Half Page Invoice Template Excel for Simple and Professional Invoicing

In today’s fast-paced business world, having a clear and organized system for managing payments is essential. The need for streamlined financial documents has led many to search for ways to create simple yet effective billing statements that can be customized to meet specific needs. A well-designed tool can help businesses save time while maintaining a professional appearance.

Creating a compact, easy-to-use format ensures that key information is displayed without overwhelming the recipient. By choosing the right layout and adjusting it to match business requirements, professionals can avoid clutter and present their details in a concise manner. This approach not only improves communication with clients but also enhances the overall payment process.

Utilizing customizable systems allows for adjustments on various aspects, including company logo placement, contact details, and pricing. These flexible solutions can be tailored to suit the size and type of business, whether it’s for freelancers, small enterprises, or larger organizations. Efficiently managing billing records has never been easier with the right resources at hand.

Half Page Invoice Template Excel Overview

In today’s competitive business environment, efficient document management is crucial. One of the most important elements of this is creating clear and concise billing documents. A well-organized layout allows businesses to deliver key payment details while keeping things professional and easy to understand for clients.

There are various tools available that make it easier to generate such documents. A streamlined format helps convey the necessary information–such as amounts due, contact information, and service details–without overwhelming the recipient. This format is especially useful for businesses looking for a quick solution to track payments without complicated processes.

By utilizing customizable solutions, companies can adjust the design to fit their specific needs, making each record unique while maintaining consistency. Whether you are managing a small business or freelancing, a tailored layout can make your billing process more efficient and visually appealing.

Benefits of Using Excel for Invoices

Utilizing spreadsheet software for creating financial documents offers numerous advantages that enhance both efficiency and accuracy. The ability to quickly adjust and customize the layout of each document makes it a preferred choice for businesses of all sizes. With built-in features like formulas and data management tools, the process of generating and tracking payments becomes seamless.

One of the main benefits is the automation of calculations. Instead of manually adding up amounts, a well-designed system automatically calculates totals, taxes, and discounts, reducing the risk of errors. This functionality saves time and ensures that all figures are correct, even in more complex billing scenarios.

Moreover, the flexibility of spreadsheet software allows for easy updates and adjustments. Whether adding new services, changing prices, or updating client details, changes can be made quickly without having to redesign the entire document. This adaptability makes it easier to maintain consistent records and tailor documents to specific needs.

How to Customize Invoice Templates

Customizing billing documents is essential for maintaining a professional appearance while ensuring all necessary details are clearly presented. By adjusting certain elements such as layout, fonts, and content placement, businesses can create a unique format that suits their specific needs and brand identity. The process is simple and can be tailored to reflect various business types, from freelancers to large enterprises.

When adjusting the layout, it’s important to consider the balance between aesthetics and functionality. Make sure that key details–such as client information, amounts, and terms–are easy to find. You can also customize columns for additional data, like discounts or payment methods, to meet specific requirements.

Here’s an example of a basic structure for customization:

| Field | Description |

|---|---|

| Company Name | Add your business or personal name at the top for branding. |

| Client Information | Insert details like the client’s name, address, and contact information. |

| Services Provided | List the services or products provided, with corresponding prices. |

| Amount Due | Ensure the total amount is clearly highlighted for easy reference. |

| Payment Terms | Customize payment methods and due dates according to your needs. |

By making these adjustments, you can ensure that each document not only looks professional but also meets your specific business requirements.

Downloadable Billing Document Formats

For businesses seeking an efficient way to create payment records, downloadable formats provide a quick and customizable solution. These ready-to-use documents can be easily modified to suit different needs, offering flexibility for professionals across various industries. With just a few clicks, users can access well-designed layouts that can be tailored to match branding and specific client requirements.

Benefits of Downloadable Formats

Using downloadable documents saves time and effort. With built-in formulas and pre-arranged structures, these formats eliminate the need for manual setup, allowing users to focus on customizing the content. Whether you’re tracking services rendered, adjusting payment terms, or adding business details, the layout is already optimized for clarity and functionality.

How to Access and Use These Documents

Many resources online offer free and paid options for downloading customizable formats. Once downloaded, simply open the document in your preferred software, adjust the fields, and save the file for future use. This process makes it easy to generate professional, clean records without starting from scratch each time.

Downloading these formats can streamline your billing process, making it faster and more efficient. By using these pre-designed solutions, businesses can maintain consistent, accurate records while saving valuable time and resources.

Key Features of a Billing Document

Creating effective billing records requires a balance of functionality and clarity. The most useful documents contain specific features that ensure key information is displayed accurately while maintaining a professional appearance. A well-structured layout simplifies the payment process for both businesses and clients, reducing the chances of misunderstandings or errors.

Essential Components for Clear Communication

Among the most important features are sections for client and business information, service details, and payment terms. These areas help both parties quickly identify key facts, such as amounts due, service descriptions, and deadlines. A logical flow between these sections also makes the document easy to navigate and understand.

Customizable Fields for Flexibility

Another key aspect is the ability to adjust fields based on specific business needs. Whether it’s adding custom discount options, modifying the currency format, or changing tax rates, a flexible layout makes it easier to cater to varying requirements. Customizable fields allow businesses to maintain consistency while ensuring that every document suits the individual situation.

Additionally, automated calculations and clear, visible totals are crucial for reducing errors and saving time. These features ensure that both sides are on the same page when it comes to the financial details, making the process smooth and efficient.

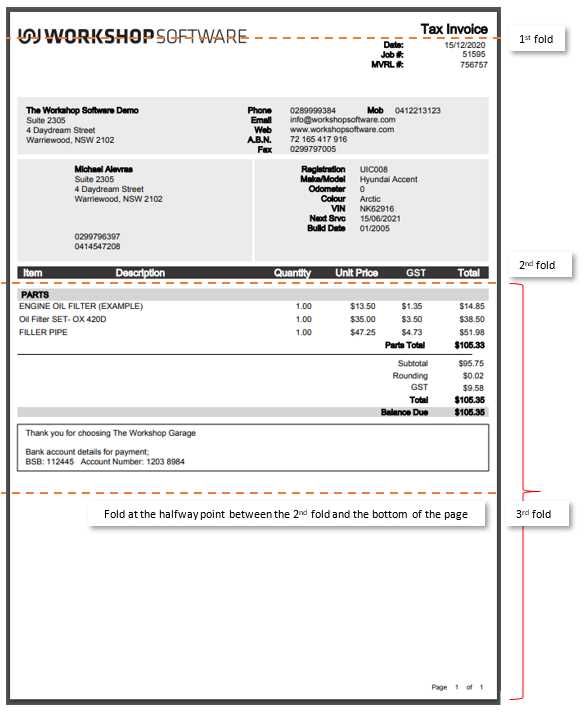

Why Choose a Compact Layout

Choosing a more compact design for financial documents can offer several advantages for businesses. A streamlined layout that uses less space is not only visually appealing but also more efficient for quick reading and processing. This format allows for easy handling, making it ideal for those who need to send or store records with minimal fuss.

A smaller document size can enhance the overall presentation by focusing on the essentials. With fewer elements cluttering the page, important details such as amounts, services rendered, and deadlines stand out more clearly. This approach helps to deliver the necessary information without overwhelming the recipient.

Additionally, a more compact format is often easier to print, share, and store. Whether you’re dealing with physical copies or digital files, smaller documents can save on both paper and digital storage space. This practical choice also offers greater convenience when managing large volumes of billing records.

Step-by-Step Guide to Document Setup

Setting up a professional billing record is a straightforward process that can be customized to fit your business needs. With just a few simple steps, you can create a well-organized document that captures all the essential details, from service descriptions to payment terms. Follow these instructions to quickly configure a document layout suited to your business operations.

Here’s a step-by-step guide to help you create an efficient layout:

| Step | Description |

|---|---|

| 1. Open the Software | Start by opening your preferred spreadsheet software to begin the document setup. |

| 2. Set Document Size | Choose an appropriate document size that suits your needs. A smaller layout will work for a concise, easy-to-read format. |

| 3. Input Business Details | Enter your business name, address, and contact information at the top for easy identification. |

| 4. Add Client Information | Insert client details such as name, address, and phone number in a separate section for clarity. |

| 5. List Services or Products | Provide a clear description of services rendered or items sold, along with their respective prices. |

| 6. Include Payment Terms | Specify payment due dates, methods, and any applicable discounts or penalties for late payments. |

| 7. Finalize and Save | Review the document for accuracy, save it, and you’re ready to send or print. |

By following these steps, you can easily create a professional and organized billing record tailored to your specific needs.

Improving Invoicing Efficiency with Spreadsheet Tools

Managing billing records efficiently is essential for maintaining cash flow and reducing administrative overhead. By utilizing spreadsheet software, businesses can streamline the invoicing process, automate repetitive tasks, and ensure accuracy in calculations. The flexibility of these tools allows for easy customization, so every document can be tailored to meet specific business needs while saving time and effort.

Automating Calculations and Reducing Errors

One of the most powerful features of spreadsheet tools is their ability to automate calculations. By setting up formulas for taxes, discounts, and totals, you can eliminate the need for manual input, significantly reducing the chances of errors. This ensures that the figures are always accurate, which is especially important when dealing with large volumes of transactions.

Creating Reusable and Customizable Layouts

Spreadsheet software also makes it easy to create reusable layouts. Once a basic structure is set up, it can be saved and used for future records, with only minor adjustments needed. This reduces the amount of time spent on designing new documents and allows businesses to focus on other tasks. By creating templates with predefined fields for customer details, service descriptions, and payment terms, you can ensure consistency and professionalism with every document.

Using these tools effectively helps businesses improve overall efficiency, save time, and ensure that each record meets professional standards, all while minimizing errors and effort. Spreadsheet software offers an ideal solution for businesses looking to enhance their billing workflow.

Common Mistakes to Avoid in Billing Records

Creating clear and accurate billing documents is essential for smooth business operations. However, there are common errors that can lead to confusion or delays in payments. Avoiding these mistakes ensures that clients receive the right information in a timely manner, helping maintain a professional reputation and avoiding payment disputes.

Key Errors to Watch Out For

- Missing or Incorrect Contact Information – Always double-check that both your business and the client’s details are correct. Errors in contact information can delay payments or cause confusion.

- Unclear Payment Terms – Clearly state the due date, accepted payment methods, and any late fees. Vague or missing terms can lead to delayed payments and miscommunication.

- Not Including Itemized Details – Always provide a clear breakdown of services or products rendered. Failure to do so can make it difficult for clients to understand the charges.

- Overcomplicated Formatting – Keep the layout simple and easy to read. Overly complex designs or hard-to-read fonts may confuse clients, leading to errors in processing.

- Incorrect Tax Calculations – Ensure that taxes are calculated correctly, and check the applicable rates in your region. Mistakes here can affect the total amount due and lead to disputes.

- Omitting Discounts or Promotions – If a discount or promotion applies, make sure to clearly state it on the document. Leaving it out may result in clients paying more than expected.

How to Avoid These Mistakes

To prevent these issues, take time to review your documents before sending them. Double-check all figures, verify client details, and ensure all fields are filled out correctly. Using clear and concise language, along with a simple layout, helps eliminate confusion. Additionally, setting up a consistent format for all your records can minimize the risk of making these errors repeatedly.

How to Add Business Details in Spreadsheet Documents

Including accurate business information in your financial documents is crucial for ensuring that clients can easily contact you and understand who is billing them. Properly displaying this data not only enhances the professionalism of your documents but also ensures transparency and clarity. Here’s a step-by-step guide on how to add your business details to your financial documents using spreadsheet tools.

Steps to Add Business Information

- Step 1: Choose a Layout – Before adding any details, decide where you want to place your business information. Common spots include the top or bottom of the document, where it’s most visible to your client.

- Step 2: Add Your Business Name – Place your business name at the top in a larger font to make it stand out. Ensure it is clear and matches your official branding.

- Step 3: Include Your Address – Below your business name, include the full address. This should consist of your street address, city, state, and zip code.

- Step 4: Contact Information – Add a phone number and email address for easy communication. You may also want to include a website URL if relevant.

- Step 5: Add Your Business Registration Number – If applicable, include your business registration or tax identification number. This adds legitimacy and can be helpful for clients who need it for accounting purposes.

Additional Tips

- Consistency: Keep the format consistent across all your documents to ensure your information is always easy to find.

- Alignment: Align your business information neatly, either to the left, center, or right, depending on your overall document layout.

- Fonts and Style: Use clear, professional fonts and make sure the text size is readable. Avoid overly decorative fonts.

By following these simple steps, you can ensure that your business details are always presented in a clear, organized, and professional manner in every document.

Setting Payment Terms in Spreadsheet Documents

Clearly defining payment terms in your financial records is essential for ensuring smooth transactions and timely payments. By setting clear expectations, businesses can avoid misunderstandings and maintain professional relationships with clients. In spreadsheet tools, these terms can be easily added and customized to fit your specific needs. Here’s how you can set up and manage payment conditions within your document layout.

Follow these steps to specify payment terms effectively:

| Step | Description |

|---|---|

| 1. Choose a Section | Select a location within your document to display payment terms clearly. Typically, this information is placed near the total amount or at the bottom for easy reference. |

| 2. Add Payment Due Date | Specify the due date for the payment. This could be a fixed number of days from the document date or a specific calendar date. |

| 3. Specify Accepted Payment Methods | List the methods through which payments can be made, such as bank transfers, checks, or online payment platforms. Ensure all options are available and easily accessible. |

| 4. Include Late Fees or Discounts | Clearly state any penalties for late payments or discounts for early payments. This encourages clients to pay on time and rewards timely payers. |

| 5. Define Payment Installments (if applicable) | If the payment is to be made in installments, include the breakdown of amounts and due dates for each installment. |

By following these steps, you can ensure that all the necessary payment details are outlined in a way that is easy for your clients to understand, reducing the chances of missed payments and enhancing your business’s cash flow management.

How to Calculate Totals Automatically

Automating the calculation of totals in financial documents saves time and ensures accuracy. By using built-in functions in spreadsheet tools, businesses can quickly calculate subtotals, taxes, discounts, and final amounts without manually entering complex formulas. This feature helps to avoid errors and reduces the risk of miscalculations.

Steps to Set Up Automatic Calculations

- Step 1: List All Items – Start by entering the description of each service or product, followed by their individual prices in separate rows.

- Step 2: Add Quantity and Price – Include the quantity of each item and its corresponding price per unit. For products or services sold in bulk, ensure the correct number is entered to calculate totals accurately.

- Step 3: Use Formulas for Subtotals – To calculate the subtotal for each item, multiply the quantity by the price. In most spreadsheet software, use the formula =Quantity * Price.

- Step 4: Apply Tax Calculation – Use the tax rate formula to calculate tax. For example, =Subtotal * Tax Rate. Ensure you apply the appropriate tax percentage depending on your region.

- Step 5: Calculate Total Amount – To find the total, sum all subtotals and taxes. You can use the SUM formula to add up values automatically. For example, =SUM(C2:C10), where C2 to C10 represents your subtotal column.

Common Formulas for Automatic Totals

- Subtotal: =Price * Quantity

- Tax Amount: =Subtotal * Tax Rate

- Total Amount: =SUM(Subtotal Column + Tax Column)

- Discount: =Subtotal * Discount Rate (if applicable)

By following these steps, you can set up automatic calculations to ensure that your financial records are always accurate and easy to manage. This approach eliminates the need for manual math, saving both time and effort while reducing the risk of errors.

Managing Client Information in Spreadsheet Tools

Efficiently managing client information is key to maintaining strong business relationships and ensuring smooth transactions. Storing and organizing contact details, purchase history, and other relevant data in a structured way not only saves time but also improves communication. Spreadsheet software offers a versatile platform to keep all this information organized and accessible when needed.

By creating a dedicated section for each client, you can easily track their contact details, order history, and payment status. This organized approach helps to streamline your operations, as you can quickly reference past interactions and tailor your service to each client’s needs.

Steps to Organize Client Information

- Step 1: Create Client Profiles – Set up a row for each client and include columns for their name, company, phone number, email address, and billing address.

- Step 2: Add Purchase and Payment Details – Include columns for tracking the items or services purchased, along with the dates and amounts paid. This will help you monitor client transactions and payment status.

- Step 3: Use Filters for Easy Access – Use the filter function to quickly sort and find client information based on specific criteria, such as payment status or recent orders.

- Step 4: Link Data for Quick Updates – Link data across multiple sheets to keep client information updated in real-time. For example, linking a client’s payment history with their contact details allows for seamless updates.

Benefits of Managing Client Information in Spreadsheets

- Improved Accuracy: Storing and updating client details in one centralized location reduces the risk of errors and ensures all information is current.

- Time Efficiency: Easy access to client data speeds up your workflow and reduces the need for repeated searches or data entry.

- Better Communication: With organized records, you can personalize your interactions with clients, addressing their specific needs and concerns more effectively.

By using these strategies, you can manage client information more efficiently, ensuring that your business runs smoothly and your clients receive the best possible service.

Best Practices for Document Layout

A well-organized document layout ensures that important information is easy to read and understand, helping maintain professionalism and preventing misunderstandings. By following best practices for structuring your financial records, you can create clear and efficient documents that will be both easy for clients to process and efficient for your business to manage.

When creating billing records, focus on clarity, simplicity, and logical organization. Proper alignment, font choices, and consistent formatting will make the document more visually appealing and easier for the reader to navigate. Here are some key guidelines to consider when designing your document layout.

Key Guidelines for Effective Layout

- Clear Header – Include your business name, contact details, and a unique document identifier at the top. This helps your clients quickly identify your company and reference the document easily.

- Organized Structure – Group related information together. Typically, the services or products provided should be listed with their descriptions, quantities, and prices in separate columns. Use tables to ensure a neat, structured look.

- Readable Font and Size – Use professional fonts such as Arial or Times New Roman. Ensure that the text size is large enough to read easily but not so large that it looks unbalanced. Avoid using too many font styles; consistency is key.

- Whitespace – Incorporate whitespace in your document. Proper spacing between sections and text blocks makes it easier for the reader to digest the information. Avoid overcrowding the document with too much text or too many numbers in close proximity.

- Highlight Important Information – Use bold or italics to emphasize key details such as payment due dates, totals, and special notes. However, be careful not to overuse these formatting options, as they can distract from the core content.

- Logical Flow – Ensure that the information flows in a logical order. Start with basic details like contact information, followed by a breakdown of charges, then total amounts, and payment instructions at the end.

Additional Tips

- Consistency: Use the same structure for every document to create a professional, cohesive look that clients can easily recognize.

- Align Text Properly: Align text in a way that guides the reader naturally through the document. Most often, text is aligned left, but numbers and totals should be right-aligned for clarity.

- Include Legal Information: If applicable, add any necessary legal or regulatory disclaimers, such as tax identification numbers or terms and conditions.

By implementing these

Why Spreadsheet Tools Are Ideal for Billing

When it comes to creating and managing billing documents, using spreadsheet software offers unmatched flexibility and efficiency. These tools allow users to easily customize layouts, perform calculations automatically, and track financial data in real-time. Whether you’re running a small business or managing larger operations, a spreadsheet can simplify the billing process, reduce errors, and improve accuracy.

Here are some reasons why spreadsheet software is particularly well-suited for generating financial records:

Advantages of Using Spreadsheet Tools for Billing

- Customizable Layouts: Spreadsheet software allows complete control over the design of the document. You can tailor the format to meet your specific needs, whether you require additional fields or a simpler structure.

- Automatic Calculations: With built-in formulas, spreadsheet tools can automatically calculate totals, taxes, discounts, and other financial figures. This helps avoid manual errors and saves valuable time.

- Data Management: Spreadsheets provide easy access to stored data. You can track client information, previous payments, and purchase history in the same file, enabling quick reference and updates.

- Reusability: Once you’ve set up a billing document, it’s easy to reuse it for future clients or transactions. This reduces the time spent creating new documents from scratch.

- Quick Updates: Any changes to pricing, taxes, or other variables can be instantly reflected throughout the document. This ensures that your financial records are always up to date with minimal effort.

- Cost-Effective: Spreadsheet tools are typically included in many office software suites or are available for free, making them an affordable option for businesses of all sizes.

Additional Features That Enhance Billing

- Templates: Many spreadsheet tools come with pre-built formats, which you can easily adapt to your business’s needs.

- Data Validation: Spreadsheet software allows you to set data validation rules, ensuring that only correct information (like numbers or dates) is entered into fields.

- Sorting and Filtering: Easily sort and filter data to find specific transactions, client details, or financial information when you need it most.

- Integration with Other Tools: Spreadsheets can often be integrated with other software such as accounting tools or payment systems, allowing for seamless data transfer and record-keeping.

In summary, spreadsheet tools provide a powerful, customizable, and efficient way to manage billing tasks, making them an ideal choice for both small and large-scale operations.

Using Formulas for Accurate Calculations

In any financial document, precision is crucial. By leveraging the power of formulas in spreadsheet software, you can ensure that all calculations are accurate and automatically updated. Formulas eliminate the need for manual calculations, reduce human error, and streamline the process of adding up totals, applying taxes, and tracking discounts. With just a few simple formulas, you can make your financial records both efficient and reliable.

Here are some common formulas used to ensure accuracy in financial records:

Common Formulas for Financial Documents

- SUM: The SUM function adds up a range of values, such as the costs of various items or services. Example: =SUM(B2:B10) will sum the values from cells B2 to B10.

- Multiplication: To calculate the total cost for an item, you multiply its unit price by the quantity purchased. Example: =B2*C2 multiplies the value in cell B2 (unit price) by the value in cell C2 (quantity).

- Tax Calculation: To calculate the tax on a subtotal, you can multiply the subtotal by the applicable tax rate. Example: =D2*0.08 calculates 8% tax on the value in cell D2.

- Discount Application: If a discount is applied, use the formula to subtract the discount amount from the total. Example: =E2-(E2*0.10) subtracts a 10% discount from the value in cell E2.

- Final Total: Combine multiple values like the subtotal and tax to get the final amount. Example: =SUM(D2:D10)+F2 adds the values from D2 to D10 and adds the tax amount in cell F2.

Benefits of Using Formulas

- Time Savings: Automating calculations ensures that totals are updated instantly, saving time and effort.

- Accuracy: Reduces the risk of manual errors, making your documents more reliable and professional.

- Consistency: Formulas ensure that calculations are performed in the same way every time, providing consistency across documents.

- Ease of Updates: If any value changes, the formula will automatically adjust the related totals and calculations.

By incorporating formulas into your financial records, you can automate and streamline the entire process, ensuring accuracy while saving time. Whether you’re calculating totals, taxes, or discounts, formulas provide a reliable way to keep your documents error-free and professional.

Printing and Sharing Your Billing Document

Once your financial document is complete, it’s time to distribute it to your clients. Whether you prefer to send a hard copy or share a digital version, understanding the best practices for printing and sharing your document ensures it reaches the recipient in a clear, professional format. Proper formatting and file management make the sharing process smoother and more reliable for both you and your clients.

In this section, we will explore the best ways to print and share your billing documents, including tips on file formats, email options, and paper size considerations.

Printing Your Document

- Check Layout Before Printing: Before sending a physical copy, always preview your document to ensure it fits the page and looks organized. Use the “Print Preview” feature to ensure proper alignment and that no crucial information is cut off.

- Select the Correct Paper Size: Most billing documents are formatted for standard letter-sized paper (8.5″ x 11″). Ensure the document fits within these dimensions, or adjust the layout if necessary.

- Choose High-Quality Print Settings: For a professional appearance, set your printer to high-quality printing mode, ensuring that text and numbers are sharp and easy to read.

- Print in Color (if needed): While black and white printing is common, consider using color for elements such as your logo or key highlights to make your document stand out.

Sharing Your Document Digitally

- Convert to PDF: Converting your document to a PDF format before sharing ensures that it looks the same on any device and maintains its formatting. PDFs are widely accepted and are easy to open across different platforms.

- Emailing the Document: Attach the PDF file to an email with a brief, professional message. Ensure the email subject line and body are clear, specifying that the document pertains to a recent transaction or service rendered.

- Cloud Storage Links: If the document is too large or you prefer not to send attachments, you can upload the file to cloud storage (like Google Drive or Dropbox) and share the link with the client for easy access.

- Secure Document Sharing: For added security, consider using encrypted document sharing services or password-protecting your file before sending it, especially if it contains sensitive financial information.

By following these best practices for printing and sharing, you can ensure your billing documents are delivered in a professional, timely, and secure manner. Whether by mail or email, providing clear and easy-to-read documents reflects well on your business and helps facilitate smoother transactions.

Free Resources for Billing Document Formats

When creating financial records for your business, having access to ready-made document layouts can save valuable time and effort. There are many free resources available online that provide customizable designs for billing documents. These resources offer various formats and styles to suit your needs, from simple templates to more complex designs that reflect your brand identity. Whether you’re looking for a minimalist design or something more detailed, there are plenty of options to explore.

Here are some popular platforms and tools where you can find free resources to create professional-looking financial documents:

- Google Docs: Google offers free, customizable billing layouts that can be easily edited and shared online. These documents are fully accessible from any device with internet access, making them an ideal choice for businesses on the go.

- Canva: Canva provides a wide range of free templates that can be modified to suit your specific requirements. You can customize everything from fonts and colors to logos, creating a unique design that aligns with your business branding.

- Microsoft Office Online: Microsoft Office offers free access to basic document layouts that you can download and use directly in Word. These templates can be edited and saved for later use, and they include built-in formatting for a professional appearance.

- Zoho: Zoho provides a free suite of tools, including billing document formats, which you can customize based on your business needs. The platform also allows integration with other tools, making it easy to manage your records.

- Invoice Generator: Invoice Generator is an online tool that lets you create and download free billing records. The platform offers straightforward and easy-to-use templates, allowing you to input your details quickly and generate a professional document.

- Template.net: Template.net offers a variety of free document layouts for creating billing statements. The platform provides access to different formats that can be downloaded and customized based on your preferences.

By utilizing these free resources, you can ensure that your financial records are well-designed, professional, and easy to create. With a wide range of options available, you’ll find the perfect format to meet your business’s needs without having to spend money on premium software or services.