Download Customizable Retail Invoice Template for Easy Billing

In every business, managing transactions and keeping accurate financial records is essential. One of the most important aspects of this process is providing clear, organized documents that outline the details of each sale or service provided. Having a well-structured document for billing can not only streamline your operations but also enhance professionalism and trust with clients.

With a customizable solution, businesses can easily generate detailed and consistent statements, ensuring that all necessary information is included. These documents help both the company and its customers keep track of payments, outstanding balances, and tax-related matters. A carefully designed document can save time and avoid confusion, making it an indispensable tool in daily operations.

By using a flexible format, businesses can adapt to various needs, from adding discounts to specifying payment terms. Whether you’re a small shop owner or managing a larger enterprise, having a practical way to organize and deliver billing statements is crucial. In the following sections, we will explore the key elements and best practices to create the perfect document for your needs.

Essential Features of a Billing Document

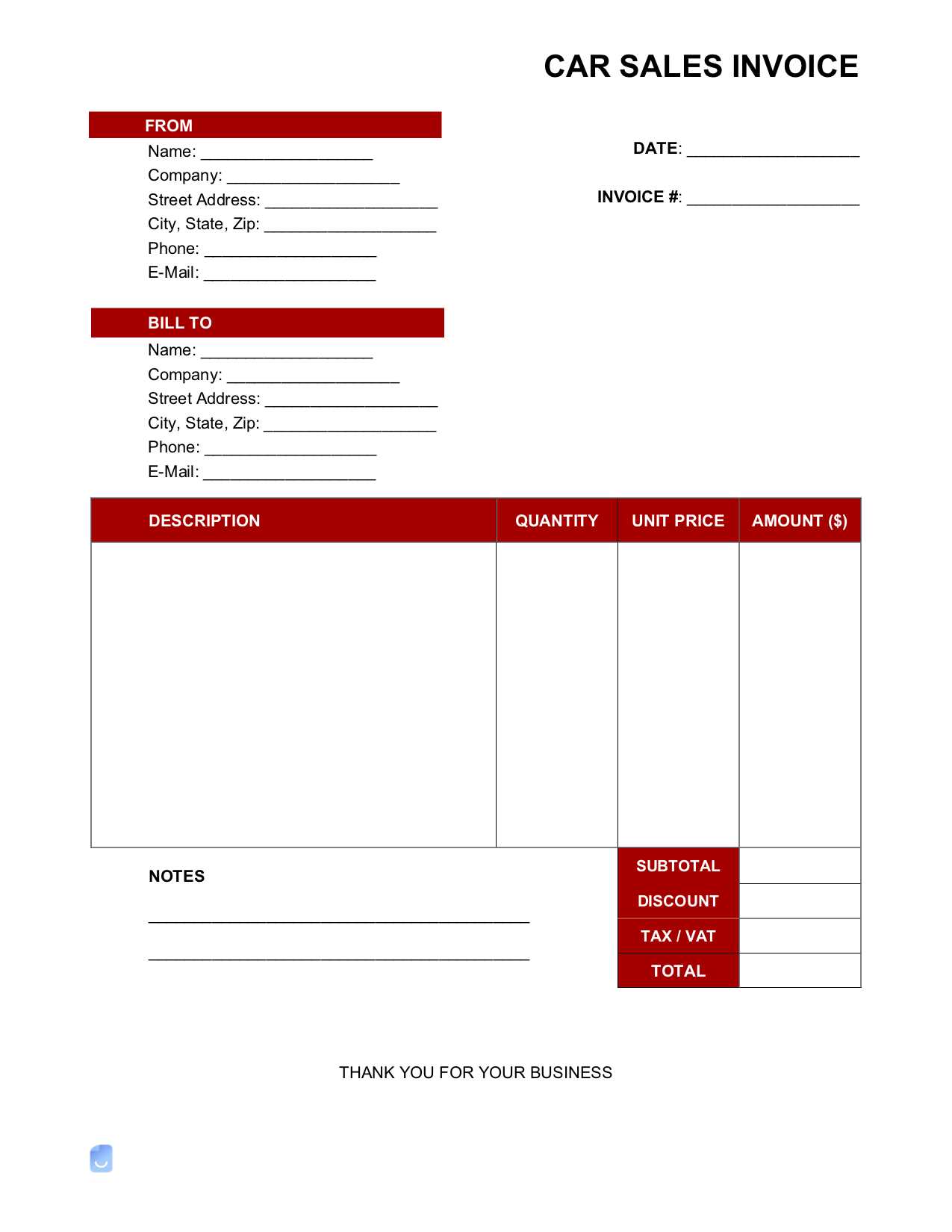

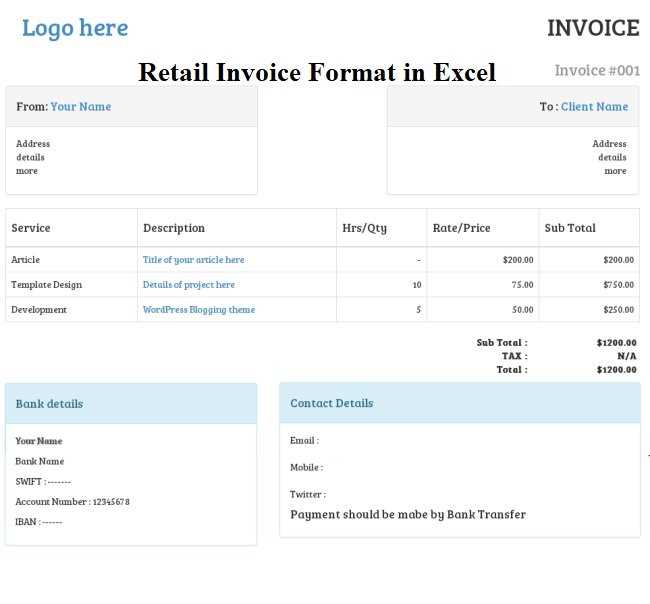

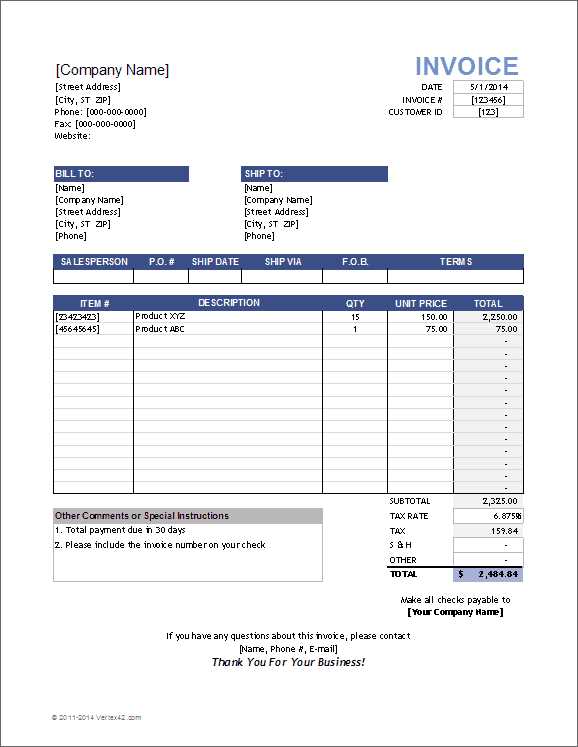

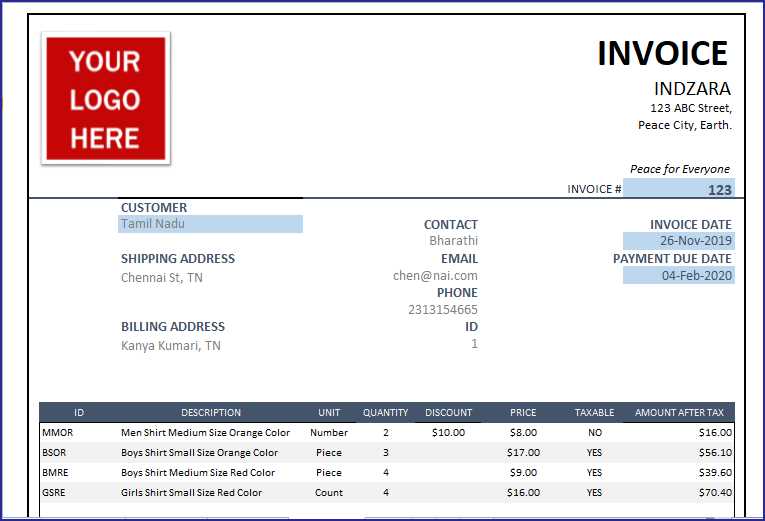

For any business, providing a clear and professional record of each transaction is essential for maintaining smooth operations. A well-organized statement includes several key elements that not only ensure accuracy but also improve the customer experience. Here are the fundamental features that every billing document should have:

- Business Information: The name, address, and contact details of the company issuing the document.

- Customer Information: The name, address, and contact details of the recipient to ensure proper identification.

- Unique Identifier: A distinct number or code assigned to each document for easy reference and tracking.

- Detailed Description of Products or Services: A clear breakdown of what was purchased or provided, including quantities and prices.

- Payment Terms: Information about the payment due date, acceptable payment methods, and any penalties for late payments.

- Tax Information: The applicable taxes or fees, clearly showing the tax rate and total amount calculated.

- Total Amount: The overall sum due, including all applicable costs and taxes.

These key features help create an organized, transparent, and legally sound record of any transaction. They ensure that both parties are on the same page regarding the details of the exchange, payment expectations, and delivery terms.

Why You Need a Billing Document Format

In any business, maintaining clear and consistent records of transactions is crucial for financial management and customer satisfaction. Having a standardized format for generating these records ensures accuracy, saves time, and reduces the risk of errors. Using a pre-designed structure offers numerous benefits that contribute to smooth operations and professional communication with clients.

Benefits of Using a Standardized Format

- Consistency: A pre-defined structure ensures that all necessary information is included in every record, leading to consistency across all transactions.

- Time-Saving: By using a ready-made format, businesses can quickly create accurate documents without starting from scratch each time.

- Professional Appearance: A well-designed document enhances the credibility of the business and improves client trust.

- Accuracy: Reduces the chances of missing key details such as pricing, tax rates, or payment terms, ensuring accuracy in every transaction.

Streamlining Financial Management

- Easy Record Keeping: A consistent document format helps with organizing and storing transaction records, making it easier to access them later for reporting or audits.

- Clear Communication: A structured document ensures that all essential information is communicated clearly to clients, reducing confusion or disputes over details.

- Legal Compliance: Using a standardized format ensures that all necessary information, such as tax calculations and payment terms, is included, helping businesses comply with regulations.

By adopting a reliable and uniform format for all transactions, businesses can enhance their operational efficiency and create a more organized approach to financial documentation.

How to Create a Billing Document

Creating a clear and professional document for each transaction is a crucial part of running a business. By following a few simple steps, you can design a reliable record that includes all the necessary details, helping both your business and customers stay organized. Below are the key steps to create an effective document for any sale or service provided.

- Step 1: Include Business Information – Start by adding your company’s name, address, phone number, and email. This ensures that the customer can easily contact you if needed.

- Step 2: Add Customer Information – Include the customer’s name, address, and contact details so that there is no ambiguity about the recipient of the document.

- Step 3: Assign a Unique Reference Number – Each document should have a unique identification number for easy tracking and future reference.

- Step 4: List Products or Services – Provide a detailed description of the items or services provided, including the quantity, unit price, and any relevant codes or identifiers.

- Step 5: Include Tax and Discounts – Clearly specify any taxes or discounts applied to the total amount to ensure transparency in the billing process.

- Step 6: Specify Payment Terms – Outline the payment due date, accepted methods of payment, and any penalties for overdue payments.

- Step 7: Calculate Total Amount Due – Summarize the total amount, including product/service costs, taxes, and any discounts applied.

By following these steps, you can create a well-organized document that is easy for both your business and customers to understand, track, and process efficiently.

Top Software for Generating Billing Documents

Using the right software can significantly streamline the process of creating billing records. The best tools offer a range of features to help you customize, automate, and manage financial documentation with ease. Whether you’re a small business owner or managing a large enterprise, selecting the right platform can save time and ensure accuracy. Below are some of the top software options for generating professional billing records:

- QuickBooks: Known for its comprehensive features, QuickBooks allows users to create, send, and track billing records, all while integrating with accounting features for complete financial management.

- FreshBooks: FreshBooks offers a user-friendly interface with customizable options, making it ideal for small businesses and freelancers looking to create and manage billing documents efficiently.

- Zoho Invoice: Zoho Invoice offers a wide array of customizable templates and tools for automating payment reminders and managing recurring billing, making it perfect for growing businesses.

- Wave: Wave is a free solution that provides invoicing, accounting, and receipt scanning features. It is ideal for small businesses looking for a simple, no-cost option to manage their documentation.

- Invoice Ninja: Invoice Ninja is a great option for freelancers and small businesses, with a focus on flexibility and customization. It also offers an open-source version for users who prefer more control over their software.

Each of these platforms provides unique features tailored to different business needs, whether you’re looking for an all-in-one accounting solution or a simple tool to streamline your billing process.

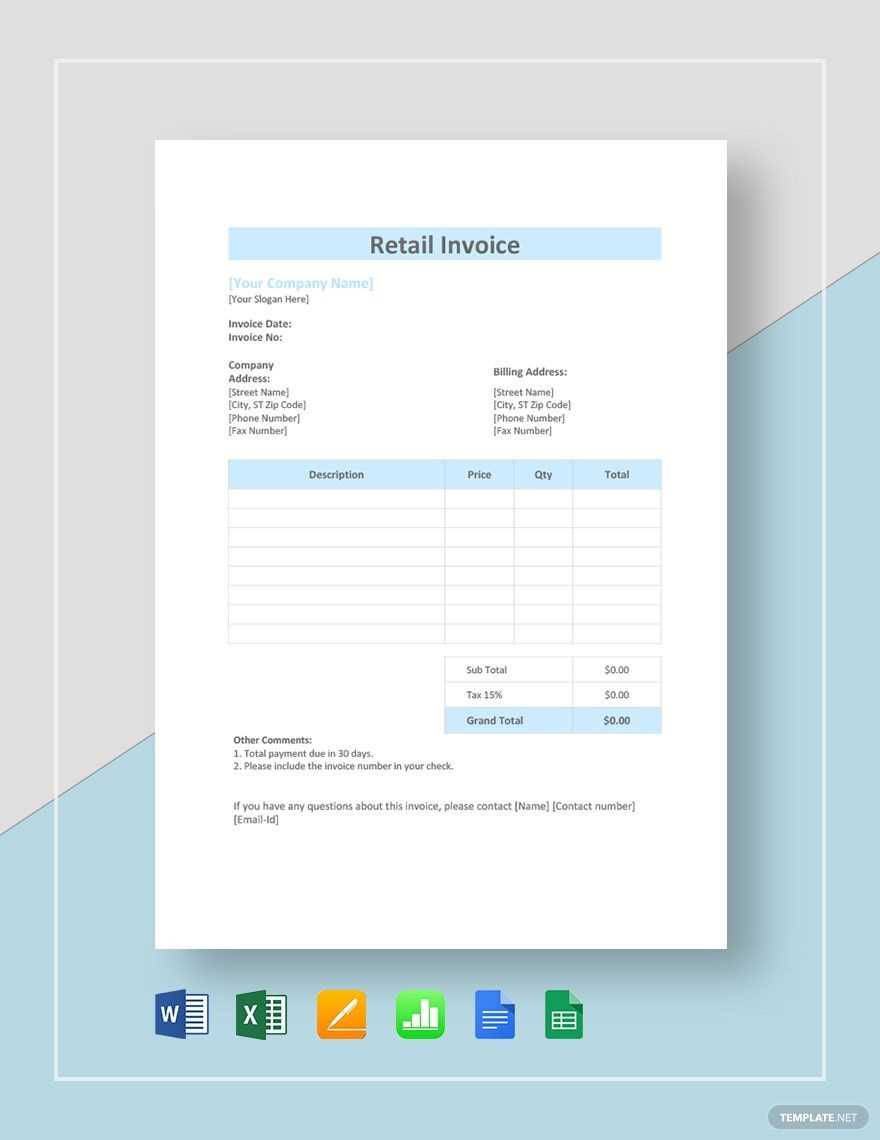

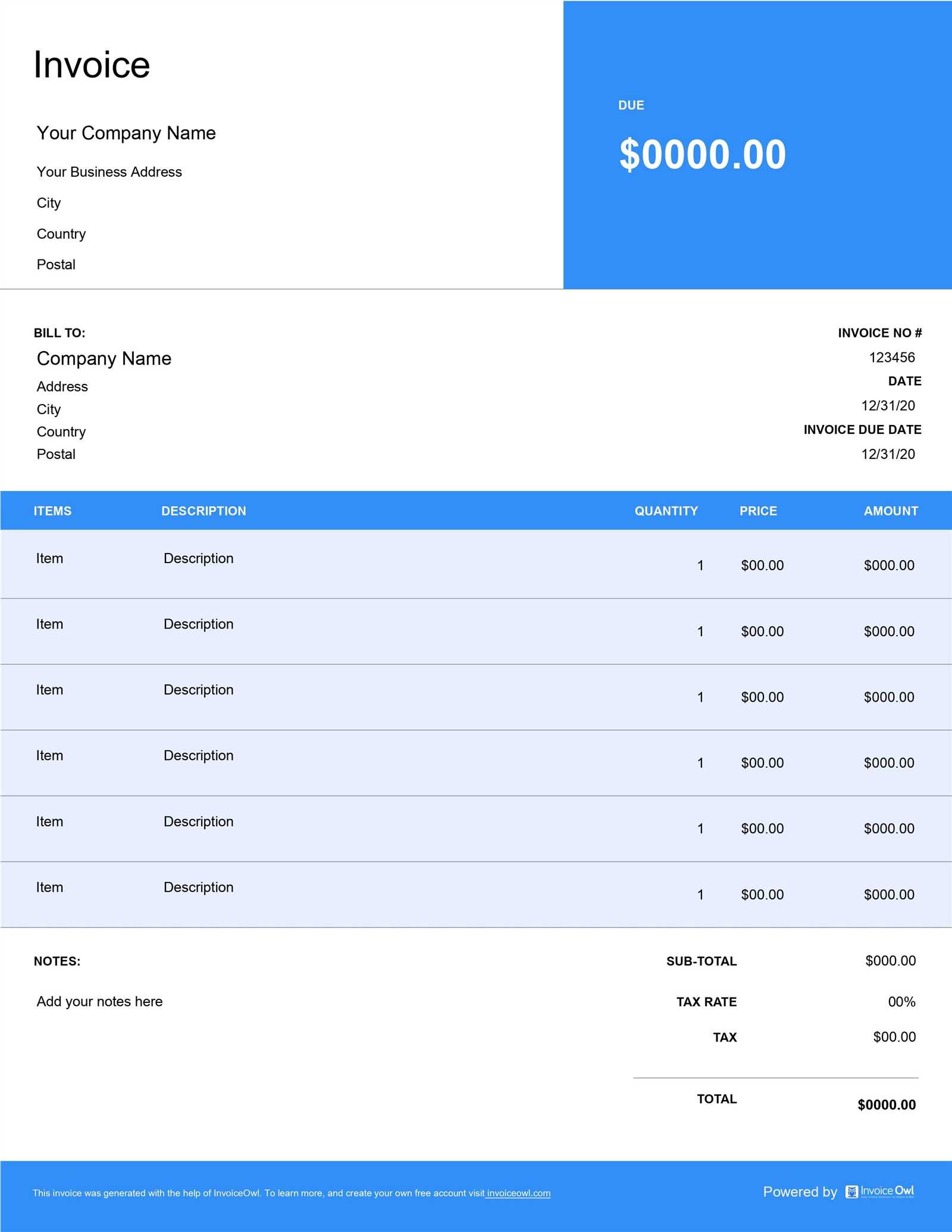

Benefits of Customizable Billing Formats

Having the ability to personalize your financial documents offers numerous advantages that can help your business operate more efficiently and maintain a professional image. Customizable formats give you the flexibility to tailor each record according to your specific needs, making them more relevant and easier to understand for both your business and customers. Here are the main benefits:

- Branding Opportunities: Customize your document with your company logo, colors, and fonts to create a consistent brand experience for your customers.

- Flexibility for Different Transactions: Personalizing your format allows you to adapt it to various types of transactions, from one-time sales to recurring services, ensuring it meets your specific business needs.

- Improved Professionalism: Custom designs help project a more professional image, giving clients the confidence that they are working with a reliable and organized business.

- Enhanced Clarity: By adjusting the layout and structure, you can highlight important details, such as payment terms, tax information, and total amounts due, ensuring everything is easy to understand.

- Increased Efficiency: A tailored document format can streamline the creation process, allowing your business to generate records quickly and consistently without missing any critical information.

Customizable formats provide a level of control that standard documents cannot, helping businesses stay organized, improve communication with clients, and maintain a high level of professionalism in all financial exchanges.

Common Mistakes When Using Billing Formats

While using a pre-designed structure for creating financial documents can save time, there are several common pitfalls that businesses should be aware of. These errors can lead to confusion, delays, and even legal issues. Understanding these mistakes can help you avoid them and ensure your documents are accurate and professional. Here are some of the most frequent issues:

- Missing Key Information: Failing to include essential details such as the business name, contact information, or unique reference number can lead to confusion and missed payments.

- Incorrect Payment Terms: Not clearly outlining payment deadlines or accepted payment methods can cause misunderstandings and delays in receiving funds.

- Not Accounting for Taxes Properly: Overlooking taxes or incorrectly applying tax rates can result in discrepancies and legal complications. Always ensure the correct tax rates are applied based on the local regulations.

- Using Inconsistent Formatting: A lack of consistency in design and structure can make documents appear unprofessional and difficult to read, reducing the clarity of the information.

- Overcomplicating the Document: Including unnecessary details or complex language can make the document overwhelming. Keep it simple and focused on the most relevant information.

- Not Customizing for Different Needs: Using a one-size-fits-all format without adjusting it for specific transactions or customers may lead to missed opportunities for personalization and flexibility.

Avoiding these common mistakes can help streamline the billing process, ensuring that all transactions are clearly documented and easily understood by both your business and clients.

How to Include Tax Information Correctly

Accurate tax information is crucial for ensuring compliance with local regulations and maintaining transparency with your clients. When creating a financial record, it’s important to clearly display all tax-related details, including applicable rates and the total amount due. Properly outlining tax information helps avoid misunderstandings and ensures that both parties are aware of the exact amounts involved.

Steps to Include Tax Information

- Specify the Tax Rate: Always include the applicable tax rate for the items or services provided. This can vary depending on the region, so be sure to check local tax laws.

- Show Breakdown of Tax: List the tax amount separately from the base cost of the products or services, so clients can easily see how the tax is calculated.

- Highlight Exemptions or Discounts: If certain items are tax-exempt or there are applicable discounts, be sure to clearly mention them to avoid confusion.

- Indicate Total Tax Amount: Provide a summary of the total tax amount at the bottom of the document, showing both individual and cumulative taxes to give a clear overview.

Best Practices for Clarity

- Use Clear Labels: Ensure that terms such as “Tax,” “Tax Rate,” and “Total Amount” are clearly labeled to avoid any ambiguity.

- Stay Updated: Regularly check for changes in tax laws to make sure the information on your documents remains accurate and compliant.

- Double-Check Calculations: Verify all calculations to prevent errors, as mistakes in tax calculations can lead to legal and financial issues.

By properly including tax information, you ensure that both your business and clients are fully aware of the amounts due and comply with necessary legal requirements.

Design Tips for Clear Billing Documents

A well-designed financial document is essential for ensuring that both you and your clients can easily read and understand the details of a transaction. A clean and organized layout helps to avoid confusion and improves the overall professionalism of your business. Here are some practical design tips to create clear and effective documents:

- Keep it Simple: Avoid clutter by using a straightforward layout. Keep the information well-organized with clearly defined sections for the transaction details, taxes, and total amounts.

- Use Consistent Fonts: Choose legible fonts and maintain consistency throughout the document. Use bold for headings and important details, and avoid using too many different styles that can make the document hard to follow.

- Organize Information in Sections: Break the document into logical sections such as business details, customer information, itemized list, and total payment, to make it easier to scan and understand.

- Incorporate Visual Hierarchy: Make important information, such as total amounts due or due dates, stand out by using larger fonts or bold text. This helps draw attention to key details.

- Use Clear Labels and Headings: Clearly label each section with headings like “Products/Services,” “Payment Terms,” and “Tax Information,” so the reader knows exactly where to look for specific information.

- Whitespace is Important: Adequate spacing between sections, items, and text will make the document look less cramped and easier to read.

By applying these design tips, you can create professional, organized documents that are easy to understand and that will leave a positive impression on your clients.

How to Add Discounts and Offers

Incorporating discounts and special offers into financial records is a great way to incentivize purchases and reward customers. When properly applied, they can help increase sales while maintaining transparency and clarity. It is essential to clearly present these reductions so that the customer understands the value they are receiving. Here’s how to correctly add discounts and offers to your documents:

Steps to Apply Discounts

- Clearly Display Discounted Amount: List the original price first, followed by the discount applied. This helps customers see the amount they’re saving and the final price they need to pay.

- Specify Discount Percentage or Value: If the discount is a percentage, make sure to mention it (e.g., “10% off”). If it’s a fixed amount, state the value (e.g., “Save $20”).

- Indicate Conditions: If there are specific conditions for the discount, such as a minimum purchase or limited-time offers, include them clearly on the document.

Best Practices for Offers

- Use Prominent Labels: Highlight the discount or special offer with bold text or a different color to make it stand out from other details.

- Provide Offer Expiry Date: If the offer is time-sensitive, always include the expiration date to ensure customers are aware of the offer’s validity period.

- Offer Multiple Discounts: If applicable, allow the customer to combine discounts or offers. Clearly state this and ensure the calculation is accurate.

Adding discounts and offers in a clear and transparent manner ensures that customers can easily understand the savings and enhances the overall transaction experience.

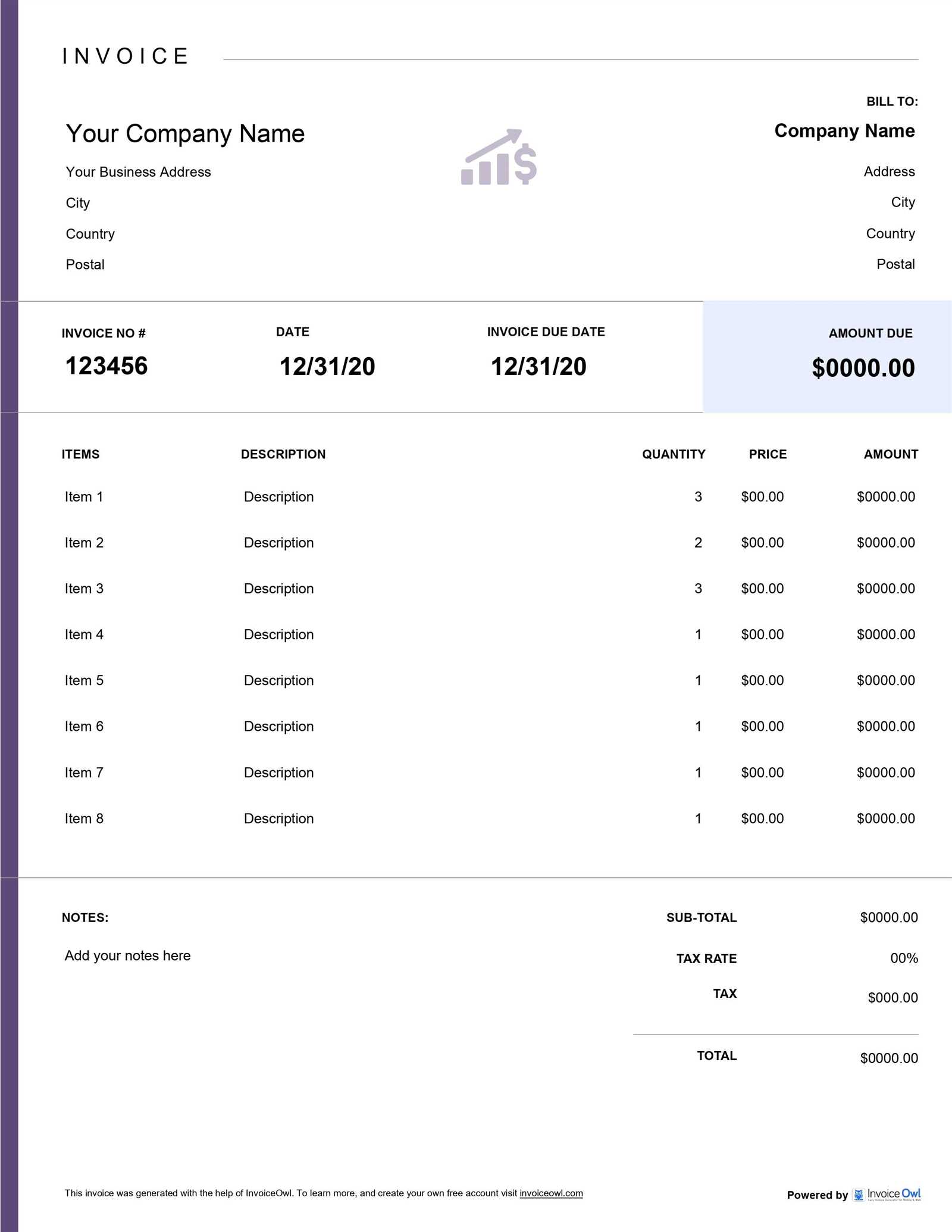

Integrating Payment Terms in Your Document

Clearly defined payment terms are crucial to ensure smooth transactions between businesses and customers. By specifying when and how payments should be made, you help prevent confusion and set expectations. Including these terms in your financial record not only fosters transparency but also helps protect both parties in case of delayed payments or disputes. Here’s how to effectively integrate payment terms:

- Define Payment Deadlines: Clearly state when payment is due, whether it’s within 30 days, 60 days, or any other agreed period.

- State Accepted Payment Methods: Mention the methods of payment you accept, such as credit cards, bank transfers, or online payment systems.

- Include Late Payment Penalties: If you charge late fees, specify the amount or percentage that will be added to overdue payments.

- Outline Early Payment Discounts: If you offer discounts for early payments, make sure to include the percentage and applicable conditions.

- Specify Partial Payment Terms: If applicable, describe the possibility of paying in installments and any conditions related to partial payments.

Incorporating clear payment terms not only improves communication but also helps establish trust and encourages timely payments, ensuring a smoother and more professional business relationship.

Tracking Sales with Billing Documents

Accurately tracking sales is essential for understanding business performance and managing finances. By documenting each transaction properly, businesses can easily monitor revenue, analyze trends, and ensure proper record-keeping. Sales tracking helps with inventory management, forecasting, and compliance. Here’s how you can effectively use billing records to track your sales:

- Record Detailed Information: Each document should include essential details such as item descriptions, quantities sold, unit prices, and total amounts. This data forms the foundation for accurate sales tracking.

- Use Unique Identifiers: Assign a unique reference number to each transaction to facilitate easy tracking and retrieval of records. This also helps in organizing and categorizing sales data.

- Include Dates: Always include the date of the transaction to track when the sale occurred. This helps with period-based sales analysis and revenue reporting.

- Track Payment Status: Clearly indicate whether the payment has been received or is still pending. This ensures that you can easily follow up on unpaid transactions.

- Generate Reports: Use the data from your documents to create regular sales reports. These reports provide insights into sales volume, popular products, and customer behavior.

By integrating these practices into your financial documentation, you can efficiently track sales, manage cash flow, and make informed decisions to grow your business.

Using Documents for Financial Reporting

Financial reports are essential for assessing the performance and health of a business. One of the key components of these reports is the data derived from transaction records. By effectively using billing documents, businesses can gain valuable insights into their financial status, track revenue, and ensure proper documentation for accounting purposes. Here’s how you can leverage these records for financial reporting:

Key Data for Financial Reports

- Revenue Tracking: Documented sales transactions provide a clear picture of total revenue, helping businesses assess their income over specific periods.

- Expense Management: Including itemized details allows businesses to track costs and compare them against earnings, assisting in budget management and cost control.

- Profit Margins: By tracking sales and associated costs, businesses can calculate profit margins and identify areas for improvement in pricing strategies or cost reduction.

- Tax Compliance: Proper records support accurate tax reporting by providing the necessary documentation for tax deductions, exemptions, and liabilities.

How to Use the Data Effectively

- Generate Regular Reports: Use transaction records to create monthly, quarterly, or annual financial summaries that highlight key performance indicators (KPIs).

- Analyze Cash Flow: By tracking incoming payments and outstanding balances, businesses can better manage cash flow and ensure they have enough liquidity for operations.

- Ensure Transparency: Consistent and accurate record-keeping ensures that financial reports are transparent, helping to maintain trust with stakeholders and comply with regulations.

By utilizing billing documents for financial reporting, businesses can enhance their ability to make informed decisions, manage resources efficiently, and plan for future growth.

Ensuring Legal Compliance in Billing Documents

When creating financial records, it is important to ensure that they meet all legal requirements to avoid potential disputes or fines. These documents must contain specific information to be legally binding and accepted by authorities. Adhering to these legal guidelines not only helps businesses stay compliant but also builds trust with customers and partners. Here are some key aspects to consider:

- Correct Business Details: Always include the full name, address, and contact information of both the business and the customer. This ensures the document can be properly identified and linked to a specific transaction.

- Clear Payment Terms: Clearly outline payment deadlines, accepted methods, and any applicable late fees or discounts. This helps avoid misunderstandings and ensures compliance with payment regulations.

- Proper Tax Information: Include the appropriate tax rates and amounts, as well as any tax identification numbers required by local laws. This is essential for both tax reporting and compliance with national and regional tax codes.

- Itemized Details: Provide a breakdown of goods or services provided, including quantity, description, price, and total amount due. This level of detail helps with clarity and ensures the document reflects the actual transaction accurately.

- Legal Terms and Conditions: Include any necessary terms or disclaimers, such as return policies or warranties, that are legally required in your jurisdiction.

By ensuring your financial documents adhere to these guidelines, you can avoid legal complications, improve business practices, and maintain a professional image with clients and authorities.

How to Store and Organize Billing Records

Properly storing and organizing financial documents is essential for businesses to maintain accurate records and ensure smooth operations. These documents serve as important references for tracking sales, managing finances, and complying with tax regulations. A well-organized system allows for easy retrieval and better overall management of financial data. Here are some strategies for efficient organization:

Physical Storage Methods

- Filing Cabinets: Use labeled folders or binders to categorize records by date, client, or transaction type. This ensures that documents are easy to locate when needed.

- Paperless System: Consider scanning hard copies and storing them digitally. This saves space and reduces the risk of losing physical documents due to damage or misplacement.

- Secure Storage: Always store sensitive records in a locked filing cabinet or a secure digital storage system to protect client information and comply with privacy regulations.

Digital Storage and Organization

- Cloud Storage: Utilize cloud-based systems to store and access records from any location. This is particularly useful for businesses with multiple offices or remote teams.

- Organizing by Folders: Create specific folders for each client or project, and subfolders for individual transactions. Using clear naming conventions helps with easy document retrieval.

- Backup Systems: Regularly back up your digital files to avoid data loss. Ensure backups are stored securely and are easy to restore if needed.

By implementing these practices, businesses can ensure their records are well-organized, easily accessible, and secure for long-term use. This not only improves operational efficiency but also helps with future audits, financial reports, and compliance with regulations.

Best Practices for Sending Billing Documents

Sending accurate and timely financial records is a critical step in maintaining good business relationships and ensuring efficient payment processing. It’s essential that these documents are clear, professionally formatted, and delivered through reliable channels. By following some best practices, businesses can minimize errors, reduce delays, and enhance customer satisfaction. Here are key strategies to follow:

Ensure Accuracy and Completeness

- Double-Check Information: Verify that all details, including client information, product descriptions, pricing, and payment terms, are correct before sending the document. Mistakes can cause delays and confusion.

- Itemized Breakdown: Provide a detailed list of products or services with quantities and pricing to help clients easily understand what they are being charged for.

- Clear Payment Instructions: Include clear instructions on how and where payments can be made, and any relevant deadlines or late fees to ensure timely settlement.

Choose the Right Delivery Method

- Email Delivery: Sending documents via email is a quick and efficient way to reach clients. Ensure that the document is in a commonly used format such as PDF to preserve the layout and content.

- Physical Copies: For clients who prefer hard copies or in cases of formal business relationships, sending a printed version via mail may still be necessary.

- Track Deliveries: Use tracking tools for email or physical mail to confirm that the document has been received by the recipient, which can help resolve any potential disputes.

By following these practices, businesses can ensure that their financial communications are clear, accurate, and delivered on time, improving cash flow and maintaining strong client relationships.

How to Follow Up on Unpaid Bills

It’s common for businesses to experience delayed payments from clients. However, following up on unpaid amounts is essential to ensure timely cash flow and maintain healthy financial operations. The process requires a polite and systematic approach to remind clients of outstanding payments without damaging the relationship. Here are effective steps to follow when reaching out to clients for overdue payments:

1. Review the Payment Terms

Before contacting a client, double-check the payment terms outlined in the agreement. Ensure that the payment deadline has passed and that the amount is accurate. This helps you be confident when addressing the situation.

2. Send a Friendly Reminder

If the payment is slightly overdue, send a gentle reminder via email or phone. Be polite and professional, reminding the client of the due date and providing a copy of the original document for reference.

3. Escalate the Communication If Necessary

If the payment remains unpaid after the reminder, escalate the communication with a more direct follow-up. You can send a formal letter or make a phone call to request immediate payment.

4. Offer Payment Plans or Options

If the client is facing financial difficulties, consider offering alternative payment plans or options. This flexibility can ensure that you still receive payment while maintaining the client relationship.

5. Document All Communication

It is important to keep records of all communication with the client regarding overdue payments. This will protect your business in case the situation escalates and legal action becomes necessary.

Sample Follow-Up Table

| Follow-Up Step | Action | Timing |

|---|---|---|

| First Reminder | Polite email or phone call | 1-3 days after due date |

| Second Reminder | Formal letter or second phone call | 7-10 days after due date |

| Escalation | Legal action or collection agency referral | 14-30 days after due date |

By following these steps and maintaining clear communication with clients, you can efficiently manage unpaid balances and minimize the impact on your business.