Best Ecommerce Invoice Template for Streamlined Online Billing

Running an online business involves managing many aspects, one of which is ensuring that your financial transactions are clear and professional. When a sale is made, you need a reliable way to document the details of the exchange, ensuring both parties are on the same page about the amount owed, payment terms, and other essential information. A well-structured document is key to maintaining trust and professionalism in every transaction.

In this article, we will explore how to create and use an effective billing document that helps streamline your business operations. From customizing the design to managing payment information, understanding the best practices can save time and reduce errors. Whether you’re handling one-off sales or managing a growing customer base, having the right tool can make all the difference in maintaining smooth financial operations.

By focusing on practical features and tips, we aim to provide you with the knowledge you need to set up and use billing records that suit your specific business needs. Whether you’re just starting out or looking to improve your current process, understanding these key components will help keep your financials organized and professional.

Why You Need an Ecommerce Invoice Template

For any online business, clear and professional documentation is essential to ensure smooth transactions. Having a standardized method for presenting purchase details helps both you and your customers stay organized. It provides a clear record of the goods or services sold, payment terms, and other important details, reducing misunderstandings and potential disputes.

Using a pre-designed document helps save time and eliminates errors that may arise when creating one from scratch. With a consistent format, you can quickly issue professional records for every transaction, regardless of the volume of sales. This not only makes your business appear more polished but also improves efficiency by streamlining administrative tasks.

Additionally, having a reliable document can be beneficial for tax purposes, accounting, and future references. By maintaining accurate and consistent financial records, you ensure that you are prepared for audits, tax filings, and other legal requirements. Automation can also help in this area, allowing for quick generation and delivery without having to repeat the same steps every time.

Ultimately, a well-structured billing document helps establish trust with your customers and builds credibility for your brand. When your clients receive clear, professional records, it reassures them about your business’s reliability and attention to detail.

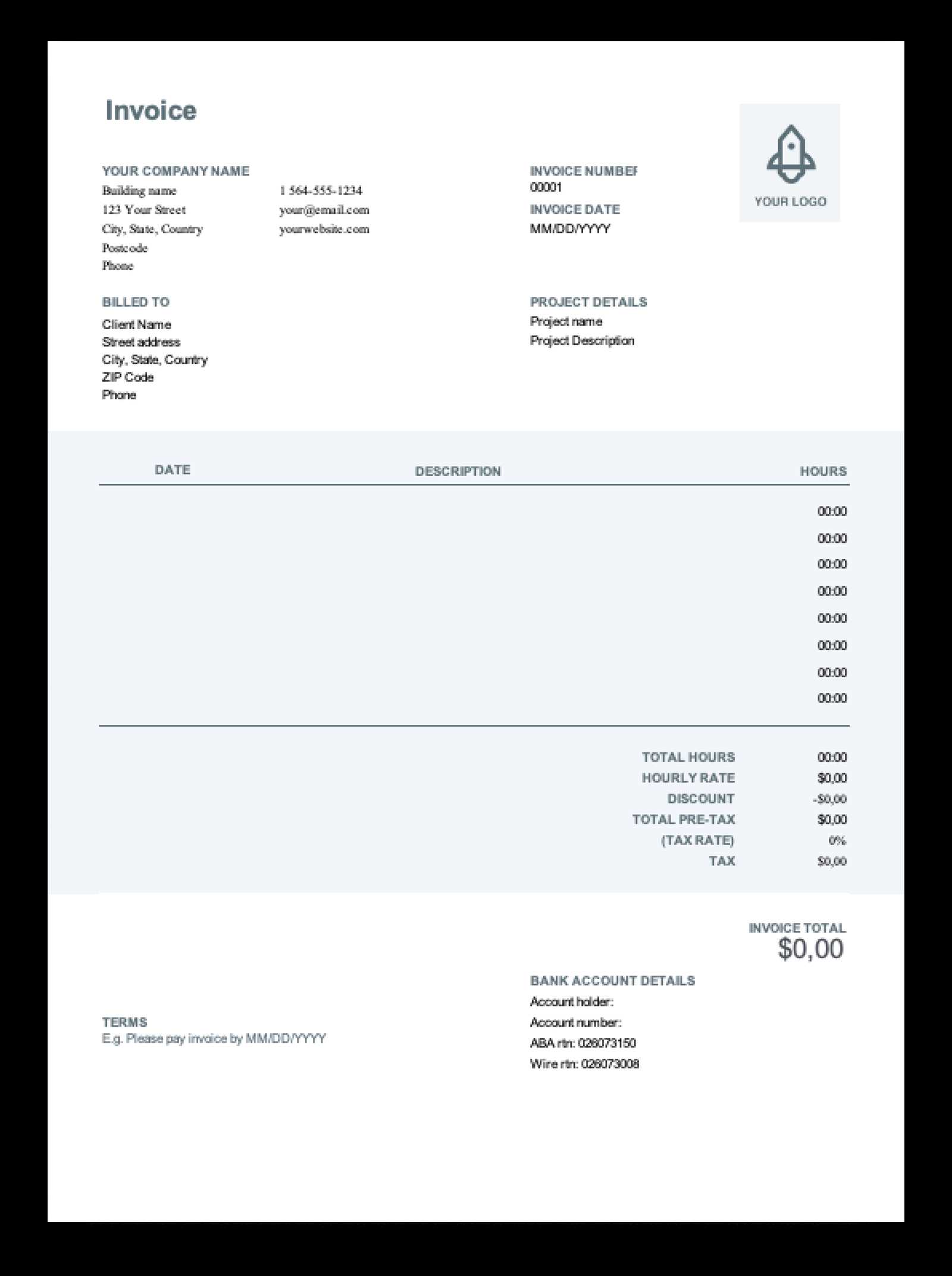

How to Create an Invoice for Ecommerce

Creating a professional document for sales transactions is crucial for every online business. This document serves as a record of the sale, outlines the products or services provided, and confirms the amount due. Properly crafting such a record ensures clarity and maintains your business’s professionalism.

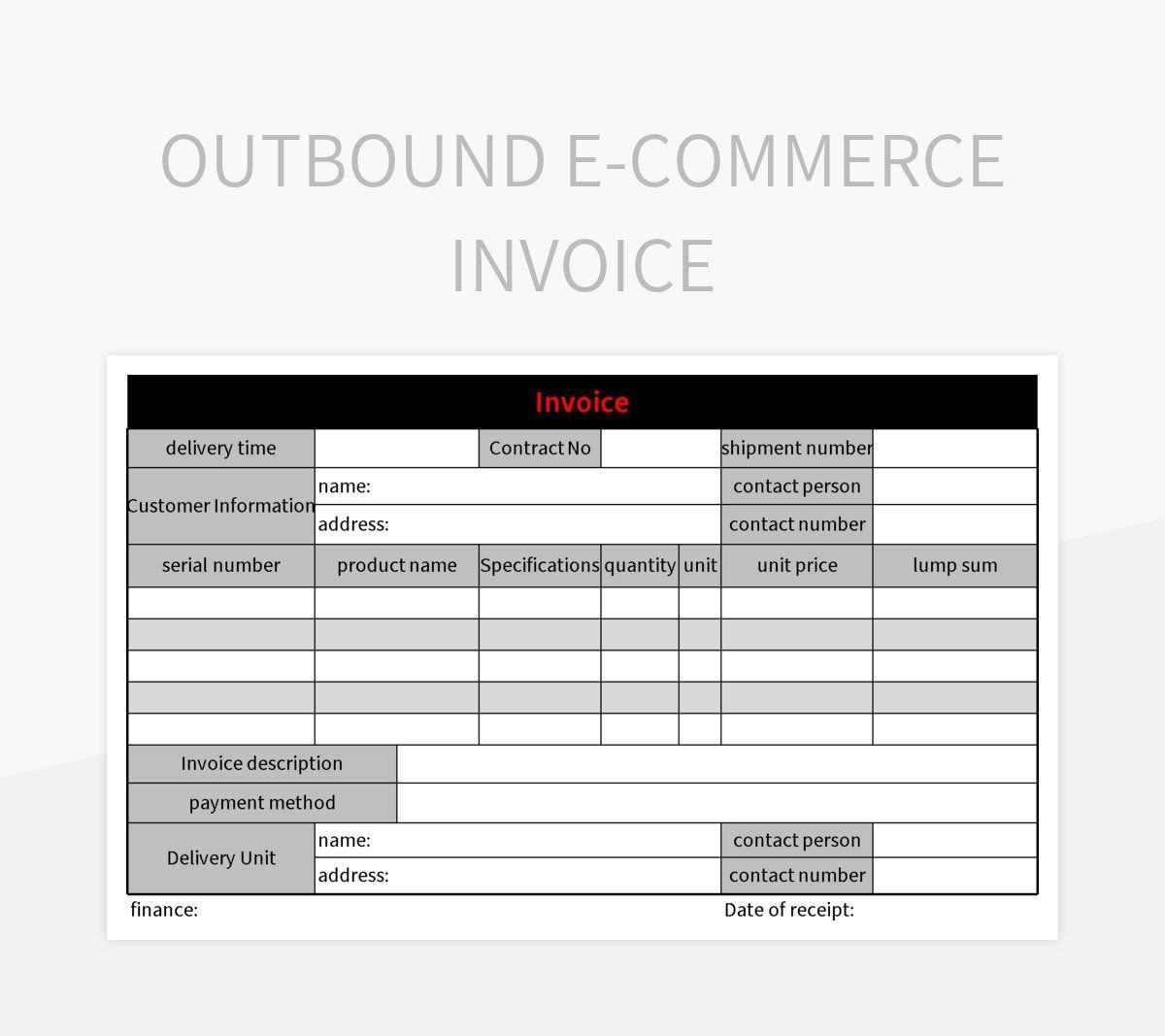

Steps to Craft a Clear Billing Record

Follow these basic steps to create an effective document that covers all the essential details:

- Include Business Information: Start with your business name, address, and contact details. This information is vital for your customers and helps in building trust.

- Include Customer Details: Clearly state the customer’s name, address, and contact information. This ensures that the document is personalized and can be easily tracked.

- List the Products or Services: Detail the items sold, including descriptions, quantities, and individual prices. If applicable, include SKU numbers for easy identification.

- Include Payment Information: State the total amount due, the payment method, and any taxes or additional fees that apply. Be sure to highlight the payment due date.

- Provide Terms and Conditions: If necessary, outline payment terms, such as late fees or installment options. This is especially important for customers who are on payment plans.

Tools for Easy Creation

There are several tools available that can help automate the process of generating these records, saving you time and reducing the chances of errors. Some popular options include:

- Invoice generation software

- Online platforms with customizable forms

- Spreadsheet templates for manual creation

By following these steps and utilizing the right tools, you can quickly create well-organized documents that ensure smooth transactions and maintain a professional image for your business.

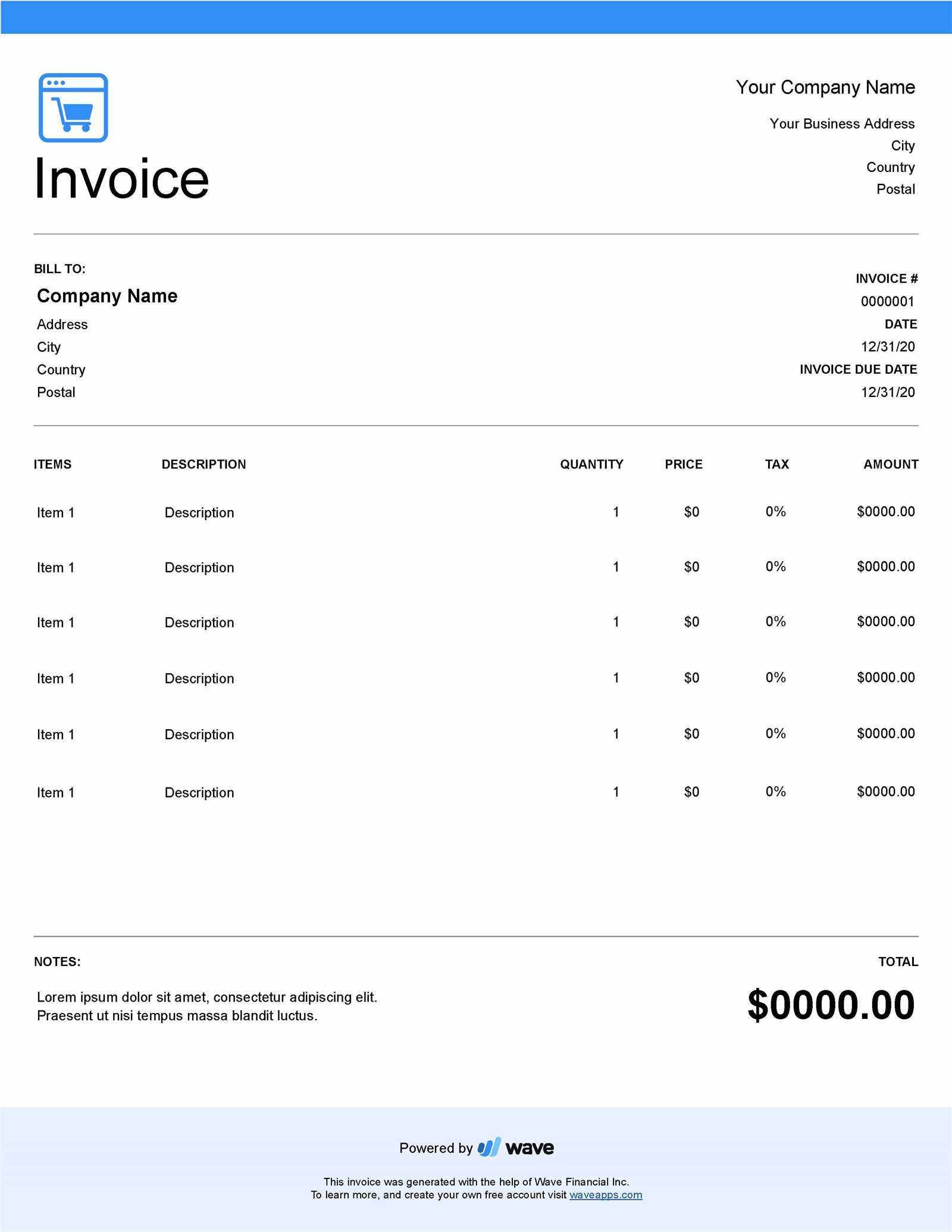

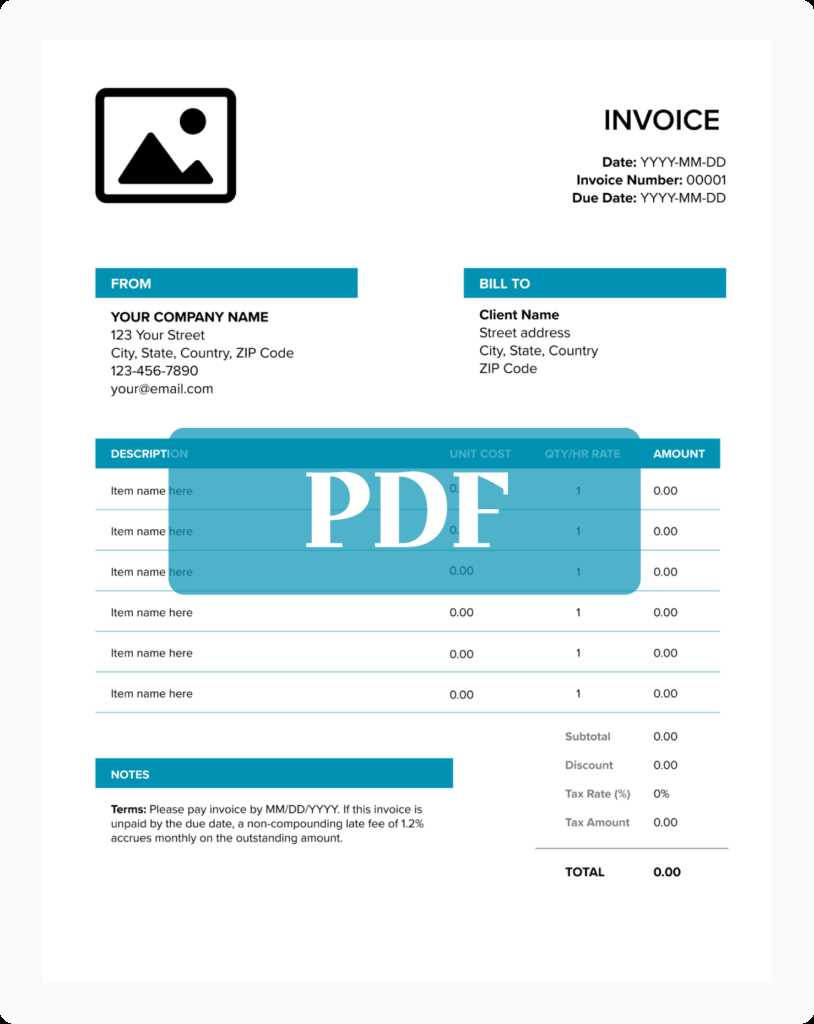

Essential Features of an Ecommerce Invoice

When creating a document to record sales transactions, it’s crucial to include specific elements that ensure clarity, accuracy, and professionalism. A well-structured document not only serves as proof of purchase but also protects both the business and the customer by clearly outlining the terms of the transaction. Below are the key features every sales record should include.

- Business and Customer Information: This includes the seller’s name, address, and contact details, along with the buyer’s name and address. This information ensures proper identification for both parties involved.

- Transaction Date: Always include the date when the transaction occurred. This helps track when the payment is due and provides a clear timeline of the purchase.

- Unique Identification Number: A unique reference number or code is essential for organizing and tracking all transactions. It also simplifies searching for specific records in the future.

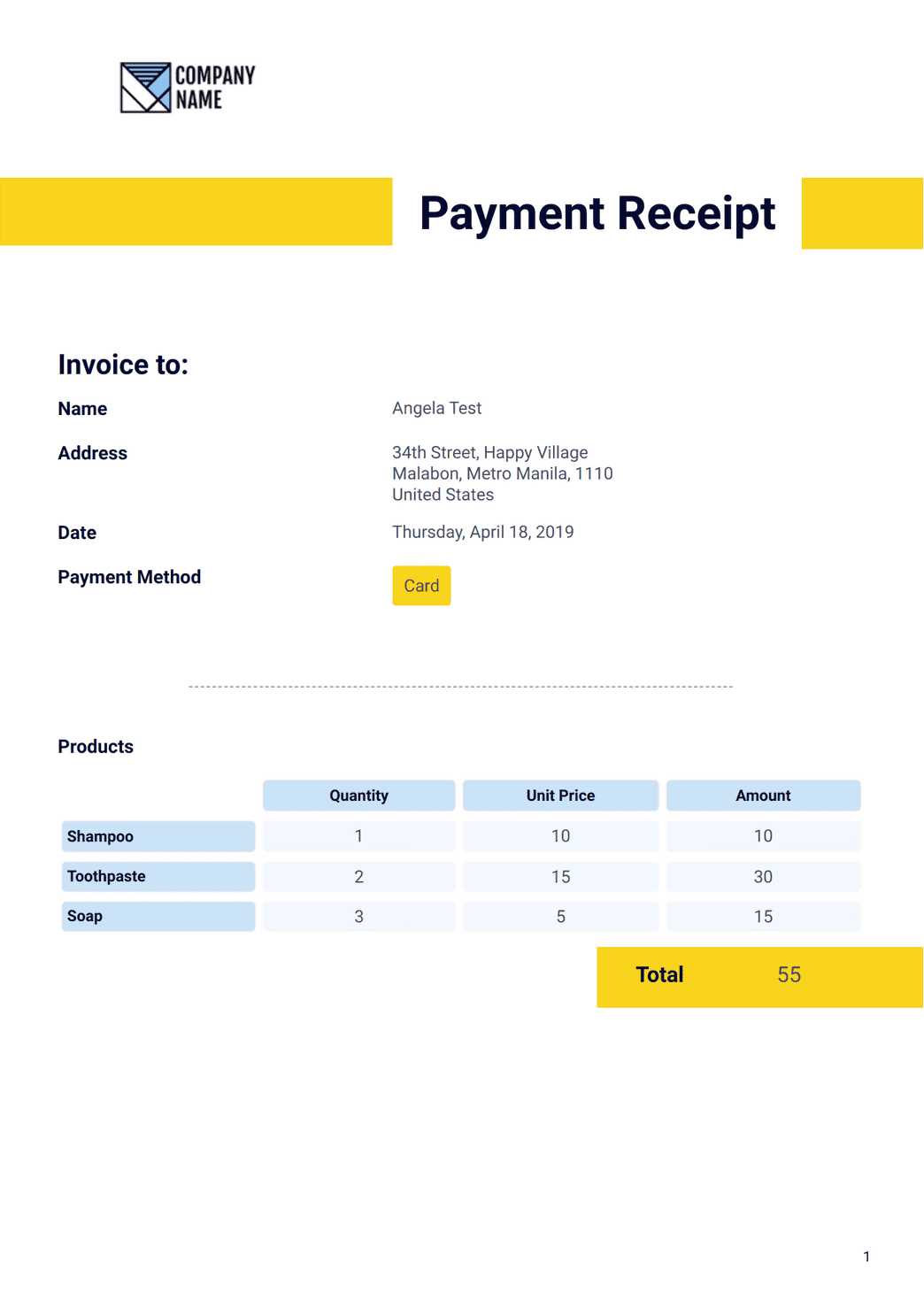

- Detailed List of Products or Services: Each item should be described clearly, including quantity, unit price, and total cost. If applicable, SKU numbers or product codes should also be included for easy reference.

- Subtotal and Total Amount: The subtotal should reflect the cost of all items before any additional charges, such as taxes or shipping fees. The total amount due should be clearly stated at the bottom, making it easy for the buyer to see the final cost.

- Taxes and Fees: Any applicable taxes, fees, or discounts should be clearly listed to avoid confusion. This transparency helps customers understand the full cost of their purchase.

- Payment Terms: Clearly state the due date for payment and any applicable terms, such as late fees or installment options. This ensures both parties are aware of when payment is expected and the consequences for delayed payment.

- Payment Methods: Indicate the methods accepted for payment, whether it’s credit card, bank transfer, or other online payment solutions. This makes it easier for the customer to pay and for the business to manage different payment options.

By including these essential features, businesses can ensure their transactions are clearly documented, reducing confusion and promoting trust between the seller and the buyer. These elements help create a professional and transparent record that can be referenced in the future if needed.

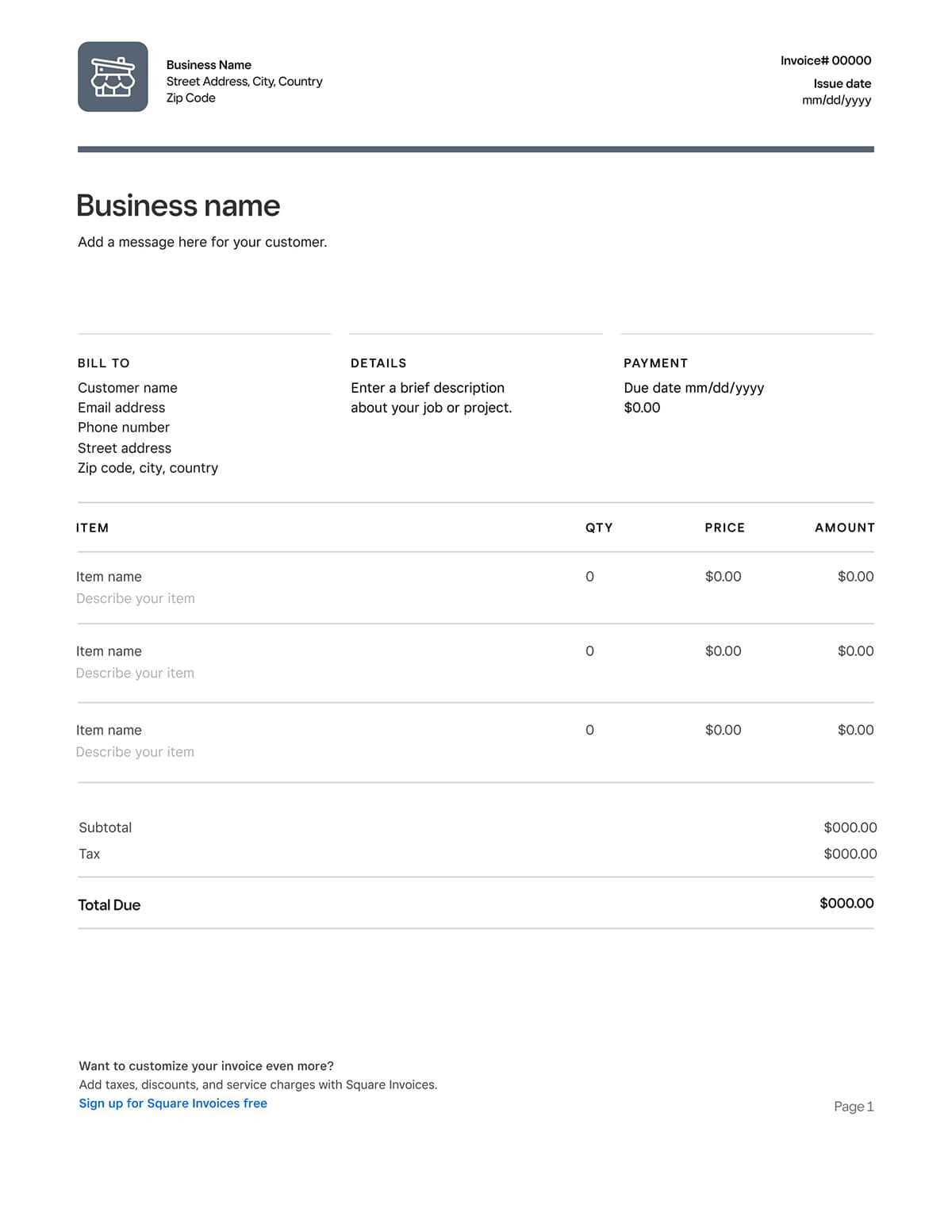

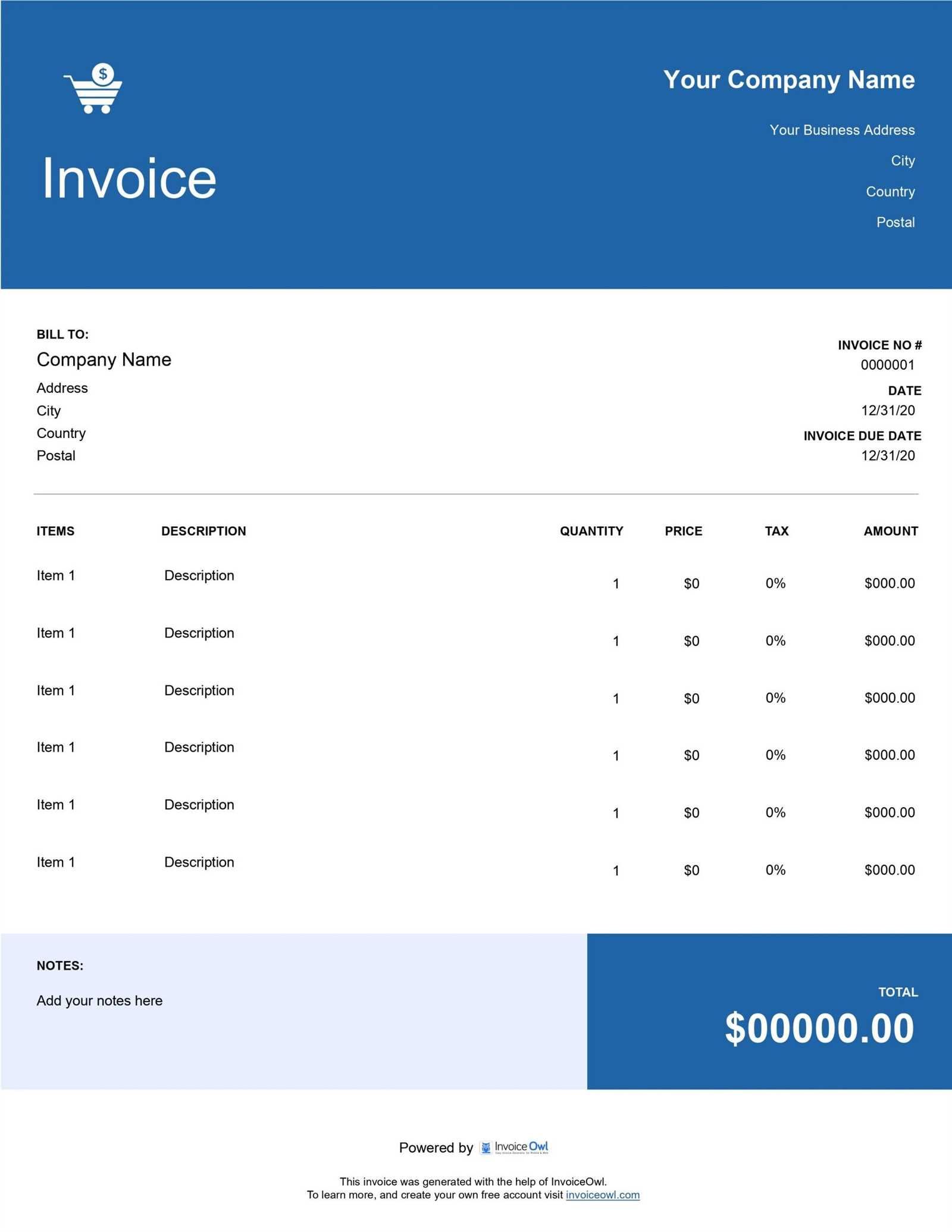

Customizing Your Invoice Template for Branding

One of the most effective ways to enhance your business’s image is by incorporating your brand identity into every aspect of your customer interactions, including the sales records. Personalizing these documents not only reinforces your business identity but also ensures that customers have a consistent experience across all touchpoints. A professional design aligned with your branding can leave a lasting impression on your clients.

Here are a few key elements to consider when customizing your sales records to reflect your brand:

| Element | Branding Tip |

|---|---|

| Logo | Place your company logo at the top of the document for immediate brand recognition. Ensure it is clear and high-quality to reflect your professionalism. |

| Color Scheme | Use your brand’s colors throughout the document to maintain consistency. Incorporating your brand palette for headings, borders, and text can enhance the visual appeal. |

| Font Choice | Use fonts that are consistent with your website and other marketing materials. Choose readable, professional fonts that align with your brand’s style–whether modern, traditional, or playful. |

| Tagline or Message | Consider adding your brand’s tagline or a short, friendly message at the bottom of the document to leave a personalized touch. This could be a thank-you note or a reminder of your commitment to quality service. |

| Design Layout | Ensure the layout is clean and organized, with easy-to-read sections. A well-structured design helps reinforce professionalism and reliability. |

By paying attention to these details, you create a cohesive experience for your customers and increase the perceived value of your business. Customizing these documents doesn’t just improve the look–it also strengthens your brand’s presence, making your business more memorable with every transaction.

Top Tools for Generating Ecommerce Invoices

Managing financial transactions effectively is crucial for online businesses. One way to streamline this process is by using specialized tools that help you quickly generate clear and professional records for every sale. These tools can save you time, reduce errors, and ensure that each transaction is documented accurately, enhancing your business’s efficiency and professionalism.

Popular Software Solutions

There are several software solutions available that automate the creation of sales records. These platforms often come with customizable features, allowing you to tailor each document to fit your business needs. Some of the best options include:

- FreshBooks: An easy-to-use accounting tool that allows you to create professional records, track payments, and manage taxes effortlessly. It’s ideal for small to medium-sized businesses.

- QuickBooks: A robust accounting platform with features for generating and managing sales documents, tracking expenses, and reconciling payments. It’s especially useful for larger businesses or those with complex financial needs.

- Zoho Invoice: A user-friendly platform that offers automated invoicing, multi-currency support, and customizable templates. It’s a great option for businesses with international clients.

- Wave: A free tool for small businesses that helps generate sales records, track payments, and integrate with your accounting software. It’s particularly popular for freelancers and entrepreneurs.

Online Platforms for Quick Creation

If you’re looking for a quick and simple way to create sales records without the need for complex software, several online platforms provide easy-to-use tools that allow you to generate documents in minutes. These tools are ideal for businesses looking to keep things simple yet professional:

- Invoice Ninja: A cloud-based platform that lets you create custom documents, track payments, and even accept online payments. It’s free for basic use, making it perfect for startups and small businesses.

- PayPal: In addition to being a popular payment processor, PayPal offers a straightforward way to create and send professional records to customers directly from the platform.

- Invoicely: A free and paid platform that offers an intuitive interface for generating professional sales documents. It also integrates with several accounting and payment systems.

By using these tools, you can automate the process of creating clear and accurate records, which saves you time and ensures that every transaction is documented correctly. Whether you need a simple, quick solution or a more robust accounting platform, there’s a tool out there to fit your business needs.

Automating Invoices in Your Online Store

For online businesses, manually creating records for each transaction can quickly become overwhelming, especially as sales volumes grow. Automating this process not only saves valuable time but also reduces the risk of human error and ensures that every customer receives accurate and timely documentation. By setting up an automated system, you can streamline your business operations and focus on other critical tasks while maintaining professionalism in every sale.

Benefits of Automating the Billing Process

- Time Efficiency: Automated tools generate records instantly, eliminating the need for manual input and saving hours of administrative work.

- Consistency: Automation ensures that every transaction follows the same format, providing a consistent experience for your customers.

- Accuracy: Reducing manual data entry minimizes the chances of mistakes, ensuring that all information is correct and up-to-date.

- Improved Cash Flow: With automated systems, you can set up payment reminders, track outstanding balances, and ensure timely payments from customers.

How to Set Up Automated Billing in Your Online Store

Integrating automation into your store’s financial processes is easier than it seems. Follow these steps to get started:

- Choose an Automation Tool: Select a platform or software that integrates with your store’s checkout system and automatically generates records. Some popular tools include FreshBooks, QuickBooks, and Shopify’s built-in invoicing features.

- Customize Your Settings: Most tools allow you to personalize templates with your business logo, colors, and other branding elements. Make sure the settings are configured to reflect your store’s style and payment terms.

- Enable Automatic Payment Reminders: Set up automatic email reminders for customers when payments are due or if a payment hasn’t been received by the specified date.

- Integrate Payment Gateways: Link your payment processor to the system so that once a payment is made, a record is automatically generated and sent to the customer.

By implementing automation in your store, you can ensure that your billing process runs smoothly without constant manual intervention. This not only enhances operational efficiency but also improves the overall customer experience, making your business look more organized and professional.

Best Practices for Invoice Numbering

Properly numbering sales records is essential for maintaining an organized and professional system. A clear and logical numbering system allows you to track each transaction efficiently, avoid duplicates, and ensure that all documents are easy to reference. By following best practices, you can keep your financial records in order and simplify processes for both your business and your customers.

Key Principles for Numbering Sales Documents

When developing a numbering system for your business, there are several important factors to consider. Below are some key guidelines to help you create an efficient and organized method:

| Best Practice | Explanation |

|---|---|

| Sequential Numbers | Start with a simple, sequential numbering system (e.g., 001, 002, 003). This ensures that each record has a unique identifier and avoids confusion between transactions. |

| Include a Prefix | Consider adding a prefix to the number, such as the year or a specific department code, for easier identification. For example, “2024-001” could represent the first document of the year 2024. |

| Avoid Gaps | Do not skip numbers in your sequence. Skipping could create confusion and make it difficult to track your records. Keep the sequence continuous for clarity. |

| Keep It Short | While the number should be unique, it should also be simple and concise. Long strings of numbers or complicated systems can be difficult to manage and track over time. |

| Track Your Numbers | Use software or spreadsheets to track which numbers have been issued and ensure no duplicates. This will help you maintain consistency and accuracy over time. |

Additional Tips for Numbering

- Consider Using Automations: Many accounting software platforms and online tools allow for automatic generation of unique numbers for each transaction. This reduces the risk of human error.

- Set Clear Guidelines: Create an internal guideline for your team on how to use and assign numbers, especially if more than one person is handling the process.

- Include a Date Reference: Some businesses prefer to include the transaction date within the numbering system to make it easier to trace documents over time (e.g., “23-08-001” for the first transaction on August 23rd).

By implementing a clear and structured numbering system, you can enhance the organization of your financial records and ensure that your business remains professional and efficient. Consistency and clarity in numbering will improve tracking, prevent err

How to Handle Taxes in Ecommerce Invoices

Properly handling taxes is a crucial aspect of managing financial transactions for any business. Ensuring that the correct amount of tax is applied and accurately recorded helps avoid legal issues and maintains transparency with your customers. Whether you’re charging sales tax, VAT, or any other form of tax, it’s essential to follow the right procedures to stay compliant with local and international tax laws.

Steps for Managing Taxes in Sales Documents

To ensure that tax is handled correctly in your records, follow these steps:

- Know the Tax Rates: Understand the applicable tax rates for your region and your industry. Different products or services may have different tax rates, and they can vary depending on the country or even the state or province.

- Collect Customer Tax Information: Depending on the location of your customers, you may need to collect information about their tax status, such as whether they are tax-exempt or subject to a specific rate.

- Clearly Display Tax Amounts: On your transaction records, clearly separate the taxable amount from the non-taxable amount. Include both the tax rate and the total tax applied, so the customer can easily understand how the final price is calculated.

- Include Tax Identification Number: Include your tax ID number on the document, especially if you are dealing with international customers. This helps ensure compliance with various tax regulations.

Best Practices for Tax Handling

- Use Automated Tools: Many accounting platforms and online tools can automatically calculate taxes based on location and the type of goods or services sold. This reduces the risk of human error and ensures that your tax calculations are up to date.

- Stay Updated on Tax Laws: Tax regulations can change frequently. Regularly check for updates in tax laws to ensure that your business remains compliant and avoids any penalties or fines.

- Provide Detailed Breakdown: Always provide a clear breakdown of how taxes are calculated, including the tax rate applied, the taxable amount, and the total tax charged. This ensures transparency and builds trust with your customers.

- Understand International Taxation: If you’re selling internationally, be aware of VAT, GST, or other local taxes that may apply to cross-border transactions. Include the necessary tax information and ensure that international shipping charges are handled correctly in your records.

By carefully managing and displaying taxes in your transaction records, you not only comply with the law but also build trust and transparency with your customers. Proper tax handling ensures that your business runs smoothly, avoiding legal complications and helping you maintain a good reputation.

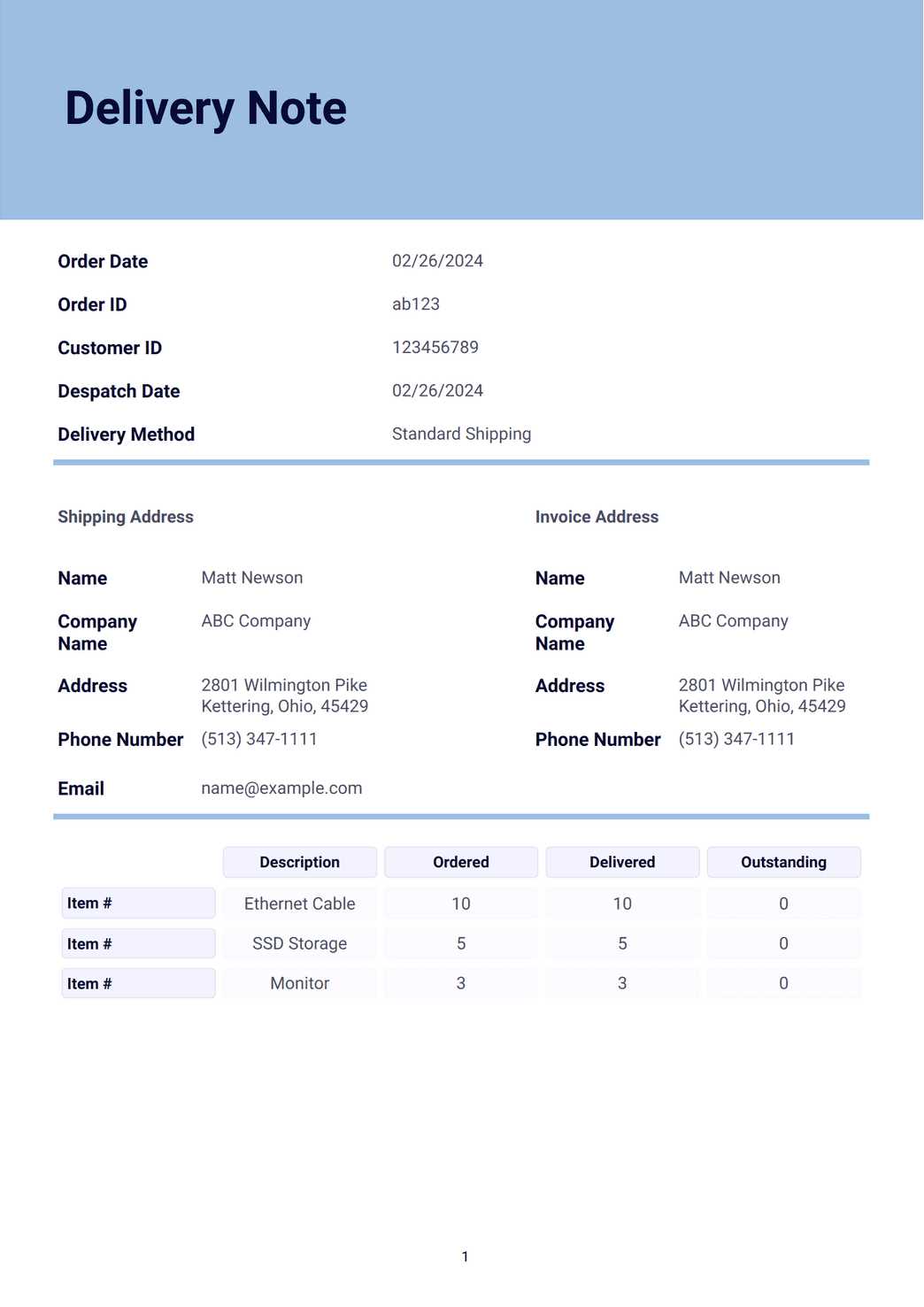

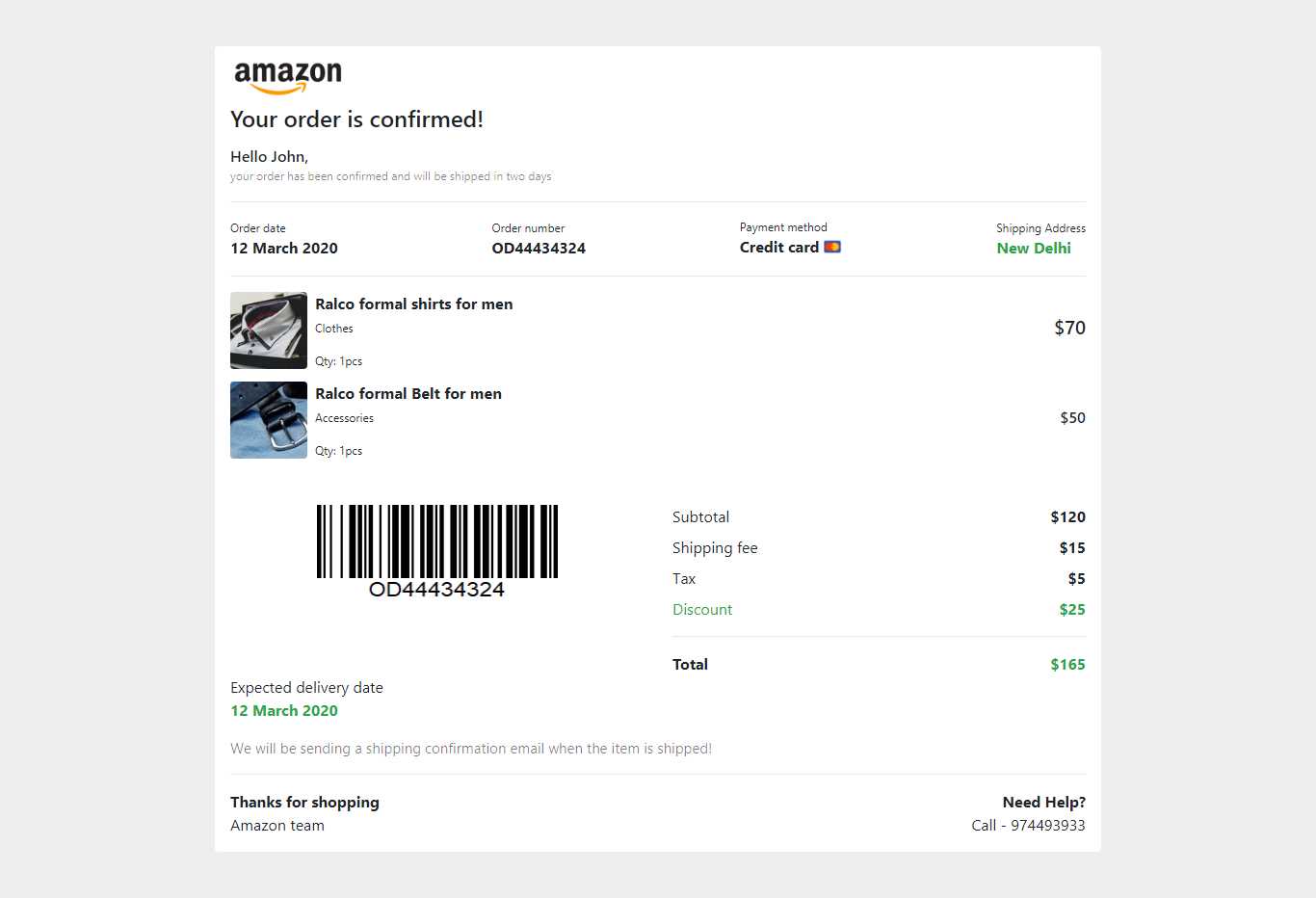

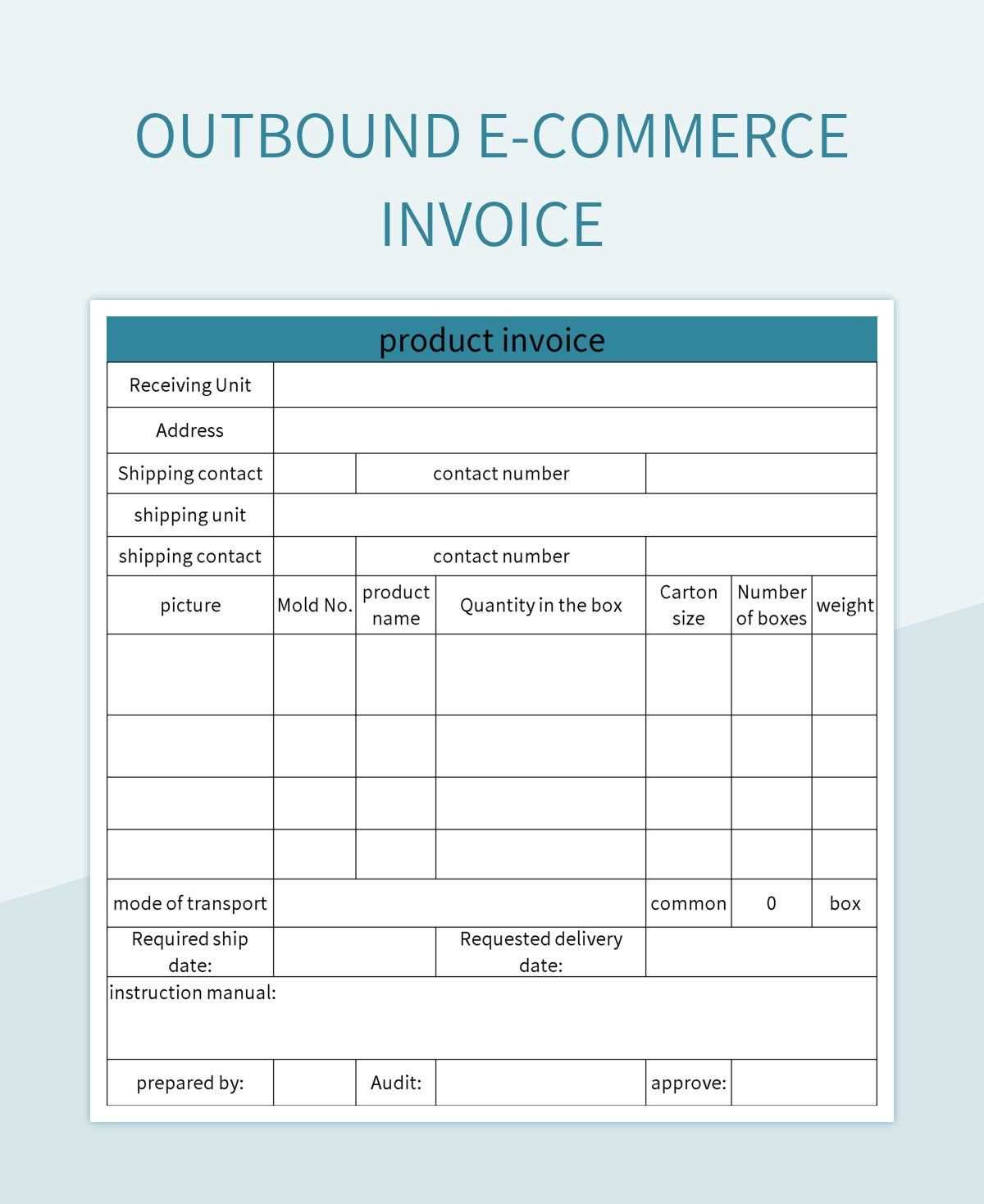

Managing Shipping Costs on Your Invoices

When running an online business, managing shipping costs effectively is crucial for both profitability and customer satisfaction. Shipping fees can significantly impact the overall cost of a transaction, so it’s important to present these charges clearly and fairly on your sales records. By accurately displaying shipping costs and explaining how they are calculated, you can avoid confusion and help customers understand the full cost of their purchase.

How to Include Shipping Fees in Sales Documents

To ensure a smooth process and maintain transparency, follow these guidelines when including shipping charges in your sales records:

- Separate Shipping Charges: Clearly list shipping fees as a distinct line item. This ensures that the customer can easily see the exact cost for shipping, separate from the cost of the products or services purchased.

- Provide Clear Descriptions: Specify the type of shipping (e.g., standard, expedited, international) and any applicable delivery timelines. This helps set customer expectations and reduces misunderstandings about delivery times.

- Include Shipping Carrier Information: If possible, include the name of the carrier (e.g., USPS, FedEx, UPS) and the tracking number. This adds a layer of transparency and allows customers to track their shipment with ease.

- Show Shipping Discounts (if applicable): If you’re offering free or discounted shipping, make sure this is reflected on the sales record. Highlight the savings to show your customer the value they are receiving.

Best Practices for Shipping Costs on Records

- Offer Multiple Shipping Options: Allow customers to choose from different shipping methods, each with a clear price. This flexibility allows customers to select the best option for their needs and helps them understand the price breakdown.

- Use Shipping Calculators: Many online platforms and checkout systems come with built-in shipping calculators that automatically determine the cost based on location, package weight, and delivery speed. This ensures accurate shipping costs for each transaction.

- Be Transparent About Shipping Policies: Make sure your shipping policies are clearly stated on your website, including any extra fees for international orders, expedited shipping, or handling. Transparency helps avoid customer frustration after the purchase.

- Automate Shipping Cost Calculations: Consider using automated tools that integrate with your payment and order systems to calculate shipping costs automatically. This minimizes human error and speeds up the checkout process.

By handling shipping costs clearly and professionally in your sales records, you can avoid confusion, ensure a better customer experience, and maintain a fair pricing structure. Clear communication about shipping helps you build trust with your customers and fosters a smoother transaction process.

Adding Payment Terms to Ecommerce Invoices

Clear payment terms are essential for maintaining smooth transactions and ensuring timely payments from your customers. By outlining the expected payment schedule, methods, and any late fees, you can avoid misunderstandings and create a more professional and transparent transaction process. Well-defined payment terms also help protect your business and encourage prompt payments, reducing the likelihood of delayed or missed payments.

Key Elements to Include in Payment Terms

When drafting payment terms for your records, it’s important to be specific and clear. Here are the key components you should include:

- Due Date: Always include the payment due date, clearly indicating when the payment should be made. For example, “Payment due within 30 days of receipt” or “Due by [specific date].”

- Accepted Payment Methods: List the payment methods you accept (e.g., credit card, bank transfer, PayPal, etc.). This ensures that your customer knows how they can pay and helps prevent confusion.

- Late Payment Fees: Specify any fees that will be charged if payment is not made by the due date. For instance, “A late fee of 1.5% per month will be applied to overdue amounts.”

- Early Payment Discounts: If applicable, include details of any discounts for early payments, such as “5% discount for payments made within 10 days.” This can encourage quicker payment and improve cash flow.

- Payment Terms for Installments: If your business offers installment plans, specify the payment schedule, such as “First payment due on [date], with subsequent payments due monthly.”

Best Practices for Clear Payment Terms

- Be Concise and Direct: Use simple, straightforward language to avoid any confusion about your payment expectations. The clearer the terms, the less room for ambiguity.

- Make Terms Visible: Ensure that your payment terms are clearly visible and not buried in small print. Place them prominently in the document to make sure customers can easily find them.

- Align Terms with Your Policies: Ensure that your payment terms align with your business policies and financial goals. For example, if you require faster payments to improve cash flow, set shorter payment terms.

- Regularly Review and Update: Periodically review your payment terms to ensure they still meet your needs and reflect any changes in your business practices or local regulations.

By setting clear and fair payment terms, you help customers understand their obligations and encourage prompt payments. This clarity not only improves your cash flow but also strengthens your professional relationship with clients, promoting trust and transparency in all transactions.

Importance of Invoice Date and Due Date

Setting clear and accurate dates in your sales records is essential for effective business management. Both the issue date and the due date play key roles in ensuring timely payments, maintaining professional standards, and keeping track of transactions. By properly managing these dates, you can avoid payment delays, maintain consistent cash flow, and strengthen relationships with your customers.

Why the Issue Date Matters

The issue date marks the official creation of the sales document and is the starting point for both record-keeping and payment scheduling. It’s crucial for several reasons:

- Tracking Transactions: The issue date helps you and your customers keep track of when the transaction took place, making it easier to reference and organize your financial records.

- Legal and Tax Compliance: In many regions, businesses are required to maintain accurate records that include the date of issue for tax purposes. This ensures that your business remains compliant with local regulations.

- Customer Expectations: The issue date can help your customer understand when the transaction officially took place, ensuring transparency and reducing potential disputes.

Why the Due Date is Crucial

The due date is just as important as the issue date. It represents the deadline for payment and serves as a reminder for both parties. Here’s why it’s essential:

- Encourages Timely Payment: Clearly indicating a due date helps to set customer expectations and encourages prompt payment, which is critical for maintaining healthy cash flow in your business.

- Helps Avoid Late Fees: If you specify a due date and communicate it clearly, customers are less likely to miss the deadline and incur any late fees, which also helps avoid awkward follow-up communications.

- Streamlines Financial Planning: Knowing exactly when payments are due allows your business to plan for expenses, salaries, and other financial obligations, ensuring smoother operations.

By including both the issue date and the due date in your transaction records, you can maintain clarity, professionalism, and efficiency in your financial processes. These simple yet important details contribute significantly to effective cash flow management and customer satisfaction.

International Ecommerce Invoices and Currency

When conducting business across borders, it is essential to consider the complexities of different currencies, tax regulations, and international transaction rules. Accurate currency management and clear documentation are crucial for ensuring smooth payments, avoiding misunderstandings, and staying compliant with local financial laws. By understanding how to handle these aspects correctly, businesses can foster better relationships with international clients and streamline the payment process.

Handling Currency for Global Transactions

One of the key challenges in international sales is managing currency differences. It’s important to clearly state the currency in which the payment should be made to avoid confusion and ensure that both parties are on the same page. Here are a few best practices for managing currency in your records:

- Specify the Currency: Always include the currency in which the transaction is being processed, whether it’s USD, EUR, GBP, or another. This reduces any potential confusion and ensures that the payment is made in the correct form.

- Currency Conversion Fees: If applicable, mention who is responsible for any currency conversion fees or international transaction charges. This should be clearly stated in the payment terms to avoid surprises for the customer.

- Exchange Rate Consideration: If the payment is being made in a different currency than your business’s primary one, consider including the exchange rate at the time of the transaction. This ensures that both parties agree on the amount and avoids disputes over fluctuating exchange rates.

Best Practices for International Transactions

In addition to currency management, handling international transactions requires an understanding of different tax laws, payment methods, and other factors. To make international payments smoother, consider the following:

- Tax Regulations: Be aware of the specific tax requirements for cross-border transactions, such as VAT or GST, depending on the location of your business and the customer. Clearly indicate any taxes or duties applicable in the transaction record.

- Preferred Payment Methods: Offer flexible payment methods that are common in international trade, such as PayPal, wire transfers, or international credit cards. This ensures that customers from different countries can pay with ease.

- Legal Requirements: Understand the legal requirements in both your country and the customer’s location. This might include providing certain documents or meeting specific requirements for cross-border sales, especially in the case of high-value items.

By addressing currency differences and complying with international payment regulations, you can simplify the payment process for global customers. This will not only improve your operations but also increase customer satisfaction and reduce the risk of payment delays or errors.

Design Tips for Professional Invoices

A well-designed sales document not only reflects your brand’s professionalism but also ensures clarity and ease of understanding for your customers. The layout, font choices, and overall organization can make a big difference in how the transaction is perceived. By paying attention to key design elements, you can enhance the customer experience, reduce the chance of errors, and create a visually appealing and functional document.

Here are some important design tips to create professional and effective sales records:

- Keep It Simple and Clean: Avoid cluttering the document with too much information or overly complex elements. Use a minimalist design that highlights the most important details, such as the transaction amount, payment terms, and contact information. A clean design ensures that customers can quickly find the information they need.

- Use Consistent Branding: Your sales record is an extension of your brand, so make sure it aligns with your business’s visual identity. Use your company’s colors, logo, and fonts to maintain brand consistency and professionalism.

- Organize Information Logically: Ensure that the content is easy to follow by organizing sections in a clear hierarchy. Group related details together (e.g., customer details, items purchased, total amount) and use headings to make it easy for customers to locate specific information.

- Choose Readable Fonts: Choose clear and legible fonts, especially for important information like the total amount due or due dates. Stick to no more than two complementary fonts, and ensure they are easily readable across all devices and formats.

- Include Clear Payment Instructions: Make the payment terms and due date stand out. Use bold text or a larger font size to highlight important dates, amounts, and payment methods, ensuring that your customer knows exactly what to expect.

- Provide Sufficient White Space: Don’t cram too much information into small spaces. Adequate white space between sections and around the edges of the document helps the reader focus and prevents the design from feeling crowded.

- Make It Mobile-Friendly: Many customers will view your sales records on their phones or tablets, so it’s important to ensure that the design is responsive. Test how the layout appears on different devices and ensure that it is readable and user-friendly on all screen sizes.

By applying these design tips, you can create a visually appealing and easy-to-understand sales document that enhances professionalism, improves customer satisfaction, and promotes smooth business transactions.

How to Track Invoice Payments Effectively

Keeping track of payments is a crucial part of managing any business. Ensuring that all transactions are recorded accurately and payments are received on time helps maintain healthy cash flow and avoids financial discrepancies. Effective tracking also allows you to follow up on overdue amounts promptly, ensuring that you stay on top of outstanding balances.

Steps to Monitor Payments Efficiently

Tracking payments doesn’t have to be a complicated process. By following a few simple steps and implementing the right tools, you can ensure smooth payment tracking:

- Record Payment Dates: Always record the exact date when a payment is received. This helps you stay organized and ensures that you can verify payment status in case of any disputes or inquiries.

- Link Payments to Specific Transactions: Make sure each payment is linked to the correct sale. This allows you to track which items have been paid for and which are still pending, giving you an accurate view of your financial situation.

- Use Payment Tracking Software: Utilize automated tools or software designed to track payments. Many accounting systems allow you to input or import payment details, which can save time and reduce the chance of errors.

- Set Up Payment Reminders: If payments are due, set up automatic reminders for your customers. This helps keep both parties aware of the due date and reduces the likelihood of late payments.

- Monitor Outstanding Balances: Regularly check for unpaid balances and overdue amounts. Having a system in place to monitor these will help you stay proactive and follow up with customers before the situation becomes problematic.

Best Practices for Following Up on Late Payments

- Send Friendly Reminders: If a payment is overdue, start with a polite reminder email or message. Clearly state the amount due and the new due date, if necessary.

- Offer Multiple Payment Options: Provide customers with several payment methods to make it easier for them to pay. This could include credit cards, bank transfers, or online payment systems.

- Be Transparent About Late Fees: If you charge late fees, make sure to communicate this clearly in your terms. If the customer does not pay on time, notify them about the additional charges in a professional manner.

- Keep Records of All Communications: Track all communication with your customers regarding payments. This can be helpful in case of any disputes or confusion about the payment terms.

By following these steps and implementing effective payment tracking strategies, you can ensure that your business runs smoothly and that all financial transactions are properly documented. Timely payments and organized record-keeping are essential for maintaining good customer relationships and ensuring long-term financial success.

Common Mistakes to Avoid in Ecommerce Invoices

Errors in transaction documentation can lead to confusion, delayed payments, and strained customer relationships. Small mistakes in recordkeeping can quickly become costly, both financially and reputationally. By understanding the most common mistakes and how to avoid them, businesses can improve their professionalism, reduce misunderstandings, and ensure a smoother transaction process for both themselves and their customers.

Key Mistakes to Avoid

Here are some of the most common mistakes that businesses make when issuing sales records, and tips on how to prevent them:

- Incorrect or Missing Payment Details: Always ensure that the payment instructions are clear and accurate. Omitting essential information like the payment method, due date, or bank details can cause unnecessary delays and confusion. Be precise and clear about how and when the payment should be made.

- Not Including Taxes or Shipping Costs: It’s crucial to include all relevant charges, including taxes and shipping costs, in your document. Failing to do so can lead to customer complaints and disputes. Always ensure that these amounts are listed separately and clearly.

- Ambiguous Terms and Conditions: Unclear terms or vague payment instructions can create confusion about expectations. Be specific about the payment deadlines, any applicable discounts, and the penalties for late payments. Clear terms help avoid misunderstandings.

- Incorrect Customer Details: Verify the accuracy of customer information before issuing any records. Incorrect names, addresses, or contact details can lead to delays in delivery and payment, and may even cause legal issues in the case of a dispute.

- Failing to Use Sequential Numbering: A sales record should have a unique number to help track transactions. Using duplicate numbers or failing to maintain a proper numbering system can cause confusion and make it harder to reconcile payments. Keep a sequential numbering system for clarity and organization.

How to Avoid These Mistakes

- Double-Check All Information: Before sending any documents, take a moment to review all details. Ensure that dates, amounts, and customer information are accurate, and that all necessary charges are included.

- Use Automation Tools: Consider using automated systems or software to create and send your documents. Many accounting tools automatically populate customer information, taxes, and shipping costs, which reduces the risk of manual errors.

- Standardize Your Process: Create a standardized system for generating and reviewing all records. Consistency helps reduce errors and ensures that nothing is overlooked in the process.

- Include Clear Contact Information: Always provide a way for customers to reach you in case of issues or questions. Clear contact details can prevent confusion and help resolve any problems quickly.

By avoiding these common mistakes and focusing on accuracy, businesses can enhance their professionalism and reduce the likelihood of issues with payments or customer dissatisfaction. Careful attention to detail ensures smooth and efficient transactions that benefit both you and your clients.

Legal Requirements for Ecommerce Invoices

When conducting business, it’s important to ensure that all financial transactions are documented in a legally compliant manner. Whether you’re operating locally or internationally, specific regulations govern how these records should be structured, what information must be included, and how they should be stored. Understanding and adhering to these legal requirements can help you avoid penalties, protect your business, and ensure that your customers have the necessary documentation for their records.

Here are some key legal requirements that you must consider when creating transaction documents for your business:

- Required Business Information: The law generally requires that certain business details be included, such as the company’s legal name, address, tax identification number (TIN), and contact details. This information helps establish the legitimacy of the transaction and ensures compliance with tax regulations.

- Clear Breakdown of Charges: It is essential to clearly list all charges associated with a sale, including product costs, taxes, shipping fees, and any other relevant expenses. Failure to provide a clear breakdown may result in confusion or disputes over the total amount due.

- Tax Information: Depending on your location and the nature of the transaction, you may be required to collect and remit taxes such as VAT or sales tax. Your document should clearly indicate the tax amount and rate applied to the sale, and include your VAT or sales tax number if applicable.

- Payment Terms and Deadlines: The document should state the agreed payment terms, such as the payment due date, available payment methods, and any penalties for late payments. These terms are often legally required and must be clearly outlined to avoid misunderstandings.

- Sequential Numbering: Most jurisdictions require businesses to maintain a sequential numbering system for all transactions. This ensures that each sale is uniquely identified and can be traced back if needed, for example, during audits or tax filings.

- Currency and Amounts: The document should clearly specify the currency in which the payment is due, especially for international transactions. This helps avoid confusion regarding exchange rates and ensures that both parties understand the value of the transaction.

By meeting these legal obligations, you not only stay compliant with the law but also build trust with your customers. It’s important to regularly review and update your documentation practices to stay current with any changes in local or international regulations, as tax and business laws can evolve over time.