Guide to Building a Custom Invoice Template for Your Business

Managing financial transactions effectively is a crucial part of running a business. One of the key components of this process is designing a well-structured document that ensures clarity and professionalism when requesting payments from clients. Whether you’re a freelancer or managing a larger company, having a consistent, organized approach to sending financial requests can save time and reduce errors.

In this guide, we will explore how to craft a clear, functional, and visually appealing document that outlines the details of a transaction. From layout choices to important fields and legal considerations, we will walk you through all the essential steps to ensure your business looks professional and your clients understand exactly what is being requested.

Consistency and clarity are vital when creating such documents. By focusing on these principles, you can avoid confusion and enhance trust with your customers, ultimately leading to smoother business operations and more timely payments.

Creating a Payment Request Document

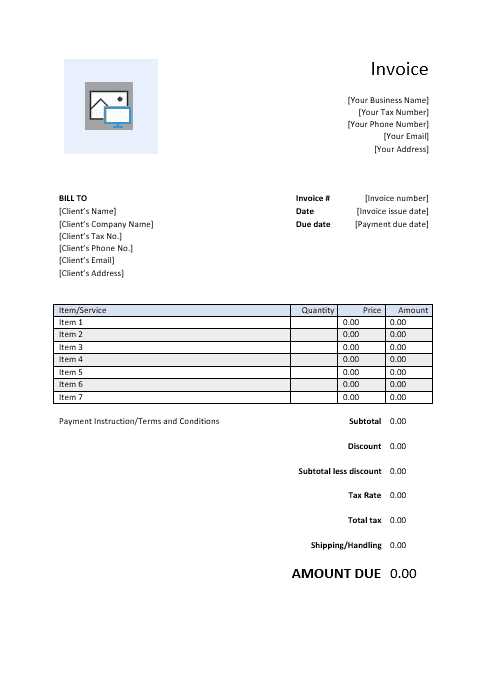

To streamline the process of requesting payments from clients, it’s important to have a structured, clear, and professional-looking document. A well-designed billing form not only helps ensure that all essential details are covered, but also contributes to a smooth and efficient transaction process. This section will guide you through the necessary components and considerations when creating such a document for your business needs.

Key Components of a Payment Request Form

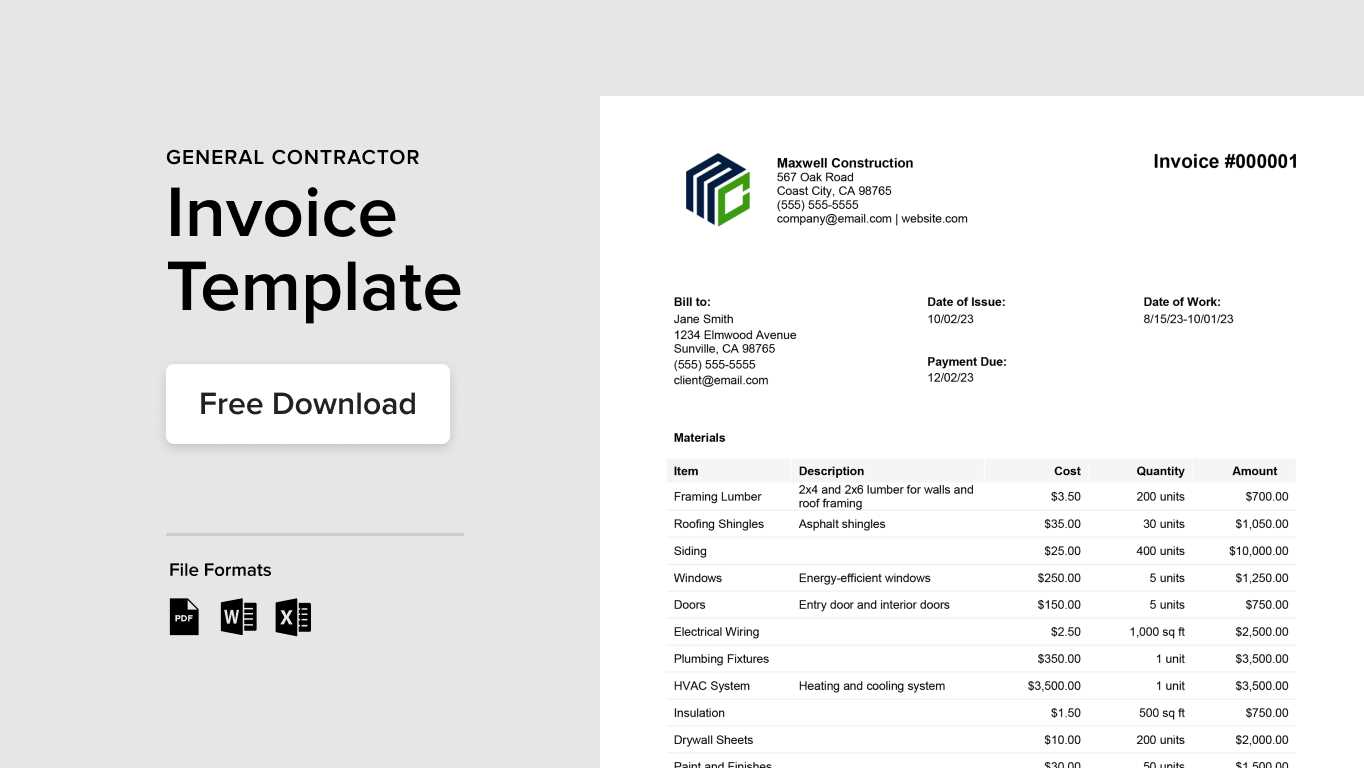

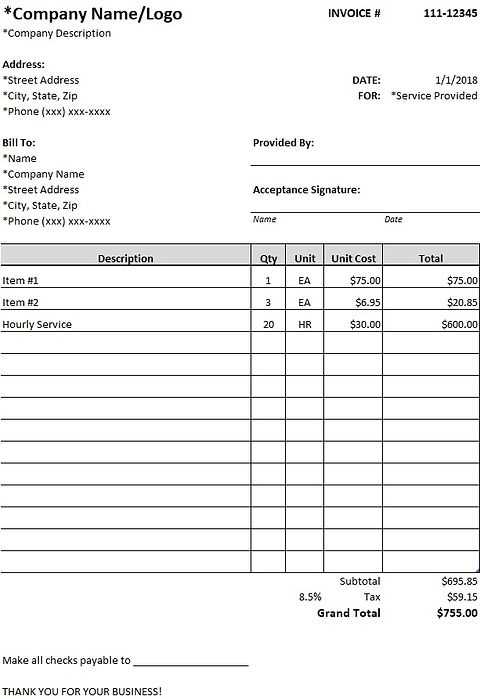

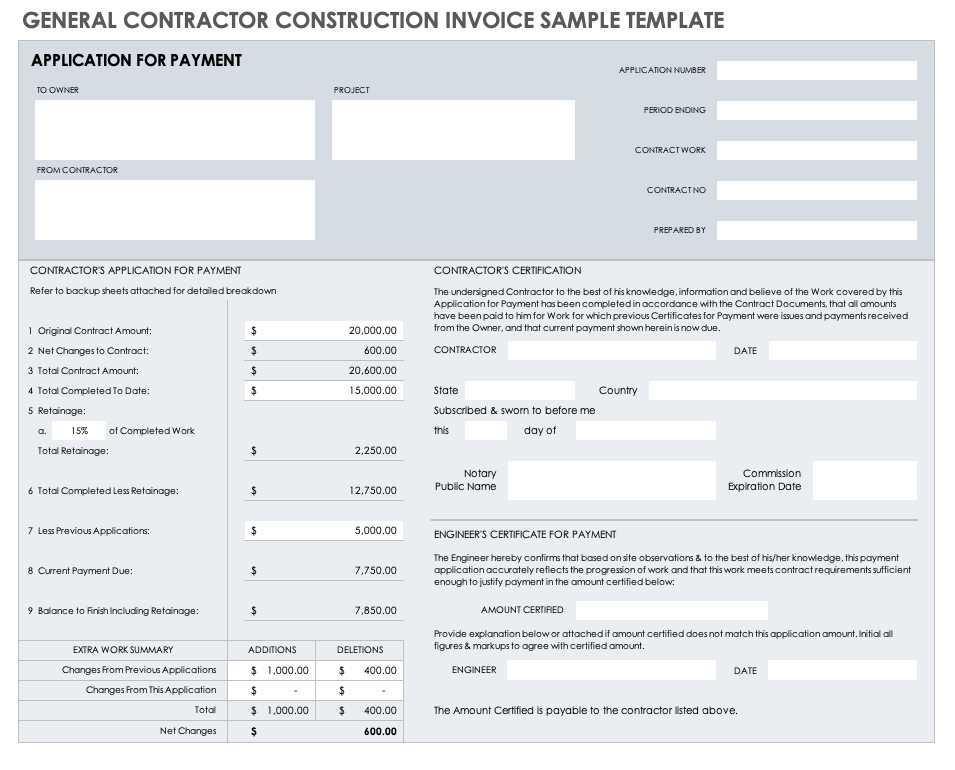

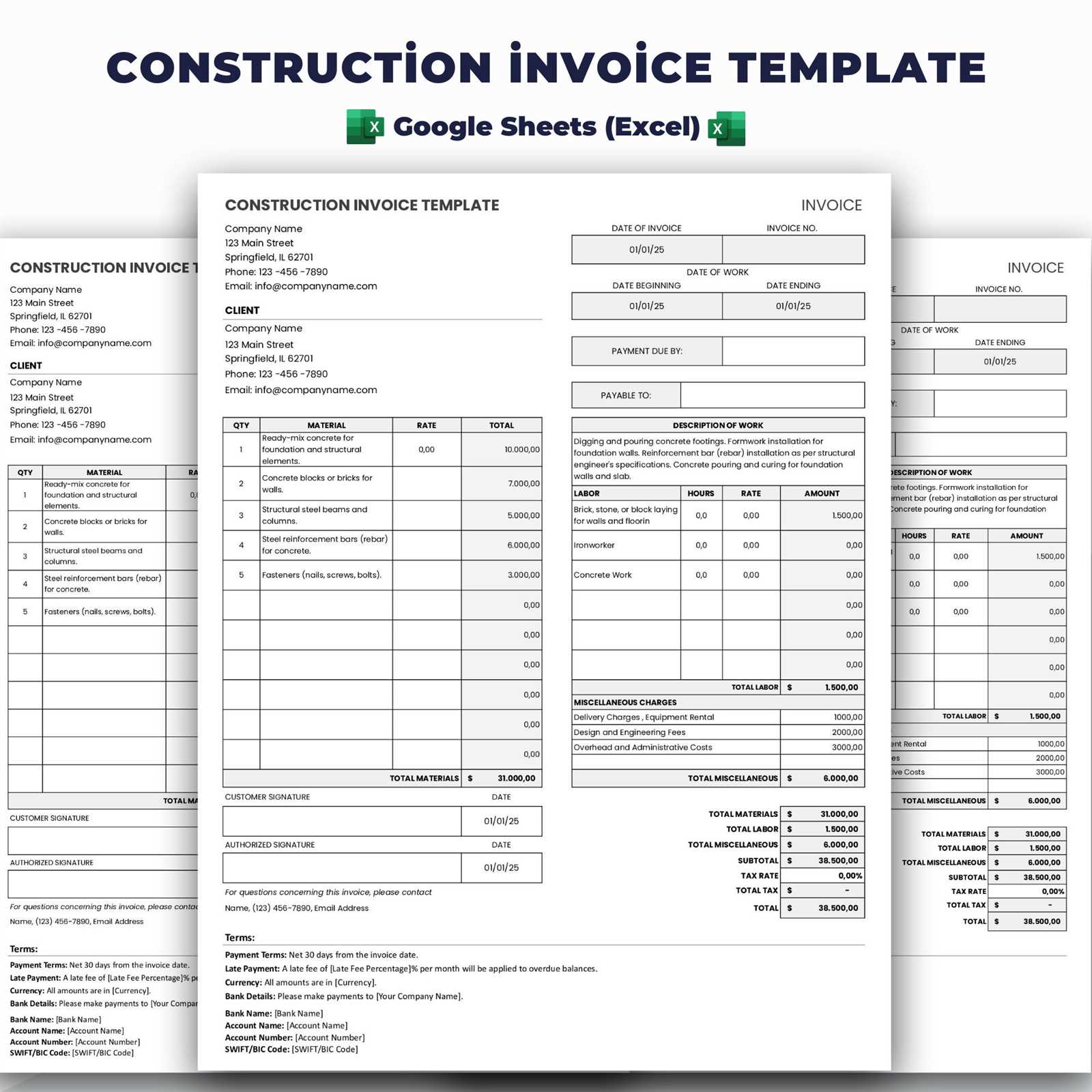

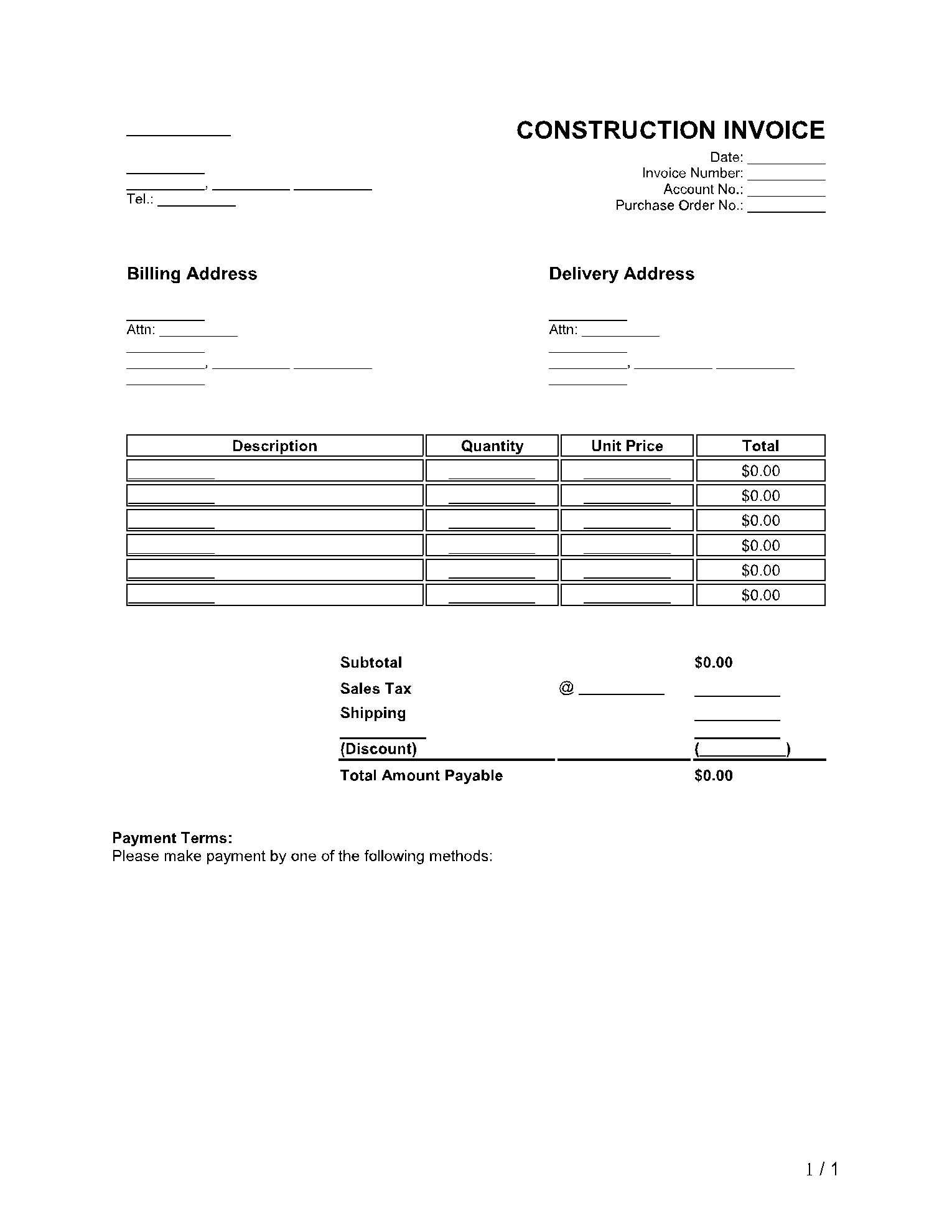

A properly crafted payment request should include certain critical elements to ensure clarity and compliance with financial practices. These components provide both the sender and recipient with clear, essential information that helps facilitate timely payments. Below are the typical sections included in a standard request document:

| Section | Description |

|---|---|

| Business Information | Include your company name, address, and contact details to establish identity and facilitate communication. |

| Client Details | List the recipient’s name, company name, and address to ensure the document is directed to the correct party. |

| Transaction Date | Indicate the date of the transaction to clarify the timeframe for payment. |

| Payment Amount | Clearly state the total amount due and any applicable taxes or fees. |

| Payment Terms | Define the payment due date, any early payment discounts, and late fees if applicable. |

Design and Layout Considerations

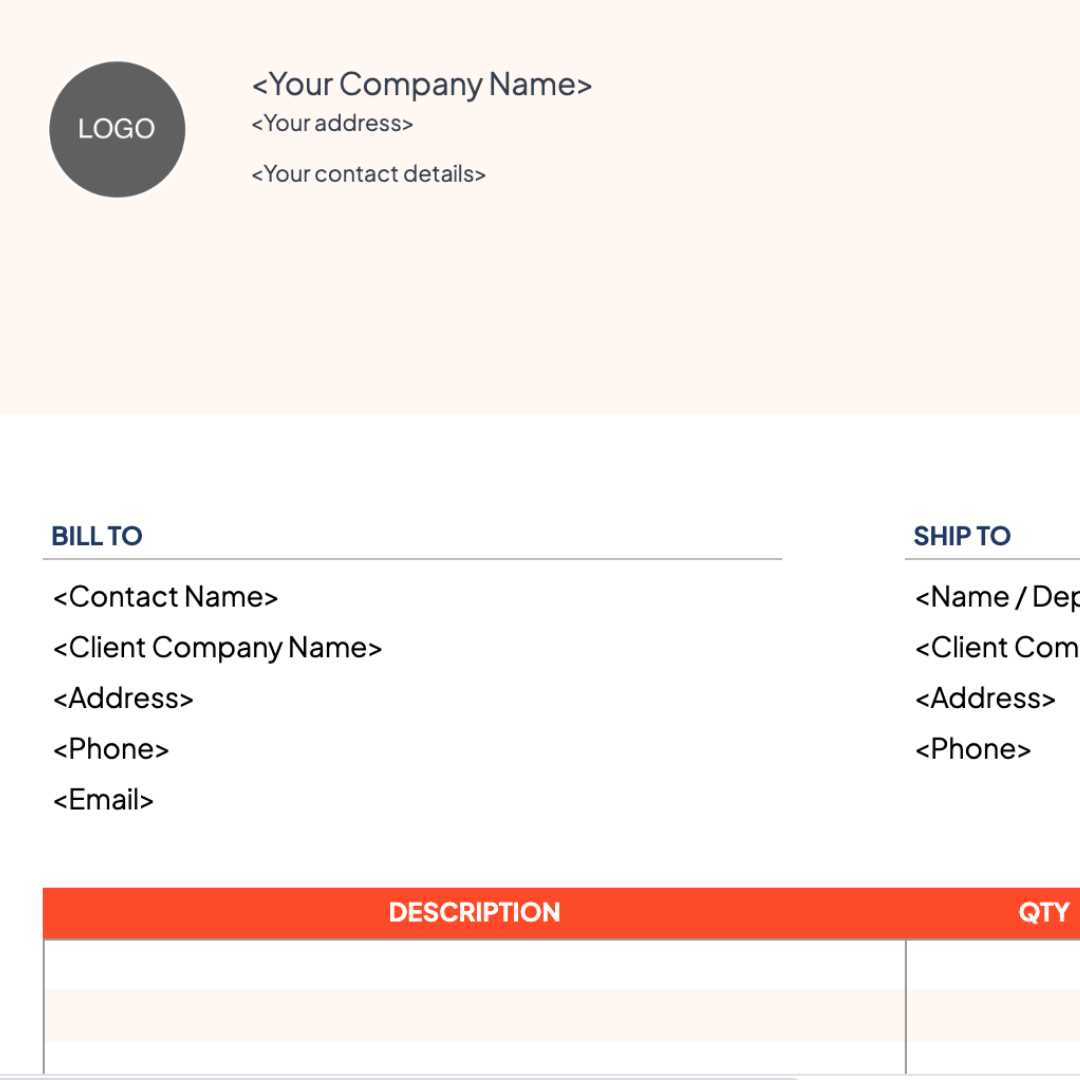

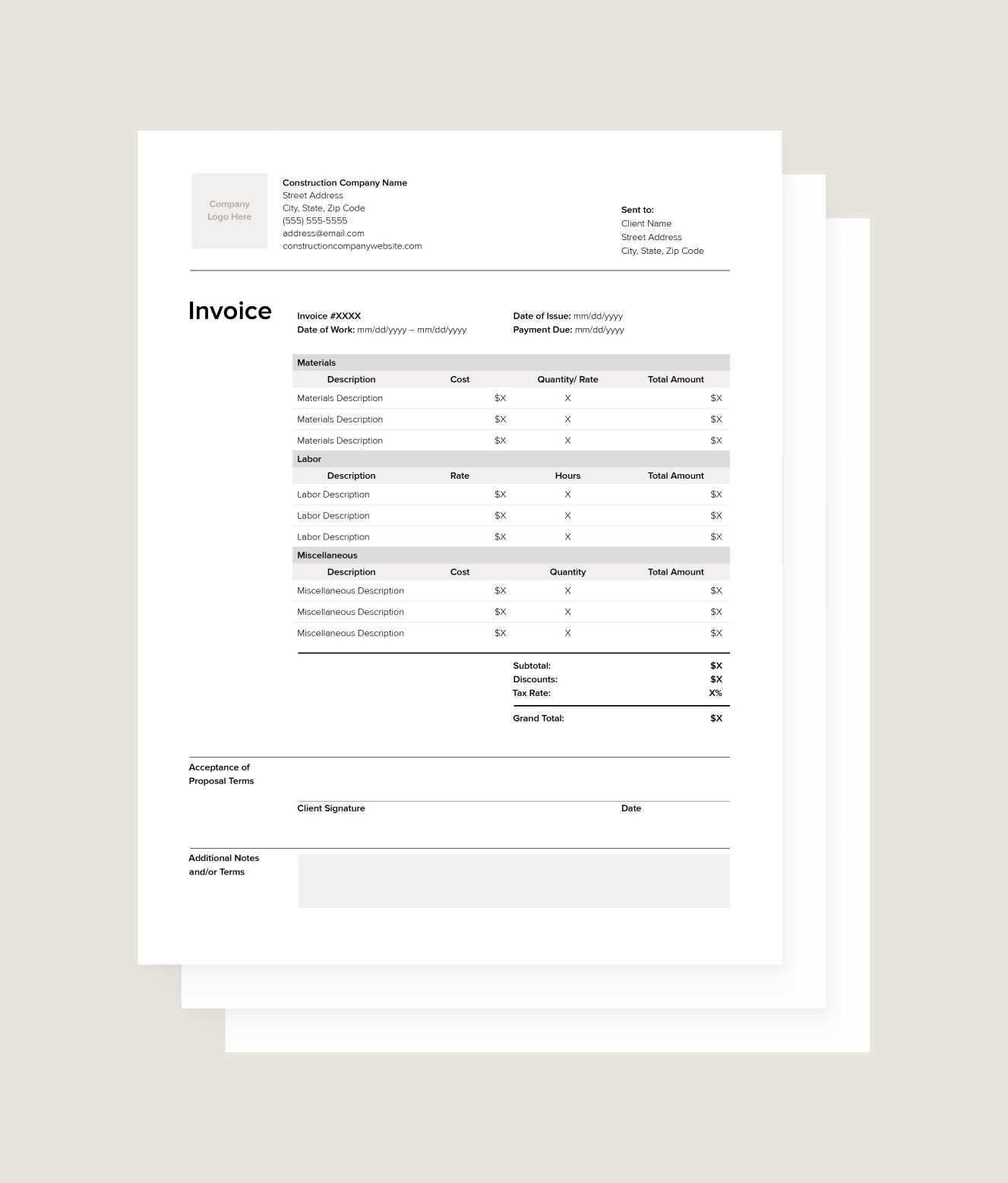

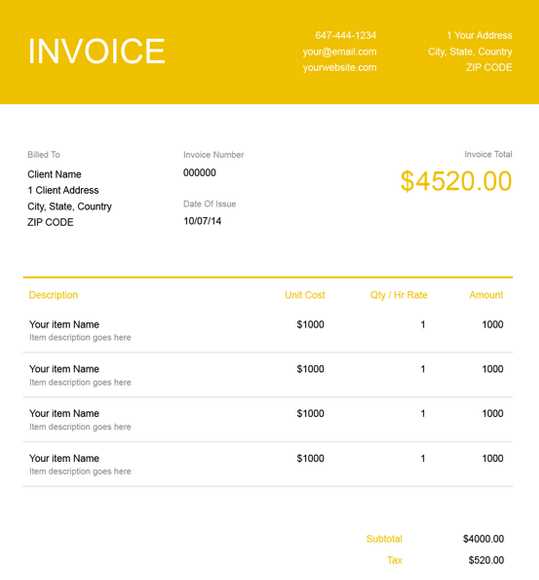

When designing the layout of your payment request form, simplicity and readability are key. A clean, organized structure helps the recipient quickly understand the details without confusion. Use appropriate font sizes and spacing to create a document that looks professional and is easy to navigate. Incorporate your branding elements, such as your logo or color scheme, to make the document uniquely yours, while maintaining a polished, formal appearance.

Why You Need a Payment Request Form

Having a standardized document for requesting payments is essential for maintaining clear communication with clients and ensuring smooth financial transactions. Without a consistent format, there is a greater chance of misunderstandings, missed details, or errors that could delay payments. A well-structured payment request helps both businesses and clients stay organized, fostering trust and efficiency in the process.

Here are some key reasons why using a pre-designed structure for payment requests is important:

- Professionalism: A formalized document reflects well on your business and shows clients that you are organized and serious about your financial operations.

- Consistency: Using the same format for all transactions ensures that both you and your clients are always on the same page and know exactly what information to expect.

- Efficiency: With a standardized approach, you can create and send requests faster, reducing administrative time and allowing you to focus on other tasks.

- Reduced Errors: A clear and structured format minimizes the chances of omitting crucial details or making mistakes in calculations.

- Legal Protection: Including all necessary information, such as payment terms and tax details, helps ensure compliance with legal requirements and protects both parties in case of disputes.

Overall, having a reliable system for generating and sending payment requests will help your business run more smoothly and professionally, while also improving cash flow and client relationships.

Key Elements of a Payment Request Document

A well-structured payment request is crucial for ensuring clarity and avoiding misunderstandings during the financial transaction process. It should clearly outline the necessary details that both parties need to understand the terms of the agreement. These critical components ensure that the document is both comprehensive and professional, facilitating smooth communication and timely payments.

Here are the most important sections to include in any payment request form:

- Business Information: Always include your company name, address, and contact details. This establishes your identity and makes it easier for the client to get in touch if needed.

- Recipient Details: Clearly state the client’s name, company (if applicable), and address. This ensures the document reaches the right person and company.

- Transaction Date: This should be the date when the goods or services were provided or when the payment is due. It helps both parties track the timeline of the transaction.

- Payment Amount: List the total amount due, including any taxes, shipping costs, or additional fees. It’s essential to break down the charges in a clear and transparent manner.

- Payment Terms: Include details like the due date for the payment, applicable late fees, early payment discounts, or installment options if any.

- Unique Identifier: Assigning a unique reference number helps with tracking and organizing your financial documents, ensuring there’s no confusion between different transactions.

- Itemized List: If applicable, provide a breakdown of the products or services provided. This allows the recipient to understand exactly what they are paying for and confirms the agreed-upon terms.

Including these elements ensures that both you and your clients are on the same page, reducing the risk of disputes and making the payment process as smooth as possible.

How to Choose Billing Software

Selecting the right software for generating payment requests is essential for streamlining your business’s financial operations. The right tool can save time, reduce errors, and ensure that all necessary details are accurately included in every document. However, with many options available, it’s important to choose one that suits your specific needs and integrates smoothly with your business workflow.

When evaluating billing software, consider the following factors to ensure you select the most suitable solution:

- Ease of Use: Look for software with an intuitive interface that doesn’t require extensive training. The simpler it is to navigate, the quicker you can create and send requests.

- Customization Options: Choose a tool that allows you to tailor the documents to reflect your branding. Features like logo insertion, color schemes, and custom fields can help maintain a professional and personalized appearance.

- Integration Capabilities: Ensure the software can integrate with other tools you use, such as accounting software, payment gateways, or customer relationship management (CRM) systems. This can save time and reduce manual data entry.

- Automation Features: Automation tools, like recurring billing or automatic payment reminders, can help streamline your processes and ensure you never miss a due date.

- Security: Make sure the software offers secure encryption to protect sensitive financial data. Look for features like password protection and secure cloud storage to safeguard client information.

- Cost: Evaluate the pricing structure to ensure it fits within your budget. Some tools offer free versions with limited features, while others may require a subscription for more advanced capabilities.

- Customer Support: Choose software with reliable customer service, so you can get help quickly if any issues arise during the billing process.

By considering these factors, you can choose a solution that not only fits your needs but also helps improve the efficiency of your business operations.

Designing a Professional Billing Layout

Creating a clean and professional layout for your payment request document is essential for making a positive impression on your clients. A well-designed structure not only enhances readability but also ensures that all critical information is easy to locate. A clear, well-organized document helps avoid confusion and contributes to faster payment processing.

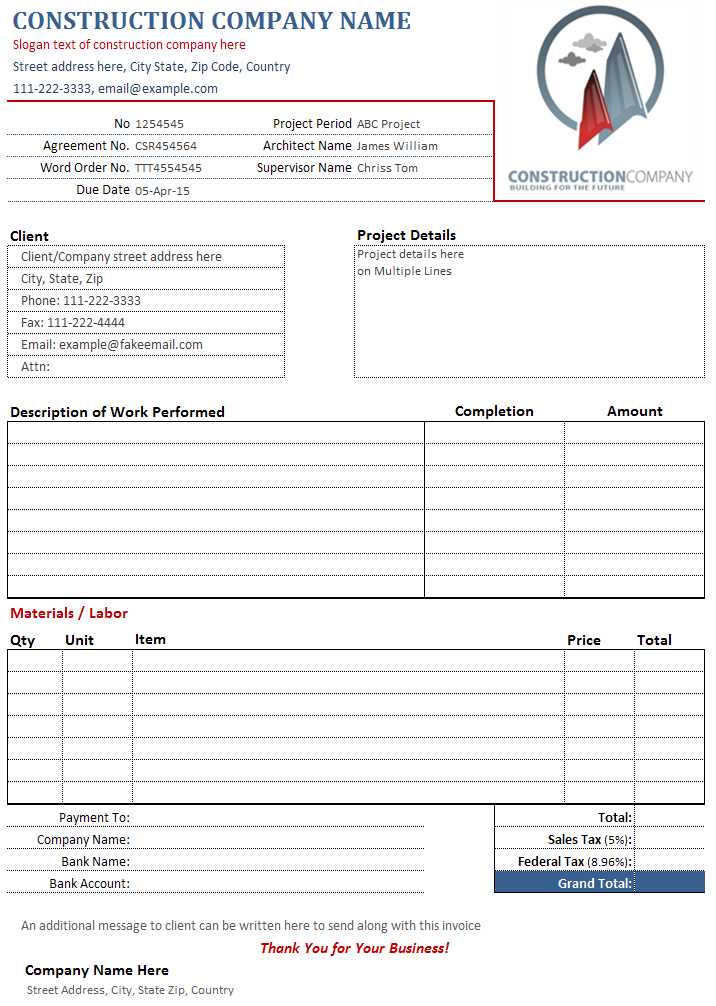

Here are some key design elements to consider when creating an effective layout:

| Design Element | Importance |

|---|---|

| Header Section | Place your business name, logo, and contact details at the top to establish your identity and ensure clients know how to reach you. |

| Client Information | Make sure the recipient’s name, address, and contact details are clearly listed so there’s no confusion about who is being billed. |

| Clear Itemization | List the products or services provided in a simple, itemized format to ensure transparency. This helps clients understand exactly what they are paying for. |

| Payment Due Date | Prominently display the payment due date to avoid misunderstandings. This helps ensure timely payments and sets clear expectations. |

| Footer Section | Include payment instructions, terms, and conditions, as well as any necessary disclaimers at the bottom for easy reference. |

By focusing on these design elements, you can create a payment request document that not only looks professional but also functions efficiently. A clean layout contributes to better communication with your clients and can help build long-lasting business relationships.

Best Practices for Payment Request Customization

Customizing your payment request documents is crucial for maintaining a professional appearance while ensuring that the specific needs of your business are met. Tailoring the layout and content to reflect your brand and your client’s expectations can improve both the look and functionality of your documents. Personalization enhances the experience for your clients and makes the transaction process smoother.

Key Areas to Personalize

When adapting your payment request documents, consider the following key areas where customization can make a significant impact:

| Customizable Element | Why It Matters |

|---|---|

| Branding | Include your company logo, colors, and fonts to create a cohesive, professional appearance that aligns with your brand identity. |

| Terms & Conditions | Ensure that your payment terms, discounts, and late fees are clearly stated and reflect the specific conditions of each agreement. |

| Client Information | Customize each document with the recipient’s details to avoid any confusion and ensure the payment request reaches the correct individual. |

| Itemization | Adjust the level of detail depending on the complexity of the transaction, making sure that all charges are clear and easy to understand. |

Tips for a Consistent and Professional Look

While customization is important, it’s equally crucial to maintain a balance between personalization and professionalism. Here are some tips to ensure your payment requests are both tailored and polished:

- Consistency: Ensure that your customization choices align with your overall brand identity for consistency across all documents.

- Clarity: Keep the layout simple and easy to navigate. Avoid overwhelming clients with excessive information or too many design elements.

- Legibility: Use clear fonts and maintain a logical structure. Important details such as payment amounts and due dates should be prominent.

- Responsive Design: If sending digital copies, ensure t

How to Include Payment Terms

Clearly outlining the payment terms in your financial documents is essential for setting expectations and ensuring a smooth transaction. By providing specific details on due dates, late fees, and any applicable discounts, you can help avoid misunderstandings and promote timely payments. Establishing transparent payment conditions also protects both parties in the event of disputes.

Key Payment Terms to Include

When including payment terms, it’s important to cover all relevant aspects that can affect the timing and amount of payment. Here are the most common elements to include:

- Due Date: Specify the exact date by which the payment must be made. This helps avoid confusion and ensures both parties are clear on when the funds are expected.

- Late Fees: If applicable, outline any fees that will be charged if payment is not made by the due date. This serves as a reminder for clients to pay on time.

- Early Payment Discounts: Offer an incentive for early payment by stating any discounts available if payment is received before the due date.

- Payment Methods: Include the methods of payment you accept, whether it’s bank transfer, credit card, PayPal, or other options.

- Currency: If you deal with international clients, specify the currency in which the payment should be made to avoid confusion.

How to Phrase Payment Terms Clearly

The way you phrase the terms can make a big difference in how easily they are understood. Be concise and use clear, direct language to avoid any ambiguity. For example:

- “Payment is due within 30 days from the date of the document.” (This clarifies the due date.)

- “A late fee of 1.5% per month will be charged on overdue balances.” (This communicates any penalty for delays.)

- “A 10% discount will be applied if payment is received within 10 days of the date list

Creating a Clear Billing Reference System

A well-organized numbering system for payment requests is essential for maintaining accurate records and ensuring smooth communication between you and your clients. A unique reference number allows both parties to easily track and identify specific transactions, reducing the chances of confusion or errors. This is especially important as your business grows and the volume of transactions increases.

Here are some key considerations when developing a clear reference number system for your billing documents:

System Element Importance Sequential Numbers Ensure that each reference number follows a sequential order (e.g., 001, 002, 003) to easily track documents over time. Prefix or Suffix Incorporate a prefix (e.g., INV for invoices) or suffix (e.g., 2024 for the year) to categorize or organize your documents by type or time period. Client-Specific Codes If applicable, include a unique code for each client or project to differentiate documents and maintain better organization for your records. Date-based Numbers Incorporating the date in your numbering system (e.g., 2024-001) can help quickly identify when a transaction occurred, adding another layer of organization. By implementing a clear and logical numbering system, you make it easier to manage and track all of your financial documents, simplifying the administrative process for your business. This approach also helps clients refer to specific transactions quickly, reducing confusion and facilitating smoother communication.

Setting Up Tax Calculations on Billing Documents

Properly calculating and displaying taxes on financial documents is essential for maintaining compliance with local tax regulations and ensuring that clients are charged the correct amount. Including accurate tax information helps avoid confusion and fosters trust between you and your clients. Understanding how to set up tax calculations efficiently will streamline your billing process and keep your business organized.

When setting up tax calculations, it’s important to follow these key steps:

- Determine Applicable Tax Rates: Research the tax rates relevant to your location and the products or services you offer. Different regions or industries may have specific tax rates, such as sales tax or VAT, that apply to your transactions.

- Identify Tax Categories: Some items or services may be subject to different tax rates or exemptions. Be sure to categorize products or services that qualify for specific tax rates, and apply them accordingly.

- Include a Breakdown of Taxes: Always itemize taxes separately from the base cost of the product or service. This makes it clear to your clients how much tax they are being charged and helps maintain transparency.

- Calculate Total Amount: Ensure that the total amount due includes both the base price and the applicable taxes. This way, the final amount is accurate and reflects the correct charges.

- Tax Registration Number: If required by law, include your business’s tax registration number on your document to ensure compliance and to avoid legal issues.

For example, if you are providing a service that is subject to a 10% sales tax, you should display the cost of the service, followed by a line for the tax amount, and then a final total that includes both the service cost and the tax.

By carefully setting up and displaying tax calculations, you can ensure that your financial documents are accurate, transparent, and compliant with tax laws.

Adding Company Branding to Your Billing Document

Incorporating your company’s branding into your payment request documents helps to establish a professional and cohesive appearance. A branded document not only enhances your business’s identity but also reinforces your reputation with clients. By maintaining a consistent design across all client communications, you create a unified experience that aligns with your brand’s values and message.

Key Elements to Include for Branding

When customizing your billing documents with your brand’s identity, consider these key design elements:

- Logo: Position your company’s logo at the top of the document to make your brand immediately recognizable. It’s an essential part of the overall design that reinforces your business identity.

- Color Scheme: Use your company’s primary colors throughout the document to ensure consistency with your marketing materials and website. This creates a sense of familiarity for your clients.

- Font Style: Choose fonts that align with your brand’s style. Stick to professional, easy-to-read fonts to ensure clarity while still keeping a cohesive look with your branding guidelines.

- Tagline or Slogan: If your company has a memorable tagline or slogan, consider including it in the footer or header. This adds a personal touch and reinforces your brand message.

Practical Tips for Brand Consistency

To maintain a professional appearance and ensure your branding is consistent, follow these additional tips:

- Keep It Simple: Avoid overloading the document with too many design elements. Focus on clean lines, clear typography, and effective use of your brand colors.

- Use High-Quality Images: Ensure that your logo and any other images used are high-resolution to prevent pixelation and maintain a polished look.

- Align with Other Materials: Ensure that the branding on your billing documents matches the look and feel of other materials like your website, business cards, and email signatures to reinforce brand recognition.

By integrating your company’s branding into your payment requests, you not only improve the visual appeal

Common Mistakes in Billing Documents

Creating a payment request document might seem straightforward, but there are several common mistakes that can lead to confusion, delays, and even disputes. These errors can range from simple formatting issues to critical omissions that impact the clarity of the document. Avoiding these pitfalls is essential for ensuring a smooth and professional transaction process.

Frequent Errors to Avoid

Here are some of the most common mistakes made when creating financial documents, along with tips on how to avoid them:

Mistake How to Avoid It Missing or Incorrect Payment Details Ensure that payment instructions, methods, and bank details are clearly outlined to avoid delays in payment processing. Unclear Payment Due Date Always specify an exact payment date and clearly indicate the terms (e.g., “Payment due within 30 days of issue date”). Not Itemizing Charges Clearly break down the cost of goods or services so that your client understands exactly what they are paying for. Omitting Client Information Make sure the recipient’s full name, address, and contact details are included to avoid confusion about the payer. Incorrect Tax Calculations Verify that the correct tax rate is applied and that taxes are itemized separately from the main amount to maintain transparency. How to Ensure Accuracy and Professionalism

To avoid these mistakes, always double-check your documents before sending them out. Keep a checklist of the key components to include in your financial records. Additionally, consider using digital tools or software that automatically generate billing documents with built-in error checks to help reduce the chances of mistakes.

By paying attention to these common errors and ensuring your billing documents are accurate

How to Automate Billing Document Generation

Automating the creation of payment requests can save time and reduce the likelihood of human error. By using automation tools, you can generate accurate, professional documents in minutes, ensuring consistency across all transactions. Automating this process not only speeds up billing but also helps maintain organized records, streamline workflows, and ensure timely follow-ups for outstanding payments.

Steps to Automate Billing Document Creation

Here are the key steps to effectively automate your billing document generation:

- Choose the Right Software: Select a tool or platform that supports automated document generation. Many accounting or invoicing software solutions offer this feature, allowing you to set up templates that automatically populate with customer and transaction details.

- Set Up Client Information: Ensure that all client details, such as contact information, payment terms, and past transaction history, are stored in your software. This data will be automatically pulled into each document, reducing the need for manual input.

- Create Custom Templates: Design a template that suits your business needs. Set up fields for product or service descriptions, quantities, rates, and applicable taxes. Automation tools can then fill in these fields based on transaction data.

- Automate Payment Reminders: Many platforms allow you to set up automatic reminders for overdue payments. This can help you stay on top of collections and avoid missing follow-up opportunities.

Benefits of Automating Your Billing Process

Automating your payment request generation process offers several key advantages:

- Time Savings: Automation reduces the time spent on manual entry, allowing you to focus on more important tasks.

- Consistency: Automatically generated documents ensure a uniform appearance and structure, which helps maintain professionalism.

- Accuracy: Automation eliminates the risk of human error in calculations and data entry, ensuring that your financial records are always correct.

- Improved Cash Flow: By speeding up document generation and automating reminders, you can ensure faster payment collection and better cash flow management.

By implementing automated billing solutions, you can streamline your processes, improve accuracy, and save valuable time while enhancing your clients’ experience.

Tips for Making Billing Documents Mobile-Friendly

With the increasing use of mobile devices for business and personal transactions, it’s essential to ensure that your financial documents are optimized for viewing on smaller screens. Mobile-friendly documents provide a smoother user experience, making it easier for clients to review, approve, and process payments on the go. By designing your billing documents with mobile devices in mind, you can increase accessibility and improve client satisfaction.

Here are some practical tips to help you create mobile-optimized billing records:

- Use a Simple Layout: Keep the design clean and straightforward. Avoid clutter and excessive information on one screen. Prioritize the most important details, such as payment amounts, due dates, and contact information, so they are easy to locate on smaller screens.

- Optimize Font Size: Use larger, readable fonts that are easy to view on mobile devices. Text should be at least 12-14 points to ensure readability without requiring zooming or scrolling.

- Ensure Responsive Design: Ensure that your document automatically adjusts to fit the screen size of the device. Many invoicing tools offer responsive design features that resize the document depending on the display.

- Limit Graphics and Images: While your company logo or branding elements are important, keep them minimal to avoid loading delays or formatting issues on mobile devices. Too many images can slow down the viewing experience.

- Include Clickable Links: Make sure that any URLs or email addresses are clickable. This allows clients to easily visit your website or contact you directly from their mobile device without having to manually enter information.

- Provide Mobile Payment Options: If you accept payments through digital platforms, include clickable payment buttons that take users directly to a payment portal. This facilitates easy and quick payments right from their mobile device.

By following these tips, you ensure that your financial documents are easy to read and interact with, regardless of the device your clients use. This improves efficiency and makes the payment process more convenient, leading to faster and smoother transactions.

How to Handle Currency and International Billing

When conducting business internationally, it’s essential to account for different currencies, exchange rates, and varying local tax regulations. Whether you’re selling to clients overseas or purchasing goods and services from foreign suppliers, clear and accurate financial documents are critical for avoiding confusion and ensuring timely payments. Handling currency correctly and adapting your documents for international transactions can help you maintain professionalism and build trust with clients from various countries.

Managing Currency and Exchange Rates

One of the first things to address when working with international transactions is ensuring that the correct currency is used. Here are a few best practices:

- Use Local Currency: Always use the client’s local currency for international transactions, unless otherwise agreed. This makes it easier for your clients to understand and process the payment.

- Display Exchange Rates: If you must charge in your own currency, clearly show the exchange rate used to convert the price to the client’s currency. This helps avoid confusion and builds trust.

- Provide Multiple Currency Options: If possible, offer clients the option to choose their preferred currency for payment. Many online payment gateways support multi-currency options, making the process smoother.

Adapting for International Regulations and Taxes

Different countries have varying tax laws and billing requirements. When dealing with cross-border transactions, take the following points into consideration:

- Specify Tax Rates: Include the relevant tax rates for the client’s location. Some countries have Value-Added Tax (VAT), while others may charge different sales taxes. Ensure you apply the right tax rates for international clients based on their location.

- Include Legal Requirements: Certain countries require specific information on financial documents, such as tax identification numbers, company registration details, or other legal notices. Always check the legal requirements for billing in the client’s country.

- Clear Payment Terms: Be explicit about payment terms, such as due dates and late fees, especially when working across time zones. This will help reduce confusion and establish clear expectations.

By accurately handling currency conversions, exchange rates, and local tax regulations, you can avoid potential problems with international clients and ensure smooth, hassle-free transactions. Clear documentation and attention to detail in this area help mai

Legal Considerations for Billing Documents

When preparing payment requests, it’s important to consider the legal requirements that apply to these documents. Each country, and sometimes specific industries, may have regulations about what information must be included to ensure the document is valid and enforceable. Understanding these legal aspects helps protect both the business and the client, ensuring that both parties are in compliance with relevant laws and regulations.

Here are some key legal considerations to keep in mind when creating your financial documents:

- Accurate Business Information: Always include your full business name, address, and contact details. Many jurisdictions require that businesses clearly identify themselves on any formal transaction document.

- Tax Identification Numbers: Depending on your location, you may be required to include your tax identification number or VAT number on your payment request. This helps ensure compliance with tax laws.

- Clear Payment Terms: Include specific payment terms, such as the due date, penalties for late payments, and accepted payment methods. Being clear about these terms helps avoid disputes later on.

- Itemized List of Services or Products: Legally, it’s often required to provide a breakdown of the goods or services being billed, including quantities, unit prices, and any applicable taxes. This helps both parties verify the accuracy of the charges.

- Currency and Exchange Rate Information: If you’re dealing with international transactions, include the currency in which the payment is due, as well as any exchange rate details, if applicable. This ensures both parties understand the financial terms clearly.

- Legal Disclaimers: In some cases, you may need to include specific disclaimers or legal notices, particularly for specific industries or international transactions. These can vary by location, so it’s important to research the requirements based on your operating region.

- Invoice Numbering: Make sure to include a unique invoice number for each document. This is a legal requirement in many regions, helping track and reference the payment request for record-keeping and dispute resolution purposes.

Failure to include these essential elements can lead to disputes, delays, or non-compliance with local laws. By ensuring that all necessary legal information is included, you create a clear, enforceable document that protects your business and fosters trust with clients.

How to Maintain Billing Records

Keeping accurate and organized records of all financial transactions is essential for any business. Properly maintaining these documents not only helps you manage your cash flow but also ensures compliance with tax regulations, simplifies accounting processes, and provides a clear overview of your business’s financial health. Establishing a systematic approach to record-keeping is crucial to maintaining transparency and avoiding mistakes in the long run.

Best Practices for Organizing Financial Documents

Here are some effective practices for managing and storing your payment-related records:

- Use Digital Tools: Invest in accounting software or digital platforms that help you store and organize your records. These tools can automatically generate and archive documents, track payments, and even calculate taxes, reducing the risk of errors.

- Keep Records Categorized: Separate documents by type (e.g., payments received, services rendered, and taxes) and by date to simplify searches when needed. Use folders or digital categories to group relevant data together.

- Ensure Consistency in Document Naming: Use a clear and consistent naming system for each record, such as including the date or client name in the document title. This will make it easier to find specific records when needed.

- Track Payment Status: Maintain a system to monitor whether payments have been received, are overdue, or are pending. This ensures you stay on top of collections and avoid misunderstandings with clients.

- Backup Your Records Regularly: Make sure to back up your digital records regularly, either through cloud storage or external drives. This ensures that your documents are safe and can be accessed in case of technical failure.

Compliance and Legal Considerations

In addition to organizing your records efficiently, there are several compliance and legal aspects to consider:

- Retain Records for Required Period: Different jurisdictions may have specific rules about how long you are required to keep financial documents. In many cases, it’s recommended to hold onto records for at least 5–7 years for tax and audit purposes.

- Ensure Secure Access: Protect sensitive financial records with proper security measures, whether through encrypted digital storage or secure physical storage. Ensure that