Home Rental Invoice Template for Easy Billing

Managing the financial aspect of leasing properties can be a complex task, but using the right tools can simplify the process significantly. Proper documentation is essential to ensure clarity and avoid misunderstandings between property owners and renters. A well-structured statement helps both parties stay organized and clear about their responsibilities.

Customizable formats allow for flexibility, ensuring that all necessary details are included in a clear and professional manner. Whether you are a first-time lessor or an experienced landlord, these documents help ensure accurate record-keeping and timely payments, reducing the chances of errors and disputes.

By using an efficient form, owners can easily specify charges, payment schedules, and terms, making the transaction transparent for both sides. This guide will explore the essential features of such documents and provide tips on how to create, manage, and track them effectively.

Home Rental Invoice Template Guide

Creating an accurate and professional document for property transactions is essential for both lessors and tenants. These records ensure that all financial obligations are clearly outlined and understood. This section will guide you through the steps of preparing a well-structured document, covering the key components and tips for making the process easier.

Key Components of a Property Billing Document

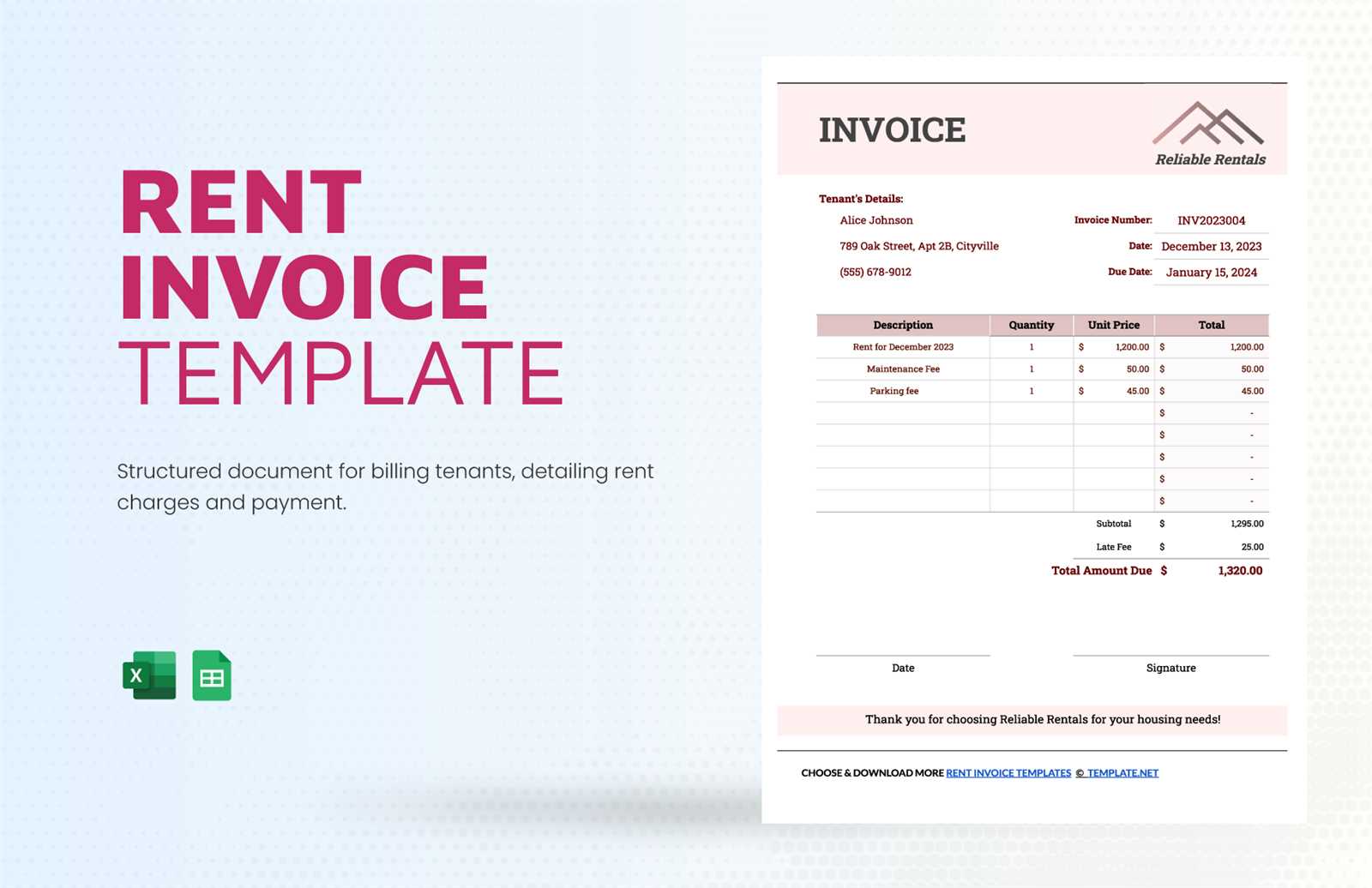

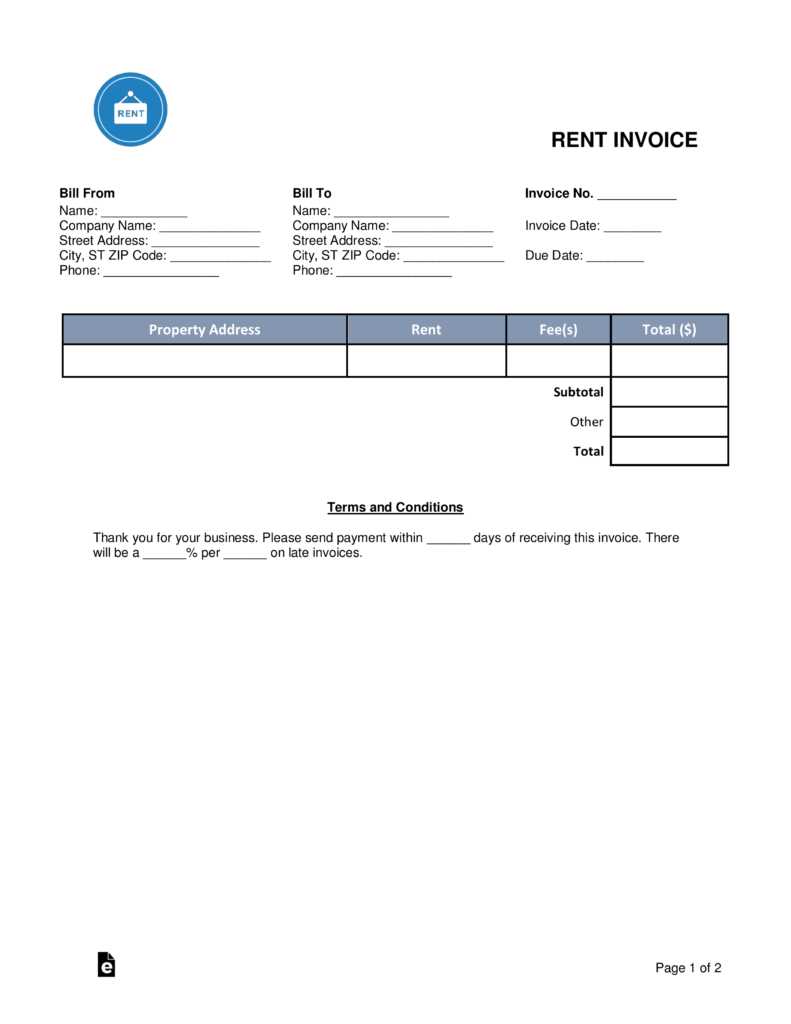

When preparing a statement for property-related charges, it is crucial to include all necessary details. The following elements should always be present:

- Tenant Information: Full name, address, and contact details of the tenant.

- Landlord Details: Name, address, and contact information for the property owner.

- Property Address: Exact location of the rented property.

- Billing Period: Dates covering the period the charges apply to.

- Charges Breakdown: Detailed list of fees, rent amounts, utilities, and any additional costs.

- Due Date: The date by which payment is expected.

- Payment Methods: Accepted payment methods and instructions for completing the transaction.

Tips for Creating Effective Billing Records

Follow these tips to ensure your documents are clear, professional, and easy to manage:

- Ensure all information is accurate and up-to-date.

- Use a clean, easy-to-read format with appropriate spacing and sections.

- Include clear payment terms to avoid confusion about deadlines or additional fees.

- Keep a copy of every document for your records and track payments efficiently.

- Consider automating the process if managing multiple properties to save time.

By following these guidelines, both landlords and tenants can have a smooth and transparent financial experience, reducing the risk of misunderstandings or missed payments.

Why Use a Rental Invoice Template

Organizing financial interactions between landlords and tenants is essential to ensure smooth transactions. A structured document simplifies the process, helping both parties clearly understand their financial obligations and deadlines. This approach not only enhances transparency but also makes record-keeping significantly easier.

Enhanced Clarity and Professionalism

Using a prepared format adds a layer of professionalism to any financial document. With all essential details presented in a clear manner, both landlords and tenants can avoid common misunderstandings. This structure also allows both parties to reference specific charges or terms quickly, supporting a smooth rental experience.

Improved Record-Keeping and Tracking

A consistent format enables easy tracking of payments over time, making it simpler to review past transactions if needed. It also provides a helpful reference during tax preparation or financial audits, as well as when resolving any payment disputes. By having a reliable, repeatable document format, landlords can better manage their finances while keeping tenants informed.

Utilizing this organized approach streamlines communication and contributes to a more seamless property management experien

Key Elements of Rental Invoices

A comprehensive financial document for leasing arrangements should include certain essential elements to ensure clarity and accuracy. By detailing each part of the transaction, landlords and tenants can avoid misunderstandings and keep all necessary information organized.

Essential Information to Include

When preparing this type of document, it’s important to include specific details that cover both parties’ needs. These elements create a transparent record of the terms and make future reference easier:

- Contact Details: Full names, addresses, and contact numbers for both the property owner and the tenant.

- Property Address: The physical address of the leased property to ensure clarity on which unit or space the charges apply to.

- Billing Cycle: The dates covering the period for which payment is being requested, whether monthly, quarterly, or another timeframe.

- Itemized List of Charges: A breakdown of all costs, such as monthly dues, utilities, and any applicable fees, clear

Customizing Your Invoice Template

Adapting your billing document to fit specific needs can make it more effective and professional. By tailoring the layout and content, you ensure that all essential information is easy to understand and accessible. This customization also allows for adding unique details that may be relevant to particular agreements.

Adjusting Key Sections

Personalizing each section ensures that both the layout and wording suit the specific requirements of the arrangement. Here are some areas you may want to adjust:

- Contact Information Placement: Make sure the details of both parties are clear and prominently displayed, whether at the top or bottom of the document.

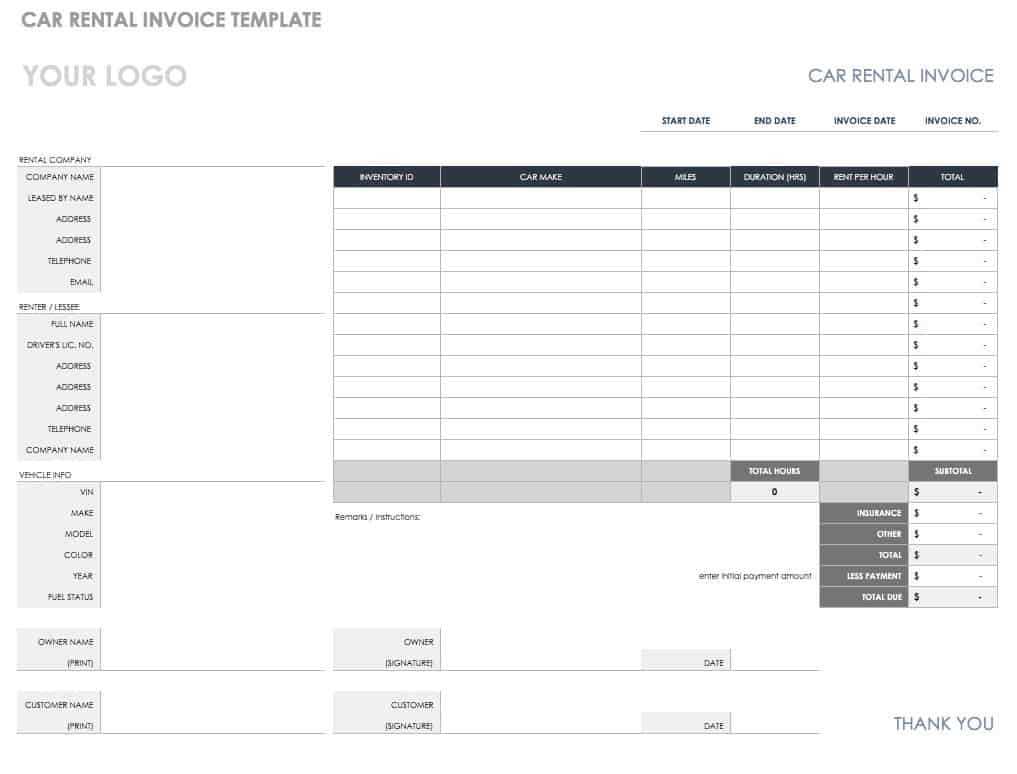

- Branding Elements: Add your logo, company name, or any relevant visual elements to give the document a professional appearance.

- Payment Terms: Modify terms to reflect the agreed-upon timelines, and include any instructions specific to your preferred payment methods.

- How to Include Rent and Fees

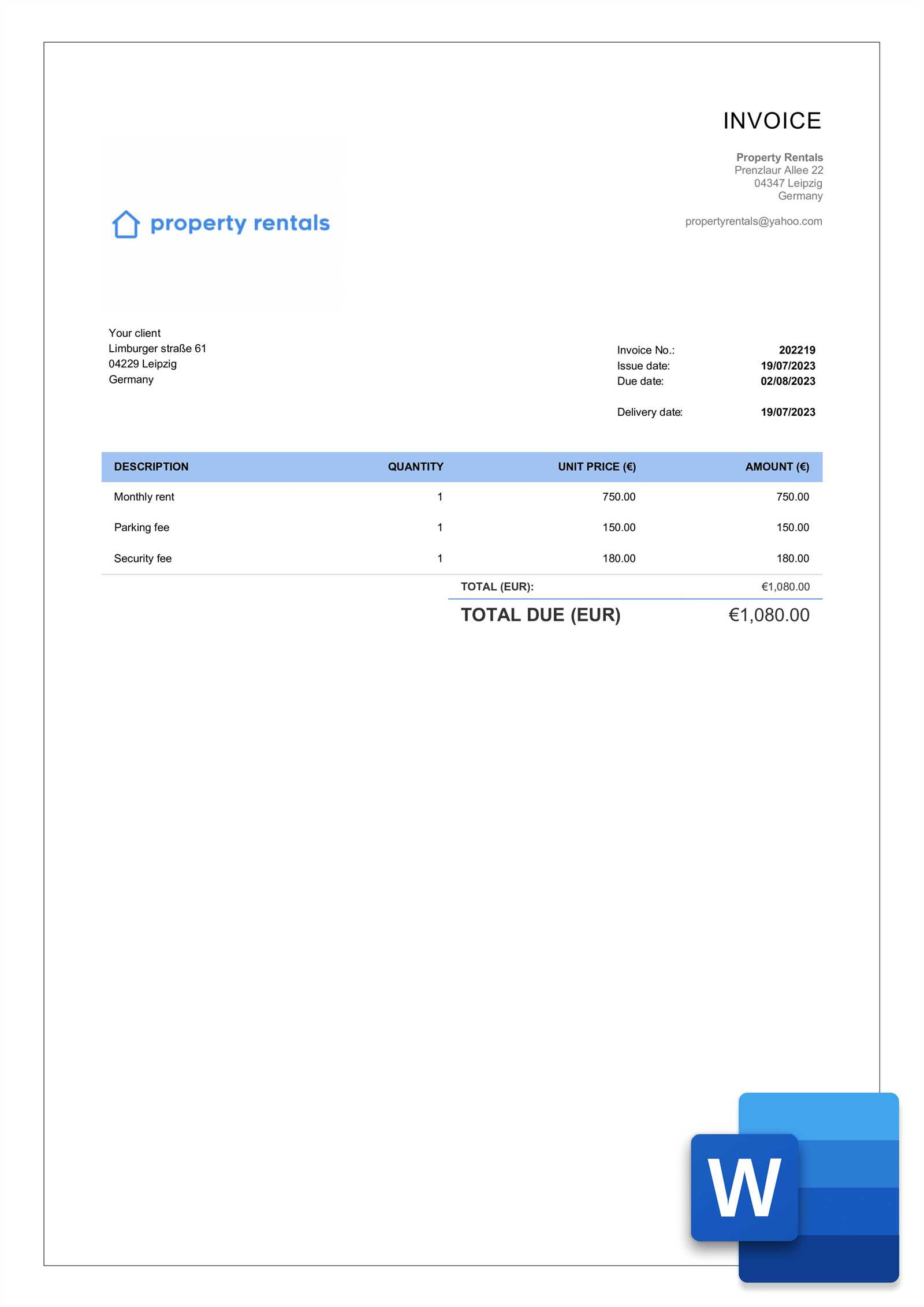

When creating a billing document for leasing purposes, it’s essential to clearly outline the main charges and any additional costs involved. Breaking down these details ensures transparency and helps both parties understand exactly what is due. A structured approach to listing charges can prevent misunderstandings and facilitate smoother transactions.

Itemizing Primary Charges

Start with the primary charge, such as the monthly dues, presented prominently near the top. This central amount should be easy to find, allowing both parties to quickly see the essential payment. To make this even clearer, use a bolded or highlighted font, which helps this key figure stand out on the page.

Adding Additional Costs and Services

In addition to the main charge, there may be other periodic or one-time costs to account for. These might include maintenance fees, utilities, or specific service charges. Listing each of these separately, with a brief description, ensures clarity and allows tenants to see how each item contributes to the total.

Adding Payment Terms to Invoices

Including clear payment terms in any billing document is vital for ensuring that both parties understand their financial obligations and expectations. Payment conditions specify when and how the amount should be settled, reducing the chance of confusion or delayed payments. By clearly outlining these terms, you foster trust and ensure smoother transactions.

Types of Payment Terms to Include

There are various payment conditions that you may want to specify, depending on the nature of the agreement. Some of the common options include:

- Due Date: Specify the exact date by which the payment should be made to avoid delays.

- Late Fees: Clarify any penalties for delayed payments, such as a fixed fee or a percentage increase for each overdue day.

- Early Payment Discounts: Offering a discount for early payment can incentivize prompt settlement.

- Payment Methods: Indicate which forms of payment are acceptable, such as bank transfers, checks, or online platforms.

Making Payment Terms Clear

Ensure that the payment terms are easily visible and straightforward. You can list them near the total amount due, so there’s no ambiguity regarding when and how the payment should be made. If necessary, include a brief reminder in the body text, reinforcing the due date and applicable fees.

Clear and concise payment terms help to avoid misunderstandings and keep both parties on the same page, making the entire payment process more efficient and transparent.

Invoice Format Best Practices

To ensure clarity and professionalism, structuring a billing document in a logical and consistent manner is essential. A well-organized format can help both the issuer and the recipient quickly locate important details, making the entire process smoother and more efficient. Implementing a clean and concise layout ensures that all necessary information is communicated clearly, minimizing confusion.

Here are some best practices for creating an effective billing document:

- Keep it Simple: Use a straightforward layout that highlights key sections such as contact information, amounts due, and payment instructions.

- Organize Information Logically: Present the data in a way that is easy to follow. Group similar items together and use tables or sections for each category of information.

- Be Consistent: Stick to a uniform design across all your documents, using consistent fonts, spacing, and alignment for readability.

Recommended Table Layout for Clear Presentation

Including a table in your document to display charges helps break down each cost clearly. Below is a sample structure for an effective table:

Description Amount Date Basic Service Charge $500 01/05/2024 Utility Fees $50 01/05/2024 Late Fee $25 01/06/2024 Total Due $575 Clear and accurate formatting ensures that recipients understand the breakdown of charges and can easily process payments without confusion.

Benefits of Using an Invoice Template

Utilizing a predefined structure for billing can significantly streamline the process of creating and sending documents. It eliminates the need to start from scratch each time, saving valuable time while ensuring consistency across all transactions. Moreover, it reduces the risk of errors, ensuring that all necessary details are included and clearly presented.

Key Advantages of Predefined Billing Formats

- Time Efficiency: With a ready-to-use structure, you no longer have to format your documents manually. This allows you to quickly fill in the required information and send it without delay.

- Consistency: Using the same layout for all your financial documents helps establish a professional image and ensures that your recipients are familiar with the format.

- Accuracy: A well-organized structure reduces the chance of missing key information, such as dates, amounts, or payment terms, which can cause confusion.

- Easy Customization: Templates can be easily tailored to suit specific needs, whether adjusting fields for different charges or adding personalized notes.

Sample Billing Structure

The following table shows a basic format for an effective billing document:

Service Description Amount Due Date Basic Charge $500 01/15/2024 Additional Services $100 01/15/2024 Total $600 Using a structured document not only ensures that everything is organized but also helps maintain a professional approach in your financial transactions, improving communication and reducing mistakes.

Common Mistakes to Avoid

When preparing billing documents, several common errors can undermine their effectiveness and lead to confusion or delays in payments. These mistakes often result from overlooking important details or not adhering to a consistent structure. Recognizing these pitfalls can help ensure that your documents are clear, professional, and accurate.

Key Pitfalls to Watch Out For

- Missing Key Information: Failing to include crucial details such as the recipient’s information, service dates, or the correct amount can lead to disputes or payment delays.

- Ambiguous Payment Terms: Not clearly stating when payments are due or outlining penalties for late payments can cause confusion for the recipient.

- Inconsistent Formatting: A disorganized or inconsistent layout may make it difficult for the reader to locate important details quickly.

- Incorrect Amounts: Ensure that all charges are accurate, including any discounts, fees, or adjustments. Double-checking figures can prevent costly mistakes.

Example of Common Errors

Below is a table illustrating common mistakes in billing documents:

Error Type Impact Solution Missing Service Date Delays in payment due to confusion over when the service was provided Always include a clear date for services rendered Unclear Payment Terms Potential misunderstandings over payment deadlines or penalties State payment deadlines and any penalties clearly in the document Incorrect Total Amount Disputes over the total sum due, causing payment delays Double-check the total amount and ensure all charges are included By avoiding these common mistakes, you can ensure that your billing documents are effective, accurate, and prompt payments.

Digital vs Paper Rental Invoices

When choosing how to prepare and send billing documents, businesses and individuals face the decision between digital and traditional paper formats. Each option offers its own set of advantages and challenges, and understanding the differences can help you decide which method works best for your needs. The shift toward electronic documentation has gained momentum, but paper remains a preferred choice in certain circumstances.

Advantages of Digital Documents

- Efficiency: Digital bills can be created and sent within moments, saving time compared to manual processes.

- Cost-Effectiveness: Sending electronic files eliminates the cost of printing, postage, and other physical resources.

- Easy Storage: Digital records are easier to store, search, and access when needed, offering a more organized and accessible archive.

- Environmentally Friendly: Using digital formats reduces paper waste and contributes to eco-friendly practices.

Benefits of Paper Documents

- Traditional Preference: Some individuals or businesses prefer receiving physical documents for record-keeping or legal reasons.

- Physical Proof: Paper documents provide a tangible record of transactions, which may be important for those who require hard copies for filing purposes.

- Accessibility: Paper documents can be kept and reviewed offline, ensuring accessibility even without internet access.

- Legal Compliance: In some cases, physical documents may be required to meet specific legal or regulatory obligations.

Both formats offer distinct benefits. While digital records are more convenient, paper bills continue to play an important role for those seeking more traditional methods or dealing with specific legal requirements. Evaluating the context and your preferences will help you choose the right option for your billing practices.

How to Track Payments with Invoices

Efficient tracking of payments is a crucial part of maintaining a smooth financial process. By using well-structured billing documents, individuals and businesses can easily monitor which payments have been received and which are still pending. A clear payment record helps avoid confusion and ensures timely follow-up when necessary. Here’s how to effectively track payments using these documents.

Key Elements for Tracking

To accurately track payments, it’s important to include certain key elements in your billing statements. These include:

- Invoice Number: Each document should have a unique number for easy reference.

- Due Date: Clearly state the payment deadline to avoid any ambiguity about when payments are due.

- Payment Status: Indicate whether the payment is pending, partially paid, or completed.

- Amount Due: Ensure the total amount due is clearly visible, including any additional fees or taxes.

Organizing Payment Records

Once payments are made, keep an organized record by marking each document with the payment status and date received. Consider using a digital system or spreadsheet to track this information efficiently. Regularly updating the status will help you stay on top of your finances and ensure that no payments are overlooked.

What to Do After Sending an Invoice

Once you’ve sent a billing document, the process doesn’t stop there. It’s important to stay organized and monitor the payment status to ensure everything is processed correctly. There are several steps to take after sending out these records to help keep everything on track and ensure timely payment. Here’s a guide on how to proceed effectively.

Monitor Payment Status

After sending the document, it’s crucial to keep an eye on the payment status. This ensures that you can follow up with the client if needed. Consider setting reminders for the due date and periodically checking whether the payment has been received. You can use tools or software to track the status automatically.

Follow-Up on Unpaid Balances

If the payment has not been received by the due date, send a polite reminder. Ensure the tone is professional and offers clarity on how the payment can be made. If necessary, set up a series of reminders at regular intervals until the payment is processed.

Step Action Timing Monitor Payment Check payment status regularly Before and after the due date Send Reminder Send a gentle follow-up if overdue After the due date, if no payment is received Confirm Payment Verify when payment is received and update records Upon receipt of payment By staying proactive and organized, you can streamline the payment process and avoid any potential issues related to overdue payments.

Creating a Professional Document Look

Having a polished and clean design for your billing statements can make a significant impact on how your business is perceived. A well-organized document not only conveys professionalism but also ensures that clients can easily understand the details of the transaction. It’s important to focus on both the aesthetic and functional aspects to create a seamless experience for both parties.

Focus on Layout and Clarity

One of the most important aspects of a professional look is a clear and organized layout. The information should be presented in a logical order, making it easy for the recipient to quickly find important details such as payment amounts, dates, and contact information. A cluttered document can confuse the reader, so prioritize white space and simple formatting.

Use of Branding and Personalization

Including your business logo and brand colors helps create a personalized touch. Ensure that the design reflects your brand’s identity, which can make the document feel more authentic and trustworthy. Additionally, including a greeting or a personal note can strengthen client relationships and enhance the overall experience.

Key elements for a professional look include:

- Clear, well-organized sections with distinct headings

- Minimalistic and easy-to-read fonts

- Consistent use of colors that align with your branding

- Accurate, detailed, and concise information

By focusing on these design principles, you can create documents that not only look professional but also enhance your credibility and foster trust with your clients.

Essential Tools for Billing Creation

To streamline the process of preparing and sending billing statements, using the right tools is essential. These tools help ensure accuracy, save time, and provide a more professional and consistent appearance for your documents. With a variety of options available, selecting the right one can greatly improve the efficiency of your billing process.

Online Platforms and Software

There are numerous digital platforms and software solutions designed to simplify the creation of payment requests. These tools often come with pre-built designs, automatic calculations, and easy customization options. Many of them also allow for automated reminders and direct client communication, further reducing manual work.

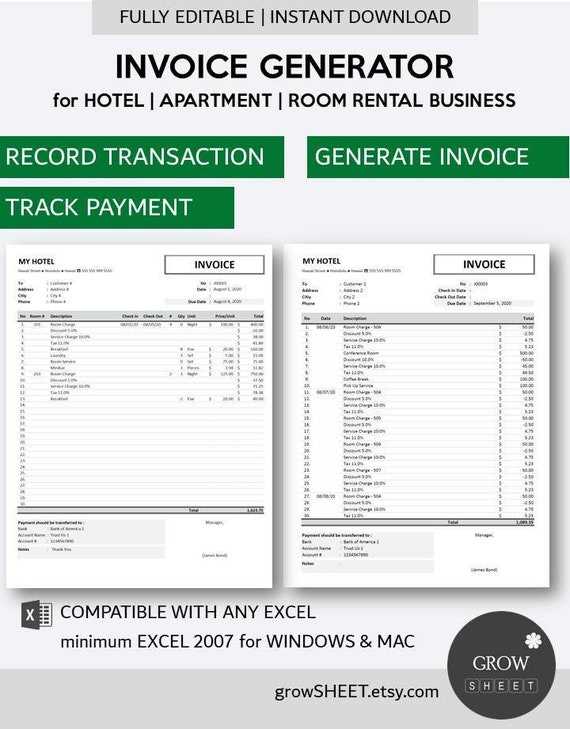

- Accounting Software: Popular accounting software like QuickBooks or Xero can generate detailed records and billing statements with ease.

- Online Generators: Websites like Wave or Zoho provide free or affordable templates for quick and easy billing statement creation.

- Spreadsheet Programs: Tools like Excel or Google Sheets can be customized to create professional-looking statements, with the added benefit of tracking payments and outstanding balances.

Additional Tools to Consider

- Payment Processing Systems: Integrating a payment processor like PayPal, Stripe, or Square can allow clients to pay directly through the billing statement, making the transaction smoother.

- PDF Editors: For those who prefer to manually customize documents, PDF editors like Adobe Acrobat provide advanced features for adjusting layouts, adding logos, and securing sensitive data.

- Email Management Tools: Platforms such as Mailchimp or Outlook can help in automating the sending of payment requests and follow-ups to clients.

Using the right tools ensures that the process of billing is not only efficient but also maintains a professional appearance that instills trust and reliability with your clients.

Legal Considerations for Billing Statements

When creating payment requests, it is important to understand the legal aspects involved to ensure that the document is both valid and enforceable. Certain details and practices need to be followed to avoid disputes and to comply with relevant regulations. From including the right information to understanding your responsibilities, knowing these considerations will help you maintain professionalism and safeguard your interests.

Key Legal Requirements

There are several elements that need to be present in billing documents to comply with the law and to ensure that both parties are protected:

Element Description Accurate Personal Information Both the payer’s and payee’s full names, addresses, and contact details should be clearly listed. Clear Payment Terms Specify the due date, payment methods accepted, and any penalties for late payment to avoid future misunderstandings. Itemized Charges Provide a breakdown of charges, including dates, quantities, and rates, so that both parties can easily understand the charges. Tax Information Ensure that taxes, such as sales tax or VAT, are clearly noted in compliance with local laws and regulations. Payment Confirmation After payment is received, issue a receipt or confirmation to formally close the transaction. Compliance with Local Laws

Each region or country may have specific rules governing payment requests, including how taxes should be handled and what information is required. Make sure to familiarize yourself with the legal guidelines in your area, such as:

- Consumer Protection Laws: Regulations regarding transparency and fairness in financial transactions.

- Data Protection Regulations: Ensure that personal and financial information is handled securely, in line with data protection laws.

- Contract Law: Understand how your payment documents relate to any rental or lease agreements, including any binding legal clauses.

By staying informed about the legal considerations, you can ensure that your documents are both clear and enforceable, which will minimize risks and contribute to smoother business transactions.

How to Handle Late Payments

Dealing with overdue payments is a common issue that requires a balanced approach. While it’s important to ensure that funds are collected on time, it is equally vital to maintain a professional and fair relationship with your clients. By addressing late payments effectively, you can minimize financial disruptions while also preserving business relationships.

To manage overdue amounts, start by sending a polite reminder once the payment deadline has passed. This gentle nudge serves as a reminder of the agreement and encourages timely payment. If the payment is still not received, follow up with a more formal notice outlining the consequences of continued delays, including any potential late fees or service interruptions. Always be transparent about these terms from the beginning to set clear expectations.

If the overdue payment persists, you may consider offering alternative payment options or a payment plan to accommodate the payer’s situation. Flexibility can sometimes encourage resolution without damaging the relationship. However, it is also essential to establish boundaries and know when to escalate the matter further, such as through legal channels or debt collection services, if necessary.

In all cases, communication is key. Approach the situation with professionalism, keeping records of all correspondences and agreed-upon actions to avoid misunderstandings and protect your interests.

Automating Invoice Creation and Management

Automating the process of generating and tracking payment requests can significantly improve efficiency and reduce human error. By using automation tools, businesses can streamline repetitive tasks, ensuring consistent and timely billing while allowing more focus on strategic operations. Implementing these systems provides a smoother experience for both the service provider and the client.

Key Benefits of Automation

- Time Efficiency: Automatically generated documents save valuable time compared to manual creation.

- Accuracy: Automation reduces errors that may arise from manual data entry or miscalculations.

- Consistency: Each request follows the same structure and format, ensuring professionalism in every transaction.

- Tracking and Reporting: Automated systems often come with built-in tracking features, making it easier to monitor payments and outstanding amounts.

Tools for Automation

There are several software solutions and platforms designed for automating billing tasks. Some of the most popular options include:

- Accounting Software: Tools like QuickBooks and Xero can generate and track payments with ease.

- Dedicated Billing Platforms: Services like FreshBooks and Zoho Invoice specialize in billing automation and management.

- Payment Processors: Platforms such as Stripe and PayPal offer built-in invoicing features that can be set to automatically generate billing statements and track payments.

By incorporating automation into your payment process, you can save time, enhance operational efficiency, and ensure that your clients receive their payment requests on schedule.

Free Templates vs Paid Options

When it comes to choosing a document creation tool, there are two main options: free resources and premium services. While both options offer distinct advantages, the right choice depends on the specific needs of the user. Free tools can provide basic functionality, but they often come with limitations. On the other hand, paid solutions may offer enhanced features and more customization options.

Advantages of Free Options

- Cost-Effective: Free tools are ideal for individuals or small businesses working with limited budgets.

- Quick Setup: Many free resources are easy to access and use, with little to no setup time.

- Basic Functionality: For those who need simple, straightforward documents, free options can be sufficient.

Benefits of Paid Services

- Customization: Paid tools typically offer a higher level of flexibility, allowing users to tailor the design and content to their specific requirements.

- Professional Features: Premium services often include advanced features like automated calculations, integration with other software, and reporting tools.

- Customer Support: Paid platforms usually provide better customer service, offering support for any technical issues or inquiries.

Ultimately, the choice between free and paid options depends on the complexity of your needs and the level of functionality required. Free tools may be sufficient for occasional use, while more regular users or businesses with specific needs may benefit from the additional features provided by paid services.