Online Shopping Invoice Template for Efficient and Professional Billing

Managing financial records efficiently is a key aspect of any business, especially for those operating in the digital marketplace. Ensuring that all transactions are accurately documented can save time, reduce errors, and foster a professional relationship with customers. One of the most effective ways to achieve this is by using a structured document that outlines each sale in detail.

By utilizing a standardized document format, sellers can easily generate consistent and clear records for each purchase. This allows for smooth communication with customers and helps to prevent misunderstandings regarding payments. Whether you are just starting or managing a growing business, having an organized system in place can make the entire process seamless and more efficient.

Customizing these records to fit your specific needs not only enhances your business’s professionalism but also streamlines the management of orders. From tracking product sales to ensuring compliance with tax regulations, using the right document structure can simplify the administrative side of your operations.

Understanding Online Shopping Invoice Templates

In any e-commerce business, keeping accurate records of each transaction is essential for smooth operations. A well-structured document that provides clear details about a sale helps both the business owner and the customer track purchases, payments, and product details. Such documents simplify bookkeeping, ensure tax compliance, and build trust between sellers and buyers.

Why Structure Matters

Having a consistent format for your records is crucial for several reasons. It not only ensures accuracy but also makes it easier to track and manage financial data. A standardized document allows you to:

- Keep a clear record of transactions

- Prevent confusion with customers about payments

- Enhance your business’s professionalism

- Make tax filing and financial reporting simpler

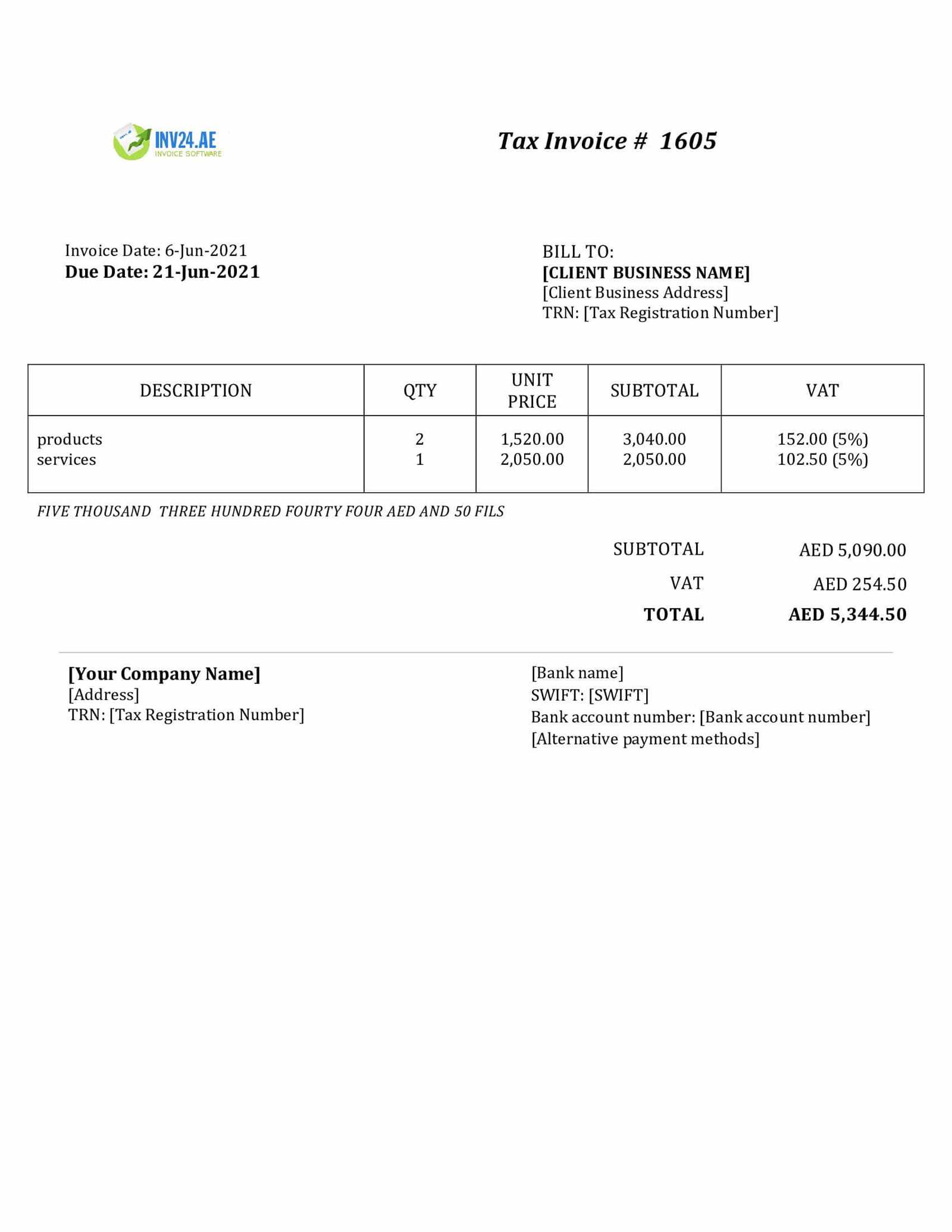

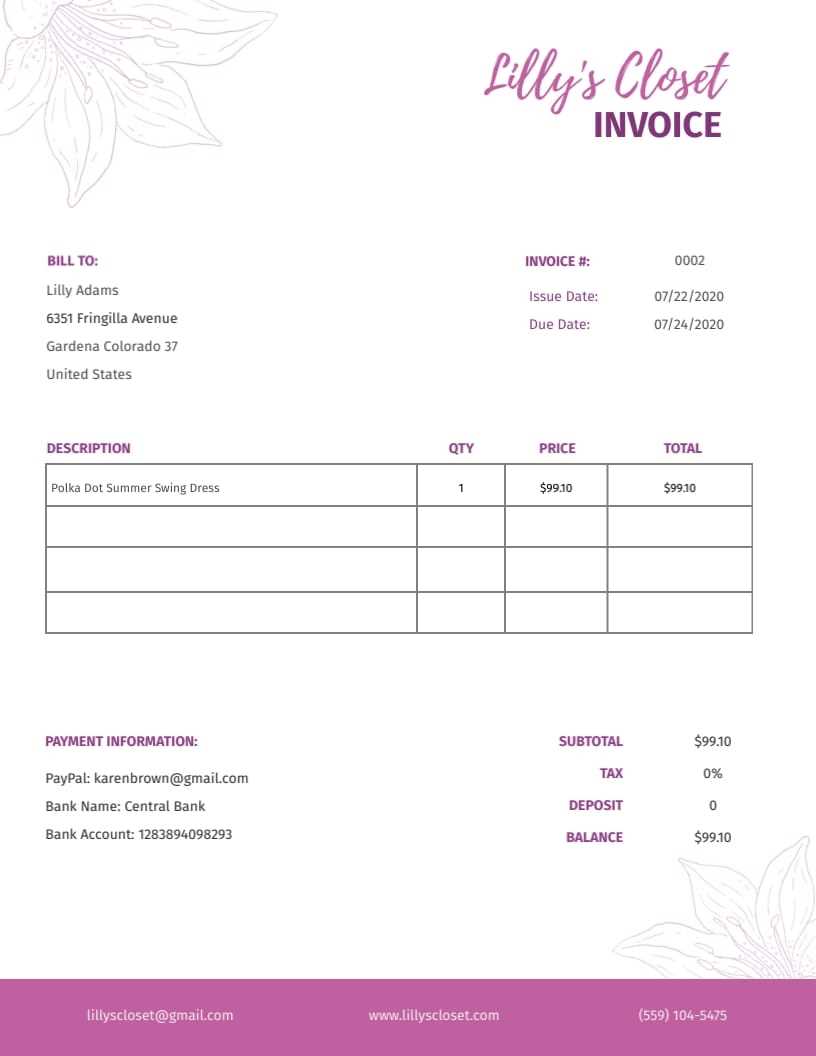

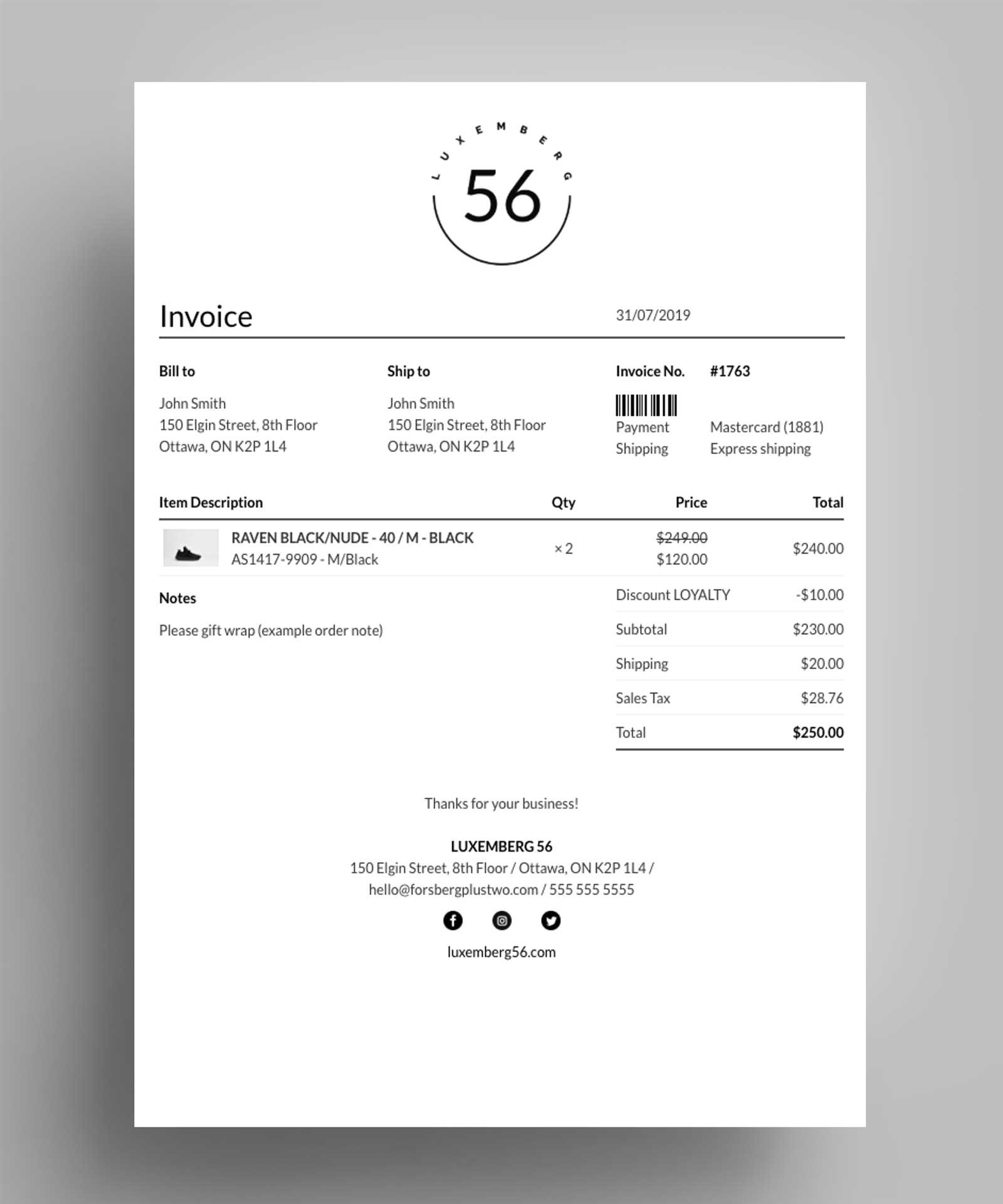

Essential Elements of a Proper Record

A complete and effective sales document should include the following key components:

- Customer Information: Name, address, and contact details for easy identification.

- Purchase Details: Item names, quantities, and individual prices to clarify what has been purchased.

- Total Amount: The full cost, including applicable taxes and shipping fees.

- Payment Information: Clear details about how the transaction was paid, whether via card, bank transfer, or other methods.

- Business Details: Contact information, including company name, address, and tax ID number, for transparency and credibility.

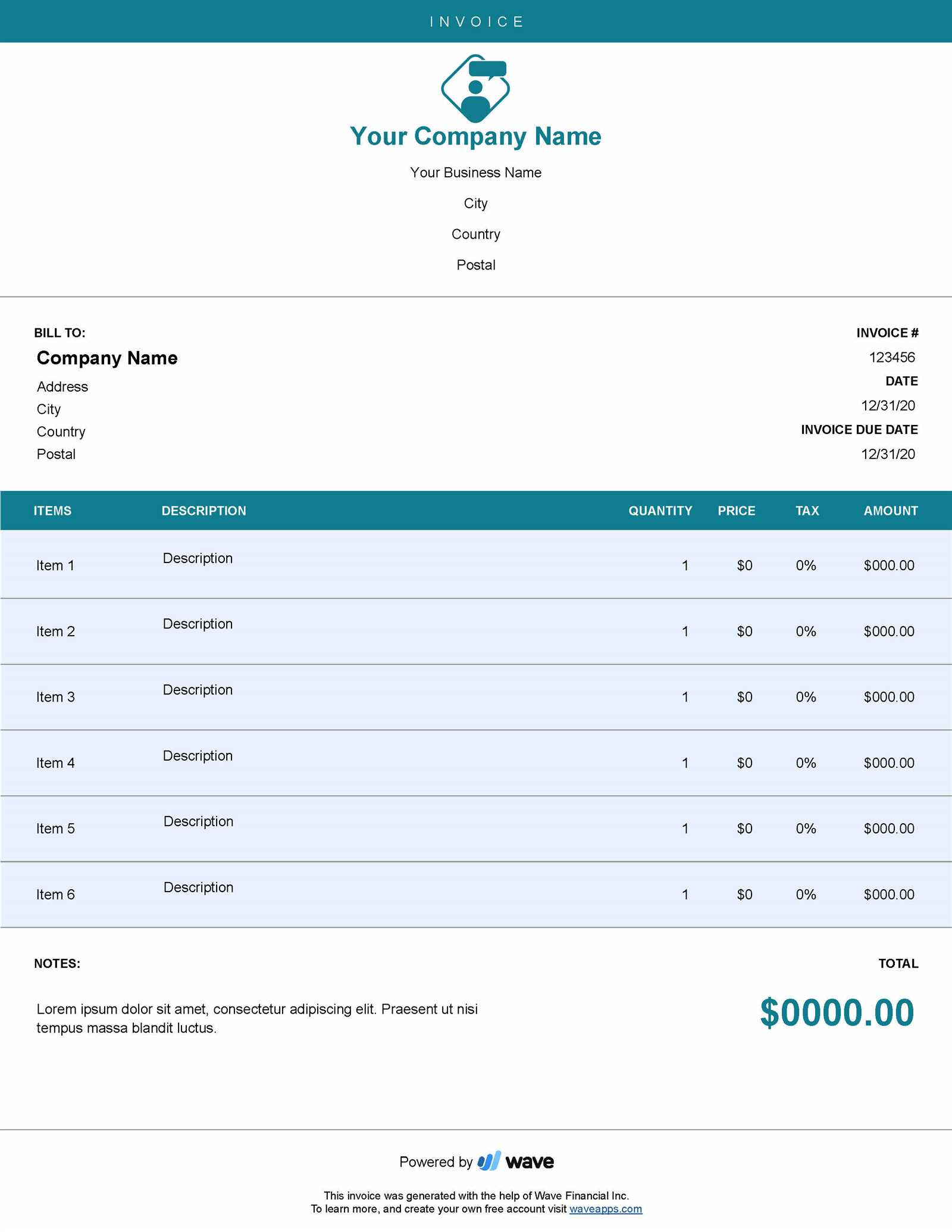

What is an Invoice Template

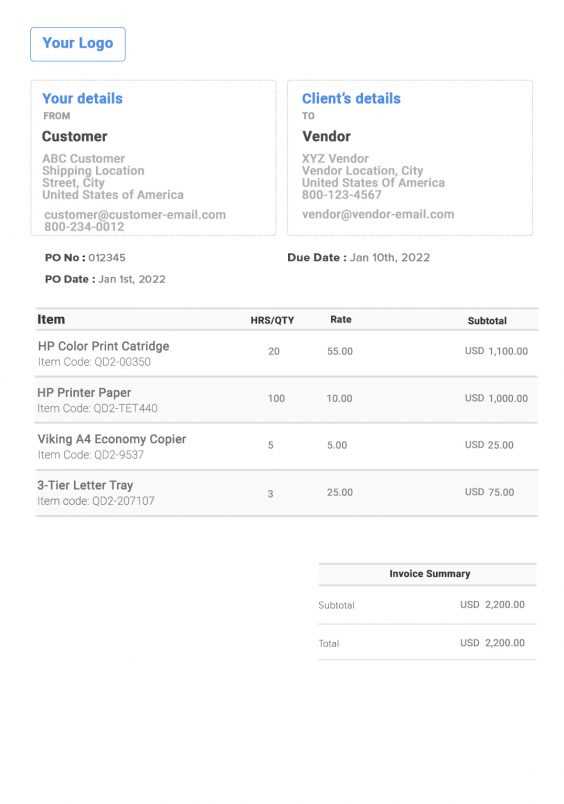

A well-organized document designed to capture essential details of a transaction is crucial for maintaining clarity and professionalism in any business. It serves as a standardized tool that outlines the products or services purchased, payment terms, and other important information needed to complete a transaction. By using such a structured format, businesses can ensure consistent, accurate records for each sale.

Key Features of a Structured Record

A properly designed sales document includes several critical elements that help both the seller and the buyer keep track of the transaction:

- Buyer and seller contact details

- A list of purchased items or services with corresponding prices

- Total amount due, including any applicable taxes and fees

- Payment terms and instructions

- Unique identification number or reference for the transaction

Why It’s Essential for Businesses

Using a consistent format for all transactions provides several advantages. It simplifies accounting and inventory management, helps prevent errors, and ensures that all legal requirements are met. Whether you’re just starting out or managing a large-scale operation, having a reliable system in place is vital for smooth business operations.

Key Benefits of Using Templates

Utilizing a pre-structured document for each transaction offers significant advantages that improve efficiency, consistency, and professionalism in business operations. By relying on a standardized format, businesses can reduce the chances of errors, save time, and create a more organized workflow.

| Benefit | Description |

|---|---|

| Time Savings | Pre-made formats eliminate the need for creating documents from scratch, speeding up the process of generating records for each transaction. |

| Consistency | Using a standard format ensures that every record looks professional and includes all necessary information, making it easier to review and process. |

| Accuracy | Structured documents reduce human error by ensuring all fields are filled out properly and in the correct order, leading to fewer mistakes. |

| Brand Professionalism | Having a uniform appearance in all sales records helps build a reliable and trustworthy image for your business. |

| Customization | Templates can be easily tailored to fit specific business needs, allowing businesses to add personal touches while maintaining organization. |

Why Accuracy Matters in Invoices

Maintaining precision in transaction records is crucial for the smooth operation of any business. Small errors in these documents can lead to misunderstandings with customers, financial discrepancies, or even legal issues. Ensuring that all details, such as pricing, quantities, and payment terms, are correct from the outset helps avoid complications down the line.

Impact on Customer Trust

When a business provides incorrect details in a sales record, it can cause confusion for the customer, potentially leading to disputes. Accuracy reassures buyers that they are being charged correctly and fairly, which enhances trust and strengthens the customer relationship. A precise record reflects professionalism and shows that the business values its customers.

Financial and Legal Considerations

Incorrect details in transaction records can cause problems beyond just customer relationships. For example, errors in pricing or tax calculations can result in financial losses or problems during audits. Inaccurate reporting can also lead to compliance issues, especially when it comes to tax regulations. Accurate records help ensure that the business meets its legal obligations and avoids potential penalties.

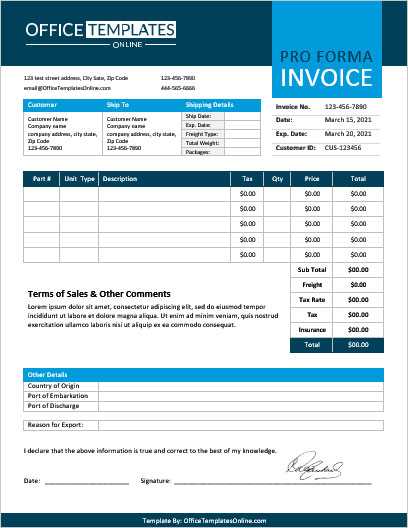

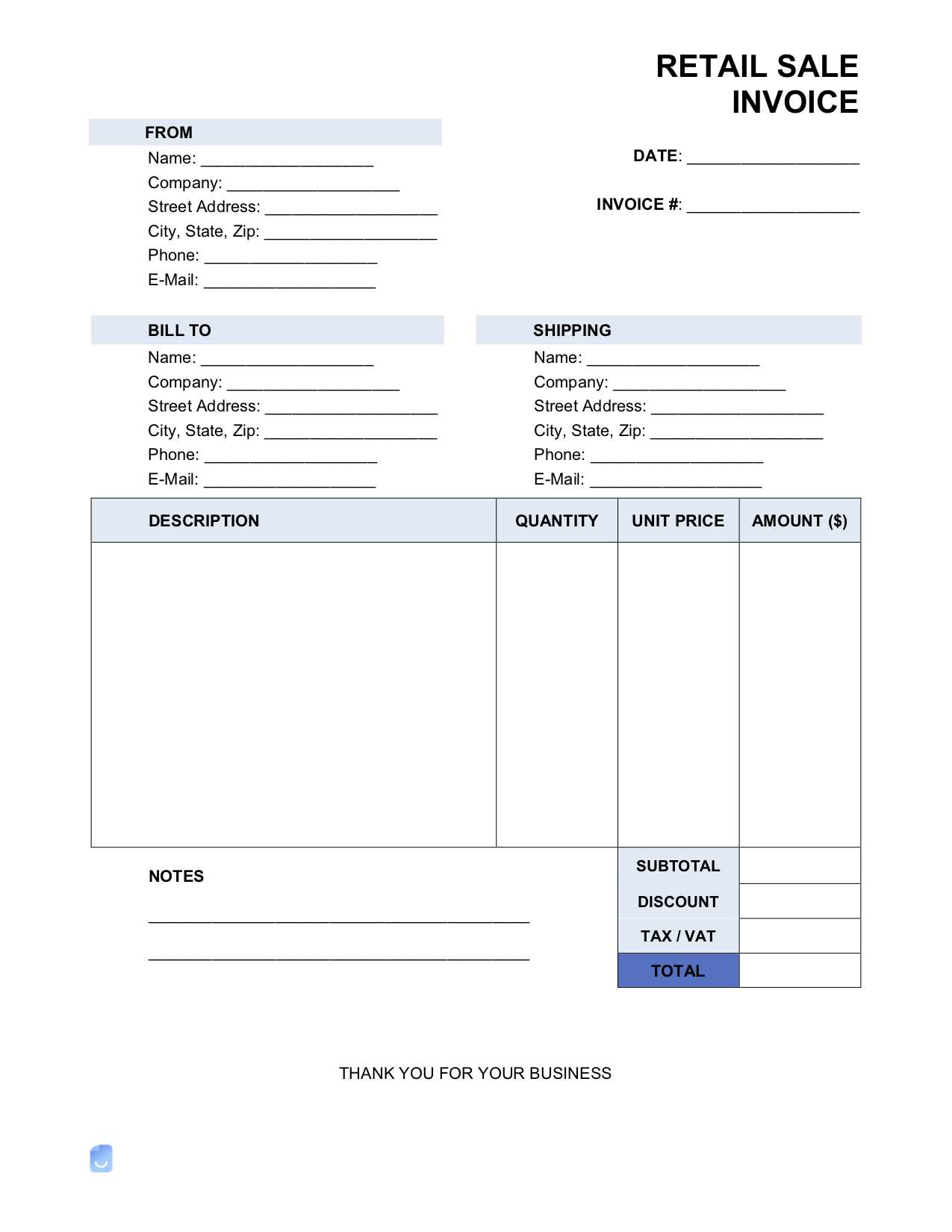

How to Create Your Own Template

Designing a custom document format for your business allows you to personalize the way you track and communicate sales information. By creating a structure that aligns with your needs, you ensure that every essential detail is included, while keeping your records consistent and professional. Here are the key steps to creating an effective record-keeping system for your transactions.

Step-by-Step Guide to Designing Your Record

When creating a custom document, the following elements should be considered to ensure it covers all necessary aspects of a transaction:

| Step | Description |

|---|---|

| 1. Determine Key Information | Decide what details need to be included, such as customer information, product descriptions, quantities, pricing, and payment terms. |

| 2. Choose a Layout | Design a layout that is clean and easy to read, with clear sections for each part of the document. Group related items together for better clarity. |

| 3. Add Custom Branding | Incorporate your company logo, colors, and contact information to make the document uniquely yours and reinforce your brand identity. |

| 4. Include Payment Instructions | Clearly state payment methods, due dates, and any late fees or terms for the transaction. |

| 5. Review for Consistency | Ensure that the structure and format remain consistent across all documents to maintain professionalism and prevent confusion. |

Tips for Refining Your Custom Record

Once the basic structure is in place, consider refining it by adding features such as a unique reference number for each document or space for notes to clarify specific terms. Testing it with a few mock transactions will help identify any areas that need improvement. A well-designed document will streamline your workflow and ensure all records are accurate and complete.

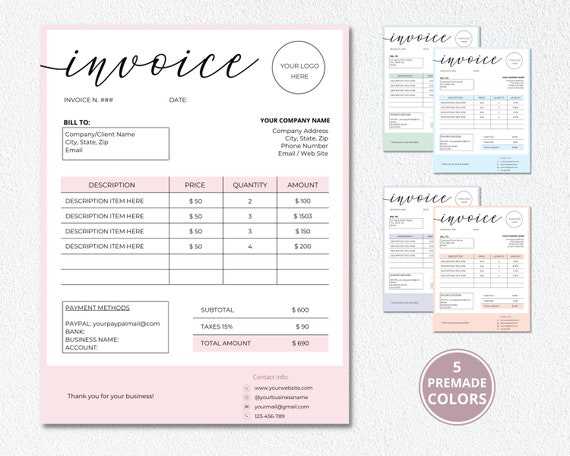

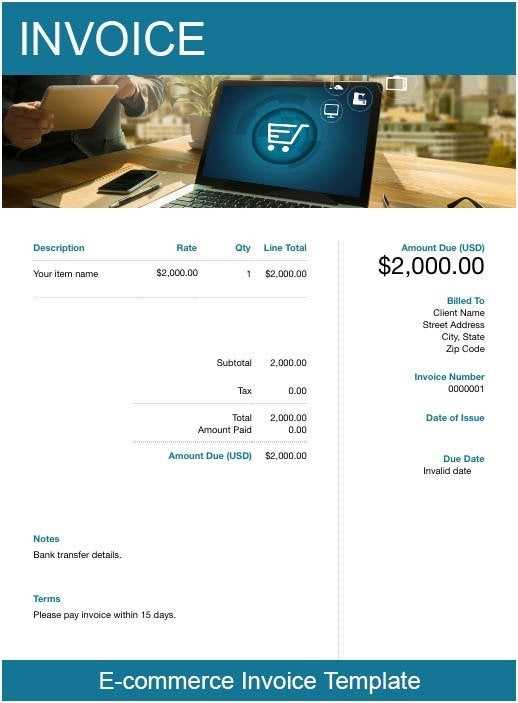

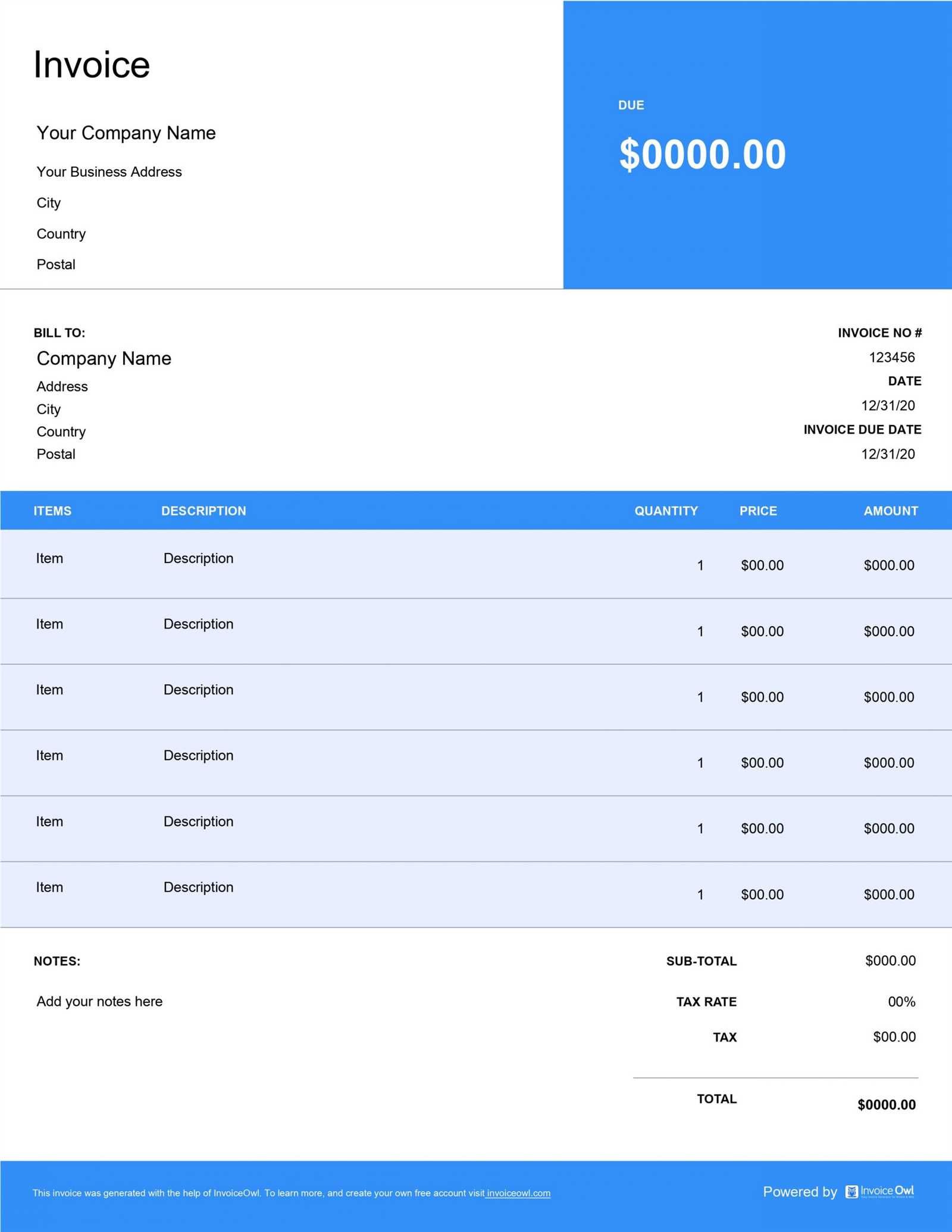

Free Templates vs Paid Options

When it comes to creating a standardized document for business transactions, there are two primary options: free solutions and paid services. Each comes with its own set of advantages and limitations. Understanding the differences between these options is crucial to making the right choice for your business needs.

Advantages of Free Solutions

Free options can be an excellent starting point for businesses that are just getting off the ground. They typically offer basic functionality and enough flexibility to cover the essential details of a sale. Some benefits of using free solutions include:

- Cost-effective: No financial investment is required, making it ideal for small businesses with limited budgets.

- Ease of access: Many free options are readily available online, requiring little to no setup time.

- Simplicity: Free options often provide simple, straightforward layouts, making them easy to use for basic documentation needs.

Benefits of Paid Solutions

Paid solutions typically offer advanced features and customization options that can better suit the needs of growing businesses. These services often provide:

- Customization: Paid options allow for greater flexibility in design, enabling businesses to fully align their documents with their branding.

- Advanced functionality: Features like automated calculations, tax management, and integration with accounting software are often available with paid services.

- Customer support: With paid options, businesses can often access dedicated support teams to troubleshoot issues and ensure smooth operation.

While free solutions can serve well in the short term, paid options are better suited for businesses that require scalability, higher customization, and more advanced features. Depending on the size and complexity of your operation, choosing the right solution can significantly impact the efficiency of your workflow.

Customizing Invoice Templates for Your Business

Personalizing the format used to document transactions is crucial for creating a professional and cohesive brand image. Customizing the structure not only reflects your business’s unique identity but also helps ensure that all necessary details are clear and accessible. A customized document can improve customer experience and streamline your internal processes.

One of the key benefits of tailoring these documents is that it allows you to include specific information that is unique to your business needs. Whether it’s adding your company logo, altering the layout, or adjusting the terms, customizing the format ensures that all relevant data is easily understood. Consider the following steps to make your records align with your brand:

- Branding: Incorporate your company logo, colors, and fonts to make the document distinctly yours and reinforce your business’s identity.

- Field Customization: Add or remove fields to ensure that only the most relevant information is displayed. This can include anything from product descriptions to special instructions.

- Payment Details: Modify payment terms, include installment options, or add late fee clauses based on your business model.

- Legal Compliance: Ensure that your business’s tax ID, regulatory information, and any other legal details are included to avoid confusion or legal complications.

By tailoring your documents to fit your business, you can create a seamless, branded experience for your customers while making your internal workflow more efficient. A custom layout not only improves functionality but also helps you maintain a consistent image across all communication channels.

Essential Information to Include in Invoices

Every transaction record needs to clearly communicate all relevant details to avoid confusion and ensure smooth processing. A well-organized document provides transparency for both the buyer and the seller, ensuring that there are no misunderstandings regarding payment or the goods and services provided. Including the right elements helps maintain professionalism and facilitates smoother financial and legal procedures.

Key Elements to Include

To create a comprehensive record, it’s important to include the following essential details:

| Information | Description |

|---|---|

| Transaction Reference Number | A unique identifier for each document that helps track and manage records. |

| Buyer and Seller Information | Names, addresses, and contact details of both parties involved in the transaction. |

| List of Goods or Services | Details of what was sold, including descriptions, quantities, and unit prices. |

| Total Amount | The total cost, including any taxes, discounts, or additional fees. |

| Payment Terms | Details on when payment is due, including any late fees or early payment discounts. |

| Payment Methods | Information on accepted payment options and instructions for how to make payments. |

Why These Details Matter

These elements are not only necessary for proper documentation but also help ensure that transactions are clear and legally sound. Including the correct information aids in accounting, tax reporting, and reduces the potential for disputes. By presenting all essential data in a structured manner, you create a smoother experience for both parties.

Best Practices for Professional Invoices

Creating a polished and professional document for business transactions is essential for establishing trust with clients and ensuring timely payments. A well-structured document not only helps avoid confusion but also reflects positively on your business, showcasing your attention to detail and commitment to professionalism. By following certain best practices, you can enhance the efficiency and clarity of your transactions.

The following table outlines key practices for creating professional and effective documents:

| Practice | Description |

|---|---|

| Clear Layout | Ensure that all information is organized and easy to read, with logical sections for items like payment details, product descriptions, and totals. |

| Accurate Information | Verify that all data, such as prices, taxes, and contact information, is accurate and up-to-date to avoid misunderstandings or delays. |

| Consistency | Maintain a consistent format across all documents to create a professional appearance. Use the same fonts, colors, and layout styles for each record. |

| Timeliness | Send the record promptly after the transaction is completed. This helps maintain smooth cash flow and shows that you are organized. |

| Branding | Incorporate your company logo, colors, and contact details to reinforce your brand identity and ensure recognition by clients. |

| Payment Instructions | Clearly state the accepted payment methods, due dates, and any late fees to help avoid confusion and ensure timely payment. |

By implementing these best practices, you ensure that every transaction is documented clearly and professionally, helping to streamline your business processes and improve customer satisfaction.

How Invoice Templates Save Time

Efficient documentation is crucial for businesses to maintain smooth operations. By streamlining the process of creating transaction records, businesses can save valuable time, reducing the need for repetitive tasks. Having a pre-designed structure in place makes it easier to generate detailed documents without having to start from scratch each time. This not only boosts productivity but also ensures consistency across all records.

Here are some of the key ways in which pre-designed documents can save time:

- Pre-filled Fields: With predefined sections, much of the required information, like business details or payment terms, is automatically included, reducing the need for manual entry.

- Consistency: Using the same layout each time ensures uniformity, saving time on design and formatting adjustments.

- Fewer Errors: When essential fields are clearly structured, there’s less room for mistakes, which can save time spent on correcting errors.

- Faster Processing: A ready-to-use structure allows for quicker preparation and delivery, helping you close transactions more efficiently.

- Easy Updates: Updating fields like pricing or product details in a pre-set layout is quicker than starting from scratch each time.

By reducing the time spent on creating and formatting each document, businesses can focus more on growth and customer satisfaction, rather than the administrative work involved in transaction processing.

Automating Your Invoice Generation

Automating the process of creating transaction records can significantly reduce the time and effort spent on administrative tasks. With the right tools in place, you can streamline the creation and distribution of detailed documents, ensuring that every transaction is recorded accurately and consistently. This process not only saves time but also minimizes human error, allowing you to focus on more important aspects of your business.

Benefits of Automation

By automating the generation of your transaction records, you can experience several key benefits:

- Increased Efficiency: Automatically generating documents means that you no longer have to manually input information for each transaction, saving significant time.

- Reduced Errors: Automation reduces the risk of human error by eliminating the need for repetitive manual data entry.

- Consistency: Automated systems ensure that every record follows the same structure, maintaining consistency and professionalism across all transactions.

- Faster Processing: The quicker you can generate and send transaction records, the faster your payment cycle becomes, helping to improve cash flow.

Tools for Automation

There are several software tools available that can help automate the creation of transaction records, from simple templates to more advanced systems that integrate with your sales platform. Some of the most common tools include:

- Accounting software: Many accounting platforms offer built-in automation for transaction documentation, directly pulling data from your sales or payment systems.

- CRM systems: Customer Relationship Management tools can automatically generate records when a purchase is made, streamlining the process.

- Custom scripts: For more technical users, custom scripts or APIs can be used to automatically generate and send documents based on specific triggers or customer actions.

By integrating automation into your business workflow, you ensure that transaction records are generated quickly, consistently, and without the risk of error, giving you more time to focus on growing your business.

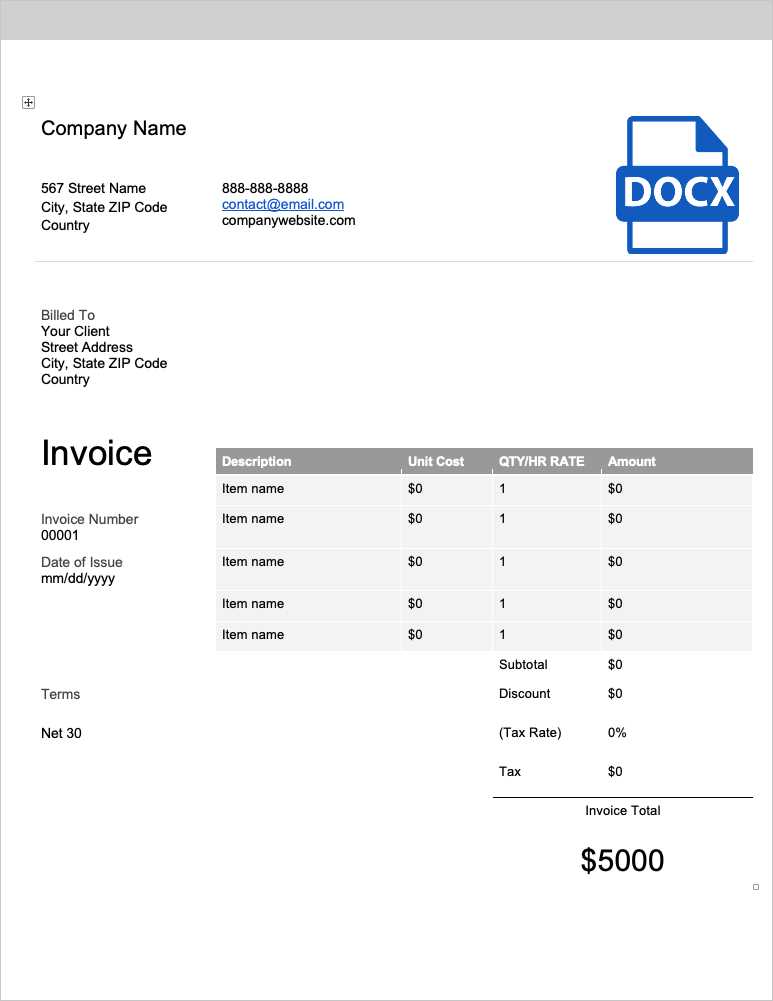

Choosing the Right Format for Your Template

Selecting the appropriate format for your business transaction documents is crucial for ensuring that both you and your clients can easily access, read, and store important information. Different formats offer varying levels of compatibility, ease of use, and functionality, so it’s essential to choose one that aligns with your business needs and the preferences of your clients. A well-chosen format enhances the professional appearance of your documents and ensures that all the necessary details are easily understood.

Considerations for Choosing the Right Format

When deciding on a format for your transaction records, consider the following factors:

- Compatibility: Ensure that the format you choose is compatible with the software your clients use. Common formats include PDF, Word, Excel, and even cloud-based options that can be easily accessed from different devices.

- Ease of Use: Choose a format that is easy for you to create and update, while also being user-friendly for your clients to view and interact with.

- Security: Some formats, like PDFs, offer enhanced security features such as password protection or digital signatures, which may be important for sensitive transactions.

- Professional Appearance: The format you select should reflect your business’s professional standards and contribute to building trust with your clients.

Popular Formats to Consider

Here are some of the most commonly used formats for business transaction documents:

- PDF: The most widely accepted format for business documents. It’s portable, easy to view across platforms, and maintains formatting integrity.

- Word Documents: These are editable, making them useful for customizing content but may not maintain formatting across different devices as reliably as PDFs.

- Excel: Ideal for documents with detailed data, such as pricing or quantity lists. It allows for easy updates and calculations but may not be as visually polished as PDFs.

- Cloud-Based Formats: Cloud storage services like Google Docs or Sheets allow for easy collaboration and access, especially for teams that need to update or share documents in real time.

Choosing the right format for your transaction records depends on the nature of your business, the preferences of your clients, and your need for flexibility. Consider the pros and cons of each option to make an informed decision that will streamline your documentation process and ensure smooth communication with your clients.

Integrating Payment Methods into Invoices

Integrating payment options directly into transaction records is essential for streamlining the payment process and offering convenience to your clients. By providing clear, accessible payment methods, you not only ensure that clients can easily make payments, but you also enhance professionalism and transparency. The inclusion of various payment methods allows clients to choose the option that works best for them, helping to ensure quicker and more efficient transactions.

Types of Payment Methods to Include

Different payment methods can be incorporated into your transaction documentation, depending on the preferences of your clients and the payment systems your business supports. Below are some of the most commonly used payment options:

- Credit and Debit Cards: One of the most widely accepted payment methods, providing convenience for both businesses and clients.

- Bank Transfers: Useful for larger transactions, especially for businesses that work with clients on a regular basis.

- Digital Wallets: Services like PayPal, Google Pay, or Apple Pay allow for quick and secure online payments.

- Checks: Although less common in digital transactions, checks may still be used in certain industries for formal payments.

- Cash on Delivery: For businesses offering physical goods, this payment method is still relevant, particularly for local deliveries.

Best Practices for Payment Method Integration

When including payment options in your transaction documents, it’s important to follow a few key guidelines:

- Clarity: Clearly state the accepted payment methods on the document, specifying any relevant account information, such as bank details or wallet identifiers.

- Multiple Options: Offer a variety of payment methods to accommodate different client preferences and maximize the chances of timely payment.

- Due Dates: Be sure to include payment deadlines, so clients understand the timeframe in which payments should be made to avoid late fees or other consequences.

- Security: Ensure that all payment methods listed are secure, and inform clients of any safety measures taken to protect their financial information.

By incorporating a variety of payment options into your transaction documents, you make it easier for clients to fulfill their obligations and help streamline the payment process for both parties. This small but essential step can improve cash flow and client satisfaction while reducing payment delays.

Legal Considerations for E-Commerce Invoices

When conducting business transactions, it is important to understand the legal requirements surrounding transaction records. These documents serve as evidence of a sale and outline the agreed-upon terms, including payment terms, product details, and buyer and seller information. Ensuring that your transaction records comply with relevant legal frameworks can help protect both you and your clients in case of disputes or audits.

Key Legal Elements to Include

There are certain details that must be present in every transaction record to comply with tax laws and commercial regulations. Failure to include the necessary information could result in penalties or legal complications. The following elements are essential:

- Business Identification: Include your company’s name, address, and tax identification number, which helps verify your legitimacy.

- Buyer’s Information: Document the buyer’s details, including their name and address. This is necessary for both shipping and legal purposes.

- Transaction Date: Always list the date the transaction occurred, as this is critical for tracking payments and managing financial records.

- Item Description: Clearly describe the items sold, including quantities and prices, to avoid any confusion about the transaction.

- Payment Terms: Specify payment deadlines, interest rates for late payments, and accepted methods of payment. This protects both parties in case of delayed payments.

- Tax Information: Include any applicable taxes or VAT (Value-Added Tax) according to the regulations in your jurisdiction.

Regional and International Compliance

For businesses operating internationally, understanding the legal requirements of each country you sell to is crucial. Different regions have varying tax laws, consumer protection regulations, and business reporting standards. In some cases, you may need to adapt your transaction records to reflect local rules. For example:

- EU Compliance: Within the European Union, businesses must comply with the EU VAT Directive, which mandates that businesses charge VAT on products sold within the EU.

- U.S. Sales Tax: In the United States, sales tax rates and regulations can vary by state, so businesses need to ensure they comply with state-specific requirements.

- Global Data Protection Laws: Ensure that customer data is handled in accordance with privacy laws such as GDPR in Europe or CCPA in California.

Ensuring that your transaction records are legally compliant not only helps avoid penalties but also fosters trust with your customers. Legal transparency in business practices promotes better relationships and reduces the risk of disputes down the road. Always consult with a legal expert or tax professional to ensure you are meeting all necessary requirements for your specific business location and industry.

How to Manage Multiple Invoices

Handling numerous transaction records can quickly become overwhelming, especially for businesses dealing with a high volume of sales. Without a proper system in place, it can be easy to lose track of payments, due dates, and client details. To streamline the process and ensure accuracy, it’s essential to implement effective methods for managing multiple documents efficiently.

Organize Your Records

One of the first steps in managing multiple transaction records is to establish a consistent organizational system. This will not only save you time but also minimize the risk of errors or confusion. Consider the following strategies:

- Sort by Client: Group records based on the client or company to make it easier to track payment histories and outstanding balances.

- Use Date Ranges: Organize records by dates, such as monthly or quarterly, to quickly assess payments and due dates.

- Categorize by Status: Label each document based on whether it’s paid, pending, or overdue. This will help you easily identify which transactions require follow-up.

Utilize Software Tools

Manual tracking can be time-consuming and error-prone. Utilizing software tools can significantly improve the process of managing multiple documents. Here are some features that can make the task easier:

- Automation: Use automated systems that generate and send reminders for overdue payments, helping you stay on top of due dates.

- Centralized Data: Cloud-based tools store all records in one place, allowing you to access documents from anywhere, at any time.

- Reporting Features: Many software programs offer reporting capabilities, giving you a quick overview of your financials, including unpaid transactions, upcoming due dates, and overall revenue.

Set Up Regular Audits

To ensure accuracy and avoid potential financial discrepancies, regularly auditing your records is a smart practice. You can set a specific time each month or quarter to review your accounts, confirm payments, and resolve any issues that arise. Regular audits will help keep your records organized and up to date, reducing stress and ensuring business continuity.

In conclusion, effectively managing multiple transaction records requires a mix of organization, automation, and regular monitoring. By using the right tools and strategies, you can streamline the process, ensure timely payments, and maintain a healthy cash flow for your business.

Common Mistakes to Avoid in Invoices

Even the smallest errors in transaction documents can lead to confusion, delayed payments, or legal issues. It’s essential to be mindful of common mistakes when creating these records. By understanding and avoiding these pitfalls, you can ensure smoother transactions and maintain strong relationships with clients.

Incorrect or Missing Information

One of the most frequent mistakes is providing incomplete or incorrect details. This can lead to delays in processing payments or disputes. To avoid this, always ensure the following information is accurate:

- Client Details: Double-check the recipient’s name, address, and contact information to avoid errors.

- Item Descriptions: Clearly list the products or services provided, including quantities, unit prices, and any discounts applied.

- Payment Terms: Specify the payment due date and any late fees or early payment discounts to set clear expectations.

Unclear Payment Instructions

Failure to provide clear payment instructions is another mistake that can cause confusion. Clients need to know exactly how and where to send their payments. Make sure you include:

- Payment Methods: Clearly list acceptable methods of payment, such as bank transfers, credit cards, or online payment platforms.

- Bank Details: If applicable, provide accurate bank account details or other necessary payment information.

- Reference Numbers: Include any reference numbers or identifiers to help track the payment easily.

Not Reviewing for Accuracy

Rushing through the creation of a document can lead to simple mistakes, like incorrect totals or miscalculated taxes. Always take time to review the entire document before sending it out to ensure that all figures, taxes, and discounts are correctly applied.

Failure to Maintain Consistency

Inconsistency in formatting or terminology can make your documents look unprofessional and confusing. Use a uniform style for every transaction record, including consistent fonts, layout, and language. This improves clarity and helps maintain a professional image.

By avoiding these common mistakes, you can prevent unnecessary delays and errors, ensuring that your transaction records are always accurate, clear, and professional.

Improving Customer Trust with Invoices

Clear and transparent billing documents are essential in establishing and maintaining trust with your clients. A well-structured and accurate record not only ensures smooth transactions but also strengthens the relationship between a business and its customers. When customers feel that they are receiving fair and honest service, they are more likely to return and recommend the business to others.

One of the key ways to build trust through transaction records is by providing clarity and transparency. Ensuring that all charges are clearly explained, and any terms or conditions are easy to understand, shows that you respect your clients and their time. It also demonstrates that you are committed to offering value without hidden fees or confusion.

Another important factor is the accuracy of the information. Providing error-free records with correct totals, accurate product descriptions, and the right payment details communicates professionalism and reliability. When customers trust the documentation, they are more confident in their decision to do business with you.

In addition to clarity and accuracy, a well-crafted document can further enhance trust by including personalization. Tailoring transaction records with your business’s branding, adding personal messages, or providing customized payment instructions can make your customers feel valued. A business that takes the time to personalize its documentation is one that cares about its customer experience.

By focusing on transparency, accuracy, and personalization in your billing documents, you can build stronger relationships with your clients, creating a sense of security and trust that benefits both parties.