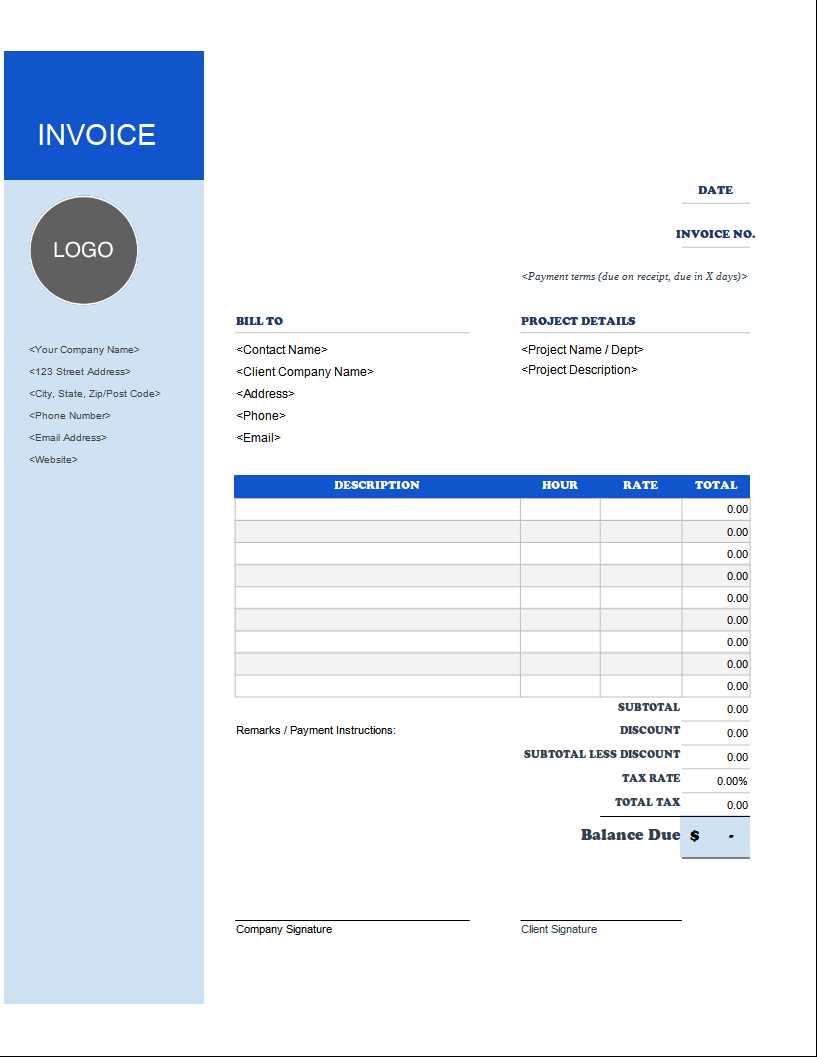

Free Self Employed Invoice Template to Customize for Your Business

Managing the financial side of your freelance or small business work can be a challenge, especially when it comes to creating documents that clearly outline payments. Having an efficient way to request payment not only saves time but also helps maintain a professional image with clients. Whether you’re offering services or goods, understanding how to structure a clear and easy-to-understand document is key to smooth transactions.

Organizing financial requests effectively allows you to track earnings and maintain an accurate record of business activities. With the right resources, you can streamline this process and focus more on delivering your work. Instead of reinventing the wheel for each project, you can rely on tools designed to simplify this aspect of your business.

Customization is crucial, as each project or client may have different needs. A flexible system ensures that you can tailor the document to fit your specific requirements, including payment schedules, terms, and contact details. This way, you ensure clarity and avoid misunderstandings that can arise from poorly structured payment requests.

Free Self Employed Invoice Template Guide

Creating a professional document for requesting payments is an essential task for independent professionals. It helps to establish clear communication with clients, ensuring they understand the agreed-upon terms, deadlines, and amounts. This guide will walk you through the process of building an effective financial request, making sure it is well-organized and tailored to your business needs.

Key Components of a Payment Request

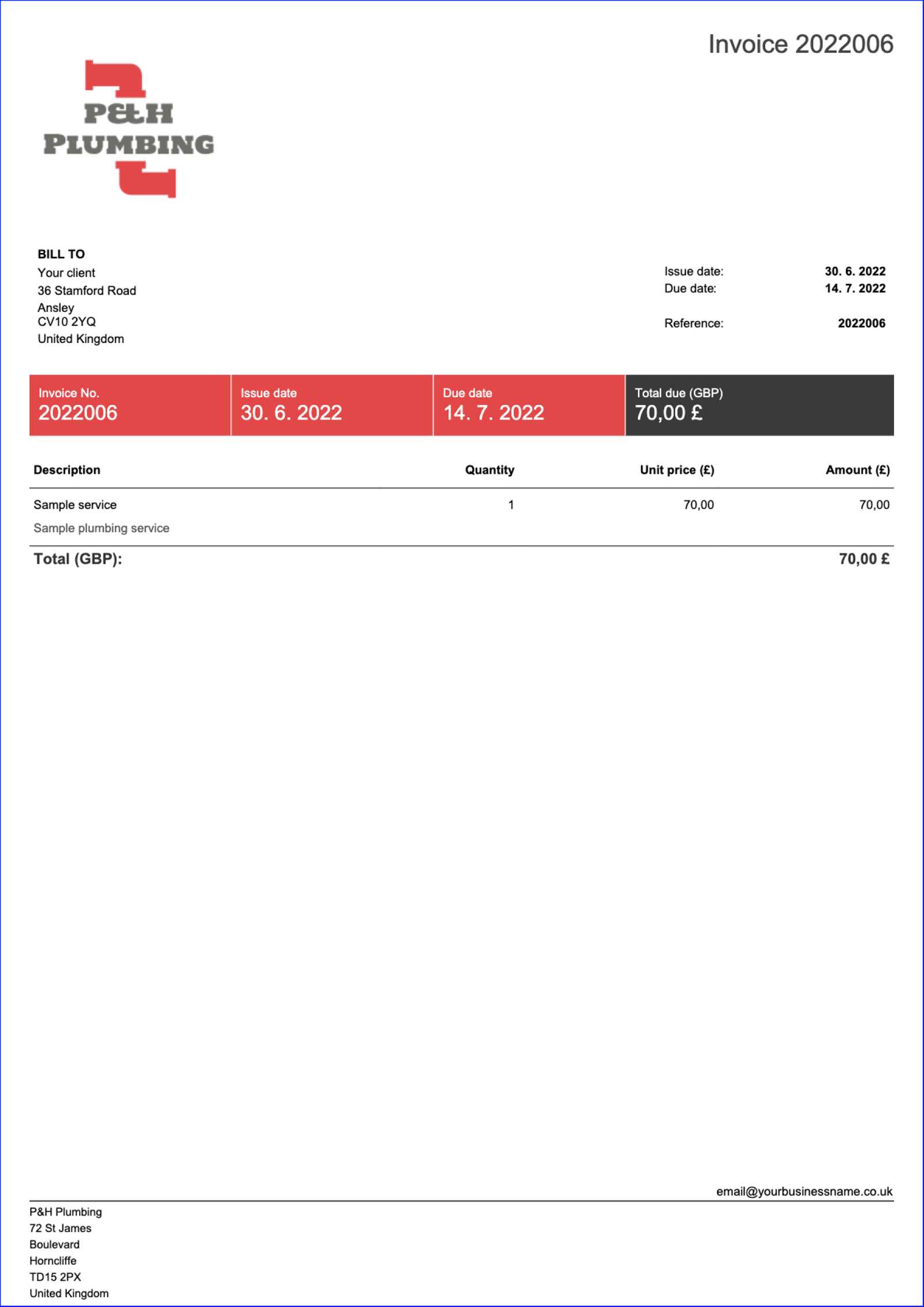

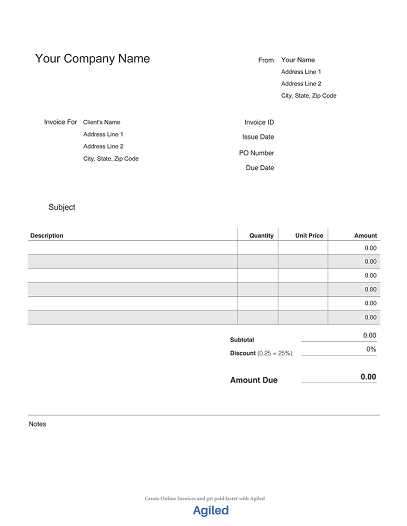

While each document can be customized to suit specific needs, certain elements are universally important for clarity and professionalism. By understanding these components, you can ensure that your request is complete and easy for clients to process. Here are the main sections you should include:

| Component | Description |

|---|---|

| Contact Information | Clearly list your name, business name (if applicable), and any other relevant contact details. |

| Client Details | Include the name and contact information of the person or company you’re invoicing. |

| Services or Products | A detailed breakdown of what you provided, including quantities, rates, or hourly charges. |

| Payment Terms | Specify when payment is due, any late fees, and acceptable methods of payment. |

| Total Amount Due | Summarize the total amount that needs to be paid, ensuring it aligns with the services or products listed. |

Customizing Your Document for Efficiency

Once you understand the key elements, you can easily personalize the document to reflect your business style and unique client requirements. Whether you’re a freelancer, small business owner, or contractor, there are various formats available that allow for easy customization. With a well-designed structure, you can focus more on your work and less on the paperwork.

Why Use a Free Invoice Template

Managing payments efficiently is an essential part of running any business, but creating documents from scratch each time can be time-consuming and error-prone. By using pre-designed forms, you can simplify this process while maintaining a professional appearance. A well-structured document ensures that clients clearly understand the terms and amounts, which helps prevent confusion and delays in payment.

Time-saving is one of the main advantages of using a ready-made form. Instead of focusing on design or layout every time you need to request payment, you can simply input the necessary details and send it out. This allows you to concentrate on your core work, without worrying about the administrative aspects of your business.

Another benefit is the accuracy that comes with using a proven, standard layout. With the essential components already in place, such as payment terms, contact details, and amounts due, there is less room for mistakes. These templates are designed to meet the common needs of most businesses, so you can be confident that your document is both clear and complete.

Additionally, having a pre-made form can enhance your professionalism. Clients appreciate receiving documents that are well-organized and easy to read. A consistent and clean format can help build trust and reflect positively on your business, making it easier to maintain strong client relationships.

Benefits of Customizing Your Invoice

Personalizing your financial documents is more than just about design–it’s about ensuring clarity, fostering professionalism, and streamlining communication with your clients. When you tailor these documents to fit your specific business needs, you create an experience that not only enhances your credibility but also ensures that the key details are easily understood. Customization can make the payment process smoother, reducing misunderstandings and speeding up transactions.

Build a Stronger Brand Identity

One of the primary advantages of customizing these documents is the ability to incorporate your brand identity. By adding your logo, using your company colors, or choosing fonts that match your business’s style, you make your documents instantly recognizable. This adds a layer of professionalism, reinforcing your business image and making a lasting impression on clients.

Ensure Clear Communication

Customizing your documents allows you to highlight the most important details in a way that suits your specific business model. Whether it’s adding a breakdown of services, special payment terms, or unique instructions for clients, this flexibility ensures that there are no misinterpretations. Clear communication of payment expectations, due dates, and late fees helps avoid confusion and fosters trust between you and your clients.

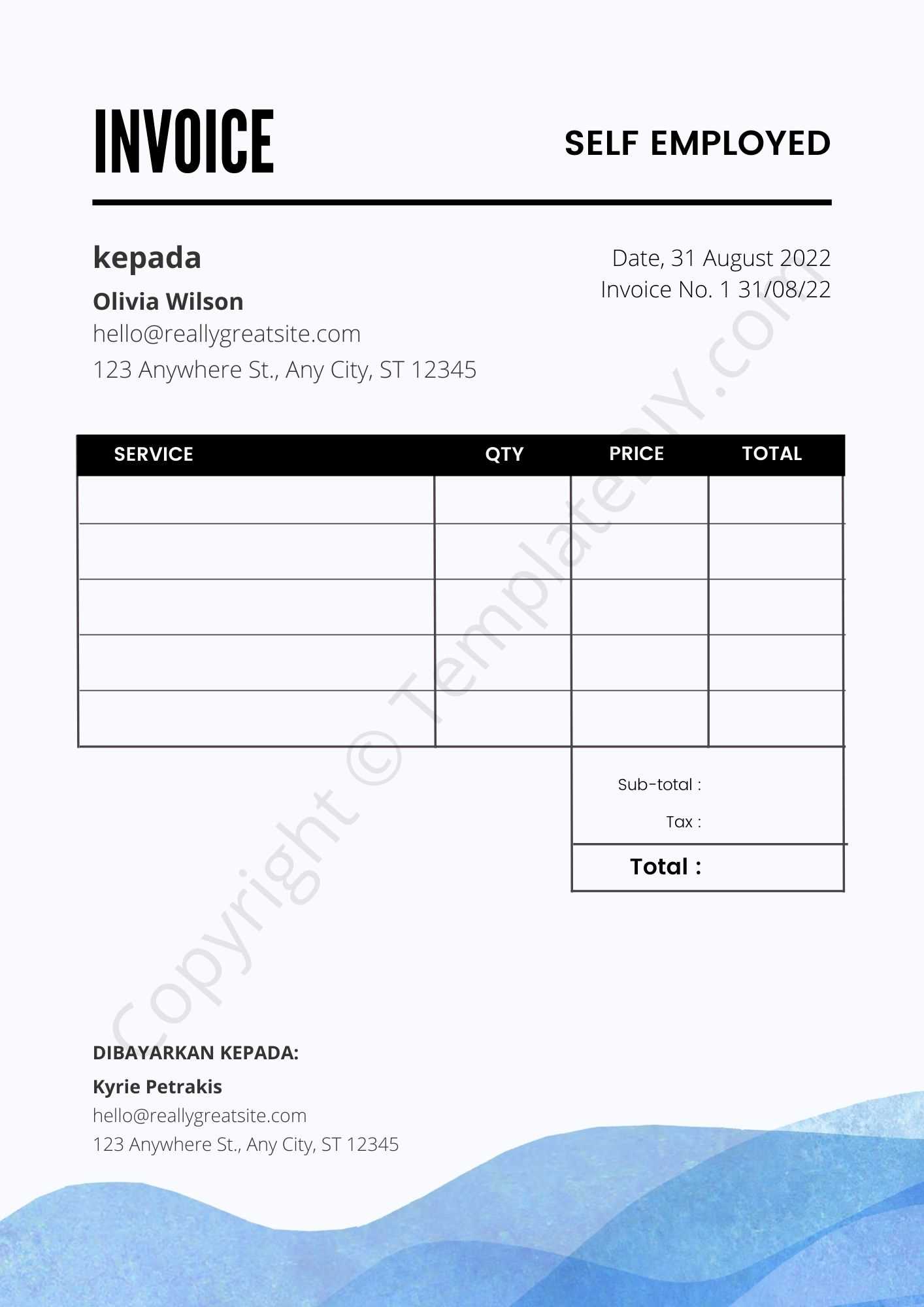

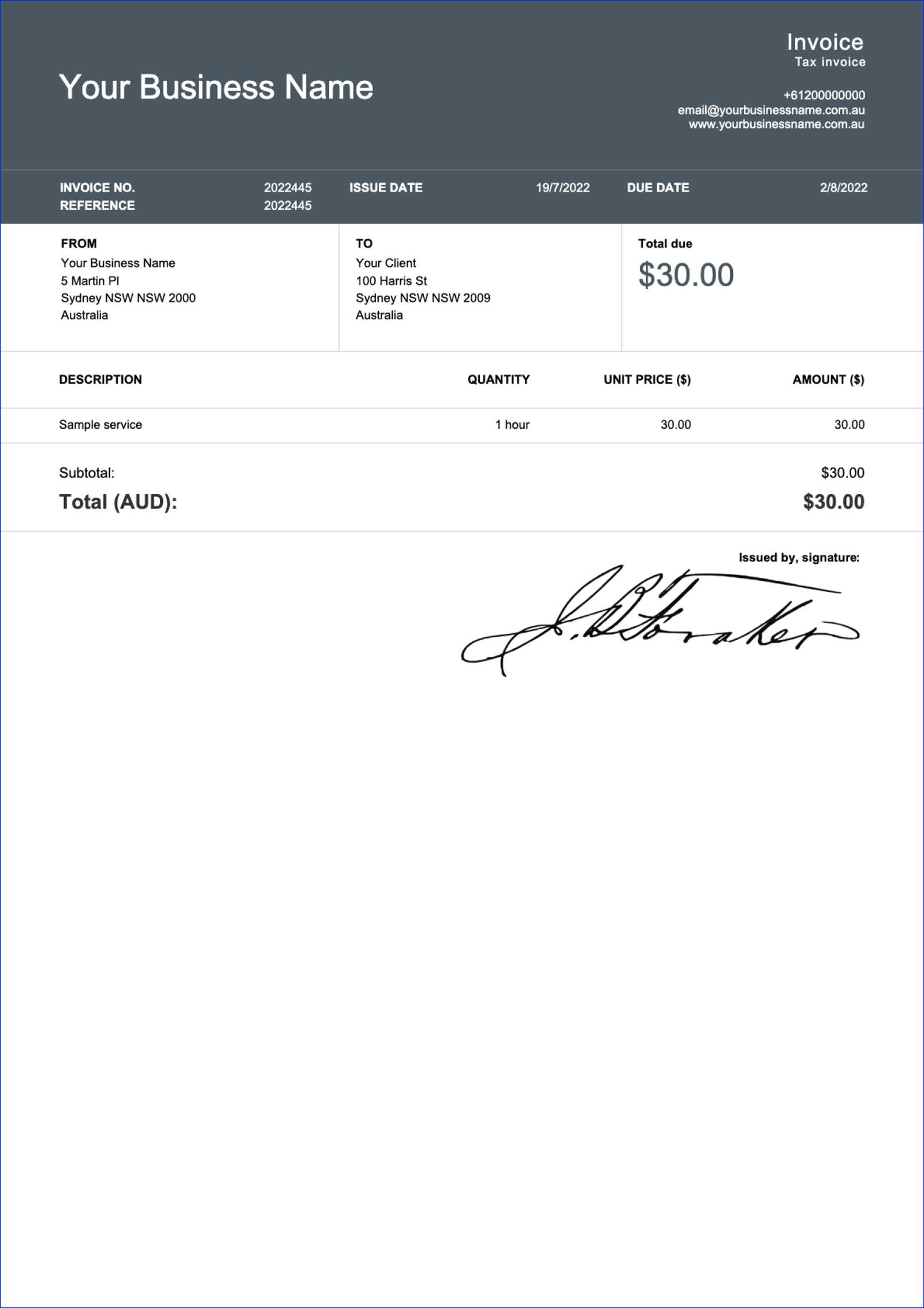

How to Create a Simple Invoice

Creating a straightforward payment request document doesn’t have to be complicated. By focusing on key details, you can build a clear and effective form that communicates all the necessary information to your clients. The goal is to ensure that all essential elements are included and that the layout is simple to understand, making it easier for clients to process the payment promptly.

Follow these simple steps to create an efficient document:

- Start with your details: Include your business name, address, phone number, and email at the top of the document.

- Add client information: Clearly state the name of the client, their business name (if applicable), and their contact information.

- List services or products: Include a description of what was provided, along with quantities and individual prices. This breakdown helps clients understand exactly what they are being charged for.

- Specify the total amount due: Sum up the cost of all services or products, including any applicable taxes or discounts.

- State payment terms: Indicate when payment is due, your preferred method of payment, and any penalties for late payments.

By following these steps, you can create a basic but functional document that meets the needs of both you and your client. A simple, clear structure ensures transparency and helps foster a smooth transaction process.

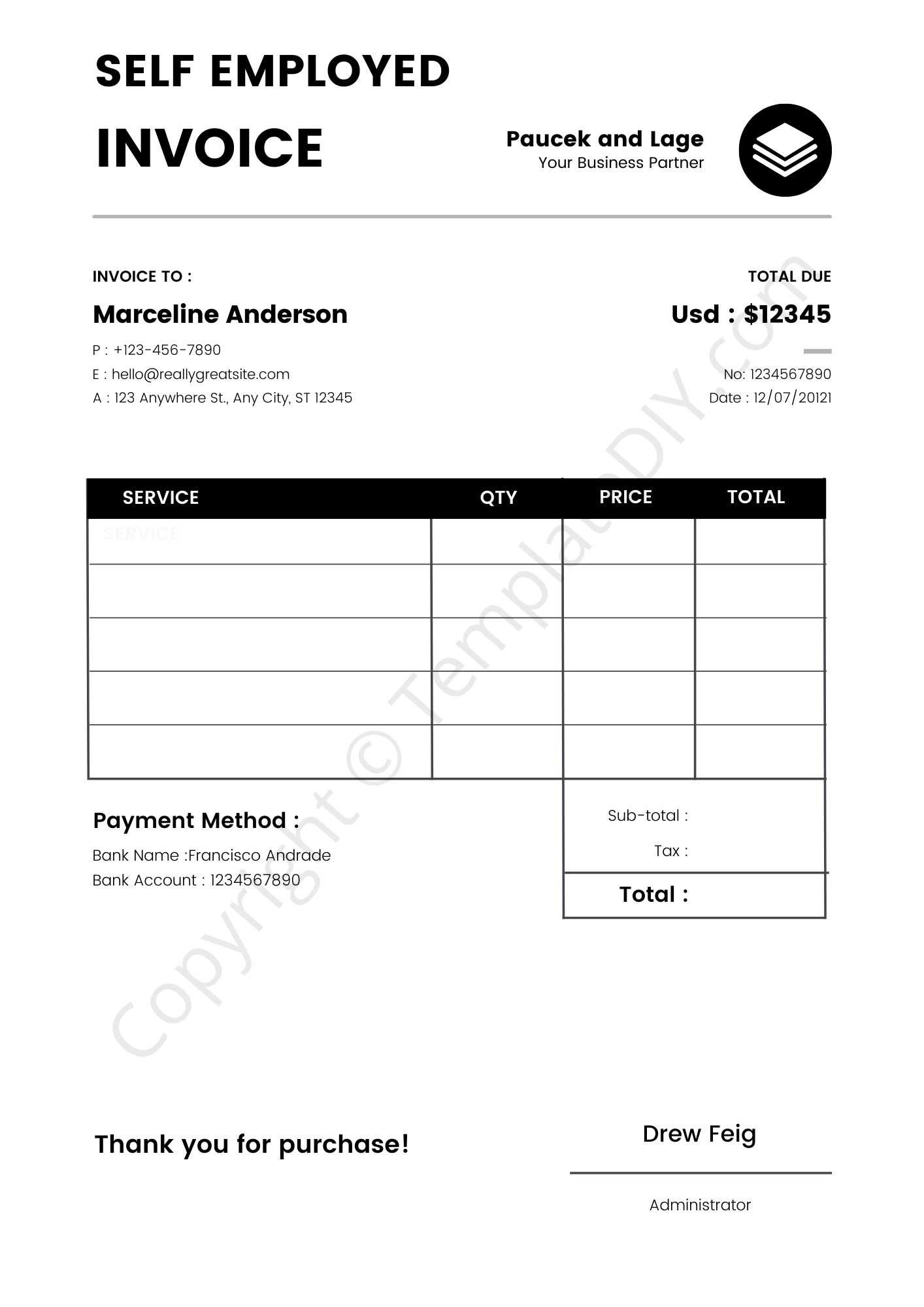

Essential Elements of an Invoice

To ensure that your financial documents are complete and effective, it’s crucial to include specific information that both you and your clients can easily understand. These key components not only help in organizing the payment process but also ensure that there is no confusion when it comes to expectations and terms. A well-structured document makes it clear what was provided, what the cost is, and when the payment is due.

Key Details to Include

While the layout and design can vary, certain details should always be present to ensure clarity and accuracy. Here are the essential elements that must be included:

- Contact Information: Include your full name or business name, address, phone number, and email. Similarly, add the client’s details to ensure clear identification.

- Description of Services or Goods: Provide a detailed breakdown of what you’ve delivered. This could be hours worked, services rendered, or products sold.

- Quantity and Price: Clearly list the quantity of goods or hours of service, along with the respective cost for each item or service provided.

- Total Amount Due: Include the full amount owed, factoring in any taxes or discounts.

- Payment Terms: Specify the payment deadline and any additional terms, such as late fees or early payment discounts.

- Invoice Number: A unique number for each document to help you track payments and maintain accurate records.

Why These Elements Matter

Including these essential components helps avoid any confusion or delays. It ensures that both you and your client are on the same page regarding what has been provided and the terms for payment. Clear communication through these details also helps maintain a professional image, which is vital for long-term business success.

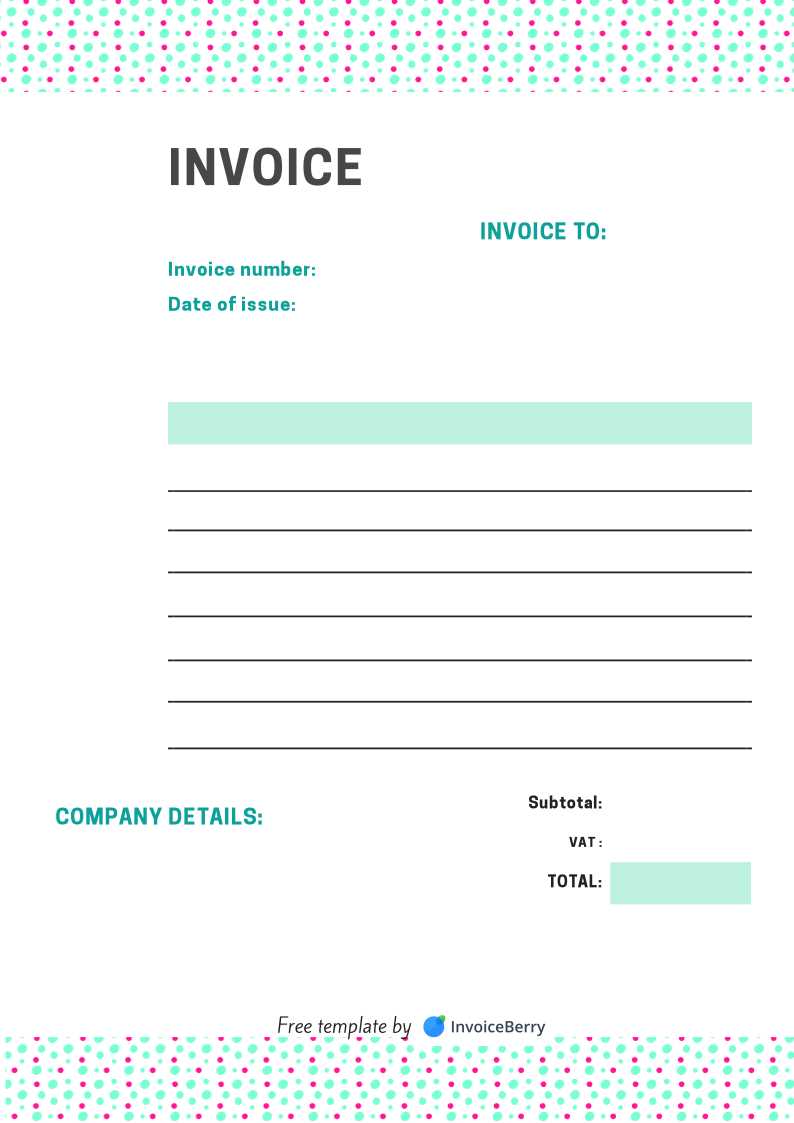

Best Free Templates for Freelancers

For independent professionals, having the right document for billing clients is essential for smooth transactions. Whether you’re offering services or selling products, a well-organized and easy-to-use document can save time and improve your workflow. Many online resources provide excellent, pre-designed formats that you can adapt to your specific needs, ensuring both professionalism and efficiency in handling financial requests.

Top Options for Simple and Effective Forms

Several websites offer customizable options for independent contractors looking to create polished financial documents. These options vary in style and functionality but all share a common goal: to streamline the payment process. Here are a few of the best options available:

- Microsoft Word Templates: A simple and widely accessible option, Word templates offer professional-looking formats that can be quickly edited to fit your needs. You can find many free designs with easy-to-fill fields for your business details, client information, and service descriptions.

- Google Docs Forms: For those who prefer a cloud-based solution, Google Docs provides several templates that can be accessed, edited, and stored online. This is a great choice for freelancers who need to access their documents from multiple devices or locations.

- Canva: Known for its design capabilities, Canva offers beautifully designed documents that can be customized to reflect your brand. Its drag-and-drop interface makes it simple to modify layout, fonts, and colors, ensuring your billing forms stand out.

- Zoho Invoice: This tool offers a more advanced solution with customizable templates that you can save, track, and manage all your financial requests from one place. Ideal for freelancers who want to automate or streamline their invoicing process.

Choosing the Right Format

When selecting a pre-designed format, consider the type of work you do and the clients you serve. If you work with multiple clients or projects, a digital format with tracking capabilities might be the best choice. If you’re looking for something quick and simple for occasional use, a downloadable Word or Google Docs template could be a better fit. The goal is to choose something that fits your needs while still maintaining a polished, professional appearance.

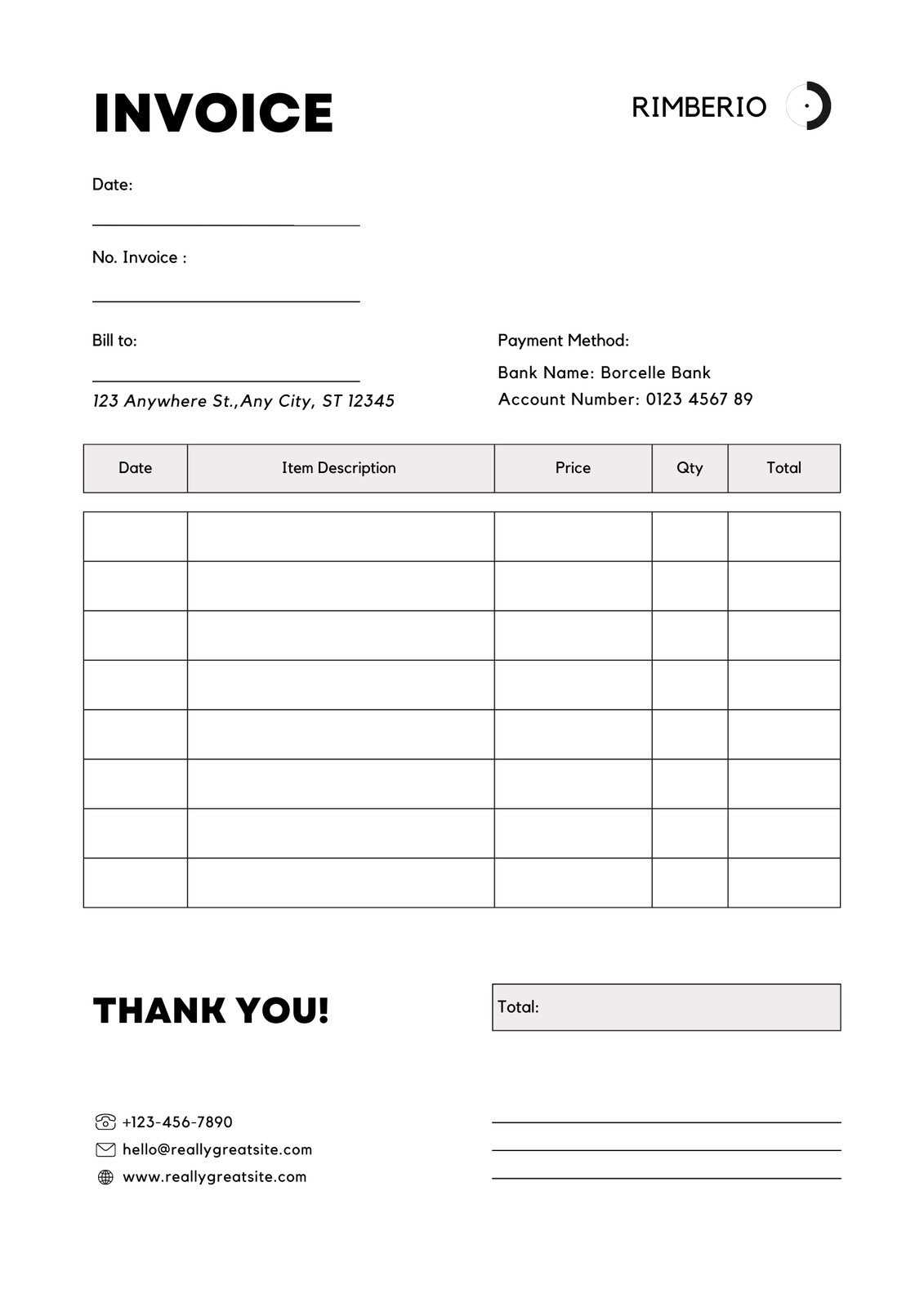

How to Personalize Your Invoice Design

Customizing your payment request document not only reflects your brand but also enhances your professionalism. By adding personalized touches, you make the document stand out while ensuring it aligns with your business identity. Personalization can range from small design elements, such as fonts and colors, to more functional aspects, like layout and additional fields that better fit your specific needs.

Essential Design Elements to Personalize

When customizing your financial request form, several design aspects can be adjusted to make it uniquely yours. Here are the key elements to consider:

- Branding: Incorporate your logo and business name at the top of the document to ensure your clients can easily identify your company. Using your brand colors throughout the document also helps reinforce your business identity.

- Fonts and Layout: Choose fonts that match your brand’s style–professional yet easy to read. Additionally, adjusting the layout can make the document more intuitive, with important details highlighted in a clear and organized way.

- Additional Information: Depending on your needs, you might want to include custom fields, such as project numbers, payment references, or service details. This ensures the document captures all the necessary information specific to your business operations.

Example of a Personalized Payment Request

Here’s a simple example of how a customized document could be structured to reflect your business:

| Component | Personalization Example |

|---|---|

| Header | Business logo, company name, and contact info in brand colors |

| Service Description | Detailed description of the project or service provided |

| Terms & Payment | Clear payment instructions, including preferred method and due date |

| Footer | Optional business tagline or additional contact details for further inquiries |

By incorporating these elements into your document, you create a polished and professional look that reflects your brand, while also providing clients with all the necessary information they need for a smooth payment process.

Choosing the Right Format for Your Invoice

Selecting the right structure for your payment request is crucial for ensuring clarity and efficiency. The format you choose can significantly impact how quickly your client processes the payment and how easily they understand the terms. Depending on your business needs and the tools you use, there are several options to consider. Each format offers different features, so it’s important to select the one that works best for you and your clients.

Factors to Consider When Choosing a Format

Here are some key factors that can help guide your decision when selecting the most appropriate structure for your financial documents:

- Ease of Use: The format should be simple to edit and customize. If you’re using digital tools like Google Docs or Microsoft Word, ensure the layout is easy to modify as you add details for each project.

- Client Preferences: Some clients may prefer a PDF, while others may be comfortable with an online platform. It’s important to understand how your clients like to receive payment requests and offer that option.

- Tracking and Management: If you need to manage multiple payment requests, consider using a format that allows you to track and store documents easily. Digital platforms like Zoho or QuickBooks can help you stay organized by automating reminders and payment history.

- Design Flexibility: Choose a format that allows you to incorporate your branding elements, such as logos, colors, and fonts. A well-branded document can enhance your business image and create a professional impression.

Types of Formats to Consider

Depending on the nature of your work and your preferences, here are the most common formats for creating and sending a financial request:

- PDF: This is the most commonly used format, as it is easy to share, secure, and can be opened on nearly any device. It’s ideal if you want to ensure your document’s design and formatting remain intact.

- Word/Google Docs: These formats offer flexibility in editing and are easy to update for recurring clients. They can also be converted into PDFs for final delivery.

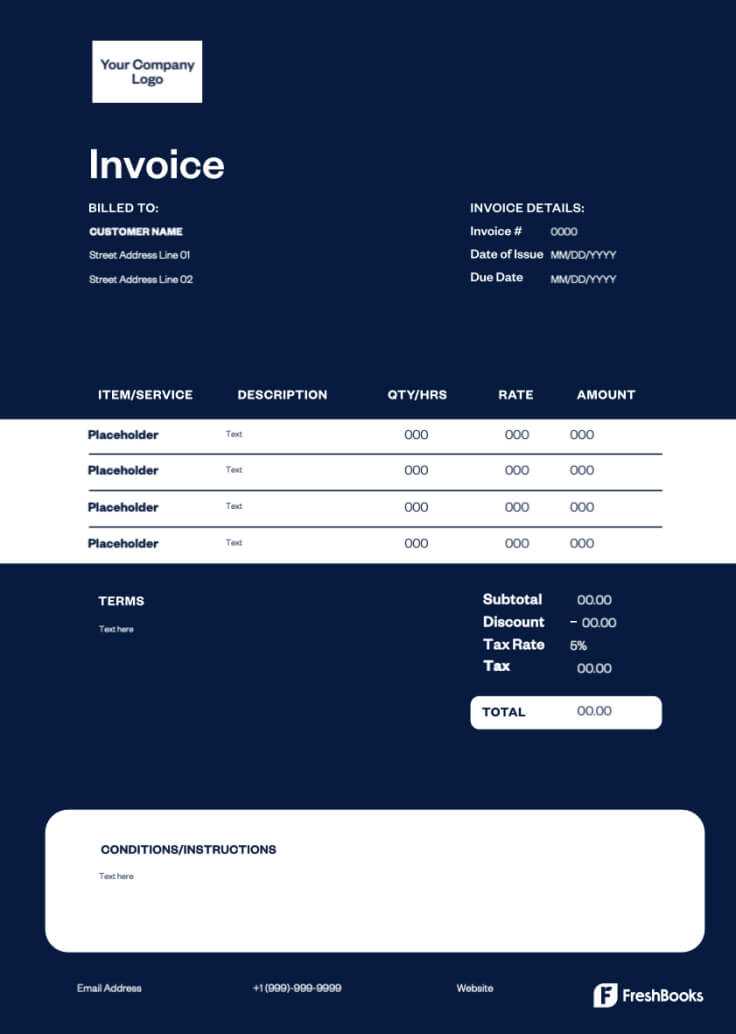

- Online Tools (e.g., Zoho, FreshBooks): If you prefer automation and need to manage multiple payment requests, online invoicing tools can simplify the process by providing templates, tracking, and payment reminders.

- Excel/Google Sheets: For freelancers or small businesses that handle large volumes of transactions, spreadsheets can be used to create detailed, itemized payment requests while also tracking payments and taxes.

Ultimately, the format you choose should balance ease of use with your business needs. By unde

Top Software for Editing Invoice Templates

Choosing the right software to create and modify your billing documents can greatly enhance the efficiency and professionalism of your business. Various tools are available that allow for easy customization, offering both basic and advanced features to meet your needs. These programs provide the flexibility to design and manage payment requests that are both functional and visually appealing. Whether you’re a freelancer or a small business owner, selecting the right editing software can save time and ensure your financial documents meet professional standards.

Here are some of the top software options for editing and customizing billing documents:

- Microsoft Word: A widely used tool that offers a range of customizable templates. It’s simple to use, and many versions come with pre-built designs that you can modify to suit your needs.

- Google Docs: Ideal for cloud-based collaboration, Google Docs allows you to create, edit, and share documents easily. It also provides flexibility for customization, and templates can be saved and reused across devices.

- Canva: Known for its design capabilities, Canva allows users to create visually striking documents with a variety of fonts, graphics, and layouts. Its intuitive drag-and-drop interface makes customization easy for both beginners and advanced users.

- Zoho Invoice: This software offers customizable options tailored for small businesses and freelancers. It allows for easy creation of professional billing documents and offers additional features such as payment tracking and client management.

- FreshBooks: A popular tool for freelancers and small businesses, FreshBooks provides customizable designs and automation features, such as recurring billing and online payment options, making the process of managing finances seamless.

- QuickBooks: Best known for accounting, QuickBooks also provides easy-to-use customization options for creating financial documents. It integrates well with accounting features, making it a good choice for businesses that need both invoicing and financial management in one place.

Each of these software solutions offers unique features that cater to different business needs. Choosing the right one depends on the level of customization you require, as well as whether you need additional tools for tracking payments, managing clients, or handling taxes. By selecting the right platform, you can save time and create professional payment requests that are easy for both you and your clients to use.

Tips for Professional Invoice Formatting

Creating a well-organized and professional payment request can make a significant difference in how clients perceive your business. Clear formatting not only helps clients understand the details of what they are being charged for but also reflects positively on your business. A clean, structured document conveys competence and professionalism, helping to build trust and ensuring smoother transactions.

Key Formatting Tips for a Polished Look

To achieve a professional appearance and ensure your documents are both functional and visually appealing, consider the following formatting tips:

- Use a Clean and Simple Layout: Avoid cluttering the document with unnecessary information or complex designs. A clear, simple structure with distinct sections for contact details, services provided, payment terms, and total amount is easier to read and process.

- Maintain Consistent Font Styles: Stick to one or two fonts that are easy to read. Use a larger font size for the header and section titles to create a visual hierarchy. Consistency in font choices makes the document look more cohesive and professional.

- Include Adequate Spacing: Ensure there is enough white space between sections and details. Proper spacing not only improves readability but also creates a less cramped, more organized document.

- Align Text Properly: Make sure all text is aligned correctly–such as aligning amounts to the right and descriptions to the left. This creates a cleaner look and ensures that clients can easily follow the document.

- Use Borders or Lines: Incorporating subtle borders or lines to separate sections can help guide the reader’s eye and make the document feel more organized.

Visual Elements to Enhance Professionalism

In addition to formatting, subtle design elements can elevate your document’s appearance and reinforce your brand identity:

- Incorporate Your Brand Colors: Use your business’s color scheme to make the document visually consistent with your overall brand. This helps reinforce brand recognition and creates a more polished look.

- Logo Placement: Position your logo at the top of the page to ensure that your brand is front and center. This not only adds a professional touch but also helps with brand recognition.

- Visual Consistency: Ensure that any design elements you include, such as icons, borders, or shading, are consistent throughout the document. This reinforces the cohesive feel and professionalism of the overall design.

By following these formatting tips, you can create documents that not only serve their functional purpose but also leave a lasting, positive impression on your clients. A well-formatted document is a small but powerful way to showcase your business’s professionalism and attention to detail.

How to Include Payment Terms Effectively

Clearly outlining the terms for payment is essential to avoid misunderstandings and ensure timely transactions. Including payment details in your billing document not only sets expectations but also helps in maintaining a professional relationship with your clients. These terms should be unambiguous and easy to find within the document so that there is no confusion regarding the due date, accepted payment methods, or penalties for late payments.

Key Elements to Include in Payment Terms

To ensure that your payment terms are both clear and effective, here are the critical elements to include:

- Due Date: Clearly state the specific date by which the payment should be made. This helps to avoid any ambiguity and ensures your clients know exactly when the payment is expected.

- Accepted Payment Methods: List the payment methods you accept, such as bank transfers, credit cards, online payment systems (e.g., PayPal, Stripe), or checks. This ensures the client knows how to pay and avoids delays caused by method misunderstandings.

- Late Fees or Penalties: If you charge late fees for overdue payments, clearly specify the amount or percentage of the fee and when it will be applied. For example, “A late fee of 2% will be applied to any payments made after 30 days.” This creates an incentive for clients to pay on time.

- Early Payment Discounts: If you offer any discounts for early payments, be sure to include those terms. For example, “A 5% discount will be applied if payment is received within 10 days.” This can encourage faster payments and improve cash flow.

- Invoice Reference: Include a note requesting the client to reference the document number when making payment. This helps with identifying and tracking the payment, especially if you have multiple clients or projects.

How to Present Payment Terms Clearly

For maximum clarity, place the payment terms in a prominent spot on your document, usually near the bottom, or after the service or product details. Use bold or italicized text to make them stand out, ensuring they are easy to find and read. Consider grouping the terms together in a section labeled “Payment Terms” to give them visibility.

Here’s an example of how payment terms could be written:

Payment Terms: - Due Date: [Insert Due Date] - Accepted Payment Methods: Bank Transfer, PayPal, Credit Card - Late Fee: A 5% fee will be applied after [X] days. - Early Payment Discount: 10% off if paid within 7 days.

Including these payment details in a clear and professional manner not only helps avoid confusion but also builds a transparent and reliable business relationship with your clients.

Understanding Tax Information on Invoices

Incorporating tax details into your payment requests is a crucial step in ensuring legal compliance and transparency with your clients. Tax laws can vary by country, region, and type of service, so it’s important to understand what information needs to be included and how to present it correctly. Accurate tax reporting not only avoids potential legal issues but also ensures that your clients are aware of the exact breakdown of costs, helping to build trust and professionalism.

Key Tax Information to Include

When preparing your billing documents, it is essential to include the necessary tax-related information to avoid confusion and ensure transparency. Below are the key elements that should be included in the tax section:

- Tax Rate: Specify the percentage rate that applies to the service or product being billed. This rate can depend on your location or the nature of the transaction (e.g., sales tax, VAT, or GST).

- Tax Amount: Clearly state the actual tax amount that is being charged based on the total cost of services or products. This helps clients see exactly how much tax is being applied.

- Tax Registration Number: If required by your jurisdiction, include your tax registration number or VAT ID number. This shows that your business is registered for tax purposes and ensures compliance with local tax laws.

- Exemption Details (if applicable): If any part of the transaction is tax-exempt (due to the nature of the service or the client’s status), indicate this exemption clearly on the document.

Example of Tax Information Breakdown

Here’s an example of how you can format the tax information on your payment request:

| Service Description | Amount | Tax Rate | Tax Amount |

|---|---|---|---|

| Consulting Services | $500.00 | 10% | $50.00 |

| Total | $500.00 | $50.00 |

In the example above, the tax is clearly shown alongside the service amount, making it easy for the client to understand the breakdown. If your business is registered for VAT or sales tax, including this information ensures you meet legal requirements and avoid any misunderstandings with your clients.

By understanding and incorporating tax details accurately, you ensure smooth transactions, maintain professionalism, and stay compliant with tax regulations.

How to Send Invoices Efficiently

Timely and effective delivery of billing documents is essential for ensuring prompt payment and maintaining positive relationships with clients. Streamlining your process for sending requests for payment can save you time, reduce errors, and improve your cash flow. Whether you send documents via email, online tools, or traditional mail, implementing a consistent, efficient approach will enhance your business operations and help you get paid faster.

Steps to Streamline the Delivery Process

To send your payment requests efficiently, consider these key steps:

- Use Digital Tools for Automation: Online platforms such as FreshBooks, QuickBooks, and Zoho allow you to create, send, and track your payment documents automatically. These tools often come with built-in reminders for clients, reducing the risk of overdue payments.

- Maintain a Client Database: Keeping a well-organized list of client contact details helps you quickly access the information needed to send billing documents. Digital tools often allow you to store client information securely and use it for bulk billing, which can save time if you have multiple clients.

- Double-Check Your Information: Before sending out any payment request, make sure the details are accurate. Verify amounts, services, tax rates, and due dates. Sending incorrect documents can delay payment and harm your professional reputation.

- Choose the Right Delivery Method: Depending on client preferences, you can send documents via email, online payment platforms, or traditional mail. For most clients, digital delivery is the quickest and most cost-effective method, but it’s important to know your clients’ preferences for ease and efficiency.

Tracking and Follow-Up Strategies

In addition to streamlining the sending process, it’s crucial to have a system for tracking and following up on payments. This ensures that no payment goes unnoticed and you can take action when necessary.

- Set Reminders: Most online tools offer automatic reminders for both you and your clients. Set these up to be sent a few days before and after the due date, so clients are reminded of outstanding payments.

- Keep a Payment Log: Maintain a record of all sent documents, including dates of delivery, amounts, and payment statuses. This log helps track unpaid amounts and identify clients who frequently delay payments.

- Follow Up Professionally: If payment has not been received by the due date, send a polite follow-up email or message. Be firm but courteous in your communication, and remind the client of the payment terms outlined in your document.

By automating and organizing your payment request process, you can minimize errors and delays while maximizing efficiency. This not only saves you time but also ensures a smoother, more professional transaction for both you and your clients.

Automating Your Invoice Process

Automating the billing and payment request process can save you significant time, reduce errors, and improve cash flow. Instead of manually creating and sending payment requests for every project or transaction, automation tools allow you to streamline the entire process. By setting up templates, reminders, and automatic updates, you can focus more on growing your business while ensuring that payments are consistently and promptly received.

Benefits of Automating Billing Tasks

Here are some of the key advantages of automating your billing and payment request process:

- Time-Saving: Automation tools handle the repetitive tasks of creating, sending, and tracking requests for payment, freeing up time that can be spent on more important aspects of your business.

- Consistency: Automated systems ensure that every payment request is consistent in terms of format, content, and timing, helping you maintain a professional and reliable image with clients.

- Reduced Errors: Manual data entry can lead to mistakes, such as incorrect amounts or payment details. Automation significantly reduces the risk of human error, ensuring more accurate transactions.

- Faster Payments: With automated reminders and due date tracking, clients are more likely to pay on time, improving your cash flow and minimizing the need for follow-up communication.

How to Set Up Automation for Billing

Setting up an automated system for managing your payment requests doesn’t have to be complicated. Many online tools and platforms offer customizable features that you can tailor to your needs. Here are the basic steps to get started:

- Choose the Right Software: Look for platforms like FreshBooks, QuickBooks, or Zoho that offer invoicing automation. These tools often include pre-built templates, automatic tax calculations, and the ability to set recurring billing schedules.

- Create Billing Templates: Design a standardized billing format that can be reused for each client. Include all the necessary fields such as service descriptions, payment due dates, and tax information. Templates make the process faster and more consistent.

- Set Up Recurring Billing (if applicable): If you provide services on a subscription or regular basis, set up automatic recurring billing. This ensures that payments are collected at regular intervals without manual intervention.

- Activate Payment Reminders: Many automated systems allow you to schedule reminders to be sent to clients a few days before and after the payment due date. This reduces the need for manual follow-ups and helps ensure timely payments.

- Integrate Payment Gateways: Use integrated payment systems (e.g., PayPal, Stripe) to allow clients to pay directly through the payment request, streamlining the process for both you and your clients.

By automating your billing process, you can increase efficiency, reduce administrative burden, and improve your client experience. Investing in the right tools and processes will lead to a more organized and profitable business operation.

Common Invoice Mistakes to Avoid

Creating accurate payment requests is essential for smooth transactions and maintaining a professional image with clients. However, mistakes in your billing documents can lead to confusion, delayed payments, or even disputes. Understanding the most common errors and how to avoid them can help streamline your process and ensure that you get paid on time without unnecessary complications.

Common Mistakes to Watch Out For

Here are some of the most frequent mistakes businesses make when preparing their payment documents:

- Missing Contact Information: Always include the correct details for both parties, including your business address, phone number, and email. Omitting this information can delay communication and payments.

- Incorrect Amounts: Double-check the amounts you’re billing for services or products. Even small errors can lead to disputes and confusion, so it’s essential that all calculations are accurate.

- Unclear Payment Terms: Clearly state payment deadlines, methods, and any late fees. Ambiguity can cause confusion and delays, so it’s best to ensure your payment terms are explicit and easy to understand.

- Failure to Include Taxes: In many regions, taxes must be included separately in your billing document. Not including the correct tax details can result in non-compliance and may cause delays in payment processing.

- Not Using a Unique Identifier: Always assign a unique reference number to each billing request. This allows both you and your client to track the payment easily and reduces the chance of payments being lost or overlooked.

How to Prevent These Mistakes

By implementing simple checks and using automated tools, you can avoid these common errors:

- Use Software for Accuracy: Automated tools can help reduce errors in calculations and formatting. Many invoicing platforms also have built-in templates to ensure consistency and completeness.

- Verify Details Before Sending: Always review the document for missing or incorrect information before sending it out. A second set of eyes can help catch errors you may have missed.

- Standardize Your Process: By using a consistent format and set of procedures for all your payment requests, you can minimize the chance of forgetting essential details.

Example of a Properly Formatted Payment Request

Here is an example of a correctly formatted payment request that avoids common mistakes:

| Item/Service | Amount | Tax | Total |

|---|---|---|---|

| Consulting Session | $200.00 | $20.00 (10%) | $220.00 |

| Total | $200.00 | $20.00 | $220.00 |

In this example, all necessary details such as service description, amounts, taxes, and total charges are clearly laid out, minimizing confusion and preventing common errors.

By taking the time to ensure your payment requests are free of mistakes, you can avoid payment delays, build stronger client relationships, and present a more professional image.

How to Track Your Payments

Monitoring payments is an essential aspect of maintaining a healthy cash flow and ensuring timely receipt of funds. Without a proper system in place, it can be easy to lose track of outstanding balances and overdue amounts. Implementing a consistent method for tracking payments helps avoid delays, reduces the risk of missed payments, and provides clarity on which clients have settled their balances and which still owe money.

Methods for Effective Payment Tracking

Here are some effective ways to track payments and ensure you stay on top of your financial transactions:

- Use Accounting Software: Investing in reliable accounting tools like QuickBooks, FreshBooks, or Xero can streamline the payment tracking process. These platforms allow you to automatically log received payments, track overdue amounts, and generate detailed financial reports.

- Set Up a Payment Schedule: Establish clear payment schedules for all clients, including due dates and preferred payment methods. This helps both you and your clients stay on the same page regarding when funds are expected.

- Maintain a Payment Log: For those who prefer a more hands-on approach, keep a manual record of all transactions. A simple spreadsheet can be used to track amounts, dates, payment methods, and any notes related to the payment status.

- Use Reminders and Alerts: Set up email or calendar reminders for upcoming payments or overdue balances. Many accounting systems and project management tools offer built-in notification features to automatically remind you when a payment is due or late.

Benefits of Tracking Payments

Proper payment tracking offers several advantages for your business:

- Improved Cash Flow Management: Keeping track of payments ensures you know when funds are coming in, helping you better plan for future expenses and avoid cash flow issues.

- Better Client Relationships: Timely reminders and clear communication regarding payments show your clients that you are organized and professional, which can lead to smoother transactions and stronger working relationships.

- Reduced Risk of Late Payments: By staying on top of due dates and sending reminders, you reduce the likelihood of missing out on payments or having to chase clients for overdue amounts.

- Transparency and Accountability: Tracking payments helps you keep accurate financial records and allows you to quickly identify and resolve any discrepancies with clients.

By putting an efficient tracking system in place, you can maintain a smoother, more organized approach to managing payments, leading to faster payments and a more secure financial situation.

How to Handle Late Payments

Dealing with overdue payments is an unfortunate but inevitable part of business. Late payments can create cash flow problems and cause unnecessary stress, especially if you rely on timely transactions to cover your expenses. Understanding how to handle these situations professionally can help you protect your business relationships while ensuring you get paid for the services or products you’ve provided.

Steps to Manage Late Payments Effectively

When you encounter overdue payments, it’s important to take a structured approach to resolve the issue. Here are some steps you can take to ensure payments are made while maintaining positive client relationships:

- Send a Reminder: As soon as a payment becomes overdue, send a polite reminder to the client. Sometimes, a simple nudge is all it takes to prompt action. Be sure to include all relevant details, such as the outstanding amount and the original due date.

- Follow Up with a Formal Notice: If there’s still no response after your initial reminder, send a formal letter or email outlining the overdue balance, any applicable late fees, and a new payment deadline. Make sure the tone remains professional, but firm.

- Offer Payment Options: In cases where clients are having difficulty paying in full, consider offering flexible payment options, such as splitting the amount into smaller installments. This can make it easier for clients to pay off their balance without straining their finances.

- Set Clear Terms in Advance: To avoid future late payments, make sure your payment terms are clearly outlined from the start. This includes specifying due dates, any interest or fees for late payments, and consequences for not adhering to the terms.

- Know When to Escalate: If the client continues to delay payments despite multiple reminders, it may be necessary to escalate the situation. You can send a final notice indicating legal action, or you may need to hire a collections agency to recover the outstanding balance.

When to Charge Late Fees

Charging late fees is an effective way to encourage timely payments. However, it’s important to communicate these fees upfront and ensure your clients are aware of them. Below is an example of how you might structure late fees in your terms:

| Due Date | Late Fee | Additional Charges |

|---|---|---|

| Up to 5 days | No Fee | No Additional Charges |

| 6-10 days | 5% of the total amount | No Additional Charges |

| 11-20 days | 10% of the total amount | Interest of 1% per day |