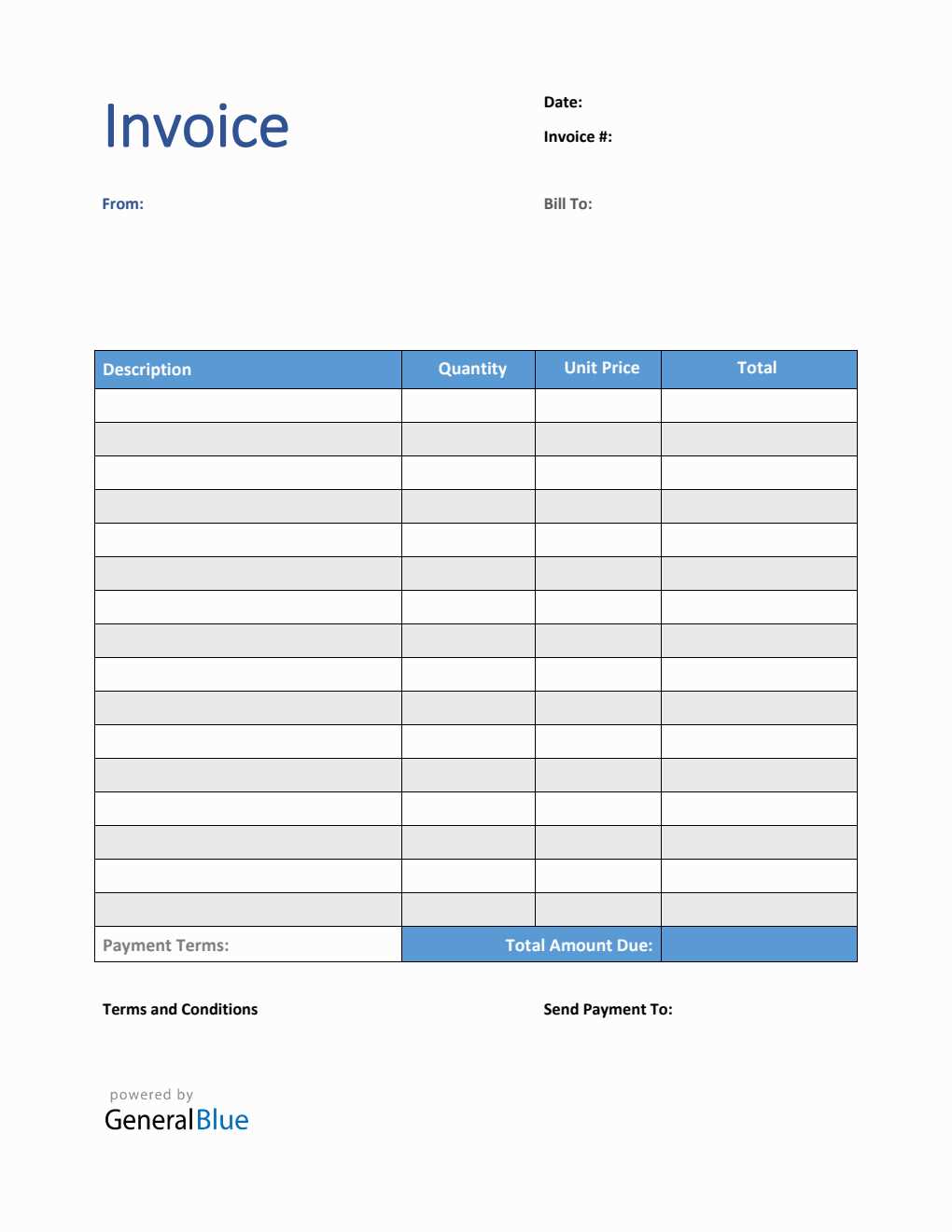

Download Your Free Blank Invoice Template PDF for Simple Invoicing

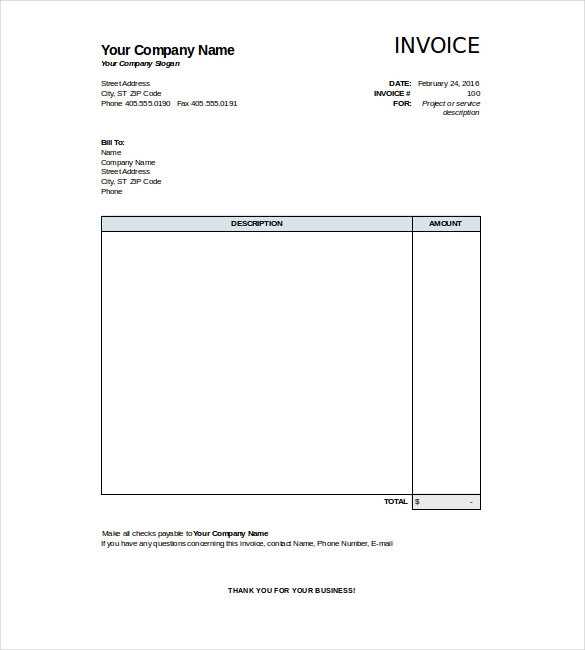

Organizing finances and managing records is essential for businesses and freelancers alike. Clear and structured billing documents play a crucial role in ensuring transactions are handled efficiently and professionally. Using a ready-made document format can save time, enhance accuracy, and help create a consistent look that clients appreciate. This type of prepared format simplifies record-keeping and minimizes errors, making it easier to focus on core business activities.

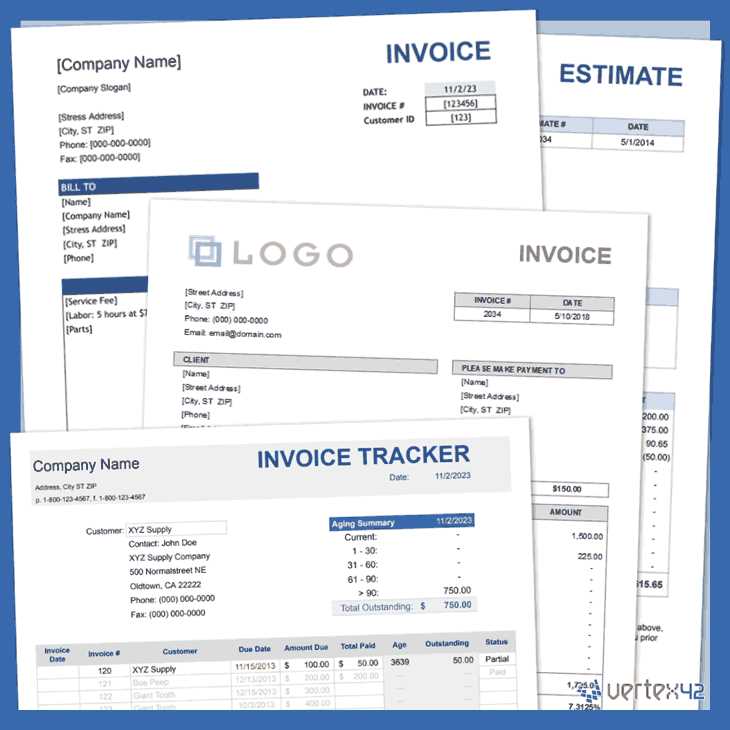

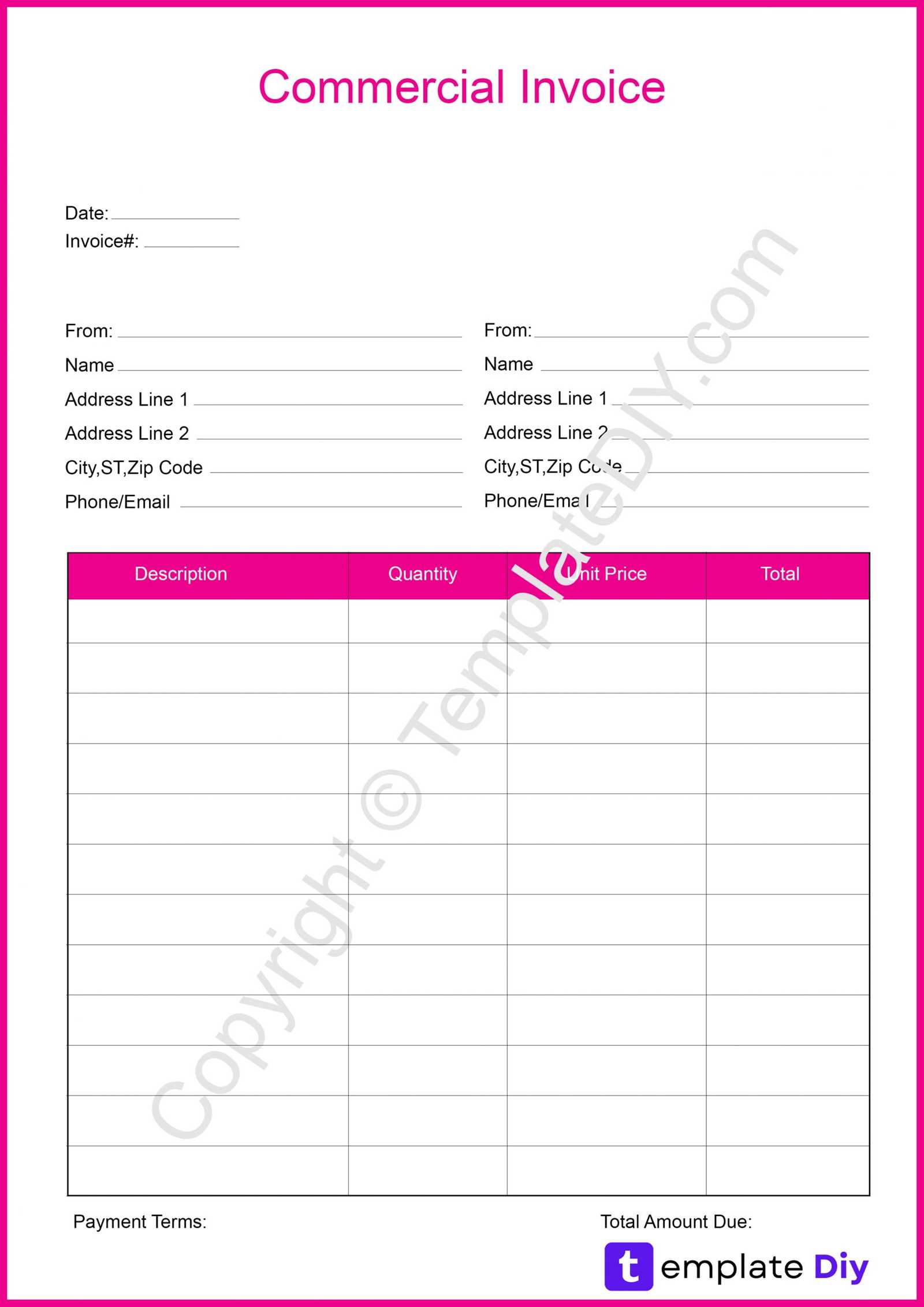

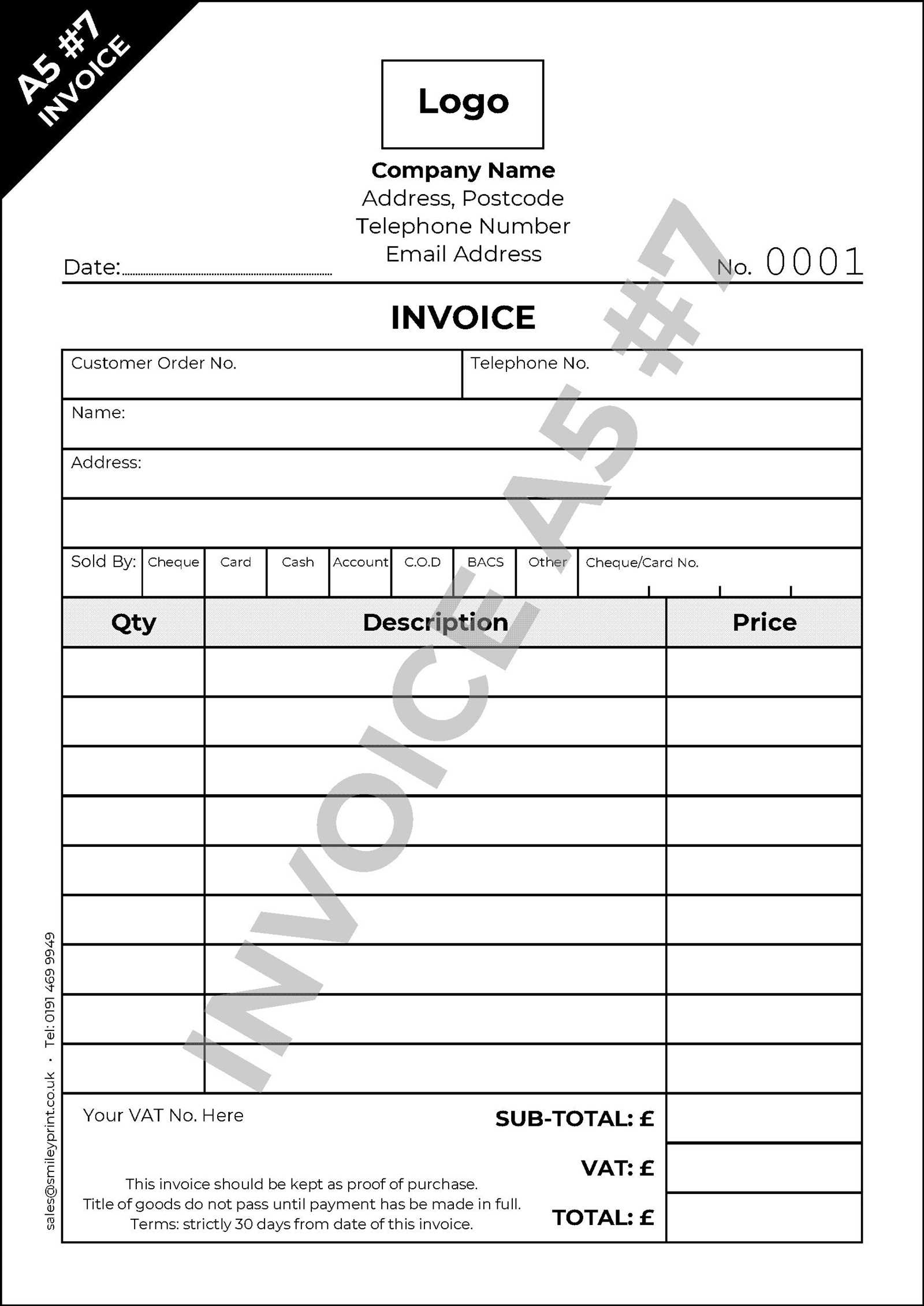

Opting for pre-designed forms also helps standardize financial operations. Whether used for one-time projects or regular transactions, having a structured document ensures all necessary details are included. With the added flexibility of customization, these files can be tailored to meet specific needs, from adding logos to adjusting payment terms, making them suitable for any type of service provider.

By using such efficient formats, individuals and companies can ensure a smooth financial process. The uniformity and professionalism that come with structured forms not only improve client trust but also streamline follow-up and payment tracking, allowing for better cash flow management. This approach to creating financial documents allows for greater accuracy, clarity, and efficiency in

Essential Guide to Blank PDF Invoices

For anyone handling transactions, using a well-structured document format can streamline the entire process, ensuring clarity and organization. A carefully crafted form serves as a reliable foundation for any financial interaction, helping businesses present clear information and facilitating smoother exchanges with clients or customers.

Choosing the right document layout can enhance the quality and efficiency of financial records. Here are some key advantages of using a pre-designed format:

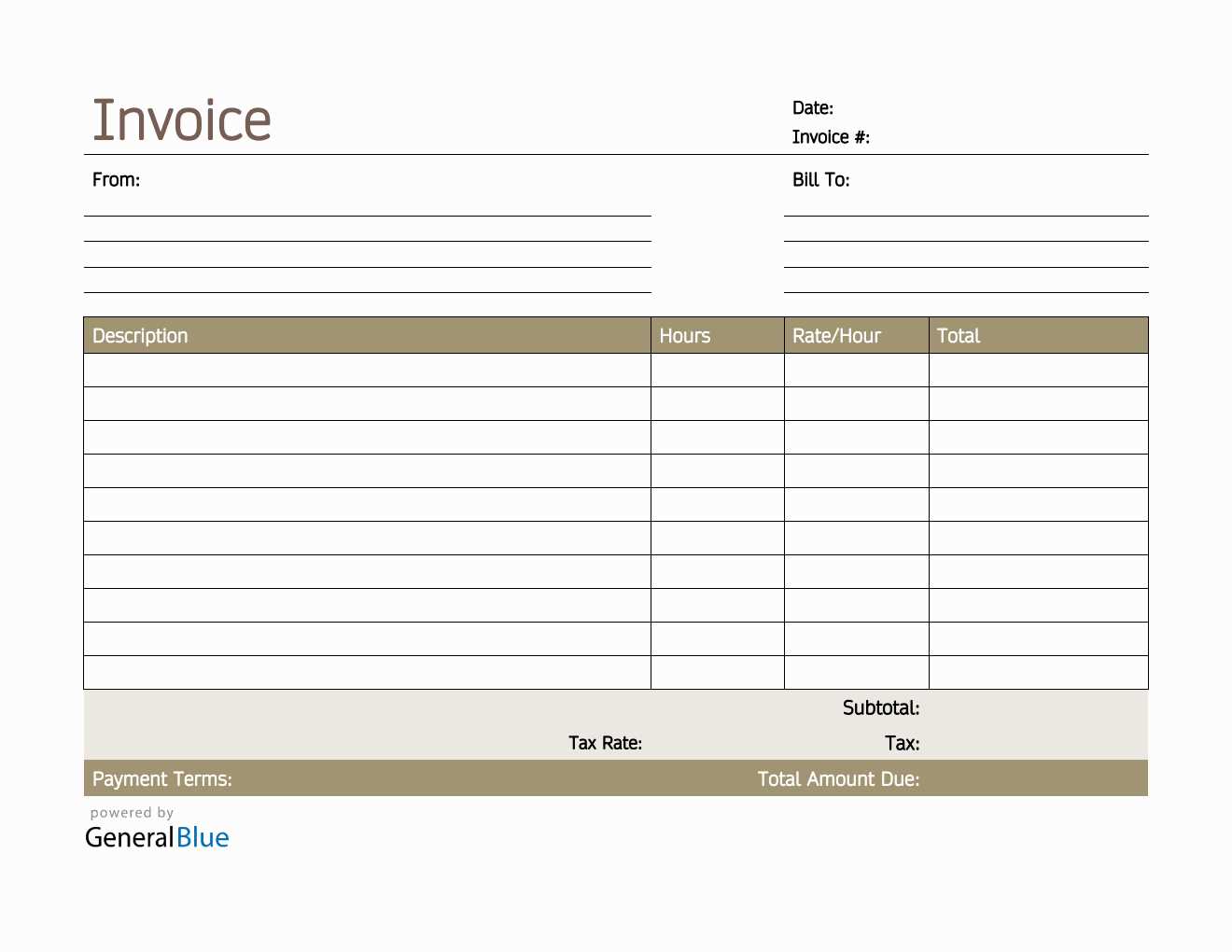

- Time-saving: With a ready-to-use format, there’s no need to start from scratch, allowing you to focus on the content instead.

- Consistency: A uniform layout across all financial records helps establish a professional appearance and build trust.

- Flexibility: Editable fields offer the freedom to add custom elements like logos or specific terms.

To

Benefits of Using Blank Invoice PDFs

Employing a standardized financial document format can greatly enhance organization and efficiency in managing transactions. Pre-designed forms offer a straightforward solution for keeping track of essential details, making it easier for professionals to manage payments and improve client interactions. These prepared formats can save valuable time, provide a consistent layout, and allow for easy customization to suit different business needs.

Here are some key advantages of using these structured formats:

| Benefit | Description | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Time Efficiency | A pre-made format eliminates the need to create a new document for each transaction, reducing time spent on administrative tasks. | |||||||||

| Professional Consistency |

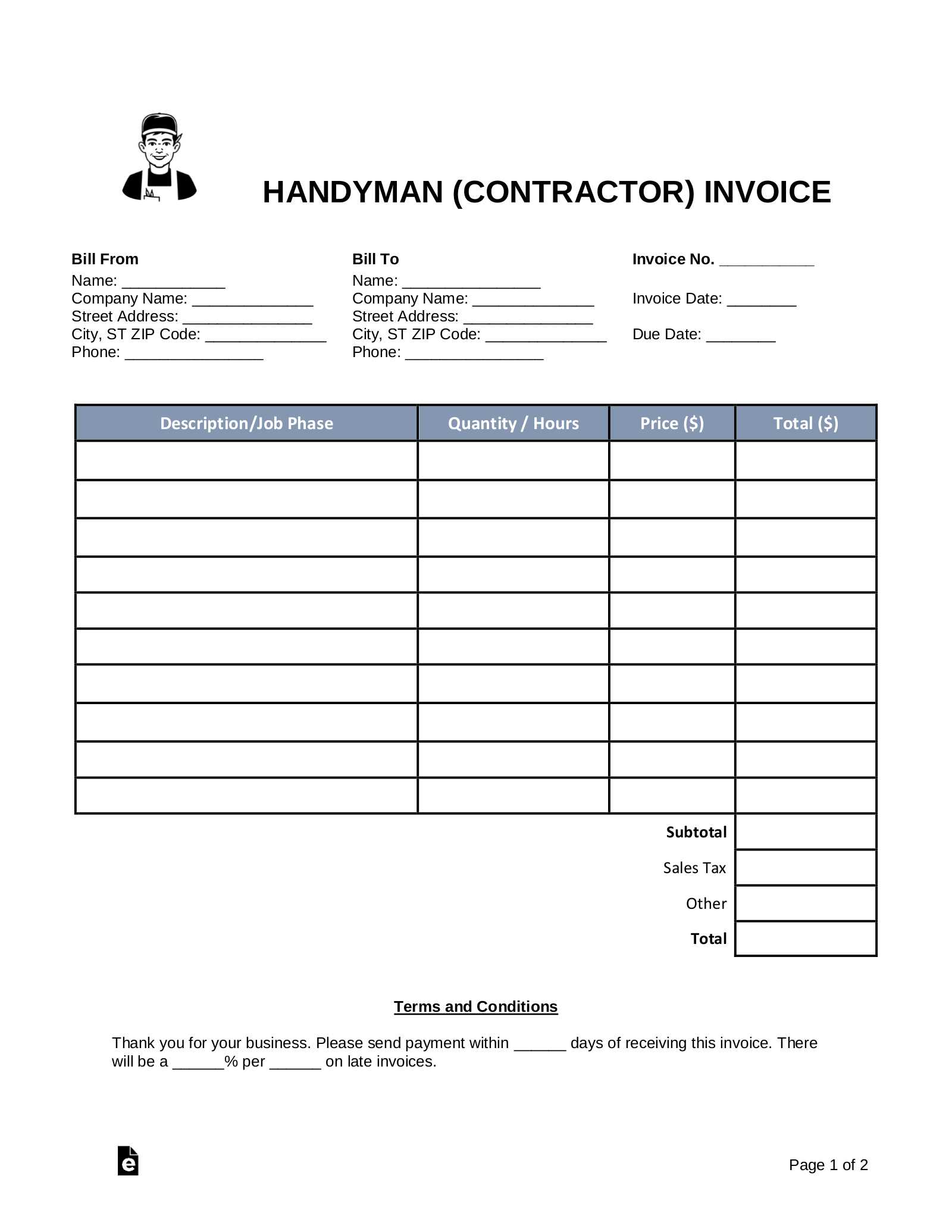

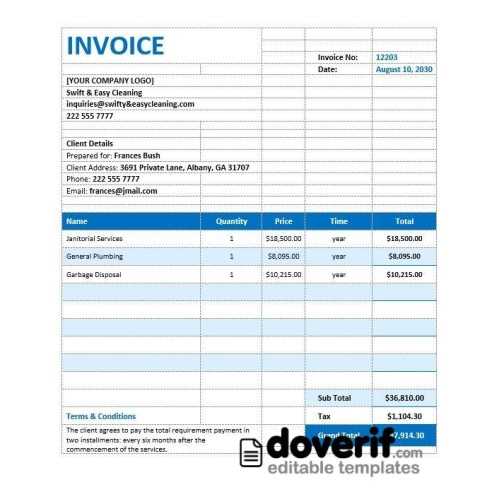

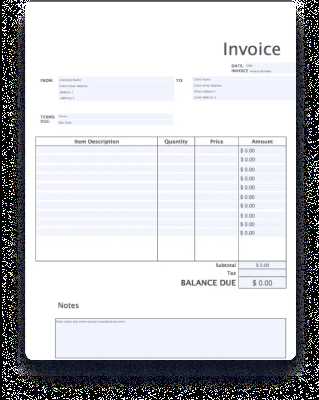

| Section | Description |

|---|---|

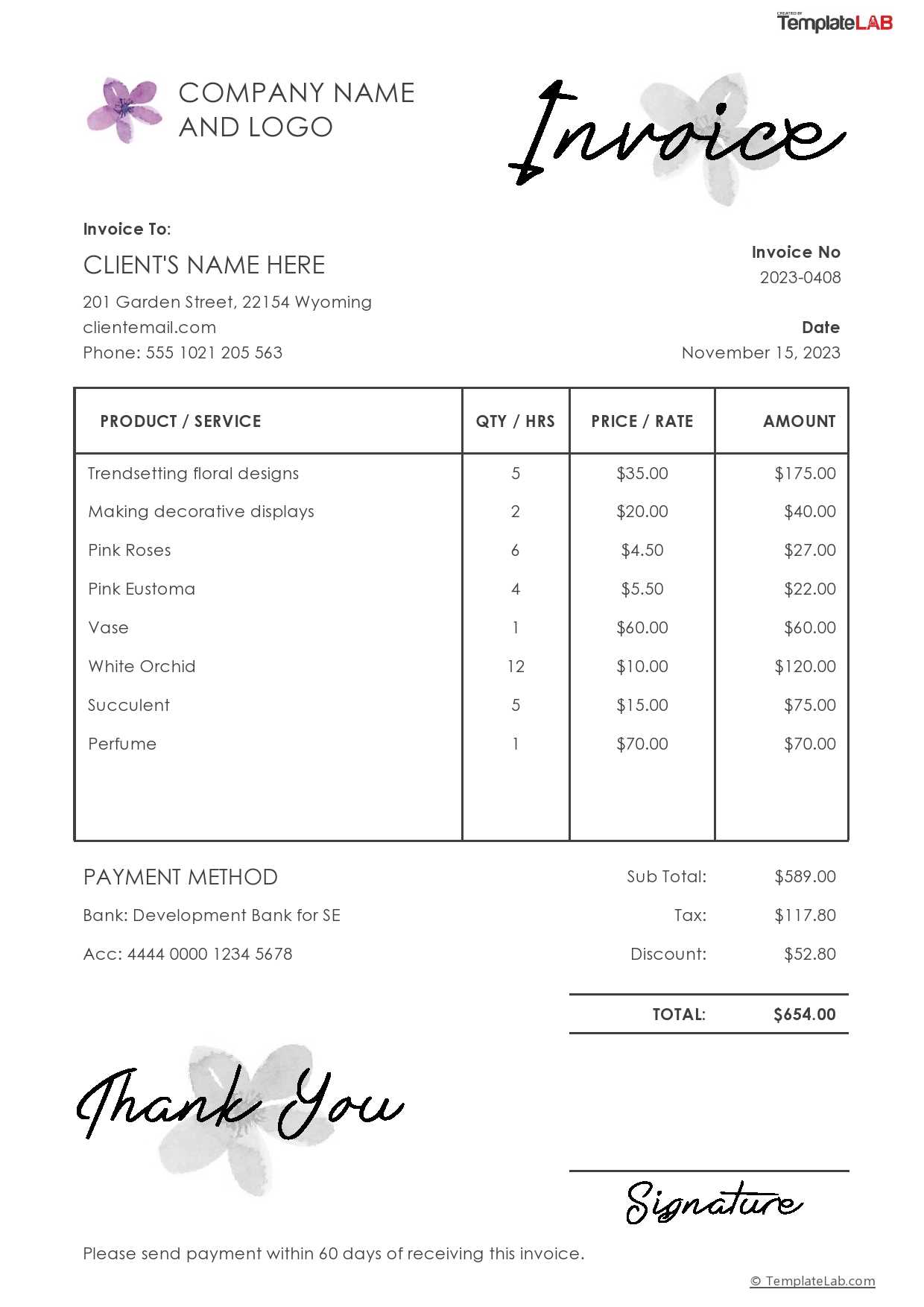

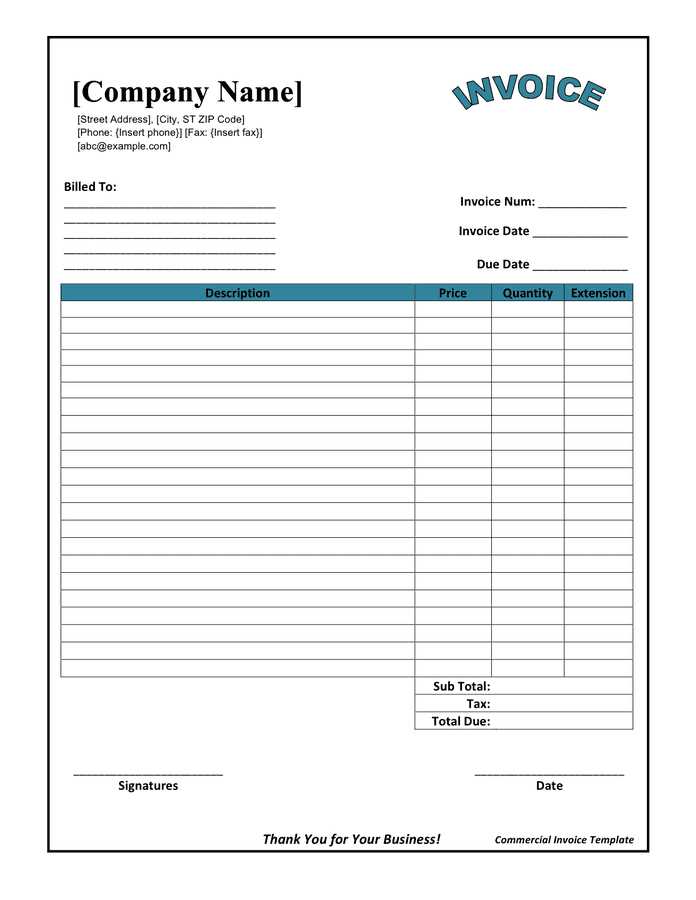

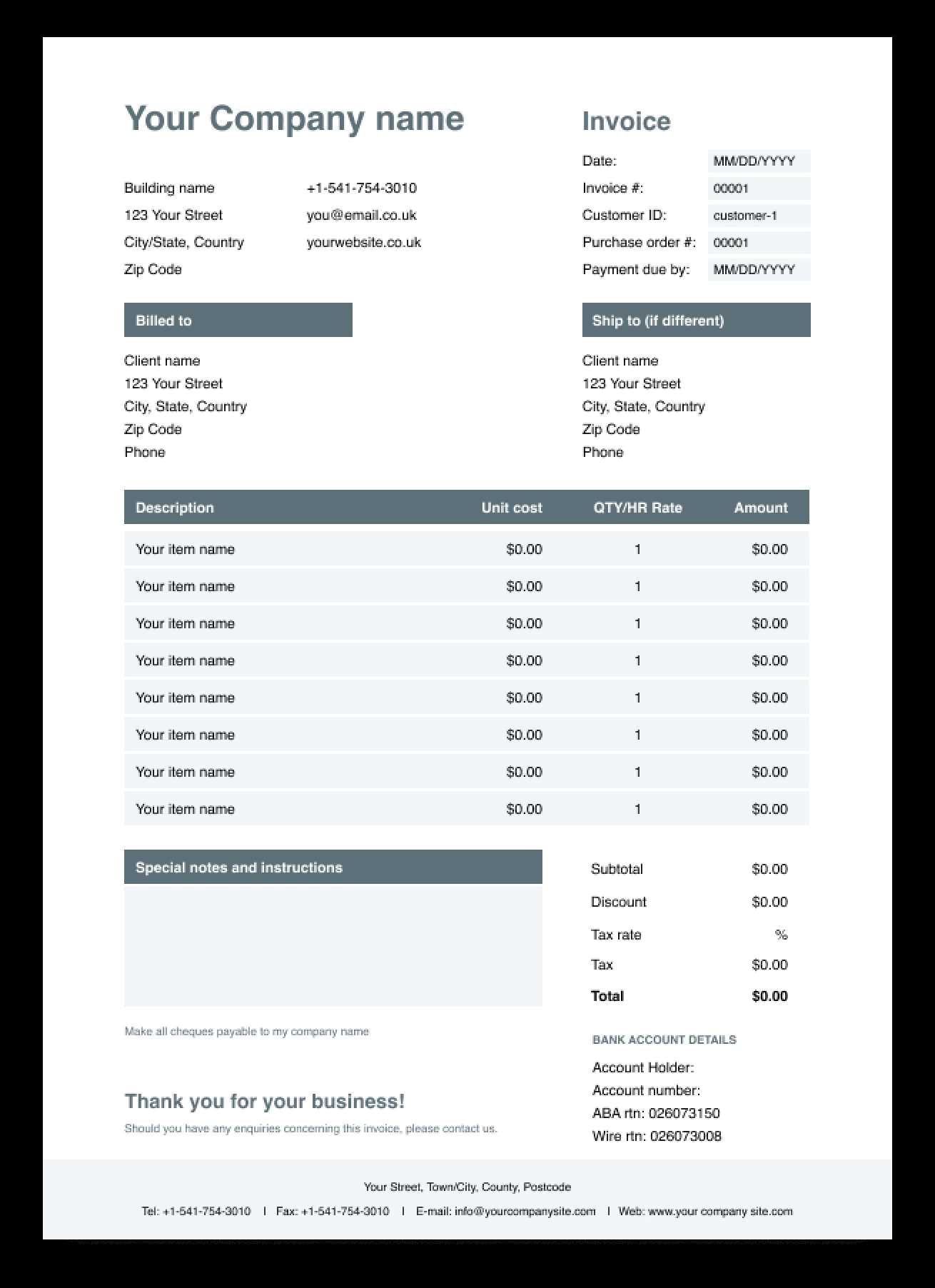

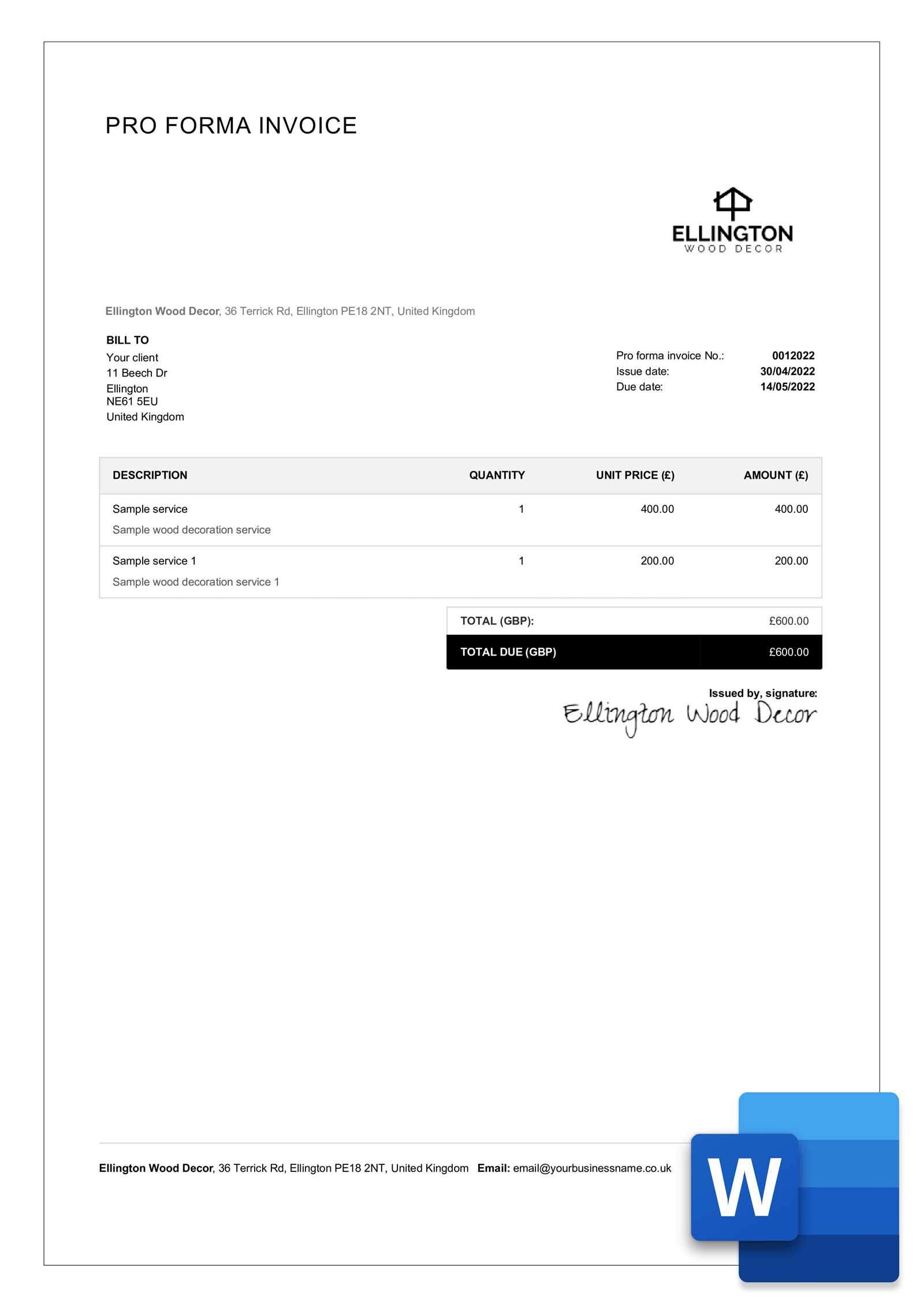

| Header | Include your business name, logo, and contact details prominently at the top. |

| Recipient Details | Clearly list the recipient’s name, address, and any other relevant contact information. |

| Itemized List | Present a clear breakdown of products or services provided, including quantity, unit price, and total amount. |

| Payment Terms | Include due dates, payment methods, and any applicable late fees. |

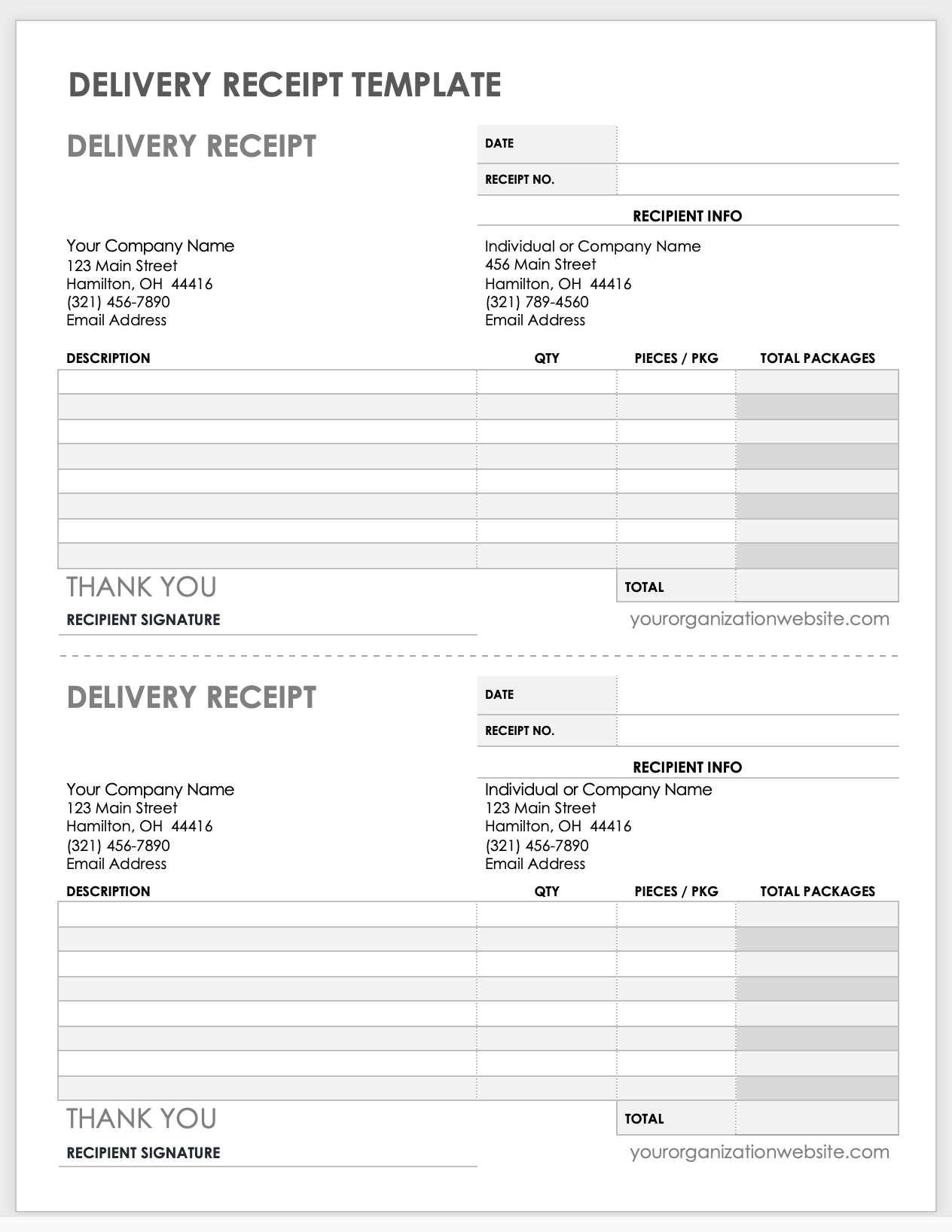

Optimizing for Print and Digital Use

Ensure that the document design works well both in printed form and as a digital document. A versatile design allows for easy viewing on different devices or printing without loss of quality. Be mindful of margins and spacing to ensure the content is well-positioned on both screens and paper.

By applying these design principles, you can create financial documents that not only look professional but are also easy to navigate, ensuring smooth transactions and better communication with your clients.

Common Mistakes in Invoicing

Creating financial records is a critical aspect of business transactions. However, there are common errors that can lead to misunderstandings, delayed payments, or even damage to professional relationships. It’s important to be aware of these mistakes and take steps to avoid them to ensure smooth and effective transactions.

Common Errors in Financial Record Creation

Here are some of the most frequent mistakes made when preparing business documents:

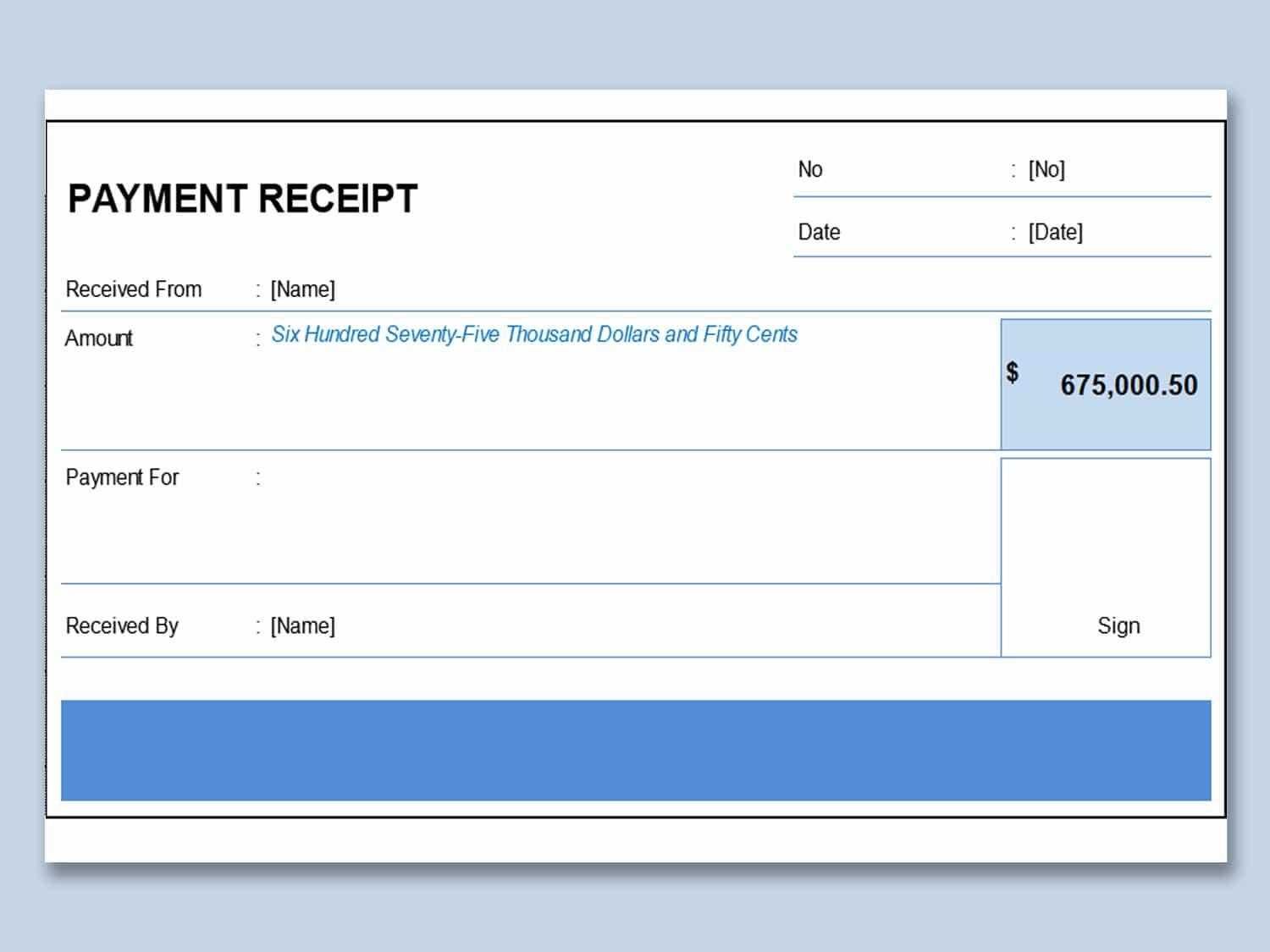

- Missing Contact Information: Failing to include complete contact details for both your business and the recipient can lead to confusion and delays. Always include up-to-date addresses, phone numbers, and email addresses.

- Unclear Payment Terms: If the payment due date, method, or any additional fees are not explicitly stated, clients may overlook them or delay payment. Be clear and precise about payment expectations.

- Incorrect or Missing Details: Errors in listing products or services, such as incorrect quantities, pricing, or descriptions, can cause disputes. Double-check all entries for accuracy.

- Not Including a Unique Identifier: Every document should have a unique number for reference. This helps to track and manage multiple transactions more efficiently.

- Failure to Include Due Dates: Without a specified due date, payment timelines can become unclear. Always include a due date to ensure timely payments.

How to Avoid These Mistakes

Here are some strategies to minimize errors and ensure your financial records are accurate and professional:

- Double-check Details: Before sending, review all entries for accuracy, including client information, service descriptions, quantities, and prices.

- Use Standardized Formats: Use a consistent layout and structure for all documents to avoid missing important fields and to maintain a professional appearance.

- Automate When Possible: If you frequently create similar records, consider using software that can automate parts of the process, reducing the chance of human error.

By being mindful of these common mistakes and implementing these strategies, you can ensure a smoother, more efficient process, which will improve both your internal workflow and customer satisfaction.

How PDF Invoices Improve Efficiency

Efficient business operations depend on the seamless management of financial transactions. Digital documents offer numerous advantages over traditional paper-based ones, particularly when it comes to organization, processing speed, and accessibility. By shifting to digital formats, businesses can streamline the entire process, from creation to distribution and record-keeping.

Key Advantages of Digital Documents for Efficiency

Here are the main ways that switching to digital formats can significantly enhance the efficiency of financial document management:

- Instant Delivery: Digital files can be sent immediately via email or uploaded directly to a client portal, eliminating the delays associated with physical mail. This speed reduces waiting times for both parties and accelerates payment cycles.

- Automated Processes: Many tools allow for automated creation and sending of documents, ensuring that repetitive tasks are handled quickly and without errors. This reduces manual labor and increases consistency.

- Improved Accuracy: Using digital forms helps reduce the risk of human error. With automated calculations and pre-filled fields, the likelihood of mistakes is minimized, ensuring greater accuracy and reliability.

- Easy Storage and Retrieval: Digital records are easy to store in cloud-based systems or databases, making them quickly accessible for future reference or audits. No need to sift through physical files to find necessary documents.

- Better Security: Digital documents can be encrypted, password-protected, and backed up, providing enhanced security compared to paper documents that may be lost or damaged.

How This Leads to Improved Business Performance

By adopting digital formats for business records, organizations can experience the following benefits:

- Faster Transactions: With quicker delivery and processing times, businesses can ensure that payments are made on time, improving cash flow and reducing delays.

- Reduced Administrative Costs: Automation reduces the need for manual input and paper-based processes, leading to cost savings on labor and materials.

- Enhanced Customer Experience: Clients appreciate the convenience and speed of receiving and processing digital documents. This improves satisfaction and strengthens business relationships.

Overall, transitioning to digital financial documents is a strategic move that enhances the efficiency of business operations while providing added security, accuracy, and convenience.

Editable Invoice Templates for Freelancers

Freelancers often face unique challenges when it comes to managing their financial documents. Having customizable and flexible forms that can be quickly updated for each project or client is essential for maintaining efficiency and professionalism. Editable formats allow freelancers to easily input specific details for each job, ensuring that every document reflects the scope of work and payment terms accurately.

Benefits of Customizable Financial Documents for Freelancers

Here are the main advantages of using editable forms for freelance work:

- Personalization: Customizable forms allow freelancers to tailor each document according to the client’s needs, project specifics, and agreed-upon payment structure.

- Time Efficiency: With editable fields, freelancers can quickly generate financial records without needing to start from scratch every time, saving time on repetitive tasks.

- Consistency: Using the same format across all client documents ensures consistency, which is essential for building a professional brand and ensuring clarity for clients.

- Ease of Use: Many editable options are user-friendly, allowing freelancers with minimal technical skills to create accurate and clear records easily.

Why Freelancers Need Customizable Financial Documents

For freelancers, maintaining organized and accurate financial records is key to managing cash flow, taxes, and professional relationships. Customizable forms not only streamline the creation process but also make it easier to track various services and payments across different clients. This ensures that every detail is captured correctly, reducing the risk of misunderstandings or errors.

By incorporating editable financial documents into their workflow, freelancers can stay organized, save time, and focus on delivering high-quality work while maintaining a professional approach to managing payments.

Why PDF Format

Choosing the right document format is essential for ensuring that your records are easily accessible, professional, and reliable. The versatility and consistency of certain file types make them particularly suited for business use. One format that stands out for its broad acceptance and ability to preserve document integrity across different devices is the portable format. It provides a range of advantages that help simplify the management and sharing of essential business documents.

Key Benefits of Using Portable Document Format

Here are some of the primary reasons why many businesses and professionals prefer this format:

- Universal Compatibility: This format can be opened on almost any device, including computers, tablets, and smartphones, without losing its formatting. This makes it ideal for sharing documents with clients and colleagues, regardless of the platform they’re using.

- Document Integrity: Unlike other formats that may change based on the software or operating system, files in this format retain their original layout, fonts, and images, ensuring that what you see is what the recipient will see.

- Security Features: This format allows you to add password protection, encryption, and other security features, ensuring that your documents remain confidential and tamper-proof.

- Easy to Print: Documents in this format are designed to look the same when printed as they do on the screen, making them an excellent choice for physical copies, whether for internal use or client distribution.

- Compact File Size: Portable files are often smaller in size than other formats, making them easier to store, send, and download without compromising quality.

Why It’s the Preferred Format for Businesses

For businesses that deal with various forms of documentation, the portable format offers a simple yet effective way to manage records. Whether you’re sending contracts, reports, or other professional materials, this format ensures consistency and easy access for both you and your recipients. Its reliability, security, and compatibility make it the top choice for business communication.