How to Create an Invoice with Payment Template

Managing financial transactions efficiently is crucial for any business. Clear and organized documents ensure smooth interactions between service providers and clients, reducing confusion and potential delays. The right tools can significantly streamline this process, making it easier to track what’s owed and when it’s due.

One of the most effective ways to stay organized is by using a standardized format for requesting funds. These documents not only detail the amount due but also provide necessary information such as deadlines, services rendered, and payment methods. Utilizing a well-designed structure can help maintain professionalism while improving cash flow management.

In this guide, we’ll explore how to create these documents that meet legal requirements and look professional, while also ensuring that clients understand their obligations clearly. Whether you’re a freelancer, small business owner, or part of a larger enterprise, understanding the importance of well-crafted financial requests can make a significant difference in maintaining good business relationships and ensuring timely compensation.

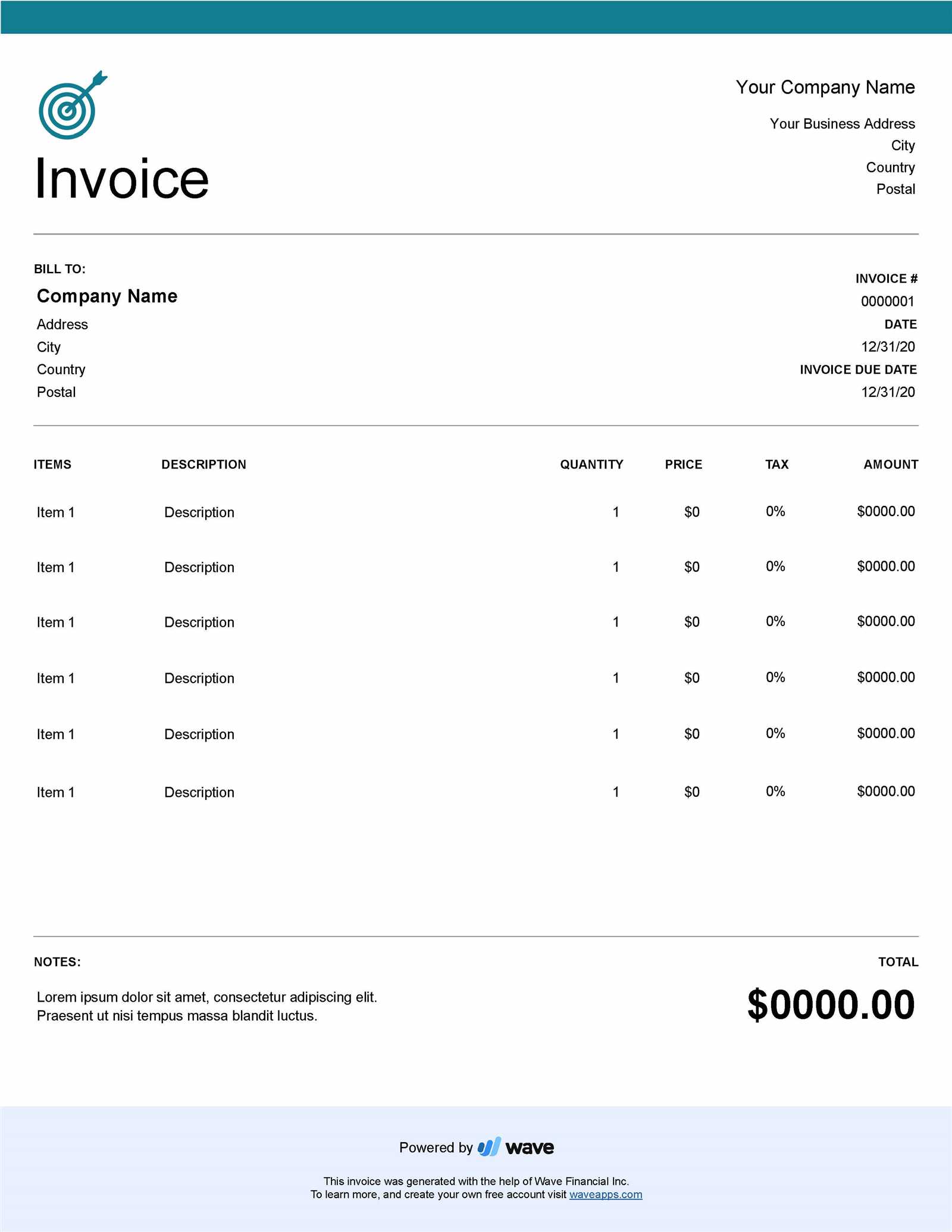

Invoice with Payment Template

In business transactions, it is essential to have a clear and structured way of requesting funds. A well-organized document can prevent misunderstandings and help ensure timely receipt of compensation. By using a consistent format, businesses can communicate all the necessary details–such as the amount due, services provided, and payment terms–in a professional manner that encourages prompt action.

Such documents also serve as a valuable record for both parties, offering clarity and reducing the risk of disputes. When designed effectively, they not only enhance efficiency but also reinforce trust between the service provider and the client. Whether used for routine transactions or more complex arrangements, having a standardized approach simplifies the entire process.

Key Elements of a Well-Structured Document

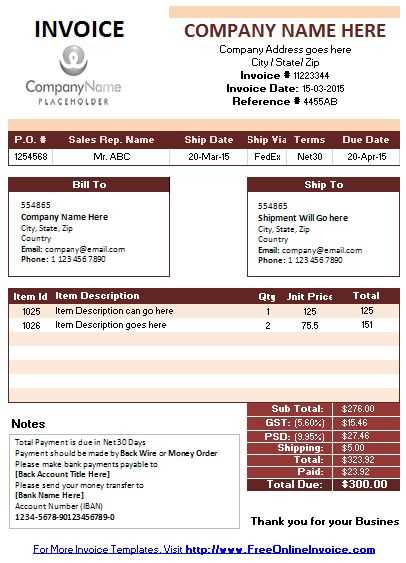

A solid framework for these financial requests should include the following key components: the total amount owed, deadlines for submission, services rendered, and payment methods. Each element plays a vital role in making sure all necessary information is clearly communicated. Adding legal requirements and terms can further protect both parties by outlining expectations and responsibilities.

Benefits of Using a Consistent Format

Standardizing this process brings several advantages. It reduces errors, saves time on manual entry, and provides a clear overview of transactions for future reference. Moreover, automating the creation of these documents can speed up the process and minimize administrative workload. Ultimately, a streamlined approach helps businesses maintain smooth operations and build lasting relationships with their clients.

What Is an Invoice with Payment Template

In any business transaction, the process of requesting compensation is essential. A formal document that outlines the amount owed, the services provided, and the terms of settlement helps ensure both parties understand their responsibilities. Such a document serves as a written agreement, clearly defining expectations and reducing the likelihood of confusion or disputes.

This type of document is typically designed to be reusable, meaning that businesses can easily generate similar requests for each new transaction. By incorporating consistent formatting and necessary details, it ensures that both the service provider and client have the same understanding of the agreement, from the amount due to the deadline for payment.

Purpose of a Structured Document

These financial records are more than just tools for requesting funds; they also act as official records for accounting purposes. When created correctly, they help businesses track what has been paid, what is outstanding, and when payments are due. Efficiency and clarity are key to maintaining smooth operations, especially when dealing with numerous clients or transactions.

Why Use a Standardized Approach

Having a consistent format ensures that nothing important is overlooked. Standardizing the way requests are issued reduces errors, saves time, and provides a professional image. This approach makes it easier to maintain financial records and speeds up the process of getting paid for services rendered.

Benefits of Using Payment Invoice Templates

Utilizing a pre-designed format for financial requests offers several advantages for businesses. It simplifies the process of issuing formal documents, saves time, and reduces the likelihood of errors. A consistent structure ensures all necessary details are included, making the document clear and professional. This efficiency allows businesses to focus more on their core operations while ensuring that the billing process is streamlined.

Standardized documents also help in maintaining proper records, aiding in financial tracking and reporting. When you use a consistent format, it’s easier to keep track of outstanding balances and due dates. This can result in faster payments and more organized finances for your business.

Key Advantages

| Benefit | Description |

|---|---|

| Time-saving | Pre-designed structures eliminate the need to create new documents from scratch for each transaction. |

| Consistency | A standardized format ensures all essential details are included, minimizing mistakes. |

| Professionalism | Using a polished, well-organized layout helps maintain a professional image with clients. |

| Improved Tracking | Easy-to-follow formats make it simpler to monitor payments and identify overdue amounts. |

| Efficiency | Automating document creation speeds up the process, reducing administrative workload. |

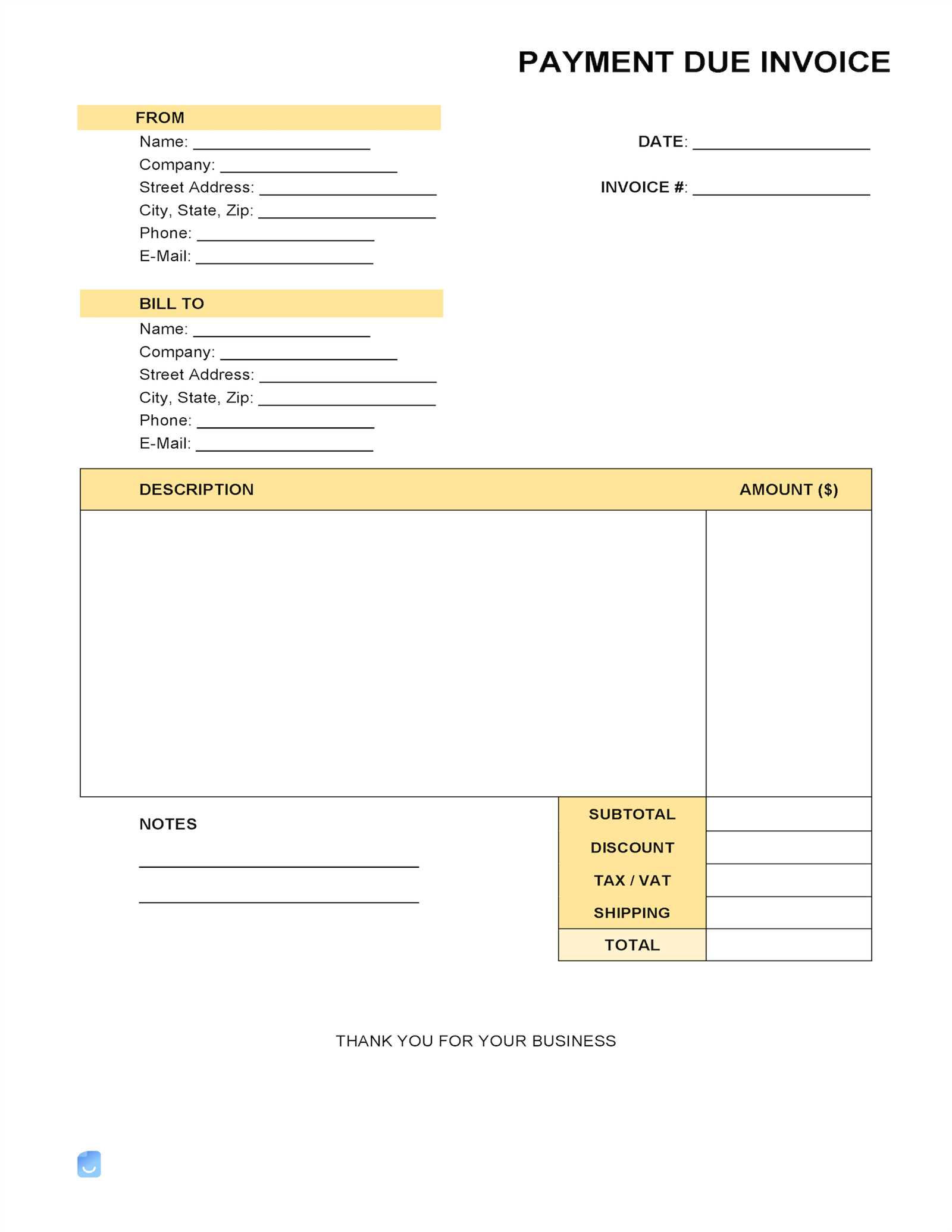

How to Create an Effective Invoice

Creating a clear and professional document for requesting funds is an essential step in maintaining smooth financial operations. The key to an effective document is ensuring that all critical details are included, such as the total amount due, services provided, and deadlines for payment. A well-structured layout helps avoid confusion and sets clear expectations for both the client and the service provider.

To ensure accuracy and efficiency, the format should be simple yet comprehensive, making it easy for the recipient to understand the obligations. Incorporating specific terms, payment methods, and relevant dates helps clarify the agreement and reduces the likelihood of disputes or late payments.

Key Elements to Include

When drafting such documents, it’s crucial to include the following information:

- Service Details – A clear description of the services or products provided.

- Amount Due – The exact amount to be paid, including taxes and additional charges if applicable.

- Payment Terms – Clearly state when the payment is due and any penalties for late payments.

- Contact Information – Include both your business contact details and those of the client.

Tips for Clarity and Accuracy

To avoid errors, always double-check that all the details are correct, including the calculations and dates. Using automated software to generate these documents can reduce human error and speed up the process. Additionally, keeping the design clean and straightforward ensures that your recipient can quickly understand the essential information. A professional, easy-to-read format will leave a positive impression and contribute to timely settlements.

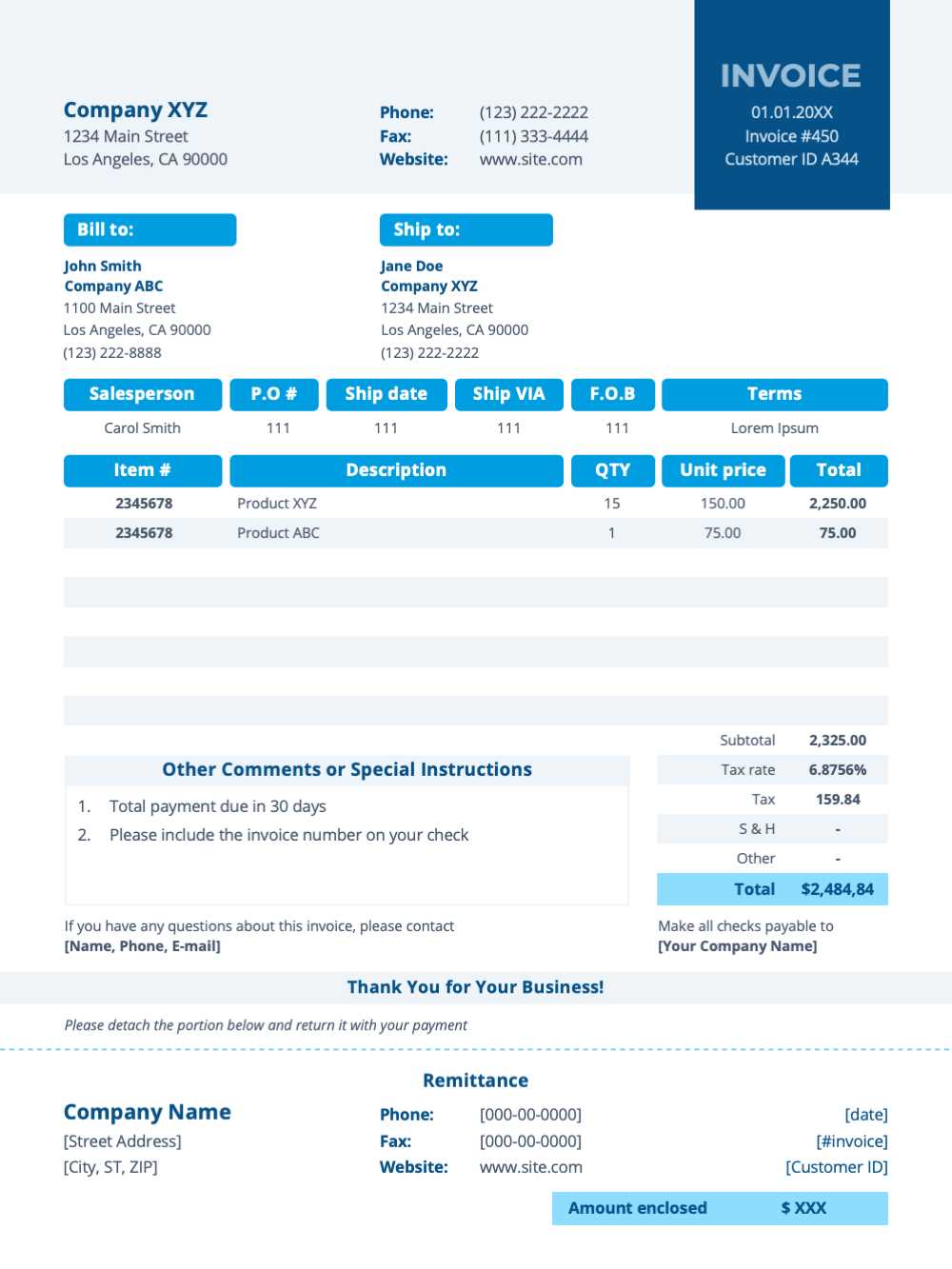

Choosing the Right Template for Your Business

Selecting the correct structure for financial documents is essential for maintaining a professional image and ensuring smooth operations. The right format not only saves time but also ensures that all important details are included, reducing the risk of errors and miscommunication. It’s important to choose a design that reflects your brand, meets your industry’s requirements, and simplifies the billing process for both you and your clients.

When selecting a structure, consider your business type, transaction volume, and any specific needs related to payment terms or legal requirements. The ideal format should be versatile enough to accommodate different types of transactions while remaining clear and easy to understand.

Factors to Consider

- Industry Requirements – Different industries may require certain legal or regulatory information to be included in financial documents. Researching industry standards can help you stay compliant.

- Customization Options – A customizable format allows you to adapt the document to various types of transactions, from simple to complex.

- Ease of Use – Choose a design that is easy to update and fill out, whether manually or automatically, to streamline the process.

- Branding – Ensure the document format reflects your company’s brand and professionalism, creating a cohesive client experience.

Free vs Paid Options

- Free Formats – Many online platforms offer free designs, which are suitable for small businesses or freelancers with minimal needs.

- Paid Solutions – Investing in a premium version may offer advanced features, such as automated calculations, tracking, or integration with accounting software.

Ultimately, the right structure will streamline your workflow, help maintain professionalism, and ensure that all necessary details are communicated clearly to your clients.

Customizing Invoice Templates for Your Needs

Tailoring financial documents to your specific business requirements ensures that you capture all the essential information while reflecting your brand identity. Customization allows you to add, remove, or modify fields, making the document more suited to your industry and client needs. By adjusting the structure, you can improve clarity, streamline the billing process, and make the entire workflow more efficient.

Customizing these forms can also help improve client relationships by ensuring the document reflects your company’s professionalism and attention to detail. Whether you’re handling one-time projects or long-term contracts, personalization helps create a document that aligns with the expectations of both parties involved.

Key Areas to Customize

- Business Details – Include your logo, contact information, and company address to maintain a professional and consistent appearance.

- Service Descriptions – Adjust the layout and wording to provide clear descriptions of the goods or services offered, ensuring your clients fully understand what they are paying for.

- Payment Terms – Customize the payment terms according to your business policies, including due dates, late fees, and any applicable discounts or promotions.

- Legal Information – Add any necessary legal clauses, such as refund policies or terms of service, to ensure transparency and compliance.

Benefits of Personalization

- Brand Consistency – Personalizing the document allows you to maintain consistency across all business communications, reinforcing your brand identity.

- Clarity and Understanding – Customizing fields ensures that clients know exactly what they are being billed for and when payment is expected.

- Efficiency – A personalized design makes it easier to track and manage payments, reducing administrative overhead and speeding up the billing process.

Whether you choose to make minor adjustments or completely overhaul the structure, customizing these forms to fit your business needs can improve client satisfaction and help you maintain control over your financial processes.

Essential Elements of a Payment Invoice

To create a clear and effective document for requesting funds, there are several key components that must be included. These elements ensure that both the service provider and client are on the same page regarding the amount due, services provided, and the terms of payment. A well-structured financial document helps avoid misunderstandings, delays, and potential disputes.

Each part of the document plays a crucial role in conveying important information. From the contact details to the breakdown of charges, every element should be carefully considered and tailored to your business needs. Ensuring that these elements are clear and accurate will improve your professional image and increase the likelihood of timely payments.

Key Components to Include

- Contact Information – Include your business name, address, phone number, and email, as well as the client’s details to ensure proper communication.

- Unique Reference Number – A unique identifier for each document helps keep track of records and makes referencing easier.

- Itemized List of Services or Goods – Provide a detailed breakdown of the products or services delivered, including quantities and unit prices.

- Amount Due – Clearly state the total amount owed, including taxes and any additional fees, to avoid confusion.

- Due Date – Specify the exact date by which payment should be received to set clear expectations.

- Payment Instructions – Include details on how and where the payment should be made, whether by bank transfer, check, or another method.

- Terms and Conditions – Outline any terms related to late fees, discounts, or refunds to protect your business and clarify your policies.

Why These Elements Matter

Each of these components helps ensure that the recipient of the document fully understands their financial obligations. The clearer and more detailed the document, the less room there is for confusion or miscommunication. By including all necessary information, you create a professional, transparent, and effective financial record that helps facilitate timely and accurate payments.

How to Add Payment Terms to an Invoice

Clearly outlining the terms for settling the amount due is a vital aspect of any financial document. By specifying when payment is expected and any additional conditions, both parties understand their responsibilities. Properly defined terms help avoid misunderstandings and set the tone for timely transactions.

Adding payment terms ensures that clients are aware of the deadlines and any penalties for delayed payments. These terms should be straightforward and easy to understand, providing clarity on when the funds are due and what methods are accepted for payment.

Key Elements to Include

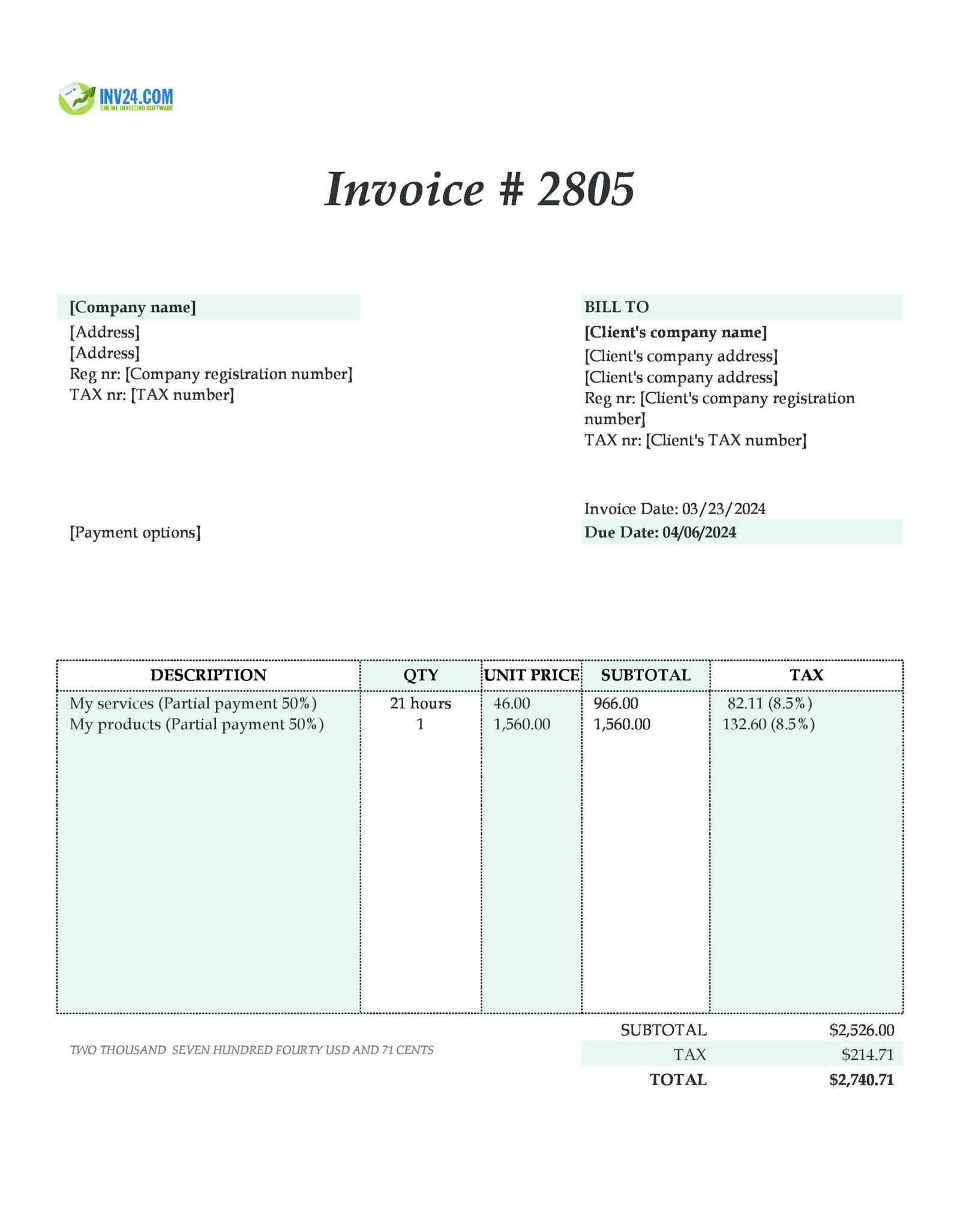

- Due Date – Clearly state the exact date when the payment is due. This can be a specific calendar date or a set number of days after the transaction or service date.

- Late Fees – Specify any penalties or interest charges for late payments. For example, “A late fee of 1.5% will be applied to any balance unpaid after 30 days.”

- Discounts for Early Payment – If applicable, offer incentives for early payment, such as a percentage discount if the payment is received within a certain timeframe.

- Accepted Payment Methods – Indicate the methods through which payment can be made, whether by bank transfer, credit card, PayPal, or another method.

- Partial Payments – If applicable, specify whether partial payments are allowed, and outline any terms related to them (e.g., deposit amounts or installment schedules).

Best Practices for Payment Terms

- Be Clear and Concise – Use simple language to ensure there is no ambiguity in the terms.

- Make Them Easy to Find – Position the payment terms section prominently within the document, so clients can easily locate them.

- Ensure Consistency – Keep the payment terms consistent across all documents to prevent confusion and maintain professionalism.

- Stay Flexible When Necessary – While clear terms are important, some flexibility with repeat clients or large transactions can foster better relationships.

Including well-defined payment terms in your documents sets clear expectations, which can lead to quicker payments and a smoother working relationship with clients.

Common Mistakes to Avoid in Invoices

While creating financial documents for clients, it’s crucial to ensure that all details are accurate and clear. Mistakes in these records can lead to confusion, delays, and even disputes. By being mindful of common errors, you can create a more professional and efficient billing process that promotes timely payments and reduces administrative work.

Even minor mistakes can affect cash flow and client trust. Ensuring that all the necessary elements are correctly included and formatted can help prevent these issues. Below are some of the most frequent errors to watch out for when preparing these documents.

Common Errors to Watch For

- Incorrect or Missing Contact Information – Failing to include your business’s name, address, or contact details can delay communication and hinder the payment process.

- Missing or Wrong Amounts – Double-check the calculations and ensure that both the subtotal and total amounts are correct, including taxes and any discounts.

- Unclear Service Descriptions – Provide detailed descriptions of the goods or services provided. Vague or incomplete descriptions may confuse clients and delay payment.

- Failure to Include a Due Date – Without a clear due date, clients may not know when payment is expected, leading to delayed payments.

- Omitting Payment Terms – Not stating how payments should be made or the penalties for late payments can create confusion and result in missed deadlines.

How to Avoid These Mistakes

- Review Your Documents – Always double-check for any mistakes in calculations, missing information, or unclear language before sending out the document.

- Use Automated Software – Consider using invoicing software to minimize human error and ensure that all necessary details are included in each document.

- Standardize Your Process – Create a consistent structure for all documents, which can help avoid omissions and ensure professionalism across the board.

By being attentive to these common mistakes, you can ensure a smoother, more efficient billing process that encourages prompt payment and fosters better client relationships.

How to Ensure Timely Payments with Invoices

Ensuring that payments are made promptly is a critical aspect of maintaining healthy cash flow for any business. Clear communication, well-structured financial documents, and defined expectations are essential for encouraging timely settlements. When both parties understand when and how payments are due, the process becomes much smoother and more predictable.

To help ensure prompt payments, there are several best practices that can be implemented when creating these financial records. From setting clear deadlines to offering incentives for early settlement, these strategies can help reduce delays and improve your business’s efficiency.

Best Practices for Timely Payments

- Clearly Define Payment Terms – Specify exact due dates, late fees, and acceptable methods of payment to avoid confusion.

- Send Documents Early – Provide your client with the financial request well in advance of the due date to give them enough time to process the payment.

- Follow Up on Unpaid Balances – If payments are overdue, sending friendly reminders or offering payment plans can help encourage quick resolution.

- Offer Early Payment Discounts – Incentivize quicker payments by offering small discounts for early settlements. This motivates clients to pay ahead of schedule.

- Use Automated Reminders – Leverage software that sends automatic reminders to clients as the due date approaches and after it passes.

Strategies for Clear Communication

| Strategy | Description |

|---|---|

| State Expectations Clearly | Clearly outline the due date, late fees, and available payment options in the document. |

| Maintain Professional Tone | Keep all communication polite and professional, especially when following up on overdue payments. |

| Offer Flexible Payment Methods | Allow clients to pay in ways that are most convenient for them, such as online transfers, checks, or credit card payments. |

By implementing these strategies and best practices, businesses can significantly reduce the chances of delayed payments and foster a smoother financial relationship with clients. The clearer and more organized the payment process, the more likely clients are to meet deadlines consistently.

Tracking Payments with Invoice Templates

Effectively monitoring transactions is a crucial part of managing business finances. By keeping track of who has paid and when, businesses can stay organized and ensure they don’t miss any payments. A well-structured financial record not only makes this process easier but also helps in tracking outstanding amounts and identifying patterns in payment behavior.

Using an organized format to monitor when payments are made and whether they align with the terms can save time and reduce errors. This tracking helps businesses manage cash flow, follow up on overdue accounts, and provide clients with accurate information regarding their balances.

Steps to Track Payments

- Assign Unique Numbers – Giving each financial document a unique reference number makes it easier to track individual transactions.

- Record Dates – Always note the date a payment was made and match it to the expected due date to ensure accuracy in your records.

- Mark Paid and Unpaid Entries – Clearly differentiate between paid and unpaid amounts. This helps in following up with clients and managing outstanding balances.

- Track Partial Payments – If a client pays in installments, make sure to record each payment separately and adjust the outstanding balance accordingly.

Using Tools for Efficient Tracking

- Accounting Software – Consider using accounting software that integrates payment tracking and provides real-time updates on balances.

- Automated Reminders – Set up automated reminders for outstanding payments, ensuring clients are alerted before and after the due date.

- Digital Records – Keep all transaction records in a digital format for easy searching, reference, and backup.

Implementing a structured tracking system ensures that all transactions are recorded accurately, reducing the risk of missed or forgotten payments. This level of organization allows businesses to stay on top of their finances and foster smoother relationships with clients.

Free vs Paid Invoice Template Options

When choosing a format for creating financial documents, businesses often face the decision between using free or premium solutions. Both options come with their own set of advantages and limitations. Understanding the differences can help you determine which option best suits your needs based on your business size, frequency of transactions, and desired features.

Free solutions typically offer basic functionality and are a good choice for small businesses or freelancers just starting. On the other hand, paid options often provide more customization, advanced features, and integration with other business tools. The decision ultimately depends on how much control, flexibility, and automation you need in your financial processes.

Benefits of Free Options

- No Cost – The most obvious advantage is that free solutions require no financial investment, making them a great choice for startups or those on a tight budget.

- Ease of Use – Many free tools are simple to use, allowing you to create basic documents quickly without the need for complex software knowledge.

- Basic Features – Free options usually cover the essential features, such as including service details, amounts, and due dates.

Advantages of Paid Options

- Advanced Customization – Premium solutions often allow for greater flexibility in design and layout, enabling you to fully align documents with your branding and business needs.

- Automation – Paid platforms typically offer features like automated reminders, payment tracking, and integration with accounting software, which can save time and reduce errors.

- Increased Security – Paid tools often come with enhanced security features, ensuring that your financial data is protected from unauthorized access.

- Support and Updates – Many premium services provide customer support and regular updates, ensuring that you have access to the latest features and assistance when needed.

While free options can be effective for basic needs, businesses that require more advanced features or expect to scale may benefit from investing in a paid solution. Assessing your business’s specific needs and future growth will help you determine the best path forward.

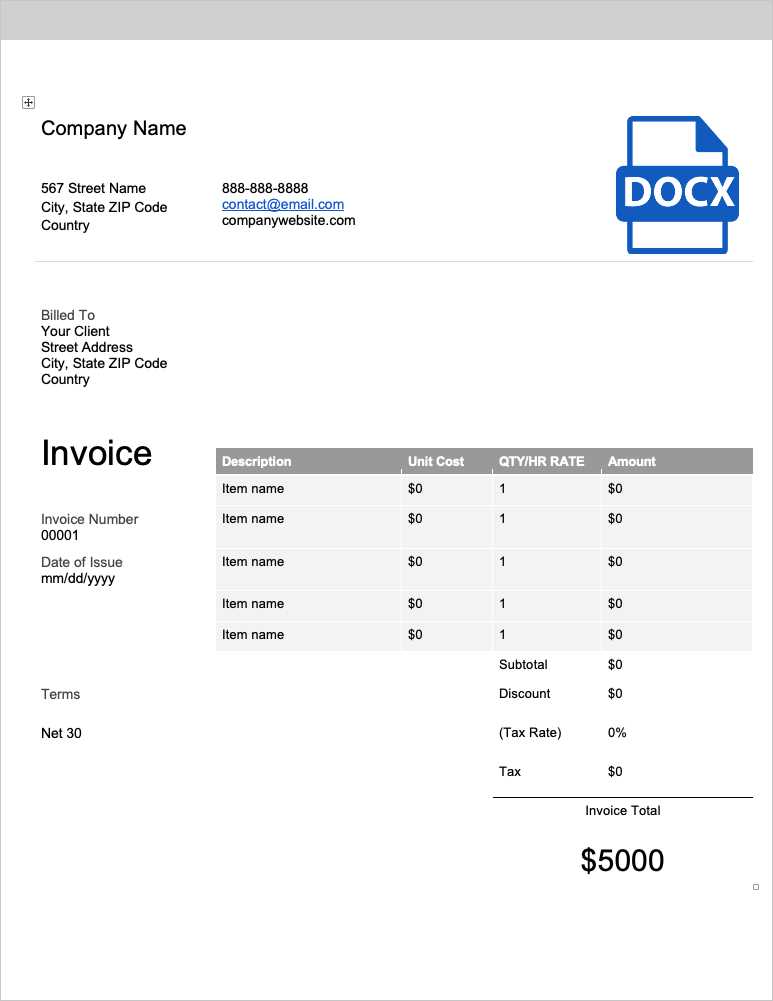

How to Automate Invoice Generation

Automating the creation of financial documents can save a significant amount of time and reduce errors. By using the right tools, businesses can streamline the process of generating and sending out bills, ensuring that everything is consistent and on schedule. Automation allows you to focus more on the core aspects of your business while reducing administrative burdens.

Automation typically involves using specialized software or platforms that integrate with your accounting or customer management systems. These tools can automatically populate the required fields, apply calculations, and even send out reminders, making the entire process much more efficient.

Steps to Automate the Process

- Choose the Right Software – Select a platform that meets your needs, such as invoicing software, accounting software, or a business management tool with automated billing features.

- Set Up Client Profiles – Store client information, including billing addresses, payment terms, and preferred methods of payment, so that each document is generated with the correct details.

- Define Templates and Formats – Create a standard structure for your documents, including branding, item descriptions, and any required legal language. This will ensure consistency for all generated bills.

- Automate Calculations – Use the software’s built-in functions to automatically calculate totals, taxes, discounts, and any other relevant fees based on your pricing structure.

- Set Up Recurring Billing – For clients with regular charges, configure the system to automatically generate and send documents on a set schedule, such as weekly, monthly, or quarterly.

- Enable Payment Reminders – Set automated reminders to be sent to clients before and after the due date, ensuring they are aware of upcoming or overdue payments.

Benefits of Automating the Process

- Efficiency – Automating manual tasks reduces the time spent on generating documents, allowing your team to focus on more important work.

- Accuracy – Automation minimizes human error in calculations, formatting, and data entry.

- Consistency – By using predefined templates, you can ensure that each document is uniform and professional in appearance.

- Timeliness – Automation ensures that documents are generated and sent on time, reducing the risk of delayed payments.

By automating the generation of your financial documents, you not only save time but also improve the accuracy and professionalism of your business’s financial operations. Whether you’re a small business owner or managing a larger team, automation can simplify the entire billing process and help keep everything running smoothly.

Legal Requirements for Invoice Templates

When creating financial documents, it is essential to ensure that all necessary legal information is included to comply with regulations. Certain details must be present to make the document legally valid and to avoid potential disputes with clients or regulatory authorities. These legal requirements may vary by country, industry, or business type, but there are a few common elements that businesses should always include.

Failure to meet these requirements can lead to issues such as delayed payments, fines, or legal challenges. Understanding what is legally required and ensuring that all elements are accurately represented will help protect both the business and its clients.

Key Legal Elements to Include

| Legal Requirement | Description |

|---|---|

| Business Information | Include the full legal name of your business, address, and contact details, as well as your company registration number (if applicable). |

| Client Information | Ensure the recipient’s name or business name, along with their address and contact information, is clearly listed. |

| Document Number | Assign a unique identifier to each document to maintain proper records and assist with tracking payments. |

| Date of Issue | The date when the document is created should be included to track payment deadlines accurately. |

| Description of Goods or Services | Clearly state what is being sold or provided, including the quantity, unit price, and any additional charges. |

| Tax Information | Include tax rates and amounts if applicable. This is particularly important for VAT-registered businesses in many jurisdictions. |

| Payment Terms | Specify the terms of payment, such as the due date, late fees, and any discount for early payment, if applicable. |

Additional Considerations

- Currency – Always specify the currency in which payments are expected, especially for international transactions.

- Legal Disclaimers – Some industries may require specific legal disclaimers to be included on each financial record.

- Digital Signatures – In certain cases, including an electronic signature may be legally required for validation, particularly for digital records.

By ensuring that all of these legal requirements are met, businesses can avoid legal challenges and ensure smoother transactions with clients. Keeping your financial documentation compliant with local laws protects both your business and your clients and promotes a professional and trustworthy image.

How to Format an Invoice for Clarity

Properly formatting your financial documents ensures that all the important details are easily understood by both parties. A well-organized layout not only enhances professionalism but also reduces the chances of misunderstandings or payment delays. Clear formatting helps recipients quickly find critical information like amounts due, payment terms, and service descriptions.

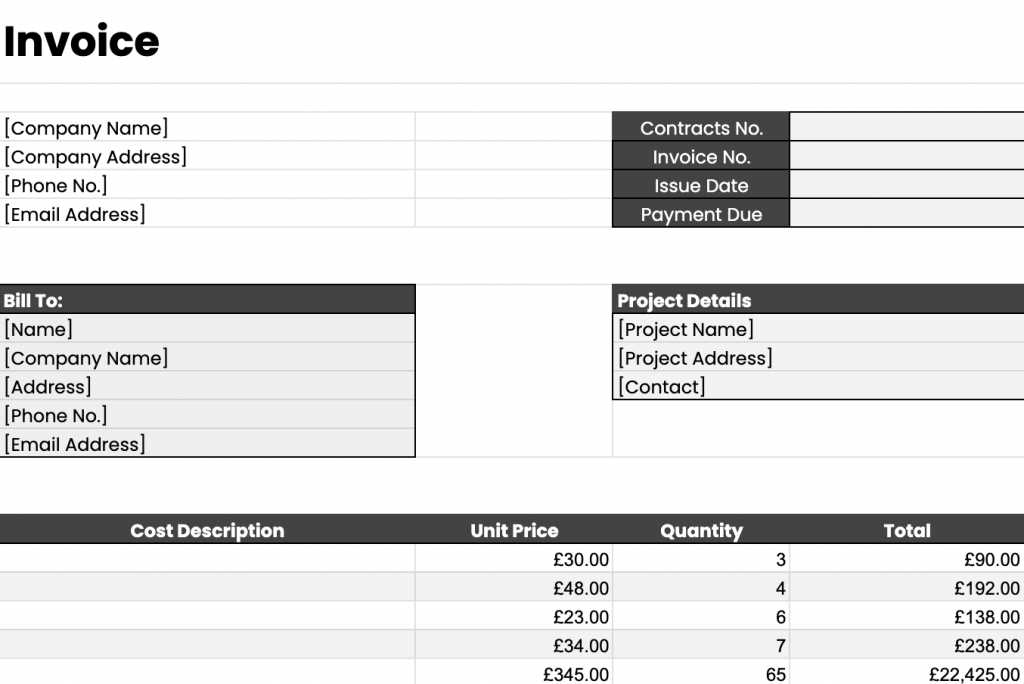

When designing a document for easy readability, it’s essential to focus on structure, font choice, and the logical flow of information. Using headings, bullet points, and well-defined sections can guide the reader’s attention to the most important elements, minimizing confusion and ensuring everything is in its place.

Key Formatting Tips for Clarity

- Use Clear Headings – Divide the document into distinct sections with bold, clear headings for each area, such as “Bill To”, “Services Provided”, and “Total Due”.

- Logical Flow of Information – Organize the content in a logical order, starting with business and client details, followed by services or goods provided, and finally, payment details.

- Consistent Fonts and Colors – Use legible fonts and ensure consistent color schemes throughout the document. Avoid using too many different fonts or bright colors that can make the document appear cluttered.

- Highlight Important Information – Emphasize key details like the total amount due and payment deadline by making them bold or using larger font sizes.

- Group Similar Items – If listing multiple services or products, group related items together and use bullet points or tables to make them easy to read.

- Include a Summary Section – A clear summary section at the bottom, listing the subtotal, taxes, and total amount due, helps recipients quickly verify the details.

By following these tips, you can ensure that your documents are easy to understand, helping to build trust and foster positive relationships with your clients. A well-formatted document shows attention to detail and professionalism, which can be crucial for timely and accurate settlements.

Best Practices for Sending Payment Invoices

Sending financial documents to clients is an important task that requires careful consideration to ensure timely and accurate payment. Properly managing the process not only ensures that the recipient understands the charges but also helps maintain a professional relationship. Following best practices for delivering these documents can help avoid misunderstandings and streamline the payment process.

Effective communication and organization are key when sending financial records. Ensuring that the document is clear, sent at the right time, and delivered through the appropriate channels will increase the chances of prompt payment and reduce the need for follow-up communications.

Key Practices for Sending Financial Documents

- Send Promptly After Service Completion – Ensure that you send the document soon after the product or service is delivered to avoid any delays in receiving payment.

- Use a Professional Delivery Method – Choose a reliable delivery method, whether it’s via email, postal mail, or an online platform, to ensure the document reaches the intended recipient securely.

- Include Clear Payment Instructions – Make sure the recipient knows how to make the payment by providing clear instructions, including accepted payment methods, bank account details, or payment portal links.

- Double-Check Details – Verify all information before sending, including the recipient’s details, the amount, and payment terms, to avoid any mistakes that could cause confusion or delays.

- Send a Reminder – If the due date is approaching or has passed, sending a gentle reminder can help ensure timely payment without sounding overly aggressive.

Additional Considerations

- Maintain a Professional Tone – The language you use should be polite, clear, and businesslike, regardless of the communication medium.

- Include a Unique Reference Number – Use a unique number to easily track and reference the document, especially for clients who may have multiple transactions with you.

- Provide a Contact Point – Always include a way for the recipient to reach out with any questions or concerns regarding the charges.

By following these best practices, businesses can ensure that the process of sending and receiving financial documents is efficient, professional, and conducive to maintaining positive relationships with clients. Proper handling can help reduce late payments and avoid potential disputes, making for smoother financial operations.

Invoice Template Software and Tools

Using specialized software and tools to create financial documents can significantly streamline your workflow. These platforms offer a range of features that help businesses generate, customize, and send accurate bills efficiently. Whether you’re a freelancer, small business owner, or large corporation, leveraging these tools can save you time, reduce errors, and ensure that your documentation remains consistent and professional.

Modern tools are designed to make the creation of these documents as easy as possible, offering built-in templates, automated calculations, and integration with other business systems. With a variety of software options available, it’s important to choose the right one that fits your business needs, whether you’re looking for simple functionality or more advanced features like reporting and client management.

Popular Software and Tools for Creating Financial Documents

| Tool Name | Key Features | Best For |

|---|---|---|

| QuickBooks | Customizable templates, automatic tax calculations, integration with accounting software | Small businesses, freelancers, and accounting teams |

| Zoho Invoice | Automated reminders, client portals, time tracking integration | Freelancers, consultants, and service-based businesses |

| FreshBooks | Invoice tracking, online payments, expense management | Service providers, small to medium-sized businesses |

| Wave | Free to use, customizable designs, invoicing, and accounting features | Small businesses, startups, and freelancers |

| Invoicely | Multi-currency support, recurring billing, online payments | Global businesses, freelancers, and consultants |

Choosing the Right Tool for Your Business

- Evaluate Your Needs – Consider factors such as the number of clients, complexity of services, and specific features you need, such as recurring billing or multi-currency support.

- Ease of Use – Ensure the platform is user-friendly and has an intuitive interface to avoid wasting time on training.

- Integration Options – Look for software that integrates well with other tools you use, such as accounting, CRM, or payment systems.

- Budget – Compare the costs of different tools to find the one that fits your business size and budget. Some options offer free basic plans with premium features available for larger needs.

By selecting the right software or tool, you can simplify your billing process and improve your overall business efficiency. Whether you need a simple solution or a more advanced system, the right tool can help you stay organized, save time, and ensure accu

How to Handle Late Payments with Invoices

Late payments are a common challenge that many businesses face, but how you handle them can significantly impact your cash flow and customer relationships. When clients fail to meet deadlines, it’s crucial to address the issue professionally and promptly to avoid disruptions to your operations. Clear communication and effective follow-up strategies can help minimize delays and encourage clients to settle their balances quickly.

Addressing overdue balances requires a careful approach, balancing firmness and professionalism. Early reminders, clear terms, and strategic follow-ups can often resolve issues before they escalate, ensuring a smoother process for both you and your clients.

Steps to Take When Payments Are Delayed

- Send a Friendly Reminder – If the deadline has passed, send a polite reminder soon after the due date, noting the amount and payment terms. A simple email or message can sometimes resolve the issue without further action.

- Clarify Terms and Late Fees – Make sure the client is aware of any agreed-upon terms, including late fees or penalties for overdue balances. Clear communication about consequences can encourage prompt action.

- Offer Payment Options – Sometimes clients delay payments because of financial difficulty. Offering payment plans or alternative payment methods can help facilitate a quicker resolution.

- Contact via Phone – If emails go unanswered, a direct phone call can be a more personal and effective way to discuss the situation, ensuring your request is taken seriously.

- Enforce Late Fees – If your terms specify late fees, don’t hesitate to apply them once the grace period has passed. This can encourage clients to prioritize settling their balances.

When to Escalate the Issue

- Seek Legal Advice – If attempts to resolve the issue amicably fail, consider seeking legal advice or professional debt collection services. This should be a last resort after other methods have been exhausted.

- Review Client Relationships – If a client continues to ignore payments, it may be necessary to reassess the business relationship and consider whether it is worth continuing.

By addressing late payments with clear communication, flexible options, and appropriate follow-up, you can mitigate the risks and maintain positive client relationships while ensuring your business stays financially healthy.