Free Rent Invoice Template for Word

Organizing monthly transactions can be a challenging aspect of property management. Having an organized, consistent way to keep track of each payment and detail streamlines communication, reduces misunderstandings, and helps build positive relationships with clients. For anyone managing multiple properties or tenants, clarity in documentation is invaluable.

Utilizing a structured approach to financial records not only saves time but also improves accuracy. Creating documents that are clear, professional, and adaptable can help in maintaining organized records and making sure all involved parties stay informed.

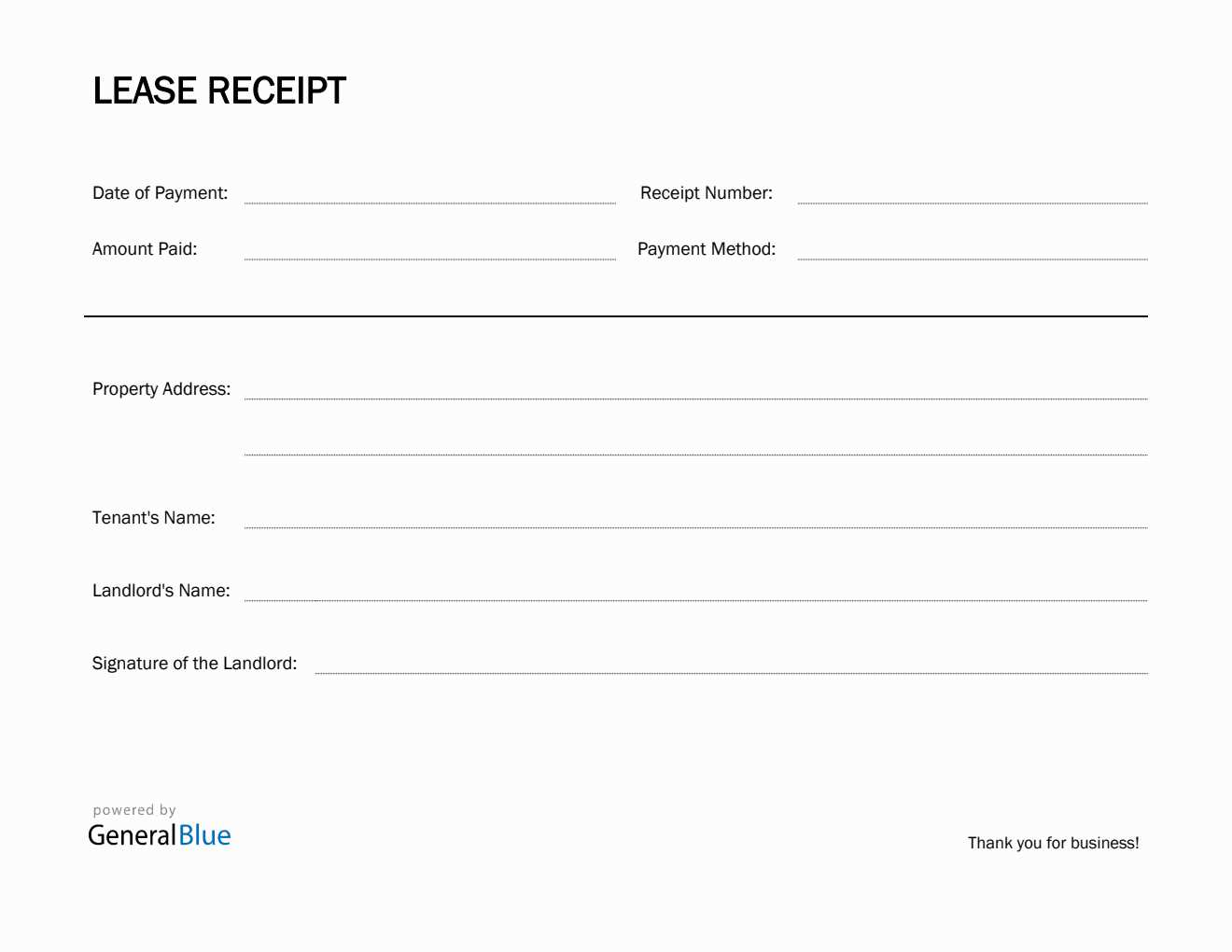

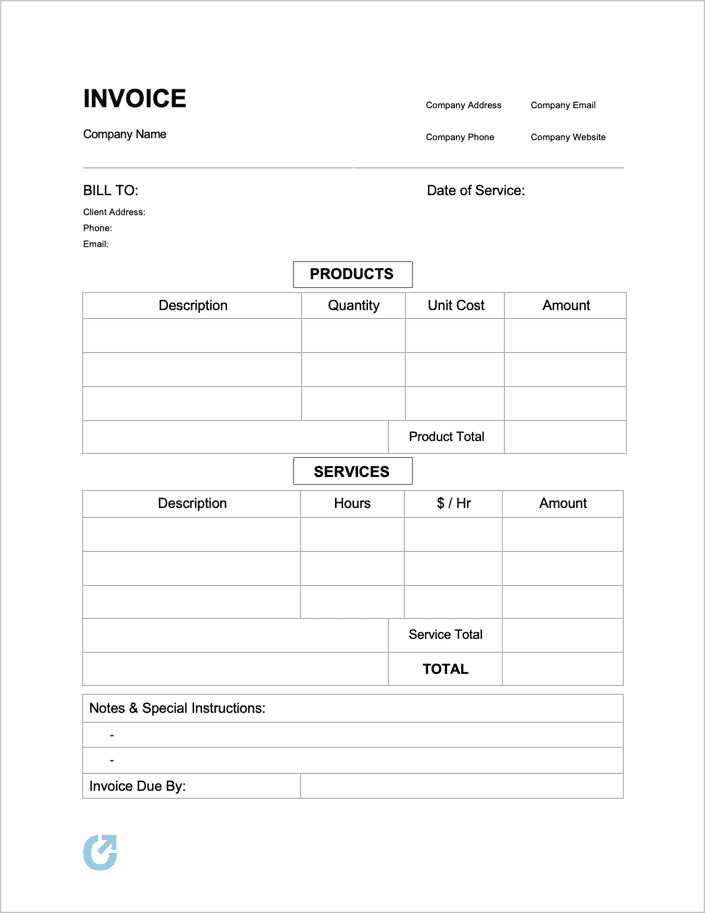

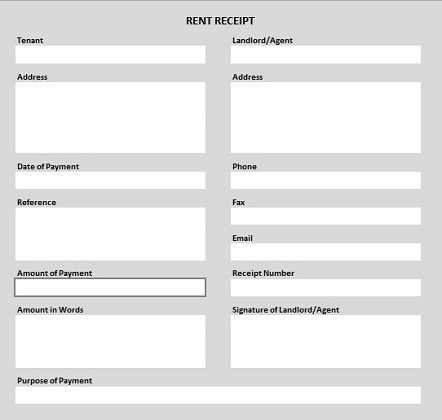

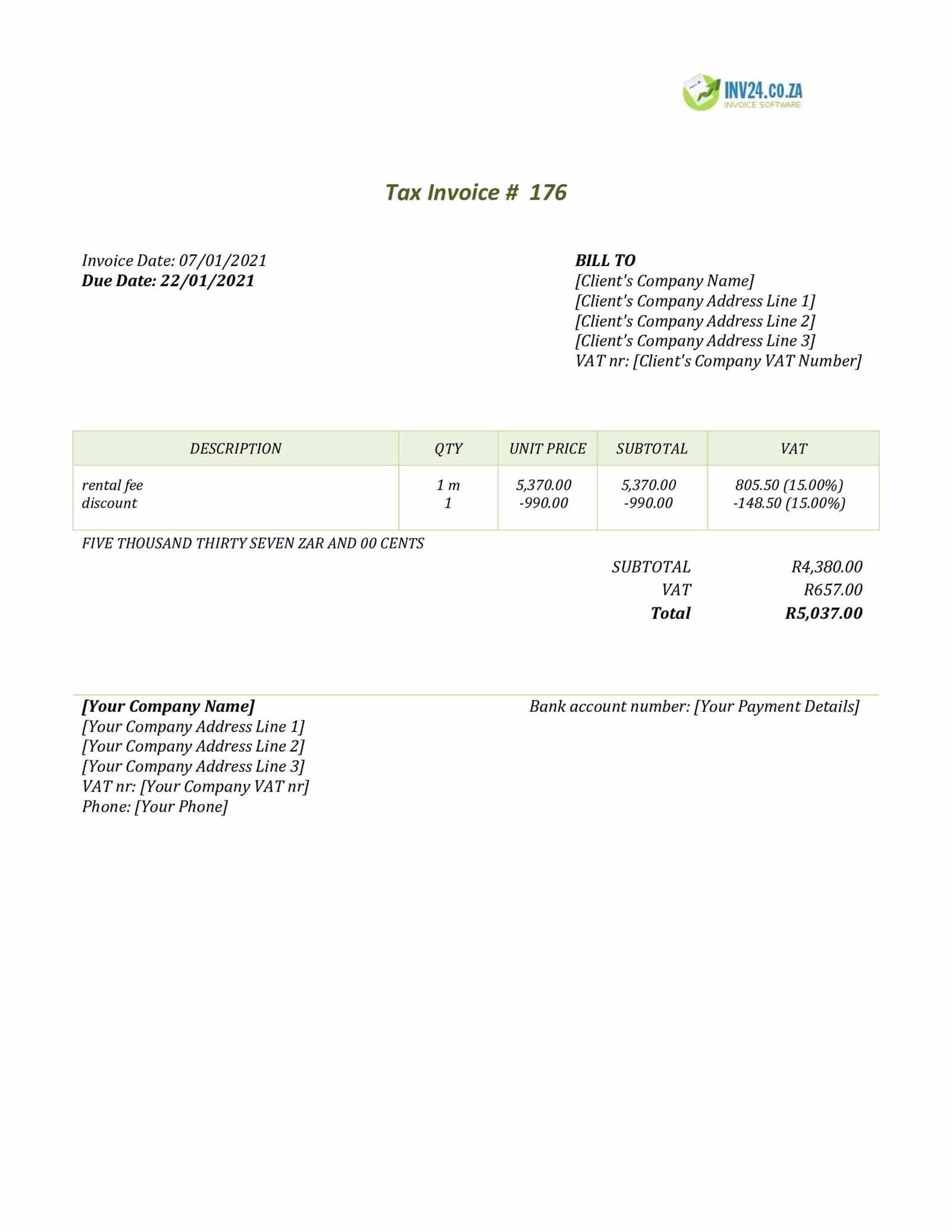

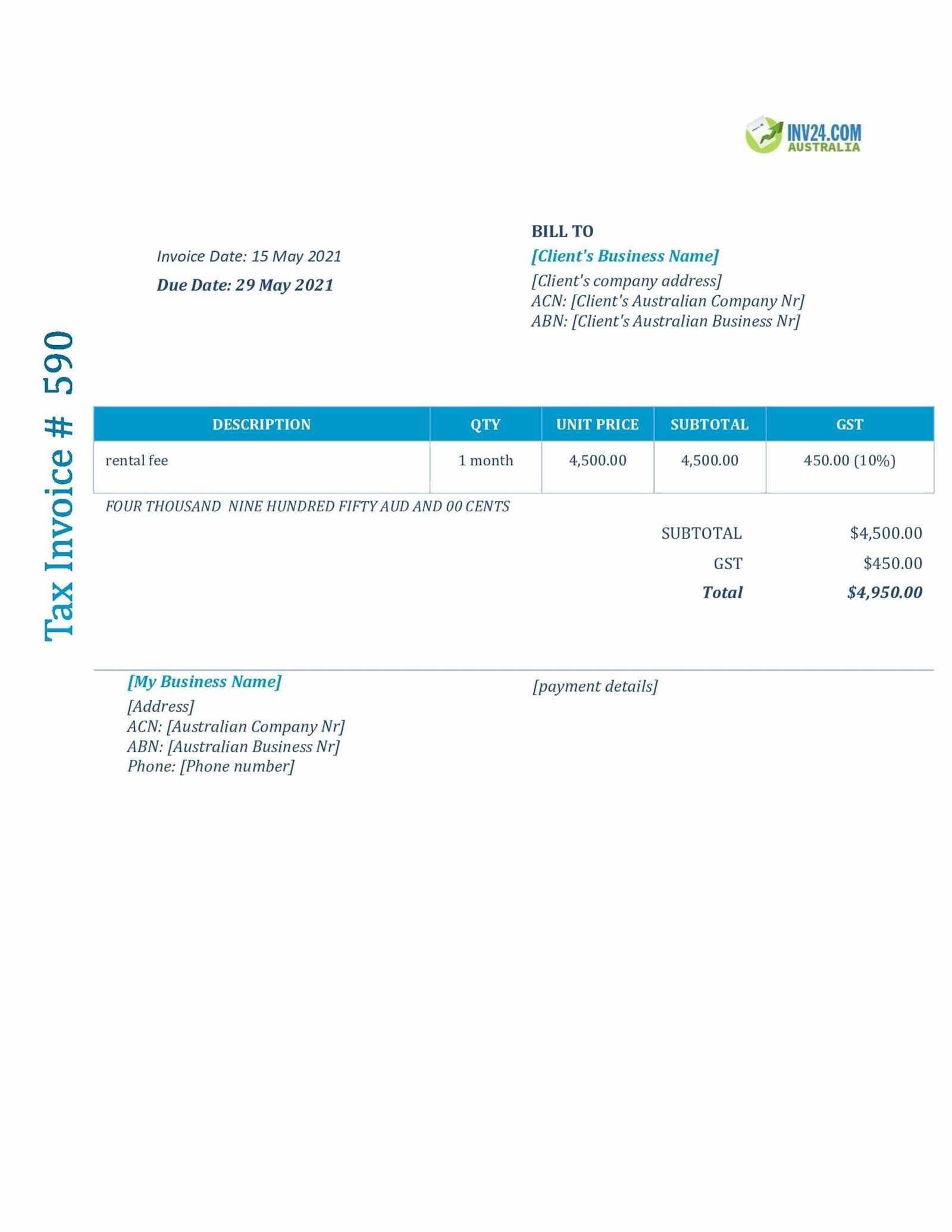

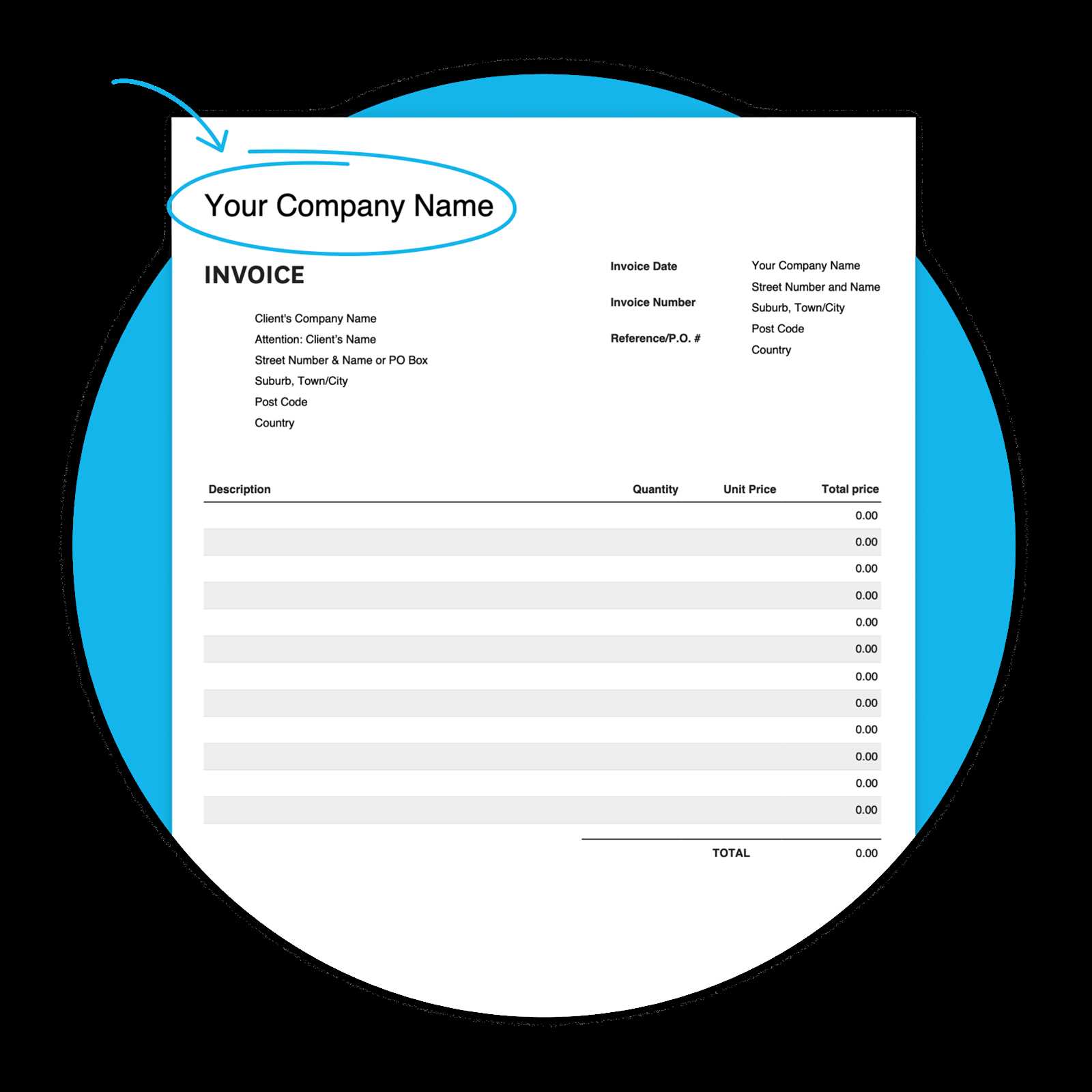

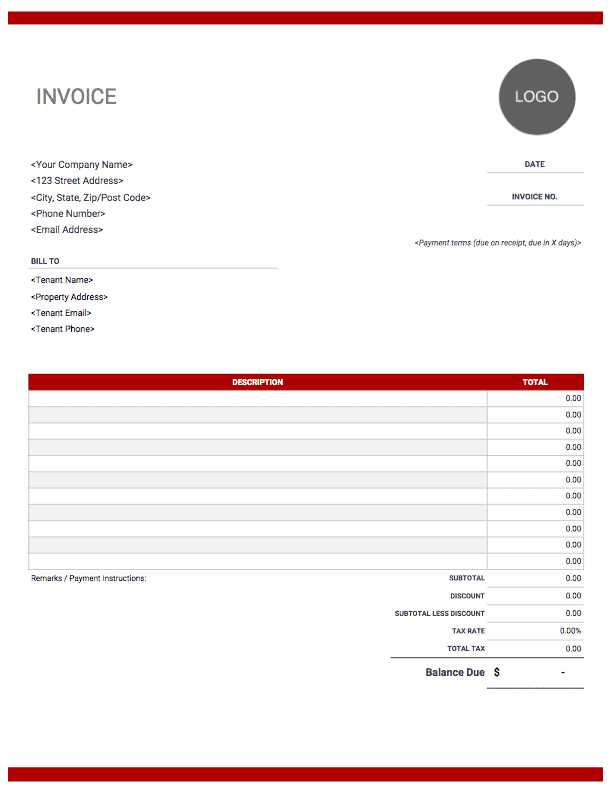

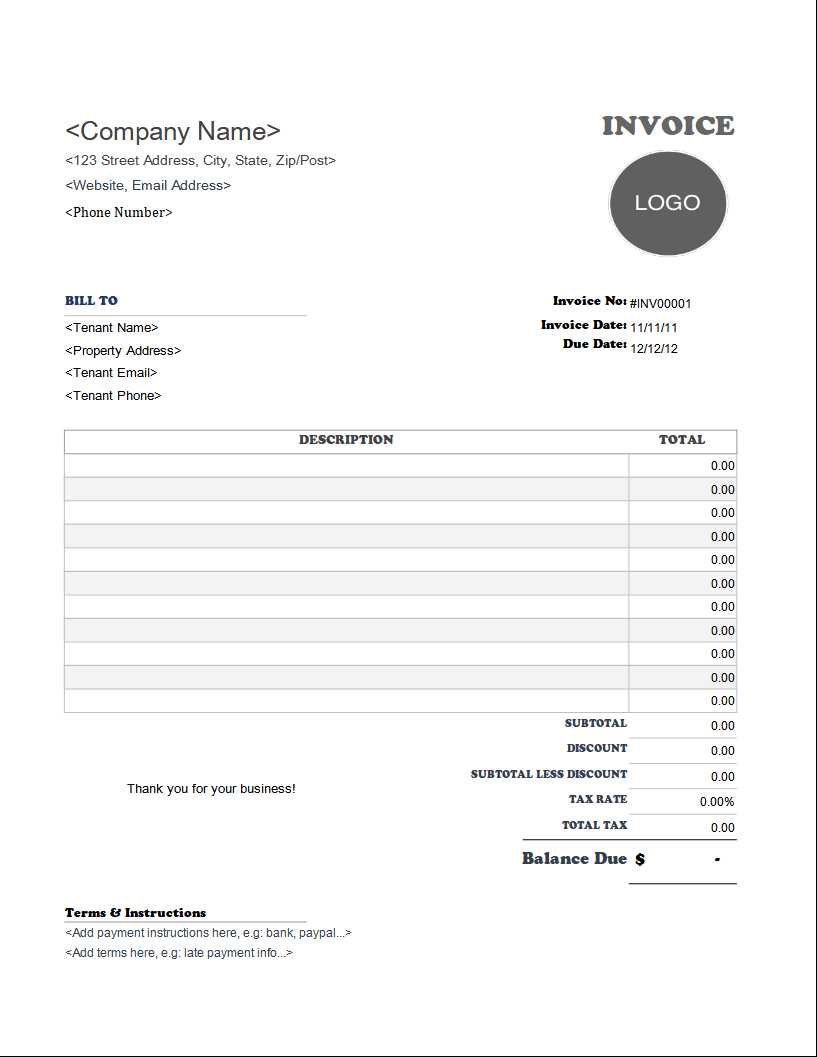

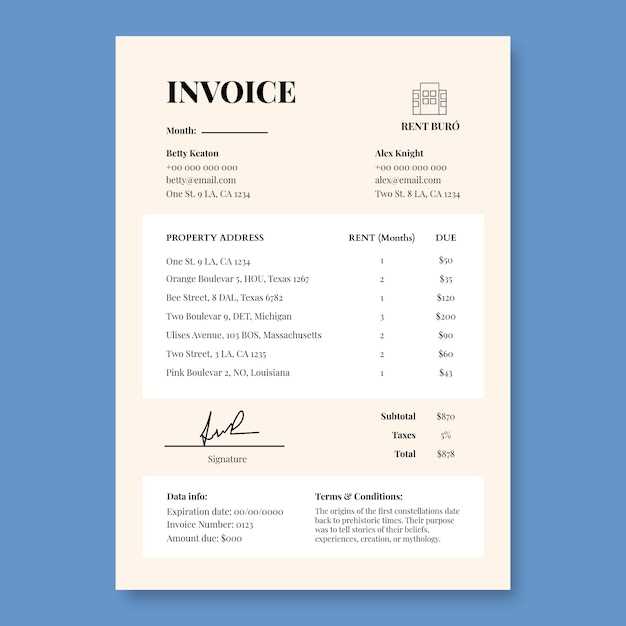

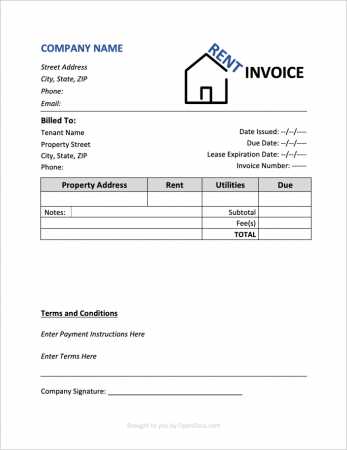

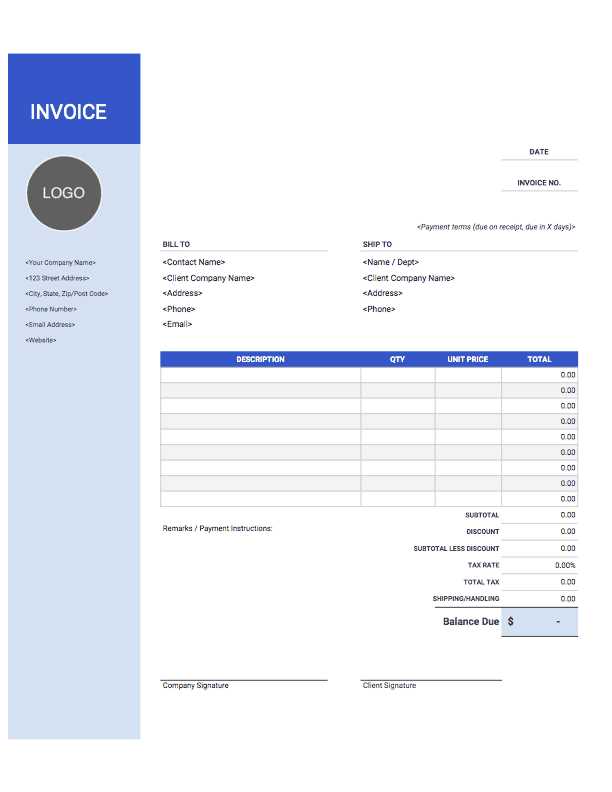

Using pre-designed document layouts is an easy way to create polished forms without spending extra time on formatting. These resources allow property managers and landlords to quickly prepare necessary files with all essential information, enabling them to focus more on core responsibilities.

Simple Document Layout for Property Payment Tracking

Managing payment records with consistency and clarity is essential for smooth property operations. A pre-made document layout can streamline your process, helping you to organize details in a straightforward, professional format. With these resources, you avoid spending extra time on design, ensuring a clear and efficient method for handling financial documentation.

Essential Sections for Effective Payment Records

Ensuring that each document is well-structured helps communicate important information to both parties. Below are key sections that can enhance the clarity and usability of these records:

| Section | Description | ||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Details |

Simple Document Layout for Property Payment TrackingManaging payment records with consistency and clarity is essential for smooth property operations. A pre-made document layout can streamline your process, helping you to organize details in a straightforward, professional format. With these resources, you avoid spending extra time on design, ensuring a clear and efficient method for handling financial documentation. Essential Sections for Effective Payment RecordsEnsuring that each document is well-structured helps communicate important information to both parties. Below are key sections that can enhance the clarity and usability of these records:

Adapting the Document for Your NeedsThis structured layout provides a balance between simplicity and detail. Users can easily adjust sections based on specific requirements, making it versatile for a variety of property arrangements. This way, the record remains both professional and relevant to unique needs. Benefits of Using a Structured Document for Payment RecordsUtilizing a pre-made document format can simplify the process of managing regular financial transactions, particularly in the property sector. This approach helps standardize records, making it easier to track payments, reduce errors, and maintain a professional appearance. Here are some of the key advantages of incorporating this type of format into your routine.

|