Top Work Invoice Templates for Effortless and Professional Billing

Efficient billing is an essential part of running any business, whether you are a freelancer, contractor, or small business owner. Having a well-organized system for generating payment requests ensures that clients receive clear, professional documents that reflect the value of the services rendered. In today’s fast-paced environment, creating these documents manually can be time-consuming and prone to errors, which is why many turn to pre-designed solutions.

By using structured forms, you can significantly reduce the complexity of invoicing. These tools offer flexibility and customization, allowing you to maintain a professional image while saving valuable time. Whether you’re looking to streamline your process or ensure consistency in your financial communications, the right approach can make all the difference in managing your cash flow and client relationships.

In this guide, we explore various options for easily creating and managing billing documents. From free resources to advanced software solutions, we’ll cover what you need to know to choose the best option for your needs, ensuring smooth transactions and reliable payment tracking.

Work Invoice Templates: A Comprehensive Guide

Creating clear and accurate payment requests is a critical step in any business transaction. Whether you provide services or sell products, the document you send to clients should reflect professionalism and ensure transparency. With the right structure, you can avoid confusion, reduce the risk of errors, and accelerate payment processes. In this guide, we’ll cover everything you need to know about crafting efficient and professional billing documents.

Key Components of a Billing Document

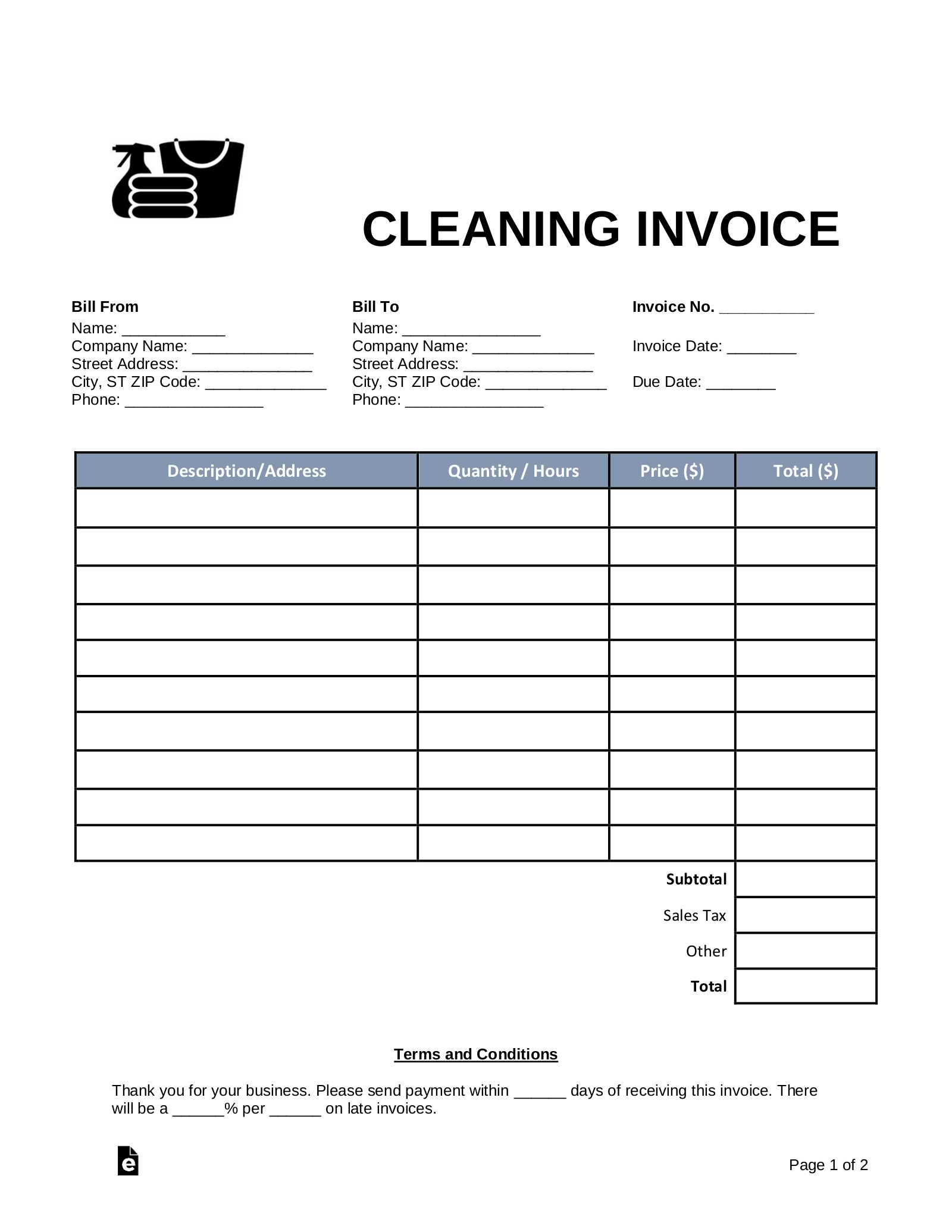

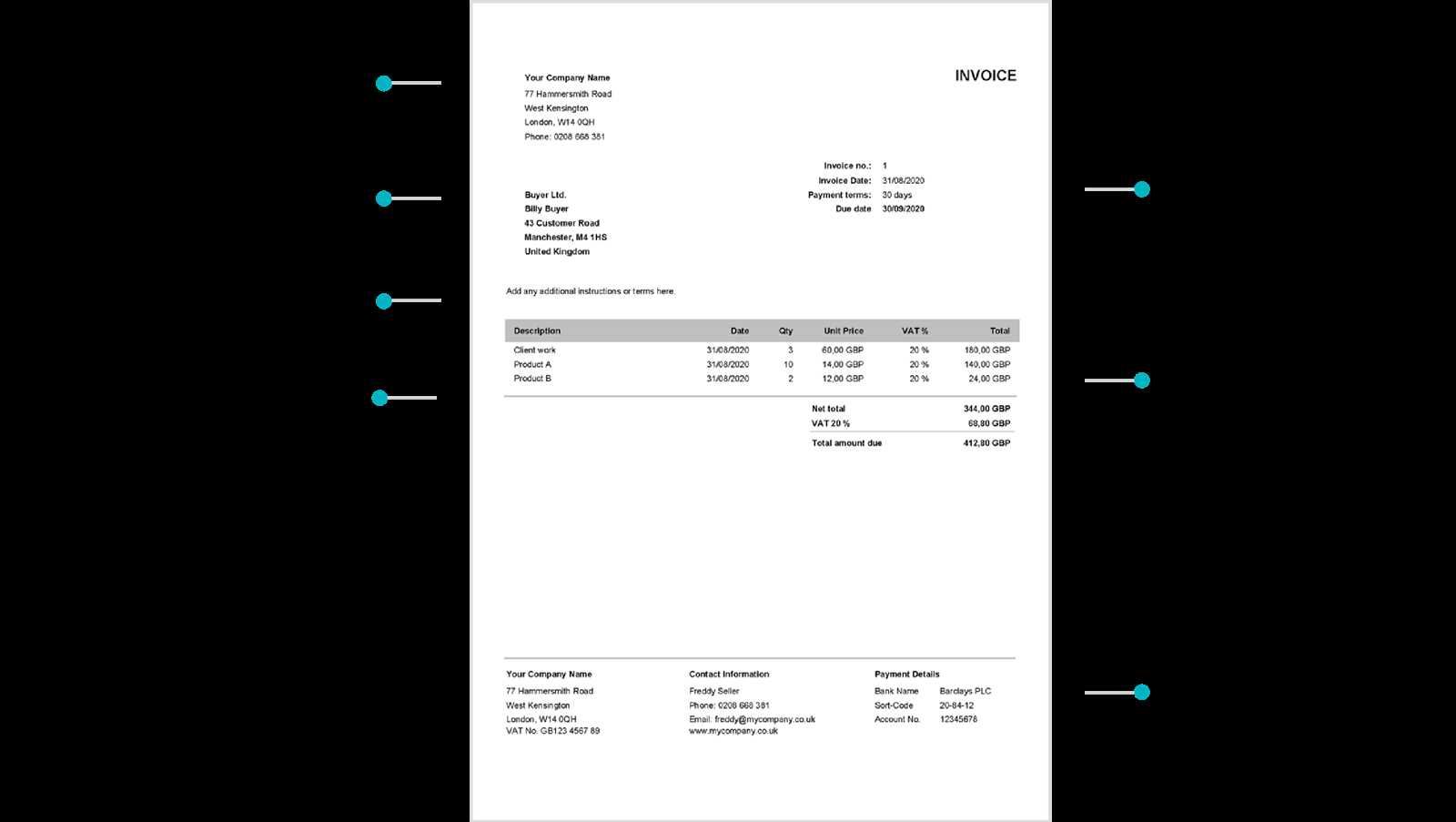

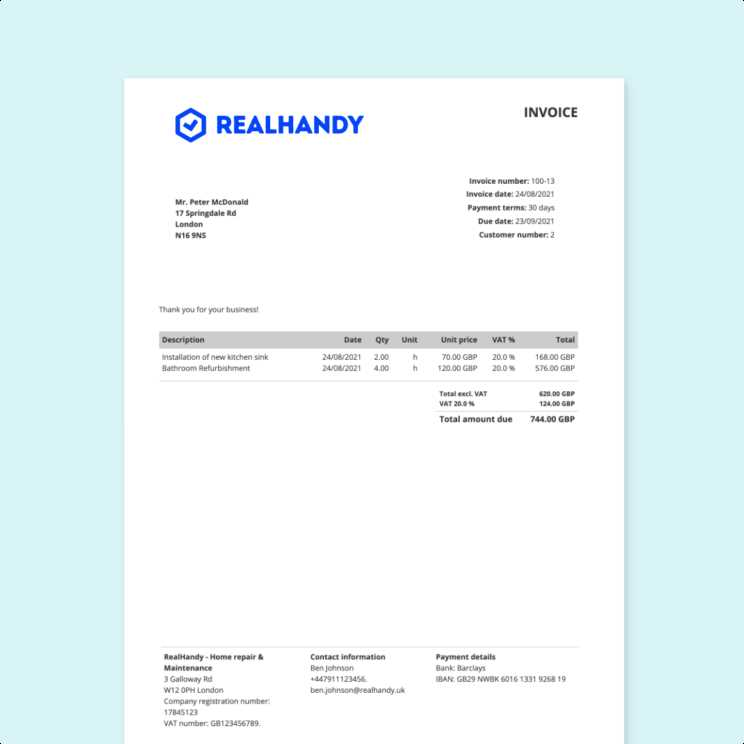

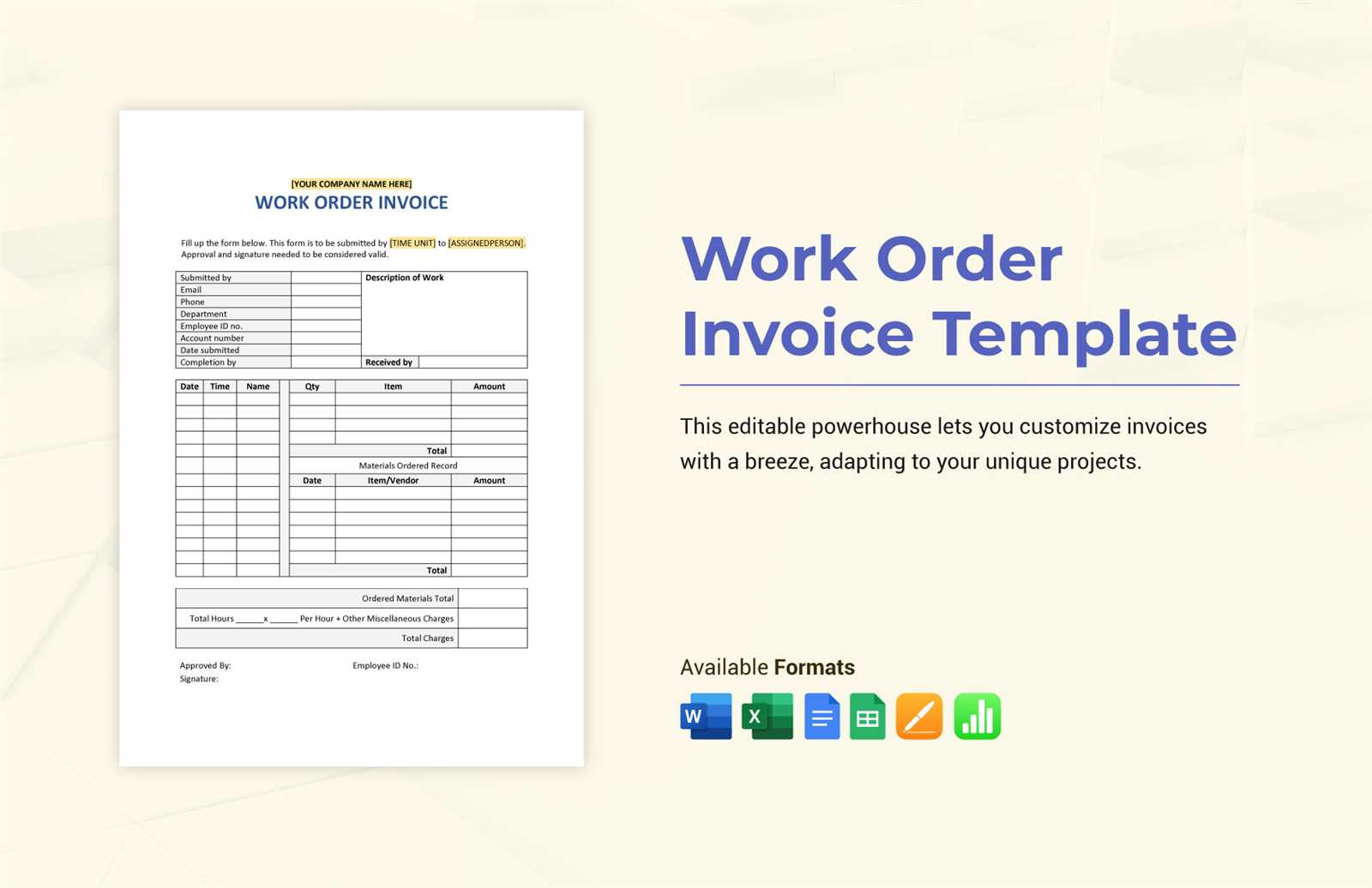

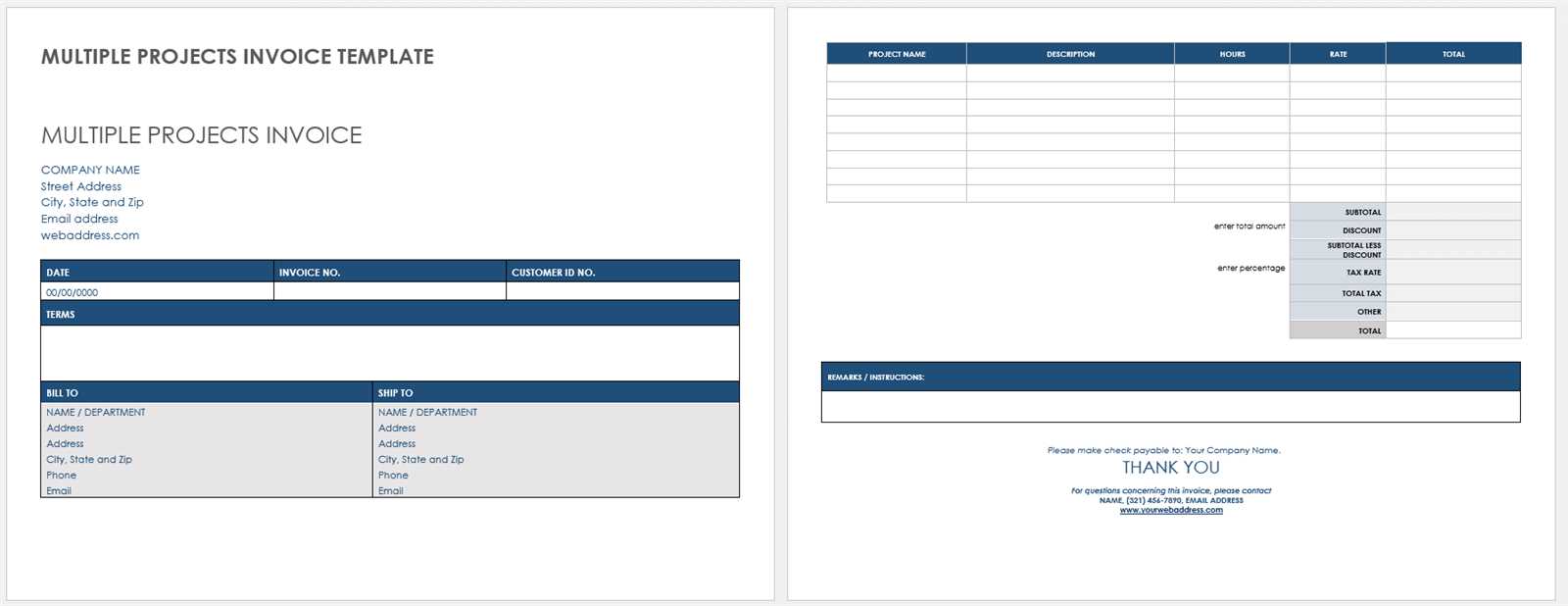

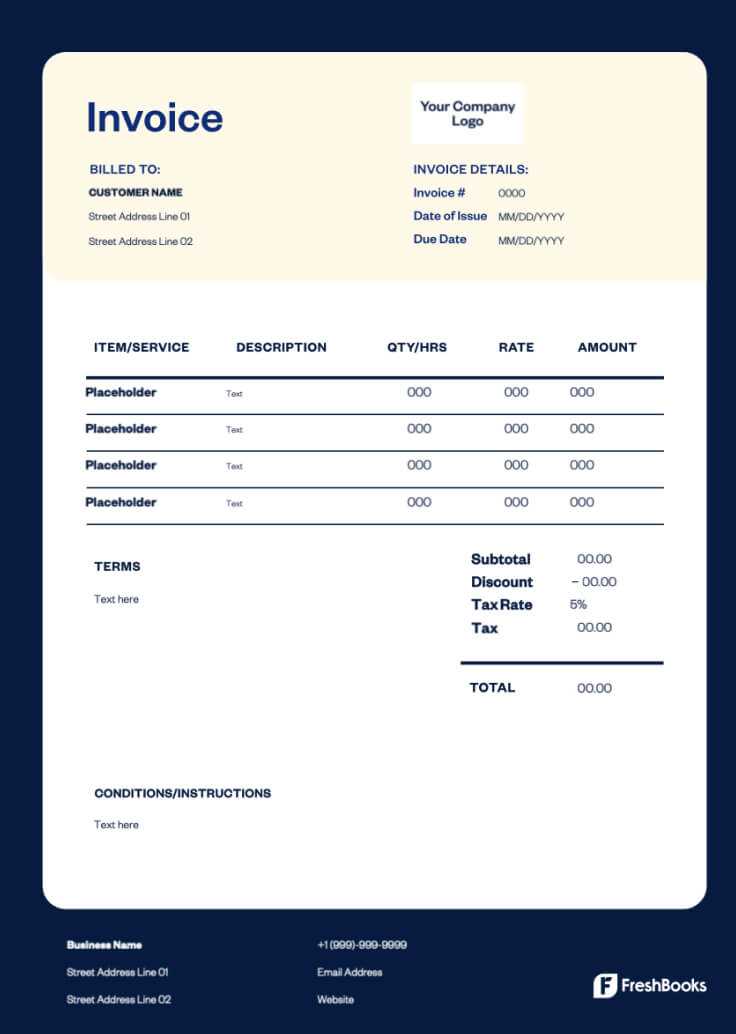

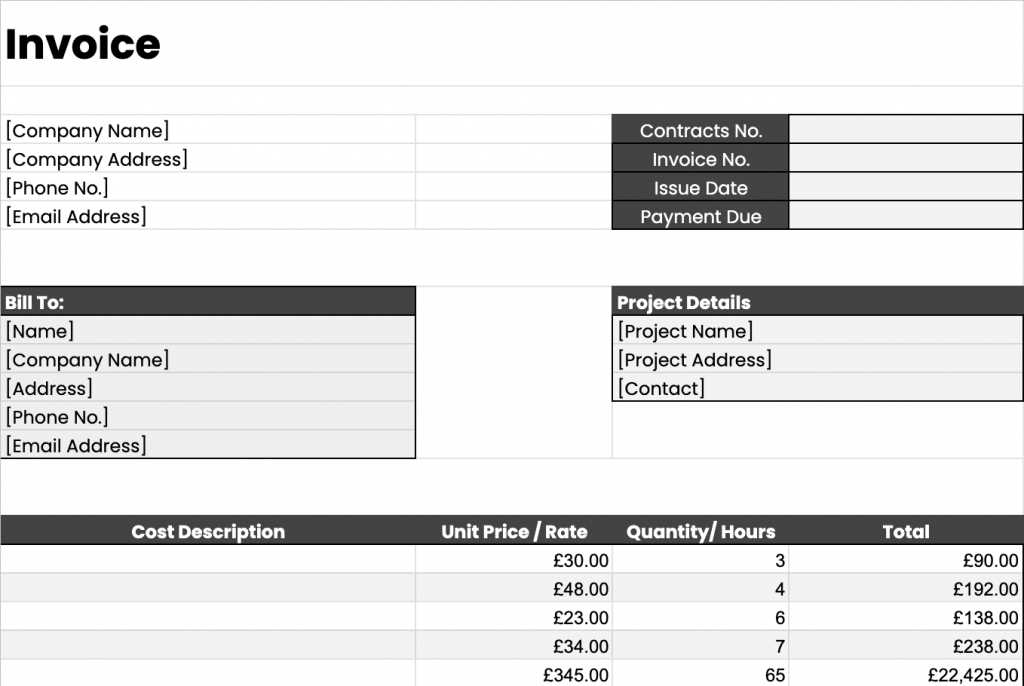

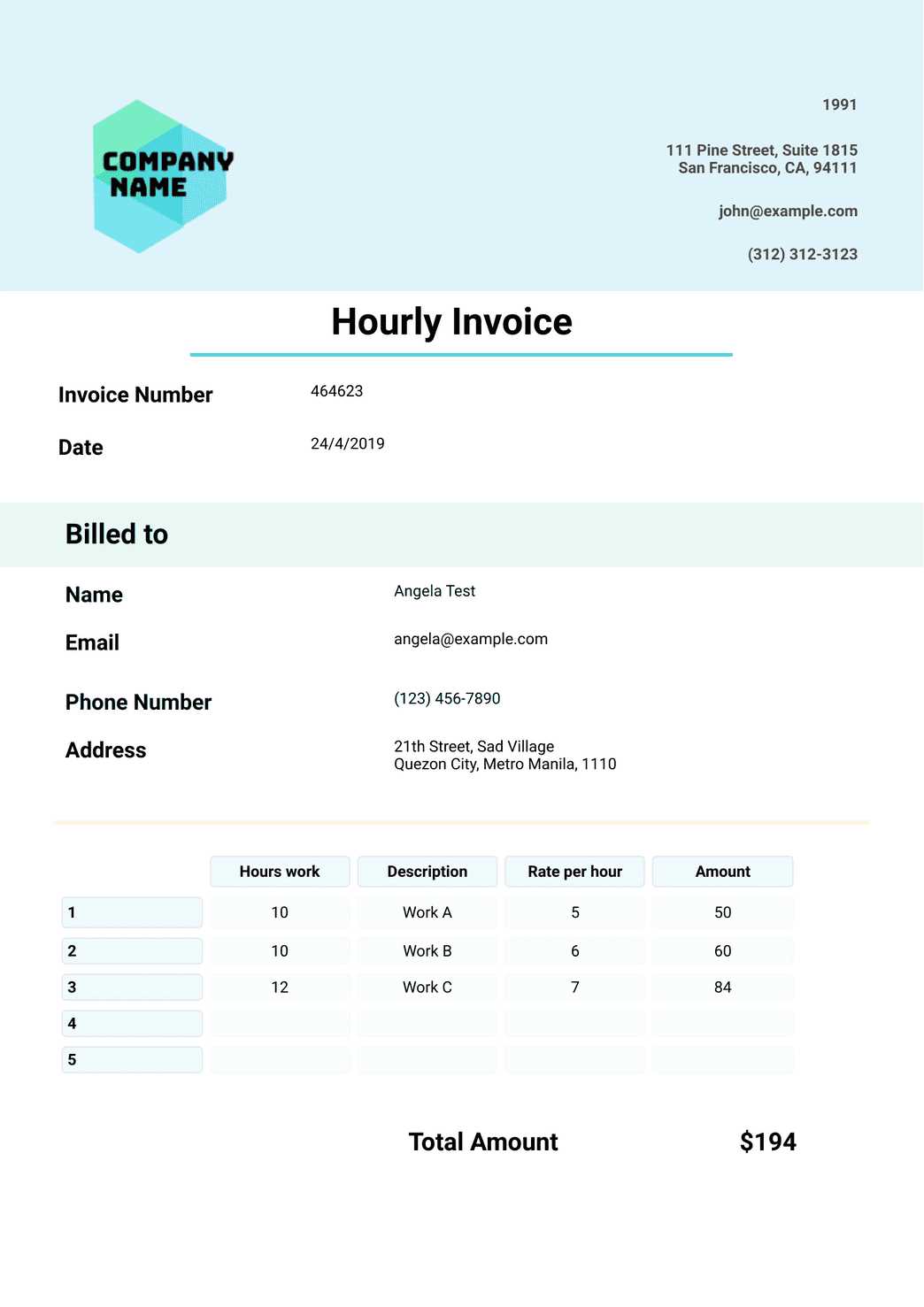

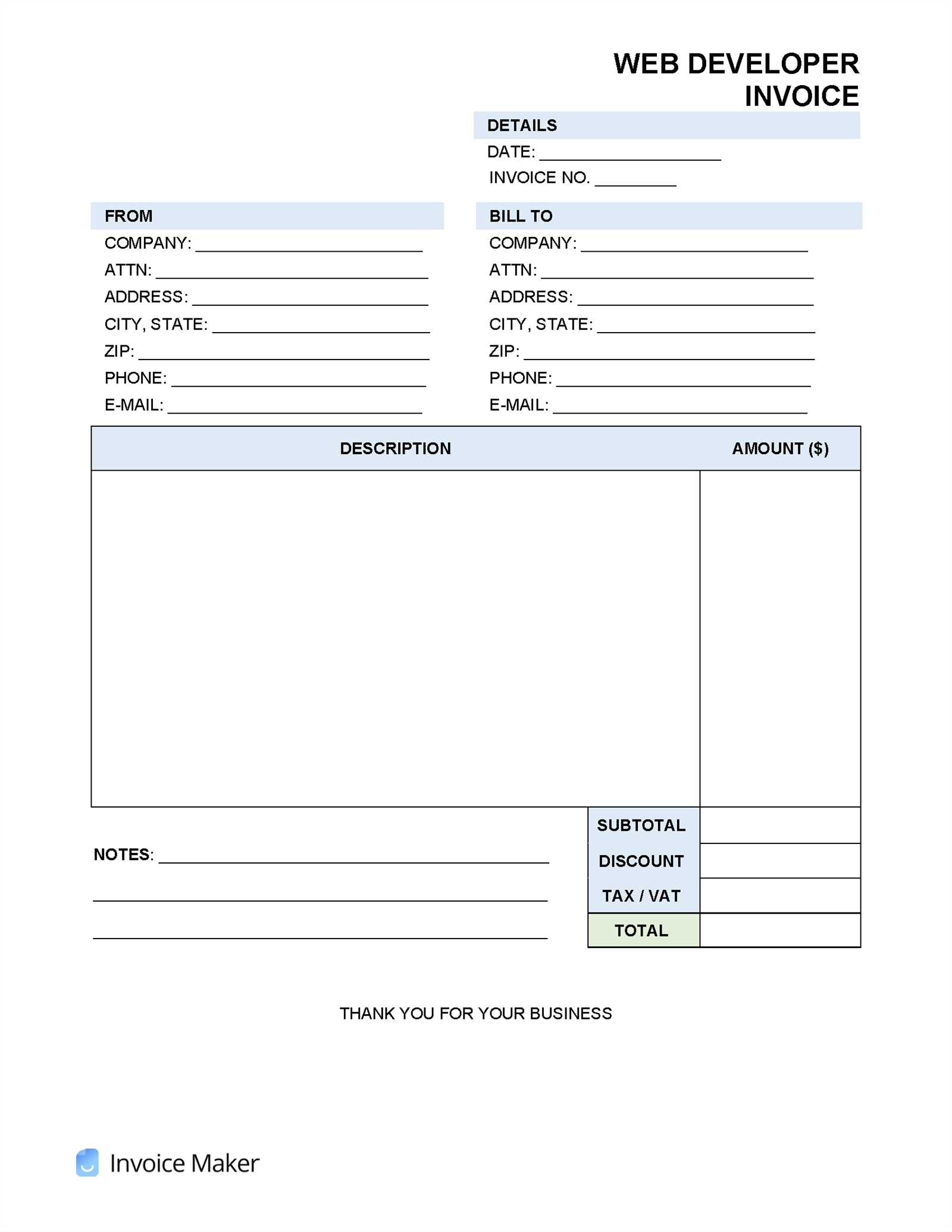

A well-organized payment request includes several important sections to ensure all relevant details are included. The first step is to add your business information, including your name or company name, contact details, and any identifying numbers (e.g., tax identification). Next, the recipient’s details should be clearly displayed, ensuring the client knows who the document is addressed to.

Additionally, the body of the document should include a breakdown of the services or goods provided, their costs, and the total amount due. Adding payment terms, such as the due date and accepted payment methods, is also essential for clarity. Clarity in these sections ensures that clients know exactly what is being charged, why, and when payment is expected.

Why Pre-Designed Solutions Are Useful

For businesses looking to save time and ensure consistency, pre-designed solutions offer a quick and easy way to create accurate documents. These pre-made systems often include the necessary fields for customization and allow you to simply plug in your data, streamlining the entire process. Using an automated approach can also minimize mistakes and reduce the time spent manually creating each request.

By relying on a structured, professional format, you ensure that your financial transactions are handled in an organized manner, improving client relationships and payment efficiency.

Why Work Invoice Templates Matter

Having a structured approach to generating payment requests is essential for businesses of all sizes. When your billing documents are clear, consistent, and professional, it not only speeds up payment cycles but also helps maintain positive relationships with clients. Relying on pre-built systems to create these documents brings numerous benefits that go beyond mere convenience.

Benefits of Using Pre-Designed Solutions

- Time Efficiency: Pre-built systems save time by eliminating the need to start from scratch with each transaction.

- Consistency: Using a standard format ensures that all your payment requests have a professional and uniform look.

- Accuracy: Reducing human error is crucial, especially when dealing with financial documents. A set structure ensures all necessary details are included and calculated correctly.

- Legal Compliance: Many pre-designed systems come with built-in legal guidelines to ensure your documents meet industry standards and regulations.

Impact on Client Relationships

When clients receive well-organized documents, it enhances their perception of your professionalism and trustworthiness. It also reduces confusion about payment terms and expectations, leading to quicker resolutions in case of any issues. Additionally, the clarity in these documents can serve as a reminder for clients, encouraging timely payments and improving cash flow.

In summary, using an efficient system to create payment documents not only streamlines internal processes but also boosts your business’s reputation and financial management.

How to Choose the Right Template

Selecting the right structure for generating payment documents is crucial to ensuring both efficiency and professionalism. With so many options available, it can be challenging to determine which design will best meet your needs. The key is to find a format that aligns with your business style, simplifies the process, and ensures clarity for your clients.

Factors to Consider When Choosing a Format

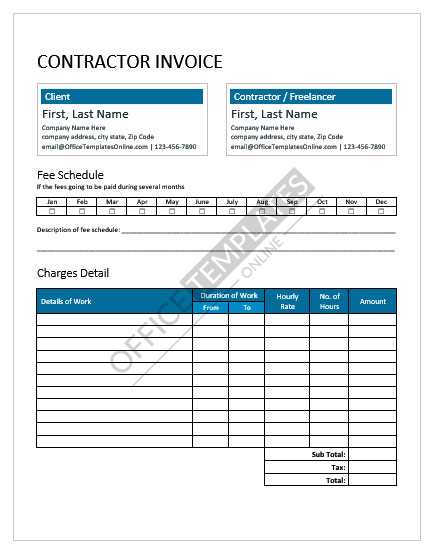

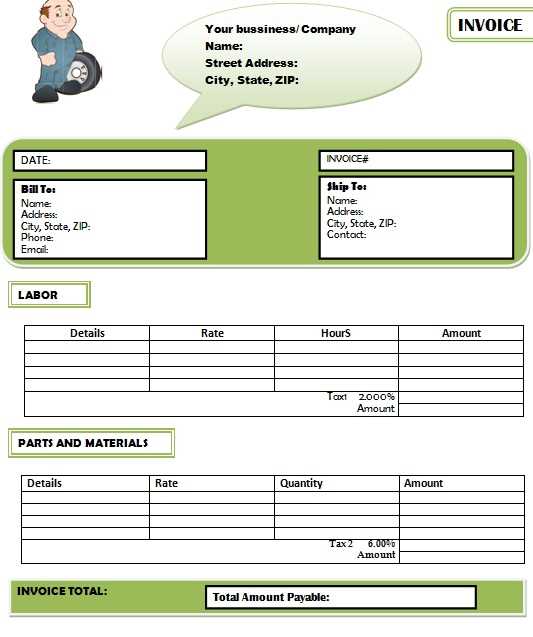

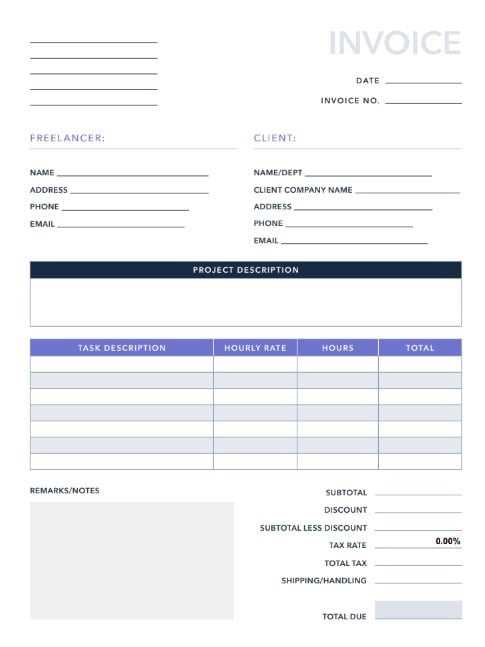

- Business Type: Consider the nature of your services or products. A simple layout may be sufficient for small-scale operations, while larger businesses may need more detailed fields to include extra information.

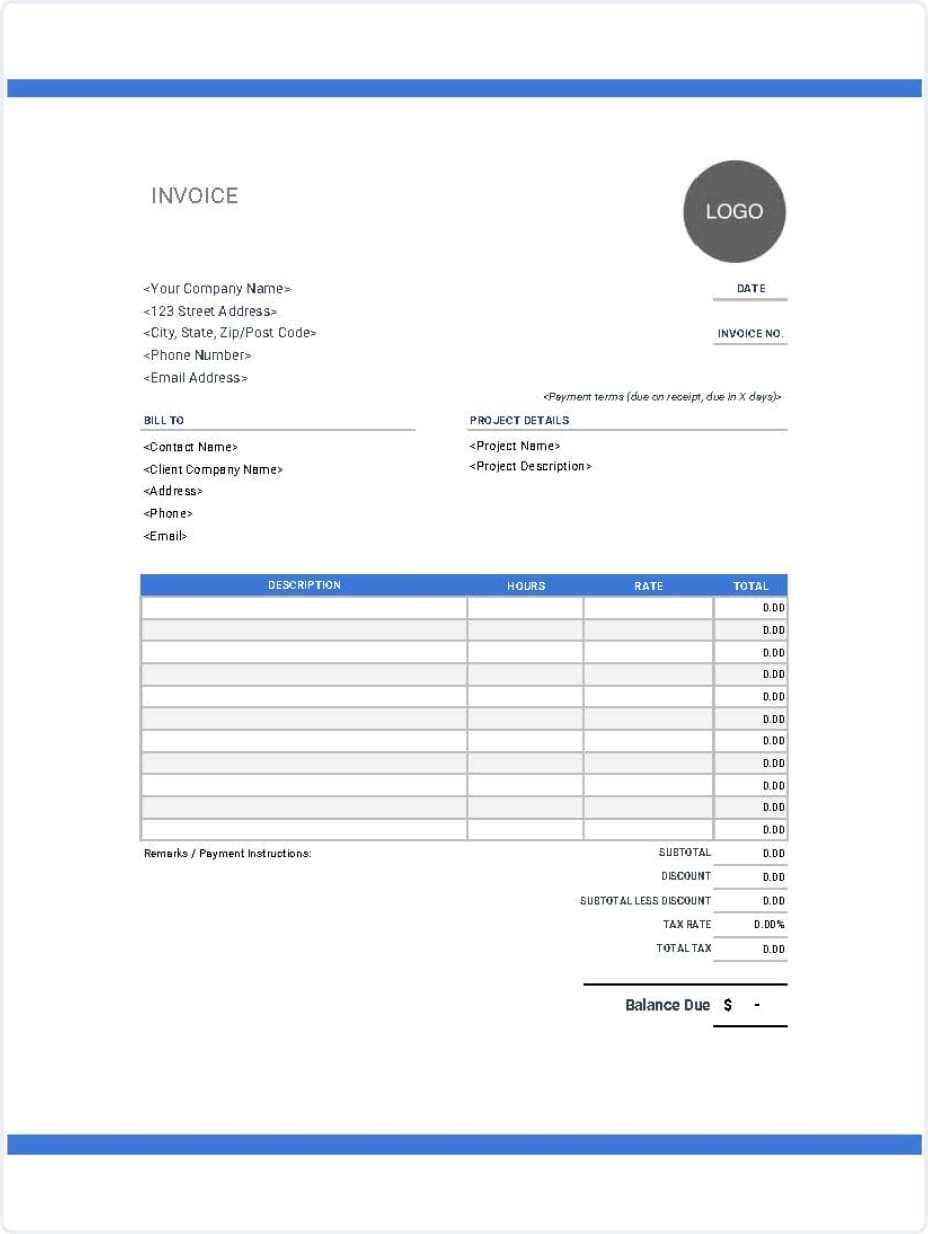

- Customization Options: Look for solutions that allow flexibility in adjusting the layout, colors, and branding to maintain a cohesive business identity.

- Ease of Use: Choose a format that is easy to fill out and understand. This will minimize the time spent creating documents and reduce the chances of making mistakes.

- Compatibility: Make sure the solution integrates well with your other tools, such as accounting software or payment platforms, to streamline your workflow.

- Legal Requirements: Ensure the design complies with industry-specific laws, including tax regulations and payment terms.

Evaluating Your Options

There are many ways to obtain a suitable design, from free online tools to premium software. Free options are often simple and effective for small businesses, while paid solutions might offer more robust features, such as automated calculations or recurring billing options. Whichever route you choose, ensure the format supports your specific needs and enhances your financial operations.

Essential Elements of a Work Invoice

A well-structured payment request is essential for ensuring smooth transactions and clear communication between businesses and clients. Including the right information in your document helps avoid confusion, accelerates payment processes, and maintains professionalism. There are several key components that every payment document should contain to ensure clarity and transparency.

- Business Information: This includes your name or company name, contact details, and any necessary business identification numbers (e.g., tax ID). It’s important to make sure your clients can easily reach you if needed.

- Client Details: The recipient’s information, including their name, address, and contact information, should be clearly listed to ensure the document is addressed correctly.

- Unique Document Number: Each payment request should have a unique reference number. This makes it easier for both parties to track payments and avoid confusion with multiple transactions.

- Description of Goods or Services: A detailed list of the items or services provided is essential. This helps the client understand exactly what they are being charged for and minimizes disputes.

- Pricing and Total Amount: Clearly state the price for each service or item, including any taxes or additional fees. The final amount due should be easily identifiable, ensuring there are no surprises.

- Payment Terms: Include the payment due date and acceptable payment methods. This sets clear expectations for both parties and helps prevent delays.

- Additional Notes or Terms: If there are any specific conditions (e.g., late payment penalties or discounts for early payments), these should be outlined here to ensure mutual understanding.

By ensuring these elements are included in your document, you create a clear and professional payment request that can lead to faster payments and smoother business operations. Each section plays a role in reducing confusion and keeping the billing process efficient.

Free vs Paid Invoice Templates

Choosing between complimentary and premium options can greatly impact your professional documentation needs. Each type has its own benefits, catering to different requirements, styles, and budgets. While free versions may suit those with straightforward needs, paid versions often provide more features and customization for advanced uses.

Advantages of Free Options

Free options are accessible and often suitable for simple, immediate needs. They usually offer basic formats that are easy to use, making them ideal for individuals or small businesses with limited resources. However, they may lack advanced functionality and support.

Benefits of Paid Options

Paid options generally come with enhanced features, such as greater customization, professional designs, and dedicated support. This can lead to a more polished look and efficient experience, especially useful for larger organizations or professionals seeking brand alignment.

| Component | Description | ||||

|---|---|---|---|---|---|

| Contact Information | Include both your details and the client’s, such as names, addresses, phone numbers, and email addresses. | ||||

| Service Descriptions | Provide a brief description of each task or project component, along with the hours or rate associated. | ||||

| Aspect | Digital Format | Printed Format |

|---|---|---|

| Delivery Speed | Instant; documents can be emailed or shared online within seconds. | Slower; relies on postal services, which can delay delivery. |