Customizable British Invoice Template for Professional Invoicing

Managing payments and keeping track of transactions is an essential aspect of any business. Whether you’re a freelancer, small business owner, or running a larger company, having the right structure for financial documentation is crucial. A well-structured document not only ensures clarity but also helps maintain professionalism in your dealings.

Customizing a payment record form for your specific needs can save time and prevent errors. With the right approach, you can create documents that meet legal requirements and are easy for your clients to understand. A simple, clear format helps establish trust and ensures smooth transactions.

Understanding the key elements to include in these forms is important for compliance with regulations. From essential contact details to tax information, each section plays a critical role in keeping your business organized. The right layout can also support better cash flow management and improve your chances of getting paid on time.

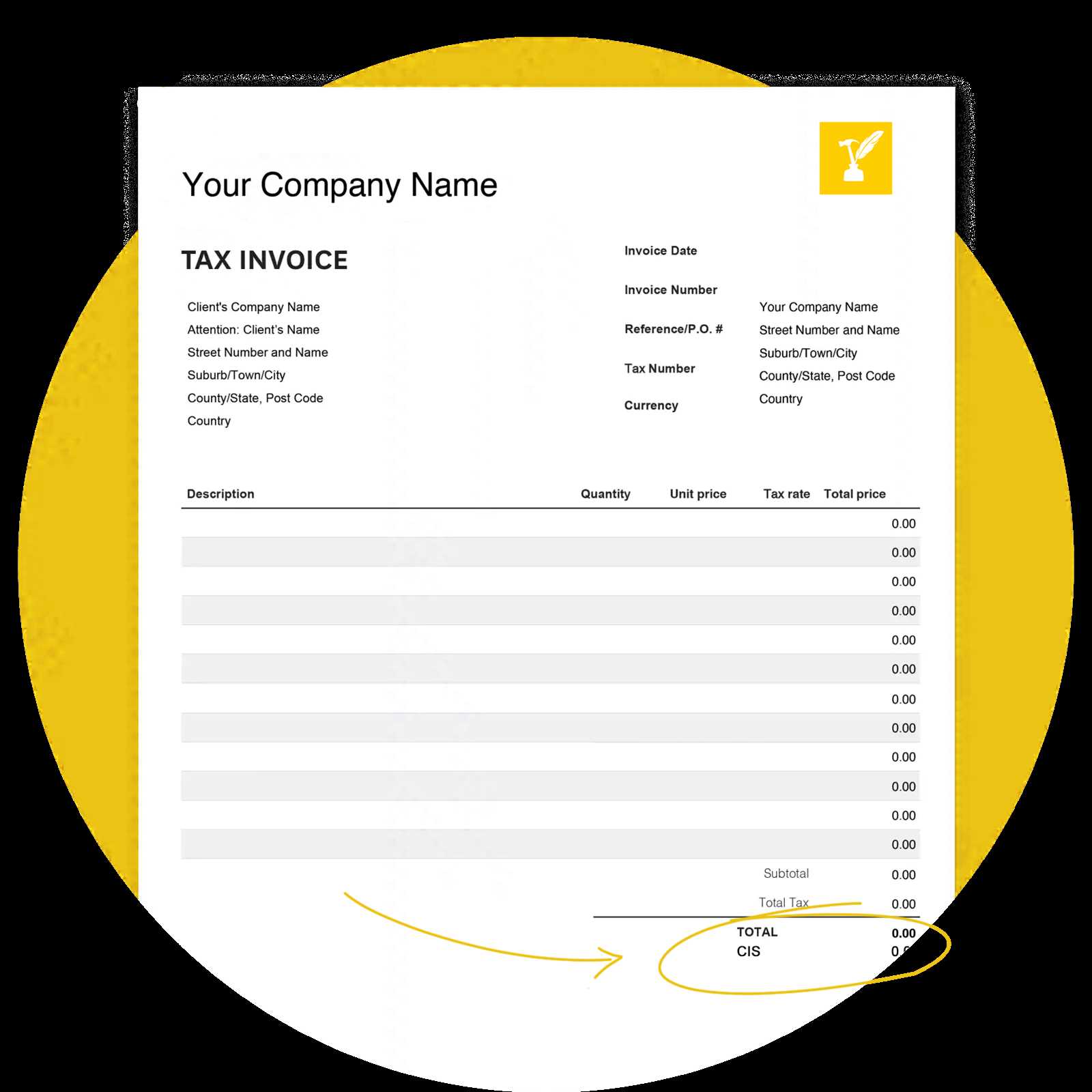

British Invoice Template Overview

Creating a professional payment document is a crucial part of any business transaction. A properly designed form serves as a formal request for payment, detailing the services or goods provided, along with payment terms. It not only ensures clarity but also serves as a record for both the supplier and the client, helping prevent misunderstandings.

Customizable documents allow businesses to easily modify the layout, content, and style to suit their brand. Having a well-organized structure means that all necessary information is included in a clear and easily understandable format, from the total amount due to the payment methods available.

Efficient use of such forms simplifies financial tracking, facilitates smooth cash flow management, and ensures legal compliance. Whether for a small startup or a large enterprise, customizing a payment request form helps create consistency and professionalism in financial communication.

Why Use a British Invoice Template

Having a ready-made document for requesting payments can save time and ensure accuracy in business transactions. By using a predefined structure, businesses can streamline the process, reduce human error, and create consistent, professional records. This approach helps maintain clarity and efficiency, which is essential for building trust with clients and ensuring smooth financial operations.

Consistency and Professionalism

Using a well-structured payment request form guarantees that all necessary details are consistently included in every transaction. This not only helps in maintaining a professional image but also ensures that clients can easily understand the terms of the agreement. Consistent documentation makes it simpler to track payments and manage finances effectively.

Legal and Tax Compliance

Another key benefit of using a predefined payment record is compliance with local legal and tax regulations. A properly formatted document helps meet the required standards, including the inclusion of tax identification numbers, VAT details, and payment terms. This reduces the risk of disputes and potential issues with regulatory authorities.

Key Features of an Invoice Template

When creating a document for requesting payment, certain elements are essential to ensure it is clear, professional, and legally sound. These key features not only make the document functional but also help maintain consistency across all financial communications. By including the necessary details, businesses can avoid confusion and ensure both parties are on the same page.

Essential Information

Every well-structured payment document must include vital information such as the recipient’s and sender’s contact details, the unique reference number, and a clear breakdown of services or products provided. These elements ensure that the client understands what they are paying for and can easily reference the transaction in the future.

Payment Terms and Legal Compliance

Clear payment terms, such as due dates and accepted payment methods, are crucial for setting expectations. Additionally, including necessary tax information, such as VAT numbers or other regional tax codes, ensures compliance with local regulations. These features protect both the business and the client, reducing the risk of misunderstandings or disputes.

How to Customize Your Invoice

Customizing your payment request form allows you to tailor it to your business needs, ensuring that it aligns with your brand and communicates the necessary information clearly. By adjusting certain elements, you can make the document more professional, personalized, and relevant to the services or products you offer. Below are key areas to focus on when customizing your payment record.

Personalizing the Layout and Design

One of the first steps in customizing a payment record is choosing a layout that reflects your business’s style. This includes selecting fonts, colors, and logos that align with your brand identity. A well-designed document can make a positive impression on clients and reinforce your business’s professionalism.

Adjusting the Content and Structure

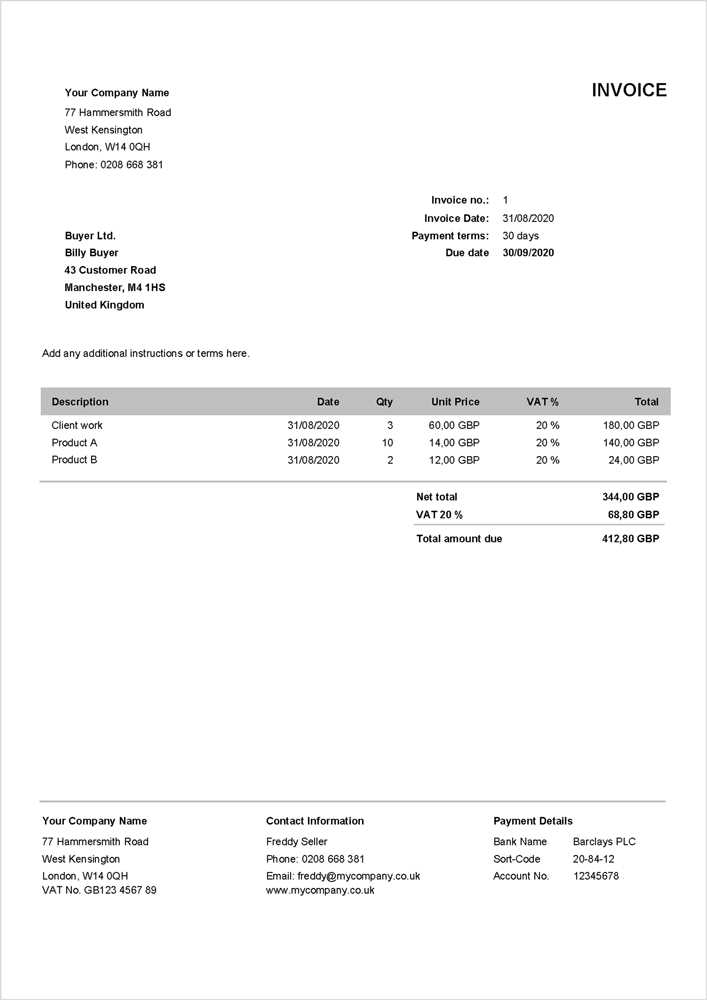

Next, you can modify the content to include all relevant details. This includes adjusting the section for services or products, adding extra fields for discounts or additional fees, and ensuring that the payment terms are clearly stated. Here’s an example of how to structure this information:

| Item | Description | Unit Price | Quantity | Total |

|---|---|---|---|---|

| Service 1 | Detailed description of service | £100 | 2 | £200 |

| Service 2 | Additional service provided | £150 | 1 | £150 |

| Total | £350 | |||

By organizing your document in a way that makes sense for your business, you ensure both clarity and ease of understanding for the client.

Essential Elements of a UK Invoice

For a payment request document to be legally valid and professionally presented, it must include specific key components. These elements ensure that both the client and the business are fully aware of the terms of the transaction. By following these guidelines, you can create a clear, concise, and compliant financial record.

Contact and Business Information

Every document must include the names and contact details of both the business and the client. This includes the full legal name, address, and contact information for both parties. It’s also important to include your business registration number or VAT number, especially for tax purposes. This provides transparency and helps establish the authenticity of the document.

Detailed Breakdown of Products or Services

Clear descriptions of the goods or services provided, along with their corresponding quantities and prices, should be listed. This ensures there is no confusion about what the client is paying for. The total cost should be clearly stated, and any taxes or additional charges must be outlined separately. Itemization helps avoid disputes and provides clarity on the value of each aspect of the transaction.

Payment terms such as the due date and accepted methods should also be included. These details help set clear expectations and prevent delays in payment.

Common Mistakes to Avoid in Invoices

Even small errors in your payment request documents can lead to confusion, delays in payment, or even legal issues. It’s essential to ensure that every detail is accurate and well-organized. By avoiding common mistakes, you can maintain professionalism and streamline your financial processes.

Incorrect or Missing Details

One of the most frequent mistakes is leaving out important information or providing incorrect details. This can include anything from a misspelled name, incorrect contact details, to missing tax identification numbers or payment terms. Double-checking all the information before sending ensures that there are no misunderstandings and prevents the need for revisions after the document is sent.

Unclear Payment Terms

Another common mistake is not specifying the payment terms clearly. Without an explicit due date or payment method, clients may delay payments or become confused about how to settle their bills. Always include clear instructions about when payment is expected and which methods are acceptable, whether it’s by bank transfer, credit card, or another method. This minimizes the risk of payment delays.

Understanding Invoice Numbering System

A clear and consistent numbering system is essential for managing payment request documents. The invoice number serves as a unique identifier for each transaction, making it easier to track, reference, and organize records. A well-structured numbering system also ensures compliance with legal and accounting standards, helping businesses avoid confusion or potential disputes.

Why a Numbering System is Important

Each payment request form should have a unique number to avoid duplication and maintain proper records. A sequential numbering system helps keep things organized, making it easier to search for specific documents when needed. It also aids in auditing, helping both businesses and clients track the history of transactions over time.

How to Structure Your Numbering System

There are different approaches to structuring your numbering system. Here is an example of how you can organize it:

| Format | Example | Explanation |

|---|---|---|

| Year-Month-Sequence | 2024-01-001 | This format includes the year, month, and a sequential number for each transaction. |

| Client ID-Sequence | CL001-045 | This format combines a client identifier with a sequential number, helpful for businesses with multiple clients. |

| Simple Sequential | 0001, 0002, 0003 | This is a basic, sequential numbering system that is easy to implement but may lack some organization. |

By choosing the right numbering structure, businesses can easily keep track of their records while ensuring the system remains scalable as the number of transactions grows.

Best Practices for UK Invoicing

Following best practices when creating payment documents not only ensures timely and accurate payments but also helps maintain professionalism and avoid legal issues. Properly structured financial records are vital for a smooth business operation, whether you’re a small entrepreneur or a larger enterprise. Implementing the right practices will enhance your business credibility and streamline your financial processes.

Timeliness and Clarity

Sending payment requests promptly and providing clear, detailed information is crucial. Always ensure that the document is sent well before the due date and contains all the necessary details, including a precise description of the goods or services provided, payment terms, and any applicable taxes. Clear, unambiguous communication reduces the risk of disputes and late payments.

Accurate Record Keeping

Maintaining accurate records is essential for both business operations and legal compliance. Ensure that each transaction is recorded with a unique reference number and the correct details. Keep track of issued documents and payments to manage cash flow effectively. Using a digital system can simplify this process and help prevent errors.

Here are some key practices to follow:

| Best Practice | Explanation |

|---|---|

| Include Clear Payment Terms | Specify due dates, payment methods, and any late fees to avoid misunderstandings. |

| Use Professional Design | Ensure that your document has a clean, consistent format with your business branding. |

| Double-Check Details | Verify all client and transaction information before sending to prevent errors. |

| Send Early | Issue payment requests as soon as the product or service is delivered to maintain cash flow. |

By adhering to these best practices, you can avoid unnecessary complications and ensure a smooth invoicing process, leading to better financial management and improved relationships with clients.

How to Add Tax Information Properly

When preparing payment documents, including accurate tax details is essential for both legal compliance and transparency. Properly documenting taxes not only ensures that you meet local regulations but also provides clarity for the client regarding how the total amount is calculated. Whether you’re dealing with VAT or other applicable taxes, it is important to include the correct information in the right format.

Including Tax Identification Numbers

For tax purposes, it is crucial to include your business’s tax identification number, as well as the client’s, if applicable. This information helps authorities identify the transaction in case of audits and ensures that the tax is applied correctly. The number should be prominently displayed, often near the business details or in a specific tax section of the document.

Listing the Correct Tax Rates and Amounts

Make sure to clearly state the applicable tax rate and the total amount of tax charged. This should be calculated based on the value of the goods or services provided, ensuring that the tax percentage is accurate. It’s also advisable to include a breakdown of how the tax was calculated. Here’s an example of how to structure this information:

| Description | Amount | Tax Rate | Tax Amount |

|---|---|---|---|

| Product/Service | £500 | 20% | £100 |

| Total | £500 | – | £100 |

| Grand Total | £600 | – | – |

By clearly listing the tax rate and amount, along with the total cost, you help prevent confusion and ensure compliance with tax regulations. Properly formatted tax information also fosters trust and transparency between you and your clients.

Design Tips for a Professional Invoice

A well-designed payment request form can make a lasting impression on clients and ensure that all necessary details are easy to find. Good design isn’t just about aesthetics; it’s also about clarity and functionality. A professional-looking document reflects the credibility of your business and makes it easier for clients to understand and process payments.

Keep It Clean and Organized

One of the most important design principles is simplicity. An organized layout allows the client to quickly find the information they need. Use clear headings, a logical flow, and sufficient white space to prevent the document from feeling cluttered. Here are some tips for keeping your design clean:

- Use a simple, easy-to-read font like Arial or Helvetica.

- Separate sections with clear headings (e.g., “Payment Details,” “Items Provided”).

- Ensure there is enough space between sections so the document doesn’t feel cramped.

- Avoid using too many colors; stick to one or two that complement your branding.

Highlight Key Information

To ensure important details stand out, use formatting techniques such as bolding, underlining, or using larger font sizes for key sections like the total amount due, payment due date, and your contact information. These elements should be easy to spot at a glance. Here’s a list of elements to emphasize:

- Total amount due: Make it bold or in a larger font to ensure it is immediately visible.

- Due date: Clearly highlight this to avoid payment delays.

- Business details: Include your company name, address, and contact information at the top for easy reference.

- Payment methods: Make sure to list all accepted methods so clients can choose the most convenient option.

By following these simple design principles, your payment request forms will not only look professional but also ensure that your clients can quickly find all the relevant details, reducing the chances of confusion or delays.

Legal Requirements for UK Invoices

When creating a payment document, it’s essential to ensure that all legal requirements are met. Whether you’re a small business owner or a freelancer, understanding the necessary legal details will help you stay compliant with tax laws and avoid potential issues. Certain information must be included in each document to make it valid and legally recognized, particularly for tax reporting and auditing purposes.

Tax Identification Number – If your business is VAT registered, you must include your VAT number on every payment request document. This ensures that the transaction is legally recognized and helps in the reporting of taxes to the relevant authorities.

Correct Breakdown of VAT – If VAT is charged, you need to clearly separate the amount of VAT from the total cost of the goods or services. This ensures transparency and allows clients to see how the tax is calculated. Include both the net amount (before VAT) and the VAT amount, as well as the total (including VAT).

Mandatory Details – In addition to the tax information, other key details must be included, such as the business name, the client’s name, the unique reference number for the transaction, and the issue date. These elements are required to help identify the document and maintain proper records for both parties.

By ensuring that your payment documents meet these legal requirements, you help protect your business from fines and complications related to tax laws. Always double-check that these essential elements are included before sending the document to your client.

Using Software for Invoice Creation

In today’s digital world, creating payment documents manually can be time-consuming and prone to errors. Utilizing software tools for generating these records can save time, improve accuracy, and ensure consistency across all your transactions. With many tools available, businesses can customize their documents, automate calculations, and even track payment status, all in a few clicks.

Streamlined Process – Software solutions allow businesses to automate the process of generating and sending payment requests. Most tools come with pre-designed templates, so you only need to input the necessary details, such as the client’s name, the services provided, and the amount due. This eliminates the need for manual formatting and reduces the chances of errors.

Customization and Branding – Many software tools offer the ability to customize documents with your company’s branding. You can add your logo, choose specific fonts, and adjust the layout to match your company’s style. This helps maintain a professional appearance while also saving you the time and effort of designing each document from scratch.

Tracking and Organization – Invoice software often includes tracking features, which allow you to monitor the status of each transaction. From tracking payment due dates to sending automated reminders, these features can help you stay on top of outstanding payments and improve your cash flow management.

By using the right software, businesses can simplify the invoicing process, maintain consistency, and ensure compliance with legal requirements, ultimately saving time and reducing administrative burdens.

Invoice Templates for Different Businesses

Different types of businesses often have unique needs when it comes to creating payment request documents. Whether you are in retail, services, or freelancing, the layout, sections, and details required can vary. Using the right structure tailored to your specific industry can help maintain clarity, professionalism, and consistency, ultimately improving cash flow and client relationships.

Common Industries and Their Requirements

Each industry may require a slightly different approach to organizing payment records. Below are some common sectors and the features that should be considered when preparing documents for each:

- Freelancers and Consultants: Typically need a simple, clear breakdown of services rendered, the hourly or project rate, and any additional fees or expenses. Including detailed descriptions of services is important for transparency.

- Retail Businesses: Often require itemized lists of products sold, including product codes, quantities, and prices. These documents may also need to reflect discounts or promotions applied to the sale.

- Contractors: Often require a detailed list of materials used, labor hours, and the specific tasks performed. Clear references to contracts and agreements are also necessary.

- Subscription-based Services: Require clear billing periods, subscription plans, and renewal dates. A recurring fee structure should be clearly noted to avoid confusion.

- Non-profit Organizations: Often have specific requirements for donations or grants, including donor information and the legal necessity to provide tax-exempt status details.

Customizing Your Documents for Specific Needs

To ensure that your payment request records meet the specific needs of your business and industry, it’s important to:

- Use relevant descriptions for the goods or services provided, especially if they require detailed explanations.

- Include additional fields or sections that reflect industry-specific needs, such as project milestones for contractors or billing cycles for subscription services.

- Consider adding personalized branding elements, such as logos, to make the document look professional and consistent with your company’s image.

Choosing the right structure for your payment requests, based on your business type, can help ensure that all essential information is included and presented in a professional manner. It also makes it easier for your clients to process payments on time.

How to Save Time with Templates

Creating payment records from scratch can be a time-consuming task, especially when you have to regularly generate them for different clients. Using pre-designed formats or structured documents can significantly reduce the time spent on this process. By having a reusable structure in place, you can streamline your workflow, ensure consistency, and focus on the core aspects of your business.

Benefits of Using Pre-Formatted Documents

One of the main advantages of using pre-designed documents is the ability to quickly input the necessary details without worrying about formatting. Here’s how it helps:

- Efficiency: With a ready-made structure, you can simply fill in the client’s name, products, services, and prices, rather than spending time formatting each new document from scratch.

- Consistency: Pre-built structures ensure that all of your payment requests follow the same format, which improves professionalism and minimizes errors.

- Customizability: Once you have a standard structure, you can easily modify it for different clients or projects, adding or removing sections as necessary without compromising on the overall look or feel.

Streamlining Repetitive Tasks

Another way to save time is by automating repetitive tasks such as calculating totals, taxes, and discounts. Many software tools allow you to set up formulas that automatically calculate these details, reducing the chance of human error. This means you don’t have to manually input numbers every time, which speeds up the process significantly.

By utilizing a well-designed, reusable structure for your payment documents, you can save valuable time and reduce the effort spent on administrative tasks. This efficiency allows you to focus on more critical aspects of running your business while maintaining professionalism in every transaction.

Choosing Between Word or Excel Templates

When deciding on the best format for your payment request documents, choosing the right software is crucial. Both Word and Excel offer distinct advantages depending on your needs. Word is known for its flexibility in formatting and design, while Excel excels in handling calculations and data organization. The choice between the two will largely depend on the complexity of your transactions and how you want to present the information.

Advantages of Using Word Documents

Word-based documents are ideal for creating clean, well-designed records with a professional appearance. They provide a greater degree of freedom when it comes to formatting and customization. Here are some reasons to choose Word:

- Design Flexibility: Word allows you to easily adjust the layout, fonts, and logos, giving you more creative control over the look of the document.

- Easy to Use: For users who are more focused on presenting information in a straightforward, text-heavy format, Word’s simple interface makes it easy to create and edit documents quickly.

- Professional Appearance: Word documents are often preferred for industries where branding and presentation matter, allowing for a polished, customized look.

Why Choose Excel for Payment Documents

Excel, on the other hand, is excellent for handling calculations and organizing data. If your transactions involve multiple items, quantities, or need automatic calculations (like tax or discounts), Excel can save you time and effort. Here are a few reasons to consider Excel:

- Automated Calculations: With Excel, you can set up formulas to automatically calculate totals, taxes, and any other variables, which minimizes human error and ensures accuracy.

- Data Organization: Excel makes it easier to handle large amounts of data, especially for businesses with frequent transactions or recurring billing cycles.

- Structured Data: If you need to keep detailed records of payments or client histories, Excel is a powerful tool for organizing and storing that data in an efficient, easily accessible format.

In summary, Word is ideal for creating visually appealing, simple documents that prioritize design, while Excel is best suited for handling complex calculations and managing large datasets. Consider the nature of your business and the level of customization or automation you need when choosing between these two options.

Free vs Paid Invoice Templates

When choosing a structure for your payment request documents, one key decision is whether to go for free or paid options. While free designs may seem like a cost-effective solution, paid ones often offer more advanced features, customization, and support. Understanding the differences between the two can help you select the best choice based on your business needs and budget.

Benefits of Free Payment Request Documents

Free formats can be an excellent starting point for small businesses or individuals just beginning to manage their transactions. Here are some advantages of using free structures:

- Zero Cost: Free options don’t require any upfront investment, making them a great choice for businesses with limited budgets.

- Quick and Easy: Most free designs are easy to access and use. You can find a variety of pre-made layouts that require little to no customization.

- Simplicity: Free options often come with basic features that are sufficient for businesses with simple invoicing needs, such as freelancers or sole proprietors.

Advantages of Paid Payment Request Documents

On the other hand, paid solutions often provide additional functionality, flexibility, and professionalism. These options can be particularly beneficial for businesses looking for more advanced features or greater control over their documents. Here’s why you might consider a paid structure:

- Customization: Paid options often allow more flexibility to customize the layout, design, and fields to match your business’s branding and specific requirements.

- Automated Features: Many paid formats offer built-in tools for tax calculations, payment tracking, and recurring billing, saving you time and reducing the chance of errors.

- Support and Updates: Paid options often come with customer support and regular updates to keep the system running smoothly and in compliance with the latest regulations.

- Professionalism: Premium designs tend to look more polished, which can help your business appear more established and trustworthy in the eyes of clients.

In conclusion, the decision between free and paid options depends on your specific needs and budget. If you require only basic features and have a limited budget, free solutions might work well. However, if you need advanced features, greater customization, or a more professional appearance, investing in a paid solution could provide long-term benefits for your business.

How to Send Invoices Effectively

Sending payment documents in a timely and professional manner is critical for ensuring smooth transactions and maintaining positive relationships with clients. The process involves not just the creation of the document, but also how it is delivered, followed up on, and tracked. By following best practices, you can improve the efficiency of your billing process and reduce the likelihood of delayed payments.

Key Steps for Sending Payment Requests

Here are some essential steps to follow when sending payment requests:

- Ensure Accuracy: Before sending, double-check that all the details are correct, including amounts, client information, and payment terms. This will minimize disputes and questions later on.

- Choose the Right Method: Depending on your client’s preference, you can send the document via email, through a business portal, or by post. Email is the most common method, as it’s quick and easy to track.

- Set Clear Payment Terms: Make sure to specify the payment due date and the preferred method of payment (e.g., bank transfer, credit card, etc.). Include any late fees or interest charges if applicable.

- Attach Supporting Documents: If necessary, attach any contracts, agreements, or other supporting documents that help clarify the charges or terms of the deal.

Effective Follow-up Strategies

Sending the payment document is only the first step. Following up ensures that clients are aware of the payment terms and encourages prompt action. Consider these strategies:

- Send Reminders: If the payment date is approaching and you haven’t received a response, send a polite reminder a few days before the due date. This can help prompt timely payment without sounding too aggressive.

- Track Status: Keep track of which payment requests have been sent, and whether payments have been received. Use accounting or invoicing software to help you monitor the status of each payment.

- Maintain Professionalism: Whether you’re sending an initial request or a reminder, always communicate professionally. Being courteous and respectful will help maintain positive relationships and encourage timely payments.

Example of a Payment Record Format

Here’s an example of how you might format a payment document when sending it to a client:

| Description | Amount |

|---|---|

| Service/Product 1 | $500 |

| Service/Product 2 | $200 |

| Total | $700 |

Following these steps and strategies for sending payment documents will help you improve the efficiency and professionalism of you

Tracking Payments with Your Invoice Template

Keeping track of payments is a critical aspect of maintaining healthy cash flow in any business. Using a well-organized structure to record transactions can help you monitor which payments have been received and which are still outstanding. By incorporating payment tracking features directly into your document format, you can simplify the process and ensure no payment slips through the cracks.

One of the easiest ways to track payments is by including a payment status section in your document. This can help both you and your clients keep track of whether a payment is pending, overdue, or completed. Here are some ways to effectively monitor payments:

- Include Payment Status Columns: Add a “Status” column in your layout to indicate whether the payment is pending, paid, or overdue. This provides a clear visual reference for both you and the client.

- Record Payment Dates: Include a field for the payment date to track when a payment is received. This is particularly useful for monitoring late payments and following up with clients accordingly.

- Track Partial Payments: If a client makes a partial payment, note this in your record. This way, you can adjust the total amount due and avoid confusion later on.

Many businesses also use accounting software or invoicing tools that integrate with these manual formats. This allows for automatic updates to payment statuses, reducing the need for constant manual checks. Whether you use a simple document or advanced software, tracking payments is essential for staying on top of your finances and ensuring that all debts are settled in a timely manner.