Rent Payment Invoice Template for Easy and Accurate Billing

Managing financial transactions between property owners and tenants can often be challenging, especially when it comes to ensuring accuracy and timely payments. A well-organized method of tracking these exchanges not only improves cash flow but also helps in maintaining transparency and avoiding disputes. Using a professional and standardized document for each transaction can simplify the process for both parties.

Whether you are a landlord or a tenant, having a clear and structured way to document charges and amounts due is essential. This can be achieved through a standardized form that outlines all necessary details, ensuring that both parties are on the same page regarding the terms of the arrangement. By using such a system, it becomes easier to track outstanding balances, confirm received funds, and keep records for future reference.

Having a customizable document allows you to adjust the details according to your needs, making it easier to reflect specific terms of the lease or rental agreement. This approach not only saves time but also ensures that the document remains legally valid, with all required information presented in a clear and concise manner.

Rent Payment Invoice Template Overview

When it comes to documenting financial transactions between property owners and tenants, having a standardized structure is key to avoiding confusion and ensuring both parties are on the same page. A well-constructed document for recording amounts due and the terms of the transaction helps streamline the process, maintain clear records, and build trust between landlord and tenant.

This document serves as a formal record that outlines important details such as the amount owed, due dates, and other essential terms. By using a consistent format, both parties can easily reference the agreement, track payment history, and avoid misunderstandings in the future. Additionally, such records can be crucial for legal or accounting purposes.

Key Features of an Effective Document

An effective document for rental transactions includes several key components to ensure clarity and accuracy. These components provide all necessary details and make it easy to track the status of financial exchanges. Below are the most common features to look for:

| Feature | Description |

|---|---|

| Transaction Details | Includes the amount due, description of the charges, and due date. |

| Sender and Recipient Information | Lists the names, addresses, and contact information for both the landlord and tenant. |

| Terms and Conditions | Outlines the payment terms, including penalties for late payments or early settlement discounts. |

| Payment Method | Specifies how the transaction can be completed (e.g., bank transfer, check, etc.). |

Advantages of Using a Structured Document

Utilizing a consistent structure for financial records offers several advantages. It simplifies communication between landlord and tenant, reduces errors, and creates an easily accessible record for future reference. It also ensures compliance with the lease agreement and can serve as proof in case of disputes. By following a standard format, you can guarantee that all necessary details are included and no important information is overlooked.

How to Create a Rent Invoice

Creating a structured document for documenting financial transactions between a landlord and a tenant requires attention to detail and consistency. By following a systematic approach, both parties can easily track amounts due, ensure all necessary information is included, and avoid misunderstandings. Whether you are a property owner or a tenant, understanding how to construct a clear and accurate statement is essential to keeping everything organized.

The first step in preparing such a document is to include all the essential details. Sender and recipient information should be clearly listed, including names, addresses, and contact details. This ensures that there is no confusion about who is involved in the transaction.

Next, outline the amount owed and any additional charges that may apply, such as maintenance fees or late fees. Make sure to specify the due date and any agreed-upon terms related to payment methods, whether it’s by bank transfer, check, or another method. This section should be simple and clear to avoid any ambiguity.

Additionally, it’s important to mention the payment terms. Include details such as the period the charges cover (e.g., monthly, quarterly), and if applicable, a breakdown of the total amount. This transparency helps both parties understand exactly what is being paid for and reduces the potential for disputes.

Finally, don’t forget to leave space for any notes or additional instructions. If there are any special conditions for the transaction, such as discounts for early payments or penalties for late settlement, these should be clearly mentioned in the document. By incorporating all these elements, you can create a comprehensive and effective record that simplifies the process and ensures all expectations are met.

Essential Elements of a Rent Invoice

When creating a document to record the financial obligations between a property owner and a tenant, it’s crucial to include several key components to ensure clarity and accuracy. These elements provide transparency, helping both parties understand the details of the transaction and reducing the chances of disputes. A well-organized document also makes it easier to track payments and manage financial records.

The first essential element is the identification information for both parties involved. This includes the full names, addresses, and contact details of both the landlord and tenant. Ensuring this information is accurate helps avoid confusion and ensures that the transaction can be easily traced back to the correct individuals.

Next, it is important to clearly state the amount due for the period in question. This figure should be broken down as needed to show any additional charges, such as maintenance fees, utilities, or other agreed-upon costs. Be specific about the payment period (e.g., weekly, monthly) to avoid misunderstandings about what is being charged.

The due date is another key component. This should be prominently displayed so that both parties are aware of the deadline for completing the transaction. If any penalties for late settlement apply, these should be clearly mentioned to encourage timely payments and help avoid disputes.

Finally, it is important to include the method of payment available for the transaction. Whether the payment is to be made by bank transfer, check, or other means, specifying the payment options ensures both parties are clear about how the funds should be transferred. This can help prevent delays or complications in completing the transaction.

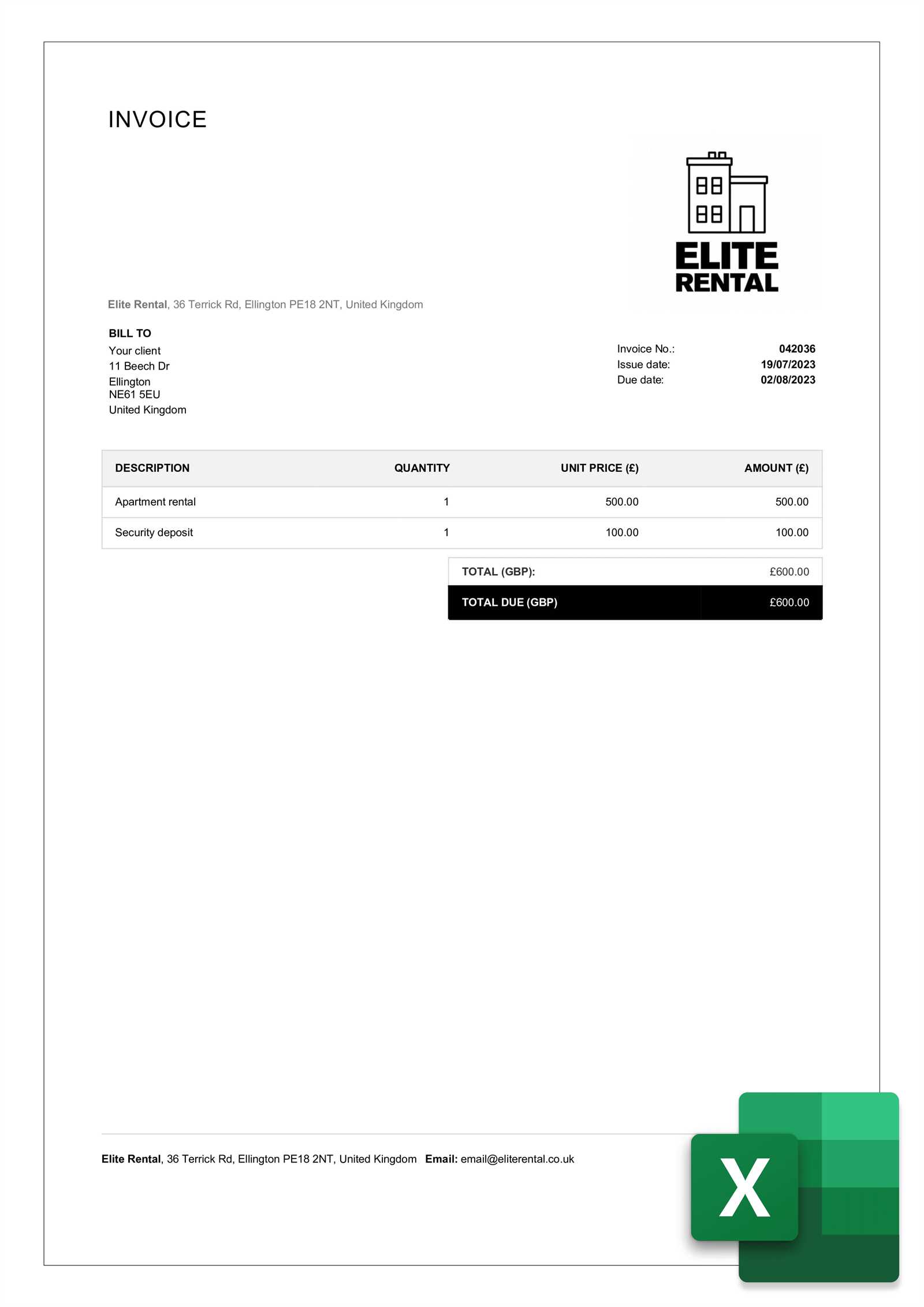

Free Rent Invoice Templates You Can Use

If you’re looking to streamline the process of documenting financial transactions with tenants, utilizing a ready-made form can save time and ensure consistency. Free templates are widely available online, offering easy-to-use formats that can be customized to fit your needs. These resources help you create professional documents without having to design them from scratch, making the process much more efficient.

Benefits of Using a Free Template

Free forms provide several advantages, especially for property owners who need to issue statements regularly. By using a pre-designed structure, you eliminate the risk of omitting crucial information or making formatting errors. Templates also allow for quick updates, ensuring you can adjust details like charges or due dates without hassle. With a user-friendly interface, these templates are perfect for those who may not be familiar with financial document creation.

Where to Find Reliable Templates

There are numerous websites offering free, downloadable forms that are both professional and easy to use. Look for those that allow for customization so you can adjust the document to fit your specific requirements. Many of these resources offer templates in various formats, including Word, Excel, and PDF, so you can choose the one that best suits your workflow.

By using a free template, you ensure that each transaction is documented clearly and professionally, helping to maintain organized records and avoid potential misunderstandings with tenants.

Benefits of Using an Invoice Template

Utilizing a standardized document to record financial transactions can significantly simplify the billing process for both property owners and tenants. By relying on a pre-designed structure, you can ensure accuracy, consistency, and efficiency in all your transactions. This approach not only saves time but also helps reduce errors and improve overall communication between both parties.

Time and Effort Savings

One of the primary advantages of using a structured document is the time it saves. Instead of manually creating a new document from scratch for every transaction, a pre-made format allows you to quickly input the necessary details. This streamlining of the process makes it easier to manage multiple records without getting bogged down by repetitive tasks.

Improved Accuracy and Consistency

By using a standardized format, you reduce the risk of leaving out important information or making mistakes. Each essential detail, such as the amount owed, due date, and contact information, is clearly organized, minimizing the chances of miscommunication. Furthermore, consistency across documents helps maintain a professional appearance and ensures that all necessary components are included each time.

Record Keeping is another key benefit. Using a standardized document simplifies organizing financial records, making it easier to track outstanding balances, monitor payment histories, and maintain a clear overview of all transactions. This level of organization is invaluable for accounting purposes or resolving any potential disputes down the line.

In short, using a structured document can save time, improve accuracy, and enhance overall efficiency, leading to smoother transactions and better communication with tenants.

Customizing Your Rent Invoice Template

When creating a document to track financial obligations, it’s important to tailor the structure to meet your specific needs. Customizing a pre-made format ensures that all relevant information is included and that it accurately reflects the terms of the agreement between the property owner and the tenant. Personalization helps make the document more relevant, professional, and easier to understand for both parties.

Adjusting Key Details

The first step in customization is ensuring that all important details are accurately represented. This includes adjusting fields such as the property information, payment amounts, and due dates. Depending on the terms of the rental agreement, you might need to add or remove sections to reflect specific charges, like maintenance fees, utilities, or other agreed-upon costs. Ensuring that the amounts are correctly broken down is crucial to avoiding any confusion.

Design and Branding

In addition to the functional aspects, customizing the visual layout of your document can also make a difference. Adding your business logo, contact details, and even specific fonts or colors can help personalize the document and give it a more professional appearance. A clear and well-organized format not only looks more polished but also makes the document easier to navigate and understand.

By customizing your record-keeping document, you ensure that it fits your unique requirements, whether for personal or business use. This not only streamlines the process but also promotes clarity, professionalism, and consistency in all your financial transactions.

How to Track Rent Payments Effectively

Tracking financial transactions accurately is essential for both property owners and tenants. A clear system for monitoring amounts owed and received helps maintain transparency, avoid misunderstandings, and ensure that all obligations are met on time. By implementing an organized method of record-keeping, both parties can stay on top of their finances and address any issues promptly.

Using a Consistent Record-Keeping System

The foundation of effective tracking is a reliable system to record each exchange. Whether you use a spreadsheet, software, or a printed ledger, consistency is key. Make sure to record each transaction as soon as it occurs, noting the amount paid, date of payment, and any relevant details such as payment method or remaining balance. This habit ensures that you have up-to-date information at all times.

Setting Up Payment Reminders

Another effective way to track transactions is by setting up automatic reminders for both the sender and the recipient. This ensures that deadlines are never missed and reduces the risk of overdue balances. You can use email reminders, mobile notifications, or calendar alerts to prompt both parties to complete the transaction before the due date arrives. Keeping track of due dates in this way minimizes the chances of late fees or other complications.

By utilizing these strategies, you create a streamlined process that promotes accountability and keeps both parties informed. With clear records and regular reminders, managing financial obligations becomes a more efficient and organized task, ultimately contributing to a positive relationship between tenant and landlord.

Understanding Invoice Terms for Rent

When managing financial transactions between property owners and tenants, it’s essential to have a clear understanding of the terms used in any related documents. These terms outline the expectations, conditions, and obligations of both parties, ensuring that the exchange is transparent and understood. Familiarizing yourself with the language and key components of such records can help prevent misunderstandings and ensure smooth, timely transactions.

Key Terms to Know

The most important terms usually include the due date, which indicates the deadline by which the amount must be paid. This is crucial for both the property owner and tenant to keep track of when payments are expected. Another important term is the amount due, which refers to the total sum that needs to be paid, whether it’s for a specific period or an accumulated amount over time. Knowing this helps avoid confusion about how much is owed at any given moment.

Additional Terms and Conditions

Additional terms may include penalties for late settlements, such as extra charges that are applied if payment is not made on time. Some agreements may also specify discounts or incentives for early settlement, offering a reduced amount if the transaction is completed before the due date. These terms help to encourage timely payments and ensure fairness between both parties.

By carefully reading and understanding the terms included in any such document, both landlords and tenants can ensure they are fully informed of their responsibilities, helping to maintain a professional and transparent relationship.

How Rent Invoices Improve Cash Flow

Efficient tracking and recording of financial transactions play a crucial role in managing the flow of money in any business, especially for property owners. By clearly documenting amounts due and ensuring timely collection, landlords can significantly improve their cash flow. A structured approach to billing ensures that there are no missed payments and helps to maintain a consistent revenue stream, which is vital for managing ongoing expenses and investments.

Benefits of Clear Documentation

When each transaction is recorded with precision, it becomes easier to monitor outstanding balances and plan ahead. Here are several ways in which a structured document can positively impact cash flow:

- Timely Collections: Clear records help ensure that tenants are aware of the due date, reducing the chances of late payments.

- Reduced Disputes: A detailed document provides transparency, which minimizes the likelihood of disagreements about amounts owed or terms of the agreement.

- Better Financial Planning: With organized records, property owners can predict income more accurately, helping to plan for future expenses or investments.

- Streamlined Accounting: By using standardized documents, financial records are easier to track and categorize, improving overall bookkeeping efficiency.

Improving Payment Reminders

Another key advantage is the ability to send timely reminders based on the structured document. Property owners can use the information provided to automatically trigger reminders to tenants before payments are due. This simple but effective system helps maintain a steady cash flow and reduces the need for frequent follow-ups or last-minute settlements.

Ultimately, using a systematic approach to managing financial transactions enhances overall business efficiency, reduces cash flow disruptions, and ensures a smooth financial operation for property owners.

Rent Invoice Template for Landlords

For property owners, maintaining clear and organized financial records is essential to managing rental properties effectively. A standardized document that outlines amounts owed and terms can help ensure timely transactions and reduce the risk of disputes. By using a structured format, landlords can easily track outstanding balances and maintain a professional relationship with tenants.

Landlords can benefit from customizing such a document to reflect the unique terms of their agreements, ensuring that all necessary details are included. This makes it easier to manage multiple properties or tenants, and also helps in keeping accurate records for tax purposes and legal compliance.

Key Elements for Landlords

A good record-keeping document for landlords should include the following essential elements:

| Component | Description |

|---|---|

| Landlord Details | Full name, address, and contact information of the property owner. |

| Tenant Details | Full name, address, and contact information of the tenant. |

| Amount Due | The total amount owed, including rent, utilities, or additional fees if applicable. |

| Due Date | The specific date by which payment should be made. |

| Payment Method | How the tenant is expected to pay, whether by check, bank transfer, or other means. |

| Property Details | Address of the rental property and any other relevant identifying information. |

By including these components, landlords can ensure that all the necessary information is communicated clearly and professionally, making it easier to track finances and resolve any issues that may arise. This approach also helps establish a transparent and consistent process for managing payments and keeping financial records organized.

Automating Rent Invoice Generation

Automating the process of creating financial records for rental transactions can save property owners a significant amount of time and reduce the likelihood of errors. By using software tools or online platforms, landlords can set up a system that generates documents automatically based on pre-set criteria, ensuring that all necessary information is included and up-to-date. This process streamlines accounting tasks and improves efficiency in tracking rental activities.

How Automation Works

Automating document creation typically involves setting up a system that pulls information from a database or form. For example, a property management software can be linked to the tenant’s payment history, contract details, and due dates, automatically generating records based on that data. Once the document is created, it can be sent directly to the tenant via email or another method of communication.

Benefits of Automating Financial Records

- Time Efficiency: With automation, there is no need to manually input details each time a new document needs to be generated. This saves valuable time and eliminates repetitive tasks.

- Accuracy: Automation ensures that all data entered is accurate, reducing the risk of human error in financial documents. Information like the due date, amount owed, and contact details will always be correct.

- Consistency: Automated systems ensure that all documents are created using the same format and structure, maintaining a professional appearance and ensuring consistency across transactions.

- Improved Cash Flow Management: Automation can include features like reminders for due dates, helping both landlords and tenants stay on track and reducing the likelihood of late payments.

By automating this process, landlords can reduce the administrative burden, stay organized, and focus on more important aspects of property management, all while ensuring accurate and timely financial documentation.

Common Mistakes in Rent Invoicing

Creating financial records for property transactions can be straightforward, but mistakes in this process can lead to confusion, delayed payments, and unnecessary disputes. Even small errors can have significant consequences, making it essential for property owners to be aware of common pitfalls when generating documentation for tenants. Avoiding these mistakes ensures a smooth process and promotes clear communication between both parties.

Omitting Key Information

One of the most common mistakes is failing to include all necessary details in the document. Missing crucial information such as the due date, amount due, or tenant contact information can lead to misunderstandings. Always ensure that every important field is filled out clearly and accurately. This includes providing details on any additional charges, payment methods, or special terms outlined in the rental agreement.

Incorrect Calculation of Amounts

Another frequent error is incorrectly calculating the total amount owed. This could involve miscalculating charges or failing to account for applicable fees, like maintenance costs or utilities. It’s essential to break down all charges in a transparent way to avoid confusion. Ensuring the calculations are correct from the start minimizes the risk of disputes over the amount due.

Inconsistent or Missing Dates

Not specifying a due date or using inconsistent dates between documents can lead to confusion about payment expectations. Both parties need to be clear on when payment is due. If deadlines change or if payments are being processed for different periods, these should be clearly stated to avoid misunderstandings.

Not Sending Reminders or Follow-ups

Even if a document is generated correctly, failing to send reminders or follow-ups can lead to delayed payments. Setting up a system to remind tenants before the deadline and follow up after the due date can ensure timely settlements and maintain cash flow.

By being aware of these common mistakes and taking steps to avoid them, property owners can create clear, accurate financial documents that keep transactions smooth and professional.

How to Avoid Rent Payment Disputes

Disputes over financial transactions can lead to frustration and strain relationships between property owners and tenants. Ensuring clarity, accuracy, and effective communication can help prevent such issues from arising. By taking proactive steps to establish clear expectations and provide detailed documentation, both parties can avoid misunderstandings and foster a positive, professional relationship.

Clear and Detailed Documentation

The most effective way to avoid disputes is by providing a detailed and transparent record of amounts owed, due dates, and any additional charges. A well-structured document should outline all necessary information, including amounts due, payment terms, and any extra fees (such as for maintenance or utilities). Clear documentation prevents confusion and ensures both parties are on the same page regarding the terms of the agreement.

Timely Communication and Reminders

Another key factor in avoiding disputes is maintaining open and timely communication. Sending reminders about upcoming deadlines or follow-ups after the due date can help prevent missed payments. Property owners should ensure tenants are aware of any changes to the agreement or if there are any outstanding balances. By staying in regular contact, both sides can address potential issues before they escalate into disputes.

By focusing on clear communication, transparency in financial records, and timely follow-ups, property owners and tenants can reduce the chances of conflicts, ensuring a smooth and professional relationship throughout the rental term.

Legal Requirements for Rent Invoices

When creating financial records for rental transactions, property owners must ensure that they comply with relevant legal requirements. These documents serve as proof of the transaction and can be crucial in the event of disputes or legal actions. Different jurisdictions may have specific regulations regarding what needs to be included in these documents, how they should be formatted, and how long they must be kept for. Understanding these requirements helps avoid legal issues and ensures that all records are both accurate and legally valid.

Key Legal Considerations

While the exact requirements can vary, the following elements are typically required to ensure compliance with legal standards:

- Clear Identification: The document must clearly identify both the landlord and the tenant, including full names, addresses, and contact details.

- Accurate Payment Details: It is important to list the amount owed, any additional charges (e.g., maintenance or utilities), and the payment period covered by the transaction.

- Due Date: The document must specify the date by which the payment is due to avoid any confusion or ambiguity regarding the timeline.

- Legal Language: Ensure the language used is clear and formal. Any terms or clauses related to late fees, interest, or penalties for non-payment should be outlined explicitly.

- Signature or Acknowledgment: Depending on local laws, a signature or other form of acknowledgment from both parties may be required to validate the document.

Record-Keeping and Retention

Another critical aspect is the retention of these records. Most jurisdictions require that such documents be kept for a specified period, often ranging from one to several years. Property owners should ensure they store these documents securely and in an organized manner, ready for review if needed. Additionally, digital copies of these records are often considered legally valid, as long as they are stored securely and meet the local standards for electronic documentation.

By understanding and adhering to these legal requirements, property owners can ensure they are protecting both their interests and their tenants’ rights, minimizing the risk of legal challenges or disputes in the future.

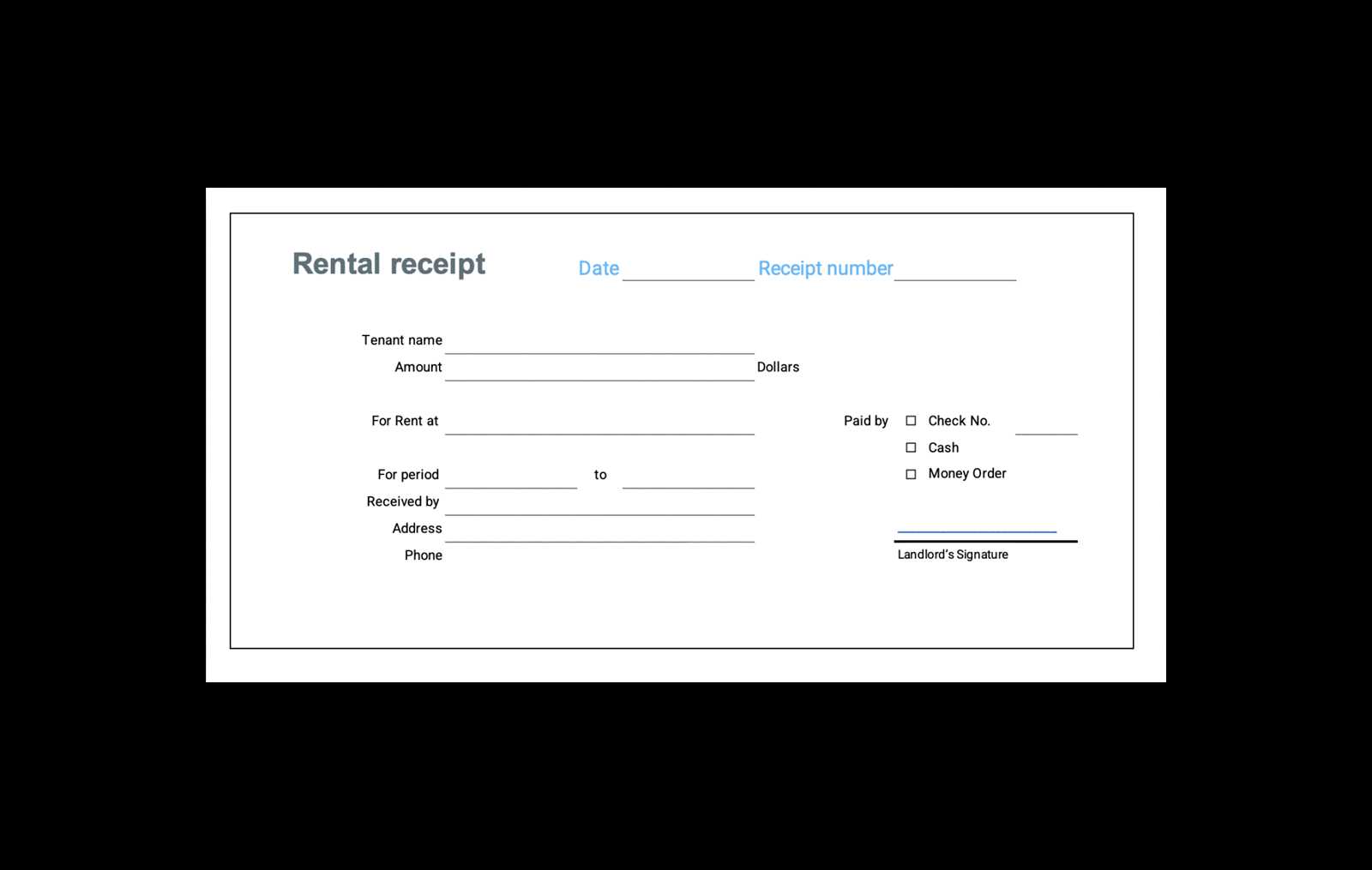

Rent Invoice Template for Tenants

For tenants, receiving a clear and accurate financial record is essential for tracking expenses and ensuring that payments are made on time. Having a structured document that outlines the amount owed, due dates, and payment terms helps tenants stay organized and avoid misunderstandings. This record also serves as proof of the transaction and can be useful for budgeting or resolving any disputes that may arise over the course of the tenancy.

Essential Information for Tenants

A well-organized document should provide all the necessary details in a transparent manner. Key elements to expect in a document from the property owner include:

- Tenant Details: Your full name, address, and contact information should be included to ensure the document is correctly attributed to you.

- Amount Due: The total amount owed for the specified period, including any additional fees or charges, such as maintenance costs or utilities.

- Payment Instructions: Information on how to make the payment, whether by check, bank transfer, or another method.

- Due Date: The date by which the payment should be completed, along with any late fees or penalties if the payment is delayed.

- Property Address: The full address of the property for which you are being charged, especially if the landlord manages multiple units.

Benefits of a Detailed Financial Record

Having a detailed record of financial transactions benefits tenants in multiple ways. It helps ensure that no payments are overlooked, and the terms of the agreement are clearly outlined. Additionally, it allows for better financial planning and can serve as documentation for tax purposes, should it be needed in the future. Moreover, it fosters a professional relationship between tenants and landlords, as both parties are kept informed about the status of any obligations.

By ensuring that each financial record includes the relevant details, tenants can avoid confusion and ensure a smooth and transparent rental experience.

Best Practices for Rent Payment Records

Maintaining accurate and organized financial records for rental transactions is essential for both property owners and tenants. Proper documentation not only ensures clarity but also helps in avoiding disputes, staying compliant with legal requirements, and simplifying future financial planning. Adopting best practices for tracking these transactions can streamline the process, reduce errors, and ensure both parties have a clear understanding of their financial obligations.

Key Best Practices for Maintaining Accurate Records

There are several strategies that can help ensure rental transactions are accurately recorded and easy to track. Below are some best practices to follow:

| Best Practice | Description |

|---|---|

| Consistency | Ensure that all financial documents are created and stored in a consistent format. This helps avoid confusion and makes it easier to review past transactions. |

| Detailing Charges | Include all relevant charges, such as maintenance fees or utility costs, in the document. This ensures transparency and reduces the potential for disputes. |

| Clear Deadlines | Always specify due dates clearly and note any penalties for late submissions. This helps both parties stay on track and avoid missed or delayed payments. |

| Digital and Physical Copies | Maintain both digital and physical copies of financial records. Digital records make it easier to store and search, while physical copies provide a backup in case of technical issues. |

| Regular Updates | Regularly update records to reflect any changes, such as adjustments in charges or contract amendments. Keeping records current ensures accuracy and prevents confusion down the line. |

By following these best practices, both property owners and tenants can ensure that their financial dealings are well-documented, transparent, and easily accessible. Whether you’re managing one property or multiple units, adopting these strategies will help maintain clear communication and reduce the risk of erro