Free Zoho Invoice Template Download for Easy Invoicing

Managing financial transactions can be a complex and time-consuming task for any business. Whether you are a freelancer, a small business owner, or part of a larger organization, having a streamlined system for issuing professional payment requests is crucial. With the right tools, you can simplify this process, saving time and ensuring accuracy.

Ready-to-use billing documents offer an excellent solution to streamline your financial processes. These documents can be easily customized to meet your specific needs, ensuring that every client receives clear, professional communication about their payments. A well-organized system helps reduce errors, improve client satisfaction, and speed up your cash flow.

By using accessible resources, you can take the guesswork out of creating customized payment requests. No need for complex designs or technical knowledge–simply select the right format and adapt it to suit your business. The result is a fast, efficient method of handling finances that supports growth and professional integrity.

Why Choose Zoho Invoice Templates

When it comes to managing billing and payments, having an efficient and organized system is key to maintaining smooth operations. A professional and well-structured document for requesting payments can enhance your credibility, save time, and eliminate the need for repetitive tasks. Choosing the right solution to generate these documents can significantly improve your workflow.

Streamlined and Professional Documents

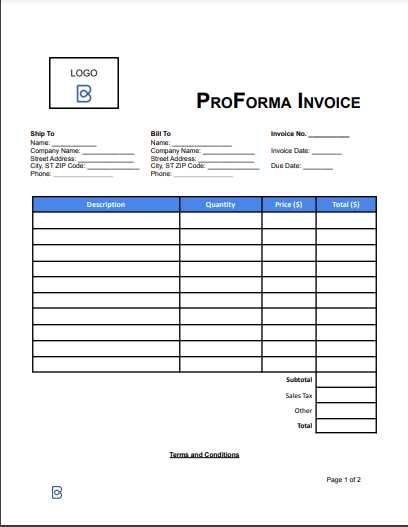

Ready-made solutions allow you to create high-quality, polished documents without the need for design skills or specialized software. With customizable options, you can quickly tailor each document to your business’s specific needs, ensuring consistency across all client communications. This simplicity combined with professionalism makes it a top choice for businesses of all sizes.

Time and Effort Saving Features

Automated features, such as pre-filled client information and itemized lists, make the creation process quick and effortless. With minimal input, you can generate accurate documents in seconds, freeing up valuable time that can be used for other business tasks. This efficiency is one of the main reasons businesses choose these ready-made solutions.

Benefits of Using Free Templates

Adopting ready-made solutions for billing and payment management offers several key advantages for businesses looking to streamline their operations. These resources can drastically simplify the process, saving both time and effort while maintaining a professional appearance in all client communications. By utilizing accessible resources, businesses can focus more on growth and less on repetitive administrative tasks.

Cost-Effective and Accessible

One of the main benefits of these ready-to-use documents is that they are available without any additional costs. Small businesses and freelancers with limited budgets can easily access high-quality formats without the need for expensive software or external assistance. This affordability makes them an ideal solution for those looking to reduce overhead costs.

Customization to Suit Your Needs

These documents are highly customizable, allowing businesses to adjust them according to specific needs. Whether you need to add or remove sections, adjust fonts, or include company branding, the flexibility ensures that each document matches your business style. The personalization available ensures that your communications remain aligned with your company’s image and values.

How to Download Zoho Templates

Getting access to ready-made resources for creating billing documents is straightforward. These formats are available from various platforms, and the process of obtaining them is simple and user-friendly. With just a few steps, you can have a professional document format tailored to your needs, ready for use in no time.

Step-by-Step Process

Follow these easy steps to acquire the document formats for your business:

| Step | Description |

|---|---|

| 1 | Visit the platform or website offering the documents. |

| 2 | Select the format that fits your business needs. |

| 3 | Choose the customization options that suit your preferences. |

| 4 | Click the “Get” or “Access” button to obtain the format. |

| 5 | Save the document to your device for immediate use. |

Accessing and Saving the Document

Once you’ve selected your preferred format, it’s easy to save it to your computer. The resource will be in a format compatible with common document editing tools, allowing you to open and adjust it right away. Ensure your files are stored securely for future access whenever needed.

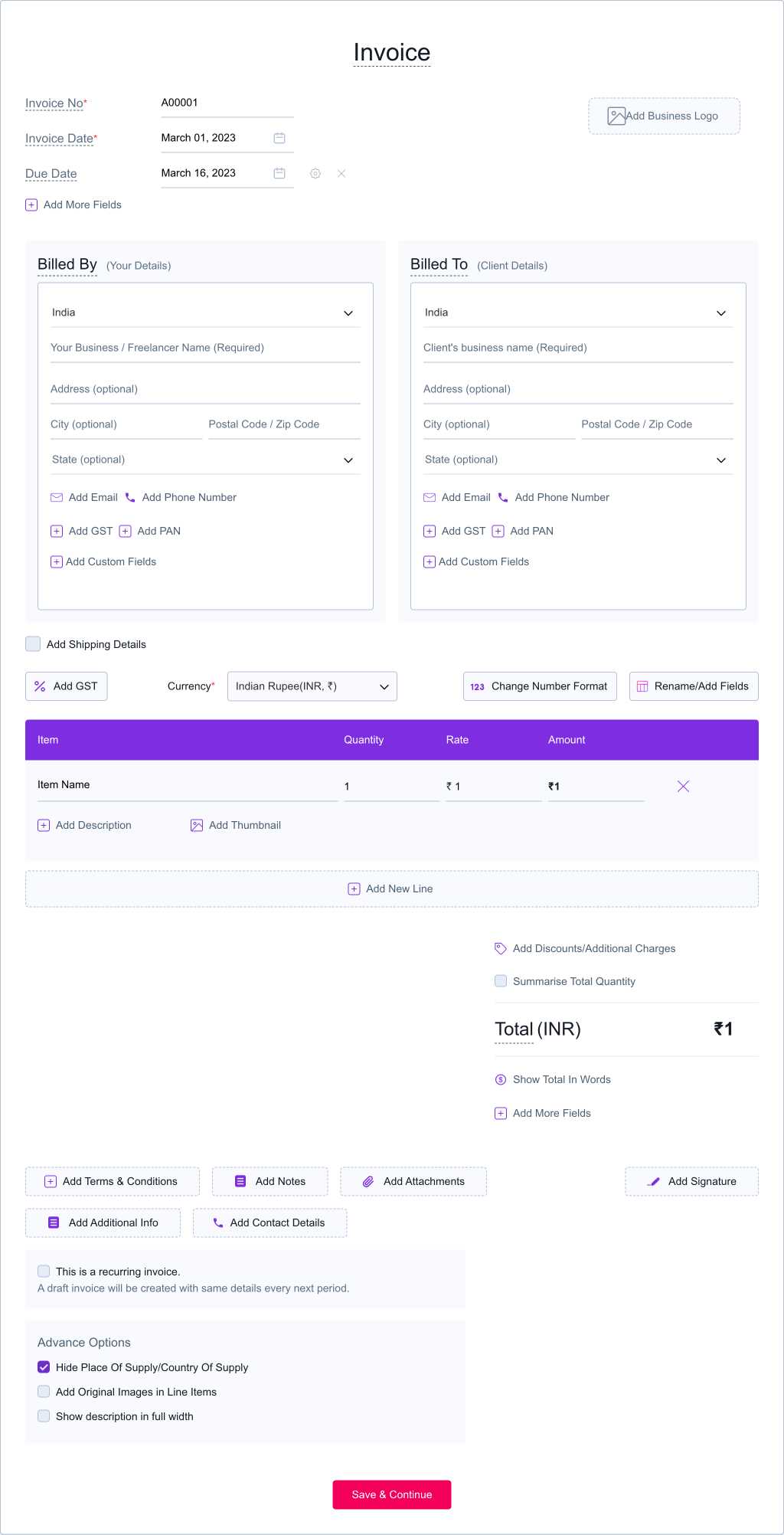

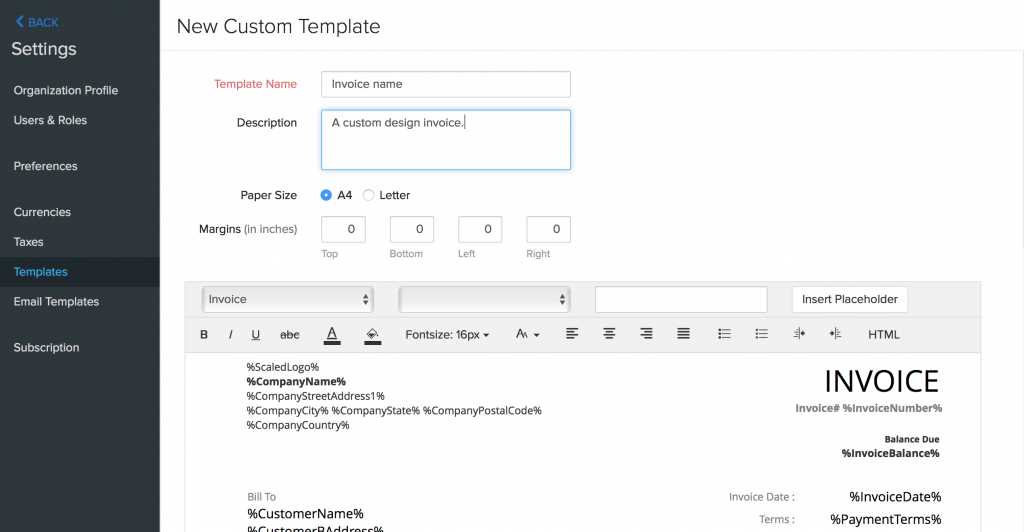

Customizing Your Zoho Invoice Template

Personalizing your billing document can significantly enhance your business’s professional appearance and make communication with clients clearer. Customization allows you to adjust the content and layout to meet specific needs, ensuring that every document aligns with your company’s brand identity. This flexibility makes it easier to present a polished and consistent image to clients.

Modifying Layout and Design

The first step in tailoring your document is adjusting the layout. This can include rearranging sections like the client’s information, itemized lists, and payment terms. Most solutions allow you to drag and drop elements, making the process simple and intuitive. You can also change fonts, colors, and spacing to match your brand’s style and ensure that the document looks professional and cohesive.

Adding Company Branding

Incorporating your company’s logo, slogan, or any other branding elements helps establish a strong brand presence. Most platforms allow you to easily upload your logo and place it where it’s most visible, such as at the top or in the footer of the document. By customizing the header or footer, you can further personalize the document to reflect your unique business identity.

Streamlining Billing with Zoho

Efficient billing is crucial for maintaining smooth cash flow and ensuring timely payments. Automating key processes can significantly reduce the time spent on manual tasks, allowing businesses to focus on growth. By leveraging simple tools, you can enhance the speed and accuracy of your financial transactions, ensuring that everything is handled seamlessly.

Key Features for Streamlining Billing

Using an automated system can help simplify various aspects of billing. Below are some of the most useful features that can optimize the process:

| Feature | Benefit |

|---|---|

| Automated Reminders | Reduce follow-up effort by sending automatic payment reminders to clients. |

| Recurring Billing | Set up regular billing cycles for clients, reducing the need for manual entry. |

| Payment Tracking | Monitor payments in real time, ensuring that nothing slips through the cracks. |

| Customizable Layout | Tailor documents to match your branding and business requirements. |

Improving Accuracy and Reducing Errors

Automation minimizes human error by ensuring that details such as amounts, dates, and client information are correctly entered. This accuracy leads to fewer disputes and faster resolution times, allowing businesses to maintain a professional reputation.

Zoho Invoice Template for Freelancers

For freelancers, managing payments and keeping track of billing is a vital part of maintaining a smooth business operation. Having a professional, customizable document for payment requests can save time and help ensure consistency across all client interactions. With the right resources, freelancers can easily create accurate and polished documents without spending excessive time on administrative tasks.

Why Freelancers Need a Customized Solution

Freelancers often juggle multiple clients and projects, so having an efficient and simple way to handle payment requests is essential. Customizable formats allow freelancers to tailor each document to specific client needs while maintaining a professional image. Features such as client details, service descriptions, and payment terms can be easily adjusted to ensure that every document is accurate and personalized.

Key Features for Freelancers

Here are some essential features that freelancers can benefit from when using customizable billing formats:

| Feature | Benefit |

|---|---|

| Client Information Storage | Save client details for quick access and consistent data entry. |

| Service Breakdown | Easily list services and rates to ensure clarity and transparency. |

| Flexible Payment Terms | Customize payment due dates, late fees, and methods according to the agreement. |

| Professional Design | Ensure that every payment request maintains a polished and businesslike appearance. |

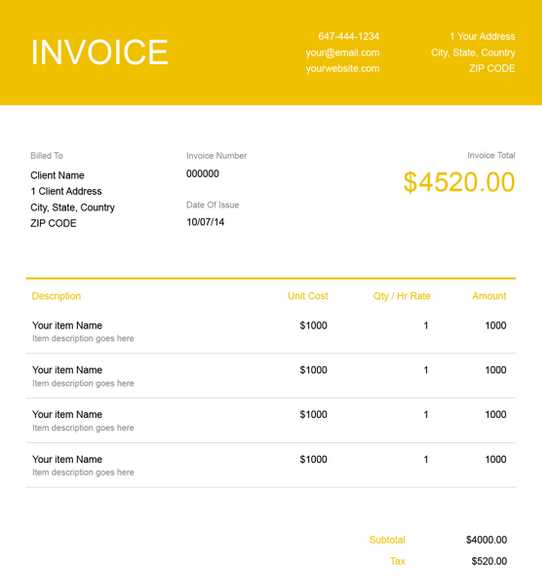

Creating Professional Invoices in Minutes

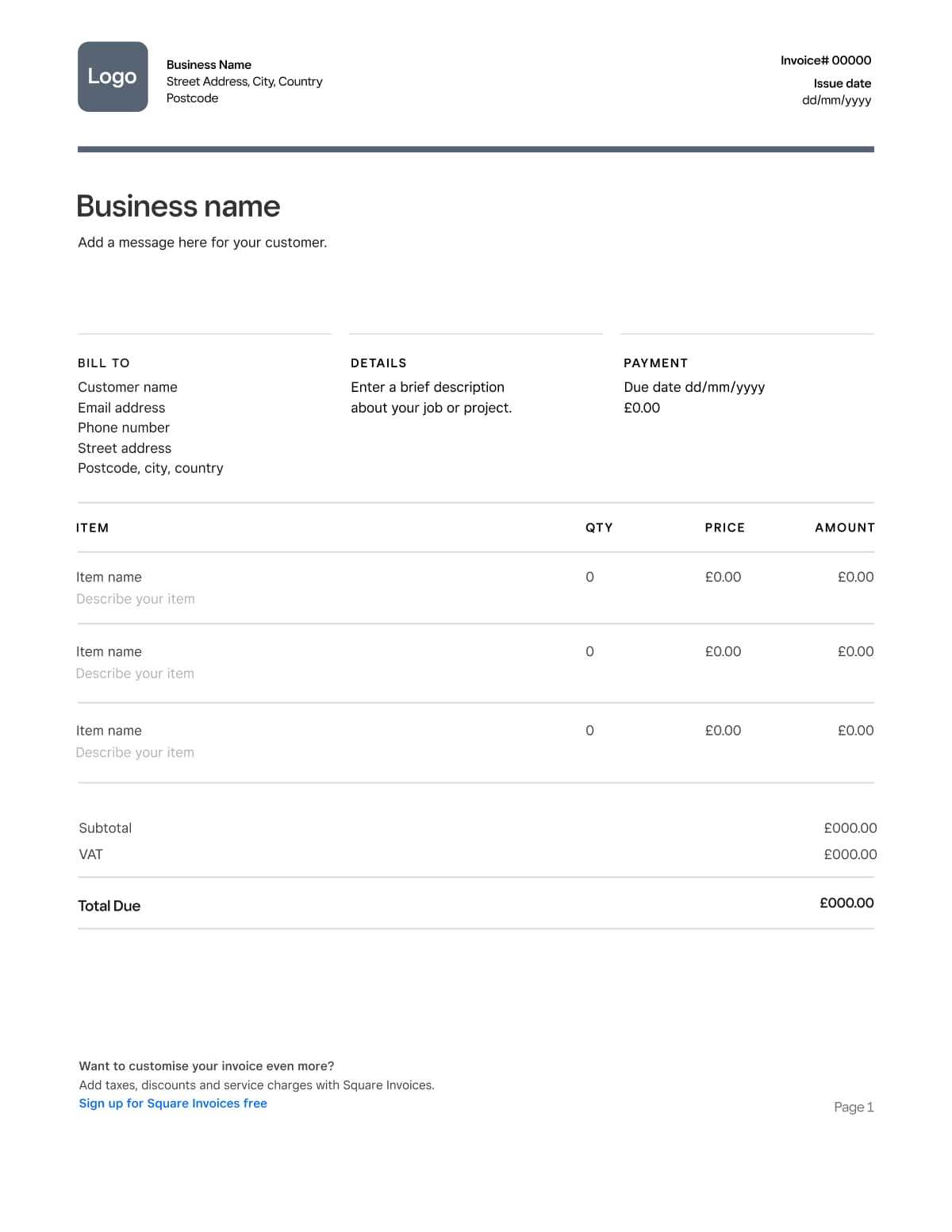

Generating a well-organized payment request doesn’t need to take up much of your time. With the right tools, you can create clear, professional documents in just a few minutes. These resources are designed to simplify the process, allowing businesses to focus on more important tasks while ensuring their clients receive accurate and professional communication every time.

Fast and Easy Setup

Setting up a polished payment document is simple and quick. By choosing a format that can be easily customized, you can have a professional-looking document ready in just a few clicks. Most platforms allow you to enter client details and item descriptions, automatically generating a document that’s ready to send in moments.

Efficiency and Accuracy Combined

The use of automated features ensures accuracy, reducing the risk of errors that can occur during manual entry. You can automatically calculate totals, apply taxes, and set up payment terms, eliminating the need for complex calculations. This not only saves time but also improves the overall efficiency of your billing process.

| Feature | Benefit |

|---|---|

| Pre-filled Client Information | Speed up document creation with saved client data for recurring projects. |

| Automatic Calculations | Ensure accurate totals and taxes with built-in calculation tools. |

| Customizable Design | Quickly adjust the layout to match your business branding and style. |

| Multiple Payment Methods | Offer clients various options to pay quickly and conveniently. |

Zoho Invoice Features You Should Know

When selecting the right billing solution for your business, it’s essential to understand the key features that can enhance your workflow and improve efficiency. A robust system offers a range of tools designed to automate and streamline the entire process. These tools not only save time but also ensure that your documents are accurate and professional.

Essential Features to Look For

Here are some of the most useful features that can help optimize your payment management process:

- Automated Reminders: Set up automatic reminders to ensure timely payments without the need for manual follow-ups.

- Customizable Layout: Easily tailor the document’s design to match your business’s branding and style.

- Recurring Billing: Automatically send invoices for subscription-based services or regular projects.

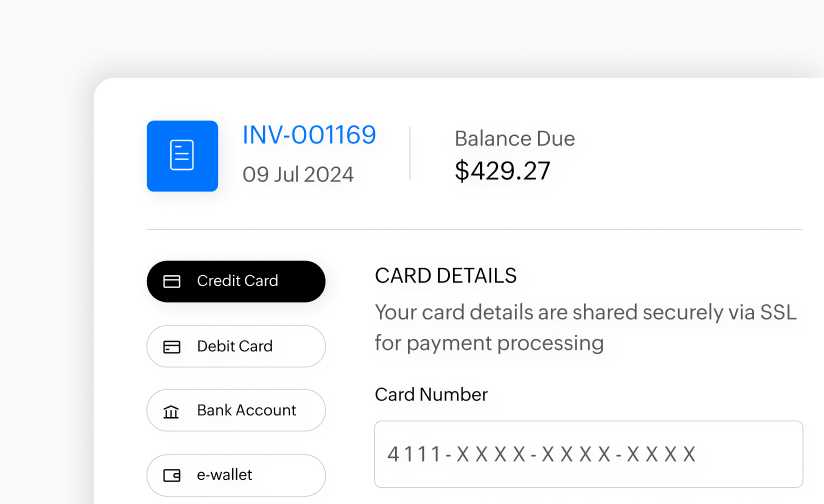

- Multiple Payment Options: Offer clients the flexibility to pay through various methods, such as credit cards, bank transfers, or online payment gateways.

Advanced Functionalities for Enhanced Efficiency

In addition to the basic features, advanced functionalities can help businesses manage their billing processes with even greater efficiency:

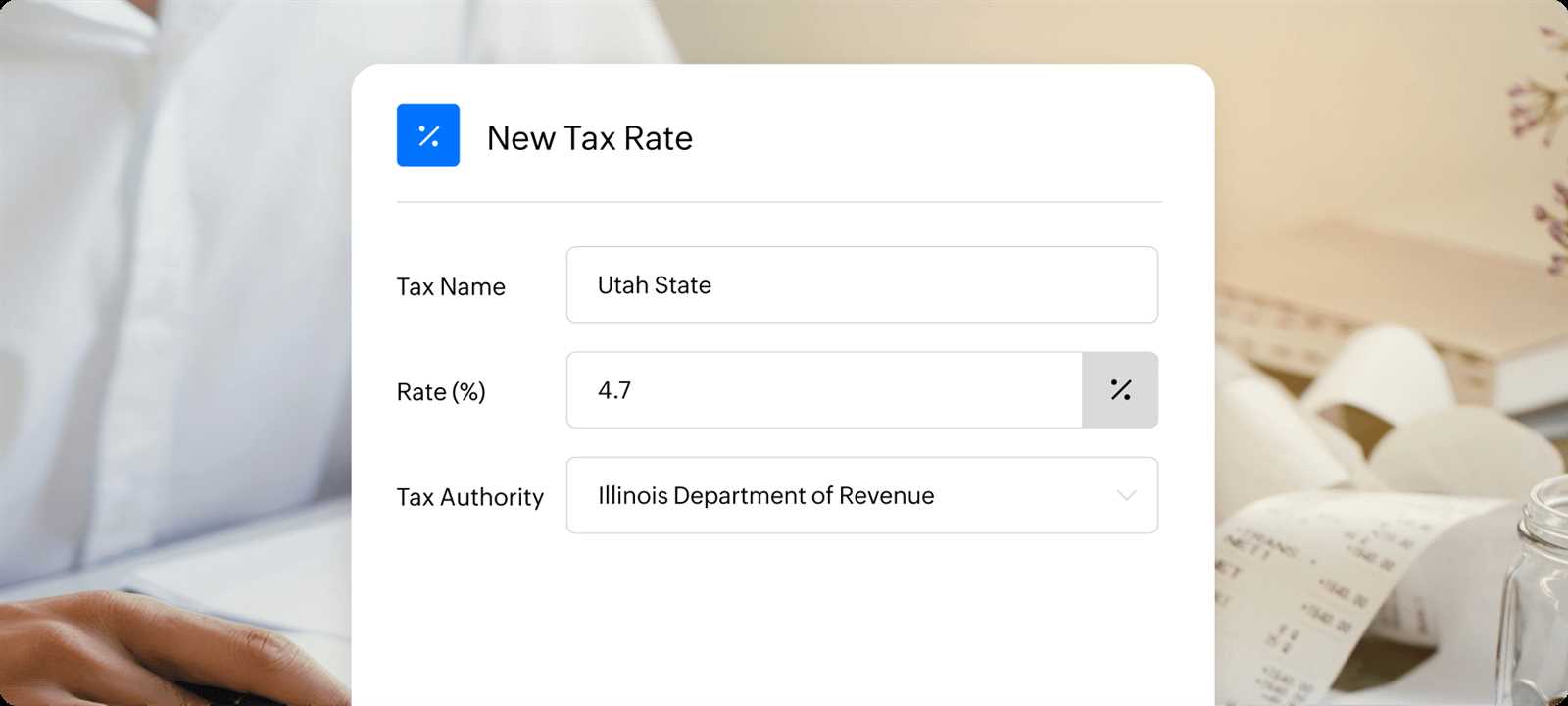

- Tax Management: Easily apply taxes based on regions or services to ensure that all charges are accurately calculated.

- Payment Tracking: Keep track of payment statuses in real-time to ensure that all transactions are up to date.

- Client Portal: Give your clients direct access to view and pay bills, improving communication and payment speed.

- Reporting Tools: Generate detailed reports to analyze your financial data and make informed business decisions.

Save Time with Automated Invoices

Automating the process of creating and sending payment requests can significantly reduce the time spent on manual tasks. By streamlining routine actions, businesses can focus more on core activities while ensuring that all transactions are handled efficiently and without errors. Automated solutions take the guesswork out of repetitive billing processes, making it easier to stay organized and meet deadlines.

How Automation Saves Time

Here are some key ways automation can help businesses save valuable time:

- Recurring Payments: Set up billing cycles for ongoing clients, so you never need to manually generate requests each time.

- Instant Calculations: Automatically calculate totals, taxes, and discounts, reducing the risk of human error and saving time on complex math.

- Predefined Templates: Use ready-made designs for consistency and efficiency in document creation, eliminating the need to start from scratch every time.

- Scheduled Delivery: Automatically schedule when and how documents are sent to clients, ensuring timely and consistent communication.

Advanced Features for Further Efficiency

Automating additional features can take your time-saving efforts to the next level:

- Payment Reminders: Automatically send reminders to clients for overdue payments, saving time on follow-up emails and phone calls.

- Integration with Payment Systems: Link your billing system directly with payment processors, allowing for seamless transactions and faster settlements.

- Automatic Client Data Entry: Automatically populate client information from your database, reducing the need for manual data entry.

Zoho Templates for Small Businesses

For small businesses, maintaining an efficient and professional payment process is essential for building strong client relationships and ensuring timely payments. Having customizable, user-friendly resources for generating professional documents can save time and reduce errors. These tools allow small business owners to quickly create polished documents that reflect their brand, while ensuring consistency across all client interactions.

Why Small Businesses Benefit from Customizable Resources

Small businesses often operate with limited resources, so optimizing administrative tasks is crucial. Using flexible solutions to create professional documents on demand helps streamline operations and eliminates the need for complex software or manual processes. Customization options ensure that each document can be tailored to specific client needs, from payment terms to branding details.

Key Features for Small Business Owners

Here are some of the most beneficial features that can help small businesses optimize their billing practices:

- Branding Options: Customize designs to reflect your business’s unique look and feel, enhancing your professional image.

- Simple Client Management: Save client details and easily apply them to new documents, speeding up the process and minimizing errors.

- Quick Calculations: Automatically calculate totals, taxes, and discounts to avoid manual errors and reduce time spent on calculations.

- Recurring Billing: Automate recurring charges for repeat customers, ensuring steady cash flow without extra effort.

How to Organize Your Invoicing System

Efficient management of payment requests is vital for any business to ensure timely collection and accurate financial records. Organizing your billing process allows you to stay on top of outstanding payments, prevent errors, and streamline cash flow. A well-structured approach can help reduce the time spent on administrative tasks and improve client relations by providing clear, professional documentation.

Steps to Create an Organized Billing Process

Here are some important steps to help you organize your payment management system:

- Standardize Your Documents: Create a consistent format for all payment requests. This helps maintain professionalism and makes documents easier to track.

- Track Deadlines: Set clear due dates for each payment and monitor overdue requests to ensure nothing slips through the cracks.

- Centralize Client Information: Keep all client details in one place, making it easier to create accurate documents and avoid errors.

- Automate Reminders: Use automated systems to send out payment reminders, reducing the need for manual follow-ups.

Tools for Simplifying Your Billing System

To further streamline your process, here are some tools that can make organization even easier:

- Cloud Storage: Use cloud-based tools to store and access payment records securely from anywhere.

- Integration with Payment Processors: Link your billing system with payment processors to automatically update payment statuses and avoid double-entry.

- Reporting Tools: Generate reports to monitor outstanding payments and analyze trends to forecast future cash flow.

Template Compatibility with Accounting Tools

Integrating your billing system with accounting software can significantly simplify the management of your financial data. By ensuring compatibility between your documents and accounting tools, you can automatically sync transactions, monitor cash flow, and generate financial reports. This streamlined process reduces manual data entry, minimizes errors, and saves valuable time, all while keeping your accounting system up-to-date.

Benefits of Integration

Here are some key advantages of using billing solutions that work seamlessly with accounting platforms:

- Effortless Data Transfer: Automatically transfer financial data between systems to keep records accurate and current.

- Time-Saving Automation: Automate the posting of transactions to your accounting software, eliminating manual input.

- Real-Time Updates: Instantly update your accounting records as payments are made, allowing you to track financial progress in real-time.

- Consistent Reporting: Generate unified reports that include both payment data and financial performance, providing a clearer picture of your business’s health.

Popular Accounting Tools for Integration

Several popular accounting platforms offer seamless integration with document generation tools, providing even greater efficiency:

- QuickBooks: Sync transactions and track income and expenses automatically from your billing documents.

- Xero: Connect and sync payment details directly with Xero’s cloud-based accounting solution for real-time financial updates.

- FreshBooks: Automatically update billing and payment statuses within FreshBooks, simplifying the accounting process.

- Wave: Integrate easily with Wave’s free accounting software to manage both finances and client billing in one place.

Zoho Template vs Competitors

When comparing billing document solutions, it’s essential to evaluate how each option stands out in terms of functionality, user-friendliness, and integration with other business tools. Several platforms offer similar features, but the overall user experience and value they provide can differ significantly. Whether you are looking for simplicity, customization options, or seamless software integration, understanding the differences between various providers can help you make an informed decision.

Key Factors to Consider

Here are some aspects to consider when comparing one document creation tool to its competitors:

- Ease of Use: Some solutions prioritize simplicity, making it easy for users to create and manage their documents with minimal effort, while others offer more advanced customization options that require a steeper learning curve.

- Customization: The ability to personalize documents to suit your brand’s identity and style is crucial. Some platforms offer more flexible design options than others.

- Integrations: Integration with other software, such as accounting tools, payment processors, and CRM systems, is vital for streamlining your workflow. Ensure the platform you choose connects easily with your existing systems.

- Cost Efficiency: While many platforms offer competitive pricing, some provide more features for a similar price. It’s essential to balance your budget with the tools offered by each platform.

Popular Competitors to Consider

Several platforms compete in the space of document creation and management. Here are some notable alternatives:

- FreshBooks: Known for its user-friendly interface and seamless integration with accounting tools, FreshBooks is a popular choice for small businesses and freelancers.

- QuickBooks: Offers a comprehensive accounting suite with billing and invoicing features, ideal for businesses looking for a one-stop financial management solution.

- Wave: A free option that provides essential document creation tools, ideal for small businesses with simple needs.

- Invoice Ninja: A versatile tool that supports various document formats and integrates with popular payment gateways, providing flexibility for business owners.

How to Keep Your Invoices Organized

Maintaining a well-organized billing system is crucial for ensuring that financial records are accurate and easily accessible. An efficient system not only saves time when retrieving information but also helps prevent errors and improves cash flow management. Whether you are a freelancer or running a small business, keeping track of your financial documents in an orderly manner is essential for smooth operations and timely payments.

Key Strategies for Organization

Here are some practical tips to help you stay organized:

- Use a Consistent Naming Convention: Create a clear and consistent naming system for all of your financial documents. Include important details such as the client’s name, the date, and a unique identifier in each file name to make them easy to find later.

- Sort by Date: Organizing documents chronologically is one of the simplest ways to keep everything in order. Ensure that your files are named and stored according to the date of issue, which will make tracking payments and due dates straightforward.

- Utilize Folders and Categories: Group your documents into folders based on clients, payment statuses, or project types. This makes it easier to access related documents and helps with both physical and digital filing systems.

- Implement Digital Storage Solutions: Going digital can save significant space and offer quicker access to your records. Cloud storage services allow for easy backup and retrieval, ensuring your documents are safe and organized at all times.

Using Software to Stay Organized

In addition to manual organization, various tools can help automate and streamline your processes:

- Cloud-Based Management Tools: Platforms like Google Drive, Dropbox, and OneDrive provide convenient ways to organize and access your records from anywhere, reducing the risk of misplacing documents.

- Accounting Software: Many accounting tools offer features to automatically categorize and track your financial documents, ensuring that everything is in order and synced with your accounting records.

- Customizable Dashboards: Some software tools offer dashboards that give you a visual overview of your finances, highlighting outstanding payments and pending actions.

Zoho Invoice Template for Efficient Payment Tracking

Tracking payments effectively is a critical part of managing your business’s cash flow and financial health. An efficient system allows you to keep an eye on pending payments, monitor overdue balances, and ensure that you receive compensation for the services or products you provide. By integrating streamlined tools into your billing process, you can maintain a clear overview of your financial interactions and avoid confusion or missed payments.

Using a structured approach to document your transactions ensures that no details are overlooked, and each payment is accurately recorded. With customizable billing forms, you can track the status of each payment, from the initial request to when the amount is fully paid. These tools also offer the ability to mark each entry with relevant payment statuses, such as “paid,” “pending,” or “overdue,” which simplifies follow-ups and reporting.

With the right set of tools in place, automating notifications and reminders for upcoming or overdue payments becomes possible. This not only saves time but also ensures a professional approach to client communications. Keeping track of your transactions in an organized manner helps prevent confusion, reduces the chances of human error, and ensures that your financial records remain accurate at all times.