Download Free Online Invoice Template for Quick and Easy Billing

Managing financial transactions is a critical part of any business operation. Having a consistent and professional method for documenting payments ensures smooth communication with clients and partners. With a variety of tools available, creating detailed and clear payment records has never been easier or more accessible.

By using customizable documents that can be quickly adjusted to fit specific needs, entrepreneurs and companies can save valuable time. These tools offer a simple way to outline charges, due dates, and payment details, providing a seamless experience for both the sender and the recipient. Whether you’re a freelancer or a growing business, these resources help streamline the billing process and maintain professionalism.

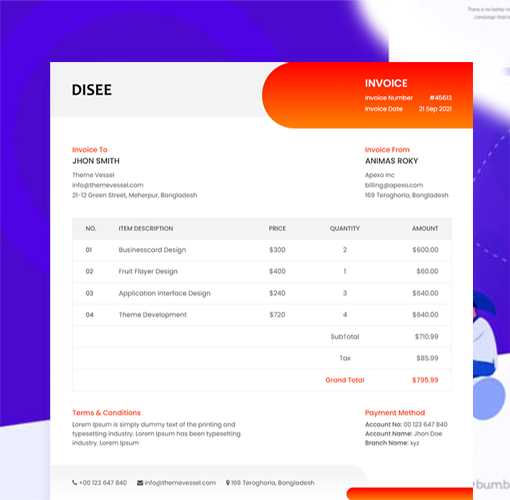

Ready-made documents offer a range of designs and structures, making it easy to choose the right format. The best part is that they can be accessed instantly, allowing you to focus on the work that truly matters, rather than worrying about creating complex financial records from scratch.

Free Online Invoice Templates for Your Business

For any business, having an efficient way to document payments and manage billing is essential. Customizable documents that clearly outline transactions help ensure smooth operations and foster trust with clients. By using pre-designed formats, you can save time and avoid the hassle of creating complex records from scratch.

Accessing these resources is a simple and effective way to maintain consistency across all financial communications. Whether you are a freelancer, small business owner, or a growing company, ready-made formats offer a flexible and professional solution to suit your needs. They allow you to include all the necessary information, such as payment amounts, dates, and service descriptions, in a well-organized and easy-to-read manner.

Customizable designs enable you to adapt documents to fit the unique requirements of your business. With a few simple modifications, you can personalize each file to match your branding or the specific needs of different clients, ensuring both clarity and professionalism in every transaction.

Why Use an Invoice Template?

Efficient billing is essential for maintaining financial order in any business. Using a structured format to document payments ensures that every transaction is clearly recorded and easy to track. Whether you’re managing a large company or running a small freelance business, having a standardized method simplifies the entire process and improves professionalism.

By utilizing ready-made documents, you can quickly generate clear, organized records without the need to create one from scratch each time. This not only saves time but also reduces the risk of errors, ensuring that all the necessary details are included in each transaction. These resources also offer a clean, uniform design, enhancing the clarity of the payment process for your clients.

Here’s a simple comparison of manual entry versus using a pre-structured format:

| Manual Creation | Using a Pre-Structured Format |

|---|---|

| Time-consuming process of designing each document | Instant access to customizable designs |

| Increased risk of missing important details | Clear sections for all essential information |

| Potential for inconsistent formatting | Uniform and professional appearance every time |

| High chances of repetitive errors | Minimized errors with easy-to-follow structure |

Benefits of Free Online Invoice Tools

Utilizing pre-built resources to generate payment records offers numerous advantages for businesses of all sizes. These tools help streamline the billing process, making it quicker, more accurate, and easier to maintain consistency across all transactions. Whether you are managing a small freelance operation or running a larger company, these tools can save time and reduce errors while keeping your financial records organized and professional.

Time-Saving Efficiency

One of the biggest benefits of using automated billing tools is the significant amount of time they save. Instead of manually creating each document, these resources provide pre-structured formats that can be customized quickly, allowing you to focus on other important tasks. Some of the key time-saving advantages include:

- Instant document creation: Generate a document with just a few clicks.

- Customization options: Easily personalize the design to suit your needs.

- Reduced manual work: No need to start from scratch each time.

Professionalism and Consistency

Another major benefit is the professional appearance and consistent format these tools offer. Having a uniform structure for all payment records enhances your business’s image, ensuring clients always receive clear, organized documents. Some of the key reasons for maintaining consistency include:

- Improved client trust: Clients will appreciate the clear and reliable format.

- Branded design: Customize to match your company’s colors and logos.

- Accurate details: Automatically include all necessary payment information.

Overall, these tools are a great way to simplify your billing process and maintain a professional image, no matter the size of your business.

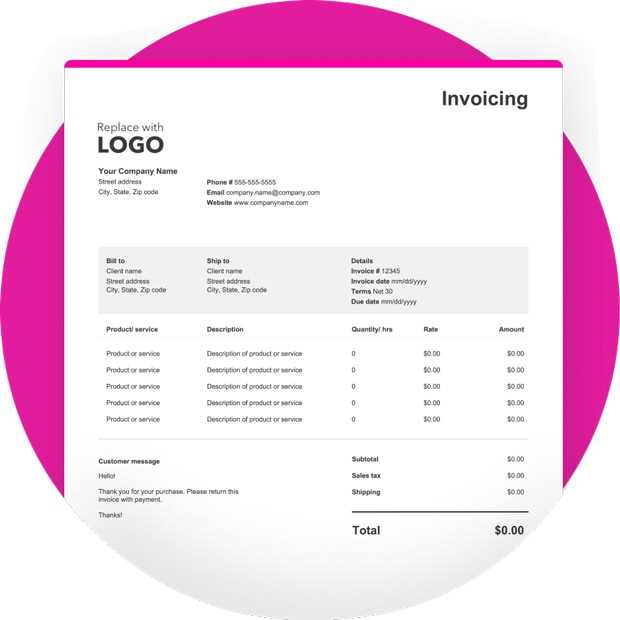

How to Customize Your Invoice Template

Personalizing your billing documents ensures that they reflect your brand identity while also including all the necessary information. Customization allows you to adjust the layout, content, and design, making the document more aligned with your business needs and client preferences. With a few simple steps, you can create a professional and branded payment record every time.

Step-by-Step Customization Process

Here are the key steps to personalize your document and make it fit your business needs:

- Modify the Header: Add your company logo, name, and contact details. This creates an immediate professional impression.

- Adjust the Layout: Choose between different formats and styles to find one that suits your preferences.

- Include Client Information: Ensure that the recipient’s name, address, and contact info are clearly displayed.

- Customize Item Details: List products or services provided with accurate descriptions, quantities, and prices.

- Set Payment Terms: Clearly outline payment deadlines, due dates, and accepted payment methods.

Advanced Customization Tips

If you want to go further in personalizing your document, consider these additional options:

- Add Custom Notes: Include personalized messages or terms and conditions that apply to the transaction.

- Adjust Font and Color Scheme: Choose fonts and colors that align with your brand for a cohesive look.

- Integrate Payment Links: For easy client payments, you can add links to payment gateways or banking details.

By customizing your billing records, you not only streamline your financial processes but also present your business in a more professional and organized way.

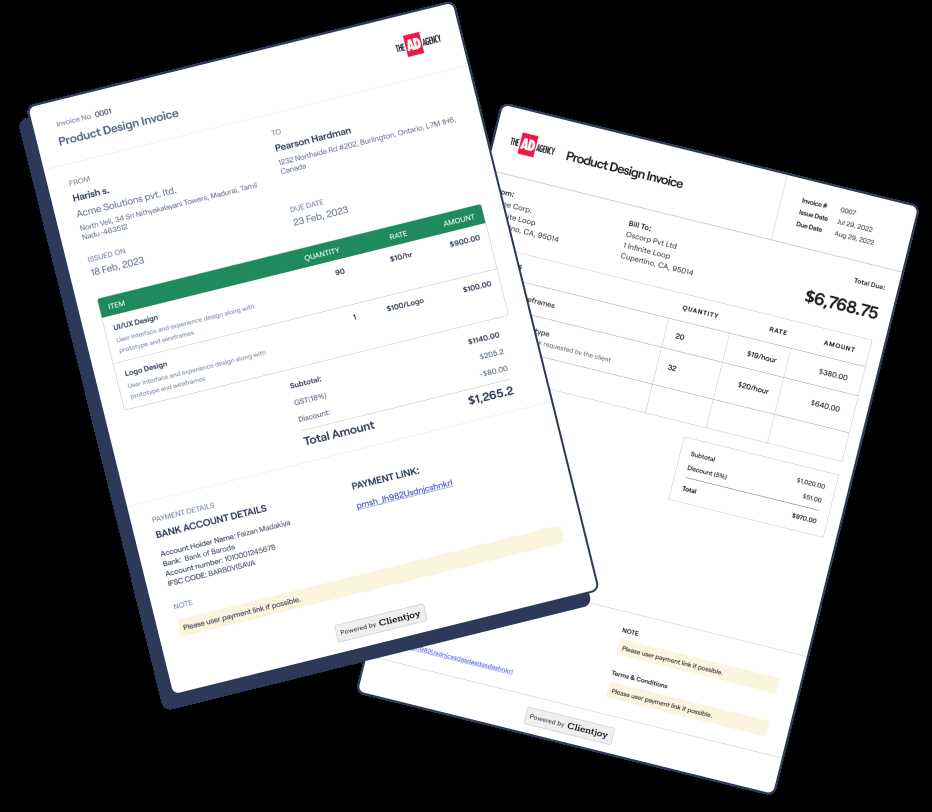

Best Platforms for Free Invoice Templates

When it comes to generating professional payment records, using the right platform can make all the difference. The best platforms offer a variety of customizable options that cater to different business needs, from simple designs to more advanced features. Whether you’re a freelancer or managing a larger enterprise, these services provide user-friendly tools that allow you to create documents quickly and efficiently.

Each platform provides a wide range of pre-designed formats that can be tailored to match your brand and the specific requirements of your clients. Many of these services also integrate with other business tools, such as accounting software, making it easier to manage your finances. Here’s a selection of some of the top platforms that offer high-quality and easy-to-use resources:

- Wave: Known for its simplicity and ease of use, Wave offers customizable designs and additional features like automatic tracking of payments and expenses.

- Zoho Invoice: Offers a wide range of customizable layouts, with the ability to automate reminders and track payments in real time.

- Invoice Simple: A user-friendly platform that allows you to create clear, professional payment documents in just a few steps. It also offers mobile apps for on-the-go use.

- PayPal Invoicing: Best for businesses already using PayPal, it allows you to send branded payment requests and track client payments all in one place.

- Invoicely: Offers a range of templates with features like recurring billing, expense tracking, and multi-currency support for global businesses.

These platforms make it easy to generate polished and consistent billing records, saving time while maintaining a professional appearance.

Save Time with Automated Invoice Generation

Automating the process of generating payment records can significantly reduce the time spent on administrative tasks. Instead of manually entering details for each transaction, automated systems can quickly generate professional documents based on predefined information. This allows you to focus more on growing your business and less on repetitive paperwork.

By using automation tools, you can streamline your entire billing process. These tools allow you to set up templates with customizable fields for client names, service descriptions, payment amounts, and due dates. Once the details are entered, the system automatically populates the document and formats it accordingly, saving you valuable time. This also helps eliminate the chances of human error and ensures consistency across all documents.

Key benefits of automated generation:

- Speed: Create and send documents in a matter of minutes, reducing time spent on manual tasks.

- Accuracy: Automatically populated fields reduce the risk of mistakes and missing information.

- Consistency: Maintain a uniform format for all transactions, presenting a professional appearance to clients.

- Convenience: Set up recurring billing for regular clients, making the process even more efficient.

Whether you need to issue documents weekly, monthly, or on-demand, automated tools provide the efficiency and accuracy you need to keep your business operations running smoothly. With automation, you can ensure that your payment records are always accurate and on time, while freeing up time for other essential tasks.

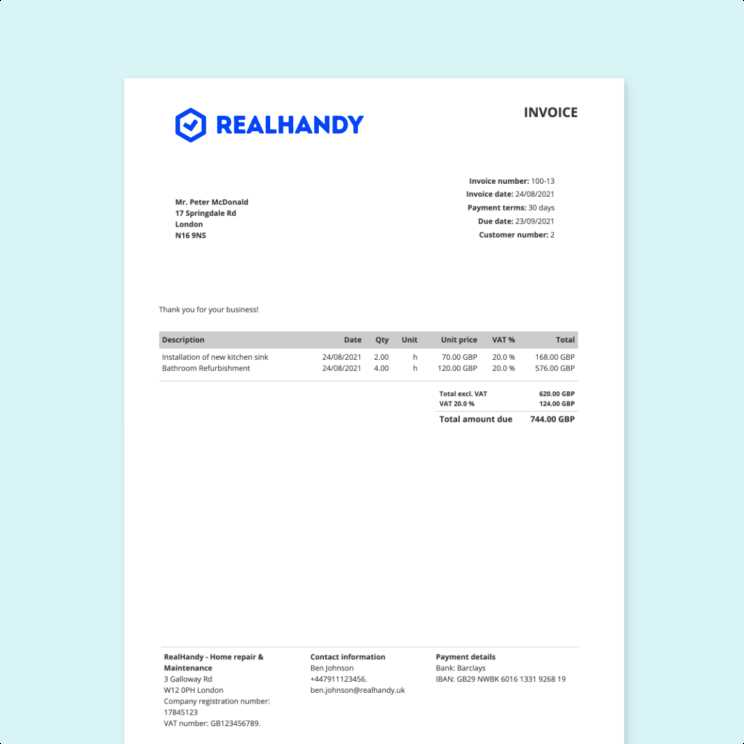

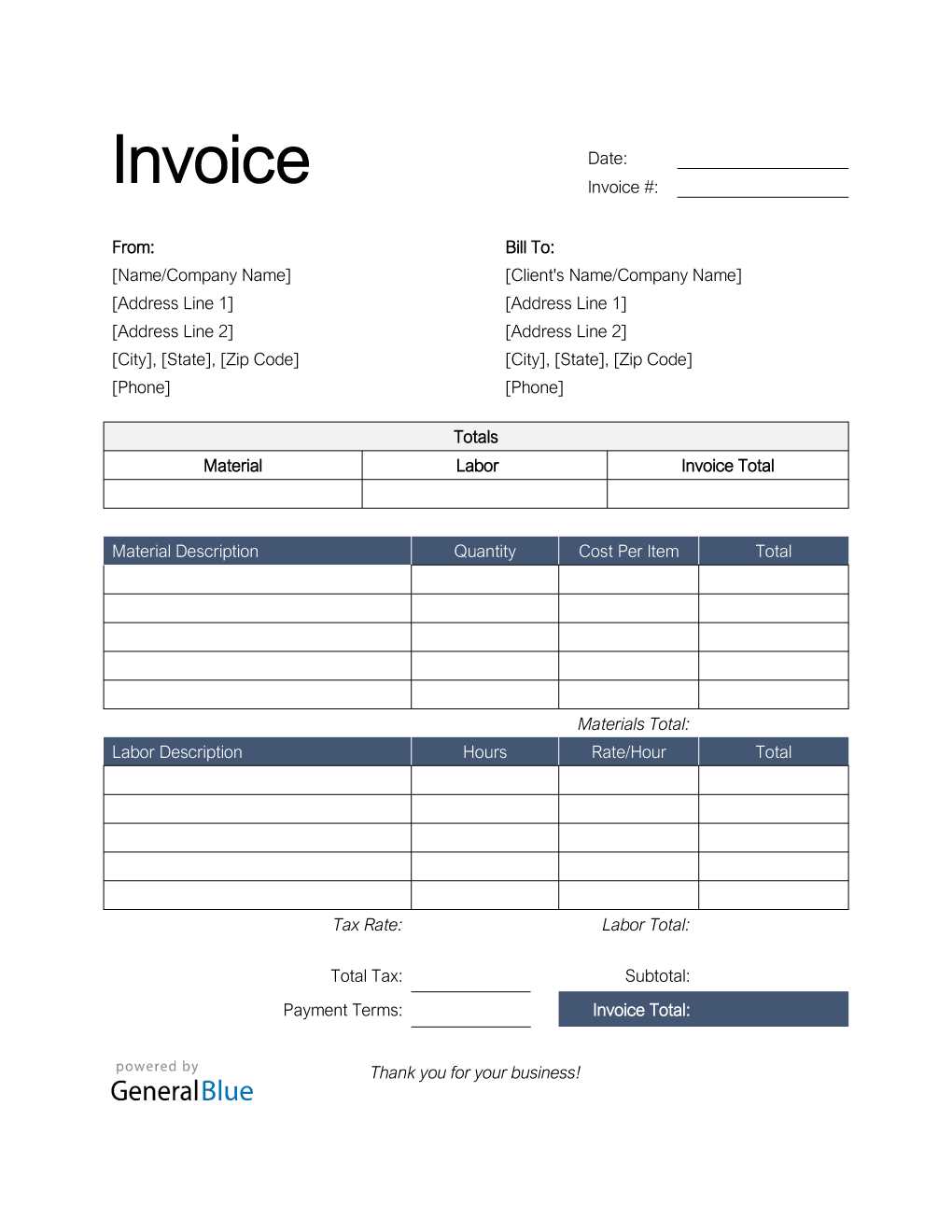

Common Features in Invoice Templates

Regardless of the design or format, most billing documents include a set of core features that are essential for proper record-keeping and clear communication between businesses and their clients. These features ensure that both parties understand the transaction details, payment terms, and expectations. Whether you are issuing a simple receipt or a detailed payment request, certain elements are universally necessary to maintain professionalism and accuracy.

The following table outlines the most common elements included in billing records:

| Feature | Description |

|---|---|

| Business Information | Includes the name, address, and contact details of the business issuing the document. |

| Client Details | Contains the recipient’s name, company (if applicable), and address to ensure proper identification. |

| Unique Identifier | A reference number or code assigned to each document for easy tracking and organization. |

| Itemized List | Detailed breakdown of goods or services provided, including quantities, descriptions, and unit prices. |

| Total Amount Due | The final amount owed, usually calculated by adding the cost of individual items, taxes, and any discounts. |

| Payment Terms | Details about the payment due date, acceptable payment methods, and any late fees or penalties for overdue payments. |

| Additional Notes | Optional section for terms and conditions, special instructions, or personalized messages to the client. |

Including these core features ensures that all critical information is present and easy to understand. By maintaining consistency across your payment records, you also promote professionalism and improve communication with clients.

How to Choose the Right Template

Selecting the right format for your payment records is essential for maintaining professionalism and ensuring that all necessary details are clearly presented. The right design will not only reflect your brand but also make the billing process more efficient and error-free. With various options available, it’s important to consider a few key factors when choosing a suitable document layout for your business needs.

Here are some important considerations to help you choose the best format:

- Business Size and Needs: Consider whether you need a simple, straightforward layout for smaller transactions or a more detailed design for complex invoices with multiple items and pricing.

- Customization Options: Look for formats that allow for easy customization, such as adding your logo, adjusting fonts, or including personalized messages or terms.

- Branding Consistency: Ensure that the design aligns with your brand’s identity, using matching colors, logos, and fonts to create a cohesive and professional appearance.

- Ease of Use: Choose a layout that is simple to navigate and use, so you can quickly input details and generate documents without confusion or unnecessary steps.

- Payment Terms and Flexibility: Some designs allow you to clearly specify payment due dates, discounts, or late fees, making it easier to manage client expectations and avoid misunderstandings.

By focusing on these factors, you can find a format that suits both your business style and your clients’ needs, helping streamline the payment process and ensure timely transactions.

Tips for Creating Professional Invoices

Creating well-structured and professional payment documents is essential for maintaining a positive relationship with your clients and ensuring timely payments. A clear and organized document not only communicates your expectations but also enhances your business’s credibility. Here are some key tips to help you create polished and professional billing records every time.

1. Keep the Design Clean and Simple: A cluttered or overly complicated layout can make it difficult for clients to quickly find essential information. Stick to a simple, clean design that highlights the most important details, such as the amount due, payment terms, and contact information.

2. Include All Necessary Information: Ensure that your document includes all relevant details, such as your company’s name and contact information, the recipient’s details, a unique reference number, and a clear description of the products or services provided. Missing information can cause confusion or delays in payment.

3. Use Professional Language: The tone of your document should reflect your business’s professionalism. Use clear, concise language and avoid informal or ambiguous terms. Include precise payment terms and deadlines, and make sure the client understands the expectations clearly.

4. Provide Clear Payment Instructions: Include clear instructions on how clients can pay, whether it’s through bank transfer, credit card, or another method. If applicable, provide payment details such as account numbers or links to online payment systems.

5. Be Consistent: Consistency is key to creating a professional image. Use the same format for all billing records, and include the same elements in every document. This will help clients recognize your business’s communications and make the payment process more streamlined.

6. Double-Check for Accuracy: Before sending out any payment requests, take a moment to review the document for errors. Ensure that all figures are correct and that no important information is missing. Small mistakes can create confusion and delay payments.

By following these tips, you can create polished and professional documents that build trust with your clients, reduce misunderstandings, and ultimately lead to faster payments.

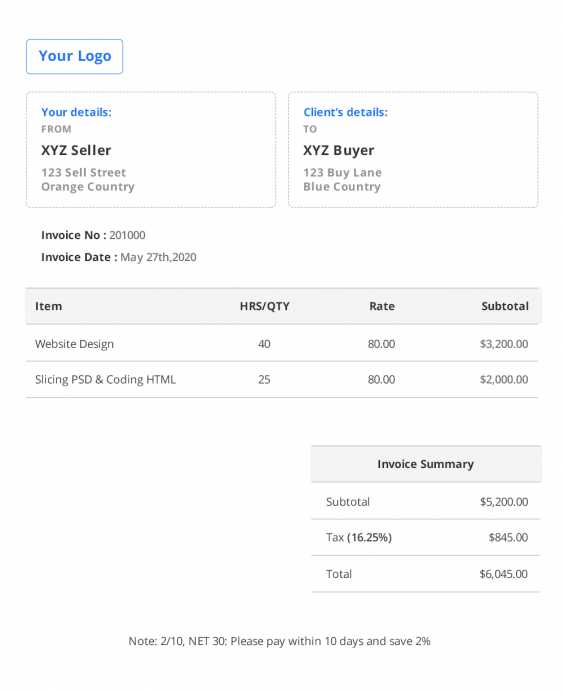

Invoice Templates for Freelancers and Contractors

Freelancers and contractors often need to create detailed billing documents for a variety of clients, and having the right format can make this process much easier. These professionals typically work on a project basis, with varying amounts and payment schedules. A well-structured document not only helps organize payments but also enhances professionalism and ensures prompt compensation.

For independent workers, a good billing record should include specific elements that clearly outline the services provided, payment terms, and expectations. These documents also need to be flexible enough to handle one-time projects or recurring work. Here are some important features to look for when choosing the right document format:

- Clear Breakdown of Services: List each task or service provided, along with the corresponding rates, to ensure transparency for both you and your client.

- Flexible Payment Terms: Make sure to include clear terms that account for deposits, milestone payments, or full payments due at project completion.

- Detailed Client Information: Include the client’s name, address, and contact details to prevent confusion, especially when working with multiple clients at once.

- Personalized Branding: Customize the document with your business logo and branding to maintain a consistent professional image.

- Recurring Billing Option: If you offer ongoing services, choose a format that allows for easy duplication or modification of recurring billing entries.

- Notes Section: Include a section for additional instructions, project-specific details, or payment instructions to make communication clearer.

By using the right structure for your billing records, freelancers and contractors can save time, minimize confusion, and ensure they get paid on time. These formats are especially valuable for managing multiple clients, projects, and payment schedules efficiently.

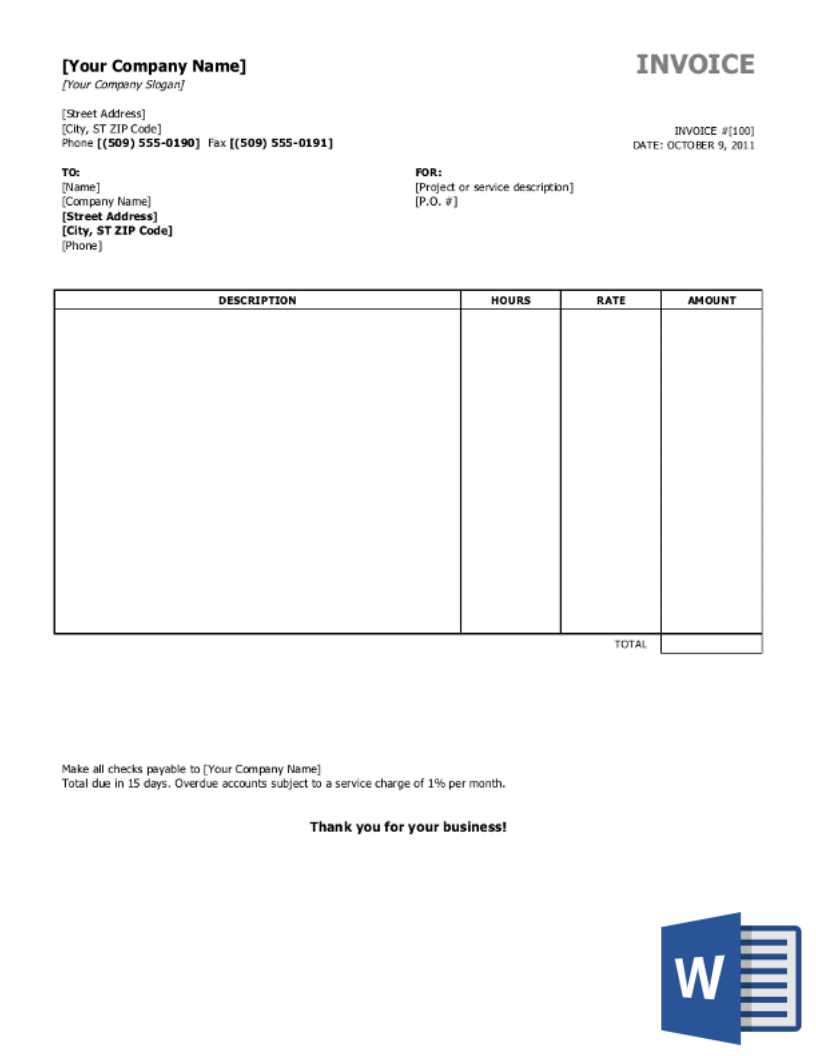

How to Download and Use Invoice Templates

Getting started with billing documents is easy when you have the right format at your disposal. Many platforms provide ready-made resources that can be downloaded and customized according to your needs. These documents save time and ensure consistency across all transactions, so you don’t have to design each one from scratch.

Here is a simple step-by-step guide to help you download and start using these pre-designed resources effectively:

- Choose the Right Platform: Start by selecting a trusted website or tool that offers a variety of formats suited to your needs. Look for one that allows you to easily customize the design and fields.

- Download the Document: Once you’ve found the format that works best for your business, simply click the download button. Most platforms offer formats in popular file types such as PDF, Word, or Excel.

- Customize Your Document: Open the downloaded file in the appropriate program and add your business details, logo, client information, and the specifics of the transaction. Ensure that all fields are filled in accurately.

- Review and Edit: Double-check all the information, including pricing, dates, and payment instructions. This step helps avoid mistakes that could delay payment.

- Save and Send: Once you are satisfied with the document, save it with a unique file name for easy tracking. You can then send it to your client via email or another method of your choice.

Using these pre-made formats can save you time, increase accuracy, and present a professional image to your clients. Just make sure to regularly update the document with any changes in your business or services to keep everything up-to-date.

Integrating Invoice Templates with Accounting Software

Streamlining the billing and accounting process is essential for managing your business finances effectively. By integrating billing document layouts with accounting software, you can automate and simplify much of the financial record-keeping. This integration allows for real-time data syncing, making it easier to track payments, expenses, and revenue without manual entry.

Many modern accounting tools offer built-in features that allow you to generate and customize payment requests directly within the software. This can save you time, reduce errors, and provide more accurate financial insights. Here’s how integration typically works and the benefits it offers:

| Feature | Description |

|---|---|

| Automatic Data Syncing | All information entered into your billing layout is automatically updated in your accounting records, keeping both systems aligned. |

| Seamless Payment Tracking | Once a payment request is sent and processed, the software updates the payment status and tracks outstanding balances. |

| Real-Time Reporting | Integrating your billing documents with accounting tools provides you with real-time reports, helping you monitor your cash flow and expenses. |

| Recurring Billing | For ongoing projects or subscription-based services, accounting software can automate recurring payments and reminders. |

| Tax Calculation | Automatically calculate taxes based on your location and the goods or services provided, helping you stay compliant and avoid manual errors. |

By integrating your billing documents with accounting software, you eliminate the need for double entry and reduce the risk of mistakes. This integration makes the entire financial process more efficient and accurate, allowing you to focus on growing your business rather than managing administrative tasks.

Key Elements of an Effective Invoice

An effective payment request is more than just a document; it’s a tool that ensures clear communication between you and your clients. Whether you’re billing for products, services, or consulting work, the right structure will help avoid confusion, speed up the payment process, and present a professional image. Understanding the key elements that should be included in every billing document is essential for smooth transactions and maintaining strong business relationships.

Here are the most important components to include in any effective billing record:

- Business Information: Clearly display your business name, address, contact details, and tax identification number (if applicable). This establishes credibility and ensures the client knows exactly who issued the document.

- Client Details: Include the name and contact information of the client receiving the payment request. Accurate details help ensure the document reaches the right person or department.

- Unique Reference Number: Assign a unique identification number to each document for easy tracking and record-keeping. This helps both you and your client reference the specific transaction in the future.

- List of Goods or Services Provided: Provide a detailed description of each item or service, including the quantity, rate, and total cost for each line item. This ensures clarity and transparency about what the client is being charged for.

- Subtotal and Total Amount Due: Display the subtotal of all items, followed by any applicable taxes, fees, or discounts. Clearly indicate the total amount due, making it easy for clients to understand the final charge.

- Payment Terms: Specify the payment due date, accepted payment methods, and any penalties or late fees for overdue payments. This helps set clear expectations regarding when and how payments should be made.

- Notes or Additional Information: Include any relevant additional information, such as specific terms of service, warranties, or special instructions. This section allows for personalized communication with the client.

Including these key elements ensures that your billing documents are complete, clear, and professional. A well-organized request will not only expedite payment but also reflect positively on your business’s professionalism and attention to detail.

How to Avoid Common Invoice Mistakes

Creating a billing document may seem straightforward, but there are several pitfalls that can lead to confusion, delayed payments, or even strained client relationships. Recognizing these common errors and understanding how to avoid them is crucial for maintaining professionalism and ensuring timely compensation for your work. By paying attention to detail and following best practices, you can significantly reduce the likelihood of mistakes that may hinder your financial processes.

Here are some strategies to help you steer clear of frequent errors:

- Double-Check Client Information: Always verify that the client’s name, address, and contact details are correct before sending. Mistakes in this area can lead to payment delays and confusion.

- Be Precise with Descriptions: Ensure that each service or product is clearly described, including the quantity, unit price, and total cost. Vague descriptions can lead to disputes about what was provided.

- Consistent Numbering: Use a unique identifier for each document to keep your records organized. This prevents overlap and confusion between multiple requests, especially when dealing with several clients.

- Clearly State Payment Terms: Include specific details about payment methods, due dates, and any penalties for late payments. This sets clear expectations and helps avoid misunderstandings.

- Review for Mathematical Errors: Carefully calculate totals, taxes, and discounts before sending. Simple mistakes can lead to overcharging or undercharging, which may affect your credibility.

- Include a Call to Action: Encourage prompt payment by including clear instructions on how to settle the account, along with your contact information for any questions or clarifications.

By being mindful of these common pitfalls, you can create more effective and professional billing documents. Taking the time to carefully review each document before sending it will not only enhance your reputation but also facilitate a smoother payment process, ensuring that you get compensated for your hard work in a timely manner.

Managing Payments with Invoice Templates

Effectively managing payments is essential for maintaining healthy cash flow and ensuring that your business operations run smoothly. One of the key tools for accomplishing this is having a well-organized and clear payment document that outlines the terms and amounts due. With the right format, tracking and managing payments becomes simpler, allowing for faster processing and fewer misunderstandings with clients.

Utilizing a structured document allows you to track not only what has been billed but also when payments are due, the status of any outstanding amounts, and the payment methods available. This can help reduce administrative workload and avoid confusion with clients. Here’s how using a detailed document format can help streamline payment management:

Benefits of Using Organized Payment Documents

- Clear Payment Terms: Establishing clear expectations for payment due dates, accepted payment methods, and penalties for overdue accounts helps ensure timely payments and reduces the chances of late fees or disputes.

- Easy Tracking: With detailed records for each transaction, you can easily track which clients have paid, which invoices are pending, and which amounts are outstanding, helping you stay on top of your finances.

- Improved Client Communication: A well-organized document makes it easy to follow up with clients about outstanding balances and can be used as a reference for any future correspondence related to the payment process.

How to Streamline Your Payment Process

- Automate Reminders: Many platforms offer automated reminder systems that notify clients of upcoming or overdue payments. This can save you time and ensure that payments are received on time without requiring constant manual follow-up.

- Offer Multiple Payment Methods: Providing different payment options, such as bank transfers, credit cards, or online payment platforms, makes it easier for clients to pay you quickly and efficiently.

- Maintain Accurate Records: Keep a record of all transactions, including partial payments, tax calculations, and discounts. This will help you stay organized and prevent mistakes when reconciling your accounts.

By managing payments with a clear and consistent billing system, you can reduce delays, improve client r

Tracking and Organizing Invoices Online

Staying organized is key to maintaining financial clarity and efficiency in any business. Managing multiple billing records manually can be overwhelming, especially as your business grows. Utilizing digital tools to track and manage your payment documents ensures that you never lose track of outstanding balances or important due dates. By keeping everything in one place, you can easily access, update, and monitor the status of all your transactions.

Digital solutions offer a streamlined approach to organizing and tracking your payment requests. With the right system, you can automate many aspects of the billing process, reducing errors and saving time. Here’s how you can manage your documents more effectively:

Key Features of Digital Tracking Systems

- Centralized Record Keeping: All your documents are stored in one secure platform, making it easy to access past and current records whenever you need them.

- Automatic Updates: Many systems automatically update the status of each request, including payment confirmations and overdue notices, helping you stay on top of your finances.

- Easy Sorting and Filtering: With digital systems, you can sort your documents by date, client, or status, allowing you to quickly find the information you need without sifting through piles of paperwork.

- Customizable Alerts: Set up automatic reminders for upcoming payment deadlines, overdue amounts, or upcoming client meetings to ensure no task is forgotten.

- Secure Cloud Storage: Storing documents in the cloud provides secure, off-site access to your records, allowing you to view them from any device and protect them from data loss.

Benefits of Organizing Your Documents Digitally

- Time Savings: With everything organized and automated, you spend less time on administrative tasks and more time growing your business.

- Improved Accuracy: Reducing manual entry helps minimize human errors, ensuring that your billing records are accurate and up to date.

- Increased Professionalism: A well-organized system reflects a professional image to your clients, making it easier to send polished documents and follow up on payments seamlessly.

- Easy Reporting: Many platforms offer built-in reporting tools, giving you insights into your revenue, payment history, and client habits, which can help with financial forecasting and decision-making.

By implementing a digital solution for tracking and organizing your payment documents, you can streamline your workflow, stay organized, and improve both your financial management and client relationships. This efficient app

Free Invoice Templates for Small Businesses

For small businesses, managing finances efficiently is essential to maintaining cash flow and sustaining growth. One of the key components of financial management is ensuring that you can create and send clear, professional payment documents quickly. Having a structured format for these documents can save time, reduce errors, and enhance your business’s professionalism. Fortunately, there are many accessible tools available that provide customizable formats for your billing needs without any cost, helping small businesses operate smoothly without spending on expensive software.

Here are some benefits of using customizable billing formats for your small business:

Why Use Customizable Billing Documents?

- Cost-Effective: These tools allow you to create professional-looking documents without investing in expensive software, keeping costs low for your small business.

- Time-Saving: Pre-designed structures make it easier to fill in the details quickly, speeding up the process of generating payment records and reducing the chances of mistakes.

- Professional Appearance: Even if you’re a solo entrepreneur or a small team, a well-designed document helps present your business in a credible and trustworthy light to clients.

- Customization Options: You can tailor the layout to suit your specific needs, from adding your logo and business name to adjusting the content based on the nature of your services or products.

Where to Find Useful Billing Formats for Your Business

- Spreadsheet Software: Platforms like Google Sheets or Microsoft Excel offer ready-made layouts that you can personalize and save for future use.

- Accounting Software: Many basic accounting platforms offer free billing layouts as part of their services, designed for small business owners looking for simple solutions.

- Online Resources: There are multiple websites that provide downloadable structures in various formats such as Word or PDF, ideal for quick customization.

- Mobile Apps: Some mobile apps offer customizable payment documents that can be easily created from your phone, allowing for flexibility and convenience on the go.

Utilizing customizable formats for your payment requests ensures your business remains organized, efficient, and professional. With a variety of tools available, you can create clear, accurate, and timely documents without unnecessary complexity or expense.

Why Switching to Online Templates is Smart

Adopting digital solutions for managing your billing documents is a smart move for any business. In today’s fast-paced environment, using traditional, paper-based methods can be time-consuming, error-prone, and inefficient. By switching to customizable, digital formats, businesses can streamline their operations, improve accuracy, and save valuable time. The shift to digital also allows for easy access to past records, automatic updates, and the ability to manage documents from anywhere, all of which contribute to more efficient workflows.

Here are some key reasons why making the transition to digital billing formats is beneficial:

- Enhanced Efficiency: Digital formats allow for quick creation and modification, reducing the time spent on manual entry and ensuring that you can generate payment documents in a matter of minutes.

- Increased Accuracy: By using structured layouts, you minimize the chances of errors, such as incorrect calculations or missing information, which are common with handwritten or manually created records.

- Convenience: With cloud-based solutions, you can easily access and manage your documents from any location, whether you’re in the office, at home, or on the go. This makes it easier to keep track of payments and client interactions.

- Improved Professionalism: Digital formats give your documents a polished, uniform look, which can enhance your business’s image and help foster trust with clients.

- Automated Reminders and Follow-ups: Many digital platforms offer automated features, such as reminders for overdue payments, reducing the need for manual follow-ups and ensuring that no payment is overlooked.

By switching to digital billing solutions, businesses can save time, reduce human error, and improve overall operational efficiency. The benefits of better organization, easier document management, and improved client communication make digital formats a smart choice for companies of all sizes.