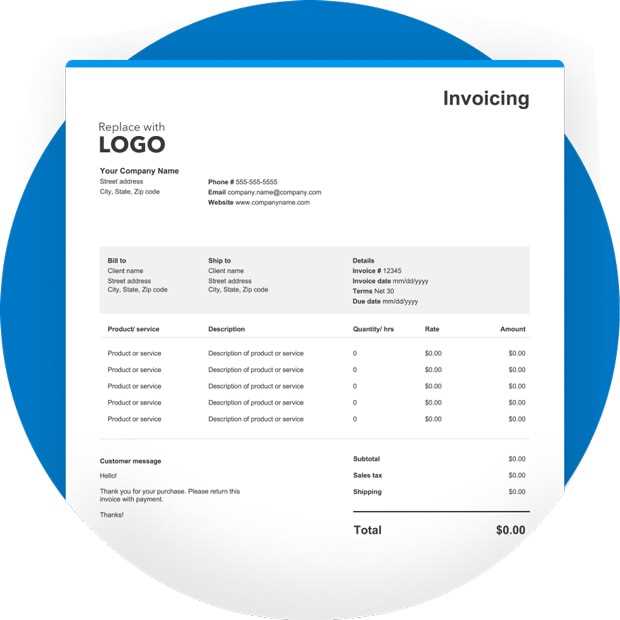

Key Elements of a Time-Based Billing Document

When creating a document for work that is based on time spent, it is essential to include several critical components to ensure clarity and accuracy. These elements help both the service provider and the client understand the details of the transaction and prevent misunderstandings. Properly structured documents can streamline the payment process and facilitate a professional interaction between both parties.

Essential Components to Include

Here are the key elements that should be present in a time-based billing document:

- Work Description: A clear and detailed summary of the tasks completed during the billing period. This helps the client understand what work was done and justifies the charges.

- Time Spent: Document the number of hours or time increments spent on each task. This provides transparency for the amount of effort involved in the project.

- Cost Per Time Unit: The amount charged per unit of time, which is essential for calculating the total payment. This can vary based on experience, complexity, or service type.

- Total Amount: The final sum based on time worked and the cost per unit, often including additional charges for extra services or materials.

- Payment Terms: Clearly state the due date for payment and any applicable late fees or discounts for early payment.

Formatting and Presentation

Presenting the information in an organized and easy-to-read format is crucial. Use tables or lists to display the work description, time spent, and costs. This not only makes it easier for clients to understand but also provides a professional appearance that can help build trust and credibility.

Customizing Billing Documents for Your Business

Adapting your billing documents to suit the specific needs of your business is essential for creating a professional and efficient payment process. Customization allows you to incorporate relevant details, reflect your brand identity, and ensure the accuracy of financial records. By tailoring the structure and content, you can enhance client communication and streamline your business operations.

Key Customization Options

Here are some important aspects you can adjust to align the document with your business requirements:

- Branding: Include your company logo, contact information, and business colors to create a personalized and professional appearance.

- Service Descriptions: Customize the layout to reflect the specific services or products you provide, making it easier for clients to understand the charges.

- Payment Instructions: Adapt the payment terms and instructions to suit your preferred methods, such as bank transfer details or online payment links.

- Tax Information: Ensure that relevant tax details, such as VAT or sales tax, are clearly specified in line with your country’s regulations.

- Legal Disclaimers: Add any necessary terms or conditions that apply to your billing process, including refund policies or late payment penalties.

Using Software for Customization

Many software tools offer customizable features, allowing you to adjust the layout, add fields, and automate certain sections. This reduces manual work, ensuring that every document you send is consistent and professional. Choose a platform that gives you flexibility while maintaining an intuitive interface for ease of use.

How to Add Taxes to Your Billing Document

Including tax calculations in your financial records is crucial for maintaining transparency and complying with local regulations. Accurately adding taxes ensures both you and your clients are aware of the exact amounts being paid and prevents any future misunderstandings. By following clear steps, you can easily incorporate taxes into your documents while adhering to legal requirements.

Understanding Tax Calculations

Before adding taxes, it is important to understand the specific tax rules that apply to your business. Different regions may have varying tax rates, and some goods or services may be exempt from taxation. Here are the main tax-related components to include:

- Tax Type: Specify whether you are applying VAT, sales tax, or another form of tax.

- Tax Rate: Ensure you are using the correct tax rate for the region where the transaction is taking place.

- Taxable Amount: This is the total amount of your charges before tax is added. The tax rate will be applied to this value.

- Tax Total: Calculate the total tax amount by multiplying the taxable amount by the tax rate.

Steps to Add Tax to Your Document

Follow these steps to accurately add tax to your billing document:

| Step | Description |

|---|---|

| Step 1 | Identify the taxable items and their respective rates. |

| Step 2 | Calculate the total tax by applying the tax rate to the taxable amount. |

| Step 3 | Include the tax amount in the total sum, ensuring it is clearly displayed on the document. |

| Step 4 | Verify all calculations and ensure compliance with local tax laws. |

Invoice Formatting Best Practices

Properly structuring your billing documents is essential for clear communication and professionalism. A well-organized layout not only makes it easier for your clients to understand the charges but also ensures accuracy in financial records. By following a few best practices, you can create documents that are both visually appealing and easy to navigate, preventing confusion and delays in payments.

Key Elements to Include

To ensure clarity and comprehensiveness, your documents should include the following essential elements:

- Contact Information: Clearly display both your and your client’s contact details, including addresses and phone numbers.

- Service Description: Provide a brief but clear breakdown of the services or products provided.

- Payment Details: Include payment terms, due dates, and acceptable payment methods.

- Total Amount: Clearly show the total due after including all applicable charges and taxes.

Best Practices for Document Layout

Following a structured layout not only enhances readability but also ensures your document meets professional standards:

| Best Practice | Description |

|---|---|

| Use Clear Headings | Make sections easy to identify with bold and descriptive headings. |

| Organize Information | Group similar information together (e.g., service details, totals) for clarity. |

| Use Consistent Fonts | Choose a readable font and maintain consistent size and style throughout. |

| Provide Clear Totals | Make sure totals are easy to locate and calculated correctly. |

Tracking Hours for Accurate Billing

Accurate tracking of work hours is crucial for ensuring that your clients are billed correctly for the time spent on their projects. By keeping detailed records, you can avoid discrepancies and ensure transparency in your billing process. Whether you are working on a short-term task or a long-term project, tracking time effectively helps maintain fairness and strengthens professional relationships.

Methods for Tracking Time

There are several ways to track your work hours efficiently, depending on your preferences and the complexity of your tasks. Here are some commonly used methods:

- Manual Logs: Keep a handwritten or digital log to record the start and end times of each task. This can be simple, but requires consistent attention.

- Time Tracking Software: Use specialized software or apps that automatically track your working hours, making it easier to manage and calculate totals.

- Timesheets: Fill out timesheets on a regular basis to document the hours worked for each project or client.

- Project Management Tools: Many project management platforms include time tracking features, allowing you to log hours alongside task progress.

Best Practices for Accurate Time Tracking

To ensure the reliability of your work hours and avoid errors, consider these best practices:

- Record Hours in Real-Time: The sooner you log your hours, the more accurate your records will be.

- Break Tasks Into Smaller Segments: Tracking smaller tasks can provide a clearer picture of time spent on specific activities.

- Review Logs Regularly: Check your records frequently to identify any discrepancies or missing data before finalizing your billing.

- Be Transparent: Provide clear, detailed information to your clients about how time was spent, ensuring they understand the work that has been completed.

Common Mistakes in Hourly Invoices

When billing clients based on the time spent on a project, there are several common errors that can affect the accuracy and professionalism of your billing. These mistakes can lead to confusion, delayed payments, and strained client relationships. It is essential to understand and avoid these pitfalls to ensure clear and fair transactions.

One of the most frequent mistakes is not keeping accurate records of the time worked, which can result in discrepancies between the hours billed and the actual time spent on tasks. Another issue is failing to clearly break down the work performed, which can leave clients confused about the services provided. Additionally, overlooking the application of taxes or additional fees can also lead to billing errors and compliance issues.

By paying attention to detail and following best practices for documenting and presenting your time-based charges, you can avoid these common errors and maintain positive relationships with your clients.

Tips for Faster Payment Processing

Ensuring that payments are processed quickly is essential for maintaining healthy cash flow and strong client relationships. There are several strategies that can help speed up the payment process and minimize delays. By implementing a few key practices, you can encourage timely payments and reduce the risk of overdue balances.

Provide Clear and Accurate Details

Ensure that all the necessary information is included in your billing statement. Clear details such as services provided, time spent, and agreed-upon costs will reduce confusion and make it easier for clients to process payments.

Offer Convenient Payment Options

Make it as easy as possible for clients to pay by offering multiple payment methods. This could include online payment portals, bank transfers, or credit card options. The more accessible the payment process, the quicker it can be completed.

Set Clear Payment Terms

- Specify due dates clearly to avoid confusion.

- Set penalties for late payments to encourage prompt settlement.

- Offer early payment discounts as an incentive for quicker payments.

Automate Reminders

Setting up automated reminders for upcoming or overdue payments can help ensure clients are aware of their obligations and prompt them to make the necessary payments on time.

Managing Multiple Clients with One Template

When handling multiple clients, it is essential to have an efficient system that allows you to maintain organization while tailoring each statement to specific needs. A well-structured framework can help streamline your workflow, ensuring that every detail is personalized for each client without the need to create separate documents for every interaction.

Personalizing the Structure for Each Client

By using a single framework, you can easily customize information for each client, such as project descriptions, services provided, and payment terms. This approach helps you save time while ensuring each client receives relevant details tailored to their unique requirements.

Key Features to Include for Multiple Clients

- Client-specific details: Ensure that each document includes the client’s name, contact information, and project specifics.

- Customizable pricing sections: Adjust prices and services as needed for each client to reflect the scope of work.

- Flexible payment terms: Modify payment schedules and methods to suit individual client agreements.

- Tracking project milestones: Include clear sections to note the progress of each project to keep both parties informed.

Automating Repetitive Tasks

Many platforms offer automation tools that allow you to save custom configurations for each client. This can significantly speed up the process of creating statements and help prevent errors. By utilizing such tools, you can update only the necessary fields and quickly generate new documents with minimal effort.

Integrating Payment Methods into Invoices

When creating a document to request payment, it’s important to clearly outline the various ways clients can settle their outstanding balance. By providing multiple payment options, you not only make the process easier for the client but also increase the likelihood of receiving timely payments. A well-organized payment section ensures clarity and reduces confusion regarding how and when payments should be made.

To achieve this, it’s crucial to include specific details about the available methods, payment instructions, and any necessary references that will assist in the transaction process. Clear communication in this section prevents delays and provides a seamless experience for both parties.

Common Payment Methods to Include

- Bank Transfer: Provide bank account details, including IBAN, SWIFT/BIC code, and any other required information for international transfers.

- Credit or Debit Card: Mention any payment gateway or card processing system you use, such as PayPal, Stripe, or Square.

- Online Payment Platforms: Specify services like PayPal, Venmo, or any other platforms your business supports.

- Cheque: If applicable, give instructions on where to mail the cheque and any necessary references or account numbers.

Providing Clear Instructions

Each method should include precise instructions to ensure the client can easily follow the process. For example, if using bank transfer, you should provide account details, payment reference codes, or any specific instructions for faster processing. Similarly, if using online payment systems, including direct links or payment buttons can simplify the process for the client.

Ensuring Legal Compliance in Invoices

For any business, it’s essential to ensure that the documents issued for requesting payment comply with local laws and regulations. Legal compliance not only protects your business but also helps maintain trust with clients and ensures smooth financial operations. Failing to adhere to these legal requirements could lead to disputes, fines, or complications with tax authorities.

To avoid legal issues, it’s crucial to include all necessary details and follow the specific regulations required in your jurisdiction. This might include tax identification numbers, clear payment terms, and appropriate documentation for deductions or exemptions.

Key Elements for Legal Compliance

- Business Identification: Include your business name, address, and contact information. Ensure that the tax identification number or VAT registration is clearly visible if required by local law.

- Client Information: Clearly state the name and address of the client to avoid any ambiguity about who the payment is due from.

- Transaction Details: Provide a detailed breakdown of the products or services provided, including the description, quantity, and dates of service. This ensures that everything is transparent and auditable.

- Payment Terms: Mention the payment due date and any penalties for late payments to protect your business interests.

Additional Considerations

- Tax Information: Be sure to include applicable taxes, such as VAT or sales tax, with clear breakdowns. This is essential for both you and your client when it comes to financial reporting and tax filing.

- Legal Language: Use clear and legally accepted terms in your documents. Ensure that all terms and conditions are written in a manner that complies with your local jurisdiction’s standards.

Automating Billing Systems

Efficient billing processes are critical for businesses that charge based on the time spent on tasks. Automating these systems helps streamline operations, reduces human errors, and ensures timely payments. By integrating automated tools, businesses can save time, enhance accuracy, and improve client satisfaction.

Automation tools can track working hours, generate reports, and calculate charges, ensuring that no details are missed. These systems can also provide clients with easy-to-understand breakdowns, making transactions more transparent and efficient.

Designing a Professional Layout

Creating a well-organized and visually appealing document is essential for any business transaction. A professional layout ensures clarity and promotes trust between you and your clients. When designing this document, it’s important to focus on readability, structure, and a clear representation of all relevant details.

Consider these key elements when crafting a professional layout:

| Element | Description |

|---|---|

| Contact Information | Include your business name, address, and contact details at the top for easy reference. |

| Client Details | Clearly display the client’s information to avoid any confusion regarding the recipient. |

| Services or Products | List the items or services provided, with concise descriptions and associated costs. |

| Terms | Outline payment terms, including any due dates or payment methods accepted. |

By focusing on these components, you can ensure a polished and professional appearance, while making the document easy to read and understand for your clients.

Maintaining Consistency in Invoicing

Establishing a consistent approach to documenting business transactions is crucial for professionalism and operational efficiency. Consistency not only helps in building trust with clients but also simplifies record-keeping and financial management. Whether it’s the format, language, or the structure of your documents, uniformity ensures clarity and reduces the chances of confusion.

Key Areas to Focus On

- Format: Ensure that the layout remains uniform across all documents, making it easy for clients to understand and for you to process.

- Terminology: Use clear, consistent terminology for services provided, payment terms, and other important details.

- Visual Design: Stick to a similar color scheme, font style, and structure to maintain a professional and cohesive appearance.

Benefits of Consistency

- Improved Client Trust: A consistent approach helps clients feel more comfortable with your services and financial transactions.

- Efficient Record-Keeping: Standardizing the way you document transactions makes it easier to track and manage finances over time.

- Smoother Communication: When details are consistently presented, there is less room for misinterpretation.