How to Customize Your Zuora Invoice Template for Better Billing

Effective billing is an essential component of business operations, ensuring both accuracy and professionalism in financial transactions. Customizing billing statements can greatly enhance customer experience, streamline accounting processes, and align with a company’s branding. Whether you’re handling one-time charges or recurring fees, tailoring your financial documents to meet specific needs is crucial for clarity and efficiency.

In this guide, we will explore the key elements involved in creating personalized billing statements that reflect your business structure. From layout adjustments to adding necessary details, we’ll cover the most important considerations to ensure your documents are both compliant and customer-friendly. By the end of this article, you’ll have a better understanding of how to optimize these documents to fit your business needs.

Customizing these financial forms allows you to convey the right information in a clear, readable format. This ensures that clients receive accurate details regarding their charges and payments. Additionally, well-designed statements can help reduce errors, save time, and improve overall business efficiency.

Understanding the Importance of Billing Document Customization

Having a well-structured and professional financial document is crucial for any business. It serves not only as a record of transactions but also as a tool for clear communication with customers. Customizing these documents to match your business needs ensures that all necessary details are conveyed accurately and in an easily understandable format. A personalized approach helps build trust, minimizes errors, and streamlines payment processes, ultimately benefiting both the company and its clients.

When businesses use standardized formats, they risk overlooking key information or creating confusion for clients. Customizable documents allow companies to highlight specific details such as payment terms, taxes, and itemized charges. Additionally, aligning the document design with the brand identity can enhance customer experience and reinforce professionalism.

| Benefit | Importance |

|---|---|

| Accuracy | Ensures that all transaction details are correctly presented to avoid misunderstandings. |

| Clarity | Improves readability and helps clients quickly understand the charges. |

| Branding | Custom design can reinforce brand identity and professionalism. |

| Efficiency | Speeds up processing by reducing errors and improving communication. |

In conclusion, tailoring your financial documents is essential for improving both internal processes and external relations. By creating a document that suits your specific business model and customer needs, you can enhance your overall workflow, avoid costly mistakes, and ensure a smooth transaction experience for everyone involved.

What is a Custom Billing Document Format

A custom billing document format is a pre-designed layout that businesses use to present detailed information about transactions to their clients. These documents typically include essential elements like payment amounts, taxes, billing dates, and itemized charges. The goal is to provide a clear, concise, and professional summary of the financial exchange, ensuring both parties understand the terms and amounts due.

Such a format can be highly flexible, allowing businesses to adjust it according to specific needs, industry standards, or client requirements. It can be modified to include branding elements, personalized customer data, and even specialized billing rules that apply to particular situations or subscription models.

Key Components of a Custom Billing Document

| Component | Purpose |

|---|---|

| Transaction Details | Provides a breakdown of charges, including products or services rendered. |

| Payment Terms | Outlines due dates, late fees, and payment methods accepted. |

| Tax Information | Shows applicable tax rates and amounts to ensure transparency. |

| Branding | Incorporates company logos and design elements to enhance professionalism. |

Benefits of Using a Custom Billing Document Format

Using a tailored format improves the clarity and accuracy of financial records, helping clients quickly understand their obligations. It also saves time by automating parts of the billing process, reducing manual errors, and ensuring that all critical information is included in every statement. Whether you’re managing one-time payments or recurring billing cycles, customizing your financial documents is key to ensuring smooth operations and maintaining positive client relationships.

Benefits of Using Custom Billing Document Formats

Utilizing a personalized billing format provides numerous advantages for businesses, making the financial management process more efficient and streamlined. These documents not only improve the clarity of financial information but also enhance the overall customer experience. By customizing the layout and content, companies can ensure that their billing statements meet both internal standards and external client expectations.

Automation is one of the key benefits. Automating the creation and distribution of these documents reduces manual workload, minimizes errors, and accelerates the billing cycle. With pre-configured layouts, the process becomes more efficient, allowing teams to focus on other important tasks.

Additionally, customized financial statements ensure consistency across all communications. A uniform design reinforces a professional brand image and ensures that clients receive the same high-quality experience every time. This consistency can increase trust and foster long-term relationships with customers.

Flexibility is another major benefit. Businesses can easily tailor documents to fit specific needs, including detailed breakdowns of charges, discounts, and taxes, or even include personalized client information. This adaptability makes it easier to cater to various industries, pricing models, and customer preferences.

Finally, using a custom format enhances compliance. By ensuring that all necessary legal and tax information is included, businesses can avoid potential issues and stay in line with local regulations. This proactive approach helps reduce the risk of costly mistakes and disputes.

How to Create a Custom Billing Document

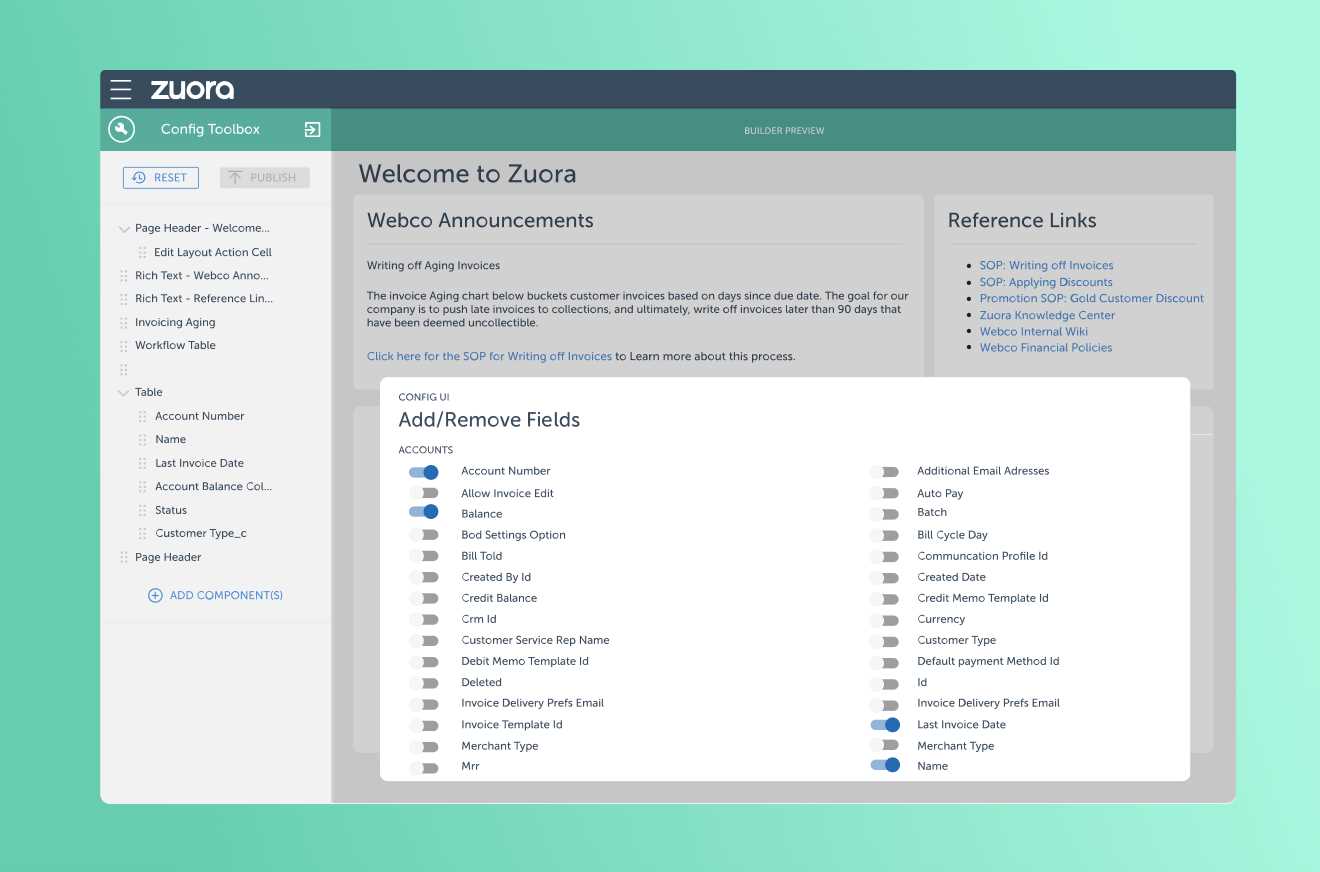

Creating a customized billing document involves adjusting various elements to match your business’s specific needs, ensuring that all required information is clearly displayed. By configuring a unique layout, businesses can present financial details in a way that is both professional and aligned with their branding. This process typically includes adding necessary transaction details, payment instructions, and any applicable terms and conditions.

The first step is to choose the appropriate structure for your financial statements. Selecting a design that suits your company’s needs is essential. You should ensure that the document includes spaces for all critical elements, such as customer information, product/service details, tax rates, and due dates.

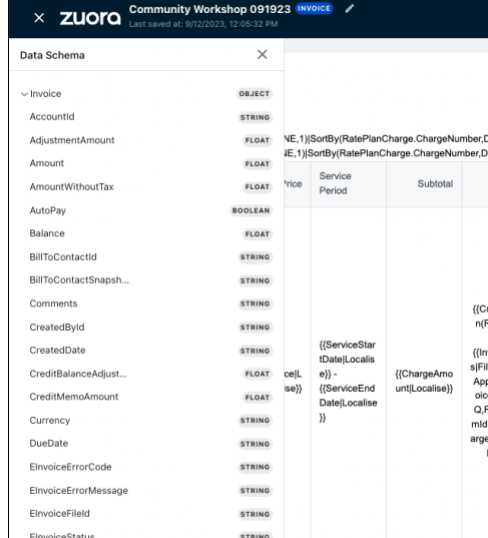

Next, customize the content to reflect your business model. Whether you are dealing with one-time payments or recurring subscriptions, the format must be flexible enough to handle these variations. This can include itemized charge descriptions, discounts, and payment terms that vary by customer or service type. It’s important to ensure that all fields are correctly mapped to your billing system to prevent errors.

Once the layout and content are set, apply branding elements to make the document instantly recognizable to your clients. Incorporate your company’s logo, colors, and other branding features to create a polished and cohesive look that reinforces your business’s identity. This not only improves the aesthetic appeal but also builds trust with customers.

Finally, after the document structure and content are finalized, test the format to ensure it generates the correct information and displays it accurately. Double-check for compliance with tax regulations and any specific requirements for your industry. Once everything is in place, you can start generating and sending your customized financial statements to clients.

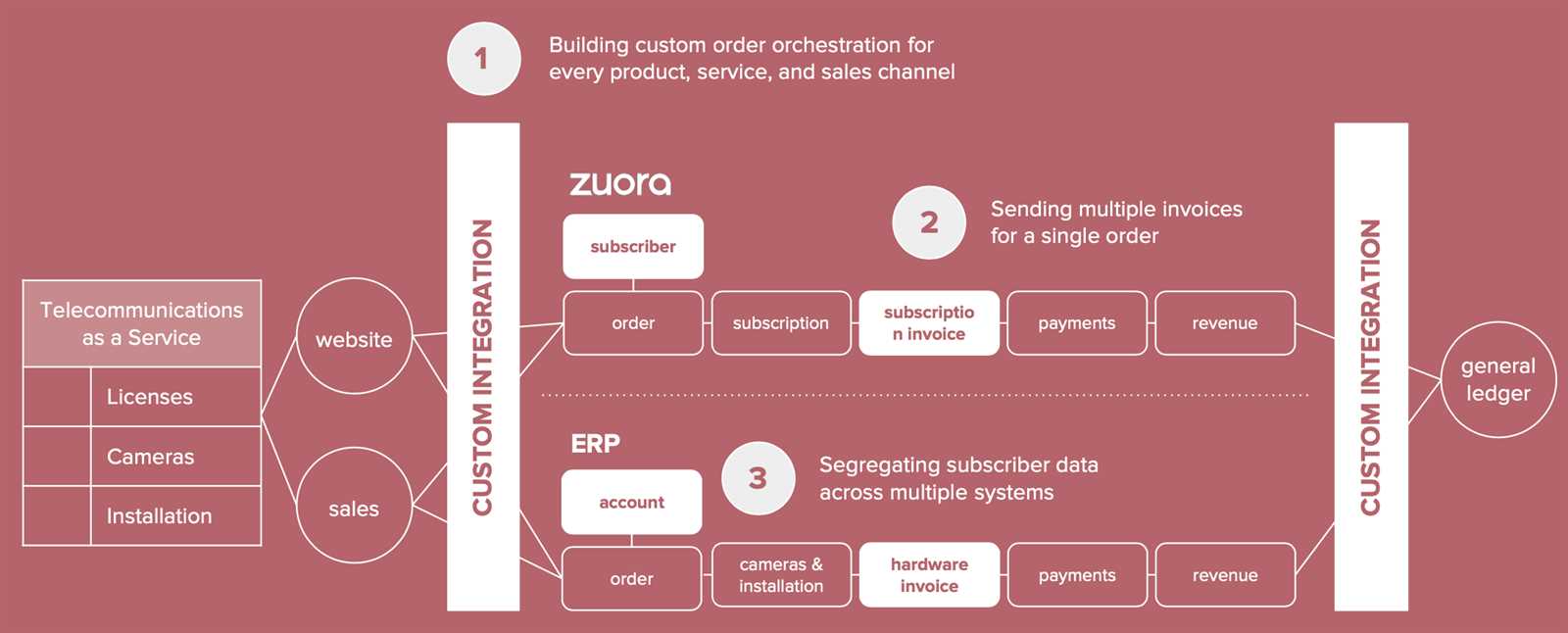

Integrating Billing Systems with Other Platforms

Integrating a billing system with other software platforms is essential for streamlining operations, improving accuracy, and enhancing the overall customer experience. By connecting financial management tools with other business applications, such as customer relationship management (CRM) systems or accounting software, businesses can ensure that all data flows seamlessly between platforms. This integration helps automate processes, reduce manual data entry, and improve decision-making by providing a unified view of financial and customer information.

Here are some key benefits of integrating billing systems with other platforms:

- Improved Data Accuracy: Automation reduces the risk of human error by eliminating the need for duplicate data entry across systems.

- Faster Billing Processes: Integrating platforms helps automate invoicing, payment processing, and reporting, speeding up the entire billing cycle.

- Centralized Data Management: Having all your customer and financial data in one place simplifies reporting, analysis, and compliance efforts.

- Better Customer Experience: Synchronizing customer data between platforms ensures that clients receive accurate, timely information and can manage their accounts efficiently.

To achieve a smooth integration, businesses typically need to follow these steps:

- Assess System Requirements: Understand the technical specifications of both the billing system and the platform you wish to integrate with, including APIs and data formats.

- Map Data Flow: Identify which data needs to be shared between systems, such as payment information, customer details, and service usage records.

- Set Up Integration Points: Use available connectors, third-party tools, or custom integrations to link the systems and enable seamless data transfer.

- Test the Integration: Before going live, thoroughly test the integration to ensure data is syncing correctly, and all processes are working as expected.

- Monitor and Optimize: Regularly review the integration to ensure it continues to function efficiently and make adjustments as needed.

By successfully integrating your billing system with other platforms, you can enhance operational efficiency, reduce errors, and provide your customers with a more streamlined experience. This approach allows businesses to focus on growth while maintaining accurate and timely financial processes.

Key Features of a Custom Billing Document Format

A well-designed billing document is more than just a summary of charges–it is a comprehensive tool for clear communication between a business and its clients. The most effective billing formats include several key features that enhance their functionality and ensure they serve their intended purpose. These features not only provide transparency but also help streamline payment processes and minimize errors.

One essential element of a custom financial statement is the ability to clearly display transaction details. This includes a breakdown of the goods or services provided, unit prices, and quantities, allowing clients to easily verify charges. Providing this level of detail reduces confusion and builds trust with customers.

Payment terms are another critical feature. These should be prominently displayed to ensure the client understands the due date, accepted payment methods, and any potential late fees. By including this information upfront, businesses can reduce payment delays and improve cash flow.

Another important aspect is branding integration. Including your company’s logo, color scheme, and font style not only reinforces brand identity but also contributes to a polished, professional look. This can help build a stronger relationship with customers by making the document feel more personalized and aligned with the company’s values.

Tax information is also a necessary inclusion. Whether it’s value-added tax (VAT), sales tax, or other applicable charges, clearly displaying these details ensures compliance with local regulations and prevents misunderstandings. This feature is especially important for businesses operating in multiple regions with varying tax laws.

Finally, flexibility in design is crucial. The document should be adaptable to different business models, such as one-time charges or recurring subscriptions. Customization options allow companies to modify the format according to specific needs, ensuring that the document accurately reflects the transaction type and customer requirements.

Layout Customization Tips for Billing Documents

Customizing the layout of your financial documents is key to ensuring they are both functional and professional. A well-organized structure makes it easier for customers to read and understand the details of their charges. Customizing the design to match your business needs also helps reinforce brand identity and improve the overall user experience. In this section, we’ll explore several tips to effectively adjust the layout of your billing statements.

1. Keep It Clean and Organized

When customizing the layout, clarity should be the top priority. Avoid clutter by leaving adequate space between sections and ensuring that information is well-organized. Key sections like customer details, transaction breakdown, and payment terms should each have distinct areas on the page. Use headings and subheadings to break down the content into digestible parts, making it easier for clients to find the information they need.

2. Focus on Important Details

Ensure that essential information stands out. Bold key elements like the total amount due, payment deadlines, and account numbers. This helps clients quickly identify critical points, especially when they are reviewing multiple documents. You may also consider using color or other design features to highlight these important items without overwhelming the overall aesthetic.

Additionally, include clear section labels to categorize details such as itemized charges, taxes, and payment instructions. This makes the document easier to navigate, particularly for clients who need to review or reference specific items.

3. Incorporate Your Brand’s Identity

Incorporating your business’s branding elements into the layout helps create a cohesive experience for your clients. Use your company’s logo, color scheme, and font style consistently throughout the document. This adds a professional touch and reinforces your brand image. Make sure the design elements complement the content and don’t distract from the key information on the page.

By focusing on clarity, organization, and branding, you can ensure that your billing documents are not only effective in conveying necessary details but also aligned with your company’s professional standards. A well-designed layout can help foster trust with clients and improve their overall satisfaction with your business.

How to Add Tax Information to Billing Documents

Including tax details in your financial documents is crucial for ensuring compliance with local and international tax regulations. Whether you are dealing with sales tax, VAT, or other applicable taxes, it’s important to display this information clearly and accurately for both the business and the customer. In this section, we’ll explore how to properly add tax information to your billing statements and ensure that all tax-related data is presented in a way that is both transparent and easy to understand.

The first step in adding tax information is to clearly define which types of taxes apply to the transaction. This may vary depending on your location, industry, or the type of goods or services provided. Once the tax types are identified, make sure to list them separately on the document, ideally in a distinct section labeled “Taxes” or “Tax Breakdown.” This ensures that customers can easily identify the exact taxes they are being charged.

Next, ensure that the tax rates are clearly stated next to the corresponding tax name. It is important to list the rate percentage (e.g., 5%, 10%, etc.) and the corresponding amount for each tax applied to the total charges. This allows customers to see exactly how much they are being charged in taxes and understand the calculation behind the final amount due.

For businesses operating in multiple regions or countries, it’s critical to consider regional tax laws and include the appropriate rates for each location. You can segment the tax information by region or apply different rates depending on the client’s billing address. Make sure to adjust your system to account for these variations, ensuring that the tax information is correct and complies with the specific tax laws of each jurisdiction.

Lastly, provide a summary of taxes at the end of the document that totals all the applicable taxes. This should be placed near the final amount due to give a clear picture of the overall charges. It’s helpful to break down the taxes so clients can easily compare them to the original prices, ensuring full transparency in the billing process.

Setting Up Payment Terms in Billing Documents

Establishing clear and concise payment terms in your billing statements is essential for managing cash flow and ensuring timely payments from customers. Payment terms outline when and how payments are expected, including due dates, payment methods, and any penalties for late payments. Setting these terms accurately not only reduces confusion but also helps foster trust and transparency with clients. In this section, we’ll explore how to effectively incorporate payment terms into your financial documents.

The first step in setting up payment terms is to clearly define the payment due date. This date should be prominently displayed on the document, allowing customers to easily identify when payment is expected. It’s also helpful to include a reminder of the due date in the document’s footer or summary section to ensure it catches the customer’s attention before they finalize the payment.

Next, specify the accepted payment methods. Whether you accept credit cards, bank transfers, checks, or online payment gateways, it is important to list the options available. This ensures customers know how they can pay and helps avoid delays caused by misunderstandings about payment channels.

Another important aspect to include is any late fee policy. If payments are not received by the due date, outline the fees or interest that will apply. Clearly state the percentage or flat fee that will be charged, as well as the grace period if one is offered. Including this information upfront can encourage timely payments and reduce the likelihood of delays.

In cases where customers have negotiated special payment terms, such as installment payments or discounts for early payment, be sure to customize these terms for each client. This ensures that unique arrangements are respected and documented accurately, fostering a positive business relationship.

Finally, always test your setup to ensure that payment terms are correctly applied to each billing document, reflecting the agreed-upon conditions. Clear and accurate payment terms contribute to smoother transactions and help maintain a consistent cash flow for your business.

Best Practices for Billing Document Design

Designing a clear and effective billing document is essential for ensuring smooth communication between businesses and their clients. A well-structured design not only enhances the visual appeal but also improves readability and customer understanding. When creating these documents, following best practices can help ensure they are professional, informative, and user-friendly. Below are some key guidelines for creating effective billing document layouts.

- Keep the Layout Simple and Clean: Avoid clutter by using ample white space and separating sections clearly. A clean, organized layout makes it easier for clients to review and understand the charges.

- Prioritize Key Information: Make sure the most important details–such as the total amount due, payment terms, and due date–are clearly visible and easy to locate. Use bold fonts or larger text for these items to draw attention.

- Use Clear Section Headings: Break the document into distinct sections such as customer information, services rendered, taxes, and payment instructions. Each section should be clearly labeled to help the client navigate the document efficiently.

- Incorporate Branding Elements: Ensure the design aligns with your brand by including your company’s logo, color scheme, and font style. A consistent design reinforces professionalism and helps build brand recognition.

- Provide a Detailed Breakdown of Charges: An itemized list of services or products with individual pricing, taxes, and applicable discounts helps customers understand how their total was calculated.

- Ensure Mobile-Friendliness: Many clients may view their billing documents on mobile devices. Ensure the design is responsive and adapts well to smaller screens, maintaining readability and usability.

- Highlight Payment Instructions: Clearly display payment methods, account numbers, and due dates. Including payment options in an easy-to-find location can help clients make timely payments and avoid confusion.

- Include Legal and Tax Information: Make sure to comply with legal and tax regulations by including necessary tax breakdowns, disclaimers, and terms of service in a clear and accessible manner.

By following these best practices, businesses can create billing documents that are not only visually appealing but also highly functional, ensuring that clients can easily understand and act upon the information presented. A well-designed document reflects positively on your company and contributes to a smooth and professional customer experience.

How to Automate Billing Document Generation

Automating the generation of billing statements is an effective way to streamline financial operations, reduce manual work, and ensure timely and accurate document delivery. By setting up an automated process, businesses can ensure that their clients receive consistent and error-free statements without the need for manual intervention. In this section, we will discuss the steps to automate the creation and distribution of billing documents, ensuring efficiency and accuracy.

1. Set Up Recurring Billing Rules

The first step in automating the generation of billing documents is to configure recurring billing rules based on your business model. This ensures that customers who subscribe to ongoing services are billed automatically at regular intervals. These rules should define:

- Billing frequency: Daily, weekly, monthly, or annual intervals.

- Service start and end dates: Define the period for which the billing document will be generated.

- Billing cycle alignment: Align billing cycles with your internal processes to ensure consistency.

Once these rules are in place, the system can automatically generate billing documents based on the parameters you’ve set.

2. Use Custom Triggers and Templates

Next, set up triggers to automatically create and send billing documents when certain actions occur. For example, when a service period ends or a payment is due, a trigger can initiate the document generation process. Custom templates can be used to ensure that all documents follow the same format, reducing the need for manual adjustments. Key features of custom triggers and templates include:

- Personalization: Templates can be tailored to include customer-specific information, such as service usage, discounts, or special terms.

- Automation of delivery: Once a billing document is generated, set up automated email notifications or integrations with other systems to send the document directly to the client.

- Error checking: Automated systems can perform checks to ensure all necessary data is included, reducing the risk of errors in the document.

3. Monitor and Adjust Billing Workflows

Once automated processes are set up, it’s important to monitor and optimize them regularly. By reviewing the efficiency of your billing workflows and making adjustments as needed, you can ensure continuous improvement. Key aspects to review include:

- System performance: Ensure that the automation system is running smoothly and generating documents on time.

- Customer feedback: Pay attention to any client complaints or feedback regarding document clarity or delivery timing.

- Compliance updates: Keep your automation settings updated to comply with any regulatory or tax changes that could impact the content of the documents.

By automating the generation of billing documents, you not only save time but also reduce errors and ensure that your clients receive timely and accurate statements. Automa

Billing Document Error Troubleshooting

When working with automated billing systems, errors in document generation can occasionally occur. These issues can range from incorrect information appearing on the document to formatting problems that make it difficult for clients to read or understand. Troubleshooting these errors effectively is crucial to ensuring smooth operations and maintaining customer trust. In this section, we’ll discuss common issues and provide solutions to address them.

1. Incorrect Data Displayed

One of the most common issues with billing documents is incorrect data, such as wrong charges, dates, or client details. This can happen due to discrepancies between your billing system and the data input or syncing issues. To resolve this:

- Check the Data Sources: Ensure that all relevant data, such as customer information, product details, and pricing, is correctly entered into the system. Cross-check against your customer records to verify accuracy.

- Review Automated Calculations: Make sure that calculations for taxes, discounts, and total amounts are being generated correctly by the system. If discrepancies occur, examine the logic in your billing rules.

- Examine Data Synchronization: If your system is integrated with other platforms (e.g., CRM or ERP), ensure that data synchronization is functioning properly, as delays or errors in syncing can lead to inaccurate information.

2. Formatting and Layout Issues

Another frequent issue involves improper formatting or layout problems that make the document difficult to read. This could include misaligned text, missing sections, or inconsistent font styles. To fix these issues:

- Check Layout Configuration: Review the layout settings to ensure that sections such as service breakdown, payment terms, and taxes are properly spaced and aligned. Test different screen sizes to verify responsiveness.

- Test Document Generation: Perform tests by generating sample documents under various conditions to check for layout issues. This helps identify any formatting problems early on.

- Review Branding Elements: If custom branding (such as logos, fonts, or colors) is causing issues, make sure the design elements are correctly applied and do not interfere with the readability or structure of the document.

By carefully diagnosing and addressing common issues with billing documents, you can minimize errors and improve the accuracy and presentation of your financial statements. Regular system checks and maintenance, along with thorough testing, will help ensure that your billing process runs smoothly and your clients receive clear, professional documents every time.

Using Billing Templates for Recurring Charges

Recurring billing is a crucial component for businesses offering subscription-based services or products. Automating this process helps maintain consistent cash flow while reducing manual work and human error. To streamline the creation and delivery of these regular billing statements, businesses can use predefined document layouts that automatically adjust to each billing cycle. In this section, we’ll explore how to utilize these layouts effectively for recurring billing scenarios.

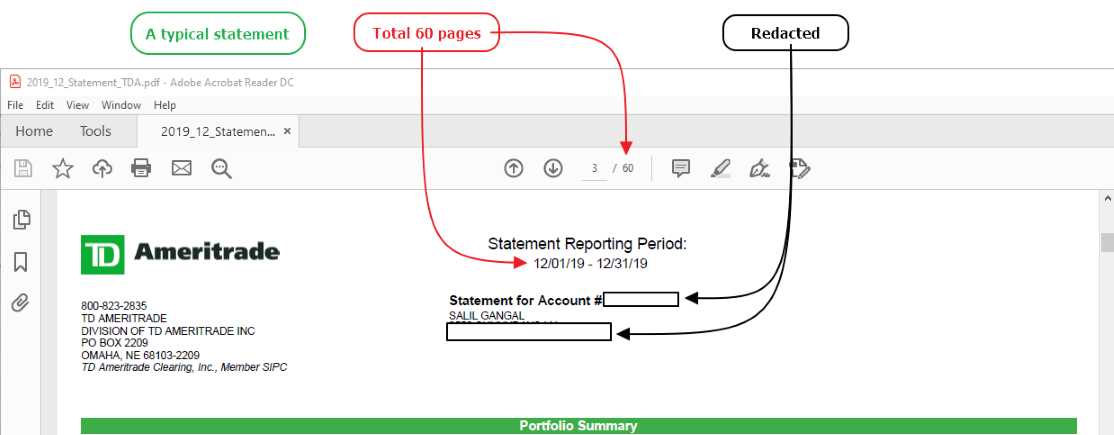

One of the key benefits of using billing document layouts for recurring charges is the ability to set up consistent and automated billing schedules. These layouts can be designed to reflect the same structure each time a new billing cycle occurs, reducing the need for manual input while ensuring customers always receive accurate and timely statements. Whether your business operates on a monthly, quarterly, or annual billing cycle, automated document generation helps to ensure that each client is invoiced appropriately, based on the terms of their subscription.

Customizing your layout for recurring billing scenarios involves setting up automatic triggers that generate a document each time a payment is due. These documents can include all the necessary details, such as service charges, applicable taxes, and any discounts, with values updated according to the client’s usage or subscription plan. By defining specific rules for each customer type or service package, the layout can be tailored to automatically adjust based on the customer’s unique requirements.

Flexible billing periods can also be easily managed using recurring billing layouts. By setting the start and end dates of each subscription or service period, you can ensure that documents are generated on the correct date, reflecting any usage or adjustments made during the cycle. Additionally, integrating these layouts with payment systems ensures that each document is accompanied by the appropriate payment instructions and due date, making the process even more seamless for customers.

Ultimately, using billing layouts for recurring charges allows businesses to save time, improve accuracy, and enhance the customer experience by ensuring that all relevant information is clearly presented in each document. Automation not only reduces administrative burdens but also helps build a more efficient and reliable billing process.

Exporting and Importing Billing Document Layouts

Managing billing document layouts often involves transferring them between different systems or environments, especially when customizing or updating formats for various client needs. The ability to export and import these layouts ensures consistency across multiple platforms and saves time when adapting documents for new business processes or clients. This section will guide you through the steps for exporting and importing these layouts, making it easier to maintain uniformity and streamline document management.

Exporting a billing layout typically involves extracting the current design and settings from your system into a portable format, such as a file that can be saved locally or shared with other users or platforms. This process is useful when you need to transfer layouts to another system or store them as backups for future use. When exporting, it’s important to include all related elements–such as custom fields, calculated charges, and formatting rules–so the layout can be recreated accurately in a new environment.

Steps for Exporting Layouts:

- Access the Layout Management Interface: Navigate to the section where layouts are configured and managed.

- Select the Layout: Choose the specific layout you wish to export from the list of available designs.

- Export to File: Use the available export options to generate a file containing the layout’s structure and settings.

- Save the File: Choose a secure location to store the exported file for later use or transfer.

On the other hand, importing layouts allows you to bring in pre-configured designs or templates from external sources. This feature is especially valuable when integrating with third-party systems, updating to a new version of the layout, or applying a standardized document format across multiple clients or departments. Once imported, the system can automatically apply the layout to newly generated documents or allow users to manually assign it as needed.

Steps for Importing Layouts:

- Select Import Option: In the layout management section, choose the option to import a new design or format.

- Upload the File: Locate and upload the exported layout file you wish to import into the system.

- Verify the Import: After uploading, verify that all elements and settings have been correctly imported and are ready for use.

- Apply the Layout: Once the import is successful, apply the layout to relevant documents or customize further if needed.

By mastering the export and import process, you can efficiently manage your billing document designs across different systems, ensuring that your business remains agile and adaptable to changing requirements while maintaining consistency and accuracy in client communications.

Managing Multi-Currency Billing Documents

For businesses operating internationally, handling transactions in multiple currencies is a common challenge. Properly managing these transactions in billing documents ensures clarity, accuracy, and timely payments, while reducing the risk of confusion for both the company and its clients. This section will discuss how to effectively manage multi-currency billing, ensuring that your documents are correctly formatted and that exchange rates are accurately applied across different regions.

Multi-currency billing requires a system that can handle not only different currencies but also the varying exchange rates that fluctuate over time. It’s essential to set up proper configurations in your billing system that allow for seamless calculation and presentation of charges in the client’s preferred currency. This ensures that the customer sees the correct amount and can make payments without facing additional confusion or discrepancies due to currency conversions.

Key Considerations for Multi-Currency Management

- Currency Settings: Ensure that the system supports multiple currencies and is set up to automatically recognize the currency used by each client. This includes defining exchange rates and making sure they are updated regularly to reflect market conditions.

- Localized Payment Terms: Alongside the currency, make sure to consider local payment methods and regional taxes, which may vary from one country to another.

- Handling Exchange Rate Fluctuations: Decide whether exchange rates will be fixed at the time of the transaction or whether they will be updated dynamically based on real-time market rates.

Example of Multi-Currency Billing Setup

Here is an example of how multi-currency details might be presented in a billing document:

| Item | Amount | Currency | Exchange Rate | Total (Local Currency) |

|---|---|---|---|---|

| Service A | 100 | USD | 1.1 | 110 EUR |

| Service B | 50 | EUR | 1 | 50 EUR |

| Service C | 200 | GBP | 1.2 | 240 EUR |

In this example, the services provided in different currencies (USD, EUR, and GBP) are converted into the client’s local currency (EUR) using the current exchange rate. This ensures that the client sees a total that accurately reflects the amount they owe, without any ambiguity due to currency differences.

By carefully configuring your system to handle multi-currency transactions, you can ensure that your billing documents remain clear, professional, and accurate. This not only enhances the customer experience but also ensures compliance with local regulations and simplifies financial management for your business.

How to Ensure Billing Document Compliance

Ensuring compliance with local laws and regulations is a critical aspect of managing billing processes. Businesses must follow specific guidelines regarding what information needs to be included on each document, how taxes should be applied, and how to present charges transparently. Failure to comply with these requirements can lead to legal consequences and damaged customer trust. This section will outline key strategies to ensure that your billing documents meet all necessary legal and regulatory standards.

Key Considerations for Document Compliance

- Legal Requirements: Different regions have different legal requirements for the content of billing statements. These may include mandatory fields such as tax identification numbers, detailed descriptions of services provided, and specific formatting rules. Make sure to research the regulations in each jurisdiction where you operate.

- Tax and VAT Compliance: Ensuring that all applicable taxes and value-added tax (VAT) are correctly applied is essential. This includes ensuring that the right tax rates are used based on the customer’s location and the nature of the service or product provided.

- Currency and Payment Terms: If your business operates internationally, it’s crucial to clearly specify the currency in which payment is due and the payment terms, including any late fees or discounts for early payment.

Ensuring Accurate Compliance in Billing Documents

To guarantee that your billing documents comply with all regulations, it’s essential to integrate automated checks into your system that verify whether each document meets the necessary legal criteria. Below is an example of how compliance-related data might appear on a standard billing document.

| Field | Required Information |

|---|---|

| Tax Identification Number | Required for businesses in certain jurisdictions, particularly for VAT purposes. |

| Service Description | Provide a clear description of each service or product provided to ensure transparency. |

| Tax Breakdown | Show how taxes are applied (e.g., sales tax, VAT) and the tax rate used. |

| Payment Terms | Clearly state payment due date, late fees, and any applicable discounts. |

| Currency | Indicate the currency in which payment is expected. |

Integrating compliance checks into your billing document generation system ensures that every document issued automatically contains the necessary legal details. This minimizes human error and the risk of overlooking important regulations.

By taking the steps to ensure that your billing documents are fully compliant, you protect your business from legal issues, build trust with customers, and maintain smooth financial operations. Regularly updating your system to account for changi

Common Mistakes When Creating Billing Document Layouts

Designing billing document layouts can be a complex task, especially when trying to ensure clarity, accuracy, and compliance with all relevant standards. Even with the best intentions, mistakes can occur that affect the effectiveness of the document or create confusion for customers. In this section, we will explore some of the most common errors businesses make when creating billing layouts, and how to avoid them.

Common Mistakes to Avoid

- Inconsistent Branding: One of the most frequent mistakes is neglecting to maintain consistent branding throughout the layout. If your documents do not align with your company’s visual identity, they can appear unprofessional and unreliable.

- Missing or Incorrect Information: Failing to include essential details, such as tax identification numbers, payment due dates, or service descriptions, can lead to confusion and potential legal issues. Always ensure that all necessary fields are included and correctly filled out.

- Not Accounting for Different Currencies: For businesses with international customers, it’s important to ensure that the correct currency and conversion rates are applied. Failing to do so can lead to overcharging or undercharging clients, and cause misunderstandings.

- Complex Layouts: While it’s important to include all relevant information, overly complex layouts can overwhelm customers. Avoid clutter and keep the design clear and easy to understand.

- Lack of Customization for Client Needs: Using the same layout for all clients, without considering individual needs or preferences, can reduce the effectiveness of your documents. Customizing the layout based on customer-specific requirements can improve the overall experience.

How to Avoid These Mistakes

- Consistent Templates: Regularly update and audit your document layouts to ensure they reflect your branding guidelines and contain all relevant information in a clear and organized manner.

- Automation for Accuracy: Leverage automation to ensure that all necessary fields are populated correctly and that each document is consistent and accurate. Automating tasks such as tax calculations and currency conversions can reduce errors.

- Simplify the Layout: Focus on simplicity by organizing information logically and avoiding unnecessary details that might confuse the customer. A clean, well-structured layout helps ensure that clients can quickly understand the charges and payment instructions.

- Customization for Clients: Ensure that you provide a degree of flexibility in the layout to accommodate different types of customers, whether they require specific billing formats or additional information tailored to their service agreement.

By avoiding these common mistakes and following best practices, businesses can create effective, clear, and professional billing layouts that improve the customer experience and reduce the risk of errors or disputes.