How to Use a Video Editor Invoice Template for Efficient Billing

For freelancers in the creative industry, managing payments is as crucial as delivering high-quality work. A well-organized financial document helps streamline the billing process, ensuring timely payments and minimizing misunderstandings with clients. Whether you’re just starting or looking to refine your approach, using a structured format for your financial statements can save you both time and effort.

Customizable billing structures allow you to present your services clearly and professionally. By including necessary details like work hours, service rates, and payment instructions, you ensure transparency and prevent confusion. This also shows clients that you are serious about your business and value their time and investment.

Moreover, having a consistent format means that all essential information is included every time, reducing the chances of errors or missing details. With the right layout, you’ll be able to create a document that not only looks polished but also reflects your professionalism in every project you take on.

Video Editor Invoice Template Overview

For freelancers and professionals in the creative field, having a standardized approach to billing is essential. A structured document allows you to clearly communicate the details of your work and the associated costs, making the payment process smoother for both parties. The right structure can also help avoid confusion and disputes, ensuring that your clients understand exactly what they are paying for and when.

In essence, this document serves as an official record of services rendered, listing everything from the hours worked to the final cost. It’s important that the layout is simple yet comprehensive, covering all the necessary information without being overly complicated. The goal is to create a tool that enhances your professionalism and ensures timely payments.

Customization is a key feature, as different types of creative work may require different details. For instance, you may need to adjust the format based on the type of service provided, the project’s scale, or the specific needs of your client. With the right format, you’ll have the flexibility to tailor the document to suit various situations while maintaining a consistent structure.

Why You Need an Invoice Template

Having a consistent and professional billing system is essential for anyone offering services. Without a well-organized document, it becomes challenging to ensure that all aspects of your work are accurately recorded and compensated. A standardized approach helps eliminate confusion, prevent mistakes, and ensures that clients are clear about what they are paying for and why.

Using a predefined format can significantly speed up the billing process. Instead of creating a new document from scratch every time, you can quickly fill in the necessary details, ensuring that you don’t forget important elements like service descriptions, hours worked, or payment instructions. This not only saves time but also reduces the risk of errors that could lead to payment delays or disputes.

Consistency is another key reason why having such a structure is important. Clients appreciate clarity and transparency. When they receive a polished, professional document that includes all relevant information, it enhances your credibility and helps build trust. Additionally, with a reliable framework in place, you can focus more on your work and less on the administrative side of things.

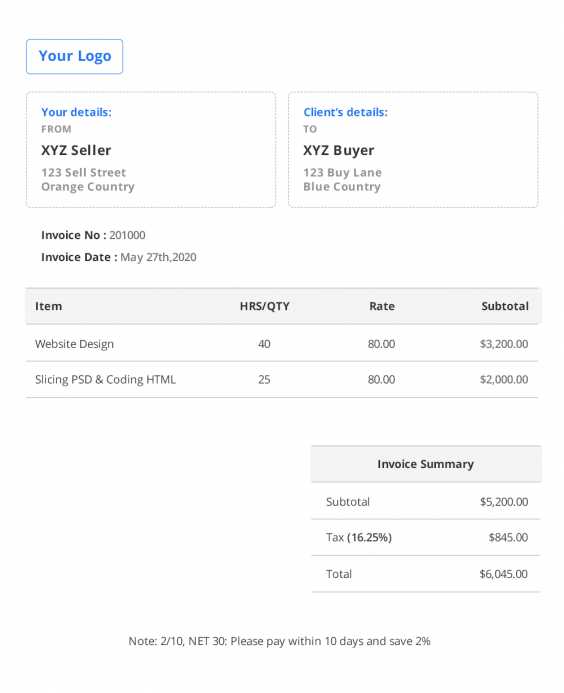

Essential Elements of an Invoice

A professional billing document should include specific information to ensure clarity and accuracy. These key components help both the service provider and the client understand the terms of payment, the work completed, and the financial obligations involved. By covering all essential details, you create a transparent and straightforward process for collecting payments.

First, it is important to include your contact details as the service provider, including your name, address, and any other relevant information such as business registration numbers. This establishes your identity and allows the client to easily reach you if needed. Equally important is the client’s information–ensure you list their name, address, and any other necessary details to confirm who the payment is being made to.

Another critical element is a clear description of the services provided. This should outline what was done, how long it took, and any specific terms related to the work. Including this level of detail helps the client understand exactly what they are paying for and justifies the final amount due. Along with the service description, it’s essential to include the payment amount, along with any applicable taxes, fees, or discounts.

Finally, providing clear payment terms is crucial. This includes the due date, the method of payment accepted, and any late fees if applicable. This not only helps ensure timely payments but also sets expectations for both parties, preventing potential conflicts down the road.

How to Customize Your Template

Customizing a billing document allows you to tailor it to your specific needs, ensuring it reflects your personal or business brand while remaining functional and professional. By adjusting the layout and content, you can make sure the document suits various types of work and clients. Customization not only improves the document’s appearance but also enhances its clarity and usability.

Step-by-Step Customization Process

To begin customizing, you should first consider the basic structure of the document. Ensure it includes all necessary sections, such as your contact information, client details, service description, and payment terms. From there, you can adjust the design elements to make the document more visually appealing or better aligned with your branding.

Common Customization Options

Here are some key areas you can adjust to suit your needs:

| Section | Customization Options |

|---|---|

| Header | Change font style, add logo or business name |

| Client Details | Adjust fields for client name, company, and contact information |

| Service Description | Modify the format to list tasks or projects clearly |

| Payment Terms | Include payment methods, due dates, and late fees |

| Footer | Add additional contact details, terms, or social media links |

These elements can be tailored to meet the unique requirements of each project or client, ensuring that your billing documents are both professional and personalized. Customization not only makes your work stand out but also ensures that your clients have a clear understanding of the terms and expectations associated with the payment process.

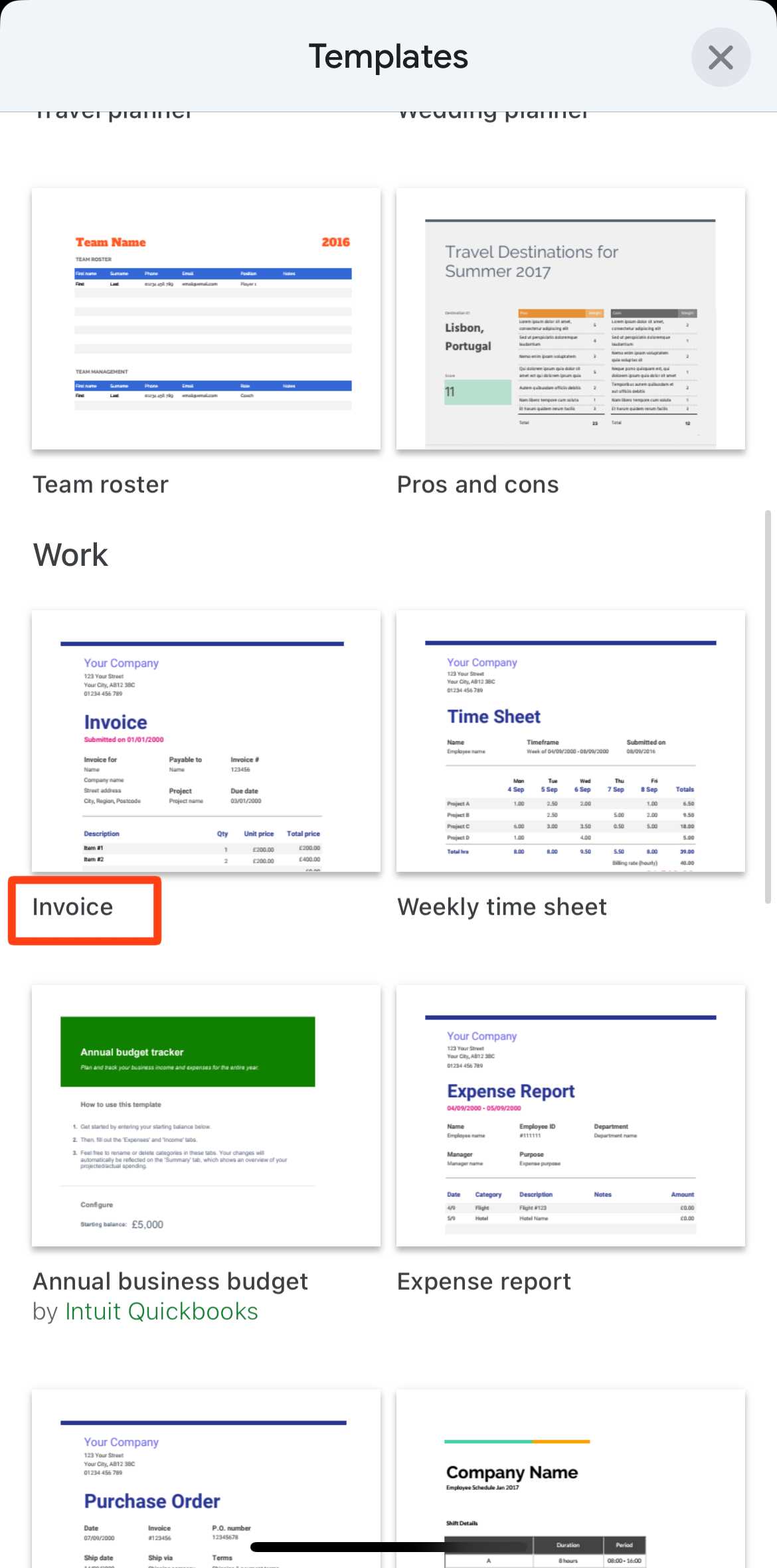

Free Billing Documents Available Online

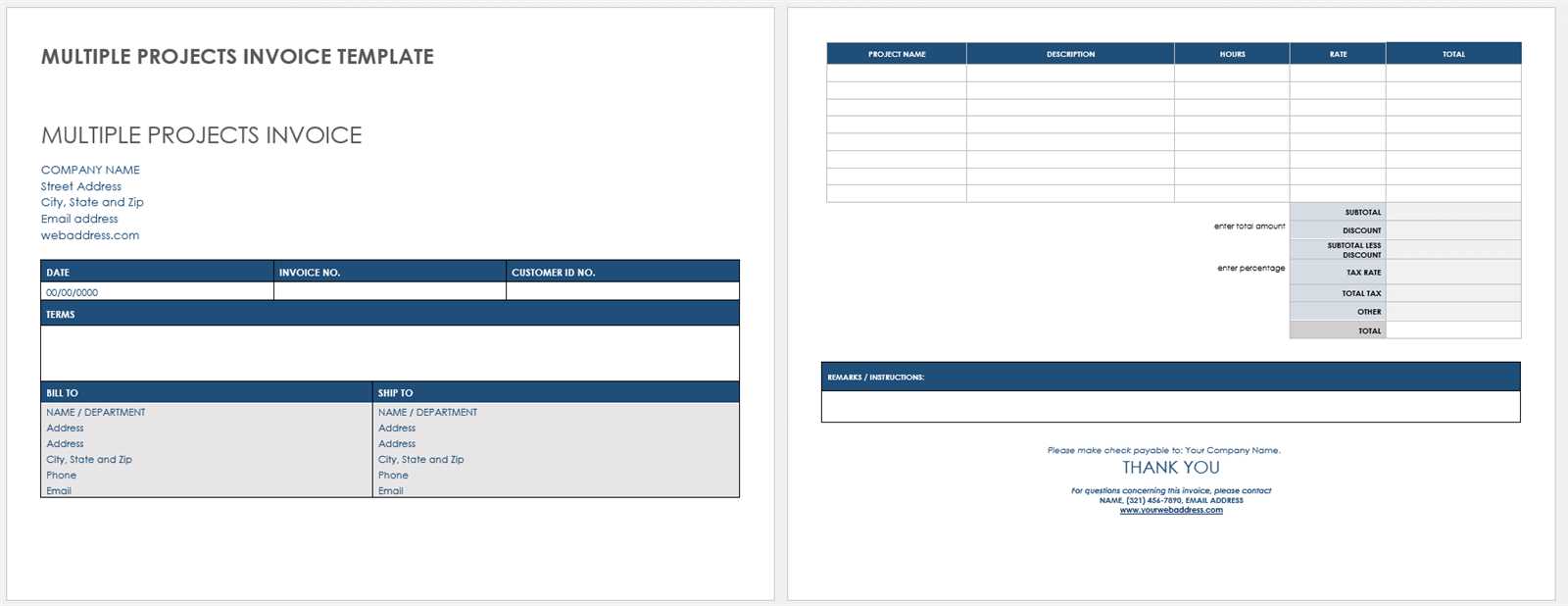

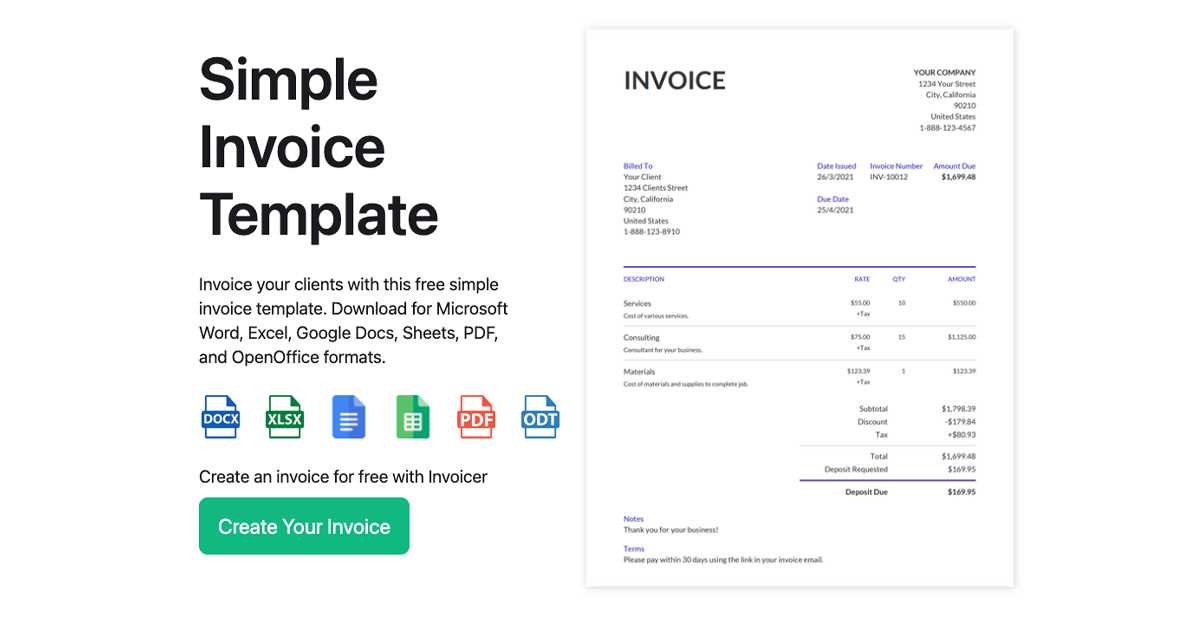

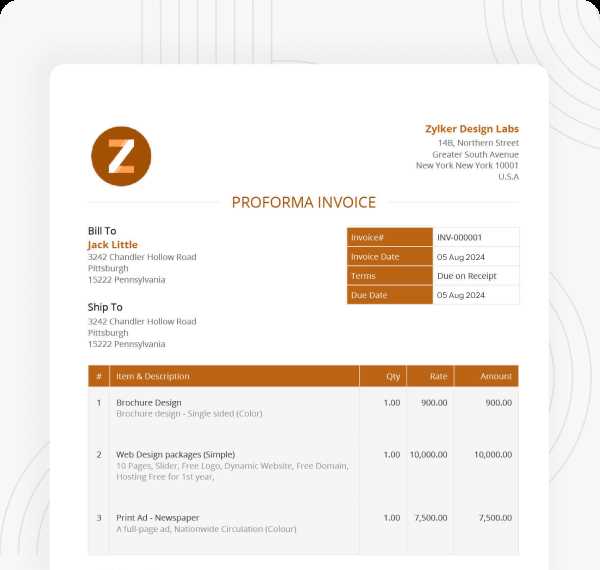

There are numerous free resources available online that provide ready-to-use formats for creating professional billing documents. These free options are designed to save time, allowing you to focus on your work while ensuring that your financial records are accurate and well-presented. These resources range from simple layouts to more complex designs, catering to various needs and preferences.

When searching for free options, it’s important to consider what best fits your specific needs. Whether you are just starting out or looking for a more polished approach, many of these free resources offer customizable layouts that allow you to quickly adjust the details to suit your project.

| Platform | Features |

|---|---|

| Google Docs | Free, easy to edit, and cloud-based for easy sharing |

| Microsoft Word | Offers a range of professional templates with customizable options |

| Canva | Customizable designs with visually appealing layouts and user-friendly interface |

| Zoho | Free invoicing software with templates that allow for seamless integration and customization |

| Invoicely | Free and simple to use, offering customization options and invoice tracking features |

These platforms allow you to select from a variety of formats, so you can find one that best fits the nature of your work and client expectations. Using these free tools can help you stay organized and maintain a professional image while managing payments efficiently.

Choosing the Right Format for Your Invoices

Selecting the correct structure for your billing documents is essential to ensure clarity and professionalism. The right format will help communicate the details of your services clearly, making it easier for clients to understand what they are paying for and when payment is due. A well-organized layout not only speeds up the process of creating and sending bills but also establishes a consistent approach to how you handle payments.

Consider Your Client’s Needs

The format you choose should align with the preferences of your clients. Some clients might prefer a more traditional, straightforward design, while others may appreciate a visually polished layout. It’s important to ensure that the format is easy to read and free from unnecessary complexity, as this helps avoid confusion and delays.

Key Aspects to Consider

When choosing a format, there are several factors to keep in mind to make sure your documents are effective:

| Factor | Considerations |

|---|---|

| Clarity | Ensure that all details, such as hours worked, service descriptions, and totals, are easily distinguishable |

| Flexibility | Pick a layout that can be easily customized for different clients and projects |

| Professionalism | A clean, organized structure reflects your business’s credibility and trustworthiness |

| Ease of Use | Choose a format that is quick to fill out and straightforward to edit, saving you time |

| Compatibility | Ensure the format is compatible with common document editors or invoicing platforms |

By carefully selecting a format that meets these criteria, you can ensure that your billing documents not only look professional but are also functional and efficient for both you and your clients. The right format will help you maintain a consistent approach to payments and avoid unnecessary back-and-forths with clients regarding their financial obligations.

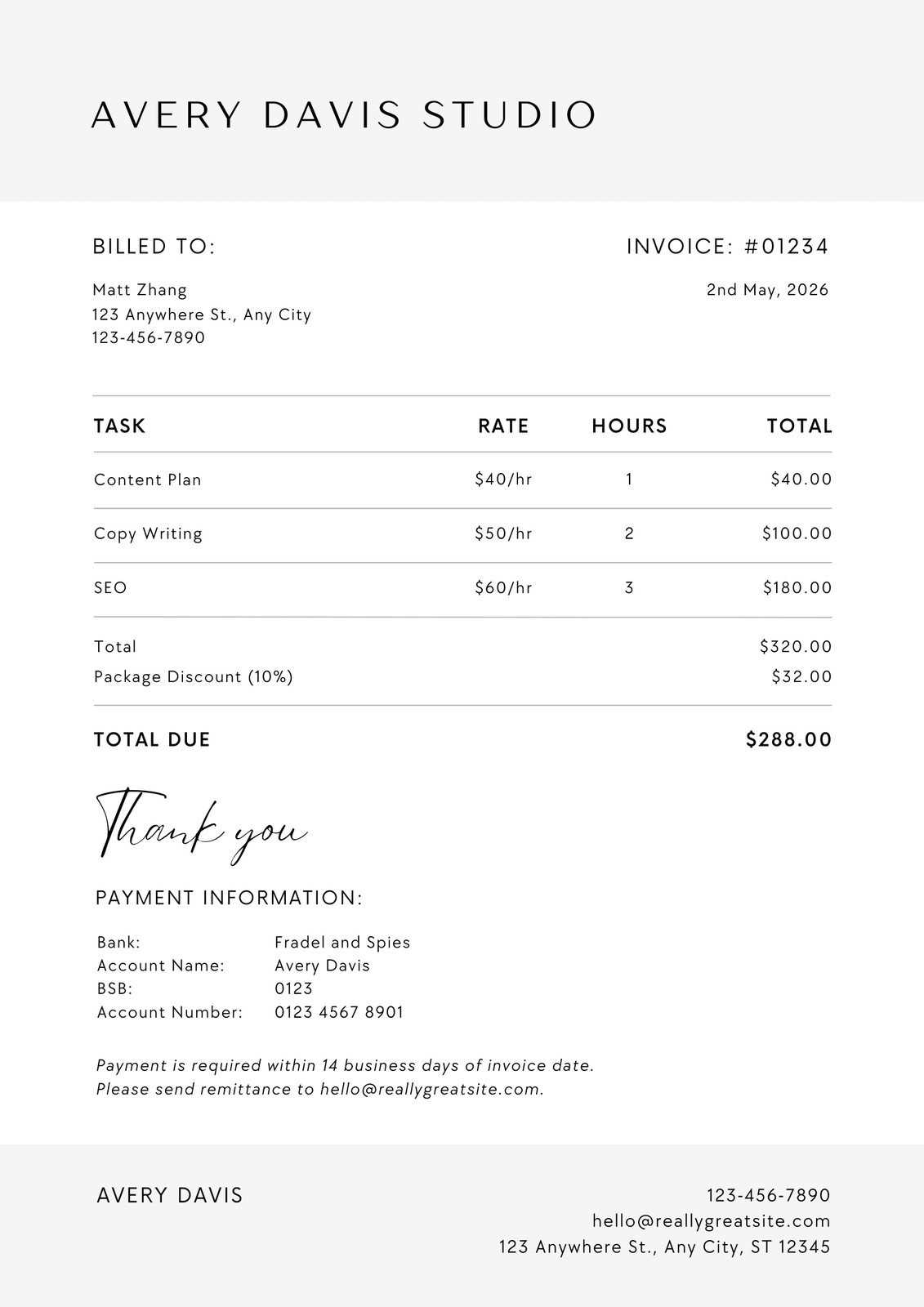

Steps to Create a Professional Invoice

Creating a well-organized and professional billing document is essential for freelancers and business owners to ensure smooth transactions with clients. The process involves more than just listing the amount owed; it’s about providing clear and concise details that help both parties understand the terms and expectations of the payment. A properly structured document not only facilitates prompt payment but also enhances your professional image.

Step-by-Step Guide

Follow these steps to create a professional billing document that accurately reflects the services you’ve provided and ensures prompt payment:

| Step | Description |

|---|---|

| 1. Include Your Business Information | Make sure your name, address, email, and phone number are clearly displayed at the top. If applicable, add your business registration or tax ID number. |

| 2. Add Client Information | Include the client’s name, address, and contact information to confirm who the payment is for. |

| 3. List Services Provided | Provide a clear breakdown of the services performed, including hours worked and rates. This helps the client understand what they are paying for. |

| 4. Specify Payment Terms | State the total amount due, along with any taxes or additional fees, and include payment due dates and accepted methods of payment. |

| 5. Add Unique Invoice Number | Assign a unique number to each document for record-keeping and easy reference. |

| 6. Include Notes or Terms | Use this section to add special payment instructions, discounts, or additional terms specific to the transaction. |

Final Touches

After entering all necessary information, review the document for accuracy. Ensure that there are no spelling mistakes or missing details, as this could delay payments or cause confusion. Once you’re satisfied, send the document to your client in a timely manner, ensuring you choose the most effective delivery method, whether by email, physical mail, or online billing platform.

By following these steps, you’ll create a professional and transparent billing document that reflects your attention to detail and helps maintain strong client relationships.

How to Add Payment Terms to Invoices

Including clear payment terms in your billing documents is crucial for setting expectations with your clients and ensuring that you receive timely payments. Payment terms outline the conditions under which payments should be made and provide important details that help avoid confusion or delays. By specifying these terms, you create transparency and professionalism in your business transactions.

Here are the key elements you should consider when adding payment terms to your documents:

- Due Date: Specify the exact date by which payment is expected. This helps your clients know when they need to make the payment to avoid any late fees.

- Accepted Payment Methods: List the methods through which you accept payments, such as bank transfers, PayPal, credit cards, or checks.

- Late Payment Fees: Define any late fees that will apply if payment is not made by the due date. This can be a flat fee or a percentage of the total amount due.

- Discounts for Early Payment: If applicable, you can offer a discount for early payment to encourage your clients to pay ahead of schedule.

- Installment Options: If you allow payment in installments, outline the schedule for payments, including the amount due for each installment and the payment deadlines.

Once you’ve decided on the terms, clearly list them in the appropriate section of your billing document, preferably near the total amount due. This ensures that your clients are aware of the conditions before making the payment.

By establishing and clearly communicating your payment terms, you reduce the risk of misunderstandings and late payments, helping you maintain a smooth cash flow and professional relationship with your clients.

Best Tools for Invoice Generation

Generating professional and accurate billing documents can be a time-consuming task, especially if done manually. Fortunately, there are various tools available that can help automate the process, ensuring that your statements are clear, consistent, and error-free. These tools offer a range of features, from customizable designs to automated calculations, saving you both time and effort while maintaining a professional appearance.

Here are some of the best tools that can help streamline your billing process:

- FreshBooks: This user-friendly platform allows you to create, send, and manage billing documents with ease. It also provides features like automatic reminders for overdue payments, expense tracking, and financial reporting.

- QuickBooks: QuickBooks is a comprehensive accounting software that includes invoicing features. It allows you to generate invoices, track payments, and integrate with other financial tools to manage your business finances more effectively.

- Wave: Wave is a free accounting tool that includes customizable billing document generation. It’s an excellent choice for small businesses and freelancers, offering additional features like payment processing and expense management.

- Zoho Invoice: Zoho provides a free invoicing solution with various customizable templates. It also includes features for tracking time, expenses, and payments, making it ideal for professionals who need to manage multiple projects simultaneously.

- PayPal: Known for its payment processing, PayPal also offers tools for creating simple yet professional billing documents. It’s particularly useful if you already use PayPal for transactions, as it allows you to send invoices and receive payments directly.

- Canva: While primarily a design tool, Canva offers customizable templates for creating visually appealing billing documents. This is a great option if you want to make your documents stand out with unique, personalized designs.

By using these tools, you can generate accurate, professional documents that reflect your brand and help ensure timely payments. Each tool has its own unique features, so choosing the right one depends on your specific needs, whether it’s simple billing or full accounting management.

Common Mistakes to Avoid in Invoices

Creating a professional and accurate billing document is crucial for maintaining a smooth working relationship with clients. Even small errors can lead to delays in payments or cause confusion. Understanding common mistakes and taking steps to avoid them can help ensure that your documents are clear, concise, and effective in securing timely payments.

Errors That Can Lead to Delayed Payments

There are several common pitfalls that service providers should be mindful of when generating billing documents:

- Missing or Incorrect Client Information: Ensure that your client’s details are accurate, including their name, address, and contact information. Incorrect or incomplete details can delay payments and create confusion.

- Unclear or Vague Descriptions: Always provide detailed descriptions of the services you’ve performed. Avoid using vague terms like “miscellaneous” or “other services,” as these can lead to misunderstandings about what the client is paying for.

- Omitting Payment Terms: Always include clear payment terms, such as due dates, accepted methods of payment, and any penalties for late payments. Not including these terms can lead to confusion and delays.

- Inaccurate Calculation of Total Amount: Double-check all numbers before sending the document. Incorrect calculations can create distrust and complicate the payment process.

- Not Including a Unique Identifier: Failing to assign a unique number to each billing document can make it harder to track payments, especially for repeat clients or long-term projects.

Professional Presentation Mistakes

Beyond technical errors, presentation also plays a significant role in how your billing documents are perceived. Some common mistakes in this area include:

- Poor Formatting: A cluttered or poorly formatted document can make it hard for the client to find important details, such as the amount due or payment instructions. Ensure your document is clean, organized, and easy to read.

- Not Including Your Business Information: If your business name, contact information, or tax ID number is missing, it can look unprofessional. It’s important to include all relevant details so the client knows who they’re dealing with.

- Not Adding a Thank You Note: Including a short note of appreciation for the client’s business can improve the overall tone of the document and strengthen your client relationships.

Avoiding these common mistakes will help ensure that your billing documents are both clear and professional, reducing the risk of payment delays and improving your business reputation.

Legal Requirements for Video Editing Invoices

When preparing billing documents for services rendered, it’s essential to ensure that they comply with relevant legal standards and regulations. These documents are not only essential for financial transactions but also for tax purposes and maintaining professionalism. Different jurisdictions have varying requirements, but there are some common legal elements that every service provider should include to avoid issues down the road.

Key Legal Elements to Include

While specific legal requirements may differ depending on location or type of business, these are the most common elements that should be included to ensure compliance:

- Business Information: Include your business name, address, and tax identification number (TIN). If you are a registered business entity, you should also add your registration or license number.

- Client Information: Include the name, address, and contact details of the client to ensure that the payment is correctly attributed to them.

- Unique Document Number: Each document should have a unique reference number for easy identification and tracking. This is particularly important for record-keeping and audits.

- Service Description: Clearly describe the services provided, including any agreed-upon rates, quantities, or project milestones. This will help clarify the terms of the work done and avoid any disputes.

- Payment Terms: Specify the due date, accepted payment methods, and any late fees that may apply if the payment is not received on time.

- Tax Information: Depending on your jurisdiction, you may be required to add taxes such as VAT, sales tax, or other applicable duties to the total amount due. Ensure that the correct tax rates are applied and clearly listed.

Jurisdiction-Specific Requirements

It is important to note that legal requirements can vary based on your location. Different countries, and even states or regions within a country, may have specific rules regarding what must be included in billing documents. Here are a few examples:

- United States: In the U.S., service providers are typically required to include their Employer Identification Number (EIN) for tax reporting purposes. Some states may also require specific language regarding tax exemptions or additional fees.

- European Union: In EU countries, VAT must be included for businesses that are registered for VAT purposes. The document should also include your VAT number.

- United Kingdom: In the UK, businesses are required to issue a VAT invoice if they are VAT-registered. The invoice must also state whether VAT is included in the price and the rate applied.

- Australia: In Australia, businesses must include the Australian Business Number (ABN) and may be required to include GST if the business is registered for the Goods and Services Tax.

Ensuring that your billing documents meet all legal requirements not only protects your business but also establishes trust with your clients. Always stay up to date with local regulations to ensure full compliance and avoid any potential issues with authorities.

How to Handle Late Payments in Invoices

Dealing with delayed payments is a common challenge for many service providers and businesses. Late payments can disrupt your cash flow and create unnecessary stress. It’s important to address these issues professionally and consistently to ensure timely payments while maintaining good relationships with clients. There are several strategies you can implement in your billing documents to manage and mitigate the impact of late payments.

Prevention: Setting Clear Expectations

The best way to handle late payments is to prevent them from occurring in the first place. Setting clear expectations with your clients about payment terms from the start can reduce the likelihood of delays.

- Specify Payment Deadlines: Clearly state the due date for payment in your billing document. This eliminates any ambiguity about when the payment is expected.

- Outline Late Fees: Include information about any penalties for late payments, such as a percentage increase for each overdue week or a flat late fee.

- Offer Multiple Payment Options: Make it easy for clients to pay by offering various payment methods, such as bank transfers, credit card payments, or online payment systems.

- Send Reminders: Consider sending a friendly reminder a few days before the payment due date to prompt your client to make the payment on time.

Handling Late Payments Professionally

If a payment becomes overdue, it’s important to follow up promptly and professionally. Here are steps you can take to handle late payments while maintaining a positive client relationship:

- Send a Polite Reminder: If the payment is late, send a polite reminder as soon as possible. Often, clients may simply forget or overlook the due date. A gentle nudge can be enough to resolve the issue.

- Follow Up with a Formal Notice: If the payment remains unpaid after your initial reminder, send a formal notice detailing the overdue amount, including any applicable late fees. Be clear about the consequences of further delays.

- Provide Payment Plans: If the client is facing financial difficulties, consider offering a payment plan that breaks the total amount into smaller installments. This can help both parties come to a fair solution without straining the relationship.

- Consider Legal Action: As a last resort, if the payment remains unpaid despite repeated attempts to collect, you may need to consider legal action or working with a collections agency to recover the funds.

By setting clear payment terms and following up professionally when necessary, you can reduce the occurrence of late payments and maintain a positive relationship with your clients while protecting your business’s cash flow.

Organizing Your Invoice Records

Keeping accurate and well-organized records of your financial transactions is essential for both managing your cash flow and meeting legal and tax obligations. Properly organized billing records help you track payments, monitor overdue amounts, and quickly retrieve important details when needed. Whether you’re managing a small business or freelancing, maintaining a systematic approach to your financial documents ensures efficiency and professionalism.

Methods for Organizing Financial Documents

There are several methods you can use to keep your billing records organized, each with its own advantages depending on your business needs:

- Digital Filing Systems: Using digital tools to store your financial records can make them easy to organize and access. Cloud-based platforms or accounting software like QuickBooks or FreshBooks allow you to categorize and search for specific documents quickly.

- Physical Filing: For those who prefer a physical system, create clearly labeled folders or binders for each client or project. Ensure that each folder contains the corresponding documents, such as contracts, payment receipts, and billing statements.

- Spreadsheets: Use spreadsheet software (e.g., Microsoft Excel, Google Sheets) to track payments and outstanding balances. Spreadsheets are versatile and allow for customizable fields such as payment dates, amounts, and due dates.

- Accounting Software: For more advanced financial management, accounting software automatically tracks your transactions, generates reports, and keeps everything in one centralized location. Many platforms even integrate with payment processing systems to streamline record-keeping.

Best Practices for Organizing Records

To maximize efficiency and avoid errors in your financial records, follow these best practices:

- Consistent Naming Conventions: Establish a consistent naming system for your documents, such as including the client name, project title, and date. This will make it easier to locate specific records when needed.

- Regular Updates: Set aside time regularly (e.g., weekly or monthly) to update your records and ensure that they are current. This helps prevent a backlog of paperwork and allows you to stay on top of outstanding payments.

- Backup Your Records: Always back up your digital records, either through cloud storage or an external hard drive. In case of system failure, having a backup ensures that you don’t lose critical information.

- Track Payment Status: Use a system to clearly track whether a payment has been made or if it is still pending. Consider color coding or using flags in your files to show payment statuses for each project or client.

By implementing an organized approach to managing your financial documents, you can ensure that your business remains efficient and professional, reducing the risk of missed payments or compliance issues.

Tracking Payments with Your Invoice Template

Efficiently managing and tracking payments is crucial for maintaining smooth business operations and healthy cash flow. By using an organized system within your billing documents, you can easily monitor which payments have been received and which are still outstanding. Having a clear method for tracking payments allows you to follow up on overdue amounts and ensure timely collections, while also reducing the risk of financial confusion or errors.

To effectively track payments, it’s important to include specific fields or sections in your billing records that provide the necessary details for easy identification and monitoring. Here are some tips for ensuring that you can efficiently track payments:

- Payment Status Field: Include a dedicated space on your billing document that indicates the status of each payment, such as “Paid,” “Pending,” or “Overdue.” This makes it easier to quickly assess the state of your finances at a glance.

- Transaction Reference Numbers: When a client makes a payment, ask them to provide a reference number (such as a transaction ID or payment confirmation). Record this number on your billing document to help identify the payment when reconciling your accounts.

- Due Dates and Payment Deadlines: Clearly display the payment due date in your billing documents. By keeping track of when payments are due, you can promptly follow up with clients if the payment is not received on time.

- Partial Payments Tracking: If clients make partial payments, be sure to update your records accordingly. Track the amount paid and adjust the outstanding balance on your billing documents to reflect the remaining payment due.

By incorporating these elements into your billing system, you can ensure that you stay on top of all payments, minimizing the risk of delays and misunderstandings with clients. Proper tracking also helps simplify financial record-keeping, especially when it comes time for tax reporting or audits.

How to Send Your Invoice to Clients

Delivering your billing documents to clients efficiently and professionally is key to ensuring smooth transactions and timely payments. There are various methods to send these documents, each with its advantages. Choosing the right method not only makes the process easier for you, but it also adds a level of professionalism that can enhance your relationship with clients.

Methods of Sending Billing Documents

Depending on the client’s preferences and the nature of your business, there are several ways you can send your billing records:

- Email: Sending your billing documents via email is one of the fastest and most convenient methods. Attach the document as a PDF or another easily accessible file format, and ensure the subject line clearly states that the message contains a billing statement.

- Online Payment Platforms: Many businesses now use online payment systems such as PayPal, Stripe, or other invoicing software, which allow you to send billing records directly through the platform. These tools often include options for setting payment reminders and tracking payment status.

- Postal Mail: For clients who prefer a hard copy or when dealing with legal or high-value transactions, sending a physical copy by mail might be necessary. Always use a reliable postal service, and consider using certified mail for important or large transactions to ensure delivery confirmation.

- Cloud Sharing: Some service providers use cloud-based tools like Google Drive or Dropbox to share documents. By sending a secure link to your client, they can access the billing document directly from the cloud. Be sure to set the appropriate permissions to maintain confidentiality.

Best Practices for Sending Billing Records

Regardless of the method you choose, following these best practices will help ensure your documents are received and processed in a timely manner:

- Clear Subject Line and Message: In your email or message, make sure to use a clear subject line like “Billing Statement for [Client Name]” and include a brief message outlining the contents of the document. This helps the client immediately recognize the importance of the communication.

- Double-Check the Recipient’s Contact Details: Ensure that you have the correct contact information for your client, whether it’s an email address or postal address. Mistakes in contact details can delay the delivery and cause unnecessary follow-ups.

- Follow-Up Reminder: If you haven’t received payment within the agreed timeframe, send a polite reminder. A short email or message confirming the payment due and providing the billing details can encourage the client to pay promptly.

- Confirm Receipt: After sending the billing document, ask the client to confirm receipt. This is particularly important for postal deliveries or if using less common methods to ensure they’ve received the document without issues.

Sending your billing records in a timely and professional manner is crucial for maintaining a smooth workflow and ensuring payments are made on time. By using the right method and adhering to best practices, you can simplify the payment process and minimize any potential delays.

Improving Client Relationships with Clear Invoices

Maintaining strong, professional relationships with clients is essential for the success of any business. One of the simplest yet most effective ways to foster trust and enhance communication is by providing clear and transparent billing statements. When your clients can easily understand the costs and services outlined in your records, it reduces confusion, minimizes disputes, and builds confidence in your professionalism.

The Importance of Clarity in Billing

Clear and well-organized billing documents help clients understand exactly what they are being charged for, when they need to pay, and how they can make the payment. Here are several reasons why clarity is key to a strong client relationship:

- Transparency Builds Trust: When clients can see detailed breakdowns of the charges, they are less likely to feel confused or misled. Transparency creates an environment of trust, making it easier to handle any billing concerns or questions.

- Reduced Misunderstandings: A clear bill helps eliminate any misunderstandings about pricing, services rendered, or payment terms. Clients can easily verify the details, reducing the chance of disputes over charges.

- Timely Payments: By making it clear when payment is due and what amount is expected, you increase the likelihood of on-time payments. Clear instructions on how to pay and what to do in case of an issue will also ensure a smooth process.

Best Practices for Clear Billing Records

To create clear, effective billing documents that improve client relationships, follow these best practices:

- Provide Detailed Descriptions: Break down the services or products provided with specific descriptions. This helps clients understand exactly what they are paying for and why it’s valuable.

- Clear Payment Terms: Make your payment terms easy to understand. Include the due date, any applicable late fees, and the preferred payment methods. Clients will appreciate the straightforwardness of these terms.

- Professional Design: A clean, organized format enhances readability. Use consistent fonts, alignments, and sections to make your billing record aesthetically pleasing and easy to navigate.

- Timely Delivery: Send your billing statements promptly. Delays in sending bills can cause frustration and confusion. Ensure that your clients have the information they need in a timely manner.

- Responsive Communication: Be quick to respond if clients have questions or concerns about their bill. Addressing issues promptly ensures clients feel heard and valued, contributing to stronger relationships.

By ensuring that your billing documents are clear, detailed, and easy to understand, you can foster stronger, more positive client relationships. Clients will appreciate your professionalism and transparency, and they will be more likely to continue doing business with you in the future.