Top Graphic Designer Invoice Templates for Professional Billing

Effective financial documentation is essential for smooth client interactions and ensuring timely payments. For those in creative industries, having a well-organized billing approach can make transactions easier and build trust with clients.

A polished billing document not only reflects professionalism but also makes it clear what services have been provided and the associated costs. Customizing documents to match the branding and style of your services adds a personal touch that clients appreciate. Organized and visually appealing billing materials set a strong foundation for future collaborations and can streamline follow-ups.

Clear, concise layouts help clients understand charges at a glance, while well-defined terms reduce the chance of misunderstandings. Whether it’s a single project or ongoing work, using the right layout and approach for these documents supports better project tracking and a seamless payment process.

Graphic Designer Invoice Template Guide

Creating professional billing documents is an essential aspect of maintaining smooth client relationships and ensuring prompt payments. A well-structured format helps clarify service details, costs, and payment expectations, fostering clear communication with clients.

For those working on creative projects, a personalized and thoughtfully designed billing format can leave a lasting impression. From itemizing tasks to highlighting payment deadlines, each detail plays a role in representing a polished and reliable business presence. Customizing these documents to match your brand’s unique identity not only reinforces professionalism but also builds trust.

By utilizing flexible layouts, creatives can adapt billing documents to different project needs, whether one-time assignments or recurring services. An organized and visually appealing format enhances readability, reduces potential misunderstandings, and makes the entire process more straightforward for clients and service providers alike.

How to Choose the Right Invoice Format

Selecting an effective billing format is crucial for clear communication and seamless financial transactions. The right layout not only reflects your professionalism but also organizes essential information for easy client review and prompt payment.

Consider your project types and client preferences when deciding on a format. For instance, detailed projects may require a breakdown of services and associated costs, while simpler tasks might benefit from a concise layout. Ensuring each document is easy to understand and visually aligned with your brand helps create a consistent client experience.

Explore flexible formats that allow you to adjust sections based on the scope of work and payment terms. A customizable approach supports both one-time projects and long-term collaborations, making it easier to manage various needs while keeping your branding intact. Ultimately, the ideal format enhances clarity, professionalism, and client trust.

Creating a Customizable Invoice for Designers

Building a flexible billing document allows creative professionals to adapt their format for different clients and project types. Customizable designs can cater to specific branding needs, making it easier to present a consistent and professional image while highlighting essential details.

Essential Elements for Flexibility

A versatile layout should include adjustable sections for descriptions, rates, and payment terms. This ensures each document accurately reflects the scope and nature of the work provided. Adding options for customization, such as a personal logo or color scheme, reinforces brand identity and sets a distinct tone.

Adapting for Various Project Types

Whether working on a one-time assignment or a recurring project, a customizable format enables smoother adjustments to sections like task lists and payment schedules. Flexibility in design supports both straightforward and complex projects, allowing you to present details in a way that aligns with each client’s needs while keeping the document aesthetically aligned with your brand.

Essential Elements for a Professional Invoice

A well-structured billing document is key to ensuring transparency and fostering trust with clients. Including the right components makes it easier for clients to understand the details of the service provided and for professionals to maintain organized records.

- Contact Information: Both your details and the client’s should be clearly displayed. This includes names, addresses, phone numbers, and email addresses to facilitate easy communication.

- Service Description: Clearly outline each task or project phase with a brief description. This helps clients understand the scope of work and ensures no details are overlooked.

- Pricing Structure: List the rates for each service provided. Whether hourly or project-based, including a breakdown of charges allows clients to see exactly what they’re paying for.

- Total Amount Due: Highlight the final amount to be paid. Displaying it prominently reduces confusion

Design Tips for a Unique Invoice Layout

Creating an original billing document layout can help leave a lasting impression on clients and reflect your brand’s style. A visually distinctive yet functional format enhances readability, communicates professionalism, and makes it easier for clients to process payment details smoothly.

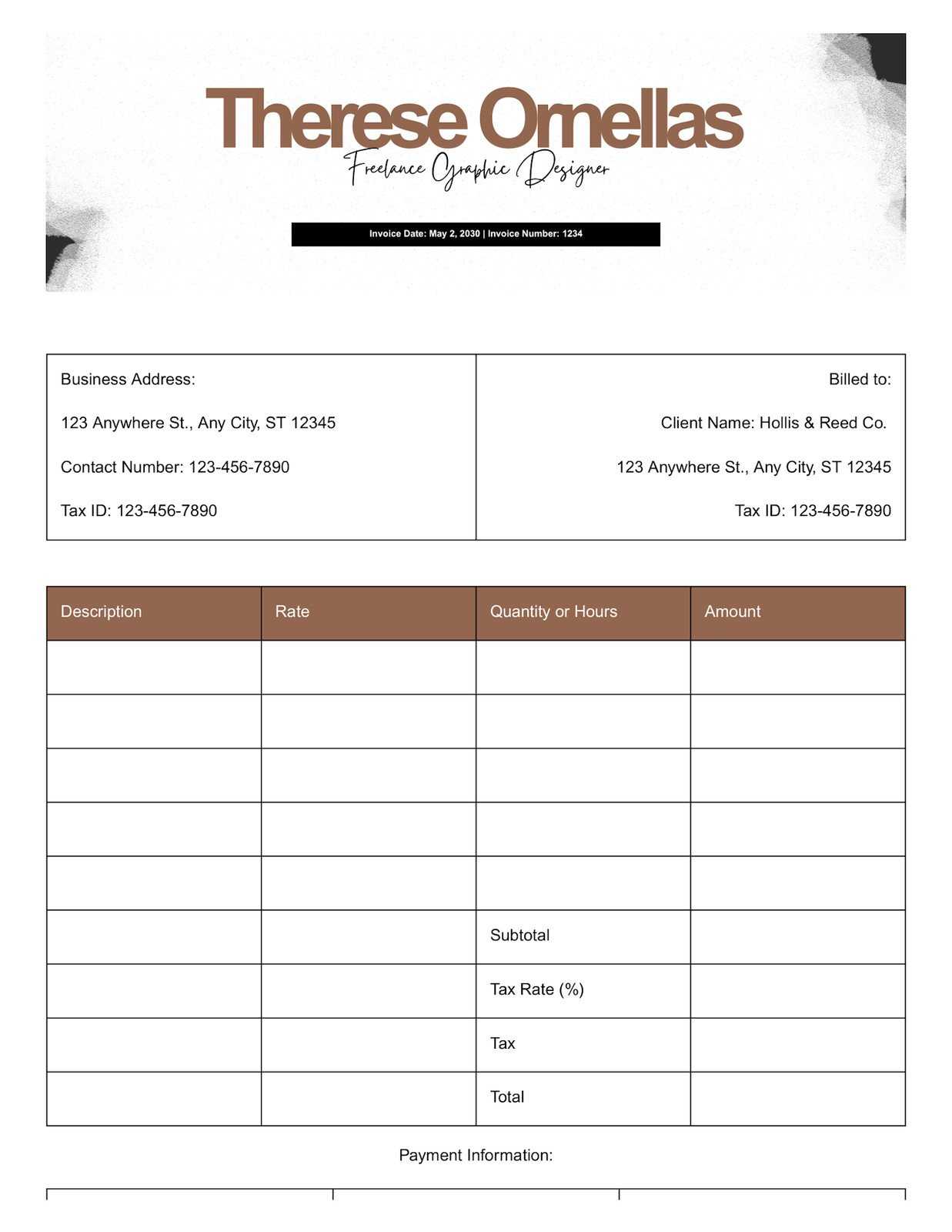

Incorporate Branding Elements

Add unique touches such as a personal logo, custom color scheme, and consistent fonts that align with your overall brand identity. Using a color palette that reflects your business style not only enhances aesthetics but also adds a memorable, professional flair to your document. Branding elements help distinguish your work and create a cohesive experience across client interactions.

Prioritize Clear Layout and Readability

A well-organized structure is essential for clarity. Divide sections logically with clear headings and ample white space to improve readability. Avoid clutter by only including necessary details, ensuring clients can quickly find essential information like due dates and payme

Benefits of Using an Invoice Template

Utilizing a pre-designed billing document offers numerous advantages that streamline financial processes and improve client interactions. A consistent, ready-made format reduces time spent on administrative tasks and ensures that all necessary details are included for a smooth transaction.

Time-Saving Advantages

- Quick Setup: With a ready-to-use layout, you can focus on entering specific information without having to design the structure from scratch every time.

- Consistent Format: A template ensures that every document follows the same structure, which is essential for maintaining a professional appearance and making the process more efficient.

Enhanced Professionalism and Accuracy

- Predefined Sections: Templates often include all the necessary components, such as service descriptions, payment terms, and contact information, which reduces the risk of missing important details.

- Clear Presentation: A well-organized format allows you to present information in a way that’s easy to follow, boosting your credibility and making the process more transparent for clients.

Incorporating a standardized format into your workflow ensures accuracy, consistency, and professionalism, ultimately improving client satisfaction and facilitating timely payments.

Common Mistakes in Designer Invoices

Many professionals make simple yet costly errors when creating billing documents. These mistakes can cause confusion for clients, delay payments, or create legal and financial issues. Recognizing and avoiding these common pitfalls can help maintain professionalism and ensure smoother transactions.

Omitting Essential Information

One of the most frequent mistakes is failing to include key details such as payment terms, the due date, and service descriptions. Without these critical components, clients may be unclear about the charges or when to make a payment, potentially leading to misunderstandings or delayed transactions.

Unclear Pricing and Calculations

Another common issue is presenting vague or incomplete pricing details. Ensure that every service is clearly itemized, and provide transparent rates, whether hourly or project-based. Double-check calculations and totals to avoid any discrepancies that could confuse clients and harm your reputation.

By being mindful of these common mistakes, professionals can create clear, accurate, and effective billing documents that help maintain strong, trusting relationships with clients.

Popular Software for Generating Invoices

There are numerous tools available that simplify the process of creating professional billing documents. These software solutions offer customizable options, templates, and features that streamline the entire process, saving both time and effort while ensuring accuracy.

Software Key Features Pricing FreshBooks Easy-to-use, customizable templates, time tracking, and client management Starting at $15/month QuickBooks Invoice creation, expense tracking, integration with accounting software Starting at $25/month Zoho Invoice Multi-currency support, recurring billing, automatic payment reminders Free for up to 5 clients, paid plans start at $9/month Wave Free invoicing, accounting, and receipt scanning tools Free Invoicely Multi-currency support, custom branding, and invoicing for multiple businesses Free, paid plans start at $4.99/month Choosing the right tool depends on your specific needs, such as the number of clients you handle, the complexity of your services, and your budget. These software options make it easier to generate accurate, professional documents quickly and efficiently.

How to Structure Invoice for Big Projects

When handling large-scale projects, it’s crucial to organize billing documents clearly to avoid confusion and ensure timely payments. A well-structured payment request not only outlines the services rendered but also includes detailed breakdowns, timelines, and payment terms, which are essential for both parties involved.

Section Description Client Information Include the full name or company name, contact details, and address of the client. Project Details Describe the project scope, deliverables, and any special terms or conditions agreed upon. Itemized Breakdown List all services or tasks provided, with rates for each and total costs, to ensure transparency. Payment Schedule Outline the payment phases, such as deposits, milestone payments, or final balance due. Terms and Conditions Clearly state payment deadlines, late fees, and any other relevant terms to avoid future disputes. Tax Information Include applicable taxes (if any), clearly separated from the overall amount to ensure compliance. By breaking down the information in this clear and structured manner, you help avoid misunderstandings and create a smooth payment process for substantial projects.

Freelance vs. Agency Invoice Templates

When it comes to billing for services, freelancers and agencies often have different requirements and structures for their payment requests. While both need to ensure clarity and professionalism, the details included in the billing documents can vary greatly depending on the size and complexity of the project. Freelancers typically work independently, while agencies may handle multiple team members and more complex operations, resulting in different approaches to organizing their payment requests.

Aspect Freelancer Agency Client Information Basic contact details of the freelancer. Includes agency name, client details, and representative contacts. Service Description Simple, often focusing on specific tasks or services provided. More detailed, covering multiple team contributions or services offered by different departments. Payment Terms Clear and direct, often with specific deadlines or milestones. Includes more complex terms such as deposits, progress payments, and final balances. Formatting Simple, straightforward layout for clarity. More structured, possibly including branded design, and additional sections like project codes or team member breakdowns. Tax and Legal Information Minimal, typically only sales tax or personal tax identification number. More detailed, often including VAT numbers, legal disclaimers, and company registration details. Choosing the right structure based on your work style and business type can make the billing process smoother and more efficient, helping clients understand the terms clearly and ensuring timely payments.

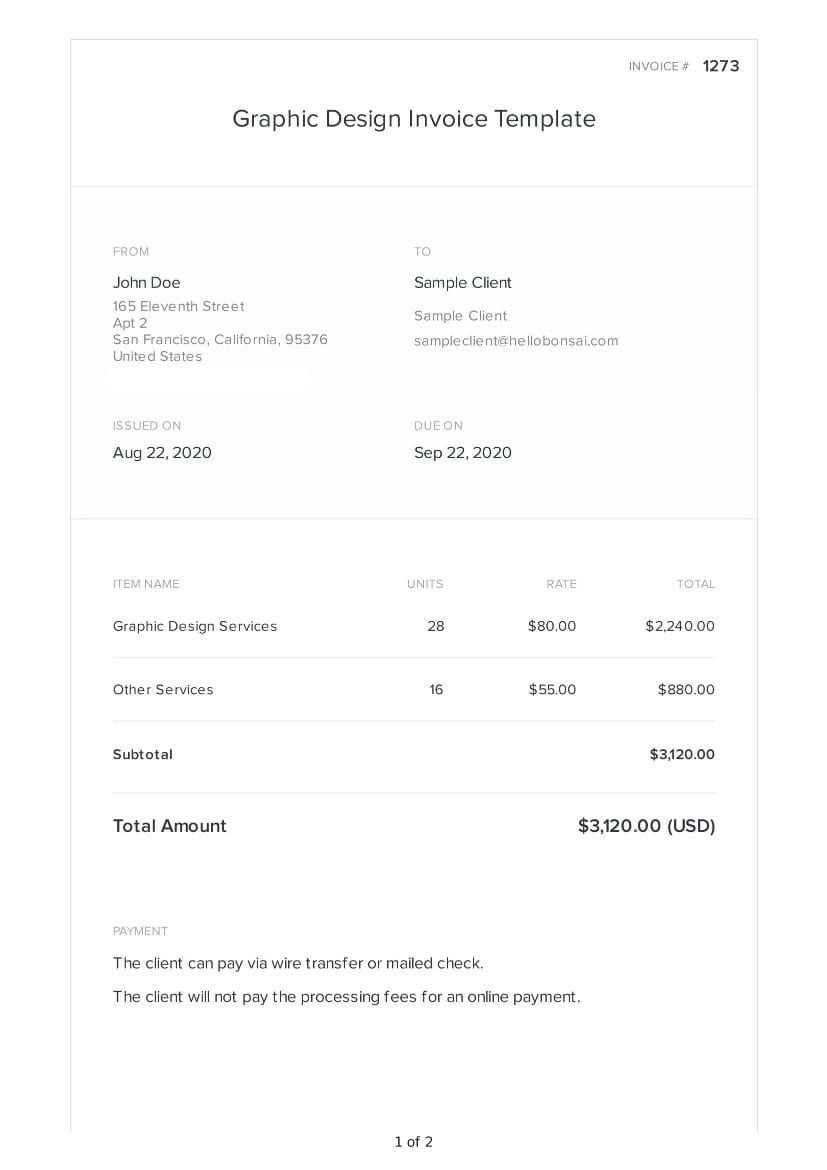

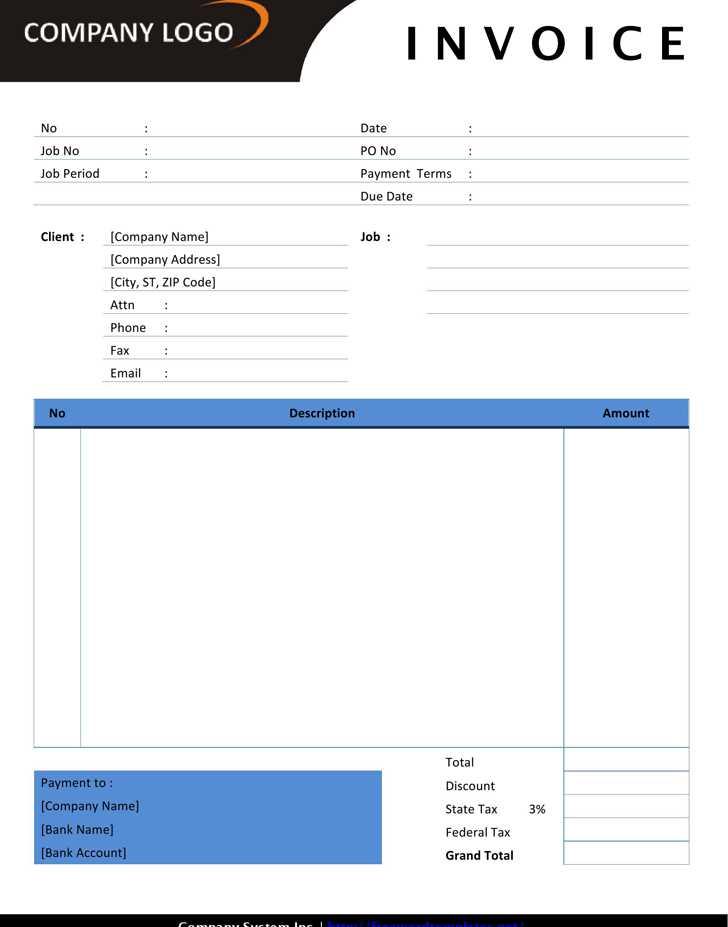

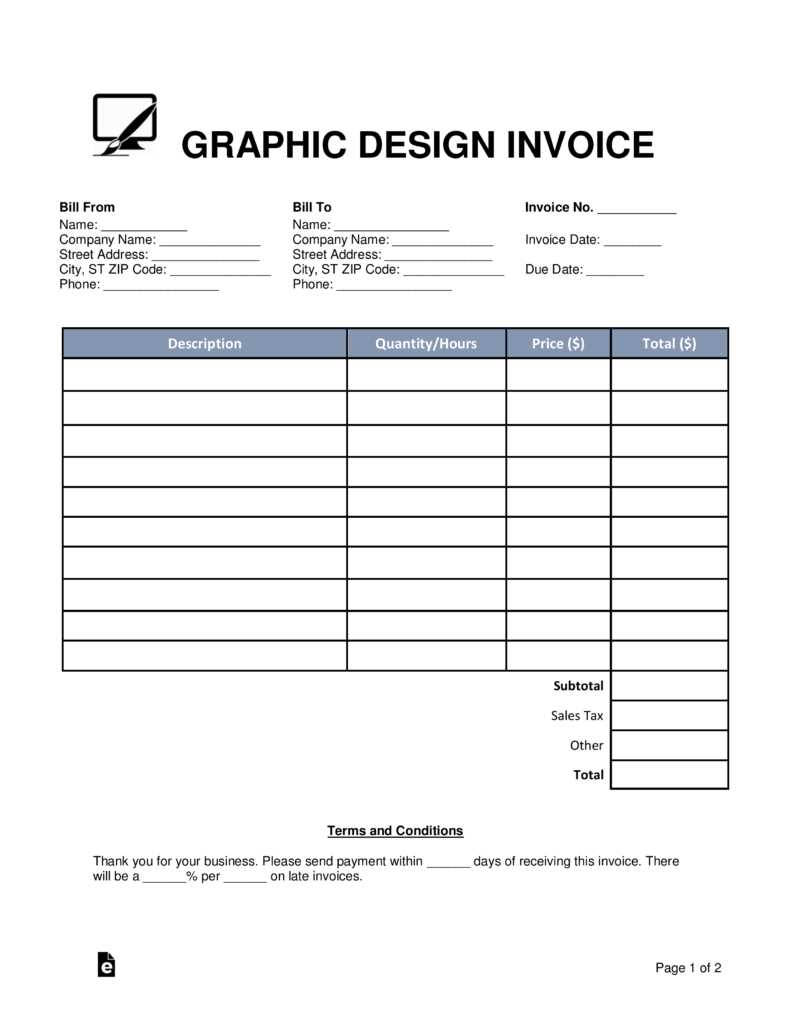

Top Free Invoice Templates for Designers

For professionals offering creative services, having an organized and visually appealing document for billing is crucial. There are many free resources available online that provide customizable documents, ensuring that you can create a professional-looking billing statement without spending extra money on software. These documents can save time, reduce errors, and make the payment process easier for clients to understand.

Best Free Options for Professionals

- Simple and Clean Layouts: These are great for those who want a straightforward, no-frills billing system that still looks professional.

- Modern Designs: Templates that incorporate contemporary design elements, perfect for showcasing your creative flair while maintaining clarity.

- Comprehensive Breakdown: Templates that offer detailed sections for project phases, hours worked, and costs, ideal for larger projects with multiple deliverables.

- Personalized Branding: These templates allow customization to include logos, colors, and unique fonts that align with your brand identity.

Where to Find Free Options

- Google Docs: Easily accessible and editable, perfect for quick customizations.

- Microsoft Word: Offers a variety of pre-made documents that can be tailored to your needs.

- Online Invoice Generators: Websites like Invoice Generator provide free templates that are simple to fill in and use.

- Canva: Known for its design capabilities, Canva offers a range of creative and free document templates for billing purposes.

Using a free billing document template can make the task of invoicing far more efficient, allowing you to focus on what you do best while ensuring that clients get clear, well-organized payment requests.

How to Automate Invoice Creation

Automating the process of generating billing documents can save significant time and reduce the likelihood of errors. By leveraging software and tools, you can streamline the creation of these essential documents, ensuring accuracy and consistency across all transactions. The automation process involves setting up templates, using integrated systems, and automating recurring tasks to produce professional billing records with minimal effort.

Benefits of Automation

Using automation for document creation offers several advantages:

- Time Savings: No more manually entering the same information repeatedly; let the system do the work.

- Consistency: Ensure that every document follows a uniform format, increasing professionalism and clarity.

- Reduced Errors: Automating calculations and data entry reduces the risk of mistakes that can occur with manual processes.

- Efficiency: Create multiple documents in bulk and send them to clients swiftly.

How to Set Up Automation

To automate the process, consider the following steps:

- Choose the Right Software: Select a platform that integrates billing functions and allows for easy customization.

- Create Reusable Templates: Design your documents once and use them as a foundation for all future transactions.

- Integrate with Accounting Tools: Many platforms sync with financial software to automatically import relevant data, streamlining the process even further.

- Set Up Recurring Tasks: If you offer ongoing services, automate the generation of monthly or periodic billing records.

By implementing automation, you free up time to focus on your core work while ensuring that the billing process remains accurate and timely.

Including Payment Terms on Invoices

Clearly outlining payment terms is essential for ensuring both parties are aware of the expectations regarding the settlement of financial transactions. These conditions help avoid misunderstandings and delays, establishing a clear agreement about when and how the payment should be made. By specifying details such as due dates, late fees, and acceptable methods of payment, you ensure that the payment process runs smoothly and professionally.

Why Payment Terms Matter

Including payment terms is critical for both the service provider and the client. It sets expectations and ensures transparency in the transaction. Key elements such as payment deadlines and penalties for late payments can serve as incentives for timely payment while protecting the service provider from financial delays.

- Prevents Disputes: Having clear terms helps both parties understand their obligations and reduces the chance of disputes.

- Ensures Timely Payment: A clear due date and payment schedule encourage clients to pay on time.

- Establishes Professionalism: Clear terms convey a sense of professionalism and organization.

Key Elements to Include

To make sure your payment terms are comprehensive, include the following elements:

- Due Date: Specify the exact date when the payment is expected to be made.

- Accepted Payment Methods: Indicate which forms of payment are acceptable (e.g., bank transfer, credit card, etc.).

- Late Payment Penalties: If applicable, mention any fees or interest charged for overdue payments.

- Discounts for Early Payment: Some clients may benefit from discounts if they pay ahead of schedule; make this clear in your terms.

By including clear and detailed payment terms, you help set the foundation for a smooth transaction and reduce potential issues down the road.

Best Practices for Client-Friendly Invoices

Creating clear, professional documents that are easy for clients to understand and process is crucial for maintaining a positive relationship. By following a few key practices, you can ensure that your financial statements not only meet legal and business requirements but also provide a seamless experience for your clients. A well-organized statement can make a significant difference in the payment process and the client’s overall satisfaction.

To make sure your documents are client-friendly, consider the following best practices:

- Clear and Simple Layout: Avoid clutter and keep the design clean. Organize sections logically with headings like services provided, amounts, and payment details to make it easy for clients to locate important information.

- Easy-to-Read Fonts: Use legible fonts and avoid excessive decoration. The font size should be large enough to read comfortably, and text should be clear without the need for extra effort.

- Itemized Details: Break down services and charges clearly. Clients appreciate transparency, so list each service or product with its corresponding cost.

- Simple Payment Instructions: Ensure the payment methods and due dates are clearly stated. Include all necessary details like bank account information or online payment links to facilitate easy transactions.

- Contact Information: Always include your contact details, such as email or phone number, so clients can easily reach you for any questions or clarifications regarding the statement.

By following these practices, you not only ensure the document is efficient but also create a professional image that promotes trust and smooth transactions with your clients.

Organizing Documents

Maintaining an efficient and clear system for tracking financial documents is essential for smooth business operations. Properly organized records not only help you stay on top of transactions but also ensure that your clients receive accurate statements in a timely manner. A well-structured approach can save time and reduce errors when preparing and sending financial reports.

Here are some key steps to help you organize your documents effectively:

- Use Consistent Naming Conventions: Assign unique, sequential numbers or codes to each document. This allows you to easily track and reference them when needed.

- Maintain a Categorized Filing System: Group documents based on their type or client. Use folders or digital systems to store records by categories such as completed projects, pending payments, and receipts.

- Implement Clear Date Tracking: Keep track of when documents were issued and due. Include clear dates on every document to avoid confusion and ensure timely payment follow-ups.

- Store Backup Copies: Keep digital or physical copies of all important documents for future reference. Cloud storage or dedicated folders can offer easy access when needed.

- Regularly Review and Update Records: Periodically go through your files to ensure they’re up-to-date and well-organized. This helps prevent the accumulation of outdated or irrelevant documents.

By following these organizational practices, you ensure a more streamlined process for managing your financial records and maintain professionalism in your business operations.