How to Create and Customize an Amazon VAT Invoice Template

Managing financial records for your online business is essential for smooth operations and compliance with tax regulations. One of the key documents that sellers must generate regularly is a formal sales record, especially when dealing with transactions that include tax charges. This document serves as proof of purchase and provides clear details of the financial transaction between the seller and the buyer.

Creating accurate and well-structured records is crucial for maintaining transparency and avoiding complications during tax assessments. Properly formatted sales documents can make it easier to track revenue, handle refunds, and comply with local tax laws. The right approach to generating these documents can save time and reduce errors when filing your taxes.

In this guide, we’ll explore how to effectively prepare these essential financial records, customize them to fit your business needs, and ensure they meet the necessary legal standards. Whether you’re a small business owner or a large seller, understanding how to create these forms correctly will streamline your financial management and make tax season less stressful.

What is a Sales Tax Record Format

In the world of online retail, maintaining accurate financial documentation is essential for both business owners and customers. A specific type of document is used to provide a detailed account of transactions involving tax charges. This record not only outlines the financial exchange but also includes important information related to the tax amounts, ensuring compliance with local regulations.

For sellers, creating these documents in a clear and standardized format simplifies the process of tracking sales and managing tax responsibilities. By having a predefined structure for these records, it becomes easier to include all the necessary elements such as transaction details, tax rates, and contact information. This ensures that both the seller and the buyer have a clear understanding of the financial terms and obligations associated with each transaction.

These documents are critical during audits or when filing tax returns, as they provide an official record that can be referred to when calculating tax liabilities. Having a reliable system in place for generating such records helps avoid errors and ensures that the business operates within the legal framework required for tax reporting.

Understanding Tax Documents for Online Sellers

For online sellers, particularly those engaged in cross-border trade, managing tax-related paperwork is a crucial part of running a business. These documents not only serve as proof of the sale but also include important details about the tax charges associated with the transaction. Properly generated tax records are required by law and are essential for tracking sales and fulfilling tax obligations.

As a seller, having a clear understanding of how to create and manage these documents ensures that your business remains compliant with tax laws in various regions. Such records typically contain details about the products sold, the tax amount, and both the buyer’s and seller’s information. Properly handling these forms can prevent errors in tax calculations and help avoid legal issues during audits or financial reviews.

Furthermore, creating these records in a standardized format helps streamline business operations. It reduces the chances of mistakes when processing transactions and ensures that all required information is included. This is especially important for sellers who deal with international customers, as tax laws and requirements may vary between countries.

Why You Need a Tax Record Format

For any business involved in transactions with tax implications, maintaining accurate and consistent financial documents is essential. These records not only ensure that your operations comply with legal requirements but also help in managing and tracking your sales efficiently. Without a standardized approach to creating such documents, the risk of errors increases, leading to potential legal or financial complications.

Using a pre-designed structure for generating these records allows sellers to consistently include all necessary details, such as product information, pricing, and tax amounts. This ensures that each document is both complete and compliant with regulations, making it easier for businesses to handle taxes, refunds, and audits. Additionally, it provides a clear record of all transactions, which can be helpful for future reference or when dealing with customer queries.

Moreover, having a set format simplifies the process, saving time and effort when creating new documents. Instead of manually ensuring that every required element is included, a structured format automates much of the work, allowing sellers to focus on other aspects of their business. It also reduces the risk of overlooking important details that could affect tax calculations or customer satisfaction.

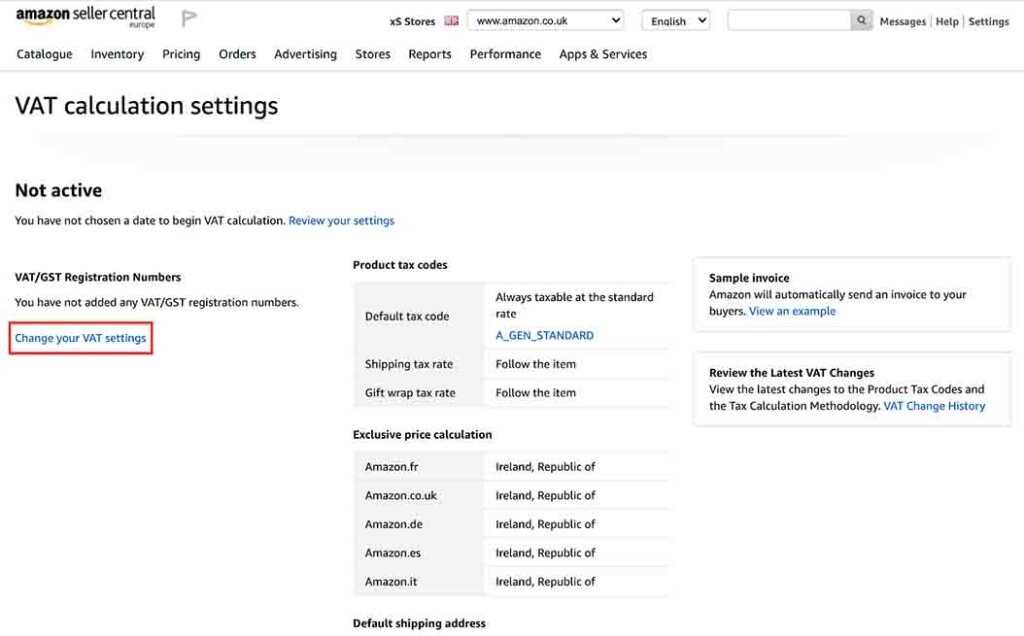

How to Download Sales Tax Record Format

To streamline the process of creating accurate tax documents, many online platforms offer downloadable formats that can be customized to meet business needs. These ready-to-use files are designed to save time and ensure consistency when preparing necessary paperwork for tax purposes. By downloading a suitable file, sellers can easily incorporate all the required details and remain compliant with tax regulations.

Steps to Access the Correct File

First, navigate to the section of the platform where financial documents and reporting tools are available. Look for options related to tax records or sales receipts, and find the file that fits your business type and region. Many platforms offer different versions of the document to accommodate local tax laws, so it’s important to select the one that meets your specific needs.

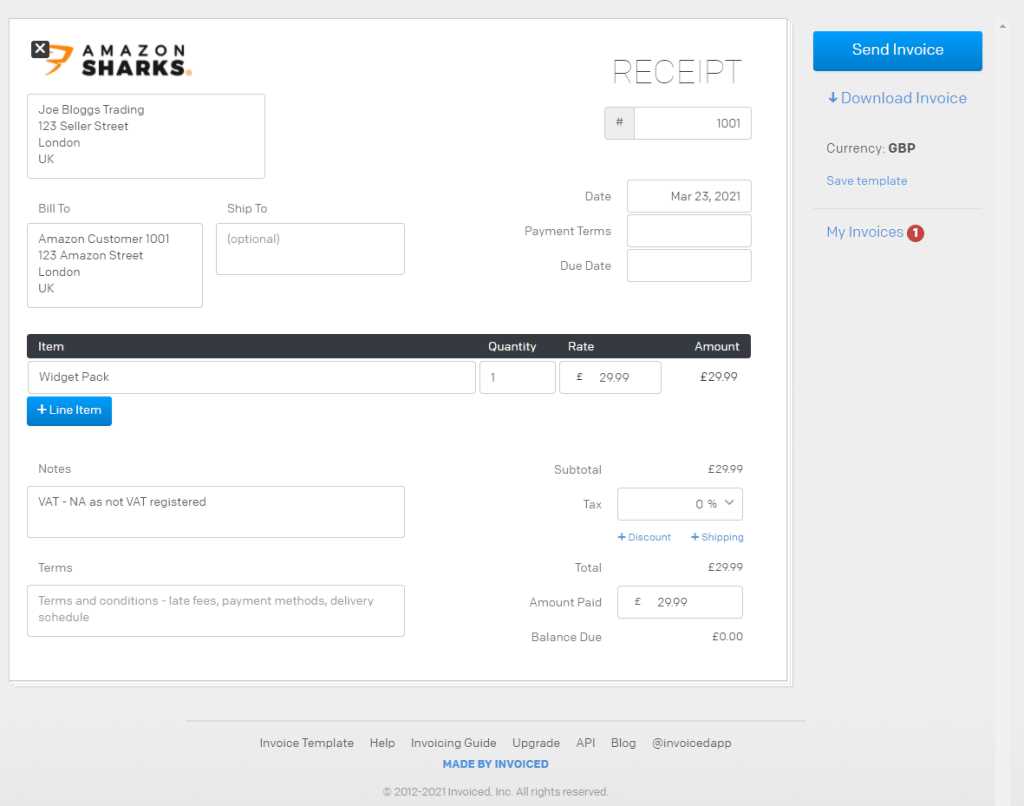

Customizing the Downloaded Record

Once you’ve downloaded the appropriate format, you can begin personalizing it with your business and transaction details. Most platforms provide an easy-to-edit structure that allows you to input necessary information such as buyer contact, transaction amounts, and applicable charges. Customizing these documents is essential for ensuring they reflect the specifics of each sale accurately.

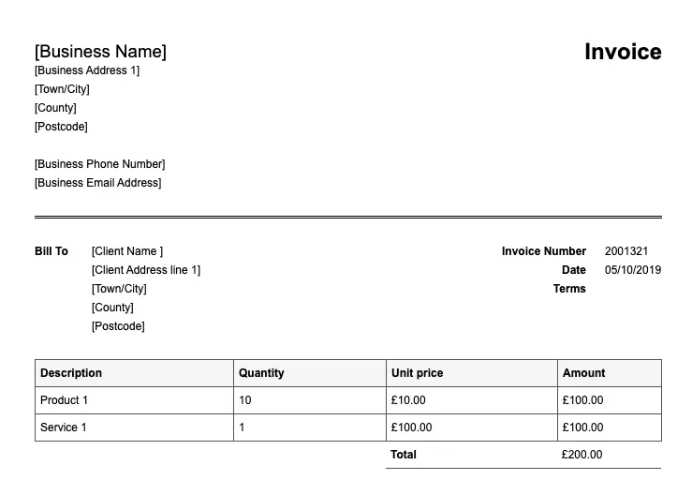

Customizing Your Sales Tax Record

Once you have the basic structure for your tax document, personalizing it to reflect your business details and the specifics of each transaction is key. Customization ensures that the document accurately represents your business practices while meeting legal requirements. Tailoring the document also helps maintain a professional image and makes it easier to track financial records over time.

To start, you’ll need to input important information such as your business name, contact details, and tax identification number. This allows your customers to easily recognize the source of the transaction. Additionally, make sure to include the correct breakdown of the sale, including product details, prices, and any applicable charges. Personalizing the format also allows you to add any custom notes or terms of sale that might be relevant to your business.

Ensuring accuracy when filling out these details is crucial to avoid errors that could impact tax filings or cause confusion with customers. A well-organized and clear document can also help if you ever need to reference a transaction for returns or audits.

Key Elements of a Sales Tax Document

When preparing a document for sales with tax charges, it’s essential to include all the necessary details that ensure compliance with tax regulations. These key components help both the seller and buyer understand the specifics of the transaction, as well as how tax was applied. Missing any of these elements could lead to confusion or errors in tax reporting.

Essential Information to Include

- Seller’s Business Information: This should include the business name, address, and tax identification number.

- Buyer’s Information: Include the buyer’s name, address, and contact details if applicable.

- Transaction Details: Clearly list the products or services sold, including quantity and price.

- Tax Rate and Amount: Specify the tax rate applied and the total tax amount for the transaction.

- Unique Document Identifier: Each record should have a unique reference number for tracking and identification purposes.

Additional Considerations

- Payment Terms: If relevant, include the payment method and payment due date.

- Custom Notes: Add any special terms or conditions that apply to the sale.

Including these key elements not only ensures that your documentation is complete but also helps in maintaining a smooth process when filing taxes or addressing customer queries. Having a standard format with all required components also makes it easier to generate these records quickly and accurately for every transaction.

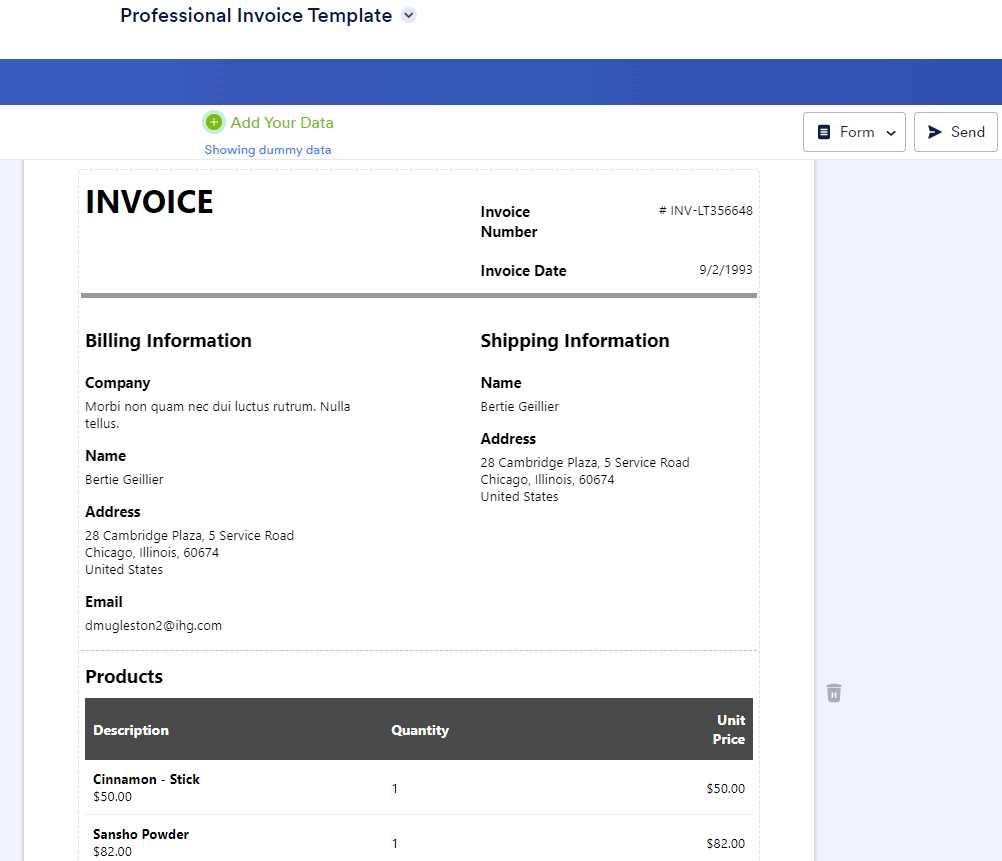

Step-by-Step Guide to Using the Sales Tax Document Format

Creating a well-organized sales document is crucial for managing your business transactions and ensuring compliance with tax regulations. By following a clear and structured approach, you can generate accurate records for each sale. This guide will walk you through the process of using a pre-designed file to efficiently create the necessary paperwork for every transaction.

Step 1: Download and Open the File

The first step is to download the document from a reliable source. After downloading, open the file in your preferred software that supports editing the format, such as a spreadsheet or word processor. Ensure that the document is set up to include all the necessary fields, including transaction details, tax amounts, and customer information.

Step 2: Input Transaction Details

Once the document is open, start by entering the specific details of the transaction. This includes the names of the products or services sold, quantities, unit prices, and the total sale amount. Make sure to double-check the accuracy of the entered information to avoid errors in the final record.

Step 3: Add Tax Information

Next, input the relevant tax rate applied to the sale. Depending on the region or country, this rate may vary, so it’s important to enter the correct percentage. The document will automatically calculate the total tax amount, ensuring that both the seller and the buyer understand the exact breakdown of the cost.

Step 4: Review and Save

After filling in all the required fields, review the document carefully to ensure that everything is accurate and complete. Once confirmed, save the file with a unique reference number or any other identifier you choose to help you track the document later.

By following these simple steps, you can easily generate professional sales records that are both clear and legally compliant. Customizing the format for each transaction will help maintain consistency across your business and ensure accurate record-keeping for tax purposes.

How to Include Tax Information Correctly

When preparing financial documents that involve tax charges, it’s important to include the correct tax details to ensure compliance with the relevant regulations. Properly including this information ensures transparency in your transactions and helps avoid errors during audits or tax filings. Accurate tax details also reassure customers that all charges are properly calculated and applied.

The first step is to clearly state the applicable tax rate. Different regions or countries may have varying rates, so it’s essential to enter the right percentage for the specific location of the transaction. Ensure that the rate is correctly calculated based on the total price of the products or services sold. Accuracy in this step is vital, as even a small mistake can result in incorrect tax reporting.

Next, make sure the total amount of tax charged is clearly displayed in the document. This should be calculated based on the tax rate and the sale amount. The total tax amount should be easy to identify and separate from other amounts, such as the subtotal and any discounts. It’s also important to include the tax identification number of your business if required by local tax authorities.

Lastly, check for any special tax exemptions or reductions that might apply to the sale. If your business is eligible for any tax breaks or specific rules, be sure to include that information in the document to prevent confusion. By carefully reviewing these details, you can ensure that your tax documents are both accurate and compliant with local tax laws.

Setting Up Your Business Information

Accurate business information is essential when preparing any type of financial record or sales document. Ensuring that your business details are correctly entered helps maintain professionalism and allows for proper tracking of your transactions. This section will guide you through the key pieces of information you need to include, ensuring that your records are complete and compliant with legal requirements.

Essential Business Details to Include

- Business Name: The official name of your company, as registered with tax authorities.

- Business Address: Your physical location or the registered office address where the business operates.

- Tax Identification Number: This unique identifier is used for tax reporting purposes and must be accurate to ensure compliance.

- Contact Information: This includes your phone number, email address, or any other way customers or authorities can reach you.

Additional Considerations

- Website or Online Store URL: If applicable, include the link to your website or online platform where transactions are made.

- Business Registration Number: Depending on your region, you may need to include a business registration number as part of your formal documentation.

By ensuring all of these details are correctly included in your records, you create a transparent and trustworthy process for both customers and tax authorities. Taking the time to verify this information will help avoid delays or complications in future business dealings or tax audits.

Common Mistakes When Creating Sales Tax Documents

When generating sales records that include tax details, it’s crucial to ensure accuracy and completeness to avoid errors that could lead to issues with customers or tax authorities. There are several common mistakes that sellers often make when preparing these documents, which can cause confusion, delays, or even legal complications. Being aware of these mistakes can help ensure that your records are always in order.

Common Mistakes to Avoid

| Mistake | Description |

|---|---|

| Missing Tax Identification Number | Failing to include your business’s tax ID number or using an incorrect one can cause confusion and legal issues. |

| Incorrect Tax Rate | Using the wrong tax percentage, especially if rates differ by region, can result in incorrect calculations and penalties. |

| Not Listing Complete Customer Details | Incomplete customer information, such as missing names or addresses, can cause problems with tracking or verifying transactions. |

| Omitting Product Details | Not clearly listing the products or services sold, including quantities and unit prices, may lead to confusion or disputes. |

| Not Including Clear Payment Terms | Failing to state payment deadlines, methods, or conditions can lead to misunderstandings regarding payment expectations. |

How to Avoid These Mistakes

- Always double-check the details: Before finalizing any record, review the information for accuracy, especially tax rates and customer details.

- Use standardized formats: Consistently use a template or predefined format to avoid forgetting important elements.

- Keep up with tax regulations: Stay informed about any changes to tax rates or requirements that may affect your sales transactions.

By avoiding these common errors, you ensure that your sales documents are complete, accurate, and compliant, helping you maintain smooth business operations and build trust with your customers.

Why Accurate Sales Tax Records Are Crucial

Accurate documentation of tax-related details in sales transactions is essential for both businesses and customers. These records serve not only as proof of the transaction but also as a key element for financial transparency and compliance with tax laws. Ensuring these details are correct helps avoid disputes, prevent legal issues, and streamline the process of managing finances.

Legal and Financial Implications

When tax records are not accurate, it can lead to serious legal and financial consequences. Incorrectly reporting tax amounts can result in fines, penalties, or even audits by tax authorities. For businesses, this could mean significant financial loss, damage to reputation, and potential legal action. Proper record-keeping ensures that businesses remain compliant with local tax laws and regulations, preventing unnecessary complications.

Building Trust with Customers

Clear and correct records also foster trust with customers. When customers see that tax details are properly calculated and transparently presented, it assures them that the business is following the proper procedures. This is especially important for international transactions, where tax regulations may differ. Trust in your business practices is a cornerstone of maintaining long-term customer relationships.

In conclusion, accuracy in tax documentation is not just a matter of compliance–it’s a way to protect your business, avoid penalties, and build customer confidence.

Using Sales Tax Documents for Tax Purposes

For businesses, maintaining accurate records of all transactions is essential for tax reporting and compliance. Sales records containing tax-related information are a critical part of the documentation needed during tax season. These records ensure that businesses can claim deductions, verify tax payments, and meet regulatory requirements. Proper use of tax documents can simplify the filing process and help avoid potential audits or fines.

Key Benefits of Accurate Tax Records

- Tax Deductions: Properly detailed documents allow businesses to claim eligible deductions, reducing the overall tax burden.

- Tax Reporting: Detailed records provide the information needed for accurate tax returns and filings, reducing the risk of mistakes or omissions.

- Audit Protection: Having a well-organized and clear record can protect businesses in case of an audit by tax authorities.

- Financial Transparency: Maintaining accurate documentation ensures that both internal stakeholders and external authorities can review transactions with clarity.

How to Use Tax Records Effectively

- Store All Documents: Keep a record of each sale, including tax details, for the required retention period set by tax authorities.

- Use Accurate Calculations: Ensure that the tax rates applied to each transaction match the current regulations.

- Reconcile with Tax Returns: Cross-check your sales records against your tax filings to ensure consistency and accuracy.

By using tax documents effectively, businesses can stay compliant with regulations, streamline their accounting processes, and avoid costly errors during tax filing. It’s a key practice that can save time and money in the long run.

Managing Multiple Sales Tax Documents Efficiently

When handling numerous transactions, keeping track of tax-related records can quickly become overwhelming. Efficiently organizing and managing multiple documents ensures that businesses stay on top of their financial and tax obligations. The key is to create a streamlined system for sorting, storing, and retrieving these records to prevent errors and delays during audits or tax filings.

Organizing Your Tax Records

One of the first steps in managing multiple tax-related documents is establishing an organized structure. Businesses should categorize records by date, transaction type, or client to make retrieval simple. Digital tools can assist in organizing these documents more efficiently by offering automated sorting, tagging, and searching features.

Utilizing Software for Automation

Adopting software solutions for financial management can significantly reduce the burden of handling large volumes of transactions. Many programs are designed to automate the calculation, recording, and archiving of sales and tax details. By integrating such software into your workflow, you can save time and reduce human error. Automation ensures that each document is correctly formatted and stored without the risk of missing critical data.

Regular Review and Reconciliation

Establish a routine for reviewing your records periodically to ensure everything is up to date and accurate. Regular reconciliation between your documents and financial statements ensures consistency and helps identify any discrepancies early on. This practice prevents errors from accumulating, making your year-end tax filings more efficient and accurate.

By applying these techniques, businesses can effectively manage a large volume of tax documents, save time, and ensure compliance with regulatory requirements.

How to Save and Export Your Document

Once you’ve created a detailed record or financial document, it’s crucial to save and export it in a format that is both accessible and secure. Whether you’re storing it for future use, sharing it with clients, or submitting it for tax purposes, having the ability to easily export and save your document ensures that it can be quickly retrieved when needed.

Steps to Save Your Record

Before exporting, ensure that your document is properly saved in your preferred location. Here are the steps to save your work:

- Choose the Right Format: Depending on the use, you may want to save the file in different formats such as PDF, Excel, or Word. Each format has its advantages, depending on whether you need to print, share, or edit the document further.

- Name the File Clearly: Use a clear and consistent naming convention so that files are easy to identify later. Include relevant details like the date, transaction number, or client name.

- Organize Your Files: Store your documents in a logical folder structure, either on your computer or cloud storage. Categorize them by type, client, or time period for easier retrieval.

Exporting Your Record

After saving your document, you can export it for sharing or submission. Here’s how to do it efficiently:

- Export to PDF: Saving your document as a PDF ensures that the format stays intact across devices and operating systems. This is especially useful when sending documents via email or uploading them online.

- Export to Excel or CSV: For records that need further editing or calculation, exporting to Excel or CSV allows easy manipulation and analysis of data.

- Cloud Backup: Save a copy of your document to the cloud for easy access from any device and for backup purposes. This protects your work from loss due to hardware failure.

By following these steps, you can ensure that your records are safely saved and ready for future use or sharing, without the risk of losing important data.

Handling Different Tax Rates in the Document

When creating financial records or sales summaries, it’s important to correctly manage varying tax rates based on the products or services sold. Different regions, products, or services may be subject to different tax percentages, and these need to be reflected accurately in your documents. Ensuring the correct tax rates are applied is essential for compliance and to avoid errors in financial reporting.

Steps to Handle Multiple Tax Rates

To effectively manage different tax rates, follow these steps:

- Identify Applicable Tax Rates: Determine the tax rate for each product or service based on its classification, region, or industry. Some items may qualify for reduced or zero rates, while others may have standard rates.

- Assign Correct Rates to Items: For each product or service listed in your record, ensure the correct tax rate is applied. This ensures that the total amount reflects the appropriate charge.

- Separate Tax Calculations: For clarity, separate the total amount and the tax breakdown in your document. This makes it easier to track how much tax has been applied and ensures transparency.

Automating Tax Calculations

Many modern financial tools or software can automatically calculate and apply the correct tax rates based on predefined rules. Using such systems helps to reduce human error and saves time, especially when dealing with multiple tax rates.

- Use Tax Settings in Software: Many accounting or business management tools allow you to set up tax rates based on the location, product category, or service type. This feature ensures accuracy by automatically applying the right rate to each transaction.

- Review Regularly: Periodically check the tax rates in your software to ensure they are up-to-date with current tax laws. Rates may change due to new legislation or other factors.

By correctly managing varying tax rates and leveraging automation tools, businesses can ensure that their financial documents remain accurate, reducing the potential for errors and improving overall efficiency.

Ensuring Legal Compliance with Tax Documents

When creating financial documents for transactions, it’s essential to ensure that all required information is properly included in order to meet legal requirements. Proper documentation helps businesses comply with local tax regulations, avoid potential fines, and maintain accurate records. Understanding the key components and guidelines for generating these documents can significantly reduce the risk of errors and penalties.

Key Legal Requirements for Financial Documents

Each region or country has specific rules regarding the content and format of financial records. These documents should include key details to meet tax authority requirements and ensure that both the buyer and seller are on the same page regarding payments and obligations. Here’s a breakdown of essential components:

| Element | Description |

|---|---|

| Seller’s Details | Name, business registration number, and contact details of the seller should be clearly listed. |

| Buyer’s Information | The buyer’s name, contact, and billing address should be recorded for transparency. |

| Transaction Date | Accurate dates of the transaction, including the sale date and payment date, must be specified. |

| Tax Breakdown | Any applicable taxes should be listed separately, along with the rate and total amount. |

| Unique Identification Number | Each document should have a unique identifier for tracking purposes. |

| Item Descriptions | Clear descriptions of the products or services provided, along with quantities and prices. |

Importance of Accurate Documentation

Having accurate and complete documentation is not just about meeting tax obligations–it also protects the business. Incorrect or incomplete records can lead to issues during audits, financial disputes, and potential tax penalties. To avoid these risks, it’s vital to:

- Follow local tax laws: Always stay updated on the latest tax regulations and requirements in your jurisdiction.

- Maintain clear records: Ensure every transaction is properly documented and the information is easily accessible for review.

- Regularly audit documents: Periodically check the accuracy of your financial records to ensure compliance.

By adhering to legal guidelines and ensuring that each document meets the necessary requirements, businesses can maintain good standing with tax authorities and avoid unnecessary complications in the future.

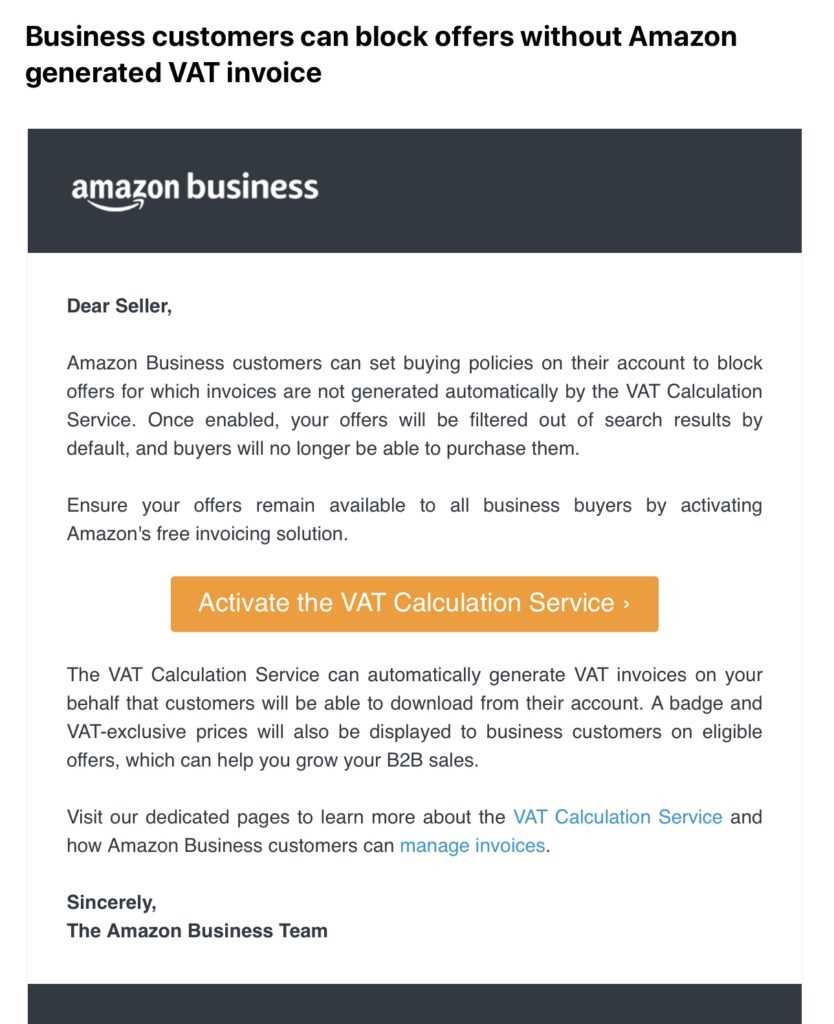

Benefits of Automating Tax Document Creation

Automating the generation of financial records offers numerous advantages for businesses. By reducing the manual input of information, automation streamlines the process, saves time, and helps ensure accuracy. In an increasingly fast-paced business environment, efficiency and precision are essential. With automated systems, businesses can quickly produce error-free documents while maintaining compliance with relevant regulations.

Time Efficiency

Manual creation of financial documents can be time-consuming, especially when dealing with large volumes of transactions. Automation significantly reduces the time spent on these tasks. With predefined settings and automatic data entry, the process of generating accurate records becomes almost instantaneous, allowing employees to focus on more strategic aspects of the business.

Improved Accuracy

One of the key benefits of automation is the reduction of human error. By eliminating manual data entry, businesses can avoid mistakes such as incorrect calculations, missing details, or inconsistent formatting. Automated systems pull data directly from reliable sources, ensuring that each document is accurate and complete. This not only enhances the reliability of the financial records but also minimizes the risk of costly compliance errors.

In addition to saving time and improving accuracy, automating the creation of financial documents can enhance overall business productivity. It simplifies workflows, reduces the need for repetitive tasks, and ensures that all documentation is in line with regulatory requirements, making the process more efficient and cost-effective.