Invoice Template for Home Repairs Easy Customization and Use

Managing payments efficiently is essential for anyone in the construction or maintenance business. Whether you’re a handyman, plumber, or electrician, having a reliable way to document and request payment is crucial. Using a well-organized document helps maintain professionalism and ensures both parties are clear on the services provided and the agreed amount.

By utilizing a customizable billing structure, professionals can streamline their operations, save time, and reduce misunderstandings. A properly designed form provides a clear summary of tasks completed, materials used, and total costs, making it easier to track earnings and manage financial records. This tool can also serve as a reference for future projects and tax purposes.

In this article, we’ll explore how such documents can benefit your business, what essential elements should be included, and how to make sure the process of billing is both efficient and professional. Whether you’re just starting out or looking for a more organized approach, this guide will help you get on the right track.

Invoice Template for Home Repairs

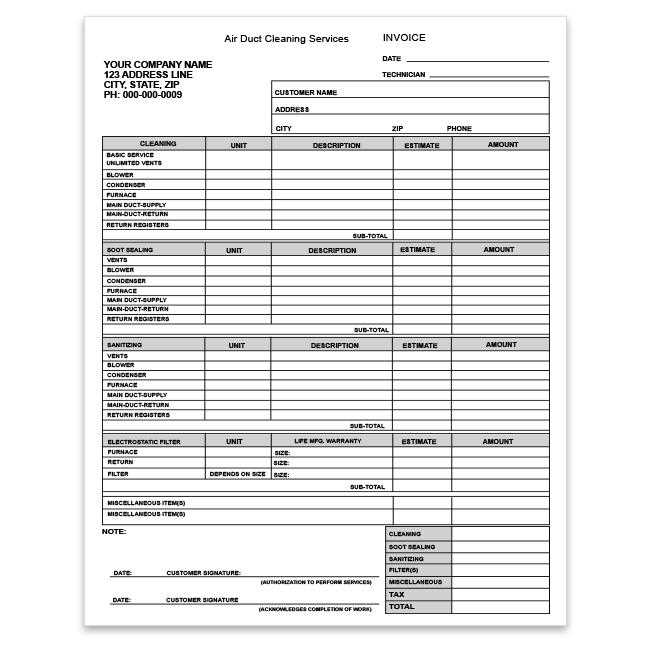

A well-structured document is essential when requesting payment after completing a project. It provides a detailed summary of the work completed, materials used, and the agreed-upon fees. This record helps both parties stay organized and ensures clear communication about the transaction. With a customizable structure, it can be adapted to various types of tasks, making it a versatile tool for any professional service provider.

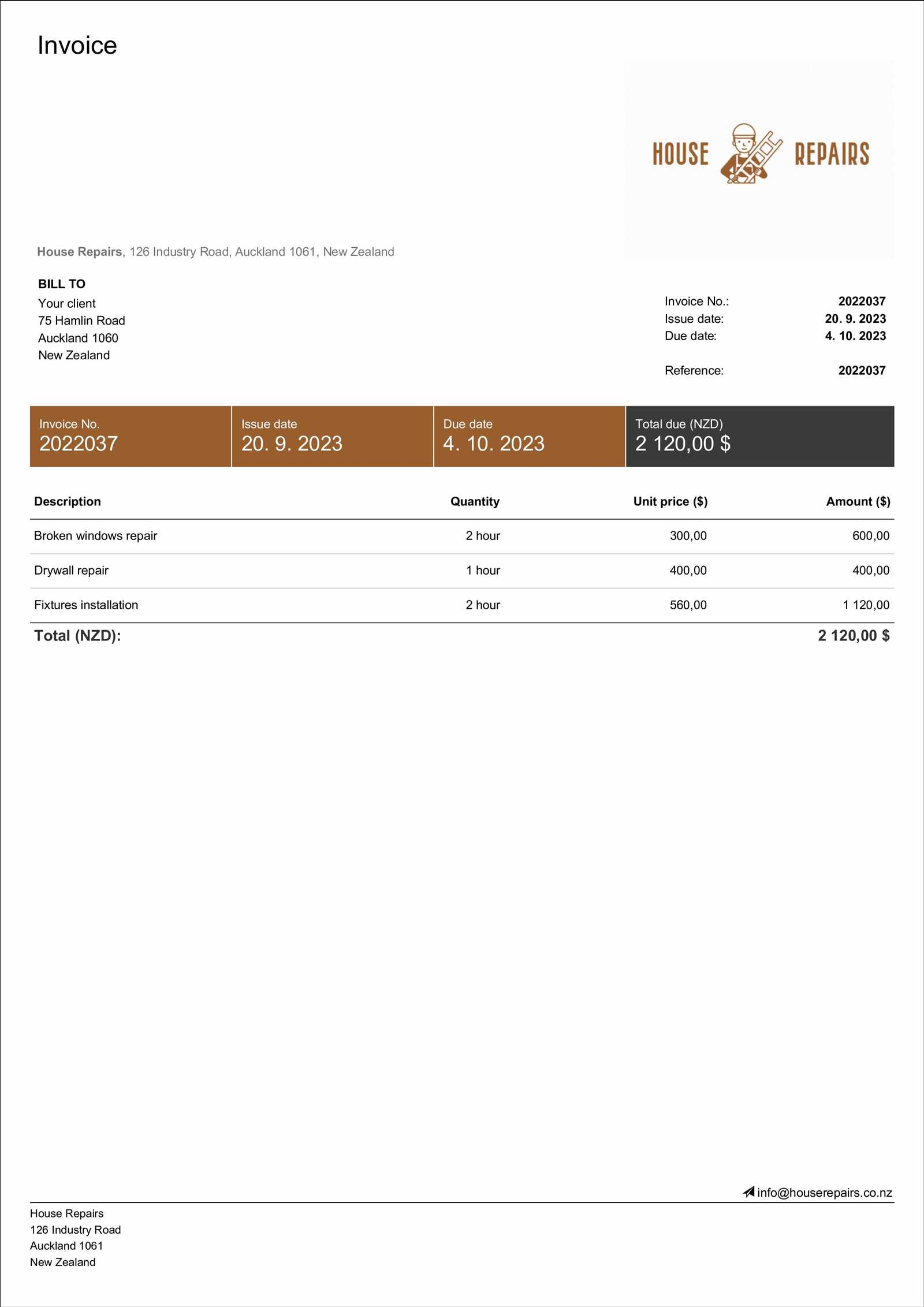

The following example outlines the key components you should include in your billing document. Each section ensures that the customer understands the charges and helps maintain transparency in your business transactions.

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Labor | 5 hours | $50 | $250 |

| Materials | 5 items | $30 | $150 |

| Total Amount | $400 | ||

By including these sections, you can present a clear, professional overview of the services provided, ensuring that there are no misunderstandings regarding payment expectations. Adjusting quantities, prices, and item descriptions is simple, making this structure adaptable for various types of work.

Why You Need an Invoice Template

When managing a service-based business, clear and organized documentation is crucial for both you and your clients. Providing a detailed statement after completing a job not only helps establish trust but also ensures smooth transactions and clear expectations. Without a standardized way of presenting your charges, you risk confusion or disputes regarding payment.

Key Benefits of Having a Standardized Document

- Professionalism: A well-structured bill gives your business a polished and credible appearance, making clients more likely to trust your services.

- Clarity: Including all relevant details helps both parties understand the work done, the cost breakdown, and the payment terms.

- Record Keeping: A consistent format allows you to maintain organized records, which is crucial for tax purposes or tracking payments.

- Time Efficiency: Having a pre-designed format saves time when issuing payment requests, allowing you to focus on your core work.

What Happens Without It?

- Confusion can arise if clients are unclear on what they are being charged for.

- Manual or inconsistent billing practices can lead to missed payments or delays in processing.

- Without proper documentation, it may be harder to resolve disputes or follow up on unpaid balances.

Using a clear, reliable structure for all your transactions ensures that every payment request is accurate and professional, helping your business run more smoothly and efficiently.

Benefits of Using a Pre-Made Template

Using a ready-made structure to document your service charges can save time and reduce the chances of errors. Instead of starting from scratch every time, a pre-designed format ensures that all necessary information is included and formatted consistently. This approach simplifies the billing process, making it easier for both you and your clients to manage payments.

Time-Saving and Convenience

- Quick Setup: A pre-built format eliminates the need to manually design every new record, allowing you to focus more on your actual work.

- Easy Customization: You can quickly fill in relevant details such as services performed, hours worked, and materials used, saving you time while keeping things professional.

Consistency and Accuracy

- Predefined Structure: The key elements of the job, such as labor, parts, and costs, are already outlined, ensuring that nothing important is overlooked.

- Reduced Errors: With a set format, the likelihood of missing or incorrect details is minimized, which helps avoid confusion or disputes down the line.

By utilizing an established structure, you can ensure that every billing statement is clear, professional, and easy to process, leading to smoother transactions and better customer relationships.

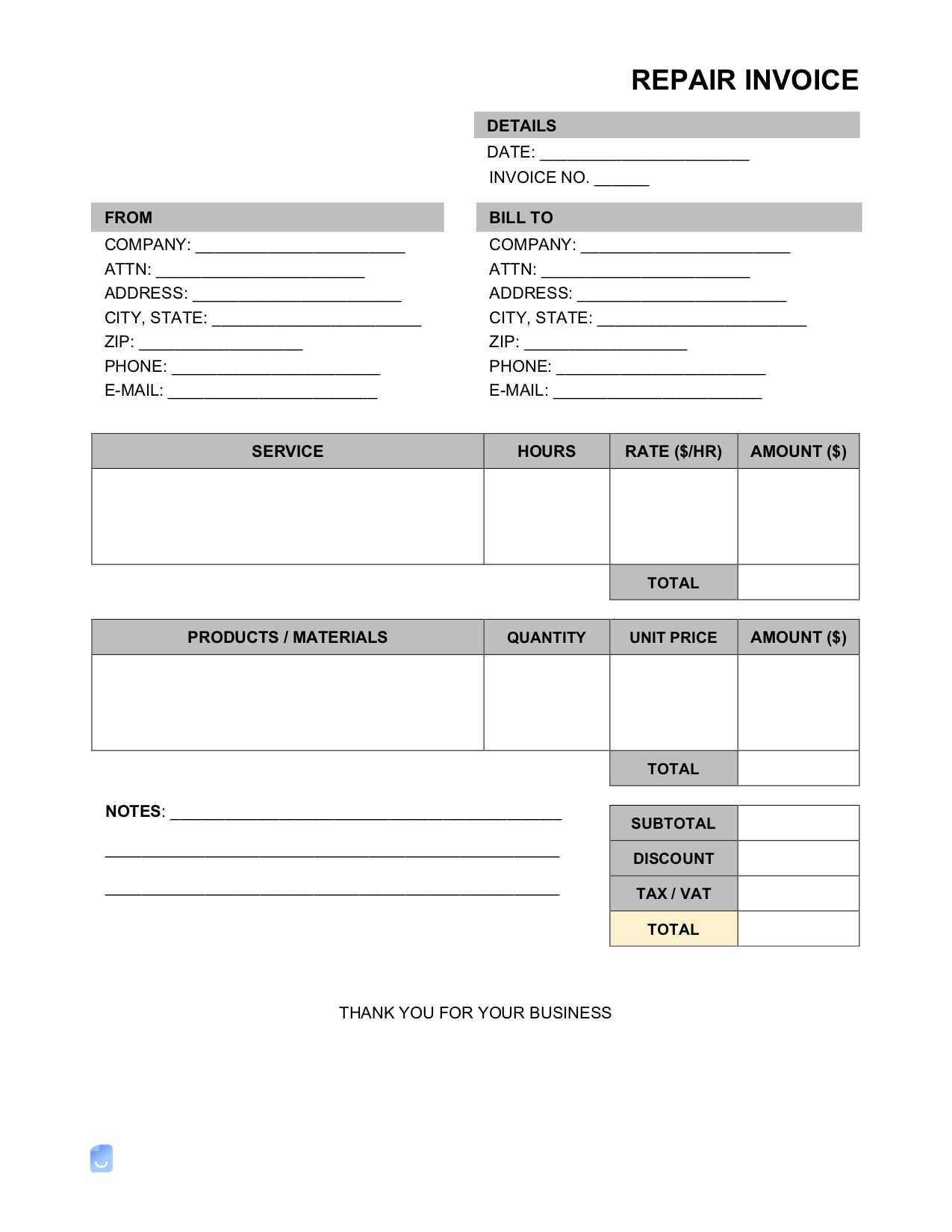

How to Create Your Own Invoice

Designing your own document to request payment is a straightforward process that allows you to personalize your billing method according to the services you provide. Having full control over the structure and details enables you to reflect the nature of your work accurately, while maintaining professionalism. Follow these simple steps to ensure you include everything necessary for a smooth transaction.

Step 1: Include Essential Information

Start by including the most important details about the service provided, as well as payment terms. A clear breakdown will help your client understand what they are being charged for and avoid confusion. Here’s what to include:

- Your business or personal name and contact information

- Client’s name and address

- Detailed description of the work completed

- Dates when services were performed

- Cost breakdown (labor, materials, taxes, etc.)

- Payment due date and instructions

Step 2: Organize the Cost Breakdown

A well-organized summary of charges helps both parties keep track of what was agreed upon. Below is an example of how to structure your cost breakdown:

| Service Description | Quantity | Unit Cost | Total Cost |

|---|---|---|---|

| Labor (5 hours) | 1 | $50 | $250 |

| Materials (Paint, Nails) | 5 | $30 | $150 |

| Total | $400 | ||

Once you’ve filled in the necessary details, your document will be ready to send to your client. With a customized format, you’ll ensure that all important elements are covered, making the process easier and more transparent for both parties involved.

Essential Elements in a Repair Invoice

When requesting payment for a completed task, it’s important to include specific details that ensure transparency and clarity between you and your client. A well-organized document not only helps the client understand the costs but also provides a reference for both parties if there are any questions later. The following elements are crucial to include in your billing statement to ensure it’s clear, accurate, and professional.

Key Information to Include

- Your Business Details: Include your name, business name (if applicable), phone number, and email address to make it easy for the client to contact you if needed.

- Client’s Details: Clearly list the name, address, and contact information of the client receiving the service.

- Work Description: Provide a detailed description of the services you performed, including the specific tasks, materials used, and the time spent.

- Dates of Service: Include the start and end dates of the work performed to give context to the charges.

- Payment Terms: Specify when payment is due, any penalties for late payments, and the accepted methods of payment (e.g., check, bank transfer, etc.).

Cost Breakdown

A detailed cost breakdown is one of the most important elements of your document, as it provides a transparent overview of the charges. Below is a simple example of how to format the costs:

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Labor (4 hours) | 1 | $45 | $180 |

| Materials (Tools, Paint) | 3 | $20 | $60 |

| Grand Total | $240 | ||

By including these key details, your document will provide a clear record of the work completed and make it easy for clients to understand the charges. Additionally, it helps maintain a professional image, which can build trust and lead to future business opportunities.

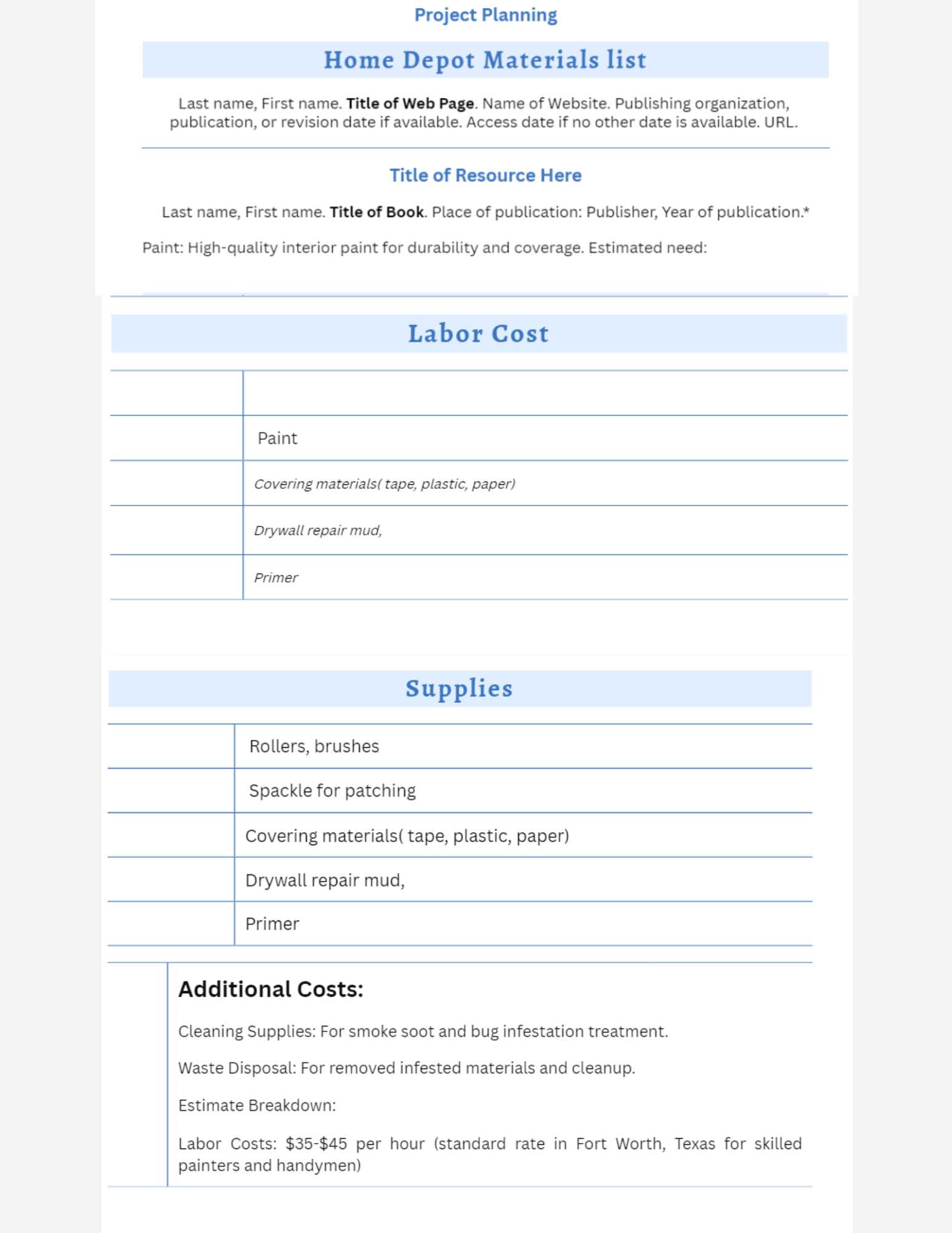

Customizing Your Invoice for Different Jobs

Each task you perform may have unique characteristics that affect how you document the charges. Tailoring your billing statement to fit the specific nature of the job can help make the transaction clearer and more accurate. Whether you’re handling a simple task or a large-scale project, adjusting the structure of your statement can ensure you capture all relevant details and present a professional image.

Factors to Consider When Customizing

- Complexity of the Work: For larger projects, break down the tasks into more detailed line items. A simple job may only need a brief summary, while a more involved project could require a more thorough description of each step taken.

- Materials Used: If different materials are used for each project, list them separately and adjust their costs accordingly. For example, high-end materials like custom finishes or specialty parts should be clearly distinguished from more standard items.

- Labor Time: For jobs that require more time, list the number of hours worked and the applicable hourly rate. For quick tasks, a flat fee may be more appropriate.

Example of Customization Based on Job Type

Consider the difference between a simple plumbing fix and a full renovation. Here’s how you could adjust your document for each:

- Small Plumbing Fix: A brief description of the issue, time spent, and materials used. A flat rate might be appropriate for this type of work.

- Full Renovation: A more detailed breakdown of each part of the job, including demolition, installation, materials, and specialized labor. You may also want to include a payment schedule if the work is going to span over several weeks.

By tailoring the structure and details of your document based on the type of service provided, you make it easier for clients to understand the charges while ensuring accurate records for both parties.

Common Mistakes to Avoid in Invoices

When requesting payment for services rendered, it’s important to ensure that the documentation is clear, accurate, and free from errors. Small mistakes can lead to confusion, delayed payments, or even disputes. Being aware of common pitfalls and addressing them beforehand can help streamline the process and maintain professionalism.

Here are some of the most frequent mistakes to watch out for when preparing a billing statement:

- Missing Client Information: Failing to include the client’s full name, address, and contact details can cause delays in communication and potential misunderstandings.

- Unclear Work Descriptions: Vague or generic descriptions of the work completed can confuse the client. Always include specific details about what was done, materials used, and time spent.

- Incorrect or Incomplete Pricing: Ensure that unit prices and total costs are clearly listed and accurate. Double-check that all charges, including taxes or additional fees, are included in the final total.

- Omitting Payment Terms: Without clear payment instructions, including the due date and accepted payment methods, clients may not know how or when to pay.

- Not Including Dates: Both the service date and the payment due date should be clearly mentioned. Omitting these details can create confusion about when the job was completed and when payment is expected.

- Failure to Follow Up: After sending a billing statement, don’t forget to follow up if payment is delayed. Clear communication is key to ensuring timely transactions.

By avoiding these common mistakes, you’ll reduce the risk of confusion, ensure smoother transactions, and build stronger, more trusting relationships with your clients.

How to Choose the Right Template

Selecting the appropriate structure to document the work and costs is essential for maintaining professionalism and clarity in your business transactions. The right format should not only reflect the services provided but also align with your business needs and the type of work you perform. There are several factors to consider when choosing the best layout for your billing documents.

Here are some important aspects to keep in mind when selecting the most suitable option:

- Ease of Use: Choose a format that is easy to fill out and doesn’t require extensive customization every time. The more straightforward it is to add details, the faster you can generate the document and move on to other tasks.

- Customization Options: Ensure the format allows for the necessary adjustments based on the type of service performed. You should be able to add line items, update prices, and include detailed descriptions without limitations.

- Professional Appearance: The layout should present a polished, professional look that helps build trust with your clients. Choose a design that is simple, clean, and easy to read.

- Compatibility: Make sure the format is compatible with the software or tools you use, whether it be a word processor, spreadsheet program, or online platform. It should be easy to save, send, and print as needed.

- Legal Compliance: Some regions may require specific information or formatting to be included in a billing document. Be sure that the structure you choose meets any necessary legal requirements, such as tax information or payment terms.

By considering these factors, you’ll be able to select a format that fits both your business needs and the expectations of your clients, ensuring smooth, efficient transactions every time.

Free vs Paid Invoice Templates

When it comes to creating a document for billing clients, you have the option of using free or paid formats. Each has its own set of advantages and limitations, and choosing the right one depends on your business needs, the complexity of your services, and how much customization you require. Understanding the differences between free and paid options can help you make an informed decision about which one is best suited for your operations.

Advantages of Free Templates

Free options can be a great starting point for small businesses or independent contractors who need a simple, no-cost solution. Here are some of the key benefits:

- Cost-Effective: Naturally, the main benefit of using a free option is that it comes at no cost, which is perfect if you’re just starting or working with a limited budget.

- Simplicity: Many free formats are straightforward and easy to use, making them ideal for basic billing needs without too many complexities.

- Quick Setup: Since they’re typically easy to access and modify, free options allow you to get started quickly, without wasting time on complicated setups.

Advantages of Paid Templates

On the other hand, paid formats often offer a more robust set of features and customization options. Here’s why you might consider investing in a premium option:

- Customization: Paid solutions often provide more flexibility, allowing you to tailor the structure to meet specific needs, such as adding custom fields, logos, or branding elements.

- Advanced Features: Some paid options come with additional features like automatic tax calculations, recurring billing, and integration with accounting software, which can save time and reduce errors.

- Professional Look: Premium formats are often designed with a polished, professional layout that reflects well on your business, improving client perception.

While free options can work well for basic needs, investing in a paid format may be worthwhile if you require additional functionality, frequent customization, or a more professional appearance for your business documentation.

Best Software for Invoice Creation

Choosing the right software to generate billing documents can greatly streamline your workflow and ensure accuracy in all your transactions. Whether you are a small business owner or a contractor, using the right tools can save you time, reduce human error, and improve the overall client experience. There are many options available, each offering a range of features tailored to different business needs. Below are some of the best software solutions for creating professional payment requests.

Top Software for Billing Documents

- QuickBooks: QuickBooks is a popular accounting tool that provides an easy way to create detailed payment requests. With customizable templates, automated reminders, and integration with other accounting features, it is ideal for businesses of all sizes.

- FreshBooks: FreshBooks is known for its user-friendly interface and customizable documents. It allows you to easily track time, manage expenses, and send professional bills, making it perfect for freelancers and small businesses.

- Zoho Invoice: Zoho Invoice offers a robust set of features, including online payment integration and multi-currency support. It’s an excellent option for businesses with international clients or those requiring detailed reporting tools.

- Wave: Wave is a free accounting software that provides invoicing and financial management tools. It’s an excellent option for small businesses or freelancers who need a simple and effective way to handle billing.

- Invoicely: Invoicely is an online platform that allows you to create professional documents, track payments, and manage clients. It offers a free plan, with the option to upgrade for additional features like time tracking and recurring billing.

Factors to Consider When Choosing Software

- Customization: Look for software that offers customizable features, such as the ability to add your branding, adjust templates, and add specific line items relevant to your business.

- Integration: Ensure that the tool you choose integrates well with other systems you may be using, such as accounting software or payment gateways.

- Ease of Use: The software should be intuitive and easy to navigate, allowing you to generate payment requests quickly without requiring extensive training or technical knowledge.

- Pricing: Consider the pricing structure–many tools offer free versions or trials, while others have paid plans based on usage or features. Choose one that fits your budget while offering the necessary functionality.

By selecting the right software, you can enhance the efficiency and professionalism of your billing processes, allowing you to focus more on your work and less on paperwork.

How Invoices Help with Tax Filing

Accurate record-keeping is crucial when it comes to managing your finances and filing taxes. Having clear and organized records of the services you’ve provided and the payments you’ve received simplifies the tax process and helps ensure compliance with tax laws. Well-documented payment requests not only provide proof of income but also help track business expenses, making it easier to claim deductions and reduce your taxable income.

Tracking Income and Expenses

Detailed records of your transactions give you a clear overview of your earnings and expenses. This is especially important during tax season when you need to report income and calculate deductions. Here’s how they can assist:

- Income Documentation: Each document serves as a record of the payments you’ve received, making it easy to report accurate earnings on your tax return.

- Expense Tracking: If you purchase materials or other goods necessary for your work, you can list those expenses on your records, allowing you to claim deductions and reduce taxable income.

- Proof of Payment: Having a formal record ensures there’s no dispute about whether a client has paid or not, which can be important if you’re asked to provide evidence of income during an audit.

Simplifying Tax Deductions

In addition to helping you track income, a well-organized payment record system can also help you identify deductions you may qualify for:

- Business Expenses: From materials to transportation costs, being able to document business expenses makes it easier to claim deductions and lower your taxable income.

- Tax Rates: If your work involves different tax rates depending on the location or service, documenting each transaction ensures you’re accurately reporting taxes owed.

- Clear Financial Overview: Organized records of payments and costs can help identify any errors or discrepancies that may need to be corrected before filing your taxes.

By using structured records, you’ll have a more straightforward and less stressful tax filing experience, knowing you have all the necessary details at hand to ensure accuracy and avoid penalties.

Importance of Clear Payment Terms

When it comes to business transactions, clearly defined payment terms play a vital role in ensuring that both parties are on the same page. Ambiguous or unclear expectations can lead to misunderstandings, delays in payment, and potential conflicts. Establishing clear and concise payment guidelines from the start not only helps set the right expectations but also fosters trust and professionalism in your client relationships.

Why Clear Terms Matter

Setting clear payment terms can benefit both the service provider and the client in several key ways:

- Preventing Payment Delays: By specifying when payment is due and outlining acceptable payment methods, you reduce the risk of late payments. Clients will know exactly when they are expected to pay, minimizing misunderstandings.

- Avoiding Confusion: When terms are laid out clearly, both parties understand the expectations from the outset. This includes specifying whether payments are one-time, recurring, or due in installments, as well as whether deposits are required.

- Professionalism: Clear terms demonstrate that you are organized and professional in your approach to business. This can help build trust with clients and make them more likely to follow through with payments promptly.

- Legal Protection: Having well-defined payment terms in writing ensures that you have legal recourse if a payment dispute arises. It can serve as a contract that holds both parties accountable.

What Should Be Included in Payment Terms?

To ensure transparency and avoid confusion, the following elements should be included when defining payment expectations:

- Due Date: Clearly state the date by which payment must be made, whether it’s upon completion or within a certain number of days (e.g., 30 days).

- Accepted Payment Methods: Specify the methods by which payment can be made, such as cash, bank transfer, or credit card.

- Late Fees: If applicable, include any penalties for late payments, such as interest charges or fixed fees, to incentivize timely payments.

- Deposit Requirements: If you require an upfront deposit before starting work, outline the amount and the conditions under which it will be refunded or credited.

By being clear about your payment terms, you can avoid misunderstandings, reduce the risk of late payments, and maintain positive relationships with your clients.

Formatting Tips for Professional Invoices

The way you format your billing document can make a significant impact on how your business is perceived by clients. A clean, organized, and professional layout not only ensures clarity but also builds trust and conveys that you take your work seriously. By paying attention to key design and structural elements, you can create a document that is easy to read, legally sound, and aligned with your brand’s identity.

Key Formatting Tips

- Use a Clear Header: Start with a bold, easy-to-read header that includes your business name, logo (if applicable), and contact details. This helps establish your brand and makes it easy for clients to reach out if they have any questions.

- Include Essential Information: Ensure that the document includes key details such as the client’s name, job description, dates of service, and total amount due. These elements should be prominently displayed so that clients can quickly identify important information.

- Organize Information Logically: Break down the work or services provided into clear sections. This might include itemized costs, taxes, and discounts, with each element separated for easy understanding.

- Highlight Payment Due Date: The due date should be easy to locate. Place it near the total amount due and make sure it stands out so clients are reminded of the payment timeline.

- Keep It Simple and Consistent: Stick to a simple, professional font like Arial or Times New Roman, and use consistent formatting throughout the document. Avoid clutter by leaving enough white space between sections to keep everything readable.

- Use Tables for Itemization: Organize the list of services or products provided into a table, with columns for descriptions, quantities, and pricing. This method is not only visually appealing but also helps clients quickly verify charges.

- Include Payment Methods: Clearly list the accepted payment methods at the bottom of the document. Whether you accept bank transfers, credit cards, or checks, clients should easily know how to settle their balance.

- Incorporate Your Branding: If you have a brand color scheme, fonts, or other design elements, integrate them into the document to give it a cohesive, professional look that reflects your business’s identity.

By following these formatting tips, you can ensure that your billing document looks polished, professional, and easy to understand. A well-structured document is not only more likely to be paid on time but also helps build your reputation as a reliable, organized service provider.

How to Track Payments Using Invoices

Accurately tracking payments is crucial for maintaining smooth cash flow and avoiding disputes with clients. By properly documenting each transaction and keeping a detailed record, you ensure that you have clear visibility into your financial situation. Using well-organized billing records not only helps with financial planning but also aids in ensuring that clients fulfill their payment obligations on time.

Steps to Effectively Track Payments

- Assign Unique Identifiers: Each billing document should have a unique number. This makes it easier to track individual transactions and avoid confusion when referencing specific documents.

- Record Payment Status: Keep a clear record of whether each payment has been made, is pending, or has been partially paid. This helps you track outstanding balances and follow up as needed.

- Include Payment Dates: Always include the payment due date on your records. Once the payment is made, note the actual payment date. This will help in tracking any overdue payments and calculating any late fees.

- List Payment Methods: Document the method used for each payment, whether by cash, check, bank transfer, or credit card. This helps in case you need to verify transactions later or reconcile your accounts.

- Provide Detailed Descriptions: Include a description of the work completed or products provided along with the cost breakdown. This ensures that both you and your client know exactly what has been paid for and prevents misunderstandings.

Tools and Methods for Payment Tracking

- Spreadsheets: Use spreadsheet software like Excel or Google Sheets to track payments. Set up columns for unique numbers, amounts, due dates, payment status, and methods, and update it regularly.

- Accounting Software: Accounting programs like QuickBooks or FreshBooks automatically track and categorize payments, giving you a clear overview of your finances and allowing for easy generation of reports.

- Manual Logs: If you prefer a more hands-on approach, you can maintain a manual log. Write down each transaction, mark off when payments are made, and keep track of any outstanding amounts in a dedicated ledger or notebook.

By using these tracking methods, you can stay organized and ensure that all payments are accounted for. Not only does this keep your financial records in order, but it also helps you stay on top of any outstanding balances, reducing the risk of missed payments and improving overall cash flow.

Legal Aspects of Repair Invoices

When conducting business transactions, particularly for services rendered, it’s important to ensure that all documentation is legally sound and adheres to applicable laws. A well-crafted billing document not only serves as proof of services provided but also outlines the terms of the agreement between the service provider and the client. Understanding the legal requirements surrounding these documents can help protect both parties and ensure smooth financial and legal operations.

Key Legal Elements in a Billing Document

Several critical elements must be present in a billing document to ensure that it holds up legally and provides clarity for both parties involved. The following table highlights some of the key details to include:

| Element | Importance |

|---|---|

| Service Description | Clearly outlines the work performed, ensuring that both the client and provider agree on what was done and the associated costs. |

| Terms and Conditions | Defines the agreed-upon payment terms, including due dates, late fees, and any discounts. It ensures both parties know their obligations. |

| Contact Information | Includes both the service provider’s and client’s contact details, which helps with communication and is vital for resolving any disputes. |

| Legal Compliance | Indicates adherence to local laws, including tax regulations and consumer protection rights, making the document legally enforceable. |

| Payment Confirmation | Ensures that the transaction can be tracked and serves as proof of payment made or received, which can be essential in case of disputes or audits. |

Additional Considerations

- Tax Compliance: Ensure that you apply the correct tax rates based on local tax laws and include any applicable sales tax in the final amount. Failure to comply can result in legal complications or fines.

- Written Agreement: For larger or ongoing projects, it’s wise to have a written agreement that clearly outlines payment expectations, deadlines, and dispute resolution processes. This document can complement your billing and serve as a reference in case of disagreements.

- Consumer Protection Laws: In many regions, there are laws protecting consumers from unfair billing practices. Make sure your documentation is clear, transparent, and free from deceptive terms or hidden fees.

- Record-Keeping: It’s important to retain a copy of all billing records for a specific period, as required by local regulations. This can be vital in case of audits or legal proceedings.

By ensuring that your billing documents meet legal standards, you can avoid potential disputes, safeguard your business, and create a professional relationship with your clients built on trust and transparency.

How to Send and Follow Up on Invoices

Successfully sending and following up on billing documents is essential for maintaining a smooth financial process and ensuring timely payments. Clear communication and organized follow-ups not only help your clients understand their obligations but also establish professionalism and trust. Knowing when and how to send reminders or take action on overdue payments is just as important as creating the billing document itself.

Sending Your Billing Documents

Once your work is completed, it’s important to send the billing document promptly. The quicker your client receives the bill, the sooner they can process it. Here are a few best practices for sending your billing documents:

- Use Clear Communication: Send your document with a professional, friendly message. A simple email with a polite note stating that the document is attached and outlining the payment terms can set the right tone.

- Choose the Right Format: Ensure your document is in a widely accepted format, such as PDF, so that it is easily accessible and printable for the client. Avoid using editable formats that may cause confusion or give the impression of changing terms.

- Specify Payment Instructions: Include clear instructions on how the client can make payment, whether via bank transfer, online payment, or other methods. Make sure your payment details are easy to locate in the document.

- Send via Email or Mail: Depending on your client’s preferences, you can send your billing document either by email or traditional mail. Email is faster, but some clients may prefer physical copies for their records.

Following Up on Outstanding Payments

If payment is not received by the agreed-upon due date, it’s important to follow up in a timely and professional manner. Here are steps to follow when reminding clients about overdue payments:

- Send a Friendly Reminder: If the payment is only slightly overdue, a friendly reminder email or phone call is appropriate. Politely remind the client of the due date and kindly ask when you can expect payment.

- Offer Payment Plans: If a client is unable to pay in full, you might consider offering flexible payment options. This can help you get paid while maintaining good relations with the client.

- Set Clear Deadlines: If the initial reminder goes unanswered, send a follow-up message with a firm deadline for payment. Be professional but clear about any consequences of further delays, such as late fees or service suspension.

- Keep a Record of Communication: Maintain a log of all communication related to payments, including reminders and responses. This can be important if the issue escalates or legal action becomes necessary.

- Be Persistent but Professional: Persistence is key, but always remain polite and professional. A gentle nudge can help your client prioritize payment without damaging your relationship.

By being proactive in sending and following up on billing documents, you can reduce the chances of delayed payments and maintain healthy cash flow. Clear communication and timely reminders create a positive experience for both you and your clients, fostering a professional relationship that encourages prompt payment.